Dynamic Spillovers from US (Un)Conventional Monetary Policy to African Equity Markets: A Time-Varying Parameter Frequency Connectedness and Wavelet Coherence Analysis

Abstract

1. Introduction

2. Methodology

2.1. Return and Conditional Volatility

2.2. TVP Frequency Connectedness Approach

2.3. Wavelet Coherence

3. Data

4. Empirical Results

4.1. Static TVP Frequency Connectedness Analysis

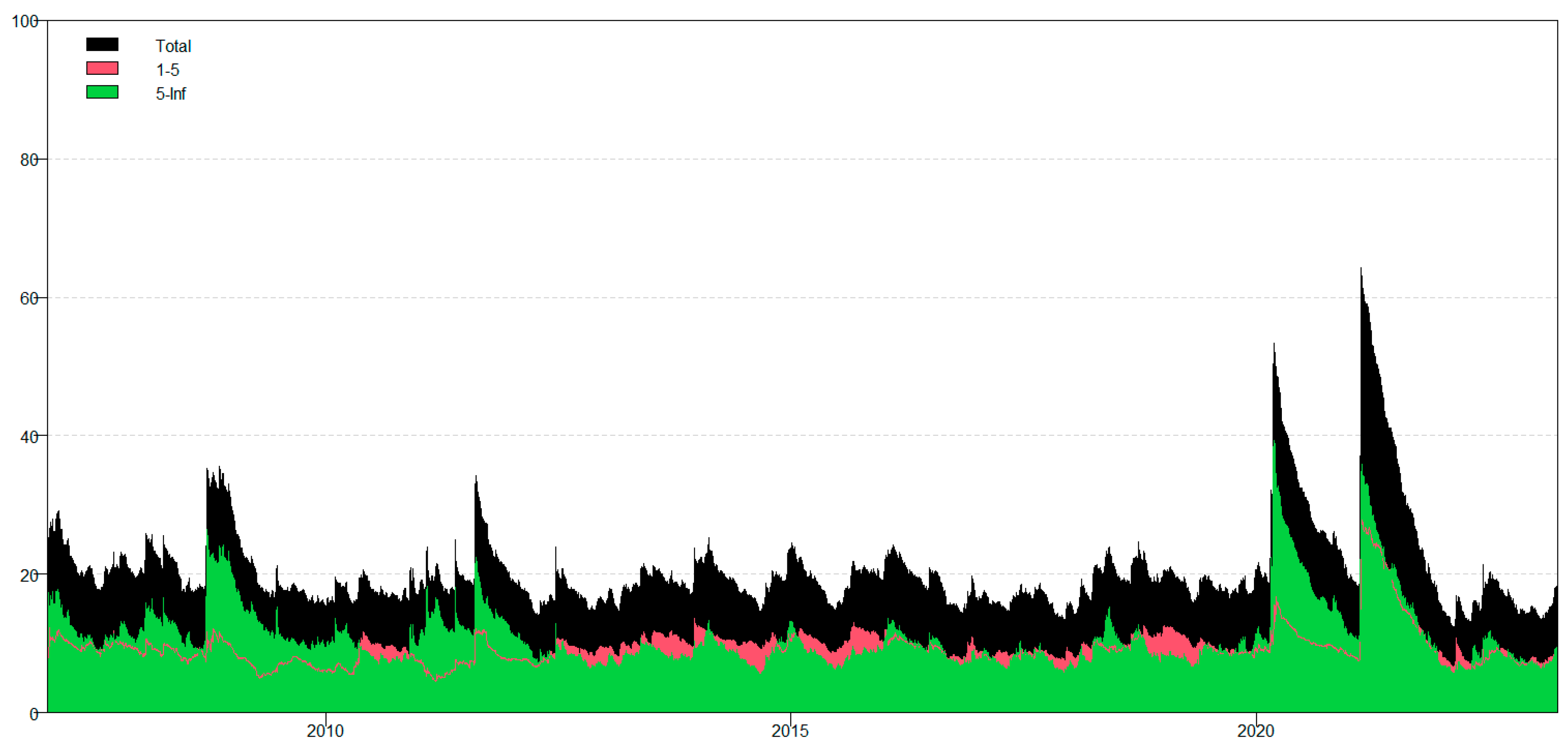

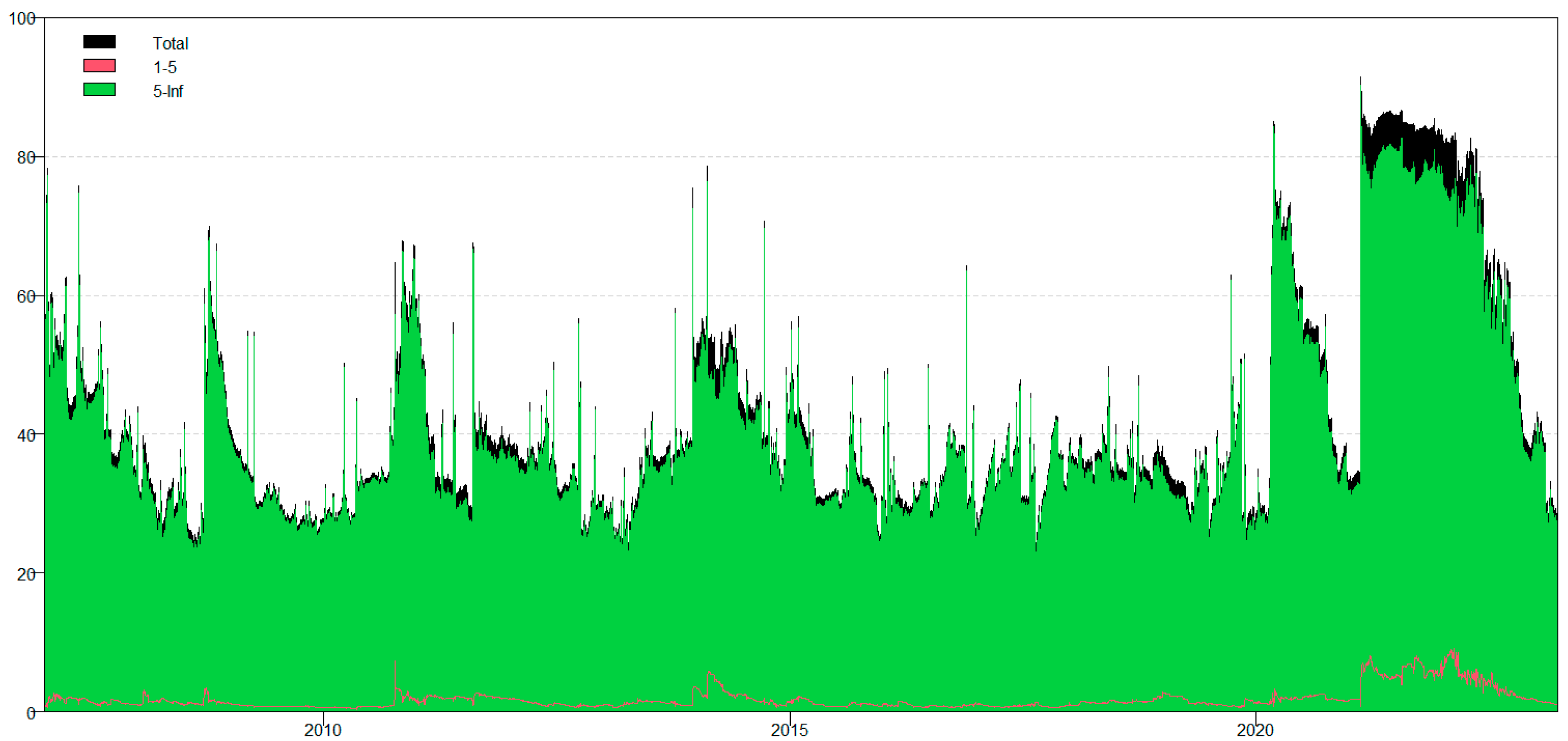

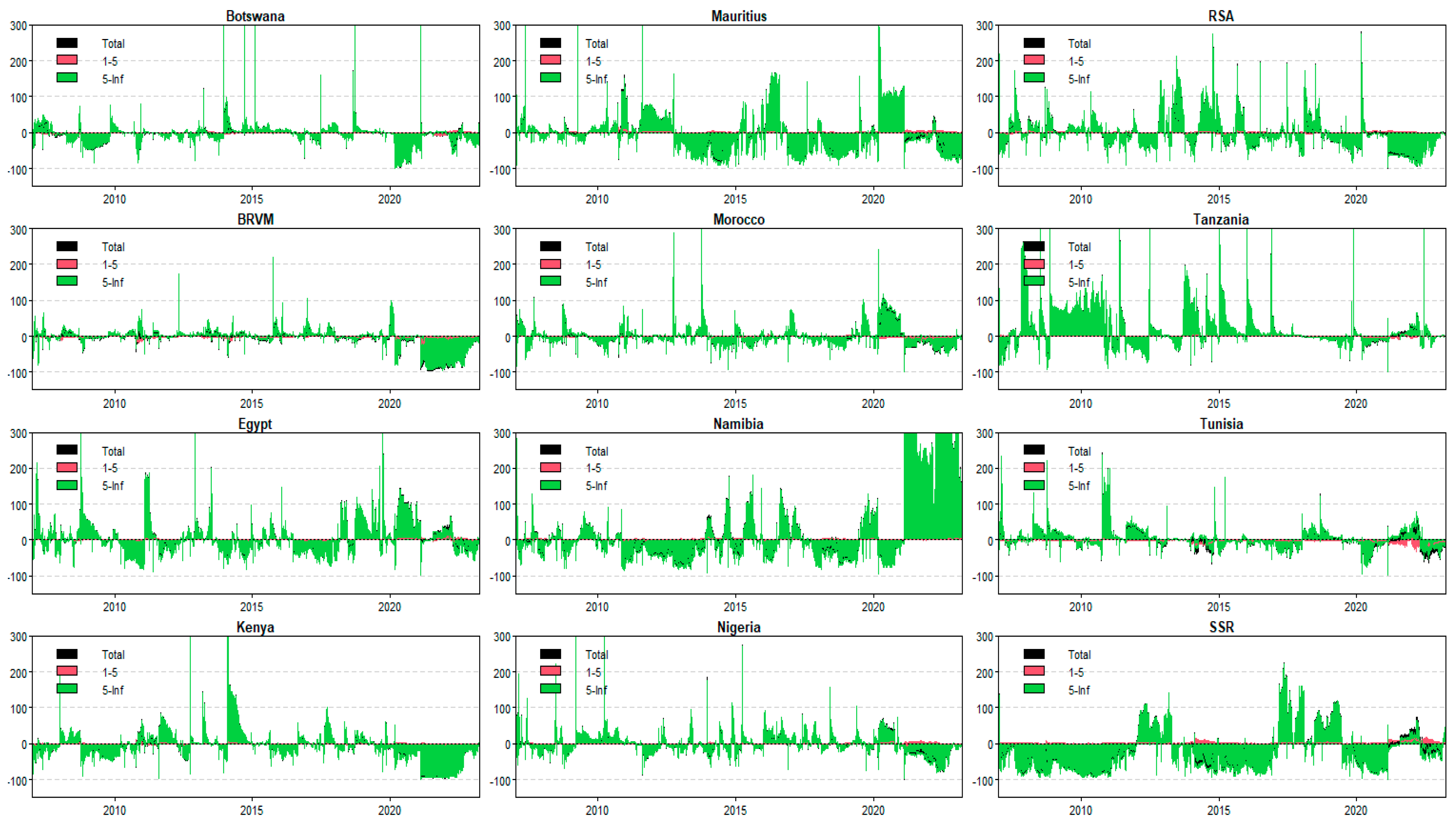

4.2. Dynamic TVP Frequency Connectedness Analysis

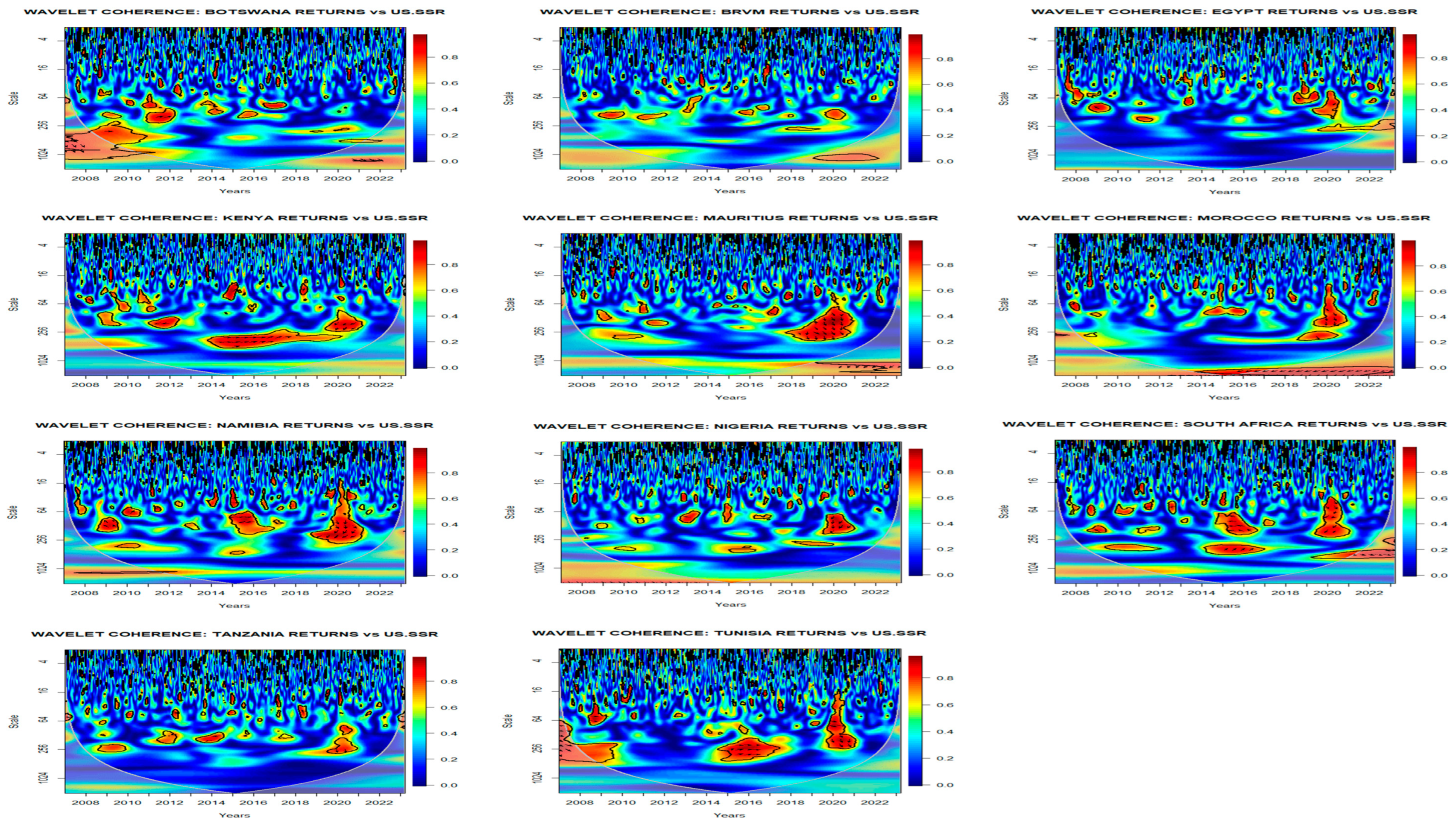

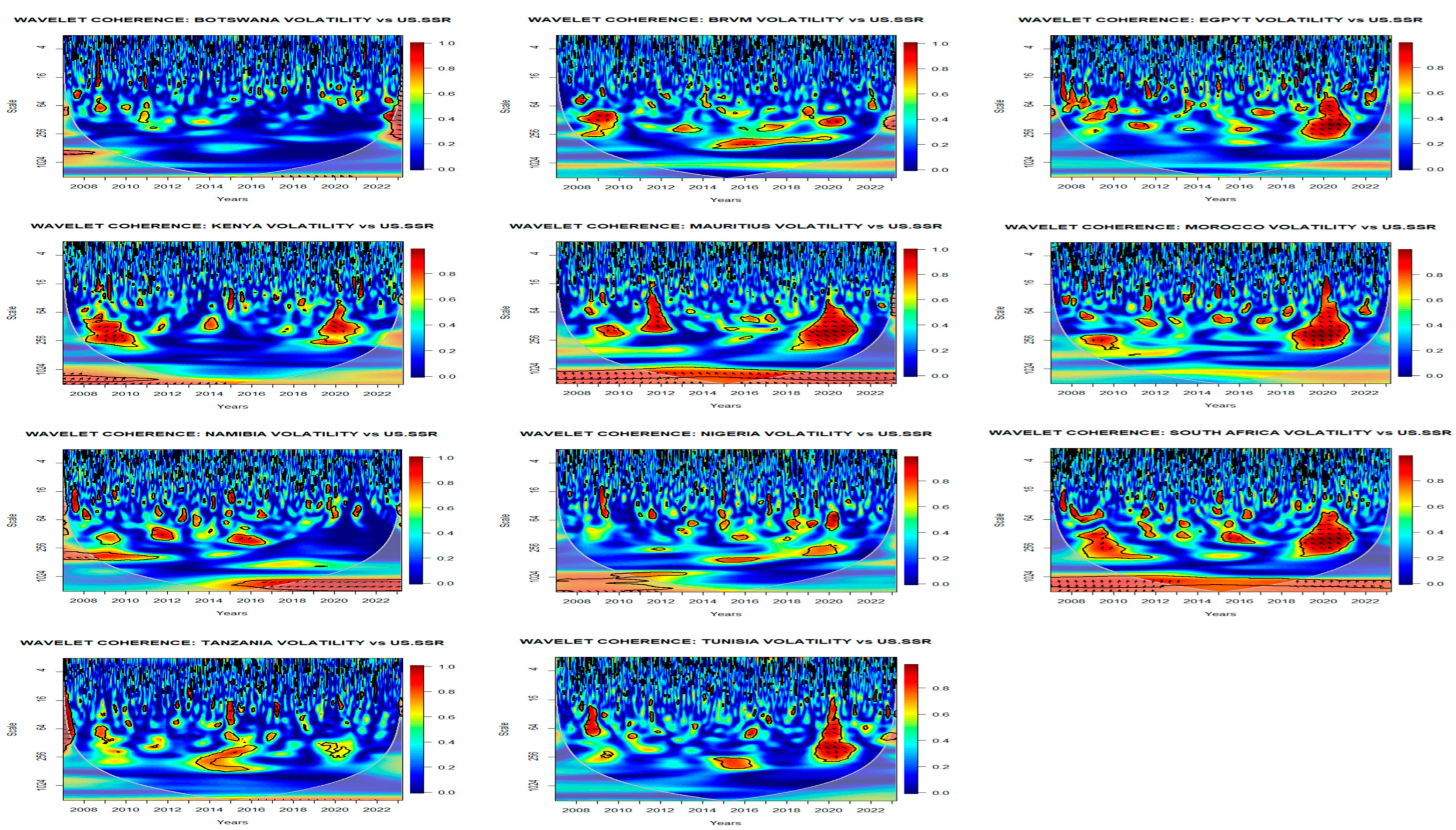

4.3. Wavelet Coherence Analysis

, →, (

, →, ( ) or anti-phase/negative co-movements with SSR leading (lagging) stock returns/volatility as shown by ↓,

) or anti-phase/negative co-movements with SSR leading (lagging) stock returns/volatility as shown by ↓,  , ← (

, ← ( ). The 5% significance levels are denoted by the solid black lines surrounding the contours.

). The 5% significance levels are denoted by the solid black lines surrounding the contours.5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Review of Previous Literature

| Author | Measure of UMP | Country | Period | Method | Result |

| Lim et al. (2014) | 3M TB (liquidity channel), yield curve (portfolio rebalancing), VIX (Confidence channel) | 60 emerging and developing countries (incl. Egypt, Lesotho, Mauritius, Morocco, Mozambique, Namibia, Nigeria, South Africa, Uganda) | 2000:q1–2013:q2 | OLS regressions | TB and Yield curve decrease equity flows whilst VIX is insignificant |

| Bowman et al. (2015) | Policy announcements, maturity extension program (MEP), and FOMC speeches | 17 EMEs (incl. South Africa) | 2006:M01–2013:M12 | VAR and event study | US UMP slightly increases the equity prices of EMEs |

| Aizenman et al. (2016) | QE and tapering governor, press and FOMC announcements | 10 robust and 15 fragile emerging economies (incl. South Africa) | 27/11/2012–03/10/2013 | Event study | Full sample: negative effect of Ben QT and Press QE announcements; fragile countries: positive effect of Ben QE and negative effect of Press QE announcements |

| Estrada et al. (2016) | Taper tantrum dummy | 22 developing countries (Egypt, Kenya, South Africa) | 2013:M05–2013:M06 | Regression analysis/event study | Taper tantrum had negative effect on all African equities |

| Anaya et al. (2017) | Fed Balance Sheet | 19 EMEs (incl. South Africa) | 2008:M01–2014:M12 | GVAR and event study | US UMP increased real equity returns in EME for first 5 months |

| Gupta et al. (2017) | Treasury yield and tapering dummy | 20 EMEs (incl. South Africa) | 01/10/2008–01/09/2016 | Event Study and OLS | US UMP decreases equity prices in EME |

| Fratzscher et al. (2018) | Bernanke speeches and FOMC statements: dummy variables capturing QE, TR (purchases of TB) and LIQ (Fed liquidity operations) | 52 industrialized and emerging economies (including South Africa) | 01/01/2008–31/12/2012 | OLS regressions | QE1 (announcements and operations) increased equity flows to advanced economies whilst QE2 and QE3 triggered a rebalancing outside the US; announcements stronger than actual purchases |

| Apostolou and Beirne (2019) | Fed balance sheet | 13 EMEs (incl. South Africa) | 2003:M01–2018:M12 | GARCH-in-mean | UMP has negative impact on equity markets |

| Kabundi et al. (2020) | FRED Policy Interest Rate (PIR) and Asset Purchase | South Africa | 1990:M01–2018:M02 | BVAR and event study | US CMP and UMP have positive impact on SA equities after 20 months |

| Kalu et al. (2020) | US 10-year bond and Treasury Bill | Six African countries (Egypt, Kenya, Ghana, Morocco, Nigeria, South Africa) | 01/05/2013–31/12/2018 | FE, RE and PMG | US UMP has a negative effect on African equities |

| Meszaros and Olson (2020) | Monetary base and Divisia M4 | SA | 1960:Q1–2008:Q3 (Non-QE period) and 2008:Q4–2018:Q3 (QE period) | VAR | US UMP increase SA stock prices for Non-QE periods but decreased for Divisia QE policies |

| Ono (2020) | SSR | 23 industrialized and emerging economies (incl. South Africa) | 09/01/2004–29/12/2017 | GVAR | US CMP and UMP tightening, and easing has negative impact on SA equity markets for first 4 months; stronger effect during UMP |

| Bhattarai et al. (2021) | US Treasuries, debt and mortgage-backed securities | 13 EMEs (incl. South Africa) | 2008:M01–2014:M11 | Bayesian PVAR | US UMP increases stock prices |

| Lubys and Panda (2021) | FOMC Policy announcements, | BRICS | 01/01/2008–01/01/2017 | Event Study, AR, CAR and CAPM | US UMP announcements have a positive (negative) impact on the SA consumer and financial (materials) sectors |

| Wei and Han (2021) | Policy rate and dummy for FOMC policy announcements | 37 industrialized and emerging economies (incl. South Africa) | 01/01/2011–30/01/2020 | Event study | positive effect policy rate for full sample negative (insign.) effect of UMP announcement (policy rate) during COVID-19 period |

| Yildirim and Ivrendi (2021) | US mortgage spread and US term spread | 20 EMEs and 20 AEs | 01/06/2007–01/02/2013 | SVAR | US UMP causes negative shocks on stock prices in both AEs and EMEs |

| Abdullah and Hassanien (2022) | US SSR | Egypt | 2001:Q1–2019:Q4 | SVAR | US UMP has a significant positive impact on equity prices up to 17 quarters then turns negative |

| Ntshangase et al. (2023) | Dummy variable as a proxy for United States’ QE | 12 EMEs (South Africa, Algeria, Morocco and Tunisia) | 2000:Q1–2020:Q4 | Panel VAR | US UMP has no significant impact on stock prices |

| Cui et al. (2024) | SSR | 33 emerging and advanced countries (incl. South Africa) | 2002:Q2–2021:Q4 | TGVAR | EMEs are more vulnerable to spillover effects than AEs, and EMs are much more exposed to monetary policy shocks than AEs |

Appendix B. Total, Short-Run and Long-Run Static Connectedness Results (Returns)

| Panel A: Total static connectedness | Botswana | BRVM | Egypt | Kenya | Mauritius | Morocco | Namibia | Nigeria | RSA | Tanzania | Tunisia | SSR | From |

| Botswana | 88.9 | 0.75 | 0.98 | 1.25 | 1.06 | 1.01 | 1.53 | 1.43 | 1.12 | 0.95 | 1.02 | 0.70 | 11.81 |

| BRVM | 0.96 | 85.56 | 1.41 | 1.66 | 1.17 | 1.66 | 1.06 | 1.62 | 1.14 | 1.22 | 1.97 | 0.57 | 14.44 |

| Egypt | 1.17 | 1.13 | 82.71 | 1.46 | 1.35 | 1.39 | 2.67 | 1.47 | 2.82 | 1.03 | 1.89 | 0.92 | 17.29 |

| Kenya | 1.15 | 1.04 | 1.34 | 81.22 | 2.18 | 1.57 | 1.76 | 2.55 | 2.01 | 2.43 | 1.82 | 0.93 | 18.78 |

| Mauritius | 1.30 | 1.09 | 1.49 | 1.51 | 81.24 | 2.12 | 2.93 | 1.61 | 2.44 | 0.90 | 2.25 | 1.10 | 18.76 |

| Morocco | 1.26 | 1.30 | 1.23 | 1.39 | 2.05 | 83.91 | 1.85 | 1.28 | 1.74 | 1.03 | 1.86 | 1.10 | 16.09 |

| Namibia | 0.88 | 0.66 | 1.16 | 0.93 | 1.60 | 1.36 | 56.19 | 1.03 | 33.03 | 0.80 | 1.40 | 0.97 | 43.81 |

| Nigeria | 1.48 | 1.20 | 1.30 | 2.29 | 2.02 | 1.56 | 1.88 | 82.90 | 2.14 | 1.19 | 1.28 | 0.76 | 17.10 |

| RSA | 0.68 | 0.75 | 1.18 | 1.07 | 1.15 | 1.38 | 30.45 | 0.96 | 59.70 | 0.82 | 0.93 | 0.90 | 40.30 |

| Tanzania | 0.76 | 1.09 | 0.88 | 2.48 | 1.43 | 1.29 | 0.99 | 1.22 | 1.04 | 87.40 | 0.91 | 0.51 | 12.60 |

| Tunisia | 0.90 | 1.33 | 1.42 | 1.28 | 2.40 | 2.00 | 2.54 | 1.23 | 1.55 | 0.73 | 83.72 | 0.91 | 16.28 |

| SSR | 1.33 | 0.85 | 1.69 | 1.57 | 2.46 | 1.84 | 1.89 | 1.92 | 1.25 | 1.02 | 1.30 | 82.89 | 17.11 |

| To | 11.89 | 11.19 | 14.09 | 16.88 | 18.87 | 17.18 | 49.55 | 16.32 | 50.28 | 12.12 | 16.64 | 9.34 | 244.36 |

| Inc. Own | 100.08 | 96.75 | 96.81 | 98.11 | 100.12 | 101.09 | 105.74 | 99.22 | 109.98 | 99.52 | 100.36 | 92.24 | TCI = 20.36 |

| Net | 0.08 | −3.25 | −3.19 | −1.89 | 0.12 | 1.09 | 5.74 | −0.78 | 9.98 | −0.48 | 0.36 | −7.76 | |

| Panel B: Short-run static connectedness (frequency band = 1–5 days) | |||||||||||||

| Botswana | 48.54 | 0.34 | 0.44 | 0.47 | 0.49 | 0.47 | 0.75 | 0.62 | 0.52 | 0.42 | 0.47 | 0.18 | 5.17 |

| BRVM | 0.46 | 55.10 | 0.68 | 0.64 | 0.58 | 0.88 | 0.58 | 0.70 | 0.61 | 0.61 | 0.93 | 0.28 | 6.95 |

| Egypt | 0.54 | 0.55 | 46.18 | 0.59 | 0.62 | 0.76 | 1.53 | 0.61 | 1.66 | 0.48 | 0.77 | 0.44 | 8.54 |

| Kenya | 0.39 | 0.48 | 0.43 | 38.62 | 0.63 | 0.57 | 0.61 | 0.72 | 0.64 | 0.66 | 0.61 | 0.33 | 6.05 |

| Mauritius | 0.53 | 0.51 | 0.60 | 0.60 | 43.59 | 0.83 | 1.07 | 0.67 | 0.83 | 0.41 | 1.05 | 0.45 | 7.55 |

| Morocco | 0.51 | 0.66 | 0.62 | 0.61 | 0.90 | 46.98 | 0.86 | 0.57 | 0.81 | 0.47 | 0.93 | 0.51 | 7.45 |

| Namibia | 0.60 | 0.42 | 0.65 | 0.52 | 0.93 | 0.85 | 37.96 | 0.59 | 20.51 | 0.43 | 0.89 | 0.59 | 26.98 |

| Nigeria | 0.65 | 0.52 | 0.52 | 0.79 | 0.81 | 0.60 | 0.81 | 40.45 | 0.67 | 0.45 | 0.62 | 0.30 | 6.75 |

| RSA | 0.43 | 0.43 | 0.57 | 0.60 | 0.58 | 0.80 | 20.61 | 0.51 | 39.57 | 0.43 | 0.52 | 0.52 | 26.01 |

| Tanzania | 0.44 | 0.52 | 0.46 | 0.91 | 0.54 | 0.59 | 0.55 | 0.51 | 0.62 | 50.99 | 0.39 | 0.25 | 5.78 |

| Tunisia | 0.44 | 0.69 | 0.64 | 0.56 | 1.03 | 0.89 | 1.03 | 0.54 | 0.71 | 0.41 | 46.42 | 0.34 | 7.27 |

| SSR | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.08 | 0.08 |

| To | 4.99 | 5.13 | 5.61 | 6.30 | 7.11 | 7.25 | 28.41 | 6.05 | 27.58 | 4.77 | 7.18 | 4.20 | 114.58 |

| Inc. Own | 53.53 | 60.23 | 51.80 | 44.92 | 50.71 | 54.22 | 66.37 | 46.50 | 67.14 | 55.77 | 53.60 | 4.27 | TCI = 18.81 |

| Net | −0.18 | −1.82 | −2.93 | 0.25 | −0.44 | −0.21 | 1.43 | −0.70 | 1.57 | −1.01 | −0.09 | 4.12 | |

| Panel C: Long-run static connectedness (frequency band = 6 days–end of the period) | |||||||||||||

| Botswana | 39.65 | 0.41 | 0.55 | 0.78 | 0.57 | 0.54 | 0.78 | 0.81 | 0.60 | 0.53 | 0.56 | 0.52 | 6.64 |

| BRVM | 0.50 | 30.46 | 0.73 | 1.02 | 0.60 | 0.78 | 0.47 | 0.92 | 0.53 | 0.61 | 1.04 | 0.29 | 7.49 |

| Egypt | 0.63 | 0.58 | 36.53 | 0.87 | 0.73 | 0.63 | 1.14 | 0.86 | 1.16 | 0.56 | 1.12 | 0.47 | 8.74 |

| Kenya | 0.76 | 0.56 | 0.91 | 42.60 | 1.55 | 1.00 | 1.16 | 1.83 | 1.37 | 1.77 | 1.21 | 0.60 | 12.72 |

| Mauritius | 0.78 | 0.59 | 0.90 | 0.91 | 37.65 | 1.29 | 1.86 | 0.94 | 1.61 | 0.49 | 1.20 | 0.65 | 11.21 |

| Morocco | 0.76 | 0.64 | 0.61 | 0.77 | 1.15 | 36.94 | 0.99 | 0.71 | 0.93 | 0.56 | 0.93 | 0.58 | 8.63 |

| Namibia | 0.28 | 0.24 | 0.51 | 0.41 | 0.68 | 0.51 | 18.23 | 0.44 | 12.52 | 0.38 | 0.51 | 0.38 | 16.84 |

| Nigeria | 0.83 | 0.67 | 0.78 | 1.49 | 1.22 | 0.96 | 1.08 | 42.44 | 1.48 | 0.74 | 0.66 | 0.46 | 10.36 |

| RSA | 0.27 | 0.32 | 0.61 | 0.47 | 0.57 | 0.59 | 9.84 | 0.46 | 20.13 | 0.38 | 0.41 | 0.37 | 14.30 |

| Tanzania | 0.32 | 0.57 | 0.42 | 1.57 | 0.89 | 0.70 | 0.44 | 0.70 | 0.42 | 36.41 | 0.52 | 0.26 | 6.82 |

| Tunisia | 0.46 | 0.64 | 0.78 | 0.72 | 1.37 | 1.11 | 1.50 | 0.69 | 0.84 | 0.32 | 37.30 | 0.57 | 9.01 |

| SSR | 1.33 | 0.84 | 1.68 | 1.56 | 2.45 | 1.83 | 1.88 | 1.91 | 1.24 | 1.01 | 1.29 | 82.82 | 17.03 |

| To | 6.90 | 6.05 | 8.48 | 10.58 | 11.76 | 9.93 | 21.14 | 10.27 | 22.70 | 7.35 | 9.46 | 5.15 | 129.78 |

| Inc. Own | 46.56 | 36.52 | 45.01 | 53.19 | 49.41 | 46.87 | 39.37 | 52.71 | 42.84 | 43.75 | 46.76 | 87.96 | TCI = 25.45 |

| Net | 0.26 | −1.43 | −0.27 | −2.14 | 0.56 | 1.30 | 4.31 | −0.09 | 8.41 | 0.53 | 0.45 | −11.88 | |

Appendix C. Total, Short-Run and Long-Run Static Connectedness Results (Volatility)

| Panel A: Total static connectedness | Botswana | BRVM | Egypt | Kenya | Mauritius | Morocco | Namibia | Nigeria | RSA | Tanzania | Tunisia | SSR | From |

| Botswana | 72.70 | 1.01 | 3.84 | 0.97 | 2.32 | 1.74 | 6.50 | 1.90 | 2.14 | 1.40 | 2.82 | 2.66 | 27.30 |

| BRVM | 1.53 | 78.95 | 2.21 | 1.47 | 1.73 | 1.81 | 3.91 | 1.45 | 1.34 | 1.79 | 1.87 | 1.95 | 21.05 |

| Egypt | 2.16 | 1.12 | 53.54 | 2.56 | 4.60 | 4.55 | 8.20 | 3.51 | 6.86 | 4.41 | 3.25 | 5.25 | 46.46 |

| Kenya | 1.49 | 1.72 | 3.89 | 63.59 | 4.28 | 2.33 | 5.67 | 3.17 | 2.18 | 5.83 | 2.88 | 2.98 | 36.41 |

| Mauritius | 2.05 | 1.56 | 5.62 | 3.00 | 46.00 | 3.91 | 11.92 | 2.73 | 6.19 | 4.14 | 2.86 | 10.02 | 54.00 |

| Morocco | 1.69 | 1.45 | 4.02 | 1.79 | 5.41 | 66.89 | 4.51 | 2.91 | 3.14 | 2.63 | 3.20 | 2.36 | 33.11 |

| Namibia | 1.58 | 1.51 | 6.70 | 3.34 | 8.76 | 3.24 | 36.28 | 3.18 | 10.97 | 8.30 | 2.24 | 13.90 | 63.72 |

| Nigeria | 2.05 | 0.94 | 4.48 | 2.62 | 3.65 | 2.57 | 4.95 | 68.95 | 2.26 | 2.85 | 1.99 | 2.70 | 31.05 |

| RSA | 1.72 | 1.25 | 5.27 | 3.11 | 4.83 | 3.28 | 19.33 | 2.76 | 48.09 | 3.39 | 2.91 | 4.07 | 51.91 |

| Tanzania | 1.53 | 0.95 | 3.79 | 1.80 | 2.47 | 1.96 | 4.61 | 2.20 | 2.39 | 71.61 | 2.15 | 4.54 | 28.39 |

| Tunisia | 1.69 | 0.58 | 3.26 | 1.57 | 3.02 | 2.70 | 4.59 | 2.35 | 2.75 | 2.18 | 71.94 | 3.37 | 28.06 |

| SSR | 2.93 | 1.58 | 8.73 | 4.64 | 9.07 | 3.55 | 17.23 | 4.22 | 8.59 | 11.49 | 13.80 | 24.18 | 75.82 |

| To | 20.42 | 13.66 | 51.80 | 26.85 | 50.17 | 31.62 | 91.41 | 30.37 | 48.83 | 48.39 | 29.96 | 53.81 | 497.29 |

| Inc. Own | 93.12 | 92.61 | 105.34 | 90.43 | 96.16 | 98.52 | 127.69 | 99.37 | 96.92 | 120.01 | 101.90 | 77.99 | TCI = 41.44 |

| Net | −6.88 | −7.39 | 5.34 | −9.57 | −3.84 | −1.48 | 27.69 | −0.68 | −3.08 | 20.01 | 1.90 | −22.01 | |

| Panel B: Short-run static connectedness (frequency band = 1–5 days) | |||||||||||||

| Botswana | 18.81 | 0.11 | 0.23 | 0.05 | 0.14 | 0.11 | 0.20 | 0.21 | 0.13 | 0.15 | 0.22 | 0.23 | 1.75 |

| BRVM | 0.23 | 34.53 | 0.32 | 0.30 | 0.28 | 0.30 | 0.20 | 0.20 | 0.26 | 0.22 | 0.26 | 0.32 | 2.89 |

| Egypt | 0.13 | 0.04 | 5.50 | 0.07 | 0.16 | 0.14 | 0.11 | 0.11 | 0.16 | 0.15 | 0.21 | 0.25 | 1.54 |

| Kenya | 0.03 | 0.12 | 0.13 | 10.62 | 0.19 | 0.07 | 0.15 | 0.14 | 0.10 | 0.06 | 0.13 | 0.15 | 1.26 |

| Mauritius | 0.06 | 0.04 | 0.12 | 0.09 | 5.20 | 0.17 | 0.08 | 0.08 | 0.07 | 0.06 | 0.12 | 0.17 | 1.07 |

| Morocco | 0.12 | 0.15 | 0.36 | 0.11 | 0.32 | 13.92 | 0.09 | 0.21 | 0.23 | 0.16 | 0.31 | 0.23 | 2.28 |

| Namibia | 0.01 | 0.01 | 0.08 | 0.04 | 0.05 | 0.03 | 2.68 | 0.03 | 0.46 | 0.09 | 0.05 | 0.24 | 1.10 |

| Nigeria | 0.10 | 0.08 | 0.15 | 0.14 | 0.14 | 0.09 | 0.14 | 12.41 | 0.10 | 0.14 | 0.10 | 0.15 | 1.32 |

| RSA | 0.03 | 0.05 | 0.12 | 0.07 | 0.05 | 0.07 | 0.18 | 0.05 | 4.75 | 0.03 | 0.09 | 0.06 | 1.79 |

| Tanzania | 0.12 | 0.05 | 0.25 | 0.04 | 0.15 | 0.11 | 0.13 | 0.18 | 0.05 | 9.57 | 0.20 | 0.32 | 1.59 |

| Tunisia | 0.35 | 0.11 | 0.60 | 0.22 | 0.49 | 0.37 | 0.34 | 0.28 | 0.33 | 10.37 | 24.22 | 0.94 | 4.40 |

| SSR | 0.04 | 0.02 | 0.09 | 0.04 | 0.06 | 0.04 | 0.18 | 0.04 | 0.05 | 10.12 | 0.07 | 0.88 | 0.75 |

| To | 1.22 | 0.77 | 2.45 | 1.16 | 0.02 | 1.51 | 2.80 | 1.54 | 1.95 | 1.54 | 1.76 | 3.06 | 21.77 |

| Inc. Own | 20.03 | 35.30 | 7.95 | 11.78 | 7.22 | 15.43 | 5.49 | 13.95 | 6.70 | 11.11 | 25.98 | 3.94 | TCI = 13.20 |

| Net | −0.55 | −2.12 | 0.91 | −0.10 | 0.95 | −0.77 | 1.70 | 0.21 | 0.16 | −0.05 | −2.65 | 2.31 | |

| Panel C: Long-run static connectedness (frequency band = 6 days–end of the period) | |||||||||||||

| Botswana | 53.89 | 0.90 | 3.61 | 0.93 | 2.19 | 1.62 | 6.30 | 1.69 | 2.01 | 1.25 | 2.60 | 2.44 | 25.54 |

| BRVM | 1.29 | 44.42 | 1.89 | 1.17 | 1.45 | 1.51 | 3.70 | 1.24 | 1.08 | 1.56 | 1.61 | 1.63 | 18.15 |

| Egypt | 2.03 | 1.08 | 48.03 | 2.49 | 4.45 | 4.41 | 8.08 | 3.40 | 6.70 | 4.26 | 3.03 | 5.00 | 44.93 |

| Kenya | 1.46 | 1.60 | 3.75 | 52.96 | 4.09 | 2.26 | 5.52 | 3.03 | 2.09 | 5.77 | 2.75 | 2.84 | 35.15 |

| Mauritius | 1.99 | 1.52 | 5.50 | 2.91 | 40.80 | 3.74 | 11.84 | 2.65 | 6.12 | 4.08 | 2.75 | 9.85 | 52.94 |

| Morocco | 1.58 | 1.30 | 3.66 | 1.67 | 5.09 | 52.97 | 4.42 | 2.70 | 2.91 | 2.47 | 2.89 | 2.13 | 30.83 |

| Namibia | 1.57 | 1.49 | 6.62 | 3.30 | 8.72 | 3.21 | 33.60 | 3.14 | 10.51 | 8.21 | 2.19 | 13.66 | 62.62 |

| Nigeria | 1.95 | 0.86 | 4.33 | 2.47 | 3.51 | 2.47 | 4.81 | 56.54 | 2.16 | 2.71 | 1.89 | 2.55 | 29.72 |

| RSA | 1.69 | 1.20 | 5.15 | 3.04 | 4.78 | 3.21 | 18.15 | 2.71 | 43.34 | 3.36 | 2.82 | 4.00 | 50.12 |

| Tanzania | 1.41 | 0.90 | 3.54 | 1.75 | 2.33 | 1.85 | 4.47 | 2.02 | 2.34 | 62.04 | 1.95 | 4.23 | 26.80 |

| Tunisia | 1.34 | 0.47 | 2.66 | 1.35 | 2.53 | 2.33 | 4.25 | 2.07 | 2.42 | 1.81 | 47.72 | 2.43 | 23.66 |

| SSR | 2.89 | 1.56 | 8.63 | 4.60 | 9.01 | 3.51 | 17.05 | 4.17 | 8.55 | 11.38 | 3.72 | 23.30 | 75.07 |

| To | 19.20 | 12.89 | 49.35 | 25.69 | 48.15 | 30.12 | 88.60 | 28.83 | 46.88 | 46.85 | 28.21 | 50.76 | 475.52 |

| Inc. Own | 73.09 | 57.31 | 97.38 | 78.65 | 88.95 | 83.09 | 122.20 | 85.37 | 90.22 | 108.89 | 75.92 | 74.05 | TCI = 45.94 |

| Net | −6.33 | −5.27 | 4.43 | −9.47 | −4.79 | −0.71 | 25.99 | −0.89 | −3.24 | 20.06 | 4.55 | −24.32 | |

References

- Abdullah, Ahmed Ashour, and Ahmed Mohamed Hassanien. 2022. Spillovers of US unconventional monetary policy to emerging markets: Evidence from Egypt. International Journal of Economics and Finance 14: 1. [Google Scholar] [CrossRef]

- Aguiar-Conraria, Luís, and Maria Joana Soares. 2014. The continuous wavelet transform: Moving beyond uni-and bivariate analysis. Journal of Economic Surveys 28: 344–75. [Google Scholar] [CrossRef]

- Agyei, Samuel Kwaku, Zaghum Umar, Ahmed Bossman, and Tamara Teplova. 2023. Dynamic connectedness between global commodity sectors, news sentiment, and sub-Saharan African equities. Emerging Markets Review 56: 101049. [Google Scholar] [CrossRef]

- Aizenman, Joshua, Menzie D. Chinn, and Hiro Ito. 2016. Monetary policy spillovers and the trilemma in the new normal: Periphery country sensitivity to core country conditions. Journal of International Money and Finance 68: 298–330. [Google Scholar] [CrossRef]

- Anaya, Pablo, Michael Hachula, and Christian J. Offermanns. 2017. Spillovers of US unconventional monetary policy to emerging markets: The role of capital flows. Journal of International Money and Finance 73: 275–95. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, Ioannis Chatziantoniou, and David Gabauer. 2020. Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. Journal of Risk and Financial Management 13: 84. [Google Scholar] [CrossRef]

- Anyikwa, Izunna, and Andrew Phiri. 2023. Connectedness and spillover between African equity, commodity, foreign exchange and cryptocurrency markets during the COVID-19 and Russia-Ukraine conflict. Future Business Journal 9: 48. [Google Scholar] [CrossRef]

- Anyikwa, Izunna, and Pierre Le Roux. 2020. Integration of African stock markets with the developed stock markets: An analysis of co-movements, volatility and contagion. International Economic Journal 34: 279–96. [Google Scholar] [CrossRef]

- Apostolou, Apostolos, and John Beirne. 2019. Volatility spillovers of unconventional monetary policy to emerging market economies. Economic Modelling 79: 118–29. [Google Scholar] [CrossRef]

- Baruník, Jozef, and Tomáš Křehlík. 2018. Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics 16: 271–96. [Google Scholar] [CrossRef]

- Ben Yaala, Sirine, and Jamel Eddine Henchiri. 2023. Predicting stock market crashes on the African stock markets: Evidence from log-periodic power law model. African Journal of Economic and Management Studies. [Google Scholar] [CrossRef]

- Bernanke, Ben S. 2020. The new tools of monetary policy. American Economic Review 110: 943–83. [Google Scholar] [CrossRef]

- Bhattarai, Saroj, Arpita Chatterjee, and Woong Yong Park. 2021. Effects of US quantitative easing on emerging market economies. Journal of Economic Dynamics and Control 122: 104031. [Google Scholar] [CrossRef]

- Boako, Gideon, and Paul Alagidede. 2016. Global commodities and African stocks: A ‘market of one?’. International Review of Financial Analysis 44: 226–37. [Google Scholar] [CrossRef]

- Boako, Gideon, and Paul Alagidede. 2018. African stock markets in the midst of the global financial crisis: Recoupling or decoupling? Research in International Business and Finance 46: 166–80. [Google Scholar] [CrossRef]

- Bollerslev, Tim, Robert F. Engle, and Jeffrey M. Wooldridge. 1988. A capital asset pricing model with time-varying covariances. Journal of political Economy 96: 116–31. [Google Scholar] [CrossRef]

- Bowman, David, Juan M. Londono, and Horacio Sapriza. 2015. US unconventional monetary policy and transmission to emerging market economies. Journal of International Money and Finance 55: 27–59. [Google Scholar] [CrossRef]

- Cagli, Efe Caglar. 2023. The volatility spillover between battery metals and future mobility stocks: Evidence from the time-varying frequency connectedness approach. Resources Policy 86: 104144. [Google Scholar] [CrossRef]

- Chatziantoniou, Ioannis, David Gabauer, and Rangan Gupta. 2023. Integration and risk transmission in the market for crude oil: New evidence from a time-varying parameter frequency connectedness approach. Resources Policy 84: 103729. [Google Scholar] [CrossRef]

- Chiah, Mardy, and Angel Zhong. 2020. Trading from home: The impact of COVID-19 on trading volume around the world. Finance Research Letters 37: 101784. [Google Scholar] [CrossRef]

- Chodorow-Reich, Gabriel. 2014. Effects of Unconventional Monetary Policy on Financial Institutions. No. w20230. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Choi, Sun-Yong, Andrew Phiri, Tamara Teplova, and Zaghum Umar. 2024. Connectedness between (un) conventional monetary policy and islamic and advanced equity markets: A returns and volatility spillover analysis. International Review of Economics & Finance 91: 348–63. [Google Scholar]

- Cui, Baisheng, Jiaqi Li, and Yi Zhang. 2024. Asymmetries in the international spillover effects of monetary policy: Based on TGVAR model. The North American Journal of Economics and Finance 69: 102029. [Google Scholar] [CrossRef]

- De Rezende, Rafael B., and Annukka Ristiniemi. 2023. A shadow rate without a lower bound constraint. Journal of Banking & Finance 146: 106686. [Google Scholar]

- Diebold, Francis X., and Kamil Yilmaz. 2009. Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal 119: 158–71. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Elsayed, Ahmed H., and Ricardo M. Sousa. 2022. International monetary policy and cryptocurrency markets: Dynamic and spillover effects. The European Journal of Finance, 1–21. [Google Scholar] [CrossRef]

- Estrada, Gemma B., Donghyun Park, and Arief Ramayandi. 2016. Taper tantrum and emerging equity market slumps. Emerging Markets Finance and Trade 52: 1060–71. [Google Scholar] [CrossRef]

- Fausch, Jürg, and Markus Sigonius. 2018. The impact of ECB monetary policy surprises on the German stock market. Journal of Macroeconomics 55: 46–63. [Google Scholar] [CrossRef]

- Fratzscher, Marcel, Marco Lo Duca, and Roland Straub. 2018. On the international spillovers of US quantitative easing. The Economic Journal 128: 330–77. [Google Scholar] [CrossRef]

- Gagnon, Joseph, Matthew Raskin, Julie Remache, and Brian Sack. 2011. The financial market effects of the Federal Reserve’s large-scale asset purchases. International Journal of Central Banking 7: 45–52. [Google Scholar]

- Giovannetti, Giorgia, and Margherita Velucchi. 2013. A spillover analysis of shocks from US, UK and China on African financial markets. Review of Development Finance 3: 169–79. [Google Scholar] [CrossRef]

- Gupta, Poonam, Oliver Masetti, and David Rosenblatt. 2017. Should Emerging Markets Worry About US Monetary Policy Announcements? Washington, DC: World Bank Policy Research Working Paper, p. 8100. [Google Scholar]

- Huang, Jionghao, Baifan Chen, Yushi Xu, and Xiaohua Xia. 2023. Time-frequency volatility transmission among energy commodities and financial markets during the COVID-19 pandemic: A Novel TVP-VAR frequency connectedness approach. Finance Research Letters 53: 103634. [Google Scholar] [CrossRef] [PubMed]

- Huertas, Gonzalo. 2022. Why Follow the Fed? Monetary Policy in Times of US Tightening. No. 2022–2243. Washington, DC: International Monetary Fund. [Google Scholar]

- Kabundi, Alain, Tumisang Loate, and Nicola Viegi. 2020. Spillovers of the conventional and unconventional monetary policy from the US to South Africa. South African Journal of Economics 88: 435–71. [Google Scholar] [CrossRef]

- Kalu, Ebere, Chinwe Okoyeuzu, Angela Ukemenam, and Augustine Ujunwa. 2020. Spillover effects of the US monetary policy normalization on African stock markets. Journal of Economics and Development 22: 3–19. [Google Scholar] [CrossRef]

- Krippner, Leo. 2020. A note of caution on shadow rate estimates. Journal of Money, Credit and Banking 52: 951–62. [Google Scholar] [CrossRef]

- Lavigne, Robert, Subrata Sarker, and Garima Vasishtha. 2014. Spillover effects of quantitative easing on emerging-market economies. Bank of Canada Review 2014: 23–33. [Google Scholar]

- Lim, Jamus Jerome, Sanket Mohapatra, and Marc Stocker. 2014. Tinker, Taper, QE, Bye? The Effect of Quantitative Easing on Financial Flows to Developing Countries. Washington, DC: World Bank Policy Research Working Paper, p. 6820. [Google Scholar]

- Lubys, Justinas, and Pradiptarathi Panda. 2021. US and EU unconventional monetary policy spillover on BRICS financial markets: An event study. Empirica 48: 353–71. [Google Scholar] [CrossRef]

- Marfatia, Hardik A., Rangan Gupta, and Keagile Lesame. 2021. Dynamic impact of unconventional monetary policy on international REITs. Journal of Risk and Financial Management 14: 429. [Google Scholar] [CrossRef]

- Mensah, Jones Odei, and Paul Alagidede. 2017. How are Africa’s emerging stock markets related to advanced markets? Evidence from copulas. Economic Modelling 60: 1–10. [Google Scholar] [CrossRef]

- Meszaros, John, and Eric Olson. 2020. The effects of US quantitative easing on South Africa. Review of Financial Economics 38: 321–31. [Google Scholar] [CrossRef]

- Ntshangase, Lwazi Senzo, Sheunesu Zhou, and Irrshad Kaseeram. 2023. The Spillover effects of US unconventional monetary policy on inflation and non-inflation targeting emerging markets. Economies 11: 138. [Google Scholar] [CrossRef]

- Ono, Shigeki. 2020. Impacts of conventional and unconventional US monetary policies on global financial markets. International Economics and Economic Policy 17: 1–24. [Google Scholar] [CrossRef]

- Papadamou, Stephanos, Costas Siriopoulos, and Nikolaos A. Kyriazis. 2020. A survey of empirical findings on unconventional central bank policies. Journal of Economic Studies 47: 1533–77. [Google Scholar] [CrossRef]

- Plakandaras, Vasilios, Rangan Gupta, Mehmet Balcilar, and Qiang Ji. 2022. Evolving United States stock market volatility: The role of conventional and unconventional monetary policies. The North American Journal of Economics and Finance 60: 101666. [Google Scholar] [CrossRef]

- Polat, Onur, Hasan Murat Ertuğrul, Burçhan Sakarya, and Ali Akgül. 2024. TVP-VAR based time and frequency domain food & energy commodities connectedness an analysis for financial/geopolitical turmoil episodes. Applied Energy 357: 122487. [Google Scholar]

- Putniņš, Tālis J. 2022. Free Markets to Fed Markets: How Modern Monetary Policy Impacts Equity Markets. Financial Analysts Journal 78: 35–56. [Google Scholar] [CrossRef]

- Rigobon, Roberto. 2019. Contagion, spillover, and interdependence. Economía 19: 69–100. [Google Scholar] [CrossRef]

- Shen, Tao, Xi Xi Mai, Yuan Chang, and Cheng Tao Deng. 2024. The dynamic connectedness between renewable energy market and environmental protection industry based on time and frequency perspective. Energy Strategy Reviews 53: 101371. [Google Scholar] [CrossRef]

- Siyou, Romuald Noel Kenmoe, and Marius Ayou Bene. 2023. African Stock Market Dynamics and Comovement. African Development Finance Journal 5: 150–74. [Google Scholar]

- Sugimoto, Kimiko, Takashi Matsuki, and Yushi Yoshida. 2014. The global financial crisis: An analysis of the spillover effects on African stock markets. Emerging Markets Review 21: 201–33. [Google Scholar] [CrossRef]

- Takyi, Paul Owusu, and Isaac Bentum-Ennin. 2021. The impact of COVID-19 on stock market performance in Africa: A Bayesian structural time series approach. Journal of Economics and Business 115: e105968. [Google Scholar] [CrossRef] [PubMed]

- Tillmann, Peter, Geun-Young Kim, and Hail Park. 2019. The spillover effects of US monetary policy on emerging market economies. International Journal of Finance & Economics 24: 1313–32. [Google Scholar]

- Tiwari, Aviral Kumar, Emmanuel Joel Aikins Abakah, Mohammad Abdullah, David Adeabah, and Vinita S. Sahay. 2024. Time-varying relationship between international monetary policy and energy markets. Energy Economics 131: 107339. [Google Scholar] [CrossRef]

- Torrence, Christopher, and Gilbert P. Compo. 1998. A practical guide to wavelet analysis. Bulletin of the American Meteorological Society 79: 61–78. [Google Scholar] [CrossRef]

- Umar, Zaghum, Ayesha Sayed, Mariya Gubareva, and Xuan Vinh Vo. 2023. Influence of unconventional monetary policy on agricultural commodities futures: Network connectedness and dynamic spillovers of returns and volatility. Applied Economics 55: 2521–35. [Google Scholar] [CrossRef]

- Urom, Christian, Gideon Ndubuisi, Gaye Del Lo, and Denis Yuni. 2023. Global commodity and equity markets spillovers to Africa during the COVID-19 pandemic. Emerging Markets Review 55: 100948. [Google Scholar] [CrossRef]

- Wei, Xiaoyun, and Liyan Han. 2021. The impact of COVID-19 pandemic on transmission of monetary policy to financial markets. International Review of Financial Analysis 74: 101705. [Google Scholar] [CrossRef]

- Wu, Jing Cynthia, and Fan Dora Xia. 2016. Measuring the macroeconomic impact of monetary policy at the zero lower bound. Journal of Money, Credit and Banking 48: 253–91. [Google Scholar] [CrossRef]

- Yildirim, Zekeriya, and Mehmet Ivrendi. 2021. Spillovers of US unconventional monetary policy: Quantitative easing, spreads, and international financial markets. Financial Innovation 7: 86. [Google Scholar] [CrossRef]

- Zheng, Wenyuan, Bingqing Li, Zhiyong Huang, and Lu Chen. 2022. Why was there more household stock market participation during the COVID-19 pandemic? Finance Research Letters 46: 102481. [Google Scholar] [CrossRef]

| Panel A: Returns | Botswana | BRVM | Egypt | Kenya | Mauritius | Morocco | Namibia | Nigeria | RSA | Tanzania | Tunisia | SSR |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 0.007 | 0.033 | −0.033 | 0.008 | 0.023 | 0.007 | −0.015 | 0.060 | 0.017 | 0.032 | 0.051 | −1.323 |

| Std. Dev. | 0.412 | 0.806 | 1.832 | 0.839 | 0.702 | 0.763 | 3.184 | 1.081 | 1.221 | 1.178 | 0.526 | 2.763 |

| Skewness | 0.972 | 0.151 | −2.367 | 0.341 | −0.701 | −0.630 | 0.875 | 0.062 | −0.184 | 0.573 | −0.753 | 1.227 |

| Kurtosis | 54.656 | 7.665 | 16.849 | 15.056 | 43.770 | 13.275 | 1641.750 | 12.727 | 8.279 | 57.817 | 14.672 | 3.444 |

| Jarque-Bera | 660,580 | 5403 | 52,955 | 36,047 | 411,386 | 26,493 | 664,000,000 | 23,391 | 6922 | 1538 | 743,153 | 34,239 |

| ADF | −33.807 *** | −40.165 *** | −10.237 *** | −32.055 *** | −46.519 *** | −36.313 *** | −102.321 *** | −32.443 *** | −41.315 *** | −36.395 *** | −36.501 *** | −11.268 *** |

| PP | −57.865 *** | −59.090 *** | −58.905 *** | −40.005 *** | −48.519 *** | −46.622 *** | 102.850 *** | −47.057 *** | −55.293 *** | −68.291 *** | −47.118 *** | −92.204 *** |

| KPSS | 0.30 | 0.18 | 0.19 | 0.23 | 0.29 | 0.15 | 0.15 | 0.14 | 0.08 | 0.13 | 0.32 | 0.26 |

| LB(10) | 235.010 *** | 95.541 *** | 302.034 *** | 89.911 *** | 44.767 *** | 60.280 *** | 12.137 | 61.305 *** | 84.100 *** | 76.046 *** | 58.992 *** | -- |

| LB2(10) | 1165.30 *** | 818.37 *** | 1312.20 *** | 1182.30 *** | 1832.20 *** | 2792.10 *** | 1099.20 *** | 701.66 *** | 5613.00 *** | 2566.60 *** | 2049.90 *** | -- |

| ARCH test(10) | 1037.68 *** | 586.78 *** | 616.598 *** | 1174.23 *** | 1137.69 *** | 1396.98 *** | 1189.50 *** | 623.978 *** | 1579.57 *** | 1712.51 *** | 1356.15 *** | -- |

| Panel B: Volatility | Botswana | BRVM | Egypt | Kenya | Mauritius | Morocco | Namibia | Nigeria | RSA | Tanzania | Tunisia | -- |

| Mean | 0.144 | 0.572 | 2.217 | 0.478 | 0.406 | 0.451 | 41.995 | 0.847 | 1.344 | 1.992 | 0.211 | -- |

| Std. Dev. | 0.525 | 0.606 | 3.711 | 1.004 | 1.447 | 0.791 | 705.151 | 1.716 | 1.908 | 8.991 | 0.433 | -- |

| Skewness | 13.278 | 8.260 | 6.306 | 18.689 | 8.580 | 13.174 | 27.239 | 18.146 | 7.199 | 12.333 | 12.992 | -- |

| Kurtosis | 229.593 | 118.999 | 49.479 | 514.406 | 93.139 | 257.734 | 836.802 | 451.222 | 78.076 | 201.097 | 246.654 | -- |

| Jarque-Bera | 12864953 | 3393239 | 573265 | 64988400 | 2081033 | 16210080 | 173000000 | 49982027 | 1444346 | 9849827 | 14840476 | -- |

| ADF | −25.191 *** | −36.150 *** | −8.030 *** | −19.993 *** | −8.427 *** | −13.276 *** | −17.263 *** | −19.096 *** | −9.879 *** | −20.665 *** | −25.385 *** | -- |

| PP | −19.850 *** | −36.283 *** | −7.750 *** | −15.077 *** | −11.323 *** | −18.319 *** | −12.745 *** | −17.667 *** | −8.617 *** | −11.930 *** | −23.208 *** | -- |

| KPSS | 0.09 | 0.28 | 0.33 | 0.36 * | 0.37 * | 0.31 | 0.12 | 0.37 * | 0.41 * | 0.26 | 0.28 * | |

| LB(10) | 148.09 *** | 107.060 *** | 39.694 *** | 95.144 *** | 91.010 *** | 101.750 *** | 11.403 | 85.576 *** | 31.356 *** | 46.558 *** | 74.586 *** | -- |

| LB2(10) | 3.274 | 9.467 | 21.344 ** | 21.790 ** | 64.846 *** | 31.940 *** | 0.007 | 27.120 *** | 47.139 *** | 0.416 | 5.361 | -- |

| ARCH test(10) | 3.237 | 9.221 | 21.339 ** | 21.307 ** | 61.859 *** | 31.787 *** | 0.007 | 27.292 *** | 44.491 *** | 0.412 | 5.354 | -- |

| Net Receivers | Net Transmitters | |

|---|---|---|

| Panel A: Returns spillovers | ||

| Total | BRVM, Egypt, Kenya, Nigeria, Tanzania, US_SSR | Botswana, Mauritius, Morocco, Namibia, RSA, Tunisia |

| SR | Botswana, BRVM, Egypt, Mauritius, Morocco, Nigeria, Tanzania, Tunisia | Kenya, Namibia, RSA, US_SSR |

| LR | BRVM, Egypt, Kenya, Nigeria, US_SSR | Botswana, Mauritius, Morocco, Namibia, RSA, Tanzania, Tunisia |

| Panel B: Volatility spillovers | ||

| Total | Botswana, BRVM, Kenya, Mauritius, Morocco, Nigeria, RSA, US_SSR | Egypt, Namibia, Tanzania, Tunisia |

| SR | Botswana, BRVM, Kenya, Morocco, Tanzania, Tunisia | Egypt, Mauritius, Namibia, Nigeria, RSA, US_SSR |

| LR | Botswana, BRVM, Kenya, Mauritius, Morocco, Nigeria, RSA, US_SSR | Egypt, Namibia, Tanzania, Tunisia |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Phiri, A.; Anyikwa, I. Dynamic Spillovers from US (Un)Conventional Monetary Policy to African Equity Markets: A Time-Varying Parameter Frequency Connectedness and Wavelet Coherence Analysis. J. Risk Financial Manag. 2024, 17, 474. https://doi.org/10.3390/jrfm17110474

Phiri A, Anyikwa I. Dynamic Spillovers from US (Un)Conventional Monetary Policy to African Equity Markets: A Time-Varying Parameter Frequency Connectedness and Wavelet Coherence Analysis. Journal of Risk and Financial Management. 2024; 17(11):474. https://doi.org/10.3390/jrfm17110474

Chicago/Turabian StylePhiri, Andrew, and Izunna Anyikwa. 2024. "Dynamic Spillovers from US (Un)Conventional Monetary Policy to African Equity Markets: A Time-Varying Parameter Frequency Connectedness and Wavelet Coherence Analysis" Journal of Risk and Financial Management 17, no. 11: 474. https://doi.org/10.3390/jrfm17110474

APA StylePhiri, A., & Anyikwa, I. (2024). Dynamic Spillovers from US (Un)Conventional Monetary Policy to African Equity Markets: A Time-Varying Parameter Frequency Connectedness and Wavelet Coherence Analysis. Journal of Risk and Financial Management, 17(11), 474. https://doi.org/10.3390/jrfm17110474