What Drives Asset Returns Comovements? Some Empirical Evidence from US Dollar and Global Stock Returns (2000–2023)

Abstract

:1. Introduction

- A set of potentially relevant drivers of asset returns comovements is considered. This set includes a comprehensive and balanced list of macroeconomic and non-macroeconomic factors;

- Differently from existing contributions focusing on stocks/currency returns comovements, this paper evaluates the forecasting accuracy of models explaining time-varying correlations.

2. Determinants of Asset Returns Correlations and Expected Coefficients Signs

- CBOE VIX Volatility Index;

- Equity Market Volatility Tracker: Business Investment and Sentiment Index;

- ECB Systemic Stress Composite Indicator;

- World Equity Risk Premium;

- US 1-year Expected Inflation;

- World Economic Policy Uncertainty Index;

- Crude Oil Price;

- US Term Structure;

- US Consumer Confidence Index.

- (a)

- The effects of US Expected Inflation on stock returns;

- (b)

- The effects of US Expected Inflation on US Dollar returns.

3. Empirical Evidence

3.1. Effects of Single Macroeconomic and Financial Variables on Returns Correlations

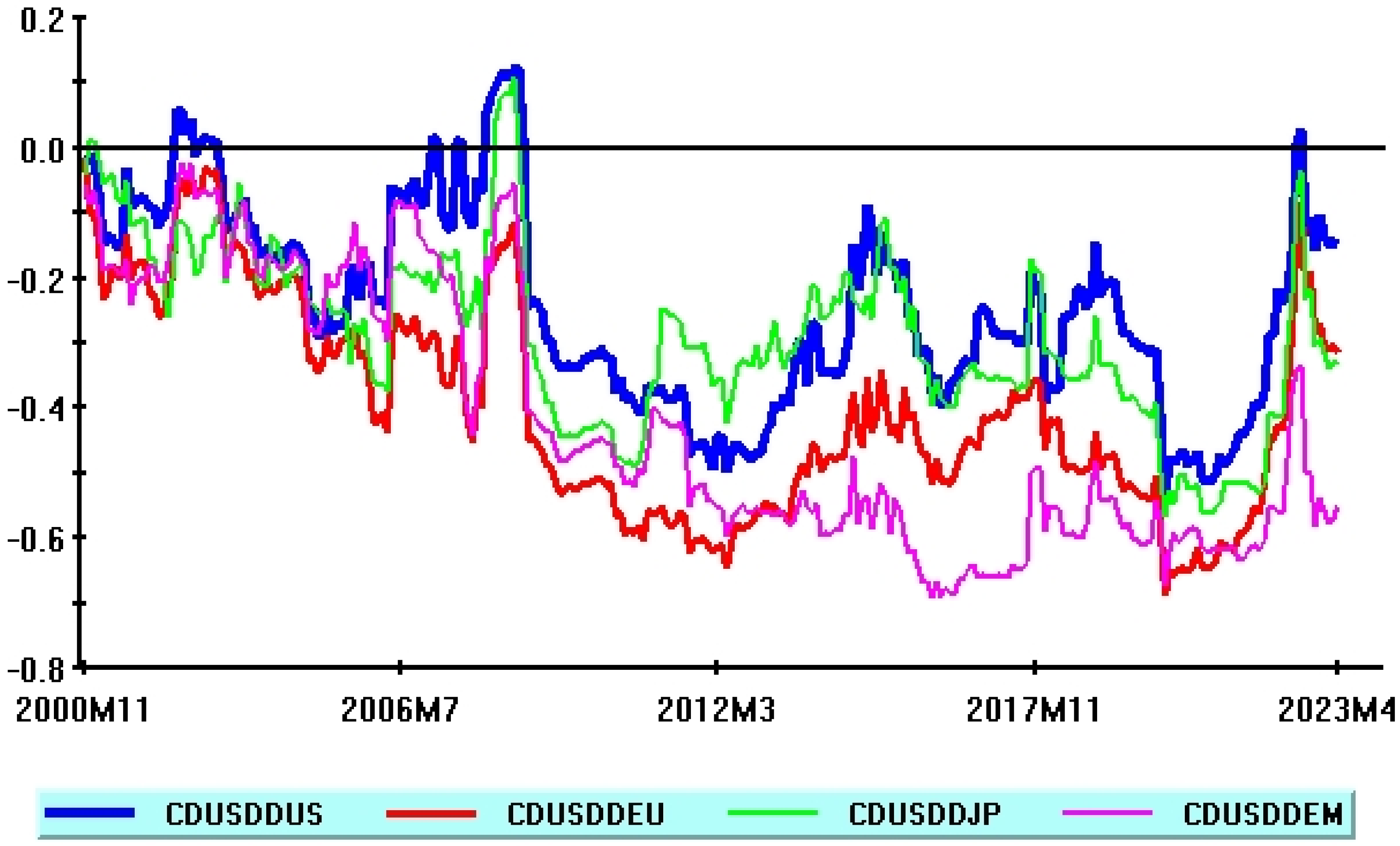

- ⍴usd, j,t: time-varying conditional correlation, at time (t), between US Dollar returns and stock prices (j) returns (j: European Stocks; US Stocks; Emerging Markets Stocks; Japanese Stocks);

- c: constant term;

- vt: macroeconomic or financial variable, at time (t);

- εt: error term.

3.2. Multiple Regressions

- ⍴USD,j,t: conditional correlation between the defensive asset (US Dollar) and stock price (j: European Stocks; US Stocks; Emerging Markets Stocks; Japanese Stocks) returns at time (t);

- c: Constant Term;

- Repungl: World Economic Policy Uncertainty Index (rescaled by/1000);

- Rerp: World Equity Risk Premium (rescaled by/10);

- Roil: Oil Price (rescaled by/100);

- Rinf1Y: US 1-year Expected Inflation (rescaled by/10);

- εt: Error Term.

3.3. Forecasting Performance of Alternative Models

- A common pattern of forecast errors relative to different asset return comovements;

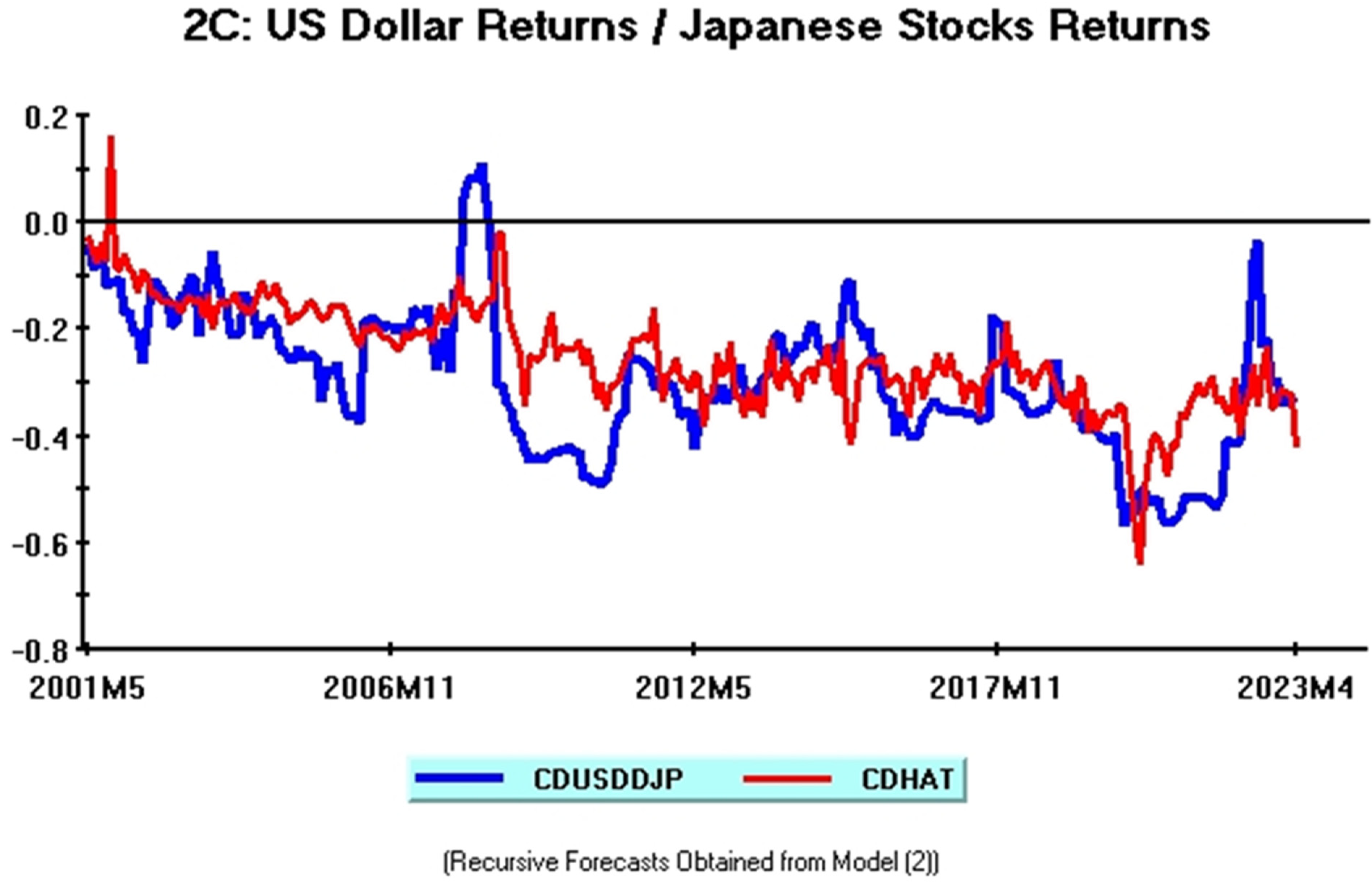

- A close correspondence between the results from PT tests and some relevant directional accuracy features emerging from various plots.

3.4. Parameters Stability

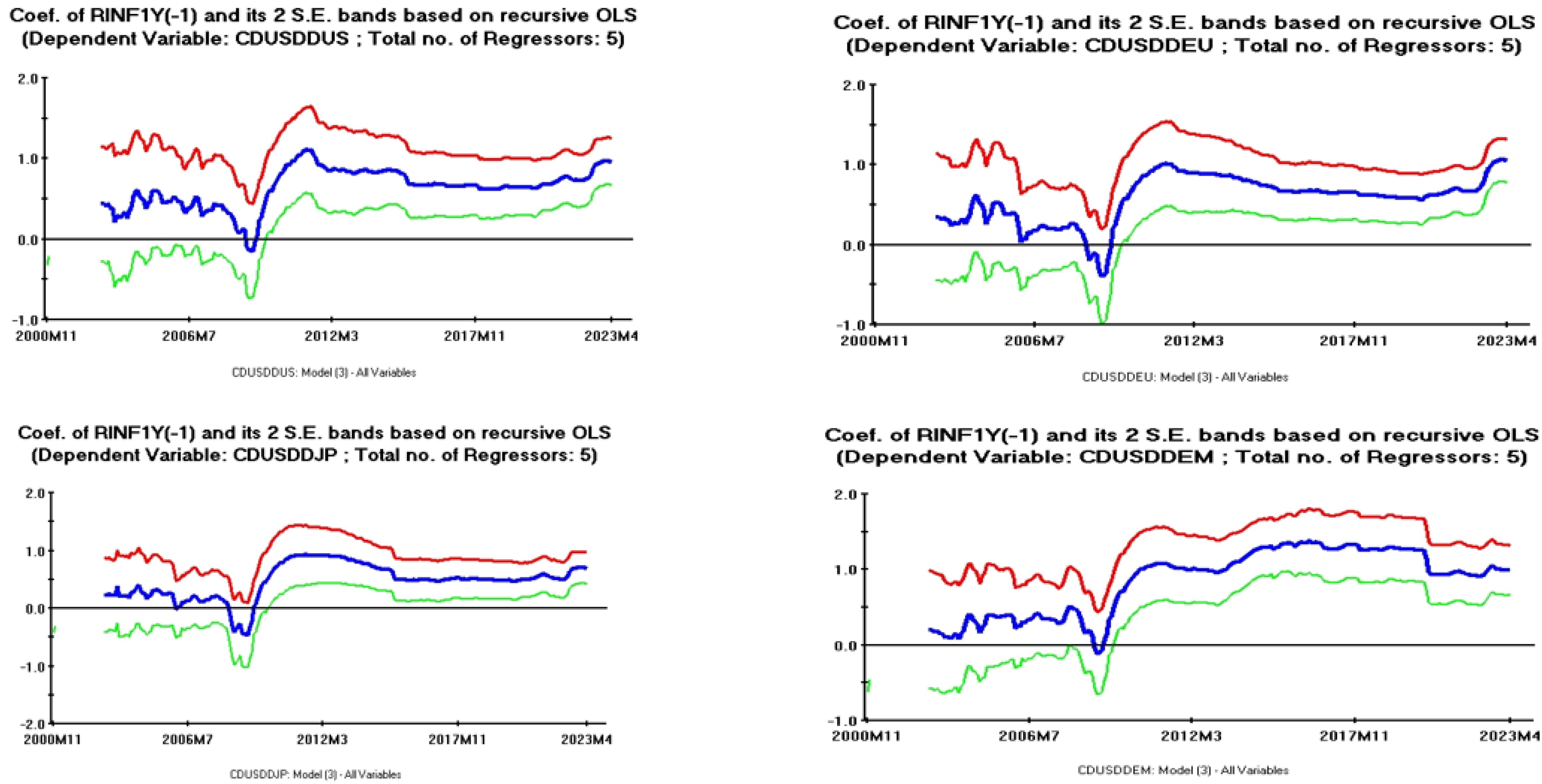

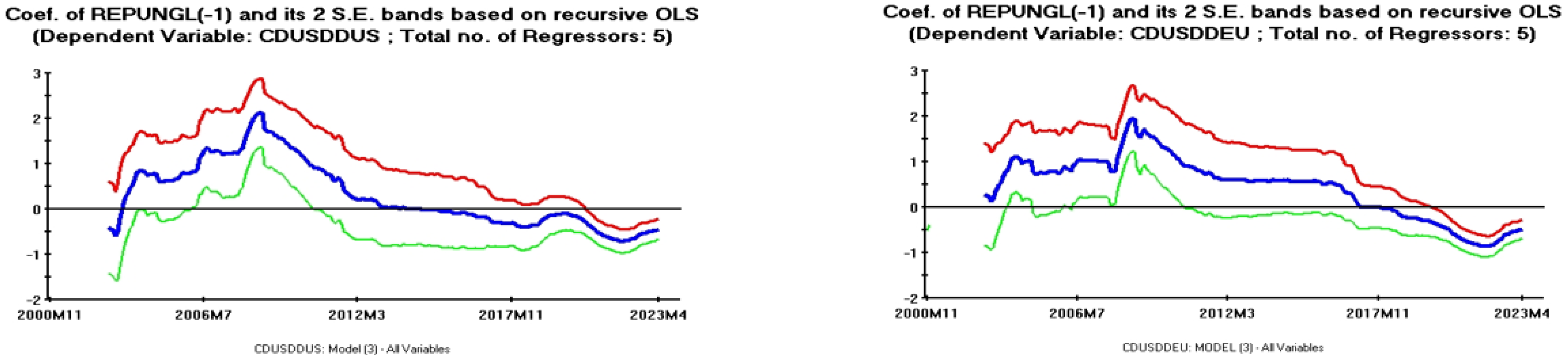

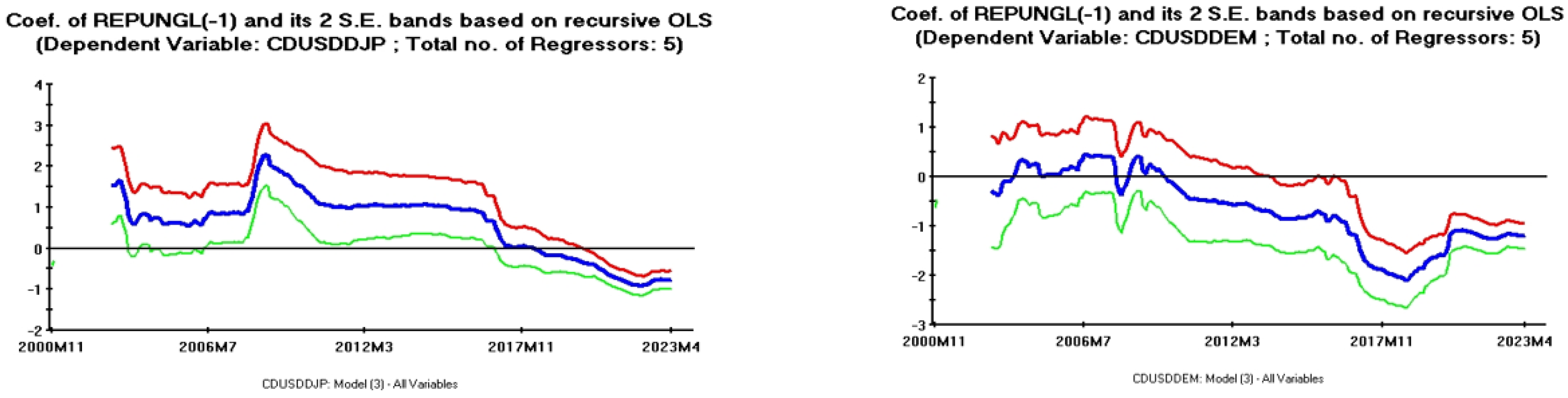

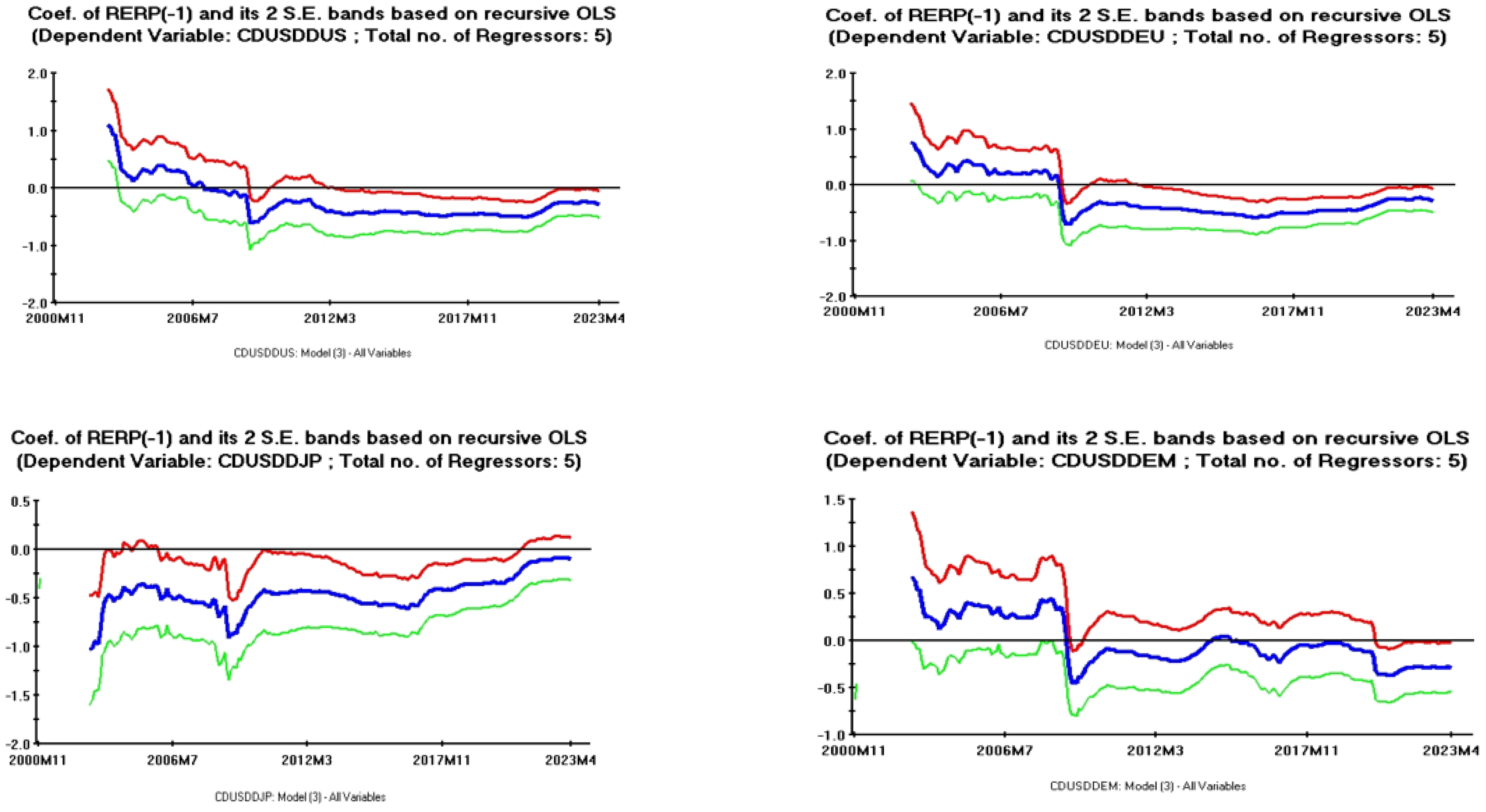

- Focusing on various figures, a clear instability is apparent, for all recursive coefficients, during the period corresponding to the 2007/2008 US Great Financial Crisis.

4. Concluding Remarks

- Differently from existing research, a large set of potential drivers of asset returns correlations is explored. This set includes macroeconomic variables, economic policy uncertainty and consumer sentiment indicators, financial variables related to market volatility, systemic stress, and risk premium indicators;

- Differently from existing contributions, a major focus of this paper is on the predictive accuracy of alternative econometric models, evaluated both through standard forecast metrics (MAE, RMSE) and through a non-parametric test for directional accuracy (Pesaran and Timmermann 1992).

- A simpler model, including only the lagged value of 1-year US Expected Inflation as an explanatory variable (Model 1);

- A more complex model, adding lagged World Economic Policy Uncertainty as a predictor (Model 2);

- A more general model, including all lagged significant macroeconomic and financial variables (i.e., in addition to the above quoted predictors, lagged values of the World Equity Risk Premium and Oil Price) (Model 3).

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

- US Dollar Nominal Effective Exchange Rate, Thomson Reuters code: “USJPNEBBF”;

- MSCI United States of America, Thomson Reuters code: “MSUSAML”;

- MSCI Europe, Thomson Reuters code: “MSEROP$”;

- MSCI Japan, Thomson Reuters code: “MSJPAN$”;

- MSCI Emerging Markets US Dollar, Thomson Reuters code: “MSEMKF$”.

- CBOE Volatility Index VIX, Fed. Res. Bank of St. Louis code: “VIXCLS”;

- Equity Market Volatility Tracker, Fed Res. Bank of St. Louis code: “EMVMACRO BUS”;

- ECB Systemic Stress Composite Indicator, Thomson Reuters code: “EMCISSI”;

- World Equity Risk Premium, Thomson Reuters code: “WDASERP”.

- US 1-year Expected Inflation, Fed. Res. Bank of St. Louis code: “EXPINF1YR”;

- World Economic Policy Uncertainty Index, Thomson Reuters code: “WDEPUCUPR”;

- Crude Oil Brent Spot Price, Thomson Reuters code: “EIACRBR”;

- US Consumer Confidence Index, Thomson Reuters code: “USCNFCONQ”;

- US Term Structure of Interest Rates, computed as the difference between US Government Bond Yield 10-year and US Treasury Bill Rate 3-month:

- US Government Bond Yield 10-year, Thomson Reuters code: “TRUS10T”;

- US Treasury Bill Rate 3-month, Thomson Reuters code: “USGBILL3”.

| 1 | Data sources and codes for these series, as well as for other time series used in this paper, are provided in Appendix A. |

| 2 | Min et al.’s work (2016) is closely related to the present paper, and documents that increases in global volatility shocks, measured by various volatility indicators, decrease conditional correlations between equity returns and safe-haven currencies returns. |

| 3 | All asset prices data are obtained from Thomson Reuters—Datastream. See Tronzano (2023), sct.3, for details about these series and relative Thomson Reuters codes. See also Appendix A. The Multivariate Garch model is the standard Dynamic Conditional Correlation model outlined in Engle’s (2002) seminal paper. The Maximum Likelihood algorithm converged after 38 iterations, providing statistically significant coefficients for all variables at standard significance levels. More details about asset returns properties, the Multivariate Garch model specification, and diagnostic tests can be found in Tronzano (2023), sct. 4.2. |

| 4 | An identical conclusion applies to the empirical investigation carried out in sct. 3.3, where a more restrictive specification (Model (2)) is also applied in order to evaluate the forecasting performance. The unconditional correlation between World Economic Policy Uncertainty and US 1-year Expected Inflation is in fact negligible (−0.15). See Model (2) in sct. 3.3. |

| 5 | According to one referee, inflationary expectations might sometimes be jointly determined with stocks/US Dollar return comovements, thus raising a simultaneity problem that could bias β4 coefficient estimates. The theoretical discussion carried out in Section 2, based on the effects of US 1-year Expected Inflation on stock returns and US Dollar returns, leads to exclude the existence of this simultaneity problem, while the estimates of the US inflationary expectations parameter are always fully in line with a priori expectations (see Table 1; Table 2). The argument put forward by the referee must, however, be taken into account when evaluating the effects associated with US inflationary expectations. Thus, although the existence of a strongly significant and positive coefficient is a robust empirical regularity, I agree that, occasionally, there may be a small bias in the estimated value of this coefficient. |

| 6 | Following one referee’s suggestion, standard diagnostic tests have been performed on regression equations employed in this sub-section. Since Model (3) provides the best forecasting performance (see Table 3 below), I focus on this specific model, which includes all four lagged explanatory variables. Results from diagnostic tests (available from the author upon request) are evaluated assuming a significance level of 1%. The absence of residuals serial correlation is always strongly rejected, whereas the null hypothesis of homoscedasticity is never rejected. Serial correlation, however, is not a problem in this setup since the Newey and West (1987) estimator is robust to autocorrelation. The functional form specification is not rejected, except in the case of US Dollar/Emerging Markets Stocks return correlations. Therefore, although nonlinear econometric techniques may provide further useful insights, linear regression models appear broadly appropriate in this context. The null hypothesis of residuals normality is not rejected for US Dollar returns against Emerging Markets Stocks returns and Japanese stock returns, while being rejected in the remaining cases. In these last cases, therefore, statistical inferences should be interpreted with some caution, given the small sample size of our data set. Finally, following a further referee suggestion, the Cumulative Sum of Recursive Residuals and Cumulative Sum of Squares of Recursive Residuals tests were also carried out (plots available upon request). Overall, this evidence reiterates the strong destabilizing effects (documented later in Section 3.4, see Figure 3, Figure 4 and Figure 5), exerted by the 2007–2008 Great Financial Crisis, the 2010/2012 Eurozone Debt Crisis and the COVID-19 pandemic period. |

| 7 | Note that, if the sign of all the elements of the actual dependent variable (or its forecast values) is the same, the Pesaran and Timmermann (1992) statistic is undefined. |

| 8 | One minor exception is represented by returns comovements relative to Japanese stocks. In this case, there is a consistent forecast improvement when moving from the simpler model (Model 1) to Model 2. However, differently from other cases, no further improvement is observed when comparing Model 2 with the more sophisticated specification including macroeconomic and financial variables (Model 3). |

| 9 | Additional plots related to the US Dollar/Emerging Markets case are available upon request. |

| 10 | See, among many others, Pesaran and Pesaran (2010) and Hwang et al. (2013) as regards conditional volatility and conditional correlation patterns during the 2008 Great Financial Crisis. Contagion effects during this crisis are discussed, among others, in Hemche et al. (2016). Lane (2012) provides an in-depth analysis of the main features of the European Sovereign Debt Crisis. Financial turmoils induced by the burst of the COVID-19 pandemic are discussed, among others, in Tarchella and Abderrazak (2021), as regards their effects on equity markets, and in Sikiru and Salisu (2021), as regards hedging strategies to protect asset portfolios against major turbulences. |

| 11 | The analysis of parameter stability through recursive coefficients plots is the simplest way to explore the stability of proposed regression models. As documented in this sub-section, this analysis points out some instabilities in regression models, mainly related to major financial crises of the last two decades and the COVID-19 pandemic period. As observed by an anonymous referee, structural breaks or regime changes could be captured through different and more complex methodologies relying on dummy variables or Markov regime-switching models. I acknowledge that the search for structural breaks or regime changes is strongly related to the analysis of the present sub-section: the use of the above quoted methodologies represents, therefore, a relevant extension of this empirical investigation (see also the critical remarks in the concluding section (§ 4)). |

| 12 | |

| 13 | Recursive estimates relative to oil price effects on conditional correlations display very stable patterns except for some instabilities during the Great Financial Crisis. In subsequent periods, these coefficients always display negative values, in line with their expected sign. Since quantitative estimates of these coefficients are very low, in most cases they are not statistically significant (see β3 coefficients in Table 2). |

| 14 | |

| 15 | The former type of data break is clearly more consistent with the present empirical investigations (see Figure 2). |

| 16 | See Rossi (2021), sct. 4.2, for an in-depth technical discussion about these issues. In short, these solutions involve “aggregate then forecast” strategies (i.e., the use of Factor Models), “forecast while aggregating” approaches, and “forecast then aggregate” approaches (i.e., forecasts combination from a variety of different models). As discussed in Rossi (2021), sct. 4.2.2, the “forecast while aggregating” approach is an emerging field, currently widely used not only in economics and finance, but also in many other research areas. Moreover, while in traditional Factor Models, information is not directly extracted with a forecasting purpose, “shrinkage methodologies” employed in the “Big Data” literature perform this task. These methodologies, i.e., all those techniques aimed at reducing parameters proliferation, are often based on automated predictive algorithms (machine learning) in complex environments. Shrinkage methodologies, moreover, may be imposed either in frequentist or in Bayesian setups. |

References

- Aslanidis, Nektarios, and Oscar Martinez. 2021. Correlation regimes in international equity and bond returns. Economic Modelling 97: 397–410. [Google Scholar] [CrossRef]

- Baker, Steven, Nicholas Bloom, and Steven Davis. 2023. Equity Market Volatility Tracker: Macroeconomic News and Outlook: Inflation. Available online: https://fred.stlouisfed.org/series/emvmacroinflation (accessed on 6 September 2023).

- Batten, Jonathan, Harald Kinateder, Peter Szilagyi, and Niklas Wagner. 2021. Hedging stocks with oil. Energy Economics 93: 1–14. [Google Scholar] [CrossRef]

- Behmiri, Niaz, Matteo Manera, and Marcella Nicolini. 2019. Understanding dynamic conditional correlation between oil, natural gas and non-energy commodity futures markets. Energy Journal 40: 55–76. [Google Scholar] [CrossRef]

- Caballero, Ricardo, and Arvind Krishnamurthy. 2008. Collective risk management in a flight to quality episode. Journal of Finance 63: 2195–230. [Google Scholar] [CrossRef]

- Cai, Yijie, Ray Chou, and Dan Li. 2009. Explaining international stock correlations with CPI fluctuations and market volatility. Journal of Banking and Finance 33: 2026–35. [Google Scholar] [CrossRef]

- Campbell, John, and John Cochrane. 1999. Force of habit: A consumption-based explanation of aggregate stock market behavior. Journal of Political Economy 107: 205–21. [Google Scholar] [CrossRef]

- Campbell, John, Karine Serfaty-De Medeiros, and Louis Viceira. 2010. Global currency hedging. Journal of Finance 65: 87–121. [Google Scholar] [CrossRef]

- Chan, Kalok, Jian Yang, and Yinggang Zhou. 2018. Conditional co-skewness and safe-haven currencies: A regime switching approach. Journal of Empirical Finance 48: 58–80. [Google Scholar] [CrossRef]

- Chaudhari, Manav, and Benjamin Marrow. 2022. Inflation Expectations And Stock Returns. Chicago: University of Chicago, Department of Economics and Booth School of Business. [Google Scholar]

- Chiang, Thomas. 2019. Economic policy uncertainty, risk and stock returns: Evidence from G7 stock markets. Finance Research Letters 29: 41–49. [Google Scholar] [CrossRef]

- Chiang, Thomas. 2021. Geopolitical risk, economic policy uncertainty and asset returns in Chinese financial markets. China Finance Review International 11: 474–501. [Google Scholar] [CrossRef]

- Chiang, Thomas, Bang Nam Jeon, and Huimin Li. 2007. Dynamic correlation analysis of financial contagion: Evidence from Asian markets. Journal of International Money and Finance 26: 1206–28. [Google Scholar] [CrossRef]

- Ciner, Cetin, Constantin Gurdgiev, and Brian Lucey. 2013. Hedges and safe havens: An examination of stocks, bonds, oil and exchange rates. International Review of Financial Analysis 29: 202–11. [Google Scholar] [CrossRef]

- Clarida, Richard, and Daniel Waldman. 2019. Is bad news about inflation good news for the exchange rate? In Asset Prices and Monetary Policy. Edited by John Campbell. Chicago: University of Chicago Press. [Google Scholar]

- Dong, Xiyong, and Seong-Min Yoon. 2019. What global economic factors drive emerging Asian stock markets returns? Evidence from a dynamic model averaging approach. Economic Modelling 77: 204–15. [Google Scholar] [CrossRef]

- Dong, Xiyong, Changhong Li, and Seong-Min Yoon. 2021. How can investors build a better portfolio in small open economies? Evidence from Asia’s four little dragons. North American Journal of Economics and Finance 58: 101500. [Google Scholar] [CrossRef]

- Dua, Pami, and Divya Tuteja. 2016. Financial crises and dynamic linkages across international stock and currency markets. Economic Modelling 59: 249–61. [Google Scholar] [CrossRef]

- Ehrmann, Michael, and Marcel Fratzscher. 2004. Exchange rates and fundamentals: New evidence from real-time data. Journal of International Money and Finance 24: 317–41. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroscedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Eraslan, Veysel. 2017. Do sovereign rating announcements affect emerging market exchange rate correlations? A multivariate DCC-GARCH approach. Applied Economics 49: 2060–82. [Google Scholar] [CrossRef]

- Estrella, Arturo, and Gikas Hardouvelis. 1991. The term structure as a predictor of future economic activity. Journal of Finance 46: 555–76. [Google Scholar] [CrossRef]

- Filis, George, Stavros Degiannakis, and Christos Floros. 2011. Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. International Review of Financial Analysis 20: 152–64. [Google Scholar] [CrossRef]

- Garcia, Fernando, Francisco Guijarro, Javier Oliver, and Rima Tamošiûnienè. 2018. Hybrid fuzzy neural network to predict price direction in the German DAX-30 index. Technological and Economic Development of Economy 24: 2161–78. [Google Scholar]

- Gomes, Pedro, and Abderrahim Taamouti. 2016. In search of the determinants of European asset market comovements. International Review of Economics and Finance 44: 103–17. [Google Scholar] [CrossRef]

- Greene, William H. 1993. Econometric Analysis, 2nd ed. New York: Macmillan Publishing Company. [Google Scholar]

- Güngör, Arifenur, and Hüseyin Taştan. 2021. On macroeconomic determinants of co-movements among international stock markets: Evidence from DCC-MIDAS approach. Quantitative Finance and Economics 5: 19–39. [Google Scholar] [CrossRef]

- Hemche, Omar, Fredi Javadi, Samir Maliki, and Abdoulkarim Cheffou. 2016. On the study of contagion in the context of the subprime crisis. A dynamic conditional correlation multivariate GARCH approach. Economic Modelling 52: 292–99. [Google Scholar] [CrossRef]

- Holló, Daniel, Manfred Kremer, and Marco Lo Duca. 2012. CISS—A Composite Indicator of Systemic Stress in the Financial System. ECB Working Papers Series n. 1426. Frankfurt am Main: European Central Bank. [Google Scholar]

- Hwang, Eugene, Hong-Ghi Min, Bong-Han Kim, and Hyeongwoo Kim. 2013. Determinants of stock market comovements among US and emerging economies during the US financial crisis. Economic Modelling 35: 338–48. [Google Scholar] [CrossRef]

- Kallberg, Jarl, and Paolo Pasquariello. 2008. Time-series and cross-sectional excess comovements in stock indexes. Journal of Empirical Finance 15: 481–502. [Google Scholar] [CrossRef]

- Kroner, Kenneth, and Jahangir Sultan. 1993. Time-varying distributions and dynamic hedging with foreign currency futures. Journal of Financial and Quantitative Analysis 28: 535–51. [Google Scholar] [CrossRef]

- Kroner, Kenneth, and Victor Ng. 1998. Modeling asymmetric comovements of asset returns. Review of Financial Studies 11: 817–44. [Google Scholar] [CrossRef]

- Lane, Philip. 2012. The European sovereign debt crisis. Journal of Economic Perspectives 26: 49–68. [Google Scholar] [CrossRef]

- Li, Sile, and Brian Lucey. 2017. Reassessing the role of precious metals as safe havens—What colour is your haven and why? Journal of Commodity Markets 7: 1–14. [Google Scholar] [CrossRef]

- Lilley, Andrew, Matteo Maggiori, Brent Neiman, and Jesse Schreger. 2022. Exchange rate reconnect. Review of Economics and Statistics 104: 845–55. [Google Scholar] [CrossRef]

- Lintner, John. 1965. The valuation of risky assets and the selection of risky investments in stock portfolios and capital budget. Review of Economics and Statistics 47: 13–37. [Google Scholar] [CrossRef]

- Markovitz, Harry. 1952. Portfolio Selection. Journal of Finance 7: 77–91. [Google Scholar]

- Meesad, Phayung, and Risul Islam Rasel. 2013. Predicting stock market price using support vector regression. Paper presented at the 2013 International Conference on Informatics, Electronics and Vision (ICIEV), Dhaka, Bangladesh, May 17–18. [Google Scholar]

- Min, Hong-Ghi, Judith McDonald, and Sang-Ook Shin. 2016. What makes a safe-haven? Equity and currency returns for six OECD countries during the financial crisis. Annals of Economics and Finance 17: 365–402. [Google Scholar]

- Mossin, Jan. 1966. Equilibrium in a capital asset market. Econometrica 34: 768–83. [Google Scholar] [CrossRef]

- Newey, Whitney, and Kenneth West. 1987. A simple, positive semi-definite, heteroscedasticity and autocorrelation consistent covariance matrix. Econometrica 55: 703–08. [Google Scholar] [CrossRef]

- Pesaran, Bahram, and Hashem Pesaran. 2010. Conditional volatility and correlations of weekly returns and the VaR analysis of 2008 stock market crash. Economic Modelling 27: 1398–416. [Google Scholar] [CrossRef]

- Pesaran, Hashem, and Allan Timmermann. 1992. A simple nonparametric test of predictive performance. Journal of Business & Economic Statistics 10: 461–65. [Google Scholar]

- Pesaran, Hashem, Davide Pettenuzzo, and Allan Timmermann. 2006. Forecasting time series subject to multiple structural breaks. Review of Economic Studies 73: 1057–84. [Google Scholar] [CrossRef]

- Poshakwale, Sunil, and Anandadeep Mandal. 2016a. Determinants of asymmetric return comovements of gold and other financial assets. International Review of Financial Analysis 47: 229–42. [Google Scholar] [CrossRef]

- Poshakwale, Sunil, and Anandadeep Mandal. 2016b. What drives asymmetric dependence structure of asset return comovements? International Review of Financial Analysis 48: 312–30. [Google Scholar] [CrossRef]

- Rapach, David, and Mark Wohar. 2006. Structural Breaks and Predictive Regression Models of Aggregate US Stock Returns. Journal of Financial Econometrics 4: 238–74. [Google Scholar] [CrossRef]

- Rossi, Barbara. 2021. Forecasting in the Presence of Instabilities: How Do We Know Whether Models Predict Well and How to Improve Them. Economic Working Paper Series, Working Paper n. 1711. Barcelona: Universitat Pompeu Fabra. [Google Scholar]

- Saaed, Tareq, Elie Bouri, and Khoa Tran. 2020. Hedging strategies of green assets against dirty energy assets. Energies 13: 3141. [Google Scholar] [CrossRef]

- Sharpe, William. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19: 425–42. [Google Scholar]

- Shi, Yujie. 2022. What influences stock market co-movements between China and its Asia-Pacific trading partners after the Global Financial Crisis? Pacific-Basin Finance Journal 72: 101722. [Google Scholar] [CrossRef]

- Sikiru, Abdulsalam, and Afees Salisu. 2021. Hedging with financial innovations in the Asia-Pacific markets during the COVID-19 pandemic. The role of precious metals. Quantitative Finance and Economics 5: 352–72. [Google Scholar] [CrossRef]

- Syllignakis, Manolis, and Georgios Kouretas. 2011. Dynamic correlation analysis of financial contagion: Evidence from the Central and Eastern European Markets. International Review of Economics and Finance 20: 717–32. [Google Scholar] [CrossRef]

- Tarchella, Salma, and Dhaoui Abderrazak. 2021. Chinese jigsaw: Solving the equity market response to the COVID-19 crisis: Do alternative asset provide effective hedging performance? Research in International Business and Finance 58: 101499. [Google Scholar] [CrossRef] [PubMed]

- Teräsvirta, Timo. 2006. Forecasting economic variables with nonlinear models. In Handbook of Economic Forecasting. Edited by Graham Elliott, Clive Granger and Allan Timmermann. Amsterdam: Elsevier, vol. 1, pp. 414–57. [Google Scholar]

- Timmermann, Allan. 2008. Elusive Return Predictability. International Journal of Forecasting 24: 1–18. [Google Scholar] [CrossRef]

- Tronzano, Marco. 2020. Safe-haven assets, financial crises, and macroeconomic variables: Evidence from the last two decades (2000–2018). Journal of Risk and Financial Management 13: 40. [Google Scholar] [CrossRef]

- Tronzano, Marco. 2021. Financial crises, macroeconomic variables, and long-run risk: An econometric analysis of stock returns correlations (2000 to 2019). Journal of Risk and Financial Management 14: 127. [Google Scholar] [CrossRef]

- Tronzano, Marco. 2023. Safe-Haven currencies as defensive assets in global stocks portfolios: A reassessment of the empirical evidence (1999–2022). Journal of Risk and Financial Management 16: 273. [Google Scholar] [CrossRef]

- Xu, Nancy R. 2019. Global Risk Aversion and International Return Comovements. Available online: https://ssrn.com/abstract=31744176 (accessed on 15 March 2024).

- Yousaf, Imran, Elie Bouri, Ali Shoaib, and Nehme Azoury. 2021. Gold against Asian stock markets during the COVID-19 outbreak. Journal of Risk and Financial Management 14: 186. [Google Scholar] [CrossRef]

| Variables | USD/European Stocks | USD/US Stocks | USD/Em. Mark. Stocks | USD/Japanese Stocks | ||||

|---|---|---|---|---|---|---|---|---|

| α | R2 | α | R2 | α | R2 | α | R2 | |

| CBOE VIX | 0.060 | 0.001 | 0.07 | 0.001 | 0.06 | 0.011 | −0.08 | 0.002 |

| (0.21) | (0.28) | (0.72) | (−0.40) | |||||

| Equity Market Volatility Tracker | 0.07 | 0.041 | 0.07 | 0.038 | 0.06 | 0.017 | 0.05 | 0.023 |

| (1.01) | (1.30) | (0.72) | (0.90) | |||||

| ECB Systemic Stress | −0.09 | 0.008 | 0.002 | 0.000 | 0.02 | 0.000 | −0.03 | 0.001 |

| (−0.63) | (0.12) | (0.70) | (−0.25) | |||||

| World Equity Risk Premium | −1.00 *** | 0.465 | −0.83 *** | 0.349 | −1.18 *** | 0.422 | −0.57 *** | 0.212 |

| (−7.59) | (−6.01) | (−5.22) | (−4.04) | |||||

| US 1-Year Expected Inflat. | 1.32 *** | 0.288 | 1.25 *** | 0.291 | 1.40 *** | 0.215 | 0.88 *** | 0.184 |

| (5.81) | (5.12) | (3.27) | (3.41) | |||||

| World Economic Pol. Uncertainty | −0.88 ** | 0.166 | −0.78 ** | 0.145 | −1.57 *** | 0.350 | −0.93 *** | 0.262 |

| (−2.76) | (−2.52) | (−5.40) | (−4.03) | |||||

| Oil Price | −0.22 ** | 0.169 | −0.13 | 0.063 | −0.22 * | 0.101 | −0.04 | 0.009 |

| (−2.14) | (−1.23) | (−1.78) | (−0.50) | |||||

| US Term Structure | 0.04 | 0.001 | −0.08 | 0.003 | 0.19 | 0.012 | 0.11 | 0.009 |

| (0.16) | (−0.38) | (0.58) | (0.58) | |||||

| US Consumer Confidence | 1.08 | 0.027 | 0.93 | 0.022 | −0.67 | 0.006 | 0.04 | 0.000 |

| (1.02) | (0.94) | (−0.59) | (0.04) | |||||

| Estimated Coefficients | USD/European Stocks | USD/US Stocks | USD/Em. Mark. Stocks | USD/Japanese Stocks | ||||

|---|---|---|---|---|---|---|---|---|

| c | −0.30 *** | (−3.47) | −0.19 ** | (−2.24) | −0.21 ** | (−2.43) | −0.26 *** | (−2.96) |

| β1 | −0.48 * | (−1.77) | −0.44 | (−1.57) | −1.18 *** | (−4.35) | −0.75 *** | (−3.53) |

| β2 | −0.29 * | (−1.67) | −0.29 | (−1.27) | −0.28 | (−1.04) | −0.10 | (−0.55) |

| β3 | −0.17 ** | (−2.34) | −0.07 | (−0.98) | −0.16 | (−1.56) | −0.01 | (−0.20) |

| β4 | 1.04 *** | (4.26) | 0.96 *** | (4.54) | 0.98 *** | (4.09) | 0.69 *** | (2.89) |

| Overall Regression Fit, Regression Standard Errors, F-Statistic | ||||||||

| R2 | 0.590 | 0.476 | 0.598 | 0.402 | ||||

| S.E. | 0.104 | 0.112 | 0.128 | 0.106 | ||||

| F-Stat. | 95.6 *** | 60.4 *** | 98.7 *** | 44.5 *** | ||||

| Models | CDUSDDEU | CDUSDDUS | CDUSDDEM | CDUSDDJP | ||||

|---|---|---|---|---|---|---|---|---|

| MODEL 1 (Rinf1y)t−1 | MAE: | 0.115 | MAE: | 0.107 | MAE: | 0.132 | MAE: | 0.099 |

| RMSE: | 0.139 | RMSE: | 0.130 | RMSE: | 0.179 | RMSE: | 0.124 | |

| PT TEST: | n.a. | PT TEST: | 2.097 ** | PT TEST: | n.a. | PT TEST: | n.a. | |

| MODEL 2 (Rinf1y)t−1; (Repungl)t−1 | MAE: | 0.099 | MAE: | 0.101 | MAE: | 0.120 | MAE: | 0.085 |

| RMSE: | 0.129 | RMSE: | 0.122 | RMSE: | 0.146 | RMSE: | 0.110 | |

| PT TEST: | n.a. | PT TEST: | −0.536 | PT TEST: | n.a. | PT TEST: | −0.152 | |

| MODEL 3 (All Variables)t−1 | MAE: | 0.087 | MAE: | 0.097 | MAE: | 0.107 | MAE: | 0.087 |

| RMSE: | 0.111 | RMSE: | 0.118 | RMSE: | 0.133 | RMSE: | 0.112 | |

| PT TEST: | n.a. | PT TEST: | 6.322 *** | PT TEST: | n.a. | PT TEST: | −0.153 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tronzano, M. What Drives Asset Returns Comovements? Some Empirical Evidence from US Dollar and Global Stock Returns (2000–2023). J. Risk Financial Manag. 2024, 17, 167. https://doi.org/10.3390/jrfm17040167

Tronzano M. What Drives Asset Returns Comovements? Some Empirical Evidence from US Dollar and Global Stock Returns (2000–2023). Journal of Risk and Financial Management. 2024; 17(4):167. https://doi.org/10.3390/jrfm17040167

Chicago/Turabian StyleTronzano, Marco. 2024. "What Drives Asset Returns Comovements? Some Empirical Evidence from US Dollar and Global Stock Returns (2000–2023)" Journal of Risk and Financial Management 17, no. 4: 167. https://doi.org/10.3390/jrfm17040167