Abstract

Foreign direct investment (FDI) is a key driver of economic development of both developed and developing countries. Understanding and having insights into the factors that motivate increased FDI arevery important for both academics and policy makers. A key factor that multinationals incorporate in their decisions on FDI is geopolitical risk (GPR). Therefore, this study is devotedto investigating the short-term and long-term effects of GPR on FDI in Vietnam. Data used in this study are the yearly geopolitical risk index, FDI, and other control variables covering the period from 1986 to 2021. Using the autoregressive distributed lag (ARDL) bounds testing approach, the empirical results confirm that geopolitical risk (GPR) has a significantly negative effect on FDI in Vietnam in the longterm. Specifically, in the longterm, 1 percent increase in the GPR index is associated with 5.7983 percent decrease in Vietnam’s FDI. In addition, the results derived from the ARDL model indicate that in the shortterm, GPR has a significantly positive effect on the FDI for the one-year lag, meaning that an increase in the GPR index leads to an increase in FDI. Moreover, the results derived from the error correction model (ECM) indicate that 42.89% of the disequilibria from the previous year are converged and corrected back to the long-run equilibrium in the current year. Based on the findings, some policy implications are drawn for policymakers to mitigate the negative effects of GPR on FDI.

JEL Classification:

F21; F51

1. Introduction

Globally, most all countries want to grow and prosper economically. Foreign direct investment (FDI) into a country and especially a developing country is a key driver of itseconomic prosperity. Understanding and having insights into the factors that motivate increased FDI area critical vein of research which sheds light on those actions a country can take to promote the most beneficial FDI for its economy. Multi-national corporations (MNCs) look for those characteristics within a country that will give them the greatest chance of success. But just as importantly, they look at the risks that can undermine their success. Some variables serve to enhance FDI while other variables negatively impact FDI. Countries wanting to increase FDI should promote those areas that increase beneficial FDI while avoiding those issues that inhibit FDI. These factors include everything from geopolitical risk (GPR) to economic, financial, and technological development.

A key factor multinationals incorporate in their decisions on FDI to countries like Vietnam is the GPR of a particular country or region. Research indicates that GPR’s impact is moresignificant for emerging market economies than for developed economies. The question of interest is in what ways and under what conditions GPR most impacts FDI both positively and negatively, and alsowhich components of GPR are most influential on FDI. There are a number of factors that MNCs look at to evaluate these risks. The International Country Risk Guide Index identifies 12 components of GPR including government stability, socio-economic pressure, investment profile, internal conflict, external conflict, corruption, military influence, religious tensions, law and order, ethnic tension, democratic accountability, and, lastly, bureaucracy quality.

Vietnam is an economy on the verge of moving from a frontier market to an emerging market via its transition from a central planning to a market-based economy with a wealth of economic opportunities. Vietnam’s economy has been significantly integrated in the world economy since Doi Moi (Truong and Vo 2023). In addition, foreign direct investment (FDI) inflows to Vietnam have continuously increased during the pastfew decades. Specifically, the statistics of the World Bank show that Vietnam’s FDI inflows increased by nearly 400 times its 1986 value of USD 40 million to USD 15,660 million in 2021.

Many things are driving thisdevelopment success. Vietnam stands to be a big winner from Western economies looking to disentangle their supply chain exposure to China. First and foremost, MNCs headquartered in the West are looking for countries with a qualified and low-cost labor pool and the infrastructure in place to sustain the MNCs’ supply chain needs. However, equallyimportant is the political and legal environment of the country. These risks can easily derail MNCs’ plans and cost significant resources. Although the effects of GPR on FDI inflows have been extensively studied in many countries, to our knowledge, no study has investigated the effects of GPR on Vietnam’s FDI inflows. Therefore, this study is devoted to exploring the effects of GPR on FDI inflows to Vietnam, a transition economy.

The contributions of this study to the literature are as follows. First, this study enriches our knowledge on the effects of GPR on FDI inflows in a transition economy. Vietnam provides fertile ground for a unique investigation of the effects of GPR on FDI inflows due to the fact that Vietnam’s economy has been in the transitional period with a deep and wide integration in the world economy. In addition, Vietnam has adopted the socialist-oriented market economy that is a unique model with its own characteristics in institutions and policies. By pursuing this model, Vietnam has remarkably achieved macro-economic performances in recent decades. Second, by using the ARDL (autoregressive distributed lag) bounds test approach, the short-term and long-term effects of GPR on the FDI are estimated. It is noted that the ARDL approach is proved to have some advantages in comparison with other co-integration techniques. Third, this study employs a comprehensive dataset covering the period from 1986 through to 2021 that allows for an in-depth analysis of both short-term and long-term effects of GPR on FDI.

The findings derived from the ARDL approach indicate that GPR has a significantlynegative effect on Vietnam’s FDI inflows in the long-term. Interestingly, the ARDL model reveals a positive effect of GPR on FDI in the short-term, indicating possible opportunistic FDI by these MNCs during increased GPR. In addition, an analysis using an error correction model shows that nearly half of the previousyear’s disequilibria converges back in the current year to the long-term equilibria level. Based on the findings, some policy implications are drawn for policymakers in transitional countries, like Vietnam, to mitigate the negative impact of GPR on FDI.

2. Literature Review

The effects of GPR on FDI havebeen widely investigated and documented in the literature in recent decades. There is a broad array of research examining GPR’s influence on FDI for many other countries and regions. Past research has documented that geopolitical risk (GPR) significantly affects FDI. The literature takes a number of different approaches to identify factors that either enhance or diminish the influence of GPR on FDI. Earlier research in this field focuses mainly on the impact of political and economic risks on FDI. Ramcharran (1999) investigates the effects of political and economic risks on FDI for 26 countries over the period 1992–1994. Using Euromoney’s Country Risk Data indexes as indicators of political and economic risks, the author finds a significant negative impact on FDI from increased political and economic risks. Subsequently, Mudambi and Navarra (2003) take a different approach by examining the effect of political traditions within a single country, Italy, to identify multinational FDI locational choices within this particular country. The authors contend that regional political traditions vary substantially across regions within Italy. Using a two-step econometric model, they examine the impact of local government’s political orientation on FDI within each region across Italy. Interestingly, the authors find that a transition within the local government towards a center-right political orientation positively impacts regional FDI, while the opposite is true for a change to a center-left political orientation which has a negative influence on regional FDI. The move to a far-left political orientation within a region is mostly associated with a negative change in FDI. Subsequently, Hayakawa et al. (2013) examine the impact of both financial and political risks on FDI inflows for 89 countries over the period 1985–2007. The authors use both the level of these risks and their change over time. Interestingly, the authors find that only political risk and not financial risk adversely affects FDI. For developing countries in the sample, internal conflict, corruption, military influence on politics, and bureaucratic quality were negatively related to FDI. Conversely, the authors not only find that lower financial risk levels do not increase FDI, but that for developing countries, greater financial risk may actually increase FDI. The authors contend that these results are indications of a merger and acquisition fire sale phenomenon surrounding different financial crises. If this is the case, the authors posit that financial risk may have a differing impact on green field FDI versus M&A-motivated FDI. Moreover, in a study that includes 91 countries over the period 2002–2012, Erkekoglu and Kilicarslan (2016) use panel data analysis to examine the influence on FDI of various factors including political risks. The authors identify six political risk variables which are freedom of expression and transparency, political stability and absence of violence, management effectiveness, regulatory quality, rule of law, and prevention of corruption. They also use fivecontrol variables that are FDI, consumer price inflation, GDP, exportation of goods and services, and population size. To control for interdivisional correlation, autocorrelation, and heteroscedasticity, the authors use a Driscoll–Kraay fixed-effects model. The findings indicate that FDI is positively associated with the exportation of goods and services, population, and logarithms of GDP. However, political stability and the absence of violence along with administration efficacy negatively impact FDI. Also employing panel data, Weiling and Martek (2021) use 74 developing countries for the period 2008–2017 to delve into the influence of certain political risks on sustainable development and access to clean energy by looking at FDI related to energy investment. The authors find that the risk of investment profile, law and order, religious tensions, and corruption have a significant negative impact on foreign energy investments. But, these factors’ influence can be reduced by gross domestic product, economic freedom, and host country energy demand. The authors go on to use clustering techniques to Identify commonality within sub-groups of the 74 countries, finding that developing countries will share similar political risk and macro-environmental profiles with some countries but not others. They find five clusters ranging in size from 7 to 25 countries in each similar grouping. Haiti and Iraq were outliers not paired with any cluster.

Following up on the impact of political elections, Julio and Yook (2016) identify national elections as times of political uncertainty and examine US multinational FDI across 43 countries surrounding these elections. The authors find that US multinational FDI drops by 13% on average for the time period just preceding a national election. The more competitive the election, the greater the impact on FDI. They also report that the drop in foreign FDI significantly exceeds any drop in domestic investment over the same period. Once the election is over, FDI then increases as greater political certainty returns. Though greater for emerging markets, the results were also robust for developed countries, indicating that political uncertainty universally affects a country’s FDI. Countries identified as having higher quality legal and political institutional quality have significantly less FDI variation surrounding elections. In another analysis, DesBordes (2010) delves into whether multinationals consider both global and diplomatic risk when considering FDI. The author contends that these risks are different in that diplomatic risk is country-specific based on governmental relations. However, GPR is the same for all multinationals regardless of location. Using modeling from bilateral FDI panel data with included dyadic effects, the authorfinds that both global and diplomatic political risks negatively impact FDI by US multinationals who demand higher returns when faced with these risks. Similar to GPR, a one-standard-deviation rise in diplomatic risk increases the required return by approximately 0.80%. Also employing a dyadic approach for the period 1980–2000, using a GMM estimator to a gravity model of FDI for 58 countries with 1117 dyads, Li and Vashchilko (2010) examine the impact of military conflicts as a source of political risk and uncertainty on bilateral capital flows. The authors find that for the 18 countries with a per capita real income above USD 12,000, conflicts do not significantly impact capital flows. They also report that security alliances increase cross-border capital flows, with defense pacts having the greatest influence.

From a different perspective, several empirical studies investigate the effects of GPR indexes on FDI. Busse and Hefeker (2007) look at the impact of GPR on FDI across 83 developing countries for the period 1984–2003 using the 12 components of political risk tracked by the Political Risk Services (PRS) group reported in their International Country Risk Guide. These 12 components of political risk includegovernment stability, socio-economic pressure, investment profile, internal conflict, external conflict, corruption, military influence, religious tensions, law and order, ethnic tension, democratic accountability, and, lastly, bureaucracy quality. Using an Arellano–Bond GMM dynamic estimator to control for autocorrelation and endogeneity for the time-series analysis, the authors find that government stability, internal and external conflicts, law and order, ethnic tensions, and bureaucratic quality are highly significant determinants of FDI, while a significant but weaker relationship is found between FDI, corruption, and democratic accountability. Similarly, Al-Khouri and Khalik (2013) examine the impact of political risk on FDI over the period from 1984 to 2011 for the MENA region which consists of the Middle East and North Africa by using the 12 components of political risk tracked by the Political Risk Services (PRS) group. They find that market size and, in some cases, political risk are positively related to the change in FDI. Corruption and external conflict are most correlated with FDI flows for the 12 political risk components. Results show that market size and growth, agglomeration, and openness are all positively related to FDI. The authors further find that bureaucracy and ethnic tension negatively affect FDI. Counterintuitively, the authors report that countries with higher corruption, less democracy, and high internal conflicts are more able to attract FDI. Similar to Al-Khouri and Khalik (2013) and Busse and Hefeker (2007), Rafat and Farahani (2019) also use the 12 political risk indexesfrom the International Country Risk Guide to study the link between GPR and FDI in Iran over the period 1985–2016. They use a two-stage least squares model and find that of the 12 political risk indexes, external conflict, ethnic tensions, socioeconomic condition, investment profile, and military and religious tensions have a highly significant influence on multinational FDI for Iran. Using a generalized linear model, Fania et al. (2020) examines the influence of GPR on FDI for 16 West African countries. Like previous research, the authors report that the influence of GPR on FDI varies significantly across GPR’s sub-components. Taking a different approach from the research using GPR indexes, Jensen (2008) contends that these indexes only indirectly measure the relation between political risk and political institutions. To get a more direct measure, the author uses the political risk insurance agency premiums that multinationals are charged to cover government expropriations and contract disputes. Using this unique metric, the author reports that democratic governments reduce FDI risk for multinationals primarily by placing greater constraints on the executive leaders of the countries. To better explore the relationship between democracies and lower political risk, the author goes on to collect qualitative data from 28 investors, political risk insurers, plant location consultants, and multinational international lawyers. Overall, the author finds that the possibility of expropriation and other executive policy changes is significantly increased in countries with few constraints on the leader such as Russia, Bolivia, and Venezuela.

More recently, some studies measure the effects of GPR by using the GPR index created by Caldara and Iacoviello (2022) on FDI. Using a pseudo Poisson maximum likelihood estimation for a gravity trade model, Thakkar and Ayub (2022) examine the influence of GPR on bilateral FDI data for 2001–2012 and trade data for 1948–2019. The authors find that their univariate model indicates that for a 10% increase in GPR, there is a significant drop of 3.6% for FDI and a drop of 0.5% for trade. However, for their multivariate model, the results indicate a small increase in trade of 0.04%. Some other recent research includes Nguyen et al. (2022), who examine the influence of GPR on FDI inflows and total factor productivity for 18 emerging market countries over the period 1985–2019. The authors use Granger causality panel data tests along with seemingly unrelated regression models to find that GPR has a significant negative impact on technological progress and FDI. They also find that technological progress and FDI act to mitigate GPR. Furthering the literature on technologies’ impact on FDI, using multiple databases, Bussy and Zheng (2023) conclude that greater geopolitical risk and uncertainty also negatively impact FDI. The authors report that good governance shields FDI from GPR. In addition, rather than managingGPR, multinationals with closer geographic, cultural, and commercial relationships often delay FDI at rising GPR. On the technology front, they find that FDI for R&D industries has greater resilience to GPR, hypothesizing that technology is more readily transferred outside the country. Following up, the influence of geopolitical risks on FDI for Turkey over the period 1985–2020 was examined by Altıner and Bozkurt (2023). Using an ARDL bounds test approach, where FDI is the dependent variable and geopolitical risk, growth, globalization, and inflation are the explanatory variables, the authors find (as hypothesized) that an increase in geopolitical risk negatively impacts FDI. For the control variables, inflation negatively affectsFDI while higher economic growth and globalization motivate FDI. Moreover, Yu and Wang (2023) also employ a cluster fixed-effects model on a sample of 41 countries over the period 2003–2020 to examine the influence on FDI of GPR obtained from the GPR index created by Caldara and Iacoviello (2022). The authors identify three possibly mitigating motives for FDI that serve to limit GPR. These three control variables are market seeking, natural resource seeking, and strategic resource seeking motives. Overall, they find that GPR significantly reduces FDI which spills over to impact the domestic economy. In addition, they find that all control variables are significant drivers of FDI. In addition, the authors find that these results are robust for sub-sample data. They then use as the core explanatory variable an interaction between GPR and trade dependency, finding that the trade dependency of a country mitigates the negative influence of GPR on FDI.The authors go on tofind that GPR has a significant impact on FDI for emerging economies but not developed economies.

Overall, research provides some interesting and generally consistent insights into thefactors most likely to positively and negatively impact FDI. Political, economic, and financial factors all have varying positive and negative influences on FDI depending on the country, and asour analysis shows, differ for the shortterm versus the longterm. For example, greater financial risk is generally shown to enhance FDI while most political risks negatively impact FDI. Also, in more developed economies, these variables are muted, while their effectsare much more pronounced in emerging market economies thatcan be far more dependent on FDI. Domestic politics is also shown to influence GPR. Voting that moves a region tothe political left wing direction can have a significant negative impact on FDI. Similarly, concentratingtoo much power in the executive leader position also negatively influences FDI while democracy and a more balanced political power dynamic generally lead to greater FDI. However, counterintuitively, factors such as higher corruption levels and financial risk can motivate higher FDI in some cases. Although the effects of GPR on FDI inflows have been widely studied in many countries, to our knowledge, there are no studies that specifically examine the impact of GPR on FDI for Vietnam. Therefore, this study adds to theliterature by using the ARDL model to investigate the effects of GPR on Vietnam’s FDI inflows.

3. Data Sources and Research Methodology

3.1. Data Sources

The data employed in this study are the yearly series of geopolitical risk (GPR) index, FDI, trade openness (TO), and GDP growth of Vietnam, covering the period from 1986 to 2021. This period is selected for this study because Vietnam began a program of comprehensive economic reforms (Doi Moi) in 1986, which marked the opening of its economy (the end of a central planning period of the economy). It is important to note that this study employs the geopolitical risk index that was developed by Caldara and Iacoviello (2022). Thisindex is calculated based on selected words relatedto geopolitical risk, which are commonly used by journalists when reporting on geopolitical events and threats (Micallef et al. 2023). The GPR index was normalized to 100 from the points on the base year 2000. Specifically, the data sources are presented in Table 1.

Table 1.

Data sources.

3.2. Research Methodology

To investigate the effects of geopolitical risk on FDI flows to Vietnam, the following regression model wasused in this study:

where

- LNFDI: Natural logarithm of FDI (USD) in Vietnam.

- LNGPR: Natural logarithm of GPR Index (point).

- TO: Trade openness. The trade openness is computed usingthe following equation:

- EX: Total export value (USD) of Vietnam.

- IM: Total import value (USD) of Vietnam.

- GDP: Gross domestic product (USD) of Vietnam.

- GDPG (%): Gross domestic product growth rate of Vietnam.

To investigate the short-run and long-run effects of GPR on FDI in Vietnam, this study employs an autoregressive distributed lag (ARDL) model which was developed by Pesaran et al. (2001). The ARDL model has some advantages compared to other co-integration methods. The prominent advantage of this model over other alternative co-integration methods is that an error correction model (ECM) can be estimated from the ARDL model, and hence the short-run and the long-run effects of explanatory variables on the dependent variable can be simultaneously computed. In addition, this approach does not require that all variables in the model havethe same integration order. Instead, it only requires that all variables are integrated to the order of purely zero, purely one, or a combination of both. Moreover, the ARDL approach is relatively more robust and reliable than other approaches in the case of small observations like this study. However, this approach has several disadvantages. First, this approach is based on the assumption that the relationship between the dependent variable and independent variables is symmetric (linear), meaning that a decrease and an increase in independent variables has the same effect on the dependent variable with the same magnitude. Second, this technique cannot be applied to the model that requiresone of the variables to be integrated to the order 2 or I(2).

3.2.1. Unit Root Test

As mentioned above, the ARDL bounds test requires that all variables are integrated to the order ofpurely zero [I(0)], purely one [I(1)], or a combination of both. Therefore, before performing the bounds test, the order of integration of all variables should be examinedby using unit root tests. This study employs the ADF (augmented Dickey–Fuller) and Phillips–Perron tests to examine whether the studied variables are stationary or not.

3.2.2. ARDL Bounds Test for Co-Integration

Before estimating the short-run and long-run effects of GPR on Vietnam’s FDI, co-integration tests should be performed as a required condition. In order to examine the co-integration between variables, this study employs the bounds test. The bounds test of co-integration is estimated usingthe following equation:

where represents the first difference of the variables. The null hypothesis (H0) of the bounds test is (no co-integration in the long-run between variables). If the F-statistic calculated from the bounds test is greater than the critical value of the selected significance level, the null hypothesis is rejected. Thismeans that there is a long-term relationship (co-integration) between the variables in the model. If the long-run equilibrium relationship is confirmed, the short-run and long-run effects of the GPR on the FDI are estimated using Equations (4) and (5), respectively.

4. Empirical Results

4.1. Vietnam’s FDI Inflows and the GPR for the Period 1986–2021

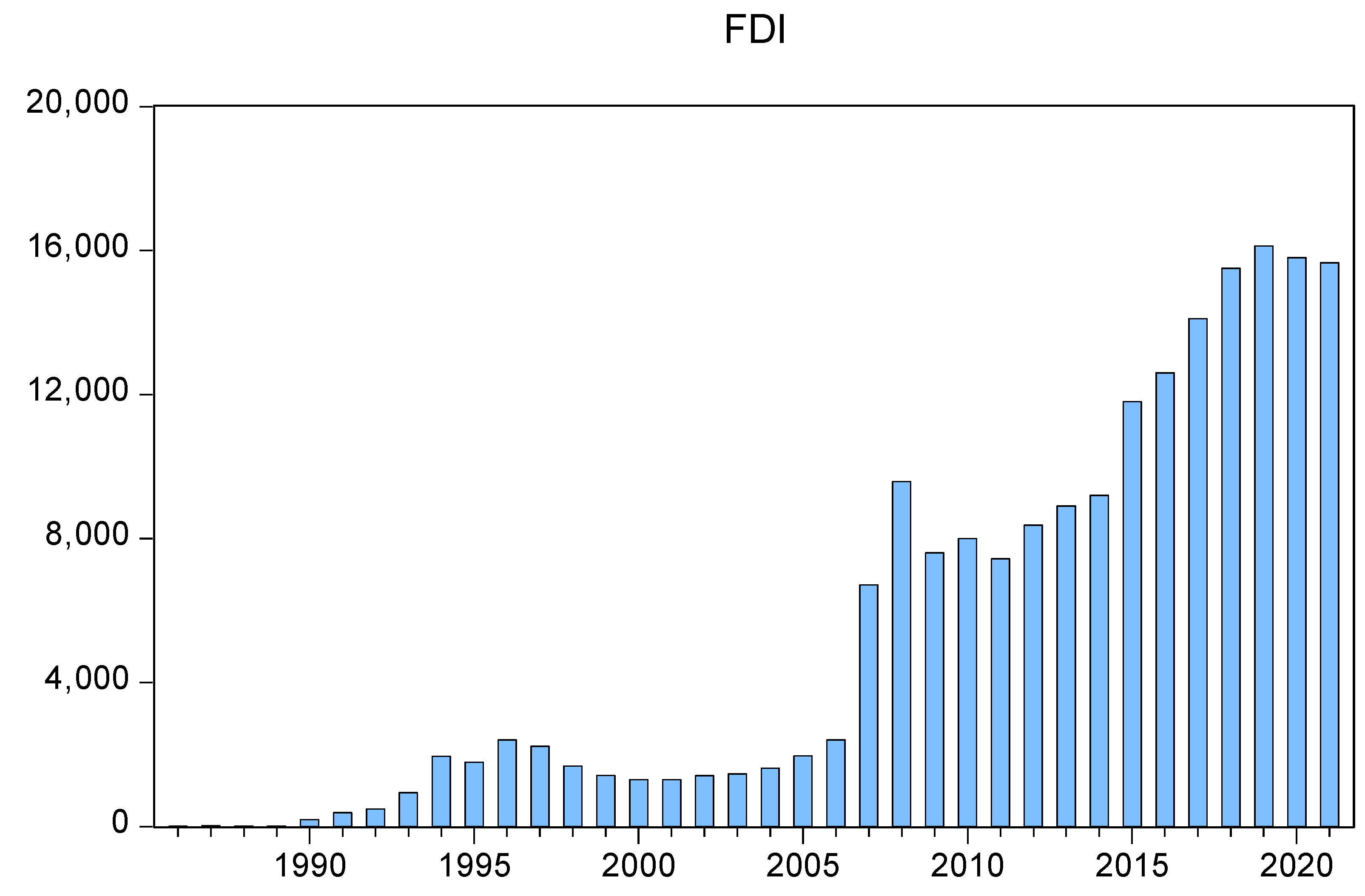

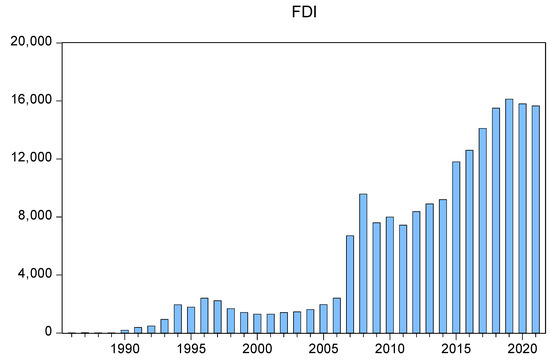

On the basis of the collected data, the descriptive statistics of the Vietnam’s FDI inflowsand GPR for the period from 1986 to 2021 are computed and summarized in Table 2. It is shown that over the same period, Vietnam’s average FDI inflows was USD 5338 million. In addition, Table 2 indicates that Vietnam’s FDI fluctuated highly during the sample period, ranging from USD 0.04 million to USD 16,120 million, with astandard deviation of 5494.76. Moreover, Figure 1 illustrates that Vietnam’s FDI inflows during the period from 1986 to 2006 is rather small comparedwith the period 2007–2021. Specifically, the EDI inflowwasonly 0.04 million USD in 1986. Vietnam’s FDI inflows gradually improved since the lifting of US trade embargo against Vietnam in 1994. In particular, Vietnam’s FDI inflows significantly increased after Vietnam joined the World Trade Organization (WTO) in 2007. In fact, Figure 1 shows that Vietnam’s FDI inflows increased from USD 6700 million in 2007to USD 16.120 million in 2019. However, Vietnam’s FDI inflows slightly decreased during the period 2020–2021 due to the COVID-19 pandemic.

Table 2.

Summary statistics of Vietnam’s FDI and GPR (1986–2021).

Figure 1.

Vietnam’s FDI inflows during the period 1986–2021.

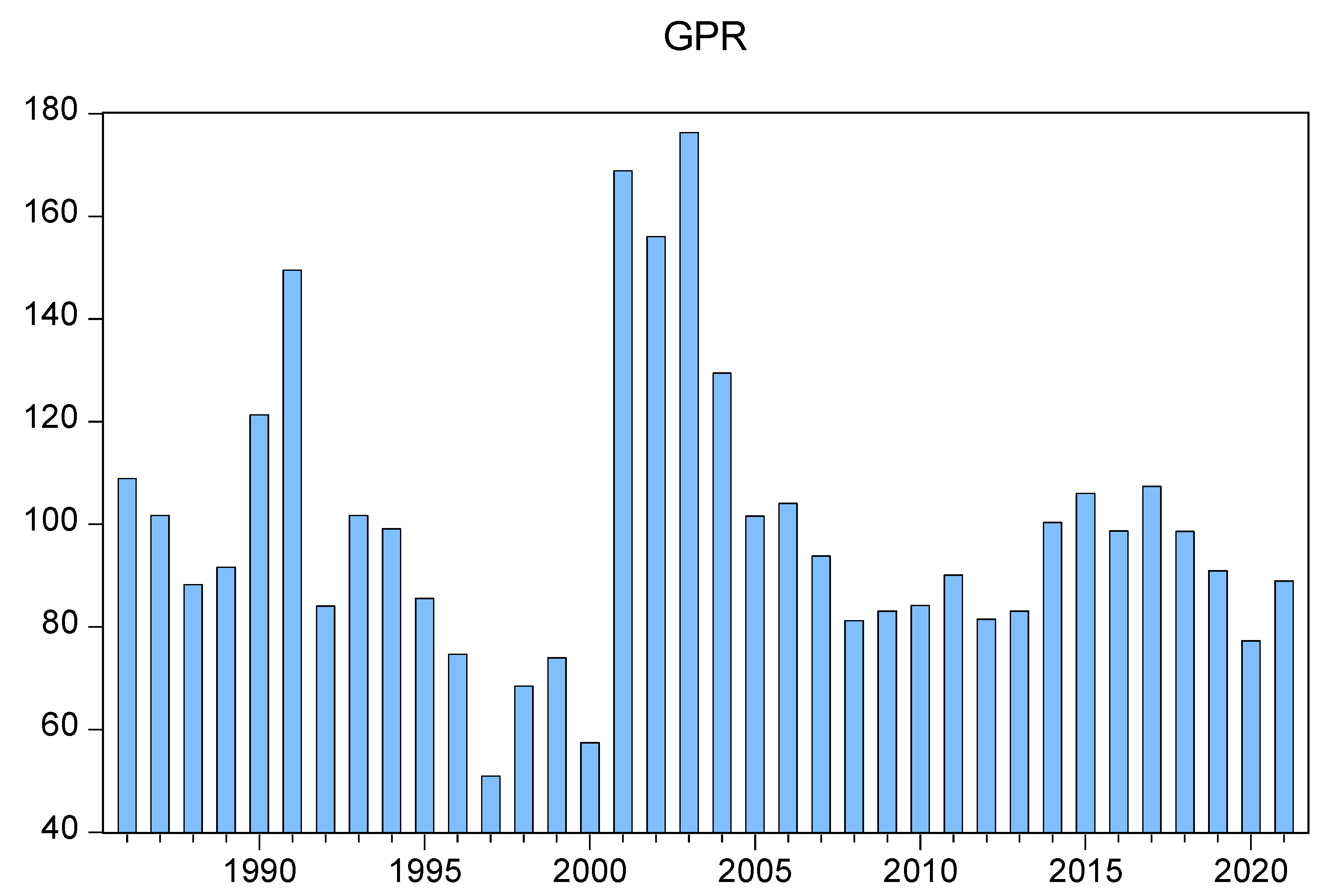

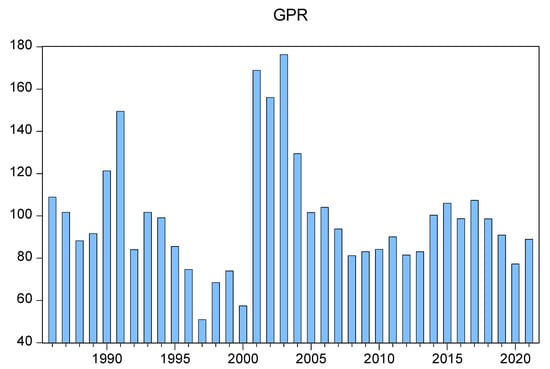

In addition, Table 2 indicates that the GPR index mean for the period from 1986 to 2021 is 98.83 points, ranging from 50.91 points to 176.30 points. Specifically, Figure 2 shows that the GPR index fluctuated highly during the period from 2000 to 2005. It is important to note that there were some big political events that took placeduring this period, such as the suicide attacks in the US on 11 September 2001, the Afghanistan War starting on 7 October 2001, and the Iraq War beginning in April 2003. The GPR index reached the highest score in 2003 (176.30 points). The GPR index was rather stable during the period from 2006 to 2021 comparedto the previous period.

Figure 2.

The GPR Index for the period 1986–2021.

4.2. Unit Root Tests

As mentioned above, this study employs the ADF and Phillips–Perron tests to check whether the variables used in the model are stationary as a required condition of the ARDL bounds test. The tests are performed for both cases of constant only and constant with time trend. The results of the tests are summarized in Table 3. The results derived from the ADF and Phillips–Perron tests consistently confirm that the null hypothesis of a unit root is statistically rejected for LNFDI and LNGPR at the level. In other word, the LNFDI and LNGPR variables are integrated to the order zero denoted as I(0). In addition, the results of the ADF and Phillips–Perron tests consistently indicate that the TO series is non-stationary at the conventional significant level of 5 percent. However, when the first differences are applied, the null hypothesis of a unit root is significantly rejected at the one percent level for the series, indicating that it is stationary. It means that TO series is integrated of order 1 or I(1). Moreover, the results of the ADF test reveal that the GDPR series is I(0) while the results of the Phillips–Perron test indicate that this series is I(1). With the evidence, it is concluded that all variables in the model fulfil the requirements of the ARDL bounds test.

Table 3.

Results of ADF unit root tests.

4.3. ARDL Bounds Test for Co-Integration

As mentioned above, this study employs the bounds test proposed by Pesaran et al. (2001) to determine the long-run relationship among variables in the model. Based on the Akaike Information Criterion, the best model used for the bounds test is ARDL (4,2,4,4). The results of the bounds represented in Table 4 indicate that the null hypothesis of no co-integration among variables is rejected at the significant level of 1 percent. Thismeans that there is a long-run equilibrium relationship between LNFDI and the regressors. Therefore, it is concluded that the ARDL model can be used to estimate the short-term and long-term effects of GPR on FDI.

Table 4.

Results of the bounds test.

4.4. Short-Term and Long-Term Effects of the GPR on Vietnam’s FDI

The short-term and long-term effects of GPR and other independent variables on Vietnam’s FDI derived from the ARDL model are presented in Table 5 and Table 6, respectively. In the short-term, the GPR index has a significantly positive effect on FDI at the one percent level for the one-year lag. This finding implies that in the short-term an increase in the GPR index leads to an increase in FDI for the one-year lag. In addition, the results reported in Table 5 indicate that TO has a significantly negative effect on the FDI at the five percent level for the three-year lag. Moreover, Table 5 reveals that in the short-term, GDP growth (GDPR) is positively associated with FDI for the three-year lag. This relationship is statistically significant at the one percent level. The implication of this evidence is that in the short-term, an increase in GDPR results in an increase in FDI for the three-year lag. Furthermore, the coefficient of error correction for the model is −0.4289 and significant at the one percent level, indicating that 42.89 percent of the disequilibria from the previous year is converged and corrected back to the long-run equilibrium in the current year.

Table 5.

The estimated short-term coefficients.

Table 6.

The estimated long-term coefficients.

In addition to estimating the short-term effect, the ARDL approach also allows for the estimation of the long-term effect of GPR on FDI. The results of the long-term of GPR on FDI are summarized in Table 6. It is observed that in the longterm, GPR has a significantly negative effect on FDI at the one percent level. Specifically, in the longterm, a one percent increase in the GPR index is associated with 5.7983 percent decrease in Vietnam’s FDI. In addition, the results presented in Table 6 show a significantly positive effect of TO on Vietnam’s FDI at the one percent level. However, in the longrun, GDPG has no significant effects on FDI.

4.5. Diagnostic Tests

To check the validity and reliability of the estimated results, the Breusch–Godfrey test for serial correlation, the ARCH test for heteroscedasticity, and the Jarque–Bera test for the normal distribution of residuals are used in this study. The results derived from these tests are presented in Table 7. Specifically, the results of the Breusch–Godfrey test confirm that that the null hypothesis of no serial correlation in the model cannot be rejected at the significance level of 5%. Therefore, it is concluded that serial correlation does not exist among the residuals. In addition, the results derived from the ARCH test confirm that the residuals are characterized by homoscedasticity. Moreover, the results of the Jarque–Bera test indicate that the null hypothesis of residuals having normal distribution cannot be rejected at the conventional significant level of fivepercent. Thismeans that the residuals of the model follow a normal distribution. These diagnostic tests ensure the reliability and validity of the estimated results.

Table 7.

Results of autocorrelation, ARCH, and normality tests.

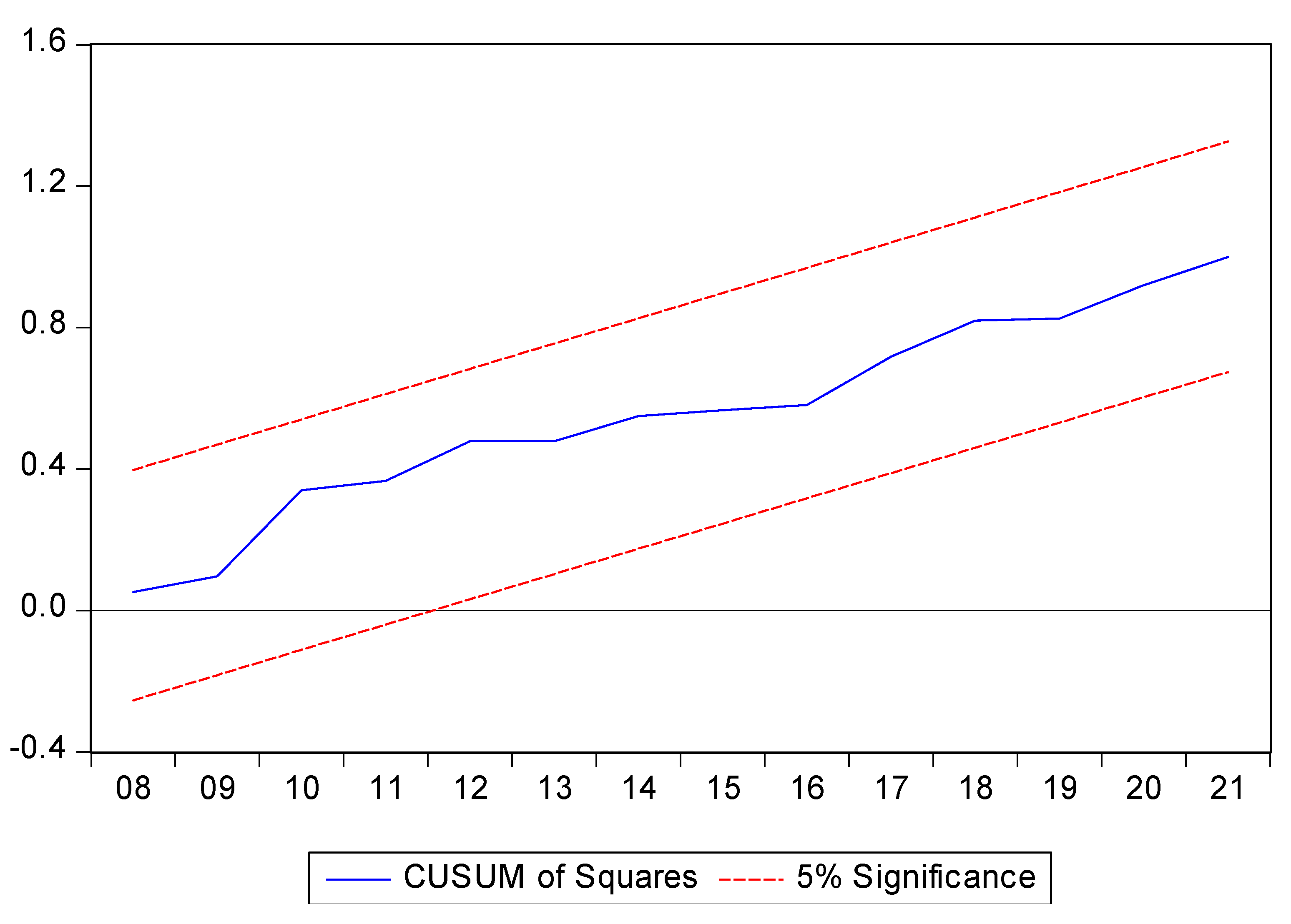

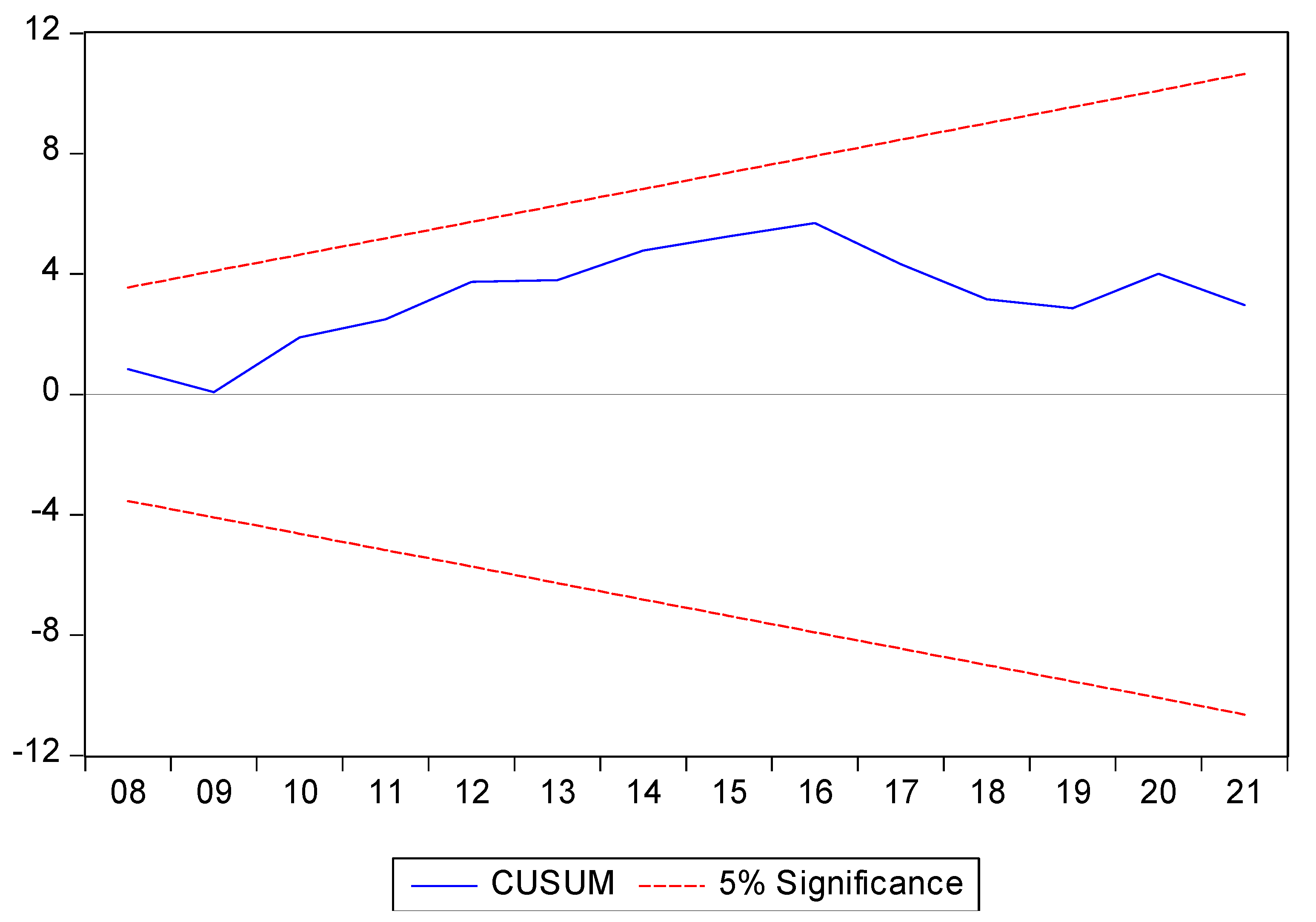

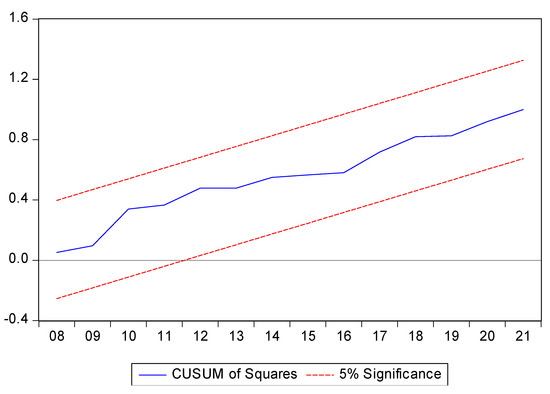

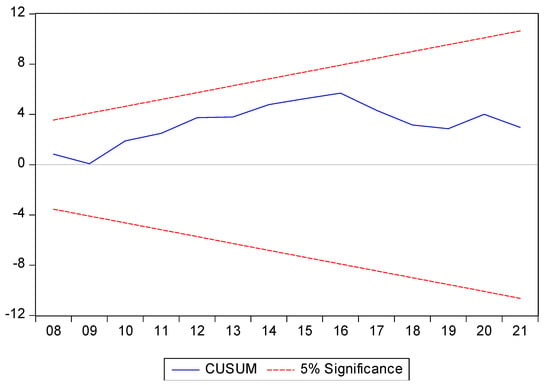

4.6. Structural Stability Tests

It is important to stress that the ARDL model is sensitive to structural breaks and the variables used in this study are also sensitive to global events. To examine the long-term stability of the coefficients in the model, this study employs the cumulative sum of the recursive residuals (CUSUM) and the cumulative sum of squared recursive residuals (CUSUMSQ) tests proposed by Brown et al. (1975). It is observed in Figure 3 that the plots of CUSUM lie inside the critical bounds at the five percent level of significance. In addition, Figure 4 shows that the plots of CUSUMSQ are almost within the critical bounds at the significance level of 5%. Therefore, it can be concluded that the model used in the study is stable over the sample period.

Figure 3.

Plots of cumulative sum of recursive residuals.

Figure 4.

Plots of cumulative sum of squares of recursive residuals.

5. Discussion of the Results

The main finding of the study is that in the longterm, GPR has a significantly negative effect on FDI. In other words, increasing GPR deters FDI inflows. This evidence is consistent with the previous empirical findings of Ramcharran (1999), DesBordes (2010), Hayakawa et al. (2013), Weiling and Martek (2021), Nguyen et al. (2022), Thakkar and Ayub (2022), Bussy and Zheng (2023), and Yu and Wang (2023). The implication of this finding is that in the context of transition economies, GPR could result in potential economic costs for MNCs. Therefore, MNCs postpone outward foreign direct investment if their perception of GPR is high. In addition, the results reveal that trade openness has a significantly positive effect on FDI in both the longterm and shortterm. This finding implies that trade openness plays an important role in attracting FDI inflows. Specifically, an improvement in trade openness is associated with an increase in FDI in both the longterm and shortterm. Finally, the results of the error correction model indicate that nearly half of the previousyear’s disequilibria converges back in the current year to the long-term equilibria level. The adjustment speed in this case is rather slow. This finding provides an insightful understanding of the adjustment process in FDI flows, which is a valuable reference for policymakers to issue appropriate policies to mitigate the negative impact of GPR on FDI.

Based on the findings, some policy implications can be drawn for policymakers in transitional countries, like Vietnam, to mitigate the negative impact of GPR on FDI. First, governments should prioritize policies that promote political stability as a signal of macro-economic stability to foreign investors. Second, governments should strengthen political and economic cooperation with other countries, focusing on leading nations that contributed to their FDI inflows through proactive diplomatic strategies, the signing of investment agreements, and participation in free trade areas. Third, it is found from the study that TO has a significantly positive effect on the FDI. Therefore, in order to stimulate exports and sustainably improve the trade balance, amanaged floating exchange rate policy should be applied. A higher level of the country’s trade openness can attract more FDI inflows. Moreover, by adopting this regime, governments can actively adjust the exchange rate in order to control inflation and absorb most of the foreign shocks or policy changes from developed economies.

6. Conclusions

This study empirically investigates the short-term and long-term effects of GPR on Vietnam’s FDI during the period from 1986 to 2021. The empirical findings derived from the ARDL approach confirm that GPR hasa significantly positive effect on FDI in the shortterm for the one-year lag. However, in the longterm, GPR has a significantly negative effect on FDI. In other words, an increase in the GPR index is associated with a decrease in Vietnam’s FDI inflows. In addition, the results reveal that trade openness (TO) has a significantly positive effect on FDI in both the longterm and shortterm. Moreover, the findings of the ARDL test indicate that in the shortterm, GDP growth (GDPR) is positively associated with FDI for the three-year lag, but it has no impact on FDI in the longterm. Finally, the results of the error correction model show that 42.89% of the disequilibria from the previous year are converged and corrected back to the long-run equilibrium in the current year.

Although this study has enriched our understanding of the effects of GPR on FDI in a transition economy, it still has limitations that should be addressed in future empirical studies. First, in this study, we investigate the effects of GPR on FDI inflows without considering the moderating effects of trade openness and economic growth variables on the association between GPR and FDI inflows. Therefore, future research could focus on the moderating effects of these variables when measuring the impact of GPR on FDI inflows. Second, due to limitations inthe data, Thisstudy could omit some determinants of the FDI, such as financial development and public governance. With this limitation, future research could investigate the effects of these factors on FDI inflows and theirmoderating effects on the relationship between GPR and FDI inflows. The third limitation of thisstudy could be the assumption that GPR has symmetric effects on FDI whereasthese effects could be asymmetric. Therefore, the symmetric effects of GPR on FDI inflows could be an interesting topic that awaits further research.

Author Contributions

Conceptualization, L.D.T. and H.S.F.; methodology L.D.T.; software, T.D.P.; formal analysis, L.D.T.; resources, T.D.P.; data curation, T.D.P.; writing—original draft preparation, L.D.T. and H.S.F.; writing—review and editing, L.D.T. and H.S.F.; project administration, L.D.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data that support the findings of this research are available from the corresponding author upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Al-Khouri, Ritab, and M. Umaima Abdul Khalik. 2013. Does political risk affect the flow of foreign direct investment into the Middle East North African region? Journal of Global Business and Technology 9: 47–59. [Google Scholar]

- Altıner, Ali, and Eda Bozkurt. 2023. Reflections of geopolitical risk on foreign direct investments: The case of Turkiye. Journal of the Human and Social Science Researches 12: 1292–309. [Google Scholar] [CrossRef]

- Brown, Robert L., James Durbin, and James M. Evans. 1975. Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society 37: 149–92. Available online: https://www.jstor.org/stable/2984889 (accessed on 30 September 2023).

- Busse, Matthias, and Carsten Hefeker. 2007. Political risk, institutions and foreign direct investment. European Journal of Political Economy 23: 397–415. [Google Scholar] [CrossRef]

- Bussy, Adrien, and Huanhuan Zheng. 2023. Responses of FDI to geopolitical risks: The role of governance, information, and technology. International Business Review 32: 102136. [Google Scholar] [CrossRef]

- Caldara, Dario, and Matteo Iacoviello. 2022. Measuring geopolitical risk. American Economic Review 112: 1194–225. [Google Scholar] [CrossRef]

- DesBordes, Rodolphe. 2010. Global and diplomatic political risks and foreign direct investment. Economics & Politics 22: 92–125. [Google Scholar] [CrossRef]

- Erkekoglu, Hatice, and Zerrin Kilicarslan. 2016. Do political risks affect the foreign direct investment inflows to host countries? Journal of Business, Economics and Finance 5: 218–32. [Google Scholar] [CrossRef]

- Fania, Nyande, Chen Yan, Joseph Bikanyi Kuyon, and Sow Djeri. 2020. Geopolitical risks (GPRs) and foreign direct investments: A business risk approach. Global Journal of Management and Business Research: B Economics and Commerce 20: 1–9. [Google Scholar] [CrossRef]

- Hayakawa, Kazunobu, Fukunari Kimura, and Hyun-Hoon Lee. 2013. How does country risk matter for FDI? The Developing Economies 51: 60–78. [Google Scholar] [CrossRef]

- Jensen, Nathan. 2008. Political risk, democratic institutions, and foreign direct investment. The Journal of Politics 70: 1040–52. [Google Scholar] [CrossRef]

- Julio, Brandon, and Youngsuk Yook. 2016. Policy uncertainty, irreversibility, and cross-border flows of capital. Journal of International Economics 103: 13–26. [Google Scholar] [CrossRef]

- Li, Quan, and Tatiana Vashchilko. 2010. Dyadic military conflict, security alliances, and bilateral FDI flows. Journal of International Business Studies 41: 765–82. [Google Scholar] [CrossRef]

- Micallef, Joseph, Simon Grima, Jonathan Spiteri, and Ramona Rupeika-Apoga. 2023. Assessing the causality relationship between the geopolitical risk index and the agricultural commodity markets. Risks 11: 84. [Google Scholar] [CrossRef]

- Mudambi, Ram, and Pietro Navarra. 2003. Political tradition, political risk and foreign direct investment in Italy. Management International Review 43: 247–65. [Google Scholar]

- Nguyen, Trang Thi Thuy, Binh Thai Pham, and Hector Sala. 2022. Being an emerging economy: To what extent do geopolitical risks hamper and FDI inflows? Economic Analysis and Policy 74: 728–46. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Rafat, Monireh, and Maryam Farahani. 2019. The country risks and foreign direct investment (FDI). Iranian Economic Review 23: 235–60. [Google Scholar] [CrossRef]

- Ramcharran, Harri. 1999. Foreign direct investment and country risk: Further empirical evidence. Global Economic Review 28: 49–59. [Google Scholar] [CrossRef]

- Thakkar, Nachiket, and Kiran Ambreen Ayub. 2022. Geopolitical risk and globalization. Journal of Applied Business and Economics 24: 140–50. [Google Scholar]

- Truong, Dong Loc, and Dut Van Vo. 2023. The asymmetric effects of exchange rate on trade balance of Vietnam. Heliyon 9: 1–14. [Google Scholar] [CrossRef]

- Weiling, Jiang, and Igor Martek. 2021. Political risk analysis of foreign direct investment into the energy sector of developing countries. Journal of Cleaner Production 302: 127023. [Google Scholar] [CrossRef]

- Yu, Miaozhi, and Na Wang. 2023. The influence of geopolitical risk on international direct investment and its countermeasures. Sustainability 15: 2522. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).