The Stability of Trend Management Strategies in Chaotic Market Conditions

Abstract

1. Introduction

2. Methods

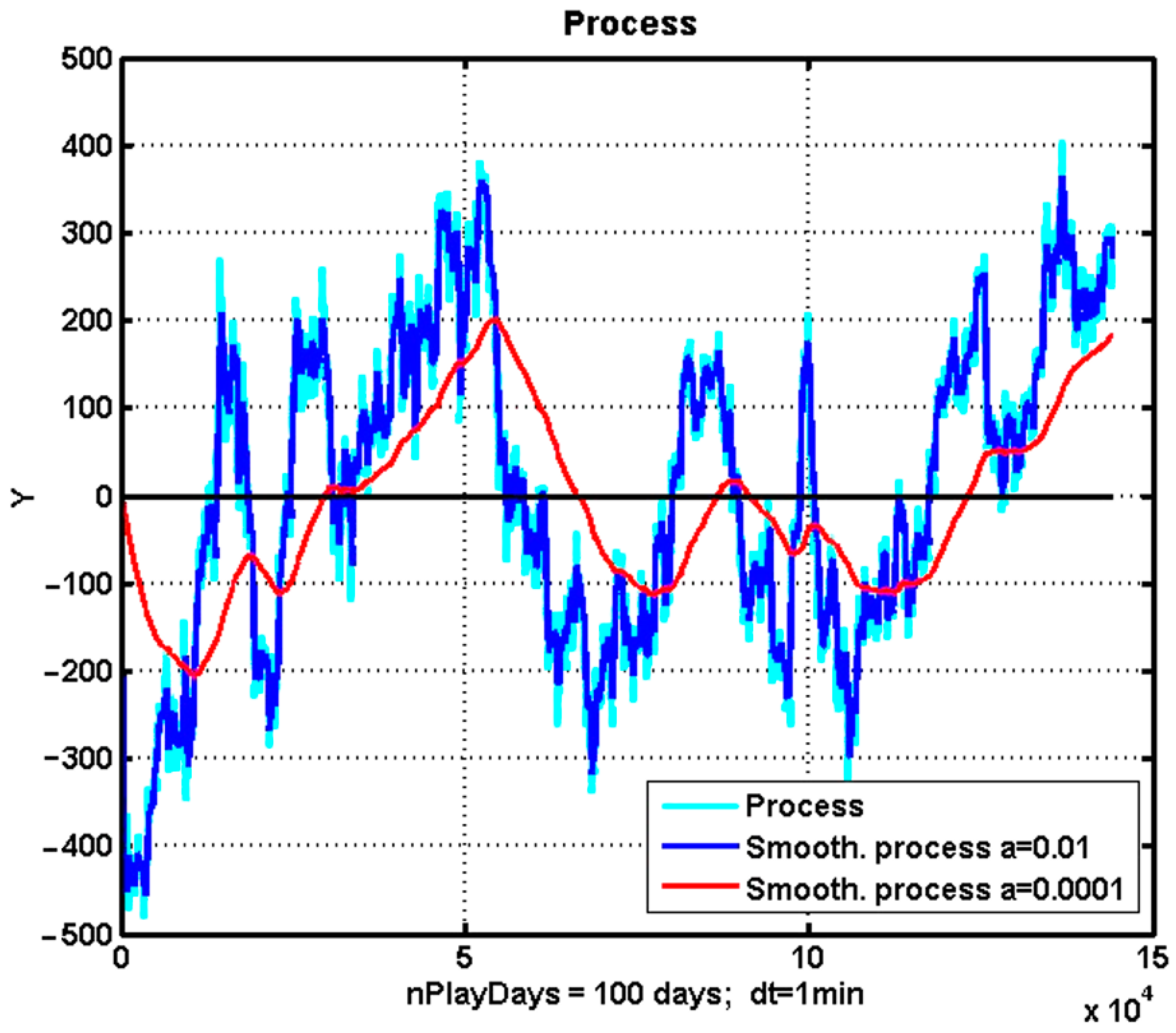

2.1. Formalization of the Control Problem Under Conditions of Stochastic Chaos

2.2. The Task of Speculative Trading Statement Based on Trend Management Strategies

3. Experiments and Results

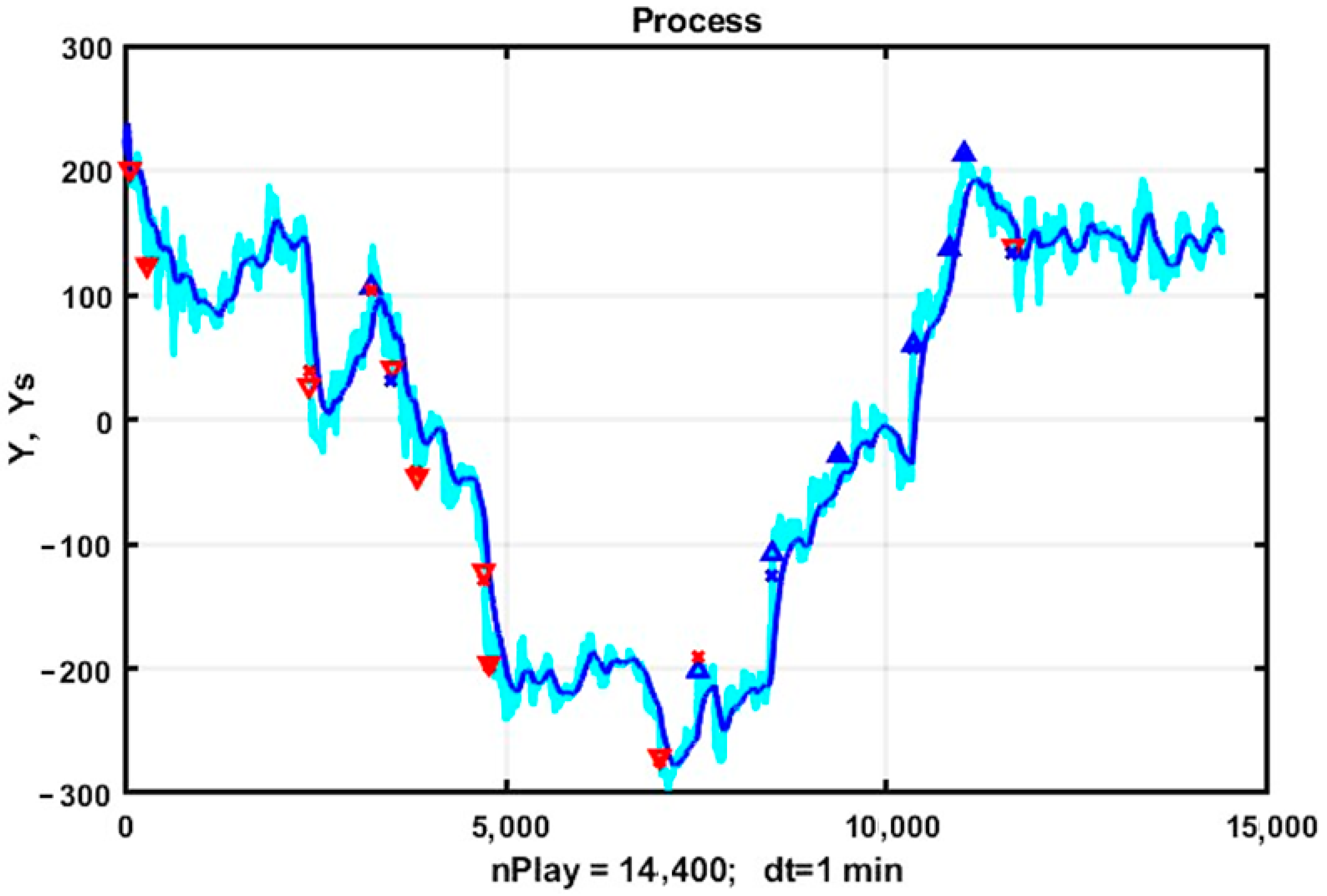

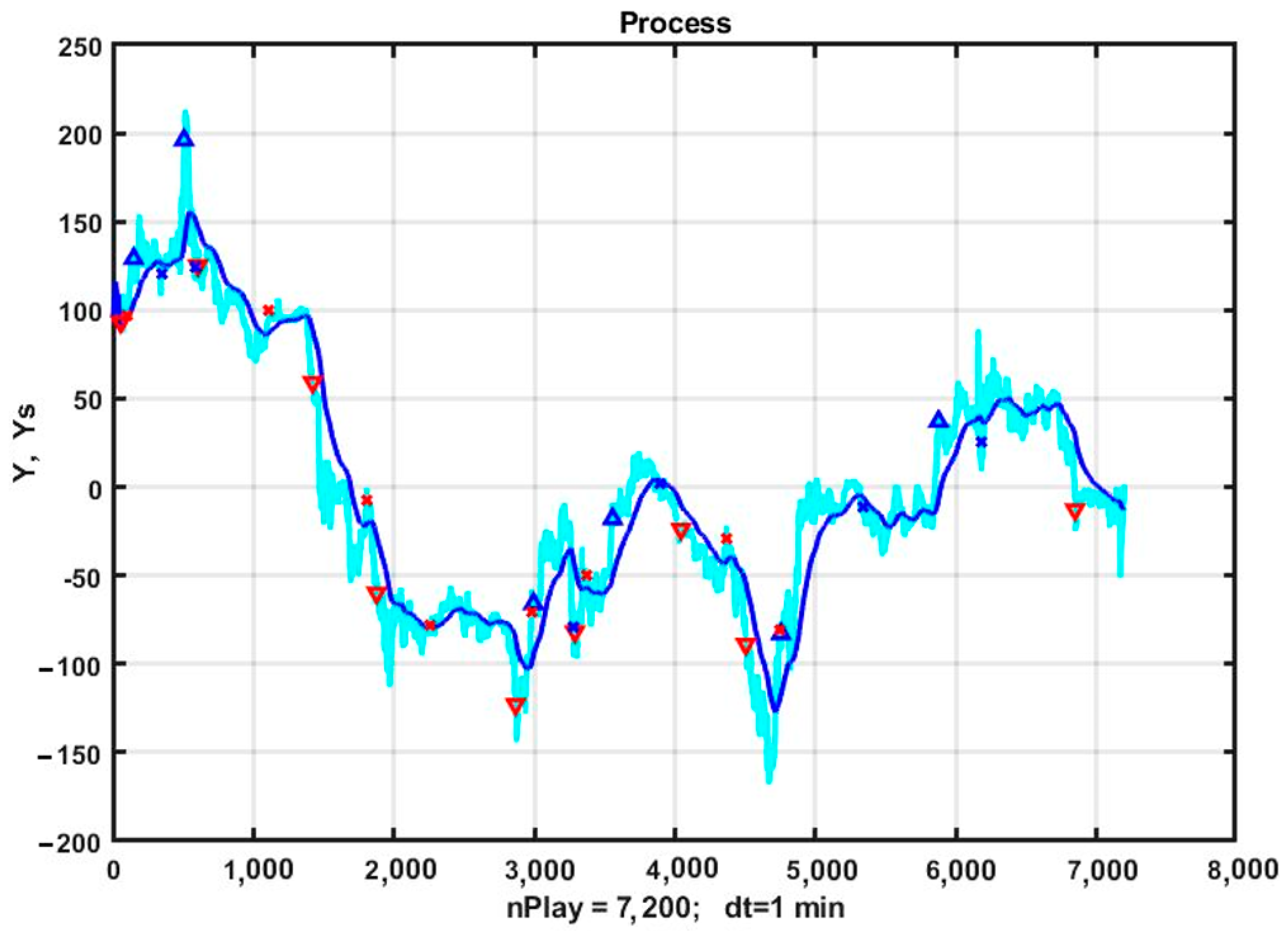

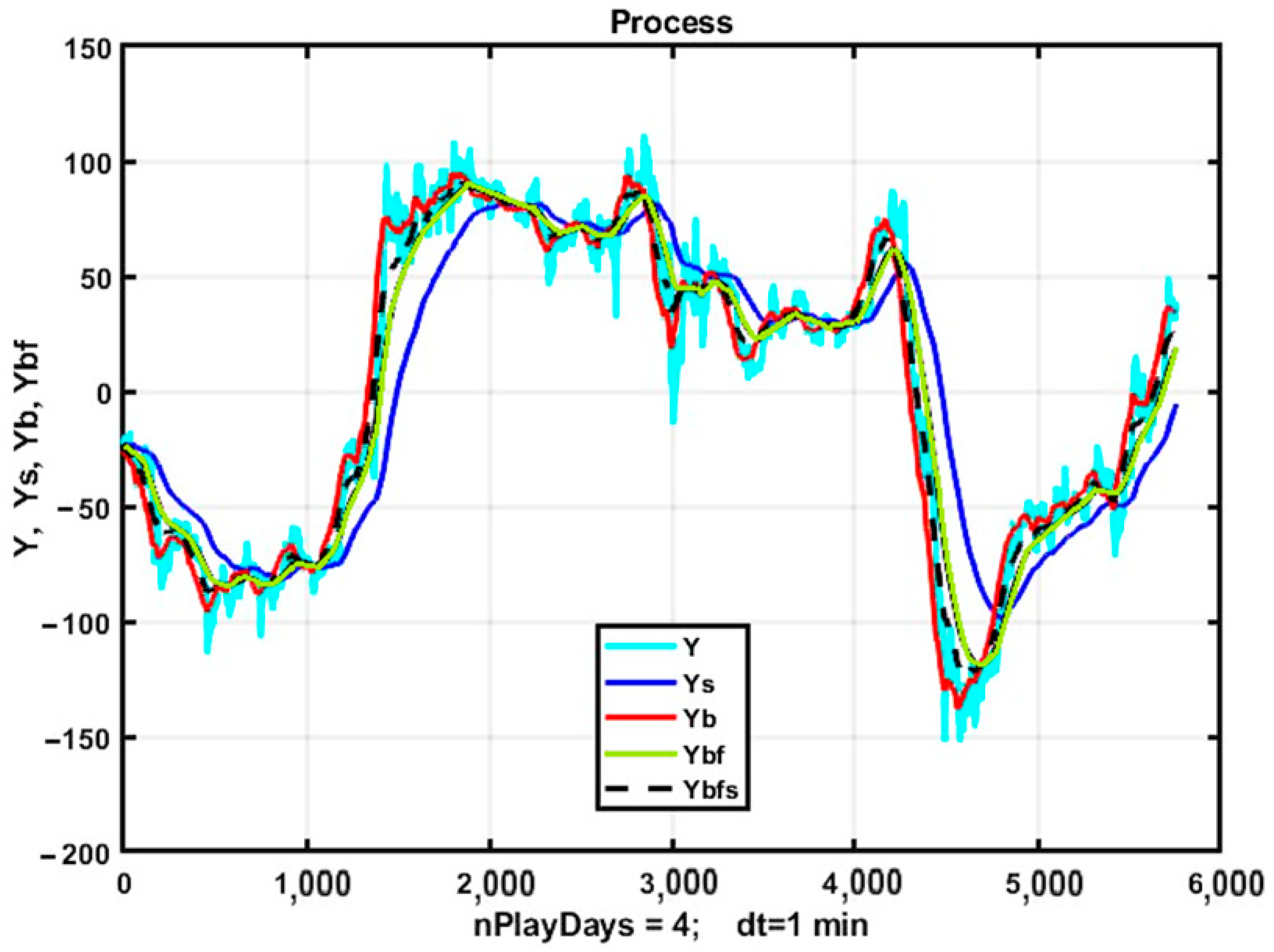

3.1. Implementation of a Flexible Trend Management Strategy: Case Study

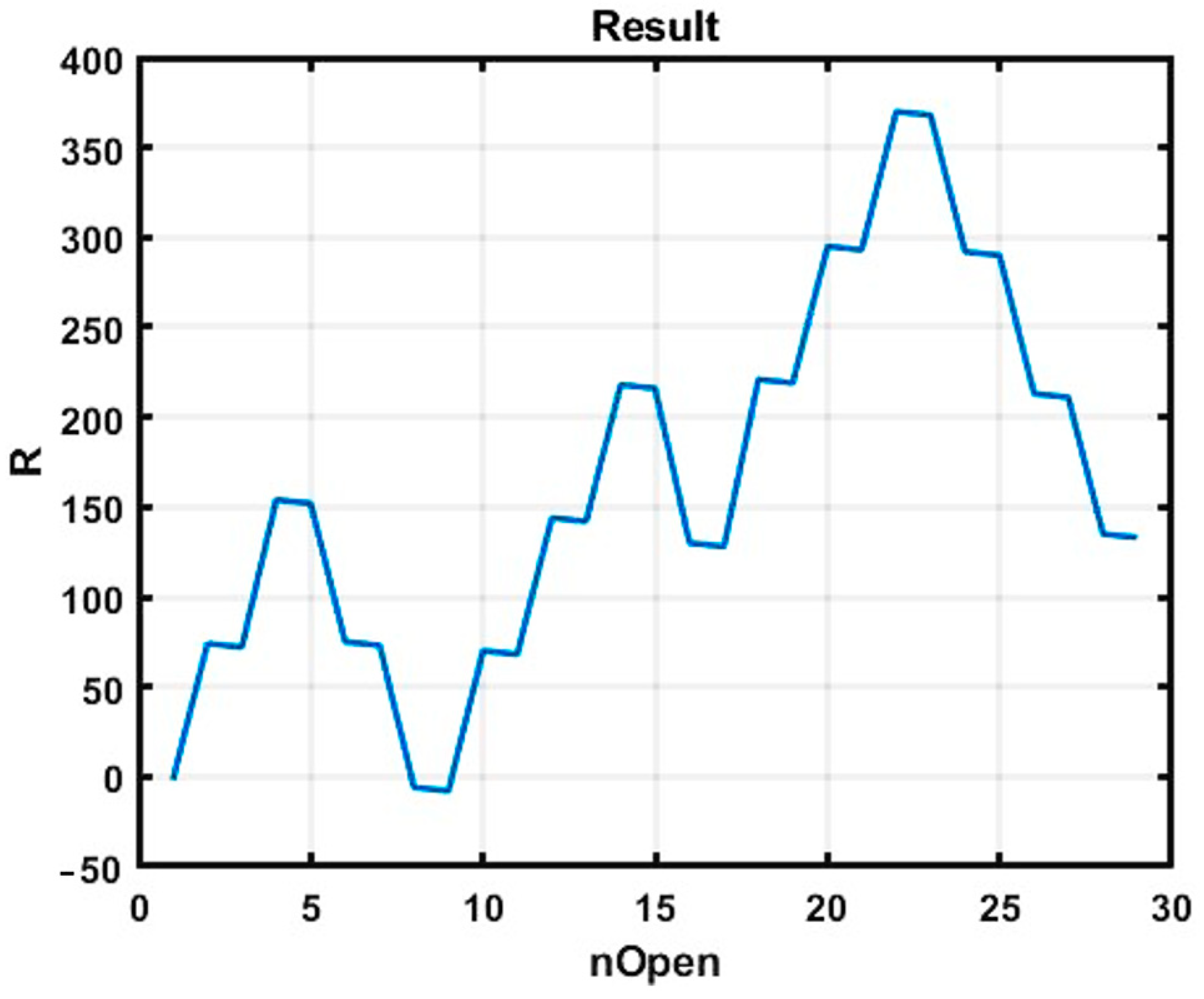

3.2. Parametric Optimization of the Simplest Trend Strategy

3.3. Preliminary Discussion of the Results

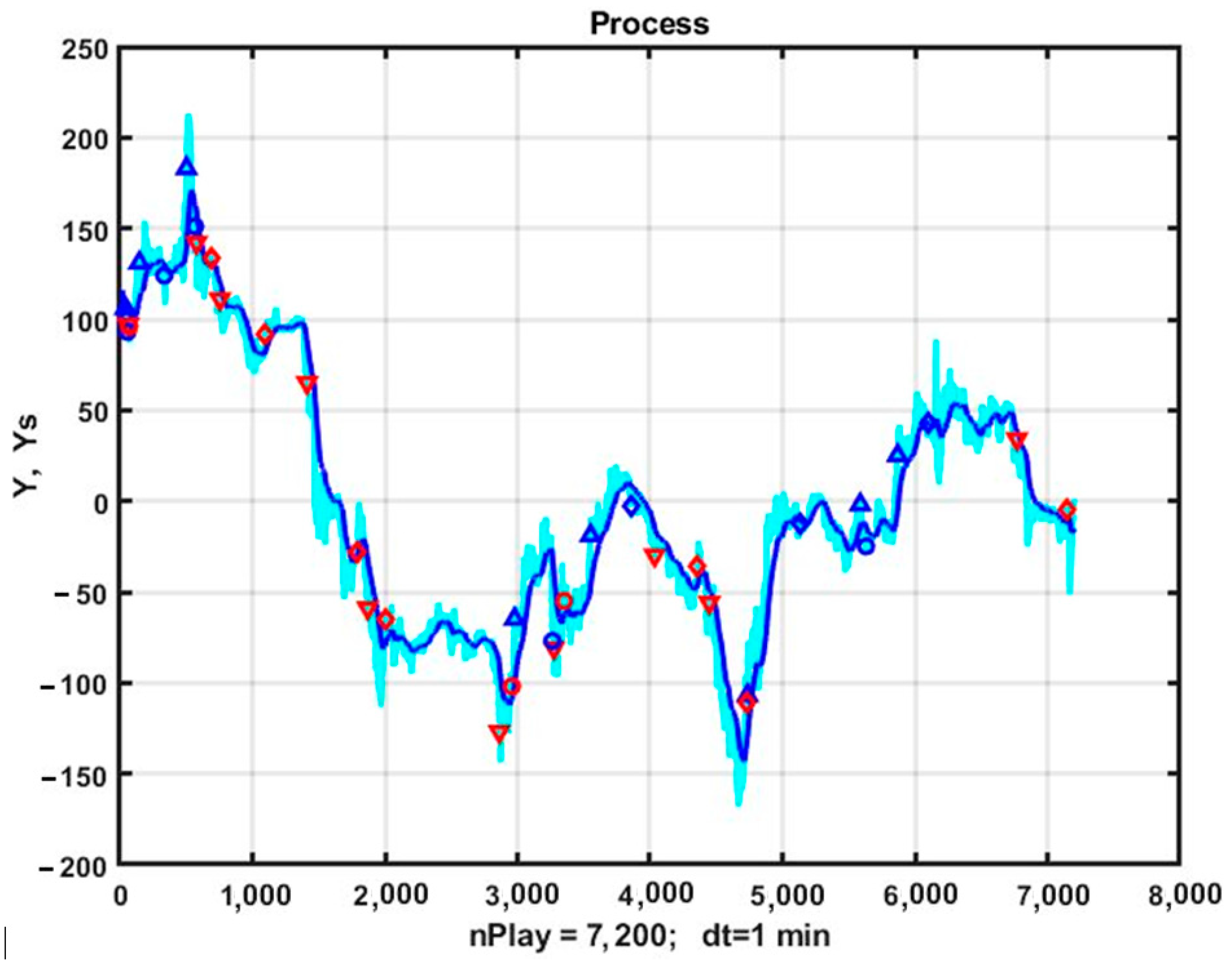

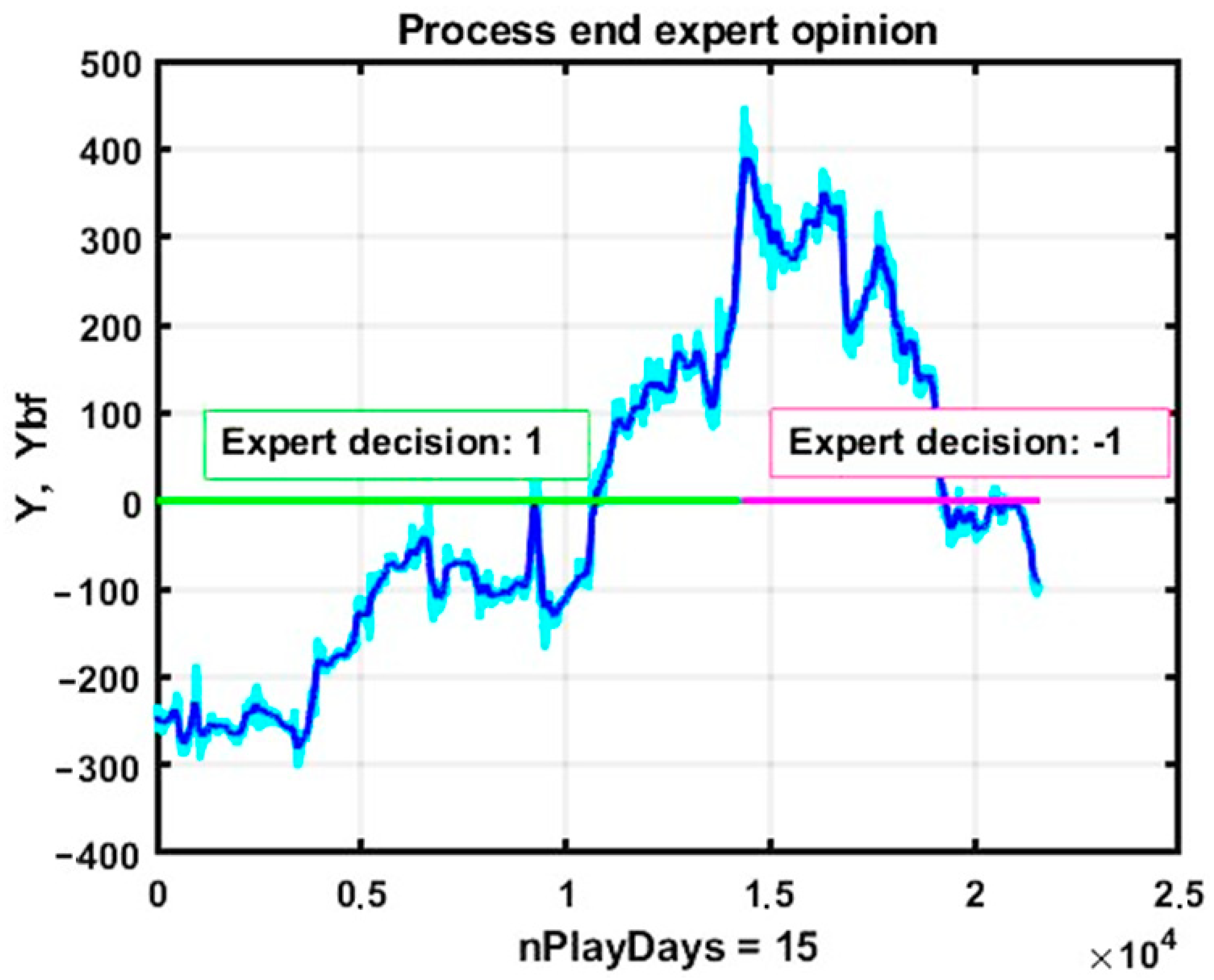

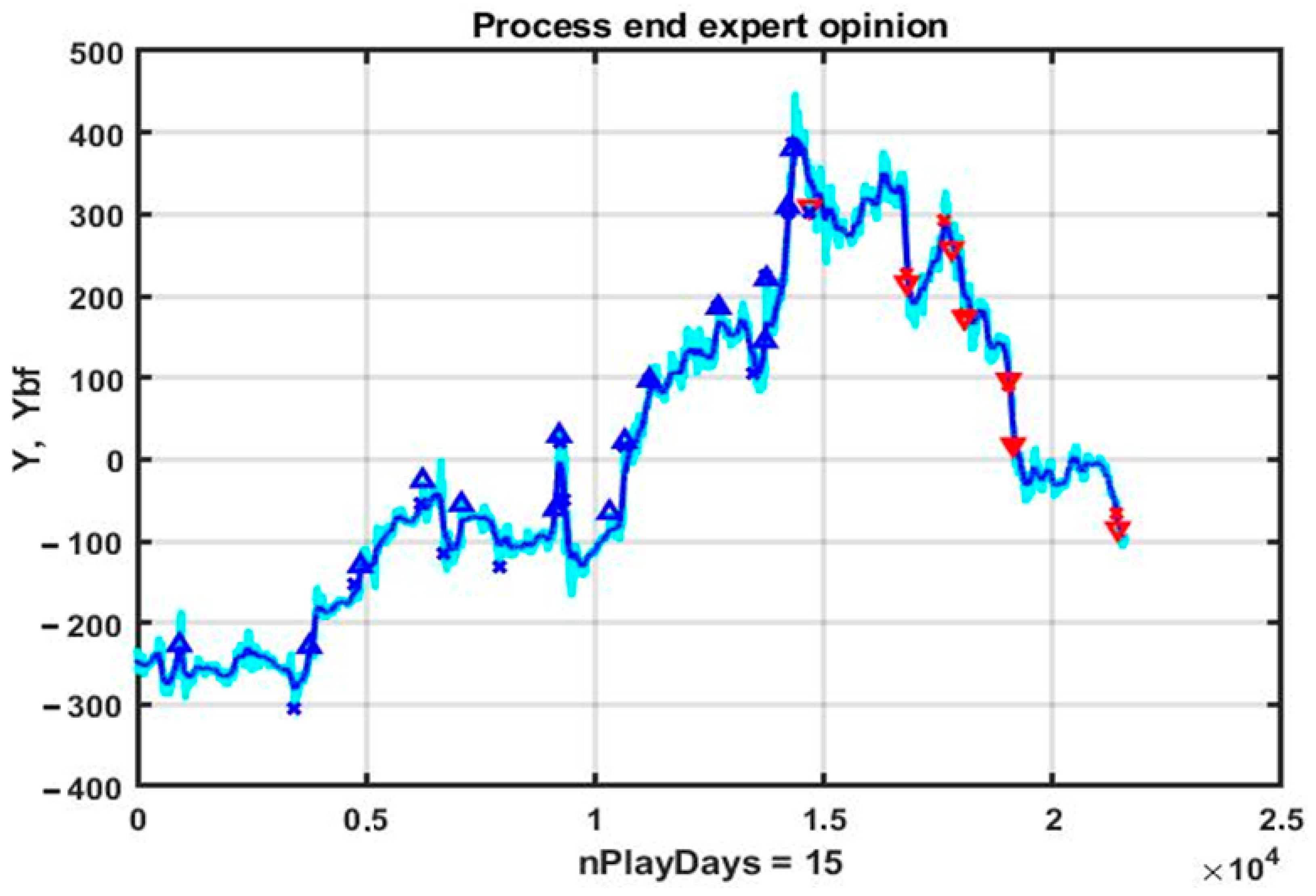

3.4. An Example of the Implementation of a Trend Management Strategy with a Flexible Exit Technology from the Market

3.5. The Results of the Parametric Optimization of the TS02 Trend Strategy

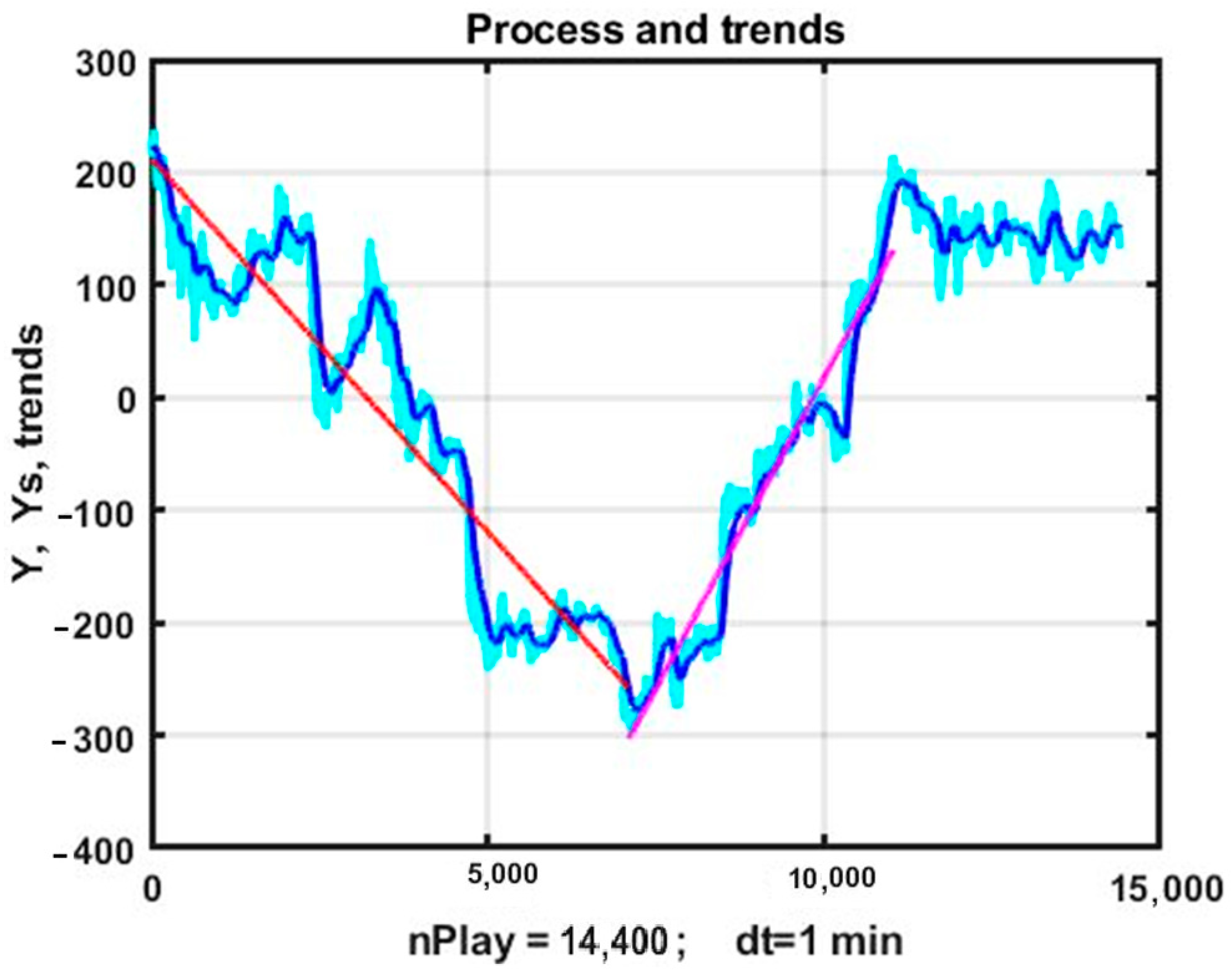

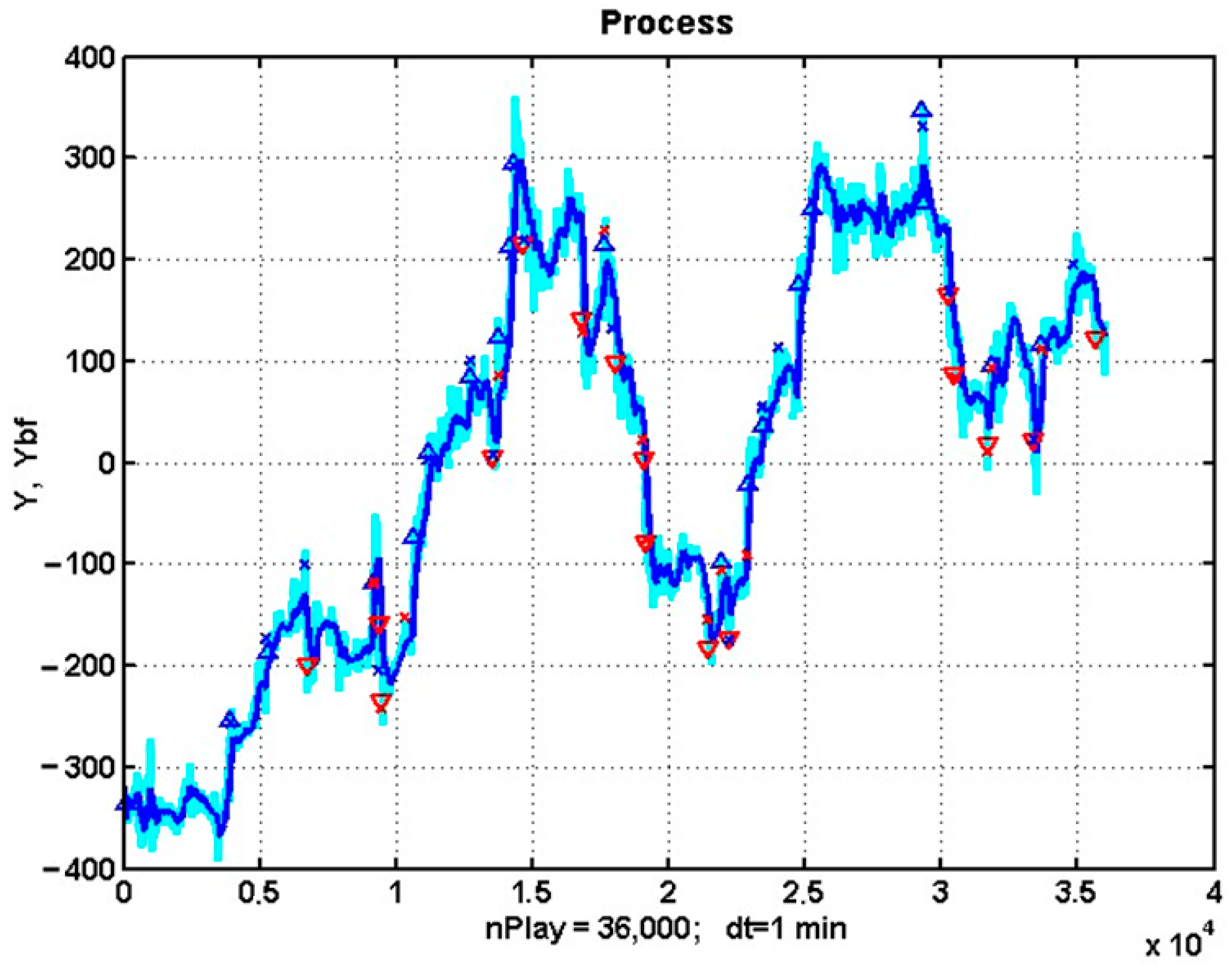

3.6. Implementation of a Trend Management Strategy with the Detection of Trends on Two Sliding Observation Windows of Different Duration

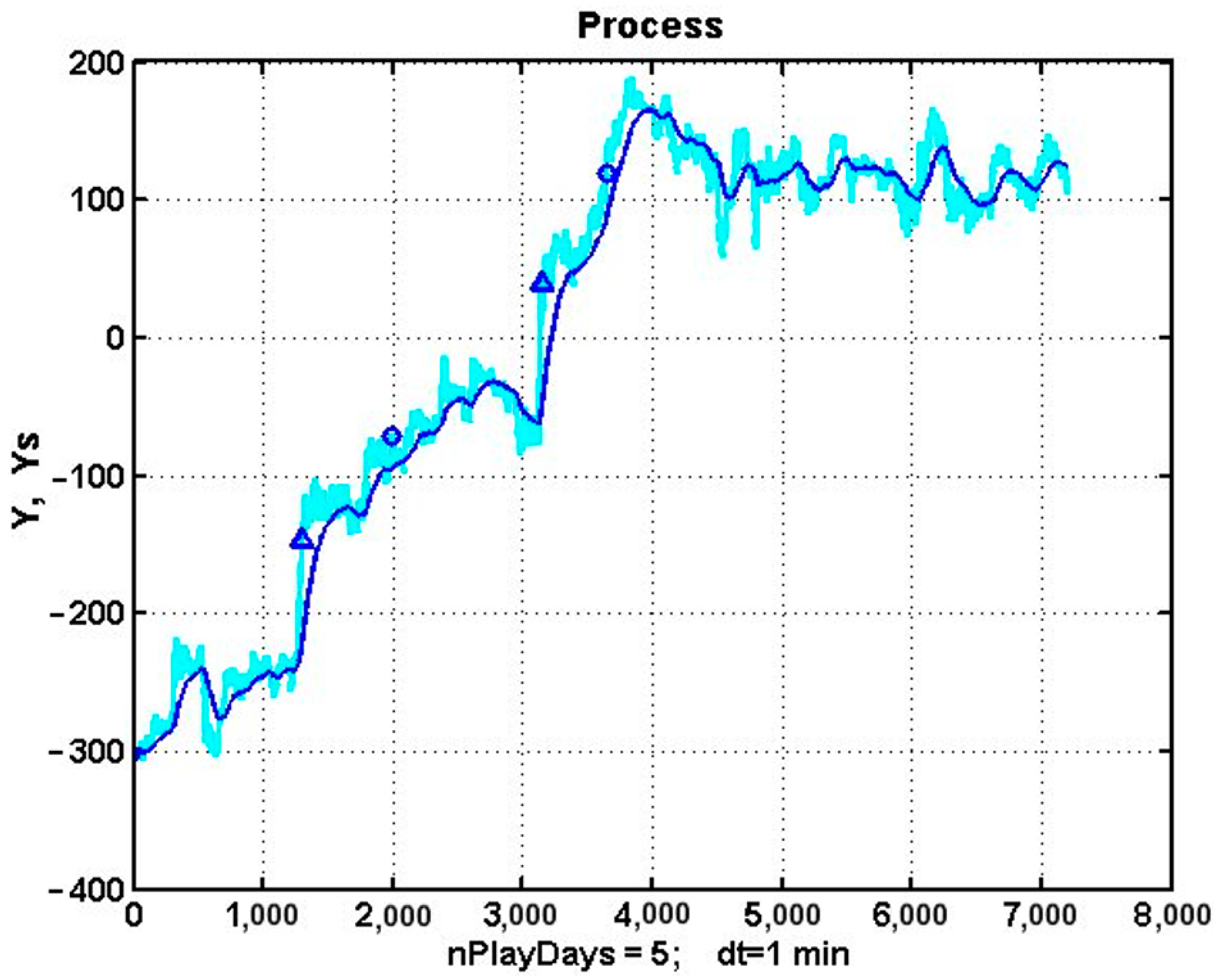

3.7. An Analysis of the Stability of Optimized Trend Strategies over Long Observation Intervals

3.8. The Problem of Identifying the System Component of a Number of Observations

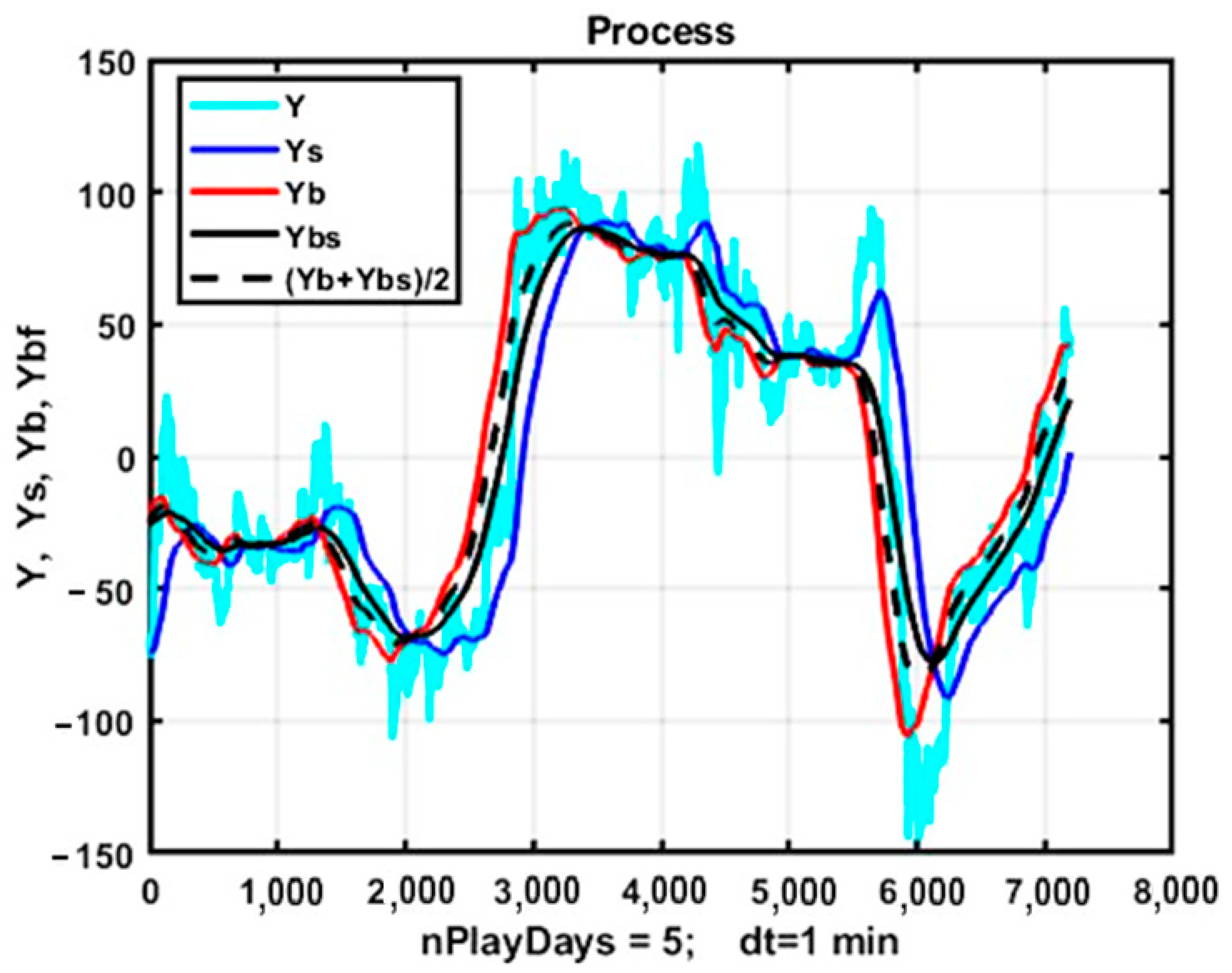

3.9. Analysis of the Effectiveness of Trend Strategies When Using a Bidirectional Exponential Filter

4. Discussion

4.1. Application of Trend Strategies with Multi-Expert Decision-Making Systems

4.2. Comparison with Contemporary Approaches in Trend-Following Strategies

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Avella Medina, M., & Ronchetti, E. (2015). Robust statistics: A selective overview and new directions. Wiley Interdisciplinary Reviews: Computational Statistics, 7(6), 372–393. [Google Scholar] [CrossRef]

- Ayed, A. B. H., Loeper, G., & Abergel, F. (2016). Robustness of mathematical models and technical analysis strategies. arXiv, arXiv:1605.00173. [Google Scholar]

- Blount, K. A., & Rush, L. (2021). Chaos theory (Vol. 3). Crush. [Google Scholar]

- Bolotin, Y., Tur, A., & Yanovsky, V. (2009). Chaos: Concepts, control and constructive use. In E. Schöll, & H. G. Schuster (Eds.), Springer series in synergetics (pp. 19–34). Springer. [Google Scholar]

- Box, G. E., Jenkins, G. M., Reinsel, G. C., & Ljung, G. M. (2015). Time series analysis: Forecasting and control. John Wiley & Sons. [Google Scholar]

- Chauhan, H., & Tyagi, H. (2019). Text mining techniques for extraction and retrieval information in research process. International Journal of Research in Electronics and Computer Engineering, 7(2), 2693–700. [Google Scholar]

- Davies, B. (2018). Exploring chaos: Theory and experiment. CRC Press. [Google Scholar]

- De Gooijer, J. G. (2017). Elements of nonlinear time series analysis and forecasting (Vol. 37). Springer. [Google Scholar]

- De Paula, A. S., & Savi, M. A. (2011). Comparative analysis of chaos control methods: A mechanical system case study. International Journal of Non-Linear Mechanics, 46(8), 1076–1089. [Google Scholar] [CrossRef]

- Du, J., Huang, T., & Sheng, Z. (2009). Analysis of decision-making in economic chaos control. Nonlinear Analysis: Real World Applications, 10(4), 2493–2501. [Google Scholar] [CrossRef]

- Dwyer, G. P., & Hafer, R. W. (Eds.). (2013). The stock market: Bubbles, volatility, and chaos. Springer Science & Business Media. [Google Scholar]

- Feldman, D. P. (2019). Chaos and dynamical systems (Vol. 7). Princeton University Press. [Google Scholar]

- Gardner, E. S., Jr. (1985). Exponential smoothing: The state of the art. Journal of Forecasting, 4(1), 1–28. [Google Scholar] [CrossRef]

- Hamidouche, B., Guesmi, K., & Essounbouli, N. (2024). Mastering chaos: A review. Annual Reviews in Control, 58, 100966. [Google Scholar] [CrossRef]

- Hotho, A., Nürnberger, A., & Paaß, G. (2005). A brief survey of text mining. Journal for Language Technology and Computational Linguistics, 20(1), 19–62. [Google Scholar] [CrossRef]

- Inglada-Perez, L. (2020). A comprehensive framework for uncovering non-linearity and chaos in financial markets: Empirical evidence for four major stock market indices. Entropy, 22(12), 1435. [Google Scholar] [CrossRef]

- Klioutchnikov, I., Sigova, M., & Beizerov, N. (2017). Chaos theory in finance. Procedia Computer Science, 119, 368–375. [Google Scholar] [CrossRef]

- Konar, A., & Bhattacharya, D. (2017). Time-series prediction and applications. Springer International Publishing. [Google Scholar]

- Lauret, P., David, M., & Calogine, D. (2012). Nonlinear models for short-time load forecasting. Energy Procedia, 14, 1404–1409. [Google Scholar] [CrossRef]

- Lempérière, Y., Deremble, C., Seager, P., Potters, M., & Bouchaud, J. -P. (2014). Two centuries of trend following. arXiv, arXiv:1404.3274. [Google Scholar] [CrossRef]

- Mahesh, T. R., Janani, R., & Vijayarani, S. (2016). Text mining research: A survey. International Journal of Innovative Research in Computer and Communication Engineering, 4(4), 6554–6571. [Google Scholar]

- Mangale, C., Meena, S., & Purohit, P. (2017). Fuzzy logic-based stock value prediction using fundamental analysis. Oriental Journal of Computer Science and Technology, 10(1), 120–126. [Google Scholar] [CrossRef][Green Version]

- Mansurov, K., Semenov, A., Grigoriev, D., Radionov, A., & Ibragimov, R. (2023). Impact of self-learning based high-frequency traders on the stock market. Expert Systems with Applications, 232, 120567. [Google Scholar] [CrossRef]

- Maronna, R. A., Martin, D. R., Yohai, V. J., & Salibián-Barrera, M. (2019). Robust Statistics: Theory and Methods (with R). John Wiley & Sons. [Google Scholar]

- Mills, T. C. (2019). Applied time series analysis: A practical guide to modeling and forecasting. Academic Press. [Google Scholar]

- Montgomery, D. C., Jennings, C. L., & Kulahci, M. (2015). Introduction to time series analysis and forecasting. John Wiley & Sons. [Google Scholar]

- Musaev, A. A. (2011). Modeling of trading assets quotations. Informatics and Automation, 17, 5–32. [Google Scholar] [CrossRef][Green Version]

- Musaev, A., & Grigoriev, D. (2022a). Multi-expert systems: Fundamental concepts and application examples. Journal of Theoretical and Applied Information Technology, 100(2), 336–348. [Google Scholar]

- Musaev, A., & Grigoriev, D. (2022b, May 16–20). State stabilization of a non-stationary technological process using a channel control strategy. 2022 International Conference on Industrial Engineering, Applications and Manufacturing (ICIEAM) (pp. 615–619), Sochi, Russia. [Google Scholar]

- Musaev, A., Makshanov, A., & Grigoriev, D. (2022). Statistical analysis of current financial instrument quotes in the conditions of market chaos. Mathematics, 10(4), 587. [Google Scholar] [CrossRef]

- Musaev, A., Makshanov, A., & Grigoriev, D. (2023a). Algorithms of sequential identification of system component in chaotic processes. Journal of Dynamics and Control, 11(5), 2566–2579. [Google Scholar] [CrossRef]

- Musaev, A., Makshanov, A., & Grigoriev, D. (2023b). Dynamic robustification of trading management strategies for unstable immersion environments. Montenegrin Journal of Economics, 19(1), 19–30. [Google Scholar] [CrossRef]

- Musaev, A., Makshanov, A., & Grigoriev, D. (2023c). The genesis of uncertainty: Structural analysis of stochastic chaos in finance markets. Complexity, 2023(1), 1302220. [Google Scholar] [CrossRef]

- Navarro-Barrientos, J. E. (2008). Adaptive investment strategies for periodic environments. Advances in Complex Systems, 11(5), 761–787. [Google Scholar] [CrossRef]

- Sanchez-Roger, M., Oliver-Alfonso, M. D., & Sanchís-Pedregosa, C. (2019). Fuzzy logic and its uses in finance: A systematic review exploring its potential to deal with banking crises. Mathematics, 7(11), 1091. [Google Scholar] [CrossRef]

- Sahni, R. (2018, July 10–12). Analysis of stock market behaviour by applying chaos theory. 2018 9th International Conference on Computing, Communication and Networking Technologies (ICCCNT) (pp. 1–4), Bengaluru, India. [Google Scholar]

- Wold, H. (1938). A study in the analysis of stationary time series [Ph.D. thesis, Almqvist & Wiksell]. [Google Scholar]

| № | 1 | 2 | 3 |

|---|---|---|---|

| TS01 Management Strategy | |||

| P* | |||

| R | −629 | −651 | −1723 |

| TS02 Management Strategy | |||

| P* | |||

| R | −367 | 654 | 14 |

| TS03 Management Strategy | |||

| P* | |||

| R | −491 | −819 | −1845 |

| № | 1 | 2 | 3 |

|---|---|---|---|

| P* | |||

| R* | 399 | −165 | 1054 |

| −629 | −818 | −1351 | |

| P+ | 0.49 | 0.47 | 0.45 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Musaev, A.; Grigoriev, D. The Stability of Trend Management Strategies in Chaotic Market Conditions. J. Risk Financial Manag. 2025, 18, 33. https://doi.org/10.3390/jrfm18010033

Musaev A, Grigoriev D. The Stability of Trend Management Strategies in Chaotic Market Conditions. Journal of Risk and Financial Management. 2025; 18(1):33. https://doi.org/10.3390/jrfm18010033

Chicago/Turabian StyleMusaev, Alexander, and Dmitry Grigoriev. 2025. "The Stability of Trend Management Strategies in Chaotic Market Conditions" Journal of Risk and Financial Management 18, no. 1: 33. https://doi.org/10.3390/jrfm18010033

APA StyleMusaev, A., & Grigoriev, D. (2025). The Stability of Trend Management Strategies in Chaotic Market Conditions. Journal of Risk and Financial Management, 18(1), 33. https://doi.org/10.3390/jrfm18010033