1. Introduction

Currently, there are more and more changes in the automotive market focused on the production of zero-emission cars. Changes in the automotive industry push the limits of possible solutions in autonomous cars, introduce innovative, based on advanced electronics, car maintenance and servicing solutions. In particular, they concern the introduction of electric drive to cars, which is related to the demand for light metals, rare metals, graphite. Environmental regulations, as well as consumer awareness of the ongoing global climate change, are increasing the demand for electric cars (EVs). The barriers that stand in the way of widespread electric motorization are the price of the car and poor electric charging infrastructure. The use of electric cars is also not synonymous with a complete lack of environmental impact. An assessment shows that charging electric cars does not necessarily reduce the carbon footprint if the energy does not come from renewable sources. It was also found that every kilometer traveled by an electric vehicle produces 35–50 times more sulfur oxides than a conventional vehicle (

Liu et al. 2012). It was found that the high weight of electric cars causes more wear on the rubber treads of the wheels and, consequently, more contamination with rubber particles. Extraction and production of materials for the construction of electric cars and their batteries is a source of environmental pollution. The carbon footprint of electric-car production is therefore not zero. Despite these reservations, so far no alternative solutions have gained significant market popularity. There are reports of using hydrogen to power vehicles. However, this possibility does not translate into widespread use. Electric motoring is a megatrend. The problems of electric motoring are primarily related to the availability and prices of battery materials that require elements such as lithium, cobalt, magnesium, nickel and graphite. Mining of these elements is concentrated in few countries in the world, which introduces risk in supply chains. Since most of the production and processing of materials for electric-car batteries is carried out in China, there is a risk of dependence on this country (

Altenburg et al. 2022). There is also a problem with the appropriate number of vehicle-charging stations (

Canizes et al. 2019;

The Global Electric Vehicle Market Overview 2023). This article briefly presents the main issues related to the risks related to the production of electric-car batteries. The research problem boils down to assessing the risk of supplies of materials necessary for the production of batteries for electric cars. They are the most critical element of the car in terms of material and cost. Materials for the construction of batteries for electric cars are sourced in several countries around the world, and most of the components are produced in China. There is a need to analyze the possibilities of supply diversification, as well as assess the risk related to the narrow scope of flexibility of supply chains on the one hand, and their widespread globalization on the other. The prices of materials for the construction of batteries affect the prices of electric cars and the purchasing power of consumers. What are the prospects for implementing the idea of a complete transition to zero-emission cars? This will probably depend primarily on advances in material solutions for the construction of batteries for electric cars. The aim of the article is to search for an answer to the question to what extent the demand for materials for the construction of electric batteries and the risk associated with the threats in their supply affect changes in the automotive industry.

The article was built from a literature review; it analyzes the technological and economical aspects of the automotive market, with particular emphasis on the issues of electric motorization. The article is organized as follows: after the Introduction, there is a

Section 2 entitled “Trends in Car Production”, which briefly presents the development trends in the automotive industry. The

Section 3 “Impact of motorization on the environment" informs about car emission. Then the

Section 4 “Risk of Electric-Car Supply Chains” presents the problems of obtaining materials for electric-car batteries, in the next

Section 5 “The Impact of Costs on the Demand for Electric Cars” the costs of electric cars are assessed and compared to the price of classic cars powered by internal-combustion engines. The next

Section 6 of the article is the “Discussion”, in which a short analysis of the data obtained from the literature review is carried out and possible directions for further pro-ecological activities in the field of the automotive industry are indicated. “Conclusions” (

Section 7) presents a synthetic summary of the most important issues of the current automotive industry.

2. Trends in Car Production

From January to May 2023, the EU car market grew by 18%, to 4.4 million registered cars. Although the market improved in May, year-to-date sales are still 23% lower compared to the same month in 2019, when 5.7 million units were registered. In this five-month period, there were double-digit gains in most markets, including the four largest: Spain (+26.9%), Italy (+26.1%), France (+16.3%) and Germany (+10.2%). In May, the share of the battery electric-car market recorded a significant increase from 9.6% to 13.8%. Hybrid electric cars are now the second-most popular choice for new-car buyers, accounting for almost a quarter of the market. However, petrol cars still have the largest share at 36.5%. (

Cuenot and Fulton 2011;

Automotive Trends Report 2023). The bulk of electric-car sales has been predominantly concentrated in three major markets: China, Europe and the United States. China totally dominated the electric-car market, making up 60% of global sales (

Melissa 2023;

Chu and Cui 2023). Czechia, Slovakia and Poland were the largest vehicle producers in 2020 (

Pavlínek 2023). COVID-19 ripple effects, including the shortages of semiconductors, continued to negatively affect car production in 2021 and 2022. The 2022 production was also negatively affected by the war in Ukraine. Current trends in the automotive industry generate regulatory and competitive pressures on European carmakers to adopt electric-car technology. Despite government messages about the need to address climate change, the transition to electric cars is mainly due to convincing consumers that their use will significantly reduce car-operating costs (

Deloitte 2023). The price of an average new car increased by about 27 percent between 2012 and 2021. This trend will probably persist. Rising car prices coupled with declining consumer purchasing power may limit car sales (

Global Strategy Group 2023). However the global automotive finance market is projected to grow from USD 245.62 billion in 2021 to USD 385.42 billion by 2028. The market is expected to grow at Compound Annual Growth Rate of 6.5% (

Fortune Business Insights 2023). The automotive industry is a major industrial and economic force in several economies. More recently, China has become a leader in the industry, particularly with regard to the production of electric cars (Electric Vehicle). The automotive industry consists of complex supply chains, which over time have evolved into a global production network (

Deloitte 2023;

Frigant and Zumpe 2014). While only a limited number of countries and companies lead the production of automobiles, the industry’s value chain is spread all over the globe and a large number of companies are involved in designing, developing, manufacturing, marketing, selling, repairing and servicing automobiles and automobile components (

ILO 2021). On average, each car contains more than 20,000 parts, which original equipment manufacturers (original equipment manufacturer) source from thousands of different suppliers (

Kapadia 2018).

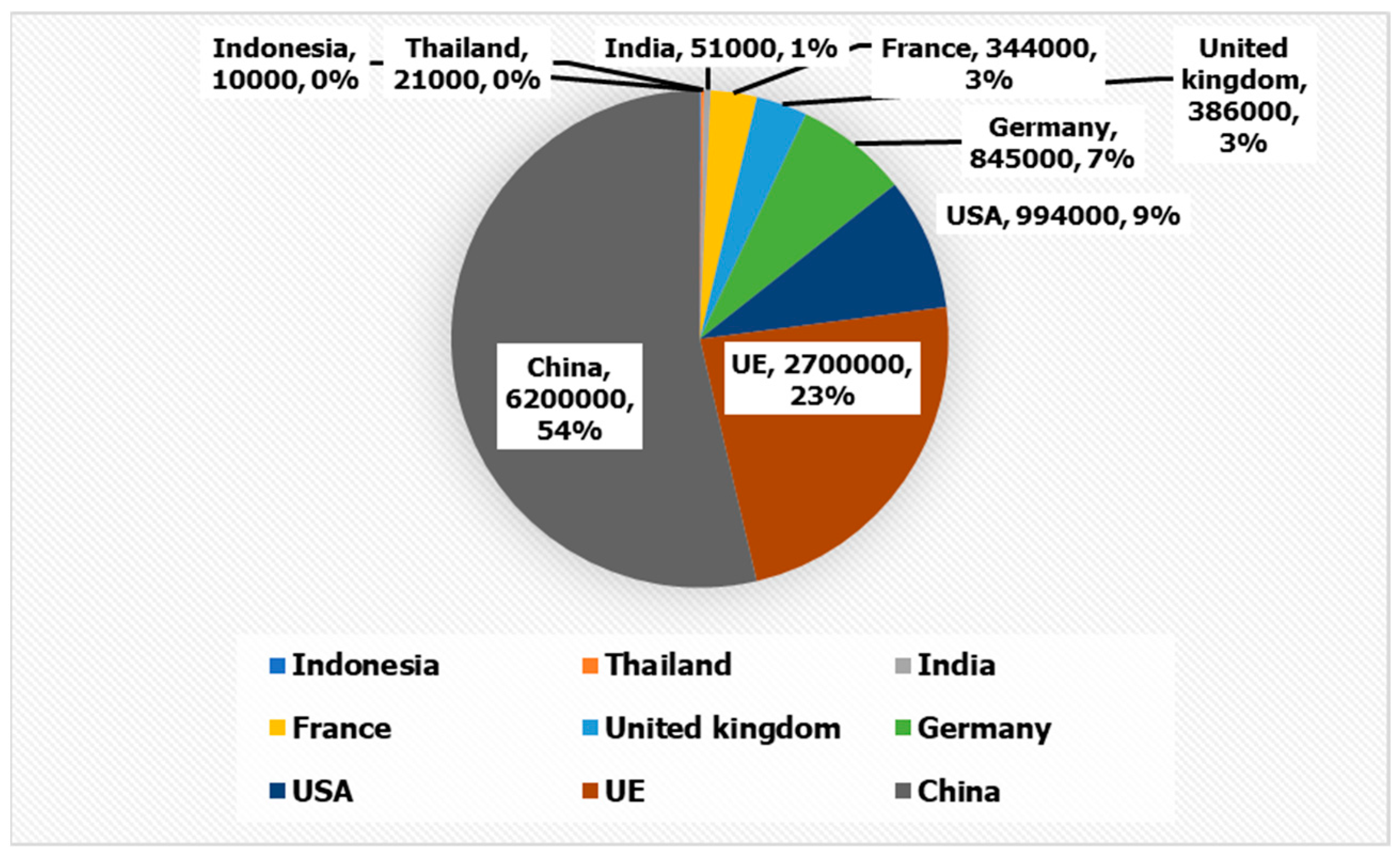

China remains the world’s largest electric-car market (

IEA 2023a). In 2022, 6.2 million electric cars were sold in the country; that was an 82% increase from 2021, and China’s sales represented 59% of the global total. Europe as a single market sold 2.7 million EVs in 2022, a 15% increase from 2021 and 25% of the global total. With 994,000 EV sales in 2022, the United States resumed its place as the second-largest national electric-car market, after briefly being supplanted by Germany in 2020 and 2021; 2022 sales were up 50% from the previous year and represented 9.3% of the global total. Rounding out the top five national electric cars markets in 2022 were Germany (845,000), the United Kingdom (386,000) and France (344,000) (

Figure 1). Japan hit an all-time high in electric-car sales of 92,000 in 2022, a 109% increase over the previous year, and improved its ranking from 17th in 2021 to 13th in 2022. Nascent markets in Southeast and South Asia grew their electric-car sales in the year. For example, Indonesia, India and Thailand recorded 10,000, 51,000 and 21,000 in 2022 sales, respectively, increases of 1,100%, 210% and 130% from 2021 (

Figure 1). The Association of Southeast Asian Nations (ASEAN) as a single market sold 39,000 electric cars in 2022, a 165% increase from the previous year.

3. Impact of Motorization on the Environment

The automotive industry is under immense pressure, both from governments and consumers, to improve the environmental sustainability of the production and use of vehicles. The transport sector is the fastest-growing contributor to greenhouse-gas emissions, accounting for 24% of CO

2 emissions and approximately 14% of total GHG emissions. Road transport—including cars, trucks, buses and two- and three-wheelers—is in turn responsible for about 75% of overall transport emissions (

IEA 2019). The transportation sector generates the largest share of greenhouse-gas emissions. Greenhouse-gas emissions from transportation primarily come from burning fossil fuel for our cars, trucks, ships, trains and planes (

St. John 2022). Over 94% of the fuel used for transportation is petroleum-based, primarily gasoline and diesel (

EPA 2023). Transformations of the automotive market towards environmental protection focus on such proposals as the production of electric cars (

Celasun et al. 2023) or hydrogen-powered cars. Overall vehicle trends are influenced by both vehicle technology and design as well as changes in the distribution of manufactured vehicles (

OICA 2023). For a specific vehicle, increased weight or power may result in higher CO

2 emissions and lower fuel consumption, all other factors being equal. Larger vehicles, in this case measured by the area taken up by four tires, also have higher CO

2 emissions and lower fuel consumption. The carbon footprint is the basis for setting regulatory standards under the greenhouse gas and Corporate Average Fuel Economy regulations. Electric vehicles do not emit exhaust fumes from the tailpipe; however, vehicle weight, horsepower and size can still affect a vehicle’s fuel economy (measured in miles per gallon of gasoline equivalent). Fuel consumption has increased for all types of vehicles since 2008. However, improvements in technology have shifted the market towards fuel economy and reduced CO

2 emissions (

Automotive Trends Report 2023).

Analyses in this work revealed that the electric car, regardless of the road conditions, achieved lower carbon-dioxide emissions, in the range of 10–65%, compared to the car with a combustion engine (

Kubik et al. 2023). Also, the authors of the paper (

Grzesiak and Sulich 2022) found a higher emissivity of gasoline-powered cars than electric cars while driving.

On the other hand, investigation of the whole footprint shows that there was not much difference in carbon-dioxide emissions in the production phase of electric and combustion vehicles. The differences are due to the presence of batteries in electric cars and the place of production (

Neugebauer et al. 2022). The CO

2 emissions associated with an electric cars depend on the energy sources used to power its batteries, which depend on the place of use, with different operating emissions. All variants have been adopted for a car lifetime of 150,000 km, as driving more miles with an electric car would require battery replacement, resulting in a significant increase in cumulative CO

2 emissions over the vehicle’s life cycle. At the stage of production of the “body” of the engine and drive, there are no differences in the level of CO

2 emissions for both analyzed car models. The biggest differences are in the production of batteries: 6337 and 19.5 kg-CO

2 for electric and internal combustion cars, respectively. Similarly, at the disposal stage, the disposal of an electric car is associated with more than 1900 kg of CO

2 emissions. This is mainly due to the high CO

2 emissions associated with battery disposal. In turn, the annual maintenance of both vehicles generates comparable CO

2 emissions. However, the type of power source has the greatest impact on the ecological use of an electric car in relation to a combustion engine. In the case of the variant, electricity from photovoltaics or wind, the cumulative CO

2 emission for an electric car is more than twice lower than for a combustion vehicle. The results obtained in the work (

Neugebauer et al. 2022) are completely different from those given in (

Teixeira and Sodré 2018;

Kubik et al. 2023;

Grzesiak and Sulich 2022), where the authors showed that the replacement of internal-combustion engines with electric cars is always beneficial from the point of view of CO

2 emissions. This is only true when the emissions related to driving the car itself are taken into account; however, when emissions (especially) in the production and operation phases are taken into account, unfortunately the conclusion is exactly the opposite. This indicates that only a complete change of habits at every stage of car production and use can help reduce CO

2 emissions and fight global warming.

4. Risk of Electric-Car Supply Chains

The basic elements regarding the development of the automotive industry are light metals, rare metals and graphite (

Barman et al. 2023). The sources of these materials are a few countries, which means that their availability is limited and the risk of supply is high. This has a significant impact on the supply chains for the production of batteries and electric cars themselves (

Racu 2023).

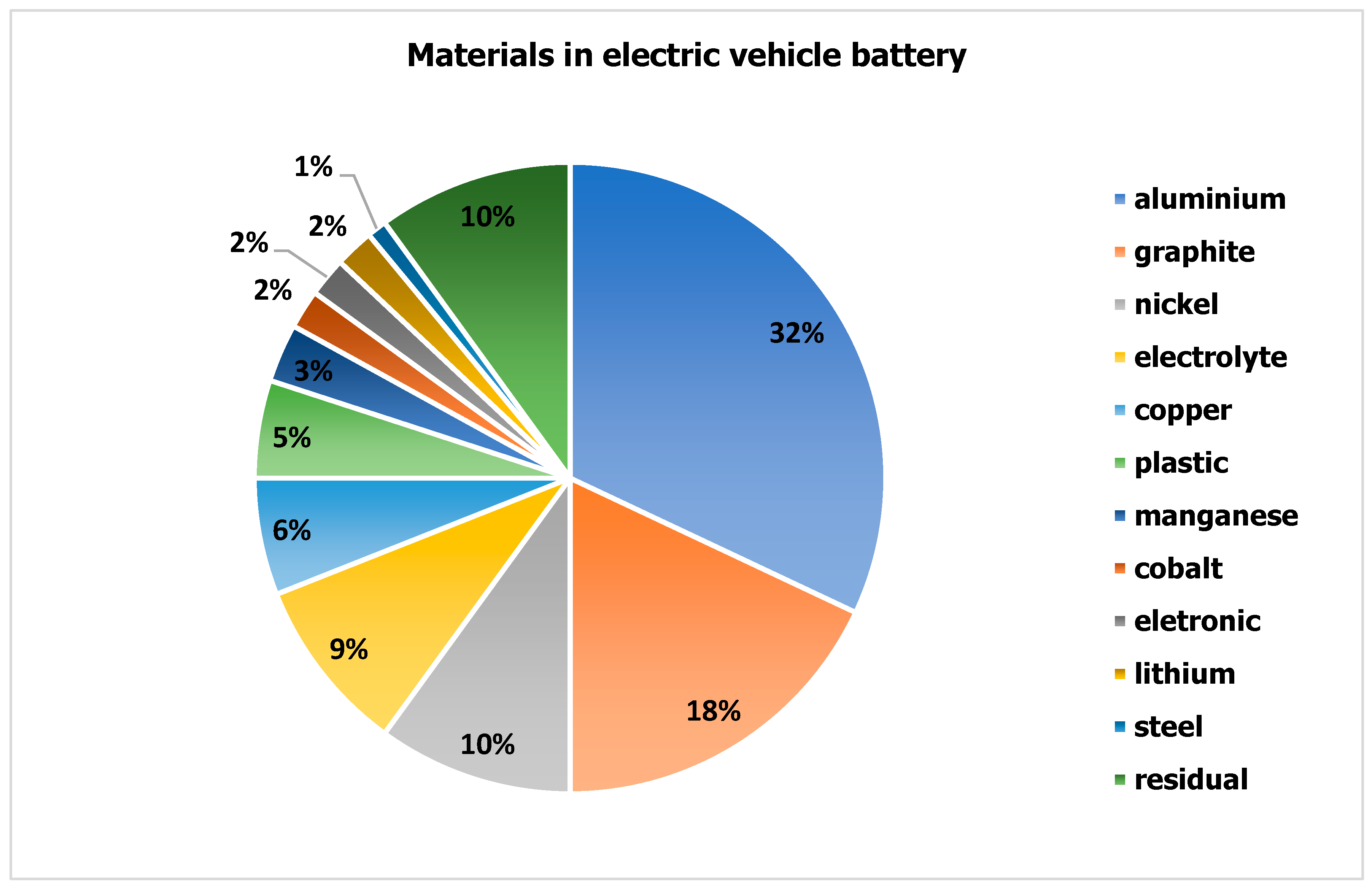

The following materials are needed to make an electric-vehicle battery (share and absolute amount) (

Ragonnaud 2023): aluminium (126 kg—32%), graphit (71 kg—18%), nickel (41 kg—10%), electrolyte (37 kg—9%), copper (22 kg—6%), plastic (21 kg—5%), manganese (12 kg—3%), cobalt (9 kg—2%), electronics (9 kg—2%), lithium (8 kg—2%), steel (3 kg—1%), residual (41 kg—10%) (

Figure 2).

Lithium-ion batteries and electric arc furnace (EAF) electrodes are used in the metallurgy. In 2021, China remained the world’s largest producer of natural graphite, with a global market share of 79% (

Ritoe et al. 2022). In 2022, the lithium-ion battery anode market became the largest end-use market for natural flake graphite.

Australia has a dominant position in the global lithium market. In 2022, Australia supplied 79% of the world’s lithium—a hard concentrate of spodumene—and secured 53% of the global supply of lithium (

Pollard 2023). In 2022 Australia produced 61,000 tons of lithum. China dominates Australia’s customer base and imported 96% of the total lithium in 2021/22. The second and third importers of Australian lithium were Belgium (2.3%) and South Korea (0.9%).

Chile is the second largest producer of lithium in the world (30,000 in 2022); next are China 19,000, Argentina 6200, Zimbabwe 800 tons, Portugal 600, Canada 500 tons and others 700 tons (

Venditti and Parker 2023). Chile is the world’s largest lithium producer from brines, and the second largest producer overall after Australia, which produces lithium from rock. Chile’s lithium production comes from just one source: the Salar de Atacama in the north, home to the one of largest lithium reserves in the world, 9.2 million tons. Chile produced almost 30% of global output in 2021, or 26,000 tons. But its sector is dominated by just two companies, with no new projects on the horizon (

Vásquez 2023). Argentina is the fourth-largest lithium-producing country in the world after Australia, Chile and China. In 2021, Argentina produced 6200 tons of lithium. That was just a little more than a fourth of Chile’s output.

The larges lithium reserves are in Bolivia (23 Mt), Argentina (20 Mt), the USA (12 Mt), Chile (11 Mt), Australia (7.0 Mt) and China 6.8 Mt) (

Venditti and Parker 2023). As the world increases its production of batteries and electric vehicles, the demand for lithium is projected to soar. Lithium is one of the richest resources on earth, but economically viable deposits are concentrated in only a few regions. In some cases, it is difficult or impossible to free lithium from the minerals associated with it (

Donnely 2023). Li-ion batteries accounted for 27% of total lithium consumption in 2010 and this number can only be expected to increase as electric and hybrid vehicles become more mainstream (

Keller and Anderson 2018). Mining costs are of great importance, as they concentrate viable lithium mining in a few countries. The lithium-mining market is narrowed down to the major players, which are mainly based in Australia, Chile and Argentina, and are key lithium producers (

Paulet 2023). This involves the risk of supply chains with the exponential growth in demand for lithium for electric-car batteries.

Graphite is used in various industries such as automotive, metallurgy, nuclear industry, powder metallurgy, fuel cells, flame retardants and others. This wide application is the result of many different, beneficial properties of graphite (

Ritoe et al. 2022). There are two types of graphite: natural and synthetic graphite. The supply of synthetic graphite is lower than that of natural graphite. Synthetic graphite is made from petroleum or coal-based needle coke. Synthetic graphite is preferred for production of electric arc furnaces (EAFs) and steel. Battery manufacturers, on the other hand, can benefit both synthetic and natural graphite. The processing of natural graphite is becoming more and more popular due to new and sustainable methods, production processes and production capabilities outside of China in countries such as Mozambique, Ukraine and Norway. Graphite is a key mineral for the energy transition, contributing to clean technology solutions. Global demand for graphite could increase by up to 500% by 2050 compared to 2018 levels. Most of this demand comes from two industries: This application is ahead of other traditional uses of graphite in the refractory and foundry industries. Hence, graphite prices are expected to be controlled by the battery market (

Miller 2023). There is a deficit in the supply of natural graphite raw material, forcing more producers to use synthetic graphite. The battery graphite supply chain is currently most dependent on China. Currently, the production of graphite, both natural and synthetic, is concentrated in China. China is estimated to cover approximately 61% of demand for synthetic graphite. Graphite mines exist in many places around the world. However, 100% of graphite is now shipped to China and processed there for anode materials for batteries (

Lalli 2021). It should be emphasized that the supplies of flake graphite for electric-car batteries are completely dependent on Chinese production. This involves the monopolization of supplies and the risk of supply chains for the automotive industry.

Raport U.S. Department of Energy Critical Materials Assessment, 2023 placed graphite in the group of critical materials. The report contains a risk matrix of supply risk versus importance to energy (

USGS 2023). The report assigns materials to three groups: available materials—phosphorus, titanium, manganese and tellurium; close to critical materials—copper, silicon, electrical steel, uranium, aluminium and fluorine; and critical materials—lithium, nickel, cobalt, graphite, gallium, platinum, magnesium, silicon carbide, dysprosium, iridium, neodymium and praseodymium (

Figure 3).

Demand for cobalt is expected to increase to 350% in 2050, mainly due to the spread of electric mobility. Currently, the EU imports most of the refined cobalt needed for battery production from China and the Democratic Republic of the Congo (DRC) (

Liesbet and van Acke 2022). All materials used in electric cars are in the group of almost-critical and critical materials. At the same time, in many cases, these materials depend on imports from China.

Manganese is industrially, economically and strategically vital to the future of the electric-car industry. For two of the three most common types of Li-ion batteries, Nickel Manganese Cobalt (NMC) and Lithium Manganese Oxide (LMO), manganese constitutes between 20% to 61% of the cathode’s composition (

Batteryjuniors.com 2022). China produces over 90% of the world’s high-purity electrolytic manganese metal (HPEMM) and high-purity manganese sulphate monohydrate (HPMSM)—the only ones that can be used in Li-ion battery production (

Giyani Corp. 2023). High-purity manganese demand is expected to surge by over 900% between 2020 and 2030, with the market facing severe and growing shortages. The USA currently has zero manganese production and is forced to import 100% of its manganese requirements. Furthermore, 90% of the world’s production capacity of high-purity manganese sulphate for electric-car batteries is not secure. This means that in the event of supply disruptions caused by, for example, geopolitical tensions, the electric-car battery industry could be at risk.

Disrupted supply chains have been hindering the production of electric cars since the beginning of the pandemic. This has forced manufacturers to change. Mercedes-Benz is switching to cheaper (but less powerful) batteries for smaller electric models, which reduces the range of travel, and investing in cheap lithium mining in California to ensure supplies for EV57 batteries. Tesla sources materials on the basis of contracts around the world, including a long-term supply contract for nickel from Canadian Vale mines (

Silberg et al. 2023).

The stability of the supply chains of raw materials for the construction of batteries is expected to worsen despite all the resource projects announced in Europe. This will be a result of the increased demand for critical materials that will increase even more sharply due to the expansion of battery-cell production. The announced expansion of European electric-car production and processing by 2030 will contribute to growth production, but will also lead to even stricter strategic material autonomy (

Bünting et al. 2023).

5. The Impact of Costs on the Demand for Electric Cars

More than 50% of the cost of an electric car is the cost of electric batteries (

Bünting et al. 2023). The prices of lithium, nickel, magnesium, cobalt and graphite increased strongly in 2022 due to the demand for these elements for the production of batteries for electric cars, the sales of which are increasing.

The effect of increased battery-material prices differed across various battery chemistries, with the strongest increase being observed for Lithium Iron Phosphate (LFP) batteries (over 25%), while Lithium Nickel Manganese Cobalt Oxide (NMC) batteries experienced an increase of less than 15% (

IEA 2023b). Due to the role that lithium plays in the construction of batteries, its price significantly affects the final cost of the car. Given that the price of lithium increased at a higher rate than the price of nickel and cobalt, the price of LFP batteries increased more than the price of NMC batteries. Nevertheless, LFP batteries remain cheaper than NCA (lithium ion battery) and NMC in terms of a unit of energy capacity.

The price of batteries also varies across different regions, with China having the lowest prices on average, and the rest of the Asia Pacific region having the highest. This price discrepancy is influenced by the fact that around 65% of battery cells are manufactured in China (

IEA 2023b).

Musk has announced his company’s plans for the prospect of selling 20 million electric cars by 2030, which would require 1.2 million tons of lithium chemicals, more than the entire market last year (

Tesla Charts a Battery-Powered Future 2023). Tesla’s LFP batteries are now 30% cheaper than high-nickel NCM and NCA cells. This is due to the recognition of the price market for Benchmark’s Lithium Ion Battery Cell Price Assessment. But their production is concentrated in China, creating a geopolitical risk for automakers. Tesla has announced that it will eliminate rare-earth elements from its electric cars. Battery production is becoming more and more associated with the strategies of the automotive industry and is increasingly dependent on decisions, projects and investments in the automotive industry (

Bridge and Faigen 2022).

The impact of electric cars on the economy and the environment is assessed differently (

Pirmana et al. 2023). Indonesia is the country with the largest nickel reserves in the world (24%), thanks to the development of electric motorization, it has an excellent opportunity to become one of the main players in the global supply chain for electric vehicles, which will have a positive impact on the country’s economy (

Pirmana et al. 2023). In the US, the increase in electric-car sales generated economic revenue from USD 23 billion to USD 94 billion and created between 162,000 and 863,000 jobs. The electric-vehicle market in the United States is projected to grow by 18.17% (2023–2028), resulting in a market volume of USD 161.60 billion in 2028 (

Alda 2023). An assessment shows that charging electric cars does not necessarily reduce the carbon footprint if the energy does not come from renewable sources. It was also found that every kilometer traveled by an electric vehicle produces 35–50 times more sulfur oxides than a conventional vehicle (

Liu et al. 2012).

Europe is currently facing rising product and energy prices. Everything indicates that purchasing power may decrease, which will translate into purchases of new electric cars, the prices of which are rising. The price of an average new car increased by about 27 percent between 2012 and 2021 and this trend is likely to continue as the consumer price index continues to rise (

Global Strategy Group 2023). Electric cars are still more expensive than comparable combustion-engine cars. The additional cost (30–50 percent) comes from the cost of the batteries (

Analazi 2023). The residual value of electric-car parts is actually EUR 4585 less than in traditional (internal-combustion engine) cars. It can therefore be predicted that the total value of electric cars will fall if the market for original-equipment-manufacturer suppliers expands. The advantage of electric cars also depends on a fall in battery prices. The cost of batteries for electric vehicles should fall, as determined by market analysis. This is mainly due to the increasingly perfect battery technology. On the other hand, the average price of an ICE passenger car is expected to increase over the next decade, driven mainly by price inflation. However, electric cars still have room for maneuver. The cost of batteries for electric cars should fall, as determined by market analysis. This is mainly due to the increasingly perfect battery technology. On the other hand, the average price of a conventional car powered solely by an internal-combustion-engine (ICE) passenger car is expected to increase over the next decade, mainly by price inflation. In the next few years, the automotive industry is expected to face a significant disruption. Large portions of the supply chain are likely to come under financial stress. Some can be saved—others may not be. Automotive OEMs (Original Equipment Manufacturers) and their suppliers should work as an ecosystem and collaboratively across the industry to ensure the transition is smooth and that key suppliers are not lost.

Regardless of the huge growth of the electric-car market, it is limited to only part of the world. The trend towards full electrification of cars continues in China, Europe and the United States (

Winebrake et al. 2017). Around 95% of global sales of electric vehicles are concentrated in these countries. In addition to government subsidies that have just been introduced or still do not exist, the main reasons for the slow progress in other parts of the world are the lack of public charging infrastructure and the high prices of electric vehicles (

Alda 2023).

During the first three months of 2023, more than 2.5 million plug-in electric cars were registered around the world, which is about 13 percent of the total volume. Global plug-in-electric-car sales exceeded 1 million in March 2023 (

Kane 2023).

One of the biggest disadvantages of electric cars is that charging the car’s battery is not convenient if you do not have access to commercial charging stations or at least a charger at home. And even with the faster chargers that you find at commercial stations, it can still take up to 30 min to fully charge your electric car (

Winters 2021).

Despite all the problems, sales of electric cars are increasing and demand is expected to increase further (

Global EV Outlook 2023). Half of electric-car sales are in China. However, these cars in China are much cheaper than in other countries. For example, in 2022, the weighted average selling price of a small BEV in China was below USD 10,000. In the same year, the price of this car in Europe and the United States exceeded USD 30,000.

6. Discussion

Forecasts predict that the largest growth in the number of electric cars will occur in three countries: China, Europe and the United States. The percentage increase in electric-car sales in these countries will account for 92.45% of the global increase in electric-car sales in 2025 (

IEA 2023b;

Global EV Outlook 2023). This means that the transformation of the automotive industry is selective and applies mainly to countries with the greatest economic development.

According to a 2023 report (Global EV Outlook by IEA), Norway, Sweden, the Netherlands and Germany remain the largest European markets for electric cars. The net zero emissions (NZE) scenario by 2050 predicts that the number of electric cars will reach 380 million. In turn, electric cars sales will grow to 60% of all vehicle sales in 2030 (2023 Global Electric Vehicle Market Review).

The barriers to promoting the automotive industry are the management of car prices and the lack of sufficient charging infrastructure. In Europe, slow chargers are being replaced by fast and ultra-fast chargers. In 2022, the number of fast chargers increased by over 55% and amounted to almost 70,000 units. Another trend that is constantly growing is the intelligent charging of electric vehicles, i.e., the use of charging devices connected to the cloud (

IEA 2023b;

Global EV Outlook 2023).

In 2022, electric cars consumed around 110 terawatt hours of electricity, doubling from the previous year. In the future, by 2030, electric cars are expected to consume less than 4% of global electricity consumption. However, with the growing demand for electricity to charge electric cars, there is a growing need to protect and manage the power grid intelligently. Electric cars affect and will significantly affect energy systems.

Lithium-ion batteries based on graphite anodes and layered oxide cathodes (NMC, NCA) dominate in a significant part of electric cars. However, as lithium-ion batteries are beginning to reach their performance limits and their production poses environmental risks and supply issues, alternatives to lithium-ion batteries are being sought. Advanced battery technologies are emerging, including designs for lithium-ion cells, silicon anodes and solid-state batteries (

Gear et al. 2023). The advanced lithium-ion battery contains critical elements and electrolytes with high supply risk. However, lithium-ion batteries are expected to maintain their dominant position. Improving cell design to improve charging speed and energy density will be key.

The limited range of batteries in electric cars is the most severe negative side of electric motoring. The average gasoline car can easily go four- or five-hundred miles on a tank of gasoline. A diesel car can drive about 1120 km. The all-electric Peugeot e-208, on the other hand, needs to be recharged every 350 km (

Tallodi 2022). Concerns related to charging infrastructure, namely the location and availability of charging points, is another issue related to electric cars. Long charging times of electric cars are negative in relation to refueling internal-combustion cars. Refueling a petrol or diesel car can take as little as 5 min. Charging an electric vehicle can take anywhere from 30 min to an hour using the latest public fast chargers. Electric cars are fast and have no delays in power delivery. However, if we consider the top segment of the electric-vehicle market, most are limited to relatively low top speeds. Some struggle to reach 144 km/h, while even a basic petrol car reaches 160 km/h. Electric cars usually cost more than their combustion counterparts. An electric car produces zero emissions; however, the method of electricity production has a direct impact on how environmentally friendly it really is. Creating the lithium-ion battery pack is also more environmentally harmful than the manufacturing process for an average petrol-powered car. On the other hand, electric cars can be a great choice. Apart from practical considerations such as low running costs and tax benefits, electric vehicles are smooth and very responsive to drive.

A vehicle is considered clean if it emits a small amount of pollutants. This usually applies to cars running on fuels other than petrol or diesel. The natural-gas vehicle (NGV) thus appears as an ecological alternative to the electric vehicle means of transport (

Sneci 2021). As the name suggests, NGVs work on natural gas, which is the same gas that we use every day to heat the house, cook, etc. This primal energy does not require any particular transformation. Biomethane or BioNGV is energy with the same properties as conventional natural gas (

Hernández et al. 2023;

Amant et al. 2020). However, they are obtained from a renewable source: methanation of organic waste from various industries, such as food processing, gastronomy, agriculture. Biomethane or BioNGV can be used to propel vehicles. The hydrogen vehicle is often compared to the electric vehicle (

Kirch 2020). Both types of vehicles do not have an internal-combustion engine and run on electricity. However, their energy source is not the same. Hydrogen-powered vehicles get their energy from a hydrogen-powered fuel cell. The only by-product of the whole process is water and heat, both of which are natural resources.

Forecasts for the car market in Europe suggest that the purchasing power driving this market may decrease due to rising car prices, inflation and declining real consumer incomes (

Global Strategy Group 2023). The authors see the risk in this industry both in external circumstances related to threats to the automotive industry and in the need for changes related to the transformation of car drives. A suppression of demand for cars is indicated in the second half of 2023 (

Ferraris et al. 2023). A slowdown in consumer demand and higher interest rates will put pressure on prices in 2023.

In Europe, some economic stagnation is expected, but not a recession. As in the USA, car sales cannot be expected to return to pre-pandemic levels. Due to the disruption of supply chains, the global economic downturn and the impact of the pandemic, the automotive industry has weakened. Despite this, it strives for innovation and presents new ideas and solutions that offer consumers more and more technologically advanced cars. Environmental regulations as well as consumer preferences have an impact on the future of the automotive industry. Currently, it seems that electric cars dominate the market in the area of environmentally friendly motoring. However, alternative solutions such as hydrogen-powered cars and others should be included in the automotive trends of manufacturers.