Tracing Knowledge Diffusion Trajectories in Scholarly Bitcoin Research: Co-Word and Main Path Analyses

Abstract

:1. Introduction

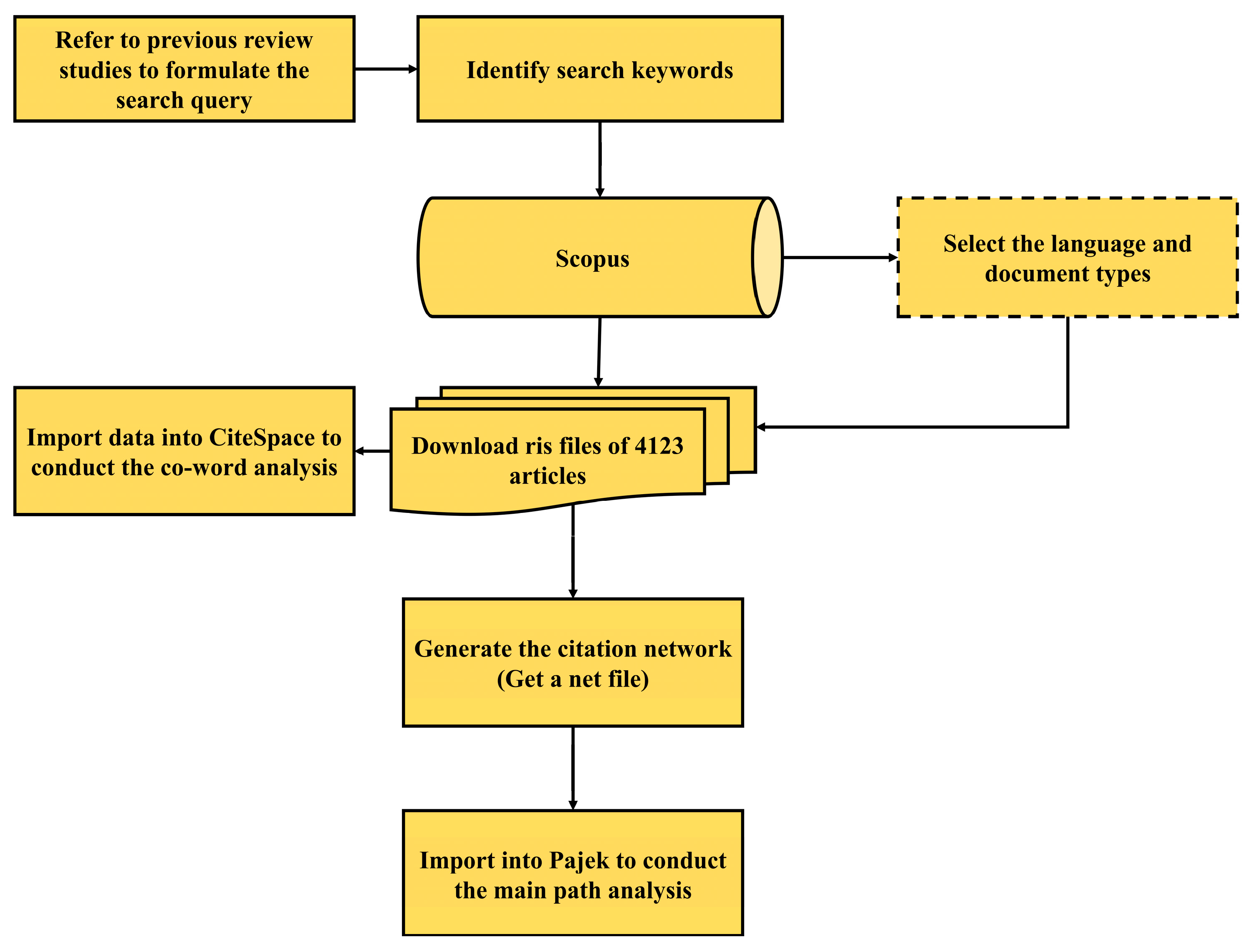

2. Methodology

2.1. Data Collection

2.2. Research Approach

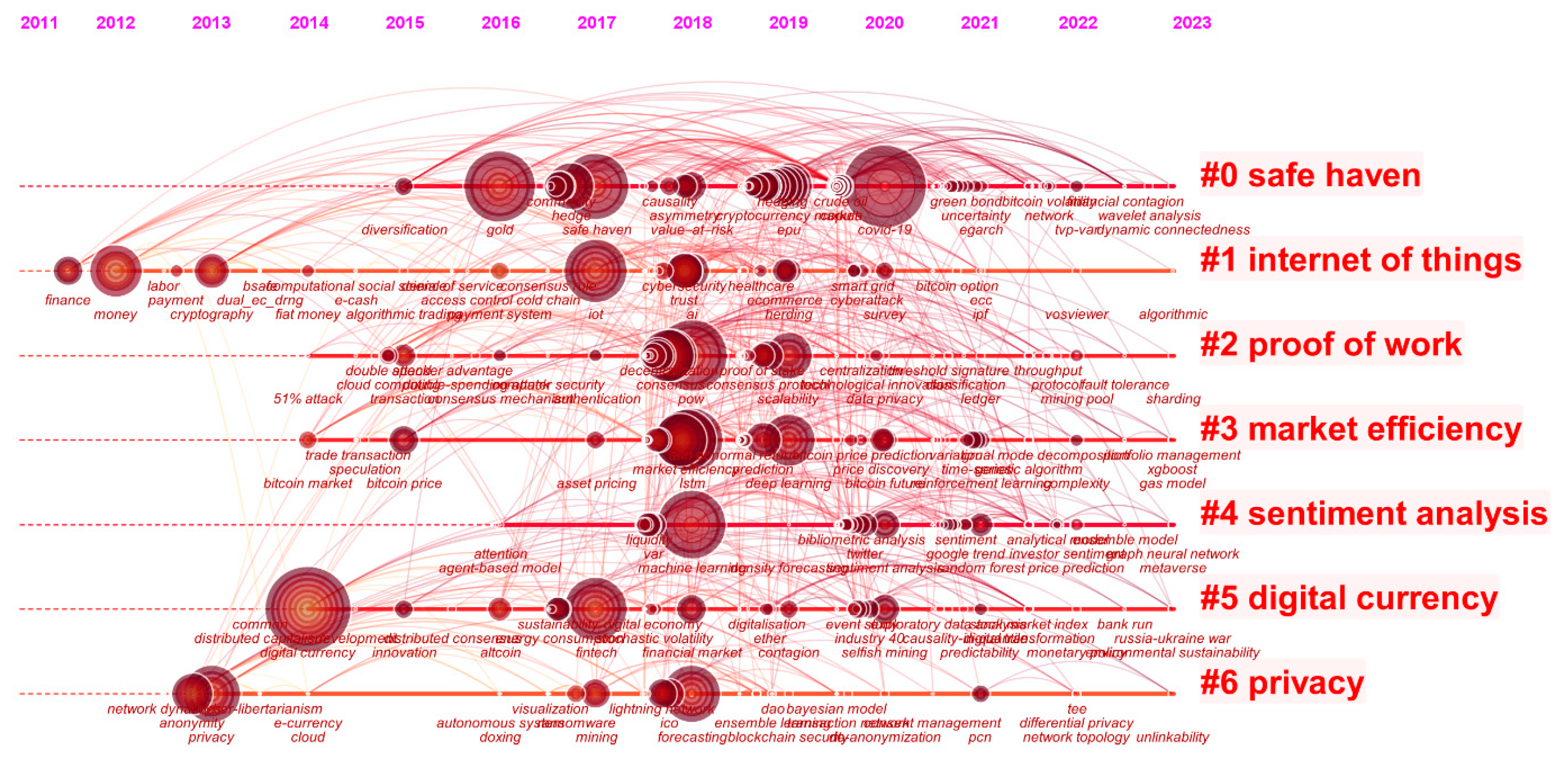

3. Findings from Co-Word Analysis

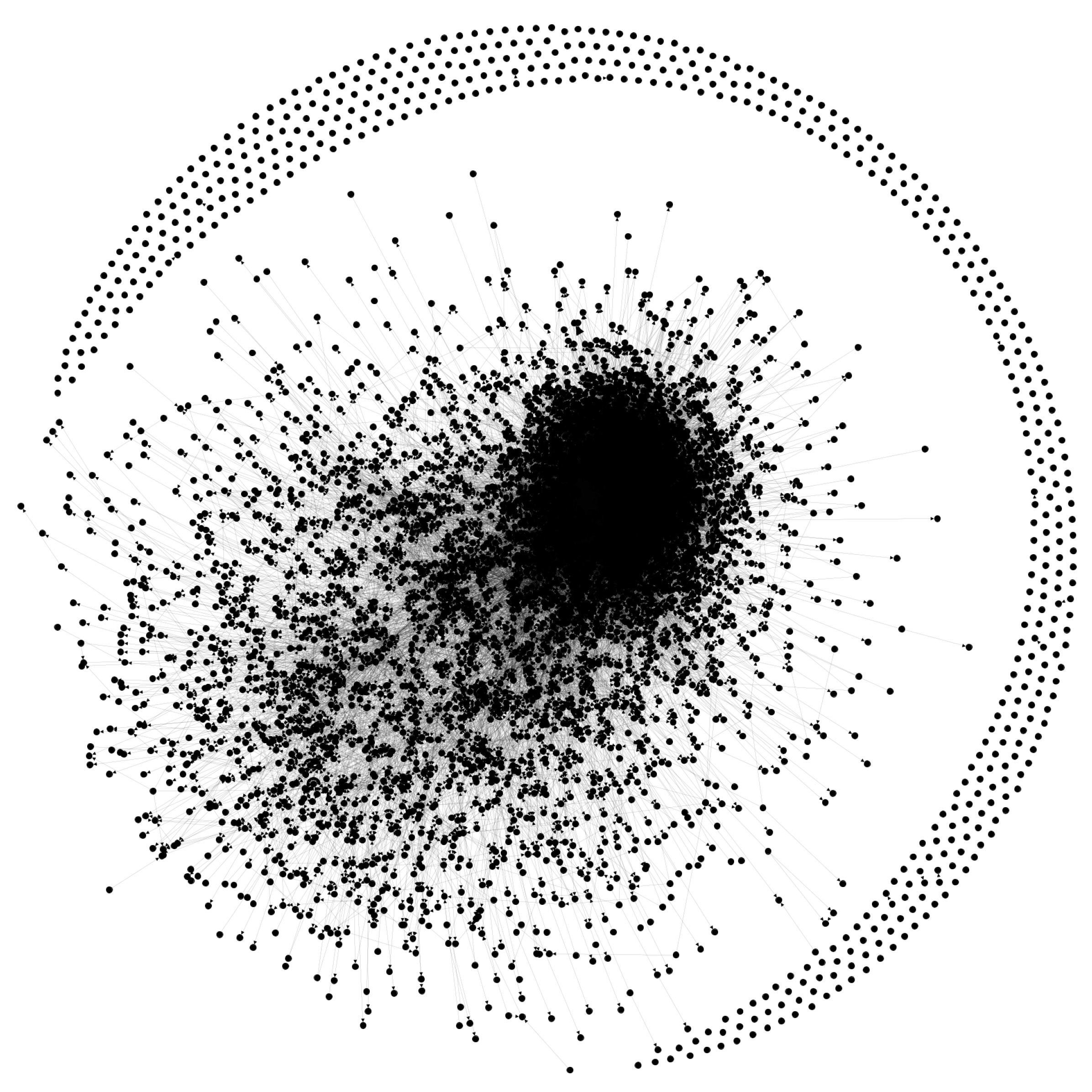

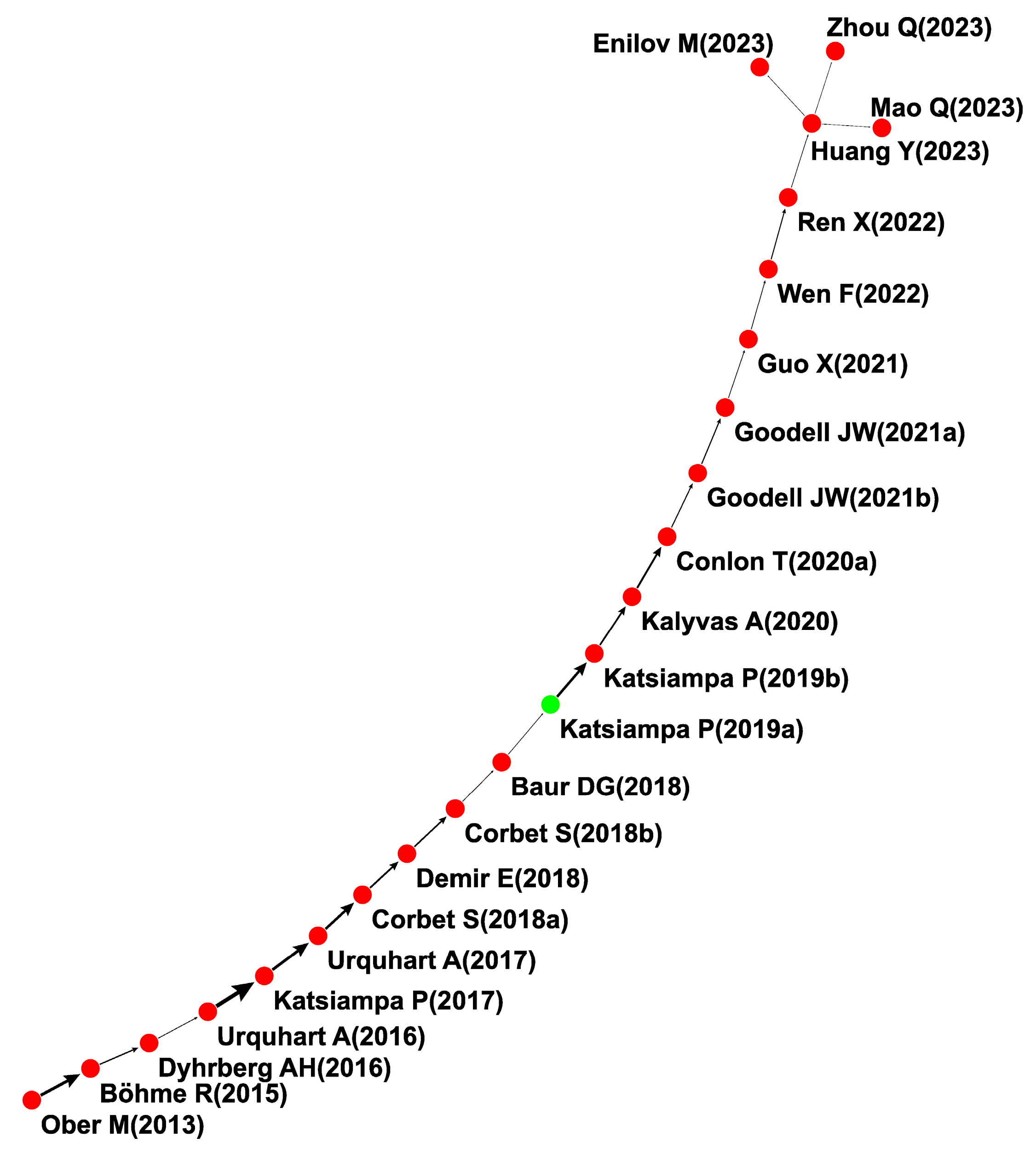

4. Findings from Main Path Analysis

4.1. Local Main Path

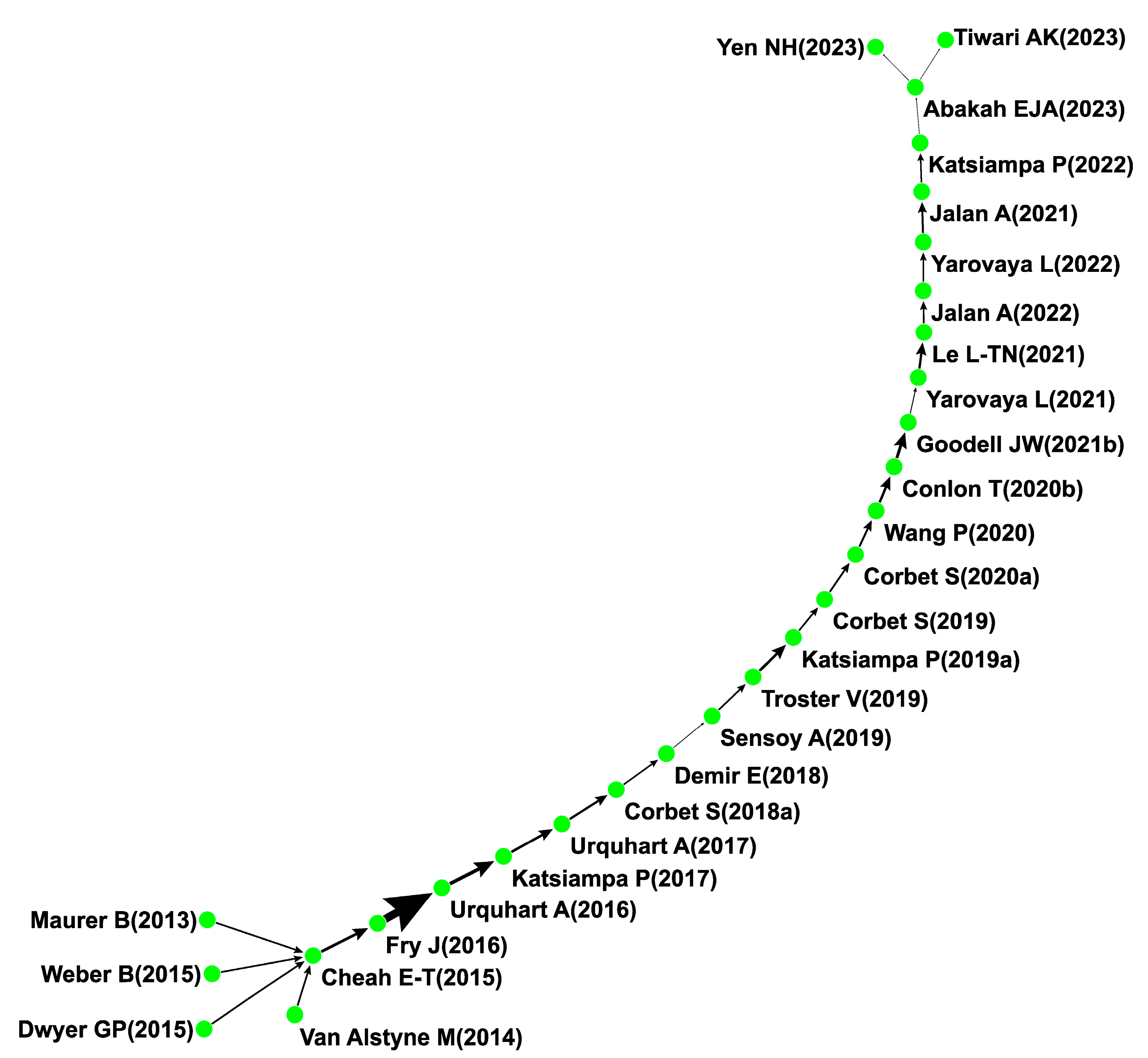

4.1.1. Forward Local Main Path

4.1.2. Backward Local Main Path

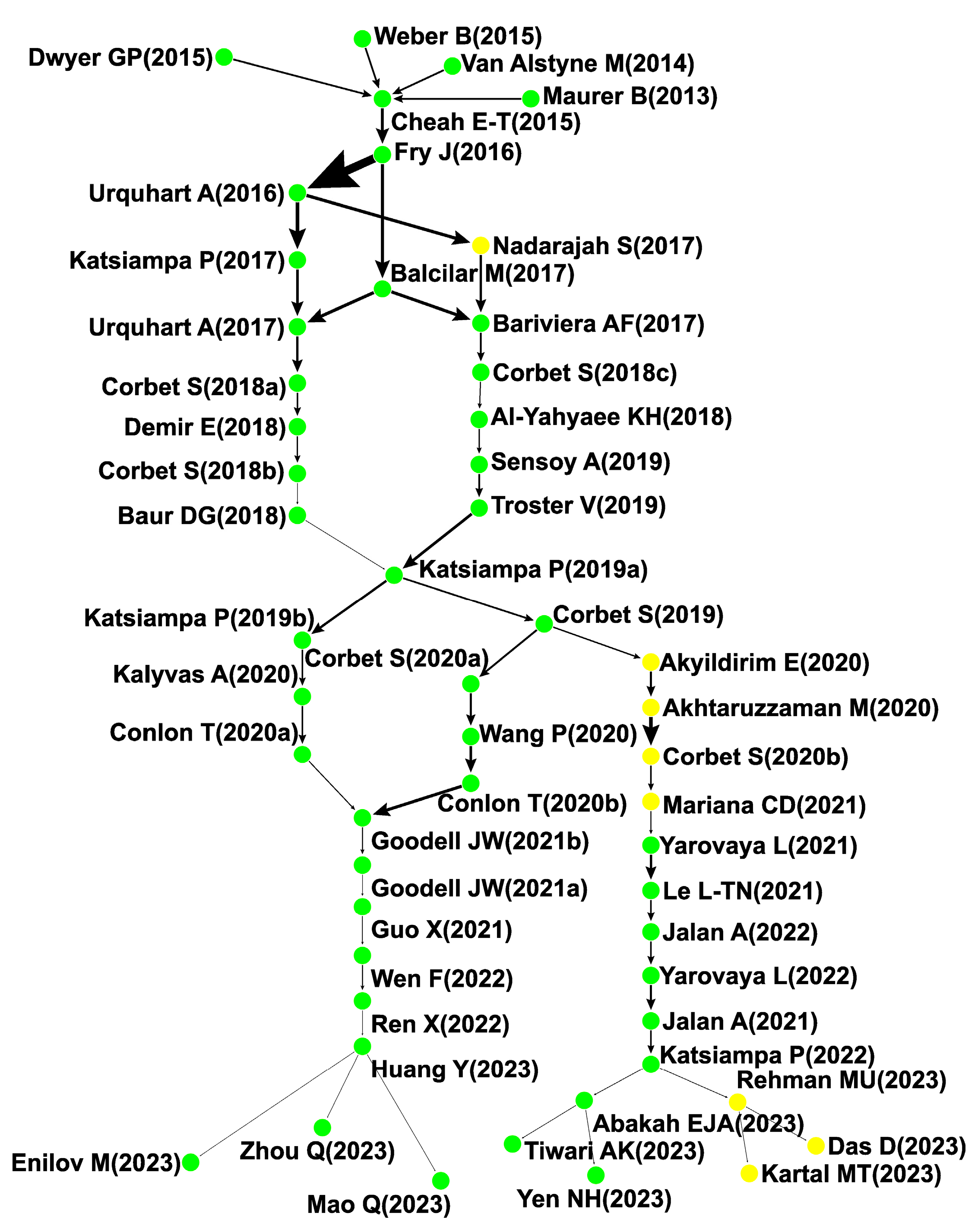

4.2. Global Main Path

4.3. Key-Route Main Path

5. Discussion

5.1. Theoretical Implications

- Bitcoin as a safe haven: Conduct an in-depth analysis of bitcoin’s role and potential as a safe haven asset, especially during economic shocks and market volatility. Examine the factors that could affect its efficacy as a safe haven in different economic contexts.

- Intersection with emerging technologies: Investigate the interplay of bitcoin with emerging technologies such as IoT and AI. Analyze the impacts of these technologies on bitcoin’s functionality, security, and environmental impact. Explore how these interactions could reshape the bitcoin and cryptocurrency ecosystem.

- Privacy and trust in bitcoin: Delve deeper into the issues of privacy and trust within the bitcoin ecosystem. Evaluate their implications on user adoption, regulatory responses, and the development of new blockchain technologies.

- Bitcoin and green financing: Research the potential role of bitcoin and blockchain technologies in promoting sustainable development and green financing. Assess the environmental costs associated with these technologies and explore potential strategies to mitigate these impacts.

- Market dynamics and predictability: Expand research on the market dynamics of bitcoin and other cryptocurrencies. Develop new models for predicting cryptocurrency price movements and volatility, incorporating factors such as investor behavior, global events, and technological advancements.

5.2. Practical Implications

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Abakah, Emmanuel Joel Aikins, Guglielmo Maria Caporale, and Luis Alberiko Gil-Alana. 2022. The Effects of Us COVID-19 Policy Responses on Cryptocurrencies, Fintech and Artificial Intelligence Stocks: A Fractional Integration Analysis. Cogent Economics and Finance 10: 2159736. [Google Scholar] [CrossRef]

- Abdeldayem, Marwan Mohamed, and Saeed Hameed Aldulaimi. 2020. Cryptocurrency in the GCC Economy. International Journal of Scientific and Technology Research 9: 1739–58. [Google Scholar]

- Aggarwal, Divya. 2019. Do Bitcoins Follow a Random Walk Model? Research in Economics 73: 15–22. [Google Scholar] [CrossRef]

- Agrawal, Anshul, Mukta Mani, and Sakshi Varshney. 2023. Bitcoin Forecasting Performance Measurement: A Comparative Study of Econometric, Machine Learning and Artificial Intelligence-Based Models. Journal of International Commerce, Economics and Policy 14: 3500084. [Google Scholar] [CrossRef]

- Ahluwalia, Saurabh, Raj V. Mahto, and Maribel Guerrero. 2020. Blockchain Technology and Startup Financing: A Transaction Cost Economics Perspective. Technological Forecasting and Social Change 151: 119854. [Google Scholar] [CrossRef]

- Ajaz, Taufeeq, and Anoop S. Kumar. 2018. Herding in Crypto-Currency Markets. Annals of Financial Economics 13: 18500069. [Google Scholar] [CrossRef]

- Akgul, Akif, Eyyup Ensari Şahin, and Fatma Yildiz Şenol. 2022. Blockchain-Based Cryptocurrency Price Prediction with Chaos Theory, Onchain Analysis, Sentiment Analysis and Fundamental-Technical Analysis. Chaos Theory and Applications 4: 157–68. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Ahmet Sensoy, and Shaen Corbet. 2020. The Influence of Bitcoin on Portfolio Diversification and Design. Finance Research Letters 37: 101344. [Google Scholar] [CrossRef]

- Akyildirim, Erdinc, Shaen Corbet, Paraskevi Katsiampa, Neil Kellard, and Ahmet Sensoy. 2020. The Development of Bitcoin Futures: Exploring the Interactions between Cryptocurrency Derivatives. Finance Research Letters 34: 101234. [Google Scholar] [CrossRef]

- Al Mamun, Md, Gazi Salah Uddin, Muhammad Tahir Suleman, and Sang Hoon Kang. 2020. Geopolitical Risk, Uncertainty and Bitcoin Investment. Physica A: Statistical Mechanics and Its Applications 540: 123107. [Google Scholar] [CrossRef]

- Albrecht, Chad, Kristopher McKay Duffin, Steven Hawkins, and Victor Manuel Morales Rocha. 2019. The Use of Cryptocurrencies in the Money Laundering Process. Journal of Money Laundering Control 22: 210–16. [Google Scholar] [CrossRef]

- Ali, Vizaad, Azah Anir Norman, and Saaidal Razalli Bin Azzuhri. 2023. Characteristics of Blockchain and Its Relationship With Trust. IEEE Access 11: 15364–74. [Google Scholar] [CrossRef]

- Aljabr, Ahmad Abdullah, Avinash Sharma, and Kailash Kumar. 2019. Mining Process in Cryptocurrency Using Blockchain Technology: Bitcoin as a Case Study. Journal of Computational and Theoretical Nanoscience 16: 4293–98. [Google Scholar] [CrossRef]

- Al-Khazali, Osamah, Elie Bouri, and David Roubaud. 2018. The Impact of Positive and Negative Macroeconomic News Surprises: Gold versus Bitcoin. Economics Bulletin 38: 373–82. [Google Scholar]

- Almeida, José, and Tiago Cruz Gonçalves. 2022. A Systematic Literature Review of Volatility and Risk Management on Cryptocurrency Investment: A Methodological Point of View. Risks 10: 107. [Google Scholar] [CrossRef]

- Almeida, José, and Tiago Cruz Gonçalves. 2023a. A Systematic Literature Review of Investor Behavior in the Cryptocurrency Markets. Journal of Behavioral and Experimental Finance 37: 100785. [Google Scholar] [CrossRef]

- Almeida, José, and Tiago Cruz Gonçalves. 2023b. Portfolio Diversification, Hedge and Safe-Haven Properties in Cryptocurrency Investments and Financial Economics: A Systematic Literature Review. Journal of Risk and Financial Management 16: 3. [Google Scholar] [CrossRef]

- Al-Nefaie, Abdullah H., and Theyazn H.H. Aldhyani. 2022. Bitcoin Price Forecasting and Trading: Data Analytics Approaches. Electronics 11: 4088. [Google Scholar] [CrossRef]

- Al-Yahyaee, Khamis Hamed, Walid Mensi, and Seong-Min Yoon. 2018. Efficiency, Multifractality, and the Long-Memory Property of the Bitcoin Market: A Comparative Analysis with Stock, Currency, and Gold Markets. Finance Research Letters 27: 228–34. [Google Scholar] [CrossRef]

- Ammous, Saifedean. 2015. Economics beyond Financial Intermediation: Digital Currencies’ Possibilities for Growth, Poverty Alleviation, and International Development. Journal of Private Enterprise 30: 19–50. [Google Scholar]

- Ammous, Saifedean. 2018. Can Cryptocurrencies Fulfil the Functions of Money? Quarterly Review of Economics and Finance 70: 38–51. [Google Scholar] [CrossRef]

- Anamika, Madhumita Chakraborty, and Sowmya Subramaniam. 2023. Does Sentiment Impact Cryptocurrency? Journal of Behavioral Finance 24: 202–18. [Google Scholar] [CrossRef]

- Andola, Nitish, Raghav, Vijay Kumar Yadav, S. Venkatesan, and Shekhar Verma. 2021. Anonymity on Blockchain Based E-Cash Protocols—A Survey. Computer Science Review 40: 100394. [Google Scholar] [CrossRef]

- Andolfatto, David, and Fernando M. Martin. 2022. The Blockchain Revolution: Decoding Digital Currencies. Federal Reserve Bank of St. Louis Review 104: 149–65. [Google Scholar] [CrossRef]

- Ansah, Albert Kofi Kwansah, and Daniel Adu-Gyamfi. 2020. Enhancing User and Transaction Privacy in Bitcoin with Unlinkable Coin Mixing Scheme. International Journal of Computational Science and Engineering 23: 381–95. [Google Scholar] [CrossRef]

- Appukuttan Nair, Damodaran. 2019. The Bitcoin Innovation, Crypto Currencies and the Leviathan. Innovation and Development 9: 85–103. [Google Scholar] [CrossRef]

- Arli, Denni, Patrick van Esch, Marat Bakpayev, and Andrea Laurence. 2021. Do Consumers Really Trust Cryptocurrencies? Marketing Intelligence and Planning 39: 74–90. [Google Scholar] [CrossRef]

- Aysan, Ahmet Faruk, Hüseyin Bedir Demirtaş, and Mustafa Saraç. 2021. The Ascent of Bitcoin: Bibliometric Analysis of Bitcoin Research. Journal of Risk and Financial Management 14: 427. [Google Scholar] [CrossRef]

- Bala, Renu, and Rajendiran Manoharan. 2020. Enhanced Bitcoin Protocol with Effective Block Creation and Verification by Trusted Miners. EAI Endorsed Transactions on Scalable Information Systems 7: 1–8. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Elie Bouri, Rangan Gupta, and David Roubaud. 2017. Can Volume Predict Bitcoin Returns and Volatility? A Quantiles-Based Approach. Economic Modelling 64: 74–81. [Google Scholar] [CrossRef] [Green Version]

- Barbu, Teodora Cristina, Iustina Alina Boitan, and Cosmin-Octavian Cepoi. 2022. Are Cryptocurrencies Safe Havens during the COVID-19 Pandemic? A Threshold Regression Perspective with Pandemic-Related Benchmarks. Economics and Business Review 8: 29–49. [Google Scholar] [CrossRef]

- Bariviera, Aurelio F. 2017. The Inefficiency of Bitcoin Revisited: A Dynamic Approach. Economics Letters 161: 1–4. [Google Scholar] [CrossRef] [Green Version]

- Barson, Zynobia, Peterson Owusu Junior, Anokye M. Adam, and Emmanuel Asafo-Adjei. 2022. Connectedness between Gold and Cryptocurrencies in COVID-19 Pandemic: A Frequency-Dependent Asymmetric and Causality Analysis. Complexity 2022: 7648085. [Google Scholar] [CrossRef]

- Batagelj, Vladimir. 2003. Efficient Algorithms for Citation Network Analysis. arXiv. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas Dimpfl. 2018. Asymmetric Volatility in Cryptocurrencies. Economics Letters 173: 148–51. [Google Scholar] [CrossRef]

- Bhushan, Bharat, Chinmayee Sahoo, Preeti Sinha, and Aditya Khamparia. 2021. Unification of Blockchain and Internet of Things (BIoT): Requirements, Working Model, Challenges and Future Directions. Wireless Networks 27: 55–90. [Google Scholar] [CrossRef]

- Blockworks. 2023. Bitcoin Price (BTC), Market Cap, Price Today & Chart History. Available online: https://blockworks.co/price/btc (accessed on 21 July 2023).

- Böhme, Rainer, Nicolas Christin, Benjamin Edelman, and Tyler Moore. 2015. Bitcoin: Economics, Technology, and Governance. Journal of Economic Perspectives 29: 213–38. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Ladislav Kristoufek, and Nehme Azoury. 2022. Bitcoin and S&P500: Co-Movements of High-Order Moments in the Time-Frequency Domain. PLoS ONE 17: e0277924. [Google Scholar] [CrossRef]

- Carley, Kathleen M., Norman P. Hummon, and Martha Harty. 1993. Scientific Influence: An Analysis of the Main Path Structure in the Journal of Conflict Resolution. Knowledge 14: 417–47. [Google Scholar] [CrossRef]

- Chatterjee, Jyotir Moy, Le Hoang Son, Srijani Ghatak, Raghvendra Kumar, and Manju Khari. 2018. BitCoin Exclusively Informational Money: A Valuable Review from 2010 to 2017. Quality and Quantity 52: 2037–54. [Google Scholar] [CrossRef]

- Cheah, Eng-Tuck, and John Fry. 2015. Speculative Bubbles in Bitcoin Markets? An Empirical Investigation into the Fundamental Value of Bitcoin. Economics Letters 130: 32–36. [Google Scholar] [CrossRef] [Green Version]

- Chen, Chaomei. 2006. CiteSpace II: Detecting and Visualizing Emerging Trends and Transient Patterns in Scientific Literature. Journal of the American Society for Information Science and Technology 57: 359–77. [Google Scholar] [CrossRef] [Green Version]

- Chen, Kaihua, Yi Zhang, and Xiaolan Fu. 2019. International Research Collaboration: An Emerging Domain of Innovation Studies? Research Policy 48: 149–68. [Google Scholar] [CrossRef]

- Chen, Xiuwen, Jianming Chen, Dengsheng Wu, Yongjia Xie, and Jing Li. 2016. Mapping the Research Trends by Co-Word Analysis Based on Keywords from Funded Project. Procedia Computer Science 91: 547–55. [Google Scholar] [CrossRef] [Green Version]

- Chicarino, Vanessa, Célio Albuquerque, Emanuel Jesus, and Antonio Rocha. 2020. On the Detection of Selfish Mining and Stalker Attacks in Blockchain Networks. Annales Des Telecommunications/Annals of Telecommunications 75: 143–52. [Google Scholar] [CrossRef]

- Coinbase. 2023. Bitcoin (BTC) Price, Charts, and News|Coinbase: Bitcoin Price, Bitcoin, BTC Price. Available online: https://www.coinbase.com/price/bitcoin (accessed on 21 July 2023).

- Conlon, Thomas, and Richard McGee. 2020. Safe Haven or Risky Hazard? Bitcoin during the COVID-19 Bear Market. Finance Research Letters 35: 101607. [Google Scholar] [CrossRef] [PubMed]

- Conlon, Thomas, Shaen Corbet, and Richard J. McGee. 2020. Are Cryptocurrencies a Safe Haven for Equity Markets? An International Perspective from the COVID-19 Pandemic. Research in International Business and Finance 54: 101248. [Google Scholar] [CrossRef] [PubMed]

- Conti, Mauro, E. Sandeep Kumar, Chhagan Lal, and Sushmita Ruj. 2018. A Survey on Security and Privacy Issues of Bitcoin. IEEE Communications Surveys and Tutorials 20: 3416–52. [Google Scholar] [CrossRef] [Green Version]

- Corbet, Shaen, Andrew Meegan, Charles Larkin, Brian Lucey, and Larisa Yarovaya. 2018a. Exploring the Dynamic Relationships between Cryptocurrencies and Other Financial Assets. Economics Letters 165: 28–34. [Google Scholar] [CrossRef] [Green Version]

- Corbet, Shaen, Brian Lucey, and Larisa Yarovaya. 2018b. Datestamping the Bitcoin and Ethereum Bubbles. Finance Research Letters 26: 81–88. [Google Scholar] [CrossRef] [Green Version]

- Corbet, Shaen, Brian Lucey, Maurice Peat, and Samuel Vigne. 2018c. Bitcoin Futures—What Use Are They? Economics Letters 172: 23–27. [Google Scholar] [CrossRef] [Green Version]

- Corbet, Shaen, Charles Larkin, and Brian Lucey. 2020a. The Contagion Effects of the COVID-19 Pandemic: Evidence from Gold and Cryptocurrencies. Finance Research Letters 35: 101554. [Google Scholar] [CrossRef]

- Corbet, Shaen, Paraskevi Katsiampa, and Chi Keung Marco Lau. 2020b. Measuring Quantile Dependence and Testing Directional Predictability between Bitcoin, Altcoins and Traditional Financial Assets. International Review of Financial Analysis 71: 101571. [Google Scholar] [CrossRef]

- Corbet, Shaen, Veysel Eraslan, Brian Lucey, and Ahmet Sensoy. 2019. The Effectiveness of Technical Trading Rules in Cryptocurrency Markets. Finance Research Letters 31: 32–37. [Google Scholar] [CrossRef]

- Cunha, Paulo Rupino, Paulo Melo, and Helder Sebastião. 2021. From Bitcoin to Central Bank Digital Currencies: Making Sense of the Digital Money Revolution. Future Internet 13: 165. [Google Scholar] [CrossRef]

- Das, Debasmita, Parthajit Kayal, and Moinak Maiti. 2023. A K-Means Clustering Model for Analyzing the Bitcoin Extreme Value Returns. Decision Analytics Journal 6: 100152. [Google Scholar] [CrossRef]

- Demir, Ender, Giray Gozgor, Chi Keung Marco Lau, and Samuel A. Vigne. 2018. Does Economic Policy Uncertainty Predict the Bitcoin Returns? An Empirical Investigation. Finance Research Letters 26: 145–49. [Google Scholar] [CrossRef] [Green Version]

- Dunbar, Kwamie, and Johnson Owusu-Amoako. 2023a. Predictability of Crypto Returns: The Impact of Trading Behavior. Journal of Behavioral and Experimental Finance 39: 100812. [Google Scholar] [CrossRef]

- Dunbar, Kwamie, and Johnson Owusu-Amoako. 2023b. Role of Hedging on Crypto Returns Predictability: A New Habit-Based Explanation. Finance Research Letters 55: 104009. [Google Scholar] [CrossRef]

- Dwyer, Gerald P. 2015. The Economics of Bitcoin and Similar Private Digital Currencies. Journal of Financial Stability 17: 81–91. [Google Scholar] [CrossRef] [Green Version]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, Gold and the Dollar—A GARCH Volatility Analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef] [Green Version]

- Enilov, Martin, and Tapas Mishra. 2023. Gold and the Herd of Cryptos: Saving Oil in Blurry Times. Energy Economics 122: 106690. [Google Scholar] [CrossRef]

- Fry, John, and Eng-Tuck Cheah. 2016. Negative Bubbles and Shocks in Cryptocurrency Markets. International Review of Financial Analysis 47: 343–52. [Google Scholar] [CrossRef] [Green Version]

- Goodell, John W., and Stephane Goutte. 2021. Co-Movement of COVID-19 and Bitcoin: Evidence from Wavelet Coherence Analysis. Finance Research Letters 38: 101625. [Google Scholar] [CrossRef]

- Guo, Xiaochun, Fengbin Lu, and Yunjie Wei. 2021. Capture the Contagion Network of Bitcoin—Evidence from Pre and Mid COVID-19. Research in International Business and Finance 58: 101484. [Google Scholar] [CrossRef]

- Huang, Yingying, Kun Duan, and Andrew Urquhart. 2023. Time-Varying Dependence between Bitcoin and Green Financial Assets: A Comparison between Pre- and Post-COVID-19 Periods. Journal of International Financial Markets, Institutions and Money 82: 101687. [Google Scholar] [CrossRef]

- Hummon, Norman P., and Kathleen Carley. 1993. Social Networks as Normal Science ∗. Social Networks 15: 71–106. [Google Scholar] [CrossRef]

- Hummon, Norman P., and Patrick Dereian. 1989. Connectivity in a Citation Network: The Development of DNA Theory. Social Networks 11: 39–63. [Google Scholar] [CrossRef]

- Jakubik, Johannes, Abdolreza Nazemi, Andreas Geyer-Schulz, and Frank J. Fabozzi. 2023. Incorporating Financial News for Forecasting Bitcoin Prices Based on Long Short-Term Memory Networks. Quantitative Finance 23: 335–49. [Google Scholar] [CrossRef]

- Jia, Shijiao, and Madhubala Bava Harji. 2023. Themes, Knowledge Evolution, and Emerging Trends in Task-Based Teaching and Learning: A Scientometric Analysis in CiteSpace. Education and Information Technologies 1–20. [Google Scholar] [CrossRef]

- Jiang, Wen, Qiuhua Xu, and Ruige Zhang. 2022. Tail-Event Driven Network of Cryptocurrencies and Conventional Assets. Finance Research Letters 46: 102424. [Google Scholar] [CrossRef]

- Kalyvas, Antonios, Panayiotis Papakyriakou, Athanasios Sakkas, and Andrew Urquhart. 2020. What Drives Bitcoin’s Price Crash Risk? Economics Letters 191: 108777. [Google Scholar] [CrossRef]

- Kartal, Mustafa Tevfik, Mustafa Kevser, and Fatih Ayhan. 2023. Asymmetric Effects of Global Factors on Return of Cryptocurrencies by Novel Nonlinear Quantile Approaches. Economic Change and Restructuring 56: 1515–35. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi. 2017. Volatility Estimation for Bitcoin: A Comparison of GARCH Models. Economics Letters 158: 3–6. [Google Scholar] [CrossRef] [Green Version]

- Katsiampa, Paraskevi, Shaen Corbet, and Brian Lucey. 2019a. High Frequency Volatility Co-Movements in Cryptocurrency Markets. Journal of International Financial Markets, Institutions and Money 62: 35–52. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Shaen Corbet, and Brian Lucey. 2019b. Volatility Spillover Effects in Leading Cryptocurrencies: A BEKK-MGARCH Analysis. Finance Research Letters 29: 68–74. [Google Scholar] [CrossRef] [Green Version]

- Kumar, Ashish, Najaf Iqbal, Subrata Kumar Mitra, Ladislav Kristoufek, and Elie Bouri. 2022. Connectedness among Major Cryptocurrencies in Standard Times and during the COVID-19 Outbreak. Journal of International Financial Markets, Institutions and Money 77: 101523. [Google Scholar] [CrossRef]

- Le, Trung Hai, Hung Xuan Do, Duc Khuong Nguyen, and Ahmet Sensoy. 2021. COVID-19 Pandemic and Tail-Dependency Networks of Financial Assets. Finance Research Letters 38: 101800. [Google Scholar] [CrossRef]

- Liu, John S., and Louis Y.Y. Lu. 2012. An Integrated Approach for Main Path Analysis: Development of the Hirsch Index as an Example. Journal of the American Society for Information Science and Technology 63: 528–42. [Google Scholar] [CrossRef]

- Manimuthu, Arunmozhi, V. Raja Sreedharan, G. Rejikumar, and Drishti Marwaha. 2019. A Literature Review on Bitcoin: Transformation of Crypto Currency into a Global Phenomenon. IEEE Engineering Management Review 47: 28–35. [Google Scholar] [CrossRef]

- Mao, Qian, Xinyuan Ma, and Yunpeng Sun. 2023. Study of Impacts of Blockchain Technology on Renewable Energy Resource Findings. Renewable Energy 211: 802–8. [Google Scholar] [CrossRef]

- Mariana, Christy Dwita, Irwan Adi Ekaputra, and Zaäfri Ananto Husodo. 2021. Are Bitcoin and Ethereum Safe-Havens for Stocks during the COVID-19 Pandemic? Finance Research Letters 38: 101798. [Google Scholar] [CrossRef] [PubMed]

- Maurer, Bill, Taylor C. Nelms, and Lana Swartz. 2013. ‘When Perhaps the Real Problem Is Money Itself!’: The Practical Materiality of Bitcoin. Social Semiotics 23: 261–77. [Google Scholar] [CrossRef] [Green Version]

- Merediz-Solà, Ignasi, and Aurelio F. Bariviera. 2019. A Bibliometric Analysis of Bitcoin Scientific Production. Research in International Business and Finance 50: 294–305. [Google Scholar] [CrossRef] [Green Version]

- Mokhtarpour, Reza, and Ali Akbar Khasseh. 2021. Twenty-Six Years of LIS Research Focus and Hot Spots, 1990–2016: A Co-Word Analysis. Journal of Information Science 47: 794–808. [Google Scholar] [CrossRef]

- Moro, Sérgio, Paulo Cortez, and Paulo Rita. 2015. Business Intelligence in Banking: A Literature Analysis from 2002 to 2013 Using Text Mining and Latent Dirichlet Allocation. Expert Systems with Applications 42: 1314–24. [Google Scholar] [CrossRef] [Green Version]

- Nadarajah, Saralees, and Jeffrey Chu. 2017. On the Inefficiency of Bitcoin. Economics Letters 150: 6–9. [Google Scholar] [CrossRef] [Green Version]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Decentralized Business Review, 1–9. [Google Scholar]

- Ober, Micha, Stefan Katzenbeisser, and Kay Hamacher. 2013. Structure and Anonymity of the Bitcoin Transaction Graph. Future Internet 5: 237–50. [Google Scholar] [CrossRef]

- Okorie, David Iheke, and Boqiang Lin. 2020. Crude Oil Price and Cryptocurrencies: Evidence of Volatility Connectedness and Hedging Strategy. Energy Economics 87: 104703. [Google Scholar] [CrossRef]

- Orastean, Ramona, Marginean Silvia Cristina, and Sava Raluca. 2019. Bitcoin in the Scientific Literature—A Bibliometric Study. Studies in Business and Economics 14: 160–74. [Google Scholar] [CrossRef] [Green Version]

- Petrolo, Damiano, Mohammad Fakhar Manesh, and Rocco Palumbo. 2023. Unpacking Business, Management, and Entrepreneurship Education Online: Insights from a Hybrid Literature Review. The International Journal of Management Education 21: 100812. [Google Scholar] [CrossRef]

- Rehman, Mobeen Ur, Paraskevi Katsiampa, Rami Zeitun, and Xuan Vinh Vo. 2023. Conditional Dependence Structure and Risk Spillovers between Bitcoin and Fiat Currencies. Emerging Markets Review 55: 100966. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Alireza Abdollahi, Karim Rejeb, and Horst Treiblmaier. 2022a. Drones in Agriculture: A Review and Bibliometric Analysis. Computers and Electronics in Agriculture 198: 107017. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Karim Rejeb, Alireza Abdollahi, Suhaiza Zailani, Mohammad Iranmanesh, and Morteza Ghobakhloo. 2022b. Digitalization in Food Supply Chains: A Bibliometric Review and Key-Route Main Path Analysis. Sustainability 14: 83. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Karim Rejeb, and John G. Keogh. 2021. Cryptocurrencies in Modern Finance: A Literature Review. Etikonomi 20: 93–118. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Karim Rejeb, Andrea Appolloni, John G. Keogh, and Mohammad Iranmanesh. 2023a. Uncovering the Green Procurement Knowledge Structure: A Systematic Citation Network Analysis. Circular Economy and Sustainability, 1–30. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Karim Rejeb, Andrea Appolloni, Sandeep Jagtap, Mohammad Iranmanesh, Salem Alghamdi, Yaser Alhasawi, and Yasanur Kayikci. 2023b. Unleashing the Power of Internet of Things and Blockchain: A Comprehensive Analysis and Future Directions. Internet of Things and Cyber-Physical Systems 4: 1–18. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Karim Rejeb, Horst Treiblmaier, Andrea Appolloni, Salem Alghamdi, Yaser Alhasawi, and Mohammad Iranmanesh. 2023c. The Internet of Things (IoT) in Healthcare: Taking Stock and Moving Forward. Internet of Things 22: 100721. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Karim Rejeb, Suhaiza Hanim Mohamad Zailani, and Alireza Abdollahi. 2022c. Knowledge Diffusion of the Internet of Things (IoT): A Main Path Analysis. Wireless Personal Communications 126: 1177–207. [Google Scholar] [CrossRef]

- Rejeb, Abderahman, Steve Simske, Karim Rejeb, Horst Treiblmaier, and Suhaiza Zailani. 2020. Internet of Things Research in Supply Chain Management and Logistics: A Bibliometric Analysis. Internet of Things 12: 100318. [Google Scholar] [CrossRef]

- Ren, Xiaohang, Rui Wang, Kun Duan, and Jinyu Chen. 2022. Dynamics of the Sheltering Role of Bitcoin against Crude Oil Market Crash with Varying Severity of the COVID-19: A Comparison with Gold. Research in International Business and Finance 62: 10167. [Google Scholar] [CrossRef] [PubMed]

- Sensoy, Ahmet. 2019. The Inefficiency of Bitcoin Revisited: A High-Frequency Analysis with Alternative Currencies. Finance Research Letters 28: 68–73. [Google Scholar] [CrossRef]

- Shen, Chien-wen, and Jung-tsung Ho. 2020. Technology-Enhanced Learning in Higher Education: A Bibliometric Analysis with Latent Semantic Approach. Computers in Human Behavior 104: 106177. [Google Scholar] [CrossRef]

- Silva Ramalho, David, and Nuno Igreja Matos. 2021. What We Do in the (Digital) Shadows: Anti-Money Laundering Regulation and a Bitcoin-Mixing Criminal Problem. ERA Forum 22: 487–506. [Google Scholar] [CrossRef]

- Sweileh, Waleed M. 2018. Research Trends on Human Trafficking: A Bibliometric Analysis Using Scopus Database. Globalization and Health 14: 106. [Google Scholar] [CrossRef] [Green Version]

- Troster, Victor, Aviral Kumar Tiwari, Muhammad Shahbaz, and Demian Nicolás Macedo. 2019. Bitcoin Returns and Risk: A General GARCH and GAS Analysis. Finance Research Letters 30: 187–93. [Google Scholar] [CrossRef]

- Urom, Christian, Ilyes Abid, Khaled Guesmi, and Julien Chevallier. 2020. Quantile Spillovers and Dependence between Bitcoin, Equities and Strategic Commodities. Economic Modelling 93: 230–58. [Google Scholar] [CrossRef]

- Urquhart, Andrew. 2016. The Inefficiency of Bitcoin. Economics Letters 148: 80–82. [Google Scholar] [CrossRef]

- Urquhart, Andrew. 2017. Price Clustering in Bitcoin. Economics Letters 159: 145–48. [Google Scholar] [CrossRef]

- Van Alstyne, Marshall. 2014. Economic and Business Dimensions: Why Bitcoin Has Value. Communications of the ACM 57: 30–32. [Google Scholar] [CrossRef]

- Wan, Jieru, You Wu, and Panpan Zhu. 2023. The COVID-19 Pandemic and Bitcoin: Perspective from Investor Attention. Frontiers in Public Health 11: 1147838. [Google Scholar] [CrossRef] [PubMed]

- Weber, Beat. 2015. Bitcoin and the Legitimacy Crisis of Money. Cambridge Journal of Economics 40: 17–41. [Google Scholar] [CrossRef]

- Wen, Fenghua, Xi Tong, and Xiaohang Ren. 2022. Gold or Bitcoin, Which Is the Safe Haven during the COVID-19 Pandemic? International Review of Financial Analysis 81: 102121. [Google Scholar] [CrossRef]

- Yarovaya, Larisa, Roman Matkovskyy, and Akanksha Jalan. 2021. The Effects of a ‘Black Swan’ Event (COVID-19) on Herding Behavior in Cryptocurrency Markets. Journal of International Financial Markets, Institutions and Money 75: 101321. [Google Scholar] [CrossRef]

- Yu, Dejian, and Libo Sheng. 2020. Knowledge Diffusion Paths of Blockchain Domain: The Main Path Analysis. Scientometrics 125: 471–97. [Google Scholar] [CrossRef]

- Yu, Dejian, and Libo Sheng. 2021. Exploring the Knowledge Development Trajectories of the Supply Chain Finance Domain: A Main Path Analysis. The International Journal of Logistics Management 32: 1315–33. [Google Scholar] [CrossRef]

- Zhou, Qingjie, Panpan Zhu, and Yinpeng Zhang. 2023. Contagion Spillover from Bitcoin to Carbon Futures Pricing: Perspective from Investor Attention. Energies 16: 929. [Google Scholar] [CrossRef]

| Cluster ID | Size | Silhouette | Mean (Year) | Label (LSI) | High-Frequency Keywords |

|---|---|---|---|---|---|

| 0 | 100 | 0.785 | 2020 | safe haven | COVID-19; gold; safe haven; hedge; EPU; cryptocurrency market; hedging; volatility spillover; granger causality; diversification |

| 1 | 65 | 0.754 | 2017 | internet of things | IoT; money; AI; cryptography; cybersecurity; trust; finance; herding; payment system |

| 2 | 64 | 0.772 | 2019 | proof of work | PoW; consensus; scalability; decentralization; consensus protocol; P2P network; consensus algorithm; proof of stake; hyperledger fabric; transaction; authentication |

| 3 | 62 | 0.83 | 2019 | market efficiency | LSTM; market efficiency; deep learning; ANN; bitcoin price; prediction; efficient market hypothesis; bitcoin future; price discovery; hurst exponent |

| 4 | 55 | 0.703 | 2020 | sentiment analysis | machine learning; sentiment analysis; VAR; twitter; liquidity; bibliometric analysis; anomaly detection; random forest; data mining; social media |

| 5 | 53 | 0.76 | 2019 | digital currency | digital currency; FinTech; financial market; altcoin; selfish mining; energy consumption; sustainability; contagion; industry 4.0; event study |

| 6 | 52 | 0.824 | 2017 | privacy | privacy; forecasting; anonymity; ICO; mining; lightning network; ransomware; PCN; de-anonymization; blockchain security |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rejeb, A.; Rejeb, K.; Alnabulsi, K.; Zailani, S. Tracing Knowledge Diffusion Trajectories in Scholarly Bitcoin Research: Co-Word and Main Path Analyses. J. Risk Financial Manag. 2023, 16, 355. https://doi.org/10.3390/jrfm16080355

Rejeb A, Rejeb K, Alnabulsi K, Zailani S. Tracing Knowledge Diffusion Trajectories in Scholarly Bitcoin Research: Co-Word and Main Path Analyses. Journal of Risk and Financial Management. 2023; 16(8):355. https://doi.org/10.3390/jrfm16080355

Chicago/Turabian StyleRejeb, Abderahman, Karim Rejeb, Khalil Alnabulsi, and Suhaiza Zailani. 2023. "Tracing Knowledge Diffusion Trajectories in Scholarly Bitcoin Research: Co-Word and Main Path Analyses" Journal of Risk and Financial Management 16, no. 8: 355. https://doi.org/10.3390/jrfm16080355