Abstract

The demand for information technology expertise has grown rapidly in the last few decades, signaling firms’ commitment to integrating IT into core business strategies. Understanding the conditions under which firms appoint a chief information officer (CIO) can provide valuable insights into the evolving role of IT in corporate governance. This study addresses a crucial gap in the literature by exploring the determinants of a firm’s decision to hire a CIO at the top management level. The study identifies several factors that influence a firm’s decision to appoint a CIO, including the firm’s size, its level of innovation, and its prior performance. The study examines these assertions by comparing the characteristics of firms that appoint a CIO at the top management level with those of similar firms in their industries that do not have a CIO position prior to the appointment. A logistic regression model that considers CIO firms and their matched firms indicates that firms that have larger capital expenditures, higher market value, or have experienced loss are more likely to hire a new CIO. Our study provides empirical evidence on why certain firms prioritize IT leadership at the executive level.

1. Introduction

The increasing pace of change in business enterprise driven by innovation, deregulation, and competition has required a large investment in intangible assets, such as information technology (IT) and research and development (R&D). These investments, associated with changes in product and service offerings, have called for higher-skilled workers who have greater levels of cognitive skills and flexibility. In this “new economy”, the demand is growing for workers with outstanding talent, training, and management ability (Krishnan et al. 2022; Evans et al. 2021; Autor et al. 1998). Accordingly, business enterprises today require not only traditional factors such as necessary capital and labor, but also new managerial skills such as “know-how information”. Bresnahan et al. (2002) argue that a firm’s ability to compete in the market depends not only on its technological capability, but also on its managers’ abilities to respond rapidly to customer needs and market demands. CIO Dive notes a spike in technology leadership change to adjust for evolving economic and business changes. Executive Neal Sample became the CIO at Walgreens in November 2023. This leadership change followed broader shifts within the company; his role implies redirecting the company’s attention to a new technology-driven transformation in the retail pharmacy sector, emphasizing the strategic importance of technology leadership (Torress 2023).

To effectively manage IT assets, modern organizations hire chief information officers (CIOs) at the top management level with the assumption that a CIO’s personal skills add value to the business organization. A study by Zhang et al. (2023) highlights how rapid digital transformation across various industries has significantly shifted the responsibilities of CIOs. They are now expected to lead innovation and digital strategy, not just manage IT resources. This supports the assertion that firms need advanced managerial skills to navigate the complexities of the modern economy. Integrating a CIO position in the top management team enables a CIO to provide economic justification for IT projects to the rest of the top management team, convince them to allocate attention and resources to strategic IT projects, and make them aware of the potential of information systems that can enhance the firm’s competitive advantage (Chau et al. 2020). Strengthening the CIO’s leadership position throughout the organization is crucial for developing IT capabilities and strategic alignment in the digital era (Wunderlich and Beck 2017). Therefore, when firms take the advantage and make the first move, ahead of competitors, by setting up a CIO position in the top executive team, they convey to the market their ability to adapt rapidly to the ever-changing business environment.

Richardson and Zmud (2002) have shown that investors are likely to reward firms that have good governance structures with higher market value. Chatterjee et al. (2001) examine the shareholder wealth effects of announcements of newly created CIO positions during the 1987–1998 time period. They find that the market reaction to CIO announcements is more pronounced in firms that are newly integrating IT into their business strategy, so-called “IT transformation firms”. In examining whether CIOs add long-term value to business enterprises, Khallaf and Skantz (2010) find that CIO firms outperform their industry average over two years following CIO appointments.

When appointed at the top management level, CIOs are pivotal in shaping IT governance, which involves aligning technology investments with the organization’s strategic goals, managing IT-related risks, and developing policies that ensure accountability and transparency in the use of technology. CIOs help establish a framework that integrates IT governance with corporate governance, ensuring that technology decisions support overall business objectives and create value for the firm (Wu et al. 2015). Effective IT governance, driven by CIO leadership, enhances decision-making processes, optimizes resource allocation, mitigates IT risks, and protects intellectual assets, ultimately leading to better organizational performance and competitive advantage (Jones et al. 2020).

The above research represents an ex post analysis of a firm’s decision to create a CIO position in the top management team, i.e., the act of hiring a new CIO. That is, prior research examines either the immediate market reaction to the announcement of hiring a new CIO or the long-term impact of a firm’s decision to appoint a new CIO at the top management level. However, these analyses do not examine the question of which factors drive a firm to create a specialized managerial position, the chief information officer, who is responsible for implementing and coordinating IT projects. Therefore, the results obtained from these analyses do not explain the intuition or the rationale behind a firm’s decision to have a new CIO position. In other words, which factors cause the demand for the CIO position ex ante? Determining the conditions under which firms appoint CIOs will help managers form realistic expectations about the benefits of having a CIO at the top management level.

To shed light on this question, this study analyzes the ex ante decision to hire a new CIO. The purpose of the current study, therefore, is to explain the rationale behind firms’ decisions to hire a new CIO. Key drivers of appointing a CIO include financial reasons, such as firm prior performance and firm size. Technical reasons for CIO appointment include key drivers such as improving the quality of IS and gaining access to new expertise. External factors for appointing a new CIO include the desire to partake in a trend that has received wide coverage in the press. This study explores the differences in firm characteristics before the CIO appointment event between a sample of firms that have announced the appointment of a CIO, and closely matched firms that did not appoint a CIO during the entire sample period. Using a peer-design technique1, firms in the CIO sample are compared to a matched group that have not created a CIO position, with a similar SIC code and size. By using this peer-design technique, we control for variations in industry and size, which are important factors that could otherwise introduce bias in our analysis.

Unlike previous studies that have primarily focused on the ex post consequences of appointing a CIO, our study examines the ex ante decision-making processes and driving forces behind a firm’s strategic choice to create a CIO position at the top management level. This novel approach provides valuable insights into the motivations and conditions that lead organizations to integrate IT leadership into their executive teams. By shedding light on these critical factors, our study offers a fresh perspective on the strategic integration of the CIO role within firms’ top management structures. The motivation behind this research stems from the significant impact that IT can have on firm performance, innovation, and long-term sustainability.

The findings of this study are of particular interest to senior management, IT leaders (especially CIOs), investors, and business consultants. Senior management can gain a fresh perspective and insights on the key drivers behind appointing CIOs and the conditions that lead to the successful integration of IT leadership into executive teams and leverage these insights to make informed decisions about the integration of IT leadership into top management teams. CIOs and IT leaders will find value in learning how their role can extend beyond managing IT to shaping governance, fostering innovation, and enhancing long-term competitiveness. Investors may benefit by identifying firms that are likely to gain a competitive advantage through strategic IT leadership. Finally, business consultants can better understand the motivations and external conditions that prompt firms to establish a CIO position and contribute to business success. Overall, the study sheds light on the strategic importance of CIOs in the modern business landscape.

The paper is structured as follows. Section 2 develops the literature review and research hypotheses. Section 3 outlines the research methodology and sample selection procedure. Section 4 indicates the empirical results of the study and Section 5 presents the limitations and contributions. Section 6 includes a summary with conclusions.

2. Literature Review and Hypotheses Development

Firm characteristics are known to shape IT strategies in various ways. Specifically, we examine how firm characteristics such as size, industry type, financial performance, and capital expenditures influence IT strategies, particularly the decision to elevate IT leadership by creating a CIO position.

2.1. Firm Size

Kallmuenzer et al. (2024) argue that firms with greater resources are more likely to adopt new IT strategies. The authors use total sales as a proxy for firm resources and conclude that firms with greater sales levels adopt a just-in-time strategy. This is consistent with Gowen and Tallon (2003), who find that IT executives of “market-focused” organizations perceive higher levels of IT value throughout the value chain. The potential of scale and scope economies of large firms motivate these firms to take the initiative of creating new management positions. Furthermore, recent studies find that larger firms not only have more resources, but also face greater scrutiny from stakeholders, which increases their likelihood of appointing a CIO to ensure effective governance and strategic alignment (Chau et al. 2020; Banker et al. 2022). This indicates that larger firms are more likely to appoint a new CIO due to their capacity to leverage IT for competitive advantage.

Prior studies have examined the association between firm size and IT investment intensity. Their findings support the hypothesis that large firms experience greater opportunities to improve their financial performance than small firms (Gremillion 1984; Harris and Katz 1991).

Therefore, it is expected that firms with larger size will value the integration of the CIO position in the organization hierarchy more than small firms and are thus more likely to appoint a new CIO. Therefore, the following hypothesis is presented:

H1:

Large firms are more likely to appoint a new CIO than small firms.

2.2. High-Tech Firms

The level of innovative activities of a firm can also drive the demand for a CIO position. That is, high-tech firms characterized by a greater level of R&D usually demand specific resources and skills to achieve a competitive advantage. Given the increasing pace of change in business enterprises driven by innovation, there is a call for skilled senior executives who can enable firms to rapidly adjust to the continuously changing business environment (Rajgopal et al. 2002). Prior studies argue that the dynamic nature of technology markets necessitates a strong IT leadership presence (Chau et al. 2020; Kettinger et al. (2021). Their findings suggest that high-tech firms with robust R&D investments are more likely to see a positive correlation between CIO appointments and improved market performance, thereby reinforcing the demand for CIOs in high-tech environments.

Kettinger et al. (1994) argue that the CIO’s role in influencing a firm’s future opportunities is more pronounced in a more dynamic environment. The hype around many high-tech firms and the publicity given to their web applications suggest that executives who do not act fast, relative to industry competitors, put their firms at risk (Ross and Feeny 2000). Advances in IT may require firms to better manage IT assets and model complex risks (Liebenberg and Hoyt 2003). Having a new CIO in a senior management team is crucial for high-tech firms due to the fact that most high-tech firms are building business strategies that have not previously existed in market industries. Accordingly, the following hypothesis is developed:

H2:

High-tech firms are more likely to appoint a new CIO than other firms.

2.3. Prior Performance

Firm prior performance is another factor that may affect the demand for a CIO position. While the CIO role is becoming increasingly common in both profitable and non-profitable firms, there may be a greater demand for such positions in firms that have experienced loss. Since CIOs are touted by their ability to derive IT services at a lower cost level and higher quality (Bandodkar and Grover 2022), firms that experience loss are expected to have greater incentives to be among the first movers to create such a position in the top management team. Khallaf and Skantz (2010) find that the market reacts favorably to the strategic change implied by CIO appointment for firms performing poorly in the year prior to the announcement. A recent study (Chawla et al. 2023) supports the argument that firm performance impacts the demand for a CIO and highlights that the structural power of the CIO can enhance firm performance, particularly in firms that need strategic improvement or reorientation. The study indicates that the appointment of a CIO is seen more favorably by the market in firms that have underperformed, reinforcing the idea that unprofitable firms appoint CIOs to signal positive change to shareholders. Additionally, Chawla and Goyal (2021) indicate that digital transformation, often led by a CIO, is critical for firms seeking to improve efficiency and performance. These findings support the notion that unprofitable firms are more likely to appoint a CIO to leverage IT for competitive advantage and signal a strategic shift.

Accordingly, an inverse relation is expected between the demand for the CIO position and firm performance. Therefore, firms that experience loss are more likely to appoint a new CIO to signal a positive message to their shareholders. Hence, the following hypothesis is presented:

H3:

Unprofitable firms are more likely to appoint a new CIO than profitable firms.

These hypotheses are not intended to be comprehensive and are limited by those driven factors that can be tested through publicly available financial data.

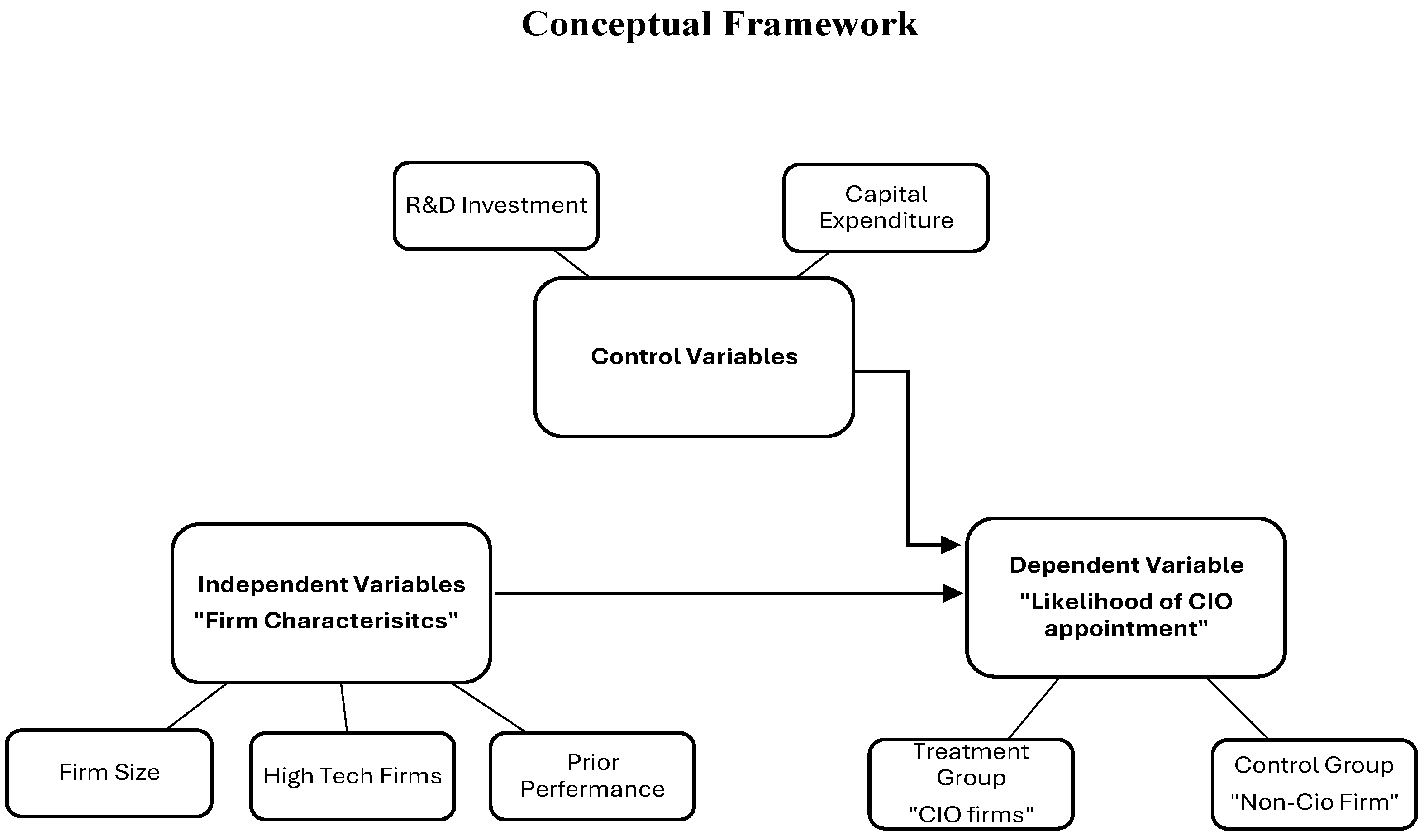

The framework described herein aims to identify the key factors or the driving forces influencing a firm’s decision to appoint a CIO at the top management level. These factors are driven by a combination of external and internal forces. The major external forces that drive firms to appoint a new CIO can arise from factors such as globalization and competition or the desire to follow a trend that has gained wide coverage in the popular press. Internal factors can include firm size, IT investment, level of innovation, and firm prior performance. Due to the difficulty of measuring the impact of external factors on the management decision to hire a new CIO, the current study assumes that the demand for the CIO position is a function of firm-specific characteristics that reflect greater resources, innovation activities, and firm performance.

Appointing a CIO holds significant theoretical importance as it directly impacts IT governance, innovation, and a firm’s competitive advantage. The CIO plays a crucial role in aligning IT investments with business strategies, ensuring that technological initiatives support organizational goals (Enns et al. 2003; Wu et al. 2015). Firm characteristics are also known to shape IT strategies in various ways and are likely to influence a firm’s decision to appoint a CIO. Figure 1 presents the conceptual framework for understanding the factors that drive a firm’s decision to appoint a chief information officer (CIO) at the top management level.

Figure 1.

Conceptual framework of driving factors to nominate a CIO.

This figure presents the main factors that drive a firm’s decision to appoint a CIO.

3. Research Methodology

To explore the factors that drive firms’ decisions to create the CIO position at the top management level, a logistic regression model was estimated. The dependent variable (CIO firm) is stated as a dummy variable, and equals 1 for CIO firms and 0 for non-CIO firms. The independent variables include firm market value, R&D expenditures, advertising expenditures, capital expenditures, and prior performance. Hence, the empirical model of interest that examines the variables that drive the demand for the CIO position is as follows:

where

Ln [prob. (CIO)/1 − prob. (CIO)] = α + β1 LOSSit−1 + β2 Log MVit−1 + β3 H-TEK + β4 R&Dit−1 + β5 CAPEXit + εit

| Ln CIO (the dependent variable) | A dummy variable that takes a value of 1 if the firm hires a CIO, and 0 otherwise, where Ln refers to the likelihood or the marginal probability ratio in favor of creating a CIO position. |

| LOSSit−1 | A dummy variable that takes a value of 1 if the net income before extraordinary items (Compustat item #18) is negative, and 0 otherwise. |

| Log MV | The natural log of the firm’s market value at the end of the year. Market value is measured as a stock closing price multiplied by the number of common shares outstanding. |

| H-TEC2 | A dummy variable that takes a value of 1 if the firm reports Compustat SIC codes 2833-2836, 8731-8734, 7371-7379, 3570-3577, 3600-3674, or 3810-3845, namely drugs, R&D services, programming, computers, electronics, or precise measurement instruments, respectively, and 0 otherwise. |

| R&Dit−1 | Research and development over sales (Compustat item # 46) to sales. |

| CAPEX | Capital expenditures (Compustat item # 30) scaled by total assets. |

The dependent variable refers to the likelihood ratio in favor of creating a new CIO position. Since IT investments are not disclosed publicly, the model includes R&D and capital expenditures as a proxy for IT investments. The results obtained from the logistic regression model will shed light on whether CIO firms have unique characteristics compared to non-CIO firms that drive the demand for the CIO position.

Sample and Data Collection

CIO announcements were obtained from the Lexis-Nexis Wire Service for the period 1987 to 20063. Each announcement was reviewed to differentiate between the creation of new CIO positions and new hires for existing roles. With the assistance of Lexis-Nexis Wire Service representatives, a search program using a variety of relevant keywords was developed. These keywords included job titles (such as chief information officer, chief technology officer, CIO, CTO, and vice president of information technology) and hiring actions (such as hire, promote, recruit, name, and appoint).

The research initially produced a total of 1306 CIO announcements (Table 1, Panel A). The first review of these announcements excluded 319 announcements that either represent a duplication of a CIO announcement or pointed to unrelated CIO hiring announcements.4 The remaining 987 announcements were checked carefully to assure the existence of the CIO position at the top management level. The firms with CIO announcements were then compared to a matched group of firms, similar in SIC code and size, that had not created a CIO position. To identify a firm as a non-CIO firm, this study used the following method: (1) initially, a firm was considered a non-CIO firm if it did not announce a CIO position during the study period (1987–2006); (2) the proxy statements of non-CIO firms were reviewed to ensure that these firms do not have a CIO position in the top management team.

Table 1.

Sample selection.

Two different sets of benchmarks were utilized in this study. In the first set, each CIO firm was matched to a non-CIO firm with the same four-digit SIC code and a similar size. In particular, a CIO firm was matched to a non-CIO firm with the same four-digit SIC code, and with year-end market values within 70–130% of the CIO’s firm in the year prior to the CIO announcement (Table 2).5 If no match was found within the specified limits of size and with the same four-digit SIC code, a three-digit and then a two-digit SIC code were used to search for a matching firm. If a matched firm could not be specified, the third step was to find a firm with the closest market value to the CIO firm.

Table 2.

CIO and matched firms—matching criteria. CIO firms are matched to non-CIO firms in terms of size and industry. Year-end market value is proxied for size. Panel A compares the market value and performance of CIO firms to non-CIO firms. Year-end market value is the stock close price multiplied by the number of common shares outstanding. Panel B show the number of firms with available matching based on the defined criteria. CIO firms are matched to non-CIO firms with the same SIC code. Non-CIO firms were between 70 and 130% of the CIO firm’s size in year t. In cases where firm’s market value is missing in Compustat files, total assets are used to find the closest match.

4. Empirical Results

Reviewing CIO announcements over the given period of time (1987–2006) reveals an increasing tendency among U.S. firms to appoint a new CIO at the top management level. The knowledge gathered from estimating the above model provides the foundation to better understand this recent trend. Panel A of Table 3 presents summary statistics for variables used in the regression analysis for the CIO sample and the control sample6. As predicted by the study hypotheses, Panel A shows that the median values for LOGMV, R&D, and CEXP are higher for the CIO sample than the control sample. A median HTEK variable of 0 for the CIO sample shows that there are more less-high-tech firms that announce the CIO position than high-tech firms.

Table 3.

Descriptive statistics and Pearson correlations. Sample consists of 475 firm observations. CIO is a dummy variable that takes the value of 1 if a firms hires a CIO for the first time and 0 otherwise; log MV is log of market value, a proxy for firm size; R&D is research and development expenditures deflated by total sales; CEXP is the capital expenditures deflated by total assets; HTEK is a dummy variable which takes the value of 1 if a CIO firm is a high-tech firm and 0 otherwise; PERF is a dummy variable that takes a value of 1 if the net income before extraordinary items is negative and 0 otherwise.

Panel B of Table 3 reports Pearson correlations between pairs of key variables. The correlations present the unconditional relationship between the dummy variable CIO and the natural logarithm of market value, R&D expenses, capital expenditures, whether a firm is a high-tech firm, and firm performance prior to CIO appointment. Consistent with prior predications, the simple correlations in Table 3 (Panel B) indicate a significantly positive relation between the demand for the CIO position and firm capital expenditures and prior performance. However, one should interpret these correlations with caution because the correlations indicate that firm prior performance is associated with other variables in the study.

In order to explain the underlying characteristics that cause the demand for the CIO position ex ante, a logistic regression model is estimated to examine whether CIO firms have unique characteristics compared to non-CIO firms that drive the demand for the CIO position. The categorical dependent variable CIO assumes a value of one if a firm appointed a CIO and zero for control firms. The regression model estimates the impact of firm size, prior performance, level of innovation, and capital expenditures on the likelihood of appointing a CIO at the top management level.

Table 4 reports significantly positive coefficients for firm characteristics that reflect an inferior financial performance, large capital expenditures, and high market value (the coefficients of loss and capital expenditures are significant at the 0.01 level, while that of market value is significant at the 0.10 level). These findings reveal that firms that have greater capital expenditure, experience a loss, or have a higher market value a year prior to appointing a new CIO are more likely to hire a new CIO. Finding a positive correlation between CIO firms and greater capital expenditure, as well as CIO firms and higher market value, is consistent with Kinney and Wempe (2002), who find that firms with greater resources are more likely to adopt new IT strategies. These findings are consistent with the hypothesis that firms appoint CIOs to reduce information asymmetry regarding the firm’s current and expected IT investment. Finding a negative correlation between a firm’s prior performance and its decision to hire a CIO reflects a positive expectation about the ability of the new CIO to improve firm performance. By appointing a CIO, management signals its commitment to take the steps needed to improve future performance. Contrary to this study’s hypothesis, the level of technology represented by high-tech firms is not driving the demand for the CIO position. The absence of a significant correlation between the likelihood of appointing a CIO and the HTEK variable may attribute to the explanation that the CIO position is deemed to be important to most business organizations regardless of their level of technology.

Table 4.

Logistic analysis of the determinants of firms’ decisions to appoint a CIO at the top management level. Shown below are the coefficient estimates from the OLS regressions, specified as follows: CIOit = α + β1 log MVit−1 + β2 R&Dit−1 + β3 CEXPit−1 + β4 HTEKit−1 + β5 PERFit−1 + e, where CIO is a dummy variable that takes the value of 1 if a firms hires a CIO and 0 otherwise; log MV is log of market value, a proxy for firm size; R&D is research and development expenditures deflated by total sales; ADV is advertising expenditures deflated by total sales; HTEK is a dummy variable which takes the value of 1 if a CIO firm is a high-tech firm and 0 otherwise; and CEXP is capital expenditures deflated by total assets. The marginal probability of hiring a CIO is estimated using the LOGIT model.

5. Limitations and Contributions

The decision to limit our sample size for CIO announcements to the period from 1987 to 2006 is due to the following reasons: (1) The specificity of the research objective. The focus on first-time CIO appointments necessitates a clear boundary for the data collection period. By limiting the sample to 2006, we ensure that our findings are relevant to the emergence of the CIO role during a pivotal time in the evolution of information technology management. This period saw significant organizational changes and the formalization of the CIO position, making it a critical time for understanding its impact on firms (Ross and Feeny 2000; Broadbent and Kitzis 2005; McAfee 2006). (2) Technological evolution. The early 2000s marked a significant shift in how organizations approached information technology, particularly with the rise of the internet and digital transformation (Chatterjee et al. 2001; Enns et al. 2003; Khallaf and Skantz 2007). Accordingly, we capture the initial impacts of these changes on corporate governance and management structures, particularly the strategic importance of the CIO role as firms began to recognize the value of information technology in driving business success. (3) Newly created position. The study focuses exclusively on firms hiring a CIO for the first time, rather than promoting an existing position, ensuring that the data reflects the initial creation of the CIO role. (4) Consistency with prior studies. Our sample period coincides with the timeframe used in the studies by Khallaf and Skantz (2007, 2010) and Chatterjee et al. (2001), which also focused on market reaction to newly created CIO positions and firm performance. This alignment not only strengthens the credibility of our research, but also allows for comparative analysis with previous findings, enhancing the overall validity of our results. There are two more important limitations to this study that deserve to be noted. The first concerns the lack of available information about IT investments. The second limitation comes from the assumption that non-CIO firms are firms that never announce the appointment of a CIO. Although an announcement of a new CIO appointment signals that the firm is establishing such a position, firms without a CIO may in fact have a de facto CIO who goes by a different title from the key words used in the current study.

To our knowledge, this is the first study to investigate the ex ante decisions or driving forces behind firms’ choices to appoint a CIO at the top management level. Prior studies have primarily examined the ex post impact of hiring a new CIO. Understanding these driving forces is strategically important as it sheds light on the motivations and conditions that lead firms to create a CIO position, providing valuable insights into the strategic integration of IT leadership within firms’ top management teams.

6. Summary and Conclusions

Despite the growing recognition of IT as a strategic asset, there is limited understanding of the specific factors that influence a firm’s decision to appoint a CIO at the top management level. This study provides an initial attempt to identify factors that drive firms’ decisions to appoint a CIO at the top management level. As is suggested by the announcements extracted from the general trade press, firms appoint CIOs to manage IT assets and improve their performance and competitive advantage. Creating a CIO position at the top management level signals the importance of IT investments to an organization and would represent one way through which a firm could capture various benefits associated with managing IT investments. Our results reveal that firms are more inclined to appoint CIOs when they experience prior loss, have large capital expenditures, and have a higher market value. The findings of this study offer valuable practical implications. For practitioners, this means that appointing a CIO can be a strategic move to leverage IT resources more effectively, particularly in times of organizational change or financial pressure. By elevating the CIO to the top management team, firms can better align their IT investments with broader business objectives, driving innovation, improving competitive advantage, and enhancing governance. Understanding the conditions that prompt firms to make this decision can help business leaders proactively identify the right timing and circumstances to appoint a CIO, ensuring that IT leadership is integrated at a strategic level to support long-term success.

The focus on the antecedents of CIO appointments, rather than solely on their outcomes, represents a significant and a meaningful departure from the existing body of literature. Our examination of ex ante decision-making processes also allows us to better understand the specific drivers and considerations that shape a firm’s decision to elevate the CIO to the top management level. This approach expands the theoretical framework around IT leadership by shedding light on the strategic factors influencing the creation of the CIO position, offering a new insight into organizational IT governance strategies. Overall, this research sheds light on the factors influencing the creation of a CIO position, offering both theoretical and practical insights that contribute to improved IT governance and competitive strategies.

While our research provides valuable insights into the factors driving firms to appoint CIOs at the top management level, there are several areas that warrant further exploration. First, future research may investigate the impact of additional factors that were not examined in this study but may play a crucial role in CIO appointments. These include the firm’s IT budget, industry specification, competitive pressures, and organizational structure, all of which could affect the strategic importance of the CIO role. Understanding how these factors interact with the firm’s decision-making process would offer a more comprehensive view of why firms elevate IT leadership. Second, the lack of detailed information on IT investments within the firms studied represents another important limitation. Future research could integrate these data to explore how specific IT investment levels or types influence the likelihood of a firm appointing a CIO. This could provide a better understanding of how financial and technological investments in IT infrastructure correlate with the appointment of top-level IT leadership. Third, the sample period of our study, from 1987 to 2006, limits the generalizability of our findings to the modern era of IT leadership, especially given the rapid technological advancements since then, including the rise of cloud computing, artificial intelligence, and data analytics. Future research could extend the time frame to explore whether these emerging technologies and digital transformation trends have influenced the decision to appoint a CIO at the top management level in recent years. By examining more recent data, researchers could determine whether the drivers for CIO appointments have evolved in line with technological advancements and organizational changes. Additionally, our study assumes that firms without CIO announcements have not created a CIO position. However, there may be firms with de facto CIOs operating under different titles that our keyword search did not capture. Future studies could explore alternative methodologies for identifying these positions, such as manual reviews of leadership roles, or cross-referencing data with other sources like corporate filings, to provide a more accurate picture of firms’ IT leadership structures.

Lastly, research could investigate how the long-term value added by CIOs evolves over time, particularly in firms that have sustained a CIO role for multiple years versus those that have recently appointed one. This would help deepen the understanding of how CIOs impact organizational performance in different phases of their tenure and whether their influence grows or diminishes as IT governance becomes more embedded within the firm’s strategic framework. In conclusion, addressing these limitations through future research could provide a deeper understanding of the factors that drive CIO appointments, offering valuable insights into how firms can strategically leverage IT leadership to enhance their competitive advantage and long-term success.

Author Contributions

Conceptualization, A.K. and A.S.; methodology, A.K.; software, J.E.; validation, A.K., A.S. and J.E.; formal analysis, A.K.; investigation, J.E.; resources, A.S.; data curation, A.S.; writing—original draft preparation, A.K.; writing—review and editing, A.S. and J.E.; visualization, J.E.; supervision, A.K.; project administration, A.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Financial data is collected from Compustat files, CIO announcements are collected from Lexis Nexis wire services. Both datasets are not publicly available and are subscribed by our university.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | The term “peer-design technique” refers to a method of comparing a group of firms to a carefully selected control group that shares key characteristics with the primary group to ensure a meaningful comparison (Stuart 2010). |

| 2 | Consistent with Chen et al. (2002), the current study sets high-tech firms to these SIC codes. |

| 3 | Refer to the limitations section for an explanation of the chosen study’s time period. |

| 4 | Unrelated CIO announcements include those announcements that declared actions taken by current CIOs to implement their IT strategies. |

| 5 | Barber and Lyon (1996) chose this size range as it yields test statistics that are well specified. |

| 6 | We used SAS 9.4. software for data analysis. |

References

- Autor, David H., Lawrence F. Katz, and Alan B. Krueger. 1998. Computing Inequality: Have Computers Changed the Labor Market? The Quarterly Journal of Economics 113: 1169–213. [Google Scholar] [CrossRef]

- Bandodkar, Nikhil, and Varun Grover. 2022. Does it Pay to Have CIOs on the Board? Creating Value by Appointing C-Level IT Executives to the Board of Directors. Journal of the Association for Information Systems 23: 838–88. [Google Scholar]

- Banker, Rajiv D., Cecilia Feng, and Paul A. Pavlou. 2022. Businessperson or Technologist: Stock Market Reaction to the Alignment between CIO Background and Firm Strategy. Journal of Management Information Systems 39: 1006–36. [Google Scholar] [CrossRef]

- Barber, Brad M., and John D. Lyon. 1996. Detecting abnormal operating performance: The empirical power and specification of test statistics. Journal of Financial Economics 41: 359–99. [Google Scholar] [CrossRef]

- Bresnahan, Timothy F., Erik Brynjolfsson, and Lorin M. Hitt. 2002. Information Technology, Workplace Organization, and the Demand for Skilled Labor: Firm-Level Evidence. The Quarterly Journal of Economics 117: 339–76. [Google Scholar] [CrossRef]

- Broadbent, Marianne, and Ellen S. Kitzis. 2005. The New CIO Leader: Setting the Agenda and Delivering Results. Cambridge, MA: Harvard Business School Press. [Google Scholar]

- Chatterjee, Debabroto, Vernon J. Richardson, and Robert W. Zmud. 2001. Examining the shareholder wealth effects of announcements of newly created CIO positions. MIS Quarterly 25: 43–70. [Google Scholar] [CrossRef]

- Chau, Dorothy C. K., Eric W. T. Ngai, Jennifer E. Gerow, and Jason Bennett Thatcher. 2020. The Effects of Business-IT Strategic Alignment and IT Governance on Firm Performance: A Moderated Polynomial Regression Analysis. MIS Quarterly 44: 1679–703. [Google Scholar] [CrossRef]

- Chawla, Raghu Nandan, and Praveen Goyal. 2021. Emerging trends in digital transformation: A bibliometric analysis. Benchmarking: An International Journal 29: 1069–112. [Google Scholar] [CrossRef]

- Chawla, Raghu Nandan, Praveen Goyal, and Deepak Kumar Saxena. 2023. The role of CIO in digital transformation: An exploratory study. Information Systems and e-Business Management 21: 797–835. [Google Scholar] [CrossRef]

- Chen, Shuping, Mark L. DeFond, and Chul W. Park. 2002. Voluntary disclosure of balance sheet information in quarterly earnings announcements. Journal of Accounting and Economics 33: 229–51. [Google Scholar] [CrossRef]

- Enns, Harvey G., Sid L. Huff, and Christopher A. Higgins. 2003. CIO lateral influence behaviors: Gaining peers’ commitment to strategic information systems. MIS Quarterly 27: 155–76. [Google Scholar] [CrossRef][Green Version]

- Evans, Peter C., Geoffrey J. Parker, Marshall W. Van Alstyne, and Dyan Finkhousen. 2021. Platform Leadership: Staffing and Training the Inverted Firm. SSRN Working Paper. Available online: https://ssrn.com/abstract=3871971 (accessed on 30 September 2024).

- Gowen, Charles R., and William J. Tallon. 2003. Enhancing supply chain practices through human resource management. The Journal of Management Development 22: 32–45. [Google Scholar] [CrossRef]

- Gremillion, Lee L. 1984. Organization size and information system use: An empirical study. Journal of Management Information Systems 1: 4–17. [Google Scholar] [CrossRef]

- Harris, Sidney E., and Joseph L. Katz. 1991. Organizational performance and information technology intensity in the insurance industry. Organization Science 2: 263–95. [Google Scholar] [CrossRef]

- Jones, Mary C., Leon Kappelman, Robert Pavur, Quynh N. Nguyen, and Vess L. Johnson. 2020. Pathways to being CIO: The role of background revisited. Information & Management 57: 103234. [Google Scholar]

- Kallmuenzer, Andreas, Alexey Mikhaylov, Mihaela Chelaru, and Wojciech Czakon. 2024. Adoption and performance outcome of digitalization in small and medium-sized enterprises. Review of Managerial Science. [Google Scholar] [CrossRef]

- Kettinger, William J., Sung Yul Ryoo, and Donald A. Marchand. 2021. We’re engaged! Following the path to a successful information management capability. The Journal of Strategic Information Systems 30: 101681. [Google Scholar] [CrossRef]

- Kettinger, William J., Varun Grover, Subashish Guha, and Albert H. Segars. 1994. Strategic information systems revisited: A study in sustainability and performance. MIS Quarterly 18: 31–58. [Google Scholar] [CrossRef]

- Khallaf, Ashraf, and Terrance Skantz. 2007. The effects of Information technology expertise on the market value of firm. Journal of Information Systems 21: 83–105. [Google Scholar] [CrossRef]

- Khallaf, Ashraf, and Terrance Skantz. 2010. Does Long-Term Performance Improve Following the Appointment of a CIO? International Journal of Accounting Information Systems 12: 57–78. [Google Scholar] [CrossRef]

- Kinney, Michael R., and William F. Wempe. 2002. Further evidence on the extent and origins of JIT’s profitability effects. The Accounting Review 77: 203–25. [Google Scholar] [CrossRef]

- Krishnan, Lata, Subictha Poorani, and Shanmuganathan Sawmya. 2022. Emerging Trends in Training Knowledge Workers; New Economy. International Journal of Learning and Development 12: 26–43. [Google Scholar] [CrossRef]

- Liebenberg, André P., and Robert E. Hoyt. 2003. The Determinants of enterprise risk management: Evidence from the appointment of chief risk officers. Risk Management and Insurance Review 6: 37–52. [Google Scholar] [CrossRef]

- McAfee, Andrew. 2006. Mastering the three worlds of information technology. Harvard Business Review 84: 141. [Google Scholar]

- Rajgopal, Shivaram, Suresh Kotha, and Mohan Venkatachalam. 2002. Managerial actions, stock returns and earnings: The case of business-to-business Internet firms. Journal of Accounting Research 40: 529–56. [Google Scholar] [CrossRef]

- Richardson, Vernon J., and R. W. Zmud. 2002. Wealth Effects Accompanying Appointments of Outside Directors to the Boards of Internet Companies. Working Paper. Lawrence: University of Kansas. [Google Scholar]

- Ross, Jeanne W., and David F. Feeny. 2000. The Evolving Role of the CIO, in framing the domains of IT management: Chapter 19. In Projecting the Future through the Past. Edited by Robert W. Zmud. Cincinnati: Pinnaflex Educational Resources Inc., pp. 385–402. [Google Scholar]

- Stuart, Elizabeth A. 2010. Matching methods for causal inference: A review and a look forward. Statistical Science 25: 1–21. [Google Scholar] [CrossRef]

- Torress, Roberto. 2023. 15 CIO Appointments That Shaped 2023. CIO Dive. Available online: https://www.ciodive.com/news/biggest-CIO-appointments-2023/700927/ (accessed on 30 September 2024).

- Wu, Shelly Ping-Ju, Detmar W. Straub, and Ting-Peng Liang. 2015. How information technology governance mechanisms and strategic alignment influence organizational performance: Insights from a matched survey of business and IT managers. MIS Quarterly 39: 497–518. [Google Scholar] [CrossRef]

- Wunderlich, Nico, and Roman Beck. 2017. We’ve Got the Power—The Relevance of IT Leadership and Organizational IT Capabilities in the Fully Digitized Business Era. Paper presented at Twenty-Fifth European Conference on Information Systems (ECIS), Guimarães, Portugal, June 5–10. [Google Scholar]

- Zhang, Xin, Yaoyu Xu, and Liang Ma. 2023. Information technology investment and digital transformation: The roles of digital transformation strategy and top management. Business Process Management Journal 29: 528–49. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).