On the Dynamic Relationship between Household Debt and Income Inequality in South Africa

Abstract

:1. Introduction

2. Literature Review

2.1. Inequalities in South Africa

2.2. Theoretical Literature on Inequality and Household Debt

2.3. Recent Empirical Literature on Inequality and Household Debt

3. Materials and Methods

3.1. Cointegration

3.2. VAR/VECM Model

4. Results

4.1. Descriptive Statistics

4.2. Stationarity Tests and Lag-Order Selection Criteria

4.3. Cointegration Test

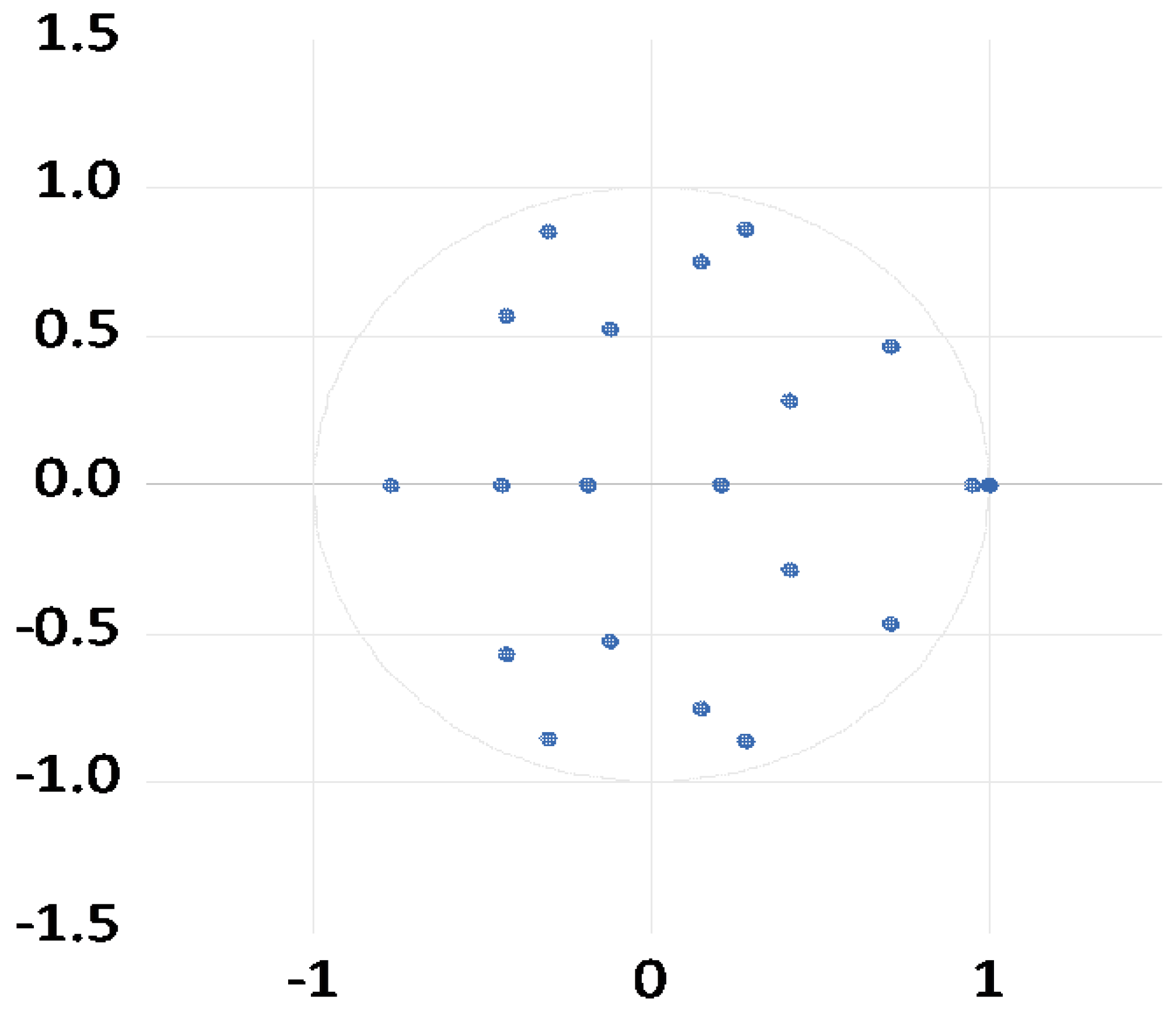

4.4. Vector Error Correction Model Estimates

4.5. Robustness Check Results (DOLS Technique)

4.6. Discussion of Results

5. Conclusions and Policy Recommendations

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Philips Perron Statistics | Conclusion | |

|---|---|---|---|

| Level | 1st Difference | ||

| 4.39 | −4.71 *** | I (1) | |

| −1.53 | −3.29 ** | I (1) | |

| c | −0.14 | −4.31 *** | I (1) |

| −2.42 | −4.88 *** | I (1) | |

| 2.74 | −4.97 *** | I (1) | |

| −1.61 | −5.94 *** | I (1) | |

| 0.19 | −3.43 *** | I (1) | |

| −2.59 | −6.31 *** | I (1) | |

| Lag | LRE-Stat | df | Prob. | RaoF-Stat | df | Prob. |

|---|---|---|---|---|---|---|

| 1 | 35.20 | 36 | 0.506 | 0.93 | (36, 33.5) | 0.575 |

| 2 | 40.17 | 36 | 0.290 | 1.13 | (36, 33.5) | 0.361 |

| 3 | 39.18 | 36 | 0.329 | 1.09 | (36, 33.5) | 0.401 |

| 4 | 43.30 | 36 | 0.187 | 1.26 | (36,33.5) | 0.249 |

| Component | Skewness | Chi-sq | df | Prob. * |

|---|---|---|---|---|

| 1 | −0.04 | 0.01 | 1 | 0.912 |

| 2 | −0.30 | 0.57 | 1 | 0.440 |

| 3 | 0.12 | 0.09 | 1 | 0.755 |

| 4 | 0.32 | 0.68 | 1 | 0.406 |

| 5 | 0.39 | 0.97 | 1 | 0.322 |

| 6 | 0.10 | 0.06 | 1 | 0.796 |

| Joint | 2.41 | 6 | 0.877 | |

| Component | Kurtosis | Chi-sq | df | Prob. |

| 1 | 2.96 | 0.00 | 1 | 0.967 |

| 2 | 4.29 | 2.66 | 1 | 0.109 |

| 3 | 3.88 | 1.25 | 1 | 0.263 |

| 4 | 2.38 | 0.60 | 1 | 0.438 |

| 5 | 2.45 | 0.47 | 1 | 0.491 |

| 6 | 2.80 | 0.06 | 1 | 0.801 |

| Joint | 5.049026 | 6 | 0.5375 | |

| Component | Jarque-Bera | df | Prob. | |

| 1 | 0.01 | 2 | 0.993 | |

| 2 | 3.23 | 2 | 0.193 | |

| 3 | 1.34 | 2 | 0.510 | |

| 4 | 1.28 | 2 | 0.525 | |

| 5 | 1.45 | 2 | 0.484 | |

| 6 | 0.12 | 2 | 0.937 | |

| Joint | 7.46 | 12 | 0.825 |

References

- Abd Samad, Khairunnisa, Siti Nurazira Mohd Daud, and Nuradli Ridzwan Shah Mohd Dali. 2020. Determinants of household debt in emerging economies: A macro panel analysis. Cogent Business & Management 7: 1831765. [Google Scholar]

- Ahlquist, John S., and Ben Ansell. 2014. Does Inequality Induce More Borrowing? Electoral Institutions and Responses to Economic Polarization. Madison: University of Wisconsin. Oxford: University of Oxford. [Google Scholar]

- Apergis, Nicholas, Ioannis Filippidis, and Claire Economidou. 2007. Financial deepening and economic growth linkages: A panel data analysis. Review of World Economics 143: 179–98. [Google Scholar] [CrossRef]

- Aron, Janine, and John Muellbauer. 2013. Wealth, credit conditions, and consumption: Evidence from South Africa. Review of Income and Wealth 59: S161–S196. [Google Scholar] [CrossRef]

- Bazillier, Rémi, and Jérôme Hericourt. 2017. The circular relationship between inequality, leverage, and financial crises. Journal of Economic Surveys 31: 463–96. [Google Scholar] [CrossRef]

- Bazillier, Rémi, Jérôme Héricourt, and Samuel Ligonnière. 2021. Structure of income inequality and household leverage: Cross-country causal evidence. European Economic Review 132: 103629. [Google Scholar] [CrossRef]

- Belabed, Christian A., Thomas Theobald, and Till Van Treeck. 2018. Income Distribution and Current Account Imbalances. Cambridge Journal of Economics 42: 47–94. [Google Scholar] [CrossRef]

- Berisha, Edmond, and John Meszaros. 2017. Household debt, economic conditions, and income inequality: A state level analysis. The Social Science Journal 54: 101–93. [Google Scholar] [CrossRef]

- Berisha, Edmond, John Meszaros, and Eric Olson. 2015. Income inequality and household debt: A cointegration test. Applied Economics Letters 22: 1469–73. [Google Scholar] [CrossRef]

- Berisha, Edmond, David Gabauer, Rangan Gupta, and Chi Keung Marco Lau. 2021. Time-varying influence of household debt on inequality in United Kingdom. Empirical Economics 61: 1917–33. [Google Scholar] [CrossRef]

- Bordo, Michael D., and Christopher M. Meissner. 2012. Does inequality lead to a financial crisis? Journal of International Money and Finance 31: 2147–61. [Google Scholar] [CrossRef]

- Botha, Erika, and Daniel Makina. 2011. Financial regulation and supervision: Theory and practice in South Africa. International Business & Economics Research Journal (IBER) 10: 27–36. [Google Scholar]

- Branson, Nicola, Julia Garlick, David Lam, and Murray Leibbrandt. 2012. Education and Inequality: The South African Case. Cape Town: SALDRU Working Paper, vol. 75, p. 28. [Google Scholar]

- Chang, Xiao, Guoqiang Li, Xinhua Gu, and Chunyu Lei. 2020. Does the inequality-credit-crisis nexus exist? An empirical re-examination. Applied Economics 52: 4044–57. [Google Scholar] [CrossRef]

- Cheah, Siew-Pong, Lin-Sea Lau, and Chee-Keong Choong. 2022. Income Inequality and Household Debt in Malaysia: Is There an Asymmetric Relationship? International Journal of Economics & Management 16: 95–105. [Google Scholar]

- Christen, Markus, and Ruskin M. Morgan. 2005. Keeping up with the Joneses: Analyzing the effect of income inequality on consumer borrowing. Quantitative Marketing & Economics 3: 145–73. [Google Scholar]

- Coibion, Olivier, Yuriy Gorodnichenko, Marianna Kudlyak, and John Mondragon. 2020. Greater Inequality and Household Borrowing: New Evidence from Household Data. Journal of the European Economic Association 18: 2922–71. [Google Scholar] [CrossRef]

- Cong Nguyen, Thang, Tan Ngoc Vu, Duc Hong Vo, and Dao Thi-Thieu Ha. 2019. Financial Development and Income Inequality in Emerging Markets: A New Approach. Journal of Risk and Financial Management 12: 173. [Google Scholar] [CrossRef]

- Destek, Mehmet Akif, and Bilge Koksel. 2019. Income inequality and financial crises: Evidence from the bootstrap rolling window. Financial Innovation 5: 21. [Google Scholar] [CrossRef]

- De Vita, Glauco, and Yun Luo. 2021. Financialization, household debt and income inequality: Empirical evidence. International Journal of Finance & Economics 26: 1917–37. [Google Scholar]

- Dumitrescu, Bogdan Andrei, Adrian Enciu, Cătălina Adriana Hândoreanu, Carmen Obreja, and Florin Blaga. 2022. Macroeconomic determinants of household debt in OECD countries. Sustainability 14: 3977. [Google Scholar] [CrossRef]

- El-Shagi, Makram, Jarko Fidrmuc, and Steven Yamarik. 2020. Inequality and credit growth in Russian regions. Economic Modelling 91: 550–58. [Google Scholar] [CrossRef]

- Enders, Walter. 2008. Applied Econometric Time Series. Hoboken: John Wiley & Sons. [Google Scholar]

- Fasianos, Apostolos, Hamid Raza, and Stephen Kinsella. 2016. Exploring the link between household debt and income inequality: An asymmetric approach. Applied Economics Letters 24: 404–09. [Google Scholar] [CrossRef]

- Fortuin, Marlin Jason, Gerhard Philip Maree Grebe, and Patricia Lindelwa Makoni. 2022. Wealth Inequality in South Africa—The Role of Government Policy. Journal of Risk and Financial Management 15: 243. [Google Scholar] [CrossRef]

- Francis, David, and Edward Webster. 2019. Poverty and inequality in South Africa: Critical reflections. Development Southern Africa 36: 788–802. [Google Scholar] [CrossRef]

- Gu, Xinhua, and Bihong Huang. 2014. Does inequality lead to a financial crisis? Revisited. Review of Development Economics 18: 502–16. [Google Scholar] [CrossRef]

- Gu, Xinhua, Pui Sun Tam, Yang Zhang, and Chun Kwok Lei. 2019. Inequality, leverage and crises: Theory and evidence revisited. The World Economy 42: 2280–99. [Google Scholar] [CrossRef]

- Hake, Mariya, and Philipp Poyntner. 2022. Keeping up with the Novaks? Income distribution as a determinant of household debt in CESEE. Review of Income and Wealth 68: S224–60. [Google Scholar] [CrossRef]

- Hanson, Bruce E. 1992. Tests for parameter instability in regressions with I (1) processes. Journal of Business & Economic Statistics 20: 45–59. [Google Scholar]

- Hundenborn, Janina, Murray V. Leibbrandt, and Ingrid Woolard. 2018. Drivers of Inequality in South Africa. Helsinki: WIDER Working Paper. [Google Scholar]

- IMF. 2020. The IMF and Income Inequality: Introduction to Inequality. International Monetary Fund. Available online: https://www.imf.org/en/Topics/Inequality/introduction-to-inequality (accessed on 10 October 2022).

- Jestl, Stefan. 2022. The impact of income inequality on household indebtedness in euro area countries. European Journal of Economics and Economic Policies: Intervention 1: 1–32. [Google Scholar]

- Johansen, Søren. 1988. Statistical Analysis of Cointegration Vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Johansen, Soren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on cointegration—With appucations to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Johnston, Alison, Gregory W. Fuller, and Aidan Regan. 2020. It takes two to tango: Mortgage markets, labor markets and rising household debt in Europe. Review of International Political Economy 28: 843–73. [Google Scholar] [CrossRef]

- Kereeditse, Michelle Koketso, and Mubanga Mpundu. 2021. Analysis of Household Debt in South Africa Pre-and Post-Low-Quality Asset Financial Crisis. International Journal of Economics and Financial Issues 11: 114. [Google Scholar] [CrossRef]

- Koh, Sharon G. M., Grace H. Y. Lee, and Eduard J. Bomhoff. 2020. The income inequality, financial depth and economic growth nexus in China. The World Economy 43: 412–27. [Google Scholar] [CrossRef]

- Krueger, Dirk, and Fabrizio Perri. 2006. Does income inequality lead to consumption inequality? Evidence and theory. The Review of Economic Studies 73: 163–93. [Google Scholar] [CrossRef]

- Kumhof, Michael, Romain Rancière, and Pablo Winant. 2015. Inequality, leverage, and crises. American Economic Review 105: 1217–45. [Google Scholar] [CrossRef]

- Lagoa, Sérgio, and Ricardo Barradas. 2020. Financialisation and inequality in the semi-periphery: Evidence from Portugal. In Financialisation in the European Periphery. Abingdon: Routledge, pp. 212–39. [Google Scholar]

- Leibbrandt, Murray, Arden Finn, and Ingrid Woolard. 2012. Describing and decomposing post-apartheid income inequality in South Africa. Development Southern Africa 29: 19–34. [Google Scholar] [CrossRef]

- Lim, Hyunjoon. 2019. The response of household debt to income inequality shocks: A heterogeneous approach. Applied Economics Letters 26: 684–89. [Google Scholar] [CrossRef]

- Lin, Ken-Hou, and Donald Tomaskovic-Devey. 2013. Financialization and US income inequality, 1970–2008. American Journal of Sociology 118: 1284–329. [Google Scholar] [CrossRef]

- Lombardi, Marco Jacopo, Madhusudan Mohanty, and Ilhyock Shim. 2017. The Real Effects of Household Debt in the Short and Long Run. Basel: BIS Working Papers, No. 607. [Google Scholar]

- Meniago, Christelle, Janine Mukuddem-Petersen, Mark A. Petersen, and Itumeleng P. Mongale. 2013. What causes household debt to increase in South Africa? Economic Modelling 33: 482–92. [Google Scholar] [CrossRef]

- Mongale, Itumeleng Pleasure, Janine Mukuddem-Petersen, Mark A. Petersen, and Christelle Meniago. 2013. Household savings in South Africa: An econometric analysis. Mediterranean Journal of Social Sciences 4: 519. [Google Scholar] [CrossRef]

- Murray, Michael P. 1994. A drunk and her dog: An illustration of cointegration and error correction. The American Statistician 48: 37–39. [Google Scholar]

- Nomatye, Anelisa, and Andrew Phiri. 2017. Investigating the Macroeconomic Determinants of Household Debt in South Africa. München: MPRA Paper, No. 83303. [Google Scholar]

- Odhiambo, Nicholas M. 2009. Interest rate reforms, financial deepening and economic growth in Kenya: An empirical investigation. The Journal of Developing Areas, 295–313. [Google Scholar] [CrossRef]

- Orthofer, Anna. 2016. Wealth inequality in South Africa: Evidence from survey and tax data. In Research Project on Employment, Income Distribution & Inclusive Growth. Capetown: Working Paper 15. [Google Scholar]

- Ozcicek, Omer, and W. Douglas Mcmillin. 1999. Lag length selection in vector autoregressive models: Symmetric and asymmetric lags. Applied Economics 31: 517–24. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for unit roots in time series regression. Biometrika 75: 335–346. [Google Scholar] [CrossRef]

- Piao, Ying’ai, Meiru Li, Hongyuan Sun, and Ying Yang. 2023. Income Inequality, Household Debt, and Consumption Growth in the United States. Sustainability 15: 3910. [Google Scholar] [CrossRef]

- Rajan, Raghuram G. 2011. Fault Lines: How Hidden Fractures Still Threaten the World Economy. Princeton: Princeton University Press. [Google Scholar]

- Roberts, Anthony, and Roy Kwon. 2017. Finance, inequality and the varieties of capitalism in post-industrial democracies. Socio-Economic Review 15: 511–38. [Google Scholar] [CrossRef]

- Rogan, Michael, and John Reynolds. 2016. Schooling inequality, higher education, and the labour market: Evidence from a graduate tracer study in the Eastern Cape, South Africa. Development Southern Africa 33: 343–60. [Google Scholar] [CrossRef]

- Sotiropoulou, Theodora, Stefanos Giakoumatos, and Antonios Georgopoulos. 2023. Financial development, economic growth, and income inequality: A Toda-Yamamoto panel causality test. Economics and Business Letters 12: 172–85. [Google Scholar] [CrossRef]

- Ssebagala, Ralph Abbey. 2017. Relieving consumer overindebtedness in South Africa: Policy reviews and recommendations. Journal of Financial Counseling and Planning 28: 235–46. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W. Watson. 1988. Testing for common trends. Journal of the American statistical Association 83: 1097–107. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W. Watson. 1993. A simple estimator of cointegrating vectors in higher Order integrated systems. Econometrica 61: 783–820. [Google Scholar] [CrossRef]

- Thornton, John, and Caterina Di Tommaso. 2020. The long-run relationship between finance and income inequality: Evidence from panel data. Finance Research Letters 32: 101180. [Google Scholar] [CrossRef]

- Uwubanmwen, Ahmed E., and Mayowa G. Ajao. 2012. The determinants and impacts of foreign direct investment in Nigeria. International Journal of Business and Management 7: 67. [Google Scholar]

- Verbeek, Marno. 2008. A Guide to Modern Econometrics. Hoboken: John Wiley & Sons. [Google Scholar]

- Wang, Shengquan. 2023. Income Inequality and Systemic Banking Crises: A Nonlinear Nexus. Economic Systems 2023: 101123. [Google Scholar] [CrossRef]

- Wilson, Francis. 2011. Historical roots of inequality in South Africa. Economic History of Developing Regions 26: 1–15. [Google Scholar] [CrossRef]

- Wood, James D. G. 2020. Can household debt influence income inequality? Evidence from Britain: 1966–2016. The British Journal of Politics and International Relations 22: 24–46. [Google Scholar] [CrossRef]

- Xu, Guangdong. 2022. Is Rajan’s Hypothesis Confirmed by Empirical Evidence? A Critical Review. Review of Radical Political Economics 54: 334–50. [Google Scholar] [CrossRef]

- Zhou, Sheunesu, and D. Tewari Dev. 2020. The impact of shadow banking on economic growth: Evidence from cross country data (2006–2018). Journal of International Commerce, Economics and Policy 11: 2050010. [Google Scholar] [CrossRef]

| HDEBT | UNEMPL | LGINI | LGDP_CAP | HSE_PRYC | SAVRATIO | |

|---|---|---|---|---|---|---|

| Mean | 0.56 | 21.95 | −0.42 | 2.29 | 0.74 | −0.04 |

| Median | 0.52 | 23.15 | −0.42 | 2.31 | 0.74 | 0.04 |

| Maximum | 0.77 | 33.55 | −0.27 | 2.44 | 1.22 | 0.48 |

| Minimum | 0.37 | 9.24 | −0.54 | 2.05 | 0.41 | −0.71 |

| Std.Dev. | 0.11 | 5.57 | 0.09 | 0.11 | 0.25 | 0.28 |

| Skewness | 0.31 | −0.60 | 0.22 | −0.51 | 0.10 | −0.71 |

| Kurtosis | 1.72 | 2.84 | 1.46 | 2.06 | 1.42 | 2.94 |

| Jarque-Bera (JB) | 3.53 | 2.60 | 4.47 | 3.36 | 4.43 | 3.63 |

| JBstatProbability | 0.17 | 0.27 | 0.10 | 0.18 | 0.10 | 0.16 |

| Sum | 23.67 | 921.90 | −17.68 | 96.45 | 31.19 | −1.88 |

| SumSq.Dev. | 0.57 | 1274.03 | 0.40 | 0.57 | 2.74 | 3.21 |

| Observations | 42 | 42 | 42 | 42 | 42 | 42 |

| Endogenous Variables: HDEBT LGINI LGDP_CAP UNEMPL HSE_PRYC SAVRATIO | ||||||

|---|---|---|---|---|---|---|

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 1 | 408.60 | NA | 1.25 × 10−16 | −19.61 | −18.05 * | −19.05 * |

| 2 | 449.49 | 55.95 * | 1.08 × 10−16 * | −19.86 | −16.75 | −18.76 |

| 3 | 484.30 | 36.63 | 1.65 × 10−16 | −19.80 | −15.15 | −18.14 |

| 4 | 525.54 | 30.38 | 2.95 × 10−16 | −20.08 * | −13.87 | −17.87 |

| Trace Statistic | ||||

| Hypothesized | Trace | 0.05 | Prob. ** | |

| No. of CE(s) | Eigenvalue | Statistic | Critical Value | Critical Value |

| None * | 0.70 | 133.28 | 95.75 | 0.000 |

| * | 0.55 | 85.95 | 69.81 | 0.002 |

| * | 0.44 | 55.16 | 47.86 | 0.009 |

| * | 0.41 | 32.18 | 29.80 | 0.026 |

| 0.20 | 11.40 | 15.49 | 0.188 | |

| Max-eigenvalue Statistic | ||||

| Hypothesized | Max-Eigen | 0.05 | Prob. ** | |

| No. of CE(s) | Eigenvalue | Statistic | Critical Value | Critical Value |

| None * | 0.70 | 47.33 | 40.08 | 0.006 |

| 0.54 | 30.79 | 33.88 | 0.111 | |

| 0.45 | 22.98 | 27.58 | 0.174 | |

| (Dependent) | Coefficient | Standarderror | t-Value |

|---|---|---|---|

| −0.012 *** | (0.003) | [−6.78] | |

| −1.562 *** | (0.168) | [−9.33] | |

| 2.125 *** | (0.152) | [13.94] | |

| 0.390 *** | (0.031) | [12.21] | |

| 0.013 | (0.025) | [0.54] | |

| 4.849 | |||

| −0.747 *** | (0.247) | [−3.02] |

| −0.822 *** [−2.11] | −0.533 *** [−6.66] | ||||

| −0.031 *** [−7.98] | −0.081 *** [−8.12] | −0.010 ** [−2.03] | |||

| 2.485 *** [5.96] | 0.196 *** [7.21] | 0.269 *** [3.75] | 0.280 *** [4.02] | 0.218 *** [7.66] | |

| −0.013 *** [−2.64] | −0.018 *** [−4.01] | 0.000 [0.08] | −0.001 [−1.38] | −0.010 ** [−2.03] | |

| 0.306 *** [6.64] | 0.149 *** [4.79] | 0.039 *** [2.30] | 0.005 *** [0.47] | 0.218 *** [7.66] | |

| −0.040 [−0.76] | −0.063 [−1.54] | −0.037 *** [−3.61] | −0.026 *** [−2.72] | −0.149 *** [−2.61] | |

| 0.224 ** [2.16] | |||||

| −5.149 *** [−7.63] | −0.879 *** [−4.71] | −0.768 *** [−5.06] | −0.354 *** [−2.67] | −0.569 [−0.49] | |

| −0.010 *** [−2.41] ** | − | − | − | − | |

| Residual Normality | Yes | Yes | Yes | Yes | Yes |

| Cointegrated | 0.29 (>0.2) | 0.08 (>0.2) | 0.26 (>0.2) | 0.27 (>0.2) | 0.27 (>0.2) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, S.; Niyitegeka, O. On the Dynamic Relationship between Household Debt and Income Inequality in South Africa. J. Risk Financial Manag. 2023, 16, 427. https://doi.org/10.3390/jrfm16100427

Zhou S, Niyitegeka O. On the Dynamic Relationship between Household Debt and Income Inequality in South Africa. Journal of Risk and Financial Management. 2023; 16(10):427. https://doi.org/10.3390/jrfm16100427

Chicago/Turabian StyleZhou, Sheunesu, and Olivier Niyitegeka. 2023. "On the Dynamic Relationship between Household Debt and Income Inequality in South Africa" Journal of Risk and Financial Management 16, no. 10: 427. https://doi.org/10.3390/jrfm16100427

APA StyleZhou, S., & Niyitegeka, O. (2023). On the Dynamic Relationship between Household Debt and Income Inequality in South Africa. Journal of Risk and Financial Management, 16(10), 427. https://doi.org/10.3390/jrfm16100427