Asymmetric Price Transmission between Crude Oil and the US Gasoline Market

Abstract

1. Introduction

2. Methods

3. Data

4. Results and Discussion

4.1. Granger Causality Test

4.2. Pass-Through of Crude Oil Prices to Regular Gasoline Prices

4.3. Pass-Through of Crude Oil Prices to Premium Gasoline Prices

4.4. Policy Implications

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | The alternative approach is the nonlinear autoregressive distributed lag (NARDL) model proposed by (Shin et al. 2014) for modeling asymmetric cointegration. The NARDL model has been used for asymmetry analysis in commodity and stock markets, for example, (Atil et al. 2014), (Kumar 2017), (Sadik-Zada and Niklas 2021). |

| 2 | A stable long-run relationship is required to estimate the ECM. First, the augmented Dickey–Fullerunit root tests (Dickey and Fuller 1979) on the price of gasoline and the price of crude oil strongly indicate that each series is integrated of order one for all datasets. As a second step, the Johansen cointegration test (Johansen 1988) is used to test for the number of cointegrating relations. The test statistics strongly indicate one cointegrating equation between all variables. As a last step, we test the hypothesis that the residuals are not stationary. In all cases, this hypothesis is rejected. Therefore, all variables are cointegrated, and Equation (1) represents a stable long-run relationship. |

| 3 | The Schwarz information criterion (Schwarz 1978) is used to determine the number of lags in each specification. Based on the SIC, two lags have been selected for both increases and decreases in the crude oil price and increases and decreases in retail gasoline price at the national level and in the state of New York. However, the optimal number of lags varies across other states, as can be seen in Table 2 and Table 3. |

| 4 | The data of gasoline price series for other states were either suspended in 2011 or were inconsistent. |

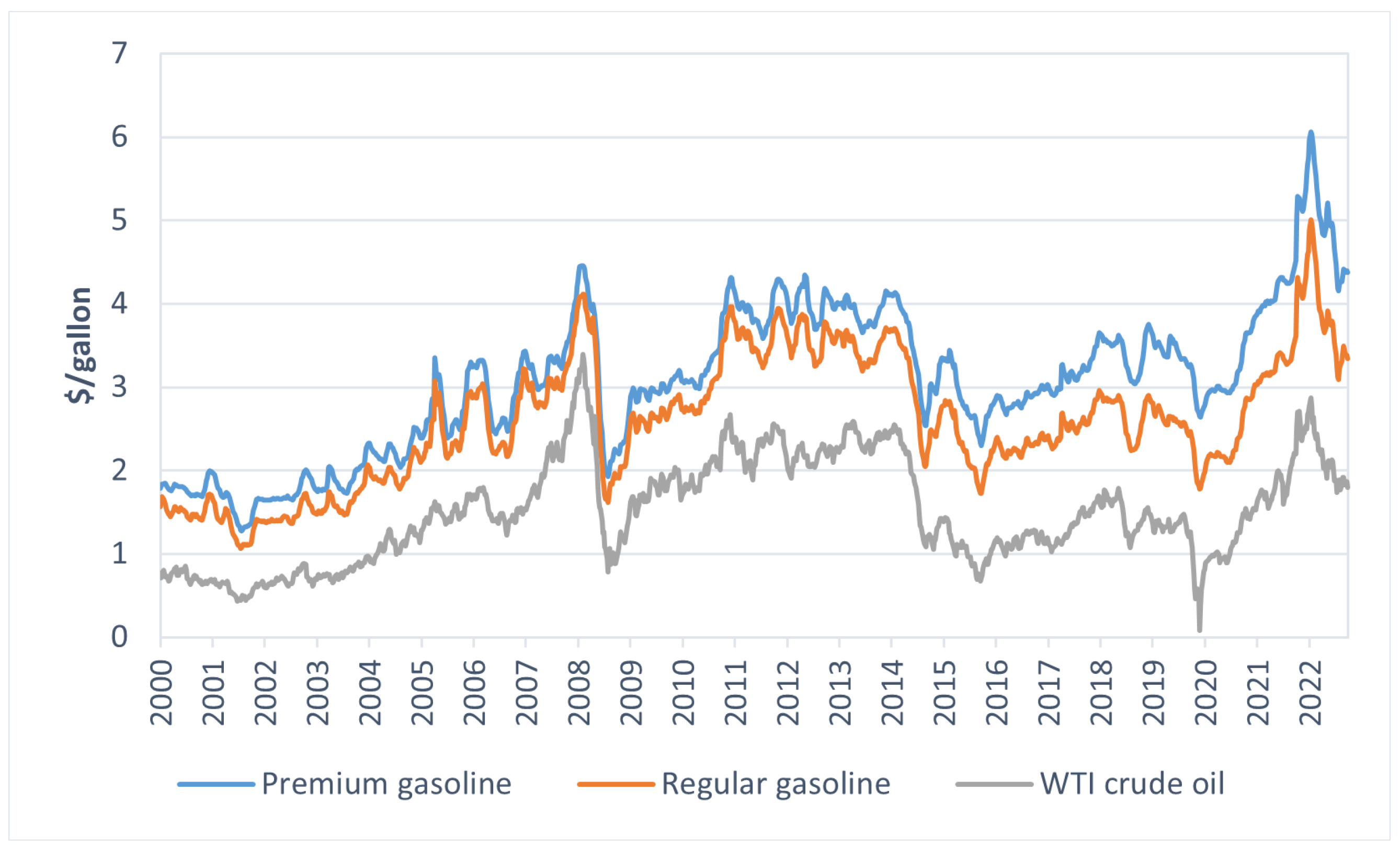

| 5 | Source: Energy Information Administration. |

References

- Atil, Ahmed, Amine Lahiani, and Duc Khuong Nguyen. 2014. Asymmetric and nonlinear pass-through of crude oil prices to gasoline and natural gas prices. Energy Policy 65: 567–73. [Google Scholar] [CrossRef]

- Bachmeier, Lance J., and James M. Griffin. 2003. New evidence on asymmetric gasoline price responses. Review of Economics and Statistics 85: 772–76. [Google Scholar] [CrossRef]

- Bacon, Robert W. 1991. Rockets and feathers: The asymmetric speed of adjustment of UK retail gasoline prices to cost changes. Energy Economics 13: 211–18. [Google Scholar] [CrossRef]

- Bagnai, Alberto, and Christian Alexander Mongeau Ospina. 2018. Asymmetries, outliers and U.K.ructural stability in the US gasoline market. Energy Economics 69: 250–60. [Google Scholar] [CrossRef]

- Bettendorf, Leon, Stéphanie A. Van der Geest, and Marco Varkevisser. 2003. Price asymmetry in the Dutch retail gasoline market. Energy Economics 25: 669–89. [Google Scholar] [CrossRef]

- Borenstein, Severin, A. Colin Cameron, and Richard Gilbert. 1997. Do gasoline prices respond asymmetrically to crude oil price changes? The Quarterly Journal of Economics 112: 305–39. [Google Scholar] [CrossRef]

- Boroumand, Raphaël Homayoun, Stéphane Goutte, Simon Porcher, and Thomas Porcher. 2016. Asymmetric evidence of gasoline price responses in France: A Markov-switching approach. Economic Modelling 52: 467–76. [Google Scholar] [CrossRef]

- Bremmer, Dale S., and Randall G. Kesselring. 2016. The relationship between U.S. retail gasoline and crude oil prices during the Great Recession: “rockets and feathers” or “balloons and rocks” behavior? Energy Economics 55: 200–10. [Google Scholar] [CrossRef]

- Chen, Hao, and Zesheng Sun. 2021. International crude oil price, regulation and asymmetric response of China’s gasoline price. Energy Economics 94: 105049. [Google Scholar] [CrossRef]

- Chou, Kuo-Wei, and Yi-Heng Tseng. 2016. Oil prices, exchange rate, and the price asymmetry in the Taiwanese retail gasoline market. Economic Modelling 52: 733–41. [Google Scholar] [CrossRef]

- Contín-Pilart, Ignacio, Aad F. Correljé, and M. Blanca Palacios. 2009. Competition, regulation, and pricing behavior in the Spanish retail gasoline market. Energy Policy 37: 219–28. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Eckert, Andrew, and Douglas S. West. 2004. Retail gasoline price cycles across spatially dispersed gasoline stations. Journal of Law and Economics 47: 245–73. [Google Scholar] [CrossRef]

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and error correction: Representation, estimation and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Galeotti, Marzio, Alessandro Lanza, and Matteo Manera. 2003. Rockets and feathers revisited: An international comparison on European gasoline markets. Energy Economics 25: 175–90. [Google Scholar] [CrossRef]

- Godby, Rob, Anastasia M. Lintner, Thanasis Stengos, and Bo Wandschneider. 2000. Testing for asymmetric pricing in the Canadian retail gasoline market. Energy Economics 22: 349–68. [Google Scholar] [CrossRef]

- Granger, Clive W. J. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society, 424–38. [Google Scholar] [CrossRef]

- Honarvar, Afshin. 2009. Asymmetry in retail gasoline and crude oil price movements in the United States: An application of hidden cointegration technique. Energy Economics 31: 395–402. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of co-integrating vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Johnson, Ronald N. 2002. Search costs, lags and prices at the pump. Review of Industrial Organization 20: 33–50. [Google Scholar] [CrossRef]

- Kumar, Satish. 2017. On the nonlinear relation between crude oil and gold. Resources Policy 51: 219–24. [Google Scholar] [CrossRef]

- Le, Thai-Ha, Sabri Boubaker, Manh Tien Bui, and Donghyun Park. 2023. On the volatility of WTI crude oil prices: A time-varying approach with stochastic volatility. Energy Economics 117: 106474. [Google Scholar] [CrossRef]

- Lewis, Matthew, and Michael Noel. 2011. The speed of gasoline price response in markets with and without Edgeworth cycles. The Review of Economics and Statistics 93: 672–82. [Google Scholar] [CrossRef]

- Lloyd, Tim A., Steve McCorriston, C. Wyn Morgan, Anthony J. Rayner, and Habtu T. Weldegebriel. 2006. Market power in U.K. food retailing: Theory and evidence from seven product groups. Paper presented at 2006 Annual Meeting, Sydney, QLD, Australia, August 12–18. [Google Scholar]

- Lutkepohl, Helmut. 1991. Introduction to Multiple Time Series Analysis. Berlin: Springer. [Google Scholar]

- McCorriston, Stephen, Christopher W. Morgan, and Anthony J. Rayner. 2001. Price transmission: The interaction between market power and returns to scale. European Review of Agricultural Economics 28: 143–59. [Google Scholar] [CrossRef]

- Noel, Michael D. 2019. Calendar synchronization of gasoline price increases. Journal of Economics & Management Strategy 28: 355–70. [Google Scholar]

- Peltzman, Sam. 2000. Prices rise faster than they fall. Journal of Political Economy 108: 466–502. [Google Scholar] [CrossRef]

- Sadik-Zada, Elkhan Richard, and Britta Niklas. 2021. Business cycles and alcohol consumption: Evidence from a nonlinear panel ARDL approach. Journal of Wine Economics 16: 429–38. [Google Scholar] [CrossRef]

- Schwarz, Gideon. 1978. Estimating the dimension of a model. The Annals of Statistics 6: 461–64. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2014. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications. New York: Springer, pp. 281–314. [Google Scholar]

- Zimmerman, Paul R., John M. Yun, and Christopher T. Taylor. 2013. Edgeworth price cycles in gasoline: Evidence from the United States. Review of Industrial Organization 42: 297–320. [Google Scholar] [CrossRef]

| Variables | Obs | Mean | Std.Dev. | Min | Max | |

|---|---|---|---|---|---|---|

| USA | Regular gasoline (USD/gallon) | 1187 | 2.597 | 0.772 | 1.059 | 5.006 |

| Premium gasoline (USD/gallon) | 1187 | 3.067 | 0.886 | 1.279 | 6.064 | |

| California | Regular gasoline (USD/gallon) | 1187 | 3.092 | 0.949 | 1.100 | 6.271 |

| Premium gasoline (USD/gallon) | 1187 | 3.332 | 0.980 | 1.302 | 6.643 | |

| Florida | Regular gasoline (USD/gallon) | 1187 | 2.545 | 0.742 | 1.037 | 4.852 |

| Premium gasoline (USD/gallon) | 1187 | 2.911 | 0.815 | 1.238 | 5.524 | |

| New York | Regular gasoline (USD/gallon) | 1187 | 2.728 | 0.792 | 1.165 | 4.938 |

| Premium gasoline (USD/gallon) | 1187 | 3.069 | 0.850 | 1.358 | 5.593 | |

| Texas | Regular gasoline (USD/gallon) | 1187 | 2.400 | 0.735 | 0.996 | 4.642 |

| Premium gasoline (USD/gallon) | 1187 | 2.758 | 0.787 | 1.178 | 5.285 | |

| WTI crude oil price (USD/barrel) | 1187 | 63.218 | 25.889 | 3.320 | 142.520 |

| Null Hypothesis | F-Statistic | p-Value |

|---|---|---|

| Crude oil prices do not Granger cause regular gasoline prices | 29.471 *** | 0.0000 |

| Regular gasoline prices do not Granger cause crude oil prices | 1.935 | 0.5134 |

| Crude oil prices do not Granger cause premium gasoline prices | 32.184 *** | 0.0000 |

| Premium gasoline prices do not Granger cause crude oil prices | 2.066 | 0.5325 |

| Variable | USA | California | Florida | New York | Texas |

|---|---|---|---|---|---|

| 1.123 *** | 0.771 *** | 1.142 *** | 0.974 ** | 1.328 *** | |

| (0.066) | (0.071) | (0.842) | (0.076) | (0.089) | |

| 0.734 *** | 0.506 *** | 0.770 ** | 0.649 ** | 0.812 ** | |

| (0.068) | (0.089) | (0.071) | (0.088) | (0.101) | |

| 0.248 ** | 0.105 | 0.137 ** | 0.226 ** | 0.352 * | |

| (0.063) | (0.071) | (0.078) | (0.064) | (0.079) | |

| 0.207 ** | 0.129 ** | 0.126 ** | 0.178 * | −0.282 | |

| (0.065) | (0.074) | (0.075) | (0.092) | (0.066) | |

| 0.003 * | 0.003 | 0.025 ** | 0.016 * | ||

| (0.081) | (0.06) | (0.089) | (0.098) | ||

| 0.005 * | 0.013 | 0.065 ** | 0.025 * | ||

| (0.041) | (0.02) | (0.045) | (0.052) | ||

| 0.033 ** | |||||

| (0.013) | |||||

| 0.014 *** | |||||

| (0.011) | |||||

| 0.144 *** | 0.341 *** | 0.028 * | 0.295 ** | 0.193 ** | |

| (0.034) | (0.029) | (0.036) | (0.034) | (0.038) | |

| 0.342 *** | 0.501** | 0.214 ** | 0.457 *** | 0.203 * | |

| (0.071) | (0.069) | (0.067) | (0.069) | (0.063) | |

| 0.083 * | 0.085 ** | 0.027 ** | 0.065 * | −0.072 | |

| (0.031) | (0.034) | (0.036) | (0.033) | (0.037) | |

| 0.115 ** | 0.202 ** | 0.02 | 0.166 * | 0.14 ** | |

| (0.071) | (0.089) | (0.067) | (0.069) | (0.063) | |

| 0.007 ** | |||||

| (0.048) | |||||

| 0.0.092 * | |||||

| (0.044) | |||||

| −0.051 *** | −0.032 * | −0.055 ** | −0.038 ** | −0.061 ** | |

| (0.006) | (0.009) | (0.006) | (0.004) | (0.038) | |

| −0.076 *** | −0.097 ** | −0.085 ** | −0.089 *** | −0.058 *** | |

| (0.013) | (0.008) | (0.019) | (0.01) | (0.016) | |

| 0.657 | 0.585 | 0.527 | 0.531 | 0.682 | |

| = | 3.371 | 2.462 | 2.935 | 3.142 | 4.192 |

| p-value | 0.000 | 0.005 | 0.000 | 0.001 | 0.000 |

| = | 4.217 | 3.514 | 4.163 | 3.772 | 2.966 |

| p-value | 0.005 | 0.000 | 0.012 | 0.004 | 0.235 |

| Variable | USA | California | Florida | New York | Texas |

|---|---|---|---|---|---|

| 1.217 *** | 0.802 ** | 1.281 *** | 1.068 *** | 1.315 *** | |

| (0.016) | (0.016) | (0.02) | (0.014) | (0.019) | |

| 0.744 ** | 0.536 ** | 0.721* | 0.607 ** | 0.701* | |

| (0.008 | (0.009) | (0.011) | (0.008) | (0.01) | |

| −0.044 | −0.006 | 0.04 * | 0.003 | −0.029 | |

| (0.017) | (0.015) | (0.22) | (0.014) | (0.021) | |

| 0.149 *** | 0.102 ** | 0.169 ** | 0.1 *** | 0.221 *** | |

| (0.015) | (0.014) | (0.019) | (0.013) | (0.018) | |

| 0.000 | 0.002 | 0.022 * | −0.1 | −0.001 | |

| (0.001) | (0.01) | (0.013) | (0.009) | (0.012) | |

| −0.015 | 0.009 | 0.069 *** | 0.014 | 0.005 | |

| (0.015) | (0.014) | (0.019) | (0.013) | (0.18) | |

| 0.042 *** | |||||

| (0.015) | |||||

| 0.0588 ** | |||||

| (0.019) | |||||

| 0.278 *** | 0.454 *** | 0.003 | 0.267 *** | 0.168 ** | |

| (0.033) | (0.032) | (0.037) | (0.033) | (0.034) | |

| 0.658 *** | 0.922 ** | 0.708 ** | 0.706 *** | 0.615 *** | |

| (0.059) | (0.068) | (0.07) | (0.074) | (0.068) | |

| 0.11 * | 0.094 ** | −0.021 | −0.005 | −0.065 * | |

| (0.036) | (0.033) | (0.036) | (0.032) | (0.036) | |

| 0.093 | −0.025 | 0.02 | 0.144 ** | 0.05 | |

| (0.056) | (0.067) | (0.066) | (0.071) | (0.060) | |

| 0.038 ** | |||||

| (0.023) | |||||

| 0.020 ** | |||||

| (0.014) | |||||

| −0.031 ** | −0.013 * | −0.038 * | −0.016 * | −0.039 ** | |

| (0.01) | (0.006) | (0.015) | (0.01) | (0.013) | |

| −0.088 ** | −0.129 ** | −0.081 ** | −0.107 *** | −0.053 *** | |

| (0.013) | (0.009) | (0.018) | (0.011) | (0.016) | |

| 0.634 | 0.612 | 0.561 | 0.520 | 0.692 | |

| = | 4.381 | 3.041 | 1.983 | 4.737 | 3.046 |

| p-value | 0.003 | 0.001 | 0.024 | 0.018 | 0.000 |

| = | 5.063 | 4.370 | 3.585 | 3.319 | 3.409 |

| p-value | 0.014 | 0.073 | 0.006 | 0.066 | 0.035 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kamyabi, N.; Chidmi, B. Asymmetric Price Transmission between Crude Oil and the US Gasoline Market. J. Risk Financial Manag. 2023, 16, 326. https://doi.org/10.3390/jrfm16070326

Kamyabi N, Chidmi B. Asymmetric Price Transmission between Crude Oil and the US Gasoline Market. Journal of Risk and Financial Management. 2023; 16(7):326. https://doi.org/10.3390/jrfm16070326

Chicago/Turabian StyleKamyabi, Najmeh, and Benaissa Chidmi. 2023. "Asymmetric Price Transmission between Crude Oil and the US Gasoline Market" Journal of Risk and Financial Management 16, no. 7: 326. https://doi.org/10.3390/jrfm16070326

APA StyleKamyabi, N., & Chidmi, B. (2023). Asymmetric Price Transmission between Crude Oil and the US Gasoline Market. Journal of Risk and Financial Management, 16(7), 326. https://doi.org/10.3390/jrfm16070326