The Impact of Non-Financial and Financial Variables on Credit Decisions for Service Companies in Turkey

Abstract

:1. Introduction

1.1. Financial Analysis

1.2. Financial Statement Items and Ratios

1.3. Non-Financial Analysis

1.4. Credit

1.5. Service Industry in Turkey

2. Methodology and Data

2.1. Aim of the Research

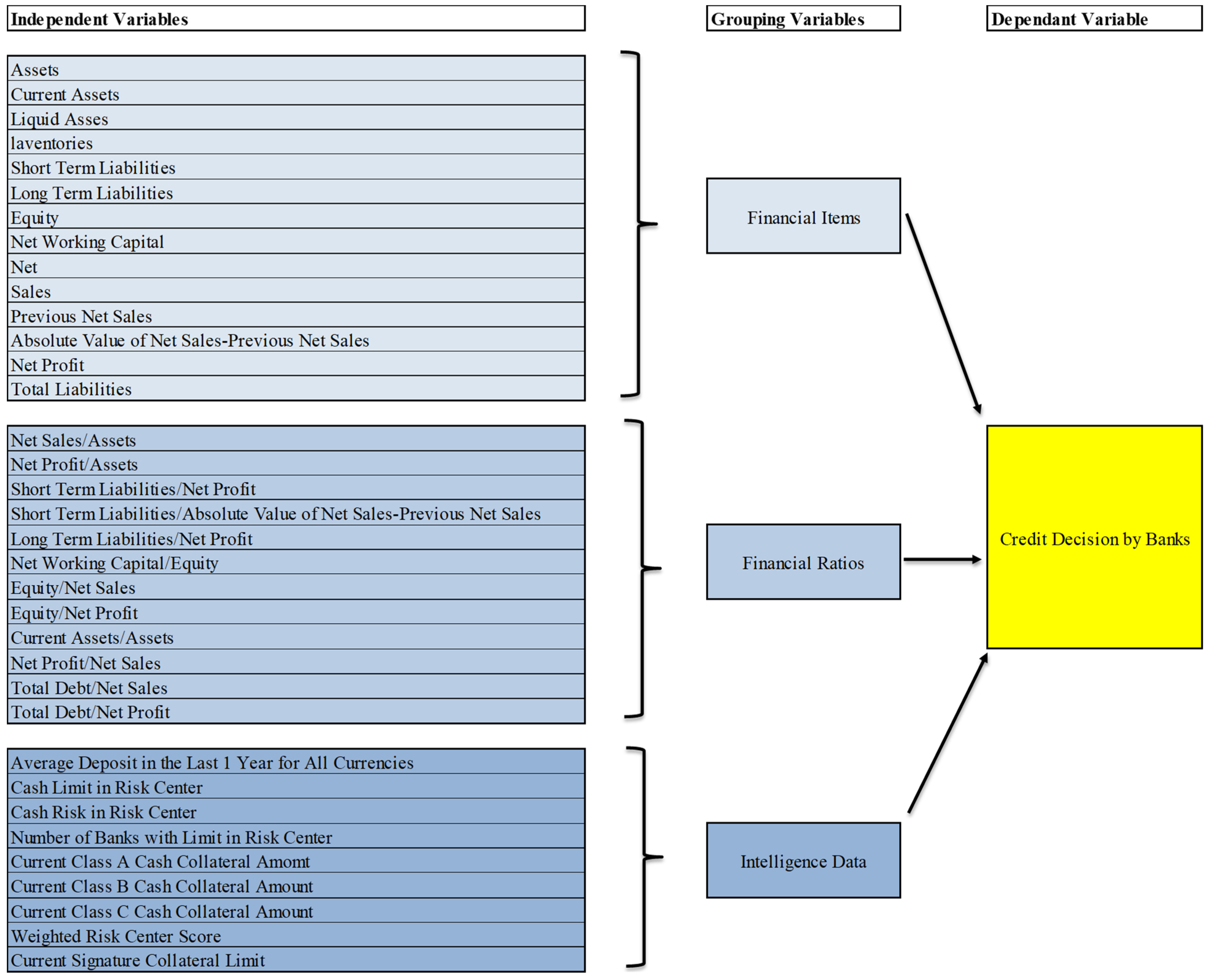

2.2. Research Methodology and Design

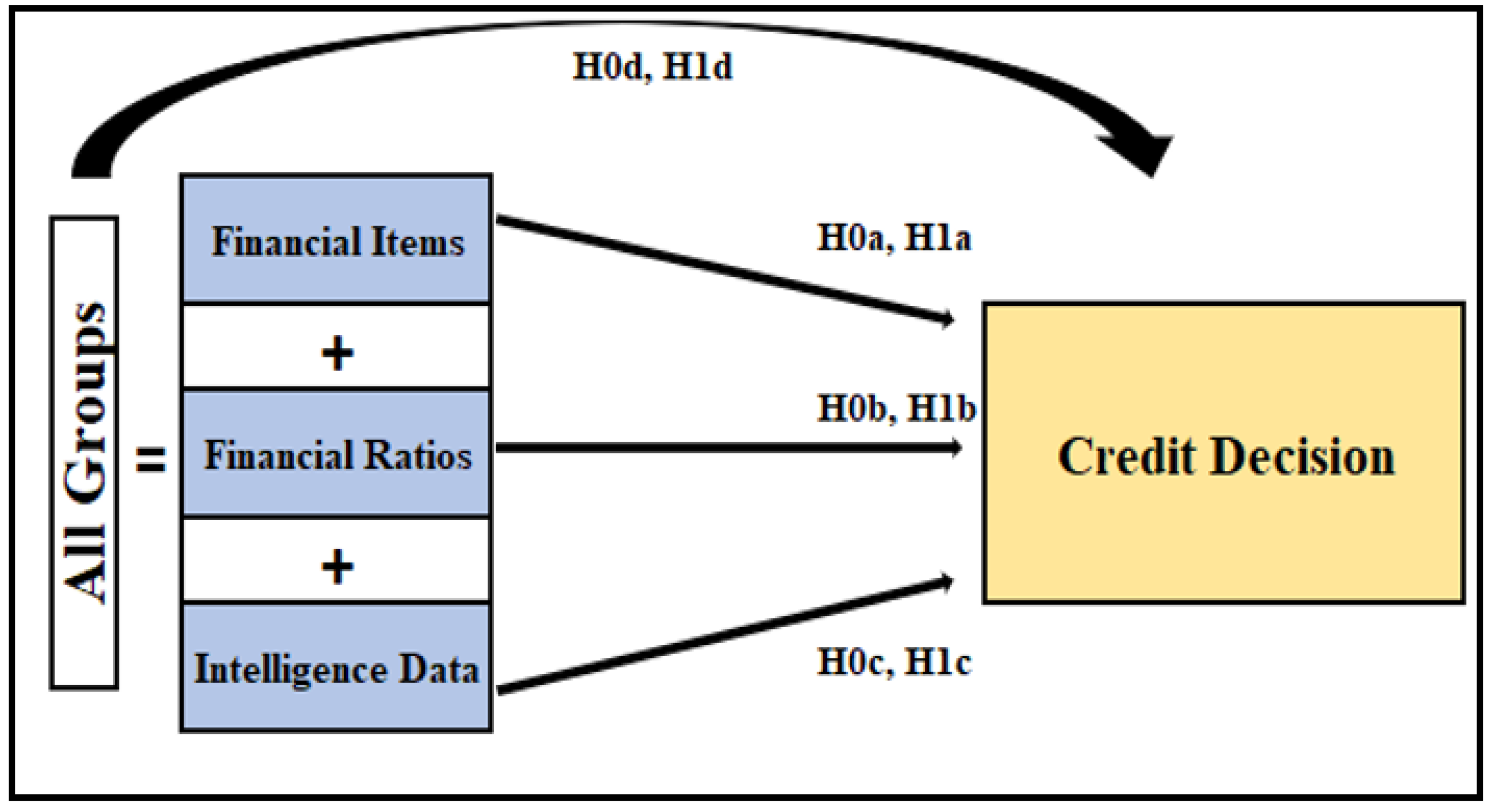

2.3. Hypotheses

2.4. Sampling, Data and Measures

2.5. Statistical Methods Used in Data Analysis

3. Data Analysis and Research Findings

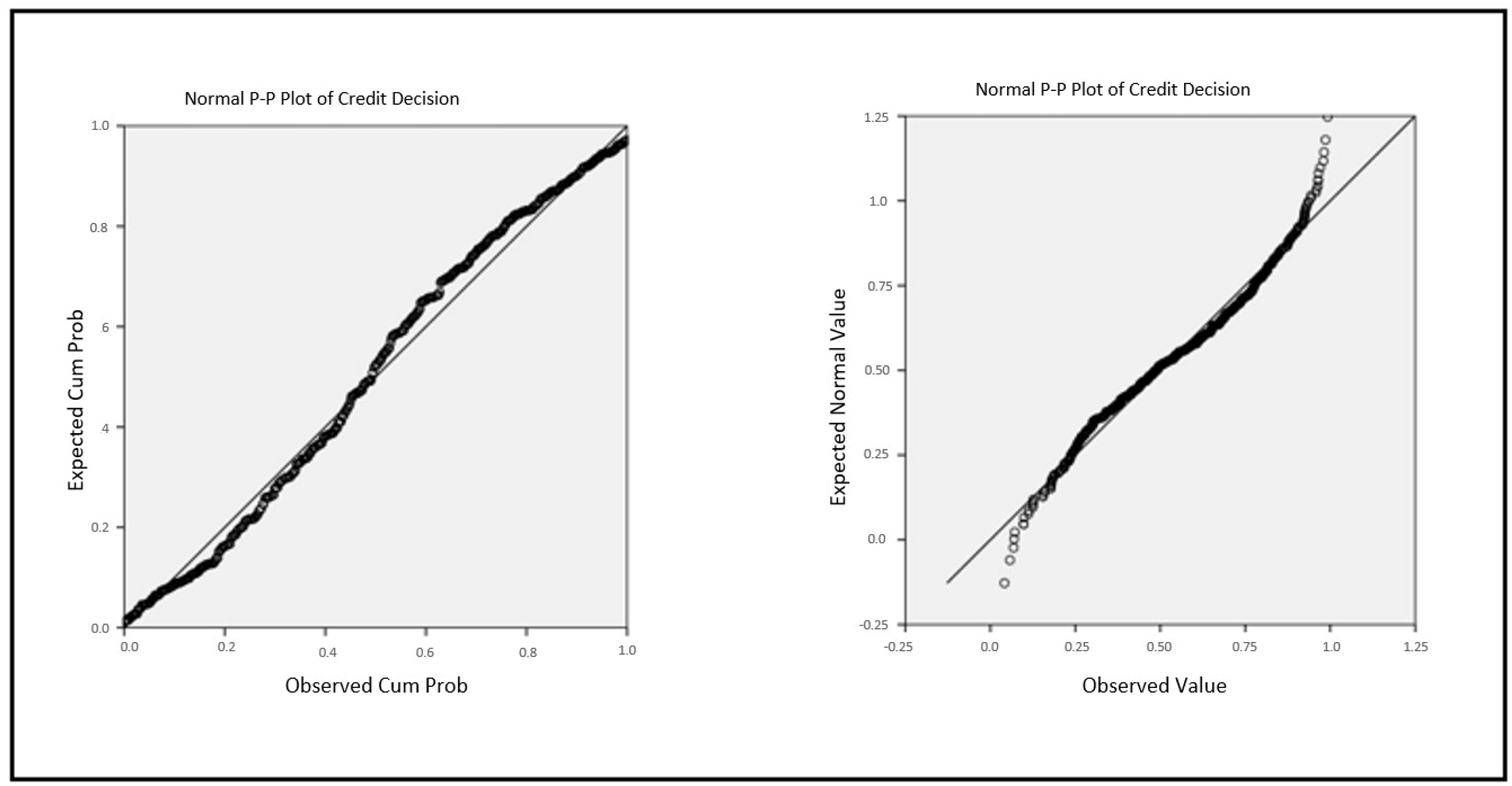

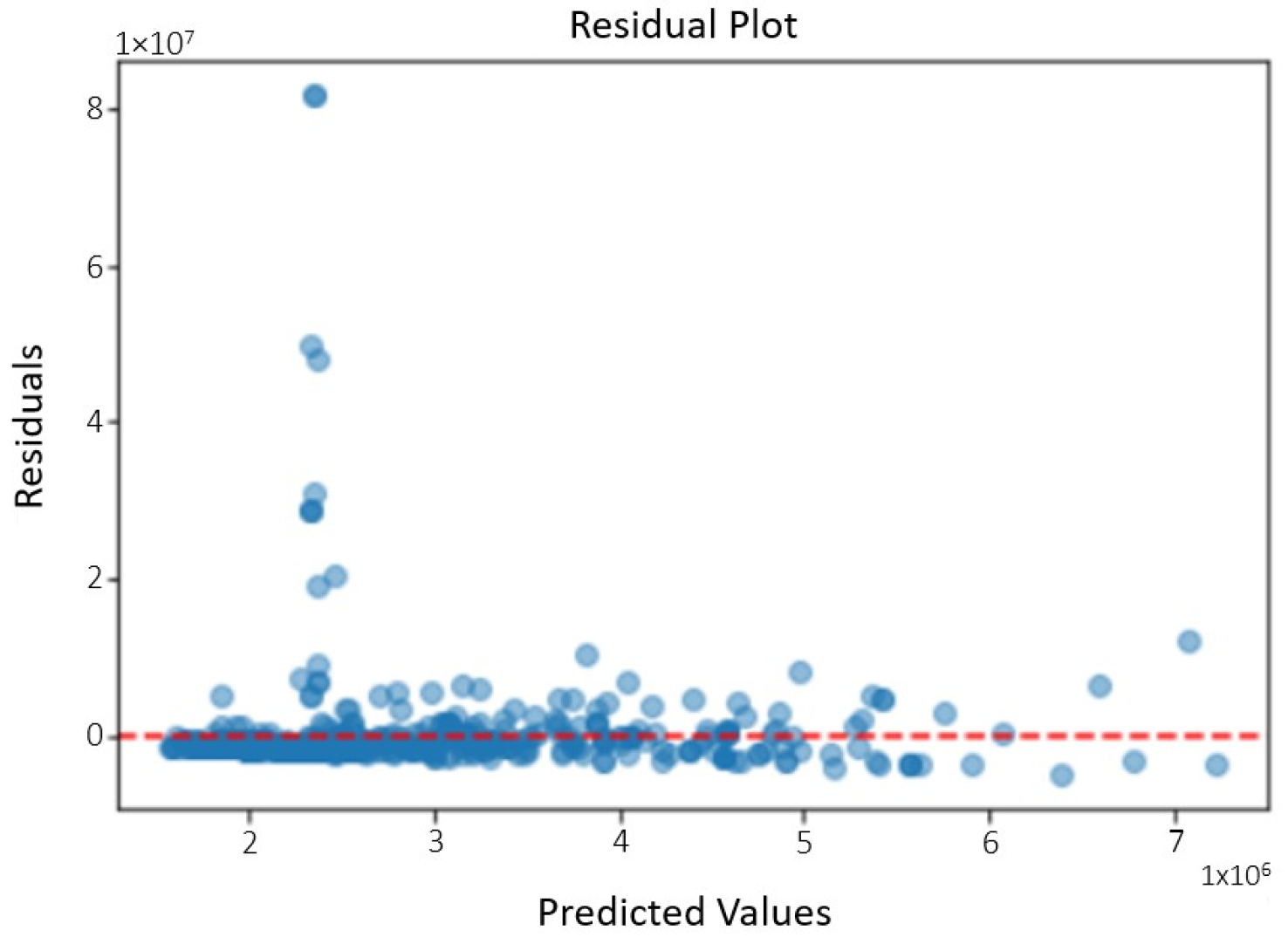

3.1. Normality Analysis

- Shapiro–Wilk Test:

- Kolmogorov–Smirnov Test:

- P–P/Q–Q (Probability–Probability/Quantile–Quantile) plot:

- Correlation Analysis: The formula for Pearson’s correlation coefficient (r) between two variables X and Y is given bywhere and represent the means of variables X and Y, respectively.

- Multiple Regression Analysis: the formula for multiple linear regression is represented as follows:where Y is the dependent variable, is the independent variable, is the regression coefficient, and is the error term.

- Adjusted R-squared (Coefficient of Determination): the formula for adjusted R-squared (Adj R2) in the multiple regression analysis was calculated aswhere and are the total sample sizes; is the number of independent variables; Y represents the observed values of the dependent variable; represents the values predicted by the regression model; and represents the mean of the dependent variable.

3.2. Financial Item Analysis

3.3. Financial Ratio Analysis

3.4. Non-Financial Analysis

3.5. All Variable Groups Analysis

4. Conclusions and Discussion

4.1. Findings and Results

4.2. Limitations and Future Study

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Altuğ, Fatih. 2010. Finansal analiz sürecinde sistematik bir yaklaşım ve öneriler (A Systematic Approach and Recommendations in the Financial Analysis Process). Ph.D. thesis, Marmara Universitesi, Istanbul, Turkey. [Google Scholar]

- Bolkvadze, Besik. 2019. The Importance of Financial Ratios in Financial Analysis of Business Entities. Globalization and Business 3: 154–157. [Google Scholar] [CrossRef]

- Ceran, M. 2019. Bankacılıkta Dijitalleşme Kapsamında Öğrenen Yapay Zekâ Desteğiyle Sorunlu Kredilerin Belirlenmesi (Identifying Non-Performing Loans with the Support of Learning Artificial Intelligence within the Scope of Digitalization in Banking). Ph.D. thesis, Marmara Üniversitesi, Social Science Institute, İstanbul, Turkey; pp. 122–28. [Google Scholar]

- Edem, Daniel Bassey. 2017. Liquidity management and performance of deposit money banks in Nigeria (1986–2011): An investigation. International Journal of Economics, Finance and Management Sciences 5: 146–61. [Google Scholar] [CrossRef]

- Erdinç, Nilüfer Yücedağ. 2020. Borsa İstanbul’da İşlem Gören İmalat İşletmelerinin Kârlılığını Etkileyen İşletmeye Özgü ve Makroekonomik Değişkenlerin Analizi (Analysis of Business-Specific and Macroeconomic Variables Affecting the Profitability of Manufacturing Businesses Traded in Borsa Istanbul). Üçüncü Sektör Sosyal Ekonomi Dergisi 55: 2109. [Google Scholar]

- Geçer, Turgay. 2014. Kredi İstihbaratı. Sosyal Bilimleri Dergisi 25: 21–35. [Google Scholar]

- Hossain, Md Junayed. 2023. Implementation of Big Data Analytics in Credit Risk Management in the Banking and Financial Services Sector: A Contemporary Literature Review. Available online: https://ssrn.com/abstract=4441658 (accessed on 1 September 2023). [CrossRef]

- İnamoğlu, Yusuf. 2013. Türkiye’de Hizmet Sektörünün Gelişimi Ve Ekonomik Büyümeye Etkisi (The Development of the Service Sector in Turkey and Its Impact on Economic Growth). Master’s thesis, Bülent Ecevit Üniversitesi, Social Science Institute, Zonguldak, Turkey; pp. 1–2. [Google Scholar]

- İş Bankası. 2012. İstihbarat. İstanbul: Eğitim Müdürlüğü Yayınları. [Google Scholar]

- Jasevičienė, Filomena, Bronius Povilaitis, and Simona Vidzbelytė. 2013. Commercial banks performance 2008–2012. Business Management and Economics Engineering 11: 189–208. [Google Scholar] [CrossRef]

- Konstantinidis, Christos V., Anastasia Tsolaki, and Nikolaos Giovanis. 2021. Estimating Competitiveness Relations Between Firms of a Multinational Group of Clothing And Footwear Manufacturing Industry In Greece. TEL 4: 789–802. [Google Scholar] [CrossRef]

- Lam, Weng Siew, Weng Hoe Jaaman, and Kah Fai Liew. 2021. Performance Evaluation of Construction Companies Using Integrated Entropy–fuzzy Vikor Model. Entropy 3: 320. [Google Scholar] [CrossRef] [PubMed]

- Mbona, Reginald Masimba, and Kong Yusheng. 2019. Financial statement analysis: Principal component analysis (PCA) approach case study on China telecoms industry. Asian Journal of Accounting Research 4: 233–45. [Google Scholar]

- Melnyk, Mariana, Iryna Leshchukh, Tetyana Medynska, and Nadiya Rushchyshyn. 2020. Potential of the sector of financial services in view of the socio-economic growth of Ukrainian regions. Economic Annals-XXI 185: 144–54. [Google Scholar]

- Mercan, Mehmet. 2013. Kredi Hacmindeki Değişimlerin Ekonomik Büyümeye Etkisi: Türkiye Ekonomisi İçin Sınır Testi Yaklaşımı (The Effect of Changes in Credit Volume on Economic Growth: Bounds Test Approach for Turkish Economy). TBB Bankacılar Dergisi 84: 54–71. [Google Scholar]

- Shapiro, Samuel S., Martin B. Wilk, and Hwei J. Chen. 1968. A comparative study of various tests for normality. Journal of the American Statistical Association 63: 1343–72. [Google Scholar] [CrossRef]

- Vakıfbank. 2011. İstihbarat, Mali Tahlil ve Skorlama Yönetmeliği (Financial Analysis and Scoring Regulation). Ankara: Law of Vakıfbank. [Google Scholar]

- Villalpando, Mario. 2014. Bank credit and productivity: Evidence from Mexican firms. Revista Mexicana de Economía y Finanzas. Nueva Época/Mexican Journal of Economics and Finance 9: 195–214. [Google Scholar]

- World Bank. 2014. The Use of Non-Financial Information in Credit Scoring: A Review of the Literature. Washington, DC: World Bank. [Google Scholar]

- Xu, Yao-Zhi, Jian-Lin Zhang, Ying Hua, and Lin-Yue Wang. 2019. Dynamic credit risk evaluation method for e-commerce sellers based on a hybrid artificial intelligence model. Sustainability 11: 5521. [Google Scholar] [CrossRef]

- Yan, Ying, and Bo Li. 2023. The Research in Credit Risk of Micro and Small Companies with Linear Regression Model. In Advances in Swarm Intelligence. ICSI 2023. Edited by Ying Tan, Yuhui Shi and Wenjian Luo. Lecture Notes in Computer Science. Cham: Springer, vol. 13969. [Google Scholar] [CrossRef]

- Yürük, A. T. 2006. Banka ve Sigorta Hukuku (Banking and Insurance Law). Eskişehir: Anadolu Üniversitesi Yayım, p. 63. [Google Scholar]

| 8. Model F | Dependent Variable | Independent Variables | B | t | p | Adj-R2 |

|---|---|---|---|---|---|---|

| F = 75.143 p = 0.000 | Credit Decision | Constant | −197,186 | −2.488 | 0.013 | 0.536 |

| Total Liabilities | 0.146 | 7.720 | 0.000 | |||

| Net Profit | 0.417 | 8.871 | 0.000 | |||

| Equity | 0.206 | 4.952 | 0.000 | |||

| Previous Net Sales | −0.120 | −7.026 | 0.000 | |||

| Net Sales | 0.084 | 5.596 | 0.000 | |||

| Current Liabilities | 0.182 | 5.084 | 0.000 | |||

| Assets | 0.061 | −2.554 | 0.011 | |||

| Absolute Value of Net Sales–Previous Net Sales | −0.076 | −2.198 | 0.028 |

| 5. Model F | Dependent Variable | Independent Variables | β | T | p | Adj-R2 |

|---|---|---|---|---|---|---|

| F = 28.510 p = 0.000 | Credit Decision | Constant | 925,721 | 4.245 | 0.000 | 0.214 |

| Current Liabilities/Net Profit | −197,123 | 10.023 | 0.000 | |||

| Total Debt/Net Profit | −80,574 | −5.919 | 0.000 | |||

| Long-Term Liabilities/Net Profit | −62,880 | 2.951 | 0.000 | |||

| Current Assets/Assets | 810,149 | −2.464 | 0.014 | |||

| Net Sales/Assets | 127,067 | 2.118 | 0.035 |

| 5. Model F | Dependent Variable | Independent Variables | β | T | p | Adj-R2 |

|---|---|---|---|---|---|---|

| F = 217.73 p = 0.000 | Credit Decision | Constant | 570,182 | 5.937 | 0.000 | 0.714 |

| Current Class A Cash Collateral Amount | 0.974 | 28.23 | 0.000 | |||

| Cash Limit in Risk Center | 0.061 | 7.076 | 0.000 | |||

| Weighted KKB Score | 1.650 | 4.370 | 0.000 | |||

| Current Class C Cash Collateral Amount | −1.313 | −3.696 | 0.000 | |||

| Number of Banks with Limits in Risk Center | −36,496 | −2.880 | 0.004 | |||

| Current Class B Cash Collateral Amount | 0.278 | 2.296 | 0.022 |

| All Significant Variables | ||

|---|---|---|

| Financial Items | Financial Ratios | Non-Financial Variables |

| Assets | Net Sales/Assets | Deposit Average in Banks Last 1 Year |

| Liquid Assets | Current Liabilities/Net Profit | Cash Limit in Risk Center |

| Inventories | Long-Term Liabilities/Absolute Value of Net Sales–Previous Net Sales | Number of Banks with Limits in Risk Center |

| Current Liabilities | Long-Term Liabilities/Net Profit | Current Class A Cash Collateral Amount |

| Equity | Net Working Capital/Equity | Current Class B Cash Collateral Amount |

| Net Working Capital | Equity/Net Sales | Current Class C Cash Collateral Amount |

| Net Sales | Equity/Net Profit | Weighted KKB Score |

| Previous Net Sales | Current Assets/Assets | Current Signature Collateral Limit |

| Absolute Value of Net Sales-Previous Net Sales | Net Profit/Net Sales | |

| Net Profit | Total Debt/Net Sales | |

| Total Liabilities | Total Debt/Net Profit | |

| 8. Model F | Dependent Variable | Independent Variables | B | t | p | Adj-R2 |

|---|---|---|---|---|---|---|

| F = 132.641 p = 0.000 | Credit Decision | Constant | 245,785 | 2.322 | 0.021 | 0.805 |

| Current Class A Cash Collateral Amount | 0.682 | 18.025 | 0.000 | |||

| Total Liabilities | 0.152 | 8.596 | 0.000 | |||

| Current Liabilities/Net Profit | 85,375 | 7.533 | 0.000 | |||

| Total Debt/Net Profit | −50,288 | −5.732 | 0.000 | |||

| Net Profit | 0.280 | 4.963 | 0.000 | |||

| Net Profit/Net Sales | −165,810 | −3.097 | 0.002 | |||

| Current Signature Collateral Limit | 1.289 | 4.081 | 0.000 | |||

| Previous Net Sales | −0.019 | −1.676 | 0.004 | |||

| Net Sales | 0.026 | 2.275 | 0.023 | |||

| Number of Banks with Limits in Risk Center | −49,598 | −4.540 | 0.000 | |||

| Cash Limit in Risk Center | 0.044 | 4.396 | 0.000 | |||

| Assets | 0.060 | −4.867 | 0.000 | |||

| Long-Term Liabilities/Net Profit | 38,906 | 3.274 | 0.001 | |||

| Net Sales/Assets | 106,938 | 3.718 | 0.000 | |||

| Current Class C Cash Collateral Amount | −0.886 | −2.992 | 0.003 | |||

| Total Debt/Net Sales | −99,727 | −2.314 | 0.021 |

| Variable Name | VIF | Variable Name | VIF | Variable Name | VIF |

|---|---|---|---|---|---|

| Total Liabilities | 1.018321 | Current Liabilities/Net Profit | 1.007908 | Current Class A Cash Collateral Amount | 1.010088 |

| Net Profit | 1.016648 | Total Debt/Net Profit | 1.010269 | Cash Limit in Risk Center | 1.013432 |

| Equity | 1.057124 | Long-Term Liabilities/Net Profit | 1.019002 | Weighted KKB Score | 1.028962 |

| Previous Net Sales | 1.077362 | Current Assets/Assets | 1.217395 | Current Class C Cash Collateral Amount | 1.055214 |

| Net Sales | 1.025715 | Net Sales/Assets | 1.1246 | Number of Banks with Limits in Risk Center | 1.06382 |

| Current Liabilities | 1.01011 | Current Class B Cash Collateral Amount | 1.27036 | ||

| Assets | 1.013703 | ||||

| Absolute Value of Net Sales–Previous Net Sales | 1.010068 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Çetin, A.İ.; Çetin, A.E.; Ahmed, S.E. The Impact of Non-Financial and Financial Variables on Credit Decisions for Service Companies in Turkey. J. Risk Financial Manag. 2023, 16, 487. https://doi.org/10.3390/jrfm16110487

Çetin Aİ, Çetin AE, Ahmed SE. The Impact of Non-Financial and Financial Variables on Credit Decisions for Service Companies in Turkey. Journal of Risk and Financial Management. 2023; 16(11):487. https://doi.org/10.3390/jrfm16110487

Chicago/Turabian StyleÇetin, Ali İhsan, Arzu Ece Çetin, and Syed Ejaz Ahmed. 2023. "The Impact of Non-Financial and Financial Variables on Credit Decisions for Service Companies in Turkey" Journal of Risk and Financial Management 16, no. 11: 487. https://doi.org/10.3390/jrfm16110487

APA StyleÇetin, A. İ., Çetin, A. E., & Ahmed, S. E. (2023). The Impact of Non-Financial and Financial Variables on Credit Decisions for Service Companies in Turkey. Journal of Risk and Financial Management, 16(11), 487. https://doi.org/10.3390/jrfm16110487