Factors Influencing the Adoption of FinTech for the Enhancement of Financial Inclusion in Rural India Using a Mixed Methods Approach

Abstract

1. Introduction

- What are the important technological, psychological, and socio-cultural factors affecting the adoption of FinTech in rural India, as elucidated by the Technology Acceptance Model (TAM), Theory of Planned Behavior (TPB), and Technology Readiness Index (TRI)?

- How do these factors influence the intention to accept and utilize FinTech services across various demographic segments within the rural population?

- How can policymakers and financial institutions utilize these findings to improve financial inclusion in rural India?

2. Literature Review

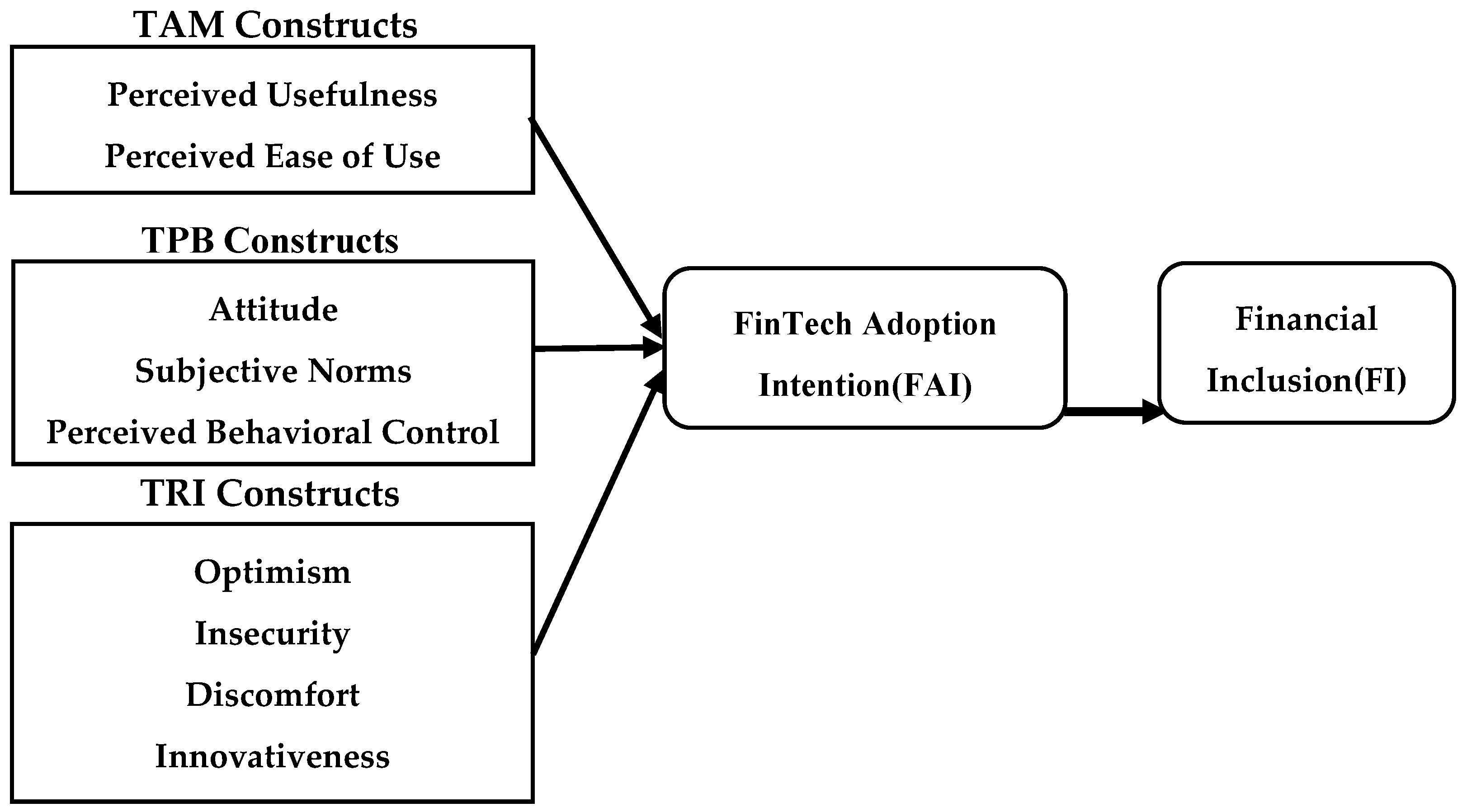

2.1. Theoretical Framework

2.2. Hypothesis Development

2.2.1. Technology Acceptance Model (TAM)

2.2.2. Theory of Planned Behavior (TPB)

2.2.3. Technology Readiness Index (TRI)

2.2.4. Financial Inclusion (FI)

3. Research Methodology

- Step 1: Questionnaire development based on a literature review and theoretical framework;

- Step 2: Sampling processes and data collection;

- Step 3: Data pre-processing for non-response bias and common method variance test;

- Step 4: Symmetric data analysis using PLS-SEM techniques;

- Step 5: Asymmetric data analysis using the fsQCA method.

3.1. Study Instruments

3.2. Participants and Data Collection

3.3. Data Pre-Processing

- Non-Response Bias Test

- Common Method Variance Test

3.4. Data Analysis Tools

4. Results and Analysis

4.1. Symmetric Analysis

4.1.1. Descriptive Analysis

4.1.2. Measurement Model Evaluation

4.1.3. Structural Model Assessment

4.2. Asymmetric Analysis

5. Discussion

6. Conclusions

6.1. Theoretical Contribution

6.2. Practical Implications

6.3. Limitations and Future Directions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abis, D., Pia, P., & Limbu, Y. (2024). FinTech and consumers: A systematic review and integrative framework. Management Decision. Available online: https://www.emerald.com/insight/content/doi/10.1108/MD-07-2023-1136/full/html (accessed on 12 January 2025).

- Ahmad, M., Ahmed, Z., Bai, Y., Qiao, G., Popp, J., & Oláh, J. (2022). Financial inclusion, technological innovations, and environmental quality: Analyzing the role of green openness. Frontiers in Environmental Science, 10, 851263. [Google Scholar] [CrossRef]

- Ajouz, M., Abuamria, F., & Hammad, J. (2021). Factors influencing mobile payment adoption and its role in promoting financial inclusion: An integrated reflective model with theory of planned behavior. In International conference on business and technology (pp. 563–581). Springer International Publishing. [Google Scholar]

- Ajzen, I. (1991). The Theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. [Google Scholar] [CrossRef]

- Alharbi, A., & Sohaib, O. (2021). Technology readiness and cryptocurrency adoption: PLS-SEM and deep learning neural network analysis. IEEE Access, 9, 21388–21394. [Google Scholar] [CrossRef]

- Ali, M., Hashmi, S. H., Nazir, M. R., Bilal, A., & Nazir, M. I. (2021). Does financial inclusion enhance economic growth? Empirical evidence from the IsDB member countries. International Journal of Finance & Economics, 26(4), 5235–5258. [Google Scholar]

- Ali, Q., Parveen, S., Yaacob, H., & Zaini, Z. (2021). The cardless banking system in Malaysia: An extended TAM. Risks, 9(2), 41. [Google Scholar] [CrossRef]

- Alqublan, L. F. (2021). The adoption of technologies in The Kingdom of Saudi Arabia’s sovereign wealth fund in propelling its attainment of vision 2030 goals. SSRN. [Google Scholar]

- Armstrong, J. S., & Overton, T. S. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 14(3), 396–402. [Google Scholar] [CrossRef]

- Ashrafi, D. M., & Easmin, R. (2023). The Role of innovation resistance and technology readiness in the adoption of QR code payments among digital natives: A serial moderated mediation model. International Journal of Business Science & Applied Management, 18(1), 19–45. Available online: https://www.researchgate.net/profile/Dewan-Mehrab-Ashrafi/publication/365823093_The_Role_of_Innovation_Resistance_and_Technology_Readiness_in_the_Adoption_of_QR_Code_Payments_Among_Digital_Natives_A_Serial_Moderated_Mediation_Model/links/6385bff1554def6193819f05/The-Role-of-Innovation-Resistance-and-Technology-Readiness-in-the-Adoption-of-QR-Code-Payments-Among-Digital-Natives-A-Serial-Moderated-Mediation-Model.pdf?origin=journalDetail&_tp=eyJwYWdlIjoiam91cm5hbERldGFpbCJ9 (accessed on 10 November 2024).

- Asif, M., Khan, M. N., Tiwari, S., Wani, S. K., & Alam, F. (2023). The impact of fintech and digital financial services on financial inclusion in India. Journal of Risk and Financial Management, 16(2), 122. [Google Scholar] [CrossRef]

- Baba, M. A., ul Haq, Z., Dawood, M., & Aashish, K. (2023). FinTech adoption of financial services industry: Exploring the impact of creative and innovative leadership. Journal of Risk and Financial Management, 16(10), 453. [Google Scholar] [CrossRef]

- Baganzi, R., & Lau, A. K. (2017). Examining trust and risk in mobile money acceptance in Uganda. Sustainability, 9(12), 2233. [Google Scholar] [CrossRef]

- Barik, R., & Sharma, P. (2019). Analyzing the progress and prospects of financial inclusion in India. Journal of Public Affairs, 19(4), e1948. [Google Scholar] [CrossRef]

- Bateman, M., Duvendack, M., & Loubere, N. (2019). Is fin-tech the new panacea for poverty alleviation and local development? Contesting Suri and Jack’s M-Pesa findings published in Science. Review of African Political Economy, 46(161), 480–495. [Google Scholar] [CrossRef]

- Bayram, O., Talay, I., & Feridun, M. (2022). Can FinTech promote sustainable finance? Policy lessons from the case of Turkey. Sustainability, 14(19), 12414. [Google Scholar] [CrossRef]

- Begum, A., Gaytan, J. C. T., & Ahmed, G. (2023). The nexus between technology and finnovation: A sustainable development model. In 2023 international conference on business analytics for technology and security (ICBATS) (pp. 1–8). Available online: https://ieeexplore.ieee.org/abstract/document/10111102/ (accessed on 7 December 2024).

- Bhattacherjee, A. (2012). Social science research: Principles, methods, and practices. University of South Florida. [Google Scholar]

- Bian, X., & Moutinho, L. (2011). The role of brand image, product involvement, and knowledge in explaining consumer purchase behaviour of counterfeits: Direct and indirect effects. European Journal of Marketing, 45(1/2), 191–216. [Google Scholar] [CrossRef]

- Bongomin, G. O. C., Balunywa, W., Mwebaza Basalirwa, E., Ngoma, M., & Mpeera Ntayi, J. (2023). Contactless digital financial innovation and global contagious COVID-19 pandemic in low income countries: Evidence from Uganda. Cogent Economics & Finance, 11(1), 2175467. [Google Scholar]

- Boomsma, A., & Hoogland, J. J. (2001). The robustness of LISREL modeling revisited. Structural Equation Models: Present and Future. A Festschrift in Honor of Karl Jöreskog, 2(3), 139–168. [Google Scholar]

- Caldeira, T. A., Ferreira, J. B., Freitas, A., & Falcão, R. P. D. Q. (2021). Adoption of mobile payments in Brazil: Technology readiness, trust and perceived quality. BBR. Brazilian Business Review, 18, 415–432. [Google Scholar]

- Chang, Y.-W., & Chen, J. (2021). What motivates customers to shop in smart shops? The impacts of smart technology and technology readiness. Journal of Retailing and Consumer Services, 58, 102325. [Google Scholar] [CrossRef]

- Chauhan, C., Parida, V., & Dhir, A. (2022). Linking circular economy and digitalisation technologies: A systematic literature review of past achievements and future promises. Technological Forecasting and Social Change, 177, 121508. [Google Scholar] [CrossRef]

- Cho, G., Hwang, H., Sarstedt, M., & Ringle, C. M. (2020). Cutoff criteria for overall model fit indexes in generalized structured component analysis. Journal of Marketing Analytics, 8(4), 189–202. [Google Scholar] [CrossRef]

- Chowdhury, E. K., & Chowdhury, R. (2024). Role of financial inclusion in human development: Evidence from Bangladesh, India and Pakistan. Journal of the Knowledge Economy, 15(1), 3329–3354. [Google Scholar] [CrossRef]

- Colby, C. L., & Parasuraman, A. (2001). Techno-ready marketing: How and why customers adopt technology. Simon and Schuster. [Google Scholar]

- Creswell, J. W., & Creswell, J. D. (2017). Research design: Qualitative, quantitative, and mixed methods approaches. Sage publications. [Google Scholar]

- Dahiya, S., & Kumar, M. (2020). Linkage between financial inclusion and economic growth: An empirical study of the emerging Indian economy. Vision, 24(2), 184–193. [Google Scholar] [CrossRef]

- Darnida, Y. C., Haryono, A., & Nurriqli, A. (2024). The Role of Financial Technology in Increasing Financial Access. Journal of Management, 3(2), 474–493. [Google Scholar]

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13, 319–340. [Google Scholar] [CrossRef]

- Demir, A., Pesqué-Cela, V., Altunbas, Y., & Murinde, V. (2022). Fintech, financial inclusion and income inequality: A quantile regression approach. The European Journal of Finance, 28(1), 86–107. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2021). Financial inclusion, digital payments, and resilience in the age of COVID-19. (World Bank Report). World Bank. [Google Scholar]

- Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2020). The Global Findex Database 2017: Measuring financial inclusion and opportunities to expand access to and use of financial services. The World Bank Economic Review, 34(Suppl. S1), S2–S8. [Google Scholar] [CrossRef]

- Dong, Z., Zhou, Z., Ananzeh, M., Hoang, K. N., Shamansurova, Z., & Luong, T. A. (2024). Exploring the asymmetric association between fintech, clean energy, climate policy, natural resource conservations and environmental quality. A post-COVID perspective from Asian countries. Resources Policy, 88, 104489. [Google Scholar] [CrossRef]

- Economic Survey. (2024). Available online: https://bfsi.economictimes.indiatimes.com/news/industry/economic-survey-2024-financial-inclusion-strategy-shifts-from-every-household-to-every-adult/111932366?utm_source=chatgpt.com (accessed on 2 February 2025).

- Flavián, C., Pérez-Rueda, A., Belanche, D., & Casaló, L. V. (2022). Intention to use analytical artificial intelligence (AI) in services–the effect of technology readiness and awareness. Journal of Service Management, 33(2), 293–320. [Google Scholar] [CrossRef]

- Garson, G. D. (2021). Data analytics for the social sciences: Applications in R. Routledge. [Google Scholar]

- Ghosh, S., & Sahu, T. N. (2021). Financial inclusion and economic status of the states of India: An empirical evidence. Economic Notes, 50(2), e12182. [Google Scholar] [CrossRef]

- Giovanis, A., Tsoukatos, E., & Vrontis, D. (2020). Customers’ intentions to adopt proximity m-payment services: Empirical evidence from Greece. Global Business and Economics Review, 22(1–2), 3–26. [Google Scholar] [CrossRef]

- Grégoire, Y., & Fisher, R. J. (2006). The effects of relationship quality on customer retaliation. Marketing Letters, 17, 31–46. [Google Scholar] [CrossRef]

- Grohmann, A., Klühs, T., & Menkhoff, L. (2018). Does financial literacy improve financial inclusion? Cross country evidence. World Development, 111, 84–96. [Google Scholar] [CrossRef]

- Haddad, A., Ameen, A., Isaac, O., Alrajawy, I., Al-Shbami, A., & Midhun Chakkaravarthy, D. (2020). The impact of technology readiness on the big data adoption among UAE organisations. Data Management, Analytics and Innovation: Proceedings of ICDMAI 2019, 2, 249–264. [Google Scholar]

- Hair, J., & Alamer, A. (2022). Partial Least Squares Structural Equation Modeling (PLS-SEM) in second language and education research: Guidelines using an applied example. Research Methods in Applied Linguistics, 1(3), 100027. [Google Scholar] [CrossRef]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- Harman, H. H. (1976). Modern factor analysis. University of Chicago Press. [Google Scholar]

- Hasan, M., Hoque, A., Abedin, M. Z., & Gasbarro, D. (2024). FinTech and sustainable development: A systematic thematic analysis using human-and machine-generated processing. International Review of Financial Analysis, 95, 103473. [Google Scholar] [CrossRef]

- Hasheem, M. J., Wang, S., Ye, N., Farooq, M. Z., & Shahid, H. M. (2022). Factors influencing purchase intention of solar photovoltaic technology: An extended perspective of technology readiness index and theory of planned behaviour. Cleaner and Responsible Consumption, 7, 100079. [Google Scholar] [CrossRef]

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43, 115–135. [Google Scholar] [CrossRef]

- Hossain, M. A., Quaddus, M., Hossain, M. M., & Gopakumar, G. (2024). Data-driven innovation development: An empirical analysis of the antecedents using PLS-SEM and fsQCA. Annals of Operations Research, 333(2), 895–937. [Google Scholar] [CrossRef]

- Igamo, A. M., Al Rachmat, R., Siregar, M. I., Gariba, M. I., Cherono, V., Wahyuni, A. S., & Setiawan, B. (2024). Factors influencing Fintech adoption for women in the post-COVID-19 pandemic. Journal of Open Innovation: Technology, Market, and Complexity, 10(1), 100236. [Google Scholar] [CrossRef]

- Irimia-Diéguez, A., Velicia-Martín, F., & Aguayo-Camacho, M. (2023). Predicting FinTech innovation adoption: The mediator role of social norms and attitudes. Financial Innovation, 9(1), 36. [Google Scholar] [CrossRef] [PubMed]

- Ji, X., Wang, K., Xu, H., & Li, M. (2021). Has digital financial inclusion narrowed the urban-rural income gap: The role of entrepreneurship in China. Sustainability, 13(15), 8292. [Google Scholar] [CrossRef]

- Kamal, S. A., Shafiq, M., & Kakria, P. (2020). Investigating acceptance of telemedicine services through an extended technology acceptance model (TAM). Technology in Society, 60, 101212. [Google Scholar] [CrossRef]

- Kaya, B., Abubakar, A. M., Behravesh, E., Yildiz, H., & Mert, I. S. (2020). Antecedents of innovative performance: Findings from PLS-SEM and fuzzy sets (fsQCA). Journal of Business Research, 114, 278–289. [Google Scholar] [CrossRef]

- Khadka, R., & Kohsuwan, P. (2018). Understanding consumers’ mobile banking adoption in Germany: An integrated technology readiness and acceptance model (TRAM) perspective. Catalyst, 18(1), 56–67. [Google Scholar]

- Khan, I., & Sahu, M. (2025). Enhancing financial inclusion in India: The impact of socioeconomic and macroeconomic factors. Journal of Financial Economic Policy, 17(2), 270–294. [Google Scholar] [CrossRef]

- Kishor, K., Bansal, S. K., & Kumar, R. (2024). The role of fintech in promoting financial inclusion to achieve sustainable development: An integrated bibliometric analysis and systematic literature review. Journal of the Knowledge Economy, 1–29. [Google Scholar] [CrossRef]

- Koomson, I., Villano, R. A., & Hadley, D. (2020). Effect of financial inclusion on poverty and vulnerability to poverty: Evidence using a multidimensional measure of financial inclusion. Social Indicators Research, 149(2), 613–639. [Google Scholar] [CrossRef]

- Kumar, S., Sahoo, S., Lim, W. M., Kraus, S., & Bamel, U. (2022). Fuzzy-set qualitative comparative analysis (fsQCA) in business and management research: A contemporary overview. Technological Forecasting and Social Change, 178, 121599. [Google Scholar] [CrossRef]

- Kumari, M. (2024). Adoption of digital financial services and its impact on financial behavior: A review of literature. International Journal of Management (IJM), 15(5), 10–26. [Google Scholar]

- Liébana-Cabanillas, F., Singh, N., Kalinic, Z., & Carvajal-Trujillo, E. (2021). Examining the determinants of continuance intention to use and the moderating effect of the gender and age of users of NFC mobile payments: A multi-analytical approach. Information Technology and Management, 22(2), 133–161. [Google Scholar] [CrossRef]

- Liljander, V., Gillberg, F., Gummerus, J., & Van Riel, A. (2006). Technology readiness and the evaluation and adoption of self-service technologies. Journal of Retailing and Consumer Services, 13(3), 177–191. [Google Scholar] [CrossRef]

- Lisha, L., Mousa, S., Arnone, G., Muda, I., Huerta-Soto, R., & Shiming, Z. (2023). Natural resources, green innovation, fintech, and sustainability: A fresh insight from BRICS. Resources Policy, 80, 103119. [Google Scholar] [CrossRef]

- Lu, X., Lai, Y., & Zhang, Y. (2023). Digital financial inclusion and investment diversification: Evidence from China. Accounting & Finance, 63, 2781–2799. [Google Scholar]

- Lusardi, A. (2019). Financial literacy and the need for financial education: Evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1–8. [Google Scholar] [CrossRef]

- Madan, K., & Yadav, R. (2018). Understanding and predicting antecedents of mobile shopping adoption: A developing country perspective. Asia Pacific Journal of Marketing and Logistics, 30(1), 139–162. [Google Scholar] [CrossRef]

- Madan, K., & Yadav, R. (2021). Factors influencing adoption intention of Indian consumers for mobile payment services. International Journal of Technology Transfer and Commercialisation, 18(3), 276–289. [Google Scholar] [CrossRef]

- Martins, C., Oliveira, T., & Popovič, A. (2014). Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management, 34(1), 1–13. [Google Scholar] [CrossRef]

- Maune, A., & Mundonde, J. (2024). Governance, Financial Inclusion and Foreign Remittances in Zimbabwe: A VECM Approach. Acta Universitatis Danubius. OEconomica, 20(1), 192–210. [Google Scholar]

- McCloskey, C. (2021). Privacy within the private order: A critical evaluation of the market-based system governing data collection in the United States. UCLJLJ, 10, 52. [Google Scholar] [CrossRef]

- McCrindle, M., & Wolfinger, E. (2009). The ABC of XYZ: Understanding the global generations. The ABC of XYZ. [Google Scholar]

- Mendoza, A. C., Ortíz, P. M., Corona, A. V., & González, G. S. (2021). Financial inclusion, remittances and entrepreneurship: An experiment in the state of Tlaxcala, Mexico. Paradigma Económico. Revista de Economía Regional y Sectorial, 13(3), 56–89. [Google Scholar]

- Mohanta, G., & Dash, A. (2022). Do financial consultants exert a moderating effect on savings behavior? A study on the Indian rural population. Cogent Economics & Finance, 10(1), 2131230. [Google Scholar]

- Morgan, P. J. (2022). Fintech and financial inclusion in Southeast Asia and India. Asian Economic Policy Review, 17(2), 183–208. [Google Scholar] [CrossRef]

- Morgan, P. J., & Trinh, L. Q. (2020). Fintech and financial literacy in Viet Nam. (ADBI Working Paper Series No. 1154). Asian Development Bank Institute (ADBI). Available online: https://hdl.handle.net/10419/238511 (accessed on 6 December 2024).

- Mufarih, M., Jayadi, R., & Sugandi, Y. (2020). Factors influencing customers to use digital banking application in Yogyakarta, Indonesia. The Journal of Asian Finance, Economics and Business, 7(10), 897–907. [Google Scholar] [CrossRef]

- Musa, H., Ahmad, N. H. B., & Nor, A. M. (2024). Extending the theory of planned behavior in financial inclusion participation model—Evidence from an emerging economy. Cogent Economics & Finance, 12(1), 2306536. [Google Scholar] [CrossRef]

- Muthukannan, P., Tan, B., Gozman, D., & Johnson, L. (2020). The emergence of a Fintech Ecosystem: A case study of the Vizag Fintech Valley in India. Information & Management, 57(8), 103385. [Google Scholar]

- Najib, M., Ermawati, W. J., Fahma, F., Endri, E., & Suhartanto, D. (2021). Fintech in the small food business and its relation with open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 88. [Google Scholar] [CrossRef]

- Negm, E. (2023). Internet of Things (IoT) acceptance model–assessing consumers’ behavior toward the adoption intention of IoT. Arab Gulf Journal of Scientific Research, 41(4), 539–556. [Google Scholar] [CrossRef]

- Nsiah, A. Y., Yusif, H., Tweneboah, G., Agyei, K., & Baidoo, S. T. (2021). The effect of financial inclusion on poverty reduction in Sub-Sahara Africa: Does threshold matter? Cogent Social Sciences, 7(1), 1903138. [Google Scholar] [CrossRef]

- O’Hern, S., & Louis, R. S. (2023). Technology readiness and intentions to use conditionally automated vehicles. Transportation Research Part F: Traffic Psychology and Behaviour, 94, 1–8. [Google Scholar] [CrossRef]

- Olya, H. G., & Altinay, L. (2016). Asymmetric modeling of intention to purchase tourism weather insurance and loyalty. Journal of Business Research, 69(8), 2791–2800. [Google Scholar] [CrossRef]

- Owusu-Peprah, N. T. (2024). World development report 2022: Finance for an equitable recovery (p. 267). World Bank. ISBN 9781464817311. [Google Scholar]

- Ozili, P. K. (2023). Digital finance research and developments around the world: A literature review. International Journal of Business Forecasting and Marketing Intelligence, 8(1), 35–51. [Google Scholar] [CrossRef]

- Paganin, G., Apolinário-Hagen, J., & Simbula, S. (2023). Introducing mobile apps to promote the well-being of German and Italian university students. A cross-national application of the Technology Acceptance Model. Current Psychology, 42(31), 27562–27573. [Google Scholar] [CrossRef] [PubMed]

- Panchasara, M., & Sharma, D. V. (2019). Exploring the role of behavioral theories in financial inclusion. SSRN 3634040. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3634040 (accessed on 14 January 2025).

- Pappas, I. O., & Woodside, A. G. (2021). Fuzzy-set Qualitative Comparative Analysis (fsQCA): Guidelines for research practice in Information Systems and marketing. International Journal of Information Management, 58, 102310. [Google Scholar] [CrossRef]

- Parasuraman, A., & Colby, C. L. (2015). An updated and streamlined technology readiness index: TRI 2.0. Journal of service research, 18(1), 59–74. [Google Scholar] [CrossRef]

- Pham, L., Williamson, S., Lane, P., Limbu, Y., Nguyen, P. T. H., & Coomer, T. (2020). Technology readiness and purchase intention: Role of perceived value and online satisfaction in the context of luxury hotels. International Journal of Management and Decision Making, 19(1), 91–117. [Google Scholar] [CrossRef]

- Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879. [Google Scholar] [CrossRef]

- Prodanova, J., San-Martín, S., & Jimenez, N. (2021). Are you technologically prepared for mobile shopping? The Service Industries Journal, 41(9–10), 648–670. [Google Scholar] [CrossRef]

- Radnan, P. Y., & Purba, J. T. (2016). The use of Information Communication Technology (ICT) as the technology acceptance model (TAM) of mobile banking. Jurnal Manajemen Dan Pemasaran Jasa, 9(2), 283–298. [Google Scholar] [CrossRef][Green Version]

- Rafique, H., Ul Islam, Z., & Shamim, A. (2024). Acceptance of e-learning technology by government school teachers: Application of extended technology acceptance model. Interactive Learning Environments, 32(6), 2970–2988. [Google Scholar] [CrossRef]

- Ragin, C. C. (2008). Redesigning social inquiry: Fuzzy sets and beyond. University of Chicago Press. [Google Scholar]

- Rai, K., Dua, S., & Yadav, M. (2019). Association of financial attitude, financial behaviour and financial knowledge towards financial literacy: A structural equation modeling approach. FIIB Business Review, 8(1), 51–60. [Google Scholar] [CrossRef]

- Ramírez-Correa, P., Grandón, E. E., & Rondán-Cataluña, F. J. (2020). Users segmentation based on the Technological Readiness Adoption Index in emerging countries: The case of Chile. Technological Forecasting and Social Change, 155, 120035. [Google Scholar] [CrossRef]

- Rasoolimanesh, S. M., Ringle, C. M., Sarstedt, M., & Olya, H. (2021). The combined use of symmetric and asymmetric approaches: Partial least squares-structural equation modeling and fuzzy-set qualitative comparative analysis. International Journal of Contemporary Hospitality Management, 33(5), 1571–1592. [Google Scholar] [CrossRef]

- Raza, M. S., Tang, J., Rubab, S., & Wen, X. (2019). Determining the nexus between financial inclusion and economic development in Pakistan. Journal of Money Laundering Control, 22(2), 195–209. [Google Scholar] [CrossRef]

- Ruffoni, E. P., & Reichert, F. M. (2024). Exploring configurations of digital servitization capabilities for value creation: An fsQCA approach. Industrial Marketing Management, 122, 131–144. [Google Scholar] [CrossRef]

- Sabir, A. A., Ahmad, I., Ahmad, H., Rafiq, M., Khan, M. A., & Noreen, N. (2023). Consumer acceptance and adoption of AI robo-advisors in fintech industry. Mathematics, 11(6), 1311. [Google Scholar] [CrossRef]

- Sarma, M., & Pais, J. (2011). Financial inclusion and development. Journal of International Development, 23(5), 613–628. [Google Scholar] [CrossRef]

- Sarma, S. (2015). Meaningful financial inclusion. Journal of Rural Development, 34(1), 115–120. [Google Scholar]

- Schuetz, S., & Venkatesh, V. (2020). Blockchain, adoption, and financial inclusion in India: Research opportunities. International Journal of Information Management, 52, 101936. [Google Scholar] [CrossRef]

- Setiawan, B., Phan, T. D., Medina, J., Wieriks, M., Nathan, R. J., & Fekete-Farkas, M. (2024). Quest for financial inclusion via digital financial services (Fintech) during COVID-19 pandemic: Case study of women in Indonesia. Journal of Financial Services Marketing, 29(2), 459–473. [Google Scholar] [CrossRef]

- Shaikh, A. A., & Karjaluoto, H. (2015). Mobile banking adoption: A literature review. Telematics and Informatics, 32(1), 129–142. [Google Scholar] [CrossRef]

- Shareef, M. A., Baabdullah, A., Dutta, S., Kumar, V., & Dwivedi, Y. K. (2018). Consumer adoption of mobile banking services: An empirical examination of factors according to adoption stages. Journal of Retailing and Consumer Services, 43, 54–67. [Google Scholar] [CrossRef]

- Sharma, D., & Munjal, P. (2024). Determining the key drivers of FinTech adoption in India. International Journal of Process Management and Benchmarking, 16(4), 533–554. [Google Scholar] [CrossRef]

- Singh, J., & Singh, M. (2023). Fintech applications in social welfare schemes during COVID times: An extension of the classic TAM model in India. International Social Science Journal, 73(250), 979–998. [Google Scholar] [CrossRef]

- Singh, S., Sahni, M. M., & Kovid, R. K. (2020). What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Management Decision, 58(8), 1675–1697. [Google Scholar] [CrossRef]

- Somesanook, P. (2024). Developing the Technology Acceptance Model (TAM) to examine fintech adoption in the Microfinance Institution (MFI): An empirical study in Laos. Journal of East Asian Studies, 22, 1–34. [Google Scholar]

- Sukhov, A., Friman, M., & Olsson, L. E. (2023). Unlocking potential: An integrated approach using PLS-SEM, NCA, and fsQCA for informed decision making. Journal of Retailing and Consumer Services, 74, 103424. [Google Scholar] [CrossRef]

- To, A. T., & Trinh, T. H. M. (2021). Understanding behavioral intention to use mobile wallets in vietnam: Extending the tam model with trust and enjoyment. Cogent Business & Management, 8(1), 1891661. [Google Scholar]

- Tóth, Z., Thiesbrummel, C., Henneberg, S. C., & Naudé, P. (2015). Understanding configurations of relational attractiveness of the customer firm using fuzzy set QCA. Journal of Business Research, 68(3), 723–734. [Google Scholar] [CrossRef]

- Verma, D., Tripathi, V., & Singh, A. P. (2021). From physical to digital: What drives generation Z for mobile commerce adoption? Journal of Asia Business Studies, 15(5), 732–747. [Google Scholar] [CrossRef]

- Wang, Y., & Zhang, Z. (2025). Digital development and rural financial inclusion: Evidence from China. Research in International Business and Finance, 73, 102637. [Google Scholar] [CrossRef]

- Wold, H. (1982). Models for knowledge. In J. Gani (Ed.), The Making of Statisticians. Springer. [Google Scholar] [CrossRef]

- World Bank. (2018). Financial inclusion overview. Available online: https://www.worldbank.org/en/topic/financialinclusion (accessed on 3 September 2024).

- Wu, C., & Lim, G. G. (2024). Investigating older adults users’ willingness to adopt wearable devices by integrating the technology acceptance model (UTAUT2) and the technology readiness index theory. Frontiers in Public Health, 12, 1449594. [Google Scholar] [CrossRef] [PubMed]

- Wu, G., & Peng, Q. (2024). Bridging the digital divide: Unraveling the determinants of fintech adoption in rural communities. SAGE Open, 14(1), 21582440241227770. [Google Scholar] [CrossRef]

- Wu, P.-L., Yeh, S.-S., & Woodside, A. G. (2014). Applying complexity theory to deepen service dominant logic: Configural analysis of customer experience-and-outcome assessments of professional services for personal transformations. Journal of Business Research, 67(8), 1647–1670. [Google Scholar] [CrossRef]

- Yadegari, M., Mohammadi, S., & Masoumi, A. H. (2024). Technology adoption: An analysis of the major models and theories. Technology Analysis & Strategic Management, 36(6), 1096–1110. [Google Scholar]

- Yan, H., Zhang, H., Su, S., Lam, J. F., & Wei, X. (2022). Exploring the online gamified learning intentions of college students: A technology-learning behavior acceptance model. Applied Sciences, 12(24), 12966. [Google Scholar] [CrossRef]

| Variables | Labels 433 | Count |

|---|---|---|

| Gender | Male | 252 |

| Female | 181 | |

| Education | 10th and below | 124 |

| Graduation and below | 197 | |

| Above graduation | 112 | |

| Age | Gen X | 182 |

| Gen Y | 251 | |

| Income * | INR 7000 and above | 265 |

| Below INR 7000 | 168 |

| Constructs | Demographic Variables | Levels | Mean | T-Statistics (p-Values) |

|---|---|---|---|---|

| FinTech adoption intention | Gender | Male | 3.89 | 3.78 (0.00) |

| Female | 3.62 | |||

| Age | X-Gen | 3.47 | −4.73 (0.01) | |

| Y-Gen | 3.76 | |||

| Income | Below Average | 3.59 | −2.19 (0.00) | |

| Above Average | 3.43 | |||

| Financial inclusion | Gender | Male | 3.65 | 3.17 (0.03) |

| Female | 3.41 | |||

| Age | X-Gen | 3.52 | −3.41 (0.03) | |

| Y-Gen | 3.87 | |||

| Income | Below Average | 3.39 | −1.21 (0.12) | |

| Above Average | 3.37 |

| PU | PEOU | ATT | SN | PBC | OPT | INS | DIS | INN | FAI | FI | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PU | 0.88 | ||||||||||

| PEOU | 0.46 | 0.89 | |||||||||

| ATT | 0.32 | 0.34 | 0.88 | ||||||||

| SN | 0.29 | 0.31 | 0.36 | 0.87 | |||||||

| PBC | 0.30 | 0.32 | 0.35 | 0.38 | 0.86 | ||||||

| OPT | 0.28 | 0.27 | 0.31 | 0.32 | 0.31 | 0.88 | |||||

| INS | −0.32 | −0.31 | −0.29 | −0.28 | −0.31 | −0.36 | 0.88 | ||||

| DIS | −0.25 | −0.29 | −0.24 | −0.33 | −0.28 | −0.29 | 0.24 | 0.87 | |||

| INN | 0.31 | 0.33 | 0.32 | 0.27 | 0.32 | 0.31 | −0.37 | −0.33 | 0.88 | ||

| FAI | 0.47 | 0.43 | 0.39 | 0.37 | 0.41 | 0.39 | −0.33 | −0.31 | 0.42 | 0.88 | |

| FI | 0.32 | 0.34 | 0.33 | 0.28 | 0.32 | 0.35 | −0.29 | −0.30 | 0.33 | 0.44 | 0.88 |

| Mean | 3.89 | 3.92 | 3.67 | 3.58 | 3.41 | 3.51 | 3.29 | 3.19 | 3.45 | 3.67 | 3.71 |

| SD | 1.19 | 0.98 | 1.38 | 1.09 | 1.34 | 0.89 | 1.21 | 1.27 | 1.07 | 1.13 | 1.29 |

| Factor Loading | 0.72–0.81 | 0.74–0.81 | 0.72–0.79 | 0.69–0.74 | 0.70–0.75 | 0.72–0.81 | 0.74–0.79 | 0.73–0.79 | 0.72–0.80 | 0.70–0.82 | 0.69–0.83 |

| Cronbach’s α | 0.83 | 0.86 | 0.81 | 0.79 | 0.79 | 0.84 | 0.81 | 0.79 | 0.81 | 0. 82 | 0.81 |

| AVE | 0.79 | 0.80 | 0.78 | 0.76 | 0.75 | 0.79 | 0.78 | 0.77 | 0.78 | 0.79 | 0.79 |

| CR | 0.91 | 0.93 | 0.89 | 0.87 | 0.86 | 0.91 | 0.90 | 0.87 | 0.90 | 0.89 | 0.91 |

| PU | PEOU | ATT | SN | PBC | OPT | INS | DIS | INN | FAI | FI | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PU | |||||||||||

| PEOU | 0.86 | ||||||||||

| ATT | 0.81 | 0.84 | |||||||||

| SN | 0.67 | 0.71 | 0.72 | ||||||||

| PBC | 0.71 | 0.77 | 0.79 | 0.81 | |||||||

| OPT | 0.79 | 0.81 | 0.83 | 0.74 | 0.78 | ||||||

| INS | 0.74 | 0.74 | 0.81 | 0.77 | 0.81 | 0.64 | |||||

| DIS | 0.71 | 0.69 | 0.79 | 0.76 | 0.79 | 0.71 | 0.76 | ||||

| INN | 0.78 | 0.80 | 0.81 | 0.79 | 0.72 | 0.81 | 0.63 | 0.62 | |||

| FAI | 0.74 | 0.81 | 0.76 | 0.80 | 0.77 | 0.80 | 0.62 | 0.63 | 0.69 | ||

| FI | 0.81 | 0.82 | 0.79 | 0.78 | 0.79 | 0.81 | 0.71 | 0.67 | 0.72 | 0.68 |

| Path | Coefficient (β) | Effect Size (f2) | Sig. (p) | R2 | SRMR |

|---|---|---|---|---|---|

| PU→FAI | 0.29 | 0.41 | 0.00 | 0.51 | 0.06 |

| PEOU→FAI | 0.31 | 0.39 | 0.00 | ||

| ATT→FAI | 0.35 | 0.29 | 0.02 | ||

| SN→FAI | 0.06 | 0.09 | 0.12 | ||

| PBC→FAI | 0.28 | 0.32 | 0.03 | ||

| OPT→FAI | 0.06 | 0.03 | 0.23 | ||

| INS→FAI | −0.19 | 0.28 | 0.04 | ||

| DIS→FAI | −0.03 | 0.08 | 0.19 | ||

| INN→FAI | 0.09 | 0.11 | 0.23 | ||

| FAI→FI | 0.34 | 0.33 | 0.00 | 0.57 |

| Constructs | H2 | Q2 |

|---|---|---|

| FAI | 0.39 | 0.36 |

| FI | 0.41 | 0.37 |

| Average | 0.40 | 0.36 |

| Configurations | Solutions | ||

|---|---|---|---|

| 1 | 2 | 3 | |

| PU |  |  |  |

| PEOU |  |  |  |

| ATT |  |  |  |

| SN | |||

| PBC |  | ||

| OPT |  | ||

| INS |  |  |  |

| DIS |  | ||

| INN |  | ||

| Consistency | 0.942 | 0.941 | 0.936 |

| Raw coverage | 0.798 | 0.613 | 0.622 |

| Unique coverage | 0.238 | 0.106 | 0.103 |

| Solution coverage | 0.789 | ||

| Solution consistency | 0.889 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jena, R.K. Factors Influencing the Adoption of FinTech for the Enhancement of Financial Inclusion in Rural India Using a Mixed Methods Approach. J. Risk Financial Manag. 2025, 18, 150. https://doi.org/10.3390/jrfm18030150

Jena RK. Factors Influencing the Adoption of FinTech for the Enhancement of Financial Inclusion in Rural India Using a Mixed Methods Approach. Journal of Risk and Financial Management. 2025; 18(3):150. https://doi.org/10.3390/jrfm18030150

Chicago/Turabian StyleJena, Rabindra Kumar. 2025. "Factors Influencing the Adoption of FinTech for the Enhancement of Financial Inclusion in Rural India Using a Mixed Methods Approach" Journal of Risk and Financial Management 18, no. 3: 150. https://doi.org/10.3390/jrfm18030150

APA StyleJena, R. K. (2025). Factors Influencing the Adoption of FinTech for the Enhancement of Financial Inclusion in Rural India Using a Mixed Methods Approach. Journal of Risk and Financial Management, 18(3), 150. https://doi.org/10.3390/jrfm18030150