The Market Reaction to Repurchase Announcements

Abstract

:1. Introduction

2. Literature Review

3. Sample

4. Research Objectives and Methodologies

4.1. Drivers of the Market Reaction to Repurchase Announcements

4.2. Market Reaction to Repurchase Announcements

4.2.1. Short-Term Market Reaction

4.2.2. Long-Term Market Reaction

4.3. Robustness Testing

4.3.1. Determinants of Achieving a Stronger Market Reaction

4.3.2. Leamer’s Global Sensitivity Analysis

5. Results

5.1. Summary Statistics

5.2. Drivers of the Market Reaction to Repurchase Announcements

5.3. Market Reaction to Repurchase Announcements

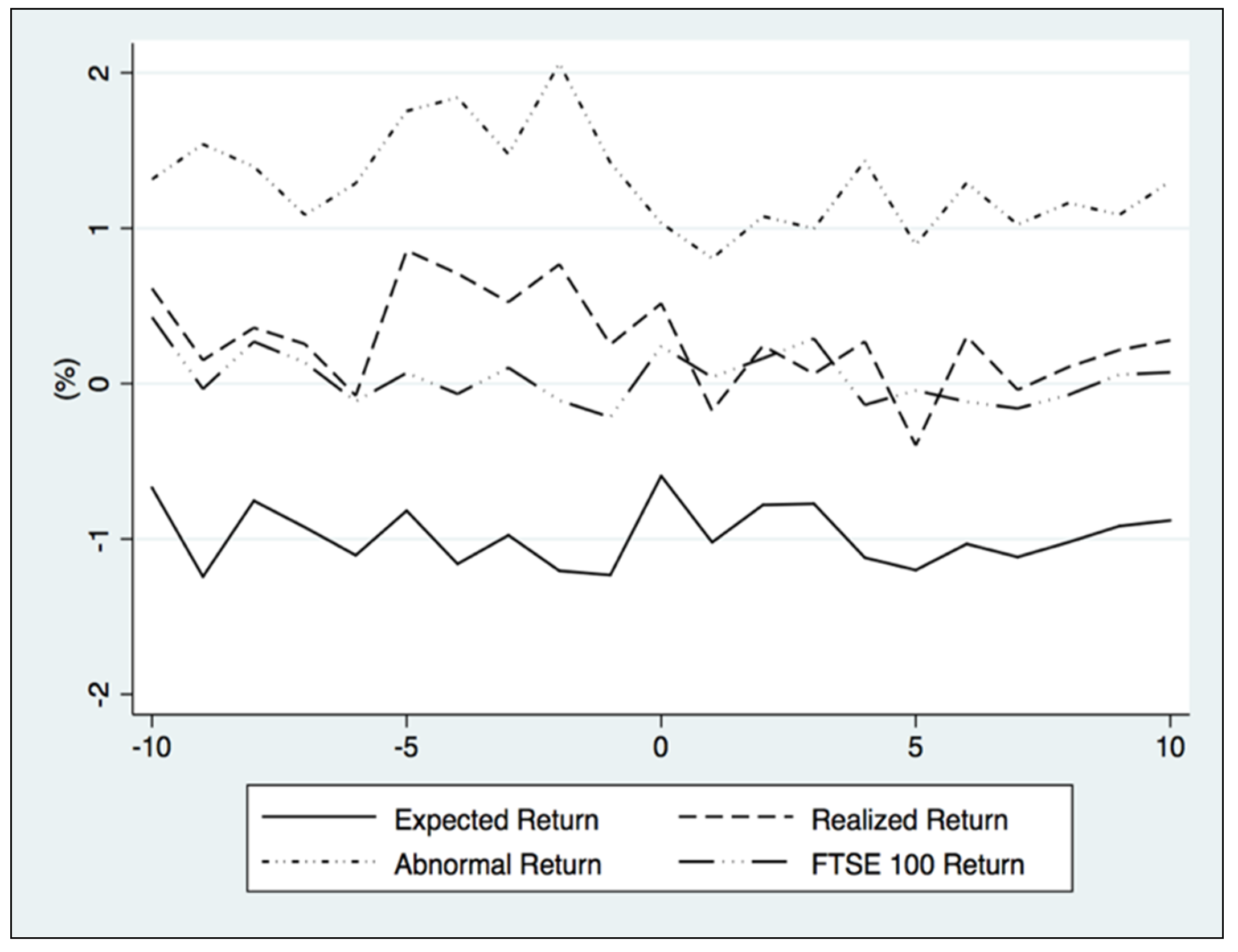

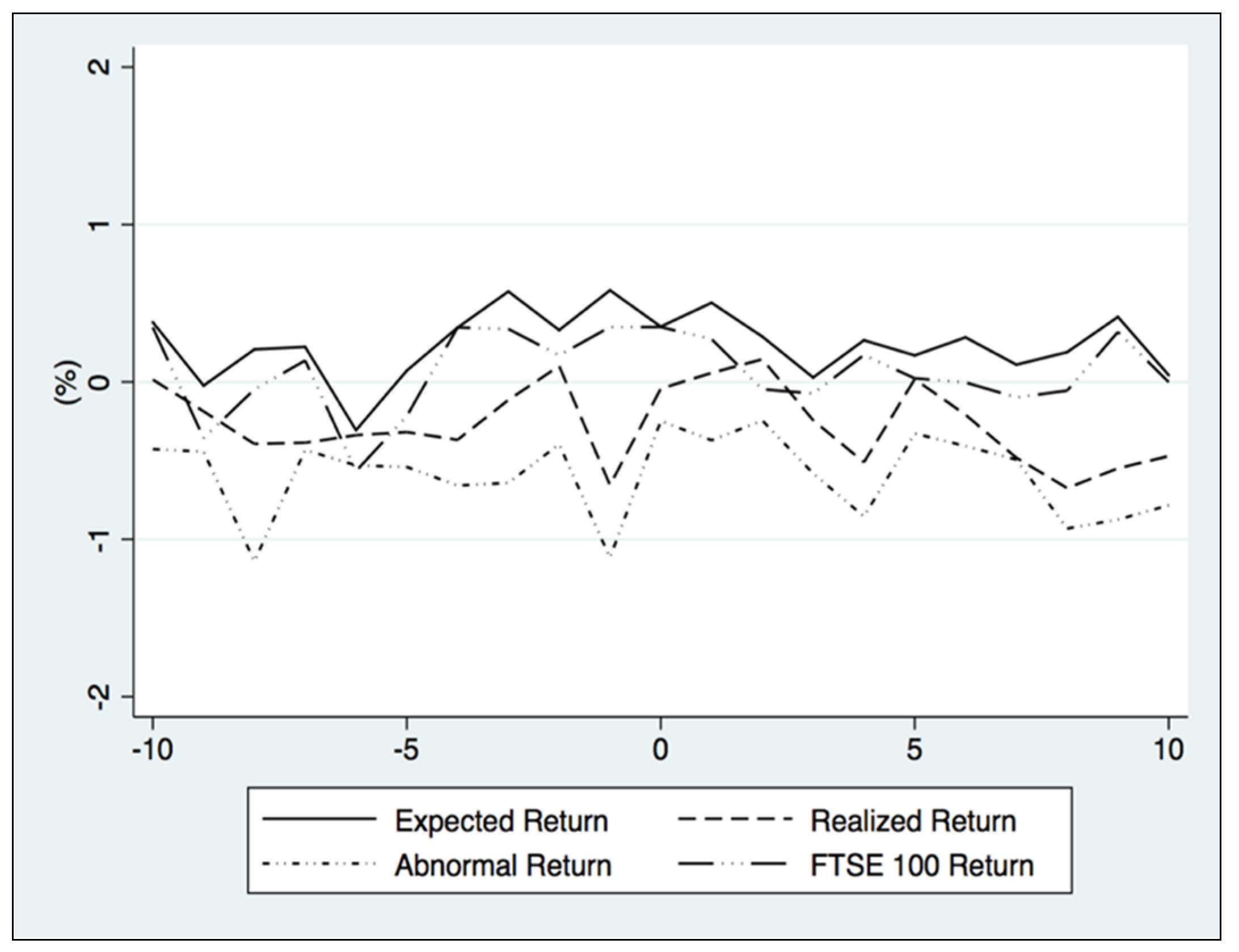

5.3.1. Short-Term Market Reaction

5.3.2. Long-Term Market Reaction

5.4. Robustness Testing

5.4.1. Determinants of Stronger Market Reaction

5.4.2. Leamer’s Global Sensitivity Analysis

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | These include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden, and the UK. |

| 2 | Requiring shareholder approval, a time limit on the payout’s completion, restriction on the repurchase price, cap on the volume of shares, disclosing transactions on the next working day, and restricting insider trading. |

| 3 | The 11-Day CAR (−5, 0, 5) is between 1% and 2% (Rees 1996; Oswald and Young 2004). |

| 4 | The 3-day CAR (−1, 0, 1) is between 2% and 2.50% (Lee et al. 2010; Andriosopoulos and Lasfer 2015). |

| 5 | The 3-day CAR (−1, 0, 1) is between 1.70% and 2.50% (Peyer and Vermaelen 2005; Chang et al. 2009). |

| 6 | The tax codes of the UK (HMRC 2017) and France (Deloitte 2017a) differentiate between repurchases and dividends, but the US and Germany (Deloitte 2017b; IRS 2016) do not. |

| 7 | The rates differ based on the marginal income tax rate. |

| 8 | In 1999, the rate for basic taxpayers remained restricted at 20%, rather than the marginal tax rate. |

| 9 | Benchmark = FTSE 100. The sample is composed of firms listed on any FTSE index, but we still chose this as the benchmark, since it represents 80% of the market (Cattlin 2021). Risk-free rate = 3-month T-Bill. |

| 10 | A tercile divides data into three equal sets, and the 1st (3rd) tercile houses the lowest (highest) one-third of the values. |

| 11 | The total number of firms is 67 (100%) of which 44 (66%) were nonfinancial and 23 (34%) were financial. |

References

- Akturk, Esen, Mehmet Baha Karan, and Burak Pirgaip. 2022. Is the effect of dividend policy on the volatility of stock prices stable? An empirical study on European countries. Spanish Journal of Finance and Accounting 51: 484–504. [Google Scholar]

- Allen, Franklin, Antonio E. Bernardo, and Ivo Welch. 2000. A theory of dividends based on tax clienteles. Journal of Finance 55: 2499–536. [Google Scholar] [CrossRef]

- Alzahrani, Mohammed, and Meziane Lasfer. 2012. Investor protection, taxes and dividends. Journal of Corporate Finance 18: 745–62. [Google Scholar] [CrossRef]

- Anagnostopoulos, Alexis, Orhan Erem Atesagaoglu, and Eva Carceles-Poveda. 2022. Financing corporate tax cuts with shareholder taxes. Quantitative Economics 13: 315–54. [Google Scholar] [CrossRef]

- Andriosopoulos, Dimitris, and Meziane Lasfer. 2015. The market valuation of share repurchases in Europe. Journal of Banking and Finance 55: 327–39. [Google Scholar] [CrossRef]

- Antoniou, Antonios, Yilmaz Guney, and Krishna Paudyal. 2008. The determinants of capital structure: Capital market oriented versus bank oriented institutions. Journal of Financial and Quantitative Analysis 43: 59–92. [Google Scholar] [CrossRef]

- Baker, H. Kent, Gary E. Powell, and E. Theodore Veit. 2003. Why companies use open-market repurchases: A managerial perspective. Quarterly Review of Economics and Finance 43: 483–504. [Google Scholar] [CrossRef]

- Baker, Malcolm, C. Fritz Foley, and Jeffery Wurgler. 2009. Multinationals as arbitrageurs: Stock market valuations on foreign direct investment. Review of Financial Studies 22: 337–69. [Google Scholar] [CrossRef]

- Barclay, Michael, and Clifford Smith. 1988. Corporate payout policy: Cash dividends versus open market repurchases. Journal of Financial Economics 22: 61–82. [Google Scholar] [CrossRef]

- Bargeron, Leonce, and Michael Farrell. 2021. The price effect of stock repurchases: Evidence from dual class firms. Management Science 67: 6568–80. [Google Scholar] [CrossRef]

- Bayraktar, Nihal. 2014. Measuring relative development level of stock markets: Capacity and effort of countries. Borsa Istanbul Review 14: 74–95. [Google Scholar] [CrossRef]

- Becht, Marco, Andrea Polo, and Stefano Rossi. 2016. Does mandatory shareholder voting prevent bad acquisitions? The Review of Financial Studies 29: 3035–67. [Google Scholar] [CrossRef]

- Berger, Tino, and Lorenzo Pozzi. 2013. Measuring time-varying financial market integration: An unobserved components approach. Journal of Banking and Finance 37: 463–473. [Google Scholar] [CrossRef]

- Boone, Audra L., Laura Casares Field, Jonathan M. Karpoff, and Charu G. Raheja. 2007. The determinants of corporate board size and composition: An empirical analysis. Journal of Financial Economics 85: 66–101. [Google Scholar] [CrossRef]

- Burns, Natasha, Brian C. McTier, and Kristina Minnick. 2015. Equity-incentive compensation and payout policy in Europe. Journal of Corporate Finance 30: 85–97. [Google Scholar] [CrossRef]

- Cadman, Emily. 2016. Services Close to 80% UK Economy. Available online: https://www.ft.com/content/2ce78f36-ed2e-11e5-888e-2eadd5fbc4a4 (accessed on 14 September 2023).

- Caton, Gary L., Jeremy Goh, Yen Teik Lee, and Scott C. Linn. 2016. Governance and post-repurchase performance. Journal of Corporate Finance 39: 155–73. [Google Scholar] [CrossRef]

- Cattlin, Rebecca. 2021. FTSE 100 Trading Guide: Constituents, Market Hours and How to Trade. Available online: https://www.forex.com/en/market-analysis/latest-research/ftse-100-trading-guide/ (accessed on 14 September 2023).

- Cesari, Amedeo D., and Neslihan Ozkan. 2015. Executive incentives and payout policy: Empirical evidence from Europe. Journal of Banking and Finance 55: 70–91. [Google Scholar] [CrossRef]

- Cesari, Amedeo D., Susanne Expenlaub, Arif Khurshed, and Michael Simkovic. 2012. The effects of ownership and stock liquidity on the timing of repurchase transactions. Journal of Corporate Finance 18: 1023–50. [Google Scholar] [CrossRef]

- Chang, Shao-Chi, Sheng-Syan Chen, and Li-Yu Chen. 2009. Does prior record matter in the wealth effect of open-market share repurchase announcements? International Review of Economics and Finance 19: 427–35. [Google Scholar] [CrossRef]

- Chen, Ni-Yun, and Chi-Chun Liu. 2021. Share repurchases and market signalling: Evidence from Earnings Management. International Review of Finance 21: 1203–24. [Google Scholar] [CrossRef]

- Chen, Sheng-Syan, Kim Wai Ho, Chia-Wei Huang, and Yanzhi Wang. 2013. Buyback behaviour of initial public offering firms. Journal of Banking and Finance 37: 32–42. [Google Scholar] [CrossRef]

- Cornish, Chloe. 2018. UK Share Buybacks Accelerate as Market Lags Behind. Available online: https://www.ft.com/content/df9bad78-2770-11e8-b27e-cc62a39d57a0 (accessed on 14 September 2023).

- Crawford, Ian, and Zhiqi Wang. 2012. Is the market underreacting or overreacting to open market share repurchases? A UK perspective. Research in International Business and Finance 26: 26–46. [Google Scholar] [CrossRef]

- Cziraki, Peter, Evgeny Lyandres, and Roni Michaely. 2021. What do insiders know? Evidence from insider trading around share repurchases and SEOs. Journal of Corporate Finance 66: 101544. [Google Scholar] [CrossRef]

- D’Mello, Ranjan, and Previn Shroff. 2000. Equity undervaluation and decisions related to repurchase tender offers: An empirical investigation. Journal of Finance 60: 2399–421. [Google Scholar] [CrossRef]

- DeAngelo, Harry. 2023. The attack on share buybacks. European Financial Management 29: 389–98. [Google Scholar] [CrossRef]

- Deloitte. 2017a. Taxation and Investment in France. Available online: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-franceguide-2017.pdf (accessed on 14 September 2023).

- Deloitte. 2017b. Taxation and Investment in Germany. Available online: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-germanyguide-2017.pdf (accessed on 14 September 2023).

- Demirguc-Kunt, Asli, and Ross Levine. 1999. Bank-Based and Market-Based Financial Systems: Cross Country Comparisons. World Bank Policy Research Papers. Washington, DC: World Bank, pp. 1–72. [Google Scholar] [CrossRef]

- Denis, David J., and Igor Osobov. 2008. Why do firms pay dividends? International evidence on the determinants of dividend policy. Journal of Financial Economics 89: 62–82. [Google Scholar] [CrossRef]

- Department for International Trade. 2016. UK Remains Number One Investment Destination in Europe. Available online: https://www.gov.uk/government/news/uk-remains-number-one-investment-destination-in-europe (accessed on 14 September 2023).

- Dhanani, Alpa. 2016. Corporate share repurchases in the UK: Perceptions and practices of corporate managers and investors. Journal of Applied Accounting Research 17: 331–55. [Google Scholar] [CrossRef]

- Dhanani, Alpa, and Roydon Roberts. 2009. Corporate Share Repurchases: The Perceptions and Practices of UK Financial Managers and Corporate Investors. Edinburgh: The Institute of Chartered Accountants of Scotland, pp. 1–151. [Google Scholar]

- Dobrica, Floarea Iosub. 2007. UK and US multinational corporations capital structure: Different approaches to shareholder value maximization. Analele ŞTiinţIfice Ale Universitatii Alexandru Ioan Cuza Din Iasi 54: 126–32. [Google Scholar]

- ecoDa. 2015. Corporate Governance Compliance and Monitoring Systems across the EU. ecoDa in Brussels Collaboration with MAZARS, pp. 1–56. Available online: https://ecoda.eu/wp-content/uploads/2019/08/31719_EcoDa_CGC_report_v2.pdf (accessed on 14 September 2023).

- Fenn, George W., and Nellie Liang. 2001. Corporate payout policy and managerial stock incentives. Journal of Financial Economics 60: 45–72. [Google Scholar] [CrossRef]

- Fernandes, Catarina, Jorge Farinha, Francisco Vitorino Martins, and Cesario Mateus. 2016a. Supervisory boards, financial crisis and bank performance: Do board characteristics matter? Journal of Banking Regulation 18: 310–37. [Google Scholar] [CrossRef]

- Fernandes, Catarina, Jorge Farinha, Francisco Vitorino Martins, and Cesario Mateus. 2016b. Determinants of European banks’ bailouts following 2007–2008 financial crisis. Journal of International Economic Law 19: 707–42. [Google Scholar] [CrossRef]

- Fernandes, Catarina, Jorge Farinha, Francisco Vitorino Martins, and Cesario Mateus. 2017. Bank governance and performance: A survey of the literature. Journal of Banking Regulation 19: 236–56. [Google Scholar] [CrossRef]

- Ferris, Stephen P., Nilanjan Sen, and Ho Pei Yui. 2006. God save the Queen and her dividends: Corporate payouts in the United Kingdom. Journal of Business 79: 1149–73. [Google Scholar] [CrossRef]

- Florackis, Chris, and Aydin Ozkan. 2009. Managerial incentives and corporate leverage: Evidence from the United Kingdom. Accounting and Finance 49: 531–33. [Google Scholar] [CrossRef]

- Frank, Murray, and Ali Sanati. 2021. Financing corporate growth. The Review of Financial Studies 34: 4926–98. [Google Scholar] [CrossRef]

- Franks, Julian, Colin Mayer, and Luc Renneboog. 2001. Who disciplines management in poorly performing companies? Journal of Financial Intermediation 10: 209–48. [Google Scholar] [CrossRef]

- Fried, Jesse M. 2014. Insider trading via the corporation. University of Pennsylvania Law Review 162: 801–39. [Google Scholar] [CrossRef]

- Geiler, Philipp, and Luc Renneboog. 2015. Taxes, earnings payout and payout channel choice. Journal of International Financial Markets, Institutions and Money 37: 178–203. [Google Scholar] [CrossRef]

- Goodacre, Harry. 2023. The Increasing Popularity of Share Buybacks Outside the US. Available online: https://www.schroders.com/en-gb/uk/intermediary/insights/the-increasing-popularity-of-share-buybacks-outside-the-us/ (accessed on 14 September 2023).

- Griffin, Paul A., and Ning Zhu. 2010. Accounting rules? Stock buybacks and stock options: Additional evidence. Journal of Contemporary Accounting and Economics 6: 1–17. [Google Scholar] [CrossRef]

- Guest, Paul M. 2008. The determinants of board size and composition: Evidence from the UK. Journal of Corporate Finance 14: 51–72. [Google Scholar] [CrossRef]

- Guest, Nicholas, Shriprakash Kothari, and Parth Venkat. 2023. Share repurchases on trial: Large-sample evidence on share price performance, executive compensation, and corporate investment. Financial Management 52: 19–40. [Google Scholar] [CrossRef]

- Hamouda, Foued, and David McMillan. 2021. Identifying economic shocks with stock repurchase programs. Cogent Economics and Finance 9: 1968112. [Google Scholar] [CrossRef]

- HMRC. 2017. Income Rax Rates and Allowances: Current and Past. Available online: https://www.gov.uk/government/publications/rates-and-allowances-income-tax/income-tax-rates-and-allowances-current-and-past (accessed on 14 September 2023).

- Hong, Hyun, Jeong-Bon Kim, and Michael Welker. 2017. Divergence of cash flow and voting rights, opacity, and stock price crash risk: International evidence. Journal of Accounting Research 55: 1167–212. [Google Scholar] [CrossRef]

- IRS. 2016. Individual Income Tax Rates, 2016. Available online: https://www.irs.gov/pub/irs-soi/16intaxrates.pdf (accessed on 14 September 2023).

- Jackson, Gregory. 2012. Understanding corporate governance in the United States. Hans Bockler Stiftung Arbeitspapier 223, 1–90. Available online: https://www.econstor.eu/bitstream/10419/116681/1/hbs_arbp_223.pdf (accessed on 14 September 2023).

- Jiang, Zhan, Kenneth A. Kim, Erik Lie, and Sean Yang. 2013. Share repurchases, catering and dividend substitution. Journal of Corporate Finance 21: 36–50. [Google Scholar] [CrossRef]

- John, Kose, Anzhela Kynazea, and Diana Knyazeva. 2015. Governance and payout precommitment. Journal of Corporate Finance 33: 101–17. [Google Scholar] [CrossRef]

- Jones, Ceri. 2014. WPP to Crank Up Buyback Programme Despite Disappointing Results. Available online: http://www.iii.co.uk/articles/150161/wpp-crank-buyback-programme-despite-disappointing-results (accessed on 14 September 2023).

- Jun, Sang-Gyung, Mookwon Jung, and Ralph A. Walkling. 2009. Share repurchases, executive options and wealth changes to stockholders and bondholders. Journal of Corporate Finance 15: 212–29. [Google Scholar] [CrossRef]

- Keimling, Norbert. 2016. An improvement towards traditional value indicators? In Predicting Stock Market Returns Using the Shiller Cape. January edition. London: Star Capital Research, pp. 1–32. [Google Scholar]

- Korkeamaki, Timo, Eva Lilijeblom, and Daniel Pasternack. 2010. Tax reform and payout policy: Do shareholder clienteles or payout policy adjust? Journal of Corporate Finance 16: 572–87. [Google Scholar] [CrossRef]

- Kulchania, Manoj, and Rohit Sonika. 2023. Flexibility in share repurchases: Evidence from UK. European Financial Management 29: 196–246. [Google Scholar] [CrossRef]

- Latif, Madiha, Shanza Arshad, Mariam Fatima, and Samia Farooq. 2011. Market efficiency, market anomalies, causes, evidences and some behavioural aspect of market anomalies. Research Journal of Finance and Accounting 2: 1–14. [Google Scholar]

- Lazonick, William. 2016. How Stock Buybacks Make Americans Vulnerable to Globalization; Mega-Regionalism-New Challenges for Trade and Innovation. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2745387 (accessed on 14 September 2023).

- Leamer, Edward E. 1985. Sensitivity analyses would help. American Economic Review 75: 308–13. [Google Scholar]

- Lee, Bong Soo, and Jungwon Suh. 2011. Cash holdings and share repurchases: International evidence. Journal of Corporate Finance 17: 1306–29. [Google Scholar] [CrossRef]

- Lee, Chun I., Demissew Diro Ejara, and Kimberly C. Gleason. 2010. An empirical analysis of European stock repurchases. Journal of Multinational Financial Management 20: 114–25. [Google Scholar] [CrossRef]

- Lin, Tsui-Jung, Yi-Pei Chen, and Han-Fang Tsai. 2017. The relationship among information asymmetry, dividend policy and ownership structure. Finance Research Letters 20: 1–12. [Google Scholar] [CrossRef]

- Lintner, John. 1965. The valuation of risk assets and the selection of risk investments in stock portfolios and capital budgets. Review of Economics and Statistics 47: 13–37. [Google Scholar] [CrossRef]

- Liu, Ying-Sing. 2021. Investor sentiment, trading activity and effect of the open-market share repurchase based on firm characteristics. Spanish Journal of Finance and Accounting 50: 39–64. [Google Scholar] [CrossRef]

- Liu, Huan, Nan Sun, Yongwei Ye, Yunqing Tao, and Yiwei Kan. 2023. The impact of corporate public market share repurchases on capital market information efficiency. Emerging Markets Finance and Trade 59: 3220–40. [Google Scholar] [CrossRef]

- Manconi, Alberto, Urs Peyer, and Theo Vermaelen. 2019. Are buybacks good for long-term shareholder value? Evidence from buybacks around the world. Journal of Financial and Quantitative Analysis 54: 1899–935. [Google Scholar] [CrossRef]

- Mateus, Cesario, Irina B. Mateus, and Thomas Hall. 2015. Are listed firms better governed: Empirical evidence on board structure and financial performance. Corporate Ownership and Control 13: 736–54. [Google Scholar] [CrossRef]

- Mazur, Mieszko, Man Dang, and Thi Thuy Anh Vo. 2023. Dividends and share repurchases during the COVID-19 economic crisis. The Journal of Financial Research 46: 291–314. [Google Scholar] [CrossRef]

- Milberg, William, and Deborah Winkler. 2010. Financialization and the dynamics of offshoring in the USA. Cambridge Journal of Economics 34: 275–93. [Google Scholar] [CrossRef]

- Oded, Jacob, and Allen Michel. 2018. Stock repurchases and EPS enhancement fallacy. Financial Analysts Journal 64: 62–75. [Google Scholar] [CrossRef]

- Oehler, Andreas, Stephan Wendt, and Matthias Horn. 2016. Internationalisation of blue-chip versus mid-cap stock indices: An empirical analysis for France, Germany and the UK. Atlantic Economic Journal 44: 501–18. [Google Scholar] [CrossRef]

- Oehler, Andreas, Stephan Wendt, and Matthias Horn. 2017a. Are investors really home-biased when investing at home? Research in International Business and Finance 40: 52–60. [Google Scholar] [CrossRef]

- Oehler, Andreas, Stephan Wendt, and Matthias Horn. 2017b. Brexit: Short-term price effects and the impact of firm-level internationalisation. Finance Research Letters 22: 175–81. [Google Scholar] [CrossRef]

- ONS. 2017. Ownership of UK Quoted Shares: 2016. Statistical Bulletin. Wales: Office for National Statistics, pp. 1–36. [Google Scholar]

- Oswald, Dennis, and Steven Young. 2004. What role taxes and regulation? A second look at open market share buyback activity in the UK. Journal of Business, Finance and Accounting 31: 257–92. [Google Scholar]

- Oswald, Dennis, and Steven Young. 2008. Share reacquisitions, surplus cash, and agency problems. Journal of Banking and Finance 32: 795–806. [Google Scholar]

- Ozkan, Neslihan. 2007. Do corporate governance mechanisms influence CEO compensation? An empirical investigation of UK Companies. Journal of Multinational Financial Management 17: 349–64. [Google Scholar] [CrossRef]

- Padgett, Carol, and Zhiqi Wang. 2007. Short-Term Returns of UK Share Buyback Activity. ICMA Centre. Available online: https://core.ac.uk/download/pdf/6565339.pdf (accessed on 14 September 2023).

- Palladino, Lenore. 2020. Do corporate insiders use stock buybacks for personal gains? International Review of Applied Economics 34: 152–74. [Google Scholar] [CrossRef]

- Palladino, Lenore, and William Lazonick. 2022. Regulating stock buybacks: The $6.30 trillion question. International Review of Applied Economics. in press. [Google Scholar] [CrossRef]

- Peyer, Urs C., and Theo Vermaelen. 2005. The many facets of privately negotiated stock repurchases. Journal of Financial Economics 75: 361–95. [Google Scholar] [CrossRef]

- Rau, P. Raghavendra, and Theo Vermaelen. 2002. Regulation, taxes and share repurchases in the United Kingdom. Journal of Business 75: 245–82. [Google Scholar] [CrossRef]

- Rees, William. 1996. The impact of open market equity repurchases on UK equity prices. European Journal of Finance 2: 353–70. [Google Scholar] [CrossRef]

- Renneboog, Luc, and Grzegorz Trojanowski. 2011. Patterns in payout policy and payout channel choice. Journal of Banking and Finance 35: 1477–90. [Google Scholar] [CrossRef]

- SEC. 2023. Share Repurchase Disclosure Modernization. Available online: https://www.sec.gov/corpfin/secg-share-repurchase-disclosure-modernization (accessed on 14 September 2023).

- Sharpe, William F. 1964. Capital asset Prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19: 425–42. [Google Scholar]

- Shilon, Nitzan. 2021. Stock buyback ability to enhance CEO compensation: Theory, evidence, and policy implications. Lewis & Clark Law Review 25: 303–59. [Google Scholar]

- Shu, Pei-Gi, Yin-Hua Yeh, Tsui-Lin Chiang, and Jui-Yi Hung. 2013. Managerial overconfidence and share repurchases. International Review of Finance 13: 39–65. [Google Scholar] [CrossRef]

- Sonika, Rohit, Nicholas F. Carline, and Mark B. Shackleton. 2014. The option and decision to repurchase stock. Financial Management 43: 833–55. [Google Scholar] [CrossRef]

- Stehle, Richard, and Udo Seifert. 2003. Stock Performance Around Share Repurchase Announcements in Germany. Humboldt University of Berlin. Available online: https://www.econstor.eu/bitstream/10419/22262/1/dpsfb200348.pdf (accessed on 14 September 2023).

- Sun, Ji, Li Ding, Jie Michael Guo, and Yichen Li. 2016. Ownership, capital structure and financing decisions: Evidence from the UK. British Accounting Review 48: 448–63. [Google Scholar] [CrossRef]

- The City UK. 2022. Key Facts About UK-Based Financial and Related Professional Services. Available online: https://www.thecityuk.com/media/ubgldxnm/key-facts-about-uk-based-financial-and-related-professional-services-2022.pdf (accessed on 14 September 2023).

- Tong, Jiao, and Marc Bremer. 2016. Stock repurchases in Japan: A solution to excessive corporate saving? Journal of Japanese and International Economies 41: 41–56. [Google Scholar] [CrossRef]

- United Nations. 2016. Development and Globalisation: Facts and Figures. United Nations UNCTAD. Available online: https://unctad.org/publication/development-and-globalization-facts-and-figures-2016 (accessed on 14 September 2023).

- Valeeva, Diliara, Tobias Klinge, and Manuel Aalbers. 2023. Shareholder payouts across time and space: An internationally comparative and cross-sectional analysis of corporate financialisaton. New Political Economy 28: 173–89. [Google Scholar] [CrossRef]

- Von Eije, Henk, and William L. Megginson. 2008. Dividends and share repurchases in the European Union. Journal of Financial Economics 89: 347–74. [Google Scholar] [CrossRef]

- Walker-Arnott, Edward. 2010. Company law, corporate governance and the banking crisis. International Corporate Rescue 7: 12–14. [Google Scholar]

- World Bank. 2023. United Kingdom. Available online: https://data.worldbank.org/country/united-kingdom (accessed on 13 September 2023).

- Yook, Ken C. 2010. Long run stock-performance following stock repurchases. Quarterly Review of Economics and Finance 50: 323–31. [Google Scholar] [CrossRef]

| Capital Gains Tax Rates7 | Dividend Tax Rates8 | ||

|---|---|---|---|

| Years | Rate (%) | Years | Rate (%) |

| 1981–1988 | 30 | 1981–1993 | 15 |

| 1988–2008 | 10 to 40 | 1993–1999 | 25 |

| 2008–2012 | 18 | 1999–2016 | 25 | 30.60 |

| 2012–2016 | 18 | 28 | 2016–2017 | 7.50 | 32.50 | 38.10 |

| 2016–2017 | 10 | 20 | ||

| Panel I: Sample Selection | Panel II: Sample Statistics | ||||

|---|---|---|---|---|---|

| Time Period | # Repurchases (Initial) | # Repurchases (Sample) | Time Period | Average % of Shares Sought | Average Value (GBP million) |

| 1985–1989 | 13 | 0 | 1985–1989 | - | - |

| 1990–1994 | 84 | 5 | 1990–1994 | 5.30 | 287 |

| 1995–1999 | 212 | 30 | 1995–1999 | 11.70 | 3039 |

| 2000–2004 | 33 | 6 | 2000–2004 | 11.00 | 3360 |

| 2005–2009 | 41 | 24 | 2005–2009 | 11.00 | 1050 |

| 2010–2014 | 36 | 2 | 2010–2014 | 14.99 | 10 |

| 1985–2014 | 419 | 67 | 1993–2010 | 11.00 | 2100 |

| Control Variable | Description | Expected Influence |

|---|---|---|

| Panel I: Hypotheses Proxies | ||

| Tax Differential | Effective higher dividend tax rate relative to a higher capital gains tax rate (Alzahrani and Lasfer 2012). | Negative |

| Leverage Ratio | Total debt relative to shareholder equity. | Negative |

| Board | Number of independent directors relative to the total board size. | Positive |

| Globalisation | The value of the KOF Swiss Economic Institute’s Index of UK’s Economic Globalisation. | Positive |

| Panel II: Additional Control Variables | ||

| Dividend | Binary: ‘1’ if ordinary dividend payout relative to the net income is above the average 4-year level around the announcement (−/+ 2years). | Positive |

| M/B Ratio | Market value relative to the book value. | Negative |

| Stock Performance | Average 6-month pre-announcement stock return excess over the average 12-month pre-announcement return. | Negative |

| Net Loss | Binary: ‘1’ if the net profit is negative. | Negative |

| Firm Type | Binary: ‘1’ if the firm is a financial institution. | Negative |

| Mean | Standard Deviation | Minimum | Maximum | |

|---|---|---|---|---|

| Panel I: Firm-Specific Variables11 | ||||

| Leverage Ratio | ||||

| All Firms | 2.079 | 3.479 | 0.013 | 14.424 |

| Nonfinancial Firms | 1.208 | 1.186 | 0.029 | 6.421 |

| Financial Firms | 3.744 | 5.449 | 0.013 | 14.424 |

| Board | ||||

| All Firms | 0.584 | 0.248 | 0.200 | 1.000 |

| Nonfinancial Firms | 0.473 | 0.153 | 0.250 | 1.000 |

| Financial Firms | 0.797 | 0.265 | 0.200 | 1.000 |

| Dividend | ||||

| All Firms | 0.522 | 0.503 | 0.000 | 1.000 |

| Nonfinancial Firms | 0.613 | 0.492 | 0.000 | 1.000 |

| Financial Firms | 0.347 | 0.486 | 0.000 | 1.000 |

| M/B Ratio | ||||

| All Firms | 2.786 | 4.223 | 0.178 | 27.790 |

| Nonfinancial Firms | 3.411 | 4.706 | 0.630 | 27.790 |

| Financial Firms | 1.590 | 2.817 | 0.178 | 14.388 |

| Stock Performance | ||||

| All Firms | 0.004 | 0.038 | −0.053 | 0.257 |

| Nonfinancial Firms | 0.007 | 0.044 | −0.053 | 0.257 |

| Financial Firms | −0.003 | 0.015 | −0.047 | 0.032 |

| Net Loss | ||||

| All Firms | 0.164 | 0.373 | 0.000 | 1.000 |

| Nonfinancial Firms | 0.090 | 0.290 | 0.000 | 1.000 |

| Financial Firms | 0.304 | 0.470 | 0.000 | 1.000 |

| Panel II: Country Specific Yearly Variables | ||||

| Tax Differential | 0.769 | 0.367 | 0.380 | 1.700 |

| Globalisation | 71.778 | 2.854 | 65.770 | 76.120 |

| Time Period | Stock Performance (%) |

|---|---|

| 1990–1994 | −0.32 |

| 1995–1999 | 0.91 |

| 2000–2004 | −0.70 |

| 2005–2009 | 0.31 |

| 2005–2007 | 0.76 |

| 2008–2009 | −0.36 |

| 2010–2014 | −0.58 |

| I | II | III | IV | V | VI | |

|---|---|---|---|---|---|---|

| Dividend | 0.068 ** (2.11) | 0.075 ** (2.38) | 0.048 (1.52) | 0.066 ** (2.06) | 0.041 (1.31) | 0.031 (1.00) |

| M/B Ratio | 0.003 (1.02) | 0.003 (0.91) | 0.004 (1.27) | 0.003 (1.12) | 0.004 (1.53) | 0.005 * (1.78) |

| Stock Performance | 0.145 (0.39) | 0.068 (0.19) | 0.263 (0.73) | 0.164 (0.44) | 0.239 (0.68) | 0.290 (0.86) |

| Net Loss | −0.074 * (−1.78) | −0.042 (−0.98) | −0.118 *** (−2.73) | −0.095 ** (−2.05) | −0.064 (−1.63) | −0.100 ** (−2.23) |

| Firm Type | 0.025 (0.80) | 0.029 (0.94) | 0.058 * (1.77) | 0.003 (0.10) | −0.001 (−0.05) | 0.001 (0.03) |

| Tax Differential | −0.076 ** (−2.03) | −0.052 (−1.91) | ||||

| Leverage Ratio | −0.011 ** (−2.59) | −0.008 * (−1.44) | ||||

| Board | 0.081 (1.03) | 0.096 (1.25) | ||||

| Globalisation | −0.018 *** (−2.94) | −0.017 *** (−2.84) | ||||

| Constant | −0.023 (−0.80) | 0.027 (0.72) | 0.002 (0.09) | −0.061 (−1.30) | 1.280 *** (2.88) | 1.230 *** (2.87) |

| Adjusted R2 | 0.197 | 0.174 | 0.206 | 0.132 | 0.229 | 0.331 |

| Obs. | 67 | 67 | 67 | 67 | 67 | 67 |

| Panel I: Nonfinancial Firms | ||||||

|---|---|---|---|---|---|---|

| Day | AR (%) | Event Window | RAR (%) | Event Window | CAR (%) | DCAR (%) |

| −10 | 1.31 ** | (−1, 0, 1) | 3.26 ** | 1.09 ** | ||

| −9 | 1.54 ** | (−10, −9) | 2.85 ** | (−2, 0, 2) | 6.40 ** | 1.28 ** |

| −8 | 1.40 ** | (−10, −8) | 4.25 ** | (−3, 0, 3) | 8.87 ** | 1.27 ** |

| −7 | 1.09 * | (−10, −7) | 5.34 ** | (−4, 0, 4) | 12.15 *** | 1.35 ** |

| −6 | 1.29 ** | (−10, −6) | 6.62 ** | (−5, 0 5) | 14.79 ** | 1.34 ** |

| −5 | 1.75 *** | (−10, −5) | 8.38 ** | (−6, 0, 6) | 17.37 ** | 1.34 ** |

| −4 | 1.84 *** | (−10, −4) | 10.22 ** | (−7, 0, 7) | 19.48 ** | 1.30 ** |

| −3 | 1.48 *** | (−10, −3) | 11.69 ** | (−8, 0, 8) | 22.04 ** | 1.30 ** |

| −2 | 2.06 *** | (−10, −2) | 13.75 *** | (−9, 0, 9) | 24.67 ** | 1.30 ** |

| −1 | 1.42 *** | (−10, −1) | 15.17 *** | (−10, 0, 10) | 27.28 ** | 1.30 ** |

| 0 | 1.03 ** | (−10, 0) | 16.21 *** | Average | 1.29 ** | |

| 1 | 0.81 * | (−10, 1) | 17.01 ** | |||

| 2 | 1.08 ** | (−10, 2) | 18.09 ** | |||

| 3 | 1.00 ** | (−10, 3) | 19.09 ** | |||

| 4 | 1.43 *** | (−10, 4) | 20.52 ** | |||

| 5 | 0.89 * | (−10, 5) | 21.42 ** | |||

| 6 | 1.29 *** | (−10, 6) | 22.71 ** | |||

| 7 | 1.02 ** | (−10, 7) | 23.73 ** | |||

| 8 | 1.16 ** | (−10, 8) | 24.90 ** | |||

| 9 | 1.09 ** | (−10, 9) | 25.98 ** | |||

| 10 | 1.30 *** | (−10, 10) | 27.28 ** | |||

| Panel II: Financial Firms | ||||||

| Day | AR (%) | Event Window | RAR (%) | Event Window | CAR (%) | DCAR (%) |

| −10 | −0.43 | (−1, 0, 1) | −2.61 | −0.87 | ||

| −9 | −0.44 | (−10, −9) | −1.43 | (−2, 0, 2) | −3.78 | −0.76 |

| −8 | −1.14 | (−10, −8) | −2.88 | (−3, 0, 3) | −5.56 | −0.79 |

| −7 | −0.43 | (−10, −7) | −3.59 | (−4, 0, 4) | −7.64 | −0.85 |

| −6 | −0.53 | (−10, −6) | −4.40 | (−5, 0 5) | −9.07 | −0.82 |

| −5 | −0.54 | (−10, −5) | −5.23 | (−6, 0, 6) | −10.54 | −0.81 |

| −4 | −0.66 | (−10, −4) | −6.16 | (−7, 0, 7) | −12.03 | −0.80 |

| −3 | −0.64 | (−10, −3) | −7.09 | (−8, 0, 8) | −14.71 | −0.87 |

| −2 | −0.40 | (−10, −2) | −7.75 | (−9, 0, 9) | −16.59 | −0.87 |

| −1 | −1.12 | (−10, −1) | −9.19 | (−10, 0, 10) | −18.37 | −0.87 |

| 0 | −0.25 | (−10, 0) | −9.70 | Average | −0.83 | |

| 1 | −0.37 | (−10, 1) | −10.36 | |||

| 2 | −0.24 | (−10, 2) | −10.87 | |||

| 3 | −0.58 | (−10, 3) | −11.73 | |||

| 4 | −0.85 | (−10, 4) | −12.87 | |||

| 5 | −0.33 | (−10, 5) | −13.47 | |||

| 6 | −0.41 | (−10, 6) | −14.14 | |||

| 7 | −0.49 | (−10, 7) | −14.92 | |||

| 8 | −0.93 | (−10, 8) | −16.14 | |||

| 9 | −0.87 | (−10, 9) | −17.30 | |||

| 10 | −0.78 | (−10, 10) | −18.37 | |||

| Average AR Nonfinancial Firms (%) | Average AR Financial Firms (%) | |

|---|---|---|

| Pre-Announcement | 1.52 *** (16.509) | −0.63 (−7.232) |

| Post-Announcement | 1.11 *** (18.134) | −0.59 (−7.276) |

| Z-Score | 3.098 *** (0.001) | −0.845 (0.398) |

| Year | Nonfinancial Firms (%) | Financial Firms (%) |

|---|---|---|

| 1st Year | −8.79 ** | −4.15 |

| 2nd Year | −7.04 *** | −0.07 |

| 3rd Year | −13.45 *** | 10.87 |

| Panel A: Intention of a Repurchase, Dependent Variable: CAR (−10, −1) | ||||||

| I | II | III | IV | V | VI | |

| Dividend | 0.941 *** (2.70) | 1.035 *** (2.91) | 0.712 * (1.90) | 0.965 *** (2.69) | 0.766 ** (2.11) | 0.671 (1.55) |

| M/B Ratio | 0.088 * (1.87) | 0.084 * (1.82) | 0.133 ** (2.31) | 0.102 ** (2.13) | 0.103 ** (2.12) | 0.154 *** (2.93) |

| Stock Performance | 3.924 (0.86) | 3.130 (0.69) | 8.404 (1.57) | 4.473 (0.97) | 4.429 (1.01) | 8.552 * (1.79) |

| Net Loss | −0.244 −(0.56) | 0.001 (0.00) | −1.133 ** (−2.27) | −0.847 * (−1.71) | −0.178 (−0.41) | −1.598 *** (−2.57) |

| Firm Type | 0.310 (0.89) | 0.360 (1.02) | 0.999 ** (2.37) | −0.400 (−0.91) | 0.093 (0.25) | 0.082 (−0.14) |

| Tax Differential | −0.620 (−1.53) | −0.751 (−1.58) | ||||

| Leverage Ratio | −0.306 *** (−3.52) | −0.282 *** (−3.20) | ||||

| Board | 2.540 *** (2.73) | 3.421 *** (2.71) | ||||

| Globalisation | −0.162 ** (−2.35) | −0.277 *** (−3.04) | ||||

| Likelihood Ratio Chi2 | 18.61 | 20.99 | 39.84 | 26.52 | 24.26 | 55.99 |

| Pseudo R2 | 0.126 | 0.142 | 0.270 | 0.180 | 0.164 | 0.380 |

| Obs. | 67 | 67 | 67 | 67 | 67 | 67 |

| Panel B: Actual Repurchase Announcement, Dependent Variable: CAR (−1, 0, 1) | ||||||

| Dividend | 0.645 * (1.88) | 0.741 ** (2.12) | 0.406 (1.13) | 0.620 * (1.79) | 0.421 (1.17) | 0.272 (0.67) |

| M/B Ratio | 0.071 (1.60) | 0.067 (1.54) | 0.093* (1.89) | 0.075 * (1.72) | 0.090 ** (1.96) | 0.115 ** (2.49) |

| Stock Performance | 6.359 (1.25) | 5.438 (1.10) | 8.522 (1.61) | 6.949 (1.34) | 6.713 (1.45) | 9.156 * (1.92) |

| Net Loss | −0.525 (−1.21) | −0.254 (−0.55) | −1.297 *** (−2.59) | −0.928 * (−1.90) | −0.449 (−1.03) | −1.657 *** (−2.67) |

| Firm Type | 0.555 (1.61) | 0.622* (1.77) | 1.198 *** (2.87) | 0.169 (0.42) | 0.284 (0.78) | 0.387 (0.73) |

| Tax Differential | −0.711 * (−1.73) | −0.722 (−1.57) | ||||

| Leverage Ratio | −0.185 *** (−3.44) | −0.185 *** (−3.10) | ||||

| Board | 1.527 * (1.83) | 2.676 ** (2.42) | ||||

| Globalisation | −0.208 *** (−2.95) | −0.296 *** (−3.40) | ||||

| Likelihood Ratio Chi2 | 14.59 | 17.66 | 27.61 | 17.96 | 23.67 | 45.18 |

| Pseudo R2 | 0.099 | 0.120 | 0.187 | 0.122 | 0.160 | 0.307 |

| Obs. | 67 | 67 | 67 | 67 | 67 | 67 |

| Panel C: Post the Announcement, Dependent Variable: CAR (0, 10) | ||||||

| Dividend | 0.986 *** (2.81) | 1.049 *** (2.94) | 0.758 ** (2.02) | 1.052 *** (2.88) | 0.808 ** (2.22) | 0.743 * (1.67) |

| M/B Ratio | 0.086 * (1.84) | 0.082 * (1.80) | 0.127 ** (2.27) | 0.104 ** (2.20) | 0.101 ** (2.13) | 0.159 *** (3.09) |

| Stock Performance | 5.984 (1.16) | 5.367 (1.06) | 11.216 * (1.73) | 6.883 (1.28) | 6.290 (1.32) | 10.962 ** (2.06) |

| Net Loss | −0.026 (−0.06) | 0.166 (0.36) | −0.839 * (−1.73) | −0.751 (−1.52) | 0.044 (0.10) | −1.510 ** (−2.42) |

| Firm Type | 0.292 (0.84) | 0.317 (0.91) | 0.909 ** (2.22) | −0.541 (−1.23) | 0.070 (0.19) | −0.481 (−0.78) |

| Tax Differential | −0.445 (−1.13) | −0.672 (−1.39) | ||||

| Leverage Ratio | −0.299 *** (−3.39) | −0.262 *** (−2.89) | ||||

| Board | 3.050 *** (3.20) | 4.415 *** (3.16) | ||||

| Globalisation | −0.171 ** (−2.46) | −0.322 *** (−3.38) | ||||

| Likelihood Ratio Chi2 | 18.80 | 20.08 | 38.45 | 29.91 | 25.02 | 58.88 |

| Pseudo R2 | 0.127 | 0.136 | 0.261 | 0.203 | 0.170 | 0.400 |

| Obs. | 67 | 67 | 67 | 67 | 67 | 67 |

| Panel A: Intention of a Repurchase, Dependent Variable: CAR (−10, −1) | ||||||

| I | II | III | IV | V | VI | |

| Dividend | ||||||

| 1st Tercile | −0.288 *** (−3.03) | −0.308 *** (−3.29) | −0.160 ** (−1.98) | −0.272 *** (−3.01) | −0.223 ** (−2.25) | −0.132 (−1.62) |

| 3rd Tercile | 0.282 *** (2.98) | 0.303 *** (3.31) | 0.185 ** (2.00) | 0.266 *** (2.95) | 0.216 ** (2.24) | 0.133 (1.57) |

| M/B Ratio | ||||||

| 1st Tercile | −0.027 * (−1.89) | −0.025 * (−1.84) | −0.030 ** (−2.33) | −0.028 ** (−2.18) | −0.030 ** (−2.16) | −0.030 *** (−2.98) |

| 3rd Tercile | 0.026 ** (2.01) | 0.024 * (1.95) | 0.034 ** (2.52) | 0.028 ** (2.35) | 0.029 *** (2.30) | 0.030 *** (3.44) |

| Stock Performance | ||||||

| 1st tercile | −1.202 (−0.86) | −0.934 (−0.69) | −1.896 (−1.56) | −1.264 (−0.97) | −1.293 (−1.02) | −1.692 * (−1.80) |

| 3rd tercile | 1.179 (0.87) | 0.919 (0.70) | 2.189 * (1.66) | 1.233 (0.99) | 1.248 (1.03) | 1.694 * (1.90) |

| Net Loss | ||||||

| 1st Tercile | 0.074 (0.56) | 0.0004 (0.01) | 0.255 ** (2.43) | 0.239 * (1.78) | 0.052 (0.41) | 0.316 *** (2.80) |

| 3rd Tercile | −0.073 (−0.56) | −0.0004 (−0.01) | −0.295 ** (−2.40) | −0.233 * (−1.76) | −0.050 (−0.41) | −0.316 *** (1.90) |

| Firm Type | ||||||

| 1st Tercile | −0.095 (−0.90) | −0.107 (−1.03) | −0.225 ** (−2.43) | −0.113 (−0.92) | −0.027 (−0.26) | −0.016 (0.14) |

| 3rd Tercile | 0.093 (0.90) | 0.105 (1.04) | 0.260 *** (2.61) | 0.110 (0.93) | 0.026 (0.26) | 0.016 (−0.14) |

| Tax Differential | ||||||

| 1st Tercile | 0.185 (1.60) | 0.148 (1.61) | ||||

| 3rd Tercile | −0.182 (−1.57) | −0.148 (−1.64) | ||||

| Leverage Ratio | ||||||

| 1st Tercile | 0.069 *** (4.48) | 0.055 (3.83) | ||||

| 3rd Tercile | −0.079 *** (−3.66) | −0.056 (−3.28) | ||||

| Board | ||||||

| 1st Tercile | −0.717 *** (−3.00) | −0.677 *** (−3.04) | ||||

| 3rd Tercile | 0.700 *** (3.02) | 0.677 *** (2.89) | ||||

| Globalisation | ||||||

| 1st Tercile | 0.047 ** (2.47) | 0.055 *** (3.03) | ||||

| 3rd Tercile | −0.045 *** (−2.56) | −0.055 *** (−3.73) | ||||

| Panel B: Actual Repurchase Announcement, Dependent Variable: CAR (−1, 0, 1) | ||||||

| Dividend | ||||||

| 1st Tercile | −0.204 ** (−1.98) | −0.226 ** (−2.25) | −0.111 (−1.15) | −0.190 * (−1.87) | −0.123 (−1.19) | −0.065 (−0.67) |

| 3rd Tercile | 0.204 ** (1.99) | 0.227 ** (2.27) | 0.114 (1.14) | 0.189 * (1.86) | 0.119 (1.19) | 0.058 (0.67) |

| M/B Ratio | ||||||

| 1st Tercile | −0.022 (−1.62) | −0.020 (−1.55) | −0.025 * (−1.91) | −0.023 * (−1.75) | −0.026 ** (−2.00) | −0.027 *** (−2.57) |

| 3rd Tercile | 0.022 * (1.69) | 0.020 (1.62) | 0.026 ** (2.02) | 0.023 * (1.83) | 0.025 ** (2.10) | 0.025 *** (2.81) |

| Stock Performance | ||||||

| 1st Tercile | −2.015 (−1.26) | −1.663 (−1.10) | −2.344 (−1.61) | −2.129 (−1.35) | −1.971 (−1.47) | −2.194 ** (−1.97) |

| 3rd Tercile | 2.009 (1.30) | 1.670 (1.13) | 2.405 * (1.70) | −2.123 (1.39) | 1.901 (1.50) | 1.978 ** (2.03) |

| Net Loss | ||||||

| 1st Tercile | 0.166 (1.25) | 0.077 (0.55) | 0.356 *** (2.81) | 0.284 ** (2.01) | 0.132 (1.05) | 0.397 *** (2.98) |

| 3rd Tercile | −0.166 (−1.22) | −0.078 (−0.55) | −0.366 *** (−2.80) | −0.283 ** (−1.96) | −0.127 (−1.04) | −0.358 *** (−2.84) |

| Firm Type | ||||||

| 1st Tercile | −0.176 * (−1.67) | −0.190 * (−1.84) | −0.329 *** (−3.06) | −0.051 (−0.42) | −0.083 (−0.78) | −0.092 (−0.73) |

| 3rd Tercile | 0.175 * (1.66) | 0.191 * (1.86) | 0.338 *** (3.28) | 0.051 (0.42) | 0.080 (0.78) | 0.083 (0.74) |

| Tax Differential | ||||||

| 1st Tercile | 0.217 * (1.83) | 0.173 (1.63) | ||||

| 3rd Tercile | −0.218 * (−1.78) | −0.156 (−1.63) | ||||

| Leverage Ratio | ||||||

| 1st Tercile | 0.050 *** (4.11) | 0.044 *** (3.45) | ||||

| 3rd Tercile | −0.052 *** (−3.83) | −0.040 *** (−3.38) | ||||

| Board | ||||||

| 1st Tercile | −0.467 * (−1.90) | −0.641 *** (−2.66) | ||||

| 3rd Tercile | 0.466 * (1.91) | 0.578 *** (2.58) | ||||

| Globalisation | ||||||

| 1st Tercile | 0.061 *** (3.20) | 0.071 *** (3.78) | ||||

| 3rd Tercile | −0.059 *** (−3.47) | −0.064 *** (−4.06) | ||||

| Panel C: Actual Repurchase Announcement, Dependent Variable: CAR (−1, 0, 1) | ||||||

| Dividend | ||||||

| 1st Tercile | −0.303 *** (−3.22) | −0.317 *** (−3.39) | −0.176 ** (−2.12) | −0.289 *** (−3.31) | −0.235 ** (−2.39) | −0.141 * (−1.76) |

| 3rd Tercile | 0.294 *** (3.11) | 0.309 *** (3.32) | 0.198 *** (2.14) | 0.276 *** (3.17) | 0.225 ** (2.35) | 0.142 * (1.69) |

| M/B Ratio | ||||||

| 1st Tercile | −0.026 * (−1.88) | −0.025 * (−1.83) | −0.029 *** (−2.31) | −0.028 ** (−2.27) | −0.029 ** (−2.17) | −0.030 *** (−3.32) |

| 3rd Tercile | 0.025 ** (1.97) | 0.024 * (1.92) | 0.033 *** (2.47) | 0.027 ** (2.41) | 0.028 ** (2.29) | 0.030 *** (3.65) |

| Stock Performance | ||||||

| 1st Tercile | −1.840 (−1.16) | −1.625 (−1.06) | −2.609 * (−1.72) | −1.895 (−1.28) | −1.830 (−1.33) | −2.083 ** (−2.09) |

| 3rd Tercile | 1.784 (1.19) | 1.581 (1.08) | 2.941 * (1.84) | 1.810 (1.33) | 1.751 (1.36) | 2.105 ** (2.21) |

| Net Loss | ||||||

| 1st Tercile | 0.008 (0.06) | −0.050 (−0.36) | 0.195 * (1.80) | 0.206 (1.55) | −0.013 (−0.10) | 0.287 *** (2.60) |

| 3rd Tercile | −0.007 (−0.06) | 0.049 (0.36) | −0.220 * (−1.79) | −0.197 (−1.57) | 0.012 (0.10) | −0.290 *** (−2.58) |

| Firm Type | ||||||

| 1st Tercile | −0.089 (−0.85) | −0.096 (−0.92) | −0.211 ** (−2.29) | 0.149 (1.24) | −0.020 (−0.19) | −0.091 (0.80) |

| 3rd Tercile | 0.087 (0.85) | 0.093 (0.92) | 0.238 ** (2.40) | −0.142 (−1.25) | 0.019 (0.19) | 0.092 (−0.78) |

| Tax Differential | ||||||

| 1st Tercile | 0.134 (1.15) | 0.127 (1.40) | ||||

| 3rd Tercile | −0.131 (−1.14) | −0.129 (−1.44) | ||||

| Leverage Ratio | ||||||

| 1st Tercile | 0.069 *** (4.24) | 0.049 *** (3.38) | ||||

| 3rd Tercile | −0.078 *** (−3.50) | −0.050 *** (−2.91) | ||||

| Board | ||||||

| 1st Tercile | −0.839 *** (−3.63) | −0.839 *** (−3.69) | ||||

| 3rd Tercile | 0.802 *** (3.69) | 0.848 *** (3.47) | ||||

| Globalisation | ||||||

| 1st Tercile | 0.049 *** (2.61) | 0.061 *** (3.46) | ||||

| 3rd Tercile | −0.047 *** (−2.70) | −0.062 *** (−4.24) | ||||

| Obs. | Mean | Std. Dev. | Min. | Max. | Positive Coef. (%) | Negative Coef. (%) | |

|---|---|---|---|---|---|---|---|

| Tax Differential | 95 | −0.053 | 0.006 | −0.077 | −0.026 | 0 (0) | 95 (100) |

| Leverage Ratio | 95 | −0.008 | 0.001 | −0.011 | −0.006 | 0 (0) | 95 (100) |

| Board | 95 | 0.096 | 0.011 | 0.054 | 0.145 | 95 (100) | 0 (0) |

| Globalisation | 95 | −0.017 | 0.001 | −0.018 | −0.012 | 0 (0) | 95 (100) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sodhi, A.; Mateus, C.; Mateus, I.; Stojanovic, A. The Market Reaction to Repurchase Announcements. J. Risk Financial Manag. 2023, 16, 443. https://doi.org/10.3390/jrfm16100443

Sodhi A, Mateus C, Mateus I, Stojanovic A. The Market Reaction to Repurchase Announcements. Journal of Risk and Financial Management. 2023; 16(10):443. https://doi.org/10.3390/jrfm16100443

Chicago/Turabian StyleSodhi, Adhiraj, Cesario Mateus, Irina Mateus, and Aleksandar Stojanovic. 2023. "The Market Reaction to Repurchase Announcements" Journal of Risk and Financial Management 16, no. 10: 443. https://doi.org/10.3390/jrfm16100443

APA StyleSodhi, A., Mateus, C., Mateus, I., & Stojanovic, A. (2023). The Market Reaction to Repurchase Announcements. Journal of Risk and Financial Management, 16(10), 443. https://doi.org/10.3390/jrfm16100443