The Effect of Religion in European Financial Statement Disclosures: A Real Earnings’ Management Case

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. Religion and Religiosity

2.1.1. Religion in Europe

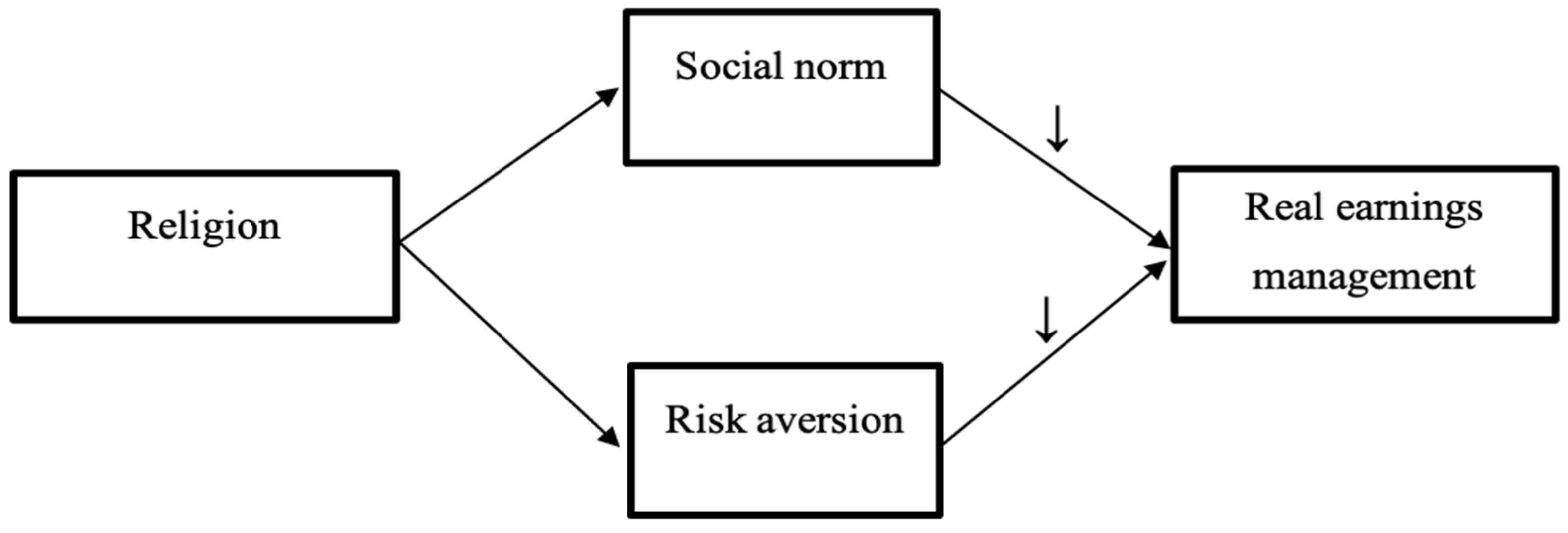

2.1.2. Social Norm

2.1.3. Risk Aversion

2.2. Earnings Management

2.2.1. Background Information on Earnings Management

2.2.2. Measurement of Earnings Management

2.2.3. Prior Research on Real Earnings Management

2.3. Religion and Earnings Management

2.4. Religion and R&D Investment

3. Research Method

3.1. Data and Sample Selection

3.2. Variables

3.2.1. Measuring the Effect of Religion

3.2.2. Measuring Real Earnings Management

3.2.3. Measuring R&D Expenditure

3.2.4. Control Variables and Others

3.3. Empirical Model

4. Results

4.1. Descriptive Statistics

4.2. Analysis of Correlation

4.3. Hypotheses Testing

4.4. Robustness Testing

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | As mentioned earlier there is no consensus in the literature on the existence of a link between religion and real earnings management. Differences in the findings could be driven from the distinctive samples used. A sorting of the related literature indicates the majority of the studies to concentrate either on companies in America or in China; whereas cross-country samples usually contain countries all over the world (Kanagaretnam et al. 2015). Our review of the related literature is in support of Kanagaretnam et al. (2015) indicating that there is little research in examining how EU listed entities behave in this context. Our primary contribution therefore is to document that differences in religiosity between countries are related to differences in real (non-accrual) earnings management and we extend prior research on the examination of this relation to the international setting by examining a more homogenous (i.e., EU) reporting setting. Additionally our study can be viewed as identifying softer dimensions such as religion, in addition to previously identified international institutional factors, that influence financial reporting behavior. Overall, our findings support the growing awareness among researchers studying international financial markets that informal institutions such as religion which is a major source of morality and ethical behavior matter in financial reporting and financial decisions, even when those decisions are made by sophisticated professional managers. |

References

- Adhikari, Binay, and Anup Agrawal. 2016. Does local religiosity matter for bank risk-taking? Journal of Corporate Finance 38: 272–93. [Google Scholar] [CrossRef]

- Aibibula, Hailipitimu, Gege Wang, and Chengcheng Zhang. 2017. Religious Belief and Firm R&D Investment. Technology and Investment 8: 142–50. [Google Scholar]

- Ball, Ray, and Lakshmanan Shivakumar. 2006. The Role of Accruals in Asymmetrically Timely Gain and Loss Recognition. Journal of Accounting Research 2: 207–242. [Google Scholar] [CrossRef]

- Bartov, Eli, Dan Givoly, and Carla Hayn. 2002. The rewards to meeting or beating earnings expectations. Journal of Accounting and Economics 33: 173–204. [Google Scholar] [CrossRef]

- Basu, Sudipta. 1997. The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics 1: 3–37. [Google Scholar] [CrossRef]

- Baxamusa, Mufaddal, and Abu Jalal. 2016. CEO’s religious affiliation and managerial conservatism. Financial Management 45: 67–104. [Google Scholar] [CrossRef]

- Brammer, Stephen, Geoffrey Williams, and John Zinkin. 2007. Religion and attitudes to corporate social responsibility in a large cross-country sample. Journal of Business Ethics 71: 229–43. [Google Scholar] [CrossRef]

- Bruce, Steve. 2002. God is Dead: Secularization in the West. Oxford: Blackwell Publishing. [Google Scholar]

- Bruns, William, and Kenneth Merchant. 1990. The dangerous morality of managing earnings. Management Accounting 72: 22–25. [Google Scholar]

- Burgstahler, David, and Ilia Dichev. 1997. Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics 24: 99–126. [Google Scholar] [CrossRef]

- Bushee, Brian. 1998. The influence of institutional investors on myopic R&D investment behavior. Accounting Review 73: 305–33. [Google Scholar]

- Cai, Ye, Yongtae Kim, Siqi Li, and Carrie Pan. 2019. Tone at the top: CEOs’ religious beliefs and earnings management. Journal of Banking & Finance C 106: 195–213. [Google Scholar]

- Callen, Jeffrey L., Morel Morel, and Grant Richardson. 2011. Do culture and religion mitigate earnings management? Evidence from a cross-country analysis. International Journal of Disclosure and Governance 8: 103–21. [Google Scholar] [CrossRef]

- Cazavan-Jeny, Anne, Thomas Jeanjean, and Peter Joos. 2011. Accounting choice and future performance: The case of R&D accounting in France. Journal of Accounting and Public Policy 30: 145–65. [Google Scholar]

- Chambers, Dennis, Ross Jennings, and Robert B. Thompson. 2002. Excess returns to R&D-intensive firms. Review of Accounting Studies 7: 133–58. [Google Scholar]

- Cheng, Shijun. 2004. R&D Expenditures and CEO Compensation. The Accounting Review 2: 305–328. [Google Scholar]

- Choi, Kyeong-Seop. 2020. National culture and R&D investments. The European Journal of Finance 26: 500–31. [Google Scholar]

- Choi, Youngtae. 2010. Religion, religiosity, and South Korean consumer switching behaviors. Journal of Consumer Behaviour 9: 157–71. [Google Scholar] [CrossRef]

- Christopoulos, Apostolos, Spyros Papathanasiou, Petros Kalantonis, Andreas Chouliaras, and Savvas Katsikidis. 2014. Investigation of cointegration and casualty relationships between the PIIGS’stock markets. Stock Markets European Research Studies 17: 109–23. [Google Scholar]

- Cialdini, Robert, and Noah Goldstein. 2004. Social influence: Compliance and conformity. Annual Review of Psychology 55: 591–621. [Google Scholar] [CrossRef]

- Cohen, Daniel, Aiyesha Dey, and Thomas Lys. 2008. Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley periods. The Accounting Review 83: 757–87. [Google Scholar] [CrossRef]

- Dechow, Patricia, and Richard Sloan. 1991. Executive incentives and the horizon problem: An empirical investigation. Journal of Accounting and Economics 14: 51–89. [Google Scholar] [CrossRef]

- Dechow, Patricia, Richard Sloan, and Amy Sweeney. 1995. Detecting earnings management. Accounting Review 70: 193–225. [Google Scholar]

- Dobbin, Frank, and Jiwook Jung. 2010. The misapplication of Mr. Michael Jensen: How agency theory brought down the economy and why it might again. In Markets on Trial: The Economic Sociology of the US Financial Crisis: Part B. Bradford: Emerald Group Publishing Limited. [Google Scholar]

- Du, Xingqiang. 2021. Religious Entrepreneurs and Corporate R&D Investment. In on Informal Institutions and Accounting Behavior. Singapore: Springer, pp. 207–59. [Google Scholar]

- Du, Xingqiang, Wei Jian, Shaojuan Lai, Yingjie Du, and Hongmei Pei. 2015. Does religion mitigate earnings management? Evidence from China. Journal of Business Ethics 131: 699–749. [Google Scholar] [CrossRef]

- Dyreng, Scott, William Mayew, and Christopher Williams. 2012. Religious social norms and corporate financial reporting. Journal of Business Finance & Accounting 39: 845–75. [Google Scholar]

- El Ghoul, Sadok, Omrane Guedhami, Yang Ni, Jeffrey Pittman, and Samir Saadi. 2012. Does religion matter to equity pricing? Journal of Business Ethics 111: 491–518. [Google Scholar] [CrossRef]

- Elias, Rafik. 2002. Determinants of earnings management ethics among accountants. Journal of Business Ethics 40: 33–45. [Google Scholar] [CrossRef]

- Garcia Osma, Beatriz. 2008. Board independence and real earnings management: The case of R&D expenditure. Corporate Governance: An International Review 16: 116–31. [Google Scholar]

- Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 40: 3–73. [Google Scholar] [CrossRef]

- Grullon, Gustavo, George Kanatas, and James Weston. 2010. Religion and Corporate (mis) Behavior. Working Paper. Houston: Rice University. [Google Scholar]

- Guan, Liming, Daoping He, and David Yang. 2006. Auditing, integral approach to quarterly reporting, and cosmetic earnings management. Managerial Auditing Journal 21: 569–81. [Google Scholar] [CrossRef]

- Guiso, Luigi, Paola Sapienza, and Luigi Zingales. 2003. People’s opium? Religion and economic attitudes. Journal of Monetary Economics 50: 225–82. [Google Scholar] [CrossRef]

- Gunny, Katherine. 2010. The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research 27: 855–88. [Google Scholar] [CrossRef]

- Healy, Paul, and James Michael Wahlen. 1999. A review of the earnings management literature and its implications for standard setting. Accounting Horizons 13: 365–83. [Google Scholar] [CrossRef]

- Hilary, Gilles, and Kai Wai Hui. 2009. Does religion matter in corporate decision making in America? Journal of Financial Economics 93: 455–73. [Google Scholar] [CrossRef]

- Hofstede, Geert. 1980. Culture and organizations. International Studies of Management & Organization 10: 15–41. [Google Scholar]

- Hofstede, Geert. 2001. Culture’s recent consequences: Using dimension scores in theory and research. International Journal of Cross Cultural Management 1: 11–17. [Google Scholar] [CrossRef]

- Ipino, Elisabetta, and Antonio Parbonetti. 2017. Mandatory IFRS adoption: The trade-off between accrual-based and real earnings management. Accounting and Business Research 47: 91–121. [Google Scholar] [CrossRef]

- Jones, Jennifer. 1991. Earnings management during import relief investigations. Journal of Accounting Research 29: 193–228. [Google Scholar] [CrossRef]

- Kalantonis, Petros, Christos Kallandranis, and Marios Sotiropoulos. 2021. Leverage and firm performance: New evidence on the role of economic sentiment using accounting information. Journal of Capital Markets Studies 5: 96–107. [Google Scholar] [CrossRef]

- Kanagaretnam, Kiridaran, Gerald Lobo, and Chong Wang. 2015. Religiosity and Earnings Management International Evidence from the Banking Industry. Journal of Business Ethics 132: 277–96. [Google Scholar] [CrossRef]

- Kohlberg, Lawrence. 1984. Essays on Moral Development/2 The Psychology of Moral Development. San Francisco: Harper & Row. [Google Scholar]

- Kumar, Alok, Jeremy Page, and Oliver Spalt. 2011. Religious beliefs, gambling attitudes, and financial market outcomes. Journal of Financial Economics 102: 671–708. [Google Scholar] [CrossRef]

- Leuz, Christian, Dhananjay Nanda, and Peter Wysocki. 2003. Earnings management and investor protection: An international comparison. Journal of Financial Economics 69: 505–27. [Google Scholar] [CrossRef]

- Ma, Lijun, Min Zhang, Jingyu Gao, and Tingting Ye. 2020. The effect of religion on accounting conservatism. European Accounting Review 29: 383–407. [Google Scholar] [CrossRef]

- Markarian, Garen, Lorenzo Pozza, and Annalisa Prencipe. 2008. Capitalization of R&D costs and earnings management: Evidence from Italian listed companies. The International Journal of Accounting 43: 246–67. [Google Scholar]

- Marquis, Christopher, and András Tilcsik. 2013. Imprinting: Toward a multilevel theory. The Academy of Management Annals 7: 195–245. [Google Scholar] [CrossRef]

- Marrakchi Chtourou, Sonda, Jean Bedard, and Lucie Courteau. 2001. Corporate Governance and Earnings Management. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=275053 (accessed on 15 August 2023).

- McGuire, Sean T., Thomas C. Omer, and Nathan Y. Sharp. 2012. The impact of religion on financial reporting irregularities. The Accounting Review 87: 645–73. [Google Scholar] [CrossRef]

- Miller, A. S. 2000. Going to Hell in Asia: The Relationship between Risk and Religion in a Cross Cultural Setting. Review of Religious Research 1: 5–18. [Google Scholar] [CrossRef]

- Miller, Alan, and John Hoffmann. 1995. Risk and religion: An explanation of gender differences in religiosity. Journal for the Scientific Study of Religion 34: 63–75. [Google Scholar] [CrossRef]

- Mukhibad, Hasan, and Ahmad Nurkhin. 2019. Islamic Business Ethics Disclosure and Earnings Management–Evidence from Islamic Banks in Indonesia. Journal of Islamic Finance 8: 31–42. [Google Scholar]

- Omer, Thomas, Nathan Sharp, and Dechun Wang. 2018. The impact of religion on the going concern reporting decisions of local audit offices. Journal of Business Ethics 149: 811–31. [Google Scholar] [CrossRef]

- Prencipe, Annalisa, Garen Markarian, and Lorenzo Pozza. 2008. Earnings management in family firms: Evidence from R&D cost capitalization in Italy. Family Business Review 21: 71–88. [Google Scholar]

- Quttainah, Majdi, Liang Song, and Qiang Wu. 2013. Do Islamic Banks Employ Less Earnings Management. Journal of International Financial Management & Accounting 24: 203–33. [Google Scholar]

- Richardson, Scott, Irem Tuna, and Peter Wysocki. 2003. Accounting for taste: Board member preferences and corporate policy choices. MIT Sloan School of Management Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=405101 (accessed on 15 August 2023).

- Roychowdhury, Sugata. 2006. Earnings management through real activities manipulation. Journal of Accounting & Economics 42: 335–70. [Google Scholar]

- Skordoulis, Michalis, Stamatios Ntanos, Grigorios Kyriakopoulos, Garyfallos Arabatzis, Spyros Galatsidas, and Miltiadis Chalikias. 2020. Environmental innovation, open innovation dynamics and competitive advantage of medium and large.sized firms. Journal of Open Innovation: Technology, Market, and Complexity 6: 195. [Google Scholar] [CrossRef]

- Stark, Rodney, and Roger Finke. 2000. Acts of Faith: Explaining the Human Side of Religion. Berkeley: University of California Press. [Google Scholar]

- Stavrova, Olga, Detlef Fetchenhauer, and Thomas Schlösser. 2013. Why are religious people happy? The effect of the social norm of religiosity across countries. Social Science Research 42: 90–105. [Google Scholar] [CrossRef] [PubMed]

- Wang, Sean, and Julia D’Souza. 2006. Earnings management: The effect of accounting flexibility on R&D investment choices. Johnson School Research Paper Series No. 33-06. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=878345 (accessed on 15 August 2023).

- Yan, Youliang, Xixiong Xu, and Jieji Lai. 2021. Does Confucian culture influence corporate R&D investment? Evidence from Chinese private firms. Finance Research Letters 40: 101719. [Google Scholar]

| Author(s) (Year) | Focus | Methodology | Setting and Year | Key Variables |

|---|---|---|---|---|

| McGuire et al. (2012) | The impact of religion on financial reporting. | Quantitative research | The sample period spans from 2006 to 2008, with 11,576 firm-year observations in U.S. | Accounting Risk, shareholder lawsuits, accounting restatements are proxies for dependent variables; religiosity is measure by MSA scores; demographic control variables include population, the median household income, political affiliation, average age, racial minorities; firm-level control variables include firm size, ROA, financial leverage, loss. |

| Dyreng et al. (2012) | Whether religion is associated with accrual choices managers make when generating corporate financial reports. | Quantitative research | 45,278 firm-year observations between 1990 and 2008 in U.S. | Discretionary accruals, accounting risk, restatement, and irregularity restatements are proxies for dependent variables; religious adherence (number of adherents in the county) is the independent variable; log of market value of equity, cash flow volatility, book-to-market ratio, ROA, leverage, sales volatility, and other variables are control variables. |

| Hilary and Hui (2009) | Whether the relation between individual risk aversion and religiosity influences organizational behavior. | Quantitative research | More than 5000 firms from 1971 to 2000 in U.S. | The main variable of interest is the degree of religiosity (REL) in the county where the firm is located; StdRet, ROA, Inv, RD, and Growth are dependent variables; control variables include population, educational attainment, the sex ratio, married population, average income, and others. |

| Callen et al. (2011) | Whether culture in general and religion in particular mitigate earnings management. | Quantitative research | A cross-country research data of 31 countries. | Aggregate earnings management score, percentage of population of different religious adherents, outside investor rights score, legal enforcement score, GDP per capita, and cultural dimension are key variables. |

| Roychowdhury (2006) | The management of operational activities. | Quantitative research | 21,758 firm-years over the period 1987–2001, including 36 industries and 4252 individual firms. | Cash flow from operations; the change in inventory; cost of goods sold; discretionary expenses. |

| Kumar et al. (2011) | Whether geographic variation in religion-induced gambling norms affects aggregate market outcomes. | Quantitative research | The sample period is from 1980 to 2005. The data set has 14,557 firm-year observations for 2172 unique U.S. firms. | Measure gambling propensity by using people’s religious beliefs; control variables include firm size, Tobin’s Q, R&D expenses, population, the median household income. |

| Ma et al. (2020) | Whether religiosity strongly influences a firm’s adoption of accounting conservatism. | Quantitative research | The sample period is 1971–2010. The valid sample contains more than 124,000 firm-year observations in U.S. | The main variable of interest is REL. REL denotes the degree of religiosity in the county where a firm is headquartered; this paper uses two measures of accounting conservatism, from Basu (1997) and Ball and Shivakumar (2006); the models control for firm size, market-to-book ratio, and leverage. |

| Adhikari and Agrawal (2016) | Whether the religious belief of entrepreneurs will play an influential role in the R&D investment decision making, and what is its mechanism? | Quantitative research | 1459 unique banks in the U.S.; year 1994–2010 | Bank risk is measured by total risk, tail risk, idiosyncratic risk, and a bank’s z-score; religiosity is measured as the number of religious adherents; control variables are bank size, profitability, the proportion of nonperforming assets, loans-to-assets ratio, deposit-to-assets ratio, tier 1 capital ratio, proportion of non-interest income, and a dummy variable for M&A activities. |

| Baxamusa and Jalal (2016) | Whether managers’ religious affiliations affect corporate decisions. | Quantitative research | 652 CEOs and 2406 firm-year observations from 1992 to 2010 in U.S. | Variables include capital structure, debt issue, amounts of investments, profit margin, CEO power. |

| Grullon et al. (2010) | Whether variation in this exogenous determinant of local culture (religiosity) affects corporate (mis)behavior. | Quantitative research | About 55,000 observations over the period 1996–2006 in the U.S. | Dependent variable is a dummy variable equal to 1 if the firm is accused of committing fraud in year t, 0 otherwise; control variables include population, firm size, the average stock return over the previous year, the book-to-market ratio, the annual standard deviation of monthly stock returns, ROA, the litigation risk score. |

| Choi (2020) | The possible link between national culture and R&D investments. | Quantitative research | 12,362 firms from 40 countries; 1990–2016 | Hofstede’s six culture variables; GDP per capita, GDP growth, and high-tech exports, sales, cash flows. |

| Du (2021) | The influence of an entrepreneur’s religious belief on R&D investment and the moderating effect of political connections. | Quantitative research | A sample of 4072 Chinese family firms; 2010 | Firm size, financial leverage, cash ratio, sales growth rate, return on sales, and firm age. |

| Region | Firm-Year Observations in EU Countries |

|---|---|

| Original observations in the Compustat database (2010–2020) | 389,119 |

| - Financial industry and missing values | −103,391 |

| - Not matched with REM dataset | −262,219 |

| - Observations related to financial variables | 23,509 |

| - Not matched with country-level dataset | −1151 |

| - Not matched with religion dataset | −1599 |

| - Final number of observations | 20,759 |

| Dependent variable | Real earnings management (REM) | Calculated by models in Roychowdhury (2006) | |

| R&D investment (R&D) | R&D expenditure/revenue in year t | ||

| Independent variable | The degree of religiosity (REL) | the proportion of people with religious beliefs in a country | |

| The degree of Christianity atmosphere | the proportion of Christians in a country | ||

| The degree of Islam atmosphere | the proportion of Muslims in a country | ||

| Control variable | Firm- specific | Company size (Size) | Natural logarithm of total asset at the end of year t |

| Return on assets (ROA) | Net income/total asset | ||

| Leverage (LEV) | Total liability/total asset | ||

| LOSS | indicator variable that equals 1 if net income was negative in the current or previous two fiscal years, and 0 otherwise | ||

| BIG4 | indicator variable that equals 1 if a Big 4 audit firm was the external auditor for a firm-year observation, and 0 otherwise | ||

| Country- specific | GDP | Natural logarithm of GDP in a country at the end of year t | |

| LAW | A country’s overall law index in year t | ||

| Others | Industry | Dummy variable as defined by each of the SIC codes used in the dataset | |

| Year | Dummy variable as defined by each of the years in the dataset | ||

| (1) | (2) | (3) | (4) | (5) | ||

|---|---|---|---|---|---|---|

| VARIABLES | N | Mean | sd | Min | Max | |

| (1) | REM | 20,761 | 0.0247 | 0.819 | −77.06 | 39.66 |

| (2) | R&D | 20,219 | 3.920 | 130.8 | −1.046 | 8108 |

| (3) | REL | 20,761 | 0.801 | 0.112 | 0.216 | 0.990 |

| (4) | Christianity | 20,761 | 0.746 | 0.137 | 0.209 | 0.995 |

| (5) | Islam | 20,761 | 0.0492 | 0.0289 | 0.0100 | 0.142 |

| (6) | SIZE | 20,761 | 5.169 | 2.381 | −6.215 | 15.52 |

| (7) | LEV | 20,761 | 0.531 | 0.321 | 0.00667 | 2.351 |

| (8) | ROA | 20,761 | −0.0465 | 0.249 | −1.463 | 0.281 |

| (9) | GDP | 20,761 | 13.41 | 1.129 | 9.801 | 15.05 |

| (10) | LAW | 20,761 | 0.750 | 0.0940 | 0.530 | 0.900 |

| REM | R&D | REL | Chris | Islam | SIZE | LEV | ROA | LOSS | BIG4 | GDP | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.290 *** | GDP | ||||||||||

| 1 | 0.024 *** | 0.248 *** | BIG4 | |||||||||

| 1 | −0.145 *** | −0.029 *** | 0.013 * | LOSS | ||||||||

| 1 | −0.585 *** | 0.120 *** | −0.00900 | −0.098 *** | ROA | |||||||

| 1 | −0.236 *** | 0.141 *** | 0.0110 | 0.031 *** | −0.113 *** | LEV | ||||||

| 1 | 0.00200 | 0.342 *** | −0.333 *** | 0.447 *** | −0.018 ** | 0.119 *** | SIZA | |||||

| 1 | 0.037 *** | −0.037 *** | −0.040 *** | 0.043 *** | 0.00500 | 0.305 *** | 0.157 *** | islam | ||||

| 1 | −0.673 *** | −0.120 *** | 0.062 *** | 0.078 *** | −0.030 *** | −0.185 *** | −0.467 *** | −0.614 *** | chris | |||

| 1 | 0.977 *** | −0.504 *** | −0.125 *** | 0.065 *** | 0.077 *** | −0.020 *** | −0.210 *** | −0.454 *** | −0.666 *** | REL | ||

| 1 | −0.031 *** | −0.034 *** | 0.030 *** | −0.031 *** | 0.026 *** | −0.075 *** | 0.039 *** | −0.004 | 0.023 *** | 0.012 * | R&D | |

| 1 | 0.017 ** | −0.031 *** | −0.034 *** | 0.030 *** | −0.031 *** | 0.026 *** | −0.075 *** | 0.039 *** | −0.00400 | 0.023 *** | 0.012 * | REM |

| (1) | (2) | |

|---|---|---|

| VARIABLES | REM | R&D |

| REL | −0.300 *** | −19.131 ** |

| (−4.42) | (−2.20) | |

| SIZE | 0.001 | 0.435 |

| (0.26) | (1.24) | |

| LEV | 0.021 | −15.597 *** |

| (0.76) | (−3.82) | |

| ROA | −0.257 *** | −44.021 *** |

| (−8.58) | (−3.16) | |

| LOSS | −0.005 | 0.834 |

| (−0.27) | (0.33) | |

| BIG4 | 0.009 | −1.037 |

| (0.89) | (−0.38) | |

| GDP | 0.009 *** | −1.601 ** |

| (2.61) | (−2.41) | |

| LAW | −0.227 *** | 10.163 |

| (−4.00) | (1.00) | |

| Constant | 0.212 ** | 29.558 ** |

| (2.15) | (2.04) | |

| Year fixed effect | Included | Included |

| Industry fixed effect | Included | Included |

| Observations | 20,038 | 19,501 |

| R-squared | 0.011 | 0.008 |

| adj_R2 | 0.00644 | 0.00644 |

| F | 1.687 | 1.687 |

| (1) | (2) | |

|---|---|---|

| VARIABLES | REM | REM |

| Christianity | −0.264 *** | |

| (−4.07) | ||

| Islam | 0.857 *** | |

| (3.33) | ||

| SIZE | 0.000 | 0.001 |

| (0.17) | (0.33) | |

| LEV | 0.022 | 0.022 |

| (0.79) | (0.79) | |

| ROA | −0.256 *** | 0.259 *** |

| (−8.60) | (−8.64) | |

| LOSS | −0.007 | −0.006 |

| (−0.32) | (−0.30) | |

| BIG4 | 0.010 | 0.014 |

| (0.95) | (1.28) | |

| GDP | 0.007 ** | 0.012 *** |

| (1.99) | (3.35) | |

| LAW | −0.217 *** | −0.044 |

| (−4.02) | (−0.76) | |

| Constant | 0.182 * | 0.251 *** |

| (1.85) | (−5.41) | |

| Year fixed effect | Included | Included |

| Industry fixed effect | Included | Included |

| Observations | 20,038 | 20,038 |

| R-squared | 0.012 | 0.011 |

| adj_R2 | 0.00644 | 0.00644 |

| F | 1.687 | 1.687 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| VARIABLES | REM | R&D | REM | REM |

| REL | −0.291 *** | −18.198 ** | ||

| (−4.38) | (−2.13) | |||

| Christianity | −0.256 *** | |||

| (−4.04) | ||||

| Islam | 0.836 *** | |||

| (3.30) | ||||

| SIZE | −0.001 | 0.612 | −0.001 | −0.000 |

| (−0.20) | (1.39) | (−0.28) | (−0.14) | |

| LEV | 0.086 ** | −17.446 *** | 0.086 ** | 0.086 ** |

| (2.25) | (−3.35) | (2.26) | (2.26) | |

| ROA | −0.467 *** | −76.966 *** | −0.465 *** | −0.471 *** |

| (−7.98) | (−3.56) | (−8.00) | (−8.04) | |

| LOSS | −0.044 * | −4.741 * | −0.045 * | −0.045 * |

| (−1.77) | (−1.69) | (−1.79) | (−1.79) | |

| BIG4 | 0.009 | −1.000 | 0.009 | 0.013 |

| (0.86) | (−0.37) | (0.92) | (1.24) | |

| GDP | 0.007 ** | −1.575 ** | 0.006 | 0.010 *** |

| (2.03) | (−2.36) | (1.48) | (2.72) | |

| LAW | −0.213 *** | 9.678 | −0.203 *** | −0.035 |

| (−3.75) | (0.92) | (−3.76) | (−0.61) | |

| Constant | 0.210 ** | 30.589 ** | 0.180 * | −0.239 *** |

| (2.14) | (2.08) | (1.84) | (−5.18) | |

| Observations | 20,036 | 19,500 | 20,036 | 20,036 |

| R-squared | 0.012 | 0.008 | 0.012 | 0.012 |

| adj_R2 | 0.00675 | 0.00675 | 0.00675 | 0.00675 |

| F | 1.675 | 1.675 | 1.675 | 1.675 |

| (1) | (2) | |

|---|---|---|

| test1 | test2 | |

| VARIABLES | REM | R&D |

| REL | −0.003 * | −0.090 |

| (−1.65) | (−0.65) | |

| SIZE | −0.004 | 0.735 ** |

| (−1.59) | (2.28) | |

| LEV | 0.051 * | −15.692 *** |

| (1.71) | (−3.60) | |

| ROA | −0.243 *** | −42.679 *** |

| (−7.78) | (−3.12) | |

| LOSS | −0.021 | −0.880 |

| (−0.95) | (−0.44) | |

| BIG4 | 0.011 | −2.032 |

| (1.01) | (−0.86) | |

| GDP | 0.011 *** | −0.868 * |

| (3.02) | (−1.72) | |

| LAW | −0.187 * | 15.726 |

| (−1.83) | (1.25) | |

| Constant | −0.067 | 3.011 |

| (−0.89) | (0.67) | |

| Observations | 18,831 | 18,318 |

| R-squared | 0.008 | 0.008 |

| adj_R2 | 0.00701 | 0.00701 |

| F | 2.579 | 2.579 |

| (1) | (2) | |

|---|---|---|

| BIG4 = 0 | BIG4 = 1 | |

| VARIABLES | REM | REM |

| REL | −0.312 ** | −0.148 *** |

| (0.146) | (0.0517) | |

| SIZE | 0.000208 | −0.0113 *** |

| (0.00521) | (0.00225) | |

| LEV | 0.116 *** | 0.0538 ** |

| (0.0393) | (0.0212) | |

| ROA | −0.393 *** | −0.532 *** |

| (0.0824) | (0.0465) | |

| LOSS | −0.0616 ** | −0.0375 *** |

| (0.0283) | (0.0142) | |

| GDP | 0.0144 | −0.00672 |

| (0.0112) | (0.00426) | |

| LAW | −0.164 | −0.220 *** |

| (0.164) | (0.0601) | |

| Constant | 0.159 | 0.448 *** |

| (0.288) | (0.107) | |

| Observations | 11,149 | 9610 |

| R-squared | 0.005 | 0.032 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Toudas, K.S.; Zhu, J. The Effect of Religion in European Financial Statement Disclosures: A Real Earnings’ Management Case. J. Risk Financial Manag. 2023, 16, 464. https://doi.org/10.3390/jrfm16110464

Toudas KS, Zhu J. The Effect of Religion in European Financial Statement Disclosures: A Real Earnings’ Management Case. Journal of Risk and Financial Management. 2023; 16(11):464. https://doi.org/10.3390/jrfm16110464

Chicago/Turabian StyleToudas, Kanellos S., and Jinxiu Zhu. 2023. "The Effect of Religion in European Financial Statement Disclosures: A Real Earnings’ Management Case" Journal of Risk and Financial Management 16, no. 11: 464. https://doi.org/10.3390/jrfm16110464

APA StyleToudas, K. S., & Zhu, J. (2023). The Effect of Religion in European Financial Statement Disclosures: A Real Earnings’ Management Case. Journal of Risk and Financial Management, 16(11), 464. https://doi.org/10.3390/jrfm16110464