Financial Distress Prediction in the Nordics: Early Warnings from Machine Learning Models

Abstract

:1. Introduction

2. Literature Review

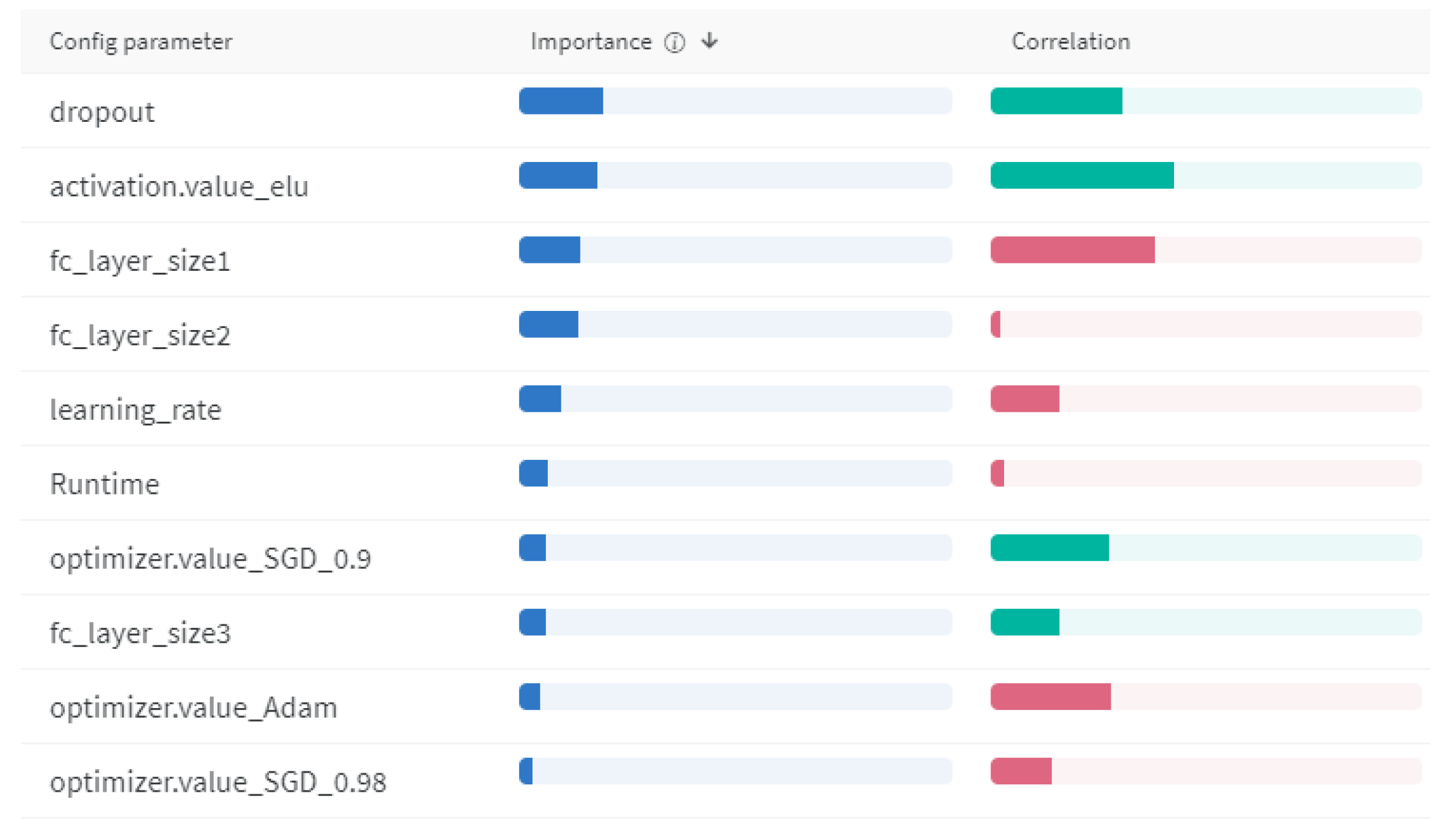

3. Data and Variables

3.1. Definition of Financial Distress

3.2. Dataset

3.3. Features

4. Models

4.1. Artificial Neural Network

4.2. Light Gradient Boosting Machine

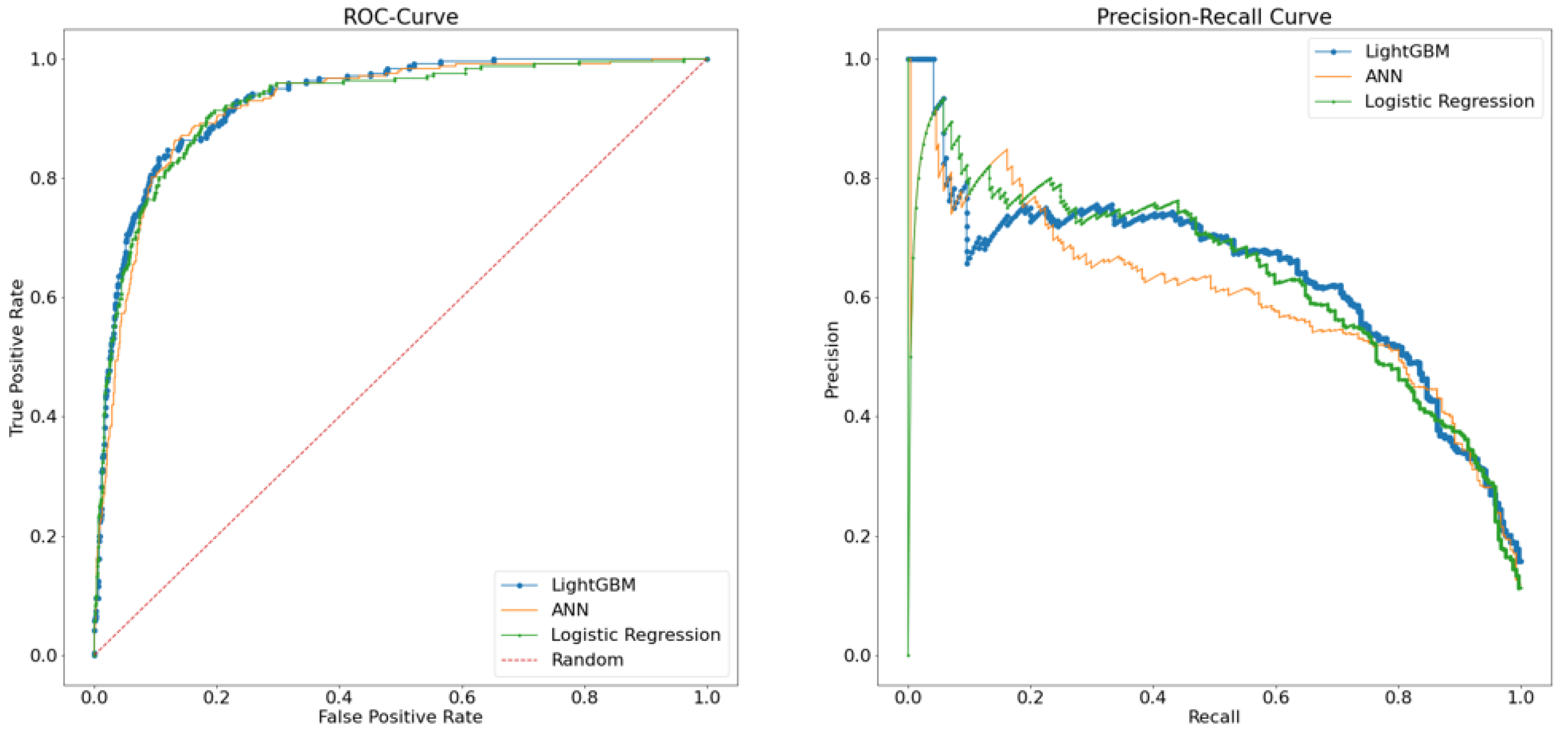

5. Results

6. Discussion

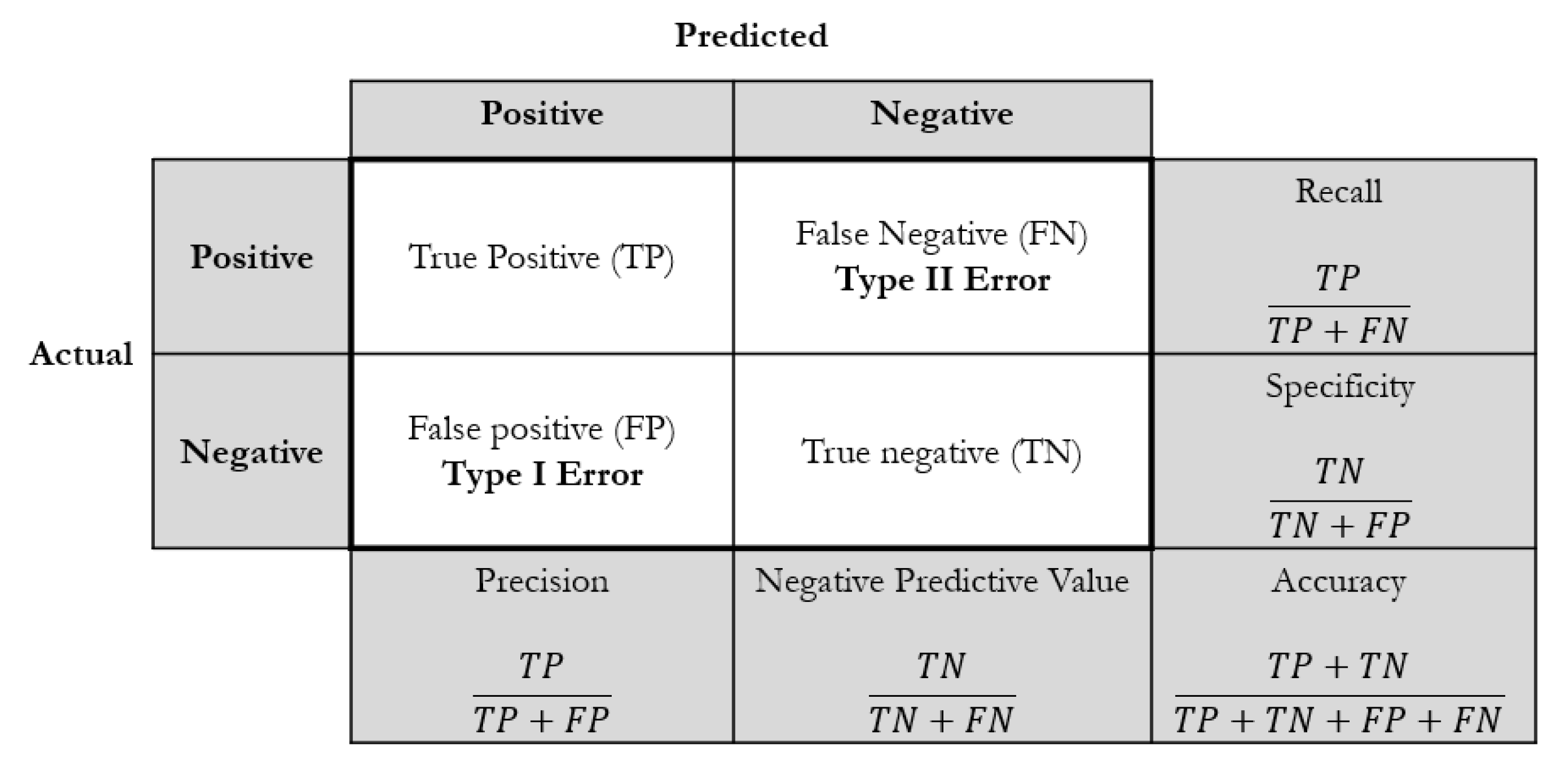

6.1. The Trade-Off between Type I and Type II Errors

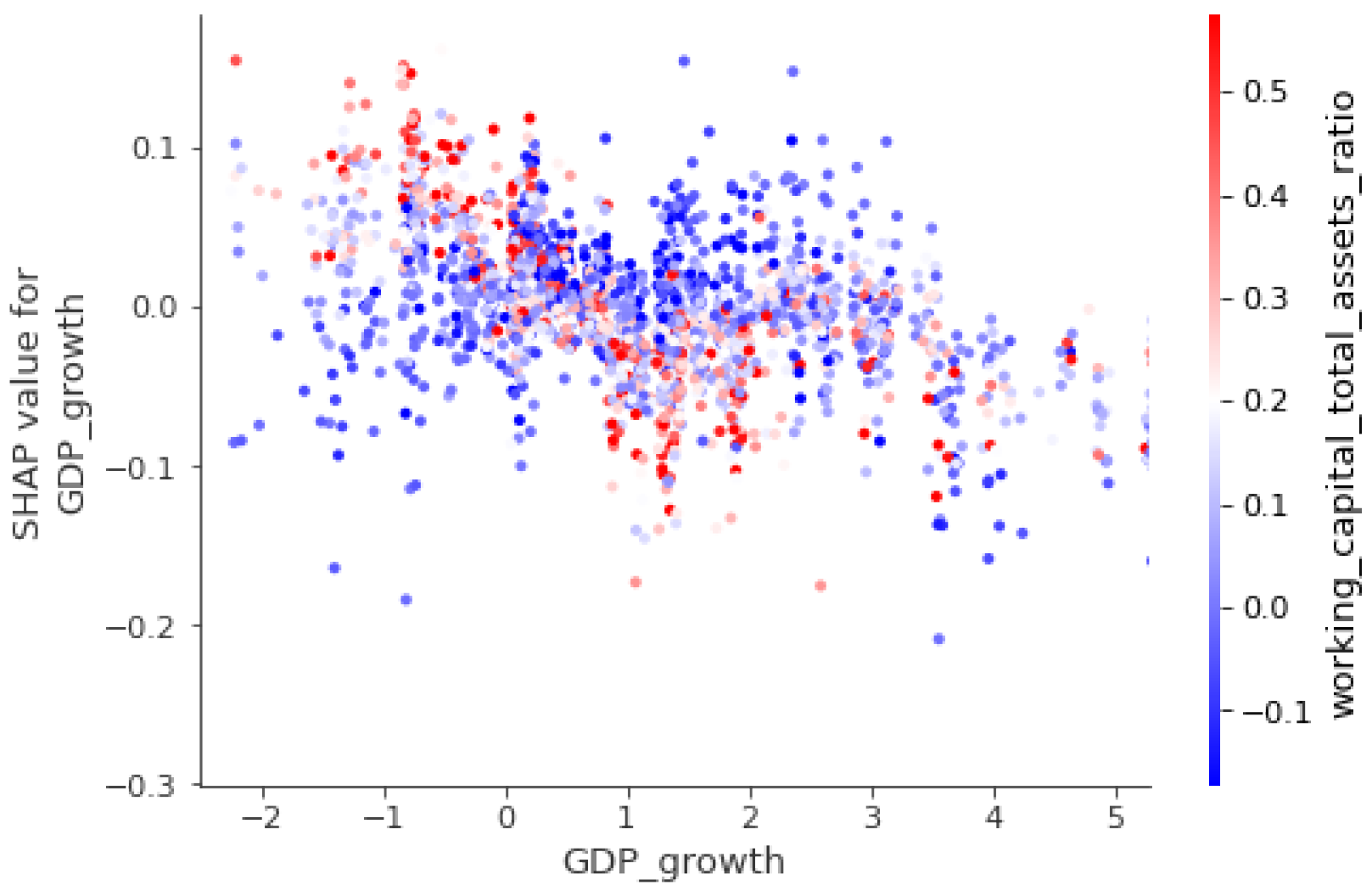

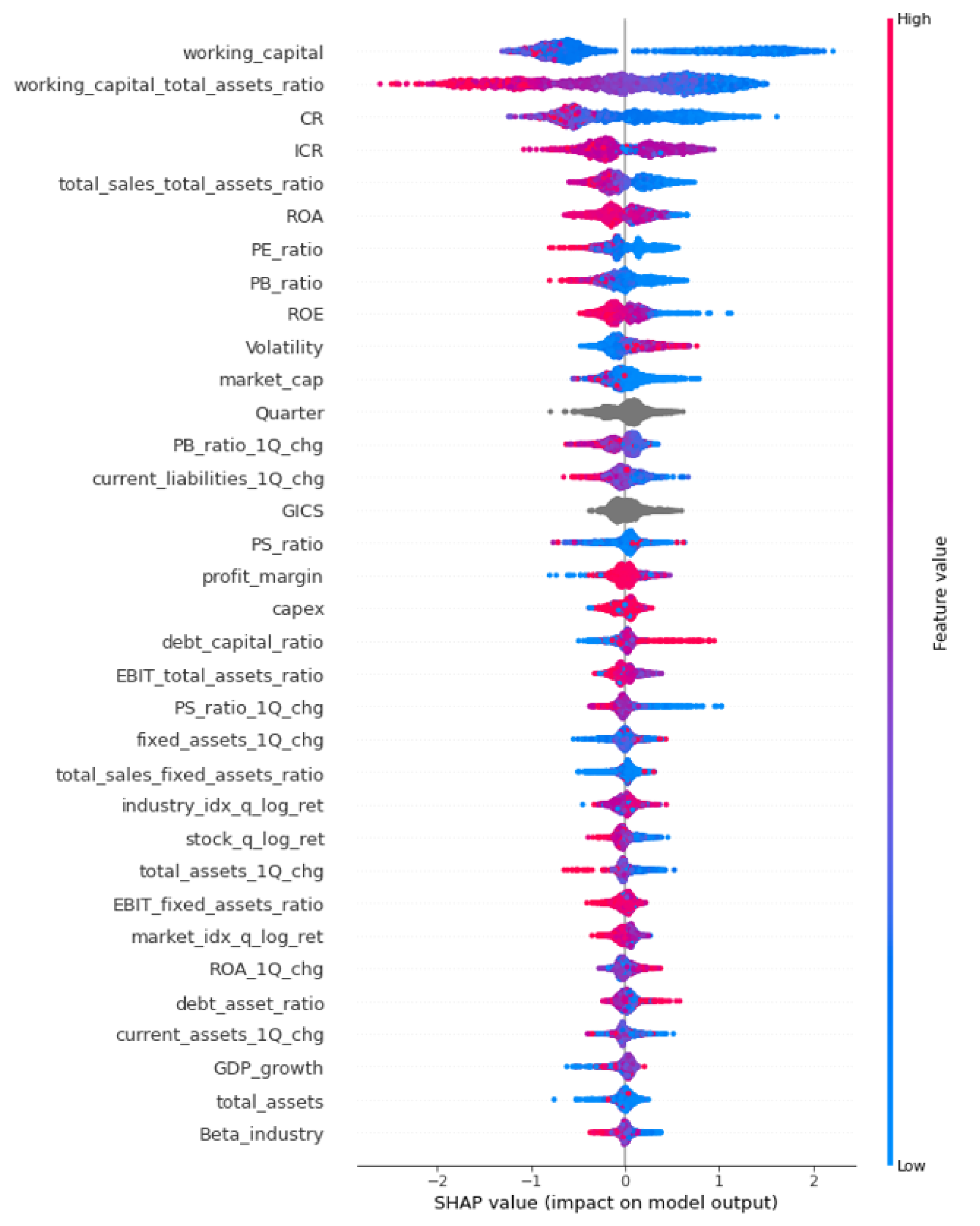

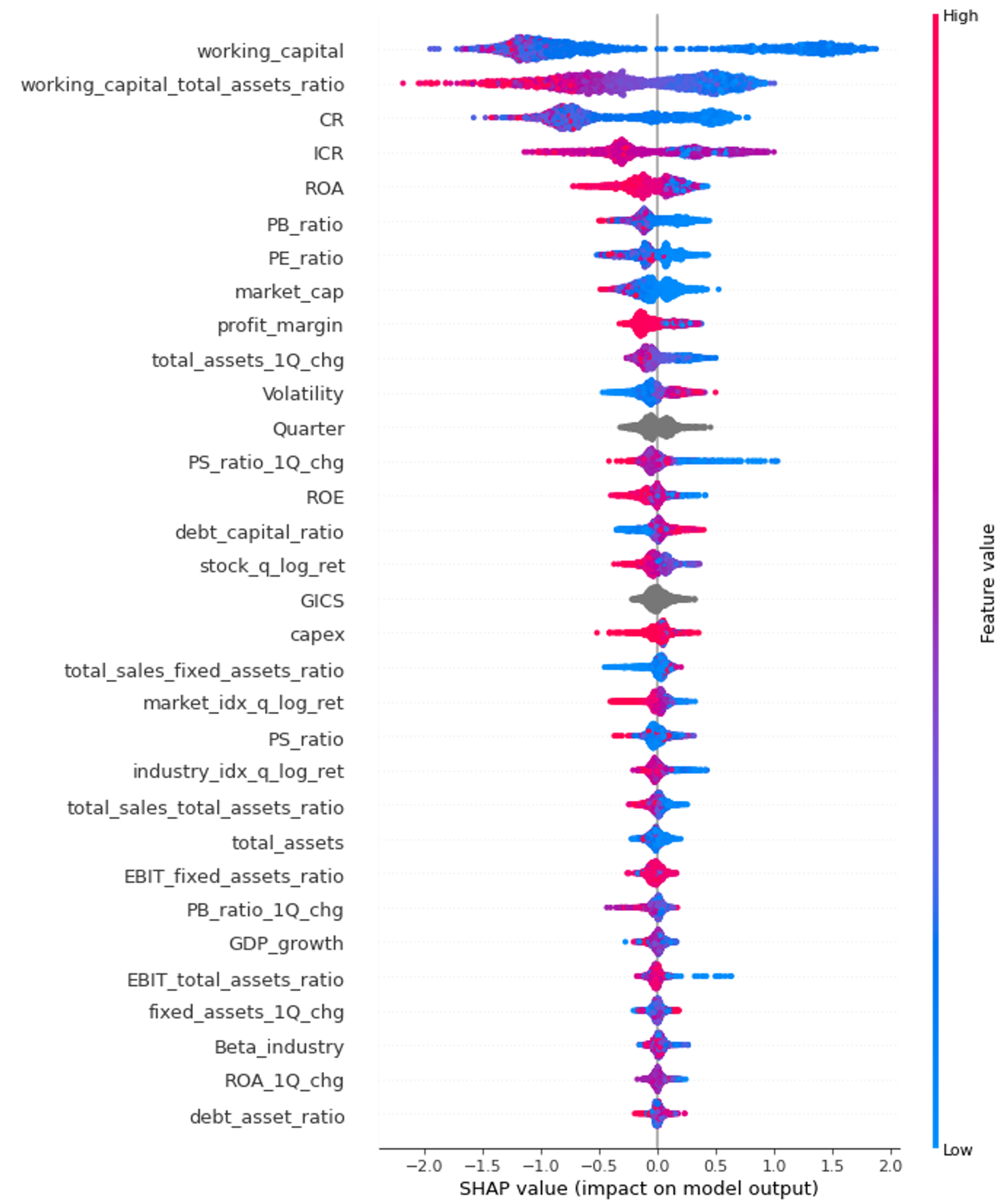

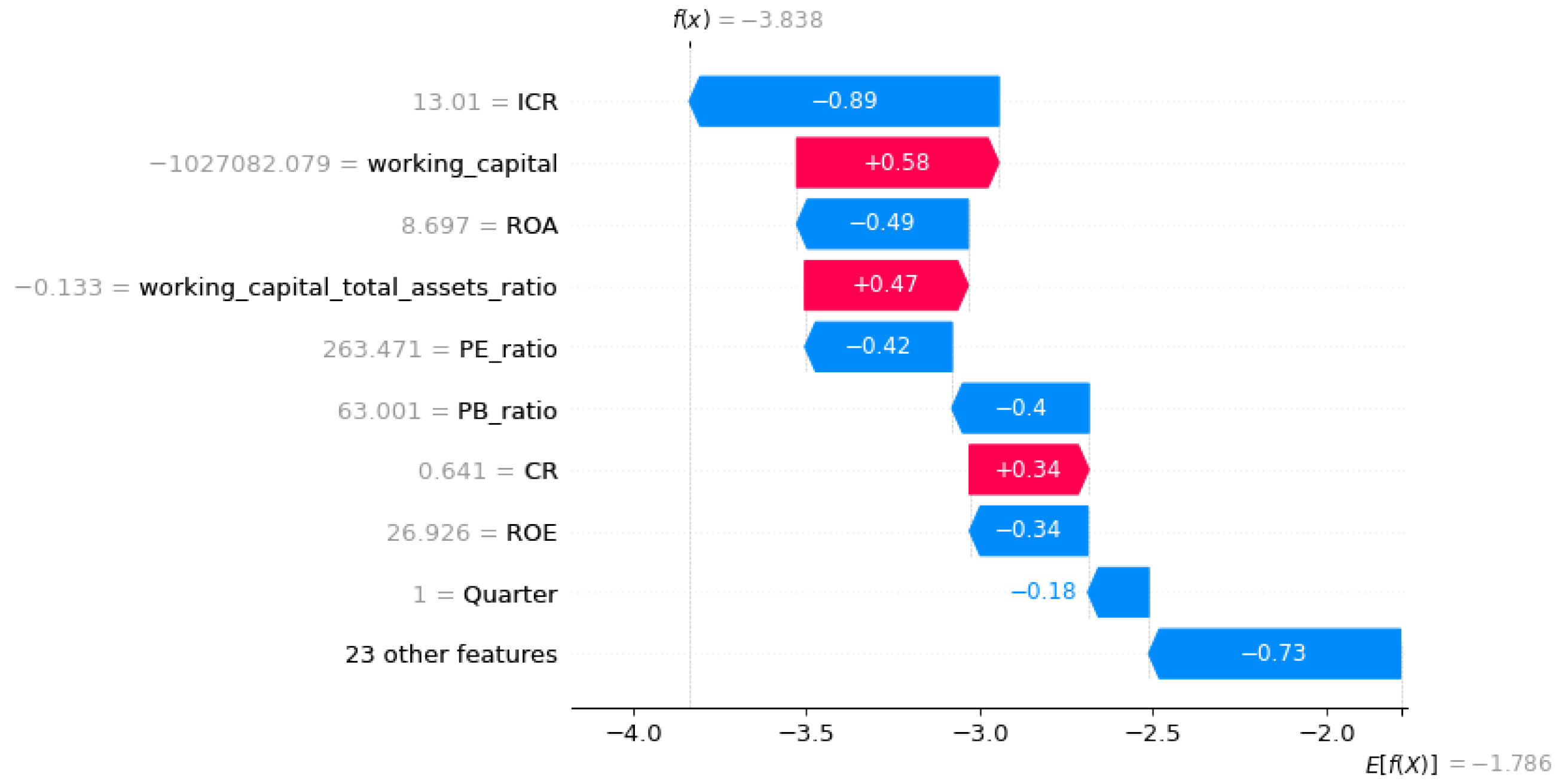

6.2. Interpreting Predictors with SHAP

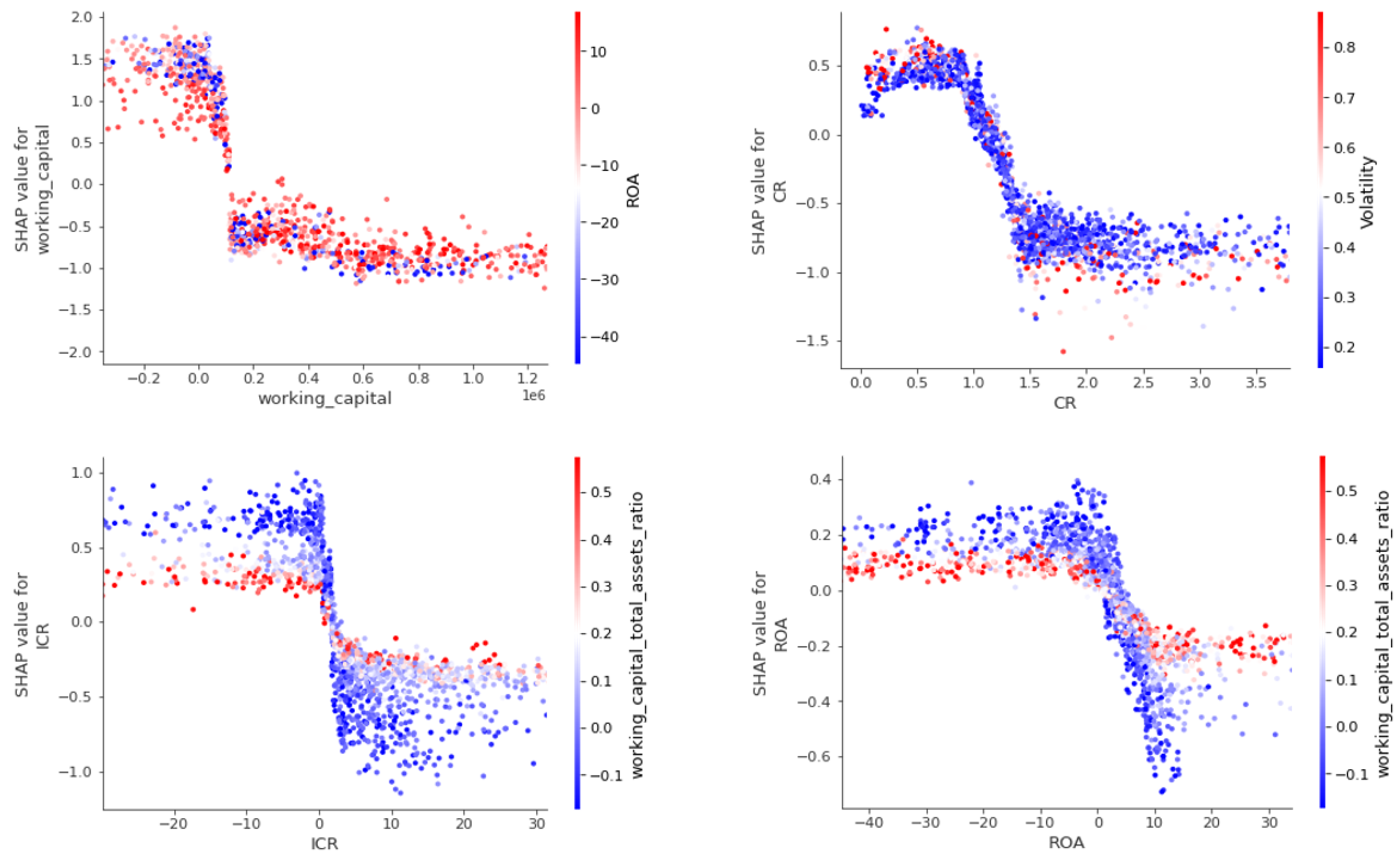

6.2.1. Global Explanations

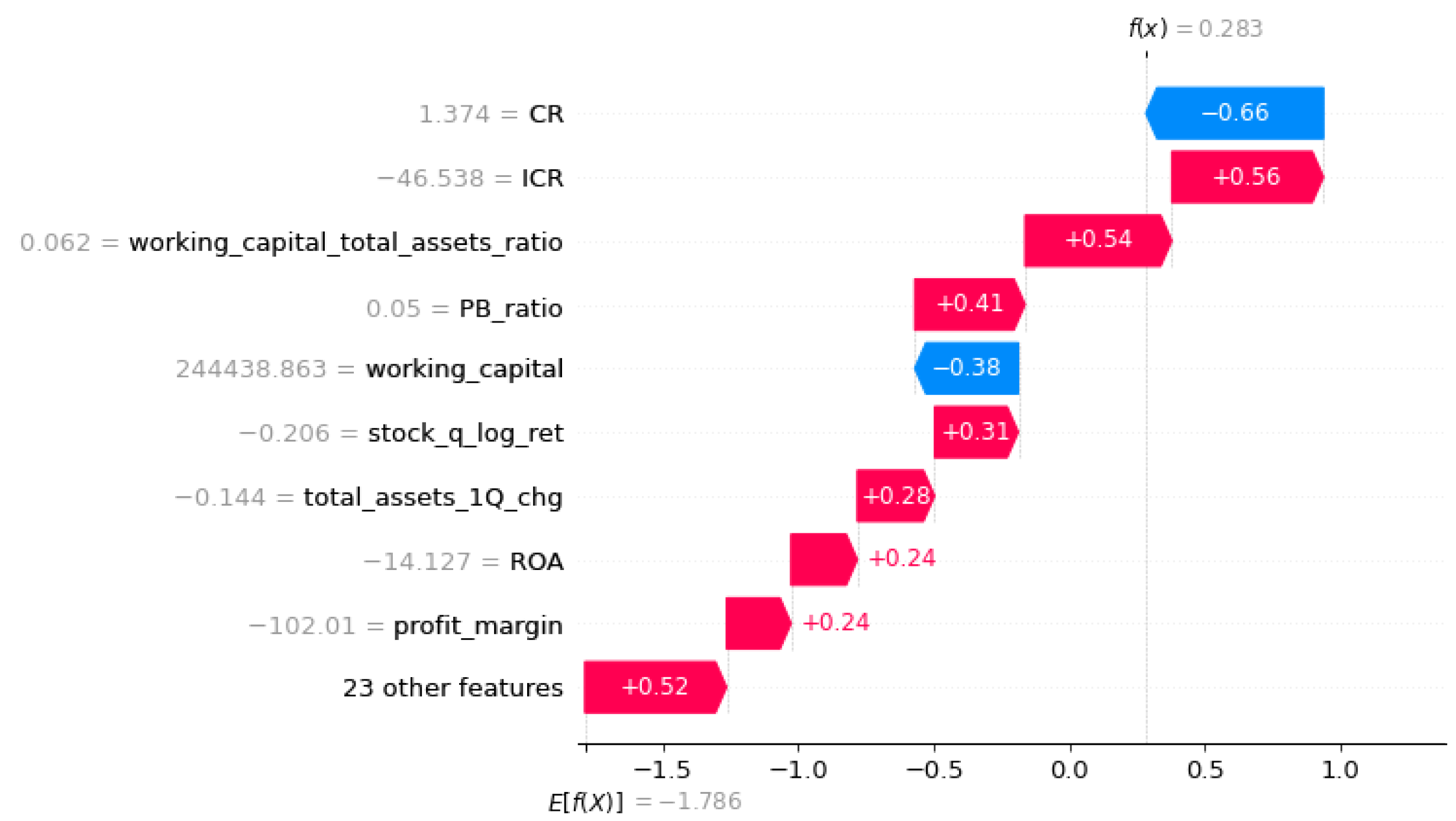

6.2.2. Local Explanations

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Measuring Model Performance

Appendix B. Supplementary Figures

Appendix B.1. Ratio Frequencies

Appendix B.2. Dependence Plots

| 1 | This paper is based on the M.Sc thesis by Birkeland Abrahamsen et al. (2022). |

| 2 | Credit rating agencies report that an ICR value below 1.5 often coincides with non-investment grade entities, see, for instance, Standard & Poor’s (https://www.spratings.com/scenario-builder-portlet/pdfs/CorporateMethodology.pdf, accessed on 1 June 2022), Moody’s (https://www.moodys.com/researchandratings/methodology/003006001/rating-methodologies/methodology/003006001/003006001/-/0/0/-/0/-/-/en/global/rr, accessed on 1 June 2022), Fitch (https://www.fitchratings.com/research/corporate-finance/corporate-rating-criteria-15-10-2021, accessed on 1 June 2022), Morningstar (https://www.dbrsmorningstar.com/research/394214/general-corporate-methodology, accessed on 1 June 2022), and Nordic Credit Rating (https://nordiccreditrating.com, accessed on 1 June 2022). |

| 3 | Balcaen and Ooghe (2006) bring forth several other reasons why judicial credit events serve as a poor foundation for dichotomous classification. Among these are the fact that it may take several years before failure is formally recorded, making the actual point of distress challenging to determine, and the possibility of other juridical exits such as merger, absorption, dissolution, and liquidation, which act to conceal distress. |

| 4 | The conversion of categorical variables into binary indicators. |

| 5 | Introducing perfect multicollinearity by redundantly specifying a dummy variable for each category. |

| 6 | different hyperparameter configurations. |

| 7 | See Appendix A for definitions and a discussion of these model performance metrics. |

References

- Aas, Kjersti, Martin Jullum, and Anders Løland. 2021. Explaining individual predictions when features are dependent: More accurate approximations to Shapley values. Artificial Intelligence 298: 103502. [Google Scholar] [CrossRef]

- Abiyev, Rahib H. 2014. Credit rating using type-2 fuzzy neural networks. Mathematical Problems in Engineering 2014: 460916. [Google Scholar] [CrossRef]

- Agrawal, Khushbu, and Yogesh Maheshwari. 2019. Efficacy of industry factors for corporate default prediction. IIMB Management Review 31: 71–77. [Google Scholar] [CrossRef]

- Altman, Edward. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Athey, Susan, and Guido W. Imbens. 2019. Machine learning methods that economists should know about. Annual Review of Economics 11: 685–725. [Google Scholar] [CrossRef]

- Awais, Mustabsar, Faisal Hayat, Noreen Mehar, and W. Ul-Hassan. 2015. Do z-score and current ratio have ability to predict bankruptcy. Developing Country Studies 5: 30–36. [Google Scholar]

- Balcaen, Sofie, and Hubert Ooghe. 2006. 35 years of studies on business failure: An overview of the classic statistical methodologies and their related problems. The British Accounting Review 38: 63–93. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial ratios as predictors of failure. Journal of Accounting Research 4: 71–111. [Google Scholar] [CrossRef]

- Bellovary, Jodi L., Don E. Giacomino, and Michael D. Akers. 2007. A review of bankruptcy prediction studies: 1930 to present. Journal of Financial Education 33: 1–42. [Google Scholar]

- Bentejac, Candice, Anna Csorgo, and Gonzalo Martinez-Munoz. 2021. A comparative analysis of gradient boosting algorithms. Artificial Intelligence Review 54: 1937–67. [Google Scholar] [CrossRef]

- Birkeland Abrahamsen, Nils-Gunnar, Emil Nylén-Forthun, and Mats Møller. 2022. Financial Distress Prediction Using Machine Learning and Xai: Developing an Early Warning Model for Listed Nordic Corporations. Master’s thesis, Norwegian University of Science and Technology, Trondheim, Norway. [Google Scholar]

- Bonfim, Diana. 2009. Credit risk drivers: Evaluating the contribution of firm level information and of macroeconomic dynamics. Journal of Banking & Finance 33: 281–99. [Google Scholar]

- Bussmann, Niklas, Paolo Giudici, Dimitri Marinelli, and Jochen Papenbrock. 2021. Explainable machine learning in credit risk management. Computational Economics 57: 203–16. [Google Scholar] [CrossRef]

- Campbell, John Y., Jens Hilscher, and Jan Szilagyi. 2008. In search of distress risk. The Journal of Finance 63: 2899–939. [Google Scholar] [CrossRef]

- Charalambakis, Evangelos C., and Ian Garrett. 2018. On corporate financial distress prediction: What can we learn from private firms in a developing economy? evidence from greece. Review of Quantitative Finance and Accounting 52: 467–91. [Google Scholar] [CrossRef]

- Chava, Sudheer, and Robert A. Jarrow. 2004. Bankruptcy prediction with industry effects. Review of Finance 8: 537–69. [Google Scholar] [CrossRef]

- Chen, Tianqi, and Carlos Guestrin. 2016. Xgboost: A scalable tree boosting system. Paper presented at the 22nd ACM SIGKK International Conference on Knowledge Discovery and Data Mining, San Francisco, CA, USA, August 13–17; pp. 785–94. [Google Scholar]

- Clevert, Djork-Arné, Thomas Unterthiner, and Sepp Hochreiter. 2015. Fast and accurate deep network learning by exponential linear units (elus). arXiv arXiv:1511.07289. [Google Scholar]

- De Lange, Petter Eilif, Borger Melsom, Christian Bakke Vennerød, and Sjur Westgaard. 2022. Explainable ai for credit assessment in banks. Journal of Risk and Financial Management 15: 556. [Google Scholar] [CrossRef]

- Desai, Chitra. 2020. Comparative analysis of optimizers in deep neural networks. International Journal of Innovative Science and Research Technology 5: 959–62. [Google Scholar]

- Dimitras, Augustinos I., Stelios H. Zanakis, and Constantin Zopounidis. 1996. A survey of business failures with an emphasis on prediction methods and industrial applications. European Journal of Operational Research 90: 487–513. [Google Scholar] [CrossRef]

- Du, Xudong, Wei Li, Sumei Ruan, and Li Li. 2020. Cus-heterogeneous ensemble-based financial distress prediction for imbalanced dataset with ensemble feature selection. Applied Soft Computing 97: 106758. [Google Scholar] [CrossRef]

- Falavigna, Greta. 2012. Financial ratings with scarce information: A neural network approach. Expert Systems with Applications 39: 1784–92. [Google Scholar] [CrossRef]

- Frydman, Halina, Edward Altman, and Duen-Li Kao. 1985. Introducing recursive partitioning for financial classification: The case of financial distress. The Journal of Finance 40: 269–91. [Google Scholar] [CrossRef]

- Hjelkrem, Lars Ole, and Petter Eilif de Lange. 2023. Explaining deep learning models for credit scoring with shap: A case study using open banking data. Journal of Risk and Financial Management 16: 221. [Google Scholar] [CrossRef]

- Iturriaga, Félix J López, and Iván Pastor Sanz. 2015. Bankruptcy visualization and prediction using neural networks: A study of us commercial banks. Expert Systems with Applications 42: 2857–69. [Google Scholar] [CrossRef]

- Jan, Chyan-Long. 2021. Financial information asymmetry: Using deep learning algorithms to predict financial distress. Symmetry 13: 443. [Google Scholar] [CrossRef]

- Jensen, Herbert L. 1992. Using neural networks for credit scoring. Managerial Finance 18: 15–26. [Google Scholar] [CrossRef]

- Jiang, Yi, and Stewart Jones. 2018. Corporate distress prediction in china: A machine learning approach. Accounting & Finance 58: 1063–109. [Google Scholar]

- Jiang, Yixiao. 2023. A primer on machine learning methods for credit rating modeling. In Econometrics—Recent Advances and Applications. London: IntechOpen. [Google Scholar]

- Jones, Stewart, David Johnstone, and Roy Wilson. 2017. Predicting corporate bankruptcy: An evaluation of alternative statistical frameworks. Journal of Business Finance & Accounting 44: 3–34. [Google Scholar]

- Ke, Guolin, Qi Meng, Thomas Finley, Taifeng Wang, Wei Chen, Weidong Ma, Qiwei Ye, and Tie-Yan Liu. 2017. Lightgbm: A highly efficient gradient boosting decision tree. Advances in Neural Information Processing Systems 30: 3146–54. [Google Scholar]

- Kim, Hyeongjun, Hoon Cho, and Doojin Ryu. 2020. Corporate default predictions using machine learning: Literature review. Sustainability 12: 6325. [Google Scholar] [CrossRef]

- Kozlovskyi, Serhii, Boris Poliakov, Ruslan Lavrov, and Natalya Ivanyuta. 2019. Management and comprehensive assessment of the probability of bankruptcy of ukrainian enterprises based on the methods of fuzzy sets theory. Problems and Perspectives in Management 17: 370–81. [Google Scholar] [CrossRef]

- Liang, Deron, Chia-Chi Lu, Chih-Fong Tsai, and Guan-An Shih. 2016. Financial ratios and corporate governance indicators in bankruptcy prediction: A comprehensive study. European Journal of Operational Research 252: 561–72. [Google Scholar] [CrossRef]

- Lin, Lin, and Jenifer Piesse. 2004. Identification of corporate distress in uk industrials: A conditional probability analysis approach. Applied Financial Economics 14: 73–82. [Google Scholar] [CrossRef]

- Lundberg, Scott, Gabriel Erion, and Su-In Lee. 2018. Consistent individualized feature attribution for tree ensembles. arXiv arXiv:1802.03888. [Google Scholar]

- Lundberg, Scott M., and Su-In Lee. 2017. A unified approach to interpreting model predictions. Advances in Neural Information Processing Systems 30: 4765–74. [Google Scholar]

- Luoma, Martti, and Erkki K. Laitinen. 1991. Survival analysis as a tool for company failure prediction. Omega 19: 673–78. [Google Scholar] [CrossRef]

- Malakauskas, Aidas, and Aušrinė Lakštutienė. 2021. Financial distress prediction for small and medium enterprises using machine learning techniques. Inžinerinė ekonomika 32: 4–14. [Google Scholar] [CrossRef]

- Melsom, Borger, Christian B. Vennerød, Petter de Lange, Lars Ole Hjelkrem, and Sjur Westgaard. 2022. Explainable artificial intelligence for credit scoring in banking. Journal of Risk 25. [Google Scholar] [CrossRef]

- Messier, William F., Jr., and James V. Hansen. 1988. Inducing rules for expert system development: An example using default and bankruptcy data. Management Science 34: 1403–15. [Google Scholar] [CrossRef]

- Mohammed, Ali Abusalah Elmabrok, and Ng Kim-Soon. 2012. Using Altman’s model and current ratio to assess the financial status of companies quoted in the Malaysian stock exchange. International Journal of Scientific and Research Publications 2: 1–11. [Google Scholar]

- Moscatelli, Mirko, Fabio Parlapiano, Simone Narizzano, and Gianluca Viggiano. 2020. Corporate default forecasting with machine learning. Expert Systems with Applications 161: 113567. [Google Scholar] [CrossRef]

- Murphy, Kevin P. 2012. Machine Learning: A Probabilistic Perspective. Cambridge, MA: MIT Press. [Google Scholar]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 18: 109–31. [Google Scholar] [CrossRef]

- Parhi, Rahul, and Robert D. Nowak. 2020. The role of neural network activation functions. IEEE Signal Processing Letters 27: 1779–83. [Google Scholar] [CrossRef]

- Qian, Hongyi, Baohui Wang, Minghe Yuan, Songfeng Gao, and You Song. 2022. Financial distress prediction using a corrected feature selection measure and gradient boosted decision tree. Expert Systems with Applications 190: 116202. [Google Scholar] [CrossRef]

- Smith, Leslie N. 2017. Cyclical learning rates for training neural networks. Paper presented at 2017 IEEE Winter Conference on Applications of Computer Vision (WACV), Santa Rosa, CA, USA, March 24–31; pp. 464–72. [Google Scholar]

- Son, Hwijae, C. Hyun, Du Phan, and Hyung Ju Hwang. 2019. Data analytic approach for bankruptcy prediction. Expert Systems with Applications 138: 112816. [Google Scholar] [CrossRef]

- Srivastava, Nitish, Geoffrey E. Hinton, Alex Krizhevsky, Ilya Sutskever, and Ruslan Salakhutdinov. 2014. Dropout: A simple way to prevent neural networks from overfitting. The Journal of Machine Learning Research 15: 1929–58. [Google Scholar]

- Tam, Kar Yan. 1991. Neural network models and the prediction of bank bankruptcy. Omega 19: 429–45. [Google Scholar] [CrossRef]

- Xu, Shuxiang, and Ling Chen. 2008. A novel approach for determining the optimal number of hidden layer neurons for fnn’s and its application in data mining. Paper presented at 5th International Conference on Information Technology and Applications (ICITA 2008), Cairns, Australia, June 23–26; pp. 683–86. [Google Scholar]

- Xu, Xiaoyan, and Yu Wang. 2009. Financial failure prediction using efficiency as a predictor. Expert Systems with Applications 36: 366–73. [Google Scholar] [CrossRef]

- Yang, Z. R., Marjorie B. Platt, and Harlan D. Platt. 1999. Probabilistic neural networks in bankruptcy prediction. Journal of Business Research 44: 67–74. [Google Scholar] [CrossRef]

| Country | Number of Listed Companies | Number of Companies after Data Cleaning | Number of Samples | Number of Distress Samples |

|---|---|---|---|---|

| Sweden | 1092 | 379 (34.7%) | 5383 | 598 (11.1%) |

| Norway | 589 | 130 (22.1%) | 2745 | 364 (13.3%) |

| Denmark | 357 | 67 (18.8%) | 1572 | 131 (8.3%) |

| Finland | 279 | 63 (22.6%) | 1344 | 112 (8.3%) |

| Total | 2317 | 639 (27.6%) | 11,044 | 1205 (10.9%) |

| Variable Name | Category | Formula/Explanation |

|---|---|---|

| Current Ratio | Liquidity Ratio | Current Assets/Current Liabilities |

| WCTA | Liquidity Ratio | Working Capital/Total Assets |

| Asset Turnover Ratio | Efficiency ratio | Operating Revenue/Total Assets |

| Fixed Asset Turnover | Efficiency ratio | Operating Revenue/Fixed Assets |

| Fixed BEP Ratio | Efficiency ratio | EBIT/Fixed Assets |

| BEP Ratio | Profitability ratio | EBIT/Total Assets |

| Profit Margin | Profitability ratio | EBIT/Operating Revenue |

| ROA | Profitability ratio | Net Income/Total Assets |

| ROE | Profitability ratio | Net Income/Shareholder Funds |

| Debt Asset Ratio | Solvency ratio | Total Debt/Total Assets |

| Debt to Capital Ratio | Solvency ratio | Current Liabilities/Capital |

| Interest Coverage Ratio | Solvency ratio | EBIT/Interest Paid |

| Working Capital | Raw value | N/A |

| EBIT | Raw value | N/A |

| Total Sales | Raw value | N/A |

| Total Assets | Raw value | N/A |

| Capital Expenditure | Raw value | N/A |

| Fixed Assets | Raw value | N/A |

| Current Assets | Raw value | N/A |

| Current Liabilities | Raw value | N/A |

| Government Bond Spread | Macro variable | 10Y Bond Yield—6M Bond Yield |

| GDP Growth | Macro variable | Quarterly GDP Growth |

| Industry Beta | Macro variable | See Equation (1) |

| Industry Index Return | Macro variable | Quarterly Log Return on MSCI-Index |

| Stock Volatility | Market variable | Annualized Quarterly Stock Volatility |

| P/B | Market variable | Price per Share/Book Value per Share |

| P/E | Market variable | Price per Share/Earnings per Share |

| P/S | Market variable | Price per Share/Sales per Share |

| Market Capitalization | Market variable | Share Price · Shares Outstanding |

| Market Index Return | Market variable | Log Return on Stock Exchange Index |

| Market Beta | Market variable | See Equation (1) |

| Stock Return | Market variable | Log Return of Stock |

| EPS | Market variable | Income Available to Common |

| Stockholders/Weighted Average | ||

| Number of Common Shares Outstanding * | ||

| GICS Code | Categorical variable | Affiliated Industry |

| Quarter | Categorical variable | Seasonal Indicator |

| Country | Categorical variable | Affiliated Country |

| GICS Prefix | Sector Name | MSCI Index | No. Companies | No. Samples |

|---|---|---|---|---|

| 10 | Energy | MXEUEN | 46 | 1202 |

| 15 | Industrials | MXEUMT | 38 | 739 |

| 20 | Materials | MXEUIN | 153 | 2755 |

| 25 | Consumer Discretionary | MXEUCD | 57 | 1130 |

| 30 | Consumer Staples | MXEUCS | 29 | 651 |

| 35 | Health Care | MXEUHC | 112 | 1534 |

| 40 | Financials | MXEUFN | N/A | N/A |

| 45 | Information Technology | MXEUIT | 100 | 1467 |

| 50 | Communication Services | MXEUTC | 39 | 541 |

| 55 | Utilities | MXEUUT | 7 | 174 |

| 60 | Real Estate | MXEURE | 58 | 851 |

| Feature | Mean | Std | Min | 25% | 50% | 75% | Max |

|---|---|---|---|---|---|---|---|

| Beta_industry | 0.53 | 0.41 | −2.88 | 0.26 | 0.5 | 0.77 | 2.57 |

| CR | 2.14 | 5.63 | 0.01 | 0.98 | 1.4 | 2.11 | 461.95 |

| EBIT_fixed_assets_ratio | −2.18 | 76.73 | −4781.08 | −0.02 | 0.04 | 0.17 | 3169.67 |

| EBIT_total_assets_ratio | −0.02 | 1.95 | −203.72 | −0.01 | 0.01 | 0.03 | 21.98 |

| GDP_growth | 0.89 | 2.49 | −9.3 | 0.1 | 0.8 | 1.9 | 8.9 |

| ICR | −275.27 | 13405.7 | −1,261,175.0 | −1.46 | 3.34 | 11.68 | 88,912.0 |

| PB_ratio | 11.2 | 221.95 | 0.0 | 1.11 | 2.6 | 6.31 | 15,659.98 |

| PB_ratio_1Q_chg | 0.41 | 16.77 | −1.0 | −0.05 | −0.01 | 0.05 | 1348.27 |

| PE_ratio | 52.73 | 583.28 | 0.0 | 0.0 | 13.37 | 36.8 | 41,883.26 |

| PS_ratio | 249.3 | 4982.21 | 0.02 | 0.88 | 2.31 | 7.83 | 199,054.15 |

| PS_ratio_1Q_chg | 0.04 | 2.1 | −1.0 | −0.05 | −0.01 | 0.01 | 177.71 |

| ROA | −2.64 | 23.18 | −271.88 | −4.24 | 3.12 | 7.26 | 221.92 |

| ROA_1Q_chg | 0.26 | 22.35 | −477.2 | −0.16 | 0.0 | 0.18 | 1661.41 |

| ROE | −4.69 | 59.95 | −1653.96 | −10.3 | 7.57 | 17.88 | 1059.74 |

| Volatility | 0.38 | 0.26 | 0.05 | 0.22 | 0.3 | 0.45 | 4.67 |

| current_assets_1Q_chg | 0.2 | 10.6 | −1.0 | −0.09 | −0.0 | 0.09 | 1107.62 |

| current_liabilities_1Q_chg | 0.21 | 9.7 | −1.0 | −0.08 | 0.01 | 0.13 | 1013.68 |

| debt_asset_ratio | 25.99 | 19.25 | 0.0 | 10.08 | 24.04 | 38.76 | 116.23 |

| debt_capital_ratio | 34.96 | 23.43 | 0.0 | 15.74 | 35.59 | 51.53 | 214.29 |

| fixed_assets_1Q_chg | 0.67 | 25.53 | −1.0 | −0.04 | −0.0 | 0.04 | 1908.94 |

| industry_idx_q_log_ret | 0.02 | 0.1 | −0.61 | −0.01 | 0.04 | 0.08 | 0.29 |

| market_idx_q_log_ret | 0.03 | 0.09 | −0.38 | −0.01 | 0.03 | 0.08 | 0.25 |

| profit_margin | −1747.83 | 36,474.2 | −2,076,500.0 | −7.72 | 3.41 | 10.53 | 650,400.0 |

| stock_q_log_ret | 0.01 | 0.26 | −2.66 | −0.1 | 0.02 | 0.14 | 1.93 |

| total_assets_1Q_chg | 0.15 | 10.11 | −1.0 | −0.03 | 0.0 | 0.04 | 1061.27 |

| total_sales_fixed_assets_ratio | 20.31 | 407.45 | −0.07 | 0.24 | 1.09 | 3.57 | 23,625.0 |

| total_sales_total_assets_ratio | 0.24 | 3.0 | −0.0 | 0.07 | 0.19 | 0.29 | 304.08 |

| WCTA | 0.13 | 0.23 | −0.96 | −0.01 | 0.1 | 0.24 | 0.98 |

| capex | −1,695,777 | 7,675,879 | −445,616,793 | −555,831 | −68,453 | −2892 | 0 |

| market_cap | 172,517,645 | 615,970,230 | 25,086 | 2,885,847 | 16,626,234 | 76,901,804 | 10,033,746,355 |

| total_assets | 124,749,445 | 406,931,326 | 14,030 | 2,050,788 | 14,036,938 | 65,435,701 | 5,149,789,660 |

| working_capital | 11,213,372 | 72,113,719 | −320,357,815 | −16,567 | 508,127 | 3,947,463 | 1,117,249,711 |

| Non-Distressed (Label 0) | Distressed (Label 1) | Total | |

|---|---|---|---|

| Training | 7871 | 964 | 8835 |

| Test | 1968 | 241 | 2209 |

| Total | 9839 | 1205 | 11,044 |

| Hyperparameter | Values |

|---|---|

| Number of hidden layers | (2, 3) |

| Perceptrons in layer 1 | |

| Perceptrons in layer 2 | |

| Perceptrons in layer 3 | (0, 16, 32) |

| Activation function | (ReLU, ELU) |

| Optimizer | (Adam, SGD w./momentum) |

| Dropout rate | |

| Learning rate Adam | |

| Learning rate SGD | Cyclical (0.001, 0.1) |

| Momentum | SGD (0.9, 0.98) |

| Hyperparameter | Values |

|---|---|

| Number of hidden layers | 3 |

| Number of perceptrons in each hidden layer | (92, 125, 32) |

| Activation function | ELU |

| Optimizer | SGD |

| Dropout rate | 0.7 |

| Learning rate SGD | Cyclical (0.001, 0.1) |

| Momentum | SGD 0.9 |

| Hyperparameter | Values |

|---|---|

| Gradient boosting method | GBDT, DART, GOSS |

| L2 regularization | (0, 0.1, 0.3) |

| Early-stopping rounds | (25, 50) |

| Number of iterations | (50, 100, 200) |

| Number of leaves | (8, 16, 31, 50) |

| Maximum depth | (−1, 25, 50, 75) |

| Learning rate | (0.01, 0.1, 0.05, 0.2) |

| Hyperparameter | Values |

|---|---|

| Gradient boosting method | GOSS |

| L2 regularization | 0.1 |

| Early-stopping rounds | 25 |

| Number of iterations | 200 |

| Number of leaves | 31 |

| Maximum depth | 50 |

| Learning rate | 0.05 |

| Model | Precision | Recall | F1 | ROC-AUC |

|---|---|---|---|---|

| LightGBM | 0.52 | 0.78 | 0.63 | 0.93 |

| ANN | 0.46 | 0.82 | 0.59 | 0.92 |

| LR | 0.74 | 0.46 | 0.57 | 0.92 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abrahamsen, N.-G.B.; Nylén-Forthun, E.; Møller, M.; de Lange, P.E.; Risstad, M. Financial Distress Prediction in the Nordics: Early Warnings from Machine Learning Models. J. Risk Financial Manag. 2024, 17, 432. https://doi.org/10.3390/jrfm17100432

Abrahamsen N-GB, Nylén-Forthun E, Møller M, de Lange PE, Risstad M. Financial Distress Prediction in the Nordics: Early Warnings from Machine Learning Models. Journal of Risk and Financial Management. 2024; 17(10):432. https://doi.org/10.3390/jrfm17100432

Chicago/Turabian StyleAbrahamsen, Nils-Gunnar Birkeland, Emil Nylén-Forthun, Mats Møller, Petter Eilif de Lange, and Morten Risstad. 2024. "Financial Distress Prediction in the Nordics: Early Warnings from Machine Learning Models" Journal of Risk and Financial Management 17, no. 10: 432. https://doi.org/10.3390/jrfm17100432

APA StyleAbrahamsen, N.-G. B., Nylén-Forthun, E., Møller, M., de Lange, P. E., & Risstad, M. (2024). Financial Distress Prediction in the Nordics: Early Warnings from Machine Learning Models. Journal of Risk and Financial Management, 17(10), 432. https://doi.org/10.3390/jrfm17100432