Abstract

The rapid rise and widespread global adoption of cryptocurrencies in recent years has fundamentally transformed the international financial landscape, with digital assets increasingly being recognized for their potential to influence the stability and performance of traditional capital markets. Against this backdrop, this study aims to empirically investigate the impact of cryptocurrency returns on Islamic vs. conventional stock returns in Gulf Cooperation Council (GCC) countries. The salient distinctions between Islamic and conventional stock markets include fundamental differences in principles, investment allocations, and risk profiles, underscoring the importance of examining the impact of cryptocurrency returns on these distinct equity segments. Daily data were collected from stock indices in five GCC countries over the period 2016–2019, including two sub-periods: before and after the 2017 crypto crash. Pooled OLS, fixed effects, random effects, and generalized linear models (GLMs) were used to analyze the data collected during the study. With the GCC increasingly focusing on cryptocurrency markets, there is growing concern about these markets’ potential impact on regional stocks. This study addresses the important questions of whether the impacts of the cryptocurrency market on Islamic vs. conventional stock markets differ throughout the GCC region and how these impacts have evolved since the crypto crash period. The findings reveal that cryptocurrency returns had a negative impact on both GCC Islamic and conventional stock market returns for the full sample period (2016–2019), and the negative effect was far more pronounced for conventional stocks. For the two sub-periods before and after the crash, only the cryptocurrency market and conventional GCC stocks remained negatively correlated, while the cryptocurrency market and the GCC Islamic stock markets became uncorrelated. Thus, for the calmer sub-periods before and after the crypto crash, the rise in cryptocurrency returns may have enticed GCC investors away from conventional stocks, perhaps resulting in a decline in their investment in these stocks. Meanwhile, those who invest in Islamic stocks may not be exposed to this temptation.

1. Introduction

The rapid growth in cryptocurrencies has led them to garner investors’ interest as a popular diversification choice (Ali et al. 2024). Despite their weak correlations with conventional financial assets, energy commodities, and precious metals, cryptocurrencies seem to be a desirable investment alternative (Guesmi et al. 2019; Okorie and Lin 2020; Platanakis and Urquhart 2020). Because cryptocurrencies provide more appealing returns than traditional investing instruments, they are presently being employed as alternative investment instruments and have grown in popularity among investors (Maitra et al. 2022; Bakar and Foziah 2023). Furthermore, since cryptocurrencies have identical characteristics to gold, they are thought of as digital gold (Rudolf et al. 2021).

In parallel with investor interest, the growing popularity of cryptocurrencies as a high-yield investment product has also spurred research into how they affect other financial assets (Elroukh 2024). Also motivating researchers is the fact that the growing cryptocurrency sector is playing an increasingly significant role in the whole financial system, as thousands of cryptocurrencies have contributed to a total market value of USD 255.5 billion, according to Jiang et al. (2022). This raises concerns about how the popularity of cryptocurrencies may affect the stability of the established financial system. In addition to the difficulties cryptocurrencies might generate for the financial system, some experts view investing in cryptocurrencies as highly hazardous due to the lack of governmental oversight over crypto’s associated activities and transactions (Aysan and Kayani 2022). Because of their decentralized nature, cryptocurrencies pose a major threat to household wealth, economic activity, and the stability of monetary and financial institutions, which is of great concern to governments (Hughes et al. 2019). Concerns over whether cryptocurrencies may upend the established hierarchy of traditional financial institutions have been raised by the market’s explosive growth. Diverse viewpoints on this issue exist; some contend that cryptocurrencies may be linked to major crimes due to their probable involvement in such activities, causing significant disruption in the existing financial system (Miglionico 2023). However, some proponents contend that cryptocurrencies provide a ground-breaking method of making payments, a substitute for traditional investing strategies, or an alternative way to raise capital (Wilson 2019).

Cryptocurrency Development and Stock Markets in the Gulf Cooperation Council (GCC) Region

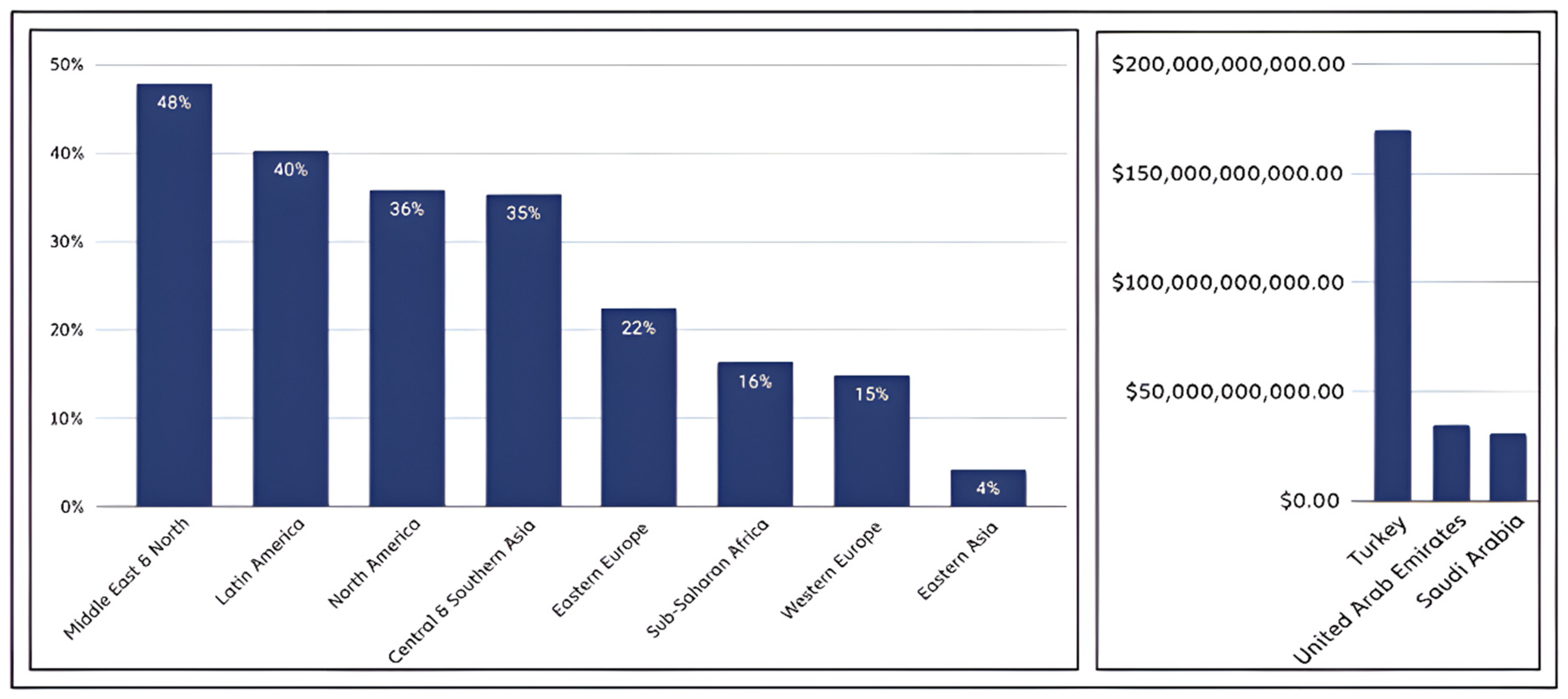

Regarding cryptocurrencies, in 2017, the Middle East and North Africa (MENA) region accounted for an estimated 4% of all cryptocurrency exchanges worldwide, while 1.5% of the entire value of cryptocurrencies was held by Gulf investors (Lukonga 2018). According to a survey conducted by the blockchain analytics platform Chinalysis, the MENA region has the fastest-growing cryptocurrency industry globally, accounting for 9.2% of global digital currency transactions from July 2021 to June 20221. Chinalysis (2022) also reported that “MENA may be one of the smaller crypto markets in the 2022 Global Crypto Adoption Index, but it’s also the fastest growing”. Figure 1 depicts the year-over-year (YoY) growth in the crypto transaction volume across regions, which includes the MENA region, for the periods 2020–2021 vs. 2021–2022. Figure 1 shows that compared to all other regions, MENA had the greatest growth rate, at 48%. Recently, Chinalysis (2023)2 indicated that the MENA region is home to three of the top thirty countries in the 2023 index: Turkey dominates in terms of raw transaction volume, followed directly by two GCC countries, namely, the UAE and Saudi Arabia, as shown in Figure 1. As stated in The International Market Analysis Research and Consulting IMARC Group’s Report (2023), it is expected that the GCC cryptocurrency market size will exhibit a growth rate of 53.85% during the period 2024–2032. According to the IMARC report, there are several factors driving the growth of the GCC cryptocurrency market, such as increased government expenditure on infrastructure development, the rapid adoption of digital technologies in various end-use sectors, and the increasing implementation of robust economic diversification strategies.

Figure 1.

Left: Year-on-year growth in crypto transaction volume by region (2020–2021 vs. 2021–2022), source: Chinalysis (2022). Right: Top 3 Middle East and North African (MENA) countries by cryptocurrency value received (2022–2023), source: Chinalysis (2023).

As stated by (Ali et al. 2024), GCC countries have recently focused more on cryptocurrency markets as a means of promoting their integration into the global economy. However, it is important to note that these countries aim to achieve that integration while remaining traditional in terms of their values and culture. Given that the GCC countries are Islamic nations, the debate around the legality and permissibility of cryptocurrency within Islamic finance is particularly relevant in this regional context. Generally, the status of cryptocurrency has been a topic of ongoing debate in Islamic finance, as these digital assets have the potential to become future forms of currency, even with government backing. However, for cryptocurrencies to be widely accepted within mainstream Islamic finance, they must overcome negative perceptions related to volatility and illicit use while also ensuring compliance with both banking regulations and Shari’ah law principles (Alam et al. 2019). The GCC region, home to major Islamic financial centers, has witnessed a range of responses from religious scholars and authorities regarding the permissibility of cryptocurrencies, highlighting the need for issuers and regulators to work closely with Shari’ah experts to develop appropriate frameworks for integrating innovative technology into the Islamic finance ecosystem. Ref. (Ali et al. 2024) also indicated that the GCC region differs substantially from both emerging and developing economies; as such, any related research conclusions drawn from international markets cannot be generalized for this region. This should encourage researchers to pay more attention to identifying the potential impacts of cryptocurrency development on GCC financial systems. In the same context, it would also be helpful to discuss the basic differences between Islamic stock markets and conventional stock markets. Delle Foglie and Panetta (2020) conducted a comprehensive review of the literature to elucidate the salient distinctions between these markets. The authors note that the foundational principles of Islamic finance, grounded in Shari’ah law, incorporate several significant differences relative to conventional finance. These include the proscription of interest (riba), excessive uncertainty (gharar), and speculation (maysir), as well as a mandate for risk–return sharing and the avoidance of investment in “unethical” industries. These Shari’ah-based tenets are manifested in a distinct set of contracts and rules that delineate the Islamic financial system from its conventional counterpart. Delle Foglie and Panetta (2020) also added that one salient distinction is that Islamic stock markets concentrate investments in sectors such as innovation, technology, healthcare, and real estate while excluding the conventional financial sector. This is attributable to the ownership-based, asset-driven nature of Islamic finance, in contrast to the interest-based, debt-driven conventional system. Consequently, Islamic equities tend to exhibit lower leverage ratios, necessitating lower return rates and demonstrating reduced volatility and risk levels compared to conventional stocks.

Recently, researchers have explored how stock markets, as one of the components of the financial system, are affected by cryptocurrency markets. Some studies found spillovers between cryptocurrencies and stock markets, while others claim that these two markets are separate (Elroukh 2024). Nevertheless, there is still a noticeable lack of empirical studies that examine how cryptocurrencies may affect the performance of Islamic stock markets in comparison to their conventional counterparts, particularly in the context of the GCC region, which has paid increasing attention to cryptocurrency markets in recent years. One of the few attempts to explore this area was reported by Sami and Abdallah (2021), who investigated the relationship between cryptocurrencies and the MENA stock markets, including those of GCC countries. They concluded that the GCC’s stock market performance is reduced by 0.015% for every 1% increase in cryptocurrency returns, providing evidence for the shifting of asset classes in portfolios under management. However, they did not examine the impacts of cryptocurrencies on Islamic and conventional stock markets in the GCC region as different entities; instead, they treated them as equal despite their different portfolio compositions. Furthermore, although their study covered the period 2014–2018, it neglected to analyze the changes in the relationship before and after the 2017 crypto crash period.

Therefore, this study contributes to the existing literature by empirically exploring the impact of cryptocurrencies on Islamic vs. conventional stock returns in the GCC region. Furthermore, this study aims to explore whether that impact changed after the 2017–2018 cryptocurrency crash period3, providing insights into the impact of the crisis on the relationship between cryptocurrencies and stock returns. Accordingly, the analysis was carried out across two sub-periods, before and after the crash.

2. Literature Review and Theoretical Framework

2.1. Literature Review

Academics, policymakers, and industry professionals have recently been engaged in extensive debates regarding the potential effects of cryptocurrency markets on financial stability, as well as their possible use in financial crimes. This heightened attention is driven by the rapid expansion and growing impact of cryptocurrency markets (Giudici et al. 2019). The proliferation of crypto assets, their inherent vulnerabilities, and their increasing integration into traditional financial institutions pose a threat to financial stability (Boyko and Dolia 2022). Recognizing these challenges, Saleem et al. (2024) argue that developing strategies to mitigate these risks and promote sustainable economic growth is crucial for maintaining equilibrium in the rapidly evolving digital finance landscape.

Research into how cryptocurrencies affect stock markets is scarce. Among the studies that do exist, Dirican and Canöz (2017) investigated the cointegration relationship between Bitcoin and particular stock indices, namely, China A50, Dow30, Nasdaq100, and S&P500, using the ARDL boundary test method over the period from May 2013 to October 2017. The study concluded that, while the price of Bitcoin rose in tandem with the Dow 30 and Nasdaq 100 indexes, it declined over time with the rise in the China A50 and S&P 500 indices.

Al-Yahyaee et al. (2020) used the quantile regression approach to provide a detailed analysis of the multifractality, long-memory process, and efficiency of six well-known cryptocurrencies to evaluate the efficiency of cryptocurrency markets in terms of liquidity and volatility. The results demonstrate that multifractality and a long-memory feature are present in all markets. Moreover, the degree of market inefficiency of cryptocurrencies fluctuates over time, with Dash exhibiting the lowest level of market inefficiency and Litecoin the highest. Consequently, it was shown that market efficiency is achieved when there is a high degree of liquidity and minimal volatility, which presents arbitrage opportunities for active traders.

Gil-Alana et al. (2020) examined the bidirectional correlations between six stock market indexes and the stochastic characteristics of six well-known cryptocurrencies using fractional integration techniques. The results showed very little evidence of cointegration between the six cryptocurrencies and the chosen stock market indexes and no evidence of cointegration amongst the cryptocurrencies themselves. These results corroborate the findings of a prior study conducted by Corbet et al. (2018), which showed how cryptocurrencies might aid in portfolio diversification for investors with short investment horizons; moreover, Trabelsi (2018) found a substantial spillover impact between cryptocurrency and other financial markets.

Ünvan (2021) used causality analysis with the value at risk (VAR) method to examine the effects of Bitcoin on a subset of stock indices from the U.S., China, Japan, and Turkey. From 3 January 2016 to 16 December 2018, weekly data from the Nikkei225, BIST100, S&P500, and SSE380 were taken into consideration. The findings showed that Bitcoin had a direct impact on the BIST100, and a two-way causal relationship between the two was established. Furthermore, one-way causal relationships were found between the S&P500 and Nikkei225, the Nikkei225 and SSE30, and the SSE380 and Bitcoin.

Using a quantile regression methodology, Ahmed (2021b) examined how vulnerable emerging equity markets are to Bitcoin volatility patterns under various market regimes (calm, bear, and bull). Total variance, upside semivariance, and downside semivariance were employed in the study as stand-ins for the realized intraday price volatility of Bitcoin. The findings showed that, whereas emerging market returns are favorably (negatively) linked with the variance obtained during bear periods (normal and bull), developed market returns are positively associated with the realized variance proxy in various market scenarios.

Sami and Abdallah (2021) specifically compared the effects of cryptocurrencies on stock market indexes in various Islamic nations, including the Gulf states and other nations in the area. They investigated how the MENA stock markets performed in relation to the cryptocurrency market. The results showed a strong correlation between the MENA region’s stock market performance and the cryptocurrency market. The results also showed that, in Gulf nations claiming full adherence to Islamic Shari’ah rules, stock market performance was reduced by 0.015% percent for every 1% increase in cryptocurrency returns. On the other hand, the stock market performance of other MENA countries (non-Gulf countries) that have the freedom to adopt Islamic Shari’ah rules or not increased by 0.013% for every 1% gain in cryptocurrency returns. The results showed that one of the indicators of a strong stock market performance in the MENA is positive Bitcoin returns.

Recently, Saleem et al. (2024) empirically investigated the impact of cryptocurrency on various facets of the financial system, including the U.S. stock market (Dow Jones Industrial Average, DIJA). The study’s findings reveal a significant positive relationship between cryptocurrency market capitalization and the DJIA, suggesting that, as cryptocurrency market capitalization grows, the DJIA tends to rise as well. They concluded that cryptocurrencies have a strong impact on the fluctuations in the stock market. It is important to note that Saleem et al. (2024) observed that the relationship between cryptocurrencies and stock markets is intricate and multi-faceted. According to their analysis, these two asset classes often exhibit a degree of correlation, particularly during periods of financial turmoil. They also observe that during periods of market stress, cryptocurrencies and stocks may demonstrate synchronized movements, with both experiencing parallel increases and decreases (Saleem et al. 2024). This notion is supported by Sharma’s (2022) research, which found a significant correlation between cryptocurrencies and the stock market after 2017.

While most of the above studies examined the relationship between cryptocurrencies and the stock markets, regardless of whether they are Islamic or conventional markets, few studies have focused on Islamic stock markets (Bakar and Foziah 2023). In this context, numerous studies have been conducted on Islamic stocks, which have traditionally been more popular than conventional ones as hedging and diversification instruments due to their resilience after the 2008 global financial crisis (Halim et al. 2017; Saiti and Noordin 2018). Mensi et al. (2015) found that Islamic stock assets provided a safe haven during financial crises, suggesting that investors fled to high-quality investments during these turbulent periods. Sensoy (2016) also discovered that, compared to their conventional counterparts, Islamic equity markets had less systemic risk and were, therefore, less strongly affected by market uncertainties.

Among the few studies that highlight the relationship between cryptocurrencies and Islamic stock markets is that conducted by Mensi et al. (2020). They investigated the relationships between Bitcoin and Sukuk markets, regional Islamic stock markets, and the Dow Jones Index using Wavelet analysis. They found that the co-movement was stronger and pointed in the same direction at lower frequencies, suggesting that long-term investors gained less from BTC diversification than short-term investors. Better short-term hedging profits through diversification are implied by co-movement in the opposite direction at high frequencies in the Bitcoin and Islamic equity markets. The most significant finding was that, in the near term, a causality test showed a significant causal flow from Bitcoin to the Sukuk, Japanese, and Asia–Pacific Islamic markets.

The relationship between Bitcoin and the main Islamic equities markets in terms of risk from 2010 to 2018 was examined by Rehman et al. (2020). They discovered evidence of a risk spillover between Bitcoin and Islamic financial markets. Bitcoin was found to have a time-varying reliance on many significant Islamic indices. They also concluded that, in addition to Bitcoin, the Islamic equity market acts as a strong hedge in a portfolio due to the benefits of diversification.

Ahmed (2021a) described how Bitcoin’s positive and negative volatility affected Islamic stock markets; the study determined that when stock markets are heading downward rather than upward, Bitcoin’s increasing volatility has a concurrent and lagging detrimental influence on Islamic indexes. If Shari’ah-compliant equities are trending both downward and upward, the reduced volatility appears to have a major impact on Bitcoin returns.

2.2. Theoretical Framework

As discussed by Maitra et al. (2022), cryptocurrencies have some unique characteristics that make them appealing for portfolio diversification with other assets such as stocks. As such, it is possible to anticipate that the cryptocurrency market’s business cycle will vary from that of other assets, such as equity markets, thus making these two assets suitable for portfolio diversification. Jeris et al. (2022) noted that cryptocurrencies can be used to hedge against different types of risk, including those associated with the stock market. In this context, Shahzad et al. (2020) argued that investors should diversify their portfolios by including cryptocurrencies as another asset class in their investments. Investors should consider the volatility of Bitcoin and the time horizon (Mohd Thas Thaker and Ah Mand 2021). For this reason, Jeris et al. (2022) proposed that cryptocurrencies have a significant impact on stock markets.

In terms of the theoretical framework used to determine the impact of cryptocurrencies on the stock market, a range of theories are employed by researchers. Saleem et al. (2024) examined the relationships between cryptocurrencies and various components of the financial system, including stock markets, the U.S. dollar, inflation, and traditional banking. They integrated theoretical perspectives from the Austrian school of economics, as well as Modern Portfolio Theory, to investigate the interactions between cryptocurrency and other elements of the financial system. Their analysis drew upon insights from the Austrian theory of capital, which emphasizes the importance of time and subjective preferences in capital allocation and formation within an economy. The Austrian theory suggests that capital goods, including cryptocurrencies, reflect individuals’ subjective evaluations of present and future utility. It also proposes that capital formation is influenced by saving, investment, entrepreneurs’ profit expectations, and market prices/interest rates. Additionally, the study conducted by Saleem et al. relied on Modern Portfolio Theory, which describes how investors can construct optimal portfolios that balance risk and returns.

Furthermore, according to Maitra et al. (2022), behavioral theories can be used to explain the link between cryptocurrencies and stocks, such as the gradual information diffusion theory and the investor conservatism theory, which explain price changes in one asset due to price movements in another asset, as noted by Narayan et al. (2019). Maitra et al. (2022) concluded that based on these two theories (gradual information diffusion and investor conservatism), cryptocurrencies may behave differently from stocks. Mensi et al. (2020) also indicated that these theories might explain how cryptocurrencies may affect the Islamic stock market as compared to the conventional market. They state that both theories can explain how changes in the prices of stock markets (Islamic or conventional) arise due to changes in the prices of cryptocurrencies. These theories suggest that Islamic stocks can behave differently in relation to cryptocurrencies, as compared to conventional stocks (Mensi et al. 2020). Accordingly, this study adopts the same theoretical framework to explain the expected differences in the impact of cryptocurrencies on Islamic stock markets compared to conventional ones.

Moreover, based on a literature review, Mensi et al. (2020) concluded that Islamic stocks have specific characteristics that make them attractive for portfolio diversification with other assets such as BTC. Such advantages became conspicuous after the global financial crisis of 2008. They describe how “investors around the world have been in search of alternative investment assets that can offer better diversification compared to equity markets. During this period, Shari’ah-compliant equities have emerged as an alternative investment class given the different institutional characteristics of Islamic stock markets. More importantly, the systematic risk of Islamic equity markets is lower than that of their conventional counterparts. Empirical studies show that these Islamic equity assets serve as a haven during financial meltdowns, suggesting investors’ flight to quality during these turbulent periods”.

Finally, it is worth mentioning that Muslim investors’ attitudes towards cryptocurrencies may prevent them from shifting their investments from the stock markets, particularly Islamic stocks4, to the cryptocurrency market. Siswantoro et al. (2020) explain that this is because cryptocurrencies are extremely volatile, meaning that they can only be defined as ‘money’ to a certain extent; furthermore, as they are primarily used for speculation, which is prohibited in Islam, Muslims may be reluctant to use cryptocurrency as money or as a currency of transaction. As such, they suggest that cryptocurrencies will not develop rapidly and will face Shari’ah-compliant investment constraints in Muslim countries.

2.3. Hypotheses Development

The literature review and theoretical framework suggest a significant relationship between cryptocurrency market returns and the returns of both Islamic and conventional stock markets in the GCC countries. Thus, we formulate our first hypothesis as follows:

Hypothesis (H1):

Cryptocurrency market returns have a significant impact on the returns of both Islamic and conventional stock markets in GCC countries; however, the magnitude of this impact varies between the two market segments.

Furthermore, we hypothesize that there was a structural break or change in the relationship between cryptocurrency and stock market returns around the 2017–2018 crash period, which could be driven by factors, including shifts in investor sentiment and risk appetite before versus after the crash, differences in how Islamic versus conventional stocks respond to cryptocurrency volatility, and potential regulatory or policy changes in the GCC markets during that period. On this basis, we formulated our second hypothesis as follows:

Hypothesis (H2):

The impact of cryptocurrency market returns on the returns of the Islamic and conventional stock markets in GCC countries is not consistent before and after the 2017–2018 cryptocurrency crash period.

3. Data and Methodology

3.1. Sampling and Data Collection

Following the existing literature (see, e.g., Palamalai et al. 2021; Bouri et al. 2020), the top ten cryptocurrencies were selected for analysis in this study, as shown in Table 1.

Table 1.

Top ten cryptocurrencies.

In terms of the GCC stock markets, the authors used daily data5 from Islamic and conventional stock market indices in five GCC countries, with the exception of the Saudi Arabian stock market, based on data availability, as shown in Table 2. The Islamic and conventional stock market indices in these countries were selected following recent related studies (see, e.g., Nomran and Haron 2021).

Table 2.

List of Islamic vs. conventional stocks of five GCC countries.

The study covered the period from 1 January 2016 to 31 December 20196, which was divided into two main sub-periods: before and after the 2017–2018 crypto crash period, as the price of cryptocurrencies generally plunged in December 2017. It is also important to note that the data collection period for this study was limited to the start of 2016, a point specifically chosen to align with the availability of complete daily return data for the ten leading cryptocurrencies examined. This timeframe included newer entrants such as Nem and Ethereum Classic, which launched at the beginning and towards the end of 2015, respectively, and for which limited historical information was available prior to 2016. Using this consistent timeframe across all assets allowed the authors to calculate the accurate average daily returns without introducing potential biases by incorporating shorter data histories for some cryptocurrencies, thereby strengthening the validity and reliability of the findings.

For more detail about data collection, Table 3 provides a summary of the study variables, their definitions, the references, and the data sources.

Table 3.

List of variables, their definitions, and the data source.

3.2. Methods

To test the study hypotheses and analyze the relationship between cryptocurrency returns and Islamic/conventional stock market returns, we employed a range of analytical panel data methods, specifically, Pooled OLS, Pooled OLS with heteroskedasticity robust standard errors, fixed effects, random effects, and GLM models. These are represented in the following Equations (1)–(4):

where the c and t subscripts show the country and day, respectively. is a constant term. The dependent variable, Y, shows the total Islamic (conventional) stock market returns in country c on day t. is a vector of the country-level control variables, while is a set of daily fixed-effects dummies that control for daily international factors (see, e.g., Ashraf 2020; Nomran and Haron 2021). is an error term.

This study employs the five-panel regression models to empirically examine the impact of cryptocurrency returns on the returns of GCC Islamic and conventional stocks across three distinct panels: the initial full sample period (A), the period before the crash (A1), and the period after the crash (A2).

4. Empirical Results and Discussion

4.1. Descriptive Statistics

The descriptive statistics of the main variables of the study for the initial full sample (Panel A) are shown in Table 4. Panel A of Table 4 indicates that the average values of the Islamic and conventional stock market returns were 0.0003 and 0.0002, respectively, meaning the returns for the Islamic indices were, on average, higher than the conventional ones in GCC countries during that period. Table 4 also shows that the average value of the cryptocurrency returns for the initial full period, 2016–2019, was 0.0015. As shown in Table 4, the standard deviations for the Islamic and conventional stock indices were 0.0106 and 0.0083, respectively, indicating that GCC Islamic stocks presented higher risk levels than their conventional counterparts. However, Table 4 also indicates that the cryptocurrency returns showed higher risk levels than both stock markets, with a value of 0.0410.

Table 4.

Descriptive statistics.

Further, Table 4 presents the descriptive statistics for the main variables for the two main sub-periods, before and after the crash (Panel A1 and Panel A2, respectively). For the period before the crash, Panel A1 of Table 4 shows that the average values of the GCC Islamic stock market returns were higher than the conventional stock returns. In contrast, the opposite was evidenced for the period after the crash, with Panel A2 showing that the average values of Islamic stock market returns were lower than the conventional ones.

Regarding cryptocurrency returns before and after the crash period, Panel A1 and Panel A2 of Table 4 depict positive and negative average values before and after that period, which were 0.0068 and −0.0036, respectively.

4.2. Results

To test the study hypotheses and analyze the relationship between cryptocurrency returns and Islamic/conventional stock market returns across three distinct panels: A, A1, and A2, we employed a range of analytical panel data methods, specifically, Pooled OLS, Pooled OLS with heteroskedasticity robust standard errors, fixed effects, random effects, and GLM models. The baseline was a Pooled OLS model, which provided an initial understanding of the relationships between variables. To address potential heteroscedasticity, the pooled OLS estimation used heteroskedasticity-robust standard errors, which ensures that the coefficient estimates are efficient and reliable, even in the presence of heteroscedasticity (see, e.g., Ashraf 2020). Fixed effects models were then used to account for time-invariant unobserved factors, allowing for within-entity variations over time. Random effects models were also employed to capture unobserved heterogeneity assumed uncorrelated with the independent variables, offering efficient estimates of the overall relationships (see, e.g., Del Lo et al. 2022). Finally, GLMs were used to explore potential nonlinearities or relax linear regression assumptions (see, e.g., Adamolekun et al. 2023). This diverse set of models aimed to provide a robust and comprehensive analysis, accounting for various statistical considerations to enhance the validity of the findings.

Table 5, Table 6 and Table 7 display the regression findings with the five-panel regression models for the impact of cryptocurrency returns on the returns of GCC Islamic and conventional stocks for all three panels, A, A1, and A2.

Table 5.

Cryptocurrency returns and Islamic vs. conventional stock returns of GCC countries: initial full sample.

Table 6.

Cryptocurrency returns and Islamic vs. conventional stock returns of GCC countries: before the crash period.

Table 7.

Cryptocurrency returns and Islamic vs. conventional stock returns of GCC countries: after the crash period.

Table 5 shows the regression findings generated while investigating the first hypothesis, H1. In this part of the study, we examined whether the cryptocurrency market returns had a significant impact on the returns of both the Islamic and conventional stock markets in GCC countries and whether the magnitude of this impact differed between the two market segments. As shown in Table 5, the findings for the initial full sample (Panel A) reveal that the impact of cryptocurrency returns on both kinds of GCC stock market returns, Islamic and conventional, was negative for all of the models; however, the magnitude differed for the Islamic stocks compared to the conventional ones, in terms of both the coefficient and the significance levels. The findings show that both Islamic and conventional stock returns were negatively affected by the cryptocurrency returns for all the regression models, with a moderate impact on Islamic stocks (at the 5% significance level and a −0.008 coefficient) and a relatively stronger impact on the conventional ones (at the 1% significance level and a −0.010 coefficient). The results remained consistent across different model specifications. Accordingly, for the initial full sample (Panel A), each 1% increase in cryptocurrency returns was associated with (0.008% and 0.010%) moderately and strongly significant decreases (at the 5% and 1% significance levels) in the GCC Islamic and conventional stocks returns, respectively. This finding supports our first hypothesis.

Table 6 and Table 7 present the regression findings generated by investigating the second hypothesis, H2. We found that the impact of the cryptocurrency market returns on the returns of Islamic and conventional stock markets in GCC countries was not constant over time, exhibiting structural differences before and after the 2017–2018 cryptocurrency crash period. After dividing the initial full sample into two sub-samples, before and after the crash, the findings remained negative for all the models for both sub-samples, before the crash period (Panel A1) and after the crash period (Panel A2).

For the sub-sample before the crash period (Panel A1), the findings, as presented in Table 6, reveal that the impact of cryptocurrency returns on GCC Islamic and conventional stock market returns remained negative for all the models; however, it was significant only for the conventional stocks. The findings reveal that each 1% increase in cryptocurrency returns was associated with a (−0.009% coefficient) decrease in the GCC Islamic stock returns; however, this negative impact was not statistically significant for all of the regression models. In contrast, each 1% increase in the cryptocurrency returns was associated with a (−0.009% coefficient7) weakly significant decrease (at the 10% significance level) in the conventional GCC stocks returns for all the regression models, except for Model 3, which was not statistically significant. Therefore, for the sub-sample before the crash period (Panel A1), both the GCC Islamic and conventional stock market returns were negatively affected by cryptocurrency returns, but the impact was different in terms of both the significance power and significance levels. While the impact on Islamic stocks was non-significant, it is relatively weak and significant for the conventional stocks for all the regression models, except for Model 3, which was not statistically significant. This finding supports our second hypothesis.

The findings for the sub-sample after the crash period (Panel A2) are displayed in Table 7. Similar to the findings for Panel A1, the findings for Panel A2, as presented in Table 7, show that the impact of cryptocurrency returns on GCC Islamic and conventional stock market returns remained negative for all models; however, it was significant only for the conventional stocks. The findings reveal that each 1% increase in cryptocurrency returns was associated with a (−0.006% coefficient) decrease in the GCC Islamic stock returns; however, this negative impact was not statistically significant for all of the regression models. In contrast, each 1% increase in the cryptocurrency returns was associated with a (−0.009% coefficient) modestly significant decrease (at the 5% significance level) in the conventional GCC stocks returns for all the regression models. Therefore, for the sub-sample after the crash period (Panel A2), both the GCC Islamic and conventional stock market returns were negatively affected by cryptocurrency returns, but the impact was different in terms of both the significance power and significance levels. While the impact on Islamic stocks was non-significant, it is relatively strong and significant for the conventional stocks for all the regression models. This finding strongly supports our second hypothesis.

In summary, the findings of this study suggest that, for the full sample, the larger the cryptocurrency returns, the smaller the GCC Islamic and conventional stock returns. However, the decline in the conventional stock markets is far greater. This means that cryptocurrency returns have a negative impact on both GCC Islamic and conventional stock market returns for the full sample period. Table 8 displays a summary of the study findings for the three panels.

Table 8.

Summary of regression findings for the impact of cryptocurrency returns on Islamic vs. conventional stock returns in GCC countries.

However, for the two main sub-periods, before and after the crash, the cryptocurrency returns showed a significant negative impact only on the conventional stock returns, while this impact was not evident in relation to the Islamic stocks, indicating that the cryptocurrency market and Islamic stock markets in GCC countries ceased to be correlated in both sub-periods, before and after the crash. Thus, before and after the crash, the rise in cryptocurrency returns may simply have enticed GCC investors away from conventional stock markets, which could result in a decline in their investment in these markets; meanwhile, those who invest in the Islamic stock markets may not be exposed to this temptation.

4.3. Discussion

In terms of the regression findings for the impact of cryptocurrency returns on the returns of GCC Islamic and conventional stocks for the full sample period (2016–2019), the cryptocurrency returns had a significant negative impact on both GCC Islamic and conventional stock market returns, and the negative effect was far more pronounced for conventional stocks. These findings align with the study of Sami and Abdallah (2021), who found that the cryptocurrency market and stock markets are interdependent, meaning that stock market prices are not isolated from movement in the cryptocurrency market. In the GCC context, Sami and Abdallah (2021) found that the GCC’s stock market performance was negatively affected by the increase in cryptocurrency returns. Generally, the finding of a negative impact of cryptocurrency returns on stock returns can be attributed to investors shifting funds between the two asset classes as part of portfolio rebalancing strategies, as well as cryptocurrencies potentially acting as substitutes for stocks in some investors’ portfolios, thereby diverting capital away from traditional equity markets and exerting downward pressure on stock returns. Several studies highlight the potential role of cryptocurrencies as a significant diversification option for investors’ portfolios (see, e.g., Corbet et al. 2018; Guesmi et al. 2019; Corbet et al. 2020; Gil-Alana et al. 2020; Okorie and Lin 2020; Platanakis and Urquhart 2020). Cryptocurrencies have grown in popularity among investors as they offer more appealing returns compared to traditional investment instruments (Maitra et al. 2022; Bakar and Foziah 2023).

The key finding was that before and after the 2017–2018 crypto crash period, cryptocurrency returns had a significant negative impact only on GCC conventional stock returns, but this impact was not evident for Islamic stocks in GCC countries, suggesting that the cryptocurrency market and the GCC Islamic stock markets became uncorrelated during those two sub-periods. This is to say that before and after the crash, the rise in cryptocurrency returns may simply have enticed GCC investors away from conventional stock markets, which could result in a decline in their investment in these markets; meanwhile, those who invest in the Islamic stock markets may not be exposed to this temptation. One possible explanation for this is that some investors in GCC Islamic stock markets favored investing in these markets due to their perceived safety as compared to volatile cryptocurrency markets. This viewpoint is supported by the fact that while investors in Islamic stocks were unaffected by any increase in returns in the cryptocurrency market, those in conventional stock markets were adversely affected by the increase in returns in the cryptocurrency market before and following the crash period. This may indicate that conventional GCC stock investors found that the risk in both the conventional stocks and cryptocurrency markets was almost equivalent8, and they chose to take advantage of the relatively large returns provided by the cryptocurrency market9. This finding seems to be in line with previous empirical studies that found Islamic equity assets to serve as a safe haven during financial crises, suggesting investors’ flight to quality assets during these turbulent periods, as mentioned by Mensi et al. (2020). Furthermore, in general, Muslim investors’ attitudes towards cryptocurrencies may prevent them from shifting their investment from Islamic stock markets to cryptocurrency markets since the characteristics of cryptocurrencies are prohibited in Islam. Muslim investors would, therefore, be reluctant to use cryptocurrency as a currency of transaction (see, Siswantoro et al. 2020).

To further elaborate on these regression results, Table 9 presents the results across the three panels summarized in Table 8. Over the full sample period (2016–2019), the findings show that cryptocurrency returns had a negative and significant impact on both Islamic and conventional stock markets. When examining the pre-crash subperiod, the findings indicate cryptocurrency returns were not significant for Islamic stocks but were negative and significant for conventional stocks. In the post-crash subperiod, the regression analysis shows the negative and significant relationship continued for conventional stocks, while Islamic stocks also became influenced by the negative effects of cryptocurrency market activity.

Table 9.

Results across sample periods.

Generally, the contrasting findings between Islamic and conventional stock markets in the GCC region can be attributed to the distinct investment principles and behaviors underlying Islamic finance vs. conventional finance. During the full sample period from 2016–2019, the speculative and volatile nature of cryptocurrencies had a significant negative impact on both Islamic and conventional stock market returns, reflecting the broad contagion effects of the cryptocurrency market. However, when examining the sub-periods before and after the crash, a divergence emerges. For Islamic stocks, the negative influence of cryptocurrency returns disappeared in the more stable pre-crash and post-crash sub-samples, as the risk-averse, asset-based investment approach of Islamic finance effectively insulated these markets from the crypto-related volatility. In contrast, conventional stocks remained susceptible to the spillover effects of cryptocurrencies even in the calmer sub-periods, likely due to the higher speculative tendencies of conventional investors. This time-varying relationship highlights the distinctive risk–return profiles and investment behaviors between Islamic and conventional equities in the face of emerging and volatile asset classes like cryptocurrencies.

However, it is important to recognize that our study, like other research, has its own set of limitations. The primary limitations of this study include the restricted data coverage and a sample of GCC countries. The data are limited to the period up to 2019 in order to avoid the confounding effects of the COVID-19 pandemic and the Ukraine war. While the authors believe the 2019 timeframe offers highly relevant insights, future research should aim to expand the data coverage to incorporate the impacts of these major global events. This would provide a more comprehensive understanding of the evolving dynamics between cryptocurrency markets and stock market performance in the GCC region. Furthermore, within this broader 2016–2019 timeframe, the use of only a two-year sub-sample period introduces further limitations.

Additionally, the study sample did not include Saudi Arabia due to data limitations. Future studies should extend the analysis to include this important GCC country, comparing the relationships between cryptocurrency markets and Islamic versus conventional stocks within the GCC region. Further, future studies should extend the analysis to compare the relationships between cryptocurrency markets and Islamic versus conventional stocks across different regional markets, as there are potential differences in how regional stock markets interpret Shari’ah compliance.

Furthermore, the low R-squared values observed in our models highlight the need for future researchers to explore additional independent variables and alternative modeling approaches that can better explain the variability in the dependent variable of interest.

Overall, this study provides a valuable foundation, but ongoing research is needed to further enhance our understanding of this rapidly evolving field.

5. Conclusions

Several studies have concluded that cryptocurrency returns are among the determinants of stock market returns. However, these studies ignored the fact that different stock markets, that is, Islamic and conventional markets, have different risk–return profiles due to the permissible/non-permissible activities in Shari’ah-compliant investments. The impact of cryptocurrency returns on the Islamic vs. conventional markets before and after the 2017–2018 crypto crash period, especially in the context of the GCC region, remains a gap in the literature.

The aim of this study was to empirically investigate the impact of the cryptocurrency market on Islamic vs. conventional stock returns in five GCC countries before and after the crypto crash. To this end, daily data from stock markets over the period from 2016 to 2019 were analyzed, using different panel data techniques to confirm the findings.

The findings of this study suggest that cryptocurrency returns have a negative impact on both Islamic and conventional GCC stock market returns for the full sample period (2016–2019). In contrast, for the two sub-periods, before and after the crash, cryptocurrency returns recorded a significant negative impact only on conventional stock returns, while no such impact was apparent in terms of the Islamic stocks, indicating that the cryptocurrency market and the Islamic stock markets in GCC countries decoupled from each other in both sub-periods, before and after the crash. Therefore, in the sub-periods before and after the crash, the rise in cryptocurrency returns may have enticed GCC investors away from conventional stock markets, which could result in a decline in their investment in these markets; meanwhile, those who invest in the Islamic stock markets may not have been as exposed to this temptation.

The findings of this study have important policy implications. In the calmer sub-periods before and after the crypto crash, the cryptocurrency market has only posed a serious threat to conventional GCC stock markets and not Islamic stocks. Thus, policymakers in the GCC region should take seriously the threat posed to conventional stock markets by cryptocurrencies. They should consider implementing appropriate regulations, policies, strategies, and oversight measures for the cryptocurrency market to ensure its stability and mitigate the potential spillover effects on conventional stock markets. In parallel, they ought to focus more attention on promoting investments in Islamic stock markets as an effective hedging instrument against the risk posed by cryptocurrencies on the GCC financial markets; this should be considered along with the absence of an equity derivative market in the GCC that would allow investors to hedge risk management in underlying assets, such as cryptocurrencies. This would contribute to maintaining the stability of the GCC’s financial systems by using Islamic stocks as the key and guaranteeing reliable financial market components.

Policymakers and regulators could also consider promoting the inclusion of cryptocurrencies as an alternative asset class in investment portfolios to enhance diversification and risk management for GCC investors. Further, policymakers and regulators in the GCC could consider enhancing collaboration and information sharing between financial authorities and market participants to better understand the dynamics and interdependencies between the cryptocurrency market and the regional stock markets.

The findings of this study also have practical implications. For example, these findings can be used by GCC stock investors to better understand the impact of cryptocurrency performance on their investment decisions, as crypto is another asset class; this would also allow them to develop more effective investment and portfolio diversification strategies. The findings of this study suggest that GCC investors could potentially benefit from diversifying their portfolios by incorporating cryptocurrencies. The results indicate that the cryptocurrency market tends to move in the opposite direction to both the conventional and Islamic stock markets in the region. This inverse relationship between the cryptocurrency market and the GCC stock markets implies that adding cryptocurrencies to investment portfolios could provide diversification advantages to help offset losses and mitigate overall portfolio risk.

Author Contributions

Conceptualization, N.M.N.; methodology, N.M.N. and R.H.; software, N.M.N.; validation, N.M.N.; formal analysis, N.M.N.; investigation, N.M.N.; resources, N.M.N., A.L., A.K., Z.H.S. and J.A.; data curation, N.M.N.; writing—original draft preparation, N.M.N., A.L. and Z.H.S.; writing—review and editing, R.H., A.L., A.K. and J.A.; visualization, N.M.N.; supervision, N.M.N. and R.H.; project administration, N.M.N. and A.L.; funding acquisition, A.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Deanship of Scientific Research, Vice Presidency for Graduate Studies and Scientific Research, King Faisal University, Saudi Arabia [GrantA471].

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | https://fastcompanyme.com/news/mena-region-is-the-fastest-growing-crypto-market-in-the-world (accessed on 18 March 2024). |

| 2 | Chinalysis issues an annual crypto index, namely, “The Global Crypto Adoption Index”, which identifies the countries where the most people are putting the greatest share of their wealth into cryptocurrency. |

| 3 | The 2017–2018 cryptocurrency crash period represents the period in which the price of cryptocurrencies plunged in December 2017 (Tan et al. 2021). |

| 4 | It is important to note that it is not only Muslims who are interested in Islamic financial markets; non-Muslims are, too. For example, Alam et al. (2017) showed that “Islamic investment products offer an avenue for Muslims and non-Muslims to invest in ethically responsible funds with an underlying asset”. This implies that only Muslims may be reluctant to use cryptocurrencies; thus, their investment decisions may not be affected by movement in the cryptocurrency markets. In contrast, non-Muslim investors in Islamic financial assets may be affected if they find better investment opportunities in the cryptocurrency market. |

| 5 | The data were sourced from major stock indices in the GCC countries, as presented in Table 2; they were retrieved from www.investing.com (accessed on 25 September 2021). |

| 6 | To exclude the effects of the COVID-19 pandemic on the markets, the study looked at the problem by analyzing data until the end of 2019. |

| 7 | All the models’ coefficients were −0.009, with the exception of Model 3, where the coefficient was −0.008. Furthermore, the models were statistically significant at the 10% level, except for Model 3, which was non-significant. |

| 8 | “The GCC cryptocurrency market may exhibit characteristics similar to those of the equity market, such as volatility clustering, bubbles and inefficiency” (Abdeldayem and Aldulaimi 2023). |

| 9 | As mentioned above, cryptocurrencies have grown in popularity among investors as they offer more appealing returns compared to traditional investment instruments (Maitra et al. 2022; Bakar and Foziah 2023). |

References

- Abdeldayem, Marwan, and Saeed Aldulaimi. 2023. Investment decisions determinants in the GCC cryptocurrency market: A behavioural finance perspective. International Journal of Organizational Analysis 32: 1073–87. [Google Scholar] [CrossRef]

- Adamolekun, Gbenga, Rilwan Sakariyahu, Rodiat Lawal, and Ammar Ahmed. 2023. Electronic trading and stock market participation in Africa: Does technology induce participation? Economics Letters 224: 110991. [Google Scholar] [CrossRef]

- Ahmed, Sarwar Uddin, Samiul Parvez Ahmed, Mohammad Abdullah, and Uttam Karmaker. 2022. Do socio-political factors affect investment performance? Cogent Economics & Finance 10: 2113496. [Google Scholar] [CrossRef]

- Ahmed, Walid Mohammed Abdelaziz. 2021a. How do Islamic equity markets respond to good and bad volatility of cryptocurrencies? The case of Bitcoin. Pacific-Basin Finance Journal 70: 101667. [Google Scholar] [CrossRef]

- Ahmed, Walid Mohammed Abdelaziz. 2021b. Stock market reactions to upside and downside volatility of Bitcoin: A quantile analysis. The North American Journal of Economics and Finance 57: 101379. [Google Scholar] [CrossRef]

- Alam, Nafis, Lokesh Gupta, Abdolhossein Zameni, Nafis Alam, Lokesh Gupta, and Abdolhossein Zameni. 2019. Cryptocurrency and Islamic Finance. In Fintech and Islamic Finance. Cham: Palgrave Macmillan, pp. 99–118. [Google Scholar] [CrossRef]

- Alam, Nafis, Lokesh Gupta, Bala Shanmugam, Nafis Alam, Lokesh Gupta, and Bala Shanmugam. 2017. Islamic Wealth Management. In Islamic Finance. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Ali, Shoaib, Muhammad Naveed, Hasan Hanif, and Mariya Gubareva. 2024. The resilience of Shariah-compliant investments: Probing the static and dynamic connectedness between gold-backed cryptocurrencies and GCC equity markets. International Review of Financial Analysis 91: 103045. [Google Scholar] [CrossRef]

- Al-Yahyaee, Khamis Hamed, Walid Mensi, Hee-Un Ko, Seong-Min Yoon, and Sang Hoon Kang. 2020. Why cryptocurrency markets are inefficient: The impact of liquidity and volatility. The North American Journal of Economics and Finance 52: 101168. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2020. Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance 54: 101249. [Google Scholar] [CrossRef] [PubMed]

- Aysan, Ahmet Faruk, and Farrukh Nawaz Kayani. 2022. China’s transition to a digital currency does it threaten dollarization? Asia and the Global Economy 2: 100023. [Google Scholar] [CrossRef]

- Bakar, Norhidayah Abu, and Nik Hazimi Mohammed Foziah. 2023. The Impact of Cryptocurrency Volatility Dynamics on the Islamic Equity Market: The Case of Emerging Asia. Asian Economics Letters 4: 70285. [Google Scholar] [CrossRef]

- Belo, Frederico, Vito D. Gala, and Jun Li. 2013. Government spending, political cycles, and the cross section of stock returns. Journal of Financial Economics 107: 305–24. [Google Scholar] [CrossRef]

- Bouri, Elie, Brian Lucey, and David Roubaud. 2020. The volatility surprise of leading cryptocurrencies: Transitory and permanent linkages. Finance Research Letters 33: 101188. [Google Scholar] [CrossRef]

- Boyko, Dotscenko, and Yu Dolia. 2022. Patterns of financial crimes using cryptocurrencies. Socio-Economic Relations in the Digital Society 2: 23–28. [Google Scholar] [CrossRef]

- Chinalysis. 2022. Chainalysis Blog|Middle East & North Africa’s Crypto Markets Grow More Than Any Other Region in 2022. Available online: https://www.chainalysis.com/blog/middle-east-north-africa-mena-cryptocurrency-adoption/ (accessed on 9 February 2024).

- Chinalysis. 2023. Chainalysis Blog|Middle East & North Africa: Crypto Takes Hold as UAE Leads the Way in Promoting Regulatory Clarity. Available online: https://www.chainalysis.com/blog/middle-east-north-africa-menacryptocurrency-adoption/ (accessed on 27 January 2024).

- Corbet, Shaen, Andrew Meegan, Charles Larkin, Brian Lucey, and Larisa Yarovaya. 2018. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters 165: 28–34. [Google Scholar] [CrossRef]

- Corbet, Shaen, Charles Larkin, and Brian Lucey. 2020. The contagion effects of the COVID-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters 35: 101554. [Google Scholar] [CrossRef]

- Del Lo, Gaye, Théophile Basséne, and Babacar Séne. 2022. COVID-19 and the African Financial Markets: Less Infection, Less Economic Impact? Finance Research Letters 45: 102148. [Google Scholar] [CrossRef]

- Delle Foglie, Andrea, and Ida Claudia Panetta. 2020. Islamic stock market versus conventional: Are Islamic investing a ‘Safe Haven’for investors? A systematic literature review. Pacific-Basin Finance Journal 64: 101435. [Google Scholar] [CrossRef]

- Dirican, Cüneyt, and İsmail Canöz. 2017. Bitcoin Fiyatları İle Dünyadaki Başlıca Borsa Endeksleri Arasındaki Eşbütünleşme İlişkisi: ARDL Modeli Yaklaşımı İle Analiz. Journal of Economics, Finance and Accounting 4: 377–92. [Google Scholar] [CrossRef]

- Elroukh, Ahmed W. 2024. Does banning cryptocurrencies affect stock markets? Studies in Economics and Finance, 4. [Google Scholar] [CrossRef]

- Gil-Alana, Luis Alberiko, Emmanuel Joel Aikins Abakah, and María Fátima Romero Rojo. 2020. Cryptocurrencies and stock market indices. Are they related? Research in International Business and Finance 51: 101063. [Google Scholar] [CrossRef]

- Giudici, Giancarlo, Alistair Milne, and Dmitri Vinogradov. 2019. Cryptocurrencies: Market Analysis and Perspectives. Journal of Industrial and Business Economics 47: 1–18. [Google Scholar] [CrossRef]

- Guesmi, Khaled, Samir Saadi, Ilyes Abid, and Zied Ftiti. 2019. Portfolio diversification with virtual currency: Evidence from bitcoin. International Review of Financial Analysis 63: 431–37. [Google Scholar] [CrossRef]

- Halim, Zairihan Abdul, Janice How, and Peter Verhoeven. 2017. Agency costs and corporate sukuk issuance. Pacific-Basin Finance Journal 42: 83–95. [Google Scholar] [CrossRef]

- He, Xinao, Runguo Xu, Kai Sun, and Jian Wang. 2024. Population intensity, location choice, and investment portfolio selection: A case of emerging economies. International Review of Financial Analysis 94: 103271. [Google Scholar] [CrossRef]

- Hughes, Alex, Andrew Park, Jan Kietzmann, and Chris Archer-Brown. 2019. Beyond Bitcoin: What blockchain and distributed ledger technologies mean for firms. Business Horizons 62: 273–81. [Google Scholar] [CrossRef]

- IMARC Group’s Report. 2023. GCC Cryptocurrency Market Report by Type, Component, Process, Application, and Country 2024–2032. Available online: https://www.imarcgroup.com/gcc-cryptocurrency-market (accessed on 2 February 2024).

- Jeris, Saeed Sazzad, ASM Nayeem Ur Rahman Chowdhury, Mst Taskia Akter, Shahriar Frances, and Monish Harendra Roy. 2022. Cryptocurrency and stock market: Bibliometric and content analysis. Heliyon 8: e10514. [Google Scholar] [CrossRef]

- Jiang, Wen, Qiuhua Xu, and Ruige Zhang. 2022. Tail-event driven network of cryptocurrencies and conventional assets. Finance Research Letters 46: 102424. [Google Scholar] [CrossRef]

- Listyarti, Indra, and Tatik Suryani. 2014. Determinant factors of investors’ behavior in investment decision in Indonesian capital markets. Journal of Economics, Business, and Accountancy Ventura 17: 45–54. [Google Scholar] [CrossRef]

- Lukonga, Inutu. 2018. Fintech, Inclusive Growth and Cyber Risks: Focus on the MENAP and CCA. IMF Working Paper. Bretton Woods: International Monetary Fund, vol. 18, pp. 1–52. [Google Scholar] [CrossRef]

- Maitra, Debasish, Mobeen Ur Rehman, Saumya Ranjan Dash, and Sang Hoon Kang. 2022. Do cryptocurrencies provide better hedging? Evidence from major equity markets during COVID-19 pandemic. The North American Journal of Economics and Finance 62: 101776. [Google Scholar] [CrossRef]

- Mensi, Walid, Mobeen Ur Rehman, Debasish Maitra, Khamis Hamed Al-Yahyaee, and Ahmet Sensoy. 2020. Does bitcoin co-move and share risk with Sukuk and world and regional Islamic stock markets? Evidence using a time-frequency approach. Research in International Business and Finance 53: 101230. [Google Scholar] [CrossRef]

- Mensi, Walid, Shawkat Hammoudeh, Juan C. Reboredo, and Duc Khuong Nguyen. 2015. Are Sharia stocks, gold and US Treasury hedges and/or safe havens for the oil-based GCC markets? Emerging Markets Review 24: 101–21. [Google Scholar] [CrossRef]

- Miglionico, Andrea. 2023. Digital payments system and market disruption. Law and Financial Markets Review 16: 181–96. [Google Scholar] [CrossRef]

- Mohd Thas Thaker, Hassanudin, and Abdollah Ah Mand. 2021. Bitcoin and stock markets: A revisit of relationship. Journal of Derivatives and Quantitative Studies: 선물연구 29: 234–56. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar, Seema Narayan, R. Eki Rahman, and Iwan Setiawan. 2019. Bitcoin price growth and Indonesia’s monetary system. Emerging Markets Review 38: 364–76. [Google Scholar] [CrossRef]

- Nomran, Naji Mansour, and Razali Haron. 2021. The impact of COVID-19 pandemic on Islamic versus conventional stock markets: International evidence from financial markets. Future Business Journal 7: 33. [Google Scholar] [CrossRef]

- Okorie, David Iheke, and Boqiang Lin. 2020. Crude oil price and cryptocurrencies: Evidence of volatility connectedness and hedging strategy. Energy Economics 87: 104703. [Google Scholar] [CrossRef]

- Palamalai, Srinivasan, Krishna Kumar, and Bipasha Maity. 2021. Testing the random walk hypothesis for leading cryptocurrencies. Borsa Istanbul Review 21: 256–68. [Google Scholar] [CrossRef]

- Patil, Sagar, and Virupaxi Bagodi. 2021. A study of factors affecting investment decisions in India: The KANO way. Asia Pacific Management Review 26: 197–214. [Google Scholar] [CrossRef]

- Platanakis, Emmanouil, and Andrew Urquhart. 2020. Should investors include bitcoin in their portfolios? A portfolio theory approach. The British Accounting Review 52: 100837. [Google Scholar] [CrossRef]

- Rehman, Mobeen Ur, Nadia Asghar, and Sang Hoon Kang. 2020. Do Islamic indices provide diversification to bitcoin? A time-varying copulas and value at risk application. Pacific-Basin Finance Journal 61: 101326. [Google Scholar] [CrossRef]

- Rudolf, Karl Oton, Samer Ajour El Zein, and Nicola Jackman Lansdowne. 2021. Bitcoin as an Investment and Hedge Alternative. A DCC MGARCH Model Analysis. Risks 9: 154. [Google Scholar] [CrossRef]

- Saiti, Buerhan, and Nazrul Hazizi Noordin. 2018. Does Islamic equity investment provide diversification benefits to conventional investors? Evidence from the multivariate GARCH analysis. International Journal of Emerging Markets 13: 267–89. [Google Scholar] [CrossRef]

- Saleem, Mohamed Nihal, Yianni Doumenis, Epameinondas Katsikas, Javad Izadi, and Dimitrios Koufopoulos. 2024. Decrypting Cryptocurrencies: An Exploration of the Impact on Financial Stability. Journal of Risk and Financial Management 17: 186. [Google Scholar] [CrossRef]

- Sami, Mina, and Wael Abdallah. 2021. How does the cryptocurrency market affect the stock market performance in the MENA region? Journal of Economic and Administrative Sciences 37: 741–53. [Google Scholar] [CrossRef]

- Sensoy, Ahmet. 2016. Systematic risk in conventional and Islamic equity markets. International Review of Finance 16: 457–66. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Elie Bouri, David Roubaud, and Ladislav Kristoufek. 2020. Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Economic Modelling 87: 212–24. [Google Scholar] [CrossRef]

- Sharma, Rakesh. 2022. Is There a Cryptocurrency Price Correlation to the Stock Market? Available online: https://www.investopedia.com/news/are-bitcoin-price-and-equity-markets-returns-correlated/ (accessed on 1 March 2024).

- Siswantoro, Dodik, Rangga Handika, and Aria Farah Mita. 2020. The requirements of cryptocurrency for money, an Islamic view. Heliyon 6: e03235. [Google Scholar] [CrossRef]

- Swamy, Vighneswara, Munusamy Dharani, and Fumiko Takeda. 2019. Investor attention and Google Search Volume Index: Evidence from an emerging market using quantile regression analysis. Research in International Business and Finance 50: 1–17. [Google Scholar] [CrossRef]

- Tan, Zhengxun, Yilong Huang, and Binuo Xiao. 2021. Value at risk and returns of cryptocurrencies before and after the crash: Long-run relations and fractional cointegration. Research in International Business and Finance 56: 101347. [Google Scholar] [CrossRef]

- Trabelsi, Nader. 2018. Are there any volatility spill-over effects among cryptocurrencies and widely traded asset classes? Journal of Risk and Financial Management 11: 66. [Google Scholar] [CrossRef]

- Ünvan, Yüksel Akay. 2021. Impacts of Bitcoin on USA, Japan, China and Turkey stock market indexes: Causality analysis with value at risk method (VAR). Communications in Statistics-Theory and Methods 50: 1599–614. [Google Scholar] [CrossRef]

- Wilson, Claire. 2019. Cryptocurrencies: The Future of Finance? In Contemporary Issues in International Political Economy. Edited by Fu-Lai Tony Yu and Diana Kwan. Singapore: Palgrave Macmillan, pp. 359–94. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).