Assessing the Decision Usefulness of Integrated Reports of Namibian Listed Companies

Abstract

1. Introduction

2. Literature Review

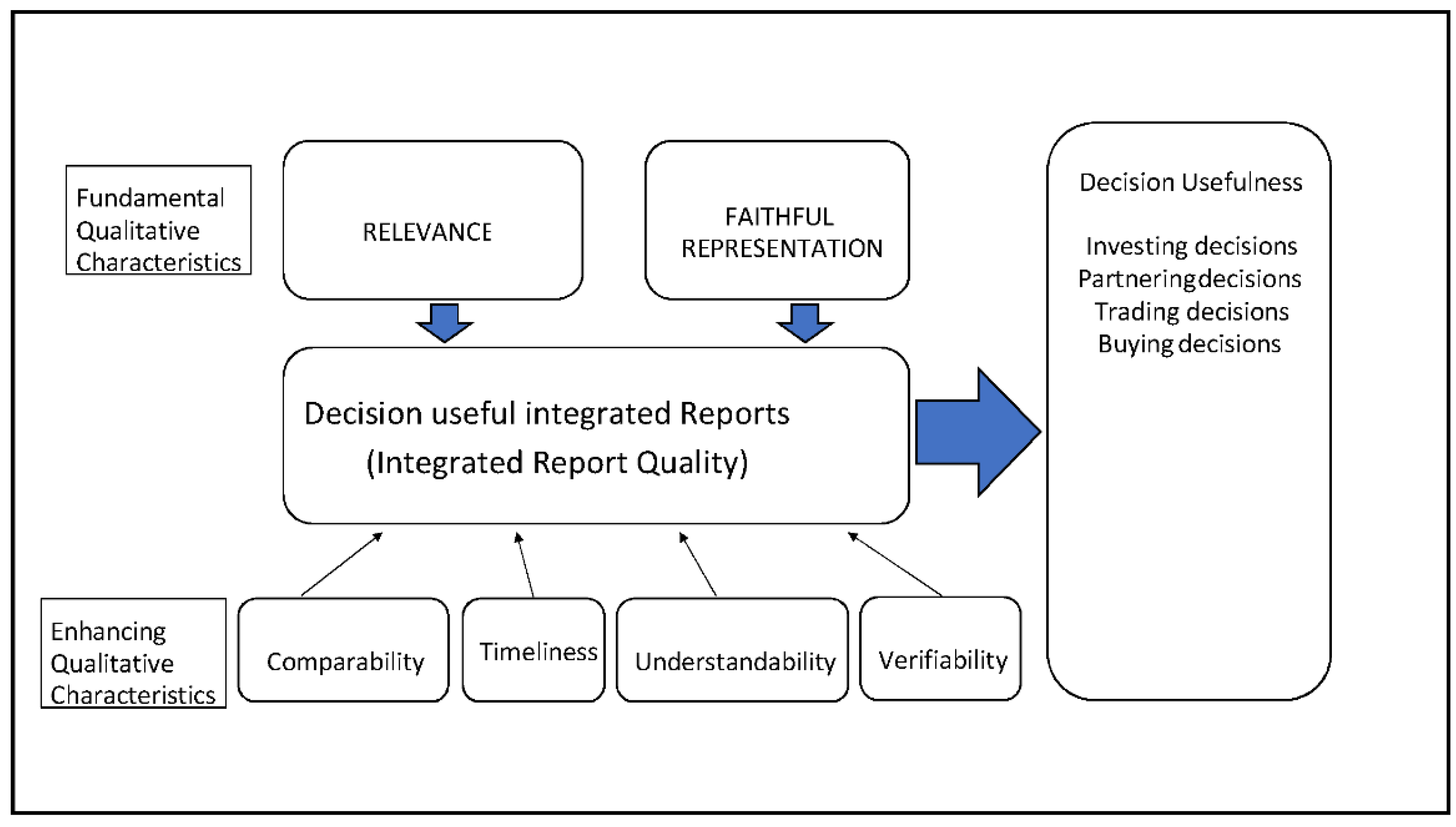

2.1. Decision Usefulness: Qualitative Characteristics

2.1.1. Relevance

- Predictive ability (i.e., aiding economic decision makers in evaluating the historical, current, or possible activities related to a business entity);

- Confirmatory value (i.e., confirming or correcting the previous evaluations); and

- Materiality (i.e., the evidence is considered as material where an omission or misstatement could affect the users’ economic decisions).

2.1.2. Faithful Representation

- Completeness (i.e., sufficient, or full disclosure of all of the required information);

- Neutrality (i.e., fairness and free from bias); and

- Error-free (i.e., no inaccuracies and omissions).

2.1.3. Understandability

2.1.4. Comparability

2.1.5. Timeliness

2.1.6. Verifiability

2.2. Quality of Integrated Reports

3. Data and Methodology

3.1. Population and Sample

3.2. Data Sources and Data Collection

4. Results of the Study

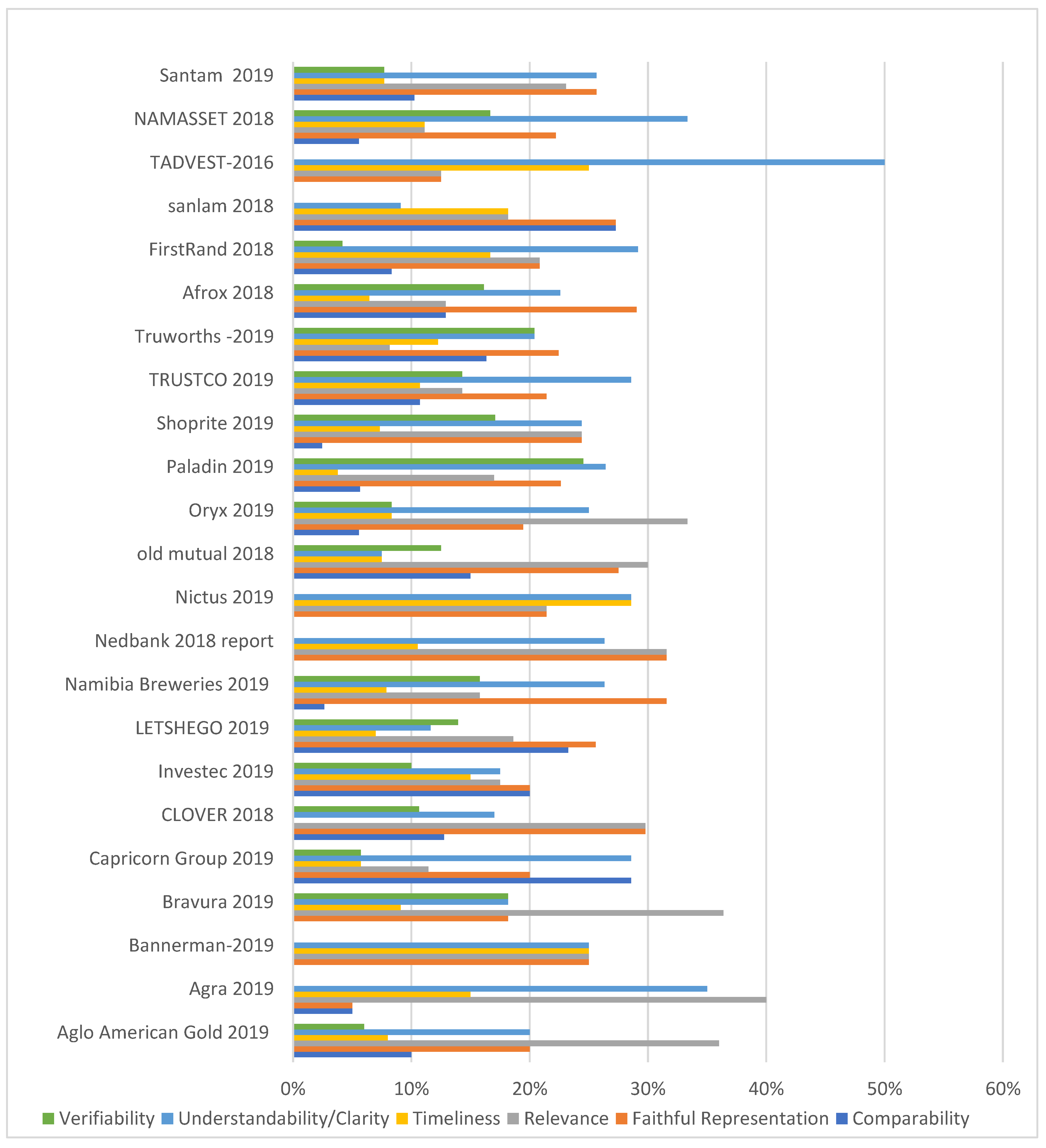

4.1. Decision-Useful by Individual Companies

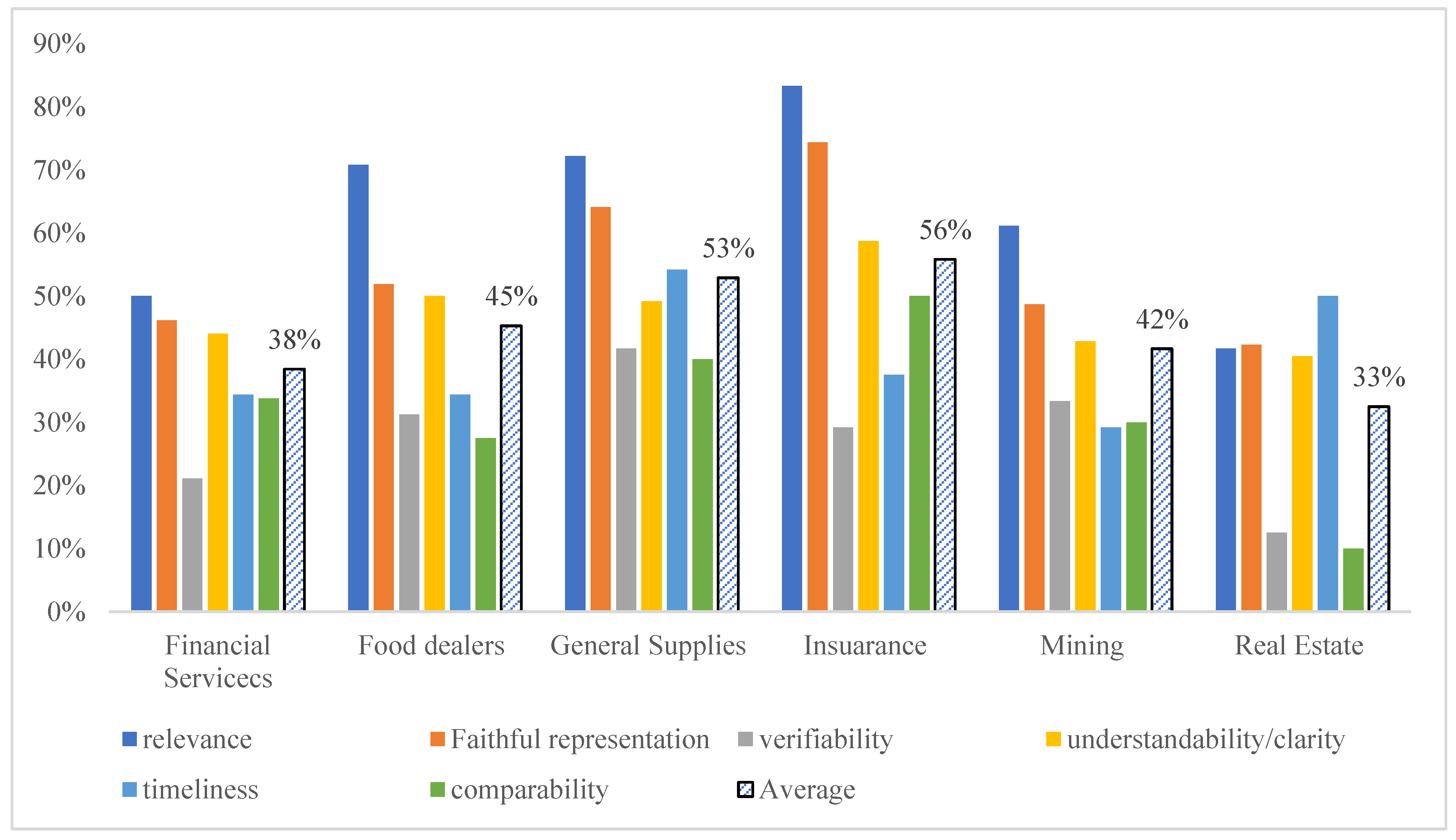

4.2. Decision Usefulness by Sector

4.3. Overall Assessment of Decision Usefulness of Integrated Reports Prepared in Namibia

5. Conclusions of Reports Decision Usefulness

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abhayawansa, Subhash, Evangeline Elijido-Ten, and John Dumay. 2019. A Practice Theoretical Analysis of the Irrelevance of Integrated Reporting to Mainstream Sell-Side Analysts. Accounting and Finance 59: 1615–47. [Google Scholar] [CrossRef]

- Adams, Carol A., and Carlos Larrinaga-González. 2007. Engaging with Organisations in Pursuit of Improved Sustainability Accounting and Performance. Accounting, Auditing & Accountability Journal 20: 333–55. [Google Scholar] [CrossRef]

- Al-Htaybat, Khaldoon, and Larissa von Alberti-Alhtaybat. 2018. Integrated Thinking Leading to Integrated Reporting: Case Study Insights from a Global Player. Accounting, Auditing and Accountability Journal 31: 1435–60. [Google Scholar] [CrossRef]

- Aljifri, Khaled, and Khaled Hussainey. 2007. The Determinants of Forward-Looking Information in Annual Reports of UAE Companies. Managerial Auditing Journal 22: 881–94. [Google Scholar] [CrossRef]

- Alsaeed, Khalid. 2006. The Association between Firm-Specific Characteristics and Disclosure: The Case of Saudi Arabia. Managerial Auditing Journal 21: 476–96. [Google Scholar] [CrossRef]

- Al-Tuwaijri, Sulaiman A., Theodore E. Christensen, and K. E. Hughes Ii. 2004. The Relations among Environmental Disclosure, Environmental Performance, and Economic Performance: A Simultaneous Equations Approach. Accounting, Organizations and Society 29: 447–71. [Google Scholar] [CrossRef]

- Alzarouni, Abdulkareem, Khaled Aljifri, Chew Ng, and Mohammad Iqbal Tahir. 2011. The Usefulness of Corporate Financial Reports: Evidence from the United Arab Emirates. Accounting & Taxation 3: 17–37. [Google Scholar]

- Amir, Eli, Trevor S. Harris, and Elizabeth K. Venuti. 1993. A Comparison of the Value-Relevance of U.S. Versus Non-U.S. GAAP Accounting Measures Using Form 20-F Reconciliations. Journal of Accounting Research 31: 230. [Google Scholar] [CrossRef]

- Ashbaugh, Hollis, and Per Olsson. 2002. An Exploratory Study of the Valuation Properties of Cross-listed Firms’ IAS and US GAAP Earnings and Book Values. The Accounting Review 77: 107–26. [Google Scholar] [CrossRef]

- Baron, Richard. 2014. The Evolution of Corporate Reporting for Integrated Performance. Organisation for Economic Co-Operation and Development (OECD) 25: 1–35. [Google Scholar]

- Barth, Mary E., Steven F. Cahan, Li Chen, and Elmar R. Venter. 2015. The Economic Consequences Associated with Integrated Report Quality: Early Evidence from a Mandatory Setting. Unpublished Working Paper. Pretoria: University of Pretoria, pp. 1–45. [Google Scholar]

- Barth, Mary E., Wayne R. Landsman, and Mark H. Lang. 2008. International Accounting Standards and Accounting Quality. Journal of Accounting Research 46: 467–98. [Google Scholar] [CrossRef]

- Bebbington, Jan, and Rob Gray. 2001. An Account of Sustainability: Failure, Success and a Reconceptualization. Critical Perspectives on Accounting 12: 557–87. [Google Scholar] [CrossRef]

- Beck, Cornelia, John Dumay, and Geoffrey Frost. 2017. In Pursuit of a ‘Single Source of Truth’: From Threatened Legitimacy to Integrated Reporting. Journal of Business Ethics 141: 191–205. [Google Scholar] [CrossRef]

- Bertaux, Daniel. 1981. From the life-history approach to the transformation of sociological practice. In Biography and Society: The Life History Approach in the Social Sciences. Edited by Daniel Bertaux. London: Sage, pp. 29–45. [Google Scholar]

- Bartolomeo, Matteo, Martin Bennett, Jan Jaap Bouma, Peter Heydkamp, Peter James, and Teun Wolters. 2000. Environmental management accounting in Europe: Current practice and future potential. European Accounting Review 9: 31–52. [Google Scholar] [CrossRef]

- Bhimani, Alnoor, Hanna Silvola, and Prabhu Sivabalan. 2016. Voluntary Corporate Social Responsibility Reporting: A Study of Early and Late Reporter Motivations and Outcomes. Journal of Management Accounting Research 28: 77–101. [Google Scholar] [CrossRef]

- Boerner, Hank. 2013. New GRI’s G4 Sustainability Reporting Guidelines. Corporate Finance Review 18: 25. [Google Scholar]

- Boonlua, Sutana, and Sirin Phankasem. 2016. Engagement in Integrated Reporting: Evidence from the International Integrating Reporting Council Adoption Framework. Journal of Business and Retail Management Research 10: 126–36. [Google Scholar]

- Cho, Charles H., and Dennis M. Patten. 2007. The Role of Environmental Disclosures as Tools of Legitimacy: A Research Note. Accounting, Organizations and Society 32: 639–47. [Google Scholar] [CrossRef]

- Chow, Chee W., and Wim A. van Der Stede. 2006. The Use and Usefulness of Non-Financial Performance Measures. Spring 7: 1–9. [Google Scholar] [CrossRef]

- Clarkson, Peter M., Yue Li, Gordon D. Richardson, and Florin P. Vasvari. 2008. Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis. Accounting, Organizations and Society 33: 303–27. [Google Scholar] [CrossRef]

- Cornell, Bradford, and Alan C. Shapiro. 1987. Corporate Stakeholders and Corporate Finance. Financial Management 16: 5–14. [Google Scholar] [CrossRef]

- Creswell, John. 1998. Qualitative Inquiry and Research Design: Choosing among Five Traditions. Thousand Oaks: Sage. [Google Scholar]

- Dandago, Kabiru Isa, and Nur Isdawani Binti Hassan. 2013. Decision Usefulness Approach To Financial Reporting: A Case For Malaysian Inland Revenue Boa. Asian Economic and Financial Review 3: 772–84. [Google Scholar]

- Davis, Greg, and Cory Searcy. 2010. A review of Canadian corporate sustainable development reports. Journal of Global Responsibility 1: 316–29. [Google Scholar] [CrossRef]

- de Villiers, Charl, and Chris J. van Staden. 2010. Shareholders’ Requirements for Corporate Environmental Disclosures: A Cross Country Comparison. British Accounting Review 42: 227–40. [Google Scholar] [CrossRef]

- de Villiers, Charl, and Chris J. van Staden. 2011. Shareholder Requirements for Compulsory Environmental Information in Annual Reports and on Websites. Hoboken: Wiley Online Library. [Google Scholar]

- de Villiers, Charl, Elmar R. Venter, and Pei-Chi Kelly Hsiao. 2016. Integrated Reporting: Background, Measurement Issues, Approaches and an Agenda for Future Research. Accounting & Finance 57: 937–59. [Google Scholar] [CrossRef]

- de Villiers, Charl, Leonardo Rinaldi, and Jeffrey Unerman. 2014. Integrated Reporting: Insights, Gaps and an Agenda for Future Research. Accounting, Auditing and Accountability Journal 27: 1042–67. [Google Scholar] [CrossRef]

- Deegan, Craig, and Michaela Rankin. 1999. The Environmental Reporting Expectations Gap: Australian Evidence. British Accounting Review 31: 313–46. [Google Scholar] [CrossRef]

- Dias, António, Lúcia Lima Rodrigues, Russell Craig, and Maria Elisabete Neves. 2019. Corporate Social Responsibility Disclosure in Small and Medium-Sized Entities and Large Companies. Social Responsibility Journal 15: 137–54. [Google Scholar] [CrossRef]

- Dienes, Dominik, Remmer Sassen, and Jasmin Fischer. 2016. What Are the Drivers of Sustainability Reporting? A Systematic Review. Sustainability Accounting, Management and Policy Journal 7: 154–89. [Google Scholar] [CrossRef]

- Dissanayake, D. M. M. B., and Athula Ekanayake. 2018. Decision Usefulness of Corporate Environmental Reporting and Firm Performance: Evidence from Sri Lanka. IUP Journal of Accounting Research & Audit Practices 17: 7–23. Available online: http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=131601017&site=ehost-live (accessed on 18 June 2021).

- Donaldson, Thomas, and Lee E Preston. 1995. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Academy of Management Review 20: 65–91. [Google Scholar] [CrossRef]

- Drake, Michael S., Darren T. Roulstone, and Jacob R. Thornock. 2016. The Usefulness of Historical Accounting Reports. Journal of Accounting and Economics 61: 448–64. [Google Scholar] [CrossRef]

- Dumay, John, Cristiana Bernardi, James Guthrie, and Matteo La Torre. 2017. Barriers to Implementing the International Integrated Reporting Framework A Contemporary Academic Perspective. Meditari Accountancy Research 25: 461–80. [Google Scholar] [CrossRef]

- Eccles, Robert G., and Michael P. Krzus. 2010. Integrated reporting for a sustainable strategy. Financial Executive 26: 28–32. [Google Scholar]

- Ernst&Young. 2010. Conseptual Framework: Objective and Qualitative Characteristics. Available online: http://www.ey.com/Publication/vwLUAssets/Supplement_86_GL_IFRS/$File/Supplement_86_GL_IFRS.pdf%0Ahttp://www.ey.com/Publication/vwLUAssets/Supplement_86_GL_IFRS/$FILE/Supplement_86_GL_IFRS.pdf (accessed on 25 May 2021).

- FASB. 2006. Conceptual Framework for Financial Reporting: Objective of Financial Reporting and Qualitative Characteristics of Decision-Useful Financial Reporting Information. Financial Accounting Standards Board—FASB 1260: 69. [Google Scholar]

- Flower, John. 2015. The International Integrated Reporting Council: A Story of Failure. Critical Perspectives on Accounting 27: 1–17. [Google Scholar] [CrossRef]

- Frias-Aceituno, Jose V., Lazaro Rodriguez-Ariza, and Isabel M. Garcia-Sanchez. 2014. Explanatory Factors of Integrated Sustainability and Financial Reporting. Business Strategy and the Environment 23: 56–72. [Google Scholar] [CrossRef]

- Glaser, Barney, and Anselm Strauss. 1967. The Discovery of Grounded Theory: Strategies for Qualitative Research. New York: Aldine Publishing Company. [Google Scholar]

- Goicoechea, Estibaliz, Fernando Gómez-Bezares, and José Vicente Ugarte. 2019. Integrated Reporting Assurance: Perceptions of Auditors and Users in Spain. Sustainability 11: 713. [Google Scholar] [CrossRef]

- Gray, Rob, Dave Owen, and Keith Maunders. 2006. Corporate Social Reporting: Emerging Trends in Accountability and the Social Contract. Accounting, Auditing & Accountability Journal 1: 6–20. [Google Scholar] [CrossRef]

- Gray, Rob, Reza Kouhy, and Simon Lavers. 1995. Corporate Social and Environmental Reporting. Accounting, Auditing & Accountability Journal 8: 47–77. [Google Scholar]

- Guest, Greg, Arwen Bunce, and Laura Johnson. 2006. How many interviews are enough? An experiment with data saturation and variability. Field Methods 18: 59–82. [Google Scholar] [CrossRef]

- Gürtürk, Anil, and Rüdiger Hahn. 2016. An Empirical Assessment of Assurance Statements in Sustainability Reports: Smoke Screens or Enlightening Information? Journal of Cleaner Production 136: 30–41. [Google Scholar] [CrossRef]

- Guthrie, James, and Federica Farneti. 2008. GRI Sustainability Reporting by Australian Public Sector Organizations. Public Money and Management 28: 361–66. [Google Scholar] [CrossRef]

- Herremans, Irene M., and Jamal A. Nazari. 2016. Sustainability Reporting Driving Forces and Management Control Systems. Journal of Management Accounting Research 28: 103–24. [Google Scholar] [CrossRef]

- IASB. 2010. The Conceptual Framework for Financial Reporting. September, pp. 1–31. Available online: https://www.iasplus.com/en/standards/other/framework (accessed on 10 June 2021).

- IASB. 2018. Conceptual Framework for Financial Reporting. Business Accounting 1: 112–28. [Google Scholar] [CrossRef]

- IFRS. 2018. Conceptual Framework for Financial Reporting Conceptual Framework at a Glance. IFRS Conceptual Framework Project Summary. March, pp. 767–85. Available online: https://www.ifrs.org/content/dam/ifrs/project/conceptual-framework/fact-sheet-project-summary-and-feedback-statement/conceptual-framework-project-summary.pdf (accessed on 10 May 2021).

- Jennifer Ho, Li-Chin, and Martin E. Taylor. 2007. An Empirical Analysis of Triple Bottom-line Reporting and Its Determinants: Evidence from the United States and Japan. Journal of International Financial Management & Accounting 18: 123–50. [Google Scholar]

- Kamala, Peter Nasiema. 2014. The Decision-Usefulness of Corporate Environmental Reports in South Africa. Unpublished Doctorate thesis, University of South Africa, Pretoria, South Africa; pp. 1–503. [Google Scholar]

- Laud, Robert L., and Donald H. Schepers. 2009. Beyond Transparency: Information Overload and a Model for Intelligibility. Business and Society Review 114: 365–91. [Google Scholar] [CrossRef]

- Leuz, Christian, Dhananjay Nanda, and Peter D. Wysocki. 2003. Earnings Management and Investor Protection: An International Comparison. Journal of Financial Economics 69: 505–27. [Google Scholar] [CrossRef]

- Lewellyn, Patsy G., and Jeanne M. Logsdon. 2017. Global Reporting Initiative G4 Sustainability Reporting Guidelines: Do They Deliver? Proceedings of the International Association for Business and Society 28: 161–72. [Google Scholar] [CrossRef]

- Lopes, Ana Isabel, and Ana Margarida Coelho. 2018. Engaged in Integrated Reporting? Evidence across Multiple Organizations. European Business Review 30: 398–426. [Google Scholar] [CrossRef]

- Marquis, Christopher, Michael W. Toffel, and Yanhua Zhou. 2016. Scrutiny, Norms, and Selective Disclosure: A Global Study of Greenwashing. Organization Science 27: 483–504. [Google Scholar] [CrossRef]

- McCartney, Sean. 2004. The use of usefulness: An examination of the user needs approach to the financial reporting conceptual framework. Journal of Applied Accounting Research 7: 52–79. [Google Scholar] [CrossRef]

- Mcnally, Mary Anne, Dannielle Cerbone, and Warren Maroun. 2017. Exploring the Challenges of Preparing an Integrated Report. Meditari Accountancy Research 25: 481–504. [Google Scholar] [CrossRef]

- Mertins, Kai, Holger Kohl, and Ronald Orth. 2012. Integrated Reporting and Integrated Thinking—A Resource oriented Perspective. In Eiasm—8th Interdisciplinary Workshop on “Intangibles, Intellectual Capital & Extra-Financial Information”. Berlin: Corporate Management Division Fraunhofer Institute for Production Systems and Design Technology Pascalstr, pp. 1–23. [Google Scholar]

- MIA-ACCA. 2016. MIA-ACCA Integrated Reporting Survey Contents. Available online: www.accaglobal.com/content/dam/ACCA_National/my/dis/MIA-ACCA-IR-survey-report_2016.pdf (accessed on 28 April 2021).

- Moloi, Tankiso. 2015. Risk management practices in the Top 20 South Africa’s listed companies: An annual/integrated report disclosure analysis. Corporate Ownership and Control 12: 928–35. [Google Scholar] [CrossRef][Green Version]

- Morse, Janice M. 1994. Designing funded qualitative research. In Handbook of Qualitative Research. Edited by Norman K. Denzin and Yvonna S. Lincoln. Thousand Oaks: Sage Publications, Inc., pp. 220–35, Chapter xii. 643p. [Google Scholar]

- Psaros, Jim, and Ken T. Trotman. 2004. The Impact of the Type of Accounting Standards on Preparers’ Judgments. Abacus 40: 76–93. [Google Scholar] [CrossRef]

- Robertson, Fiona Ann, and Martin Samy. 2015. Factors Affecting the Diffusion of Integrated Reporting—A UK FTSE 100 Perspective. Sustainability Accounting, Management and Policy Journal 6: 190–223. [Google Scholar] [CrossRef]

- Roberts, Robin W. 1992. Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Accounting, Organizations and Society 17: 595–612. [Google Scholar] [CrossRef]

- Slack, Richard, and Ioannis Tsalavoutas. 2018. Integrated Reporting Decision Usefulness: Mainstream Equity Market Views. Accounting Forum 42: 184–98. [Google Scholar] [CrossRef]

- Stainbank, Lesley, and Christopher Peebles. 2006. The Usefulness of Corporate Annual Reports in South Africa: Perceptions of Preparers and Users. Meditari Accountancy Research 14: 69–80. [Google Scholar] [CrossRef]

- Stemler, Steve. 2001. An Overview of Content Analysis. Practical Assessment, Research and Evaluation 7: 17. [Google Scholar] [CrossRef]

- Stolowy, Hervé, and Luc Paugam. 2018. The Expansion of Non-Financial Reporting: An Exploratory Study. Accounting and Business Research 48: 525–48. [Google Scholar] [CrossRef]

- Stubbs, Wendy, and Colin Higgins. 2018. Stakeholders’ Perspectives on the Role of Regulatory Reform in Integrated Reporting. Journal of Business Ethics 147: 489–508. [Google Scholar] [CrossRef]

- Unerman, Jeffrey. 2000. Methodological issues—Reflections on quantification in corporate social reporting content analysis. Accounting, Auditing & Accountability Journal 13: 667–81. [Google Scholar] [CrossRef]

- van der Meulen, Sofie, Ann Gaeremynck, and Marleen Willekens. 2007. Attribute Differences between US GAAP and IFRS Earnings: An Exploratory Study. The International Journal of Accounting 42: 123–42. [Google Scholar] [CrossRef]

- Wang, Mao Chang. 2017. The Relationship between Firm Characteristics and the Disclosure of Sustainability Reporting. Sustainability 9: 624. [Google Scholar] [CrossRef]

- Wiseman, Joanne. 1982. An Evaluation of Environmental Disclosures Made in Corporate Annual Reports. Accounting, Organizations and Society 7: 53–63. [Google Scholar] [CrossRef]

| Sector Name | Number of Companies | Sampled Companies |

|---|---|---|

| Integrated services | 12 | 6 |

| Mining | 7 | 4 |

| Banks | 4 | 2 |

| Real estate | 3 | 2 |

| Insurance | 4 | 3 |

| Manufacturing, Oil and Gas | 4 | 2 |

| General retailers/industrial, food and support services | 9 | 5 |

| Totals | 43 | 24 |

| Symmetric Measures | |||||

|---|---|---|---|---|---|

| Value | Asymptotic Standard Error a | Approximate T b | Approximate Significance | ||

| Measure of Agreement | Kappa | 0.692 | 0.040 | 14.120 | 0.000 |

| N of Valid Cases | 241 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kamotho, D.W.; Moloi, T.S.; Halleen, S. Assessing the Decision Usefulness of Integrated Reports of Namibian Listed Companies. J. Risk Financial Manag. 2022, 15, 383. https://doi.org/10.3390/jrfm15090383

Kamotho DW, Moloi TS, Halleen S. Assessing the Decision Usefulness of Integrated Reports of Namibian Listed Companies. Journal of Risk and Financial Management. 2022; 15(9):383. https://doi.org/10.3390/jrfm15090383

Chicago/Turabian StyleKamotho, Daniel W., Tankiso S. Moloi, and Simone Halleen. 2022. "Assessing the Decision Usefulness of Integrated Reports of Namibian Listed Companies" Journal of Risk and Financial Management 15, no. 9: 383. https://doi.org/10.3390/jrfm15090383

APA StyleKamotho, D. W., Moloi, T. S., & Halleen, S. (2022). Assessing the Decision Usefulness of Integrated Reports of Namibian Listed Companies. Journal of Risk and Financial Management, 15(9), 383. https://doi.org/10.3390/jrfm15090383