The Role of The Internal Auditor in Strengthening the Governance of Economic Organizations Using the Three Lines of Defense Model

Abstract

:1. Introduction

2. Theoretical Framework and Hypothesis Development

2.1. Three Lines of Defense Model

2.1.1. First Line: Operational Management

2.1.2. Second Line: Risk Management and Compliance Functions

2.1.3. Third Line: Internal Audit

3. Previous Studies

4. Practical Method of Research

4.1. Questionnaire Design

4.2. Participants

5. Data Analysis and Results

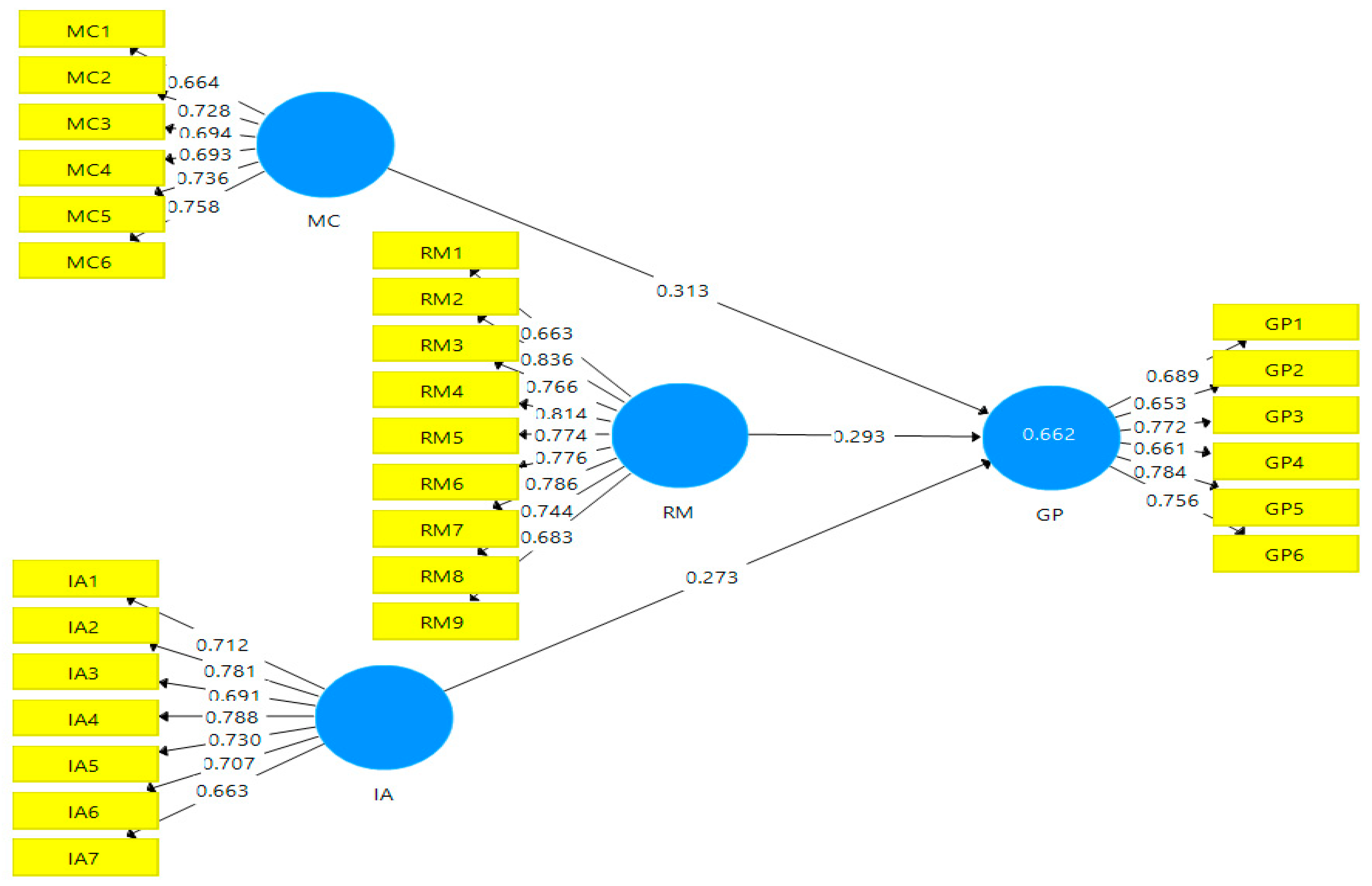

5.1. First Step: Measurement Model Assessment

5.2. Second Step: Structural Model Assessment

6. Discussion

7. Implications

8. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. The Questionnaire

| The scale | ||||||

| No. | Questions | Strongly agree | agree | neutral | disagree | Strongly disagree |

| First axis | The administration is committed to the following procedures | |||||

| 1 | Determine the regulatory requirements for the use of economic resources | |||||

| 2 | Adhere to local legislation when implementing various activities | |||||

| 3 | Adhere to ethical rules when making various decisions | |||||

| 4 | Reviewing the internal control procedures that are put in place within the sub-departments | |||||

| 5 | The administration determines the methods of communication between it and the Board of Directors | |||||

| 6 | The administration is committed to the rules of ethical behaviour in terms of integrity and reviewing the management’s minutes and decisions | |||||

| Second axis | The Board of Directors, through its committees, is committed to: | |||||

| 1 | Reviewing the oversight and supervision reports submitted by the subsidiary departments of the company | |||||

| 2 | Checking contracts with third parties and their compliance with laws | |||||

| 3 | Determine the level of risk that is accepted in the business | |||||

| 4 | Monitor the extent of compliance with the laws and legislation regulating work | |||||

| 5 | Verifying information security policies within the company | |||||

| 6 | Develop and review the company’s quality policies | |||||

| 7 | Reviewing change policies and accompanying control procedures | |||||

| 8 | Placing qualified cadres in sub-units | |||||

| 9 | Setting rules of ethical behavior in terms of integrity and reviewing plans and management decisions | |||||

| Third axis | The company’s internal audit staff has | |||||

| 1 | Provide information to management and communicate with the external auditor | |||||

| 2 | Full independence in his work to carry out his assurance services | |||||

| 3 | The Internal Audit Authority has qualified and sufficient staff to carry out its work and provide its services | |||||

| 4 | Active participation in determining the effectiveness of governance structures and risk management policies | |||||

| 5 | The advice of the internal auditor is sought when important decisions are taken by the Board of Directors | |||||

| 6 | Submitting annual reports showing the results of the internal audit work to the Board of Directors | |||||

| 7 | Periodic reports are submitted in case the auditor encounters obstacles that affect his independence | |||||

| Fourth axis | Governance procedures are described in the company | |||||

| 1 | Existence of a written and effective framework that clarifies the governance procedures within the company | |||||

| 2 | The procedures applied by the company guarantee the rights of all stakeholders fairly | |||||

| 3 | Disclosure of all important information to stakeholders | |||||

| 4 | The duties of management, the board of directors and the internal auditor are clear and non-overlapping | |||||

| 5 | The goals are strategic for the company and the set of values and principles are known to all. | |||||

| 6 | The company’s liability policies are clear | |||||

References

- Aguilera, Ruth V., and Kurt A. Desender. 2012. Challenges in the measuring of comparative corporate governance: A review of the main indices. West Meets East: Building Theoretical Bridges 8: 289–322. [Google Scholar]

- Aguilera, Ruth V., Igor Filatotchev, Howard Gospel, and Gregory Jackson. 2008. An organizational approach to comparative corporate governance: Costs, contingencies, and complementarities. Organization Science 19: 475–92. [Google Scholar]

- Agyemang, Otuo Serebour, Emmanuel Aboagye, and Aaron Yao Ofoe Ahali. 2013. Prospects and Challenges of Corporate Governance in Ghana. International Journal of Scientific and Research Publications 3: 1–9. [Google Scholar]

- Anderson, D. J., and G. Eubanks. 2015. Leveraging COSO Across the Three Defense Lines. Altamonte Springs: The Institute of Internal Auditors Research Foundation (IIARF)). [Google Scholar]

- Bantleon, Ulrich, Anne d’Arcy, Marc Eulerich, Anja Hucke, Burkhard Pedell, and Nicole V.S. Ratzinger-Sakel. 2021. Coordination challenges in implementing the three lines of defense model. International Journal of Auditing 25: 59–74. [Google Scholar] [CrossRef]

- Bäßler, Tim, and Marc Eulerich. 2022. Three Lines 4.0-Predictive Process Monitoring for Internal Audit. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Behrend, Joel, and Marc Eulerich. 2019. The evolution of internal audit research: A bibliometric analysis of published documents (1926–2016). Accounting History Review 29: 103–39. [Google Scholar] [CrossRef]

- Brickley, James A., and Jerold L. Zimmerman. 2010. Corporate governance myths: Comments on Armstrong, Guay and Weber. Journal of Accounting and Economics 50: 235–45. [Google Scholar] [CrossRef]

- Carcello, Joseph V., Marc Eulerich, Adi Masli, and David A. Wood. 2018. The Value to Management of Using the Internal Audit Function as a Management Training Ground. Accounting Horizons 32: 121–40. [Google Scholar] [CrossRef]

- Castrillo, Luis Angel, Sonia Marcos, and Juan Manuel San Martín. 2010. Corporate governance, legal investor protection, and performance in Spain and the United Kingdom. Corporate Ownership and Control 7: 416–29. [Google Scholar] [CrossRef]

- Chambers, Andrew D., and Marjan Odar. 2015. A new vision for internal audit. Managerial Auditing Journal 30: 34–55. [Google Scholar] [CrossRef]

- Christ, Margaret H., Adi Masli, Nathan Y. Sharp, and David A. Wood. 2015. Rotational internal audit programs and financial reporting quality: Do compensating controls help? Accounting, Organizations and Society 44: 37–59. [Google Scholar] [CrossRef]

- Cohen, Jacob. 1988. Set correlation and contingency tables. Applied Psychological Measurement 12: 425–34. [Google Scholar] [CrossRef] [Green Version]

- Davies, Howard, and Maria Zhivitskaya. 2018. Three lines of defence: A robust organising framework, or just lines in the sand? Global Policy 9: 34–42. [Google Scholar] [CrossRef] [Green Version]

- Davies, Marlene, and Bernadette Schlitzer. 2008. The impracticality of an international “one size fits all” corporate governance code of best practice. Managerial Auditing Journal 23: 532–44. [Google Scholar] [CrossRef]

- Decaux, Loïc, and Gerrit Sarens. 2015. Implementing combined assurance: Insights from multiple case studies. Managerial Auditing Journal 30: 56–79. [Google Scholar] [CrossRef]

- Dijkstra, Theo K., and Jörg Henseler. 2015. Consistent partial least squares path modelling. MIS Quarterly 39: 297–316. [Google Scholar] [CrossRef]

- Durrah, Omar. 2022. Do we need friendship in the workplace? The effect on innovative behavior and mediating role of psychological safety. Current Psychology. in press. [Google Scholar] [CrossRef]

- Durrah, Omar, and Ahmad Kahwaji. 2023. Chameleon leadership and innovative behavior in the health sector: The mediation role of job security. Employee Responsibilities and Rights Journal 35: 247–65. [Google Scholar] [CrossRef]

- Durrah, Omar, Olga Charbatji, Monica Chaudhary, and Fahad Alsubaey. 2022. Authentic Leadership Behaviors and Thriving at Work: Empirical Evidence from the Information Technology Industry in Australia. Psychological Reports. in press. [Google Scholar] [CrossRef]

- Eulerich, Marc, Patrick Velte, and Jochen Theis. 2015. Internal auditors’ contribution to good corporate governance. An empirical analysis for the one-tier governance system with a focus on the relationship between internal audit function and audit committee. An Empirical Analysis for the One-Tier Governance System with a Focus on the Relationship between Internal Audit Function and Audit Committee (1 July 2015). Corporate ownership and Control 13: 141–51. [Google Scholar]

- Eulerich, Marc. 2021. The New Three Lines Model for Structuring Corporate Governance—A Critical Discussion of Similarities and Differences. SSRN Electronic Journal. Available online: https://virtusinterpress.org/IMG/pdf/cocv18i2art15.pdf (accessed on 15 March 2022). [CrossRef]

- EY. 2013. Maximizing Value from Your Lines of Defence. A Pragmatic Approach to Establishing and Optimizing Your LOD Model. Insights on Governance, Risk and Compliance. Available online: http://www.ey.com/Publication/vwLUAssets/EYMaximizing-value-fromyour-lines-of-defense/$File/EY-Maximizing-valuefrom-your-lines-ofdefense.pdf (accessed on 15 March 2022).

- Falk, R. Frank, and Nancy B. Miller. 1992. A Primer for Soft Modelling. Akron: University of Akron Press. [Google Scholar]

- Fanning, Kirsten, and M. David Piercey. 2014. Internal auditors’ use of interpersonal likability, arguments, and accounting information in a corporate governance setting. Accounting, Organizations and Society 39: 575–89. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Fornell, Claes, and Jaesung Cha. 1994. Partial least squares. Advanced Methods of Marketing Research 407: 52–78. [Google Scholar]

- Gramling, Audrey A., Mario J. Maletta, Arnold Schneider, and Bryan K. Church. 2004. The role of the internal audit function in corporate governance: A synthesis of the extant internal auditing literature and directions for future research. Journal of Accounting Literature 23: 194. [Google Scholar]

- Gye-Soo, Kim. 2016. Partial least squares structural equation modelling (PLS-SEM): An application in customer satisfaction research. International Journal of u-and e-Service, Science and Technology 9: 61–68. [Google Scholar] [CrossRef]

- Hair, Joseph F., and Bryan Lukas. 2014. Marketing Research. Australia: McGraw-Hill Education. [Google Scholar]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hair, Joseph F., William Black, and Barry J. Babin. 2010. Multivariate Data Analysis: A Global Perspective. Personal communication. Available online: https://books.google.co.jp/books/about/Multivariate_Data_Analysis.html?id=SLRPLgAACAAJ&redir_esc=y (accessed on 10 July 2022).

- Harrington, L., and A. Piper. 2015. Driving success in a changing world: 10 imperatives for internal audit. The Global Internal Audit Common Body of Knowledge, CBOK. Available online: https://slideplayer.com/slide/15248009/ (accessed on 10 July 2022).

- Henseler, Jörg, Christian M. Ringle, and Rudolf R. Sinkovics. 2009. The Use of Partial Least Squares Path Modeling in International Marketing. In New Challenges to International Marketing. Bradford: Emerald Group Publishing Limited. [Google Scholar]

- IFAC, and IIA. 2018. United, Connected and Aligned. In How the Distinct Roles of Internal Audit and the Finance Function Drive Good Governance. Available online: https://www.ifac.org/knowledge-gateway/developing-accountancy-profession/publications/united-connected-and-aligned-how-distinct-roles-internal-audit-and-finance-function-drive-good (accessed on 15 March 2023).

- Iskak, Jamaludin, and Mochamad Muslih. 2022. The Effect of the Three Lines of Defense Model on the Performance of State-Owned Enterprises Moderated by the Audit Committee. International Journal of Science and Society 4: 240–55. [Google Scholar] [CrossRef]

- KPMG. 2012. The Convergence Evolution: Global Survey into the Integration of Governance, Risk and Compliance, in Cooperation with Economist Intelligence Unit. Zurich: KPMG. [Google Scholar]

- Laloux, Oliver. 2017. Combined Assurance Model Is It Something Everyone Should Aspire To? Available online: http://www.mondialcons.com/Newsletter/A%20combined%20assurance%20model_Oliver%20Laloux.pdf (accessed on 21 January 2022).

- Leech, Tim J., and Lauren C. Hanlon. 2016. Three lines of defense versus five lines of assurance. In The Handbook of Board Governance: A Comprehensive Guide for Public, Private, and Not-for-Profit Board Members. Hoboken: John Wiley & Sons, pp. 335–55. [Google Scholar]

- Lewis, Izelle. 2014. The Role of Internal Auditing in Providing Combined Assurance: Assessing Internal Financial Controls. Doctoral dissertation, University of Pretoria, Northen Sotho, South Africa. [Google Scholar]

- Luburic, Radoica. 2017. Strengthening the three lines of defence in terms of more efficient operational risk management in central banks. Journal of Central Banking Theory and Practice 6: 29–53. [Google Scholar] [CrossRef] [Green Version]

- Minto, A., and Isabella Arndorfer. 2015. The four-line-of-defence model for financial institutions. Taking the three-line-of-defence model further to reflect specific governance features of regulated financial institutions. Financial Stability Institute Working Paper-BIS 11: 1–26. [Google Scholar]

- Moeller, Robert. 2013. Executive’s Guide to COSO Internal Controls: Understanding and Implementing the New Framework. New York: Wiley and Sons. Available online: https://www.wiley.com/en-us (accessed on 15 March 2022).

- Nasaruddin, N., I. Abdul Rahman, and Mustafa Musa Jaber. 2018. PLS-SEM model of leadership characteristics facing challenges in Malaysia construction industry. International Journal of Engineering & Technology 7: 620–24. [Google Scholar]

- Nurdiani, Tanti Widia. 2022. Implementation of three lines of defense model across comparison: Sharia banks, regional banks, rural banks, and national BAN. Journal of Tianjin University Science and Technology 55: 355–61. [Google Scholar] [CrossRef]

- Pricewaterhouse Coopers (PWC). 2016. Internal Audit Matters: Combined Assurance Risk Assurance. Available online: https://www.pwchk.com/en/riskassurance/racombined-assurance-oct2016.pdf (accessed on 15 March 2022).

- PWC. 2017. The Three Lines of Defence Model of Tomorrow. Available online: https://www.pwc.nl/nl/assets/documents/pwc-3linesofdefencemodel.pdf (accessed on 15 March 2023).

- Raykov, Tenko. 1997. Estimation of composite reliability for congeneric measures. Applied Psychological Measurement 21: 173–84. [Google Scholar] [CrossRef]

- Rittenberg, Larry. 2013. Internal Audit Challenges: Integration of Strategy, Risk, Control, and Combined Assurance. Available online: https://www.pwc.co.za/en/issues/combined-assurance.html (accessed on 20 September 2022).

- Rossouw, Duane, and Marinda Marais. 2015. The Impact of Combined Assurance on the internal Audit Function. Master’s thesis, University of Pretoria, Northen Sotho, South Africa. [Google Scholar]

- Roussy, Mélanie, and Michelle Rodrigue. 2018. Internal audit: Is the third line of defense’ effective as a form of governance? An exploratory study of the impression management techniques chief audit executives uses in their annual accountability to the audit committee. Journal of Business Ethics 151: 853–69. [Google Scholar] [CrossRef]

- Sarens, Gerrit, Loïc Decaux, and Rainer Lenz. 2012. Combined Assurance: Case Studies on a Holistic Approach to Organizational Governance. Altamonte Springs: The Institute of Internal Auditors Research Foundation (IIARF). [Google Scholar]

- Schreurs, H. K., and Marinda Marais. 2015. Perspectives of chief audit executives on the implementation of combined assurance. Southern African Journal of Accountability and Auditing Research 17: 73–86. [Google Scholar]

- Tawfik, Omar Ikbal, and Omar Durrah. 2023. Factors Affecting the Adoption of E-Learning During the COVID-19 Pandemic. In Handbook of Research on Artificial Intelligence and Knowledge Management in Asia’s Digital Economy. Hershey: IGI Global, pp. 317–34. [Google Scholar]

- Tawfik, Omar Ikbal, Omar Durrah, Khaled Hussainey, and Hamada Elsaid Elmaasrawy. 2022. Factors influencing the implementation of cloud accounting: Evidence from small and medium enterprises in Oman. Journal of Science and Technology Policy Management. in press. [Google Scholar] [CrossRef]

- The Institute of Internal Auditors—Australia. 2018. Factsheet: Combined Assurance. Available online: http://iia.org.au/sf_docs/default-source/technicalresources/2018-fact-sheets/combined-assurance.pdf?sfvrsn=2 (accessed on 15 March 2022).

- The Institute of Internal Auditors (IIA). 2013. IIA Position Paper: The Three Lines of Defense in Effective Risk Management and Control. Altamonte Springs: The Institute of Internal Auditors Research Foundation (IIARF). [Google Scholar]

- The Institute of Internal Auditors (IIA). 2020. The IIA’s Three Lines Model: An Update of the Three Lines of Defense. Available online: https://global.theiia.org/about/about-internal-auditing/Pages/Three-Lines-Model.aspx (accessed on 2 March 2022).

- Wetzels, Martin, Gaby Odekerken-Schröder, and Claudia Van Oppen. 2009. Using PLS path modeling for assessing hierarchical construct models: Guidelines and Empirical Illustration. MIS Quarterly 33: 177–95. [Google Scholar] [CrossRef]

| Variables | Previous Studies |

|---|---|

| Operational management compliance with legal, regulatory, and ethical requirements (MC) | Laloux (2017); Pricewaterhouse Coopers (PWC) (2016); The Institute of Internal Auditors—Australia (2018); Eulerich (2021); The Institute of Internal Auditors (IIA) (2020); Roussy and Rodrigue (2018); |

| Risk management, compliance, and quality functions (RM) | Rittenberg (2013); Eulerich (2021); The Institute of Internal Auditors (IIA) (2020); Roussy and Rodrigue (2018); Luburic (2017) |

| The role of the assurance internal audit (IA) | Rossouw and Marais (2015); Sarens et al. (2012); The Institute of Internal Auditors—Australia (2018); Eulerich (2021); The Institute of Internal Auditors (IIA) (2020); Luburic (2017); Roussy and Rodrigue (2018) |

| Governance procedures (GP) | Roussy and Rodrigue (2018); Fanning and Piercey (2014); IFAC and IIA (2018) |

| Qualification | No. | Major | No. | Experiences | No. |

|---|---|---|---|---|---|

| Diploma | 23 | Accounting | 57 | <5 years | 28 |

| Bachelor | 81 | Finance | 48 | 5–10 years | 51 |

| Postgraduate | 19 | Others | 18 | >10 years | 44 |

| Construct | Outer Loading | Convergent Validity | |||

|---|---|---|---|---|---|

| α | rho_A | CR | AVE | ||

| (MC) | ( = 4.06 and σ = 0.546) | 0.508 | |||

| MC1 | 0.664 | 0.806 | 0.806 | 0.861 | |

| MC2 | 0.728 | ||||

| MC3 | 0.694 | ||||

| MC4 | 0.693 | ||||

| MC5 | 0.736 | ||||

| MC6 | 0.758 | ||||

| (RM) | ( = 4.02 and σ = 0.615) | ||||

| RM1 | 0.663 | 0.911 | 0.909 | 0.925 | 0.581 |

| RM2 | 0.836 | ||||

| RM3 | 0.766 | ||||

| RM4 | 0.814 | ||||

| RM5 | 0.774 | ||||

| RM6 | 0.776 | ||||

| RM7 | 0.786 | ||||

| RM8 | 0.744 | ||||

| RM9 | 0.683 | ||||

| (IA) | ( = 4.07 and σ = 0.562) | ||||

| IA1 | 0.712 | 0.850 | 0.853 | 0.886 | 0.527 |

| IA2 | 0.781 | ||||

| IA3 | 0.691 | ||||

| IA4 | 0.788 | ||||

| IA5 | 0.730 | ||||

| IA6 | 0.707 | ||||

| IA7 | 0.663 | ||||

| (GB) | ( = 3.98 and σ = 0.579) | ||||

| GB1 | 0.689 | 0.814 | 0.815 | 0.866 | 0.520 |

| GB2 | 0.653 | ||||

| GB3 | 0.772 | ||||

| GB4 | 0.661 | ||||

| GB5 | 0.784 | ||||

| GB6 | 0.756 | ||||

| Construct | MC | RM | IA | GB |

|---|---|---|---|---|

| MC | 0.713 | |||

| RM | 0.694 | 0.762 | ||

| IA | 0.703 | 0.660 | 0.726 | |

| GP | 0.665 | 0.649 | 0.647 | 0.721 |

| Hypothesis | Path Coefficient | T-Statistic | p-Value | Decision | f2 | R2 | Q2predict | GoF |

|---|---|---|---|---|---|---|---|---|

| H1: (MC → GB) | 0.313 | 2.889 | 0.004 | Supported ** | 0.080 | 0.662 | 0.327 | 0.197 |

| H2: (RM → GB) | 0.293 | 2.413 | 0.016 | Supported * | 0.083 | |||

| H3: (IA → GB) | 0.273 | 2.544 | 0.011 | Supported * | 0.069 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tawfik, O.I.; Durrah, O.; Aljawhar, K.A. The Role of The Internal Auditor in Strengthening the Governance of Economic Organizations Using the Three Lines of Defense Model. J. Risk Financial Manag. 2023, 16, 341. https://doi.org/10.3390/jrfm16070341

Tawfik OI, Durrah O, Aljawhar KA. The Role of The Internal Auditor in Strengthening the Governance of Economic Organizations Using the Three Lines of Defense Model. Journal of Risk and Financial Management. 2023; 16(7):341. https://doi.org/10.3390/jrfm16070341

Chicago/Turabian StyleTawfik, Omar Ikbal, Omar Durrah, and Karima Ali Aljawhar. 2023. "The Role of The Internal Auditor in Strengthening the Governance of Economic Organizations Using the Three Lines of Defense Model" Journal of Risk and Financial Management 16, no. 7: 341. https://doi.org/10.3390/jrfm16070341

APA StyleTawfik, O. I., Durrah, O., & Aljawhar, K. A. (2023). The Role of The Internal Auditor in Strengthening the Governance of Economic Organizations Using the Three Lines of Defense Model. Journal of Risk and Financial Management, 16(7), 341. https://doi.org/10.3390/jrfm16070341