Abstract

This study analyzes and investigates how financial factors, namely, derivatives, debt shifting, and transfer pricing, influence tax avoidance, with financial distress as an interaction variable, within the framework of stakeholder theory and positive accounting theory. Adding more uniqueness, this study injected the Maqasid Syariah elements into the framework. Conventional banks and non-bank institutions listed on the Indonesia Stock Exchange (IDX) between 2017 and 2022 were selected, comprising 414 final company-year observations. The study utilized E-Views software for data processing. The findings indicate that debt shifting negatively impacts tax avoidance, while derivatives have no significant influence. Transfer pricing positively impacts tax avoidance. Financial distress does not moderate the relationship between these financial practices and tax avoidance. From an Islamic perspective, practices such as transfer pricing and debt shifting, when used to avoid tax, contradict the principles of Maqasid Syariah, which emphasize fairness, wealth distribution, and societal welfare.

1. Introduction

Tax receipts account for around 80 percent of state revenue, making taxes one of Indonesia’s most consistent sources of income. The realization of Indonesia’s tax collections in 2017–2022 is estimated to be around 80 percent of the target. This demonstrates that Indonesia’s tax revenue has not been maximized, even though it has a significant potential source of tax revenue due to its large population and commercial activities. According to the law of the Republic of Indonesia Number 17 of 2003 on Indonesian state finances, state revenues are all from tax revenue, non-tax state revenue, and grants from inside and outside the country. In the General Provisions and Tax Procedures section of Law Number 16 of 2009, it is stated that “taxes are coercive contributions to the state by individuals or entities, with no compensation in return, directly and employed for the purposes of the state for the greatest prosperity of the people”.

According to Yustinus Prastowo, Executive Director of the Center for Indonesia Taxes Analysis (CITA), there are at least five reasons why taxation did not meet the target in 2019. (1) The onset of deteriorating commodity prices are affected by global economic conditions. (2) Due to global economic conditions, import activity declines, resulting in a fall in value-added tax. (3) Increase in non-taxable income and the amount of government tax breaks, such as tax vacations and tax allowances. (4) Inadequate use of data and information about possible tax income sources, (5) Due to the political year, the state is forced to halt access data/further information operations and postpone tax collection by numerous departments.

The company’s tax burden is determined by the difference between profit and taxable income (book-tax difference). One method of avoiding taxes is to limit the book-tax difference (Darmawan and Angelina 2021). Positive book taxation: the differences reflect the taxpayer’s efforts to reduce the number of tax payments. This action reduces the amount of tax income collected by the state.

Even though they are lawful and do not violate legislation, tax avoidance activities influence the government’s revenue. As a result, tax avoidance activity might result in losses to the state if it leads to excessive tax avoidance; this can lower revenue for the state. According to (Kovermann and Velte 2019), there are three benefits that corporations can reap from avoiding paying taxes, and they are as follows: (1). The reduction in the amount of taxes that businesses are required to pay to the government; (2). The ability for managers to earn compensation from company owners or shareholders for their actions and to avoid paying taxes is one of the benefits that might accrue to managers either directly or indirectly; (3). The availability of benefits presents managers with options to act on rent collection. Action rent extraction is an action that managers take that does not maximize the benefit of the owners or shareholders but is rather for personal purposes, such as preparing financial statements that can be aggressive or conducting transactions with a specific party. These are examples of situations in which rent extraction may occur.

Moreover, according to Putri et al. (2024), the following types of financial losses can be incurred by businesses as a direct result of engaging in tax avoidance practices: The prospect of being subjected to fines by the relevant tax authorities if an audit is carried out and fraudulent activity relating to taxes is discovered. Then, the company’s reputation is hit because of audits conducted by the relevant tax authorities. In addition to that, other shareholders were aware that the activities of tax avoidance carried out by managers in the context of rent extraction contributed to the drop in share prices.

Banks and financial institutions are the most vulnerable sectors since they are difficult for law enforcement to detect. Tax avoidance is frequently accomplished by proactive tax planning that outwits existing tax restrictions. According to PWC (2019), UK Finance says that their banking sector contributed approximately £39.700 billion in tax revenue.

Several financial transactions and commercial activities occur in the banking industry and financial institutions. This also suggests that many transaction-based tax income sources exist. The potential for tax avoidance in the banking sector is likely to occur in the context of (i) banks as tax avoidance actors employing diverse schemes and (ii) banks as conduits utilized by third parties to engage in tax avoidance (Putri et al. 2023).

Typically, the top management of banks and financial institutions engages in tax avoidance by inserting unjustified expenses so that the company’s costs appear high and profits are low or even incur losses so that the tax paid is low or nonexistent. As a result, Indonesia loses 10 to 12 trillion rupiah annually due to tax fraud by banks and financial organizations. For instance, in the tax avoidance case at the BCA bank in Indonesia, bank BCA’s efforts to evade taxes include using tax loopholes to enhance manager pay and allowances and bribing officials through out-of-the-ordinary spending based on Kompas top Indonesian listing companies highlighted by Kompas in 2014. This is further supported by a study undertaken by Vania et al. (2018), demonstrating that Islamic banks in Indonesia engage in tax avoidance via earning management. One of the motives for corporations to engage in profit management is taxation.

Transfer pricing is one method for manipulating the actual tax by transferring goods, services, and the selling price of intangible property to subsidiaries, related parties, or parties with unique relationships in multiple states (Sari et al. 2022). Transfer pricing refers to fair transactions between linked companies when determining transfer prices. However, corporations purposefully move income to affiliates in nations with low tax rates (Richardson et al. 2013). Transfer pricing can be detrimental to the state, which lends it a negative reputation. Research has been conducted to determine the influence of transfer pricing on aggressive tax avoidance strategies by corporations utilizing transfer pricing.

In addition to transfer pricing, multinational corporations frequently utilize treaty shopping as a tax avoidance method. This is also a potential tax avoidance loophole. Most nations accomplish this by withholding tax on profits and interest payments to foreign subsidiaries. To prepare for this, the Indonesian government adopted Indonesian Taxation Law No. 36 of 2008, which decreased the dividend rate earned by individual domestic taxpayers from 15 percent to 10 percent and made this change permanent. In addition, the government of Indonesia has cancelled tax treaties with tax haven nations. With this strategy, the government seeks to lessen the opportunity for businesses to evade paying taxes.

The Organization for Economic Co-operation and Development (OECD 2019) and the Group of Twenty (G20) have announced a groundbreaking project to address climate change (BEPS). This program is founded on a considerable empirical study identifying the key BEPS channels. Debt, which takes advantage of tax-deductible interest payments, is one of these outlets’ strategies. The banking industry generates nearly one-fourth of corporation tax revenues in several countries. Interest payments are tax-deductible, which permits both base erosion and profit shifting. When a bank borrows money from a third party, the interest payments it receives reduce its taxable income.

In a prior study, Buettner et al. (2016) utilized bilateral internal debt data and found considerable positive benefits of the bilateral tax rate differential, the most accurate measure of debt shifting incentives. Additionally, multinational corporations use debt shifting to transfer their tax burden via parent company loans and overseas debt (Koivisto et al. 2021; Lohse and Riedel 2013) has demonstrated that multinational corporations in Germany engage in debt shifting and reduce their debt by transferring profits from high-tax nations to low-tax nations to reduce their tax burden. Moreover, it transfers the debt to a nation with low taxes.

According to Lau (2016) and Phua et al. (2021), financial derivatives can be utilized to lower the volatility of firm earnings due to their direct effect on a company’s cash flow, which ultimately affects its profit. In addition to their usage as a method of income management, derivatives are also employed as a method of tax avoidance. Donohoe (2015) states that financial derivatives are complex tax avoidance. Due to the complexity of such derivative arrangements, businesses may exploit tax law inconsistencies. Previous studies have demonstrated that the cash effective tax rate (Cash ETR) is inversely correlated with the fair value of hedged derivative assets (Devi and Efendi 2018). A positive correlation exists between Cash ETR and the fair value of non-hedging derivative assets (liabilities). This suggests that the corporation deferred the realization of profits while accelerating the realization of losses from non-hedging derivatives to lower the amount of income tax paid.

Transfer pricing is distributing business profits to lower or avoid taxes. Moreover, transfer pricing may also be referred to as intracompany price, intercorporate price, interdivisional price, or internal price, a price set for management control over the transfer of goods and services among members (group companies). In conventional accounting literature, transfer pricing is described as transferring expenses and revenues among divisions, subsidiaries, and joint ventures within a group of affiliated firms Richardson et al. (2013).

Transfer pricing methods are responsive to opportunities for fixing values to increase private profits while avoiding paying public taxes. MNEs typically shift revenues from high-tax jurisdictions to low-tax nations (Dharmapala and Riedel 2013; Davies et al. 2018).

Extending Putri et al. (2022), while performing a unique contribution, this study highlights that tax avoidance practices, particularly within Islamic financial institutions, represent a significant gap in the literature. Islamic finance operates under distinct principles, such as the prohibition of interest and excessive uncertainty, which could affect how tax avoidance mechanisms are implemented or interpreted. The principles of shariah law emphasize fairness, transparency, and ethical financial behavior, thus potentially influencing corporate governance (Zainon et al. 2020) and tax strategies. Incorporating Islamic perspectives could deepen the understanding of how these institutions manage tax compliance while adhering to religious guidelines (Ahmed 2010).

2. Literature Review

2.1. Stakeholder Theory

According to stakeholder theory, a firm cannot operate solely for its own profit; it must also deliver benefits to all its stakeholders (Goyal 2020). Shareholders, management, employees, consumers, creditors, investors, regulators, and the government are stakeholders in financial institutions. Who has a relationship with the company and is interested in it? Stakeholders can control or influence the company’s use of economic resources.

To survive and compete, the company’s mission is supposed to meet the interests of its stakeholders. This aligns with the use of stakeholder theory. As in the contemporary period, firms need superior technology to compete and maximize profits for the benefit of their stakeholders. The government is one of the parties interested in taxation. The government will reap huge rewards when a corporation complies with its tax obligations in good faith, consequently, assisting the state government as a shareholder in acquiring tax revenues to finance development (Hanlon et al. 2014).

2.2. Positive Accounting Theory

Schroeder et al. (2019) created the positive accounting theory, which identifies specific economic aspects that can be related to the behavior of managers or financial report creators. This theory aids in the explanation and forecasting of accounting processes. Consequently, managers will be more cautious (conservative) while engaging in tax avoidance.

The positive accounting theory investigates the elements that influence the management’s attitude toward accounting standards and, consequently, the company’s lobby against accounting standards. Positive accounting theory has three hypotheses: the bonus plan hypothesis, the debt covenant hypothesis, and the political cost hypothesis (Kaya 2017).

2.3. Maqasid Shariah

Maqasid Syariah is the Islamic framework that emphasizes the objectives or higher intents of Shariah law, which include the protection of religion, life, intellect, lineage, and wealth.

When companies engage in tax avoidance through derivatives, debt shifting, or transfer pricing, they undermine the protection of wealth because these practices unfairly shift the tax burden by forcing other individuals or businesses to bear the brunt of lost revenue. It also deprives society of public goods where taxes fund essential services such as education, healthcare, and infrastructure, which are integral to the broader objectives of Maqasid Syariah (Isnaini et al. 2024). Moreover, it violates justice and fairness. Islam highlights fairness in wealth distribution as a key component of social justice. Manipulating financial systems for personal gain at the expense of the collective good goes against Islamic ethics. Hence, the focus on sustainability and justice within the Maqasid framework further supports the argument for a tax system that funds essential public services, ensuring that all members of society have access to the necessary resources (Isnaini et al. 2024; Aziz et al. 2023).

Tax avoidance in Islamic countries is a complex issue that intersects with the principles of Maqasid al-Shariah, which are the objectives of Islamic law to promote welfare and justice in society. Maqasid al-Shariah emphasizes the importance of achieving benefits (maslahah) for individuals and the community, particularly relevant in tax policies and practices. In Islamic finance, the principles of Maqasid al-Shariah guide the ethical considerations surrounding taxation and economic activities. For instance, from Indonesia, Kamaruddin et al. (2024) discusses how zakah (almsgiving) can be aligned with Maqasid al-Shariah to empower community development, highlighting the socio-economic impacts of such programs in alleviating poverty and promoting welfare. This perspective underscores the need for tax systems to generate revenue and enhance social welfare, aligning with the broader objectives of Islamic law.

Moreover, the relationship between tax policies and Maqasid al-Shariah is further explored by Hatmaka (2024), who evaluates local tax systems in Indonesia and their compliance with the principles of justice and public benefit. The study suggests that tax policies should be designed to support the community’s welfare, reflecting the core values of Maqasid al-Shariah. This is echoed by Rhetha et al. (2024), who emphasizes that the ultimate goal of Maqasid al-Shariah is to benefit the people, which can be reflected in the ethical management of tax revenues. Tax avoidance practices, however, can undermine these objectives. The work of Hanifah indicates that tax avoidance can negatively impact dividend policies, suggesting that companies may prioritize tax minimization over equitable profit distribution, which can conflict with the principles of fairness and social justice inherent in Maqasid al-Shariah (Hanifah et al. 2024). This highlights the need for Islamic countries to develop tax systems that discourage avoidance and promote compliance, thereby ensuring that tax revenues are utilized for the common good.

2.4. Tax Avoidance

According to Graham et al. (2014), tax avoidance is a business planning approach that management implements to attain firm objectives. Tax avoidance is defined by Payne and Raiborn (2018) as the endeavor to exploit tax law uncertainties for the company’s benefit. Wang (2019) defines tax avoidance as the legal violation of tax laws to reduce the corporate tax burden using tax rules. According to previous research, various indicators have been used to measure tax avoidance. Effective tax rate is one of these (ETR). ETR is deemed capable of measuring the extent of tax avoidance if a company’s ETR is lower than the industry average ETR. ETR is the ratio of a company’s tax liability to its pretax income, calculated by dividing the tax expense by the pretax income.

From Maqasid Shariah’s perspective, though legal, tax avoidance may violate Islamic principles of justice and fair wealth distribution. It undermines societal welfare by depriving communities of necessary resources, contradicting the ethical responsibility to contribute fairly to public goods and collective well-being.

2.5. Debt Shifting

Debt shifting involves transferring debt between related parties, often across borders. Companies may artificially inflate debt levels in high-tax jurisdictions to claim higher interest deductions, reducing taxable income. By inflating interest payments, a company can significantly reduce taxable income, resulting in lower tax payments. Debt shifting is interest income obtained from low-tax countries and withheld in high-tax countries. This strategy can save taxes from deductions in high-tax countries exceeding the appropriate tax payments in low-tax countries (Ruf and Weichenrieder 2012). Due to changes in foreign debt, the leverage ratio is typically more sensitive to taxation in multinational corporations. The corporate debt policy of a nation appears to follow local taxation. Generally, multinational corporations avoid paying high taxes by moving their debt to high-tax nations. This reduces business margins and tax burdens. Multinational firms move Intellectual Property to subsidiaries in low-tax jurisdictions to shift income and, as a result, pay fewer taxes (Comincioli et al. 2020).

Debt shifting can be considered against fairness and justice under Islamic law as it discourages excessive debt manipulation, particularly when used to avoid paying dues (like taxes) meant to support public welfare. Tax avoidance through debt shifting could harm the collective social welfare, as taxes fund public goods like education, healthcare, and infrastructure.

2.6. Financial Derivative

Financial derivatives are instruments whose value is derived from the value of another asset, such as stocks, bonds, or currencies. Companies often use derivatives to hedge risks (such as currency or interest rate fluctuations) or for speculative purposes. Companies may use derivatives to manipulate taxable income by creating artificial losses or shifting profits to reduce tax liabilities. This is a form of tax avoidance because it exploits financial structures without creating real economic losses. According to Zang (2012), using derivative trades is one method for managing earnings. Due to the significant rise in derivative transactions, corporations employ derivative trades to decrease their tax liability. Therefore, derivative trades can be utilized as a tax avoidance strategy. While in Maqasid Syariah, the protection of wealth emphasizes responsible wealth management. Derivatives, when used for manipulation or speculation, violate this principle by undermining the fair distribution of wealth. Rather than protecting and growing wealth for societal benefit, they can concentrate wealth in the hands of a few, harming social justice.

Donohoe (2015) states that the ambiguity of tax regulations on derivative transactions makes financial derivatives serve as objects to avoid taxes. The corporation uses this ambiguity as a loophole to avoid paying taxes. Oktavia and Martani (2013) identified a substantial correlation between financial derivative variables and tax avoidance.

2.7. Transfer Pricing

Transfer pricing is essentially indicated as fair transactions applied between affiliated companies in determining transfer prices. Transfer pricing refers to pricing goods, services, and intellectual property between related companies, often across countries. Companies may set prices to shift profits to low-tax jurisdictions, thus minimizing tax liabilities. By manipulating transfer prices, companies reduce their taxable income in high-tax countries and increase it in low-tax countries. This is a common strategy for tax avoidance. Corporations purposefully move profits to companies with special links in nations with low tax rates (Richardson et al. 2013). This gives transfer pricing a negative connotation because it can cause harm to the government. Sikka and Willmott (2010) and Amidu et al. (2019) revealed firms’ transfer price tactics in developing and developed economies to avoid taxes.

The principle of justice in Maqasid Syariah is violated if transfer pricing is used to manipulate profits, as it deprives governments of necessary revenue. Islam encourages fairness in all transactions and prohibits deceit. When used to avoid taxes, transfer pricing disrupts the equitable distribution of wealth, negatively impacting social justice and public welfare.

2.8. Financial Distress

The maximization of financial distress is one of the objectives of an established business because higher financial distress will increase the shareholders’ wealth. Azmi et al. (2020) and Kalash (2021) highlight that financial distress indicates the firm’s market value, which means financial distress is the summation of an investor’s judgments of the company’s entire. The fact that the expanding financial distress depends on the company’s success indicates that financial distress is tied to firm performancey (Azmi et al. 2020). Companies facing financial distress might resort to tax avoidance strategies to preserve cash and remain solvent. This could involve aggressive use of debt shifting, transfer pricing, or other mechanisms to minimize tax payments.

Financial distress has a significant positive effect on tax avoidance, while accounting conservatism has a significant negative effect. Furthermore, to avoid financial difficulties, firms frequently reduce expenses, notably tax charges, because taxes have little direct impact on firm performance (Swandewi and Noviari 2020). Consequently, companies typically engage in tax avoidance to reduce their tax burden. While it is understandable that distressed companies may adopt such strategies to ensure survival, engaging in unethical tax avoidance shifts the financial burden to other businesses or individuals. Islam emphasizes fairness and responsibility in managing financial difficulties, encouraging transparency and ethical conduct even in challenging times.

2.9. Framework

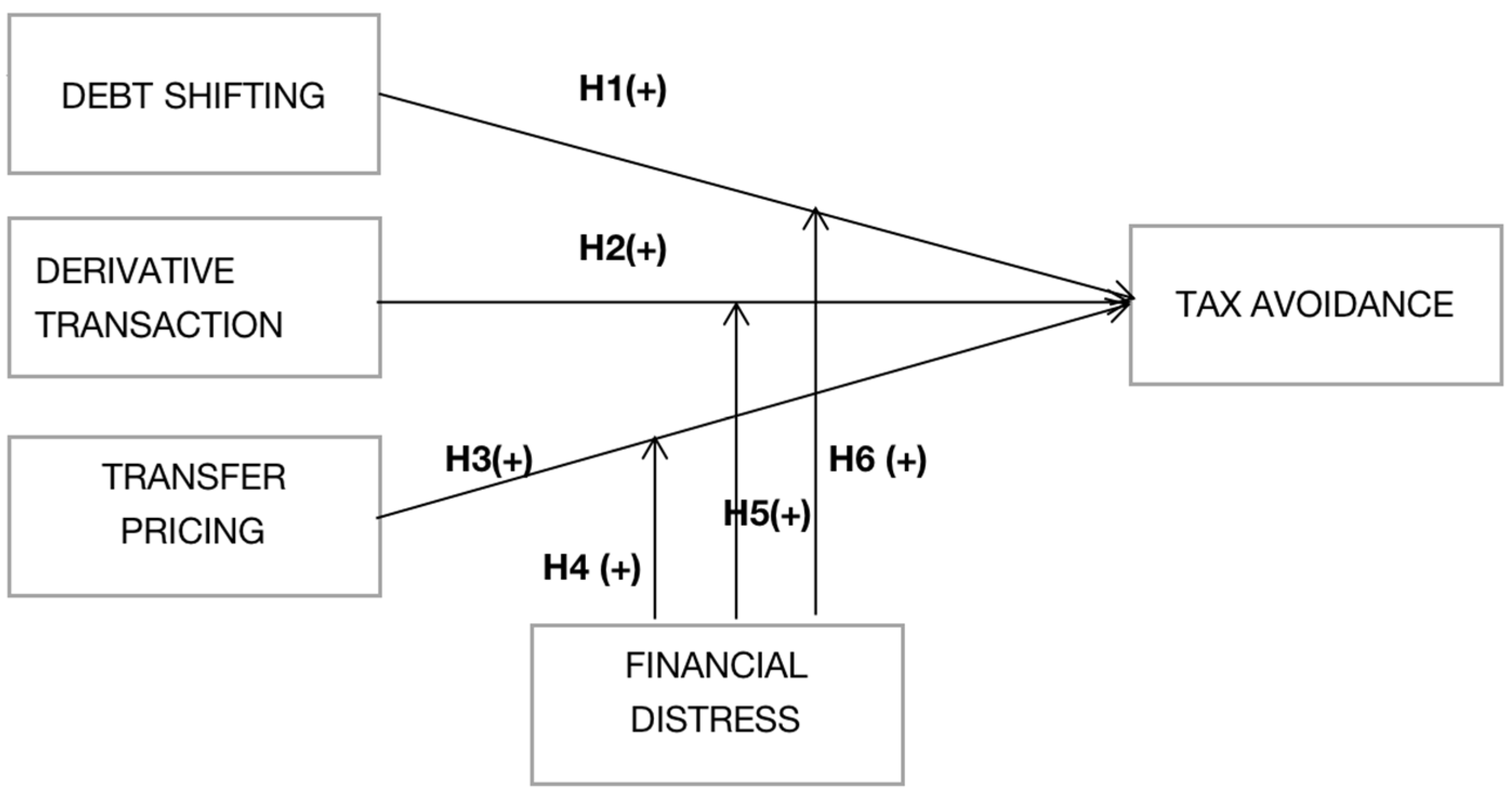

Derivatives, debt shifting, and transfer pricing are financial tools or strategies that can be misused to avoid paying taxes. From the perspective of Maqasid Syariah, tax avoidance contradicts the principles of fairness, justice, and the responsible distribution of wealth. Maqasid Syariah encourages ethical financial behavior that protects society’s well-being and promotes economic justice. With the support of stakeholder theory, positive accounting theory and Maqasid Syariah, the framework’s illustration is explained in Figure 1 below.

Figure 1.

Theoretical framework of tax avoidance effect from debt shifting, derivatives, and transfer pricing with financial distress interaction.

Based on the framework presented in Figure 1, the following hypotheses are proposed to explain the relationships between the variables affecting tax avoidance.

Hypothesis 1 (H1).

Debt shifting has a significant positive effect on tax avoidance.

Hypothesis 2 (H2).

Asserts that derivatives also have a significant positive effect on tax avoidance.

Hypothesis 3 (H3).

Posits that transfer pricing has a significant positive effect on tax avoidance.

Hypothesis 4 (H4).

Financial distress moderates the effect of debt shifting on tax avoidance.

Hypothesis 5 (H5).

Financial distress moderates the effect of financial derivatives on tax avoidance.

Hypothesis 6 (H6).

Financial distress moderates the effect of transfer pricing on tax avoidance.

3. Method

This research utilized secondary data sources as its data resource. Secondary data are research data received indirectly from a second party or documented by a third party (Saunders et al. 2012). This study aims to identify Indonesian banks that have gone public. This analysis employs financial statements from conventional banks and non-bank financial institutions from 2017 until 2022. Purposive sampling was the technique used to consider these criteria. The sample criteria are as follows.

- The banking institutions analyzed in this study were listed on the Indonesia Stock Exchange from 2017 to 2022.

- Excluding Islamic banks, regional banks, and Islamic non-bank financial institutions listed on the Indonesia Stock Exchange in 2017–2022. These institutions may already operate under Islamic financial principles, emphasizing the Maqasid Syariah ethical behaviors and social welfare. Including them could skew the analysis, thus reducing the likelihood of engaging in tax evasion or avoidance practices that violate these principles.

3.1. The Operational of Variables

This study has three independent variables, one dependent variable, and one interaction variable, as outlined in Table 1. This study evaluates the impact of debt shifting, financial derivatives, and transfer pricing on tax avoidance, with financial distress as an interaction variable. Detailed descriptions of all independent, interaction, and dependent variables are provided in Table 1.

Table 1.

Variable Measurement.

3.2. Analysis and Discussion

After filtration, based on Table 2, only 69 financial institutions met the criteria for this sampling technique according to purpose. The number of samples collected from the study’s population is as follows:

Table 2.

Sample Criteria.

3.3. Descriptive Statistics

Based on Table 3 of the data for each variable derived from the processed model, each variable has a mean value (mean), maximum value (max), and minimum value (min), as well as a standard deviation (sd). The description of the descriptive statistics of each research variable is as follows:

Table 3.

Descriptive Statistic, n = 414.

- (a)

- Debt Shifting (DS)

The mean value of debt shifting is 0.035887, with a standard deviation of 0.041501. This means that the mean value is greater than the standard deviation, indicating that the data for this variable are evenly distributed.

- (b)

- Financial Derivative (DERV)

According to data processing using Eviews 9 software, the DERV variable has an average value (mean) of 0.000908 and a standard deviation of 0.002914. This indicates that the values for this variable are evenly distributed, as the average value (mean) is less than the standard deviation.

- (c)

- Transfer Pricing (TP)

The transfer pricing variable’s average value (mean) is 0.045371, with a standard deviation of 0.124923. This indicates that the values for this variable are not uniformly distributed, as the average value (mean) is less than the standard deviation.

- (d)

- Financial distress (FV)

The financial distress variable has a range of values with an average (mean) value of 1.785541 and a standard deviation of 4.835991. This demonstrates that the average value (mean) is less than the standard deviation, indicating that the data for this variable are not evenly distributed.

3.4. Panel Data Regression Analysis

To determine which of the standard effect models to use, the fixed-effect and the random-effect models are the most appropriate for the inquiry.

- (a)

- The Chow Test

The Chow test determines whether the study model uses a common or fixed effect. Due to the probability value, the Chi-Square cross-section probability value is 0.2366. Since this value is bigger than the significance level of 0.05, the equation regression results in this study were based on a common-effect model, and the Hausman test was employed.

- (b)

- The Hausman Test

The Hausman test assesses whether a random-effect or fixed-effect probability value of a random cross-section of 0.0174 will be used in the research model. Because this number is small than the 0.05 level of significance, the regression equation results in this study were based on a fixed-effect model.

- (c)

- Lagrange Test

The Breusch–Pagan cross-section has a probability of 0.6215, as determined by the Lagrange test on the processed data. This result is more than the significance criterion of 0.05. The results of the proper regression model used in this investigation, the common-effect model, can be determined.

- (d)

- Normality Test

The objective of a normality test is to establish whether the distribution of the research sample is normal. The study’s data must have a normal distribution and a significant probability of 0.05 or 5 percent for a suitable regression model because equally distributed data are a prerequisite for successfully completing a panel data regression analysis. According to the data processing results using Eviews 9, all variables have a uniform distribution. This is supported by the Jarque–Bera probability value of over 5 percent, 0.553095. Based on a total of 414 observations, it can be concluded that the data are normally distributed.

3.5. Heteroscedasticity Test

The heteroskedasticity test determines whether the regression model identified a link between the independent variables. The regression model lacks heteroskedasticity if the probability value is bigger than 0.05. According to the data analyzed with Eviews 12 and the Glejser test, as displayed in Table 4, there is no probability coefficient with a value less than 0.05. Therefore, it can be stated that the data lack heteroscedasticity.

Table 4.

Heteroskedasticity Test.

3.6. The Multicollinearity Test

It is required to consider the correlation coefficient’s value to test for multicollinearity. The model has a multicollinearity problem if the correlation between independent variables is greater than 0.8 (>0.8). On the other hand, if the correlation between independent variables is less than 0.8, the model does not have a multicollinearity problem (0.8). However, the correlation coefficient of the interaction variable in the Table 5 above is 0.957438, indicating multicollinearity. This often occurs due to multiplication or interaction between two or more independent variables (Gujerati 2021).

Table 5.

Multicollinearity Test.

3.7. The Autocorrelation Test

The autocorrelation test is used to see a link between the error in period t and the confounding error in period t − 1 in a linear regression model (previous). The Durbin–Watson test was employed to detect the presence of autocorrelation in this investigation (DW test). Based on Table 6, the Durbin–Watson statistic value of 1.501657 is between the upper limit value (dU) 1.7813 and the lower limit value (dL) 1.5762, where (4-d) > du, and the regression model in this study does not exhibit a negative autocorrelation.

Table 6.

Autocorrelation Test Results.

3.8. Panel Data Regression Analysis

414 samples in this study satisfy the criteria with the equation below since it uses regression analysis panel data from 69 companies with six years of observation:

ETR i,t = α0 +β1DSi,t + β2DERVi,t + β3TPi,t + β4FVi,t + β5FV*DSi,t + β6FV*DERVi,t + β7FV*TPi,t e

Description:

- ETR: Tax Avoidance

- α0: Constant

- Β: Regression coefficient

- DS: Debt shifting

- DERV: Financial derivative

- TP: Transfer pricing

- FV: Financial distress

- e: Error term

ETR i,t = 0.167841 + 0.646686DSi,t + 17.47531DERVi,t − 0.166325TPi,t − 0.007589FDi.t + 0.073941FD*DSi,t − 12.32581FD*DERVi,t + 0.019017FV*TPi,t + e

The regression results in Table 7 demonstrate various impacts of financial factors on the effective tax rate (ETR). First, the ETR is zero when the independent variable remains constant. Debt shifting (DS) has a positive regression coefficient of 0.646686, meaning that for every one-unit increase in debt shifting, the ETR rises by 0.646686 units. This suggests that increasing debt shifting contributes to higher tax rates.

Table 7.

Regression Results.

Financial derivatives (DERV) significantly impact the ETR, as reflected by a high regression coefficient of 17.47531. For every one-unit increase in financial derivatives, the ETR increases by 17.47531 units. Conversely, transfer pricing (TP) has a negative regression coefficient of −0.166325, indicating that a one-unit rise in transfer pricing reduces the ETR by 0.166325 units. Financial distress (FV) also negatively influences the ETR, with a regression coefficient of −0.007589, reducing the ETR by 0.007589 for each one-unit increase in financial distress.

Interactions between financial distress and other variables further illustrate the complexity of their effects on tax avoidance. The interaction between financial distress and debt shifting has a positive regression coefficient of 0.189905, showing that a one-unit increase in this interaction raises the ETR by 0.189905 percentage points. However, the interaction of financial distress with financial derivatives has a negative coefficient of −12.32581, indicating a significant reduction in ETR by 12.32581 for each one-unit increase in this interaction. Meanwhile, financial distress interaction with transfer pricing has a positive coefficient of 0.019017, leading to a modest rise in ETR by 0.019017 percentage points.

4. Hypothesis Test

4.1. Partial Test (t-Test)

The test was carried out using the value of =5 percent to assess whether the influence caused by the dependent, independent, and interaction variables had a significant or negligible effect (0.05). The findings of panel data regression are summarized in Table 8.

Table 8.

Partial T Hypothesis Testing.

This study’s first hypothesis (H1) explores the relationship between debt shifting and tax avoidance. According to the regression equation results in Table 8, the probability of debt shifting is 0.001, which is less than the significance value of 0.05. The regression coefficient for debt shifting is 0.646686, indicating that an increase in debt shifting leads to an increase in the effective tax rate (ETR), meaning tax avoidance decreases. Thus, debt shifting negatively impacts tax avoidance, leading to the rejection of H1. From the perspective of Maqasid Syariah, debt shifting, which contributes to higher taxation compliance, aligns with safeguarding wealth by ensuring that tax revenues are used for societal benefits. By reducing tax avoidance, debt shifting can contribute to a more equitable distribution of resources, which is central to Islamic economic justice.

Hypothesis 2 (H2) examines the impact of financial derivatives on tax avoidance. Based on the regression results, the probability of financial derivatives is 0.134, greater than the significance value of 0.05. The regression coefficient for financial derivatives is 17.47531. This suggests that financial derivatives do not have a significant effect on tax avoidance, resulting in the rejection of H2. From the Maqasid Syariah perspective, financial instruments like derivatives should ideally be used in ways that support ethical economic activities. The lack of impact on tax avoidance suggests that these derivatives may not necessarily contravene Islamic principles. Still, caution is required to ensure they are not used to facilitate financial maneuvers undermining wealth preservation or social justice.

Hypothesis 3 (H3) focuses on the influence of transfer pricing on tax avoidance. The regression equation shows a probability of 0.0196, which is less than the significance value of 0.05, and the regression coefficient for transfer pricing is −0.166325. This indicates that as transfer pricing increases, the ETR decreases, meaning tax avoidance occurs. Therefore, transfer pricing positively affects tax avoidance, and H3 is accepted. Maqasid Syariah emphasizes fairness and preventing harm. Transfer pricing, when used to evade taxes, compromises the principle of wealth distribution and harms the community’s welfare by reducing the funds available for public services. From an Islamic viewpoint, such practices would violate the ethical principle of ensuring that wealth benefits society.

Hypothesis 4 (H4) investigates whether financial distress moderates the relationship between debt shifting and tax avoidance. The probability for this interaction is 0.1091, which is greater than the significance value of 0.05. The regression coefficient for this variable is 0.073941. According to the t-test findings, financial distress does not moderate the effect of debt shifting on tax avoidance, leading to the rejection of H4. Under Maqasid Syariah, wealth management should uphold justice and equity during financial distress. Even when companies face financial difficulties, they must adhere to ethical standards, ensuring that their tax obligations are not manipulated through strategies like debt shifting to the detriment of societal welfare (Rahman et al. 2021).

Hypothesis 5 (H5) explores whether financial distress strengthens the effect of financial derivatives on tax avoidance. The regression coefficient for this interaction is −12.32581, and the probability of financial derivatives and ETR being moderated by financial distress is 0.2231, greater than the significance value of 0.05. The t-test results show that financial distress does not moderate the relationship between financial derivatives and tax avoidance, resulting in rejecting H5. In the context of Maqasid Syariah, financial distress should not justify unethical financial behaviors, such as exploiting derivatives to evade taxes. The principles require transparent and fair financial practices even in times of hardship, ensuring the protection of wealth and justice for society.

Finally, Hypothesis 6 (H6) examines whether financial distress strengthens the effect of transfer pricing on tax avoidance. The regression coefficient for this interaction is 0.019017, and the probability for this moderation is greater than the significance value of 0.05. The t-test findings indicate that financial distress does not moderate the relationship between transfer pricing and tax avoidance. Therefore, H6 is rejected. From a Maqasid Syariah perspective, using financial distress to justify engaging in transfer pricing practices that lead to tax avoidance contradicts the Islamic principles of justice and wealth preservation. Even during financial challenges, businesses are expected to operate with integrity and contribute their fair share to the collective good, ensuring that tax revenues can support the broader needs of society.

4.2. Coefficient of Determination Test (Adjusted R2)

The coefficient of determination (R2) measures the model’s ability to explain the suitability relationship between the variation of the dependent variable and the independent variables’ variations in the study. The value at Adjusted R2 is always between 0 and 1. The following table describes the results of panel data regression.

Based on Table 9 below, it can be concluded that the adjusted R2 is 0.121348 or 12.121348 percent. This shows that the ownership structure variables, debt shifting (DB), financial derivative (DERV), transfer pricing, and financial distress can influence tax avoidance by 0.121348 or 12.121348 percent. At the same time, the remaining 87.878652 percent is explained by other variables not used in this study.

Table 9.

Coefficient of Determination Results.

5. Conclusions and Recommendations

This study aims to determine the effect of debt shifting, financial derivatives, transfer pricing, and financial distress on tax avoidance in the conventional banking firms and non-bank financial institutions listed on the Indonesia Stock Exchange. The sample in this study was 69 companies for 6 years. The research findings show that debt shifting has a negative impact on tax avoidance, thereby leading to the rejection of Hypothesis 1. This suggests that banks and non-bank financial institutions are less likely to engage in such practices to minimize their tax liabilities, potentially leading to overdue payments, which may discourage tax avoidance behavior. Apart from that, financial derivatives have no effect on tax avoidance, so Hypothesis 2 is also rejected. This implies that banks and non-bank financial institutions may not rely on such instruments to effectively manage their tax burden, reflecting a more conservative approach to risk management in these entities. However, Hypothesis 3 is accepted, that transfer pricing has a positive influence on tax avoidance, indicating that financial institutions may strategically utilize transfer pricing practices to reduce their taxable income. This finding is very relevant, because both banks and non-bank financial institutions are often involved in complex transactions that can be affected by transfer pricing. Finally, Hypotheses 4, 5, and 6 are rejected, indicating that financial distress does not significantly moderate the relationship between debt transfer, financial derivatives, and transfer prices. This suggests that even when financial challenges occur, these institutions do not significantly change their approach to debt assignment, financial derivatives, or transfer pricing. This may highlight a trend that the financial sector is taking precedence over compliance and ethical standards over aggressive tax avoidance strategies, even during financially challenging times. The findings highlight that Maqasid Syariah principles emphasize fairness, wealth preservation, and justice, discouraging tax avoidance practices like transfer pricing and encouraging ethical financial conduct, even during financial distress.

5.1. Implication

The results provide valuable insights into the relationship between financial strategies and tax avoidance from both a conventional and Maqasid Syariah perspective. The rejection of H1 shows that debt shifting contributes to reducing tax avoidance, implying increased tax compliance, which aligns with Maqasid Syariah’s goal of wealth preservation for societal benefit. The financial derivatives’ lack of significant impact on tax avoidance (H2) suggests that, while not necessarily against Islamic principles, their role requires careful scrutiny to avoid undermining fairness.

Transfer pricing’s positive effect on tax avoidance (H3) reflects its potential harm to equitable wealth distribution, as it reduces public revenue for essential services. The rejection of H4, H5, and H6, indicating that financial distress does not moderate the effects of debt shifting, financial derivatives, or transfer pricing, further highlights that financial hardship does not justify unethical tax avoidance. These findings reinforce the importance of adhering to ethical financial practices as highlight by Halid et al. (2021) even under distress, in line with the justice-focused principles of Maqasid Syariah.

5.2. Limitations and Suggestions

This study has limitations that can be used as a reference for future researchers to obtain more accurate results. The study only used conventional banking firms and non-bank financial institutions listed on the Indonesia Stock Exchange (IDX) from 2017 to 2022. The purposive selection method only yielded 69 samples of companies that could be used as research objects. In the future, it is hoped that banking companies (including Islamic banking) and non-bank financial institutions can contribute more to become objects in the research conducted.

The independent variable financial factors used are debt shifting, financial derivative, transfer pricing, and firm as mediating. Considering that the influence of the adjusted R-squared of the four factors is only 12.121348 percent, this indicates that many other potential variables still play a part in tax avoidance. There is still a great deal of additional monetary aspects, including profitability, leverage, bond rating, size, and growth, that have the potential to operate as independent variables in the subsequent investigation.

Author Contributions

Conceptualization, V.R.P. and N.B.Z.; project administration, M.H.S.M.Y.; investigation, M.P.Z. and I.S.; review and editing, R.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received funding from UPTM under research grant reference no UPTM.DVCRI.RMC.15 (113).

Data Availability Statement

For original data retrieval, don’t hesitate to get in touch with vidiputri@ibs.ac.id.

Acknowledgments

The authors would like to acknowledge the assistance from the Accounting Research Institute of Universiti Teknologi MARA and the Malaysian Ministry of Higher Education.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmed, Amr Mohamed El Tiby. 2010. Islamic Banking: How to Manage Risk and Improve Profitability. New York: John Wiley & Sons. [Google Scholar]

- Amidu, Mohammed, William Coffie, and Philomina Acquah. 2019. Transfer pricing, earnings management and tax avoidance of firms in Ghana. Journal of Financial Crime 26: 235–59. [Google Scholar] [CrossRef]

- Aziz, Hartinie Abd, Zuhairah Ariff Abd Ghadas, and Assane Buana Ossofo. 2023. Corporate Social Responsibility Under the Maqasid Syariah Concept in Malaysia: Why Does it Matter? Jurnal Media Hukum 30: 53–65. [Google Scholar] [CrossRef]

- Azmi, Nurul Azlin, Fazrul Hanim Abd Sata, Nor Balkish Zakaria, and Zuraidah Mohd Sanusi. 2020. Political connection and firm’s performance among Malaysian firms. International Journal of Financial Research 11: 146–54. [Google Scholar] [CrossRef]

- Buettner, Thiess, Michael Overesch, and Georg Wamser. 2016. Restricted interest deductibility and multinationals’ use of internal debt finance. International Tax and Public Finance 23: 785–97. [Google Scholar] [CrossRef]

- Comincioli, Nicola, Paola Panteghini, and Sergio Vergalli. 2020. Debt Shifting and Transfer Pricing in a Volatile World. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Darmawan, Arif, and Shella Angelina. 2021. The Impact of Tax Planning on Firm Value. Journal of Applied Accounting and Taxation 6: 196–204. [Google Scholar] [CrossRef]

- Davies, Ronald. B., Julien Martin, Mathieu Parenti, and Farid Toubal. 2018. Knocking on tax haven’s door: Multinational firms and transfer pricing. Review of Economics and Statistics 100: 120–34. [Google Scholar] [CrossRef]

- Devi, Bendi, and Subagio Efendi. 2018. Financial Derivatives in Corporate Tax Aggressiveness. The Indonesian Journal of Accounting Research 21. [Google Scholar] [CrossRef]

- Dharmapala, Dhammika, and Nadine Riedel. 2013. Earnings shocks and tax-motivated income-shifting: Evidence from European multinationals. Journal of Public Economics 97: 95–107. [Google Scholar] [CrossRef]

- Donohoe, Michael P. 2015. The economic effects of financial derivatives on corporate tax avoidance. Journal of Accounting and Economics 59: 1–24. [Google Scholar] [CrossRef]

- Goyal, Lakshmi. 2020. Stakeholder theory: Revisiting the origins. Journal of Public Affairs 22: e2559. [Google Scholar] [CrossRef]

- Graham, John R., Michelle Hanlon, Terry Shevlin, and Nemit Shroff. 2014. Incentives for tax planning and avoidance: Evidence from the field. The Accounting Review 89: 991–1023. [Google Scholar] [CrossRef]

- Gujarati, Damodar N. 2021. Essentials of Econometrics. Thousand Oaks: Sage Publications. [Google Scholar]

- Halid, Sunarti, Radziah Mahmud, Nor Balkish Zakaria, and Rahayu Abdul Rahman. 2021. Does board monitoring affect integrated reporting disclosure for better transparency and sustainability. Universal Journal of Accounting and Finance 9: 1049–57. [Google Scholar] [CrossRef]

- Hanifah, Fitria, Ekaningtyas Widiastuti, and N. Najmudin. 2024. The effect of tax avoidance, profitability, and leverage on dividend policy: Liquidity as moderating variable. Marginal Journal of Management Accounting General Finance and International Economic Issues 3: 376–87. [Google Scholar] [CrossRef]

- Hanlon, Michelle, Jeffrey L. Hoopes, and Nemit Shroff. 2014. The effect of tax authority monitoring and enforcement on financial reporting quality. The Journal of the American Taxation Association 36: 137–70. [Google Scholar] [CrossRef]

- Hatmaka, Mai Herjuna. 2024. Pajak dan pendapatan asli daerah: Evaluasi kesesuaian dengan prinsip maqasid syariah. Journal of Ecotourism and Rural Planning 1: 1–11. [Google Scholar] [CrossRef]

- Isnaini, Ulya, Fitria Solahika Salma, and Agus Eko Sujianto. 2024. Preparation of Administrative Cost Budgeting with Maqasid Syariah Approach: Case Study at Kspps Tunas Artha Mandiri Nganjuk. Formosa Journal of Multidisciplinary Research 3: 67–80. [Google Scholar] [CrossRef]

- Kalash, Ismail. 2021. The financial leverage–financial performance relationship in the emerging market of Turkey: The role of financial distress risk and currency crisis. EuroMed Journal of Business 18: 1–20. [Google Scholar] [CrossRef]

- Kamaruddin, Andi Martina, Rabiatul Adawiyah, Khodijah Nur Tsalis, and Ahmad Abbas. 2024. Implementation of maqāṣid al-syāriah in empowering the zakah community development program. Jurnal Ilmiah Mahasiswa Raushan Fikr 13: 174–85. [Google Scholar] [CrossRef]

- Kaya, İdil. 2017. Accounting choices in corporate financial reporting: A literature review of positive accounting theory. In Accounting and Corporate Reporting–Today and Tomorrow. Rijeka: Intech, pp. 129–40. [Google Scholar]

- Koivisto, Aliisa, Nicholas Musoke, Dorothy Nakyambadde, and Caroline Schimanski. 2021. The case of taxing multinational corporations in Uganda: Do multinational corporations face lower effective tax rates and is there evidence for profit shifting? (No. 2021/51). In WIDER Working Paper. Helsinki: WIDER. [Google Scholar]

- Kovermann, Jost, and Patrick Velte. 2019. The impact of corporate governance on corporate tax avoidance—A literature review. Journal of International Accounting, Auditing and Taxation 36: 100270. [Google Scholar] [CrossRef]

- Lau, Chee Kwong. 2016. How corporate derivatives use impact firm performance? Pacific-Basin Finance Journal 40: 102–14. [Google Scholar] [CrossRef]

- Lohse, Theresa, and Nadine Riedel. 2013. Do transfer pricing laws limit international income shifting? Evidence from European Multinationals. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2334651 (accessed on 22 September 2024).

- OECD. 2019. Model Tax Convention on Income and on Capita. Article 9 Concering the Taxation of Associated Enterprises. Paris: OECD. [Google Scholar]

- Oktavia, Oktavia, and Dwi Martani. 2013. Tingkat pengungkapan dan penggunaan derivatif keuangan dalam aktivitas penghindaran pajak. Jurnal Akuntansi dan Keuangan Indonesia 10: 129–46. [Google Scholar] [CrossRef]

- Payne, Dinah M., and Cecily A. Raiborn. 2018. Aggressive tax avoidance: A conundrum for stakeholders, governments, and morality. Journal of Business Ethics 147: 469–87. [Google Scholar] [CrossRef]

- Phua, Lian Kee, Char Lee Lok, Yong Xia Chua, and Tan Chin Lim. 2021. Earnings Volatility, the Use of Financial Derivatives and Earnings Management: Evidence from an Emerging Market. Malaysian Journal of Economic Studies 58: 1–20. [Google Scholar] [CrossRef]

- Putri, Vidiyanna Rizal, Nor Balkish Zakaria, and Jamaliah Said. 2022. Tax Avoidance: The Role of Transfer Pricing and Financial Factors. Asia-Pacific Management and Accounting Association. Available online: http://repository.ibs.ac.id/7227/ (accessed on 22 September 2024).

- Putri, Vidiyanna Rizal, Nor Balkish Zakaria, Jamaliah Said, and Maz Ainy Abdul Azis. 2023. Do Foreign Ownership, Executive Incentives, Corporate Social Responsibility Activity and Audit Quality Affect Corporate Tax Avoidance? Indian Journal of Corporate Governance 16: 218–39. [Google Scholar] [CrossRef]

- Putri, Vidiyanna Rizal, Nor Balkish Zakaria, Jamaliah Said, Farha Ghapar, and Rizqa Anita. 2024. Tax Tightrope: The Perils of Foreign Ownership, Executive Incentives and Transfer Pricing in Indonesian Banking. Journal of Risk and Financial Management 17: 26. [Google Scholar] [CrossRef]

- Rahman, Rahayu Abdul, Nor Balkish Zakaria, Suraya Masrom, and Enny Nurdin. 2021. Prediction of earnings manipulation on Malaysian listed firms: A comparison between linear and tree-based machine learning. International Journal of Emerging Technology Advance Engineering 11: 111–20. [Google Scholar] [CrossRef]

- Rhetha, Syintia Amanda, Yenita Karisha, Nurris Kiyani, Tri Noviantika Zain, and Muhammad Taufiq Abadi. 2024. Nilai maslahah reksadana syariah dalam perspektif maqashid syariah. Jurnal Ilmiah Research and Development Student 2: 116–25. [Google Scholar] [CrossRef]

- Richardson, Grant, Grantley Taylor, and Roman Lanis. 2013. Determinants of transfer pricing aggressiveness: Empirical evidence from Australian firms. Journal of Contemporary Accounting and Economics 9: 136–50. [Google Scholar] [CrossRef]

- Ruf, Martin, and Alfons J. Weichenrieder. 2012. The taxation of passive foreign investment: Lessons from German experience. Canadian Journal of Economics/Revue Canadienne d’Économique 45: 1504–28. [Google Scholar] [CrossRef]

- Sari, Maylia Pramono, Surya Raharja, Alfan Budiarto, Nanik Sri Utaminingsih, and Risanda Budiantoro. 2022. The determinant of transfer pricing in Indonesian multinational companies: Moderation effect of tax expenses. Investment Management and Financial Innovations 19: 267–77. [Google Scholar] [CrossRef]

- Saunders, Mark, Philip Lewis, and Adrian Thornhill. 2012. Research Methods for Business Students (6. utg.). Harlow: Pearson. [Google Scholar]

- Schroeder, Richard G., Myrtle W. Clark, and Jack M. Cathey. 2019. Financial Accounting Theory and Analysis: Text and Cases. Hoboken: John Wiley & Sons. [Google Scholar]

- Sikka, Prem, and Hugh Willmott. 2010. The dark side of transfer pricing: Its role in tax avoidance and wealth retentiveness. Critical Perspectives on Accounting 21: 342–56. [Google Scholar] [CrossRef]

- Swandewi, Ni Putu, and Naniek Noviari. 2020. Pengaruh Financial Distress dan Konservatisme Akuntansi pada Tax Avoidance. European Journal of Anaesthesiology 30: 1670. [Google Scholar] [CrossRef]

- Vania, Adela Sarah, Erik Nugraha, and Lucky Nugroho. 2018. Does earning management happen in Islamıc bank? (Indonesia and Malaysia comparison). International Journal of Commerce and Finance 4: 47–59. [Google Scholar]

- Wang, Long. 2019. Creativity as a pragmatic moral tool. Journal of Business Research 96: 1–13. [Google Scholar] [CrossRef]

- Zainon, Saunah, Sofwah Md Nawi, Rina Fadhilah Ismail, Faridah Najuna Misman, Roslina Mohamad Shaf, and Nor Balkish Zakaria. 2020. Environmental, social and governance disclosures on financial performance of public listed companies in Malaysia. Asian-Pacific Management Accounting Journal 15: 87–107. [Google Scholar] [CrossRef]

- Zang, Amy Y. 2012. Evidence on the trade-off between real activities manipulation and accrual-based earnings management. The Accounting Review 87: 675–703. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).