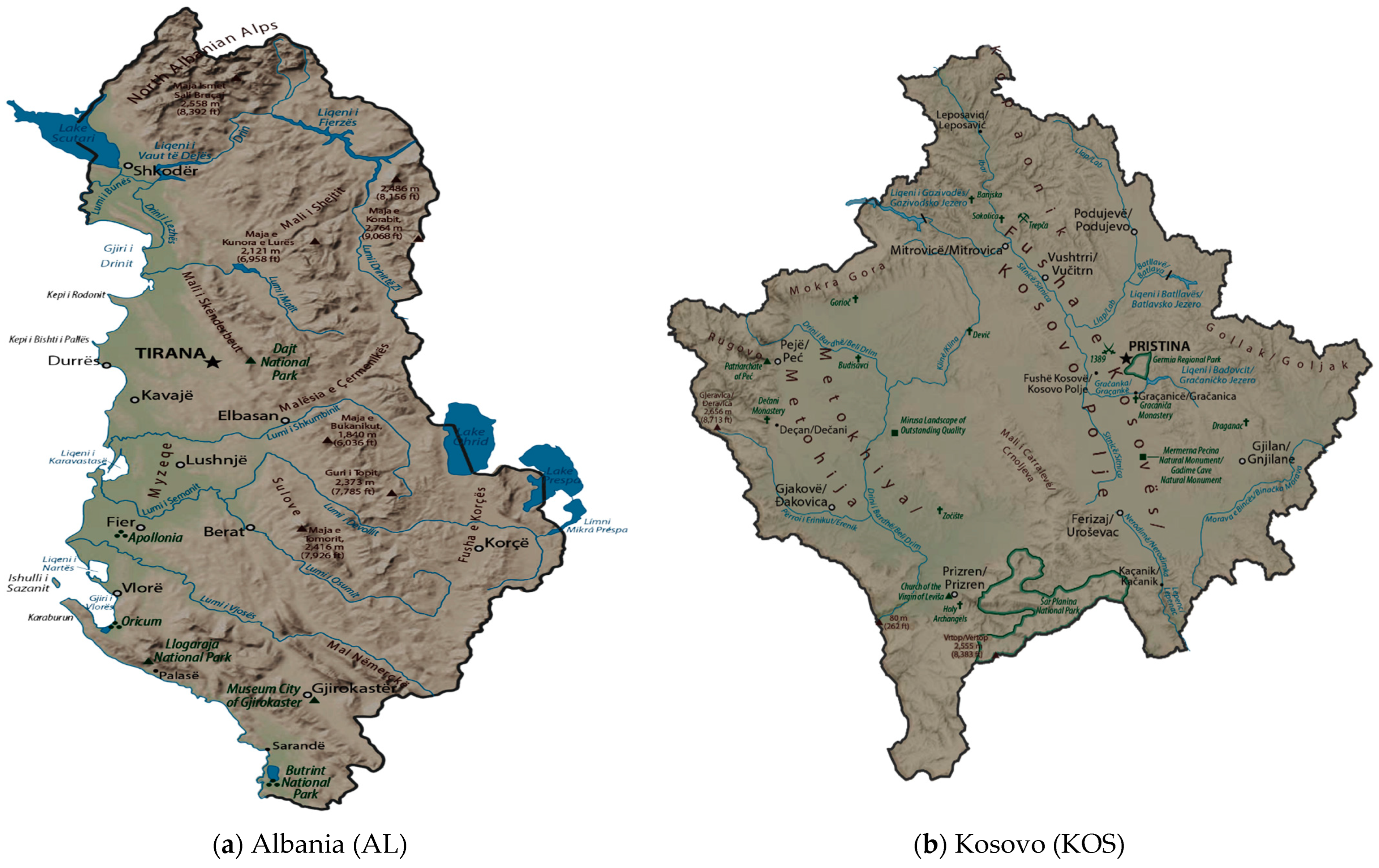

Navigating Financial Frontiers in the Tourism Economies of Kosovo and Albania during and beyond COVID-19

Abstract

1. Introduction

2. Literature Review and Developing Hypotheses

3. Materials and Methods

3.1. The Purpose of the Paper

3.2. Data Collection

3.3. Data Analysis

4. Results

- -

- Cluster analysis of navigating financial frontiers in the tourism economies of Kosovo and Albania during and beyond COVID-19

- -

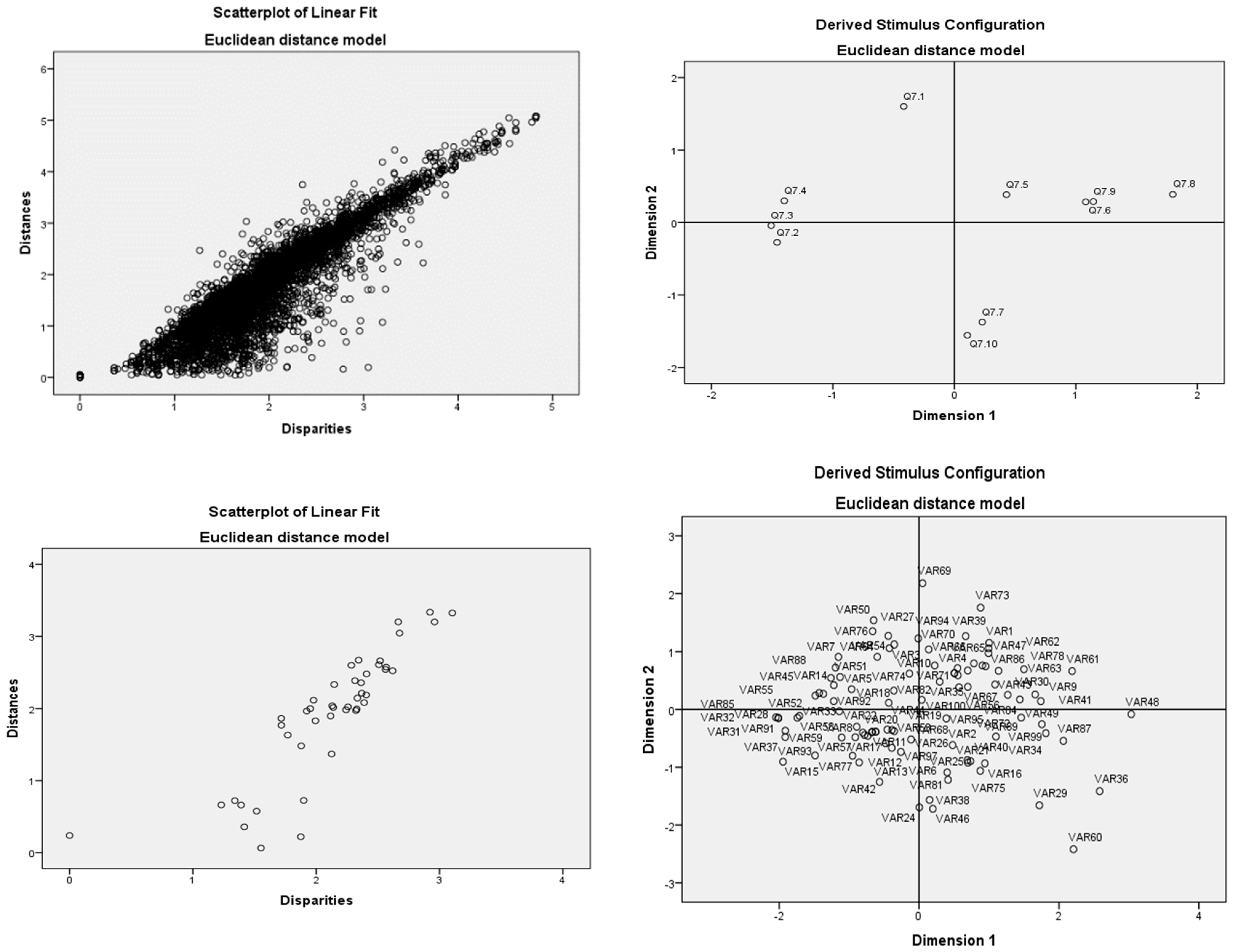

- Multidimensional measurement of navigating financial frontiers in the tourism economies of Kosovo and Albania during and beyond COVID-19

4.1. Cluster Analysis of Navigating Financial Frontiers in the Tourism Economies of Kosovo and Albania during and beyond COVID-19

4.2. Multidimensional Measurement of Navigating Financial Frontiers in the Tourism Economies of Kosovo and Albania during and beyond COVID-19

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Scales Survey

| Items | Strongly Disagree | Disagree | Neutral | Agree | Strongly Agree |

| Collection of health information by tourists (e.g., temperature control, COVID testing, etc.) | |||||

| International travel restrictions | |||||

| Restrictions on domestic and regional travel | |||||

| Mandatory quarantine for visitors | |||||

| Physical distance in travel and tourism | |||||

| Mandatory use of masks in travel and tourism | |||||

| Mandatory use of COVID-19 tracking applications | |||||

| Hygiene training for staff in travel and tourism | |||||

| Regular testing of workers’ infection in travel and tourism | |||||

| Vaccination against COVID-19 |

| Items | Strongly Disagree | Disagree | Neutral | Agree | Strongly Agree |

| Financial support and stimulus packages to shape sustainability in the tourism industry | |||||

| Changes in tourism demand and consumer behavior through innovation and accurate financial management | |||||

| The impact of control and management on the financial sustainability of the tourism industry due to financial shocks and revenue loss | |||||

| Adaptation strategies for financial resilience in the tourism industry | |||||

| Investing in sustainable tourism practices for long-term financial growth and shaping sustainability |

References

- Agrawal, Anjali, Seema N. Pandey, and Laxmi Srivastava. 2022. Pareto-Frontier Differential Evolution based Financial Approach for Multi-objective Congestion Management using Customer Participation and On-site Generation. Renewable Energy Focus 42: 253–65. [Google Scholar] [CrossRef]

- Anguera-Torrell, Oriol, Juan Pedro Aznar-Alarcón, and Jordi Vives-Perez. 2021. COVID-19: Hotel industry response to the pandemic evolution and to the public sector economic measures. Tourism Recreation Research 46: 148–57. [Google Scholar] [CrossRef]

- Ankerst, Mihael, Markus M. Breunig, Hans-Peter Kriegel, and Jörg Sander. 1999. OPTICS: Ordering points to identify the clustering structure. ACM SIGMOD Record 28: 49–60. [Google Scholar] [CrossRef]

- Ante, Lennart, and Aman Saggu. 2024. Time-Varying Bidirectional Causal Relationships between Transaction Fees and Economic Activity of Subsystems Utilizing the Ethereum Blockchain Network. Journal of Risk and Financial Management 17: 19. [Google Scholar] [CrossRef]

- Buultjens, Jeremy, I. Ratnayake, and A. C. Gnanapala. 2017. Sri Lankan tourism development and implications for resilience. Tourism and Resilience, 83–95. [Google Scholar] [CrossRef]

- Cagliesi, Gabriella, and Francesco Guidi. 2021. A three-tiered nested analytical approach to financial integration: The case of emerging and frontier equity markets. International Review of Financial Analysis 74: 101698. [Google Scholar] [CrossRef]

- Cardoso, Lucília, Arthur Filipe Araújo, Luís Lima Santos, Roland Schegg, Zélia Breda, and Carlos Costa. 2021. Country Performance Analysis of Swiss Tourism, Leisure and Hospitality Management Research. Sustainability 13: 2378. [Google Scholar] [CrossRef]

- Cardoso, Lucília, Rui Silva, Giovana Goretti Feijó de Almeida, and Luís Lima Santos. 2020. A Bibliometric Model to Analyze Country Research Performance: SciVal Topic Prominence Approach in Tourism Almeida GGFd, Leisure and Hospitality. Sustainability 12: 9897. [Google Scholar] [CrossRef]

- Dube, Kaitano, Godwell Nhamo, and David Chikodzi. 2020. COVID-19 cripples global restaurant and hospitality industry. Current Issues in Tourism 24: 1487–90. [Google Scholar] [CrossRef]

- Eurostat. 2024. Eurostat. Available online: https://ec.europa.eu/eurostat/web/main/home (accessed on 26 March 2024).

- Goodell, John W. 2020. COVID-19 and finance: Agendas for future research. Finance Research Letters 35: 101512. [Google Scholar] [CrossRef]

- Hastie, Trevor Hastie, Robert Tibshirani, and Jerome Friedman. 2009. The Elements of Statistical Learning. Data Mining, Inference, and Prediction, 2nd ed. New York: Springer. [Google Scholar] [CrossRef]

- Hsiao, Cody Yu-Ling, Tao Jin, Simon Kwok, Xi Wang, and Xin Zheng. 2023. Entrepreneurial risk shocks and financial acceleration asymmetry in a two-country DSGE model. China Economic Review 81: 102006. [Google Scholar] [CrossRef]

- Huang, Xiaodong, and Chang Lei. 2022. COVID-19 on financial growth and guidelines for green recovery in BRICS: Fresh insights from econometric analysis. Economic Change and Restructuring 56: 1243–61. [Google Scholar] [CrossRef]

- Kapecki, Tomasz. 2020. Elements of Sustainable Development in the Context of the Environmental and Financial Crisis and the COVID-19 Pandemic. Sustainability 12: 6188. [Google Scholar] [CrossRef]

- Kohler, Karsten, Bruno Bonizzi, and Annina Kaltenbrunner. 2023. Global financial uncertainty shocks and external monetary vulnerability: The role of dominance, exposure, and history. Journal of International Financial Markets, Institutions and Money 88: 101818. [Google Scholar] [CrossRef]

- Lin, Justin. Yifu, Wei Wang, and Venite Zhaoyang Xu. 2022. Distance to frontier and optimal financial structure. Structural Change and Economic Dynamics 60: 243–49. [Google Scholar] [CrossRef]

- Lloyd, Stuart P. 1982. Least Squares Quantization in PCM. IEEE Transactions on Information Theory 28: 129–37. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2021. Accounting, Reforms and Budget Responsibilities in the Financial Statements. Finance & Taxation 1: 61–69. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2022. An unstoppable and navigating journey towards development reform in complex financial-economic systems: An interval analysis of government expenses (past, present, future). Business Management and Economics Engineering 20: 329–57. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2023. A sustainable business profit through customers and its impacts on three key business domains: Technology, innovation, and service (TIS). Business, Management and Economics Engineering 21: 19–47. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, Aishwarya Gopalakrishnan, and Kafayat Kehinde Lamidi. 2024. Financing and Investing in Women-led Businesses: Understanding Strategic Profits and Entrepreneurial Expectations by Analysing the Factors that Determine Their Company Succes. Periodica Polytechnica Social and Management Sciences. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Blerta Dragusha. 2022. Incomes, Gaps and Well-Being: An Exploration of Direct Tax Income Statements before and during COVID-19 Through the Comparability Interval. International Journal of Professional Business Review 7: e0623. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, Blerta Dragusha, and Eglantina Hysa. 2023. Investigating Accounting Factors through Audited Financial Statements in Businesses toward a Circular Economy: Why a Sustainable Profit through Qualified Staff and Investment in Technology? Administrative Sciences 13: 72. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, Ismat Zarin, and Shawkat Rahman. 2022. A Novel Approach to Improving E-Government Performance from Budget Challenges in Complex Financial Systems. Complexity 2022: 16. [Google Scholar] [CrossRef]

- MacQueen, J. B. 1967. Some Methods for classification and Analysis of Multivariate Observations. Paper presented at the 5th Berkeley Symposium on Mathematical Statistics and Probability; pp. 281–97. [Google Scholar]

- Maehara, Rocío, Luis Benites, Alvaro Talavera, Alejandro Aybar-Flores, and Miguel Muñoz. 2024. Predicting Financial Inclusion in Peru: Application of Machine Learning Algorithms. Journal of Risk and Financial Management 17: 34. [Google Scholar] [CrossRef]

- Matiza, Tafadzwa. 2020. Post-COVID-19 crisis travel behavior: Towards mitigating the effects of perceived risk. Journal of Tourism Futures 8: 99–108. [Google Scholar] [CrossRef]

- Ministry of Finance. 2023. Available online: https://financa.gov.al/wp-content/uploads/2022/10/Relacioni-PB-2023.doc (accessed on 28 March 2024).

- Ministry of Finance, Labour and Transfers. 2024. Available online: https://mfpt.rks-gov.net/ (accessed on 28 March 2024).

- Steinhaus, H. 1957. Sur la division des corps matériels en parties. Bulletin of the Polish Academy of Sciences 4: 801–4. Available online: https://www.scirp.org/reference/referencespapers?referenceid=2408792 (accessed on 28 March 2024). (In French).

- Tang, Chun, Xiaoxing Liu, and Guangyi Yang. 2024. A study of financial market resilience in China—From a hot money shock perspective. Pacific-Basin Finance Journal 83. [Google Scholar] [CrossRef]

- Tase, Mirela, and Enkeleda Lulaj. 2022. The Effect of Perceptions on Tourism: An Econometric Analysis of the Impacts and Opportunities for Economic and Financial Development in Albania and Kosovo. Sustainability 14: 7659. [Google Scholar] [CrossRef]

- UNWTO. 2020. Impact Assessment of the COVID-19 Outbreak on International Tourism. 2020. Available online: https://www.unwto.org/impact-assessment-of-the-COVID-19-outbreak-on-international-tourism (accessed on 26 March 2024).

- Villacé-Molinero, Teresa, Juan José Fernández-Muñoz, and Laura Fuentes-Moraleda Alicia Orea-Giner. 2021. Understanding the new post-COVID-19 risk scenario: Outlooks and challenges for a new era of tourism. Tourism Management 86. [Google Scholar] [CrossRef]

- Wikipedia. 2024. Wikipedia. Available online: https://en.wikipedia.org/wiki/Kosovo#Geography (accessed on 26 March 2024).

- Xie, Dongshui, Caiquan Bai, and Yuwei Zhang. 2023. Relation-based governance, financial crisis shock, and economic growth in China. Economic Modelling 129: 106565. [Google Scholar] [CrossRef]

- Yuan, Chunhui, and Haitao Yang. 2019. Research on K-Value Selection Method of K-Means Clustering Algorithm. J 2: 226–35. [Google Scholar] [CrossRef]

- Zhang, Qing, Zhizhou Xu, Tianjun Feng, and Jian Jiao. 2015. A dynamic stochastic frontier model to evaluate regional financial efficiency: Evidence from Chinese county-level panel data. European Journal of Operational Research 241: 907–16. [Google Scholar] [CrossRef]

| Items | A. Effectiveness of Inhibitory Measures in Preventing the Spread of COVID-19 ((Navigating Financial Frontiers in the Tourism Economies during COVID-19 (KOS and AL) |

| F1.1 | Collection of health information by tourists (ex. temperature control, COVID testing, etc.) |

| F1.2 | International travel restrictions |

| F1.3 | Restrictions on domestic and regional travel |

| F1.4 | Mandatory quarantine for visitors |

| F1.5 | Physical distance in travel and tourism |

| F1.6 | Mandatory use of masks in travel and tourism |

| F1.7 | Mandatory use of COVID-19 tracking applications |

| F1.8 | Hygiene training for staff in travel and tourism |

| F1.9 | Regular testing of workers’ infection in travel and tourism |

| F1.10 | Vaccination against COVID-19 |

| B. State support for tourism economies beyond COVID-19 in both countries (KOS and AL)-(the aspect of financial frontiers growth in KOS and AL beyond COVID-19) | |

| F2.1 | Financial support and stimulus packages to shape sustainability in the tourism industry |

| F2.2 | Changes in tourism demand and consumer behavior through innovation and accurate financial management |

| F2.3 | The impact of control and management on the financial sustainability of the tourism industry due to financial shocks and revenue loss |

| F2.4 | Adaptation strategies for financial resilience in the tourism industry |

| F2.5 | Investing in sustainable tourism practices for long-term financial growth and shaping sustainability |

| Case Processing Summary a,b | |||||

|---|---|---|---|---|---|

| Albanian/Kosovo | |||||

| Valid | Missing | Total | |||

| N | Percent | N | Percent | N | Percent |

| 102 | 100.0 | 0 | 0.0 | 102 | 100.0 |

| Final Cluster Centers Effectiveness of inhibitory measures in preventing the spread of COVID-19 (navigating financial frontiers in the tourism economies of Kosovo (KOS) and Albania (AL) | |||

| Variables | Cluster | ||

| Gr1 AL | Gr2 KOS | Gr3 AL and KOS | |

| F1.1—Collection of health information by tourists (e.g., temperature control, COVID testing, etc.) | 3.62 | 3.27 | 4.40 |

| F1.2—International travel restrictions | 2.41 | 2.68 | 4.09 |

| F1.3—Restrictions on domestic and regional travel | 2.08 | 2.55 | 4.14 |

| F1.4—Mandatory quarantine for visitors | 2.32 | 2.50 | 3.86 |

| F1.5—Physical distance in travel and tourism | 3.59 | 2.50 | 4.16 |

| F1.6—Mandatory use of masks in travel and tourism | 3.68 | 2.41 | 4.16 |

| F1.7—Mandatory use of COVID-19 tracking applications | 3.22 | 2.09 | 4.00 |

| F1.8—Hygiene training for staff in travel and tourism | 4.19 | 3.55 | 4.37 |

| F1.9—Regular testing of workers’ infection in travel and tourism | 4.08 | 3.00 | 4.44 |

| F1.10—Vaccination against COVID-19 | 3.76 | 2.00 | 4.26 |

| ANOVA Effectiveness of inhibitory measures in preventing the spread of COVID-19 (navigating financial frontier shocks through tourism during pandemic) | Friedman | ||||||||||

| Variables | Cluster | Error | F | Sig. | Test | ||||||

| Mean Square | df | Mean Square | df | Mean ranks | |||||||

| F1.1 | 10.999 | 2 | 0.781 | 99 | 14.078 | 0.000 | 6.42 | ||||

| F1.2 | 31.752 | 2 | 0.680 | 99 | 46.694 | 0.000 | 4.57 | ||||

| F1.3 | 45.690 | 2 | 0.580 | 99 | 78.840 | 0.000 | 4.29 | ||||

| F1.4 | 27.110 | 2 | 0.836 | 99 | 32.425 | 0.000 | 4.00 | ||||

| F1.5 | 20.120 | 2 | 0.609 | 99 | 33.044 | 0.000 | 5.47 | ||||

| F1.6 | 22.513 | 2 | 0.902 | 99 | 24.963 | 0.000 | 5.83 | ||||

| F1.7 | 26.745 | 2 | 1.092 | 99 | 24.496 | 0.000 | 4.93 | ||||

| F1.8 | 5083 | 2 | 0.517 | 99 | 9833 | 0.000 | 6.98 | ||||

| F1.9 | 15.319 | 2 | 0.620 | 99 | 24.716 | 0.000 | 6.76 | ||||

| F1.10 | 37.855 | 2 | 0.939 | 99 | 40.298 | 0.000 | 5.74 | ||||

| Distances between Final Cluster Centers | Test Statistics–Friedman test | ||||||||||

| Cluster | 1 | 2 | 3 | N | 102 | ||||||

| 1 | 3030 | 3410 | Chi-Square | 158,065 | |||||||

| 2 | 3030 | 4998 | df | 9 | |||||||

| 3 | 3410 | 4998 | Asymp. Sig. | 0.000 | |||||||

| Final Cluster Centers State support for tourism economies beyond COVID-19 in both countries (KOS and AL)-(the aspect of financial frontiers growth in KOS and AL beyond COVID-19) | |||||

| Variables | Cluster | ||||

| Gr1 AL | Gr2 KOS | Gr3 AL and KOS | |||

| F2.1—Financial support and stimulus packages to shape sustainability in the tourism industry | 2.00 | 2.94 | 3.10 | ||

| F2.2—Changes in tourism demand and consumer behavior through innovation and accurate financial management | 3.00 | 3.86 | 4.00 | ||

| F2.3—The impact of control and management on the financial sustainability of the tourism industry due to financial shocks and revenue loss | 4.00 | 3.46 | 4.50 | ||

| F2. 4—Adaptation strategies for financial resilience in the tourism industry | 2.00 | 2.87 | 3.00 | ||

| F2.5—Investing in sustainable tourism practices for long-term financial growth and shaping sustainability | 3.30 | 3.72 | 4.93 | ||

| ANOVA State support for tourism economies beyond COVID-19 in both countries (KOS and AL)-(the aspect of financial frontiers growth in KOS and AL beyond COVID-19) | Friedman | |||||||

| Variables | Cluster | Error | F | Sig. | Test | |||

| Mean Square | df | Mean Square | df | Mean ranks | ||||

| F2.1 | 0.676 | 2 | 1399 | 99 | 0.483 | 0.000 | 1.61 | |

| F2.2 | 48.874 | 2 | 0.823 | 99 | 59.364 | 0.000 | 2.24 | |

| F2.3 | 8784 | 2 | 0.981 | 99 | 8956 | 0.000 | 2.15 | |

| F2.4 | 7164 | 2 | 0.847 | 99 | 8158 | 0.000 | 2.01 | |

| F2.5 | 7034 | 2 | 0.839 | 99 | 7903 | 0.000 | 1.19 | |

| Distances between Final Cluster Centers | Test Statistics–Friedman test | |||||||

| N | 102 | |||||||

| Chi-Square | 38,486 | |||||||

| df | 2 | |||||||

| Asymp. Sig. | 0.000 | |||||||

| Iteration History for the 2-Dimensional Solution (in Squared Distances) Young’s S-Stress Formula (1) Is Used (Variable-Cases) | For Matrix | Interpretation | ||||

|---|---|---|---|---|---|---|

| Iteration | S-stress | Improvement | Iteration | S-stress | Improvement | Iterations stopped because S-stress improvement is less than 0.001000 Iteration history for the 2-dimensional solution (in squared distances) Young’s S-stress Formula 1 is used (Variable–Variable) Iterations stopped because S-stress improvement is less than 0.001000 For matrix Stress = 0.24086 RSQ = 0.74054 |

| 1 | 0.34181 | 1 | 0.29545 | |||

| 2 | 0.26762 | 0.07419 | 2 | 0.27490 | 0.02055 | |

| 3 | 0.26109 | 0.00653 | 3 | 0.27008 | 0.00482 | |

| 4 | 0.26052 | 0.00057 | 4 | 0.26971 | 0.00037 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lulaj, E.; Tase, M.; Gomes, C.; Cardoso, L. Navigating Financial Frontiers in the Tourism Economies of Kosovo and Albania during and beyond COVID-19. J. Risk Financial Manag. 2024, 17, 142. https://doi.org/10.3390/jrfm17040142

Lulaj E, Tase M, Gomes C, Cardoso L. Navigating Financial Frontiers in the Tourism Economies of Kosovo and Albania during and beyond COVID-19. Journal of Risk and Financial Management. 2024; 17(4):142. https://doi.org/10.3390/jrfm17040142

Chicago/Turabian StyleLulaj, Enkeleda, Mirela Tase, Conceição Gomes, and Lucília Cardoso. 2024. "Navigating Financial Frontiers in the Tourism Economies of Kosovo and Albania during and beyond COVID-19" Journal of Risk and Financial Management 17, no. 4: 142. https://doi.org/10.3390/jrfm17040142

APA StyleLulaj, E., Tase, M., Gomes, C., & Cardoso, L. (2024). Navigating Financial Frontiers in the Tourism Economies of Kosovo and Albania during and beyond COVID-19. Journal of Risk and Financial Management, 17(4), 142. https://doi.org/10.3390/jrfm17040142