Investing in Residential Real Estate: Understanding Homebuilder Exchange-Traded Fund Performance

Abstract

1. Introduction

2. Previous Studies

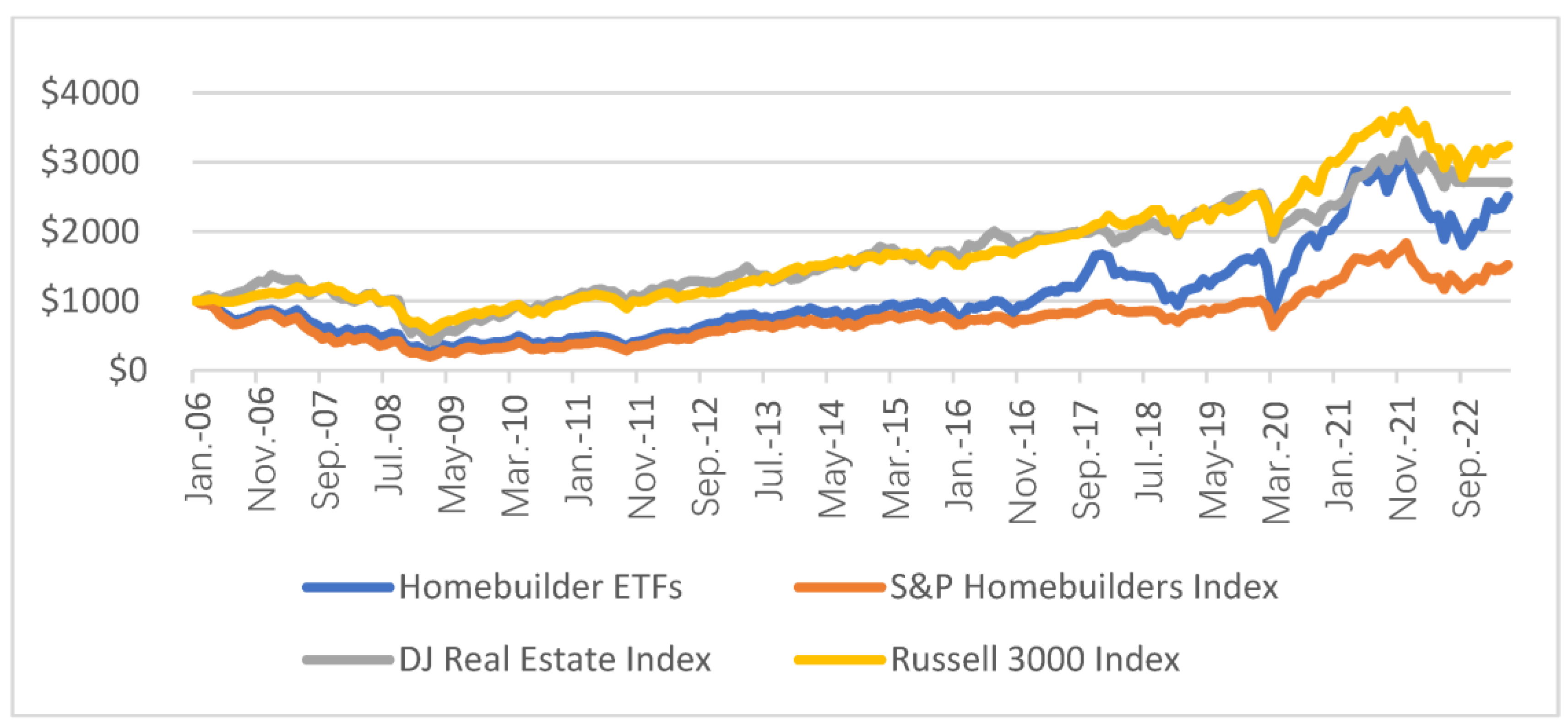

3. Data

4. Model

4.1. The Sharpe Ratio, Sortino Ratio, and Omega Ratio

4.2. Multi-Factor Model

5. Robustness Check

5.1. Dynamic Alpha Evaluation

5.2. Conditional Factor Models

5.3. Market Timing and Selectivity

5.4. Conditional Market Timing and Selectivity

5.5. Value at Risk (VaR) and Conditional Value at Risk (VaR)

6. Empirical Analysis

6.1. Correlation

6.2. Empirical Analysis of Sharpe Ratio, Sortino Ratio, and Omega Ratio

6.3. Generalized Sharpe Ratio and Calmar Ratio2

6.4. Empirical Analysis of Modified Carhart Multi-Factor Model

7. Summary and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | https://my.ibisworld.com/us/en/industry/23611a/key-statistics (accessed on 17 February 2025). |

| 2 | The authors acknowledge the reviewer’s observation regarding the limitations of commonly used performance measures such as the Sharpe, Sortino, and Omega ratios and that performance measures that follow the axiomatic framework described by Cheridito and Kromer (2013) would provide stronger analytical results. |

References

- Bond, S., & Mitchell, P. (2010). Alpha and persistence in real estate fund performance. Journal of Real Estate Finance and Economics, 41(1), 53–79. [Google Scholar] [CrossRef]

- Carhart, M. (1997). On persistence in mutual fund performance. The Journal of Finance, 52(1), 57–82. [Google Scholar] [CrossRef]

- Chen, T. K., Tsai, T. S., & Huang, M. L. (2023). ETF ownership level, ETF ownership volatility, and corporate credit risk. Journal of Accounting Review, 76, 95–143. [Google Scholar] [CrossRef]

- Cheridito, P., & Kromer, E. (2013). Reward-risk ratios. Journal of Investment Strategies, 3(1), 3–18. [Google Scholar] [CrossRef]

- Chou, W., & Hardin, W. G. (2014). Performance chasing, fund flows and fund size in real estate mutual funds. Journal of Real Estate Finance and Economics, 49(3), 379–412. [Google Scholar] [CrossRef]

- Christopherson, J. A., Ferson, W. E., & Glassman, D. A. (1998). Conditioning manager alphas on economic information: Another look at the persistence of performance. Review of Financial Studies, 11, 111–142. [Google Scholar] [CrossRef]

- Elton, E. J., Gruber, M. J., & Blake, C. R. (2010). Holdings data, security returns, and the selection of superior mutual funds. Journal of Financial and Quantitative Analysis, 46(2), 341–367. [Google Scholar] [CrossRef]

- Fama, E. F., & French, K. R. (1993). Common risk factors in the return on bonds and stocks. Journal of Financial Economics, 33(3), 3–56. [Google Scholar] [CrossRef]

- Ferson, W. E., & Schadt, R. W. (1996). Measuring fund strategy and performance in changing economic conditions. Journal of Finance, 51(2), 425–461. [Google Scholar] [CrossRef]

- Goodwin, K. R., Kanuri, S., & McLeod, R. W. (2021). Relative performance of real estate exchange-traded funds. Journal of Real Estate Portfolio Management, 27(1), 78–87. [Google Scholar] [CrossRef]

- Henriksson, R. D., & Merton, R. C. (1981). On market timing and investment performance. ii. statistical procedures for evaluating forecasting skills. Journal of Business, 54(4), 513–533. [Google Scholar] [CrossRef]

- Hurlin, C., Iseli, G., Pérignon, C., & Yeung, S. (2019). The counterparty risk exposure of ETF investors. Journal of Banking and Finance, 102, 215–230. [Google Scholar] [CrossRef]

- Jensen, M. C. (1968). The performance of mutual funds in the period 1945-1964. Journal of Finance, 23(2), 389–416. [Google Scholar] [CrossRef]

- Kaushik, A., & Pennathur, A. K. (2012). An empirical examination of the performance of real estate mutual funds 1990–2008. Financial Services Review, 21(4), 343–358. Available online: https://www.proquest.com/scholarly-journals/empirical-examination-performance-real-estate/docview/1243039086/se-2?accountid=28402 (accessed on 1 October 2024).

- Keating, C., & Shadwick, W. F. (2002). A universal performance measure. Journal of Performance Measurement, 6(3), 59–84. Available online: https://spauldinggrp.com/product/universal-performance-measure/ (accessed on 1 October 2024).

- Kon, S., & Jen, F. (1979). Estimation of time varying systematic risk and performance for mutual fund portfolios: An Application of switching regression. The Journal of Finance, 33(2), 457–475. [Google Scholar]

- Lantushenko, V., & Nelling, E. (2020). Active Management in Real Estate Mutual Funds. The Journal of Real Estate Finance and Economics, 61(2), 247–274. [Google Scholar] [CrossRef]

- Lee, C. F., & Rahman, S. (1990). Market timing, selectivity, and mutual fund performance: An empirical investigation. Journal of Business, 63(2), 261–278. [Google Scholar] [CrossRef]

- MacGregor, B. D., Schulz, R., & Zhao, Y. (2021). Performance and market maturity in mutual funds: Is real estate different? Journal of Real Estate Finance and Economics, 63(3), 437–492. [Google Scholar] [CrossRef]

- Malhotra, D. K. (2023). Market timing, selectivity, and performance of real estate mutual funds. Journal of Wealth Management, 26(4), 59–78. [Google Scholar] [CrossRef]

- Malhotra, D. K. (2024). Evaluating the performance of real estate exchange-traded funds. Journal of Risk and Financial Management, 17(1), 7. [Google Scholar] [CrossRef]

- Sharpe, W. F. (1966). Mutual fund performance. Journal of Business, 39(1), 119–138. [Google Scholar] [CrossRef]

- Sortino, F. A., & Van Der Meer, R. (1991). Downside risk. The Journal of Portfolio Management, 17(4), 27–31. Available online: https://spauldinggrp.com/product/upside-potential-ratio/ (accessed on 1 October 2024). [CrossRef]

- Treynor, J., & Mazuy, K. (1966). Can mutual funds outguess the market? Harvard Business Review, 44(4), 131–136. [Google Scholar]

| Category | Homebuilders | Building Supplies | Insulation | Paint, Stain, and Coating |

|---|---|---|---|---|

| Daiwa House Industry | Builders FirstSource | Kingspan Group | Sherwin Williams | |

| D.R. Horton | Home Depot | Owens Corning | ||

| KB Homes | Lowe’s | TopBuild | ||

| Lennar Corp. | ||||

| Meritage Homes Corp. | ||||

| Nippon Building Fund | ||||

| NVR | ||||

| Pulte Group | ||||

| Toll Brothers | ||||

| Tri Pointe Homes | ||||

| Category | Roofing | HVAC Equipment | Appliance and Furnishings | Construction Materials & Aggregates |

| Carlisle Companies | Carrier | Williams-Sonoma | Martin Marietta | |

| Owens Corning | Daikin Industries | U.S. Lime & Minerals | ||

| Johnson Controls | Vulcan Materials | |||

| Lennox | ||||

| Trane |

| Homebuilder ETFs | S&P Homebuilders Select Industry Index | DJ US Real Estate Index | Russell 3000 Index | |

|---|---|---|---|---|

| February 2006 to April 2023 | ||||

| Mean | 0.86 | 0.54 | 0.68 | 0.68 |

| Standard deviation | 8.98 | 8.13 | 6.20 | 4.62 |

| Average return per unit of risk | 0.10 | 0.07 | 0.11 | 0.15 |

| July 2007 to March 2009 | ||||

| Mean | −4.01 | −4.16 | −3.99 | −2.80 |

| Standard deviation | 10.50 | 12.01 | 11.28 | 6.23 |

| Average return per unit of risk | −0.38 | −0.35 | −0.35 | −0.45 |

| February 2020 to January 2021 | ||||

| Mean | 3.84 | 3.00 | −0.31 | 1.71 |

| Standard deviation | 18.69 | 13.44 | 7.65 | 7.95 |

| Average return per unit of risk | 0.21 | 0.22 | −0.04 | 0.22 |

| February 2021 to April 2023 | ||||

| Mean | 1.01 | 0.91 | 0.61 | 0.42 |

| Standard deviation | 9.61 | 7.97 | 4.91 | 5.28 |

| Average return per unit of risk | 0.10 | 0.11 | 0.12 | 0.08 |

| Homebuilder ETFs | S&P Homebuilders Select Industry Index | DJ US Real Estate Index | Russell 3000 Index | |

|---|---|---|---|---|

| February 2006 to April 2023 | ||||

| Homebuilder Exchange-Traded Funds | 1.00 | |||

| S&P Homebuilders Select Industry Index | 0.96 | 1.00 | ||

| DJ US Real Estate Index | 0.69 | 0.70 | 1.00 | |

| Russell 3000 Index | 0.80 | 0.77 | 0.74 | 1.00 |

| July 2007 to March 2009 | ||||

| Homebuilder Exchange-Traded Funds | 1.00 | |||

| S&P Homebuilders Select Industry Index | 0.98 | 1.00 | ||

| DJ US Real Estate Index | 0.59 | 0.45 | 1.00 | |

| Russell 3000 Index | 0.26 | 0.10 | 0.80 | 1.00 |

| February 2020 to January 2021 | ||||

| Homebuilder Exchange-Traded Funds | 1.00 | |||

| S&P Homebuilders Select Industry Index | 1.00 | 1.00 | ||

| DJ US Real Estate Index | 0.92 | 0.94 | 1.00 | |

| Russell 3000 Index | 0.88 | 0.89 | 0.94 | 1.00 |

| February 2021 to August 2023 | ||||

| Homebuilder Exchange-Traded Funds | 1.00 | |||

| S&P Homebuilders Select Industry Index | 0.99 | 1.00 | ||

| DJ US Real Estate Index | 0.67 | 0.64 | 1.00 | |

| Russell 3000 Index | 0.82 | 0.80 | 0.71 | 1.00 |

| Sharpe Ratio | Sortino Ratio | Omega Ratio | |

|---|---|---|---|

| February 2006 to April 2023 | |||

| Homebuilder Exchange-Traded Funds | 0.09 | 0.12 | 1.24 |

| S&P Homebuilders Select Industry Index | 0.05 | 0.08 | 1.16 |

| DJ US Real Estate Index | 0.10 | 0.13 | 1.32 |

| Russell 3000 Index | 0.13 | 0.18 | 1.40 |

| July 2007 to March 2009 | |||

| Homebuilder Exchange-Traded Funds | −0.40 | −0.42 | 0.38 |

| S&P Homebuilders Select Industry Index | −0.36 | −0.39 | 0.42 |

| DJ US Real Estate Index | −0.37 | −0.38 | 0.33 |

| Russell 3000 Index | −0.48 | −0.47 | 0.27 |

| COVID-19-Induced Lockdowns to First Vaccination (February 2020 to January 2021) | |||

| Sharpe Ratio | Sortino Ratio | Omega Ratio | |

| Homebuilder Exchange-Traded Funds | 0.20 | 0.30 | 1.74 |

| S&P Homebuilders Select Industry Index | 0.22 | 0.32 | 1.82 |

| DJ US Real Estate Index | −0.04 | −0.05 | 0.88 |

| Russell 3000 Index | 0.21 | 0.34 | 1.69 |

| February 2021 to April 2023 (Post-COVID-19 Vaccination roll out period) | |||

| Homebuilder Exchange-Traded Funds | 0.09 | 0.15 | 1.24 |

| S&P Homebuilders Select Industry Index | 0.10 | 0.15 | 1.27 |

| DJ US Real Estate Index | 0.10 | 0.17 | 1.31 |

| Russell 3000 Index | 0.06 | 0.09 | 1.15 |

| February 2006 to April 2023 | July 2007 to March 2009 | February 2020 to January 2021 | February 2021 to April 2023 | |

|---|---|---|---|---|

| Adjusted R2 | 0.66 | 0.72 | 0.85 | 0.62 |

| Alpha | 0.11 | −1.27 | 19.79 * | 0.82 |

| Mkt-RF | 1.40 *** | 0.77 *** | 2.47 *** | 1.35 *** |

| SMB | 0.52 *** | 0.76 | 1.98 | −0.15 |

| HML | 0.19 | 0.66 | 0.05 | 0.21 |

| MOM | −0.06 | −0.52 * | 1.94 ** | −0.44 |

| Slope of Yield Curve | −0.17 | 0.36 | −18.18 ** | −0.61 |

| Net Alpha | ||||

|---|---|---|---|---|

| Homebuilder ETFs | S&P Homebuilders Select Industry Index | DJ US Real Estate Index | Russell 3000 Index | |

| February 2006 to April 2023 | 0.11 | −0.63 | −0.20 | −0.14 *** |

| July 2007 to March 2009 (economic crisis period) | −1.27 | 7.20 | −0.68 | −0.10 |

| COVID-19-Induced Lockdowns to First Vaccination (February 2020 to January 2021) | 19.79 * | 3.90 | 3.09 | −0.15 |

| February 2021 to April 2023 (post-COVID-19 vaccination roll-out period) | 0.82 | 0.98 | −0.58 | −0.03 |

| Homebuilder Exchange-Traded Funds (ETFs) | S&P Homebuilders Select Industry Index | DJ US Real Estate Index | Russell 3000 Index | |

|---|---|---|---|---|

| Average rolling monthly alpha | −2.98 | −2.89 | 0.23 | −0.05 |

| t-statistics | ||||

| Average rolling alpha of homebuilder exchange-traded funds (ETFs) versus S&P Homebuilders Select Industry Index | −0.37 | |||

| Average rolling alpha of homebuilder exchange-traded funds (ETFs) versus DJ US Real Estate Index | −3.27 *** | |||

| Average rolling alpha of homebuilder exchange-traded funds (ETFs) versus Russell 3000 Index | −4.56 *** | |||

| Multi-Factor Model | Adjusted R-Square | |

|---|---|---|

| February 2006 to April 2023 | −0.05 | 0.70 |

| July 2007 to March 2009 (economic crisis period) | −0.27 | 0.73 |

| COVID-19-Induced Lockdowns to First Vaccination (January 2020 to 2002021) | 28.44 *** | 0.99 |

| February 2021 to April 2023 (post-COVID-19 vaccination roll-out period) | 1.61 | 0.64 |

| Treynor and Mazuy (1966) Model | ||

|---|---|---|

| αs | β2 | |

| February 2006 to April 2023 | −0.48 (−1.06) | 0.004 (0.36) |

| July 2007 to March 2009 | −0.40 (−0.20) | −0.02 (−0.50) |

| February 2020 to January 2021 | 3.49 (1.01) | −0.07 (−1.72) |

| February 2021 to April 2023 | −0.51 (−0.33) | 0.04 (0.93) |

| Treynor and Mazuy (1966) Model | ||

|---|---|---|

| αs | β2 | |

| February 2006 to April 2023 | −0.43 (−1.03) | −0.004 (−0.32) |

| July 2007 to March 2009 | −0.98 (−0.45) | −0.04 (−0.77) |

| February 2020 to January 2021 | 2.04 (0.54) | −0.04 (−0.31) |

| February 2021 to April 2023 | −1.26 (−0.73) | 0.04 (0.96) |

| Homebuilder Exchange-Traded Funds | The S&P Select Homebuilding Index | DJ U.S. Real Estate Index | Russell 3000 Index | |

|---|---|---|---|---|

| Value at Risk at 95% confidence interval | −13.97 | −12.95 | −8.01 | −8.30 |

| Expected Shortfall | −18.61 | −17.68 | −15.21 | −10.34 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

McLeod, R.W.; Malhotra, D.K. Investing in Residential Real Estate: Understanding Homebuilder Exchange-Traded Fund Performance. J. Risk Financial Manag. 2025, 18, 134. https://doi.org/10.3390/jrfm18030134

McLeod RW, Malhotra DK. Investing in Residential Real Estate: Understanding Homebuilder Exchange-Traded Fund Performance. Journal of Risk and Financial Management. 2025; 18(3):134. https://doi.org/10.3390/jrfm18030134

Chicago/Turabian StyleMcLeod, Robert W., and Davinder K. Malhotra. 2025. "Investing in Residential Real Estate: Understanding Homebuilder Exchange-Traded Fund Performance" Journal of Risk and Financial Management 18, no. 3: 134. https://doi.org/10.3390/jrfm18030134

APA StyleMcLeod, R. W., & Malhotra, D. K. (2025). Investing in Residential Real Estate: Understanding Homebuilder Exchange-Traded Fund Performance. Journal of Risk and Financial Management, 18(3), 134. https://doi.org/10.3390/jrfm18030134