Internet Banking Service Perception in Mexico

Abstract

1. Introduction

2. Literature Review

Conceptual Model

3. Materials and Methods

4. Results

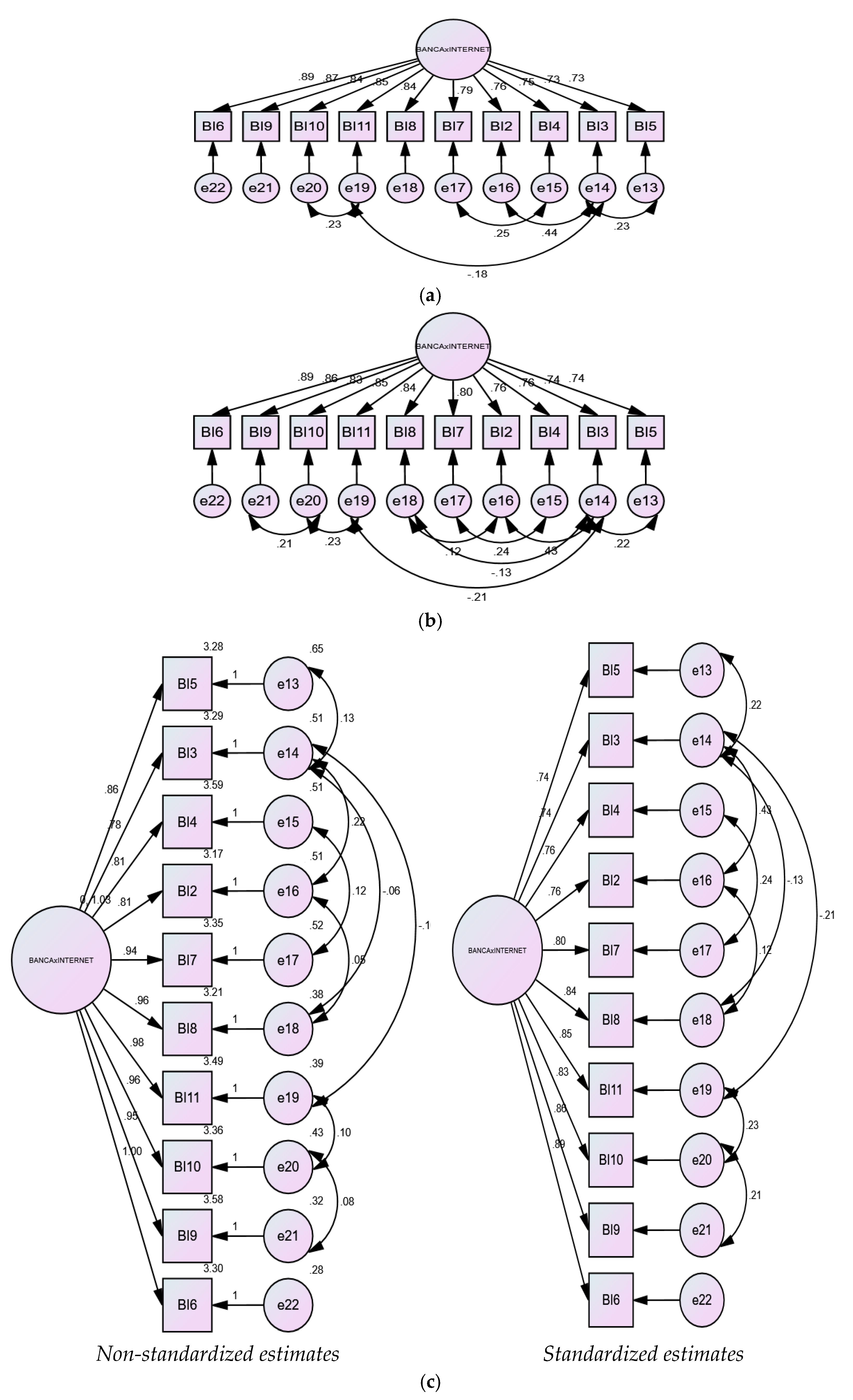

SEM Methodology for Confirmatory Analysis

5. Discussion

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Not at All Satisfied | Not Very Satisfied | Satisfied | Very Satisfied | Extremely Satisfied | Not Applicable | |

|---|---|---|---|---|---|---|

| Convenience | ||||||

| Adaptability | ||||||

| Security | ||||||

| User friendly | ||||||

| Low service charge | ||||||

| Accurate and timely service | ||||||

| Monthly account statement | ||||||

| Speed in decision-making | ||||||

| Easy transfer | ||||||

| Internet connectivity | ||||||

| Accessibility |

References

- Ahn, Sang Joo, and Seong Ho Lee. 2019. The effect of consumers’ perceived value on acceptance of an Internet-only bank service. Sustainability 11: 4599. [Google Scholar] [CrossRef]

- Akhter, Ayeasha, Md Uzzal Hossain, and Md Mobarak Karim. 2020. Exploring customer intentions to adopt mobile banking services: Evidence from a developing country. Banks and Bank Systems 15: 105–16. [Google Scholar] [CrossRef]

- Anouze, Abdel Latef M., and Ahmed S. Alamro. 2020. Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing 38: 86–112. [Google Scholar] [CrossRef]

- Arshad Khan, Mohammed, and Hamad A. Alhumoudi. 2022. Performance of E-Banking and the Mediating Effect of Customer Satisfaction: A Structural Equation Model Approach. Sustainability 14: 7224. [Google Scholar] [CrossRef]

- Avendaño, Octavio. 2018. Los retos de la banca digital en México. Revista del Instituto de Ciencias Jurídicas de Puebla, México. Nueva Época 12: 87–108. [Google Scholar] [CrossRef]

- Batista, Juan Manuel, and Germa Coenders. 2000. Modelos de ecuaciones estructurales [Structural Equation Models]. Madrid: La Muralla. [Google Scholar]

- Cassimon, Steven, Maravalle Alejandro, González Alberto, and Lou Turroque. 2022. Determinants of and Barriers to People’s Financial Inclusion in Mexico. OECD Economic Department Working Papers. No. 1728. Paris: Organisation for Economic Co-Operation and Development. [Google Scholar]

- Castillo-Villar, Fernando, and Rosalía Castillo-Villar. 2022. Mobile banking affordances and constraints by the elderly. Marketing Intelligence & Planning 41: 124–37. [Google Scholar] [CrossRef]

- Cea, María A. 2020. Análisis Multivariable. Teoría y práctica en la investigación social [Multivariate Analysis. Theory and Practice in Social Research]. Madrid: Síntesis. [Google Scholar] [CrossRef]

- Chuttur, Mohammad. 2009. Overview of the Technology Acceptance Model: Origins, Developments and Future Directions. In Sprouts: Working Papers on Information Systems. Bloomington: Indiana University, vol. 9. [Google Scholar]

- Davis, Fred D. 1985. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Doctoral thesis, MIT Sloan School of Management, Cambridge, MA, USA. [Google Scholar]

- Dircio-Palacios-Macedo, María del Carmen, Cruz-García Paula, Hernández-Trillo Fausto, and Tortosa-Ausina Emili. 2023. Constructing a financial inclusion index for Mexican municipalities. Finance Research Letters 52: 103368. [Google Scholar] [CrossRef]

- Duc, Phan. 2022. Customer satisfaction in digital banking sector in Vietnam: A metacase approach. Telos: Revista de Estudios Interdisciplinarios en Ciencias Sociales 24: 819–36. [Google Scholar] [CrossRef]

- Durai, Tabitha, and G. Stella. 2019. Digital finance and its impact on financial inclusion. Journal of Emerging Technologies and Innovative Research 6: 122–27. [Google Scholar]

- Efron, Robert. 1969. What is perception? In Proceedings of the Boston Colloquium for the Philosophy of Science 1966/1968. Edited by Robert S. Cohen and Marx W. Wartofsky. Boston Studies in the Philosophy of Science, l 4. Dordrecht: Springer. [Google Scholar] [CrossRef]

- George, Ajimon. 2018. Perceptions of Internet Banking Users—A Structural Equation Modeling (SEM) Approach. IIMB Management Review 30: 357–68. [Google Scholar] [CrossRef]

- Gronroos, Christian. 1982. Strategic Management and Marketing in the Service Sector. Helsingfors: Swedish School of Economics and Business Administration. [Google Scholar]

- Guerra, José Manuel Montero, Ignacio Danvila-del-Valle, and Mariano Méndez-Suárez. 2023. The impact of digital transformation on talent management. Technological Forecasting and Social Change 188: 122291. [Google Scholar] [CrossRef]

- Jung, Ji-Hee, and Jae-Ik Shin. 2019. The Effect of Choice Attributes of Internet Specialized Banks on Integrated Loyalty: The Moderating Effect of Gender. Sustainability 11: 7063. [Google Scholar] [CrossRef]

- Ling, Goh Mei, Yeo Sook Fern, Lim Kah Boon, and Tan Seng Huat. 2016. Understanding Customer Satisfaction of Internet Banking: A Case Study In Malacca. Procedia Economics and Finance 37: 80–85. [Google Scholar] [CrossRef]

- Martínez-Domínguez, Marlen. 2021. Adoption of Electronic Services in Mexico: The Case of E-banking, E-commerce and E-government. Economía Teoría y Práctica, Nueva Época 29: 171–94. [Google Scholar] [CrossRef]

- Mbama, Cajetan I., and Patrick O. Ezepue. 2018. Digital banking, customer experience and bank financial performance: UK customers’ perceptions. International Journal of Bank Marketing 36: 230–55. [Google Scholar] [CrossRef]

- Moreno-García, Elena, Arturo García-Santillán, and Damaris Platas. 2021. Students Perception About Digital Financial Services. International Journal of Financial Research 12: 212–24. [Google Scholar] [CrossRef]

- Nagar, Nishith, and Eshima Ghai. 2019. A Study of Bank Customer’s Reliability towards electronic Banking (E-Banking) Channel’s! International Journal of Management Studies 1: 34. [Google Scholar] [CrossRef]

- Nguyen, Linh, and Hieu Tran. 2020. Customer Perception towards Electronic Banking and its Relationship with Customer Satisfaction: An Evidence from Vietnam. International Journal of Business and Management 15: 196–208. [Google Scholar] [CrossRef]

- OECD. 2020. Advancing the Digital Financial Inclusion of Youth. Available online: www.oecd.org/daf/fin/financial-education/advancing-the-digital-financial-inclusionof-youth.htm (accessed on 7 March 2022).

- Özleblebici, Zafer, and Sahin Çetin. 2015. The role of managerial perception within strategic management: An exploratory overview of the literature. Procedia—Social and Behavioral Sciences 207: 296–305. [Google Scholar] [CrossRef][Green Version]

- Parasuraman, A. Parsu, Berry Leonard, and Valerie Zeithaml. 1988. SERVQUAL: A Multiple-Item Scale for Measuring Customer Perceptions of Service Quality. Journal of Retailing 64: 12–40. [Google Scholar]

- Picoto, Winnie N., and Inês Pinto. 2021. Cultural impact on mobile banking use—A multi-method approach. Journal of Business Research 124: 620–28. [Google Scholar] [CrossRef]

- Pradhan, Rahde, and Poshan Dahal. 2021. Effect of E-Banking on Financial Inclusion in Nepal. International Journal of Finance, Entrepreneurship & Sustainability 1: 33–40. [Google Scholar]

- Quintero Peña, José Wilmar, and Manuel Antonio Mejía Baños. 2022. Factores asociados a la adopción de la banca electrónica en México. Revista Mexicana de Economía y Finanzas, Nueva Época 17: e659. [Google Scholar] [CrossRef]

- Rahi, Samar, Majeed Mustafa Othman Mansour, Malek Alharafsheh, and Mahmoud Alghizzawi. 2021. The post-adoption behavior of internet banking users through the eyes of self-determination theory and expectation confirmation model. Journal of Enterprise Information and Management 34: 1874–92. [Google Scholar] [CrossRef]

- Ramírez Barón, María C., Blanca R. García Rivera, and Mónica F. Aran. 2019. La relación de la confianza, la actitud y el compromiso en e luso de la banca en línea. Revista de Investigación Latinoamericana en Competitividad Organizacional 3: 1. [Google Scholar]

- Raza, Syed Ali, Amna Umer, Muhammad Asif Qureshi, and Abdul Samad Dahri. 2020. Internet banking service quality, e-customer satisfaction and loyalty: The modified e-SERVQUAL model. The TQM Journal 32: 1443–66. [Google Scholar] [CrossRef]

- Roy, Sanjay Chandra, and Pronab Kumer Saha. 2015. Customer Perception of Banking Service Quality: A Study on Jamuna Bank Limited in Sylhet City. European Journal of Business and Management 7: 1–7. [Google Scholar]

- Shankar, Amit, and Charles Jebarajakirthy. 2019. The influence of e-banking service quality on customer loyalty: A moderated mediation approach. International Journal of Bank Marketing 37: 1119–42. [Google Scholar] [CrossRef]

- Shanmugam, Mohana, Yen-Yao Wang, Hatem Bugshan, and Nick Hajli. 2015. Understanding customer perceptions of internet banking: The case of the UK. Journal of Enterprise Information Management 28: 622–36. [Google Scholar] [CrossRef]

- Singh, Inderpal, Anand Nayyar, Doan Hong Le, and Subhankar Das. 2019. A conceptual analysis of internet banking users´ perception: An Indian perceptive. Espacios 40: 1–41. [Google Scholar]

- Statista. 2023. México: Usuarios de Banca en Línea 2010–2021. Statista Research Department. Available online: https://es.statista.com/estadisticas/1186233/numero-usuarios-banca-internet-mexico/#statisticContainer (accessed on 30 July 2023).

- Vig, Sakshi, Arpita Gupta, and Jugal Goyal. 2022. Customer Perception towards Online Banking. Paper presented at International Conference on Advances in Management Practices (ICAMP), Delhi, India, December 17–18. [Google Scholar] [CrossRef]

- Vuković, Marija, Pivac Snježana, and Kundid Duje. 2019. Technology Acceptance Model for the Internet Banking Acceptance in Split. Business Systems Research Journal 10: 124–40. [Google Scholar] [CrossRef]

- Weston, Rebecca, and Paul Gore. 2006. A Brief Guide to Structural Equation Modeling. The Counseling Psychologist 34: 719–51. [Google Scholar] [CrossRef]

- Yeşildağ, Eser. 2019. Factors Affecting Internet Banking Preferences and Their Relation to Demographic Characteristics. In Contemporary Issues in Behavioral Finance (Contemporary Studies in Economic and Financial Analysis, Volume 101. Edited by Simon Grima, Ercan Özen, Hakan Boz, Jonathan Spiteri and Eleftherios Thalassinos. Bingley: Emerald Publishing Limited, pp. 187–203. [Google Scholar]

- Yuan, Yang, Fujun Lai, and Zhaofang Chu. 2019. Continuous usage intention of Internet banking: A commitment trust model. Information Systems and e-Business Management 17: 1–25. [Google Scholar] [CrossRef]

- Ziolo, Magdalena, Beata Zofia Filipiak, Iwona Bąk, and Katarzyna Cheba. 2019. How to Design More Sustainable Financial Systems: The Roles of Environmental, Social, and Governance Factors in the Decision-Making Process. Sustainability 11: 5604. [Google Scholar] [CrossRef]

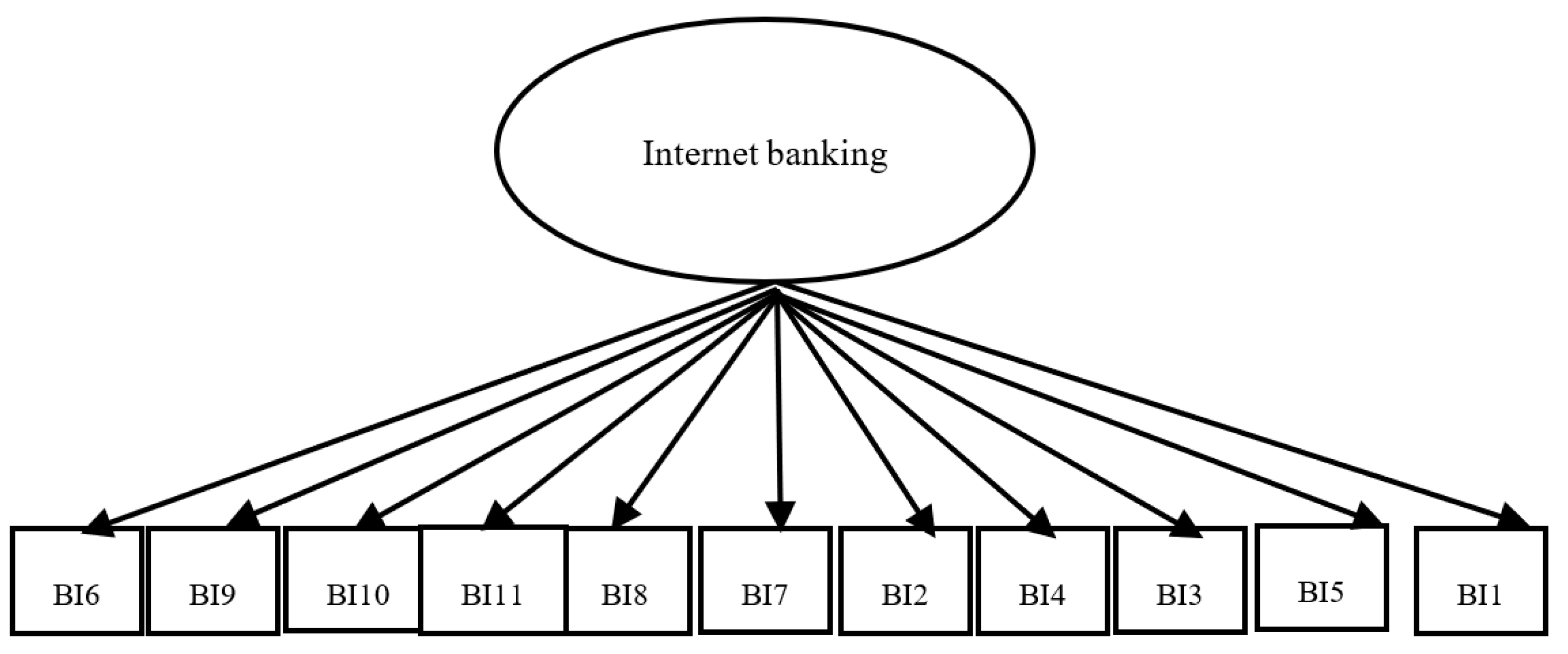

| Latent Variable | Code | Indicator |

|---|---|---|

| Internet banking | BI1 | Convenience |

| BI2 | Adaptability | |

| BI3 | Security | |

| BI4 | User friendly | |

| BI5 | Low service charge | |

| BI6 | Accurate and timely service | |

| BI7 | Monthly account statement | |

| BI8 | Speed in decision-making | |

| BI9 | Easy transfer | |

| BI10 | Internet connectivity | |

| BI11 | Accessibility |

| Latent Variable | Indicators | Average Scale If the Element Has Been Suppressed | Scale Variance If the Element Has Been Suppressed | Total Item Correlation Corrected | Squared Multiple Correlation | Cronbach’s Alpha If the Item Has Been Deleted |

|---|---|---|---|---|---|---|

| Internet banking | BI1 | 38.6548 | 89.074 | 0.668 | 0.593 | 0.912 |

| BI2 | 38.6244 | 87.797 | 0.787 | 0.755 | 0.908 | |

| BI3 | 38.5025 | 88.802 | 0.759 | 0.682 | 0.909 | |

| BI4 | 38.2030 | 88.622 | 0.744 | 0.617 | 0.910 | |

| BI5 | 38.5178 | 88.139 | 0.696 | 0.599 | 0.911 | |

| BI6 | 38.4924 | 85.588 | 0.858 | 0.766 | 0.905 | |

| BI7 | 38.4518 | 86.729 | 0.761 | 0.665 | 0.909 | |

| BI8 | 38.5888 | 86.539 | 0.804 | 0.703 | 0.907 | |

| BI9 | 38.2132 | 86.526 | 0.832 | 0.741 | 0.906 | |

| BI10 | 38.4365 | 86.023 | 0.808 | 0.720 | 0.907 | |

| BI11 | 38.3046 | 86.458 | 0.789 | 0.731 | 0.907 |

| Item | BI1 | BI2 | BI3 | BI4 | BI5 | BI6 | BI7 | BI8 | BI9 | BI10 | BI11 | MSA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BI1 | 1 | 0.75 | 0.63 | 0.48 | 0.42 | 0.59 | 0.51 | 0.56 | 0.58 | 0.55 | 0.52 | 0.928 a |

| BI2 | 1 | 0.74 | 0.6 | 0.5 | 0.69 | 0.58 | 0.68 | 0.66 | 0.64 | 0.64 | 0.883 a | |

| BI3 | 1 | 0.64 | 0.61 | 0.64 | 0.59 | 0.59 | 0.66 | 0.62 | 0.56 | 0.914 a | ||

| BI4 | 1 | 0.61 | 0.67 | 0.7 | 0.6 | 0.66 | 0.62 | 0.61 | 0.947 a | |||

| BI5 | 1 | 0.66 | 0.56 | 0.63 | 0.6 | 0.63 | 0.65 | 0.914 a | ||||

| BI6 | 1 | 0.74 | 0.77 | 0.76 | 0.71 | 0.74 | 0.958 a | |||||

| BI7 | 1 | 0.7 | 0.68 | 0.65 | 0.66 | 0.934 a | ||||||

| BI8 | 1 | 0.7 | 0.71 | 0.71 | 0.948 a | |||||||

| BI9 | 1 | 0.78 | 0.76 | 0.951 a | ||||||||

| BI10 | 1 | 0.78 | 0.953 a | |||||||||

| BI11 | 1 | 0.939 a |

| Indicators | Factor Attributes of Internet Banking | h2 | Factor | Initial Eigenvalues | ||

|---|---|---|---|---|---|---|

| Total | % of Variance | % Accumulated | ||||

| BI6 | 0.879 | 0.773 | 1 | 7.428 | 67.531 | 67.531 |

| BI9 | 0.867 | 0.752 | 2 | 0.803 | 7.298 | 74.829 |

| BI10 | 0.845 | 0.714 | 3 | 0.538 | 4.892 | 79.721 |

| BI11 | 0.840 | 0.706 | 4 | 0.482 | 4.383 | 84.103 |

| BI8 | 0.836 | 0.699 | 5 | 0.389 | 3.537 | 87.641 |

| BI7 | 0.795 | 0.632 | 6 | 0.294 | 2.669 | 90.31 |

| BI2 | 0.794 | 0.630 | 7 | 0.268 | 2.437 | 92.747 |

| BI4 | 0.764 | 0.584 | 8 | 0.239 | 2.175 | 94.922 |

| BI3 | 0.763 | 0.583 | 9 | 0.231 | 2.097 | 97.018 |

| BI5 | 0.732 | 0.536 | 10 | 0.187 | 1.699 | 98.717 |

| BI1 | 0.683 | 0.467 | 11 | 0.141 | 1.283 | 100 |

| Extraction method: maximum likelihood. a.1 extracted factors. Four iterations needed. | Extraction Sums of Squared Charges | |||||

| % of variance | % of variance | % of variance | ||||

| 7.077 | 64.336 | 64.336 | ||||

| Summary of Model Fit | |

|---|---|

| Index | Value |

| Chi-square (2 g·L) | 2.353 |

| Probability level | 0.308 |

| GFI | 0.992 |

| CFI | 0.999 |

| RMSEA | 0.035 |

| Reliability and variance extracted | |

| Construct reliability | 0.732 |

| Variance extracted | 0.695 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moreno-García, E. Internet Banking Service Perception in Mexico. J. Risk Financial Manag. 2023, 16, 364. https://doi.org/10.3390/jrfm16080364

Moreno-García E. Internet Banking Service Perception in Mexico. Journal of Risk and Financial Management. 2023; 16(8):364. https://doi.org/10.3390/jrfm16080364

Chicago/Turabian StyleMoreno-García, Elena. 2023. "Internet Banking Service Perception in Mexico" Journal of Risk and Financial Management 16, no. 8: 364. https://doi.org/10.3390/jrfm16080364

APA StyleMoreno-García, E. (2023). Internet Banking Service Perception in Mexico. Journal of Risk and Financial Management, 16(8), 364. https://doi.org/10.3390/jrfm16080364