Developing a Multidimensional Financial Inclusion Index: A Comparison Based on Income Groups

Abstract

1. Introduction

“The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little”.Franklin D. Roosevelt

2. Prior Literature

3. Materials and Methods

3.1. Sample and Data Sources

3.2. Definitions and Measures of Variables

4. Results and Discussion

4.1. PCA Application Conditions

4.2. Results of the First Stage of PCA

4.3. Results of the Second Stage of PCA

4.4. Evaluation of the Index’s Robustness

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Low income South Asia Afghanistan Sub-Saharan Africa Chad Congo Madagascar Mozambique Rwanda Uganda | Lower-Middle Income Europe and Central Asia Tajikistan Ukraine Latin America and Caribbean Belize Bolivia El Salvador Honduras Haiti Nicaragua East Asia and Pacific Cambodia Indonesia Lao PDR Myanmar Mongolia Philippines Solomon Islands (SI) Samoa Sub-Saharan Africa Cameroon Comoros Ghana Lesotho Mauritania Kenya Zambia Zimbabwe Middle East and North Africa Egypt West Bank and Gaza South Asia Bangladesh India Nepal Pakistan | Upper-Middle Income Europe and Central Asia Armenia Georgia Kosovo Moldova Albania Azerbaijan Bosnia and Herzegovina (BH) Bulgaria Macedonia Montenegro Turkish Sub-Saharan Africa Botswana Namibia Middle East and North Africa Jordan Lebanon East Asia and Pacific China, PR.: Mainland Malaysia Thailand Latin America and Caribbean Argentina Brazil Colombia Costa Rica Dominican Republic Ecuador Jamaica Panama Paraguay Peru Suriname South Asia Maldives | High Income Europe and Central Asia Belgaum Croatia Cypris Estonia Greece Hungary Italy Netherlands Latvia Poland Portugal Spain Iceland San Marino East Asia and Pacific Japan Korea Middle East and North Africa Malta Saudia Arabia United Arab Emirates (UAE) Latin America and Caribbean Chile Trinidad and Tobago (TT) Sub-Saharan Africa Mauritius Seychelles South Asia Brunei Darussalam (BD) |

| 1 | The Central Council for Financial Services Information is an organization that conducts financial services information activities in Japan. Its main objective is to enlighten the public on the importance of basic financial and economic knowledge related to daily life. |

| 2 | We take into consideration the classification of the World Bank. This classification, updated every year on 1 July, is based on the GNI per capita of the previous year (2019 in our case) in current dollars. |

References

- Ahamed, M. Mostak, and Sushanta K. Mallick. 2019. Is financial inclusion good for bank stability? International evidence. Journal of Economic Behavior and Organization 157: 403–27. [Google Scholar] [CrossRef]

- Allen, Franklin, Elena Carletti, Robert Cull, Jun Qian, Lemma Senbet, and Patricio Valenzuela. 2014. The African financial development and financial inclusion gaps. Journal of African Economies 23: 614–42. [Google Scholar] [CrossRef]

- Allen, Franklin, Asli Demirgüç-Kunt, Leora Klapper, and Maria Soledad Martinez Peria. 2016. The foundations of financial inclusion: Understanding ownership and use of formal accounts. Journal of Financial Intermediation 27: 1–30. [Google Scholar] [CrossRef]

- Atellu, Antony R. 2021. Inclusive Finance, Bank Regulation, Concentration and Financial Stability in Kenya. Doctoral dissertation, University of Nairobi, Nairobi, Kenya. [Google Scholar]

- Avom, Désiré, Chrysost Bangaké, and Hermann Ndoya. 2021. Measuring financial inclusion in African countries. Economics Bulletin 41: 848–66. [Google Scholar]

- Ayyagari, Meghana, Thorsten Beck, and Mohammad Hoseini. 2013. Finance and Poverty: Evidence from India, CEPR Discussion Paper No. DP9497. Available online: https://ssrn.com/abstract=2275150 (accessed on 25 October 2022).

- Basel Committee on Banking Supervision. 2016. Recommendations for the Application of the Core Principles for Effective Banking Supervision to the Regulation and Supervision of Institutions Engaged in Financial Inclusion. Geneva: Bank for International Settlements. Available online: http://www.bis.org/bcbs/publ/d383.pdf (accessed on 20 June 2022).

- Beck, Thorsten, Asli Demirguc-Kunt, and Maria Soledad Martine Peria. 2007. Reaching out: Access to and use of banking services across countries. Journal of Financial Economics 85: 234–66. [Google Scholar] [CrossRef]

- Bruhn, Miriam, and Inessa Love. 2014. The real impact of improved access to finance: Evidence from Mexico. The Journal of Finance 69: 1347–76. [Google Scholar] [CrossRef]

- Brune, Lasse, Xavier Giné, Jessica Goldberg, and Dean Yang. 2011. Commitments to Save: A Field Experiment in Rural Malawi. World Bank Policy Research Working Paper, No. 5748. Available online: https://ssrn.com/abstract=1904244 (accessed on 3 December 2021).

- Camara, Noelia, and David Tuesta. 2014. Measuring Financial Inclusion: A Multidimensional Index. Working Paper, N 14/26, BBVA Bank, Economic Research Department, Madrid, September. Available online: https://www.bbvaresearch.com/wp-content/uploads/2014/09/WP1426.Financial (accessed on 18 August 2021).

- Casin, Philippe, Christine Stachowiak, and François Marque. 2011. L’analyse en composantes principales de variables non stationnaires. Mathématiques et Sciences Humaines. Mathematics and Social Sciences 196: 27–40. [Google Scholar] [CrossRef]

- Cattell, Raymond B. 1966. The Scree Test for The Number Of Factors. Multivariate Behavioral Research 1: 245–76. [Google Scholar] [CrossRef]

- Chakravarty, Satya R., and Rupayan Pal. 2010. Measuring Financial Inclusion: An Axiomatic Approach. Mumbai: Indira Gandhi Institute of Development Research. Available online: http://www.igidr.ac.in/pdf/publication/WP-2010-003.pdf (accessed on 5 October 2021).

- Chikalipah, Sydney. 2017. What determines financial inclusion in Sub-Saharan Africa? African Journal of Economic and Management Studies 8: 8–18. [Google Scholar] [CrossRef]

- Chithra, Natarajan, and Murugesan Selvam. 2013. Determinants of Financial Inclusion: An Empirical Study on the Inter-State Variations in India. Available online: https://ssrn.com/abstract=2296096 (accessed on 12 November 2021).

- Cull, Robert, Tilman Ehrbeck, and Nina Holle. 2014. Financial Inclusion and Development: Recent Impact Evidence (No. 88169). Washington, DC: The World Bank, pp. 1–12. [Google Scholar]

- Demirgüç-Kunt, Asli, and Leora F. Klapper. 2012. Measuring Financial Inclusion: The Global Findex Database (No. 6025). The World Bank. Available online: https://www.bbvaresearch.com/wp-content/uploads/2014/09/WP14-26_Financial-Inclusion.pdf (accessed on 22 December 2020).

- Demirgüç-Kunt, Asli, and Leora Klapper. 2013. Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brookings Papers on Economic Activity 2013: 279–340. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and Ross Levine. 2009. Finance and inequality: Theory and evidence. Annual Review of Financial Economics 1: 287–318. [Google Scholar] [CrossRef]

- Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, and Peter Van Oudheusden. 2015. The Global Findex Database 2014: Measuring Financial Inclusion around the World. Policy Research Working Paper No. 7255. Washington, DC: World Bank. Available online: https://openknowledge.worldbank.org/handle/10986/21865 (accessed on 22 December 2021).

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, and Ansar Saniya. 2021. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19. Available online: https://www.worldbank.org/en/publication/globalfindex (accessed on 22 December 2021).

- Direction Générale du Trésor. 2019. Panorama du système financier japonais, évolutions, enjeux et vulnérabilités. Ministère de l’économie, des finances et de la souveraineté industrielle et numérique. Available online: https://www.tresor.economie.gouv.fr/Articles/2019/01/24/panorama-du-systeme-financier-japonais-evolutions-enjeux-et-vulnerabilites (accessed on 16 February 2021).

- Efobi, Uchenna, Ibukun Beecroft, and Evans Osabuohien. 2014. Access to and use of bank services in Nigeria: Micro-econometric evidence. Review of Development Finance 4: 104–14. [Google Scholar] [CrossRef]

- Elsayed, Abdullah. 2020. The Interrelationship between Financial Inclusion, Financial Stability, Financial Integrity and Consumer Protection (I-SIP Theory). Available online: http://dx.doi.org/10.2139/ssrn.3745874 (accessed on 12 February 2021).

- Financial Action Task Force. 2011. Annual Report 2011–2012. Available online: file:///C:/Users/MDPI/Downloads/FATF%20annual%20report%202011%202012%20website.pdf (accessed on 12 February 2021).

- Fungáčová, Zuzana, and Laurent Weill. 2015. Understanding Financial Inclusion in China. BOFIT Discussion Papers, No. 10/2014. Helsinki: Bank of Finland, Institute for Economies in Transition (BOFIT). ISBN 978-952-6699-80-6. Available online: https://nbn-resolving.de/urn:NBN:fi:bof-201408072217 (accessed on 8 April 2021).

- Gupte, Rajani, Bhama Venkataramani, and Deepa Gupta. 2012. Computation of financial inclusion index for India. Procedia—Social and Behavioral Sciences 37: 133–49. [Google Scholar] [CrossRef]

- Hair, Joseph F. 2009. Multivariate Data Analysis. Edited by Joseph F. Hair. Hoboken: Prentice Hall. [Google Scholar]

- Huang, Youxing, and Yan Zhang. 2019. Financial inclusion and urban–rural income inequality: Long-run and short-run relationships. Emerging Markets Finance and Trade 56: 457–71. [Google Scholar] [CrossRef]

- International Monetary Fund. 2019. Financial Access Survey Portal. Washington, DC: IMF Data. [Google Scholar]

- Jacoby, Hanan G. 1994. Borrowing Constraints and Progress through School: Evidence from Peru. The Review of Economics and Statistics 76: 151–60. [Google Scholar] [CrossRef]

- Jungo, João, Mara Madaleno, and Anabela Botelho. 2022. The Effect of Financial Inclusion and Competitiveness on Financial Stability: Why Financial Regulation Matters in Developing Countries? Journal of Risk and Financial Management 15: 122. [Google Scholar] [CrossRef]

- Kabakova, Oksana, and Evgeny Plaksenkov. 2018. Analysis of factors affecting financial inclusion: Ecosystem view. Journal of Business Research 89: 198–205. [Google Scholar] [CrossRef]

- Kaiser, Henry F. 1960. The application of electronic computers to factor analysis. Educational and Psychological Measurement 20: 141–51. [Google Scholar] [CrossRef]

- Kempson, Elaine, and Sharon Collard. 2012. Developing a Vision for Financial Inclusion. Bristol: University of Bristol for Friends Provident Foundation. Available online: https://www.bristol.ac.uk/media-library/sites/geography/migrated/documents/pfrc1205.pdf (accessed on 12 February 2021).

- Kempson, Elaine, Adele Atkinson, and Odile Pilley. 2006. Policy Level Response to Financial Exclusion in Developed Economies. Report of Personal Finance Research Centre, University of Bristol. Available online: http://www.bristol.ac.uk/media-library/sites/geography/migrated/documents/pfrc0410.pdf (accessed on 6 November 2021).

- Khan, H. R. 2011. Financial Inclusion and Financial Stability: Are They Two Sides of the Same Coin. Address by Shri HR Khan, Deputy Governor of the Reserve Bank of India, at BANCON, RBI Monthly Bulletin March 2012. pp. 553–63. Available online: https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/06SPBUL120312.pdf (accessed on 12 February 2021).

- Kithinji, Emily. 2017. Effects of Digital Banking Strategy on Financial Inclusion among Commercial Banks in Kenya. Project Presented in Partial Fulfillment of the Requirements for the Award of the Degree of Master Business Administration. Doctoral dissertation, University of Nairobi, Nairobi, Kenya. [Google Scholar]

- Leeladhar, Vivek. 2006. Taking banking services to the common man-financial inclusion. Reserve Bank of India Bulletin 60: 73–77. [Google Scholar]

- Neaime, Simon, and Isabelle Gaysset. 2018. Financial inclusion and stability in MENA: Evidence from poverty and inequality. Finance Research Letters 24: 230–37. [Google Scholar] [CrossRef]

- Nguyen, Thi Truc Huong. 2020. Measuring financial inclusion: A composite FI index for the developing countries. Journal of Economics and Development 23: 77–99. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2020. Theories of Financial Inclusion. In Uncertainty and Challenges in Contemporary Economic Behaviour (Emerald Studies in Finance, Insurance, and Risk Management). Edited by Ercan Özen and Simon Grima. Bingley: Emerald Publishing Limited, pp. 89–115. [Google Scholar] [CrossRef]

- Park, Cyn-Young, and Rogelio Mercado. 2015. Financial Inclusion, Poverty, and Income Inequality in Developing Asia. Asian Development Bank Economics Working Paper Series, No. 426. Available online: https://ssrn.com/abstract=2558936 (accessed on 26 January 2021).

- Park, Cyn-Young, and Rogelio Mercado, Jr. 2018. Financial inclusion, poverty, and income inequality. The Singapore Economic Review 63: 185–206. [Google Scholar] [CrossRef]

- Pras, Bernard, Yves Evrard, and Elyette Roux. 2003. MARKET: Etudes et Recherches en Marketing, Fondements, Méthodes, 3rd ed. Paris: Dunod, p. 699. [Google Scholar]

- Saha, Mallika, and Kumar Debasis Dutta. 2022. Revisiting financial inclusion-stability nexus: Cross-country heterogeneity. Journal of Financial Economic Policy 14: 713–42. [Google Scholar] [CrossRef]

- Sanderson, Abel, Learnmore Mutandwa, and Pierre Le Roux. 2018. A review of determinants of financial inclusion. International Journal of Economics and Financial Issues 8: 1–8. [Google Scholar]

- Sarma, Mandira. 2008. Index of Financial Inclusion. Working Paper No. 215, Indian Council for Research on International Economic Relations (ICRIER), New Delhi. Available online: http://hdl.handle.net/10419/176233 (accessed on 3 March 2021).

- Sarma, Mandira. 2012. Index of Financial Inclusion—A Measure of Financial Sector Inclusiveness. Working Paper No. 07. Delhi: Centre for International Trade and Development, School of International Studies Jawaharlal Nehru University, June. [Google Scholar]

- Sarma, Mandira. 2015. Measuring financial inclusion. Economics Bulletin 35: 604–11. [Google Scholar]

- Sarma, Mandira. 2016. Measuring financial inclusion for Asian economies. In Financial Inclusion in Asia. London: Palgrave Macmillan, pp. 3–34. [Google Scholar]

- Sarma, Mandira, and Jesim Pais. 2011. Financial inclusion and development. Journal of International Development 23: 613–28. [Google Scholar] [CrossRef]

- Serrao, Manohar Vincent, Aloysius Henry Sequeira, and Basil Hans. 2012. Designing a Methodology to Investigate Accessibility and Impact of Financial Inclusion. Household finance e-journal-CMBO. Available online: https://ssrn.com/abstract=2025521 (accessed on 27 November 2020).

- Siddik, Md, Nur Alam, and Sajal Kabiraj. 2018. Does financial inclusion induce financial stability? Evidence from cross-country analysis. Australasian Accounting, Business and Finance Journal 12: 34–46. [Google Scholar]

- The World Bank Annual Report. 2008. Year in Review, World Bank Document. Available online: http://hdl.handle.net/10986/7524 (accessed on 27 December 2020).

- Tomilova, Olga, and Myra Valenzuela. 2018. Financial Inclusion + Stability, Integrity, and Protection (ISIP). Policy Making for an Inclusive Financial System. Technical Guide. Washington, DC: CGAP, April, Available online: https://www.cgap.org/sites/default/files/publications/Technical-Guide-ISIP-Policy-Making-Nov-2018.pdf (accessed on 22 December 2021).

- Uddin, Ajim, Mohammad Ashraful Ferdous Chowdhury, and Md Nazrul Islam. 2017. Determinants of financial inclusion in Bangladesh: Dynamic GMM & quantile regression approach. The Journal of Developing Areas 51: 221–37. [Google Scholar]

- Van, Loan Thi-Hong, Anh The Vo, Nhan Thien Nguyen, and Duc Hong Vo. 2021. Financial inclusion and economic growth: An international evidence. Emerging Markets Finance and Trade 57: 239–63. [Google Scholar] [CrossRef]

- Yangdol, Rigzin, and Mandira Sarma. 2019. Demand-side factors for financial inclusion: A cross-country empirical analysis. International Studies 56: 163–85. [Google Scholar] [CrossRef]

- Zins, Alexandra, and Laurent Weill. 2016. The determinants of financial inclusion in Africa. Review of Development Finance 6: 46–57. [Google Scholar] [CrossRef]

| Measurement Methods | Author(s) | Dimensions | Measures |

|---|---|---|---|

| Principal component analysis | Jungo et al. (2022) | Access |

|

| Usage |

| ||

| Principal component analysis | Nguyen (2020) | Availability |

|

| Access |

| ||

| Usage |

| ||

| Principal component analysis | Avom et al. (2021) | Availability |

|

| Access |

| ||

| Usage |

| ||

| Three panel cointegration methods: the mean group (MG) estimator; the fixed-effects (FE) approach of the generalized method of moments; and the pooled mean group (PMG) estimator | Huang and Zhang (2019) | Availability |

|

| Access |

| ||

| Usage |

| ||

| Sarma’s methodology (Sarma 2008) | Park and Mercado (2015, 2018) | Availability |

|

| Usage |

| ||

| Principal component analysis | Camara and Tuesta (2014) | Access |

|

| Usage |

| ||

| Barriers |

| ||

| Combining the approaches of Sarma (2008) and Park and Mercado (2015) | Van et al. (2021) | Availability |

|

| Usage |

| ||

| Multidimensional approach of dimensions similar to the implemented human development index | Sarma (2008, 2012, 2015, 2016) | Availability |

|

| Access |

| ||

| Usage |

|

| Acronym | Definitions | |

|---|---|---|

| Availability | Number of bank branches per 100,000 adults | |

| Number of automated teller machines (ATMs) per 100,000 adults | ||

| BrKmsq | Number of bank branches per 1000 km2 | |

| ATMsKmsq | km2 | |

| Access | Number of deposit accounts at commercial banks per 1000 adults | |

| Number of loans accounts at commercial banks per 1000 adults | ||

| Number of debit cards per 1000 adults | ||

| Number of credit cards per 1000 adults | ||

| Urban population as a percentage of the total population | ||

| Usage | Outstanding number of deposits with commercial banks as a % of GDP | |

| Outstanding loans from commercial banks as a percentage of GDP | ||

| Number of depositors at commercial banks per 1000 adults | ||

| Number of borrowers at commercial banks per 1000 adults | ||

| α, β, λ and | Parameters to be estimated and the error term |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Brchkmsq | 1.0000 | ||||||||||||

| bradults | 0.8419 | 1.0000 | |||||||||||

| ATMskmsq | 0.9304 | 0.7200 | 1.0000 | ||||||||||

| ATMsadults | 0.4262 | 0.6204 | 0.4513 | 1.0000 | |||||||||

| depositors | 0.2419 | 0.4332 | 0.2998 | 0.6396 | 1.0000 | ||||||||

| depacct | 0.2812 | 0.4588 | 0.3439 | 0.6454 | 0.8709 | 1.0000 | |||||||

| borrowers | 0.2574 | 0.4629 | 0.3168 | 0.7131 | 0.6706 | 0.6938 | 1.0000 | ||||||

| loanacct | 0.1829 | 0.3921 | 0.2275 | 0.6552 | 0.5147 | 0.6277 | 0.8103 | 1.0000 | |||||

| Ostdep | 0.4585 | 0.4295 | 0.4805 | 0.3199 | 0.2473 | 0.3533 | 0.3516 | 0.2877 | 1.0000 | ||||

| Ostloan | 0.2126 | 0.3098 | 0.2496 | 0.3779 | 0.2867 | 0.4408 | 0.4984 | 0.4534 | 0.8081 | 1.0000 | |||

| creditcards | 0.1288 | 0.2095 | 0.1553 | 0.4907 | 0.3791 | 0.4147 | 0.5556 | 0.6016 | 0.0438 | 0.1359 | 1.0000 | ||

| debitcards | 0.1609 | 0.3187 | 0.2496 | 0.6480 | 0.6332 | 0.7186 | 0.7099 | 0.7100 | 0.1393 | 0.2847 | 0.5839 | 1.0000 | |

| Urban | 0.2798 | 0.3012 | 0.2933 | 0.4957 | 0.3909 | 0.4232 | 0.5068 | 0.5390 | 0.3169 | 0.2949 | 0.4856 | 0.4701 | 1.0000 |

| Average inter-item covariance | 0.0090072 |

| Number of items in the scale | 13 |

| Scale reliability coefficient | 0.8993 |

| Variable | KMO Index |

|---|---|

| Zbrchkm2 | 0.6196 |

| Zbrchadults | 0.7338 |

| ZATMskm2 | 0.6973 |

| ZATMsad | 0.9243 |

| Zdepositors | 0.7420 |

| Zdepaccts | 0.7926 |

| Zborrowers | 0.8660 |

| Zloanaccts | 0.8301 |

| Zoutsdepo | 0.7605 |

| Zoutstloans | 0.7782 |

| Zcreditcards | 0.8644 |

| Zdebcards | 0.8177 |

| Zurban | 0.8816 |

| Overall | 0.7903 |

| Augmented Dickey–Fuller | Phillips–Perron | KPSS | ||||

|---|---|---|---|---|---|---|

| T-Statistic | p-Value | Adj. t-Stat | Prob. | LM-Stat | ||

| Levels | ZBradlt | −5.269391 | 0.0000 *** | −7.589819 | 0.0000 *** | 0.173505 *** |

| ZATMsadlt | −5.548075 | 0.0000 *** | −6.617165 | 0.0000 *** | 0.096288 ** | |

| ZBrkmsq | −5.183138 | 0.0000 *** | −6.746831 | 0.0000 *** | 0.250556 *** | |

| ZATMKmsq | −1.88891 | 0.3378 | −3.918081 | 0.0020 *** | 0.246573 *** | |

| −7.976820 | 0.0000 *** | −7.916892 | 0.0000 *** | 0.096703 ** | ||

| Zloanaccts | −7.401598 | 0.0000 *** | −7.414708 | 0.0000 *** | 0.332711 *** | |

| Zdebcards | −10.11128 | 0.0000 *** | −10.26076 | 0.0000 *** | 0.139693 *** | |

| Zcredcards | −8.165019 | 0.0000 *** | −8.781089 | 0.0000 *** | 0.092385 ** | |

| Zurban | −6.610992 | 0.0000 *** | −8.304249 | 0.0000 *** | 0.141241 *** | |

| Zostdeps | −6.998931 | 0.0000 *** | −7.582518 | 0.0000 *** | 0.335466 *** | |

| Zostloans | −6.290706 | 0.0000 *** | −7.106409 | 0.0000 *** | 0.274875 *** | |

| Zdepositors | −4.615369 | 0.0001 *** | −4.625274 | 0.0001 *** | 0.180918 *** | |

| Zborrowres | −4.680450 | 0.0001 *** | −5.058596 | 0.0000 *** | 0.071047 ** | |

| 1st diff | DZATMKmsq | −33.26622 | 0.0000 *** | - | - | - |

| Component | Eigenvalue | Difference | Proportion | Cumulative |

|---|---|---|---|---|

| Availability—Estimate Yav | ||||

| Comp1 | 2.65242 | 1.96284 | 0.6631 | 0.6631 |

| Comp2 | 0.689578 | 0.10835 | 0.1724 | 0.8355 |

| Comp3 | 0.581226 | 0.50445 | 0.1453 | 0.9808 |

| Comp4 | 0.076776 | . | 0.0192 | 1.0000 |

| Accessibility—Estimate Yac | ||||

| Comp1 | 3.23939 | 2.45449 | 0.6479 | 0.6479 |

| Comp2 | 0.78489 | 0.260911 | 0.1570 | 0.8049 |

| Comp3 | 0.52398 | 0.27444 | 0.1048 | 0.9097 |

| Comp4 | 0.24954 | 0.047335 | 0.0499 | 0.9596 |

| Comp5 | 0.202205 | . | 0.0404 | 1.0000 |

| Usage—Estimate Yu | ||||

| Comp1 | 2.57587 | 1.65649 | 0.6440 | 0.6440 |

| Comp2 | 0.919381 | 0.596009 | 0.2298 | 0.8738 |

| Comp3 | 0.323372 | 0.141992 | 0.0808 | 0.9547 |

| Comp4 | 0.18138 | . | 0.0453 | 1.0000 |

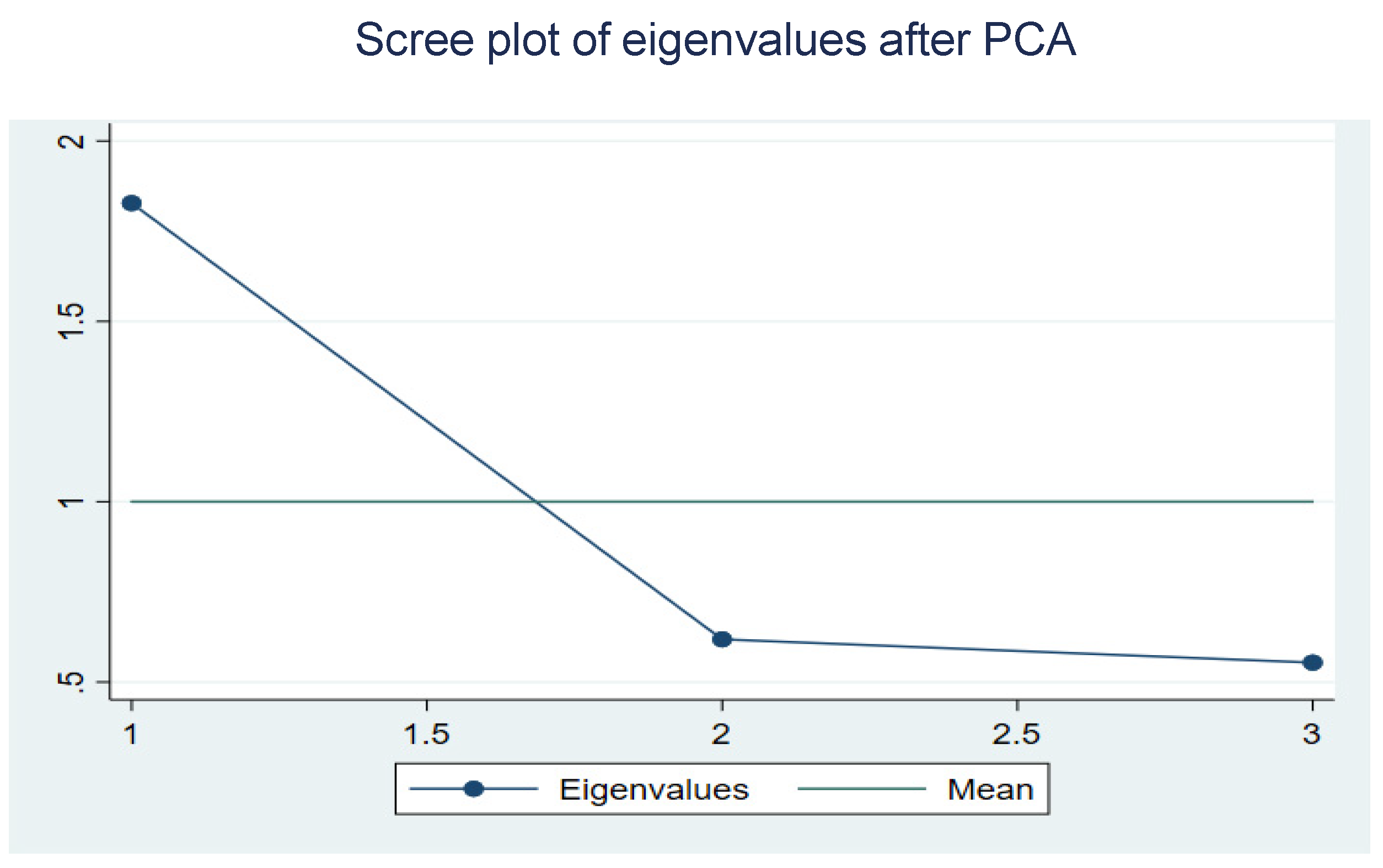

| Component | Eigenvalue | Difference | Proportion | Cumulative |

|---|---|---|---|---|

| Comp1 | 1.82752 | 1.20887 | 0.6092 | 0.6092 |

| Comp2 | 0.618649 | 0.0648187 | 0.2062 | 0.8154 |

| Comp3 | 0.55383 | 0.1846 | 1.0000 |

| Variable | KMO Index |

|---|---|

| Zavailability | 0.6474 |

| Zaccessibility | 0.6638 |

| Zusage | 0.6830 |

| Overall | 0.6636 |

| Variable | Comp1 |

|---|---|

| Zavailability | 0.5903 |

| Zaccessibility | 0.5772 |

| Zusage | 0.5642 |

| Countries | FIIndex | Ranks | Countries | FIIndex | Ranks |

|---|---|---|---|---|---|

| San Marino | 0.51712754 | 1 | Trinidad and Tobago | 0.17707082 | 47 |

| Japan | 0.50633249 | 2 | Suriname | 0.17267126 | 48 |

| Malta | 0.4011762 | 3 | Republic of Kosova | 0.16972084 | 49 |

| Poland | 0.36079909 | 4 | Philippines | 0.16956373 | 50 |

| Republic of Korea | 0.3607197 | 5 | El Salvador | 0.16826297 | 51 |

| Spain | 0.35807149 | 6 | Dominican Republic | 0.16805977 | 52 |

| Belgium | 0.32684518 | 7 | Jamaica | 0.16413421 | 53 |

| Estonia | 0.31840065 | 8 | Jordan | 0.16389441 | 54 |

| Portugal | 0.3150422 | 9 | Honduras | 0.16361695 | 55 |

| Italy | 0.30004884 | 10 | Bolivia | 0.16278091 | 56 |

| Lebanon | 0.29977184 | 11 | West Bank and Gaza | 0.16246099 | 57 |

| The Netherlands | 0.28214496 | 12 | Peru | 0.16228444 | 58 |

| Croatia | 0.2762500 | 13 | Namibia | 0.15579956 | 59 |

| Cyprus | 0.27401804 | 14 | Mozambique | 0.1546327 | 60 |

| Turkey | 0.2631012 | 15 | Indonesia | 0.14936201 | 61 |

| Iceland | 0.26175415 | 16 | Nepal | 0.14759658 | 62 |

| Bulgaria | 0.25818204 | 17 | Botswana | 0.14423108 | 63 |

| Brunei Darussalam | 0.25547694 | 18 | Azerbaijan | 0.14314418 | 64 |

| Costa Rica | 0.25171711 | 19 | India | 0.14054968 | 65 |

| China: Mainland | 0.25097494 | 20 | Lao People’s Democratic Republic | 0.14009326 | 66 |

| Chile | 0.25089021 | 21 | Paraguay | 0.13942224 | 67 |

| Greece | 0.25040516 | 22 | Kenya | 0.13610072 | 68 |

| Latvia | 0.24859421 | 23 | Nicaragua | 0.13436375 | 69 |

| Malaysia | 0.24839941 | 24 | Ghana | 0.13204394 | 70 |

| Mauritius | 0.24659766 | 25 | Samoa | 0.13131248 | 71 |

| United Arab Emirates | 0.24266296 | 26 | Ecuador | 0.13103669 | 72 |

| Seychelles | 0.2416201 | 27 | Egypt | 0.1264063 | 73 |

| Thailand | 0.24125155 | 28 | Bangladesh | 0.1151103 | 74 |

| Brazil | 0.22401967 | 29 | Tajikistan | 0.11341355 | 75 |

| North Macedonia | 0.22296472 | 30 | Cambodia | 0.11300767 | 76 |

| Hungary | 0.21935949 | 31 | Chad | 0.08407547 | 77 |

| Georgia | 0.21875586 | 32 | Solomon Islands | 0.07220478 | 78 |

| Montenegro | 0.2118795 | 33 | Uganda | 0.07177104 | 79 |

| Colombia | 0.20719921 | 34 | Haiti | 0.06889847 | 80 |

| Mauritania | 0.20487232 | 35 | Zimbabwe | 0.06788513 | 81 |

| Mongolia | 0.20179991 | 36 | Islamic Republic of Afghanistan | 0.06530299 | 82 |

| Argentina | 0.19388903 | 37 | Democratic Republic of the Congo | 0.06520064 | 83 |

| Maldives | 0.19083875 | 38 | Pakistan | 0.0621416 | 84 |

| Panama | 0.18801858 | 39 | Lesotho | 0.05976429 | 85 |

| Bosnia and Herzegovina | 0.18573008 | 40 | Zambia | 0.05675106 | 86 |

| Saudi Arabia | 0.18394895 | 41 | Cameroon | 0.05528427 | 87 |

| Moldova | 0.18200412 | 42 | Myanmar | 0.04928665 | 88 |

| Ukraine | 0.18167949 | 43 | Comoros | 0.03677993 | 89 |

| Belize | 0.18148433 | 44 | Rwanda | 0.02435577 | 90 |

| Armenia | 0.18094603 | 45 | Madagascar | 0.02074834 | 91 |

| Albania | 0.1789745 | 46 |

| ZFIIndex | ||

|---|---|---|

| ZFIIndex | Pearson Correlation | 1 |

| Account | Pearson Correlation | 0.777 ** |

| Sig. (bilateral) | 0.000 | |

| Savings | Pearson Correlation | 0.621 ** |

| Sig. (bilateral) | 0.000 | |

| ZFIIndex | ||

|---|---|---|

| ZFIIndex | Pearson Correlation | 1 |

| Literacy rate | Pearson Correlation | 0.573 ** |

| Sig. (bilateral) | 0.000 | |

| POV | Pearson Correlation | −0.729 ** |

| Sig. (bilateral) | 0.000 | |

| RIRR | Pearson Correlation | −0.132 ** |

| Sig. (bilateral) | 0.000 | |

| GINI | Corrélation de Pearson | −0.372 ** |

| Sig. (bilatérale) | 0.000 | |

| EMP | Corrélation de Pearson | 0.280 ** |

| Sig. (bilatérale) | 0.000 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gharbi, I.; Kammoun, A. Developing a Multidimensional Financial Inclusion Index: A Comparison Based on Income Groups. J. Risk Financial Manag. 2023, 16, 296. https://doi.org/10.3390/jrfm16060296

Gharbi I, Kammoun A. Developing a Multidimensional Financial Inclusion Index: A Comparison Based on Income Groups. Journal of Risk and Financial Management. 2023; 16(6):296. https://doi.org/10.3390/jrfm16060296

Chicago/Turabian StyleGharbi, Inès, and Aïda Kammoun. 2023. "Developing a Multidimensional Financial Inclusion Index: A Comparison Based on Income Groups" Journal of Risk and Financial Management 16, no. 6: 296. https://doi.org/10.3390/jrfm16060296

APA StyleGharbi, I., & Kammoun, A. (2023). Developing a Multidimensional Financial Inclusion Index: A Comparison Based on Income Groups. Journal of Risk and Financial Management, 16(6), 296. https://doi.org/10.3390/jrfm16060296