Blockchain for Accounting and Auditing—Accounting and Auditing for Cryptocurrencies: A Systematic Literature Review and Future Research Directions

Abstract

1. Introduction

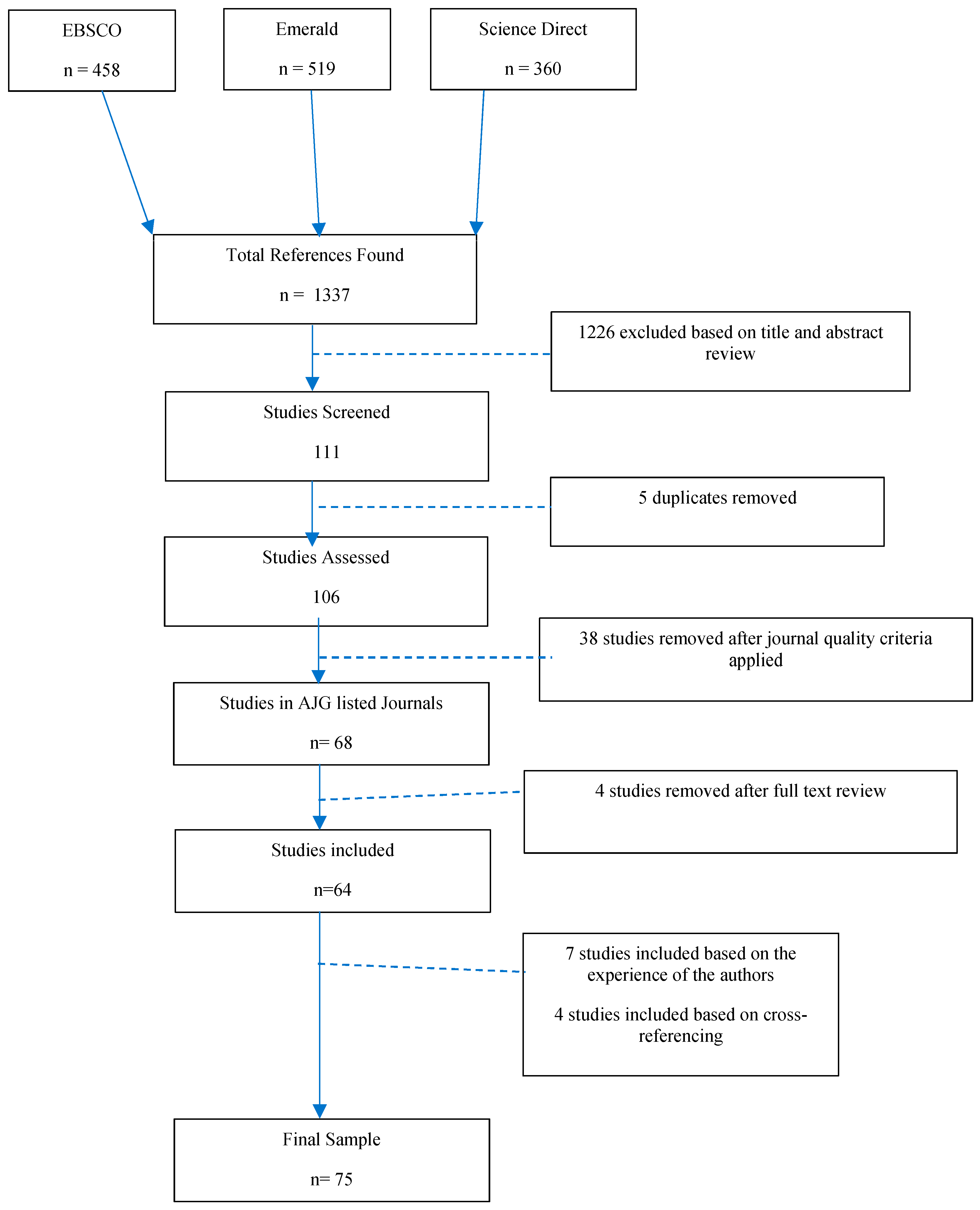

2. Conceptual Boundaries of the Review

3. Methodology

3.1. Search Protocol

3.1.1. Question Formulation

3.1.2. Inclusion Criteria

3.1.3. Search Strategy

3.1.4. Exclusion Criteria

3.1.5. Selecting Relevant Studies

3.1.6. Further Search Processes

4. Results and Discussion

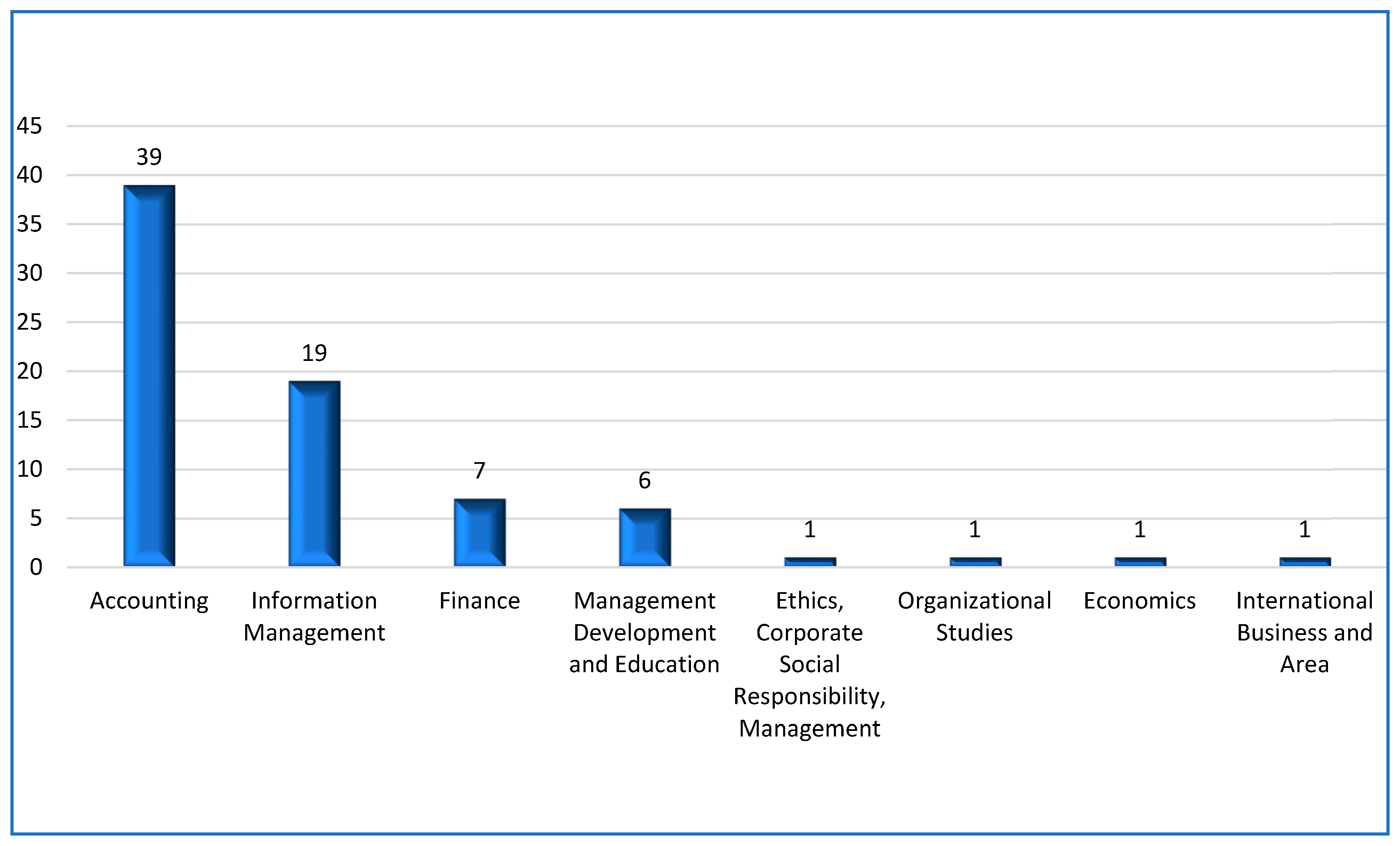

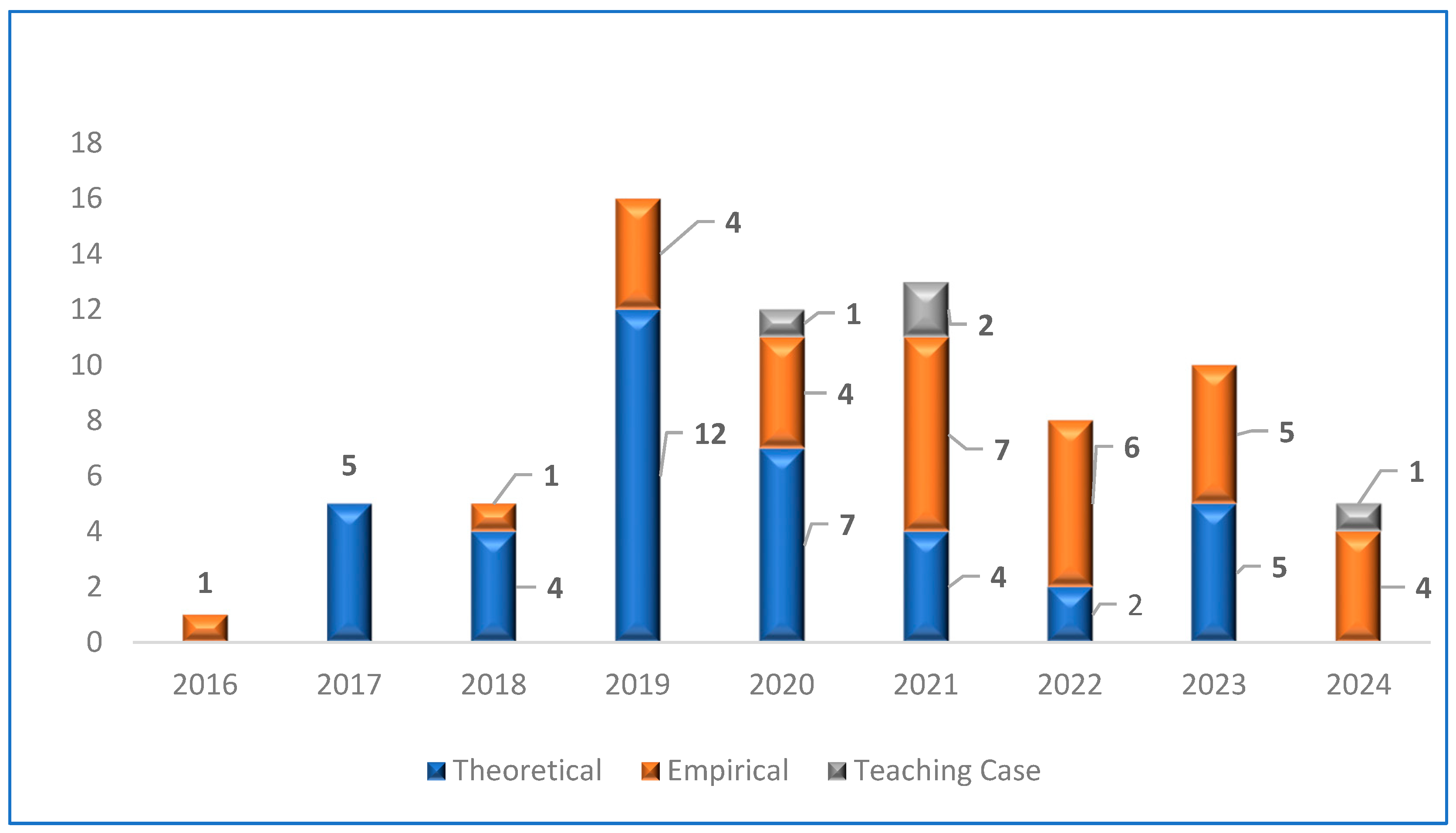

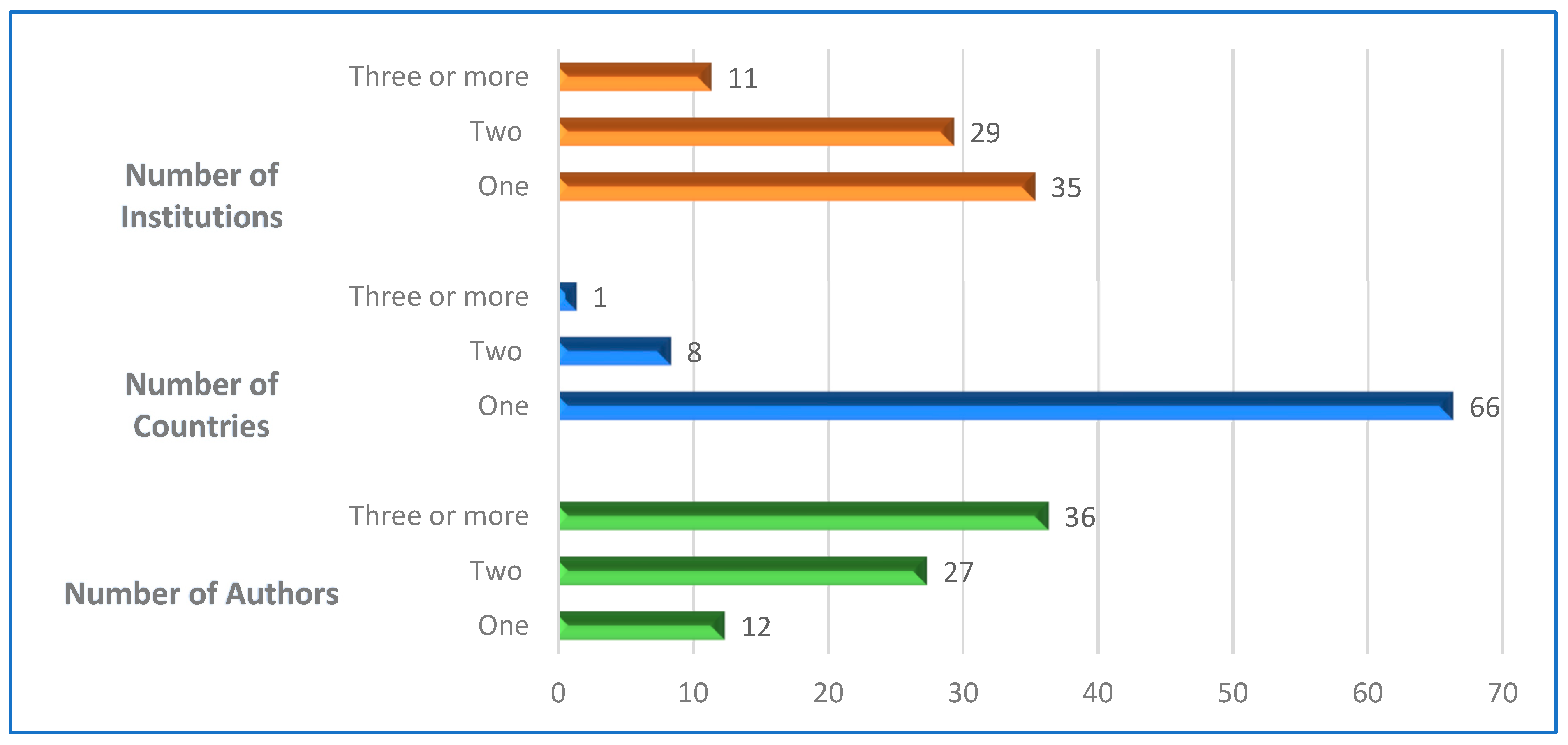

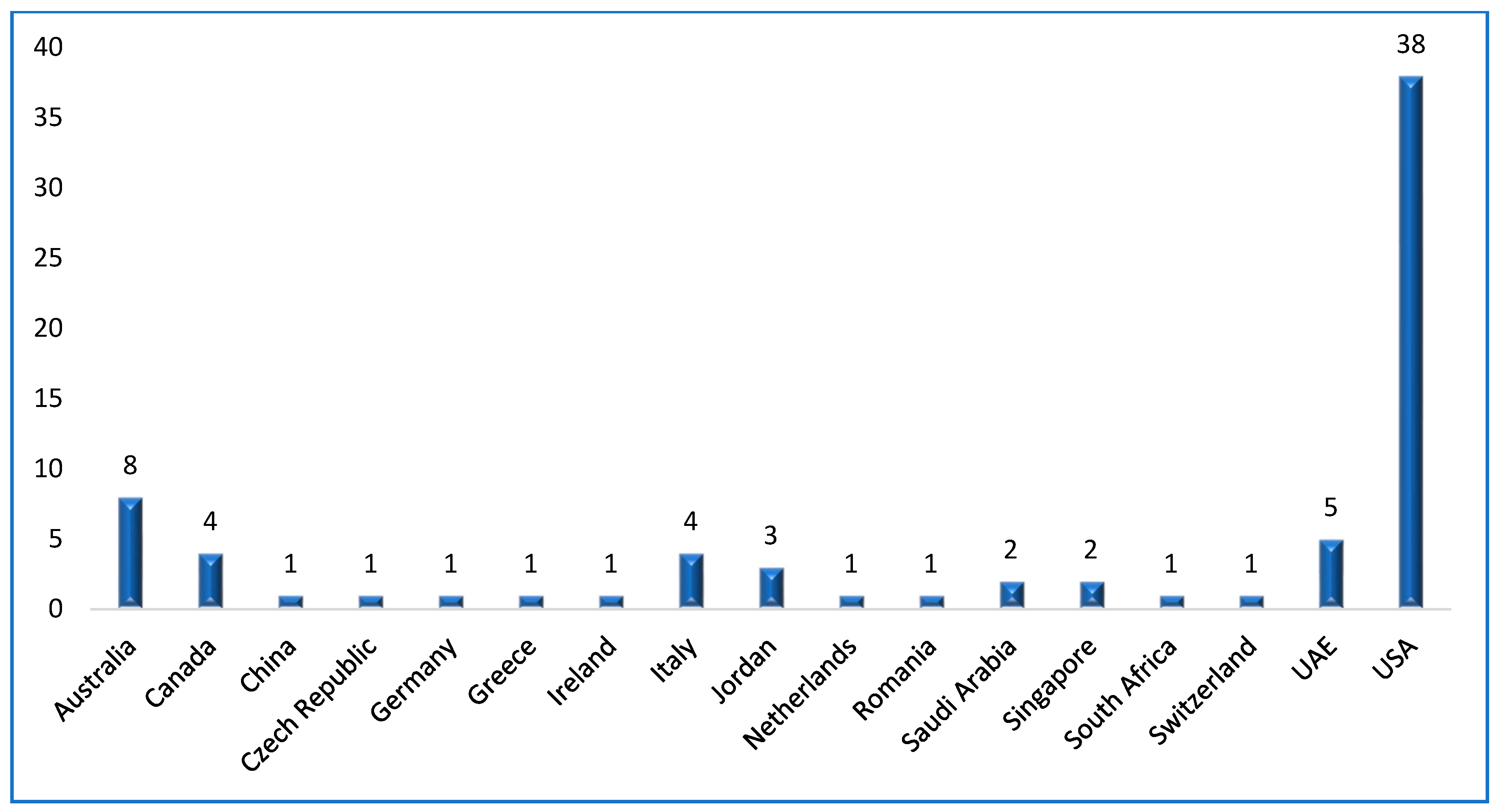

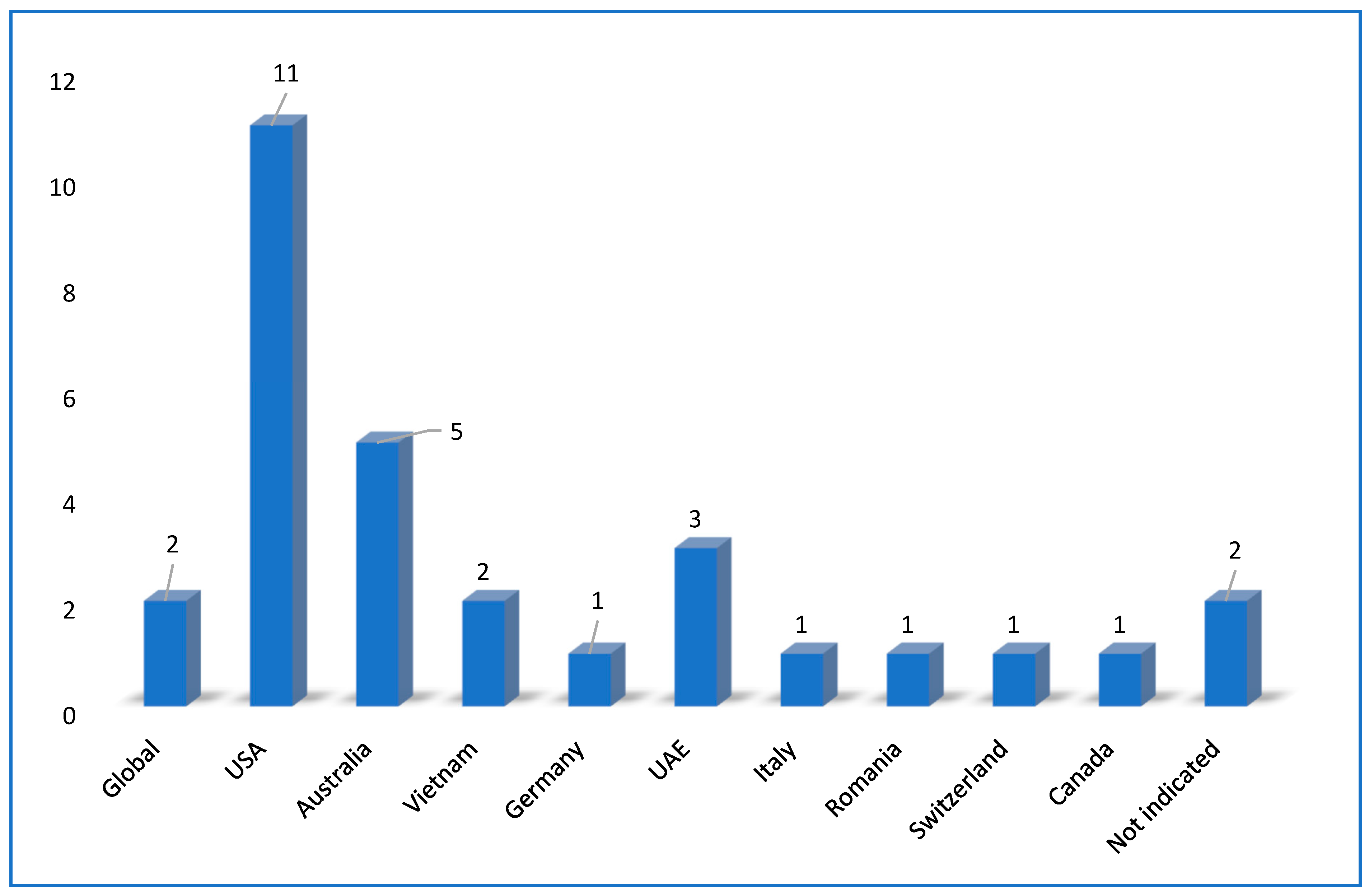

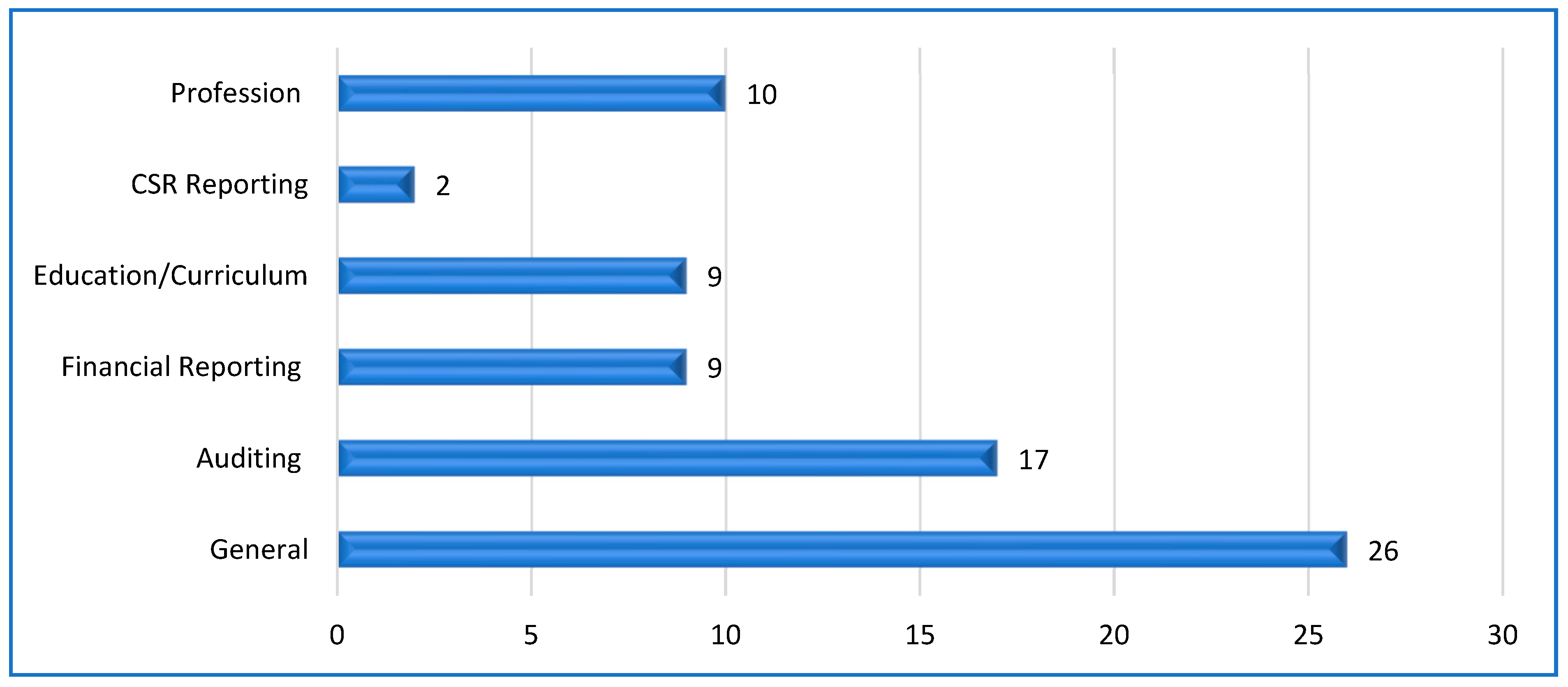

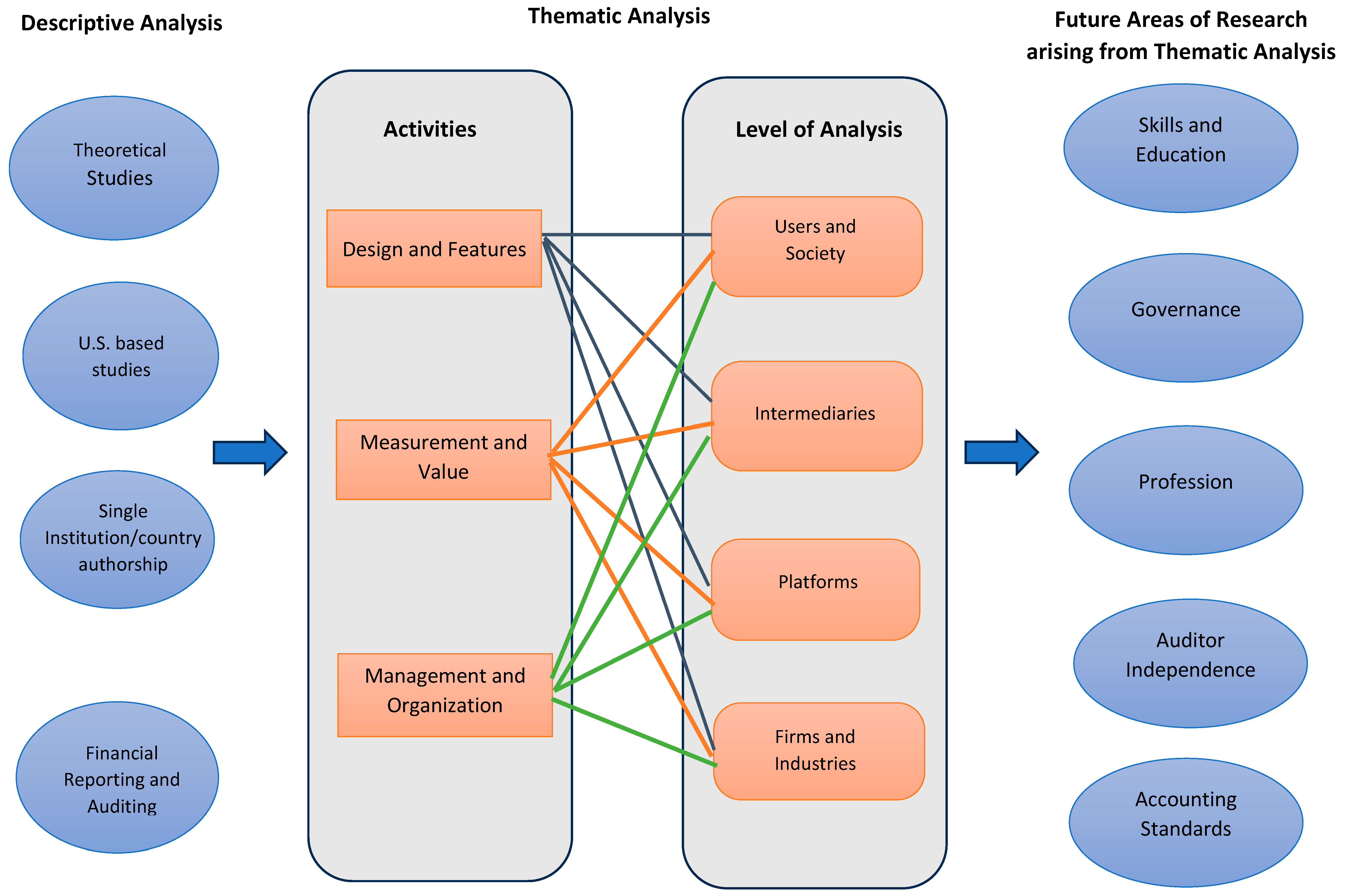

4.1. Descriptive Analysis of the Literature

4.2. Thematic Analysis of the Literature

4.2.1. Design and Features: Users and Society

Design and Features: Intermediaries

Design and Features: Platforms

Design and Features: Firms and Industries

4.2.2. Measurement and Value: Users and Society

Measurement and Value: Intermediaries

Measurement and Value: Platforms

Measurement and Value: Firms and Industries

4.2.3. Management and Organization: Users and Society

Management and Organization: Intermediaries

Management and Organization: Platforms

Management and Organization: Accounting–Auditing Firms and the Accounting–Auditing Industry

5. Future Research Agenda

6. Conclusions

Funding

Conflicts of Interest

Appendix A

| Citation | Key Research Focus | Key Research Findings |

|---|---|---|

| Abdennadher et al. (2021) | To examine how auditors and accountants view the use of blockchain technology in the United Arab Emirates following the government’s announcement that it will move 50% of all government transactions onto a platform based on blockchain technology by 2021. | Blockchain affects the accounting industry in terms of transaction recording, evidence storage, and offering a safe environment for conducting business. It alters auditors’ approach and procedure, holds promise for augmenting traditional auditing, and will automate accounting practices. Accounting professionals and auditors will become aware of and involved in blockchain development in assurance services. |

| Abu Afifa et al. (2022) | To apply an expanded Unified Theory of Acceptance and Use of Technology (UTAUT) to examine the accountant’s desire to implement blockchain. | Intention to adopt blockchain is positively influenced by performance and effort anticipation but less by social influence. Trust positively impacts ambition to adopt blockchain, effort, and performance expectations. Job relevance negatively impacts performance anticipation, while accounting information quality has a favorable influence. Computer compatibility and self-efficacy positively impact effort expectations. Compatibility has no bearing on the decision to adopt blockchain. |

| Abu Afifa et al. (2022) | Investigate the intention to use blockchain from the accountant’s point of view using an extended UTAUT model. | External constructs like accounting information quality, job relevance, and trust influence blockchain adoption. |

| Akter et al. (2024) | Examine the organizational factors that drive and hinder the adoption of blockchain in accounting. | Nine context-specific factors influence blockchain adoption; challenges include lack of knowledge and complex integration with existing systems. |

| Al Shanti and Elessa (2023) | Explore the impact of digital transformation, specifically blockchain technology, on the quality of accounting information and corporate governance in banks. | Digital transformation toward blockchain can enhance accounting information quality and strengthen corporate governance. |

| Al-Htaybat et al. (2019) | Investigate how accounting procedures and emerging technologies like blockchain connect as intellectual capital to promote value creation and achieve Sustainable Development Goals. | Gaining an in-depth understanding of new technology can improve interpretation capacity. Integrated reports can better represent new business models and enable greater disclosure. |

| Alles and Gray (2020) | Focus on the need for auditing to overcome the “first-mile problem” (FMP) in ensuring data on the blockchain matches actual data. | Training auditors can help overcome the FMP, but there is no guarantee that traditional auditors will meet the increased demand for new auditors. |

| Alsalmi et al. (2023) | Investigate the classification and accounting practices for digital currencies. | Current accounting standards do not cover digital currencies adequately; there is a need for new standards to avoid inconsistent global approaches. |

| Appelbaum and Nehmer (2020) | Analyze how auditors might examine business transactions connecting to a private or semi-private blockchain. | Blockchains covered in the study would be private or semi-private, business-to-business or business-to-consumer, and housed in a private, semi-private, or public cloud. Each blockchain would have unique protocols for operation and validation. |

| Appelbaum et al. (2022) | Explore reasons behind the lag in widescale adoption of blockchain technology for business operations and accounting. | Identifies functionality, data and process integrity, and regulatory concerns as potential explanations for the lag in adoption. Provides a framework of questions to address concerns delaying blockchain implementation. |

| Autore et al. (2024) | Investigate the association between blockchain adoption and firms’ financial reporting behavior. | Blockchain adoption may increase earnings management due to hype and reduced monitoring. |

| Beigman et al. (2023) | Present a methodology to dynamically designate principal markets and derive fair value prices for cryptocurrencies. | Principal market identification is challenging due to market fragmentation; proposes a dynamic designation methodology. |

| Brandon et al. (2024) | Examine the financial accounting and reporting issues surrounding cryptocurrencies. | Students found the case realistic, interesting, and challenging; appropriate financial accounting treatment for Bitcoin varies by client type. |

| Cai (2021) | Using a case study methodology, the study integrates traditional triple-entry accounting with blockchain technology. | Businesses will only need to make one internal entry for certain accounts using blockchain technology, with the other entry noted on a shared public ledger. Triple-entry accounting on the blockchain can significantly enhance accounting by resolving transparency and trust issues. |

| Campbell et al. (2023) | Examine the effects of automation bias in auditing blockchain environments. | Predominantly influenced by the Halo Effect, indicating a propensity for positive automation bias across management assertions. |

| Carlin (2019) | Present an overview of blockchain technology development, which can advance accounting beyond double entry. | Blockchain will change accounting, introducing blockchain-based record-keeping with profound effects on financial reporting, auditing, and management accounting. Academics need to study implementation difficulties and develop educational frameworks. |

| Centobelli et al. (2021) | Using an ecosystem viewpoint, this article attempts to develop and assess a blockchain platform for the accounting industry. | Distributed record storage on a blockchain platform increases process status information flow transparency, boosting operational efficiency. Using a mix of off-chain and on-chain solutions is no longer necessary when data is recorded on the blockchain platform. |

| Coyne and McMickle (2017) | Investigate if blockchain might replace existing accounting ledgers as a more secure option. | Blockchain transaction verification cannot be done to an adequate degree in accounting. Blockchain’s security features are not entirely functional or dependable in an accounting context. |

| Dai and Vasarhelyi (2017) | Investigate the uses of blockchain technology in the accounting and auditing profession. | Presents an accounting and assurance approach built on blockchain for more automation of assurance and accounting. |

| Dai et al. (2019) | Provide a framework for using smart contracts and blockchain technology to rethink audit practices and enable Audit 4.0. | Data integrity and proper operation of intelligent auditing modules are major challenges. A framework for utilizing smart contracts to execute Audit 4.0 is provided. Real air quality data gathered through crowdsourcing are validated and analyzed using blockchain and smart contracts. |

| Davenport and Usrey (2023) | Examine the complexities and regulatory environment for crypto assets to provide guidance on their tax classification. | One tax classification for crypto assets is not sufficient; different classifications provide more equitable tax treatment. |

| Dunn et al. (2021) | This case is designed for either undergraduate or graduate auditing and assurance courses, focusing on the auditing implications of blockchain technology and Bitcoin. | N/A |

| Dupuis et al. (2023) | Provide a holistic overview of digital assets for auditing faculty, students, and practitioners. | Contextualizes digital assets within monetary systems, outlines auditing challenges and management assertion complexities, and highlights fraud risk factors. Explores innovations in digital currency markets. |

| Dyball and Seethamraju (2021) | The paper describes a study that looked into the influence of customer use of blockchain technology on Australian accounting companies. | Australian accounting companies have either acquired or explored engagements with clients who operate Bitcoin businesses or use blockchain platforms. Blockchain technology presents unique risks and opportunities for applying and growing audit knowledge in a new field of auditing. |

| Dyball and Seethamraju (2022) | This study addresses the risks associated with auditing blockchain-based financial statements and cryptocurrencies. | Inherent and control risks are increased, and blockchain clients are thought to be riskier than traditional clients. Two possible audit approaches include increasing indirect and entity-level evidence or combining direct, indirect, account-level, and entity-level evidence. |

| Ferri et al. (2021) | Examine the auditing profession’s readiness to adopt “disruptive” technologies based on empirical data from Italian Big Four employees. | Performance expectations and social influence are primary determinants of auditors’ readiness to use blockchain. |

| Fortin and Pimentel (2024) | Examine Bitcoin as an accounting regime and its implications. | Bitcoin constitutes a new technology built on social practices and accounting language; human interactions underpin the system’s power. |

| Fülöp et al. (2022) | Examine the status quo and development tendencies of digitization in accounting. | User trust and perceived usefulness influence the adoption of digital services; risk factors did not affect perceived use. |

| Gauthier and Brender (2021) | The study examines the methods auditors are using to determine whether the present auditing standards are still relevant, given the growing usage of blockchain technology. | There is a rising need for IT auditing standards, and regulators are slow in updating or releasing new standards, contrary to the evolving IT environment. |

| Gietzmann and Grossetti (2021) | The paper questions the taxonomy of distributed ledgers and raises concerns about the consensus system and the ability to write to the ledger. | Transitioning from centralized to decentralized ledger systems keeps accounting knowledge relevant. Distributed ledger systems can create value without cryptocurrency. |

| Gomaa et al. (2023) | Develop a conceptual framework leveraging blockchain to streamline and enhance transaction reconciliation efficiency. | The proposed framework involves recording transactions on the blockchain before updating ERP systems, improving transparency and consistency. Demonstrates technical feasibility with examples. |

| Hampl and Gyönyörová (2021) | The study examines whether fiat-backed stablecoins can be classified as cash or cash equivalents under IFR Standards. | Fiat-backed stablecoins may be reported as cash equivalents if kept to meet short-term obligations. Companies must evaluate whether the material requirements of the coins have been met before reporting them as cash equivalents. |

| Hubbard (2023) | Examine potential financial accounting treatments for cryptocurrencies. | Proposes an intangible asset revaluation model; aims to inform standard setters and financial statement preparers. |

| Juma’h and Li (2023) | Examine factors influencing auditors’ intention to use blockchain. | Auditors’ knowledge is positively associated with use intention; perceived adequacy of accounting standards negatively affects intention. |

| Karajovic et al. (2019) | Assess how blockchain technology will affect the accounting industry and specific procedures. | Blockchain can help accounting businesses provide better customer service and manage transactions, records, and performance. New governance models must be created for moral decision-making and efficient crisis management. |

| Kend and Nguyen (2022) | Analyze whether blockchain technology will significantly alter Australian assurance and audit services. | The impact of BDA, robotics, and AI on auditing is considered favorable, but participants are doubtful of blockchain’s applicability in auditing practice. |

| Kokina et al. (2017) | Provide a summary of blockchain-related procedures followed by big accounting firms and identify key turning points in the technology’s development. | Big accounting firms have a positive outlook on blockchain adoption, with advantages outweighing disadvantages. |

| Lee et al. (2024) | Examine the impact of blockchain technology on taxpayer compliance among US taxpayers. | Integrating blockchain can address noncooperative behavior and reduce the tax gap; key factors include IRS efficiency and increased punishment. |

| Li and Juma’h (2022) | Examine how blockchain features must align with auditors’ task needs to enhance acceptance of blockchain-based solutions. | The auditors’ task needs to fully mediate the effect of blockchain features on acceptance. Different blockchain features hold varying importance. Strengthening auditors’ knowledge and awareness of blockchain is essential. |

| Liu et al. (2022) | Examine the potential impact of blockchain technology on accounting and auditing processes through the lens of transaction cost theory. | Blockchain offers significant advantages for accounting and auditing by enabling recording, tracking, and managing transactions and assets, potentially lowering transaction costs. |

| Liu et al. (2019) | Investigate potential blockchain effects on auditing and accounting procedures and offer ideas for auditors. | Analysis of advantages and disadvantages of permissioned vs. permissionless blockchains. Auditors should become knowledgeable about blockchain governance and technology, focusing on risk management. |

| Casciello et al. (2021) | Investigate the potential advantages and disadvantages of integrating blockchain technology into accounting and auditing procedures. | Emphasizes the value of accountants’ and auditors’ expertise and professional conscience in contrast to blockchain’s impersonal and standardized AI operating system. |

| Marei et al. (2023) | Investigate the understanding of cryptocurrencies among newly certified public accountants and accounting graduate students. | Recent graduates and CPAs have limited awareness of cryptocurrencies, likely due to a lack of exposure during education. |

| McAliney and Ang (2019) | Review two current technologies for network-based data storage and sharing—relational databases and Google Sheets—and their use in accounting organizations. | Framework to choose between blockchain and traditional databases. Organizations relying on traditional databases’ security features will face new data governance challenges. |

| McCallig et al. (2019) | Provide stakeholders with reliable information about the entity separate from the auditor and improve audit evidence to support their opinion. | Representational accuracy of financial reporting information can be demonstrated using multiple security techniques. |

| McGuigan and Ghio (2019) | Critically examine how continuing technological revolutions can expand accounting’s potential into other areas. | New technologies can expand accounting into areas like visualization, curation, performance, and disruption. |

| O’Leary (2017) | Define suggested applications of blockchain technology for transactions, such as those in supply chain or accountancy. | Companies will mainly use private and cloud-based blockchain configurations. Hybrid systems combining current and blockchain technologies may be created. |

| O’Leary (2018) | Examine how corporate blockchain systems for transaction processing are affected by transactions involving open information. | Incentives are needed for companies to abandon control of information disclosure via blockchains, such as mandates from governmental bodies or significant penalties. |

| O’Leary (2019) | Portray that conventional private blockchains are created to satisfy consortium requirements and may not be adopted by all parties involved in business. | Suggests creating a design before moving to a blockchain application, using a database combining blockchain and database features. |

| Parmoodeh et al. (2023) | Explore the impact of blockchain technology on audit practice. | Blockchain can enhance audit procedures, reduce audit budget time, and facilitate analytical procedures. |

| Pimentel et al. (2021) | Focus on why auditors are hesitant to work with clients that own cryptocurrencies. | Ownership and price of cryptocurrencies are major obstacles to offering an audit opinion. Suggests lowering audit risk by carefully screening clients and management groups and working closely with blockchain experts. |

| Qasim and Kharbat (2020) | Demonstrate ways to include blockchain technology, AI, and data analytics in accounting syllabi to increase graduates’ employability. | The accounting curriculum requires significant changes to align with new developments. |

| Qasim et al. (2022) | Determine the extent to which the current accounting curriculum reflects the ongoing digital transformation in the UAE, focusing on AI, blockchain technology, and data analytics. | Highlights recent initiatives in the UAE to test and adopt AI, blockchain technology, and data analytics, raising concerns about the adequacy of current accounting curricula. |

| Ram et al. (2016) | Choose a theoretical strategy for accounting for Bitcoin based on stewardship and neoliberalism theories. | Models based on neoliberalism and stewardship emphasize the fair value and cost of Bitcoin. |

| Roszkowska (2020) | Investigate the causes of financial scandals connected to audits and offer recommendations on how developing technologies can address these issues. | Blockchain, IoT, smart contracts, and AI can address financial reporting and audit-related issues, improving data accuracy in financial statements. |

| Rozario and Thomas (2019) | Provide a solution to the expectation gap challenge using an external audit blockchain backed by smart audit processes and smart contracts. | Smart audit techniques and blockchain could drastically alter auditing, but audit judgment will still play a big role. Future research prospects are presented. |

| Sheldon (2018) | Suggest a blockchain-based solution for compiling and disseminating cases of practitioner misconduct nationwide. | Proposes impartial access granting and creation of the blockchain by an impartial organization to avoid bias. |

| Sheldon (2019) | Examine threats to permissioned and private blockchains using IT general controls (ITGCs) as a framework for internal control over financial reporting audits. | Blockchain must obtain robust ITGCs to benefit from various systems. Several areas of consideration are named when changing a blockchain. |

| Smith (2020) | Provide practical insights into business information related to blockchain technology and its effects on risk assessment procedures. | The integrity of the verification and audit process may be preserved with decentralized and distributed systems. |

| Stein Smith (2018) | Study and evaluate the adaptations blockchain technology has created for the accounting industry. | Recognizing factors to consider and asking the right questions are clear first measures. |

| Stein Smith and Castonguay (2020) | Investigate how blockchain technology affects financial reporting and assurance and address financial data integrity and reporting challenges. | Organizations using blockchain must modify internal controls and counterparty risk assessment policies. External auditors should evaluate blockchain technology as a financial reporting risk. |

| Stern and Reinstein (2021) | Discuss how business professors teaching accounting may incorporate blockchain into their present courses or create new ones. | Results in sample course syllabi, recommended reading lists, resources for group and individual work, and student feedback. Expands students’ knowledge by focusing on business applications of blockchain. |

| Tan and Low (2017) | Study the caveats pertaining to accounting for cryptocurrencies like Bitcoin. | It is not necessary to establish a new accounting standard for Bitcoin, but it is necessary to establish whether Bitcoin is a currency or a commodity. |

| Tan and Low (2019) | Investigate how blockchain technology would change the accounting industry. | Accountants will likely continue to oversee financial reports but not be the primary oversight of blockchain technology AIS. Audits will still be required in blockchain-based AIS. |

| Tang and Tang (2019) | Offer a structure for a distributed carbon ledger (DCL) system for managing climate change. | Implementation of the DCL complements current market-based emissions trading schemes (ETSs). |

| Tiberius and Hirth (2019) | Investigate changes in auditing practices that German auditing professionals expect within the next five to ten years. | The existing annual auditing method will give way to a continuous audit strategy. New technology will play a supporting function. |

| Vincent and Barkhi (2021) | Address the dangers of joining a blockchain consortium, concerns about internal controls, and whether COSO frameworks address a collaborative supply chain ecosystem. | Explains the inherent risks of participating in a blockchain consortium and provides an overview of smart contracts. Lists possible internal control-related queries for launching a smart contract or participating in a consortium. |

| Vincent et al. (2020) | Create a blockchain architecture for businesses to allow auditors to use blockchain technology for audit and assurance services. | The proposed design solves the problems. |

| Wang and Kogan (2018) | Determine how to use blockchain in accounting and auditing while balancing information transparency and confidentiality. | Provides design frameworks for processing systems to ensure confidentiality, monitoring, and enhanced performance. |

| Weigand et al. (2020) | Formally introduce a shared system based on decentralized ledger technology (DLT) that complies with Financial Reporting Standards. | Smart contracts can develop a simple representation pattern for business exchange transactions, improving auditability and interoperability. |

| Publication Details Citation | Theories/Frameworks Applied |

|---|---|

| Abu Afifa et al. (2022) | Unified theory of acceptance and use of technology (UTAUT) |

| Abu Afifa et al. (2022) | Extended unified theory of acceptance and use of technology (UTAUT) model |

| Akter et al. (2024) | Technology–Organization–Environment (TOE) framework |

| Al Shanti and Elessa (2023) | Agency theory |

| Al-Htaybat et al. (2019) | Global brain concept, evolutionary cybernetics concept |

| Appelbaum and Nehmer (2020) | Design science research (DSR) |

| Centobelli et al. (2021) | Design science research (DSR) |

| Dyball and Seethamraju (2021) | Gendron’s (2002) typology, Greenwood and Suddaby’s (2006) archetype |

| Dyball and Seethamraju (2022) | van Buuren et al. (2014) continuum of audit approaches |

| Ferri et al. (2021) | Integrated theoretical framework merging the third version of the technology acceptance model (TAM3) and the unified theory of acceptance and use of technology (UTAUT) |

| Fülöp et al. (2022) | Technology Acceptance Model (TAM) combined with trust and perceived risk |

| Hampl and Gyönyörová (2021) | IFRS framework |

| Kend and Nguyen (2022) | Diffusion of innovation theory |

| Li and Juma’h (2022) | Task–technology fit and fit-as-mediation perspectives |

| Liu et al. (2022) | Transaction cost theory (Coase 1937) |

| McCallig et al. (2019) | Network analysis |

| O’Leary (2018) | Arrow’s impossibility theorem |

| O’Leary (2019) | Arrow’s impossibility theorem; Business logic: Semantic model |

| Ram et al. (2016) | Stewardship, neoliberalism |

| Rozario and Thomas (2019) | Design science research (DSR) |

| Sheldon (2019) | Information technology general controls (ITGCs) |

| Vincent and Barkhi (2021) | Committee of Sponsoring Organizations (COSO) integrated and COSO’s Enterprise Risk Management (ERM) frameworks |

| Weigand et al. (2020) | REA Accounting Model, Accounting Ontology |

| Citation | Avenues for Future Research |

|---|---|

| Abu Afifa et al. (2022) | Additional empirical research is required. Moreover, the authors suggest applying the model to SMEs, as they exhibit greater strength in accounting digitization. |

| Akter et al. (2024) | Gather data from actual users in the accounting domain to validate the use and anticipated adoption of blockchain in accounting and to understand the conditions under which blockchain adds value, such as specific types of blockchain and accounting areas. Additionally, future studies should employ quantitative techniques to validate the key drivers of blockchain accounting adoption identified at the organizational level and determine their relative significance. Moreover, research should explore blockchain accounting adoption across various industries, markets, and geographic regions to contextualize findings within different legal, political, and cultural jurisdictions. |

| Al-Htaybat et al. (2019) | Future research should further explore the concept of value creation and pinpoint specific indicators for various types of value, including financial, practical, societal, and environmental sustainability. This research will also concentrate on backing the 2030 UN Agenda and its goal of achieving enduring sustainable development and fulfilling the SDGs. Specifically, examining practical applications to ascertain how integrated thinking can promote sustainable value creation in support of sustainable development and the achievement of SDGs would be particularly intriguing. |

| Autore et al. (2024) | Extend the sample period and include more firms beyond early adopters, investigate motivating factors for blockchain adoption, such as real-time financial reporting and reduced accounting manipulation, measure the variation in blockchain usage among firms, develop methods to assess monitoring efforts by market participants, and explore the unintended consequences of blockchain adoption on financial reporting as the technology becomes more widely adopted. |

| Cai (2021) | The author recommends exploring the regulatory challenges, security threats, and uncertain ROI that impede the broader application of triple-entry accounting. Additionally, the author advocates for the use of empirical methodologies like experiments, interviews, surveys, and case studies to delve deeper into the theoretical framework and the concept of triple-entry accounting, thereby fostering more robust foundational support. Lastly, future research could undertake interdisciplinary studies encompassing technology, economics, and psychology. |

| Carlin (2019) | The author contends that it is vital for scholars to shift their focus toward the numerous unresolved issues associated with this transformation. In doing so, they can seize a critical opportunity to wield influence, interact with pertinent stakeholders, and generate significant impact. Moreover, this will allow them to kick-start the creation of educational frameworks that will guarantee the sustainability of the accounting and auditing sectors beyond the double-entry era. |

| Centobelli et al. (2021) | The research suggests broadening the research methods to include empirical experiments, interviews, surveys, and case studies. Furthermore, the research could be expanded to encompass larger sample sizes. It is crucial to strengthen the conceptual and theoretical underpinnings and to include a wider range of empirical contexts in the sample. The study also calls for interdisciplinary research involving the fields of technology, economics, and psychology. It’s necessary to contrast various industrial contexts to identify both common and unique trends and to further explore the impact of blockchain on accounting from both ecosystem and sociological viewpoints. |

| Dai et al. (2019) | The study suggests a potential direction for future research could be to delve into the uses of different types of blockchain (such as public, private, and permissioned) within the context of Audit 4.0. Additionally, researchers could seek methods to improve the precision of crowdsourced data while ensuring data privacy is maintained. The development of effective smart audit and reporting contracts is another significant aspect to explore. Even though IoT, blockchain, and smart contracts can effectively gather and store real data and conduct automated analyses, auditors are still required to apply their professional expertise to pinpoint process risks, assess system effectiveness, and filter and gather pertinent data. Lastly, it is crucial to investigate whether the adoption of emerging technologies and any novel audit methodologies linked with them could potentially jeopardize auditor independence. |

| Dyball and Seethamraju (2022) | The authors recommend modifying the continuum of audit methods proposed by van Buuren et al. (2014) to incorporate evidence at both the account and entity levels. This adjustment should reflect the viewpoints of audit practitioners, standard-setting entities, and regulatory bodies, which have been collected through interviews. |

| Ferri et al. (2021) | The authors propose (1) to adopt a longitudinal approach to study audit professionals’ perceptions before the implementation and after the implementation of blockchain technologies in auditing activities, (2) to employ other theoretical models, e.g., the Technology–Organization–Environment (TOE) framework to increase explanatory power, and (3) to assess the existence of any disparities between voluntary settings and mandatory settings, and across different countries in terms of technology acceptance. |

| Fortin and Pimentel (2024) | Examine the evolution of Bitcoin under the leadership of recent Bitcoin Core Developers and its mainstream adoption, exploring potential ideological fragmentation within the Bitcoin community. Additionally, research could investigate how firms reconcile clashes between traditional accounting regimes and the Bitcoin regime, particularly for firms operating within both spheres, such as Bitcoin exchange-traded funds and crypto exchanges overseen by financial regulators. Analyzing how these companies navigate competing social practices to recognize economic value will be crucial as Bitcoin’s usage and its impact on the accounting profession continue to evolve. |

| Fülöp et al. (2022) | Extend the data collection to a larger sample size. Additionally, increasing the number of variables involved could allow for more detailed research on the elements that affect the intention to apply new IT skills. This approach would provide a more refined, detailed, and comprehensive perspective on the identified factors. Consequently, a new empirical study could analyze the model of adopting services offered by Industry 4.0 within the financial accounting field in greater detail. |

| Gauthier and Brender (2021) | The authors suggest that to enhance the reliability of the results, similar surveys could be carried out in different locations (local, national, or international), encompassing organizations that are involved in setting and enforcing standards. Furthermore, new IT auditing standards should be formulated to adapt to swiftly evolving technologies (such as blockchain) and their integration into auditing. |

| Gomaa et al. (2023) | Technical implementation and security issues. |

| Hampl and Gyönyörová (2021) | The sole objective of this paper was to determine if fiat-backed stablecoins could be classified as cash equivalents under IFRS. It did not delve into the different accounting standards (like IAS 2 Inventories, IAS 38 Intangible Assets, or IFRS 9 Financial Instruments) that could be used to report fiat-backed stablecoins by the holder or issuer. Additionally, it did not investigate other kinds of stablecoins (such as collateralized and algorithmic stable coins) or their market performance. Future research could focus on those topics. |

| Hubbard (2023) | Explore the implications of firms using cryptocurrency as an investment strategy compared to using it as a medium of exchange, and analyze the strategic implications of both methods. |

| Juma’h and Li (2023) | Explore how auditors’ acceptance of permissioned and permissionless blockchains may differ across various auditing contexts. |

| Karajovic et al. (2019) | The authors propose that future research should also focus on establishing new governance models to guarantee ethical decision-making processes and effective crisis management. |

| Kend and Nguyen (2022) | There is a need for empirical tests for the technology’s impact on the quality and/or the efficiency of the audit. |

| Liu et al. (2022) | Empirical testing as data becomes available within the proposed transaction cost theory is proposed. |

| Casciello et al. (2021) | Future research will explore strategies for adopting blockchain technology through the use of case studies. This could provide insights into how and to what degree blockchain technologies might influence accounting and auditing activities. |

| McCallig et al. (2019). | There is a need for additional research to advance these designs, construct more complex models, and develop a functioning system. This subsequent research could investigate the potential application of the proposed system to other areas that necessitate confirmation as part of an audit, e.g., accounts payable. The subsequent research objective might be to examine different implementation strategies for the design proposed in this paper, for instance, an Ethereum blockchain utilizing simulated data. |

| McGuigan and Ghio (2019) | The authors emphasize the necessity for accounting researchers and practitioners to question conventional accounting perspectives, thereby facilitating the development of more advanced accountability models. |

| O’Leary (2018) | The author contends that the utilization of wash accounts can potentially influence enterprise markets, making it essential to identify their presence. As such, it is valuable to investigate alternative approaches for detecting these accounts, like those suggested by Tsikerdekis and Zeadally (2014), or to prevent their formation entirely. Additionally, to monitor events of direct interest, it might be feasible to set up continuous surveillance systems that oversee blockchains and social media. |

| O’Leary (2019) | The study suggests a potential future direction could be to investigate the use of alternative distributed databases in place of BigchainDB and also to further refine the model and present a comprehensive case study of its deployment in a virtual organization. The creation of more sample transactions could help broaden the research scope. Given the time-intensive nature of blockchain and similar structures, alternative methods such as the ‘tangle’ proposed by Popov (2018) and Heilman et al. (2017) might be worth considering. While the tangle might not have broad applicability, strategies like the tangle or hash graph (Baird 2016) could be suitable consensus mechanisms for virtual organization systems due to their distinctive features. |

| Parmoodeh et al. (2023) | Examine the insights and challenges faced by early adopters to understand how these can be adapted to accounting and audit practices. |

| Rozario and Thomas (2019) | The paper underscored that the integration of various technologies encountered numerous issues and challenges, which could pave the way for future research opportunities. One such challenge is the ambiguity surrounding the process of updating or modifying audit standards, as demonstrated by the draft comments from IAASB and PCAOB on revising or introducing new standards that advocate for the use of advanced audit analytics. Automating the implementation of these analytics on the blockchain could present a new set of challenges for standard-setters and regulators. This calls for research to ascertain how to disrupt the oversight model of financial statement audits (including its impact on audit quality) and regulate smart audit procedures on the blockchain. Another challenge is the consolidation of diverse sources of endogenous and exogenous data, which will persist as a hurdle. |

| Stein Smith (2018) | It is crucial to stay informed of the changes that take place in the blockchain field and establish structures to effectively evaluate and interact with these technologies in the future. |

| Tan and Low (2019) | Future research will need to empirically validate predictions once blockchain-based AIS are accessible. |

| Tang and Tang (2019) | The study proposes that as new algorithms and methodologies are developed, there may be a need to revise and reevaluate ETS applications. Furthermore, future research should focus on specific areas such as carbon assurance, carbon financing, decarbonization, and issues related to climate change adaptation. |

| Tiberius and Hirth (2019) | The authors present the potential for future research focused on the implications of incorporating new technologies into the auditing process. |

| Vincent and Barkhi (2021) | As a further area of research, the authors posit the necessity of examining the potential implications of a multi-company blockchain and smart contract framework from a holistic perspective that accounts for the risk and control measures of individual companies. In addition, they argue whether the governance of blockchain technology should be considered separately from the governance of individual companies. |

| Wang and Kogan (2018) | The authors propose further development of the specifics of BB-CASs, which consist of a series of smart contracts. These contracts can continuously oversee transaction activities and automatically issue alerts when certain trigger conditions are fulfilled. |

| Weigand et al. (2020) | The paper further suggests studying the effects of distributed ledger technology (DLT)-based automated information systems (AIS) on auditing and the development of a declarative language for agreement-backed smart contracts through public reporting drawn from the blockchain. |

| 1 | Nakamoto, Satoshi (24 May 2009). “Bitcoin: A Peer-to-Peer Electronic Cash System”. |

| 2 | Mellis’ work was in turn based on Hugh Oldcastle’s lost 1543 Profitable treatyce (Smyth 2010) that was probably a translation of Luca Paccioli’s Summa de Arithmetica, Geometria, Proportioni et Proportionalita (1494). |

| 3 | If a fully Blockchain-based Accounting system is achieved, then Auditing becomes automatic, and thus, one could argue, obsolete. Thus, whenever we speak of “Accounting on Blockchain”, the implications for Auditing are automatic. |

| 4 | As to the job platform Indeed, PwC was the leading Big Four recruiter in the Blockchain space in March 2019, with 40 job openings. With 17 openings, EY came in second, while Deloitte was next with 10 job offers. |

| 5 | The list only focuses on behavioral, business-oriented Information Systems research. See: https://aisnet.org/page/SeniorScholarBasket?andhhsearchterms=%22basket%22 (accessed on 23 June 2024). |

| 6 | Formerly known as the “ABS list”. |

| 7 | It was observed that at least for our sample, the journals included in the AIS list were also part of the 2021 Academic Journal Guide. |

References

- Abdennadher, Sonia, Rihab Grassa, Hareb Abdulla, and Abdulla Alfalasi. 2021. The effects of blockchain technology on the accounting and assurance profession in the UAE: An exploratory study. Journal of Financial Reporting and Accounting 20: 53–71. [Google Scholar] [CrossRef]

- Abu Afifa, Malik Muneer, Hien Vo Van, and Trang Le Hoang Van. 2022. Blockchain adoption in accounting by an extended UTAUT model: Empirical evidence from an emerging economy. Journal of Financial Reporting and Accounting 21: 5–44. [Google Scholar] [CrossRef]

- Akter, Mohsina, Tyge-F. Kummer, and Ogan Yigitbasioglu. 2024. Looking beyond the hype: The challenges of blockchain adoption in accounting. International Journal of Accounting Information Systems 53: 100681. [Google Scholar] [CrossRef]

- Al Shanti, Ayman Mohammad, and Mohammad Salim Elessa. 2023. The impact of digital transformation towards blockchain technology application in banks to improve accounting information quality and corporate governance effectiveness. Cogent Economics & Finance 11: 2161773. [Google Scholar]

- Al-Htaybat, Khaldoon, Khaled Hutaibat, and Larissa von Alberti-Alhtaybat. 2019. Global brain-reflective accounting practices. Journal of Intellectual Capital 20: 733–62. [Google Scholar] [CrossRef]

- Alles, Michael, and Glen L. Gray. 2020. “The first mile problem”: Deriving an endogenous demand for auditing in blockchain-based business processes. International Journal of Accounting Information Systems 38: 100465. [Google Scholar] [CrossRef]

- Alsalmi, Noora, Subhan Ullah, and Muhammad Rafique. 2023. Accounting for digital currencies. Research in International Business and Finance 64: 101897. [Google Scholar] [CrossRef]

- American Information Systems (AIS). n.d. Senior Scholars’ Basket of Journals. Last Retrieved on 20 June 2024. Available online: https://aisnet.org/page/SeniorScholarBasket?andhhsearchterms=%22basket%22 (accessed on 23 June 2024).

- Appelbaum, Deniz, and Robert A. Nehmer. 2020. Auditing cloud-based blockchain accounting systems. Journal of Information Systems 34: 5–21. [Google Scholar] [CrossRef]

- Appelbaum, Deniz, Eric Cohen, Ethan Kinory, and Sean Stein Smith. 2022. Impediments to blockchain adoption. Journal of Emerging Technologies in Accounting 19: 199–210. [Google Scholar] [CrossRef]

- Autore, Donald, Huimin Amy Chen, Nicholas Clarke, and Jingrong Lin. 2024. Blockchain and earnings management: Evidence from the supply chain. The British Accounting Review 56: 101357. [Google Scholar] [CrossRef]

- Baird, Leemon. 2016. The Swirlds Hashgraph Consensus Algorithm: Fair, Fast, Byzantine Fault Tolerance. Swirlds Tech Reports SWIRLDS-TR-2016-01. Available online: http://www.swirlds.com/downloads/SWIRLDS-TR-2016-01.pdf (accessed on 23 June 2024).

- Beigman, Eyal, Gerard Brennan, Sheng-Feng Hsieh, and Alexander J. Sannella. 2023. Dynamic principal market determination: Fair value measurement of cryptocurrency. Journal of Accounting, Auditing & Finance 38: 731–48. [Google Scholar]

- Berg, Chris, Sinclair Davidson, and Jason Potts. 2018. Ledgers. Available online: https://ssrn.com/abstract=3157421 (accessed on 23 June 2024).

- Bonsón, Enrique, and Michaela Bednárová. 2019. Blockchain and its implications for accounting and auditing. Meditari Accountancy Research 27: 725–40. [Google Scholar] [CrossRef]

- Brandon, Duane, Travis Holt, Jefferson Jones, James H. Long, and Jonathan Stanley. 2024. The case of bitcoins: Examining the financial accounting and reporting issues surrounding cryptocurrencies. Journal of Accounting Education 67: 100902. [Google Scholar] [CrossRef]

- Cai, Cynthia Weiyi. 2021. Triple—Entry accounting with blockchain: How far have we come? Accounting and Finance 61: 71–93. [Google Scholar] [CrossRef]

- Campbell, Cory A., Sridhar Ramamoorti, and Thomas G. Calderon. 2023. Automation Bias and the “Goldilocks Effect” in Auditing Blockchain. Journal of Emerging Technologies in Accounting 20: 29–53. [Google Scholar] [CrossRef]

- Carlin, Tyrone. 2019. Blockchain and the journey beyond double entry. Australian Accounting Review 29: 305–11. [Google Scholar] [CrossRef]

- Casciello, Raffaela, Marco Maffei, and Fiorenza Meucci. 2021. The role of institutional shareholders in the relationship between unconditional conservatism and earnings management. Corporate Ownership & Control 19: 94–104. [Google Scholar]

- Castka, Pavel, Cory Searcy, and Jakki Mohr. 2020. Technology-enhanced auditing: Improving veracity and timeliness in social and environmental audits of supply chains. Journal of Cleaner Production 258: 120773. [Google Scholar] [CrossRef]

- Centobelli, Piera, Roberto Cerchione, Pasquale Del Vecchio, Eugenio Oropallo, and Giustina Secundo. 2021. Blockchain technology design in accounting: Game changer to tackle fraud or technological fairy tale? Accounting, Auditing & Accountability Journal 35: 1566–97. [Google Scholar]

- Coase, Ronald H. 1937. The nature of the firm. Economica 4: 386–405. [Google Scholar] [CrossRef]

- Coyne, Joshua G., and Peter L. McMickle. 2017. Can blockchains serve an accounting purpose? Journal of Emerging Technologies in Accounting 14: 101–11. [Google Scholar] [CrossRef]

- Dada, Olufunmilola. 2018. A model of entrepreneurial autonomy in franchised outlets: A systematic review of the empirical evidence. International Journal of Management Reviews 20: 206–26. [Google Scholar] [CrossRef]

- Dai, Jun, and Miklos A. Vasarhelyi. 2017. Toward blockchain-based accounting and assurance. Journal of Information Systems 31: 5–21. [Google Scholar] [CrossRef]

- Dai, Jun, Na He, and Haizong Yu. 2019. Utilizing Blockchain and Smart Contracts to Enable Audit 4.0: From the Perspective of Accountability Audit of Air Pollution Control in China. Journal of Emerging Technologies in Accounting 16: 23–41. [Google Scholar] [CrossRef]

- Davenport, Stephan A., and Spencer C. Usrey. 2023. Crypto Assets: Examining Possible Tax Classifications. Journal of Emerging Technologies in Accounting 20: 55–70. [Google Scholar] [CrossRef]

- Denyer, David, and David Tranfield. 2009. Producing a systematic review. In The Sage Handbook of Organizational Research Methods. Edited by David A. Buchanan and Alan Bryman. London: Sage Publications Ltd., pp. 671–89. Available online: https://psycnet.apa.org/record/2010-00924-039 (accessed on 23 June 2024).

- Dunn, Ryan T., J. Gregory Jenkins, and Mark D. Sheldon. 2021. Bitcoin and Blockchain: Audit Implications of the Killer Bs. Issues in Accounting Education 36: 43–56. [Google Scholar] [CrossRef]

- Dupuis, Daniel, Debbie Smith, Kimberly Gleason, and Yezen Kannan. 2023. Bitcoin and Beyond: Crypto Asset Considerations for Auditors/Forensic Accountants. Journal of Forensic and Investigative Accounting 15: 489–510. [Google Scholar]

- Dyball, Maria Cadiz, and Ravi Seethamraju. 2021. The impact of client use of blockchain technology on audit risk and audit approach—An exploratory study. International Journal of Auditing 25: 602–15. [Google Scholar] [CrossRef]

- Dyball, Maria Cadiz, and Ravi Seethamraju. 2022. Client use of blockchain technology: Exploring its (potential) impact on financial statement audits of Australian accounting firms. Accounting, Auditing & Accountability Journal 35: 1656–84. [Google Scholar]

- Ferri, Luca, Rosanna Spanò, Gianluca Ginesti, and Grigorios Theodosopoulos. 2021. Ascertaining auditors’ intentions to use blockchain technology: Evidence from the Big 4 accountancy firms in Italy. Meditari Accountancy Research 29: 1063–87. [Google Scholar] [CrossRef]

- Fortin, Mélissa, and Erica Pimentel. 2024. Bitcoin: An accounting regime. Critical Perspectives on Accounting 99: 102731. [Google Scholar] [CrossRef]

- Fülöp, Melinda Timea, Dan Ioan Topor, Constantin Aurelian Ionescu, Sorinel Căpușneanu, Teodora Odett Breaz, and Sorina Geanina Stanescu. 2022. Fintech accounting and Industry 4.0: Future-proofing or threats to the accounting profession? Journal of Business Economics and Management 23: 997–1015. [Google Scholar] [CrossRef]

- Gauthier, Marion Pauline, and Nathalie Brender. 2021. How do the current auditing standards fit the emergent use of blockchain? Managerial Auditing Journal 36: 365–85. [Google Scholar] [CrossRef]

- Gendron, Yves. 2002. On the role of the organization in auditors’ client-acceptance decisions. Accounting, Organizations and Society 27: 659–84. [Google Scholar] [CrossRef]

- Gietzmann, Miles, and Francesco Grossetti. 2021. Blockchain and other distributed ledger technologies: Where is the accounting? Journal of Accounting and Public Policy 40: 106881. [Google Scholar] [CrossRef]

- Gomaa, Ahmed A., Mohamed I. Gomaa, and Ashley Stampone. 2019. A transaction on the blockchain: An AIS perspective, intro case to explain transactions on the ERP and the role of the internal and external auditor. Journal of Emerging Technologies in Accounting 16: 47–64. [Google Scholar] [CrossRef]

- Gomaa, Ahmed A., Mohamed I. Gomaa, Salem L. Boumediene, and Magdy S. Farag. 2023. The Creation of One Truth: Single-Ledger Entries for Multiple Stakeholders Using Blockchain Technology to Address the Reconciliation Problem. Journal of Emerging Technologies in Accounting 20: 59–75. [Google Scholar] [CrossRef]

- Greenwood, Royston, and Roy Suddaby. 2006. Institutional entrepreneurship in mature fields: The big five accounting firms. Academy of Management Journal 49: 27–48. [Google Scholar] [CrossRef]

- Hampl, Filip, and Lucie Gyönyörová. 2021. Can Fiat—Backed Stablecoins Be Considered Cash or Cash Equivalents Under International Financial Reporting Standards Rules? Australian Accounting Review, CPA Australia 31: 233–55. [Google Scholar] [CrossRef]

- Heilman, Ethan, Neha Narula, Thaddeus Dryja, and Madars Virza. 2017. Iota Vulnerability Report: Cryptanalysis of the Curl Hash Function Enabling Practical Signature Forgery Attacks on the Iota Cryptocurrency. Available online: https://github.com/mit-dci/tangled-curl/blob/master/vuln-iota (accessed on 23 June 2024).

- Hubbard, Benjamin. 2023. Decrypting crypto: Implications of potential financial accounting treatments of cryptocurrency. Accounting Research Journal 36: 369–83. [Google Scholar] [CrossRef]

- Juma’h, Ahmad H., and Yuan Li. 2023. The effects of auditors’ knowledge, professional skepticism, and perceived adequacy of accounting standards on their intention to use blockchain. International Journal of Accounting Information Systems 51: 100650. [Google Scholar] [CrossRef]

- Kaden, Stacey R., Jeff W. Lingwall, and Trevor T. Shonhiwa. 2021. Teaching Blockchain Through Coding: Educating the Future Accounting Professional. Issues in Accounting Education 36: 281–90. [Google Scholar] [CrossRef]

- Karajovic, Maria, Henry M. Kim, and Marek Laskowski. 2019. Thinking outside the block: Projected phases of blockchain integration in the accounting industry. Australian Accounting Review 29: 319–30. [Google Scholar] [CrossRef]

- Kauppi, Katri, Asta Salmi, and Weimu You. 2018. Sourcing from Africa: A systematic review and a research agenda. International Journal of Management Reviews 20: 627–50. [Google Scholar] [CrossRef]

- Kend, Michael, and Lan Anh Nguyen. 2022. Key audit risks and audit procedures during the initial year of the COVID-19 pandemic: An analysis of audit reports 2019–2020. Managerial Auditing Journal 37: 798–818. [Google Scholar] [CrossRef]

- Kinory, Ethan, Sean Stein Smith, and Kimberly Swanson Church. 2020. Exploring the Playground: Blockchain Prototype Use Cases with Hyperledger Composer. Journal of Emerging Technologies in Accounting 17: 77–88. [Google Scholar] [CrossRef]

- Kokina, Julia, Ruben Mancha, and Dessislava Pachamanova. 2017. Blockchain: Emergent industry adoption and implications for accounting. Journal of Emerging Technologies in Accounting 14: 91–100. [Google Scholar] [CrossRef]

- Krystle, M. 2019. Want to Work in Blockchain? Pwc Has Just Been Named Top Recruiter, Followed by Big 4 Auditing Firms. Available online: https://bitcoinexchangeguide.com/want-to-work-in-blockchain-pwc-has-just-been-named-top-recruiter-followed-by-big-4-auditing-firms/ (accessed on 12 January 2021).

- Kuhn, Daniel. 2019. Global Accounting Firm KPMG Partners with Microsoft, R3 on Telecoms Blockchain. Available online: https://www.coindesk.com/global-Accounting-firm-kpmg-partners-with-microsoft-r3-on-telecoms-Blockchain (accessed on 23 June 2024).

- Lee, Eugene Y., Gordon C. Leeroy, and Wesley Leeroy. 2024. Impact of Blockchain on Improving Taxpayers’ Compliance: Empirical Evidence from Panel Data Model and Agent-Based Simulation. Journal of Emerging Technologies in Accounting 21: 89–109. [Google Scholar] [CrossRef]

- Li, Yuan, and Ahmad H. Juma’h. 2022. The Effect of Technological and Task Considerations on Auditors’ Acceptance of Blockchain Technology. Journal of Information Systems 36: 129–51. [Google Scholar] [CrossRef]

- Liu, Manlu, Ashok Robin, Kean Wu, and Jennifer Xu. 2022. Blockchain’s Impact on Accounting and Auditing: A Use Case on Supply Chain Traceability. Journal of Emerging Technologies in Accounting 19: 105–19. [Google Scholar] [CrossRef]

- Liu, Manlu, Kean Wu, and Jennifer Jie Xu. 2019. How Will Blockchain Technology Impact Auditing and Accounting: Permissionless versus Permissioned Blockchain. Current Issues in Auditing 13: A19–A29. [Google Scholar] [CrossRef]

- Marei, Yahya, Adel Almasarwah, Mohammad Al Bahloul, and Malik Abu Afifa. 2023. Cryptocurrencies in accounting schools? Higher Education, Skills and Work-Based Learning 13: 1158–73. [Google Scholar] [CrossRef]

- McAliney, Peter J., and Ban Ang. 2019. Blockchain: Business’ next new “It” technology—A comparison of blockchain, relational databases, and Google Sheets. International Journal of Disclosure and Governance 16: 163–73. [Google Scholar] [CrossRef]

- McCallig, John, Alastair Robb, and Fiona Rohde. 2019. Establishing the representational faithfulness of financial accounting information using multiparty security, network analysis and a blockchain. International Journal of Accounting Information Systems 33: 47–58. [Google Scholar] [CrossRef]

- McGuigan, Nicholas, and Alessandro Ghio. 2019. Art, accounting and technology: Unravelling the paradoxical “in-between”. Meditari Accountancy Research 27: 789–804. [Google Scholar] [CrossRef]

- Mellis, John. 1980. A Brief Instruction, and manner, how to keep books of Accounts. In Historic Accounting Literature. London: Scholar Press, vol. 22. First published 1588. [Google Scholar]

- Moll, Jodie, and Ogan Yigitbasioglu. 2019. The role of internet-related technologies in shaping the work of accountants: New directions for accounting research. The British Accounting Review 51: 100833. [Google Scholar] [CrossRef]

- O’Leary, Daniel E. 2017. Configuring blockchain architectures for transaction information in blockchain consortiums: The case of accounting and supply chain systems. Intelligent Systems in Accounting, Finance and Management 24: 138–47. [Google Scholar] [CrossRef]

- O’Leary, Daniel E. 2018. Open information enterprise transactions: Business intelligence and wash and spoof transactions in blockchain and social commerce. Intelligent Systems in Accounting, Finance and Management 25: 148–58. [Google Scholar] [CrossRef]

- O’Leary, Daniel E. 2019. Some issues in blockchain for accounting and the supply chain, with an application of distributed databases to virtual organizations. Intelligent Systems in Accounting, Finance and Management 26: 137–49. [Google Scholar] [CrossRef]

- O’Neal, Stephen. 2019. Big Four and Blockchain: Are Auditing Giants Adopting Yet? Available online: https://cointelegraph.com/news/big-four-and-Blockchain-are-Auditing-giants-adopting-yet (accessed on 23 June 2024).

- Ovenden, James. 2017. Will Blockchain Render Accountants Irrelevant? Available online: https://channels.theinnovationenterprise.com/articles/will-blockchain-render-accountants-irrelevant (accessed on 23 June 2024).

- Ozlanski, Michael E., Eric M. Negangard, and Rebecca G. Fay. 2020. Kabbage: A Fresh Approach to Understanding Fundamental Auditing Concepts and the Effects of Disruptive Technology. Issues in Accounting Education 35: 26–38. [Google Scholar] [CrossRef]

- Parmoodeh, Abdollah Mohammad, Esinath Ndiweni, and Yasser Barghathi. 2023. An exploratory study of the perceptions of auditors on the impact on Blockchain technology in the United Arab Emirates. International Journal of Auditing 27: 24–44. [Google Scholar] [CrossRef]

- Perez, Yessi Bello. 2015. How Deloitte’s Rubix Is Approaching Blockchain Tech. Available online: https://www.coindesk.com/how-deloitte-rubix-Blockchain-tech (accessed on 23 June 2024).

- Pimentel, Erica, Emilio Boulianne, Shayan Eskandari, and Jeremy Clark. 2021. Systemizing the challenges of auditing blockchain-based assets. Journal of Information Systems 35: 61–75. [Google Scholar] [CrossRef]

- Popov, Serguei. 2018. The tangle. White Paper 1: 30. [Google Scholar]

- Qasim, Amer, and Faten F. Kharbat. 2020. Blockchain technology, business data analytics, and artificial intelligence: Use in the accounting profession and ideas for inclusion into the accounting curriculum. Journal of Emerging Technologies in Accounting 17: 107–17. [Google Scholar] [CrossRef]

- Qasim, Amer, Ghaleb A. El Refae, and Shorouq Eletter. 2022. Embracing emerging technologies and artificial intelligence into the undergraduate accounting curriculum: Reflections from the UAE. Journal of Emerging Technologies in Accounting 19: 155–69. [Google Scholar] [CrossRef]

- Ram, Asheer, Warren Maroun, and Robert Garnett. 2016. Accounting for the Bitcoin: Accountability, neoliberalism and a correspondence analysis. Meditari Accountancy Research 24: 2–35. [Google Scholar] [CrossRef]

- Risius, Marten, and Kai Spohrer. 2017. A blockchain research framework: What we (don’t) know, where we go from here, and how we will get there. Business & Information Systems Engineering 59: 385–409. [Google Scholar]

- Roszkowska, Paulina. 2020. Fintech in financial reporting and audit for fraud prevention and safeguarding equity investments. Journal of Accounting & Organizational Change 17: 164–96. [Google Scholar]

- Rozario, Andrea M., and Chanta Thomas. 2019. Reengineering the audit with blockchain and smart contracts. Journal of Emerging Technologies in Accounting 16: 21–35. [Google Scholar] [CrossRef]

- Rückeshäuser, Nadine. 2017. Do We Really Want Blockchain-Based Accounting? Decentralized Consensus as Enabler of Management Override of Internal Controls. Available online: https://www.wi2017.ch/images/wi2017-0112.pdf (accessed on 23 June 2024).

- Sheldon, Mark D. 2018. Using Blockchain to aggregate and share misconduct issues across the accounting profession. Current Issues in Auditing 12: A27–A35. [Google Scholar] [CrossRef]

- Sheldon, Mark D. 2019. A Primer for Information Technology General Control Considerations on a Private and Permissioned Blockchain Audit. Current Issues in Auditing 13: A15–A29. [Google Scholar] [CrossRef]

- Smith, Sean. 2018. Implications of Next Step Blockchain Applications for Accounting and Legal Practitioners: A Case Study. Australasian Accounting, Business and Finance Journal 12: 77–90. [Google Scholar] [CrossRef]

- Smith, Sean Stein. 2020. Blockchains impact on risk assessment procedures. Journal of Forensic and Investigative Accounting 12: 55–65. [Google Scholar]

- Smith, Sean Stein, and John Jack Castonguay. 2020. Blockchain and accounting governance: Emerging issues and considerations for accounting and assurance professionals. Journal of Emerging Technologies in Accounting 17: 119–31. [Google Scholar] [CrossRef]

- Smyth, Adam. 2010. Autobiography in Early Modern England. Cambridge: Cambridge University Press. [Google Scholar]

- Stern, Myles, and Alan Reinstein. 2021. A blockchain course for accounting and other business students. Journal of Accounting Education 56: 100742. [Google Scholar] [CrossRef]

- Stratopoulos, Theophanis C. 2020. Teaching blockchain to accounting students. Journal of Emerging Technologies in Accounting 17: 63–74. [Google Scholar] [CrossRef]

- Tan, Boon Seng, and Kin Yew Low. 2017. Bitcoin–Its economics for financial reporting. Australian Accounting Review 27: 220–27. [Google Scholar] [CrossRef]

- Tan, Boon Seng, and Kin Yew Low. 2019. Blockchain as the database engine in the accounting system. Australian Accounting Review 29: 312–18. [Google Scholar] [CrossRef]

- Tang, Qingliang, and Lie Ming Tang. 2019. Toward a Distributed Carbon Ledger for Carbon Emissions Trading and Accounting for Corporate Carbon Management. Journal of Emerging Technologies in Accounting 16: 37–46. [Google Scholar] [CrossRef]

- Tiberius, Victor, and Stefanie Hirth. 2019. Impacts of digitization on auditing: A Delphi study for Germany. Journal of International Accounting, Auditing and Taxation 37: 100288. [Google Scholar] [CrossRef]

- Tsikerdekis, Michail, and Sherali Zeadally. 2014. Multiple account identity deception detection in social media using nonverbal behavior. IEEE Transactions on Information Forensics and Security 9: 1311–21. [Google Scholar] [CrossRef]

- van Buuren, Joost, Christopher Koch, Niels van Nieuw Amerongen, and Arnold M. Wright. 2014. The use of business risk audit perspectives by non-Big 4 audit firms. Auditing: A Journal of Practice & Theory 33: 105–28. [Google Scholar]

- Vincent, Nishani Edirisinghe, and Reza Barkhi. 2021. Evaluating Blockchain Using COSO. Current Issues in Auditing 15: A57–A71. [Google Scholar] [CrossRef]

- Vincent, Nishani Edirisinghe, Anthony Skjellum, and Sai Medury. 2020. Blockchain architecture: A design that helps CPA firms leverage the technology. International Journal of Accounting Information Systems 38: 100466. [Google Scholar] [CrossRef]

- Vrontis, Demetris, and Michael Christofi. 2021. R&D internationalization and innovation: A systematic review, integrative framework and future research directions. Journal of Business Research 128: 812–23. [Google Scholar]

- Wang, Catherine L., and Harveen Chugh. 2014. Entrepreneurial learning: Past research and future challenges. International Journal of Management Reviews 16: 24–61. [Google Scholar] [CrossRef]

- Wang, Yunsen, and Alexander Kogan. 2018. Designing confidentiality-preserving Blockchain-based transaction processing systems. International Journal of Accounting Information Systems 30: 1–18. [Google Scholar] [CrossRef]

- Weigand, Hans, Ivars Blums, and Joost de Kruijff. 2020. Shared Ledger Accounting—Implementing the Economic Exchange pattern. Information Systems 90: 101437. [Google Scholar] [CrossRef]

- Wolfson, Rachel. 2020. The Big Four Are Gearing Up to Become Crypto and Blockchain Auditors. Available online: https://cointelegraph.com/news/the-big-four-are-gearing-up-to-become-crypto-and-Blockchain-auditors (accessed on 23 June 2024).

- Yadav, Gaurav. 2018. How Blockchain Will Write a New Era for Accounting Industry. Available online: https://hackernoon.com/how-blockchain-will-write-a-new-era-for-accounting-industry-f8832bf24167 (accessed on 23 June 2024).

- Young, Joseph. 2016. Ernst and Young Is Going Bitcoin While PwC, Deloitte and KPMG Push Permissioned Blockchains. Available online: https://cointelegraph.com/news/ernst-young-is-going-bitcoin-while-pwc-deloitte-and-kpmg-push-permissioned-blockchains (accessed on 23 June 2024).

| Database | Scope | Initial Search (before Applying Criteria) |

|---|---|---|

| EBSCO Business Source Ultimate | Title, subject terms, and abstract | 458 |

| Emerald | Title, subject terms, and abstract | 519 |

| Science Direct | Title, subject terms, and abstract | 360 |

| Total | 1337 |

| Publication Outlet | AJG Ranking | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Total | % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Information Systems | 4 | 1 | 1 | 1% | ||||||||

| Accounting, Auditing and Accountability Journal | 3 | 2 | 2 | 3% | ||||||||

| Critical Perspectives on Accounting | 3 | 1 | 1 | 1% | ||||||||

| Journal of Accounting and Public Policy | 3 | 1 | 1 | 1% | ||||||||

| Journal of Accounting, Auditing, and Finance | 3 | 1 | 1 | 1% | ||||||||

| Journal of International Accounting, Auditing and Taxation | 3 | 1 | 1 | 1% | ||||||||

| The British Accounting Review | 3 | 1 | 1 | 1% | ||||||||

| Accounting and Finance | 2 | 1 | 1 | 1% | ||||||||

| Accounting Research Journal | 2 | 1 | 1 | 1% | ||||||||

| Australian Accounting Review | 2 | 1 | 3 | 1 | 1 | 6 | 8% | |||||

| Current Issues in Auditing | 2 | 2 | 1 | 3 | 4% | |||||||

| Current Issues in Auditing | 2 | 1 | 1 | 1% | ||||||||

| International Journal of Accounting Information Systems | 2 | 1 | 1 | 2 | 1 | 5 | 7% | |||||

| International Journal of Accounting Information Systems | 2 | 2 | 2 | 3% | ||||||||

| International Journal of Auditing | 2 | 1 | 1 | 2 | 3% | |||||||

| International Journal of Disclosure and Governance | 2 | 1 | 1 | 1% | ||||||||

| Issues in Accounting Education | 2 | 1 | 1 | 2 | 3% | |||||||

| Journal of Accounting and Organizational Change | 2 | 1 | 1 | 1% | ||||||||

| Journal of Accounting Education | 2 | 1 | 1 | 1% | ||||||||

| Journal of Business Economics and Management | 2 | 1 | 1 | 1% | ||||||||

| Journal of Intellectual Capital | 2 | 1 | 1 | 1% | ||||||||

| Journal of Organizational Change Management | 2 | 1 | 1 | 1% | ||||||||

| Managerial Auditing Journal | 2 | 1 | 1 | 1% | ||||||||

| Research in International Business and Finance | 2 | 1 | 1 | 1% | ||||||||

| Australasian Accounting, Business, and Finance Journal | 1 | 1 | 1 | 1% | ||||||||

| Cogent Economics and Finance | 1 | 1 | 1 | 1% | ||||||||

| Higher Education, Skills, and Work-Based Learning | 1 | 1 | 1 | 1% | ||||||||

| Intelligent Systems in Accounting, Finance, and Management | 1 | 1 | 1 | 1 | 3 | 4% | ||||||

| Journal of Emerging Technologies in Accounting | 1 | 2 | 4 | 3 | 3 | 4 | 16 | 21% | ||||

| Journal of Emerging Technologies in Accounting | 1 | 1 | 1 | 1% | ||||||||

| Journal of Financial Reporting and Accounting | 1 | 1 | 2 | 3 | 4% | |||||||

| Journal of Forensic and Investigative Accounting | 1 | 1 | 1 | 2 | 3% | |||||||

| Journal of Information Systems | 1 | 1 | 1 | 1 | 1 | 1 | 5 | 7% | ||||

| Meditari Accountancy Research | 1 | 1 | 1 | 2 | 3% | |||||||

| Meditari Accountancy Research | 1 | 1 | 1 | 1% |

| Region | No. of Articles/Studies | Percentage of Total Sample |

|---|---|---|

| Africa | 1 | 1% |

| America | 42 | 56% |

| Asia | 13 | 17% |

| Australia | 1 | 1% |

| Europe | 11 | 15% |

| Oceania | 7 | 9% |

| Grand Total | 75 | 100% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Georgiou, I.; Sapuric, S.; Lois, P.; Thrassou, A. Blockchain for Accounting and Auditing—Accounting and Auditing for Cryptocurrencies: A Systematic Literature Review and Future Research Directions. J. Risk Financial Manag. 2024, 17, 276. https://doi.org/10.3390/jrfm17070276

Georgiou I, Sapuric S, Lois P, Thrassou A. Blockchain for Accounting and Auditing—Accounting and Auditing for Cryptocurrencies: A Systematic Literature Review and Future Research Directions. Journal of Risk and Financial Management. 2024; 17(7):276. https://doi.org/10.3390/jrfm17070276

Chicago/Turabian StyleGeorgiou, Ifigenia, Svetlana Sapuric, Petros Lois, and Alkis Thrassou. 2024. "Blockchain for Accounting and Auditing—Accounting and Auditing for Cryptocurrencies: A Systematic Literature Review and Future Research Directions" Journal of Risk and Financial Management 17, no. 7: 276. https://doi.org/10.3390/jrfm17070276

APA StyleGeorgiou, I., Sapuric, S., Lois, P., & Thrassou, A. (2024). Blockchain for Accounting and Auditing—Accounting and Auditing for Cryptocurrencies: A Systematic Literature Review and Future Research Directions. Journal of Risk and Financial Management, 17(7), 276. https://doi.org/10.3390/jrfm17070276