What Is the Effect of Oil and Gas Markets (Spot/Futures) on Herding in BRICS? Recent Evidence (2007–2022)

Abstract

1. Introduction

2. Literature Review

2.1. Relationship between Stock Markets and Commodity Markets

2.2. Energy Market and Herding

2.3. Geopolitics, Energy Market, and Herding

2.3.1. The Effect of Geopolitics on Energy Market

2.3.2. The Effect of Geopolitics on Herding

2.4. Speculative Activities, Energy Market, and Herding

The Effect of Speculation in Energy Market on Herding

2.5. Volatility in Energy Markets, Stock Markets, and Herding

2.5.1. The Effect of Volatility in Energy Market(s) on the Stock Market(s)

2.5.2. The Effect of Energy Market Volatility on Herding

2.6. Relationship between Energy Market, Stock Market, and Herding in BRICS

2.6.1. Relationship between the Energy Markets and the Stock Markets in BRICS

2.6.2. Relationship between Energy Markets and Herding in BRICS

3. Methodology and Data

3.1. Data and Sample(s)

3.2. The Basic Model

- (1)

- —Cross Sectional Absolute Deviation at Time t;

- (2)

- —Market Return at Time t;

- (3)

- —Return of Individual Stock at Time t;

- (4)

- N—the Number of Sample Stocks.

3.3. Models for Detecting Herding between Energy Markets and Stock Markets

- (1)

- —Daily Return of Brent Oil Index;

- (2)

- —Daily Return of Oil Generic 1st “CO” Futures;

- (3)

- —Daily Return of Henry Hub Natural Gas Index;

- (4)

- Daily Return of Natural Gas Generic 1st “NG” Futures.

3.4. Crisis Events and Herding

3.4.1. Regression Model

3.4.2. Granger Causality Test

3.5. Different States for Energy Markets and Herding in Stock Markets

Regression Model

3.6. Volatility in Energy Markets and Herding in Stock Markets

3.6.1. Spot Market Volatility

- (1)

- : Daily Return of Brent Oil Index or Henry Hub Natural Gas Index at Time t;

- (2)

- : Daily Return of Brent Oil Index or Henry Hub Natural Gas Index at Time t − 1;

- (3)

- : GARCH Volatility of Crude Oil or Natural Gas Spot Market at Time t.

- (1)

- : EWMA Volatility of Oil or Natural Gas Spot Market at Time t;

- (2)

- : First-ordered Lagged Volatility.

3.6.2. Futures Market Volatility

- (1)

- —RS Volatility of Oil or Natural Gas Futures at Time t;

- (2)

- Ot—Opening Oil or Natural Gas Futures Price at Time t;

- (3)

- Ct—Closing Oil or Natural Gas Futures Prices at Time t;

- (4)

- Ht—High Oil or Natural Gas Futures Prices at Time t;

- (5)

- Lt—Low Oil or Low Natural Gas Futures Prices at Time t.

- (1)

- GK Volatility of Oil or Gas Futures Market at Time t;

- (2)

- ;

- (3)

- .

3.6.3. The Effect of Energy Volatility on Herding in BRICS’ Stock Market

- (1)

- —Captures Volatility in the Second Quartile (25% of Distribution < σ < 50% of Distribution) and gets the value of 1, otherwise 0;

- (2)

- —Captures Volatility in the Third Quartile (50% of Distribution < σ < 75% of Distribution) and gets the value of 1, otherwise 0;

- (3)

- —Captures Volatility in the Forth Quartile (σ > 75% of Distribution) and gets the value of 1, otherwise 0;

- (4)

- —Represents GARCH and EWMA Volatility of Oil and Gas Spot Market, as well as RS and GK Volatility of Oil and Gas Futures Market;

- (5)

- Note that captures the first quartile.

3.7. Speculative Activity in Futures Market and Herding in Stock Market

- (1)

- : Speculation Ratio of Oil or Natural Gas Futures Market at Time t;

- (2)

- : Speculation Ratio of Oil or Natural Gas Futures during crisis and non-crisis periods (division method is the same as previous model);

- (3)

- Equation (14) captures any relationship between CSAD and SR if present during the whole period;

- (4)

- Equation (15) captures any relationship between CSAD and SR if present during different crisis events;

- (5)

- Equation (16) employs a quartile model to capture any relationship between CSAD and SR if present based on different levels of speculation activities via the introduction of dummy variables;

- (5a)

- captures the effect of the Speculation Ratio on CSAD when it lies in the Lower 25% of the SR Distribution;

- (5b)

- = 1 when the Speculation Ratio lies between 25% and 50% of the SR Distribution, otherwise = 0;

- (5c)

- = 1 when the Speculation Ratio lies between 50% and 75% of the SR Distribution, otherwise = 0;

- (5d)

- = 1 when the Speculation Ratio lies in the Upper 25% of the SR Distribution (Greater than 75% of Distribution), otherwise = 0.

4. Discussion and Findings

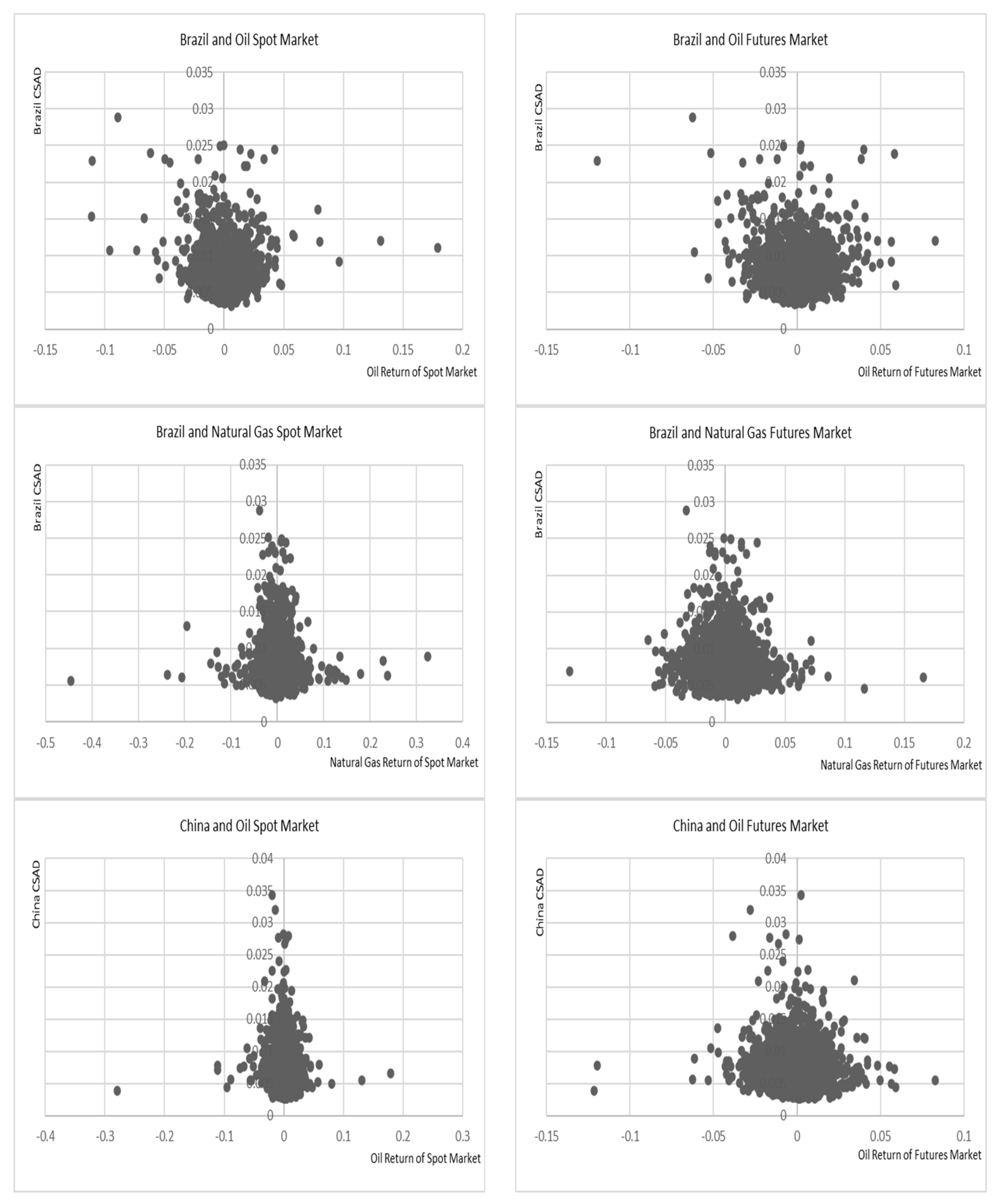

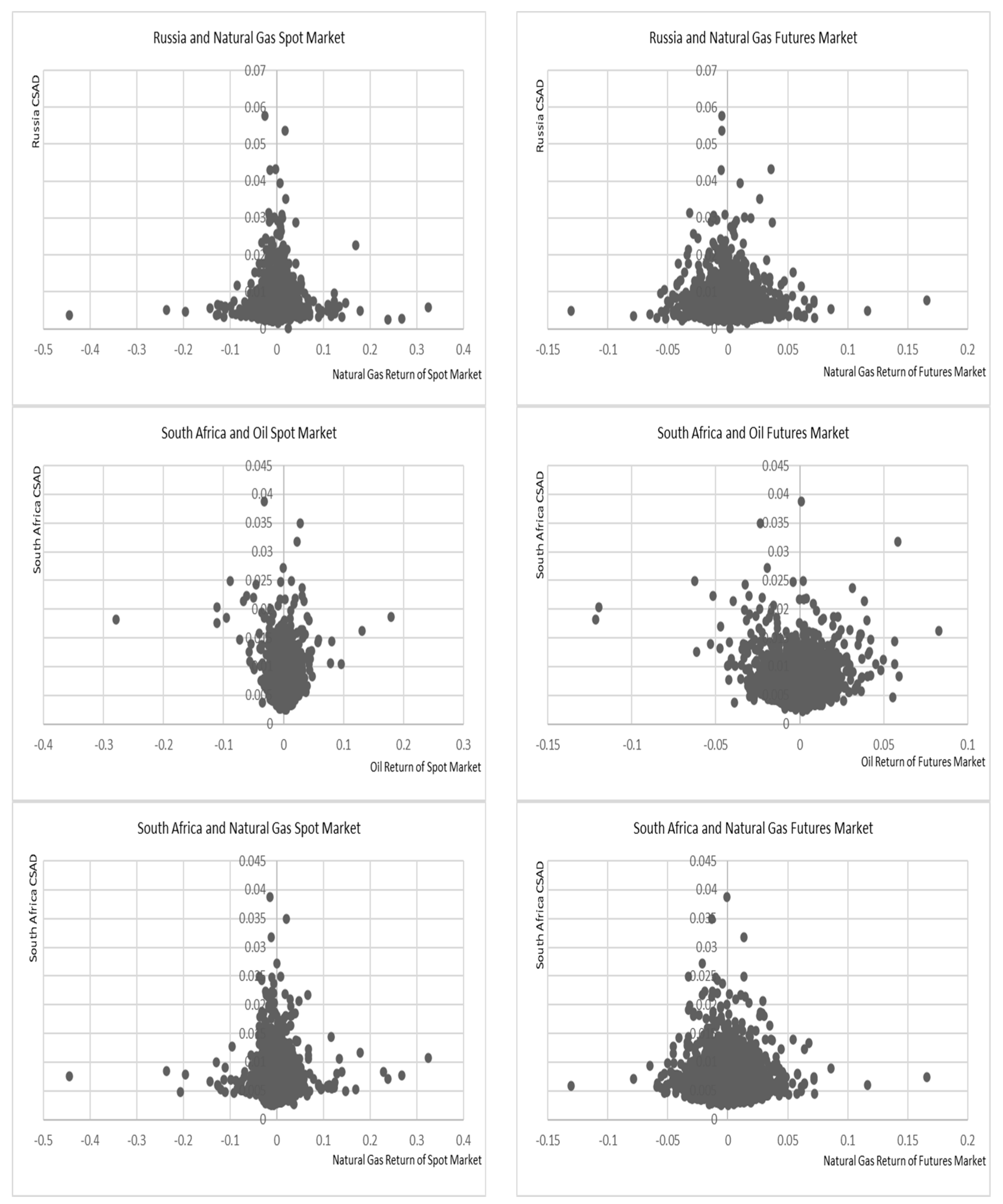

4.1. Herding in Stock Markets and the Effect of Energy Markets (Oil/Gas–Spot/Futures)

4.2. Crisis Event Effects

4.3. Energy Markets: Upward/Downward States and Their Effects on Herding

4.4. Energy Volatility Effect

4.5. Speculative Activities Effect

5. Conclusions, Implications, Limitations, and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | (1) Brazilian IBOVESPA: includes about 92 stocks; (2) Russian MOEX Index: tracks the 50 largest and most liquid stocks in Russia; (3) Chinese CSI 300: includes the top 300 stocks traded on the Shanghai Stock Exchange or Shenzhen Stock Exchange; (4) Indian S&P BSE SENSEX: consists of the 30 most liquid firms listed on the Bombay Stock Exchange; (5) South African FTSE/JSE Africa All Share Index: a market capitalisation weighted index, as the benchmark index, measures the performance of stocks that make up the top 99% of the market capitalisation of all listed companies traded on the Johannesburg Stock Exchange. |

| 2 | Henry Hub, the best known natural gas trading point, plays an important role in defining clearing prices and measures the price in USD per 1 million Btu based on the actual supply and demand of natural gas (Chen and Silberstein 2022). It is currently recognised as the benchmark of natural gas (CFI Team 2023). |

| 3 | The Brent Oil Index is the leading global price benchmark for Atlantic basin crude oil and can be employed to set the price of three-quarters of the world’s internationally traded crude oil suppliers. |

| 4 | The most important reason for choosing those contracts is that the two futures contracts are active, and they all have relatively complete data. |

| 5 | The order of GARCH is based on the AIC and BIC, even though the two criteria do not always agree. We tried different models, but the GARCH (1,1) appears to provide the best fit. Also see Hansen and Lunde (2005). |

References

- Abrahamian, Ara. 2022. How Stock Markets Historically Respond to Geopolitical Risks. [Online]. Available online: https://www.divergentplanning.com/blog/how-stock-markets-historically-respond-to-geopolitical-risks (accessed on 22 January 2023).

- Acaravci, Ali, Serkan Yilmaz Kandir, and Ilhan Ozturk. 2012. Natural Gas Prices and Stock Prices: Evidence from EU-15 Countries. Economic Modelling 29: 1646–54. [Google Scholar] [CrossRef]

- Adu, George, Paul Alagidede, and Amin Karimu. 2015. Stock Return Distribution in the BRICS. Review of Development Finance 5: 98–109. [Google Scholar] [CrossRef][Green Version]

- Aït-Sahalia, Yacine, Jochen Andritzky, Andreas Jobst, Sylwia Nowak, and Natalia Tamirisa. 2012. Market response to policy initiatives during the global financial crisis. Journal of International Economic 87: 162–77. [Google Scholar] [CrossRef]

- Akgiray, Vedat. 1989. Conditional Heteroskedasticity in Time Series of Stock Returns: Evidence and Forecasts. The Journal of Business 62: 55–80. [Google Scholar] [CrossRef]

- Alam, Md. Kausar, Mosab I. Tabash, Mabruk Billah, Sanjeev Kumar, and Suhaib Anagreh. 2022. The Impacts of the Russia–Ukraine Invasion on Global Markets and Commodities: A Dynamic Connectedness among G7 and BRIC Markets. Journal of Risk and Financial Management 15: 352. [Google Scholar] [CrossRef]

- Alamgir, Farzana, and Sakib Bin Amin. 2021. The Nexus between Oil Price and Stock Market: Evidence from South Asia. Energy Reports 7: 693–703. [Google Scholar] [CrossRef]

- Algieri, Bernardina, and Arturo Leccadito. 2019. Price Volatility and Speculative Activities in Futures Commodity Markets: A Combination of Combinations of P-values Test. Journal of Commodity Markets 13: 40–54. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, and George Filis. 2013. Oil Prices and Stock Market Correlation: A Time-varying Approach. International Journal of Energy and Statistics 1: 17–29. [Google Scholar] [CrossRef]

- Apergis, Nicholas, and Stephen M. Miller. 2009. Do Structural Oil-Market Shocks Affect Stock Prices? Energy Economics 31: 569–75. [Google Scholar] [CrossRef]

- Araneda, Axel A. 2021. Asset Volatility Forecasting: The Optimal Decay Parameter in the EWMA Model. New York: Cornell University. [Google Scholar]

- Arjoon, Vrjoon, and Chandra Shekhar Bhatnagar. 2017. Dynamic Herding Analysis in a Frontier Market. Research in International Business and Finance 42: 496–508. [Google Scholar] [CrossRef]

- Austin, Angelica. 2009. State-owned vs. Multinational Oil: New for Market Intervention. New York: The East West Institute. [Google Scholar]

- Baddeley, Michelle, Christopher Burke, W. Schultz, and Philippe Tobler. 2012. Herding in Financial Behaviour: A Behavioural and Neuroeconomic Analysis of Individual Differences. Cambridge: Faculty of Economics, University of Cambridge. [Google Scholar]

- Balcilar, Mehmet, Riza Demirer, Shawkat Hammoudeh, and Ahmed Khalifa. 2013. Do Global Shocks Drive Investor Herds in Oil-Rich Frontier Markets? Cairo: Economic Research Forum. [Google Scholar]

- Balcilar, Mehmet, Riza Demirer, and Shawkat Hammoudeh. 2014. What Drives Herding in Oil-Rich, Developing Stock Markets? Relative Roles of Own Volatility and Global Factors. North American Journal of Economics and Finance 29: 418–40. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Riza Demirer, and Talat Ulussever. 2017. Does Speculation in the Oil Market Drive Investor Herding in Emerging Stock Markets? Energy Economics 65: 50–63. [Google Scholar] [CrossRef]

- Banerjee, Abhijit V. 1992. A Simple Model of Herd Behavior. The Quarterly Journal of Economics 107: 797–817. [Google Scholar] [CrossRef]

- Banton, Caroline, Cierra Murry, and Yarilet Perez. 2022. Commodities: The Portfolio Hedge. [Online]. Available online: https://www.investopedia.com/articles/trading/05/021605.asp (accessed on 22 January 2023).

- Bashir, Muhammad Farhan. 2022. Oil Price Shocks, Stock Market Returns, and Volatility Spillovers: A Bibliometric Analysis and its Implications. Environmental Science and Pollution Research 29: 22809–28. [Google Scholar] [CrossRef]

- Bekiros, Stelios, Mouna Jlassi, Brian Lucey, Kamel Naoui, and Gazi Salah Uddin. 2017. Herding Behavior, Market Sentiment and Volatility: Will The Bubble Resume? The North American Journal of Economics and Finance 42: 107–31. [Google Scholar] [CrossRef]

- BenMabrouk, Houda, and Houda Litimi. 2018. Cross Herding between American Industries and the Oil Market. North American Journal of Economics and Finance 45: 196–205. [Google Scholar] [CrossRef]

- Bernanke, Ben S. 2016. The Relationship between Stocks and Oil Prices. [Online]. Available online: https://www.brookings.edu/blog/ben-bernanke/2016/02/19/the-relationship-between-stocks-and-oil-prices/ (accessed on 1 April 2023).

- Blasco, Natividad, Pilar Corredor, and Sandra Ferreruela. 2012. Does Herding Affect Volatility? Implications for the Spanish Stock Market. Quantitative Finance 12: 311–27. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Boubaker, Heni, and Ons Ben Larbi. 2022. Dynamic Dependence and Hedging Strategies in BRICS Stock Markets with Oil during Crisis. Economic Analysis and Policy 76: 263–79. [Google Scholar] [CrossRef]

- Boubaker, Sabri, John W. Goodell, Dharen Kumar Pandey, and Vineeta Kumari. 2022. Heterogeneous Impacts of Wars on Global Equity Markets: Evidence from the Invasion of Ukraine. Finance Research Letters 48: 1–9. [Google Scholar] [CrossRef]

- Bougatef, Khemaies, and Imen Nejah. 2023. Does Russia-Ukraine War Generate Herding Behavior in Moscow Exchange? Review of Behavioral Finance. ahead-of-print. [Google Scholar] [CrossRef]

- Bouoiyour, Jamal, and Refk Selmi. 2016. How Differently Does Oil Prices Influence BRICS Stock Markets? Journal of Economic Integration 31: 547–68. [Google Scholar] [CrossRef]

- Bouzid, Khalil Nait. 2022. The Impact Of Idiosyncratic Volatility on the Investors’ Herd Behavior in the Chinese Stock Market. International Journal of Strategic Management and Economic Studies (IJSMES) 1: 483–513. [Google Scholar]

- Bricout, Aymeric, Raphael Slade, Iain Staffell, and Krista Halttunen. 2022. From the Geopolitics of Oil and Gas to the Geopolitics of the Energy Transition: Is There a Role for European Supermajors? Energy Research & Social Science 88: 1–8. [Google Scholar]

- Brooks, Chris. 2014. Introductory Econometrics for Finance, 3rd ed. Cambridge: Cambridge University Press. [Google Scholar]

- Brunetti, Celso, Bahattin Büyükşahin, and Jeffrey H. Harris. 2013. Herding and Speculation in the Crude Oil Market. The Energy Journal 34: 83–104. [Google Scholar] [CrossRef]

- Brunetti, Celso, Bahattin Büyükşahin, and Jeffrey H. Harris. 2016. Speculators, Prices, and Market Volatility. The Journal of Financial and Quantitative Analysis 51: 1545–74. [Google Scholar] [CrossRef]

- Büge, Max, Matias Egeland, Przemyslaw Kowalski, and Monika Sztajerowska. 2013. State-Owned Enterprises in the Global Economy. [Online]. Available online: https://www.weforum.org/agenda/2013/05/state-owned-enterprises-in-the-global-economy/ (accessed on 22 January 2023).

- Cakan, Esin, Rıza Demirer, Rangan Gupta, and Hardik A. Marfatia. 2019a. Oil Speculation and Herding Behavior in Emerging Stock Markets. Journal of Economics and Finance 43: 44–56. [Google Scholar] [CrossRef]

- Cakan, Esin, Rıza Demirer, Rangan Gupta, and Josine Uwilingiye. 2019b. Economic Policy Uncertainty and Herding Behavior: Evidence from the South African Housing Market. Advances in Decision Sciences 23: 88–113. [Google Scholar]

- Cattlin, Rebecca. 2021. What Is Natural Gas? [Online]. Available online: https://www.cityindex.com/en-uk/news-and-analysis/what-is-natural-gas-and-how-do-you-trade-it/ (accessed on 1 April 2023).

- CFI Team. 2023. Henry Hub. [Online]. Available online: https://corporatefinanceinstitute.com/resources/valuation/henry-hub/ (accessed on 1 May 2023).

- Chan, Leo H., Chi M. Nguyen, and Kam C. Chan. 2015. A New Approach to Measure Speculation in the Oil Futures Market and some Policy Implications. Energy Policy 86: 133–41. [Google Scholar] [CrossRef]

- Chandler, Marc. 2022. Soaring Natural Gas Increases Market Volatility. [Online]. Available online: https://www.investing.com/analysis/natural-gas-soars-increasing-market-volatility-200629481 (accessed on 22 January 2023).

- Chang, Chia-Lin, Michael McAleer, and Yu-Ann Wang. 2020. Herding Behaviour in Energy Stock Markets during the Global Financial Crisis, SARS, and ongoing COVID-19. Renewable and Sustainable Energy Reviews 134: 1–15. [Google Scholar] [CrossRef]

- Chang, Eric C., Joseph W. Cheng, and Ajay Khorana. 2000. An Examination of Herd Behavior in Equity Markets: An International Perspective. Journal of Banking & Finance 24: 1651–79. [Google Scholar]

- Chen, James, and Samantha Silberstein. 2022. What Is Henry Hub? Definition, Location, Owner, and Connections. [Online]. Available online: https://www.investopedia.com/terms/h/henry_hub.asp (accessed on 1 May 2023).

- Chen, Matthew E., and Amy Myers Jaffe. 2007. Energy Security: Meeting the Growing Challenge of National Oil Companies. The Whitehead Journal of Diplomacy and International Relations 8: 10–21. [Google Scholar]

- Christie, William, and Roger D. Huang. 1995. Following the Pied Piper: Do Individual Returns Herd around the Market? Financial Analysts Journal 51: 31–37. [Google Scholar] [CrossRef]

- Cliffe, Callum. 2022. How to Trade or Invest in Natural Gas. [Online]. Available online: https://www.ig.com/uk/trading-strategies/how-to-trade-natural-gas-190320 (accessed on 23 January 2023).

- Cong, Rong-Gang G., Yi-Ming Wei, Jian-Lin Jiao, and Ying Fan. 2008. Relationships between Oil Price Shocks and Stock Market: An Empirical Analysis from China. Energy Policy 36: 3544–53. [Google Scholar] [CrossRef]

- Costola, Michele, and Marco Lorusso. 2022. Spillovers among Energy Commodities and the Russian Stock Market. Journal of Commodity Markets 28: 1–22. [Google Scholar] [CrossRef]

- Dai, Zhifeng, and Haoyang Zhu. 2022. Time-varying Spillover Effects and Investment Strategies between WTI Crude Oil, Natural Gas and Chinese Stock Markets related to Belt and Road Initiative. Energy Economics 108: 1–12. [Google Scholar] [CrossRef]

- DailyBulls. 2023. Are Commodities and Stocks Closely Correlated? A Comparative Analysis. [Online]. Available online: https://dailybulls.in/how-commodity-prices-affect-stocks-correlation-with-examples/#:~:text=Output%2DSensitive%20Stocks%3A%20Output%2D,%2C%20energy%2C%20and%20agricultural%20products (accessed on 3 April 2023).

- de Oliveira, Carlos Alexandre. 2022. Brazil News Brief and Action Alert—Natural Gas Consumption in Brazil Grew by 28.82% in 2021. [Online]. Available online: https://www.climatescorecard.org/2022/06/natural-gas-consumption-in-brazil-grew-by-28-82-in-2021/#:~:text=Brazil%20imports%20approximately%2050%25%20of,gas%20from%20the%20neighboring%20country (accessed on 22 January 2023).

- de Salles, Andre Assis. 2019. On the Relationship between Crude Oil Prices and Stock Market: The Brazilian Case. International Research Journal of Finance and Economics 176: 156–66. [Google Scholar]

- Degiannakis, Stavros, George Filis, and Vipin Arora. 2018. Oil Prices and Stock Markets. The Energy Journal 39: 85–130. [Google Scholar] [CrossRef]

- Devenow, Andrea, and Ivo Welch. 1996. Rational Herding in Financial Economics. European Economic Review 40: 603–15. [Google Scholar] [CrossRef]

- Dewan, Pewan, and Khushdeep Dharni. 2022. Herding and Spillover Effects in the Indian Commodity Futures Market. Journal of Agribusiness in Developing and Emerging Economies. Available online: https://www.emerald.com/insight/content/doi/10.1108/JADEE-11-2021-0288/full/html (accessed on 22 January 2023). [CrossRef]

- Ding, Jie, and Nigel Meade. 2010. Forecasting Accuracy of Stochastic Volatility, GARCH and EWMA Models under Different Volatility Scenarios. Applied Financial Economics 20: 771–83. [Google Scholar] [CrossRef]

- Dos Santos, Luís G.G., and Sérgio Lagoa. 2017. Herding Behaviour in a Peripheral European Stock Market: The Impact of the Subprime and the European Sovereign Debt Crisis. International Journal of Banking, Accounting and Finance 8: 174–203. [Google Scholar] [CrossRef]

- EIA. 2022. Henry Hub Natural Gas Spot Price. [Online]. Available online: https://www.eia.gov/dnav/ng/hist/rngwhhdm.htm (accessed on 22 January 2023).

- Elyasiani, Elyas, Lqbal Mansur, and Babatunde Odusami. 2011. Oil Price Shocks and Industry Stick Returns. Energy Economics 33: 966–74. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica: Journal of the Econometric Society 50: 987–1007. [Google Scholar] [CrossRef]

- Espinosa-Méndez, Christian. 2022. Civil Unrest And Firm Performance: Evidence From Chile. Economics and Business Letters 11: 118–24. [Google Scholar] [CrossRef]

- Federal Reserve Bank of San Francisco (FRB). 2007. What Are the Possible Causes and Consequences of Higher Oil Prices on the Overall Economy? [Online]. Available online: https://www.frbsf.org/education/publications/doctor-econ/2007/november/oil-prices-impact-economy/ (accessed on 4 April 2023).

- Fei, Fan, and Jianing Zhang. 2023. Chinese Stock Market Volatility and Herding Behavior Asymmetry during the COVID-19. Cogent Economics & Finance 11: 1–19. [Google Scholar]

- Ferreira, Paulo, Éder Pereira, and Marcus Silva. 2020. The Relationship between Oil Prices and the Brazilian Stock Market. Physica A: Statistical Mechanics and its Applications 545: 1–12. [Google Scholar] [CrossRef]

- Fleischmann, Oliver, Anne Valley, and Cormac O’Daly. 2022. FDI in the Energy Sector. [Online]. Available online: https://globalcompetitionreview.com/guide/foreign-direct-investment-regulation-guide/second-edition/article/fdi-in-the-energy-sector (accessed on 31 March 2023).

- Gabbori, Dina, Basel Awartani, Aktham Maghyereh, and Nader Virk. 2020. OPEC Meetings, Oil Market Volatility and Herding Behaviour in the Saudi Arabia Stock Market. International Journal of Finance & Economics 26: 870–88. [Google Scholar]

- Galariotis, Emilios, Styliani-Iris Krokida, and Spyros I. Spyrou. 2016. Bond Market Investor Herding: Evidence from the European Financial Crisis. International Review of Financial Analysis 48: 367–75. [Google Scholar] [CrossRef]

- Garman, Mark B., and Michael J. Klass. 1980. On the Estimation of Security Price Volatilities from Historical Data. The Journal of Business 53: 67–78. [Google Scholar] [CrossRef]

- Gatfaoui, Hayette. 2016. Linking the Gas and Oil Market with the Stock Market: Investigating the U.S. Relationship. Energy Economics 53: 5–16. [Google Scholar] [CrossRef]

- GEP. 2022. Russia-Ukraine War’s Effects on the Oil and Gas Industry. [Online]. Available online: https://www.gep.com/blog/mind/russia-ukraine-wars-effects-oil-and-gas-industry (accessed on 22 January 2023).

- Ghorbel, Achraf, Mouna Boujelbene, and Younes Boujelbene. 2014. Shocks and Herding Contagion in the Oil and Stock Markets. The IUP Journal of Applied Finance 19: 41–60. [Google Scholar]

- Granger, Clive W. J. 1969. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 37: 424–38. [Google Scholar] [CrossRef]

- Groves, Jo. 2022. How to Invest in Natural Gas. [Online]. Available online: https://www.standard.co.uk/esmoney/investing/how-to-invest-in-natural-gas-b1024012.html (accessed on 22 January 2023).

- Groww. 2022. How Oil Prices Affect Your Portfolio? [Online]. Available online: https://groww.in/blog/how-oil-prices-affect-your-portfolio (accessed on 4 April 2023).

- Halsey, Richard, Richard Bridle, and Anna Geddes. 2022. Gas Pressure: Exploring the Case for Gas-Fired Power in South Africa. Winnipeg: International Institute for Sustainable Development. [Google Scholar]

- Hampton, Liz. 2022. Price Volatility and Rising Demand Revive U.S. Natural Gas Trading. [Online]. Available online: https://www.reuters.com/business/energy/price-volatility-rising-demand-revive-us-natural-gas-trading-2022-04-08/ (accessed on 22 January 2023).

- Hansen, Peter R., and Asger Lunde. 2005. A forecast comparison of volatility models: Does anything beat a GARCH(1,1)? Journal of Applied Econometrics 20: 873–89. [Google Scholar] [CrossRef]

- Hashmi, Shabir M., Farhan Ahmed, Zainab Alhayki, and Aamir Aijaz Syed. 2022. The Impact of Crude Oil Prices on Chinese Stock Markets and Selected Sectors: Evidence from the VAR-DCC-GARCH Model. Environmental Science and Pollution Research 29: 52560–73. [Google Scholar] [CrossRef]

- Hoque, Mohammad E., Soo-Wah Low, and Mohd Azlan Shah Zaidi. 2020. The Effects of Oil and Gas Risk Factors on Malaysian Oil and Gas Stock Returns: Do They Vary? Energies 13: 3901. [Google Scholar] [CrossRef]

- Huang, Teng-Ching, Bing-Huei Lin, and Tung-Hsiao Yang. 2015. Herd Behavior and Idiosyncratic Volatility. Journal of Business Research 68: 763–70. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). 2008. World Energy Outlook 2008. Paris: IEA. [Google Scholar]

- International Energy Agency (IEA). 2022. Global Energy Crisis. [Online]. Available online: https://www.iea.org/topics/global-energy-crisis (accessed on 22 January 2023).

- Ivanov, Asen, Dan Levin, and James Peck. 2009. Hindsight, Foresight, and Insight: An Experimental Study of a Small-Market Investment Game with Common and Private Values. The American Economic Review 99: 1484–507. [Google Scholar] [CrossRef][Green Version]

- Jlassi, Mouna, and Kamel Naoui. 2015. Herding Behaviour and Market Dynamic Volatility: Evidence from the US Stock Markets. American Journal of Finance and Accounting 4: 70–91. [Google Scholar] [CrossRef]

- Jones, Charles M., and Gautam Kaul. 1996. Oil and the Stock Markets. The Journal of Finance 51: 463–91. [Google Scholar] [CrossRef]

- Joo, Kyohun, Jong Hwan Suh, Daeyong Lee, and Kwangwon Ahn. 2020. Impact of the Global Financial Crisis on the Crude Oil Market. Energy Strategy Review 30: 1–6. [Google Scholar] [CrossRef]

- Joo, Young C., and Sung Y. Park. 2021. The Impact of Oil Price Volatility on Stock Markets: Evidences from Oil-Importing Countries. Energy Economics 101: 1–13. [Google Scholar] [CrossRef]

- J.P. Morgan/Reuters. 1996. RiskMetricsTM-Technical Document, 4th ed. New York: Martin Spencer. [Google Scholar]

- Kemp, John. 2022. Column: China’s Reliance on Gas Imports Threatens Security. [Online]. Available online: https://www.reuters.com/business/energy/chinas-reliance-gas-imports-threatens-security-kemp-2022-10-07/#:~:text=China’s%20net%20import%20requirement%20climbed,2016%20and%2021%25%20in%202011 (accessed on 22 January 2023).

- Konradsson, Richard, and Theodor Porss. 2019. Stock Market Integration between the BRICS Countries—Long-term Investment Opportunities. Linköping: Linköping University. [Google Scholar]

- Kouchaksaraei, Meysam Azizi, Hamed Movahedizadeh, and Hoda Mohammadalikhani. 2016. Determinant of the Relationship between Natural Gas Prices and Leading Natural Gas Countries’ Stock Exchange. International Journal of Economics and Finance 8: 246–53. [Google Scholar] [CrossRef]

- Krishna, T. A., and B. Suresha. 2022. Intensified Geopolitical Conflicts and Herding Behavior: An Evidence from Selected Nifty Sectoral Indices during India-China Tensions in 2020. Investment Management and Financial Innovations 19: 300–12. [Google Scholar]

- Kumar, Satish, Ashis Kumar Pradhanb, Aviral Kumar Tiwari, and Sang Hoon Kang. 2019. Correlations and Volatility Spillovers between Oil, Natural Gas, and Stock Prices in India. Resources Policy 62: 282–91. [Google Scholar] [CrossRef]

- Liao, Tsai-Ling, Chih-Jen Huang, and Chieh-Yuan Wu. 2011. Do Fund Managers Herd to Counter Investor Sentiment? Journal of Business Research 64: 207–12. [Google Scholar] [CrossRef]

- Lin, William T., Shih-Chuan Tsai, and Pei-Yau Lung. 2013. Investors’ Herd Behavior: Rational or Irrational? Asia-Pacific Journal of Financial Studies 43: 755–76. [Google Scholar] [CrossRef]

- Loang, Ooi Kok. 2023. Cross Market Herding in Chinese, US and Crude Oil Markets: Quantile Regression Analysis; Kuala Lumpur, Malaysia. Available online: https://www.researchgate.net/profile/Ooi-Kok-Loang/publication/369506572_CROSS_MARKET_HERDING_IN_CHINESE_US_AND_CRUDE_OIL_MARKETS_QUANTILE_REGRESSION_ANALYSIS/links/641eb774a1b72772e4275603/CROSS-MARKET-HERDING-IN-CHINESE-US-AND-CRUDE-OIL-MARKETS-QUANTILE-REGRESSION-ANALYSIS.pdf (accessed on 22 January 2023).

- Mahunta, Rajendra. 2011. Relationship between International Crude Oil Price and Indian Stock Market (NSE). Interscience Management Review 4: 63–73. [Google Scholar] [CrossRef]

- Mandaci, Pinar Evrim, and Efe Caglar Cagli. 2022. Herding Intensity and Volatility In Cryptocurrency Markets. Finance Research Letters 46: 1–7. [Google Scholar]

- Mellow, Craig. 2022. Brazil’s Stock Market Is Up 30% This Year. Where to Find Bargains. [Online]. Available online: https://www.barrons.com/articles/brazil-stock-market-bargains-51650609904 (accessed on 22 January 2023).

- Mensi, Walid, Mobeen U. Rehman, Debasish Maitra, Khamis Hamed Al-Yahyaee, and Xuan Vinh Vo. 2021. Oil, Natural Gas and BRICS Stock Markets: Evidence of Systemic Risks and Co-Movements in the Time-Frequency Domain. Resources Policy 72: 1–24. [Google Scholar] [CrossRef]

- Mertzanis, Charilaos, and Noha Allam. 2018. Political Instability and Herding Behaviour: Evidence from Egypt’s Stock Market. Journal of Emerging Market Finance 17: 29–59. [Google Scholar] [CrossRef]

- Messis, Petros, and Achilleas Zapranis. 2014. Herding Behaviour and Volatility in the Athens Stock Exchange. The Journal of Risk Finance 15: 572–90. [Google Scholar] [CrossRef]

- Meyer, Robinson. 2022. Three Theories for Why Gas Prices Are So High. [Online]. Available online: https://www.theatlantic.com/science/archive/2022/02/why-gas-got-so-expensive/622887/ (accessed on 29 March 2022).

- Monthly Bulletin. 2004. How Do Stock Market React to Changes in Oil Prices? Frankfurt: Governing Council of the European Central Bank. [Google Scholar]

- Motilal Oswal. 2018. Can the Commodity Markets Provide Cues for Equity Trading? [Online]. Available online: https://www.motilaloswal.com/blog-details/can-the-commodity-markets-provide-cues-for-equity-trading-/1446 (accessed on 22 January 2023).

- Nadig, Smruthi. 2022. Before and After: How the Ukraine Crisis Has Affected Russian Oil. [Online]. Available online: https://www.offshore-technology.com/features/before-and-after-how-the-ukraine-crisis-has-affected-russian-oil/#:~:text=Since%20the%20second%20half%20of,the%20first%20time%20since%202014 (accessed on 9 April 2023).

- Nandha, Mohan, and Robert Faff. 2008. Does Oil Move Equity Prices? A Global View. Energy Review 30: 986–97. [Google Scholar] [CrossRef]

- Nasir, Muhammad Ali, Lutchmee Naidoo, Muhammad Shahbaz, and Nii Amoo. 2018. Implications of Oil Prices Shocks for the Major Emerging Economies: A Comparative Analysis of BRICS. Energy Economics 76: 76–88. [Google Scholar] [CrossRef]

- Noguera-Santaella, José. 2016. Geopolitics and the Oil Price. Economic Modelling 52: 301–9. [Google Scholar] [CrossRef]

- Olayele, Fred B. 2015. The Geopolitics of Oil and Gas. New York: International Association for Energy Economics. [Google Scholar]

- Ono, Shigeki. 2011. Oil Price Shocks and Stock Markets in BRICs. The European Journal of Comparative Economics 8: 29–45. [Google Scholar]

- Parkinson, Michael. 1980. The Extreme Value Method for Estimating the Variance of the Rate of Return. The Journal of Business 53: 61–65. [Google Scholar] [CrossRef]

- Pindyck, Robert S. 2004. Volatility in Natural Gas and Oil Markets. The Journal of Energy and Development 30: 1–19. [Google Scholar]

- Pinho, Carlos, and Isabel Maldonado. 2022. Commodity and Equity Markets: Volatility and Return Spillovers. Commodities 1: 18–33. [Google Scholar] [CrossRef]

- Pistilli, Melissa. 2022. 10 Top Natural Gas Producers by Country. [Online]. Available online: https://investingnews.com/top-natural-gas-producers/ (accessed on 22 January 2023).

- Pompian, Michael. 2017. How Herding Leads to Market Bubbles. [Online]. Available online: https://www.morningstar.com/articles/832975/how-herding-leads-to-market-bubbles (accessed on 22 January 2023).

- Power, Séamus A. 2018. The Deprivation-protest Paradox: How the Perception of Unfair Economic Inequality Leads to Civic Unrest. Current Anthropology 59: 765–89. [Google Scholar] [CrossRef]

- Psaropoulos, John. 2022. Timeline: Six months of Russia’s War in Ukraine. [Online]. Available online: https://www.aljazeera.com/news/2022/8/24/timeline-six-months-of-russias-war-in-ukraine (accessed on 22 January 2023).

- Rapier, Robert. 2020. Fossil Fuels Still Supply 84 Percent of World Energy—And Other Eye Openers from BP’s Annual Review. [Online]. Available online: https://www.forbes.com/sites/rrapier/2020/06/20/bp-review-new-highs-in-global-energy-consumption-and-carbon-emissions-in-2019/?sh=510922c366a1 (accessed on 22 January 2023).

- Rogers, L. Christopher G., and Stephen E. Satchell. 1991. Estimating Variance from High, Low and Closing Prices. The Annals of Applied Probability 1: 504–12. [Google Scholar] [CrossRef]

- Rogers, Leonard C.G., Stephen E. Satchell, and Youngjun Yoon. 1994. Estimating the Volatility of Stock Prices: A Comparison of Methods that Use High and Low Prices. Applied Financial Economics 4: 241–47. [Google Scholar] [CrossRef]

- Rogoff, Kenneth. 2022. Global Oil and Gas Prices Have Been Highly Volatile—What Will Happen Next? [Online]. Available online: https://www.theguardian.com/business/2022/jul/05/global-oil-gas-prices-supply-demand-us-europe#:~:text=The%20price%20of%20Brent%20crude,barrel%20after%20Russia%20invaded%20Ukraine (accessed on 22 January 2023).

- Ross, James. 2020. Hitting the Gas in South Africa—The Expanding Role of LNG and a New Round of Gas Exploration Appear Set to Alleviate the Country’s Energy Supply Problem. [Online]. Available online: https://www.nortonrosefulbright.com/en/knowledge/publications/d887b62e/hitting-the-gas-in-south-africa (accessed on 22 January 2023).

- Ross, Sean, Charles Potters, and Hans Daniel Jasperson. 2021. How Oil Prices Affect the Stock Market. [Online]. Available online: https://www.investopedia.com/ask/answers/030415/how-does-price-oil-affect-stock-market.asp (accessed on 1 April 2023).

- Sadorsky, Perry. 1999. Oil Price Shocks and Stock Market Activity. Energy Economics 21: 449–69. [Google Scholar] [CrossRef]

- Sadraoui, Tarek, Rym Regaïeg, Wajdi Moussa, Nidhal Mgadmi, and Chokri Arfa. 2022. Dynamic Spillover between the Crude Oil, Natural Gas and BRICS Stock Markets. Journal of Energy Markets 15: 1–36. [Google Scholar] [CrossRef]

- Sansarlioglu, Burhan. 2022. Geopolitical Risks Continue to Affect Commodity Market. [Online]. Available online: https://www.aa.com.tr/en/economy/geopolitical-risks-continue-to-affect-commodity-market/2548157 (accessed on 22 January 2023).

- Sanusi, Kazeem Abimbola, and Forget Mingiri Kapingura. 2022. On the Relationship between Oil Price, Exchange Rate and Stock Market Performance in South Africa: Further Evidence from Time-Varying and Regime Switching Approaches. Cogent Economics & Finance 10: 1–18. [Google Scholar]

- Scholtens, Bert, and Cenk Yurtsever. 2012. Oil Price Shocks and European Industries. Energy Economics 34: 1187–95. [Google Scholar] [CrossRef]

- Schwert, G. William. 1989. Why Does Stock Market Volatiility Change Over Time? The Journal of Finance 44: 1115–56. [Google Scholar] [CrossRef]

- Segal, Troy, and Gordon Scott. 2021. China A-Shares: Definition, History, vs. B-Shares. [Online]. Available online: https://www.investopedia.com/terms/a/a-shares.asp (accessed on 22 January 2023).

- Segal, Troy, Chip Stapleton, and Katrina Munichiello. 2022. Is Short Selling Allowed in India? [Online]. Available online: https://www.investopedia.com/ask/answers/09/short-selling-india.asp (accessed on 22 January 2023).

- Siapartners. 2022. Geopolitical Developments and Record High Oil & Gas Prices—Can Europe Reduce its Energy Dependence on Russia? [Online]. Available online: https://www.sia-partners.com/en/news-and-publications/from-our-experts/geopolitical-developments-and-record-high-oil-gas-prices (accessed on 22 January 2023).

- Staff, Al Jazeera. 2022. Infographic: How Much of Your Country’s Gas Comes from Russia? [Online]. Available online: https://www.aljazeera.com/news/2022/3/17/infographic-how-much-of-your-countrys-gas-comes-from-russia-interactive (accessed on 22 January 2023).

- Statista. 2023. Import Volume of Natural Gas into Africa in 2020, by Country. [Online]. Available online: https://www.statista.com/statistics/1197980/import-volume-of-natural-gas-in-african-countries/ (accessed on 5 June 2023).

- Taylor, Stephen J. 1987. Forecasting the Volatility of Currency Exchange Rates. International Journal of Forecasting 3: 159–70. [Google Scholar] [CrossRef]

- The Economist. 2011. The Oil Business—Bif Oil’s Bigger Brothers. [Online]. Available online: https://www.economist.com/business/2011/10/29/big-oils-bigger-brothers (accessed on 31 March 2023).

- The Investopedia Team, Khadija Khartit, and Timothy Li. 2022. The 2008 Financial Crisis and Its Effects on Gas and Oil. [Online]. Available online: https://www.investopedia.com/ask/answers/052715/how-did-financial-crisis-affect-oil-and-gas-sector.asp (accessed on 22 January 2023).

- Trueck, Stefan, and Yimeng Yu. 2016. Investor Herding and Dispersing in the Renewable Energy Sector. Sydney: Sydney Centre for Financial Risk Faculty of Business and Economics, Macquarie University. [Google Scholar]

- Ulussever, Talat, and Rıza Demirer. 2017. Investor Herds and Oil Prices Evidence in the Gulf Cooperation Council (GCC) Equity Markets. Central Bank Review 17: 77–89. [Google Scholar] [CrossRef]

- Victor, Nadeja M. 2007. On Measuring the Performance of National Oil Companies (NOCs). Stanford: Stanford University. [Google Scholar]

- Wadhwa, Puneet, and Lovisha Darad. 2022. Will the Spike in Natural Gas Prices Affect Related Stocks? [Online]. Available online: https://www.business-standard.com/podcast/markets/will-the-spike-in-natural-gas-prices-affect-related-stocks-122100400097_1.html (accessed on 22 January 2023).

- Wang, Kai-Hua, Chi-Wei Su, Yidong Xiao, and Lu Liu. 2022. Is the Oil Price a Barometer of China’s Automobile Market? From a Wavelet-based Quantile-on-Quantile Regression Perspective. Energy 240: 1–10. [Google Scholar] [CrossRef]

- Washington, Tom, and Eklavya Gupte. 2021. Interview: South Africa to Grow More Reliant on Fuel Imports as Refinery Closures Loom: SAPIA. [Online]. Available online: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/012821-interview-south-africa-to-grow-more-reliant-on-fuel-imports-as-refinery-closures-loom-sapia# (accessed on 1 June 2023).

- Wen, Fenghua, Jihong Xiao, Xiaohua Xia, Bin Chen, Zhengyan Xiao, and Jinyi Li. 2019. Oil Prices and Chinese Stock Market: Nonlinear Causality and Volatility Persistence. Emerging Markets Finance and Trade 55: 1247–63. [Google Scholar] [CrossRef]

- Workman, Daniel. 2022a. Crude Oil Exports by Country. [Online]. Available online: https://www.worldstopexports.com/worlds-top-oil-exports-country/ (accessed on 22 January 2023).

- Workman, Daniel. 2022b. Crude Oil Imports by Country. [Online]. Available online: https://www.worldstopexports.com/crude-oil-imports-by-country/ (accessed on 22 January 2023).

- World Health Organization (WHO). 2020. Novel Coronavirus—China. [Online]. Available online: https://www.who.int/emergencies/disease-outbreak-news/item/2020-DON233 (accessed on 22 January 2023).

- Worldometer. 2015a. India Natural Gas. [Online]. Available online: https://www.worldometers.info/gas/india-natural-gas/#:~:text=India%20imports%2037%25%20of%20its,(649%2C796%20MMcf%20in%202015) (accessed on 22 January 2023).

- Worldometer. 2015b. South Africa Natural Gas. [Online]. Available online: https://www.worldometers.info/gas/south-africa-natural-gas/#:~:text=South%20Africa%20imports%2078%25%20of,(134%2C197%20MMcf%20in%202015) (accessed on 22 January 2023).

- Yadav, Nikhil, Priyanka Tandon, Ravindra Tripathi, and Rajesh K. Shastri. 2020. A Dynamic Relationship between Crude Oil Price and Indian Equity Market: An Empirical Study with Special reference to Indian Benchmark Index Sensex. Benchmarking: An International Journal 28: 582–99. [Google Scholar] [CrossRef]

- Youssef, Mouna, and Khaled Mokni. 2020. Asymmetric Effect of Oil Prices on Herding in Commodity Markets. Managerial Finance 47: 535–54. [Google Scholar] [CrossRef]

- Youssef, Mouna, and Khaled Mokni. 2023. Herding Behavior in Stock Markets of Oil-importing and Oil-exporting Countries: The Role of Oil Prices. Journal of Asset Management 24: 44–58. [Google Scholar] [CrossRef]

- Zheng, Tingguo, and Houyi Ge. 2021. A Study of The Tine-Varying Characteristics Of Herding Effects In China’s Stock Market Based On A Regime-Switching Model. Journal of Financial Research 489: 170–87. [Google Scholar]

| (A) | |||||

| Variables | Brazil | China | India | Russia | South Africa |

| CSAD | −7.45 | −8.13 | −9.07 | −7.02 | −5.90 |

| (p Value) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) |

| Rmt | −64.98 | −58.95 | −58.36 | −63.23 | −60.53 |

| (p Value) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) |

| |Rmt| | −4.65 | −3 | −4.55 | −3.82 | −3.84 |

| (p Value) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) |

| Rmt2 | −7.89 | −5.11 | −8.63 | −11.65 | −6.81 |

| (p Value) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) |

| Result | Stationarity | Stationarity | Stationarity | Stationarity | Stationarity |

| (B) | |||||

| Variables | Energy Market | ||||

| ROil Spot | −13.89 | ||||

| (p Value) | (0.00) | ||||

| ROil Futures | −63.44 | ||||

| (p Value) | (0.00) | ||||

| RHH Spot | −31.99 | ||||

| (p Value) | (0.00) | ||||

| RGas Futures | −66.94 | ||||

| (p Value) | (0.00) | ||||

| σOil Spot GARCH | −6.08 | ||||

| (p Value) | (0.00) | ||||

| σOil Spot EWMA | −6.75 | ||||

| (p Value) | (0.00) | ||||

| σOil Futures GK | −5.65 | ||||

| (p Value) | (0.00) | ||||

| σOil Futures RS Vol | −5.74 | ||||

| (p Value) | (0.00) | ||||

| σHH Spot GARCH | −11.55 | ||||

| (p Value) | (0.00) | ||||

| σHH Spot EWMA | −5.08 | ||||

| (p Value) | (0.00) | ||||

| σGas Futures GK | −7.95 | ||||

| (p Value) | (0.00) | ||||

| σGas Futures RS Vol | −8.22 | ||||

| (p Value) | (0.00) | ||||

| SROil Futures | −4.66 | ||||

| (p Value) | (0.00) | ||||

| SRGas Futures | −6.13 | ||||

| (p Value) | (0.00) | ||||

| ROVX Index | −63.86 | ||||

| (p Value) | (0.00) | ||||

| R3M Index | −33.72 | ||||

| (p Value) | (0.00) | ||||

| Result | Stationarity | ||||

| Variables | Brazil | China | India | Russia | South Africa | |

|---|---|---|---|---|---|---|

| CSAD | Mean | 0.7283 | 0.6760 | 0.8315 | 0.6002 | 0.6811 |

| Median | 0.6744 | 0.6159 | 0.7736 | 0.5084 | 0.6150 | |

| Maximum | 2.8838 | 3.4303 | 3.9049 | 5.7662 | 3.8787 | |

| Minimum | 0.3158 | 0.2578 | 0.4257 | 0.0041 | 0.2231 | |

| Standard Deviation | 0.2441 | 0.2790 | 0.2503 | 0.3561 | 0.2844 | |

| Rmt | Mean | 0.0088 | 0.0008 | 0.0157 | 0.0038 | 0.0102 |

| Median | 0.0255 | 0.0257 | 0.0292 | 0.0181 | 0.0232 | |

| Maximum | 5.9404 | 3.8786 | 6.9444 | 10.9556 | 3.1536 | |

| Minimum | −6.946 | −3.9757 | −6.1243 | −17.5748 | −4.4415 | |

| Standard Deviation | 0.7697 | 0.7363 | 0.6073 | 0.8665 | 0.5371 | |

| Observations | 3711 | 3652 | 3719 | 3747 | 3752 |

| Brazil | China | India | Russia | South Africa | |

|---|---|---|---|---|---|

| 0.23 | 0.28 | 0.27 | 0.37 | 0.27 | |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| 1.74 | −3.21 | 1.79 | −0.27 | 8.09 | |

| (0.00) | (0.00) | (0.00) | (0.01) | (0.00) |

| Brazil | China | India | Russia | South Africa | |

|---|---|---|---|---|---|

| ROil Spot2 | 0.34 | −0.02 | 0.07 | 0.01 | 0.26 |

| (p Value) | (0.00) | (0.40) | (0.00) | (0.85) | (0.00) |

| ROil Futures2 | 0.93 | 0.12 | 0.4 | 0.72 | 0.97 |

| (p Value) | (0.00) | (0.21) | (0.00) | (0.00) | (0.00) |

| RGas Spot2 | 0.0023 | 0.04 | 0.01 | −0.01 | 0.03 |

| (p Value) | (0.75) | (0.00) | (0.19) | (0.24) | (0.00) |

| RGas Futures2 | 0.04 | 0.1 | 0.08 | 0.08 | 0.12 |

| (p Value) | (0.31) | (0.09) | (0.09) | (0.15) | (0.02) |

| Brazil | China | India | Russia | South Africa | ||

|---|---|---|---|---|---|---|

| Crisis Periods | ||||||

| Global Financial Crisis (15/09/2008–31/03/2009) | ROil Spot2 | 0.21 | 0.25 | 0.12 | −1.02 | 0.11 |

| (p Value) | (0.46) | (0.43) | (0.69) | (0.16) | (0.56) | |

| ROil Futures2 | 0.8 | 0.39 | 0.40 | −0.45 | −0.29 | |

| (p Value) | (0.07) | (0.25) | (0.35) | (0.60) | (0.32) | |

| RGas Spot2 | 0.19 | −0.71 | 0.06 | −1.10 | 0.38 | |

| (p Value) | (0.74) | (0.13) | (0.92) | (0.35) | (0.32) | |

| RGas Futures2 | 0.28 | 0.46 | −0.21 | 0.58 | −0.73 | |

| (p Value) | (0.63) | (0.35) | (0.73) | (0.62) | (0.08) | |

| European Debt Crisis (1/04/2010–31/01/2012) | ROil Spot2 | 1.33 | −0.84 | −1.07 | 1.05 | −0.47 |

| (p Value) | (0.01) | (0.31) | (0.08) | (0.20) | (0.20) | |

| ROil Futures2 | 0.99 | −0.61 | −1.01 | 1.83 | −0.36 | |

| (p Value) | (0.04) | (0.41) | (0.06) | (0.01) | (0.28) | |

| RGas Spot2 | 0.02 | 0.29 | 0.22 | −0.17 | −0.17 | |

| (p Value) | (0.92) | (0.47) | (0.40) | (0.63) | (0.29) | |

| RGas Futures2 | 0.24 | 0.40 | 0.13 | −0.18 | −0.07 | |

| (p Value) | (0.14) | (0.16) | (0.50) | (0.49) | (0.55) | |

| COVID-19 Crisis (31/12/2019–13/05/2022) | ROil Spot2 | 0.23 | −0.06 | 0.04 | −0.01 | 0.15 |

| (p Value) | (0.00) | (0.01) | (0.06) | (0.62) | (0.00) | |

| ROil Futures2 | 0.55 | −0.25 | 0.13 | 0.15 | 0.55 | |

| (p Value) | (0.00) | (0.00) | (0.11) | (0.24) | (0.00) | |

| RGas Spot2 | −0.01 | 0.04 | 0.002 | −0.01 | 0.0028 | |

| (p Value) | (0.56) | (0.00) | (0.79) | (0.18) | (0.83) | |

| RGas Futures2 | −0.03 | 0.03 | −0.01 | 0.0023 | −0.05 | |

| (p Value) | (0.59) | (0.62) | (0.91) | (0.97) | (0.59) | |

| Russia–Ukraine War (24/02/2022–13/05/2022) | ROil Spot2 | 0.49 | −0.42 | 0.08 | 0.18 | 1.12 |

| (p Value) | (0.30) | (0.36) | (0.84) | (0.96) | (0.01) | |

| ROil Futures2 | 0.49 | −0.28 | −0.01 | 1.12 | 1.00 | |

| (p Value) | (0.27) | (0.51) | (0.98) | (0.80) | (0.01) | |

| RGas Spot2 | 0.50 | −0.06 | 0.63 | −2.62 | −0.20 | |

| (p Value) | (0.10) | (0.84) | (0.02) | (0.27) | (0.48) | |

| RGas Futures2 | 0.46 | 0.77 | −0.07 | −3.22 | −1.49 | |

| (p Value) | (0.31) | (0.09) | (0.87) | (0.24) | (0.00) | |

| Non-Crisis Period | ||||||

| Pre-Global Financial Crisis (11/05/2007–14/09/2008) | ROil Spot2 | 0.97 | −1.15 | −0.88 | 0.98 | 1.10 |

| (p Value) | (0.17) | (0.36) | (0.37) | (0.20) | (0.13) | |

| ROil Futures2 | 1.67 | −0.35 | −0.02 | −0.41 | 0.82 | |

| (p Value) | (0.06) | (0.81) | (0.99) | (0.68) | (0.36) | |

| RGas Spot2 | 0.61 | 0.13 | −0.12 | −0.39 | 0.17 | |

| (p Value) | (0.02) | (0.77) | (0.77) | (0.18) | (0.51) | |

| RGas Futures2 | 0.31 | −0.41 | −0.0015 | −0.42 | −0.09 | |

| (p Value) | (0.31) | (0.41) | (0.99) | (0.20) | (0.77) | |

| Pre-European Debt Crisis (01/04/2009–31/03/2010) | ROil Spot2 | −0.28 | 0.90 | 0.04 | −0.32 | 0.40 |

| (p Value) | (0.58) | (0.20) | (0.97) | (0.75) | (0.44) | |

| ROil Futures2 | −0.38 | 1.27 | 1.08 | 0.49 | 1.06 | |

| (p Value) | (0.54) | (0.10) | (0.44) | (0.68) | (0.08) | |

| RGas Spot2 | −0.0030 | −0.10 | −0.09 | −0.05 | −0.01 | |

| (p Value) | (0.94) | (0.11) | (0.38) | (0.54) | (0.79) | |

| RGas Futures2 | −0.18 | 0.12 | 0.08 | −0.03 | 0.0062 | |

| (p Value) | (0.02) | (0.27) | (0.65) | (0.87) | (0.94) | |

| Pre-COVID-19 Crisis (01/02/2012–13/05/2022) | ROil Spot2 | 1.80 | 0.93 | 0.33 | 1.33 | 1.53 |

| (p Value) | (0.00) | (0.02) | (0.13) | (0.00) | (0.00) | |

| ROil Futures2 | 1.64 | 1.6 | 0.31 | 1.25 | 1.3 | |

| (p Value) | (0.00) | (0.00) | (0.12) | (0.00) | (0.00) | |

| RGas Spot2 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | |

| (p Value) | (0.73) | (0.69) | (0.75) | (0.49) | (0.23) | |

| RGas Futures2 | 0.28 | −0.0036 | −0.25 | 0.20 | 0.02 | |

| (p Value) | (0.02) | (0.98) | (0.01) | (0.08) | (0.89) | |

| Null Hypothesis | Energy Markets | Brazil | China | India | Russia | South Africa |

|---|---|---|---|---|---|---|

| Panel A: Global Financial Crisis Period (15 September 2008–31 March 2009) | ||||||

| Panel A.1: CSADi,t does not cause Performance of Energy Market(s) (Prob.) | Oil Spot Market | 0.33 | 0.48 | 0.33 | 0.57 | 0.57 |

| Oil Futures Market | 0.12 | 0.87 | 0.16 | 0.21 | 0.89 | |

| Gas Spot Market | 0.53 | 0.99 | 0.67 | 0.65 | 0.71 | |

| Gas Futures Market | 0.95 | 0.25 | 0.26 | 0.37 | 0.12 | |

| Panel A.2: Performance of Energy Market(s) does not cause CSADi,t (Prob.) | Oil Spot Market | 0.12 | 0.72 | 0.98 | 0.76 | 0.22 |

| Oil Futures Market | 0.70 | 0.44 | 0.36 | 0.21 | 0.88 | |

| Gas Spot Market | 0.47 | 0.87 | 0.44 | 0.66 | 0.15 | |

| Gas Futures Market | 0.64 | 0.52 | 0.27 | 0.70 | 0.44 | |

| Panel B: European Debt Crisis Period (1 April 2010–31 January 2012) | ||||||

| Panel B.1: CSADi,t does not cause Performance of Energy Market(s) (Prob.) | Oil Spot Market | 0.39 | 0.17 | 0.39 | 0.27 | 0.17 |

| Oil Futures Market | 0.62 | 0.76 | 0.88 | 0.01 | 0.78 | |

| Gas Spot Market | 0.51 | 0.74 | 0.14 | 0.69 | 0.26 | |

| Gas Futures Market | 0.36 | 0.73 | 0.71 | 0.84 | 0.72 | |

| Panel B.2: Performance of Energy Market(s) does not cause CSADi,t (Prob.) | Oil Spot Market | 0.12 | 0.59 | 0.75 | 0.27 | 0.32 |

| Oil Futures Market | 0.25 | 0.79 | 0.72 | 0.24 | 0.36 | |

| Gas Spot Market | 0.58 | 0.07 | 0.65 | 0.52 | 0.69 | |

| Gas Futures Market | 0.90 | 0.13 | 0.09 | 0.59 | 0.85 | |

| Panel C: COVID-19 Crisis Period (31 December 2019–13 May 2022) | ||||||

| Panel C.1: CSADi,t does not cause Performance of Energy Market(s) (Prob.) | Oil Spot Market | 0.12 | 0.80 | 0.00 | 0.70 | 0.12 |

| Oil Futures Market | 0.01 | 0.85 | 0.31 | 0.31 | 0.01 | |

| Gas Spot Market | 0.61 | 0.95 | 0.96 | 0.93 | 0.9 | |

| Gas Futures Market | 0.95 | 0.22 | 0.47 | 0.91 | 0.81 | |

| Panel C.2: Performance of Energy Market(s) does not cause CSADi,t (Prob.) | Oil Spot Market | 0.02 | 0.02 | 0.28 | 0.60 | 0.02 |

| Oil Futures Market | 0.01 | 0.02 | 0.20 | 0.20 | 0.03 | |

| Gas Spot Market | 0.83 | 0.35 | 0.93 | 0.93 | 0.86 | |

| Gas Futures Market | 0.94 | 0.18 | 0.82 | 0.91 | 0.86 | |

| Panel D: Russia–Ukraine War Crisis Period (24 February 2022–13 May 2022) | ||||||

| Panel D.1: CSADi,t does not cause Performance of Energy Market(s) (Prob.) | Oil Spot Market | 0.49 | 0.17 | 0.60 | 0.52 | 0.27 |

| Oil Futures Market | 0.53 | 0.84 | 0.70 | 0.62 | 0.10 | |

| Gas Spot Market | 0.31 | 0.23 | 0.74 | 0.21 | 0.62 | |

| Gas Futures Market | 0.77 | 0.47 | 0.55 | 0.30 | 0.55 | |

| Panel D.2: Performance of Energy Market(s) does not cause CSADi,t (Prob.) | Oil Spot Market | 0.46 | 0.02 | 0.43 | 0.18 | 0.68 |

| Oil Futures Market | 0.23 | 0.14 | 0.61 | 0.66 | 0.90 | |

| Gas Spot Market | 0.25 | 0.36 | 0.13 | 0.83 | 0.31 | |

| Gas Futures Market | 0.39 | 0.86 | 0.15 | 0.27 | 0.85 | |

| State of Energy Market | Brazil | China | India | Russia | South Africa | |

|---|---|---|---|---|---|---|

| Upward Period (REnergy > 0) | ROil Spot2 | 0.25 | −0.01 | 0.24 | 0.04 | 0.51 |

| (p Value) | (0.00) | (0.88) | (0.00) | (0.55) | (0.00) | |

| ROil Futures2 | 1.48 | 0.20 | 1.38 | 1.31 | 1.84 | |

| (p Value) | (0.00) | (0.32) | (0.00) | (0.00) | (0.00) | |

| RGas Spot2 | 0.01 | −0.02 | 0.01 | −0.01 | 0.05 | |

| (p Value) | (0.35) | (0.41) | (0.60) | (0.45) | (0.00) | |

| RGas Futures2 | −0.04 | 0.02 | 0.08 | 0.06 | 0.11 | |

| (p Value) | (0.42) | (0.77) | (0.21) | (0.41) | (0.06) | |

| Downward Period (REnergy < 0) | ROil Spot2 | 0.65 | −0.03 | 0.04 | −0.0025 | 0.18 |

| (p Value) | (0.00) | (0.37) | (0.14) | (0.94) | (0.00) | |

| ROil Futures2 | 0.72 | 0.09 | 0.13 | 0.40 | 0.71 | |

| (p Value) | (0.00) | (0.44) | (0.13) | (0.01) | (0.00) | |

| RGas Spot2 | −0.0023 | 0.05 | 0.01 | 0.01 | 0.01 | |

| (p Value) | (0.80) | (0.00) | (0.21) | (0.40) | (0.31) | |

| RGas Futures2 | 0.26 | 0.29 | 0.10 | 0.14 | 0.14 | |

| (p Value) | (0.00) | (0.01) | (0.25) | (0.20) | (0.16) |

| First Quartile (σ < 25% of Distribution)—α3 | |||||||

|---|---|---|---|---|---|---|---|

| Brazil | China | India | Russia | South Africa | |||

| Spot Market | GARCH Volatility (p value) | Oil | −8.50 | −9.06 | −4.78 | −3.67 | −27.73 |

| (0.00) | (0.00) | (0.02) | (0.00) | (0.00) | |||

| Gas | 0.12 | −1.46 | −1.36 | −14.05 | −9.95 | ||

| (0.88) | (0.11) | (0.36) | (0.00) | (0.00) | |||

| EWMA Volatility (p value) | Oil | −8.90 | −4.01 | −4.87 | −0.55 | −26.97 | |

| (0.00) | (0.00) | (0.01) | (0.00) | (0.00) | |||

| Gas | −2.63 | −2.04 | −3.86 | −9.52 | −17.89 | ||

| (0.00) | (0.02) | (0.01) | (0.00) | (0.00) | |||

| Futures Market | RS Volatility (p Value) | Oil | −7.03 | −5.62 | 1.77 | −8.23 | −22.87 |

| (0.00) | (0.00) | (0.19) | (0.00) | (0.00) | |||

| Gas | −0.73 | −1.03 | 1.37 | −1.05 | −0.78 | ||

| (0.49) | (0.34) | (0.27) | (0.00) | (0.65) | |||

| GK Volatility (p value) | Oil | −8.47 | −6.38 | −2.64 | −16.90 | −23.80 | |

| (0.00) | (0.00) | (0.20) | (0.00) | (0.00) | |||

| Gas | −3.12 | −2.19 | −0.1 | −6.01 | −7.27 | ||

| (0.00) | (0.06) | (0.51) | (0.00) | (0.00) | |||

| Second Quartile (25% of Distribution < σ < 50% of Distribution)—α4 | |||||||

| Spot Market | GARCH Volatility (p value) | Oil | 2.14 | 4.16 | −1.13 | −2.44 | 14.14 |

| (0.06) | (0.00) | (0.59) | (0.04) | (0.00) | |||

| Gas | 0.29 | −3.21 | 2.97 | 12.65 | 11.06 | ||

| (0.72) | (0.00) | (0.04) | (0.00) | (0.00) | |||

| EWMA Volatility (p value) | Oil | 5.34 | −2.68 | −0.22 | −5.50 | 9.59 | |

| (0.00) | (0.02) | (0.91) | (0.00) | (0.00) | |||

| Gas | 2.51 | −2.98 | −2.60 | 2.81 | 6.16 | ||

| (0.01) | (0.00) | (0.09) | (0.06) | (0.01) | |||

| Futures Market | RS Volatility (p Value) | Oil | −0.06 | 2.60 | −0.78 | −1.04 | 13.9 |

| (0.97) | (0.04) | (0.63) | (0.48) | (0.00) | |||

| Gas | 1.45 | −3.40 | 0.38 | 0.41 | 4.50 | ||

| (0.15) | (0.00) | (0.79) | (0.52) | (0.02) | |||

| GK Volatility (p value) | Oil | 4.14 | 1.99 | 3.96 | 10.20 | 8.16 | |

| (0.00) | (0.13) | (0.05) | (0.00) | (0.02) | |||

| Gas | 3.76 | −1.40 | 3.98 | 4.87 | 8.82 | ||

| (0.00) | (0.15) | (0.01) | (0.00) | (0.00) | |||

| Third Quartile (50% of Distribution < σ < 75% of Distribution)—α5 | |||||||

| Spot Market | GARCH Volatility (p value) | Oil | 6.61 | 5.81 | 5.56 | 3.15 | 17.38 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.01) | |||

| Gas | 2.58 | −2.83 | 7.87 | 14.91 | 17.48 | ||

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |||

| EWMA Volatility (p value) | Oil | 4.34 | 1.30 | 8.02 | −4.31 | 17.67 | |

| (0.00) | (0.20) | (0.00) | (0.00) | (0.00) | |||

| Gas | 5.03 | −2.33 | 4.99 | 9.94 | 23.36 | ||

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |||

| Futures Market | RS Volatility (p Value) | Oil | 4.45 | 3.70 | −3.78 | 7.41 | 19.03 |

| (0.00) | (0.00) | (0.01) | (0.00) | (0.00) | |||

| Gas | 2.21 | −1.42 | 1.00 | 1.93 | 7.08 | ||

| (0.02) | (0.13) | (0.40) | (0.00) | (0.00) | |||

| GK Volatility (p value) | Oil | 7.71 | 5.02 | 0.10 | 16.32 | 14.69 | |

| (0.00) | (0.00) | (0.96) | (0.00) | (0.00) | |||

| Gas | 4.53 | −1.57 | 3.52 | 6.52 | 12.69 | ||

| (0.00) | (0.12) | (0.01) | (0.00) | (0.00) | |||

| Forth Quartile (σ > 75% of Distribution)—α6 | |||||||

| Spot Market | GARCH Volatility (p value) | Oil | 9.21 | 5.64 | 6.32 | 4.46 | 32.22 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |||

| Gas | 1.20 | −1.33 | 2.97 | 13.66 | 17.34 | ||

| (0.01) | (0.15) | (0.03) | (0.00) | (0.00) | |||

| EWMA Volatility (p value) | Oil | 9.60 | 0.76 | 6.07 | 1.20 | 31.21 | |

| (0.00) | (0.46) | (0.00) | (0.00) | (0.00) | |||

| Gas | 3.57 | −1.60 | 3.62 | 8.94 | 22.65 | ||

| (0.00) | (0.11) | (0.01) | (0.00) | (0.00) | |||

| Futures Market | RS Volatility (p Value) | Oil | 7.74 | 1.98 | −0.15 | 7.73 | 29.05 |

| (0.00) | (0.08) | (0.90) | (0.00) | (0.00) | |||

| Gas | 2.60 | −2.70 | 0.18 | 0.72 | 10.56 | ||

| (0.01) | (0.00) | (0.87) | (0.02) | (0.00) | |||

| GK Volatility (p value) | Oil | 9.43 | 2.85 | 4.08 | 16.4 | 28.46 | |

| (0.00) | (0.00) | (0.04) | (0.00) | (0.00) | |||

| Gas | 4.82 | −1.30 | 2.47 | 5.56 | 15.78 | ||

| (0.00) | (0.20) | (0.08) | (0.00) | (0.00) | |||

| Brazil | China | India | Russia | South Africa | |

|---|---|---|---|---|---|

| SROil Futures | 0.000015 | −0.0001 | −0.0001 | 0.0003 | −0.0004 |

| (p Value) | (0.76) | (0.23) | (0.02) | (0.00) | (0.00) |

| SRGas Futures | −0.000001 | −0.000003 | −0.00001 | −0.000003 | 0.000003 |

| (p Value) | (0.64) | (0.31) | (0.56) | (0.14) | (0.16) |

| Brazil | China | India | Russia | South Africa | ||

|---|---|---|---|---|---|---|

| Crisis Period | ||||||

| Global Financial Crisis (15/09/2008–31/03/2009) | SROil Futures (p value) | 0.001 | 0.0001 | 0.0007 | 0.0008 | 0.0002 |

| (0.01) | (0.83) | (0.03) | (0.25) | (0.46) | ||

| SRGas Futures (p value) | 0.0001 | 0.0001 | 0.00005 | 0.0006 | 0.00002 | |

| (0.55) | (0.43) | (0.81) | (0.19) | (0.90) | ||

| European Debt Crisis (1/04/2010–31/01/2012) | SROil Futures (p value) | 0.0001 | −0.0002 | 0.00003 | 0.0002 | −0.00002 |

| (0.17) | (0.01) | (0.68) | (0.01) | (0.69) | ||

| SRGas Futures (p value) | −0.00001 | −0.000001 | −2.34 × 10−05 | −0.00002 | −0.00002 | |

| (0.52) | (0.96) | (0.07) | (0.30) | (0.01) | ||

| COVID-19 Crisis (31/12/2019–13/05/2022) | SROil Futures (p value) | 0.0001 | 0.0001 | 0.0001 | 0.0005 | 0.0004 |

| (0.57) | (0.65) | (0.51) | (0.07) | (0.25) | ||

| SRGas Futures (p value) | −0.000003 | −0.000001 | 0.000001 | −0.000001 | 0.00001 | |

| (0.38) | (0.86) | (0.82) | (0.85) | (0.18) | ||

| Russia–Ukraine War (24/02/2022–13/05/2022) | SROil Futures (p value) | 0.001 | −0.001 | −0.0002 | 0.003 | 0.0013 |

| (0.13) | (0.48) | (0.81) | (0.38) | (0.06) | ||

| SRGas Futures (p value) | −0.00005 | 0.0001 | 0.00002 | 0.0003 | −0.00003 | |

| (0.33) | (0.06) | (0.58) | (0.06) | (0.55) | ||

| Non-Crisis Period | ||||||

| Pre-Global Financial Crisis (11/05/2007–14/09/2008) | SROil Futures (p value) | 0.0004 | −0.0003 | 0.0001 | 0.0007 | 0.0006 |

| (0.00) | (0.31) | (0.65) | (0.00) | (0.00) | ||

| SRGas Futures (p value) | −0.0001 | −0.0001 | −0.0001 | 0.0001 | −0.00004 | |

| (0.18) | (0.60) | (0.47) | (0.21) | (0.55) | ||

| Pre-European Debt Crisis (01/04/2009–31/03/2010) | SROil Futures (p value) | −0.00004 | −0.0002 | −0.0004 | 0.0001 | −0.0002 |

| (0.66) | (0.10) | (0.09) | (0.49) | (0.02) | ||

| SRGas Futures (p value) | −0.00002 | 0.00004 | −0.00001 | −0.00005 | −0.00002 | |

| (0.11) | (0.09) | (0.76) | (0.13) | (0.11) | ||

| Pre-COVID-19 Crisis (01/02/2012–13/05/2022) | SROil Futures (p value) | 0.0001 | 0.0002 | −0.0001 | 0.0002 | −0.0002 |

| (0.10) | (0.13) | (0.09) | (0.00) | (0.03) | ||

| SRGas Futures (p value) | 0.0000004 | −0.000001 | −0.000001 | −0.000002 | −0.000001 | |

| (0.83) | (0.69) | (0.74) | (0.24) | (0.76) | ||

| Brazil | China | India | Russia | South Africa | ||

|---|---|---|---|---|---|---|

| First Quartile of Speculation Ratio Distribution (SR < 25%) | ||||||

| Futures Market | Oil | 2.55 | −1.64 | 1.42 | 0.94 | 11.28 |

| (p value) | (0.00) | (0.17) | (0.00) | (0.20) | (0.00) | |

| Gas | 2.05 | −2.69 | 5.15 | 0.11 | 9.14 | |

| (p value) | (0.00) | (0.00) | (0.00) | (0.73) | (0.00) | |

| Second Quartile of Speculation Ratio Distribution (25% ≤ SR < 50%) | ||||||

| Futures Market | Oil | −1.31 | −0.66 | −2.68 | −1.33 | −2.80 |

| (p value) | (0.16) | (0.54) | (0.08) | (0.14) | (0.25) | |

| Gas | −0.70 | −0.91 | −1.66 | 0.72 | −0.69 | |

| (p value) | (0.10) | (0.30) | (0.06) | (0.02) | (0.60) | |

| Third Quartile of Speculation Ratio Distribution (50% ≤ SR < 75%) | ||||||

| Futures Market | Oil | −0.34 | −1.95 | 1.69 | −1.26 | −2.53 |

| (p value) | (0.67) | (0.05) | (0.01) | (0.08) | (0.21) | |

| Gas | −0.39 | 0.93 | −3.37 | 0.40 | −2.41 | |

| (p value) | (0.32) | (0.29) | (0.00) | (0.38) | (0.00) | |

| Forth Quartile of Speculation Ratio Distribution (SR > 75%) | ||||||

| Futures Market | Oil | −1.09 | −1.40 | 0.19 | −1.18 | −3.19 |

| (p value) | (0.17) | (0.17) | (0.72) | (0.09) | −0.11 | |

| Gas | 0.64 | −2.00 | −3.81 | −0.45 | 4.58 | |

| (p value) | (0.22) | (0.02) | (0.00) | (0.13) | (0.00) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Giouvris, E. What Is the Effect of Oil and Gas Markets (Spot/Futures) on Herding in BRICS? Recent Evidence (2007–2022). J. Risk Financial Manag. 2023, 16, 466. https://doi.org/10.3390/jrfm16110466

Zhang H, Giouvris E. What Is the Effect of Oil and Gas Markets (Spot/Futures) on Herding in BRICS? Recent Evidence (2007–2022). Journal of Risk and Financial Management. 2023; 16(11):466. https://doi.org/10.3390/jrfm16110466

Chicago/Turabian StyleZhang, Hang, and Evangelos Giouvris. 2023. "What Is the Effect of Oil and Gas Markets (Spot/Futures) on Herding in BRICS? Recent Evidence (2007–2022)" Journal of Risk and Financial Management 16, no. 11: 466. https://doi.org/10.3390/jrfm16110466

APA StyleZhang, H., & Giouvris, E. (2023). What Is the Effect of Oil and Gas Markets (Spot/Futures) on Herding in BRICS? Recent Evidence (2007–2022). Journal of Risk and Financial Management, 16(11), 466. https://doi.org/10.3390/jrfm16110466