A Study about Who Is Interested in Stock Splitting and Why: Considering Companies, Shareholders, or Managers

Abstract

1. Introduction

2. Literature Review

2.1. On Hypothesis 1: To Attract More Shareholders

- to make it more convenient for small stockholders to purchase round lots;

- to keep the firm’s stock price within an optimal price range;

- to increase the number of shareholders;

- to make stocks more attractive to new investors or speculators.

“The clientele preferring a lower price range is usually thought to be uninformed or small investor.”

2.2. On Hypothesis 2: To Level off Information Asymmetries on Firm Value

2.3. On Hypothesis 3: To Provide Stock Splits/Dividends, New Shares, and Liquidity

3. Methodology

3.1. The Research Method for Hypothesis 1

3.2. The Research Method for Hypothesis 2

- Steps for calculating the return:

- 1.1.

- Identify the adjusted closing price on the first and last day of the period before the split.

- 1.2.

- Divide the adjusted closing price at the end of the period by the one at the beginning of the period. This gives the “normal return rate”.

- 1.3.

- Then, find the index’s adjusted closing price on the first and last day of the period after the split.

- 1.4.

- Divide the ending adjusted closing price by the beginning adjusted closing price.

- 1.5.

- Multiply the stock’s beta. This gives the return rate after the split has influenced the market.

- 1.6.

- Subtract the two results; the difference value shows whether the stock generates better returns than expected.

- Steps for calculating beta:

- 2.1.

- Calculate the percent change period to period for both the stock price rate (rsf) and the risk-free rate (rf).

- 2.2.

- Find the Variance of the stock price

- 2.3.

- Find the Covariance of the stock price to the risk-free rate.

- 2.4.

- Use this formula to calculate beta: .

3.3. The Research Method for Hypothesis 3

4. Data Selection and Description

- The language of the annual report is not English;

- There are different standards in annual reports;

- There are no historical yearly report documents remaining on the homepage;

- We were incapable of collecting the full data of interest.

5. Results

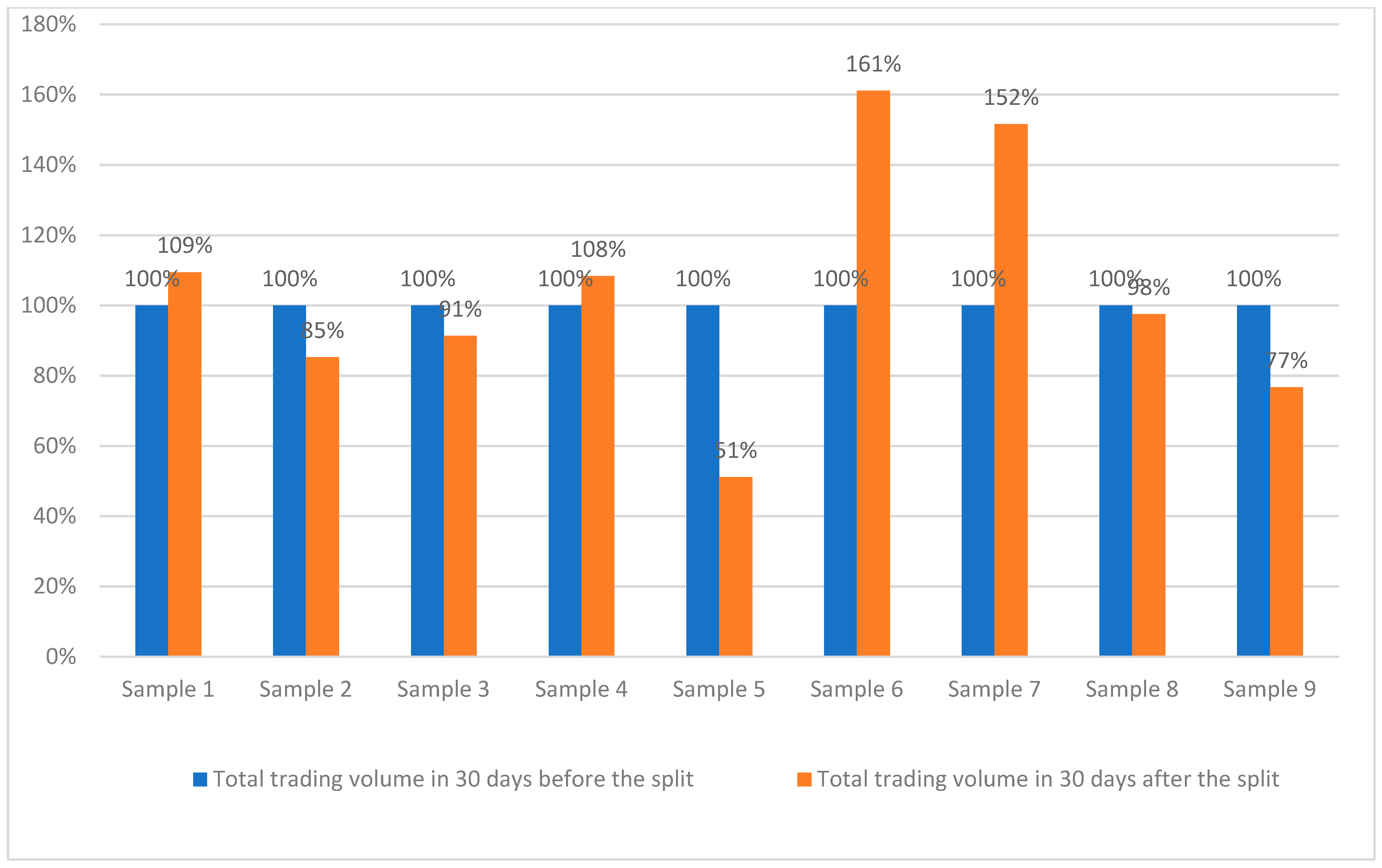

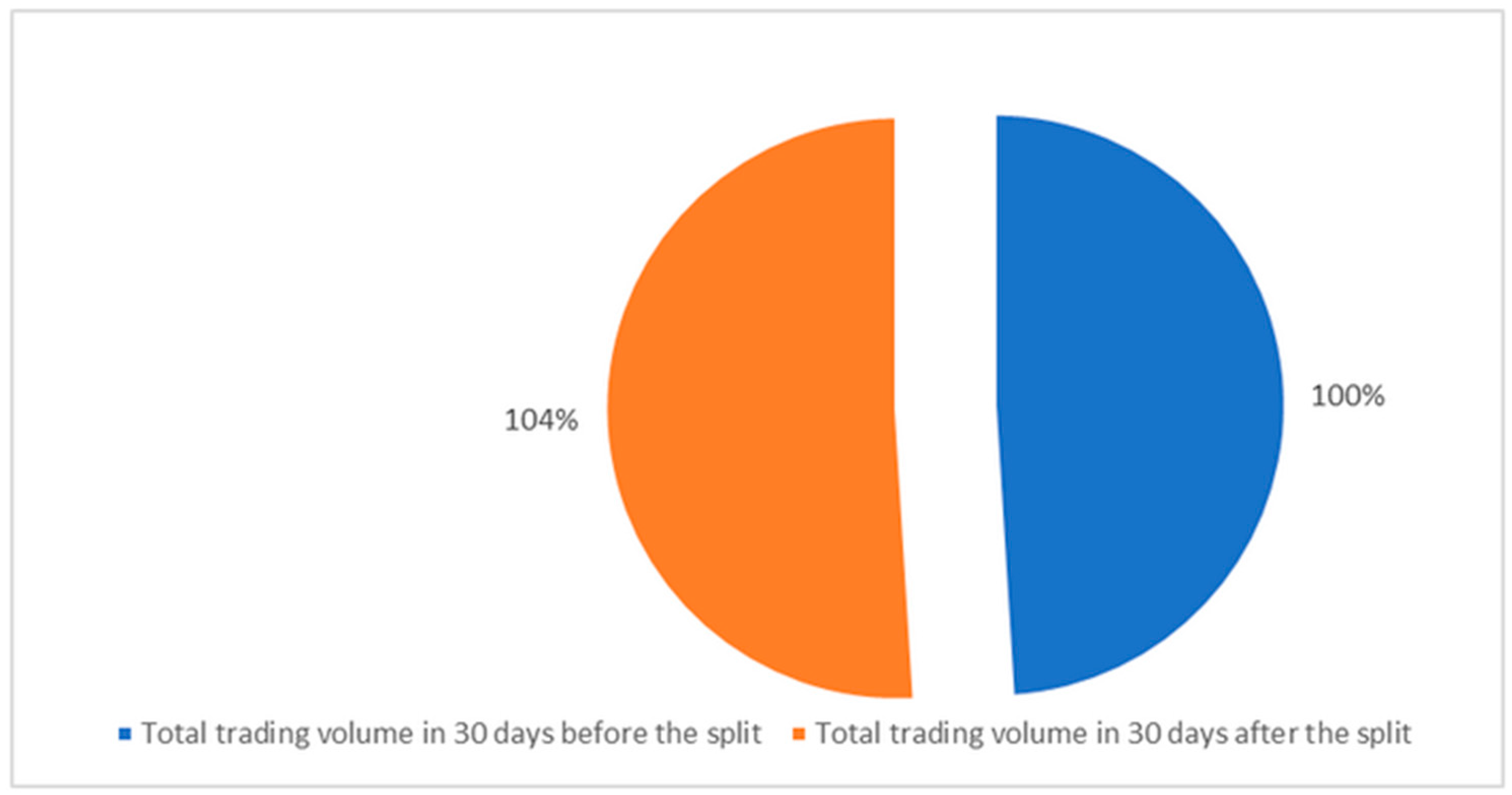

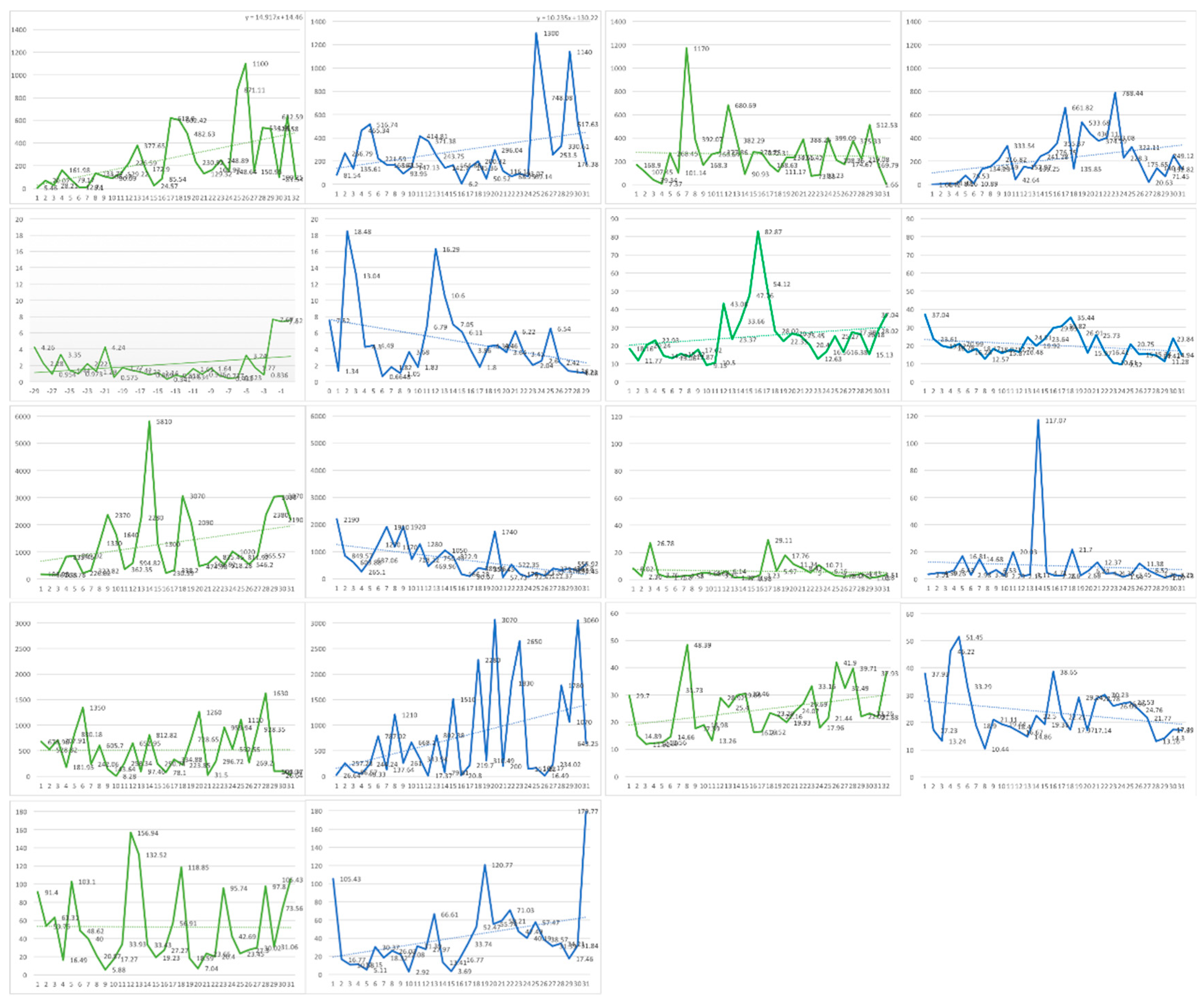

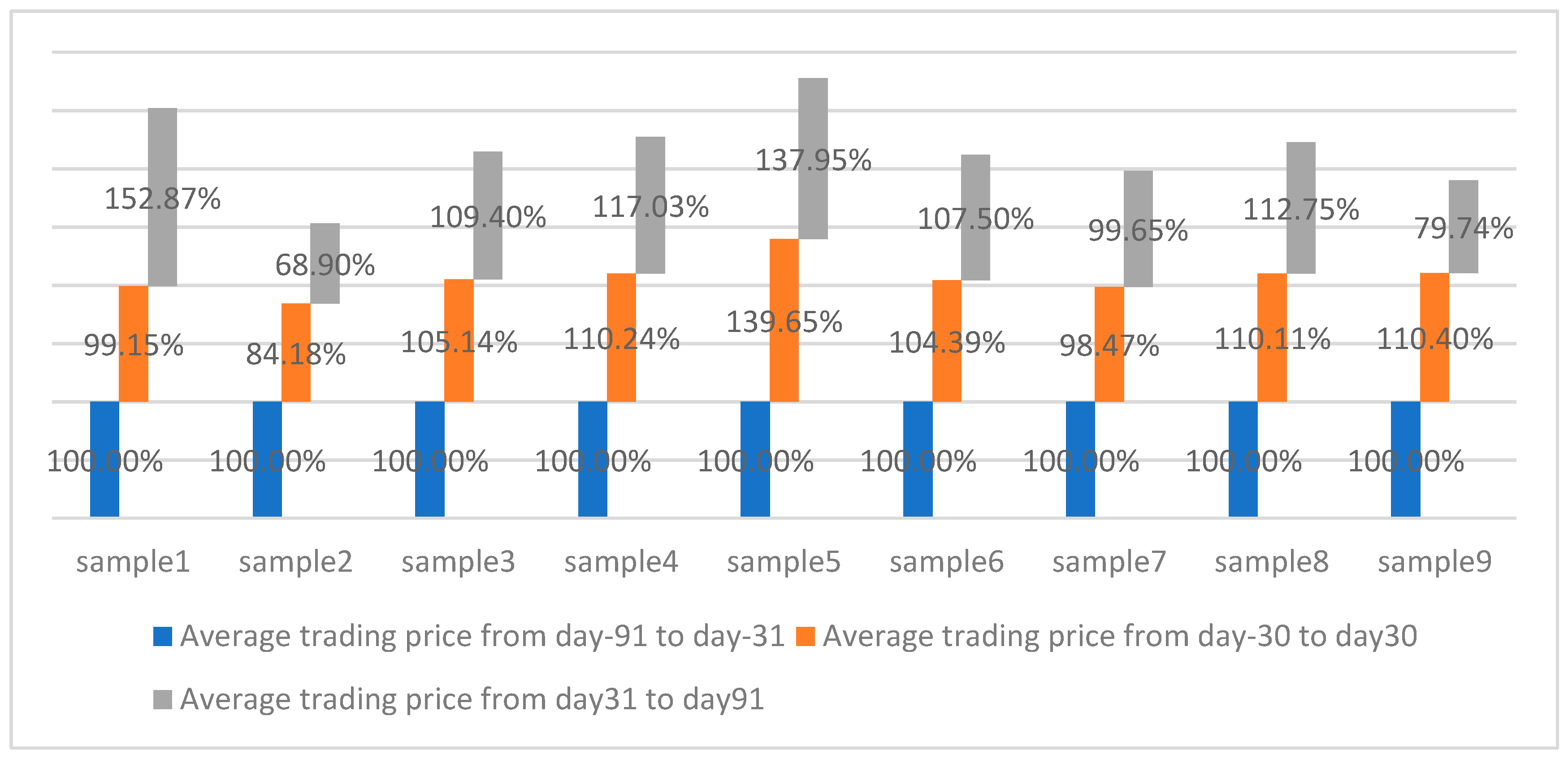

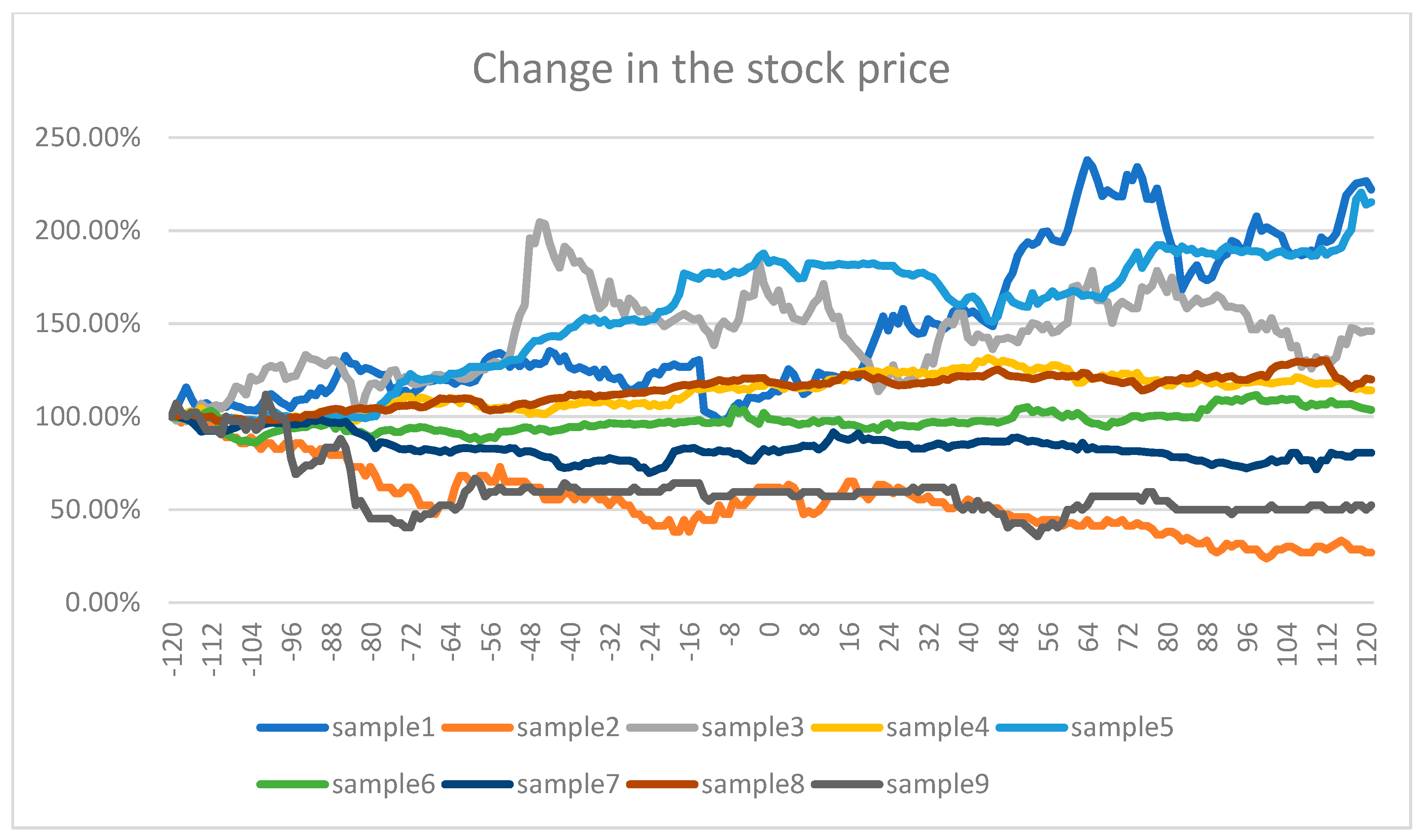

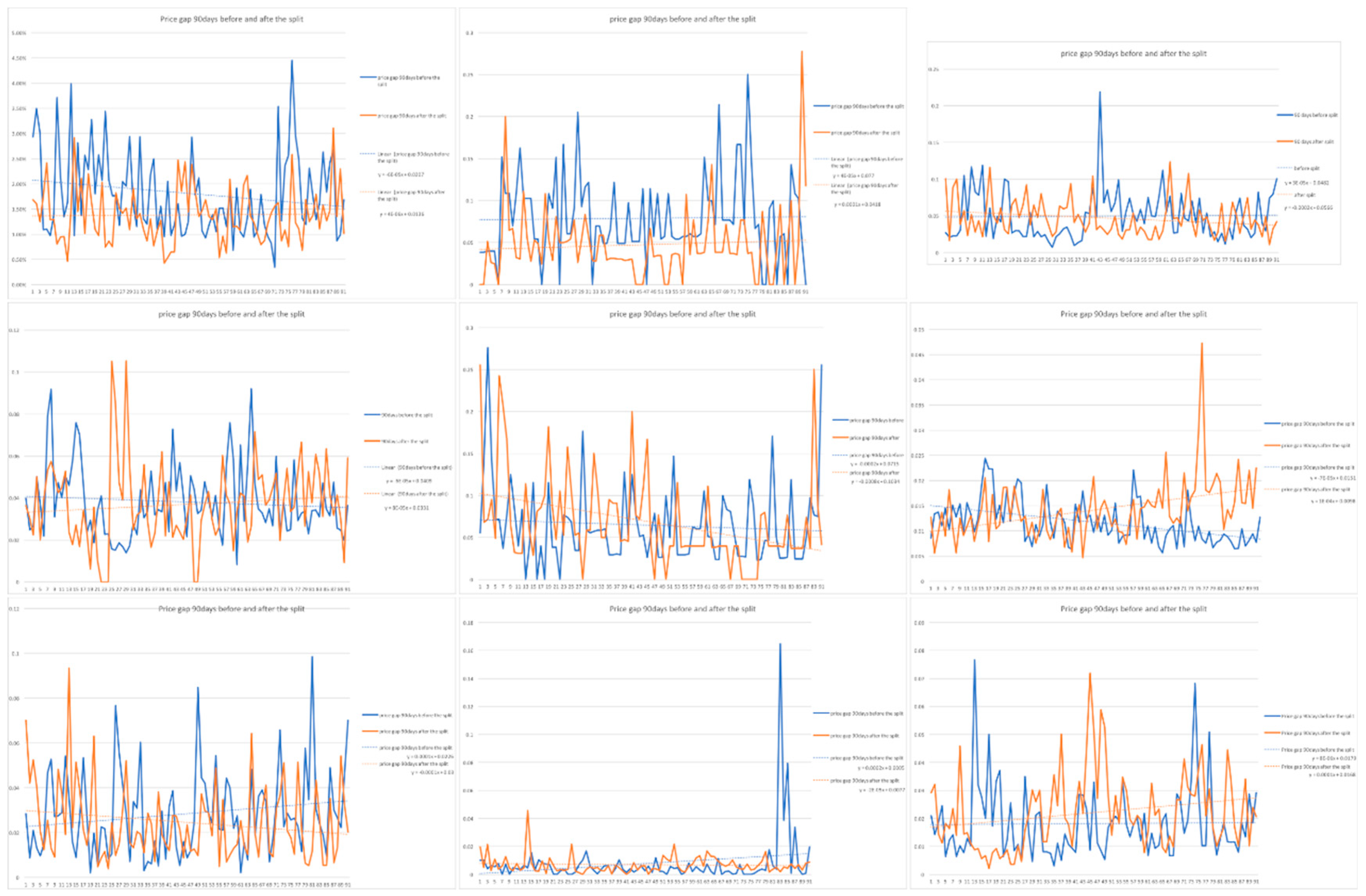

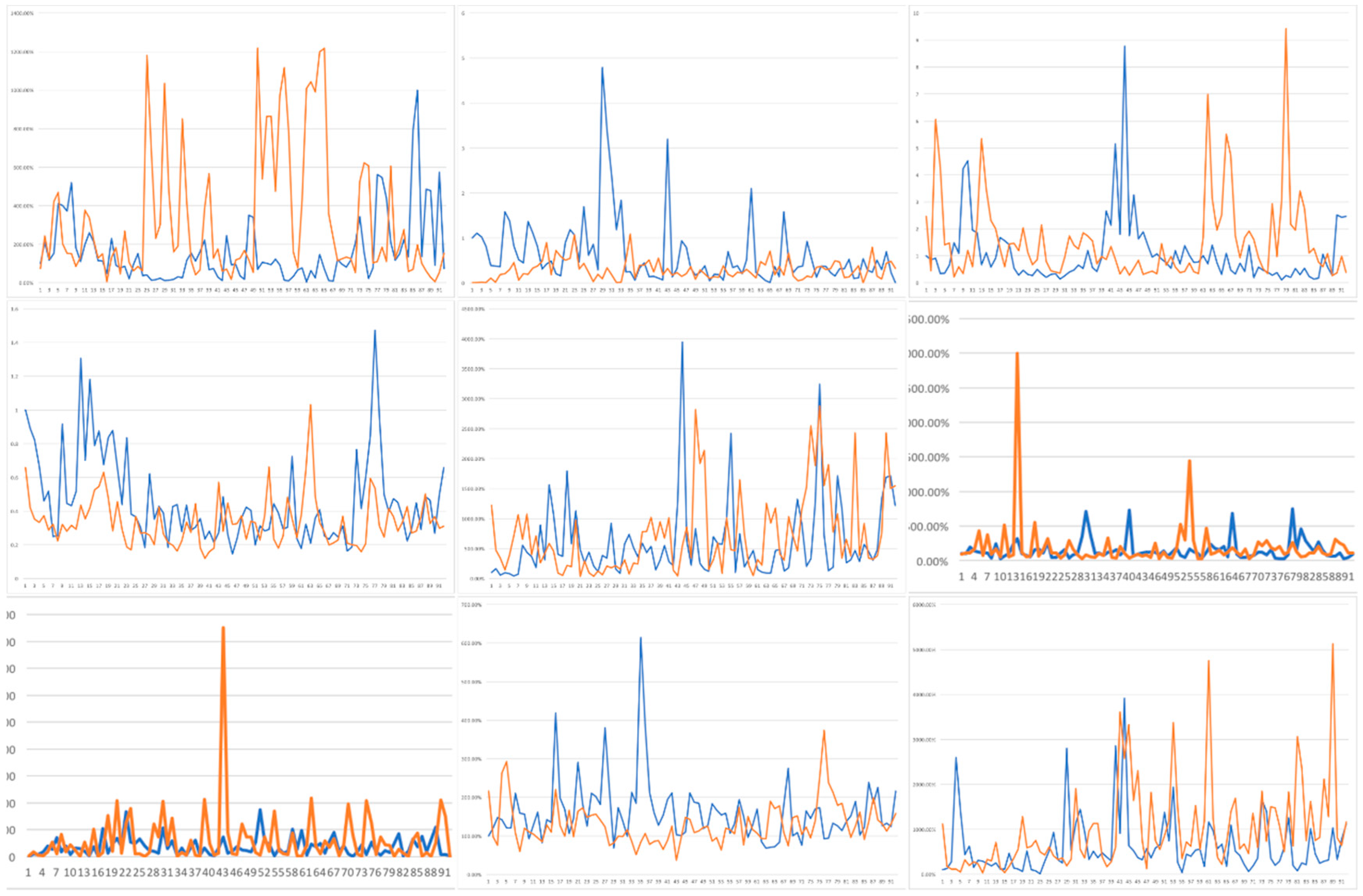

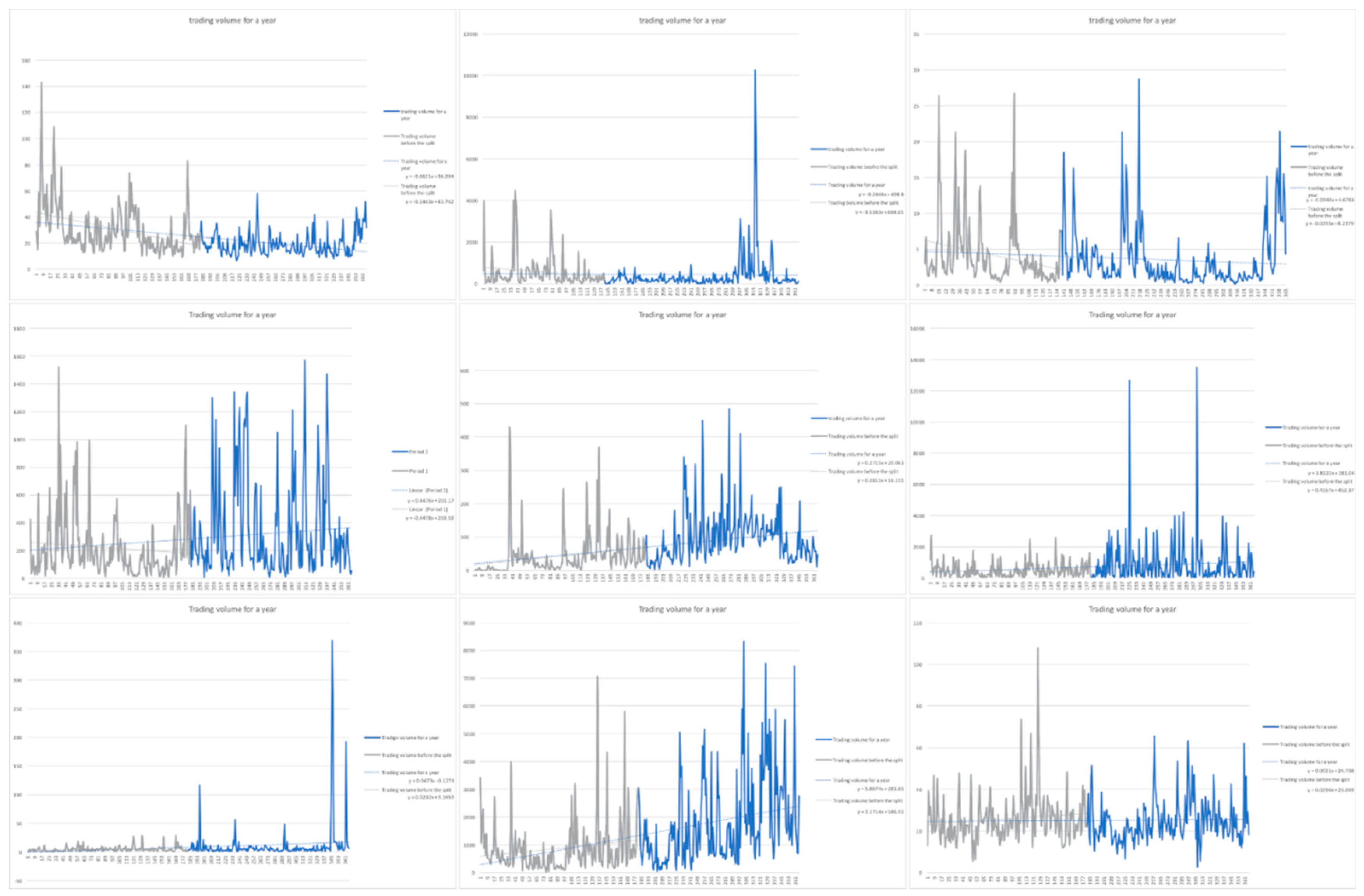

5.1. Hypothesis 1

- Stock split events have a slight impact on the market.

- There is an unexpected increase in trading volume for some samples, but “on average”, there is none.

- There was an explosive demand for shares.

- Investors are unwilling to trade their shares little by little after the split date.

- The stock price after the split is higher than the price before the split.

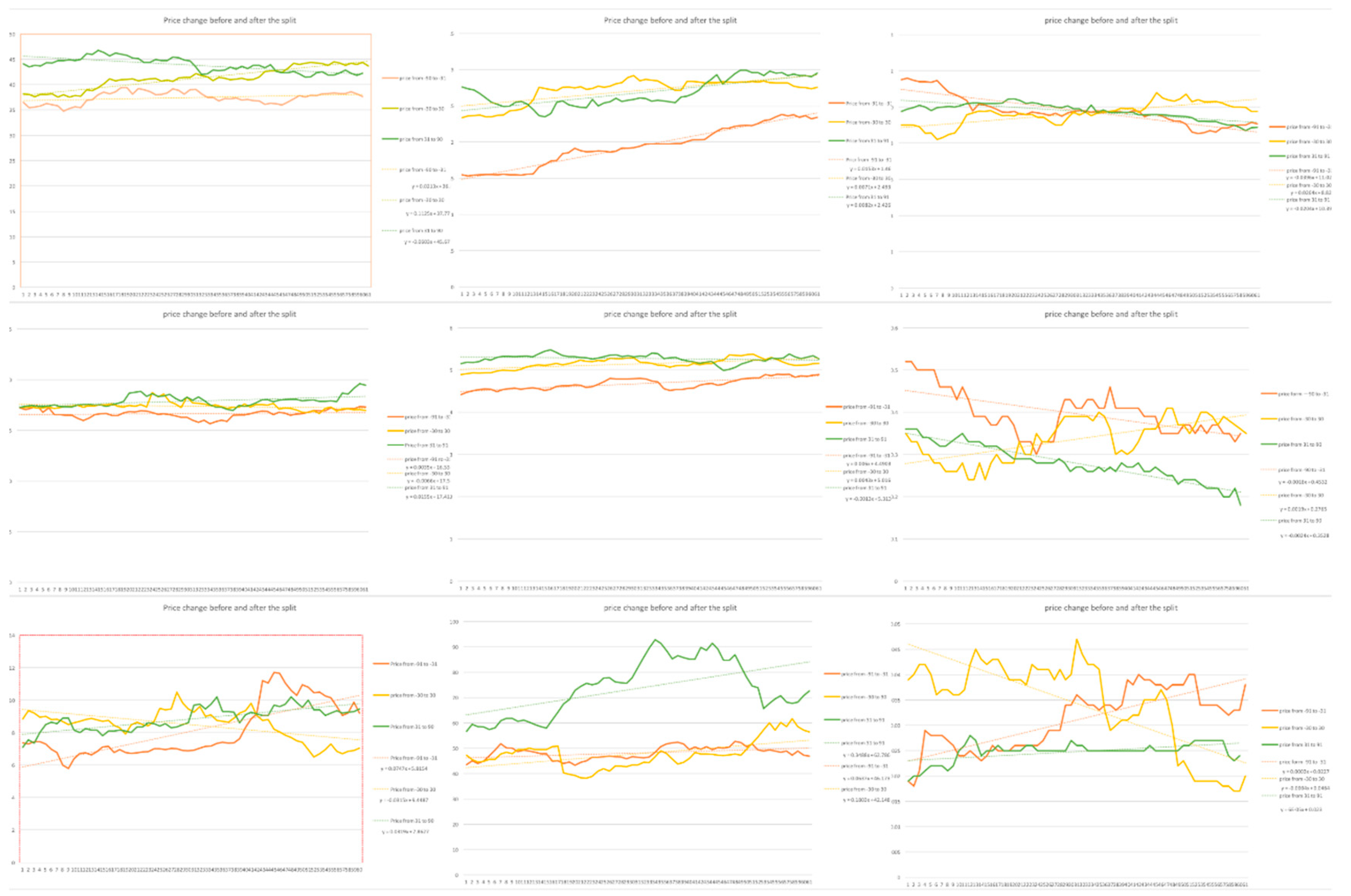

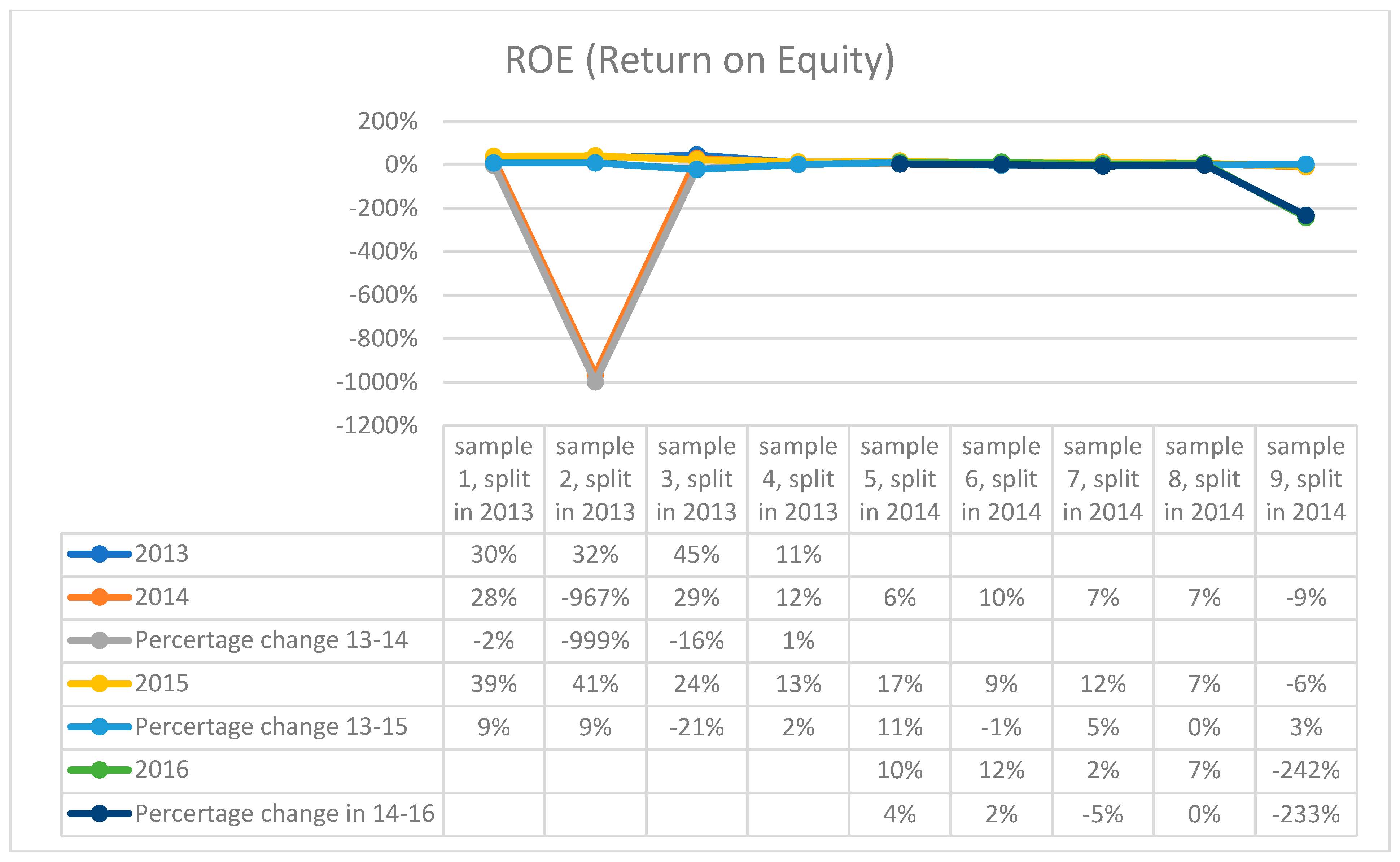

5.2. Hypothesis 2

- P1: The stock price before the stock split;

- P2: The stock price after the stock split;

- N1: The number of shares before the stock split;

- N2: The number of shares after the stock split;

- V1: The market value of the sample before the stock split;

- V2: The market value of the sample after the stock split;

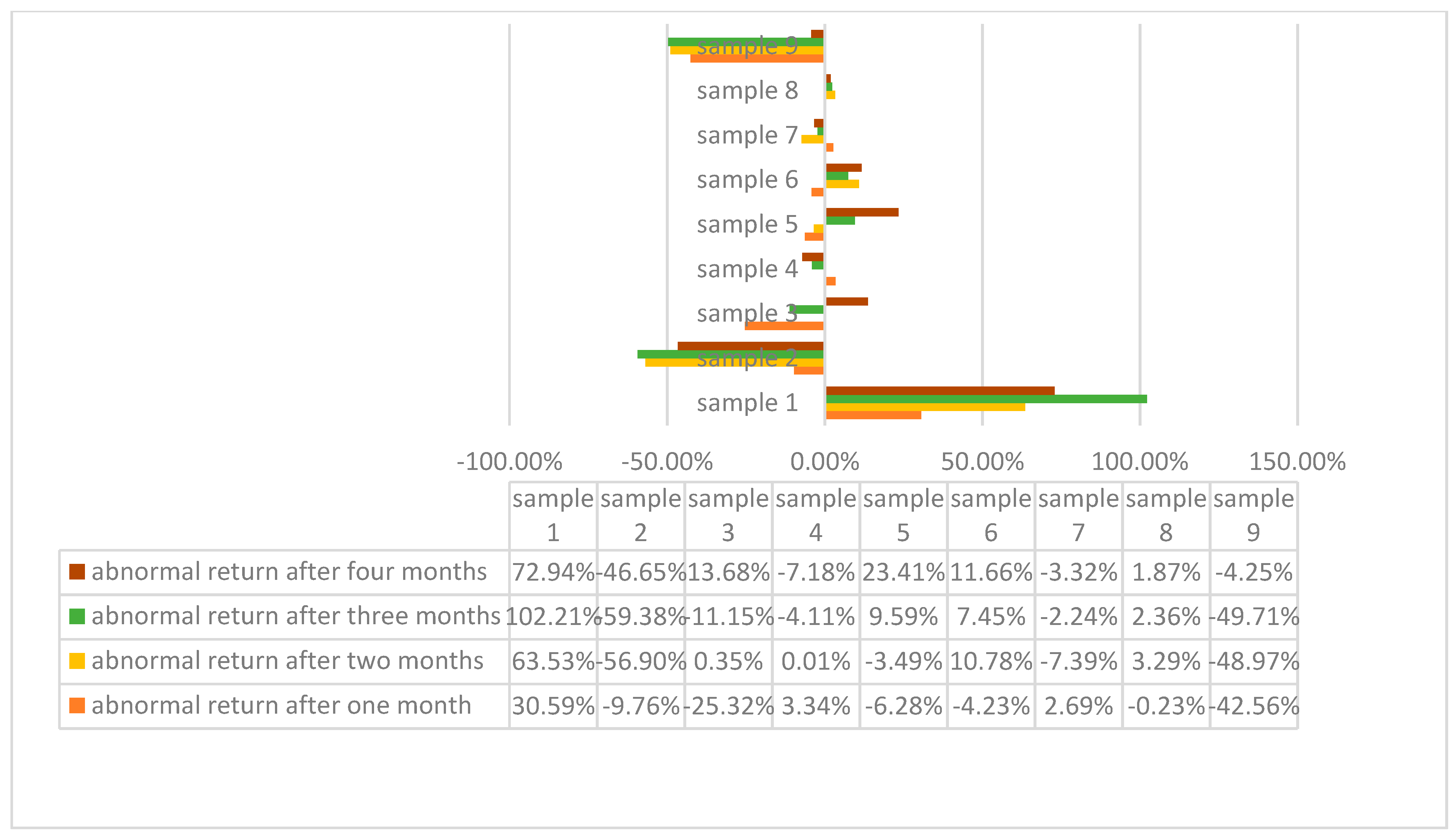

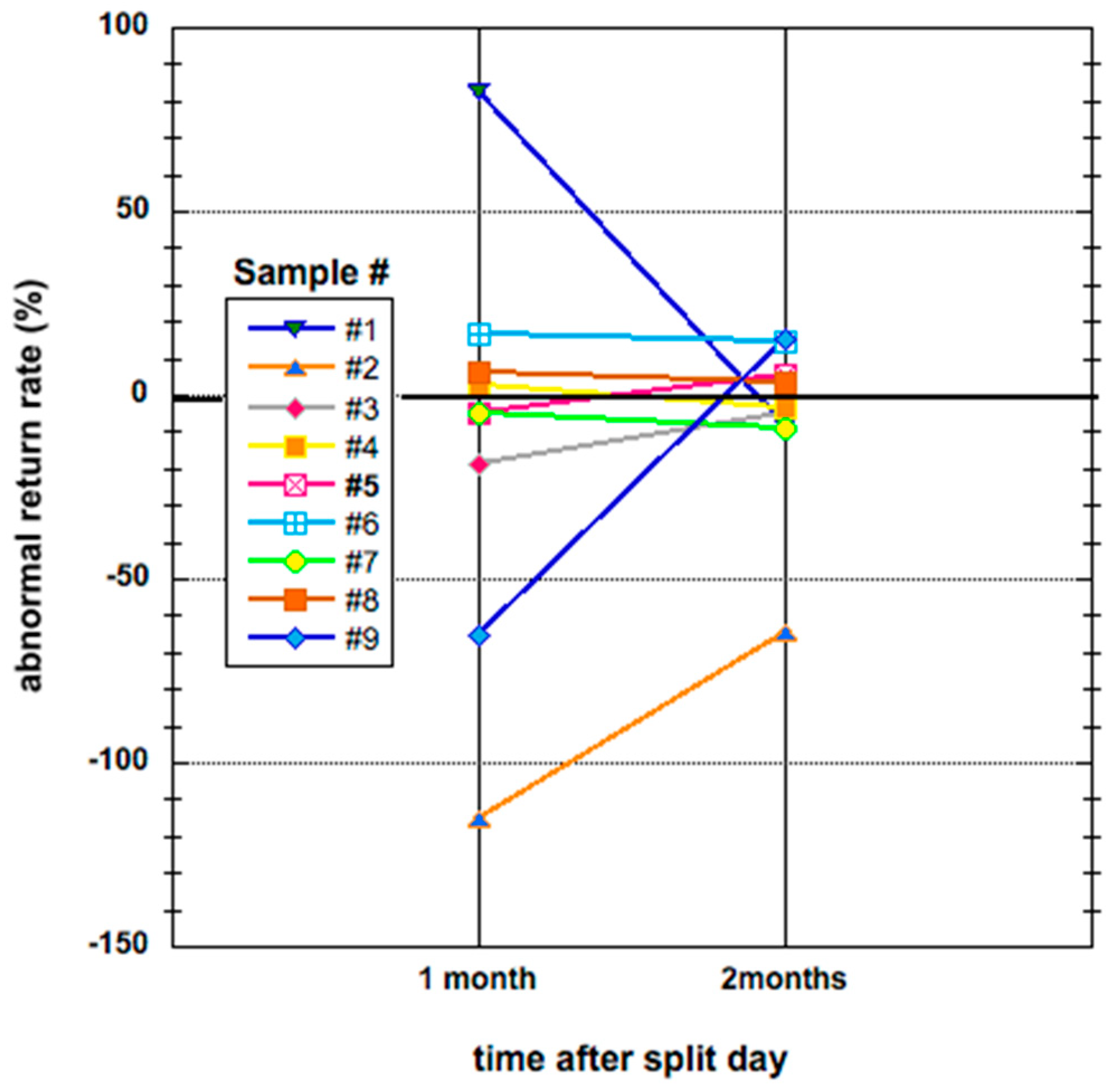

- After the first month, investors of sample 1, sample 4, and sample 7 could receive 30.59%, 3.34%, and 2.69% abnormal earning separately.

- After two months, investors of sample 1 (63.53%), sample 3 (0.35%), sample 4 (0.01%), sample 6 (7.45%), and sample 8 (3.29%) could gain abnormal earnings.

- After a season, investors of sample 1 (102.21%), sample 5 (9.59%), sample 6 (7.45%), and sample 8 (2.36%) could obtain an abnormal return.

- After four months, investors of sample 1 (72.94%), sample 3 (13.68%), sample 5 (23.41%), sample 6 (11.66%), and sample 8 (1.87%) will get the extra earnings.

5.3. Hypothesis 3

6. Conclusions

- Stock splits affect the market and slightly enhance the trading volume in the short term.

- Stock splits increase the shareholder base for the firm.

- Most of the firms are mispriced in the split year; stock split announcements reduce the level of information asymmetries.

- Investors readjust their beliefs toward the firm, but (unfortunately?) most of the investors still hold an inexact “fundamental image’’ of the firm.

- Split shares have a positive effect on the liquidity for the market.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Afdhal, Muhammad, Arung Gihna Mayapada, and Sudirman Septian. 2022. Do the COVID-19 Pandemic Affect Abnormal Returns of Stocks in Indonesia? Academy of Entrepreneurship Journal 28: 1–8. [Google Scholar]

- Ausloos, Marcel, and Kristinka Ivanova. 2003. Dynamical Model and Nonextensive Statistical Mechanics of a Market Index on Large Time Windows. Physical Review E 68: 046122. [Google Scholar] [CrossRef] [PubMed]

- Baker, H. Kent, and Gary E. Powell. 1993. The Effect of Stock Splits on the Ownership Mix of a Firm. Review of Financial Economics 3: 70–88. [Google Scholar]

- Baker, H. Kent, and Patricia L. Gallagher. 1980. Management’s View of Stock Split. Financial Management 9: 73–77. [Google Scholar] [CrossRef]

- Barker, C. Austin. 1956. Effective Stock Splits. Harvard Business Review 31: 101–106. [Google Scholar]

- Brennan, Michael J., and Thomas E. Copeland. 1988. Stock Splits, Stock Prices, and Transactions Costs. Journal of Financial Economics 22: 83–101. [Google Scholar] [CrossRef]

- Burnwal, Anshu, and Debdas Rak. 2018. Liquidity and Signalling Aspects of Stock Split: A Study with Reference to Select Indian Companies. International Journal of Research in Management and Social Science 6: 5–24. [Google Scholar]

- Copeland, Thomas. E. 1979. Liquidity Changes Following Stock Splits. American Finance Association 31: 115–141. [Google Scholar] [CrossRef]

- Cornell Law School. n.d. 17 CFR 229.201—(Item 201) Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters. Cornell Legal Information Institute. Available online: https://www.law.cornell.edu/cfr/text/17/229.201 (accessed on 10 April 2018).

- Dhesi, Gurjeet, and Marcel Ausloos. 2016. Modelling and Measuring the Irrational Behaviour of Agents in Financial Markets: Discovering the Psychological Soliton. Chaos, Solitons & Fractals 88: 119–125. [Google Scholar]

- Easley, David, Maureen O’hara, and Gideon Saar. 2001. How Stock Splits Affect Trading: A Microstructure Approach. The Journal of Financial and Quantitative Analysis 36: 25–51. [Google Scholar] [CrossRef]

- Ferreira, Paulo, and Andreia Dionísio. 2016. How Long is the Memory of the US Stock Market? Physica A: Statistical Mechanics and its Applications 451: 502–506. [Google Scholar] [CrossRef]

- GOV.UK. n.d. Make Changes to Your Private Limited Company. Available online: https://www.gov.uk/make-changes-to-your-limited-company/get-agreement-from-your-company (accessed on 15 February 2018).

- Grinblatt, Mark S., Ronald W. Masulis, and Sheridan Titman. 1984. The Valuation Effects of Stock Splits and Stock Dividends. Journal of Financial Economics 13: 461–490. [Google Scholar] [CrossRef]

- Guo, Fang, Kaiguo Zhou, and Jinghan Cai. 2008. Stock Splits, Liquidity, and Information Asymmetry. An Empirical Study on Tokyo Stock Exchange. Journal of the Japanese and International Economies 22: 417–438. [Google Scholar] [CrossRef]

- Harjoto, Maretno A., Dongshin Kim, Indrarini Laksmana, and Richard C. Walton. 2019. Corporate Social Responsibility and Stock Split. Review of Quantitative Finance and Accounting 53: 575–600. [Google Scholar] [CrossRef]

- Ikenberry, David L., Graeme Rankine, and Earl K. Stice. 1996. What do Stock Splits Really Signal? Journal of Financial and Quantitative Analysis 31: 357–375. [Google Scholar] [CrossRef]

- Karim, Mohammad A., and Sayan Sarkar. 2016. Do Stock Splits Signal Undervaluation? Journal of Behavioral and Experimental Finance 9: 119–124. [Google Scholar] [CrossRef]

- Lakonishok, Josef, and Baruch Lev. 1987. Stock Splits and Stock Dividends: Why, Who, and When. The Journal of Finance 42: 913–932. [Google Scholar] [CrossRef]

- Lamoureux, Christopher G., and Percy Poon. 1987. The Market Reaction to Stock Splits. The Journal of Finance 42: 1347–1370. [Google Scholar] [CrossRef]

- Lo, Andrew W., and Jiang Wang. 2000. Trading Volume: Definitions, Data Analysis, and Implications of Portfolio Theory. The Review of Financial Studies 13: 257–300. [Google Scholar] [CrossRef]

- McNichols, Maureen, and Ajay Dravid. 1990. Stock Dividends, Stock Splits, and Signaling. The Journal of Finance 45: 857–879. [Google Scholar] [CrossRef]

- Miller, Merton H., and Franco Modigliani. 1961. Dividend Policy, Growth, and the Valuation of Shares. The University of Chicago Press Journals 34: 411–433. [Google Scholar] [CrossRef]

- Mohr, Lois A., and Deborah J. Webb. 2005. The Effects of Corporate Social Responsibility and Price on Consumer Responses. The Journal of Consumer Affairs 39: 121–147. [Google Scholar] [CrossRef]

- Popescu, Cristina Raluca Gh, and Gheorghe N. Popescu. 2019. An Exploratory Study Based on a Questionnaire Concerning Green and Sustainable Finance, Corporate Social Responsibility, and Performance: Evidence From the Romanian Business Environment. Journal of Risk and Financial Management 12: 162. [Google Scholar] [CrossRef]

- Romito, Stefano, and Clodia Vurro. 2021. Non-Financial Disclosure and Information Asymmetry: A Stakeholder View on US Listed Firms. Corporate Social Responsibility and Environmental Management 28: 595–605. [Google Scholar] [CrossRef]

- U.S. Securities and Exchange Commission. 2016. Annual Report Pursuant to Section 13 or 15(D) of the Securities Exchange Act of 1934. July 31. Available online: https://www.sec.gov/divisions/corpfin/forms/exchange.shtml (accessed on 10 April 2018).

- Williams, John Burr. 1997. The Theory of Investment Value. Fraser Publishing: Burlington and Cambridge: Harvard University Press. First published 1938. [Google Scholar]

- Yagüe, José, J. Carlos Gómez-Sala, and Francisco Poveda-Fuentes. 2009. Stock Split Size, Signaling and Earnings Management: Evidence from the Spanish Market. Global Finance Journal 20: 31–47. [Google Scholar] [CrossRef]

| #1 | #2 | #3 | #4 | #5 | #6 | #7 | #8 | #9 |

|---|---|---|---|---|---|---|---|---|

| 1.25 | 1.1 | 1.015 | 1.068 | 1.569 | 2 | 1.333 | 1.011 | 4.899 |

| % Change in Net Profit | 2013 | 2014 | 2015 | 2016 | Total Diff. |

|---|---|---|---|---|---|

| #1(2013) | 100 | 143.94 | 268.58 | 399.29 | 299.29 |

| #2(2013) | 100 | −282.94 | 54.89 | 40.92 | −59.08 |

| #3(2013) | 100 | 80.65 | 58.17 | 73.96 | −26.04 |

| #4(2013) | 100 | 130.54 | 15.40 | 126.35 | 26.35 |

| #5(2014) | 100 | 176.97 | 150.26 | 50.26 | |

| #6(2014) | 100 | 96.48 | 140.17 | 40.17 | |

| #7(2014) | 100 | 164.58 | 31.54 | −68.46 | |

| #8(2014) | 100 | 104.01 | 124.48 | 24.48 | |

| #9(2014) | 100 | 107.34 | 103.91 | 3.91 |

| % Increase | Sample 1 | Sample 4 | Sample 5 | Sample 6 | Sample 8 |

|---|---|---|---|---|---|

| in stock price | 165.5% | 26.27% | 53.07% | 16.03% | 22.06% |

| in the the net profit | 299.29% | 26.35% | 50.26% | 40.17% | 24.48% |

| in the return on equity | 9% | 2% | 4% | 2% | 0% |

| Sample | #1 | #2 | #3 | #4 | #5 | #6 | #7 | #8 | #9 |

|---|---|---|---|---|---|---|---|---|---|

| % Abnormal return rate after | |||||||||

| 1 month | 82.66 | 115.09 | −18.71 | 2.56 | −4.55 | 16.56 | −4.81 | 6.01 | −65.38 |

| 2 months | −8.55 | −64.92 | −4.68 | −3.19 | 5.54 | 14.65 | −9.02 | 3.36 | 15.38 |

| Sample 1 | Sample 2 | Sample 3 | Sample 4 | Sample 5 | Sample 6 | Sample 7 | Sample 8 | Sample 9 |

|---|---|---|---|---|---|---|---|---|

| −0.09066 | 0.04821 | 0.01182 | −0.01784 | −0.16377 | 0.01110 | 0.08801 | 0.04164 | −0.00246 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.; Ausloos, M. A Study about Who Is Interested in Stock Splitting and Why: Considering Companies, Shareholders, or Managers. J. Risk Financial Manag. 2023, 16, 68. https://doi.org/10.3390/jrfm16020068

Chen J, Ausloos M. A Study about Who Is Interested in Stock Splitting and Why: Considering Companies, Shareholders, or Managers. Journal of Risk and Financial Management. 2023; 16(2):68. https://doi.org/10.3390/jrfm16020068

Chicago/Turabian StyleChen, Jiaquan, and Marcel Ausloos. 2023. "A Study about Who Is Interested in Stock Splitting and Why: Considering Companies, Shareholders, or Managers" Journal of Risk and Financial Management 16, no. 2: 68. https://doi.org/10.3390/jrfm16020068

APA StyleChen, J., & Ausloos, M. (2023). A Study about Who Is Interested in Stock Splitting and Why: Considering Companies, Shareholders, or Managers. Journal of Risk and Financial Management, 16(2), 68. https://doi.org/10.3390/jrfm16020068