Risk Spillovers between Bitcoin and ASEAN+6 Stock Markets before and after COVID-19 Outbreak: A Comparative Analysis with Gold

Abstract

1. Introduction

2. Data and Methodology

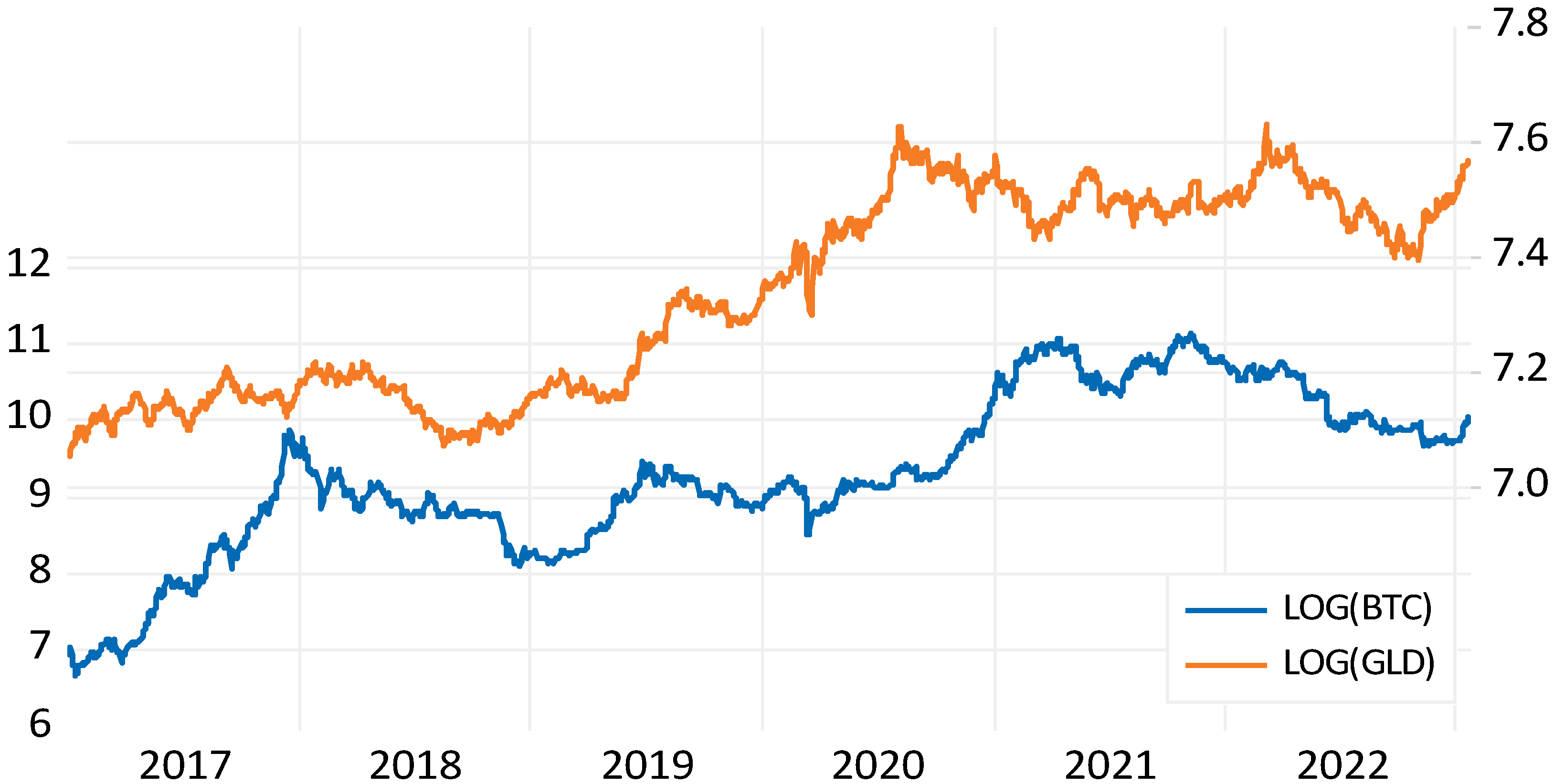

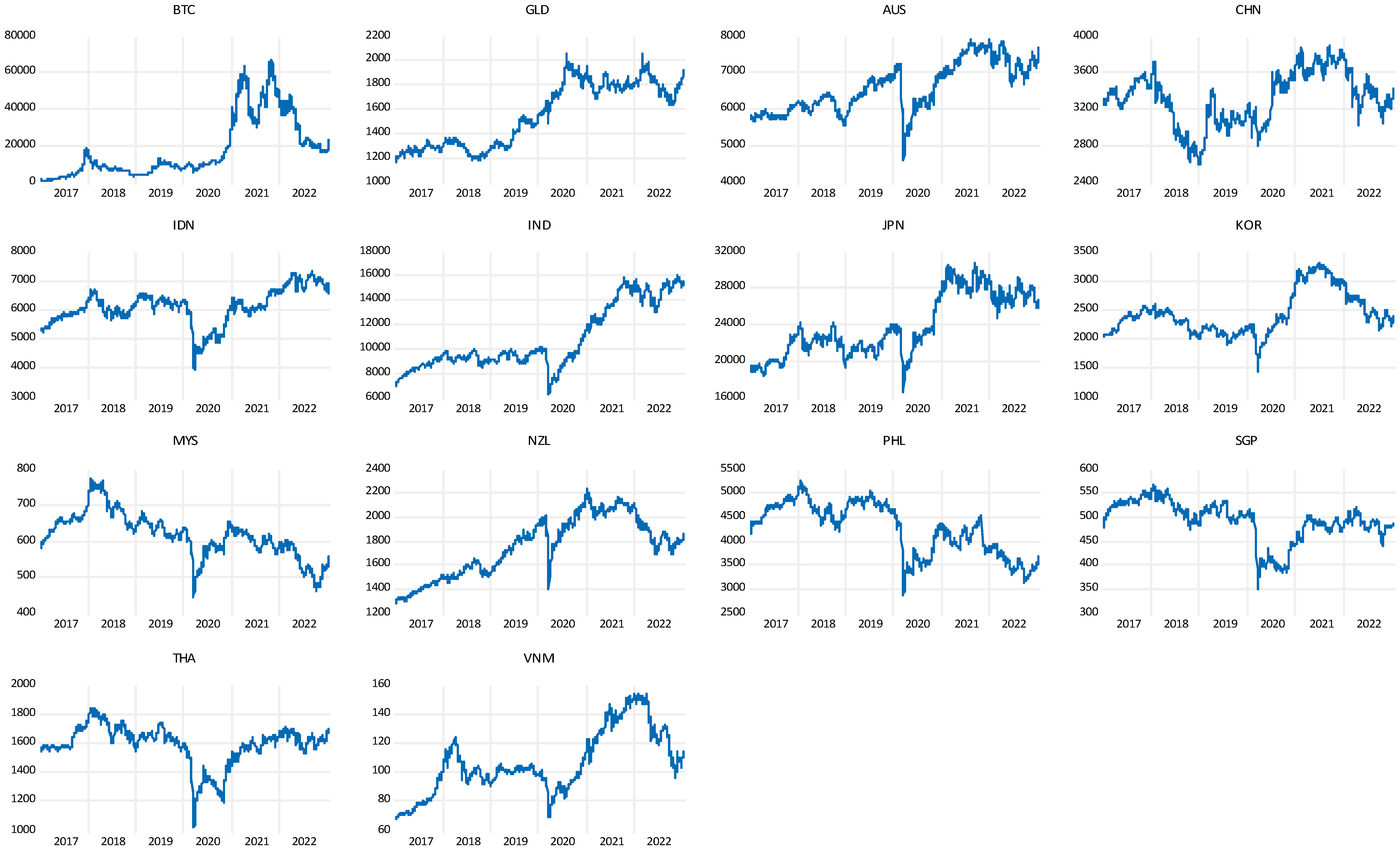

2.1. Data

2.2. Methodology

3. Empirical Results

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | https://coinmarketcap.com/ (accessed on 23 January 2023). |

References

- Aharon, David Yechiam, and Mahmoud Qadan. 2019. Bitcoin and the day-of-the-week effect. Finance Research Letters 31: 415–24. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Ahmet Sensoy, and Shaen Corbet. 2020. The influence of Bitcoin on portfolio diversification and design. Finance Research Letters 37: 101344. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, Brian M. Lucey, and Ahmet Sensoy. 2021. Is gold a hedge or a safe-haven asset in the COVID-19 crisis? Economic Modelling 102: 105588. [Google Scholar] [CrossRef]

- Ali, Fahad, Elie Bouri, Nader Naifar, Syed Jawad Hussain Shahzad, and Mohammad AlAhmad. 2022. An examination of whether gold-backed Islamic cryptocurrencies are safe havens for international Islamic equity markets. Research in International Business and Finance 63: 101768. [Google Scholar] [CrossRef]

- Ali, Fahad, Yuexiang Jiang, and Ahmet Sensoy. 2021. Downside risk in Dow Jones Islamic equity indices: Precious metals and portfolio diversification before and after the COVID-19 bear market. Research in International Business and Finance 58: 101502. [Google Scholar] [CrossRef]

- Al-Yahyaee, Khamis Hamed, Walid Mensi, and Seong-Min Yoon. 2018. Efficiency, multifractality, and the long-memory property of the Bitcoin market: A comparative analysis with stock, currency, and gold markets. Finance Research Letters 27: 228–34. [Google Scholar] [CrossRef]

- Ardia, David, Keven Bluteau, and Maxime Rüede. 2019. Regime changes in Bitcoin GARCH volatility dynamics. Finance Research Letters 29: 266–71. [Google Scholar] [CrossRef]

- Baba, Yoshihisa, Robert Fry Engle, Dennis F. Kraft, and Kenneth F. Kroner. 1990. Multivariate Simultaneous Generalized ARCH. San Diego: Department of Economics, University of California. [Google Scholar]

- Balcilar, Mehmet, Huseyin Ozdemir, and Busra Agan. 2022. Effects of COVID-19 on cryptocurrency and emerging market connectedness: Empirical evidence from quantile, frequency, and lasso networks. Physica A: Statistical Mechanics and its Applications 604: 127885. [Google Scholar] [CrossRef]

- Banerjee, Ameet Kumar, Md Akhtaruzzaman, Andreia Dionisio, Dora Almeida, and Ahmet Sensoy. 2022. Nonlinear nexus between cryptocurrency returns and COVID-19 news sentiment. Journal of Behavioral and Experimental Finance 36: 100747. [Google Scholar] [CrossRef]

- Bouri, Elie, Chi Keung Marco Lau, Brian Lucey, and David Roubaud. 2019a. Trading volume and the predictability of return and volatility in the cryptocurrency market. Finance Research Letters 29: 340–46. [Google Scholar] [CrossRef]

- Bouri, Elie, Syed Jawad Hussain Shahzad, and David Roubaud. 2019b. Co-explosivity in the cryptocurrency market. Finance Research Letters 29: 178–83. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, and Alex Plastun. 2019. The day of the week effect in the cryptocurrency market. Finance Research Letters 31: 258–69. [Google Scholar] [CrossRef]

- Caporin, Massimiliano, and Michael McAleer. 2012. Do we really need both BEKK and DCC? A tale of two multivariate GARCH models. Journal of Economic Surveys 26: 736–51. [Google Scholar] [CrossRef]

- Chan, Kenneth S., Vinh Q. T. Dang, and Jennifer T. Lai. 2018. Capital market integration in ASEAN: A non-stationary panel data analysis. The North American Journal of Economics and Finance 46: 249–60. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Miroslava Rajcaniova, and d’Artis Kancs. 2016. The economics of Bitcoin price formation. Applied Economics 48: 1799–815. [Google Scholar] [CrossRef]

- CoinMarketCap. 2023. Cryptocurrency. Available online: https://coinmarketcap.com/ (accessed on 23 January 2023).

- Conlon, Thomas, and Richard McGee. 2020. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters 35: 101607. [Google Scholar] [CrossRef]

- Duan, Kun, Zeming Li, Andrew Urquhart, and Jinqiang Ye. 2021. Dynamic efficiency and arbitrage potential in Bitcoin: A long-memory approach. International Review of Financial Analysis 75: 101725. [Google Scholar] [CrossRef]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar] [CrossRef]

- Engle, Robert Fry, and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Fakhfekh, Mohamed, and Ahmed Jeribi. 2020. Volatility dynamics of crypto-currencies’ returns: Evidence from asymmetric and long memory GARCH models. Research in International Business and Finance 51: 101075. [Google Scholar] [CrossRef]

- Fisch, Christian. 2019. Initial coin offerings (ICOs) to finance new ventures. Journal of Business Venturing 34: 1–22. [Google Scholar] [CrossRef]

- Gemici, Eray, and Müslüm Polat. 2019. Relationship between price and volume in the Bitcoin market. The Journal of Risk Finance 20: 435–44. [Google Scholar] [CrossRef]

- Goodell, John W., and Stephane Goutte. 2021. Co-movement of COVID-19 and Bitcoin: Evidence from wavelet coherence analysis. Finance Research Letters 38: 101625. [Google Scholar] [CrossRef]

- Hsu, Shu-Han, Chwen Sheu, and Jiho Yoon. 2021. Risk spillovers between cryptocurrencies and traditional currencies and gold under different global economic conditions. The North American Journal of Economics and Finance 57: 101443. [Google Scholar] [CrossRef]

- Karalevicius, Vytautas, Niels Degrande, and Jochen De Weerdt. 2018. Using sentiment analysis to predict interday Bitcoin price movements. The Journal of Risk Finance 19: 56–75. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi. 2019. An empirical investigation of volatility dynamics in the cryptocurrency market. Research in International Business and Finance 50: 322–35. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Larisa Yarovaya, and Damian Zięba. 2022. High-frequency connectedness between Bitcoin and other top-traded crypto assets during the COVID-19 crisis. Journal of International Financial Markets, Institutions and Money 79: 101578. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Shaen Corbet, and Brian Lucey. 2019. Volatility spillover effects in leading cryptocurrencies: A BEKK-MGARCH analysis. Finance Research Letters 29: 68–74. [Google Scholar] [CrossRef]

- Kumar, Ashish, Najaf Iqbal, Subrata Kumar Mitra, Ladislav Kristoufek, and Elie Bouri. 2022. Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. Journal of International Financial Markets, Institutions and Money 77: 101523. [Google Scholar] [CrossRef]

- Li, Rong, Sufang Li, Di Yuan, and Huiming Zhu. 2021. Investor attention and cryptocurrency: Evidence from wavelet-based quantile Granger causality analysis. Research in International Business and Finance 56: 101389. [Google Scholar] [CrossRef]

- Mensi, Walid, Mobeen Ur Rehman, Debasish Maitra, Khamis Hamed Al-Yahyaee, and Ahmet Sensoy. 2020. Does Bitcoin co-move and share risk with Sukuk and world and regional Islamic stock markets? Evidence using a time-frequency approach. Research in International Business and Finance 53: 101230. [Google Scholar] [CrossRef]

- Mokni, Khaled, Ahdi Noomen Ajmi, Elie Bouri, and Xuan Vinh Vo. 2020. Economic policy uncertainty and the Bitcoin-US stock nexus. Journal of Multinational Financial Management 57: 100656. [Google Scholar] [CrossRef]

- Nguyen, An Pham Ngoc, Tai Tan Mai, Marija Bezbradica, and Martin Crane. 2022. The cryptocurrency market in transition before and after COVID-19: An opportunity for investors? Entropy 24: 1317. [Google Scholar] [CrossRef]

- Paule-Vianez, Jessica, Camilo Prado-Román, and Raúl Gómez-Martínez. 2020. Economic policy uncertainty and Bitcoin. Is Bitcoin a safe-haven asset? European Journal of Management and Business Economics 29: 347–63. [Google Scholar] [CrossRef]

- Pyo, Sujin, and Jaewook Lee. 2020. Do FOMC and macroeconomic announcements affect Bitcoin prices? Finance Research Letters 37: 101386. [Google Scholar] [CrossRef]

- Ram, Asheer Jaywant. 2019. Bitcoin as a new asset class. Meditari Accountancy Research 27: 147–68. [Google Scholar] [CrossRef]

- Sensoy, Ahmet, Thiago Christiano Silva, Shaen Corbet, and Benjamin Miranda Tabak. 2021. High-frequency return and volatility spillovers among cryptocurrencies. Applied Economics 53: 4310–28. [Google Scholar] [CrossRef]

- Sethapramote, Yuthana. 2015. Synchronization of business cycles and economic policy linkages in ASEAN. Journal of Asian Economics 39: 126–36. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Elie Bouri, David Roubaud, Ladislav Kristoufek, and Brian Lucey. 2019. Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis 63: 322–30. [Google Scholar] [CrossRef]

- Sui, Xin, Guifen Shi, Guanchong Hou, Shaohan Huang, and Yanshuang Li. 2022. Impacts of COVID-19 on the return and volatility nexus among cryptocurrency market. Complexity 2022: 5346080. [Google Scholar] [CrossRef]

- Takaishi, Tetsuya, and Takanori Adachi. 2018. Taylor effect in Bitcoin time series. Economics Letters 172: 5–7. [Google Scholar] [CrossRef]

- Turner, Adam, and Angela Samantha Maitland Irwin. 2018. Bitcoin transactions: A digital discovery of illicit activity on the blockchain. Journal of Financial Crime 25: 109–30. [Google Scholar] [CrossRef]

- Vardar, Gulin, and Berna Aydogan. 2019. Return and volatility spillovers between Bitcoin and other asset classes in Turkey: Evidence from VAR-BEKK-GARCH approach. EuroMed Journal of Business 14: 209–20. [Google Scholar] [CrossRef]

- Wang, Peijin, Hongwei Zhang, Cai Yang, and Yaoqi Guo. 2021. Time and frequency dynamics of connectedness and hedging performance in global stock markets: Bitcoin versus conventional hedges. Research in International Business and Finance 58: 101479. [Google Scholar] [CrossRef]

- WHO. 2023. WHO Coronavirus Disease (COVID-19) Dashboard. Available online: https://covid19.who.int/ (accessed on 23 January 2023).

- World Bank. 2022. World Development Indicators. Available online: https://databank.worldbank.org (accessed on 3 January 2022).

- Yarovaya, Larisa, and Damian Zięba. 2022. Intraday volume-return nexus in cryptocurrency markets: Novel evidence from cryptocurrency classification. Research in International Business and Finance 60: 101592. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Shoaib Ali. 2020. The COVID-19 outbreak and high frequency information transmission between major cryptocurrencies: Evidence from the VAR-DCC-GARCH approach. Borsa Istanbul Review 20: S1–S10. [Google Scholar] [CrossRef]

- Zhang, Yue-Jun, Elie Bouri, Rangan Gupta, and Shu-Jiao Ma. 2021. Risk spillover between Bitcoin and conventional financial markets: An expectile-based approach. The North American Journal of Economics and Finance 55: 101296. [Google Scholar] [CrossRef]

| BTC | GLD | AUS | CHN | IDN | IND | JPN | KOR | MYS | NZL | PHL | SGP | THE | VNM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: (Pre-COVID-19: 2 January 2017–30 December 2019) | ||||||||||||||

| Mean | 0.0025 | 0.0003 | 0.0002 | 0.0000 | 0.0002 | 0.0004 | 0.0003 | 0.0001 | 0.0001 | 0.0005 | 0.0001 | 0.0001 | 0.0000 | 0.0005 |

| Median | 0.0025 | 0.0002 | 0.0005 | 0.0000 | 0.0000 | 0.0003 | 0.0001 | 0.0001 | 0.0000 | 0.0005 | 0.0000 | 0.0001 | 0.0000 | 0.0006 |

| Maximum | 0.2251 | 0.0298 | 0.0184 | 0.0545 | 0.0263 | 0.0516 | 0.0381 | 0.0347 | 0.0181 | 0.0183 | 0.0233 | 0.0169 | 0.0227 | 0.0378 |

| Minimum | −0.2387 | −0.0194 | −0.0329 | −0.0575 | −0.0383 | −0.0290 | −0.0514 | −0.0454 | −0.0314 | −0.0366 | −0.0217 | −0.0279 | −0.0242 | −0.0534 |

| Std. Dev. | 0.0496 | 0.0065 | 0.0063 | 0.0099 | 0.0075 | 0.0076 | 0.0094 | 0.0075 | 0.0057 | 0.0054 | 0.0070 | 0.0057 | 0.0059 | 0.0099 |

| Skewness | 0.0006 | 0.2219 | −0.8753 | −0.4447 | −0.4647 | 0.2703 | −0.6509 | −0.7117 | −0.4948 | −0.6903 | 0.0111 | −0.4273 | −0.2683 | −0.8532 |

| Kurtosis | 6.3157 | 4.3858 | 5.9302 | 8.3601 | 5.4826 | 6.5720 | 6.9163 | 6.1504 | 5.5919 | 6.7072 | 3.6427 | 4.4788 | 4.9141 | 7.5837 |

| Jarque–Bera | 357.3 a | 68.82 a | 378.7 a | 959.5 a | 228.4 a | 424.2 a | 553.5 a | 388.4 a | 250.2 a | 508.5 a | 13.44 a | 94.80 a | 128.4 a | 777.5 a |

| Observations | 780 | 780 | 780 | 780 | 780 | 780 | 780 | 780 | 780 | 780 | 780 | 780 | 780 | 780 |

| ADF | −27.08 a | −28.38 a | −21.26 a | −28.23 a | −27.96 a | −25.39 a | −28.31 a | −17.71 a | −25.56 a | −27.07 a | −28.09 a | −28.46 a | −27.20 a | −27.87 a |

| PP | −27.18 a | −28.37 a | −27.28 a | −28.23 a | −28.14 a | −25.29 a | −28.31 a | −27.97 a | −25.63 a | −27.06 a | −28.10 a | −28.53 a | −27.23 a | −28.09 a |

| KPSS | 0.3207 | 0.1193 | 0.0778 | 0.0860 | 0.1072 | 0.2328 | 0.0536 | 0.2441 | 0.1039 | 0.0555 | 0.1960 | 0.1913 | 0.1842 | 0.3020 |

| Panel B: (COVID-19 period: 31 December 2019–20 January 2023) | ||||||||||||||

| Mean | 0.0014 | 0.0003 | 0.0001 | 0.0001 | 0.0001 | 0.0005 | 0.0001 | 0.0001 | −0.0002 | −0.0000 | −0.0003 | −0.0001 | 0.0001 | 0.0002 |

| Median | 0.0015 | 0.0008 | 0.0010 | 0.0000 | 0.0000 | 0.0011 | 0.0000 | 0.0003 | 0.0000 | 0.0000 | 0.0000 | 0.0003 | 0.0000 | 0.0009 |

| Maximum | 0.1915 | 0.0497 | 0.0635 | 0.0555 | 0.0970 | 0.0741 | 0.0773 | 0.0825 | 0.0646 | 0.0684 | 0.0588 | 0.0550 | 0.0765 | 0.0509 |

| Minimum | −0.4647 | −0.0507 | −0.1001 | −0.0803 | −0.0681 | −0.1371 | −0.0627 | −0.0877 | −0.0572 | −0.0802 | −0.1337 | −0.0751 | −0.1143 | −0.0709 |

| Std. Dev. | 0.0460 | 0.0100 | 0.0127 | 0.0108 | 0.0113 | 0.0134 | 0.0132 | 0.0133 | 0.0098 | 0.0096 | 0.0129 | 0.0097 | 0.0120 | 0.0137 |

| Skewness | −1.6403 | −0.5028 | −1.2963 | −0.8551 | 0.0351 | −2.0265 | 0.0944 | −0.1497 | −0.3189 | −0.6510 | −3.0880 | −0.9542 | −2.0920 | −1.1028 |

| Kurtosis | 18.289 | 6.5991 | 13.982 | 9.4619 | 13.873 | 22.417 | 6.5024 | 9.2520 | 10.781 | 14.846 | 32.060 | 16.337 | 26.640 | 7.3122 |

| Jarque–Bera | 8140.6 | 464.91 | 4239.1 | 1487.5 | 3935.8 | 13,098 | 409.56 | 1304.3 | 2029.4 | 4727.8 | 29,383 | 6043.2 | 19,188 | 781.02 |

| Observations | 799 | 799 | 799 | 799 | 799 | 799 | 799 | 799 | 799 | 799 | 799 | 799 | 799 | 799 |

| ADF | −29.70 a | −28.17 a | −14.07 a | −28.48 a | −14.06 a | −11.16 a | −17.99 a | −17.83 a | −17.83 a | −16.32 a | −28.11 a | −9.693 a | −9.908 a | −26.67 a |

| PP | −29.67 a | −28.27 a | −33.94 a | −28.52 a | −26.64 a | −29.15 a | −27.78 a | −28.85 a | −27.62 a | −26.04 a | −28.27 a | −30.63 a | −30.92 a | −26.77 a |

| KPSS | 0.0890 | 0.1268 | 0.0653 | 0.0865 | 0.1366 | 0.1343 | 0.0875 | 0.2381 | 0.0687 | 0.0650 | 0.1018 | 0.1258 | 0.0995 | 0.2055 |

| BTC | AUS | CHN | IDN | IND | JPN | KOR | MYS | NZL | PHL | SGP | THE | VNM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: (Pre-COVID-19: 2 January 2017–30 December 2019) | |||||||||||||

| 0.0020 | 0.0003 c | 0.0001 | 0.0003 | 0.0008 a | 0.0005 c | 0.0003 | 0.0002 | 0.0006 a | 0.0002 | 0.0001 | 0.0002 | 0.0006 c | |

| 0.0001 | 0.0000 | 0.0000 | 0.0000 | 0.0000 a | 0.0000 | 0.0000 a | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |

| ARCH | 0.0885 b | 0.1047 a | 0.0649 | 0.0358 | 0.1449 a | 0.0465 a | 0.0391 a | 0.0419 | 0.0329 | 0.0263 a | 0.0386 c | 0.0469 b | 0.0780 |

| GARCH | 0.8509 a | 0.8433 a | 0.9340 | 0.9559 a | 0.7305 a | 0.9296 a | 0.9206 a | 0.9500 a | 0.9532 a | 0.9672 a | 0.9299 a | 0.9469 a | 0.9098 a |

| a | 0.0007 | 0.0175 | 0.0000 | 0.0000 | 0.0020 | 0.0210 c | 0.0024 | 0.0000 | 0.0049 | 0.0000 | 0.0068 | 0.0000 | |

| b | 0.9772 a | 0.9530 | 0.9325 | 0.9670 a | 0.9918 a | 0.9417 c | 0.9664 a | 0.9258 a | 0.9396 a | 0.9390 a | 0.9758 a | 0.9175 a | |

| AIC | −10.614 | −9.8451 | −10.297 | −10.251 | −9.8282 | −10.222 | −10.846 | −10.880 | −10.364 | −10.776 | −10.789 | −9.9529 | |

| SIC | −10.548 | −9.7794 | −10.232 | −10.185 | −9.7625 | −10.156 | −10.780 | −10.814 | −10.298 | −10.710 | −10.723 | −9.8872 | |

| Panel B: (COVID-19 period: 31 December 2019–20 January 2023) | |||||||||||||

| 0.0021 | 0.0006 c | 0.0002 | 0.0004 | 0.0010 | 0.0003 | 0.0004 | −0.0002 | 0.0002 | −0.0006 | 0.0001 | 0.0001 | 0.0007 | |

| 0.0002 c | 0.0000 b | 0.0000 a | 0.0000 a | 0.0000 | 0.0000 a | 0.0000 a | 0.0000 b | 0.0000 | 0.0000 c | 0.0000 a | 0.0000 | 0.0000 a | |

| ARCH | 0.1301 | 0.1728 a | 0.0715 a | 0.1283 a | 0.1141 a | 0.0926 a | 0.1753 a | 0.0705 a | 0.1249 a | 0.1473 b | 0.1465 a | 0.0858 a | 0.1354 a |

| GARCH | 0.7764 a | 0.7728 a | 0.8763 a | 0.7822 a | 0.8595 a | 0.8286 a | 0.7504 a | 0.8850 a | 0.8393 a | 0.7092 a | 0.7787 a | 0.8966 a | 0.7959 a |

| a | 0.0554 | 0.0113 b | 0.0342 | 0.0639 c | 0.0303 | 0.0917 c | 0.0000 | 0.0068 | 0.1210 b | 0.0076 | 0.0519 | 0.0278 | |

| b | 0.4286 b | 0.9820 a | 0.4245 a | 0.5974 a | 0.5689 a | 0.3842 a | 0.9067 a | 0.6772 a | 0.3896 a | 0.6320 a | 0.6614 a | 0.4023 | |

| AIC | −9.7738 | −9.6636 | −9.8216 | −9.6226 | −9.3180 | −9.4545 | −10.023 | −10.190 | −9.4180 | −10.288 | −9.9684 | −9.2962 | |

| SIC | −9.7093 | −9.5991 | −9.7571 | −9.5581 | −9.2536 | −9.3900 | −9.9585 | −10.126 | −9.3535 | −10.224 | −9.9040 | −9.2317 | |

| GLD | AUS | CHN | IDN | IND | JPN | KOR | MYS | NZL | PHL | SGP | THE | VNM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: (Pre-COVID-19: 2 January 2017–30 December 2019) | |||||||||||||

| 0.0003 | 0.0003 c | 0.0001 | 0.0004 | 0.0008 a | 0.0005 c | 0.0003 | 0.0002 | 0.0006 a | 0.0002 | 0.0001 | 0.0002 | 0.0006 c | |

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 a | 0.0000 | 0.0000 a | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |

| ARCH | 0.0223 a | 0.1047 a | 0.0649 | 0.0358 | 0.1449 a | 0.0465 a | 0.0391 a | 0.0419 | 0.0329 | 0.0263 a | 0.0386 c | 0.0469 b | 0.0780 |

| GARCH | 0.9540 a | 0.8433 a | 0.9340 | 0.9559 a | 0.7305 a | 0.9296 a | 0.9206 a | 0.9500 a | 0.9532 a | 0.9672 a | 0.9299 a | 0.9469 a | 0.9098 a |

| a | 0.0000 | 0.0003 | 0.0036 | 0.0008 | 0.0200 | 0.0178 | 0.0391 c | 0.0000 | 0.0019 | 0.0000 | 0.0024 | 0.0000 | |

| b | 0.9178 a | 0.9543 a | 0.9125 a | 0.9683 a | 0.6266 | 0.9080 a | 0.8596 a | 0.9487 | 0.9339 a | 0.9217 a | 0.9900 a | 0.9172 a | |

| AIC | −14.621 | −13.837 | −14.293 | −14.246 | −13.856 | −14.221 | −14.859 | −14.870 | −14.360 | −14.782 | −14.783 | −13.948 | |

| SIC | −14.555 | −13.771 | −14.228 | −14.180 | −13.791 | −14.155 | −14.793 | −14.804 | −14.295 | −14.716 | −14.718 | −13.882 | |

| Panel B: (COVID-19 period: 31 December 2019–20 January 2023) | |||||||||||||

| 0.0002 | 0.0006 c | 0.0002 | 0.0004 | 0.0010 | 0.0004 | 0.0004 | −0.0002 | 0.0002 | −0.0007 | 0.0001 | 0.0001 | 0.0007 | |

| 0.0000 a | 0.0000 b | 0.0000 a | 0.0000 a | 0.0000 | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 | 0.0000 c | 0.0000 a | 0.0000 | 0.0000 a | |

| ARCH | 0.0592 a | 0.1728 a | 0.0715 a | 0.1283 a | 0.1141 a | 0.0926 a | 0.1753 a | 0.0705 a | 0.1249 a | 0.1473 b | 0.1465 a | 0.0858 a | 0.1354 a |

| GARCH | 0.8248 a | 0.7728 a | 0.8763 a | 0.7822 a | 0.8595 a | 0.8287 a | 0.7504 a | 0.8850 a | 0.8393 a | 0.7092 a | 0.7787 a | 0.8966 a | 0.7959 a |

| a | 0.0003 | 0.0000 | 0.0058 | 0.0000 | 0.0129 | 0.0000 | 0.0456 | 0.0027 | 0.0021 | 0.0051 | 0.0000 | 0.0046 | |

| b | 0.9691 a | 0.9316 | 0.9234 a | 0.9242 b | 0.9276 a | 0.9188 a | 0.0000 | 0.8044 | 0.9874 a | 0.9305 a | 0.9218 a | 0.9619 a | |

| AIC | −12.790 | −12.694 | −12.841 | −12.623 | −12.337 | −12.477 | −13.049 | −13.198 | −12.426 | −13.307 | −12.969 | −12.323 | |

| SIC | −12.726 | −12.629 | −12.777 | −12.559 | −12.272 | −12.413 | −12.985 | −13.134 | −12.362 | −13.242 | −12.905 | −12.259 | |

| AUS | CHN | IDN | IND | JPN | KOR | MYS | NZL | PHL | SGP | THE | VNM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: (Pre-COVID-19: 2 January 2017–30 December 2019) | ||||||||||||

| 0.0003 | 0.0003 | 0.0003 | 0.0008 a | 0.0004 | 0.0003 | 0.0001 | 0.0006 a | 0.0002 | 0.0001 | 0.0002 | 0.0005 c | |

| 0.0024 | 0.0019 | 0.0022 | 0.0015 | 0.0019 | 0.0018 | 0.0025 | 0.0020 | 0.0023 | 0.0022 | 0.0020 | 0.0022 | |

| 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 b | 0.0000 a | 0.0000 b | 0.0000 c | 0.0000 b | 0.0000 a | 0.0000 b | |

| 0.0000 | 0.0000 | 0.0000 | 0.0000 | −0.0000 | −0.0000 | −0.0000 | 0.0000 c | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |

| 0.0001 a | 0.0001 a | 0.0002 a | 0.0001 a | 0.0001 a | 0.0002 a | 0.0002 a | 0.0002 a | 0.0002 a | 0.0001 a | 0.0001 a | 0.0002 a | |

| 0.2898 a | 0.2215 a | 0.1484 a | 0.4094 a | 0.1824 a | 0.0832 a | 0.2100 a | 0.1553 a | 0.2001 a | 0.1931 a | 0.2012 a | 0.2404 a | |

| 0.2286 a | 0.2657 a | 0.2794 a | 0.2591 a | 0.2767 a | 0.3007 a | 0.3027 a | 0.2987 a | 0.2874 a | 0.2763 a | 0.2810 a | 0.2859 a | |

| 0.9247 a | 0.9739 a | 0.9854 a | 0.7321 a | 0.9712 a | 0.9945 a | 0.9728 a | 0.9778 a | 0.9634 a | 0.9632 a | 0.9758 a | 0.9677 a | |

| 0.9508 a | 0.9338 a | 0.9267 a | 0.9380 a | 0.9301 a | 0.9199 a | 0.9171 a | 0.9191 a | 0.9241 a | 0.9323 a | 0.9285 a | 0.9220 a | |

| AIC | −10.581 | −9.8575 | −10.304 | −10.228 | −9.8063 | −10.236 | −10.834 | −10.868 | −10.358 | −10.776 | −10.781 | −9.9388 |

| SIC | −10.527 | −9.8038 | −10.250 | −10.174 | −9.7526 | −10.182 | −10.780 | −10.814 | −10.304 | −10.723 | −10.727 | −9.8850 |

| Panel B: (COVID-19 period: 31 December 2019–20 January 2023) | ||||||||||||

| 0.0006 c | 0.0002 | 0.0004 | 0.0010 a | 0.0004 | 0.0004 | −0.0002 | 0.0002 | −0.0007 | 0.0001 | 0.0001 | 0.0007 | |

| 0.0020 | 0.0020 | 0.0021 | 0.0023 | 0.0020 | 0.0020 | 0.0024 | 0.0025 | 0.0019 | 0.0017 | 0.0026 | 0.0015 | |

| 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 b | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | |

| 0.0000 | 0.0000 | 0.0000 b | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 b | −0.0000 | 0.0000 | 0.0000 b | 0.0000 | |

| 0.0003 a | 0.0003 a | 0.0004 b | 0.0002 a | 0.0003 a | 0.0003 a | 0.0004 a | 0.0003 a | 0.0003 a | 0.0005 b | 0.0003 a | 0.0004 a | |

| 0.4068 a | 0.2457 a | 0.3378 a | 0.3290 a | 0.2314 a | 0.4134 a | 0.2189 a | 0.3041 a | 0.4002 a | 0.3666 a | 0.2754 a | 0.3269 a | |

| 0.2187 a | 0.3393 a | 0.2391 a | 0.2978 a | 0.3613 a | 0.3137 a | 0.3340 a | 0.3726 a | 0.3152 a | 0.2186 a | 0.3145 a | 0.2330 a | |

| 0.8792 a | 0.9323 a | 0.8966 a | 0.9287 a | 0.9422 a | 0.8509 a | 0.9554 a | 0.9372 a | 0.8242 a | 0.8890 a | 0.9494 a | 0.9113 a | |

| 0.8949 a | 0.8744 a | 0.8602 a | 0.8961 a | 0.8575 a | 0.8808 a | 0.8531 a | 0.8501 a | 0.8908 a | 0.8616 a | 0.8668 a | 0.8787 a | |

| AIC | −9.7462 | −9.6505 | −9.7896 | −9.6142 | −9.2968 | −9.4334 | −9.9877 | −10.168 | −9.3653 | −10.247 | −9.9561 | −9.2563 |

| SIC | −9.6934 | −9.5978 | −9.7368 | −9.5615 | −9.2441 | −9.3807 | −9.9350 | −10.115 | −9.3126 | −10.194 | −9.9034 | −9.2036 |

| AUS | CHN | IDN | IND | JPN | KOR | MYS | NZL | PHL | SGP | THE | VNM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: (Pre-COVID-19: 2 January 2017–30 December 2019) | ||||||||||||

| 0.0003 | 0.0002 | 0.0004 | 0.0008 a | 0.0006 c | 0.0004 | 0.0002 | 0.0006 a | 0.0002 | 0.0002 | 0.0002 | 0.0006 b | |

| 0.0003 | 0.0003 | 0.0003 | 0.0003 | 0.0003 | 0.0003 | 0.0002 | 0.0003 | 0.0002 | 0.0002 | 0.0003 | 0.0004 | |

| 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 b | 0.0000 a | 0.0000 b | 0.0000 a | 0.0000 b | 0.0000 a | 0.0000 a | |

| −0.0000 a | 0.0000 | 0.0000 | −0.0000 | −0.0000 a | −0.0000 | 0.0000 | −0.0000 | −0.0000 | −0.0000 b | 0.0000 | 0.0000 c | |

| 0.0000 b | 0.0000 c | 0.0000 c | 0.0000 c | 0.0000 c | 0.0000 c | 0.0000 b | 0.0000 c | 0.0000 c | 0.0000 c | 0.0000 b | 0.0000 b | |

| 0.3281 a | 0.2240 a | 0.1652 a | 0.0335 a | 0.2408 a | 0.0851 a | 0.2097 a | 0.1898 a | 0.3023 a | 0.3008 a | 0.2177 a | 0.2838 a | |

| −0.1286 a | 0.0808 a | 0.1208 a | 0.0271 a | 0.0997 a | 0.1402 a | 0.1414 a | 0.1152 a | 0.1051 a | 0.0876 a | 0.0987 a | −0.1357 a | |

| 0.9158 a | 0.9739 a | 0.9824 a | 0.0335 a | 0.9487 a | 0.9943 a | 0.9726 a | 0.9701 a | 0.8829 a | 0.8656 a | 0.9721 a | 0.9526 a | |

| 0.9788 a | 0.9820 a | 0.9755 a | 0.0074 a | 0.9764 a | 0.9686 a | 0.9741 a | 0.9781 a | 0.9817 a | 0.9828 a | 0.9816 a | 0.9778 a | |

| AIC | −14.637 | −13.850 | −14.312 | −14.251 | −13.856 | −14.233 | −14.864 | −14.869 | −14.358 | −14.781 | −14.781 | −13.969 |

| SIC | −14.583 | −13.796 | −14.258 | −14.197 | −13.802 | −14.179 | −14.810 | −14.815 | −14.304 | −14.727 | −14.727 | −13.915 |

| Panel B: (COVID-19 period: 31 December 2019–20 January 2023) | ||||||||||||

| 0.0006 c | 0.0002 | 0.0004 | 0.0010 a | 0.0004 | 0.0001 | −0.0002 | 0.0002 | −0.0006 | 0.0001 | 0.0001 | 0.0008 c | |

| 0.0003 | 0.0003 | 0.0003 | 0.0004 | 0.0004 | 0.0003 | 0.0002 | 0.0004 | 0.0003 | 0.0004 | 0.0003 | 0.0002 | |

| 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | 0.0000 a | |

| 0.0000 | 0.0000 | 0.0000 | 0.0000 b | −0.0000 | 0.0000 b | 0.0000 c | 0.0000 | −0.0000 | 0.0000 | 0.0000 | −0.0000 c | |

| 0.0000 | 0.0000 c | 0.0000 c | 0.0000 | 0.0000 c | 0.0000 a | 0.0000 b | 0.0000 c | 0.0000 | 0.0000 | 0.0000 | 0.3500 b | |

| 0.3815 a | 0.2610 a | 0.3374 a | 0.3276 a | 0.2937 a | 0.4129 a | 0.2604 a | 0.3365 a | 0.3510 a | 0.3812 a | 0.2948 a | 0.1878 a | |

| 0.1277 a | 0.1773 a | 0.1665 a | 0.0818 a | 0.1383 a | 0.2363 a | 0.1802 a | 0.1598 a | 0.1534 a | 0.1421 a | 0.1226 a | 0.9023 a | |

| 0.8988 a | 0.9238 a | 0.8990 a | 0.9320 a | 0.9085 a | 0.8703 a | 0.9402 a | 0.9248 a | 0.8574 a | 0.8812 a | 0.9466 a | 0.9316 a | |

| 0.9563 a | 0.9379 a | 0.9458 a | 0.9652 a | 0.9562 a | 0.9142 a | 0.9311 a | 0.9350 a | 0.9494 a | 0.9518 a | 0.9582 a | 0.3500 a | |

| AIC | −12.767 | −12.680 | −12.835 | −12.596 | −12.332 | −12.429 | −13.040 | −13.182 | −12.414 | −13.293 | −12.942 | −12.318 |

| SIC | −12.714 | −12.627 | −12.782 | −12.543 | −12.279 | −12.376 | −12.988 | −13.129 | −12.361 | −13.240 | −12.889 | −12.265 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sinlapates, P.; Sriwong, T.; Chancharat, S. Risk Spillovers between Bitcoin and ASEAN+6 Stock Markets before and after COVID-19 Outbreak: A Comparative Analysis with Gold. J. Risk Financial Manag. 2023, 16, 103. https://doi.org/10.3390/jrfm16020103

Sinlapates P, Sriwong T, Chancharat S. Risk Spillovers between Bitcoin and ASEAN+6 Stock Markets before and after COVID-19 Outbreak: A Comparative Analysis with Gold. Journal of Risk and Financial Management. 2023; 16(2):103. https://doi.org/10.3390/jrfm16020103

Chicago/Turabian StyleSinlapates, Parichat, Tanit Sriwong, and Surachai Chancharat. 2023. "Risk Spillovers between Bitcoin and ASEAN+6 Stock Markets before and after COVID-19 Outbreak: A Comparative Analysis with Gold" Journal of Risk and Financial Management 16, no. 2: 103. https://doi.org/10.3390/jrfm16020103

APA StyleSinlapates, P., Sriwong, T., & Chancharat, S. (2023). Risk Spillovers between Bitcoin and ASEAN+6 Stock Markets before and after COVID-19 Outbreak: A Comparative Analysis with Gold. Journal of Risk and Financial Management, 16(2), 103. https://doi.org/10.3390/jrfm16020103