An Investigation of the Co-Movement between Spot and Futures Prices for Chinese Agricultural Commodities

Abstract

:1. Introduction

2. Theoretical Principle

2.1. Cost of Carry Model

2.2. Vector Error Correction Model (VECM)

2.3. Information Share Model (IS)

2.4. Singular Spectrum Analysis (SSA) and SSA Causality Test

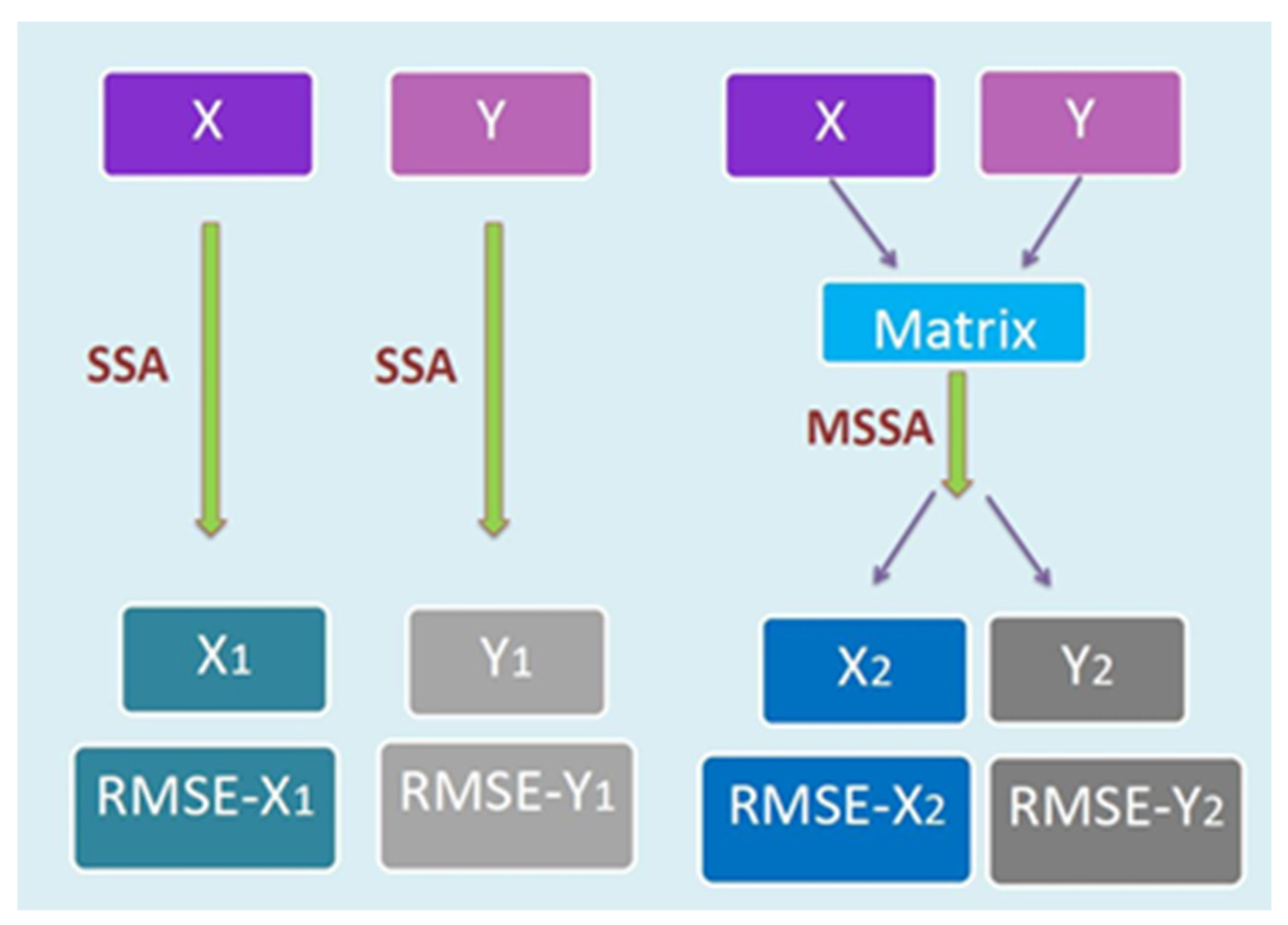

2.4.1. Singular Spectrum Analysis (SSA) and Multivariate SSA

2.4.2. SSA Causality Test

3. Descriptive Statistics of the Data

4. Empirical Results

4.1. Test of Stationarity and Co-Integration

4.2. Granger Causality Test

4.3. SSA-Based Causality Test

4.4. Information Share Model

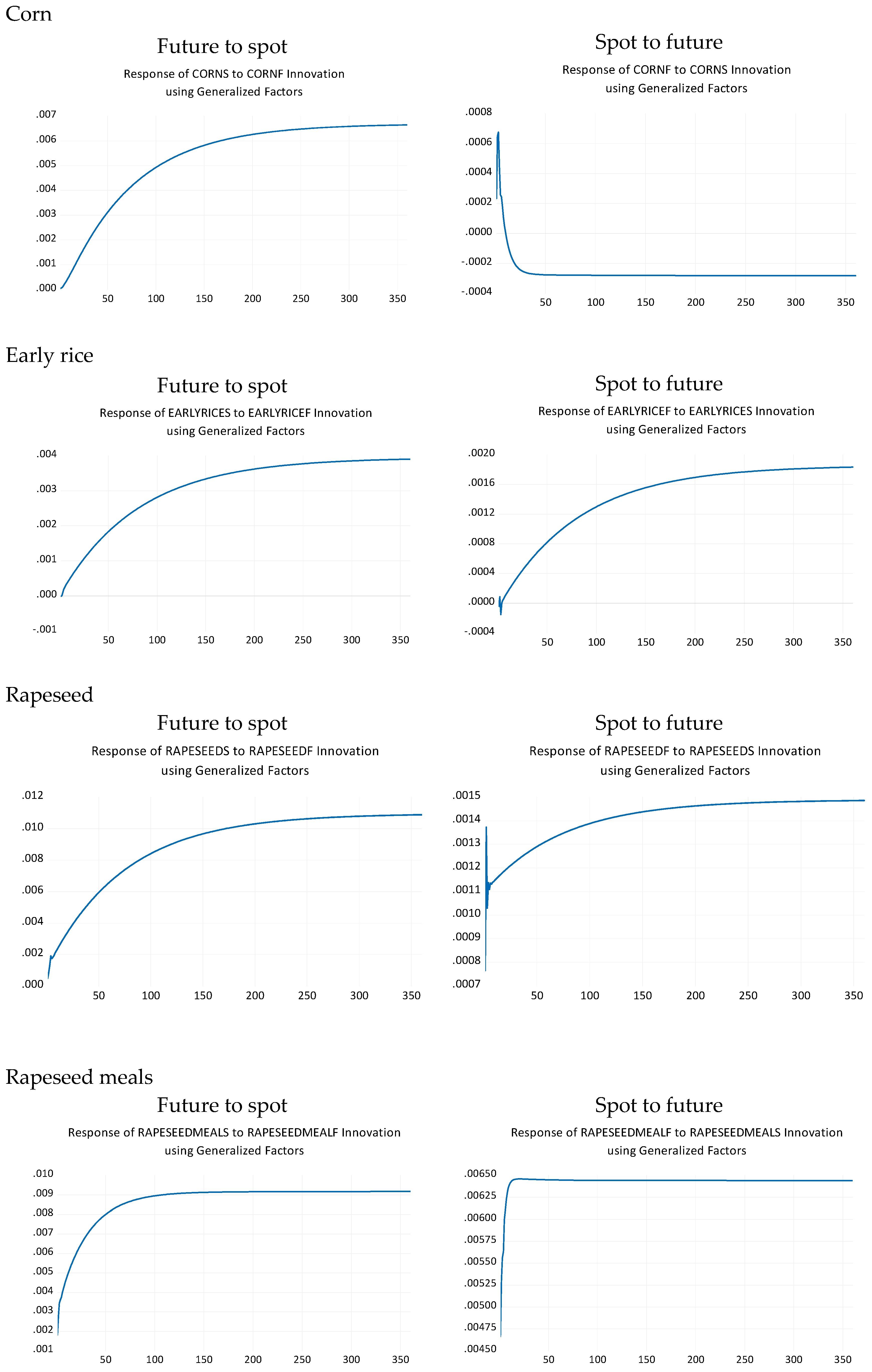

4.5. Impulse Response

5. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Alexakis, Christos, Guillaume Bagnarosa, and Michael Dowling. 2017. Do cointegrated commodities bubble together? the case of hog, corn, and soybean. Finance Research Letters 23: 96–102. [Google Scholar] [CrossRef]

- Ali, Jabir, and Kriti Bardhan Gupta. 2011. Efficiency in agricultural commodity futures markets in India: Evidence from and causality tests. Agricultural Finance Review 71: 162–78. [Google Scholar] [CrossRef]

- Arnade, Carlos, and Linwood Hoffman. 2015. The impact of price variability on cash/futures market relationships. Implications for market efficiency and price discovery. Journal of Agricultural and Applied Economics 25: 491–514. [Google Scholar] [CrossRef]

- Arnade, Carlos, Bryce Cooke, and Fred Gale. 2017. Agricultural price transmission: China relationships with world commodity markets. Journal of Commodity Markets 7: 28–40. [Google Scholar] [CrossRef]

- Baillie, Richard T., G. Geoffrey Booth, Yiuman Tse, and Tatyana Zabotina. 2002. Price discovery and common factor models. Journal of Financial Markets 5: 309–22. [Google Scholar] [CrossRef]

- Beneki, Christina, Bruno Eeckels, and Costas Leon. 2012. Signal extraction and forecasting of the UK tourism income time series: A singular spectrum analysis approach. Journal of Forecasting 31: 391–400. [Google Scholar] [CrossRef]

- Benz, Eva A., and Jördis Hengelbrock. 2008. Price discovery and liquidity in the European CO2 futures market: An intraday analysis. In AFFI/EUROFIDAI, Paris December 2008 Finance International Meeting AFFI-EUROFIDAI. Available online: https://web.archive.org/web/20140124123857id_/http://www.fbv.kit.edu:80/symposium/11th/Paper/04Commodities/Hengelbrock.pdf (accessed on 1 June 2024).

- Breitung, Jörg, and Bertrand Candelon. 2006. Testing for short- and long-run causality: A frequency-domain approach. Journal of Econometrics 132: 363–78. [Google Scholar] [CrossRef]

- Cha, Tingjun, and Jianling Xu. 2016. Multi-dimensional analysis of soybean futures market efficiency. Journal of South China Agricultural University (Social Science Edition) 3: 88–102. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 2006. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49: 1057–72. [Google Scholar] [CrossRef]

- Dolatabadi, Sepideh, Morten Orregaard Nielsen, and Ke Xu. 2015. A fractionally cointegrated VAR analysis of price discovery in commodity futures markets. Journal of Futures Markets 35: 339–56. [Google Scholar] [CrossRef]

- Engle, Robert F., and Clive W. J. Granger. 2006. Co-integration and error correction: Representation, estimation, and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Fang, Kuangnan, and Zhenzhong Cai. 2012. Research on price discovery function of stock index futures in China. Statistical Study 5: 73–78. [Google Scholar]

- Figuerola-Ferretti, Isabel, and Jess Gonzalo. 2010. Modelling and measuring price discovery in commodity markets. Journal of Econometrics 158: 95–107. [Google Scholar] [CrossRef]

- Fu, Qiang, Yuxing Wang, and Junwei Ji. 2016. Price discovery and volatility spillover effects of mini gold contracts-based on 5-minute high frequency data. International Business (Journal of the University of Foreign Economics and Trade) 2: 101–11. [Google Scholar]

- Gonzalo, Jesus, and Clive Granger. 1995. Estimation of common long-memory components in cointegrated systems. Journal of Business and Economic Statistics 13: 27–35. [Google Scholar] [CrossRef]

- Grammig, Joachim, and Franziska J. Peter. 2013. Telltale tails: A new approach to estimating unique market information shares. Journal of Financial and Quantitative Analysis 2: 439–88. [Google Scholar] [CrossRef]

- Hasbrouck, Joel. 1995. One security, many markets: Determining the contributions to price discovery. The Journal of Finance 50: 175–99. [Google Scholar] [CrossRef]

- Hassani, Hossein, Allan Webster, Emmanuel Sirimal Silva, and Saeed Heravi. 2015. Forecasting US tourist arrivals using optimal singular spectrum analysis. Tourism Management 46: 322–35. [Google Scholar] [CrossRef]

- Hassani, Hossein, Mohammad Reza Yeganegi, Atikur Khan, and Emmanuel Sirimal Silva. 2020. The effect of data transformation on singular spectrum analysis for forecasting. Signals 1: 4–25. [Google Scholar] [CrossRef]

- Hassani, Hossein, Saeed Heravi, and Anatoly Zhigljavsky. 2009. Forecasting European industrial production with singular spectrum analysis. International Journal of Forecasting 25: 103–18. [Google Scholar] [CrossRef]

- Hassani, Hossein, Saeed Heravi, and Anatoly Zhigljavsky. 2013. Forecasting UK industrial production with multivariate singular spectrum analysis. Journal of Forecasting 32: 395–408. [Google Scholar] [CrossRef]

- Hassani, Hossein, Silva Emmanuel, Gupta Rangan, and Sonali Das. 2018. Predicting global temperature anomaly: A definitive investigation using an ensemble of twelve competing forecasting models. Physica A: Statistical Mechanics and its Applications 509: 121–39. [Google Scholar] [CrossRef]

- He, Chengying, Longbin Zhang, and Chen Wei. 2011. Research on price discovery of HS300 index futures based on high frequencies data. Journal of Quantitative and Technical Economics 5: 139–51. [Google Scholar]

- Hou, Jinli. 2014. Study on the relationship between futures price and spot price of agricultural products. The Economy 4: 70–74. [Google Scholar]

- Hua, Renhai, and Qingfu Liu. 2010. The research on price discovery ability between stock index futures market and stock index spot market. Journal of Quantitative and Technical Economics 10: 90–100. [Google Scholar]

- Huang, Xu, Paula Medina Maçaira, Hossein Hassani, Fernando Luiz Cyrino Oliveira, and Gurjeet Dhesi. 2019. Hydrological natural inflow and climate variables: Time and frequency causality analysis. Physica A: Statistical Mechanics and Its Applications 516: 480–95. [Google Scholar] [CrossRef]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on cointegration-with application to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Johansen, Søssren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Joseph, Anto, Garima Sisodia, and Aviral Kumar Tiwari. 2014. A frequency domain causality investigation between futures and spot prices of Indian commodity markets. Economic Modelling 40: 250–58. [Google Scholar] [CrossRef]

- Joseph, Anto, Suresh K. G., and Garima Sisodia. 2015. Is the causal nexus between agricultural commodity futures and spot prices asymmetric? Evidence from India. Theoretical Economics Letters 5: 285–95. [Google Scholar] [CrossRef]

- Li, Zheng, Lin Bo, and Yi Hao. 2016. Re-discussion on the function of price discovery of stock index futures in China-empirical evidence from three listed varieties. Economy of Finance and Trade 7: 79–93. [Google Scholar]

- Liang, Quanxi, Guanying Yue, and Jun Chen. 2009. An empirical study on the role of futures market in sugar price formation in China. The Price (monthly issue) 3: 14–17. [Google Scholar]

- Liu, Qingfeng Wilson. 2005. Price relations among hog, corn, and soybean meal futures. Journal of Futures Markets 25: 491–514. [Google Scholar] [CrossRef]

- Liu, Qingfu, and Jinqing Zhang. 2006. A study on the function of price discovery in the futures market of agricultural products in China. Research on Industrial Economic 1: 8. [Google Scholar]

- Schwert, G. William. 1989. Tests for unit roots: A monte carlo investigation. Journal of Business and Economic Statistics 7: 147–59. [Google Scholar] [CrossRef]

- Silva, Emmanuel Sirimal, Hossein Hassani, Saeed Heravi, and Xu Huang. 2019. Forecasting tourism demand with denoneural networks. Annals of Tourism Research 74: 134–54. [Google Scholar] [CrossRef]

- Silva, Emmanuel Sirimal, Zara Ghodsi, Mansi Ghodsi, Saeed Heravi, and Hossein Hassani. 2017. Cross country relations in European tourist arrivals. Annals of Tourism Research 63: 151–68. [Google Scholar] [CrossRef]

- Taunson, Jude W., Mohd Fahmi Bin Ghazali, Minah Japang, and Abd Kamal Bin Char. 2018. Intraday lead-lag relationship between index futures and stock index markets: Evidence from Malaysia. Journal of Modern Accounting and Auditing 14: 561–69. [Google Scholar]

- Tse, Yiuman. 1999. Price discovery and volatility spillovers in the DJIA index and futures markets. Journal of Futures Markets 19: 911–30. [Google Scholar] [CrossRef]

- Wang, Qunyong, and Xiaodong Zhang. 2005. Price discovery function of crude oil futures market-analysis based on Information share model. Statistics and Decision-Making 12: 77–79. [Google Scholar]

- Wang, Yu-Shan, Chung-Gee Lin, and Shih-Chieh Shih. 2011. The dynamic relationship between agricultural futures and agriculture index in China. China Agricultural Economic Review 3: 369–82. [Google Scholar] [CrossRef]

- Xu, Yuanyuan, Fanghui Pan, Chuanmei Wang, and Jian Li. 2019. Dynamic price discovery process of Chinese agricultural futures markets: An empirical study based on the rolling window approach. Journal of Agricultural and Applied Economics 51: 664–81. [Google Scholar] [CrossRef]

- Yao, Chuanjiang, and Fenghai Wang. 2005. Empirical analysis on the efficiency of China’s agricultural futures market: 1998–2002. Research on Financial Issues 1: 43–49. [Google Scholar]

- Zhao, Zhao, and Qiang He. 2015. A dynamic study on the price relationship between copper futures and spot in China. Research on Technology, economy and Management 11: 96–100. [Google Scholar]

| Authors | Models Employed | Empirical Target |

|---|---|---|

| Dolatabadi, Sepideh Nielsen, Morten Ørregaard Xu, Ke (Dolatabadi et al. 2015) | FCVAR Model | Aluminum, nickel, copper, lead, zinc |

| Figuerola-Ferretti, Isabel Gonzalo, Jesús (Figuerola-Ferretti and Gonzalo 2010) | Permanent Transitory Model | Aluminum, copper, nickel, lead, zinc |

| Benz, Eva A Hengelbrock, Jördis (Benz and Hengelbrock 2008) | Vector Error Correction Model (VECM) | EUA |

| Tse, Yiuman (Tse 1999) | Hasbrouck Information Share model | Dow Jones Industrial Average (DJIA) |

| Arnade Carlos, Cooke Bryce & Gale Fred (Arnade et al. 2017) | VECM | Soybeans, corn, wheat, rice, etc. |

| Alexakis Christos, Bagnarosa Guillaume & Dowling Michael (Alexakis et al. 2017) | Co-integration Test | Raw pig, corn, soybean meal |

| Joseph Anto, Sisodia Garima & Tiwari Aviral Kumar (Joseph et al. 2014) | Frequency Domain Analysis | Soybeans, crude oil, natural gas, gold, etc. |

| Liu Qingfeng Wilson (Liu 2005) | Co-integration Model | Raw pig, corn, soybean meal |

| Arnade, Linwood & Hoffman (Arnade and Hoffman 2015) | VECM | Soybean, soybean meal |

| Cha Tingjun, Xu Jianling (Cha and Xu 2016) | Granger Causality Test, VECM, Information Share Model | Soybean |

| Hou Jinli (Hou 2014) | Co-integration Test, Granger Causality Test, VECM Hasbrouck Information Share Model | Soybean, soybean meal |

| Liang Quanxi, Yue Guanying, Chen Jun (Liang et al. 2009) | Co-integration test, Granger Causality Test, ECM | Sugar |

| Liu Qingfu, Zhang Jinqing (Liu and Zhang 2006) | Johansen Co-integration Test | Soybean, soybean meal |

| Yao Chuanjiang, Wang Fenghai (Yao and Wang 2005) | Johansen Co-integration Test | Soybean, wheat |

| Commodity | Return | Mean | Standard Deviation | Commodity | Return | Mean | Standard Deviation |

|---|---|---|---|---|---|---|---|

| Soybean | 0.0066 | 0.9836 | Wheat | 0.0139 | 0.8829 | ||

| 0.0246 | 0.9999 | 0.0298 | 0.9104 | ||||

| −0.0206 | 0.9586 | −0.0097 | 0.8403 | ||||

| 0.0021 | 0.5147 | 0.0157 | 0.2183 | ||||

| 0.0167 | 0.5930 | 0.0268 | 0.1931 | ||||

| −0.0202 | 0.3637 | −0.0011 | 0.2509 | ||||

| Corn | 0.0070 | 1.0232 | Early Rice | 0.0135 | 0.9612 | ||

| 0.0380 | 0.9021 | 0.0150 | 0.9501 | ||||

| −0.0400 | 1.1832 | 0.0104 | 0.9775 | ||||

| 0.0076 | 0.2401 | 0.0157 | 0.2694 | ||||

| 0.0370 | 0.1766 | 0.0286 | 0.31727 | ||||

| −0.0375 | 0.3074 | −0.0027 | 0.1798 | ||||

| Soybean Meal | 0.0048 | 1.5151 | Rapeseed | 0.0027 | 1.1097 | ||

| 0.0261 | 1.4567 | −0.0302 | 0.6622 | ||||

| −0.0275 | 1.6013 | 0.0142 | 1.2380 | ||||

| −0.0061 | 0.8365 | −0.0044 | 0.7086 | ||||

| 0.0118 | 0.9293 | −0.0003 | 0.1671 | ||||

| −0.0336 | 0.6706 | −0.0059 | 0.8257 | ||||

| Rapeseed Meal | 0.0035 | 1.5013 | |||||

| 0.0651 | 1.3102 | ||||||

| −0.0181 | 1.5703 | ||||||

| 0.0002 | 0.6083 | ||||||

| 0.0753 | 0.4473 | ||||||

| −0.0284 | 0.6573 |

| Unit Root Test | Test of Co-Integration | |||||

|---|---|---|---|---|---|---|

| Trace Statistics | ||||||

| r = 0 | r = 1 | |||||

| Soybean | 0.171 | <0.001 | 0.506 | <0.001 | 22.122 | 1.440 * |

| Corn | 0.303 | <0.001 | 0.355 | <0.001 | 39.502 | 3.944 * |

| Wheat | 0.049 | <0.001 | 0.207 | <0.001 | 20.329 | 5.590 * |

| Early Rice | 0.147 | <0.001 | 0.295 | <0.001 | 16.599 | 3.598 * |

| Soybean Meal | 0.065 | <0.001 | 0.258 | <0.001 | 33.604 | 3.719 * |

| Rapeseed Meal | 0.166 | <0.001 | 0.243 | <0.001 | 27.496 | 1.659 * |

| Rapeseed | 0.631 | <0.001 | 0.567 | <0.001 | 19.958 | 1.827 * |

| Futures Market | Spot Market | |

|---|---|---|

| Soybean | Futures price Granger causes spot price | Spot price Granger causes futures price |

| (0.007) | (0.013) | |

| Corn | Futures price Granger causes spot price | Spot price Granger does not cause futures price |

| (0.000) | (0.578) | |

| Wheat | Futures price Granger does not cause spot price | Spot price Granger does not cause futures price |

| (0.117) | (0.131) | |

| Early Rice | Futures price Granger causes spot price | Spot price Granger does not cause futures price |

| (0.064) | (0.498) | |

| Soybean Meal | Futures price Granger causes spot price | Spot price Granger does not cause futures price |

| (0.000) | (0.1263) | |

| Rapeseed Meal | Futures price Granger causes spot price | Spot price Granger does not cause futures price |

| (0.000) | (0.134) | |

| Rapeseed | Futures price Granger causes spot price | Spot price Granger does not cause futures price |

| (0.000) | (0.273) |

| Commodity | Period | No. of Obs. | Cut Point | Univariate SSA of Futures Price | Univariate SSA of Spot Price | MSSA of Futures Price by Adding Spot Price | SSA Causality Spot Price to Futures Price | MSSA of Spot Price by Adding Futures Price | SSA Causality Futures Price to Spot Price | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| L, R | RMSE | L, R | RMSE | L, R | RMSE | F Stat | Decision | L, R | RMSE | F Stat | Decision | ||||

| Soybean | Total | 2126 | 1416 | 2, 1 | 0.010 | 2, 1 | 0.006 | 2, 1 | 0.011 | 1.102 | NO | 2, 1 | 0.004 | 0.756 | YES |

| Before | 1285 | 857 | 2, 1 | 0.010 | 2, 1 | 0.007 | 2, 1 | 0.009 | 0.886 | YES | 2, 1 | 0.006 | 0.941 | YES | |

| After | 841 | 561 | 2, 1 | 0.012 | 2, 1 | 0.004 | 2, 1 | 0.011 | 0.923 | YES | 2, 1 | 0.004 | 1.033 | NO | |

| Corn | Total | 2117 | 1412 | 2, 1 | 0.011 | 3, 2 | 0.002 | 2, 1 | 0.015 | 1.298 | NO | 3, 2 | 0.003 | 1.210 | NO |

| Before | 1276 | 851 | 2, 1 | 0.010 | 4, 2 | 0.002 | 2, 1 | 0.007 | 0.716 | YES | 4, 2 | 0.001 | 0.830 | YES | |

| After | 841 | 561 | 2, 1 | 0.016 | 3, 2 | 0.003 | 2, 1 | 0.012 | 0.738 | YES | 3, 2 | 0.003 | 1.004 | NO | |

| Wheat | Total | 2107 | 1404 | 2, 1 | 0.010 | 3, 2 | 0.002 | 2, 1 | 0.010 | 1.015 | NO | 3, 2 | 0.003 | 1.175 | NO |

| Before | 1266 | 844 | 2, 1 | 0.011 | 4, 2 | 0.002 | 2, 1 | 0.007 | 0.656 | YES | 3, 2 | 0.002 | 0.711 | YES | |

| After | 841 | 561 | 2, 1 | 0.010 | 3, 2 | 0.003 | 3, 2 | 0.010 | 0.986 | YES | 3, 2 | 0.003 | 0.922 | YES | |

| Early Rice | Total | 2033 | 1355 | 2, 1 | 0.010 | 2, 1 | 0.002 | 2, 1 | 0.011 | 1.136 | NO | 2, 1 | 0.002 | 0.968 | YES |

| Before | 1192 | 795 | 2, 1 | 0.011 | 2, 1 | 0.004 | 2, 1 | 0.009 | 0.838 | YES | 2, 1 | 0.002 | 0.469 | YES | |

| After | 841 | 561 | 2, 1 | 0.011 | 2, 1 | 0.002 | 2, 1 | 0.011 | 0.985 | YES | 2, 1 | 0.002 | 1.094 | NO | |

| Soybean Meal | Total | 2124 | 1416 | 2, 1 | 0.017 | 2, 1 | 0.009 | 2, 1 | 0.018 | 1.051 | NO | 2, 1 | 0.009 | 0.941 | YES |

| Before | 1283 | 855 | 2, 1 | 0.016 | 2, 1 | 0.010 | 2, 1 | 0.019 | 1.206 | NO | 2, 1 | 0.009 | 0.946 | YES | |

| After | 841 | 561 | 2, 1 | 0.017 | 3, 2 | 0.009 | 2, 1 | 0.018 | 1.042 | NO | 3, 2 | 0.007 | 0.826 | YES | |

| Rapeseed Meal | Total | 1155 | 770 | 2, 1 | 0.018 | 4, 2 | 0.008 | 2, 1 | 0.017 | 0.960 | YES | 4, 2 | 0.009 | 1.208 | NO |

| Before | 314 | 209 | 2, 1 | 0.017 | 4, 2 | 0.005 | 2, 1 | 0.009 | 0.522 | YES | 3, 2 | 0.004 | 0.672 | YES | |

| After | 841 | 561 | 2, 1 | 0.020 | 4, 2 | 0.008 | 2, 1 | 0.017 | 0.894 | YES | 4, 2 | 0.009 | 1.114 | NO | |

| Rapeseed | Total | 1156 | 770 | 2, 1 | 0.014 | 2, 1 | 0.010 | 2, 1 | 0.013 | 0.934 | YES | 2, 1 | 0.008 | 0.807 | YES |

| Before | 315 | 210 | 2, 1 | 0.008 | 2, 1 | 0.001 | 2, 1 | 0.010 | 1.274 | NO | 2, 1 | 0.000 | 0.168 | YES | |

| After | 841 | 561 | 2, 1 | 0.014 | 2, 1 | 0.009 | 2, 1 | 0.013 | 0.960 | YES | 2, 1 | 0.006 | 0.625 | YES | |

| Futures Market | Spot Market | |||||

|---|---|---|---|---|---|---|

| Upper Bound | Lower Bound | Mean | Upper Bound | Lower Bound | Mean | |

| Soybean | 13.78 | 9.10 | 11.44 | 90.90 | 86.22 | 88.56 |

| Soybean Meal | 73.53 | 35.55 | 54.54 | 64.45 | 26.47 | 45.46 |

| Corn | 99.07 | 98.36 | 98.72 | 1.64 | 0.93 | 1.28 |

| Wheat | 17.06 | 15.80 | 16.43 | 84.20 | 82.94 | 83.57 |

| Early Rice | 59.31 | 58.81 | 59.06 | 41.19 | 40.69 | 40.94 |

| Rapeseed Meal | 62.40 | 31.46 | 46.93 | 68.54 | 37.60 | 53.07 |

| Rapeseed | 98.63 | 96.57 | 97.60 | 3.43 | 1.37 | 2.40 |

| IST1 | IST2 | IST | |

|---|---|---|---|

| Soybean | 58.81 | 0.75 | 15.14 |

| Soybean Meal | 85.10 | 71.86 | 85.11 |

| Corn | 86.87 | 92.47 | 99.62 |

| Wheat | 1.02 | 82.42 | 36.99 |

| Early Rice | 88.03 | 28.39 | 86.26 |

| Rapeseed Meal | 69.97 | 80.29 | 58.43 |

| Rapeseed | 22.75 | 99.60 | 99.72 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang, Y.; Guan, B.; Huang, X.; Hassani, H.; Heravi, S. An Investigation of the Co-Movement between Spot and Futures Prices for Chinese Agricultural Commodities. J. Risk Financial Manag. 2024, 17, 299. https://doi.org/10.3390/jrfm17070299

Fang Y, Guan B, Huang X, Hassani H, Heravi S. An Investigation of the Co-Movement between Spot and Futures Prices for Chinese Agricultural Commodities. Journal of Risk and Financial Management. 2024; 17(7):299. https://doi.org/10.3390/jrfm17070299

Chicago/Turabian StyleFang, Yongmei, Bo Guan, Xu Huang, Hossein Hassani, and Saeed Heravi. 2024. "An Investigation of the Co-Movement between Spot and Futures Prices for Chinese Agricultural Commodities" Journal of Risk and Financial Management 17, no. 7: 299. https://doi.org/10.3390/jrfm17070299

APA StyleFang, Y., Guan, B., Huang, X., Hassani, H., & Heravi, S. (2024). An Investigation of the Co-Movement between Spot and Futures Prices for Chinese Agricultural Commodities. Journal of Risk and Financial Management, 17(7), 299. https://doi.org/10.3390/jrfm17070299