Abstract

In this study, we analyze the volatility of volatility indices and estimate the Hurst parameter using data from five international markets. For our analysis, we consider daily data from VIX (CBOE), VXN (CBOE Nasdaq 100), VXD (DJIA), VHSI (HSI), and KSVKOSPI (KOSPI). The period of analysis is from January 2001 to December 2021 and incorporates various market phases, such as booms and crashes. The novelty here is the use of recent methodology, including different range-based estimators for volatility analysis. We apply the Hurst exponent to the volatility measures Vgk,t, Vp,t, Vrs,t, and Vs,t, and then estimate the volatility of volatility indices through the GARCH(1, 1) model. Based on the values of the Hurst exponent, we analyze the trace of the behavior of three trading strategies, i.e., the momentum-based strategy, the random walk, and the mean-reversion strategy. The results are highly recommended for financial analysts dealing with volatility indices as well as for financial researchers.

1. Introduction

Volatility is one of the most important factors for modeling in the financial market. It measures the rate of fluctuation of security prices over time. Using volatility, we can estimate price risk, which indicates the level of risk associated with changing prices. Further, factors that affect the curve of price dynamics are included as events of stochastic volatility, which involves each of the random elements of a financial market. This is part, for example, of the preferences of market practitioners, the financial sense of some institutions, or general random factors in a society that have an impact on price dynamics through transaction processes or trading size. These are consequences, actions, and behaviors associated with one of the most important phenomena of our world: uncertainty. This phenomenon has many potential paths, and its measures are wide-ranging. The conclusion determines how important the structure of price data is for each volatility-research model.

Several volatility models use different types of price data. For instance, we consider the well-known models of generalized autoregressive conditional heteroskedasticity and stochastic volatility, i.e., the GARCH model by Engle (1982) and Bollerslev (1986) (Engle 1982) and the SV model developed by Taylor (1986), (Hwang and Satchell 2000). There is also an alternative approach related to volatility measures based on the research of (Decreusefond and Suleyman 1998), (Gallant et al. 1999), (Parkinson 1980), (Garman and Klass 1980), (Rogers and Satchell 1991), and (Rogers et al. 1994). That is the work of Alizadeh et al. (2002), (Gallant et al. 1999), (Parkinson 1980), (Garman and Klass 1980), and (Rogers et al. 1994). In this paper, we examine the trace of volatility indices and the volatility of volatility indices from January 2001 to December 2021 from five international volatility markets: VIX (CBOE), VXN (CBOE Nasdaq 100), VXD (DJIA), VHSI (HSI), and KSVKOSPI (KOSPI). In addition, we apply the Hurst exponent to these data as a measure of long-term memory of the time series.

The Hurst exponent (H) is directly connected to the momentum-based strategy, random walk, and mean-reversion strategy. It expresses price trend dynamics, and then investors try to take advantage of the continuous trends in the market. The random walk indicates an uncorrelated (random) time series, and the mean-reversion strategy expresses that asset price volatility will return to the long-term level after an extreme event. An example of a mean-reverting process is the Ornstein–Uhlenbeck process, i.e., the tendency of a time series to return to its mean value over time. For example, (Schoebel and Zhu 1999) examined the approach of (Stein and Stein 1991) and at the same time extended the stochastic volatility model in the case where the volatility satisfies a mean-reversion Ornstein–Uhlenbeck process. In addition, (García and Requena 2019) studied different methodologies and uses of the Hurst exponent, i.e., examining the long term-memory of a time series. (Domino 2011) exa mined the use of the Hurst exponent in predicting changes in trends in the Stock Exchange. Hence, these three strategies are directly connected to the estimation of the Hurst exponent. For this reason, we use the Hurst exponent method to test the behavior of volatility indices and the volatility of volatility indices, i.e. we examine the behavior of the aforementioned strategies.

There are different methodologies for estimating the Hurst exponent, including aggregate variance, absolute moments, discrete variations, centered moving average, Lyadpunov exponent, geometric procedures, and wavelets methodology. For more details about these methodologies, their comparisons, and a bibliography review, see (García and Requena 2019) and (Hamza and Hmood 2021). In our case, we follow the original works of Hurst (1951) and Mandelbrot (1967) as well as the recent procedures outlined by (Szóstakowski 2018) and (Ceballos and Largo 2018) to describe the mathematical background of the adjusted rescaled range (R/S) analysis (Mandelbrot 1967).

As we can see below, different cases of the Hurst exponent return different results about the persistence of a time series. The indicator, H, describes the behavior of our data compared to ordinary Brownian motion (see Di Vita 2021). The study of (Rehman and Siddiqi 2009) combines the Hurst exponent with the field of econophysics. According to (Decreusefond and Suleyman 1998), in the case of mathematical finance, stochastic processes are used to model the time evolution of assets. In addition, it has been noted that after a given time, t, a real process depends both on the situation at time t and the whole history of the process up to time t. A major characteristic of that procedure is the self-similarity of a process. This is relative to the law of a random variable. More precisely, the self-similarity of a process Xα, has the same law as the process aHXt, where 0 ≤ t ≤ 1. An example of a self-similar stochastic process is a fractional Brownian motion. When a fractional Brownian motion has a Hurst exponent larger than 0.5, it means that its increments (the increments of this motion) are positively autocorrelated (Garcin 2019). Given that H belongs to the interval (0, 1), a fractional Brownian motion Xt is a centered Gaussian process with covariance function:

where σ expresses the volatility parameter, and for s, t ∈ R2. For more details about the fractional Brownian motion, see (Garcin 2019). Many studies focus on the Hurst exponent and fractal dimension analysis; it measures how rough a fractal object is (Rehman 2009).

The equation of the fractal dimension, D, in terms of the Hurst exponent is:

The interactions betwen D and H are as follows: If H = 0.5, then D expresses that the amplitude changes that correspond to two successive time intervals behave as a Brownian motion (i.e., there is no correlation between amplitude changes of these time intervals). If 0.5 < H < 1, then D represents a persistent process. Conversely, when D satisfies the range between 1.5 and 2 (0 < H < 0.5), then the process is anti-persistent (Rangarajan and Santb 2004).

The work of (Ding et al. 2021a) associates Henry’s law with the Hurst exponent and the fractional differencing parameter, i.e., their distinct linear relationship. (Ghosh and Bouri 2022) studied the long-term memory and fractality of nine CBOE volatility indices and connected the empirical results with the trading strategies in the sense that past volatility provides information for future trading predictions. That is, various volatility indices satisfy the fractal market hypothesis. For more details about the Hurst exponent and fractal dimension analysis, see (Gneiting and Schlather 2001), (Cadenas et al. 2019), (Bhatt et al. 2015), and (Fuss et al. 2020). (Da Fonseca and Zhang 2019) illustrate the computation of volatility of volatility by using high-frequency data for major indexes; the results indicate that the volatility of volatility is a rough process and it maintains the long-term memory property. A new estimation of the Hurst exponent is proposed by (Li and Teng 2022), related to the roughness of volatility. They show that truncated spot volatility is rougher than non-truncated spot volatility. (Ding et al. 2021b) studied the action and compared the results of different settings (correlation processing, trend processing, etc.) on the Hurst exponent. The study showed that these settings affect accuracy of the Hurst exponent estimation. (Das and Kumar 2021) proposed a new way for optimizing a portfolio by using a combination between the Hurst exponent and wavelet analysis. Their main result reflects that higher returns are achieved by combining government bonds with equities and gold in the case where the portfolios’ structure is accomplished by the risk exposures of each asset in the overall portfolio risk. Hence, examining Hurst exponent analysis and volatility is an important topic, as also shown in the recent papers (Kondoz et al. 2019) and (Athari and Hung 2022).

The paper is organized as follows: Section 2 represents the main results of this work in the form of hypotheses. In Section 3, we present the required mathematical background for estimating the volatility measures through range-based estimators (high, low, open, close prices) of volatility indices from five international volatility markets. These are the approaches of Alizadeh et al. (2002), Gallant et al. (1999), Parkinson (1980), Garman and Klass (1980), (Rogers and Satchell 1991), and (Rogers et al. 1994). Then we describe the method for calculating the volatility of volatility measures through the GARCH(1, 1) model, and a brief analysis of the Hurst exponent and different calculation steps are illustrated. After that, a description of our data as well as descriptive statistics are given analytically. Section 4 expresses the numerical results of the Hurst exponent method, i.e., applying the Hurst exponent to CBOE, VIX, VXN, DJIA, VXD, HSI, VHSI, and KOSPI for the period 2001–2021 (full-period) and the sub-periods 2001–2007 (before the Greek financial crisis (GFC)), 2008–2021 (after the GFC period), 2008–2010 (GFC period), and 2020–2021 (COVID-19-period). Then we apply the Hurst exponent to the volatility measures Vs,t, Vp,t, Vgk,t, and Vrs,t. Finally, our study follows a graphical representation of the previous volatility measures. In Section 5, we discuss the main results analytically, the limitations of this work, and give the main conclusion from our research.

2. Hypotheses

First, we provide the contribution of this work as well as the main research hypotheses. For the empirical analysis, we use data from five of the most powerful international markets to examine the momentum of the market as a function of booms and crashes. In this way, we use the Hurst exponent on the volatility of volatility indices and study trends in our time series during the period 2001–2021 and several sub-periods: 2001–2007 (period before GFC), 2008–2010 (GFC), 2008–2021 (period after GFC), and 2020–2021 (COVID-19). The main hypothesis (H1) is as follows: Do the values of the Hurst exponent on the volatility of volatility indices better reflect the period’s changes than the values of the Hurst exponent on the volatility indices? The answer of this question requires the following steps and corresponding hypotheses.

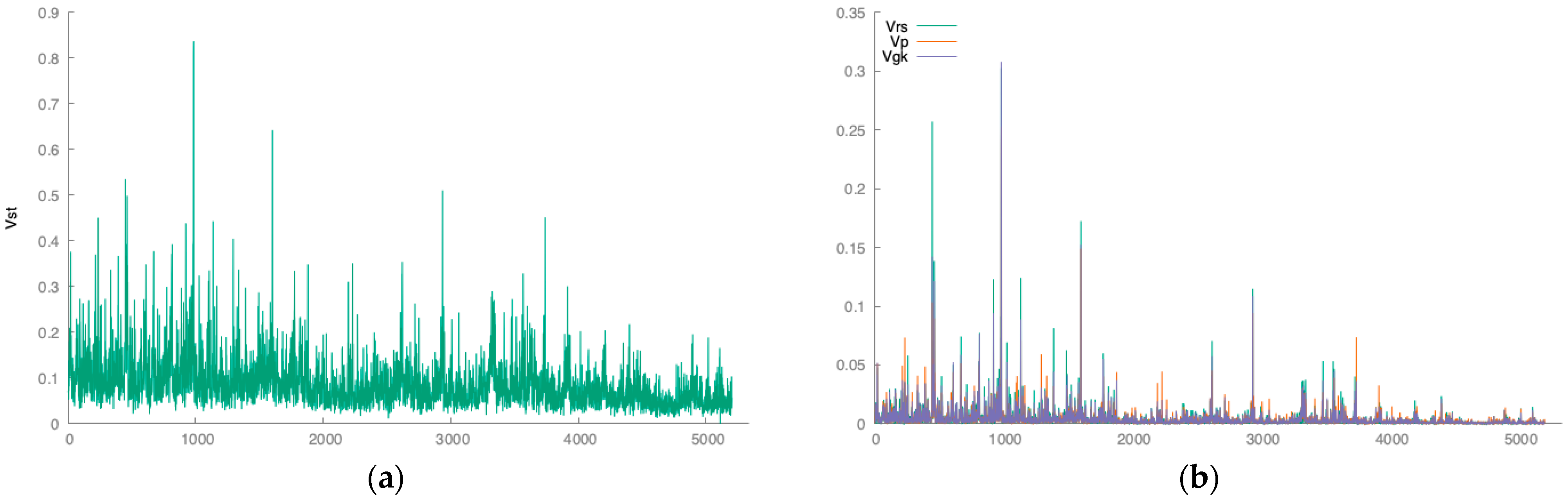

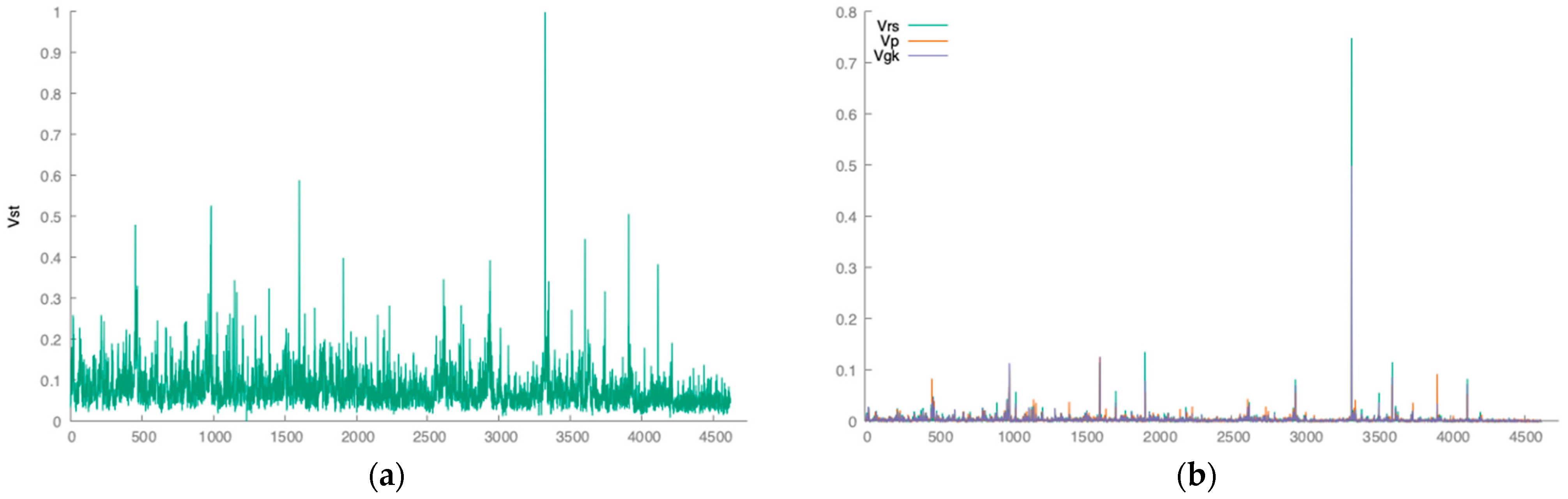

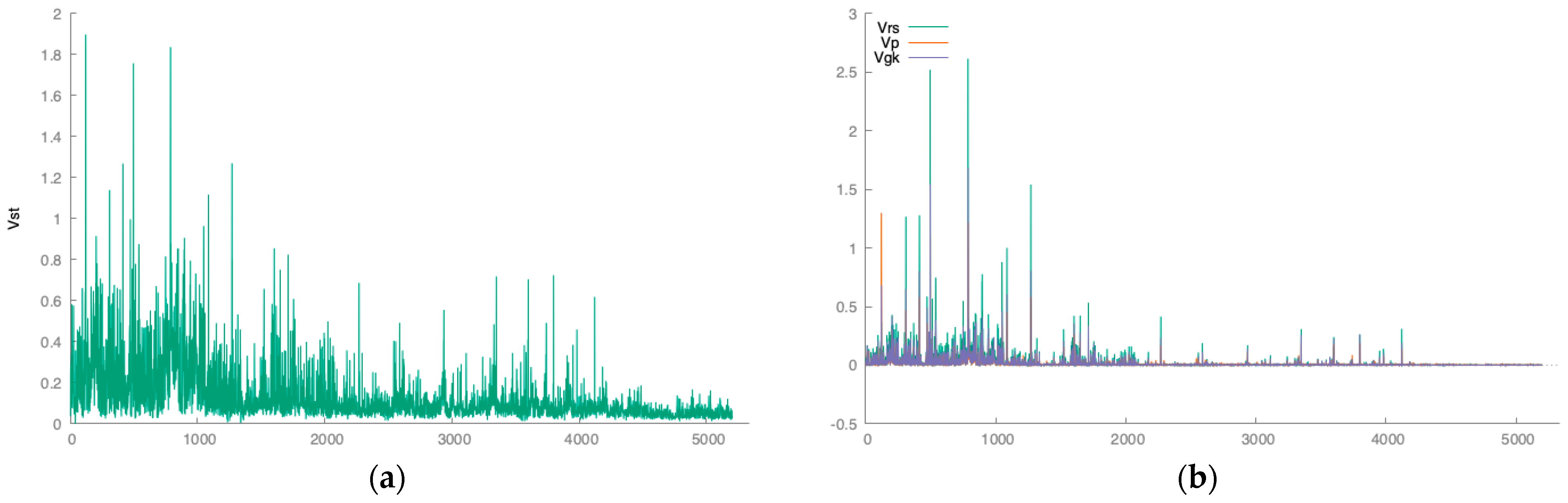

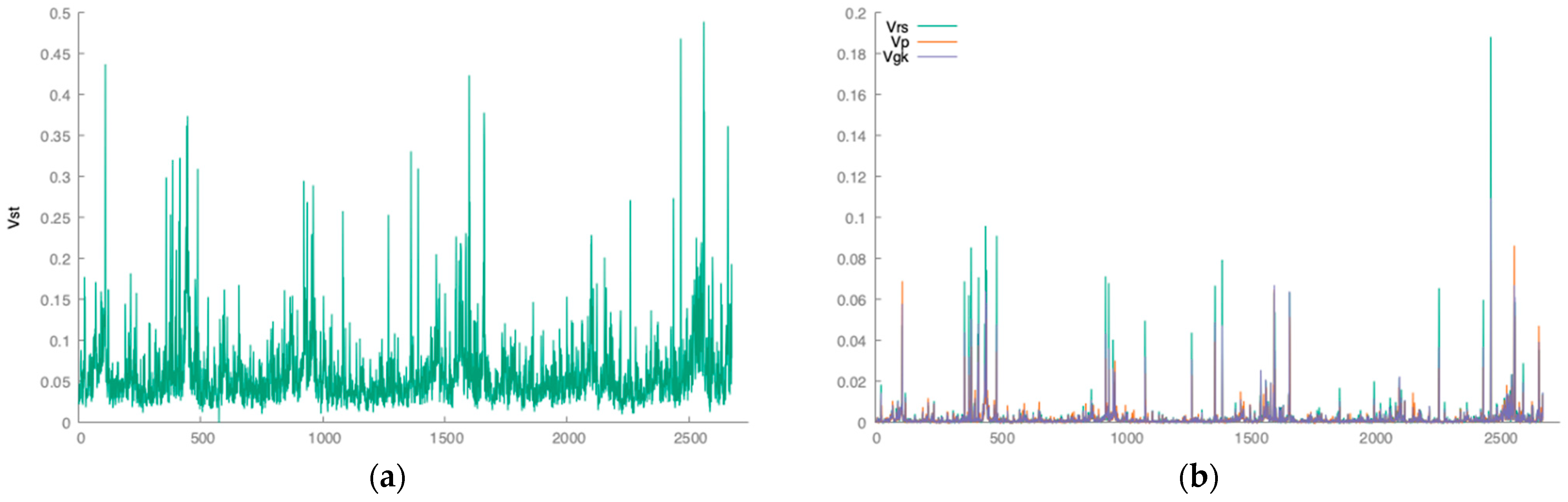

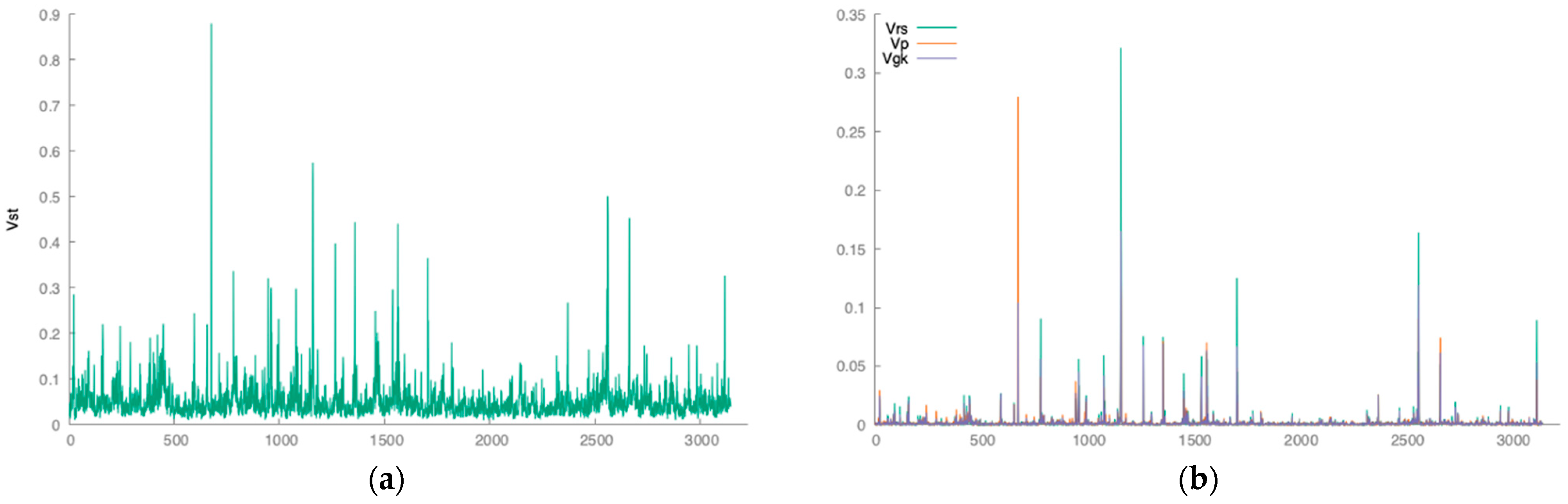

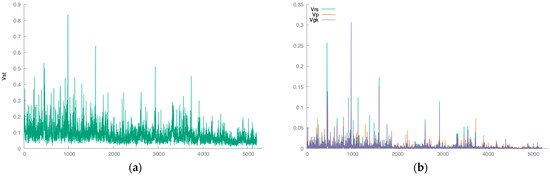

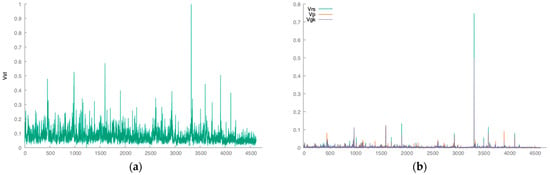

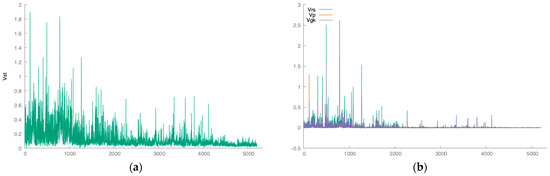

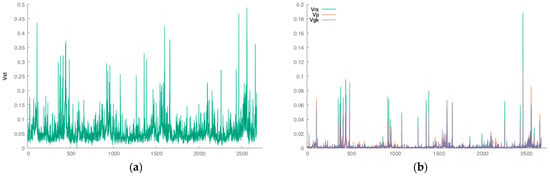

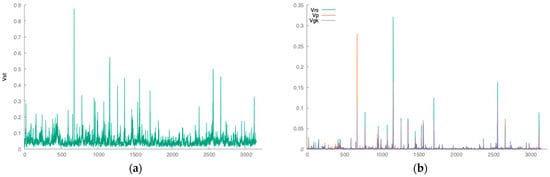

Firstly, we need to estimate the range-based estimators, Vgk,t, Vp,t, Vrs,t, and Vs,t by using the open, high, low, and close prices of five volatility indices during the period of 2001–2021. This estimation follows the procedure of (Chan and Lien 2003). The mathematical background is available in detail in the next section. According to (Chan and Lien 2003), the quantity Vs, as the first logarithmic difference between the high and low prices, overestimates the other three measures, Vp,t, Vrs,t, and Vgk,t. We extend this result by examining the GFC and COVID-19 periods. Even during intense periods, Vs overestimates the other three measures. This is the reason we isolated the Vs-figure; see for instance Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5.

Figure 1.

Time-varying dynamics of volatility measures of the CBOE Market Volatility Index. Range-based estimators (a) Vs,t and (b) Vgk,t, Vp,t, Vrs,t [Author’s own processing].

Figure 2.

Time-varying dynamics of volatility measures of the CBOE NASDAQ 100 Volatility Index. Range-based estimators (a) Vs,t and (b) Vgk,t, Vp,t, Vrs,t [Author’s own processing].

Figure 3.

Time-varying dynamics of volatility measures of the DJIA Volatility Index. Range-based estimators (a) Vs,t and (b) Vgk,t, Vp,t, Vrs,t [Author’s own processing].

Figure 4.

Time-varying dynamics of volatility measures of the HSI Volatility Index. Range-based estimators (a) Vs,t and (b) Vgk,t, Vp,t, Vrs,t [Author’s own processing].

Figure 5.

Time-varying dynamics of volatility measures of the KSVKOSPI Volatility Index. Range-based estimators (a) Vs,t and (b) Vgk,t, Vp,t, Vrs,t [Author’s own processing].

Secondly, we apply the variability analysis to the volatility indices by estimating the Hurst exponent. That is, we apply the R/S analysis to the five volatility indices, VIX (CBOE), VXN (CBOE Nasdaq 100), VXD (DJIA), VHSI (HSI), and KSVKOSPI (KOSPI). The purpose here, following the variability analysis, is to analyze the patterns of variations in the time-series. In this way, we examine the microstructure of our data and the behavior of a financial market produced by the five volatility indices.

Consequently, risk managers, investors, and modelers find the information (behavior of the time series) useful; following this, they can choose an optimal financial strategy for their portfolio (momentum-based strategy, random walk, or mean-reversion strategy).

Our second hypothesis (H2) is: Do the values of the Hurst exponent on the volatility indices reflect the well-defined behavior of the financial market in the sense of three financial strategies or do the risk managers, investors, and modelers trust the behavior of financial market based on the values of the Hurst exponent on the volatility indices? We continue our analysis of the time series in the sense of the volatility of volatility. More precise, applying GARCH(1, 1) to the volatility measures Vs,t, Vp,t, Vrs,t, and Vgk,t, we obtain the volatility of volatility indices for the period 2001–2021 and the sub-periods 2001–2007 (before the GFC), 2008–2010 (GFC), 2008–2021 (after the GFC), and 2020–2021 (COVID-19). Then, by using the Hurst exponent on these volatility of volatility indices, we test how persistent (or not) our time series data is.

Our third hypothesis (H3) is: Do the values of the Hurst exponent on the volatility of volatility indices reflect the well-defined behavior of the financial market in the sense of three financial strategies, or do the risk managers, investors, and modelers trust the momentum of the financial market based on the values of the Hurst exponent on the volatility of volatility indices? This last hypothesis relates to the case of rough (or not) volatility. The term “rough” is associated with the Hurst exponent through R/S analysis and the fact that the volatility model is a function of fractional Brownian motion. According to the works of (Cont and Das 2022) and (Fukasawa et al. 2019), if H is closer to 1 (0.5 < H < 1), then the increments of the time series are smoother than Brownian motion. Conversely, if H approaches 0 (0.5 to 0), then the increments of the time series become rougher than Brownian motion. Consequently, the term “rough” in our case is related to the distance of the values of the Hurst exponent from the value of 0.5 (Brownian motion). Thus, our final hypothesis (H4) is: How rough is the volatility or the volatility of volatility with respect to the given financial data?

In general, the Hurst exponent is related to the dynamics of the memory among the observations. For example, the case of random walk (i.e., H = 0.5) contains security prices that are unpredictable over time, and there is no memory among the observations. When H belongs to (0.5, 1), then the time series has a long-term memory, illustrating the momentum-based strategy. Finally, anti-persistent time series is illustrated by the values of 0 < H < 0.5, for which the mean-reversion strategy is proposed.

3. Methodology & Data Description

The main goal of this article is the estimation of the Hurst exponent with respect to the estimated volatility indices and the volatility of volatility indices. In particular, we follow the approach of (Chan and Lien 2003) for estimation of the volatility measures Vs,t, Vp,t, Vgk,t, and Vrs,t. Then, a GARCH model is applied to the vectors Vs,t, Vp,t, Vgk,t, and Vrs,t; after that, we proceed with the estimation of volatility of volatility. The computation of the Hurst exponent is based on (Szóstakowski 2018) and (Ceballos and Largo 2018).

First, we apply four equations corresponding to the opening, closing, high, and low market prices. Suppose that Ot represents the opening price on day t, and let Ct, Ht, and Lt be the closing, high, and low prices, respectively. Staring with the case of the first logarithmic difference between Ht and Lt, i.e., the high and low prices, we have:

based on (Decreusefond and Suleyman 1998), (Alizadeh et al. 2002) and (Gallant et al. 1999). Next, as a volatility measure, we use an underlying geometric Brownian motion with no drift as follows:

This is the Parkinson volatility (Parkinson 1980). Keeping the same diffusion process as before, we proceed to the next volatility measure, similar to (Garman and Klass 1980), which is a function of the opening, closing, highest, and lowest prices, such that:

Equivalently, we can use the following, more convenient formation:

According to (Chan and Lien 2003), when the stochastic process has a drift action, then models (2) and (4) are not effective for volatility simulation. Instead, we introduce the models of (Rogers and Satchell 1991) and (Rogers et al. 1994), which include the daily opening, highest, lowest, and closing prices, of the form:

Regarding the estimation of the volatility of volatility measures, we apply the GARCH (1, 1) model on volatility measures Vs,t, Vp,t, Vgk,t, and Vrs,t based on the volatility indices considered. In general, GARCH (Bollerslev 1986) is a method for estimating volatility measure. Here, we follow the notation of (Jafari et al. 2007) in order to describe some of the basic components of the GARCH model. Suppose that rt expresses a return on an asset. Then:

for the mean value μ, variance σ2, and εt∼iid N(0, 1). GARCH implies an estimation for the variance through the constant variables α0, …, αp and β1, …, βq such that:

More precisely in our case, a GARCH (1, 1) model has the form:

where α1 + β1 < 1 with α1 ≥ 0, β1 ≥ 0 and α0 > 0. The corresponding numerical results are available in Section 4. Finally, we apply Hurst exponent analysis in order to examine if the time series is persistent or not. According to (García and Requena 2019), the latter case indicates that our data satisfy the behavior of ordinary Brownian motion instead of the former case where there is memory associated with the data. For this reason, we use the R/S analysis (Mandelbrot 1967), which represents one of the statistical measures of the variability of the time series. For this process, we follow the references of (Szóstakowski 2018) and (Ceballos and Largo 2018).

Let the time series X of length N be divided into a sub-period of length d, where n is an integral divisor of N. Then the mean value is calculated such that:

We normalize the data in the following relationship:

for t = 1, …, n, returning in this way the cumulative time series, Z, where:

Then the respective range will be:

After that, we rescale the range by using the standard deviation Sn:

Finally, the Hurst exponent is estimated through R/S analysis

for the constant c independent of n. Let us now distinguish the different results for the different cases of H. For example, if H = 1, then the series is uncorrelated, meaning that the series is characterized by random behavior. If 0 < H < 0.5, then we have the case of anti-persistence in the time series, meaning that it has a tendency to return to the long-term mean. On the other hand, if 0.5 < H < 1, then the time series has a positive long-term autocorrelation (i.e., it is a persistent series). Our daily volatility data, obtained from five international volatility markets, includes not only closing prices but also a full range of prices, i.e., high, low, and open for each trading day. The period of analysis is from January 2001 to December 2021 and incorporates various market phases, such as a global booms and crashes, as explained above. These events include the global financial crisis (started October 2008), COVID-19 (December 2019), and Brexit (started February 2020). Next, we present the descriptive statistics of our daily data and then apply the four volatility measures, Vs,t, Vp,t, Vgk,t, and Vrs,t by using Equations (1)–(4), respectively (see Table 1 and Table 2). For all cases, the normality test is rejected.

Table 1.

Descriptive statistics of volatility indices from 5 international markets [Author’s own processing].

Table 2.

Volatility estimates. Descriptive statistics on range-based estimators. [Author’s own processing].

4. Numerical Results

In this section, we present our empirical results. We begin with the computation of the range-based estimators, Vgk,t, Vp,t, Vrs,t, and Vs,t by using the volatility indices of five international markets for all periods (2001–2021 and all sub-periods). Then we estimate the Hurst exponent on the volatility indices for the whole period of 2001–2021 and the respective sub-periods (Table 3). Further, we apply GARCH(1, 1) on the aforementioned range-based estimators in order to compute the volatility of volatility indices during the same period and sub-periods, and finally, we apply the Hurst exponent to the volatility of volatility indices. This is the desired result, because in this way we test how persistent our time series data are. The volatility of the volatility indices is estimated from an AR(1)-GARCH(1, 1)-model. The results for the variance in Equation (6) show that the p-value is equal to zero (or less than 0.05), and as a consequence, the model’s parameters are highly significant. Beyond that, the sum of parameters α and β is less than 1; this indicates that we have a stationary solution with finite expected value. In addition, the sum of the model’s coefficients is very close to one, meaning that the volatility shocks are highly persistent and in equilibrium with the extracted results of this work related to the Hurst exponent. More precisely, the general result across the whole time-period is that the Hurst exponent indicates a time series with a long-term positive autocorrelation (see Table 4). Mathematically, this is the time interval of H between the values (0.5, 1).

Table 3.

Values of the Hurst exponent on the volatility indices of 5 international markets. [Author’s own processing].

Table 4.

Values of the Hurst exponent on the volatility of volatility indices of 5 international markets. [Author’s own processing].

Based on the numerical results, we get useful information related to the Hurst exponent and the volatility of volatility. The values of the Hurst exponent before the GFC indicate a more persistent time series than the period after the GFC. In addition, the existence of a trend in the time series throughout the period of COVID-19 is stronger than during the GFC period and after the GFC period. A possible reason for that performance is the unifying behavior between the investors during the uncertain and unexpected COVID-19 period, creating in this way a stable financial momentum strategy. Some important results are as follows: The Hurst exponent on the KSVKOSPI volatility of volatility indices is close to 0.5 for most periods. This implies a random walk time series, i.e., the time series approaches the properties and general behavior of Brownian motion more than the other four volatility of volatility indices. However, the COVID-19 period on the KSVKOSPI time series has a more positive long-term autocorrelation (persistent series) than the other three crisis periods. The VIX(CBOE) is the most stable index compared to the other indices over the period 2001–2021.

There are also some remarkable points related to the volatility indices and volatility of volatility indices. Firstly, there is a difference between the values of the Hurst exponent on the volatility indices and on the volatility of the volatility indices. The values of H in the second case are close when we consider the crisis period as well as the period of COVID-19. For example and based on the Table 3, the values of the Hurst exponent on the volatility indices during the crisis time interval 2008–2010 range between 0.967554 and 0.97901. The same Hurst exponent before the crisis time interval, i.e., 2001–2007, ranges between 0.945965 and 1.01016. The respective case for the values of the Hurst exponent on the volatility of the volatility indices ranges between 0.574546 and 0.761437 (crisis period 2008–2010) and 0.559094 and 0.816659 (before crisis period, 2001–2007). Secondly, Table 3 contains three values of Hurst exponent on the volatility indices larger than 1, in contrast to the volatility of the volatility indices where the Hurst exponent is always less than 1. The case where H > 1 indicates that we need to follow a different approach in order to obtain the desired results. However, this part is out of the framework of this work. There is also the possibility (H > 1) of the existence of a non-stationary time series. In any case, the significant Hurst exponent value has a range between 0 and 1. Therefore, it is better to choose the approach and results of the Hurst exponent on the volatility of volatility indices instead of the volatility indices (and as a consequence for these three irregular situations where H is greater than 1). According to our numerical results, the Hurst exponent in the case of volatility of volatility indices is more effective than the Hurst exponent on the volatility indices, better illustrating the financial strategies. Consequently, the main hypothesis (H1) is well-defined. However, the values of the Hurst exponent on the volatility indices do not reflect the well-defined behavior of the financial market in the sense of three financial strategies for the aforementioned reasons, and thus, hypothesis (H2) is rejected. According to Table 3 and Table 4, the values of the Hurst exponent are between 0.5 and 1; this implies that both the volatility and the volatility of volatility with respect to the given financial data are not rough (hypothesis (H4)). In this paper, we also examined if the range of the time interval affects the values of the Hurst exponent; we obtained a negative result. Further, and regardless of the potential financial strategies of our time period, the values of the Hurst exponent are greater than 0.5 for the whole period of 2001–2021 (Table 4). This indicates that there is no anti-persistent time series, i.e., the future values do not tend to return to a long-term mean. This implies that there is no mean-reverting financial strategy. This type of strategy helps investors to trade despite difficult circumstances (long-term variations), given that the future values will eventually return to a long-term mean. On the other hand, and according to the Hurst exponent results (Table 4), in most cases, the market encourages a momentum-based strategy, whereby investors have the information that securities will maintain their price dynamics as a function of time (momentum), either upward or vice-versa. In this case, risk managers, investors, and modelers might go towards a specific stock market under the momentum-based strategy. There is also the option for risk managers, investors, and modelers to diversify their portfolios accordingly, considering a mix of momentum-based and mean-reverse strategies and avoiding risk investments with a value of H close to the values of a random walk. Then we could claim that the hypothesis (H4) is well-defined; that is, risk managers, investors, and modelers can rely on the values of the Hurst exponent on the volatility of volatility indices reflecting the well-defined behavior of the financial market in the sense of three financial strategies.

5. Discussion and Conclusions

The main contribution of this work is the computation of the Hurst exponent through the volatility measures by using data from five international markets during the period of January 2001 to December 2021. Based on these values of the Hurst exponent, we analyze the trace behavior of three trading strategies, i.e., the momentum-based strategy, the random walk, and the mean-reversion strategy. The values of the Hurst exponent on the volatility of volatility indices better reflects the period’s changes than the values of the Hurst exponent on the volatility indices (hypothesis (H1)). The results are highly recommended for financial analysts dealing with volatility indices as well as for financial researchers.

Firstly, according to Table 4, investors should be more careful in the case of the KSVKOSPI volatility index, because H is close to the value of 0.5 over the periods 2001–2007 (period before the GFC) and 2008–2010 (GFC period). These values indicate that there is no investing advantage based on the continuous trends of the market. This is not true for the case of COVID-19 period where H = 0.75, indicating a momentum-based strategy. The same strategy is appropriate for trading in the case of the CBOE Market volatility index, where the time series has a long-term memory according to the different values of H. Both the DJIA volatility index and HSI volatility index show a similar behavior to the CBOE Market volatility index. The CBOE Market volatility index is closer to the KSVKOSPI volatility index. Secondly, comparing the Table 3 and Table 4, we see that the values of the Hurst exponent on the volatility of volatility indices adapt better to the possible changes of the interest periods than the the Hurst exponent on the volatility indices. Thirdly, by taking advantage of the values of the Hurst exponent on the volatility of volatility indices, investors, modelers, and risk managers might diversify their portfolios by considering a mix of momentum-based and mean-reversion strategies.

This study has several limitations, which also offer potential directions for further research. Further work should examine several methods of Hurst exponent analysis and test if measures of volatility are affected by systemic volatility worldwide, or only by the systemic volatility at each stock market level. However, the dynamic model in this article (the methodology is described in the Section 3) satisfies the primary hypothesis (H1). In particular, investors, modelers, and risk managers may follow Hurst exponent values on the volatility of volatility indices for their decisions. Finally, high-frequency data and rough volatility should be considered, to determine if realized variance measures show a high/low Hurst parameter.

Author Contributions

Conceptualization, G.Z. and C.F.; methodology, G.Z.; software, G.Z.; validation, G.Z. and C.F.; formal analysis, G.Z.; investigation, G.Z.; resources, G.Z.; data curation, G.Z.; writing—original draft preparation, G.Z.; writing—review and editing, G.Z. and C.F.; visualization, G.Z.; supervision, C.F.; project administration, C.F.; funding acquisition, C.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| VIX (CBOE) | Chicago Board Options Exchange Volatility index |

| VXN (CBOE Nasdaq 100) | CBOE Nasdaq Volatility Index |

| VXD (DJIA) | Dow Jones Industrial Average Volatility Index |

| VHSI (HSI) | Hang Seng index Volatility Index |

| KSVKOSPI (KOSPI) | Korea Composite Stock Price Index |

| GFC | Global financial crisis |

| H | Hurst exponent |

| R/S | Rescaled Range Analysis |

| AR | Autoregressive Process |

| GARCH | Generalized AutoRegressive Conditional Heteroskedasticity |

References

- Alizadeh, Sassan, Michael W. Brandt, and Francis X. Diebold. 2002. Range-based estimation of stochastic volatility models. The Journal of Finance 57: 1047–91. [Google Scholar] [CrossRef]

- Athari, Seyed Alireza, and Ngo Thai Hung. 2022. Time–frequency return co-movement among asset classes around the COVID-19 outbreak: Portfolio implications. Journal of Economics and Finance 46: 736–56. [Google Scholar] [CrossRef]

- Bhatt, S. J., H. V. Dedania, and Vipul R. Shah. 2015. Fractal Dimensional Analysis in Financial Time Series. International Journal of Financial Management 5: 46–52. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Cadenas, Erasmo, Campos-Amezcua Rafael, Rivera Wilfrido, Espinosa-Medina Marco Antonio, Méndez-Gordillo Alma Rosa, Rangel Eduardo, and Tena Jorge. 2019. Wind speed variability study based on the Hurst coefficient and fractal dimensional analysis. Journal of Energy Science and Engineering 7: 361–78. [Google Scholar] [CrossRef]

- Ceballos, Roel F., and Fe F. Largo. 2018. On The Estimation of the Hurst Exponent Using Adjusted Rescaled Range Analysis, Detrended Fluctuation Analysis and Variance Time Plot: A Case of Exponential Distribution. arXiv arXiv:1805.08931. [Google Scholar]

- Chan, Leo, and Donald Lien. 2003. Using high, low, open, and closing prices to estimate the effects of cash settlement on futures prices. International Review of Financial Analysis 12: 35–47. [Google Scholar] [CrossRef]

- Cont, Rama, and Purba Das. 2022. Rough volatility: Fact or artefact? arXiv arXiv:2203.13820v2. [Google Scholar] [CrossRef]

- Da Fonseca, Jose, and Wenjun Zhang. 2019. Volatility of volatility is (also) rough. The Journal of Futures Markets 39: 600–11. [Google Scholar] [CrossRef]

- Das, Santanu, and Ashish Kumar. 2021. Long-term dependency between sovereign bonds and sectoral indices of India: Evidence using Hurst exponent and wavelet analysis. Managerial Finance 47: 1448–64. [Google Scholar] [CrossRef]

- Decreusefond, Laurent, and Ustunel Ali Suleyman. 1998. Fractional Brownian motion: Theory and applications. Esaim: Proceedings 5: 75–86. [Google Scholar] [CrossRef]

- Di Vita, Andrea. 2021. The persistent, the anti-persistent and the Brownian: When does the Hurst exponent warn us of impending catastrophes? arXiv arXiv:2104.02187. [Google Scholar]

- Ding, Liang, Yi Luo, Yan Lin, and Yirong Huang. 2021a. Revisiting the rela- tions between Hurst exponent and fractional differencing parameter for long memory. Physica A: Statistical Mechanics and Its Applications 566: 125603. [Google Scholar] [CrossRef]

- Ding, Liang, Yi Luo, Yan Lin, and Yirong Huang. 2021b. Optimal Setting for Hurst Index Estimation and Its Application in Chinese Stock Market. IEEE Access 9: 93315–30. [Google Scholar] [CrossRef]

- Domino, Krzysztof. 2011. The use of the Hurst exponent to predict changes in trends on the Warsaw Stock Exchange. Journal Physica A: Statistical Mechanics and Its Applications 390: 98–109. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of UK inflation. Econometrica 50: 987–1008. [Google Scholar] [CrossRef]

- Fukasawa, Masaaki, Tetsuya Takabatake, and Rebecca Westphal. 2019. Is Volatility Rough? arXiv arXiv:1905.04852. [Google Scholar]

- Fuss, Franz Konstantin, Yehuda Weizman, and Adin Ming Tan. 2020. The non-linear relationship between randomness and scaling properties such as fractal dimensions and Hurst exponent in distributed signals. Journal of Communications in Nonlinear Science and Numerical Simulation 96: 105683. [Google Scholar] [CrossRef]

- Gallant, Ronald, Chien-Te Hsu, and George Tauchen. 1999. Using Daily Range Data to Calibrate Volatility Diffusion and Extract the Forward Integrated Variance. Working Paper. Chapel Hill: University of North Carolina, vol. 81, pp. 617–31. [Google Scholar]

- Garcin, Matthieu. 2019. Hurst exponents and delampertized fractional Brownian motions. International Journal of Theoretical and Applied Finance 22: 1950024. [Google Scholar] [CrossRef]

- García, María de las Nieves López, and Jose Pedro Ramos Requena. 2019. Different methodologies and uses of the Hurst exponent in Econophysics. Journal of Estudios de Economía Aplicada 37: 2. [Google Scholar] [CrossRef]

- Garman, Mark B., and Michael J. Klass. 1980. On the Estimation of Security Price Volatilities from Historical Data. The Journal of Business 53: 67–78. [Google Scholar] [CrossRef]

- Ghosh, Bikramaditya, and Elie Bouri. 2022. Long Memory and Fractality in the Universe of Volatility Indices. Complexity in Financial Markets 2022: 6728432. [Google Scholar] [CrossRef]

- Gneiting, Tilmann, and Martin Schlather. 2001. Stochastic models which separate fractal dimension and Hurst effect. arXiv arXiv:physics/0109031. [Google Scholar]

- Hamza, Amjad, and Munaf Hmood. 2021. Comparison of Hurst exponent estimation methods. Journal of Economics and Administrative Sciences 27: 167–83. [Google Scholar] [CrossRef]

- Hurst, Harold E. 1951. The Long-Term Storage Capacity of Reservoirs. Transactions of the American Society of Civil Engineers 116: 770–99. [Google Scholar] [CrossRef]

- Hwang, Soosung, and Stephen E. Satchell. 2000. Market risk and the concept of fundamental volatility: Measuring volatility across asset and derivative markets and testing for the impacts of derivatives markets on financial markets. Journal of Banking and Finance 24: 759–85. [Google Scholar] [CrossRef]

- Jafari, G. R., A. Bahraminasab, and P. Norouzzadeh. 2007. Why does the Standard GARCH(1,1) model work well? arXiv arXiv:physics/0503027. [Google Scholar]

- Kondoz, Mehmet, Ilhan Bora, Dervis Kirikkaleli, and Seyed Alireza Athari. 2019. Testing the Volatility Spillover between Crude Oil Price and the U.S. Stock Market Returns. Management Science Letters 9: 1221–30. Available online: https://ssrn.com/abstract=4300741 (accessed on 5 September 2022). [CrossRef]

- Li, Yicun, and Yuanyang Teng. 2022. Estimation of the Hurst Parameter in Spot Volatility. Mathematics 10: 1619. [Google Scholar] [CrossRef]

- Mandelbrot, Benoit. 1967. How Long is the Coast of Britain? Statistical Self-Similarity and Fractional Dimension. Science New Series 156: 636–38. [Google Scholar] [CrossRef]

- Parkinson, Michael. 1980. The extreme value method for estimating the variance of the rate of return. The Journal of Business 53: 61–65. [Google Scholar] [CrossRef]

- Rangarajan, Govindan, and Dhananjay Santb. 2004. Fractal dimensional analysis of Indian climatic dynamics. Journal Chaos, Solitons and Fractals 19: 285–91. [Google Scholar] [CrossRef]

- Rehman, S., and A. H. Siddiqi. 2009. Wavelet based hurst exponent and fractal dimensional analysis of Saudi climatic dynamics. Journal of Chaos, Solitons and Fractals 40: 1081–90. [Google Scholar] [CrossRef]

- Rehman, Shafiqur. 2009. Wavelet based hurst exponent and fractal dimensional analysis of saudi climatic parameters. The International Journal of Meteorology 34: 5. [Google Scholar]

- Rogers, L. Christopher G., and Stephen E. Satchell. 1991. Estimating variance from high, low, and closing prices. Annals of Applied Probability 1: 504–12. [Google Scholar] [CrossRef]

- Rogers, Leonard C. G., Stephen E. Satchell, and Y. Yoon. 1994. Estimating the volatility of stock prices: A comparison of methods that use high and low prices. Applied Financial Economics 4: 241–47. [Google Scholar] [CrossRef]

- Schoebel, Rainer, and Jianwei Zhu. 1999. Stochastic Volatility with an Ornstein-Uhlenbeck Process: An Extension, European Finance Review. Tübinger Diskussionsbeiträge, No. 139. Tübingen: Eberhard Karls Universität Tübingen. [Google Scholar]

- Stein, Elias M., and Jeremy C. Stein. 1991. Stock Price Distributions with Stochastic Volatility: An Analytic Approach. Review of Financial Studies 4: 727–52. [Google Scholar] [CrossRef]

- Szóstakowski, Robert. 2018. The use of the Hurst exponent to investigate the quality of forecasting methods of ultra-high-frequency data of exchange rates. Statistical Review Przeglad Statystyczny 65: 200–23. [Google Scholar] [CrossRef]

- Taylor, S. 1986. Modeling Financial Time Series. New York and Chichester: John Wiley & Sons. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).