Managers’ Perception and Attitude toward Financial Risks Associated with SMEs: Analytic Hierarchy Process Approach

Abstract

:1. Introduction

2. Background

2.1. Uncertainty and Consequence

2.2. Analytic Hierarchical Process

3. Materials and Methods

4. Application of the AHP for Assessing SME Risk Perception (Data Analysis)

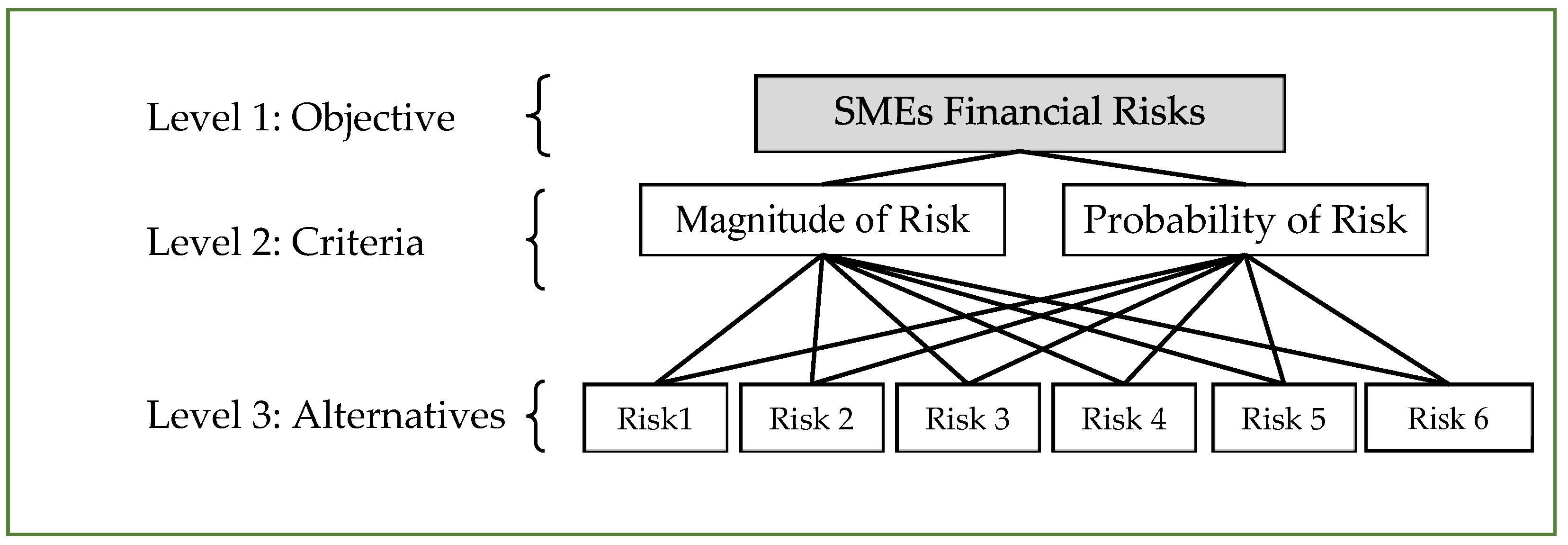

4.1. Step 1: Hierarchy Construction

4.2. Step 2: Pairwise Comparison (Building the Comparison Matrix)

4.3. Stage 3: Consistency Vector

4.4. Stage 4: Testing Consistency Index

5. Discussion

6. Conclusions

6.1. Practical Implications and Theoretical Contribution

6.2. Limitations and Future Studies

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Almaiah, Mohammed Amin, Ali Mugahed Al-Rahmi, Fahad Alturise, Mahmaod Alrawad, Salem Alkhalaf, Abdalwali Lutfi, Waleed Mugahed Al-Rahmi, and Ali Bani Awad. 2022a. Factors Influencing the Adoption of Internet Banking: An Integration of ISSM and UTAUT with Price Value and Perceived Risk. Frontiers in Psychology 13: 919198. [Google Scholar] [CrossRef]

- Almaiah, Mohammed Amin, Fahima Hajjej, Rima Shishakly, Abdalwali Lutfi, Ali Amin, and Ali Bani Awad. 2022b. The Role of Quality Measurements in Enhancing the Usability of Mobile Learning Applications during COVID-19. Electronics 11: 1951. [Google Scholar] [CrossRef]

- Almaiah, Mohammed Amin, Raghad Alfaisal, Said A. Salloum, Fahima Hajjej, Rima Shishakly, Abdalwali Lutfi, Mahmaod Alrawad, Ahmed Al Mulhem, Tayseer Alkhdour, and Rana Saeed Al-Maroof. 2022c. Measuring Institutions’ Adoption of Artificial Intelligence Applications in Online Learning Environments: Integrating the Innovation Diffusion Theory with Technology Adoption Rate. Electronics 11: 3291. [Google Scholar] [CrossRef]

- Almaiah, Mohammed Amin, Raghad Alfaisal, Said A. Salloum, Shaha Al-Otaibi, Omar Said Al Sawafi, Rana Saeed Al-Maroof, Abdalwali Lutfi, Mahmaod Alrawad, Ahmed Al Mulhem, and Ali Bani Awad. 2022d. Determinants Influencing the Continuous Intention to Use Digital Technologies in Higher Education. Electronics 11: 2827. [Google Scholar] [CrossRef]

- Almuhisen, Maram, Hüseyin Gökçekuş, and Tahir Çelik. 2021. Developing an AHP Risk Assessment Model for PPP Projects in Jordan. Journal of Engineering Research 10: 15–23. [Google Scholar] [CrossRef]

- Alrawad, Mahmaod, Abdalwali Lutfi, Sundus Alyatama, Ibrahim A. Elshaer, and Mohammed Amin Almaiah. 2022. Perception of Occupational and Environmental Risks and Hazards among Mineworkers: A Psychometric Paradigm Approach. International Journal of Environmental Research and Public Health 19: 3371. [Google Scholar] [CrossRef] [PubMed]

- Alshirah, Malek Hamed, Abdalwali Lutfi, Ahmad Farhan Alshira’h, Mohamed Saad, Nahla Mohamad El Sayed Ibrahim, and Fatihelelah Mohammed Mohammed. 2021. Influences of the Environmental Factors on the Intention to Adopt Cloud Based Accounting Information System among SMEs in Jordan. Accounting 7: 645–54. [Google Scholar] [CrossRef]

- Alsyouf, Adi, Abdalwali Lutfi, Mohammad Al-Bsheish, Mu’taman Jarrar, Khalid Al-Mugheed, Mohammed Amin Almaiah, Fahad Nasser Alhazmi, Ra’ed Masa’deh, Rami J. Anshasi, and Abdallah Ashour. 2022. Exposure Detection Applications Acceptance: The Case of COVID-19. International Journal of Environmental Research and Public Health 19: 7307. [Google Scholar] [CrossRef]

- Alsyouf, Adi, Ra’ed Masa’deh, Moteb Albugami, Mohammad Al-Bsheish, Abdalwali Lutfi, and Nizar Alsubahi. 2021. Risk of Fear and Anxiety in Utilising Health App Surveillance Due to COVID-19: Gender Differences Analysis. Risks 9: 179. [Google Scholar] [CrossRef]

- Altanashat, Mohammad, Maged Al Dubai, and Sadun Alhety. 2019. The Impact of Enterprise Risk Management on Institutional Performance in Jordanian Public Shareholding Companies. Journal of Business and Retail Management Research 13: 256–68. [Google Scholar] [CrossRef] [Green Version]

- Aminbakhsh, Saman, Murat Gunduz, and Rifat Sonmez. 2013. Safety Risk Assessment Using Analytic Hierarchy Process (AHP) during Planning and Budgeting of Construction Projects. Journal of Safety Research 46: 99–105. [Google Scholar] [CrossRef] [PubMed]

- Annamalah, Sanmugam, Murali Raman, Govindan Marthandan, and Aravindan Kalisri Logeswaran. 2018. Implementation of Enterprise Risk Management (ERM) Framework in Enhancing Business Performances in Oil and Gas Sector. Economies 6: 4. [Google Scholar] [CrossRef]

- Asgary, Ali, Ali Ihsan Ozdemir, and Hale Özyürek. 2020. Small and Medium Enterprises and Global Risks: Evidence from Manufacturing SMEs in Turkey. International Journal of Disaster Risk Science 11: 59–73. [Google Scholar] [CrossRef]

- Bohnert, Alexander, Nadine Gatzert, Robert E. Hoyt, and Philipp Lechner. 2017. The Relationship between Enterprise Risk Management, Value and Firm Characteristics Based on the Literature. Zeitschrift Für Die Gesamte Versicherungswissenschaft 106: 311–24. [Google Scholar] [CrossRef]

- Brockhaus, Robert H. 1976. Risk Taking Propensity of Entrepreneurs. In Academy of Management Proceedings. Briarcliff Manor: Academy of Management, pp. 457–60. [Google Scholar]

- Brockhaus, Robert H., and Walter R. Nord. 1979. An Exploration of Factors Affecting the Entrepreneurial Decision: Personal Characteristic vs. Environmental Conditions. In Academy of Management Proceedings. Briarcliff Manor: Academy of Management, pp. 364–68. [Google Scholar]

- Brockhaus, Robert H., Sr. 1980. Risk Taking Propensity of Entrepreneurs. Academy of Management Journal 23: 509–20. [Google Scholar] [CrossRef]

- Brustbauer, Johannes. 2016. Enterprise Risk Management in SMEs: Towards a Structural Model. International Small Business Journal: Researching Entrepreneurship 34: 70–85. [Google Scholar] [CrossRef]

- Brustbauer, Johannes K., and Mike Peters. 2013. Risk Perception of Family and Non-Family Firm Managers. International Journal of Entrepreneurship and Small Business 20: 96. [Google Scholar] [CrossRef]

- Chiles, Todd H., and John F. McMackin. 1996. Integrating Variable Risk Preferences, Trust, and Transaction Cost Economics. Academy of Management Review 21: 73–99. [Google Scholar] [CrossRef]

- Churchill, Gilbert A. 1979. A Paradigm for Developing Better Measures of Marketing Constructs. Journal of Marketing Research 16: 64–73. [Google Scholar] [CrossRef]

- Cunningham, Lawrence F., James H. Gerlach, Michael D. Harper, and Clifford E. Young. 2005. Perceived Risk and the Consumer Buying Process: Internet Airline Reservations. International Journal of Service Industry Management 16: 357–72. [Google Scholar] [CrossRef]

- Durst, Susanne, Guido Bruns, and Thomas Henschel. 2018. The Management of Knowledge Risks: What Do We Really Know? In Global Business Expansion: Concepts, Methodologies, Tools, and Applications. Hershey: IGI Global, pp. 258–69. [Google Scholar]

- Falkner, Eva Maria, and Martin R. W. Hiebl. 2015. Risk Management in SMEs: A Systematic Review of Available Evidence. The Journal of Risk Finance 16: 122–44. [Google Scholar] [CrossRef]

- Georgousopoulou, Margarita, Max Chipulu, Udechukwu Ojiako, and Johnnie Johnson. 2014. Investment Risk Preference among Greek SME Proprietors: A Pilot Study. Journal of Small Business and Enterprise Development 21: 177–93. [Google Scholar] [CrossRef]

- Havierniková, Katarína, and Marcel Kordoš. 2019. Selected Risks Perceived by SMEs Related to Sustainable Entrepreneurship in Case of Engagement into Cluster Cooperation. Entrepreneurship and Sustainability Issues 6: 1680–93. [Google Scholar] [CrossRef]

- Henschel, Thomas, and Susanne Durst. 2016. Risk Management in Scottish, Chinese and German Small and Medium-Sized Enterprises: A Country Comparison. International Journal of Entrepreneurship and Small Business 29: 112–32. [Google Scholar] [CrossRef]

- Hudáková, Mária, Jaroslav Schönfeld, Ján Dvorský, and Mária Lusková. 2017. The Market Risk Analysis and Methodology of Its More Effective Management in Smes in the Slovak Republic. Montenegrin Journal of Economics 13: 151–61. [Google Scholar] [CrossRef]

- Hudakova, Maria, Matej Masar, and Katarina Buganova. 2018a. Assessment of the financial risks of the small and medium-sized enterprises in Slovakia. Economic and Social Development: Book of Proceedings 10: 505–13. [Google Scholar]

- Hudakova, Maria, Matej Masar, Maria Luskova, and Milan Robin Patak. 2018b. The Dependence of Perceived Business Risks on the Size of SMEs. Journal of Competitiveness 10: 54–69. [Google Scholar] [CrossRef]

- ISO. 2009. Guide, ISO. 73: 2009: Risk Management Vocabulary. Geneva: International Organization for Standardization. [Google Scholar]

- Khassawneh, Abd Alwali. 2014. The influence of organizational factors on accounting information systems (AIS) effectiveness: A study of Jordanian SMEs. International Journal of Marketing and Technology 4: 36. [Google Scholar]

- Kommunuri, John, Anil Narayan, Mark Wheaton, and Lilibeth Jandug. 2016. Enterprise Risk Management and Firm Performance Empirical Evidence from Vietnam. Working Paper, New Zealand Journal of Applied Busines Research 14: 17–28. [Google Scholar]

- Lutfi, Abdalwali. 2022. Understanding the Intention to Adopt Cloud-Based Accounting Information System in Jordanian SMEs. The International Journal of Digital Accounting Research 22: 47–70. [Google Scholar] [CrossRef]

- Lutfi, Abdalwali, Adi Alsyouf, Mohammed Amin Almaiah, Mahmaod Alrawad, Ahmed Abdullah Khalil Abdo, Akif Lutfi Al-Khasawneh, Nahla Ibrahim, and Mohamed Saad. 2022a. Factors Influencing the Adoption of Big Data Analytics in the Digital Transformation Era: Case Study of Jordanian SMEs. Sustainability 14: 1802. [Google Scholar] [CrossRef]

- Lutfi, Abdalwali, Akif Lutfi Al-Khasawneh, Mohammed Amin Almaiah, Adi Alsyouf, and Mahmaod Alrawad. 2022b. Business Sustainability of Small and Medium Enterprises during the COVID-19 Pandemic: The Role of AIS Implementation. Sustainability 14: 5362. [Google Scholar] [CrossRef]

- Lutfi, Abdalwali, Mahmaod Alrawad, Adi Alsyouf, Mohammed Amin Almaiah, Ahmad Al-Khasawneh, Akif Lutfi Al-Khasawneh, Ahmad Farhan Alshira’h, Malek Hamed Alshirah, Mohamed Saad, and Nahla Ibrahim. 2023. Drivers and Impact of Big Data Analytic Adoption in the Retail Industry: A Quantitative Investigation Applying Structural Equation Modeling. Journal of Retailing and Consumer Services 70: 103129. [Google Scholar] [CrossRef]

- Lutfi, Abdalwali, Manaf Al-Okaily, Adi Alsyouf, Abdallah Alsaad, and Abdallah Taamneh. 2020. The Impact of AIS Usage on AIS Effectiveness Among Jordanian SMEs: A Multi-Group Analysis of the Role of Firm Size. Global Business Review 20: 627–39. [Google Scholar] [CrossRef]

- Lutfi, Abdalwali, Saleh Nafeth Alkelani, Malak Akif Al-Khasawneh, Ahmad Farhan Alshira’h, Malek Hamed Alshirah, Mohammed Amin Almaiah, Mahmaod Alrawad, Adi Alsyouf, Mohamed Saad, and Nahla Ibrahim. 2022c. Influence of Digital Accounting System Usage on SMEs Performance: The Moderating Effect of COVID-19. Sustainability 14: 15048. [Google Scholar] [CrossRef]

- March, James G., and Zur Shapira. 1987. Managerial Perspectives on Risk and Risk Taking. Management Science 33: 1404–18. Available online: http://www.jstor.org/stable/2631920 (accessed on 1 December 2022). [CrossRef]

- Masár, Matej, and Mária Hudáková. 2019. Attitude of slovak small and medium-sized enterprises towards risk management—Investigation of the regional differences. CBU International Conference Proceedings 7: 200–6. [Google Scholar] [CrossRef]

- Radivojević, Gordana, and Vladimir Gajović. 2014. Supply Chain Risk Modeling by AHP and Fuzzy AHP Methods. Journal of Risk Research 17: 337–52. [Google Scholar] [CrossRef]

- Saaty, Roseanna W. 1987. The Analytic Hierarchy Process—What It Is and How It Is Used. Mathematical Modelling 9: 161–76. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 1977. A Scaling Method for Priorities in Hierarchical Structures. Journal of Mathematical Psychology 15: 234–81. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 1988. What Is the Analytic Hierarchy Process? In Mathematical Models for Decision Support. Berlin/Heidelberg: Springer, pp. 109–21. [Google Scholar]

- Saaty, Thomas L. 1991. Some Mathematical Concepts of the Analytic Hierarchy Process. Behaviormetrika 18: 1–9. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 2003. Decision-Making with the AHP: Why Is the Principal Eigenvector Necessary. European Journal of Operational Research 145: 85–91. [Google Scholar] [CrossRef]

- Saaty, Thomas L., and Luis G. Vargas. 2006. Decision Making with the Analytic Network Process. Berlin/Heidelberg: Springer, vol. 282. [Google Scholar]

- Sexton, Donald L., and Nancy Bowman. 1983. Determining Entrepreneurial Potential of Students. In Academy of Management Proceedings. Briarcliff Manor: Academy of Management, pp. 408–12. [Google Scholar]

- Smith, Norman R., and John B. Miner. 1983. Type of Entrepreneur, Type of Firm, and Managerial Motivation: Implications for Organizational Life Cycle Theory. Strategic Management Journal 4: 325–40. [Google Scholar] [CrossRef]

- Stone, Robert N., and Kjell Grønhaug. 1993. Perceived Risk: Further Considerations for the Marketing Discipline. European Journal of Marketing 27: 39–50. [Google Scholar] [CrossRef]

- Unver, Saliha, and Ibrahim Ergenc. 2021. Safety Risk Identification and Prioritize of Forest Logging Activities Using Analytic Hierarchy Process (AHP). Alexandria Engineering Journal 60: 1591–99. [Google Scholar] [CrossRef]

- Yates, J. Frank, and E. R. Stone. 1992. Risk appraisal. In Risk-Taking Behavior. Edited by J. Frank Yates. Chichester: John Wiley & Sons, pp. 49–85. [Google Scholar]

- Zoghi, Farzaneh Soleimani. 2017. Risk Management Practices and SMEs: An Empirical Study on Turkish SMEs. International Journal of Trade, Economics and Finance 8: 123–27. [Google Scholar] [CrossRef] [Green Version]

| Rating | Definition | Explanation |

|---|---|---|

| 1 | Equally preferred | Alternative i and j are of equal value. |

| 3 | Moderately preferred | Alternative i has a slightly higher value than j. |

| 5 | Strongly preferred | Alternative i has a strongly higher value than j. |

| 7 | Very strongly preferred | Alternative i has a very strongly higher value than j. |

| 9 | Extremely preferred | Alternative i has a higher value than j. |

| 2,4,6,8 | Intermediate scale | The intermediate scale between two adjutant judgment |

| Reciprocal | Reverence the preference | If alternative i have a lower value than j |

| Source: | (T. L. Saaty 1991) |

| R1 | R2 | R3 | R4 | R5 | R6 | |

|---|---|---|---|---|---|---|

| Low or no profits | 1 | 0.707 | 0.852 | 0.682 | 0.597 | 0.657 |

| Low or no cash flow | 1.414 | 1 | 1.215 | 0.996 | 0.850 | 0.944 |

| Revenue shortfall | 1.174 | 0.823 | 1 | 0.787 | 0.681 | 0.765 |

| Financing issues | 1.466 | 1.004 | 1.271 | 1 | 0.860 | 0.959 |

| Customer’s payments issues | 1.675 | 1.176 | 1.468 | 1.163 | 1 | 1.136 |

| Increase in bank charges | 1.522 | 1.522 | 1.308 | 1.043 | 0.881 | 1 |

| Sum | 8.251 | 6.232 | 7.113 | 5.671 | 4.869 | 5.461 |

| R1 | R2 | R3 | R4 | R5 | R6 | |

|---|---|---|---|---|---|---|

| Low or no profits | 1 | 0.798 | 0.896 | 0.914 | 0.933 | 0.836 |

| Low or no cash flow | 1.252 | 1 | 1.107 | 1.122 | 1.133 | 1.048 |

| Revenue shortfall | 1.116 | 0.904 | 1 | 1.029 | 1.040 | 0.938 |

| Financing issues | 1.094 | 0.891 | 0.972 | 1 | 1.04 | 0.926 |

| Customer’s payments issues | 1.072 | 0.883 | 0.962 | 0.962 | 1 | 0.910 |

| Increase in bank charges | 1.196 | 1.196 | 1.066 | 1.080 | 1.098 | 1 |

| Sum | 6.731 | 5.673 | 6.002 | 6.106 | 6.244 | 5.658 |

| R1 | R2 | R3 | R4 | R5 | R6 | Wi | |

|---|---|---|---|---|---|---|---|

| Low or no profits | 0.1486 | 0.1408 | 0.1493 | 0.1496 | 0.1494 | 0.1477 | 0.1476 |

| Low or no cash flow | 0.1861 | 0.1763 | 0.1844 | 0.1837 | 0.1814 | 0.1852 | 0.1828 |

| Revenue shortfall | 0.1658 | 0.1593 | 0.1666 | 0.1685 | 0.1666 | 0.1659 | 0.1654 |

| Financing issues | 0.1626 | 0.1571 | 0.1619 | 0.1638 | 0.1666 | 0.1636 | 0.1626 |

| Customer’s payments issues | 0.1593 | 1.1556 | 0.1602 | 0.1575 | 0.1602 | 0.1609 | 0.1589 |

| Increase in bank charges | 0.1777 | 1.2109 | 0.1776 | 0.1769 | 0.1759 | 0.1767 | 0.1826 |

| ∑ = 1.000 |

| R1 | R2 | R3 | R4 | R5 | R6 | Wi | |

|---|---|---|---|---|---|---|---|

| Low or no profits | 0.1212 | 0.1135 | 0.1197 | 0.1203 | 0.1226 | 0.1203 | 0.1196 |

| Low or no cash flow | 0.1714 | 0.1605 | 0.1708 | 0.1757 | 0.1746 | 0.1729 | 0.1710 |

| Revenue shortfall | 0.1423 | 0.1321 | 0.1406 | 0.1388 | 0.1399 | 0.1400 | 0.1390 |

| Financing issues | 0.1776 | 0.1611 | 0.1786 | 0.1763 | 0.1766 | 0.1756 | 0.1743 |

| Customer’s payments issues | 0.2031 | 0.1887 | 0.2064 | 0.2050 | 0.2054 | 0.2080 | 0.2028 |

| Increase in bank charges | 0.1844 | 0.2442 | 0.1839 | 0.1839 | 0.1808 | 0.1831 | 0.1934 |

| ∑ = 1.000 |

| Size | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Random consistency | 0 | 0 | 0.58 | 0.90 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 |

| Source: | (R. W. Saaty 1987) | |||||||||

| N = 6 | Probability of Risks | Magnitude of Risks |

|---|---|---|

| Lambda max ) | 6.072 | 6.041 |

| Consistency index (CI) | 0.0144 | 0.0083 |

| Consistency ratio (CR) | 0.0116 | 0.0064 |

| Random index (RI) | 1.24 | 1.24 |

| Risk | Probability of Risk | Magnitude of Risk | Overall | Rank |

|---|---|---|---|---|

| (0.4846) | (0.5154) | risk | ||

| Low or no profits | 0.1196 | 0.1476 | 0.1340 | 6th |

| Low or no cash flow risk | 0.1710 | 0.1828 | 0.1771 | 3rd |

| Revenue shortfall | 0.1390 | 0.1654 | 0.1526 | 5th |

| Financing issues | 0.1743 | 0.1626 | 0.1683 | 4th |

| Customer’s payments issues | 0.2028 | 0.1589 | 0.1802 | 2nd |

| Increase in bank charges | 0.1934 | 0.1826 | 0.1878 | 1st |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alrawad, M.; Lutfi, A.; Almaiah, M.A.; Alsyouf, A.; Al-Khasawneh, A.L.; Arafa, H.M.; Ahmed, N.A.; AboAlkhair, A.M.; Tork, M. Managers’ Perception and Attitude toward Financial Risks Associated with SMEs: Analytic Hierarchy Process Approach. J. Risk Financial Manag. 2023, 16, 86. https://doi.org/10.3390/jrfm16020086

Alrawad M, Lutfi A, Almaiah MA, Alsyouf A, Al-Khasawneh AL, Arafa HM, Ahmed NA, AboAlkhair AM, Tork M. Managers’ Perception and Attitude toward Financial Risks Associated with SMEs: Analytic Hierarchy Process Approach. Journal of Risk and Financial Management. 2023; 16(2):86. https://doi.org/10.3390/jrfm16020086

Chicago/Turabian StyleAlrawad, Mahmaod, Abdalwali Lutfi, Mohammed Amin Almaiah, Adi Alsyouf, Akif Lutfi Al-Khasawneh, Hussin Mostafa Arafa, Nazar Ali Ahmed, Ahmad M. AboAlkhair, and Magdy Tork. 2023. "Managers’ Perception and Attitude toward Financial Risks Associated with SMEs: Analytic Hierarchy Process Approach" Journal of Risk and Financial Management 16, no. 2: 86. https://doi.org/10.3390/jrfm16020086