Determinants of Non-Performing Loans in a Small Island Economy of Fiji: Accounting for COVID-19, Bank-Type, and Globalisation

Abstract

1. Introduction

2. Literature Review

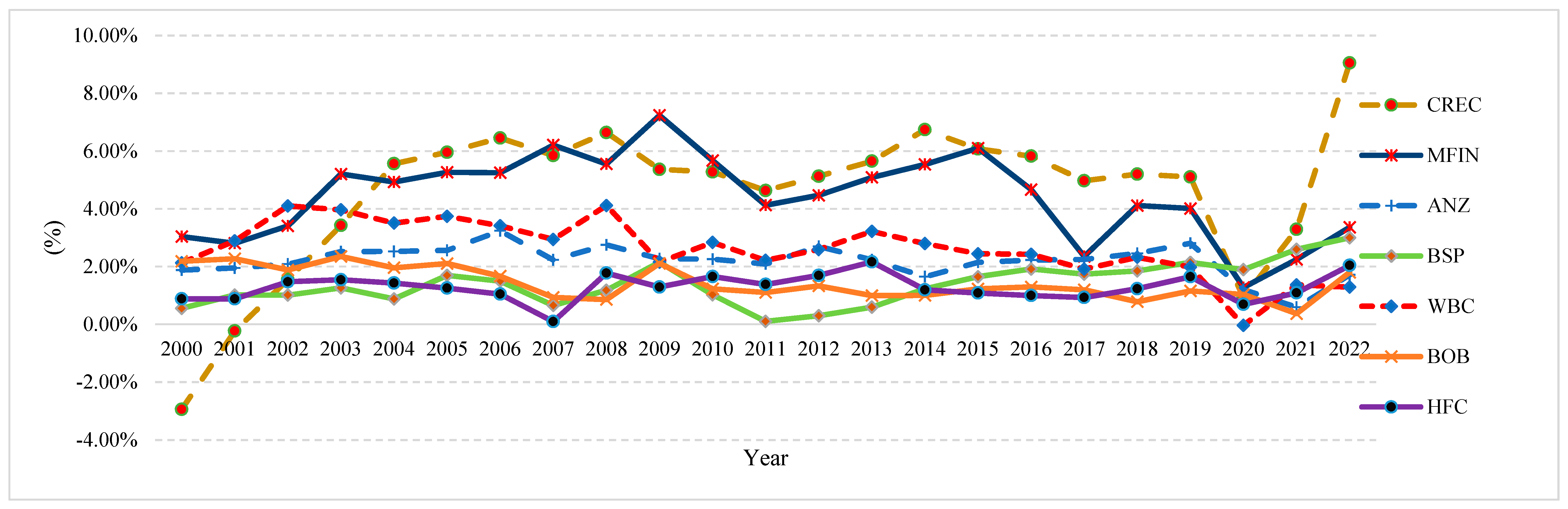

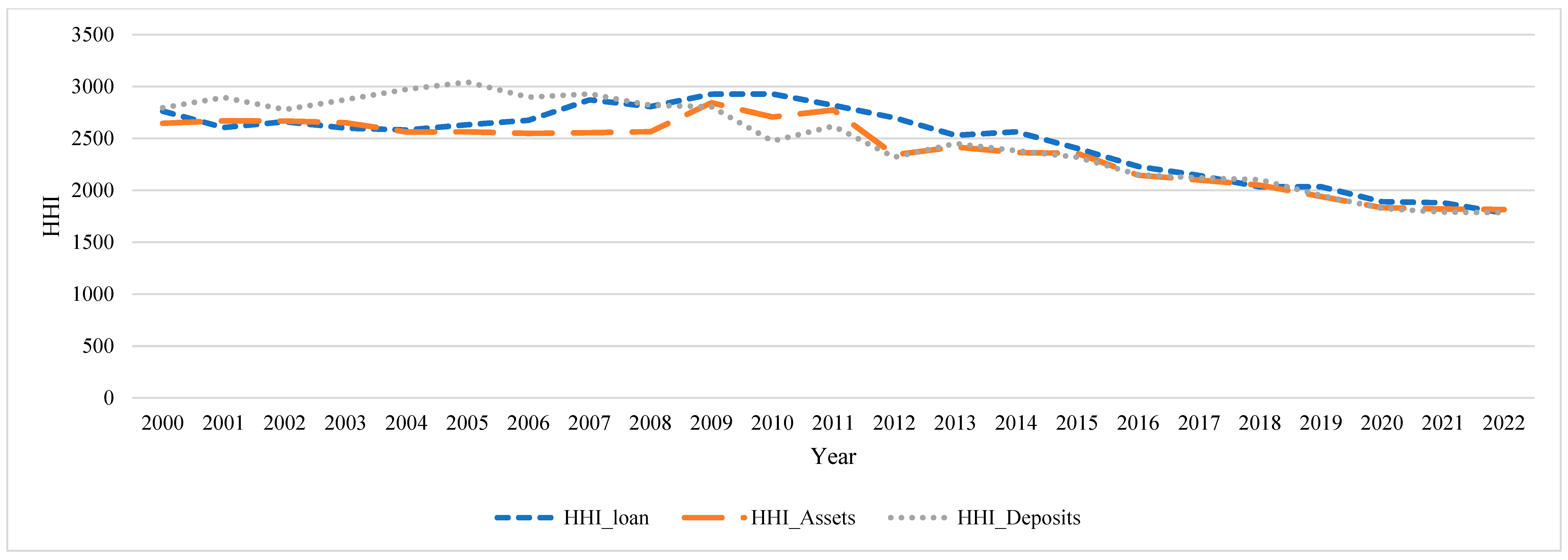

Background and Some Related Studies on Fiji’s Banking Sector

3. Data

4. Method

5. Results and Discussion

5.1. Base Model (Model I–III)

5.2. Economic Growth, Bank Type, GFC, and COVID-19

5.3. Social and Economic Globalisation

5.4. Interaction Effect with COVID-19

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | Definition | Symbol | Expected Sign | Source |

|---|---|---|---|---|

| Dependent Variable | ||||

| Non-performing loans | Bad debts/Total loans | NPLs | N/A | RBF |

| Independent/Control Variables | ||||

| Bank-Specific | ||||

| Bank size | Natural logarithm of total assets | SIZE | − | RBF |

| Net interest margin | (Interest income-interest expense)/total assets | NIM | − | RBF |

| Return on assets | Profit/total assets | ROA | − | RBF |

| Inefficiency ratio | Operating expenses/operating revenue | INEF | + | RBF |

| Capital adequacy ratio | Sum of tier capital and tier 2 capital divided by risk weighted assets | CAR | − | RBF |

| Concentration (HHI) | Herfindahl–Hirschman index based on loans | HHI_LOAN | − | RBF |

| Loan-to-deposit ratio | Total loans/total deposits | LTD | + | RBF |

| Non-bank financial institutions | 1 = NBFI, otherwise 0 | NBFI | ? | RBF |

| Commercial banks | 1 = Commercial bank, otherwise 0 | COMBANK | ? | RBF |

| Bank dummy | ||||

| ANZ | 1 = ANZ, otherwise 0 | ANZD | ? | |

| BOB | 1 = BOB, otherwise 0 | BOBD | ? | |

| BSP | 1 = BSP, otherwise 0 | BSPD | ? | |

| CRC | 1 = CREC, otherwise 0 | CRCD | ? | |

| HFC | 1 = HFC, otherwise 0 | HFCD | ? | |

| MFIN | 1 = MFIN, otherwise 0 | MFIND | ? | |

| WBC | 1 = WBC, otherwise 0 | WBCD | ? | |

| Macroeconomic | ||||

| GDP | Annual percentage change in GDP based on local currency unit (FJD) | GDPP | + | World Bank (2023) |

| Globalisation | ||||

| Economic | Economic globalisation index | EINDX | ? | KOF |

| Social | Political globalisation index | PINDX | ? | KOF |

| Structural dummy | ||||

| COVID-19 | 2019–2020 were taken as dummy variables for COVID as these were the years where there was COVID | COVID | + | Authors |

| Global Financial Crisis | The financial crisis of 2007–2008 denoted by a dummy variable | GFC | + | Authors |

| (a) Wald Test | |||

| Test Stat. | Value | d.f. | Prob. |

| F-stat. | 14.447 ※ | (6, 153) | <0.0001 |

| Chi-square | 101.132 ※ | 7 | <0.0001 |

| (b) Cross-section random (Hausman test) | |||

| Base models | Chi-square | df | Prob. |

| Equation (A1): | 19.365 † | 6 | 0.0036 |

| Equation (A2): | 27.748 † | 6 | 0.0001 |

| Independent Var. | Model I | Model II | Model III |

|---|---|---|---|

| Constant | 0.058343 *** (0.020499) | 0.051934 ** (0.025084) | 0.053348 ** (0.023409) |

| BSIZE | −0.002631 *** (0.000962) | −0.002187 (0.001391) | −0.002187 (0.001391) |

| NIM | 0.041126 * (0.023367) | 0.043847 ** (0.024211) | 0.043847 ** (0.024211) |

| ROA | −0.172920 *** (0.070262) | −0.178528 *** (0.071561) | −0.178528 *** (0.071561) |

| INEF | −0.003160 (0.070262) | −0.003546 (0.007228) | −0.003546 (0.007228) |

| CAR | 0.000574 *** (0.000161) | 0.000559 *** (0.000165) | 0.000559 *** (0.000165) |

| HHI_LOAN | −0.000010 *** (0.001828) | −0.000010 *** (0.000003) | −0.000010 *** (0.000003) |

| LTD | 0.005436 *** (0.001828) | 0.005295 *** (0.001860) | 0.005295 *** (0.001860) |

| NBFI | - | 0.001414 (0.003173) | - |

| COMB | - | - | −0.001414 (0.003173) |

| Adj-R2 | 0.370405 | 0.367090 | 0.367090 |

| F-stat | 14.447350 | 12.600060 | 12.600060 |

| DW-stat | 1.432011 | 1.426605 | 1.426605 |

| Observations | 161 | 161 | 161 |

| Independent | Model IV | Model V | Model VI | Model VII | Model VIII | Model IX |

|---|---|---|---|---|---|---|

| Constant | 0.053765 *** (0.020077) | 0.051220 ** (0.022880) | 0.051220 ** (0.022880) | 0.060704 *** (0.021096) | 0.051828 *** (0.019655) | 0.059533 *** (0.020621) |

| BSIZE | −0.002513 *** (0.000940) | −0.002284 * (0.001359) | −0.002284 * (0.001359) | −0.002757 *** (0.000967) | −0.003075 *** (0.000941) | −0.003358 *** (0.000968) |

| NIM | 0.027540 (0.023287) | 0.029026 (0.024205) | 0.029026 (0.024205) | 0.022958 (0.023669) | 0.024730 (0.022805) | 0.019564 (0.023162) |

| ROA | −0.103087 (0.072668) | −0.152845 ** (0.072220) | −0.152845 ** (0.072220) | −0.117663 (0.073910) | −0.090805 (0.071233) | −0.106831 (0.072331) |

| INEF | 0.000836 (0.007121) | 0.000611 (0.007207) | 0.000611 (0.007207) | −0.001243 (0.007380) | −0.002971 (0.007099) | −0.005364 (0.007356) |

| CAR | 0.000549 *** (0.000158) | 0.000542 *** (0.000198) | 0.000542 *** (0.000198) | 0.000550 *** (0.000157) | 0.000424 *** (0.000161) | 0.000423 *** (0.000160) |

| HHI_LOAN | 0.0000009 *** (0.000002) | −0.000009 *** (0.000003) | −0.000009 *** (0.000003) | −0.000010 *** (0.000002) | −0.000005 * (0.000003) | −0.000006 ** (0.000003) |

| LTD | 0.004944 *** (0.001791) | 0.004924 *** (0.001822) | 0.004924 *** (0.001822) | 0.005405 *** (0.001831) | 0.005013 *** (0.001753) | 0.005471 *** (0.001790) |

| GDPG | −0.000403 *** (0.000138) | −0.000401 *** (0.000133) | −0.000401 *** (0.000133) | −0.000378 *** (0.000140) | 0.000230 (0.000222) | 0.000153 (0.000231) |

| NBFI | - | −0.000728 (0.003109) | - | - | - | - |

| COMB | - | - | −0.000728 (0.003109) | - | - | - |

| GFC | - | - | - | 0.003152 (0.002956) | - | 0.003516 (0.002891) |

| COVID | - | - | - | - | 0.014800 *** (0.005302) | 0.001508 *** (0.005298) |

| Adj-R2 | 0.399793 | 0.396037 | 0.396037 | 0.400333 | 0.425468 | 0.427286 |

| F-stat | 14.32181 | 12.65745 | 12.65745 | 12.86833 | 14.16526 | 12.93714 |

| DW-stat | 1.423518 | 1.420422 | 1.420422 | 1.416154 | 1.506611 | 1.501339 |

| Observations | 161 | 161 | 161 | 161 | 161 | 161 |

| Independent Var. | Model X | Model XI |

|---|---|---|

| Constant | 0.026421 (0.028909) | 0.017789 (0.027654) |

| BSIZE | −0.002768 *** (0.001088) | −0.0022657 ** (0.001083) |

| NIM | 0.033852 (0.020478) | 0.037405 * (0.020185) |

| ROA | −0.118644 * (0.068314) | −0.105948 (0.067188) |

| INEF | −0.006252 (0.007361) | −0.004518 (0.007164) |

| CAR | 0.000239 (0.000176) | 0.000220 (0.000175) |

| HHI_LOAN | 0.000002 (0.000004) | 0.000004 (0.000004) |

| LTD | 0.005336 *** (0.001574) | 0.004969 *** (0.001532) |

| GFC | 0.002602 (0.002543) | - |

| COVID | 0.018054 *** (0.003734) | 0.018712 *** (0.003678) |

| SINDX | 0.000879 (0.000562) | 0.000930 * (0.000560) |

| EINDX | −0.001009 ** (0.000414) | −0.001011 ** (0.000414) |

| Adj-R2 | 0.447563 | 0.447375 |

| F-stat | 11.75306 | 12.81936 |

| DW-stat | 1.484985 | 1.486485 |

| Observations | 147 | 147 |

| Independent Var. | Model XII | Model XIII | Model XIV | Model XV |

|---|---|---|---|---|

| Constant | 0.031068 (0.020284) | 0.031068 (0.020284) | 0.030729 (0.020146) | 0.029320 (0.020840) |

| BSIZE | −0.002039 ** (0.000924) | −0.002039 ** (0.000924) | −0.002087 ** (0.000918) | −0.001984 ** (0.000948) |

| NIM | 0.011345 (0.021787) | 0.011345 (0.021787) | 0.006751 (0.021743) | 0.009236 (0.022015) |

| ROA | −0.017512 (0.069394) | −0.017512 (0.069394) | 0.017422 (0.070912) | −0.000299 (0.070896) |

| INEF | 0.006841 (0.007029) | 0.006841 (0.007029) | 0.010237 (0.007167) | 0.008103 (0.007197) |

| CAR | 0.000420 *** (0.000148) | 0.000420 *** (0.000148) | 0.000343 ** (0.000151) | 0.000403 *** (0.000150) |

| HHI_LOAN | −0.000004 (0.000002) | −0.000004 (0.000002) | −0.000006 (0.000002) | −0.000004 (0.000002) |

| LTD | 0.004288 *** (0.001693) | 0.004288 *** (0.001693) | 0.004110 ** (0.001684) | 0.004201 *** (0.001708) |

| GFC | 0.001928 (0.002707) | 0.001928 (0.002707) | 0.001553 (0.002693) | 0.001757 (0.002731) |

| COVID | 0.005921 * (0.003266) | 0.006047 * (0.003165) | 0.005390 (0.003494) | 0.031334 *** (0.005096) |

| NBFI※COVID | 0.024866 *** (0.005497) | - | - | - |

| COMB※COVID | - | −0.024866 *** (0.005497) | - | - |

| CRECD※COVID | - | - | 0.035455 *** (0.007486) | - |

| MFINCD※COVID | - | - | 0.017770 *** (0.006856) | - |

| HFCD※COVID | - | - | 0.003422 (0.006602) | −0.022710 *** (0.007598) |

| ANZD※COVID | - | - | - | −0.025246 *** (0.007972) |

| BOBD※COVID | - | - | - | −0.025665 *** (0.007593) |

| BSPD※COVID | - | - | - | −0.032257 *** (0.007944) |

| WBCD※COVID | - | - | - | −0.020733 *** (0.007591) |

| Adj-R2 | 0.494567 | 0.494567 | 0.502140 | 0.487988 |

| F-stat | 16.65601 | 16.65601 | 14.44796 | 11.89234 |

| DW-stat | 1.758679 | 1.758679 | 1.851695 | 1.776930 |

| Observations | 161 | 161 | 161 | 161 |

Appendix B

| Descriptive statistics | |||||||||||

| Variable Statistics | NPLs | BSIZE | NIM | ROA | INEF | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX |

| Mean | 0.01 | 13.42 | 0.04 | 0.02 | 1.09 | 48.97 | 2198.84 | 0.97 | 1.93 | 51.44 | 67.64 |

| Median | 0.01 | 13.58 | 0.03 | 0.02 | 0.58 | 18.33 | 2143.10 | 0.88 | 3.81 | 51.58 | 67.16 |

| Maximum | 0.08 | 15.02 | 0.12 | 0.14 | 38.40 | 1876.00 | 2698.07 | 8.09 | 16.10 | 53.59 | 69.15 |

| Minimum | 0.00 | 11.14 | 0.00 | −0.08 | 0.31 | 11.51 | 1780.24 | 0.01 | −17.00 | 48.52 | 66.53 |

| Std. Dev. | 0.01 | 1.18 | 0.03 | 0.03 | 4.04 | 208.60 | 297.96 | 0.80 | 7.78 | 1.59 | 0.99 |

| Skewness | 2.99 | −0.30 | 1.17 | 0.41 | 9.11 | 8.05 | 0.26 | 7.99 | −0.82 | −0.31 | 0.38 |

| Kurtosis | 13.46 | 1.65 | 2.90 | 8.72 | 84.60 | 69.27 | 1.72 | 71.50 | 4.35 | 2.02 | 1.50 |

| Probability | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Observation | 88 | 88 | 88 | 88 | 88 | 88 | 88 | 88 | 88 | 72 | 72 |

| Correlation | |||||||||||

| NPLs | BSIZE | NIM | ROA | INEF | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX | |

| NPLs | 1 | ||||||||||

| BSIZE | −0.26 | 1 | |||||||||

| NIM | 0.42 | −0.62 | 1 | ||||||||

| ROA | 0.02 | −0.12 | 0.75 | 1 | |||||||

| INEF | 0.02 | −0.25 | −0.19 | −0.41 | 1 | ||||||

| CAR | 0.05 | −0.29 | −0.11 | −0.34 | 1.00 | 1 | |||||

| HHI_LOAN | −0.25 | −0.26 | 0.10 | 0.01 | 0.19 | 0.20 | 1 | ||||

| LTD | 0.13 | −0.09 | 0.14 | 0.07 | −0.12 | −0.13 | −0.18 | 1 | |||

| GDPG | −0.51 | −0.12 | 0.04 | 0.14 | 0.01 | 0.01 | 0.56 | −0.31 | 1 | ||

| EINDX | −0.38 | −0.21 | 0.09 | 0.08 | 0.14 | 0.14 | 0.88 | −0.21 | 0.64 | 1 | |

| SINDX | 0.09 | 0.21 | −0.10 | 0.03 | −0.14 | −0.14 | −0.78 | 0.03 | −0.12 | −0.74 | 1 |

| Independent Var. | Model I | Model II | Model III |

|---|---|---|---|

| Constant | 0.050226 (0.098110) | −0.007693 (0.124417) | 0.001337 (0.117526) |

| BSIZE | −0.000236 (0.006343) | 0.003555 (0.008081) | 0.003555 (0.008081) |

| NIM | 0.113911 (0.183518) | 0.117570 (0.184113) | 0.117570 (0.184113) |

| ROA | −0.146427 * (0.082954) | −0.178253 * (0.093123) | −0.178253 * (0.093123) |

| INEF | 0.000252 (0.000423) | 0.000368 (0.000450) | 0.000368 (0.000450) |

| CAR | 0.000002 ** (0.000007) | 0.000002 (0.000007) | 0.000002 (0.000007) |

| HHI_LOAN | −0.000017 (0.000007) | −0.000001 * (0.000007) | −0.000001 * (0.000007) |

| LTD | 0.000518 (0.001749) | 0.000223 (0.001797) | 0.000223 (0.001797) |

| NBFI | - | 0.009030 (0.011872) | - |

| COMB | - | - | −0.009030 (0.011872) |

| Adj-R2 | 0.319537 | 0.315586 | 0.315586 |

| F-stat | 3.918148 | 3.674399 | 3.674399 |

| DW-stat | 1.398449 | 1.375623 | 1.375623 |

| Observations | 88 | 88 | 88 |

| Independent | Model IV | Model V | Model VI | Model VII |

|---|---|---|---|---|

| Constant | 0.089980 (0.099416) | 0.060641 (0.130376) | 0.064895 (0.122952) | 0.047803 (0.095801) |

| BSIZE | −0.003017 (0.006456) | −0.001087 (0.008511) | −0.001087 (0.008511) | −0.001693 (0.006166) |

| NIM | 0.096887 (0.181269) | 0.099491 (0.182534) | 0.099491 (0.182534) | 0.005131 (0.175532) |

| ROA | −0.077367 (0.090901) | −0.095929 (0.105658) | −0.095929 (0.105658) | −0.068458 (0.086630) |

| INEF | 0.000191 (0.000419) | 0.000248 (0.000452) | 0.000248 (0.000452) | 0.000206 (0.000399) |

| CAR | 0.000001 (0.000007) | 0.000001 (0.000007) | 0.000001 (0.000007) | −0.000003 (0.000007) |

| HHI_LOAN | −0.000018 *** (0.000007) | −0.000017 ** (0.000007) | −0.000017 ** (0.000007) | −0.000007 (0.000007) |

| LTD | −0.000251 (0.001781) | −0.000351 (0.001814) | −0.000351 (0.001814) | −0.000281 (0.001696) |

| GDPG | −0.000325 (0.000186) | −0.000308 (0.000194) | −0.000308 (0.000194) | 0.000328 (0.000287) |

| NBFI | - | 0.004254 (0.012124) | - | - |

| COMB | - | - | −0.004254 (0.012124) | - |

| COVID | - | - | - | 0.018432 *** (0.006370) |

| Adj-R2 | 0.338039 | 0.329878 | 0.329878 | 0.399533 |

| F-stat | 3.961845 | 3.676689 | 3.676689 | 4.617951 |

| DW-stat | 1.381886 | 1.370285 | 1.370285 | 1.544449 |

| Observations | 88 | 88 | 88 | 88 |

| Independent Var. | Model VIII |

|---|---|

| Constant | −0.358831 * (0.200225) |

| BSIZE | 0.019394 *** (0.004475) |

| NIM | 0.658651 *** (0.141892) |

| ROA | −0.661328 *** (0.094243) |

| INEF | 0.007157 (0.004946) |

| CAR | −0.000384 (0.000284) |

| HHI_LOAN | 0.000014 0.000008 |

| LTD | −0.001161 (0.001126) |

| COVID | 0.011977 ** (0.005545) |

| SINDX | 0.001245 (0.001990) |

| EINDX | −0.000410 (0.001537) |

| Adj-R2 | 0.718157 |

| F-stat | 11.64197 |

| DW-stat | 1.583276 |

| Observations | 72 |

| Independent Var. | Model IX | Model X | Model XI | Model XII |

|---|---|---|---|---|

| Constant | 0.087495 (0.087310) | 0.087495 (0.087310) | 0.147588 (0.092946) | 0.147737 (0.099707) |

| BSIZE | −0.004220 (0.005693) | −0.004220 (0.005693) | −0.008152 (0.006073) | −0.007861 (0.006355) |

| NIM | 0.106784 (0.166400) | 0.106784 (0.005693) | 0.002960 (0.168730) | 0.136812 (0.185866) |

| ROA | −0.005639 (0.080199) | −0.005639 (0.080199) | 0.046259 (0.081919) | 0.033141 (0.083570) |

| INEF | 0.000225 (0.000375) | 0.000225 (0.000375) | 0.0000059 (0.000377) | 0.000516 (0.000763) |

| CAR | 0.000001 (0.000006) | 0.000001 (0.000006) | 0.000004 (0.000006) | −0.0000028 (0.0000057) |

| HHI_LOAN | −0.000012 * (0.000006) | −0.000012 * (0.000006) | −0.000014 * (0.000006) | −0.000015 ** (0.000007) |

| LTD | 0.000227 (0.001601) | 0.000227 (0.001601) | 0.000832 (0.001611) | −0.007599 (0.016899) |

| COVID | 0.007121 * (0.004103) | 0.029332 *** (0.006370) | 0.005561 (0.004363) | 0.030340 *** (0.006418) |

| NBFI※COVID | 0.022212 *** (0.006917) | - | - | - |

| COMB※COVID | - | −0.022212 *** (0.006917) | - | - |

| CRECD※COVID | - | - | 0.036040 *** (0.008994) | - |

| MFINCD※COVID | - | - | 0.012892 (0.009141) | - |

| HFCD※COVID | - | - | 0.011737 (0.009420) | −0.013306 (0.010284) |

| ANZD※COVID | - | - | - | −0.023651 ** (0.010169) |

| BOBD※COVID | - | - | - | −0.022381 ** (0.010020) |

| BRED※COVID | - | - | - | 0.057969 (0.105880) |

| BSPD※COVID | - | - | - | −0.035771 *** (0.010200) |

| WBCD※COVID | - | - | - | −0.019712 * (0.010120) |

| Adj-R2 | 0.466044 | 0.466044 | 0.491639 | 0.461386 |

| F-stat | 5.745933 | 5.745933 | 5.674340 | 4.548849 |

| DW-stat | 1.785511 | 1.785511 | 2.050825 | 1.905205 |

| Observations | 88 | 88 | 88 | 88 |

| 1 | https://www.bankingsupervision.europa.eu/about/ssmexplained/html/npl.en.html, accessed on 5 August 2023. |

| 2 | Credit Corporation was established in 1978 and originated from Papua New Guinea and with operations in Fiji, Solomon Islands, and Vanuatu. |

| 3 | https://www.rbf.gov.fj/wp-content/uploads/2019/06/NA2005_03.pdf, accessed on 5 August 2023. |

| 4 | https://www.trade.gov/country-commercial-guides/fiji-trade-financing, accessed on 5 August 2023. |

| 5 | |

| 6 | Additionally, other aspects, such as insurance companies (Kumar et al. 2022b) and the stock market analysis (Kumar et al. 2022a; Kumar and Stauvermann 2022), are important for a robust operation of the financial system. |

| 7 | We have excluded the BRED bank from the sample because of the small sample size (2012–2022). Including the BRED bank reduces the total sample in the panel for all other banks, which have data since 2000 and do not capture the effect of the GFC. Nevertheless, we include the estimations with the BRED bank in Appendix B (respective tables) for additional insights. We note that the results obtained are generally consistent with the main results. |

| 8 | We set the HFC bank as a reference, hence dropping its dummy to avoid the “dummy-trap”. |

| 9 | To avoid the problem where of the number of cross-sections is less than the number of coefficients, we dropped HHI_LOAN in the first case and then we included HHI_LOAN in the second case and dropped LTD. In both cases, the results consistently support the fixed-effect method. |

| 10 | |

| 11 | Note that HFC was a non-bank until 2014. |

| 12 | As an aside, we also provide OLS-based results (see Appendix A, Table A3, Table A4, Table A5 and Table A6), which are generally consistent with the results obtained from the fixed-effect estimation method. |

References

- Abata, Matthew Adeolu. 2014. Asset quality and bank performance: A study of commercial banks in Nigeria. Research Journal of Finance and Accounting 5: 39–44. [Google Scholar]

- Adeyemi, Babalola. 2011. Bank failure in Nigeria: A consequence of capital inadequacy, lack of transparency and non-performing loans? Banks & Bank Systems 6: 99–109. [Google Scholar]

- Adusei, Charles. 2018. Determinants of non-performing loans in the banking sector of Ghana between 1998 and 2013. Asian Development Policy Review 6: 142–54. [Google Scholar] [CrossRef]

- Ahiase, Godwin, Denny Andriana, Edinam Agbemava, and Bright Adonai. 2023. Macroeconomic cyclical indicators and bank non-performing loans: Does country governance matter in African countries? International Journal of Social Economics. Available online: https://www.emerald.com/insight/content/doi/10.1108/IJSE-11-2022-0729/full/html (accessed on 5 August 2023).

- Ahmed, Shakeel, M. Ejaz Majeed, Eleftherios Thalassinos, and Yannis Thalassinos. 2021. The impact of bank specific and macro-economic factors on non-performing loans in the banking sector: Evidence from an emerging economy. Journal of Risk and Financial Management 14: 217. [Google Scholar] [CrossRef]

- Akhter, Nazmoon. 2023. Determinants of commercial bank’s non-performing loans in Bangladesh: An empirical evidence. Cogent Economics & Finance 11: 2194128. [Google Scholar]

- Ali, Muhammad, and Chin Hong Puah. 2019. The internal determinants of bank profitability and stability: An insight from banking sector of Pakistan. Management Research Review 42: 49–67. [Google Scholar] [CrossRef]

- Alnabulsi, Khalil, Emira Kozarević, and Abdelaziz Hakimi. 2022. Assessing the determinants of non-performing loans under financial crisis and health crisis: Evidence from the MENA banks. Cogent Economics & Finance 10: 2124665. [Google Scholar]

- Apergis, Nicholas. 2022. Convergence in non-performing loans across EU banks: The role of COVID-19. Cogent Economics & Finance 10: 2024952. [Google Scholar]

- Asiama, Rexford Kweku, Anthony Amoah, and Godson Ahiabor. 2020. Does mobile money business influence non-performing loans in the traditional banking sector? Evidence from Ghana. African Journal of Business and Economic Research 15: 171. [Google Scholar] [CrossRef]

- Bardhan, Samaresh, Rajesh Sharma, and Vivekananda Mukherjee. 2019. Threshold effect of bank-specific determinants of non-performing assets: An application in Indian banking. Journal of Emerging Market Finance 18: S1–S34. [Google Scholar] [CrossRef]

- Bayar, Yilmaz. 2019. Macroeconomic, institutional and bank-specific determinants of non-performing loans in emerging market economies: A dynamic panel regression analysis. Journal of Central Banking Theory and Practice 8: 95–110. [Google Scholar] [CrossRef]

- Ben Bouheni, Faten, Hassan Obeid, and Elena Margarint. 2022. Nonperforming loan of European Islamic banks over the economic cycle. Annals of Operations Research 313: 773–808. [Google Scholar] [CrossRef]

- Berger, Allen N., and Robert DeYoung. 1997. Problem loans and cost efficiency in commercial banks. Journal of Banking & Finance 21: 849–70. [Google Scholar]

- Bolarinwa, Segun Thompson, and Anthony Enisan Akinlo. 2022. Determinants of nonperforming loans after recapitalization in the Nigerian banking industry: Does competition matter? African Development Review 34: 309–23. [Google Scholar] [CrossRef]

- Carr, Marilyn, and Martha Alter Chen. 2002. Globalization and the Informal Economy: How Global Trade and Investment Impact on the Working Poor? Geneva: International Labour Office. Available online: https://www.ilo.org/employment/Whatwedo/Publications/WCMS_122053/lang--en/index.htm (accessed on 5 August 2023).

- Cetorelli, Nicola, Mattia Landoni, and Lina Lu. 2023. Non-Bank Financial Institutions and Banks’ Fire-Sale Vulnerabilities (March 2023). FRB of New York Staff Report No. 1057 2023. Available online: https://ssrn.cm/abstract=4384353 (accessed on 5 August 2023).

- Chand, Shasnil Avinesh, Ronald Ravinesh Kumar, and Peter Josef Stauvermann. 2021. Determinants of bank stability in a small island economy: A study of Fiji. Accounting Research Journal 34: 22–42. [Google Scholar] [CrossRef]

- Chandra, Aman, Tiru K. Jayaraman, and Filimone Waqabaca. 2004. Reforms in banking supervision in Fiji: A review of progress. Pacific Economic Bulletin 19: 102–14. [Google Scholar]

- Chareonwongsak, Kriengsak. 2002. Globalization and technology: How will they change society? Technology in Society 24: 191–206. [Google Scholar] [CrossRef]

- Cheng, Xiaoqiang, and Hans Degryse. 2010. The impact of bank and non-bank financial institutions on local economic growth in China. Journal of Financial Services Research 37: 179–99. [Google Scholar] [CrossRef]

- Choudhary, Rhea, Suchita Mathur, and Peter Wallis. 2023. Leverage, Liquidity and Non-Bank Financial Institutions: Key Lessons from Recent Market Events. In Financial Stability Bulletin; June. Available online: https://www.rba.gov.au/publications/bulletin/2023/jun/leverage-liquidity-and-non-bank-financial-institutions.html (accessed on 5 August 2023).

- Constant, Fouopi Djiogap, and Augustin Ngomsi. 2012. Determinants of bank long-term lending behavior in the Central African Economic and Monetary Community (CEMAC). Review of Economics & Finance 2: 107–14. [Google Scholar]

- Cortavarria-Checkley, Luis, Claudia Dziobek, Akihiro Kanaya, and Inwon Song. 2000. Loan Review, Provisioning, and Macroeconomic Linkages. WP/OO/195, IMF. Available online: https://www.imf.org/external/pubs/ft/wp/2000/wp00195.pdf (accessed on 5 August 2023).

- Cucinelli, Doriana. 2015. The impact of non-performing loans on bank lending behavior: Evidence from the Italian banking sector. Eurasian Journal of Business and Economics 8: 59–71. [Google Scholar] [CrossRef]

- Curak, Marijana, Sandra Pepur, and Klime Poposki. 2013. Determinants of non-performing loans–evidence from Southeastern European banking systems. Banks and Bank Systems 8: 45–53. [Google Scholar]

- Demirgüç-Kunt, Ash, and Harry Huizinga. 1999. Determinants of commercial bank interest margins and profitability: Some international evidence. The World Bank Economic Review 13: 379–408. [Google Scholar] [CrossRef]

- Dreher, Axel. 2006. Does globalization affect growth? Evidence from a new index of globalization. Applied Economics 38: 1091–110. [Google Scholar] [CrossRef]

- Dreher, Axel, Noel Gaston, and Pim Martens. 2008. Measuring globalisation. Gauging Its Consequences. New York: Springer. [Google Scholar]

- Duho, King Carl Tornam, Joseph Mensah Onumah, and Raymond Agbesi Owodo. 2020. Bank diversification and performance in an emerging market. International Journal of Managerial Finance 16: 120–38. [Google Scholar] [CrossRef]

- El-Chaarani, Hani, and Rebecca Abraham. 2022. The impact of corporate governance and political connectedness on the financial performance of Lebanese banks during the financial crisis of 2019–2021. Journal of Risk and Financial Management 15: 203. [Google Scholar] [CrossRef]

- Erdas, Mehmet Levent, and Zeynep Ezanoglu. 2022. How do bank-specific factors impact non-performing loans: Evidence from G20 countries. Journal of Central Banking Theory and Practice 11: 97–122. [Google Scholar] [CrossRef]

- ETH-Zurich. 2023. KOF Index of Globalization. Switzerland: KOF Swiss Economic Institute. Available online: https://kof.ethz.ch/en/forecasts-and-indicators/indicators/kof-globalisation-index.html (accessed on 5 August 2023).

- Fakhrunnas, Faaza, Rindang Nuri Isnaini Nugrohowati, Razali Haron, and Mohammad Bekti Hendrie Anto. 2022. The determinants of non-performing loans in the Indonesian banking industry: An asymmetric approach before and during the pandemic crisis. SAGE Open 12: 21582440221102421. [Google Scholar] [CrossRef]

- Fallanca, Mariagrazia, Antonio Fabio Forgione, and Edoardo Otranto. 2021. Do the determinants of non-performing loans have a different effect over time? A conditional correlation approach. Journal of Risk and Financial Management 14: 21. [Google Scholar] [CrossRef]

- Farooq, Mohammad Omar, Mohammed Elseoud, Seref Turen, and Mohamed Abdulla. 2019. Causes of non-performing loans: The experience of gulf cooperation council countries. Entrepreneurship and Sustainability Issues 6: 1955–74. [Google Scholar] [CrossRef]

- Foglia, Matteo. 2022. Non-performing loans and macroeconomics factors: The Italian case. Risks 10: 21. [Google Scholar] [CrossRef]

- Gashi, Adelina, Saranda Tafa, and Roberta Bajrami. 2022. The Impact of Macroeconomic Factors on Non-performing Loans in the Western Balkans. Emerging Science Journal 6: 1032–45. [Google Scholar] [CrossRef]

- Ghosh, Amit. 2015. Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. Journal of Financial Stability 20: 93–104. [Google Scholar] [CrossRef]

- Giammanco, Maria Daniela, Lara Gitto, and Ferdinando Ofria. 2022. Government failures and non-performing loans in Asian countries. Journal of Economic Studies, ahead-of-print. [Google Scholar] [CrossRef]

- Golitsis, Petros, Khurshid Khudoykulov, and Savica Palanov. 2022. Determinants of non-performing loans in North Macedonia. Cogent Business & Management 9: 2140488. [Google Scholar]

- Gounder, Neelesh, and Parmendra Sharma. 2012. Determinants of bank net interest margins in Fiji, a small island developing state. Applied Financial Economics 22: 1647–54. [Google Scholar] [CrossRef]

- Greenidge, Kevin, and Tiffany Grosvenor. 2010. Forecasting non-perproming loans in Barbados. Journal of Business, Finance & Economics in Emerging Economies 5: 1–30. Available online: https://www.cert-net.com/files/publications/journal/2010_1_5/79_108.pdf (accessed on 5 August 2023).

- Hajja, Yaman. 2022. Impact of bank capital on non-performing loans: New evidence of concave capital from dynamic panel-data and time series analysis in Malaysia. International Journal of Finance & Economics 27: 2921–48. [Google Scholar]

- Hakimi, Abdelaziz, Rim Boussaada, and Majdi Karmani. 2022. Is the relationship between corruption, government stability and non-performing loans non-linear? A threshold analysis for the MENA region. International Journal of Finance & Economics 27: 4383–98. [Google Scholar]

- Jubilee, Ribed Vianneca, Fakarudin Kamarudin, Ahmed Razman Abdul Latiff, Hafezali Iqbal Hussain, and Nazratul Aina Mohamad Anwar. 2022. Does globalisation have an impact on dual banking system productivity in selected Southeast Asian banking industry? Asia-Pacific Journal of Business Administration 14: 479–515. [Google Scholar] [CrossRef]

- Karadima, Maria, and Helen Louri. 2020. Non-performing loans in the euro area: Does bank market power matter? International Review of Financial Analysis 72: 101593. [Google Scholar] [CrossRef]

- Karadima, Maria, and Helen Louri. 2021. Economic policy uncertainty and non-performing loans: The moderating role of bank concentration. Finance Research Letters 38: 101458. [Google Scholar] [CrossRef]

- Khairi, Ardhi, Bahri Bahri, and Bhenu Artha. 2021. A literature review of non-performing loan. Journal of Business and Management Review 2: 366–73. [Google Scholar] [CrossRef]

- Khan, Muhammad Asif, Asima Siddique, and Zahid Sarwar. 2020. Determinants of non-performing loans in the banking sector in developing state. Asian Journal of Accounting Research 5: 135–45. [Google Scholar] [CrossRef]

- Kjosevski, Jordan, and Mihail Petkovski. 2021. Macroeconomic and bank-specific determinants of non-performing loans: The case of Baltic states. Empirica 48: 1009–28. [Google Scholar] [CrossRef]

- Kjosevski, Jordan, Mihail Petkovski, and Elena Naumovska. 2019. Bank-specific and macroeconomic determinants of non-performing loans in the Republic of Macedonia: Comparative analysis of enterprise and household NPLs. Economic Research-Ekonomska Istraživanja 32: 1185–203. [Google Scholar] [CrossRef]

- Krasniqi-Pervetica, Agnesa, and Skender Ahmeti. 2022. The effect of macroeconomic indicators on non-performing loans: The case of Balkan countries. International Journal of Applied Economics, Finance and Accounting 14: 42–49. [Google Scholar] [CrossRef]

- Kryzanowski, Lawrence, Jinjing Liu, and Jie Zhang. 2023. Effect of COVID-19 on non-performing loans in China. Finance Research Letters 52: 103372. [Google Scholar] [CrossRef]

- Kumar, Ronald Ravinesh. 2014. Modelling the supply of private used cars: A study of two prominent brands in Fiji. International Journal of Economics and Business Research 7: 419–30. [Google Scholar] [CrossRef]

- Kumar, Ronald Ravinesh, and Arvind Patel. 2014. Exploring competitiveness in banking sector of a small island economy: A study of Fiji. Quality & Quantity 48: 3169–83. [Google Scholar]

- Kumar, Ronald Ravinesh, and Peter Josef Stauvermann. 2022. Portfolios under different methods and scenarios: A case of Fiji’s South Pacific Stock Exchange. Journal of Risk and Financial Management 15: 549. [Google Scholar] [CrossRef]

- Kumar, Ronald Ravinesh, Peter Josef Stauvermann, and Aristeidis Samitas. 2022a. An application of portfolio mean-variance and semi-variance optimization techniques: A case of Fiji. Journal of Risk and Financial Management 15: 190. [Google Scholar] [CrossRef]

- Kumar, Ronald Ravinesh, Peter Josef Stauvermann, Arvind Patel, and Selvin Sanil Prasad. 2018. Determinants of non-performing loans in banking sector in small developing island states: A study of Fiji. Accounting Research Journal 31: 192–213. [Google Scholar] [CrossRef]

- Kumar, Ronald Ravinesh, Peter Josef Stauvermann, Arvind Patel, Selvin Prasad, and Nikeel N. Kumar. 2022b. Profitability determinants of the insurance sector in small Pacific Island States: A study of Fiji’s insurance companies. Engineering Economics 33: 302–15. [Google Scholar] [CrossRef]

- Kuzucu, Narman, and Serpil Kuzucu. 2019. What drives non-performing loans? Evidence from emerging and advanced economies during pre-and post-global financial crisis. Emerging Markets Finance and Trade 55: 1694–708. [Google Scholar] [CrossRef]

- Küçük, Şeyma Yilmaz. 2022. Determinants of non-performing consumer loans for Turkey: ARDL bounds testing approach. Business, Management and Economics Engineering 20: 312–28. [Google Scholar] [CrossRef]

- Loang, Ooi Kok, Zamri Ahmad, and R. V. Naveenan. 2023. Non-performing loans, macroeconomic and bank-specific variables in Southeast Asia during COVID-19 pandemic. The Singapore Economic Review 68: 941–61. [Google Scholar] [CrossRef]

- Lodhia, Sumit K., and Roger L. Burritt. 2004. Public sector accountability failure in an emerging economy: The case of the National Bank of Fiji. International Journal of Public Sector Management 17: 345–59. [Google Scholar] [CrossRef]

- Mdaghri, Alaoui A. 2022. How does bank liquidity creation affect non-performing loans in the MENA region? International Journal of Emerging Markets 17: 1635–58. [Google Scholar] [CrossRef]

- Messai, Ahlem Selma, and Fathi Jouini. 2013. Micro and macro determinants of non-performing loans. International Journal of Economics and Financial Issues 3: 852–60. [Google Scholar]

- Misman, Faridah Najuna, and M. Ishaq Bhatti. 2020. The determinants of credit risk: An evidence from ASEAN and GCC Islamic banks. Journal of risk and Financial Management 13: 89. [Google Scholar] [CrossRef]

- Nguyen, James. 2012. The relationship between net interest margin and noninterest income using a system estimation approach. Journal of Banking & Finance 36: 2429–37. [Google Scholar]

- Ofria, Ferdinando, and Massimo Mucciardi. 2022. Government failures and non-performing loans in European countries: A spatial approach. Journal of Economic Studies 49: 876–87. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2019. Non-performing loans and financial development: New evidence. The Journal of Risk Finance 20: 59–81. [Google Scholar] [CrossRef]

- Pascual, Antonio Garcia, Fabio Natalucci, and Thoomas Piontek. 2023. Nonbank Financial Sector Vulnerabilities Surface as Financial Conditions Tighten. Financial Stability, IMF Blog. April 4. Available online: https://www.imf.org/en/Blogs/Articles/2023/04/04/nonbank-financial-sector-vulnerabilities-surface-as-financial-conditions-tighten (accessed on 3 August 2023).

- Pastory, Dickson. 2021. The determinants of non-performing loans in commercial banks. In Sustainable Education and Development. Berlin and Heidelberg: Springer International Publishing, pp. 394–409. [Google Scholar]

- Petkovski, Mihail, Jordan Kjosevski, and Kiril Jovanovski. 2021. Macro and bank specific determinants of non-performing loans in Polish commercial banks. Argumenta Oeconomica 47: 107–26. Available online: https://repository.ukim.mk/bitstream/20.500.12188/18371/1/Petkovski_Kjosevski_Jovanovski_Macro_and_bank_specific.pdf (accessed on 5 August 2023). [CrossRef]

- Phung, Quang Thanh, Huong Van Vu, and Huy Phuoc Tran. 2022. Do non-performing loans impact bank efficiency? Finance Research Letters 46: 102393. [Google Scholar] [CrossRef]

- Rachman, Rathria Arrina, Yohanes Berenika Kadarusman, Kevin Anggriono, and Robertus Setiadi. 2018. Bank-specific factors affecting non-performing loans in developing countries: Case study of Indonesia. The Journal of Asian Finance, Economics and Business 5: 35–42. [Google Scholar] [CrossRef]

- Rahman, Md Lutfur, Victor Troster, Gazi Salah Uddin, and Muhammad Yahya. 2022. Systemic risk contribution of banks and non-bank financial institutions across frequencies: The Australian experience. International Review of Financial Analysis 79: 101992. [Google Scholar] [CrossRef]

- Reserve Bank of Fiji (RBF). 2023. Published Disclosure Statements, RBF, Suva, Fiji. Available online: www.rbf.gov.fj/Left-Menu/Regulatory-Framework/Published-Disclosure-Statements.aspx (accessed on 12 July 2023).

- Saliba, Chafic, Panteha Farmanesh, and Seyed Alireza Athari. 2023. Does country risk impact the banking sectors’ non-performing loans? Evidence from BRICS emerging economies. Financial Innovation 9: 1–30. [Google Scholar] [CrossRef]

- Serrano, Antonio Sánchez. 2021. The impact of non-performing loans on bank lending in Europe: An empirical analysis. The North American Journal of Economics and Finance 55: 101312. [Google Scholar] [CrossRef]

- Sharma, Parmendra, and Neelesh Gounder. 2012. Profitability determinants of deposit institutions in small, underdeveloped financial systems: The case of Fiji. Griffith Business School Discussion Papers Finance 6: 1–21. Available online: https://core.ac.uk/download/pdf/6441164.pdf (accessed on 5 August 2023). [CrossRef][Green Version]

- Sharma, Parmendra, Eduardo Roca, Vilimaina Dakai, and Savaira Manoa. 2014. An Assessment of Fiji’s Banking Sector on a Global Scale, Joint Policy Research Working Paper, Griffith Asia Institute and Reserve Bank of Fiji. Available online: https://www.griffith.edu.au/__data/assets/pdf_file/0019/219322/JPRWP1-web.pdf (accessed on 12 September 2023).

- Silaban, Pasaman. 2017. The Effect of Capital Adequacy Ratio, Net Interest Margin and Non-Performing Loans on Bank Profitability: The Case of Indonesia. International Journal of Economics and Business Administration 5: 58–69. [Google Scholar] [CrossRef]

- Siwatibau, Savenaca. 1996. The National Bank of Fiji. Pacific Economic Bulletin 11: 76–84. Available online: https://openresearch-repository.anu.edu.au/bitstream/1885/157444/1/111_national.pdf (accessed on 5 August 2023).

- Staehr, Karsten, and Lenno Uusküla. 2020. Macroeconomic and macro-financial factors as leading indicators of non-performing loans: Evidence from the EU countries. Journal of Economic Studies 48: 720–40. [Google Scholar] [CrossRef]

- Syed, Aamir Aijaz, Muhammad Abdul Kamal, Simon Grima, and Assad Ullah. 2022. The impact of financial development and macroeconomic fundamentals on nonperforming loans among emerging countries: An assessment using the NARDL Approach. Computation 10: 182. [Google Scholar] [CrossRef]

- Tatarici, Luminita Roxana, Matei Nicolae Kubinschi, and Dinu Barnea. 2020. Determinants of non-performing loans for the EEC Region. A financial stability perspective. Management & Marketing. Challenges for the Knowledge Society 15: 621–42. [Google Scholar]

- Theiri, Saliha, and Slim Hadoussa. 2023. Digitization effects on banks’ financial performance: The case of an African country. Competitiveness Review: An International Business Journal. [Google Scholar] [CrossRef]

- Umar, Muhammad, and Gang Sun. 2018. Determinants of non-performing loans in Chinese banks. Journal of Asia Business Studies 12: 273–89. [Google Scholar] [CrossRef]

- World Bank. 2023. World development indicators and Worldwide Governance Indicators. Whashington, DC: World Bank. [Google Scholar]

- Yulianti, Eka, Aliamin Aliamin, and Ridwan Ibrahim. 2018. The effect of capital adequacy and bank size on non-performing loans in Indonesian public banks. Journal of Accounting Research, Organization and Economics 1: 205–14. [Google Scholar] [CrossRef]

- Zhang, Dayong, Jing Cai, David G. Dickinson, and Ali M. Kutan. 2016. Non-performing loans, moral hazard and regulation of the Chinese commercial banking system. Journal of Banking & Finance 63: 48–60. [Google Scholar]

- Žunić, Amila, Kemal Kozarić, and Emina Žunić Dželihodžić. 2021. Non-performing loan determinants and impact of covid-19: Case of Bosnia and Herzegovina. Journal of Central Banking Theory and Practice 10: 5–22. [Google Scholar] [CrossRef]

| Descriptive statistics | |||||||||||

| Variable Statistics | NPLs | BSIZE | NIM | ROA | INEF | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX |

| Mean | 0.01 | 12.96 | 0.06 | 0.03 | 0.29 | 19.04 | 2480.72 | 0.98 | 1.66 | 49.85 | 64.33 |

| Median | 0.01 | 13.11 | 0.04 | 0.02 | 0.25 | 16.55 | 2599.35 | 0.94 | 2.00 | 50.96 | 65.26 |

| Maximum | 0.08 | 15.02 | 0.56 | 0.09 | 0.67 | 49.77 | 2928.96 | 2.58 | 16.10 | 53.88 | 69.15 |

| Minimum | 0.00 | 10.64 | 0.02 | −0.03 | 0.08 | 8.81 | 1780.24 | 0.00 | −17.00 | 39.88 | 55.41 |

| Std. Dev. | 0.01 | 1.27 | 0.05 | 0.02 | 0.13 | 7.00 | 351.55 | 0.48 | 5.56 | 3.78 | 3.66 |

| Skewness | 2.75 | −0.08 | 5.51 | 0.94 | 0.93 | 1.28 | −0.64 | 0.46 | −0.93 | −1.40 | −0.70 |

| Kurtosis | 14.18 | 1.72 | 50.49 | 4.01 | 2.96 | 4.94 | 2.10 | 4.14 | 7.73 | 3.93 | 2.76 |

| Probability | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Observation | 161 | 161 | 161 | 161 | 161 | 161 | 161 | 161 | 161 | 147 | 147 |

| Correlation | |||||||||||

| NPLs | BSIZE | NIM | ROA | INEF | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX | |

| NPLs | 1 | ||||||||||

| BSIZE | −0.4 | 1 | |||||||||

| NIM | 0.37 | −0.58 | 1 | ||||||||

| ROA | 0.14 | −0.41 | 0.68 | 1 | |||||||

| INEF | −0.15 | −0.08 | −0.15 | −0.4 | 1 | ||||||

| CAR | 0.38 | −0.58 | 0.42 | 0.55 | −0.11 | 1 | |||||

| HHI_LOAN | −0.11 | −0.34 | 0.2 | 0.14 | 0.01 | −0.06 | 1 | ||||

| LTD | 0.28 | −0.17 | 0.47 | 0.4 | −0.28 | 0.21 | 0.2 | 1 | |||

| GDPG | −0.39 | −0.06 | −0.02 | 0.16 | −0.15 | −0.05 | 0.28 | −0.01 | 1 | ||

| EINDX | −0.21 | 0.28 | −0.01 | 0.22 | 0.07 | 0.19 | 0 | 0.16 | 0.17 | 1 | |

| SINDX | −0.07 | 0.44 | −0.15 | 0.04 | 0.09 | 0.21 | −0.59 | 0 | 0.01 | 0.73 | 1 |

| Descriptive statistics | |||||||||||

| Variable Statistics | NPLs | BSIZE | NIM | ROA | INEFB | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX |

| Mean | 0.02 | 12.37 | 0.08 | 0.04 | 0.23 | 23.28 | 2480.72 | 1.15 | 1.66 | 49.85 | 64.33 |

| Median | 0.01 | 11.98 | 0.09 | 0.04 | 0.21 | 23.06 | 2599.35 | 1.13 | 2.00 | 50.96 | 65.26 |

| Maximum | 0.08 | 14.74 | 0.15 | 0.09 | 0.45 | 49.77 | 2928.96 | 2.04 | 16.10 | 53.88 | 69.15 |

| Minimum | 0.00 | 10.64 | 0.02 | −0.03 | 0.14 | 9.38 | 1780.24 | 0.69 | −17.00 | 39.88 | 55.41 |

| Std. Dev. | 0.02 | 1.30 | 0.04 | 0.02 | 0.07 | 8.15 | 353.02 | 0.26 | 5.58 | 3.78 | 3.66 |

| Skewness | 2.02 | 0.59 | −0.17 | −0.42 | 1.03 | 0.55 | −0.64 | 0.60 | −0.93 | −1.40 | −0.70 |

| Kurtosis | 8.40 | 1.88 | 1.83 | 4.03 | 3.63 | 3.20 | 2.10 | 3.41 | 7.73 | 3.93 | 2.76 |

| Jarque-Bera | 130.68 | 7.63 | 4.25 | 5.04 | 13.45 | 3.58 | 7.03 | 4.66 | 74.33 | 53.12 | 12.35 |

| Probability | 0.00 | 0.02 | 0.12 | 0.08 | 0.00 | 0.17 | 0.03 | 0.10 | 0.00 | 0 | 0 |

| Observation | 69 | 69 | 69 | 69 | 69 | 69 | 69 | 69 | 69 | 63 | 63 |

| Correlation | |||||||||||

| NPLs | BSIZE | NIM | ROA | INEFB | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX | |

| NPLs | 1 | ||||||||||

| BSIZE | −0.4 | 1 | |||||||||

| NIM | 0.37 | −0.58 | 1 | ||||||||

| ROA | 0.14 | −0.41 | 0.68 | 1 | |||||||

| INEFB | −0.15 | −0.08 | −0.15 | −0.4 | 1 | ||||||

| CAR | 0.38 | −0.58 | 0.42 | 0.55 | −0.11 | 1 | |||||

| HHI_LOAN | −0.11 | −0.34 | 0.2 | 0.14 | 0.01 | −0.06 | 1 | ||||

| LTD | 0.28 | −0.17 | 0.47 | 0.4 | −0.28 | 0.21 | 0.2 | ||||

| GDPG | −0.39 | −0.06 | −0.02 | 0.16 | −0.15 | −0.05 | 0.28 | −0.01 | 1 | ||

| EINDX | −0.21 | 0.28 | −0.01 | 0.22 | 0.07 | 0.19 | 0 | 0.16 | 0.17 | 1 | |

| SINDX | −0.07 | 0.44 | −0.15 | 0.04 | 0.09 | 0.21 | −0.59 | 0 | 0.01 | 0.73 | 1 |

| Independent | Model I | Model II | Model III |

|---|---|---|---|

| Constant | 0.096778 *** (0.028783) | 0.105741 *** (0.031420) | 0.102383 *** (0.029870) |

| BSIZE | −0.005197 *** (0.001700) | −0.005798 *** (0.001898) | −0.005798 *** (0.001898) |

| NIM | 0.019831 (0.023378) | 0.015984 (0.024022) | 0.015984 (0.024022) |

| ROA | −0.005278 *** (0.069602) | −0.223431 *** (0.069765) | −0.223431 *** (0.069765) |

| INEF | −0.000373 (0.007466) | −0.000016 (0.007495) | −0.000016 (0.007495) |

| CAR | 0.000667 *** (0.000202) | 0.000681*** (0.000203) | 0.000681 *** (0.000203) |

| HHI_LOAN | −0.000013 *** (0.000006) | −0.000011 (0.000006) | −0.000011 (0.000006) |

| LTD | 0.002705 (0.002007) | 0.002502 (0.002030) | 0.002502 (0.002030) |

| NBFI | −0.003357 (0.004679) | - | |

| COMB | 0.003357 (0.004679) | ||

| Adj-R2 | 0.423784 | 0.421876 | 0.421876 |

| F-stat | 10.05182 | 9.339808 | 9.339808 |

| DW-stat | 1.553834 | 1.565126 | 1.565126 |

| Observations | 161 | 161 | 161 |

| Independent | Model IV | Model V | Model VI | Model VII | Model VIII | Model IX |

|---|---|---|---|---|---|---|

| Constant | 0.092893 *** (0.028125) | 0.103366 *** (0.030654) | 0.103366 *** (0.030654) | 0.109772 *** (0.029660) | 0.104475 *** (0.029001) | 0.104475 *** (0.029001) |

| BSIZE | −0.005117 *** (0.001660) | −0.005821 *** (0.001851) | −0.005821 *** (0.001851) | −0.005906 *** (0.001713) | −0.006139 *** (0.001674) | −0.006139 *** (0.001674) |

| NIM | 0.006708 (0.023267) | 0.002018 (0.002918) | 0.002018 (0.002918) | −0.001979 (0.023677) | −0.0004354 (0.023119) | −0.004354 (0.023119) |

| ROA | −0.155928 ** (0.007069) | −0.152845 ** (0.072220) | −0.152845 ** (0.072220) | −0.181442 ** (0.073167) | −0.167282 ** (0.071566) | −0.167282 ** (0.071566) |

| INEF | 0.003293 (0.007397) | 0.003761 (0.007423) | 0.003761 (0.007423) | −0.000330 (0.007653) | −0.004603 (0.007614) | −0.004603 (0.007614) |

| CAR | 0.000647 *** (0.000197) | 0.000664 *** (0.000198) | 0.000664 *** (0.000198) | 0.000679 *** (0.000197) | 0.000503 *** (0.000202) | 0.000503 *** (0.000202) |

| HHI_LOAN | −0.000012 *** (0.000003) | −0.000012 *** (0.000003) | −0.000012 *** (0.000003) | −0.000013 *** (0.000003) | −0.000008 *** (0.000003) | −0.000008 *** (0.000003) |

| LTD | 0.002382 (0.001962) | 0.002140 (0.001983) | 0.002140 (0.001983) | 0.002968 (0.001980) | 0.002770 (0.001933) | 0.002770 (0.001933) |

| GDPG | −0.000383 *** (0.000133) | −0.000388 *** (0.000133) | −0.000388 *** (0.000133) | −0.000343 *** (0.000134) | 0.000173 (0.000222) | 0.000173 (0.000222) |

| NBFI | −0.003942 (0.004568) | |||||

| COMB | 0.003942 (0.004568) | |||||

| GFC | 0.004864 * (0.002864) | 0.005128 * (0.001796) | ||||

| COVID | 0.017412 *** (0.005112) | 0.014712 *** (0.005112) | ||||

| Adj-R2 | 0.451075 | 0.450115 | 0.450115 | 0.458070 | 0.483981 | 0.483981 |

| F-stat | 10.39136 | 9.731323 | 9.731323 | 10.01608 | 10.37915 | 10.37915 |

| DW-stat | 1.547243 | 1.561772 | 1.561772 | 1.578469 | 1.685662 | 1.685662 |

| Observations | 161 | 161 | 161 | 161 | 161 | 161 |

| Independent | Model X | Model XI |

|---|---|---|

| Constant | 0.033360 (0.031541) | 0.022052 (0.002991) |

| BSIZE | −0.004768 ** (0.002401) | −0.004379 * (0.002379) |

| NIM | 0.015740 (0.020790) | 0.020206 (0.020445) |

| ROA | −0.195210 *** (0.066730) | −0.179862 *** (0.065448) |

| INEF | −0.003964 (0.007269) | −0.001950 (0.007062) |

| CAR | −0.000037 (0.000199) | −0.000075 (0.000197) |

| HHI_LOAN | 0.000003 (0.000004) | 0.000006 (0.000006) |

| LTD | 0.001007 (0.001640) | 0.000640 (0.001610) |

| GFC | 0.002675 (0.002336) | - |

| COVID | 0.019045 *** (0.003430) | 0.019749 *** (0.003379) |

| SINDX | 0.001028 * (0.000542) | 0.001063 * (0.000542) |

| EINDX | −0.000644 * (0.000389) | −0.000655 * (0.000389) |

| Adj-R2 | 0.546310 | 0.545225 |

| F-stat | 11.34153 | 11.93987 |

| DW-stat | 1.71587 | 1.692227 |

| Observations | 147 | 147 |

| Independent | Model XII | Model XIII | Model XIV | Model XV |

|---|---|---|---|---|

| Constant | 0.078260 *** (0.028326) | 0.078260 *** (0.028326) | 0.077812 *** (0.028074) | 0.080672 *** (0.028624) |

| BSIZE | −0.004954 *** (0.001610) | −0.004954 *** (0.001610) | −0.005092 *** (0.001600) | −0.005197 *** (0.001639) |

| NIM | −0.010280 (0.021972) | −0.010280 (0.021972) | −0.018838 (0.021635) | −0.016129 (0.022027) |

| ROA | −0.077149 (0.070245) | −0.077149 (0.070245) | −0.035627 (0.070199) | −0.055094 (0.071550) |

| INEF | 0.006711 (0.007358) | 0.006711 (0.007358) | 0.013012 * (0.007503) | 0.008699 (0.007382) |

| CAR | 0.000530 *** (0.000187) | 0.000530 *** (0.000187) | 0.000439 ** (0.000187) | 0.000520 *** (0.000191) |

| HHI_LOAN | −0.000006 ** (0.000002) | −0.000006 ** (0.000002) | −0.000006 ** (0.000002) | −0.00006 ** (0.000002) |

| LTD | 0.002381 (0.001839) | 0.002381 (0.001839) | 0.002001 (0.001799) | 0.001875 (0.001844) |

| GFC | 0.003536 (0.002657) | 0.003536 (0.002657) | 0.003068 (0.002602) | 0.003427 (0.002644) |

| COVID | 0.006047 * (0.003165) | 0.006047 * (0.003165) | 0.003548 (0.003367) | 0.028263 *** (0.004935) |

| NBFI※COVID | 0.021575 *** (0.005393) | |||

| COMB※COVID | −0.021575 *** (0.005393) | |||

| CRECD※COVID | 0.035778 *** (0.007278) | |||

| MFINCD※COVID | 0.014931 ** (0.006669) | |||

| HFCD※COVID | 0.012971 ** (0.006707) | −0.012122 (0.007730) | ||

| ANZD※COVID | −0.025606 *** (0.007730) | |||

| BOBD※COVID | −0.020043 *** (0.007575) | |||

| BSPD※COVID | −0.031793 *** (0.007809) | |||

| WBCD※COVID | 0.020764 *** (0.007424) | |||

| Adj-R2 | 0.533639 | 0.533639 | 0.555983 | 0.539284 |

| F-stat | 12.44263 | 12.44263 | 12.13035 | 10.36428 |

| DW-stat | 1.904056 | 1.904056 | 2.090153 | 1.971168 |

| Observations | 161 | 161 | 161 | 161 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chand, S.A.; Kumar, R.R.; Stauvermann, P.J. Determinants of Non-Performing Loans in a Small Island Economy of Fiji: Accounting for COVID-19, Bank-Type, and Globalisation. J. Risk Financial Manag. 2023, 16, 436. https://doi.org/10.3390/jrfm16100436

Chand SA, Kumar RR, Stauvermann PJ. Determinants of Non-Performing Loans in a Small Island Economy of Fiji: Accounting for COVID-19, Bank-Type, and Globalisation. Journal of Risk and Financial Management. 2023; 16(10):436. https://doi.org/10.3390/jrfm16100436

Chicago/Turabian StyleChand, Shasnil Avinesh, Ronald Ravinesh Kumar, and Peter Josef Stauvermann. 2023. "Determinants of Non-Performing Loans in a Small Island Economy of Fiji: Accounting for COVID-19, Bank-Type, and Globalisation" Journal of Risk and Financial Management 16, no. 10: 436. https://doi.org/10.3390/jrfm16100436

APA StyleChand, S. A., Kumar, R. R., & Stauvermann, P. J. (2023). Determinants of Non-Performing Loans in a Small Island Economy of Fiji: Accounting for COVID-19, Bank-Type, and Globalisation. Journal of Risk and Financial Management, 16(10), 436. https://doi.org/10.3390/jrfm16100436