Artificial Intelligence in Financial Behavior: Bibliometric Ideas and New Opportunities

Abstract

1. Introduction

2. Literary Review

3. Materials and Methods

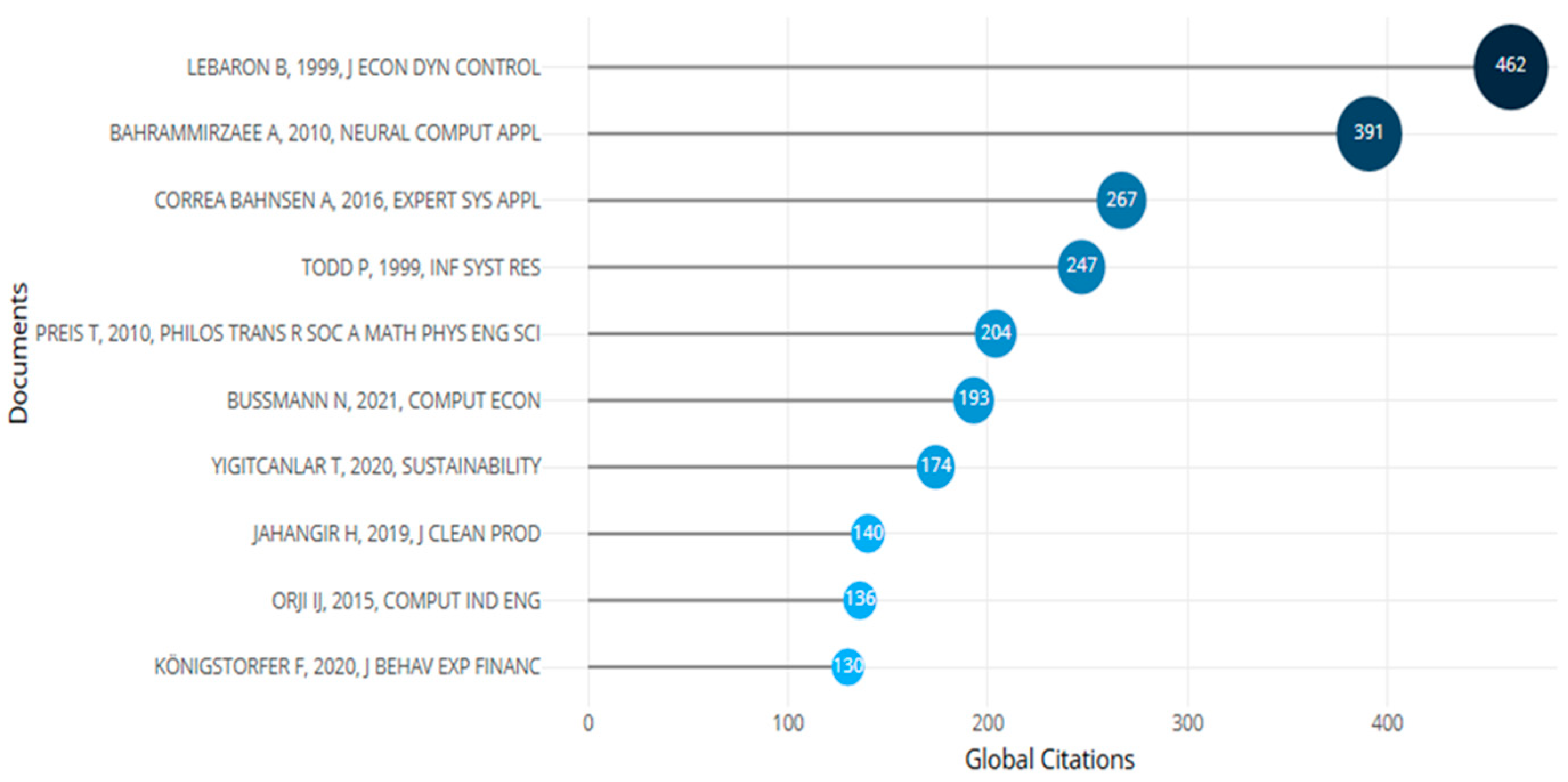

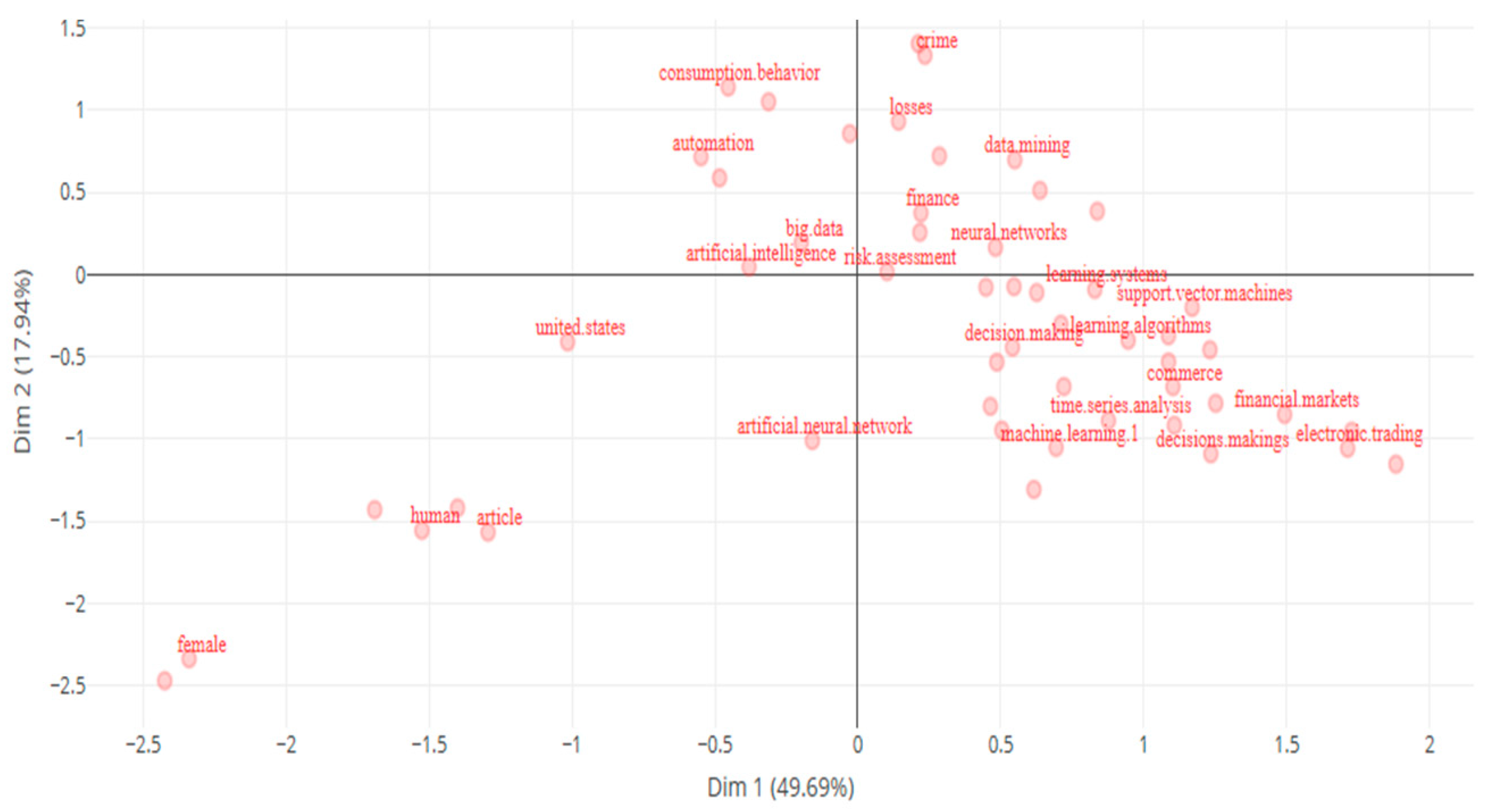

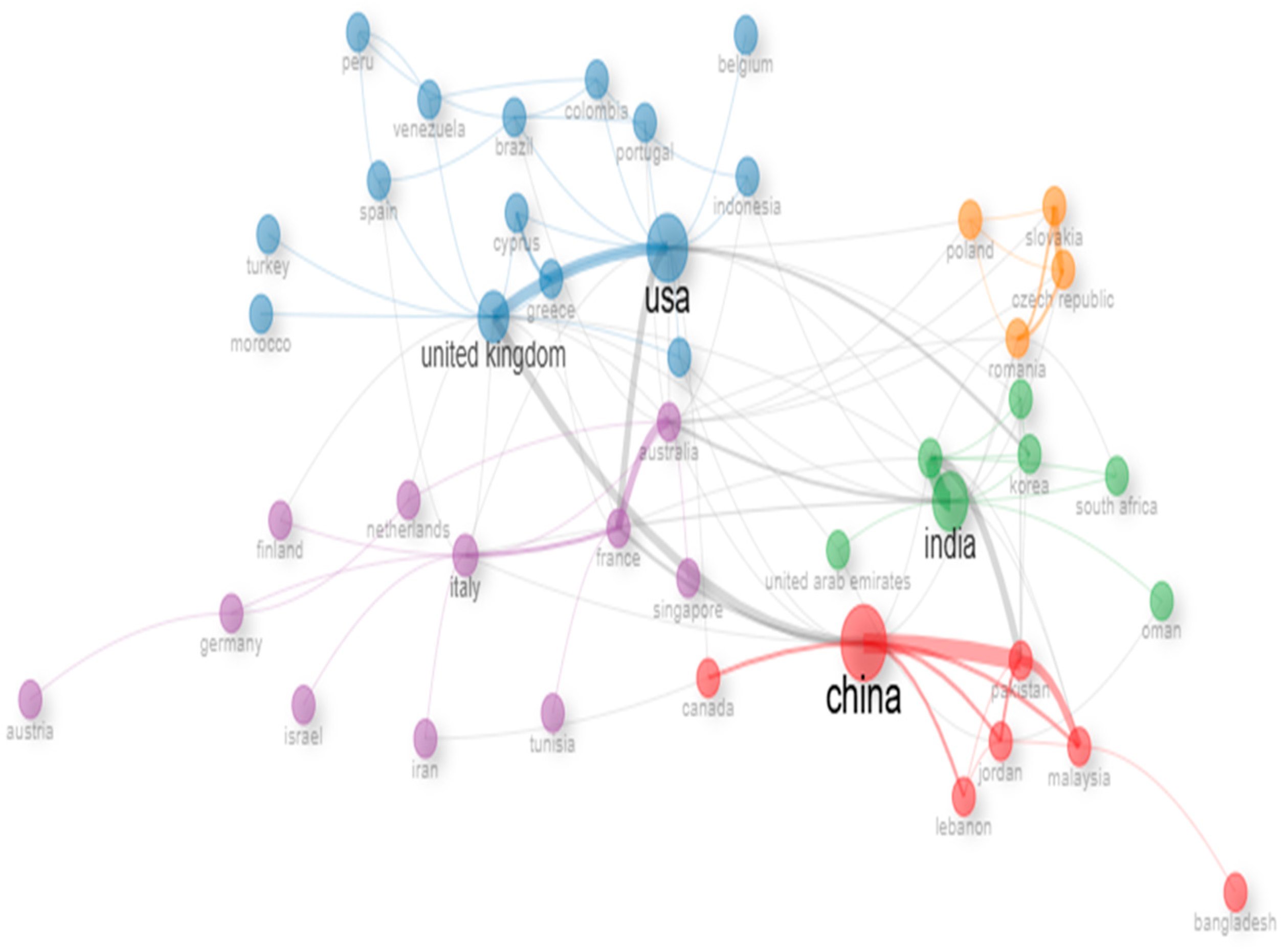

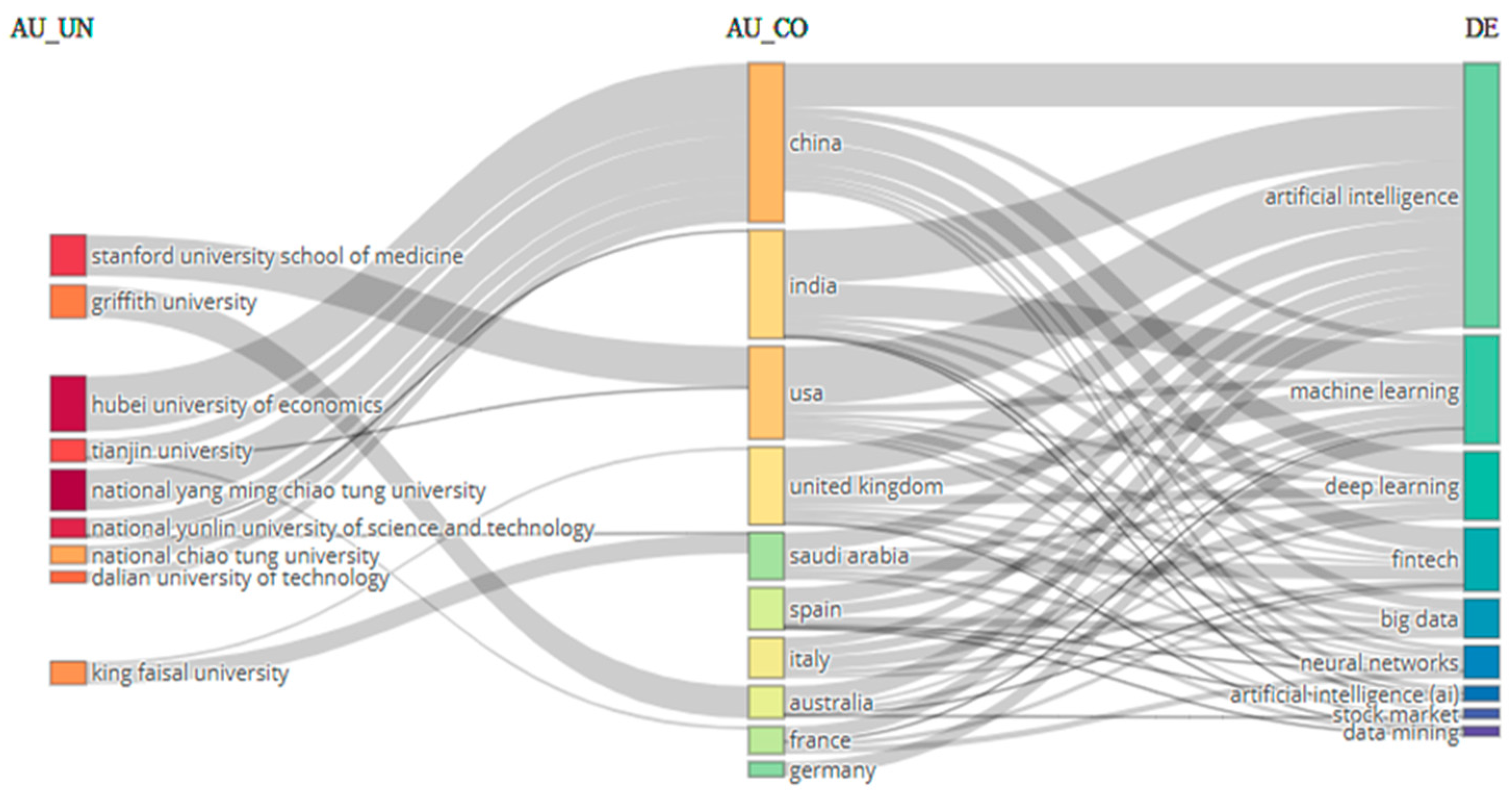

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adeyelu, O. O., Ugochukwu, C. E., & Shonibare, M. A. (2024). Ethical implications of AI financial decision-making: A review with real-world applications. International Journal of Applied Research in Social Sciences, 6(4), 608–630. [Google Scholar] [CrossRef]

- Ahmed, S., Alshater, M. M., El Ammari, A., & Hammami, H. (2022). Artificial intelligence and machine learning in finance: A bibliometric review. Research in International Business and Finance, 61, 101646. [Google Scholar] [CrossRef]

- Alavi, M., Valiollahi, A., & Pakravan, M. (2024, February 21–22). Bibliometric analysis of research trends on graph neural networks. 2024 20th CSI International Symposium on Artificial Intelligence and Signal Processing (AISP), Babol, Iran. [Google Scholar] [CrossRef]

- Bahnsen, A. C., Aouada, D., Stojanovic, A., & Ottersten, B. (2016). Feature engineering strategies for credit card fraud detection. Expert Systems with Applications, 51, 134–142. [Google Scholar] [CrossRef]

- Bahrammirzaee, A. (2010). A comparative survey of artificial intelligence applications in finance: Artificial neural networks, expert systems, and hybrid intelligent systems. Neural Computing and Applications, 19(8), 1165–1195. [Google Scholar] [CrossRef]

- Barra, A. F., Retno, D., Saputro, S., & Widianingsih, P. (2024). Bibliometric analysis of spline regression models for trend mapping and strategy development research using Vosviewer. Nucleus, 5(02), 74–81. [Google Scholar] [CrossRef]

- Boran, E., Korkmaz, N. G., & Tarım, K. (2024). Bibliometric analysis of scientific studies performed with mathematical modeling. International Journal of Educational Studies in Mathematics, 11(3), 107–136. [Google Scholar] [CrossRef]

- Bussmann, N., Giudici, P., Marinelli, D., & Papenbrock, J. (2021). Explainable machine learning in credit risk management. Computational Economics, 57, 203–216. [Google Scholar] [CrossRef]

- Chopra, P. (2024). Ethical implications of AI in financial services: Bias, transparency, and accountability. International Journal of Scientific Research in Computer Science, Engineering and Information Technology, 10(5), 306–314. [Google Scholar] [CrossRef]

- Chung, K. C., & Lin, C.-H. (2023). Drivers of financial robot continuance usage intentions: An application of self-efficacy theory. Journal of Internet Technology, 24(2), 401–410. [Google Scholar] [CrossRef]

- Devan, M., Tillu, R., & Shanmugan, L. (2023). Personalized Financial Recommendations: Real-Time AI-ML Analytics in Wealth Management. Journal of Knowledge Learning and Science Technology, 2(3), 547–559. [Google Scholar] [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Du, K., Zhao, Y., Mao, R., Xing, F., & Cambria, E. (2025). Natural language processing in finance: A survey. Information Fusion, 115, 102755. [Google Scholar] [CrossRef]

- Ellegaard, O., & Wallin, J. (2015). The bibliometric analysis of scholarly production: How great is the impact? Scientometrics, 105, 1809–1831. [Google Scholar] [CrossRef] [PubMed]

- Gao, H., Kou, G., Liang, H., Zhang, H., Chao, X., Li, C.-C., & Dong, Y. (2024). Machine learning in business and finance: A literature review and research opportunities. Financial Innovation, 10, 86. [Google Scholar] [CrossRef]

- Goodell, J. W., Kumar, S., Lim, W. M., & Pattnaik, D. (2021). Artificial intelligence and machine learning in finance: Identifying foundations, themes, and research clusters from bibliometric analysis. Journal of Behavioral and Experimental Finance, 32, 100577. [Google Scholar] [CrossRef]

- Greener, S. (2022). Evaluating literature with bibliometrics. Interactive Learning Environments, 30, 1168–1169. [Google Scholar] [CrossRef]

- Gui, Z., Huang, Y., & Zhao, X. (2024). Financial fraud and investor awareness. Journal of Economic Behavior & Organization, 219, 104–123. [Google Scholar] [CrossRef]

- Huang, A. H., & Haifeng, Y. (2022). Artificial intelligence in financial decision making. Handbook of financial decision making, forthcoming. HKUST business school research paper No. 2022-082. Available online: https://ssrn.com/abstract=4235511 (accessed on 23 July 2022).

- Ingale, K. K., & Paluri, R. A. (2022). Financial literacy and financial behaviour: A bibliometric analysis. Review of Behavioral Finance, 14(1), 130–154. [Google Scholar] [CrossRef]

- Jahangir, M. H., & Soltani, K. (2019). Applying results of the chemical analyses in determining groundwater quality for drinking, agricultural and industrial uses: The case study Rafsanjan plain, Iran. Journal of Water and Land Development, 42(VII–IX), 91–99. [Google Scholar] [CrossRef]

- Königstorfer, F., & Thalmann, S. (2020). Applications of artificial intelligence in commercial banks—A research agenda for behavioral finance. Journal of Behavioral and Experimental Finance, 27, 100352. [Google Scholar] [CrossRef]

- Kumar, R. (2025). Global trends and research patterns in financial literacy and behavior: A bibliometric analysis. Management Science Advances, 2(1), 1–18. [Google Scholar] [CrossRef]

- Lebaron, B., Arthur, W. B., & Palmer, R. (1999). Time series properties of an artificial stock market. Journal of Economic Dynamics and Control, 23(9–10), 1487–1516. [Google Scholar] [CrossRef]

- Masood, F. (2024). Impact of artificial intelligence on financial markets. International Journal of Emerging Multidisciplinaries: Social Science, 3(1), 8. [Google Scholar] [CrossRef]

- Mayor, T. (2020). Why finance is deploying natural language processing. MIT Sloan. Available online: https://mitsloan.mit.edu/ideas-made-to-matter/why-finance-deploying-natural-language-processing (accessed on 3 August 2023).

- Musto, C., Semeraro, G., Lops, P., de Gemmis, M., & Lekkas, G. (2015). Personalized finance advisory through case-based recommender systems and diversification strategies. Decision Support Systems, 77, 100–111. [Google Scholar] [CrossRef]

- Orji, I. J., & Wei, S. (2015). An innovative integration of fuzzy-logic and systems dynamics in sustainable supplier selection: A case on manufacturing industry. Computers & Industrial Engineering, 88, 1–12. [Google Scholar]

- Oyeniyi, L. D., Chinonye Esther Ugochukwu, C. E., & Mhlongo, N. Z. (2024). World Journal of Advanced Research and Reviews, 22(1), 679–694. [CrossRef]

- Passas, I. (2024). Bibliometric analysis: The main steps. Encyclopedia, 4(2), 1014–1025. [Google Scholar] [CrossRef]

- Preis, T., Reith, D., & Stanley, H. E. (2010). Complex dynamics of our economic life on different scales: Insights from search engine query data. Philosophical Transactions of the Royal Society A, 368, 5707–5719. [Google Scholar] [CrossRef]

- Ramos-Rodriguez, A.-R., & Ruiz-Navarro, J. (2004). Changes in the intellectual structure of strategic management research: A bibliometric study of the Strategic Management Journal, 1980–2000. Strategic Management Journal, 25(10), 981–1004. [Google Scholar] [CrossRef]

- Rialti, R., Marzi, G., Ciappei, C., & Busso, D. (2019). Big data and dynamic capabilities: A bibliometric analysis and systematic literature review. Management Decision, 57(8), 2052–2068. [Google Scholar] [CrossRef]

- Saheb, S. S., Kiran, P. B. N., Bhaskara Ganesh, B. U., Roopalatha, N., Syed, S. M., & William, P. (2023, December 12–13). Artificial Neural Networks Based Risk Management Analysis of Modern Commercial Banks Using Behavioral Finance Theory. 2023 4th International Conference on Computation, Automation and Knowledge Management (ICCAKM) (pp. 1–6), Dubai, United Arab Emirates. [Google Scholar] [CrossRef]

- Say, S., Dogan, M., Abdeshov, D., Tekbas, M., Sezal, L., & Erdoğan, B. (2024). Evolution of financial development research: A bibliometric analysis. Journal of Risk and Financial Management, 18(1), 10. [Google Scholar] [CrossRef]

- Shanmuganathan, M. (2020). Behavioral finance in an era of artificial intelligence: Longitudinal case study of robo-advisors in investment decisions. Journal of Behavioral and Experimental Finance, 27, 100297. [Google Scholar] [CrossRef]

- Shi, W., Ali, M., & Leong, C.-M. (2025). Dynamics of personal financial management: A bibliometric and systematic review on financial literacy, financial capability, and financial behavior. International Journal of Bank Marketing, 43(1), 125–165. [Google Scholar] [CrossRef]

- Shoetan, P. O., Oyewole, A., Okoye, C. C., & Ofodile, O. C. (2024). Reviewing the role of big data analytics in financial fraud detection. Finance & Accounting Research Journal, 6(3), 384–394. [Google Scholar] [CrossRef]

- Singh, B., Kaunert, C., & Gautam, R. (2025). Artificial intelligence in detecting herding and market overreaction: Specifying impact of behaviors on market dynamics. In Psychological Drivers of Herding and Market Overreaction (pp. 1–22). IGI Global Scientific Publishing. [Google Scholar] [CrossRef]

- Surekha, S., Sindhu, S., Veerappan, S., & Arvinth, N. (2024). Bibliometric study: Natural and engineering sciences. Natural and Engineering Sciences, 9(2), 376–385. [Google Scholar] [CrossRef]

- Suresh, K., & Pradhan, S. K. (2023). Banking sector’s financial performance: Bibliometric data analysis and its visualization. Multidisciplinary Reviews, 6(4), 2023049. [Google Scholar] [CrossRef]

- Sushkova, O., & Minbaleev, A. (2021). Legal regulation of artificial intelligence in the financial services market: A comparative analysis. SHS Web of Conferences, 118, 04007. [Google Scholar] [CrossRef]

- Talasila, S. D. (2024). AI-driven personal finance management: Revolutionizing budgeting and financial planning. International Research Journal of Engineering and Technology, 11(7), 397–407. [Google Scholar]

- Todd, P., & Benbasat, I. (1999). Evaluating the impact of DSS, cognitive effort, and incentives on strategy selection. Information Systems Research, 10(4), 356–374. [Google Scholar] [CrossRef]

- Truby, J., Brown, R., & Dahdal, A. (2020). Banking on AI: Mandating a proactive approach to AI regulation in the financial sector. Law and Financial Markets Review, 14, 110–120. [Google Scholar] [CrossRef]

- Viale, R., Mousavi, S., Filotto, U., & Alemanni, B. (Eds.). (2023). Artificial intelligence and financial behaviour. Edward Elgar Publishing. [Google Scholar] [CrossRef]

- Wang, Y. (2024). Ethical considerations of AI in financial decisions. Computing and Artificial Intelligence, 2(1), 1290. [Google Scholar] [CrossRef]

- Weinjing, C. (2025). Simulation application of virtual robots and artificial intelligence based on deep learning in enterprise financial systems. Entertainment Computing, 52, 100772. [Google Scholar] [CrossRef]

- Yarabolu, S. N., & Sriharsha, A. V. (2025). Financial modeling 2.0: The machine learning transformation. In Data analytics and AI for quantitative risk assessment and financial computation (pp. 77–106). IGI Global Scientific Publishing. [Google Scholar] [CrossRef]

- Yigitcanlar, T., Desouza, K. C., Butler, L., & Roozkhosh, F. (2020). Contributions and risks of artificial intelligence (AI) in building smarter cities: Insights from a systematic review of the literature. Energies, 13(6), 1473. [Google Scholar] [CrossRef]

- Zeng, L., & Chen, Y. (2023). Applying behavioral finance to influence consumer decision-making and behavior via human-automation interaction. In V. G. Duffy, M. Lehto, Y. Yih, & R. W. Proctor (Eds.), Human-automation interaction: Automation, collaboration, & E-services (Vol. 10). Springer. [Google Scholar] [CrossRef]

- Zhavoronok, A., Yakushko, I., Popelo, O., Kholiavko, N., Fedyshyn, M., & Dubyna, M. (2022). Mapping the literature on financial behavior: A bibliometric analysis using the VOSviewer program. WSEAS Transactions on Business and Economics, 19, 231–246. [Google Scholar] [CrossRef]

- Zupic, I., & Čater, T. (2014). Bibliometric methods in management and organization. Organizational Research Methods, 18, 429–472. [Google Scholar] [CrossRef]

| Description | Results |

|---|---|

| Timespan | 1985:2024 |

| Sources (Journals, Books, etc.) | 294 |

| Documents | 390 |

| Annual growth rate % | 13.46 |

| Document average age | 4.93 |

| Average citations per doc | 18.85 |

| Average citations per year per doc | 2.883 |

| References | 1 |

| Keywords Plus (ID) | 2561 |

| Author’s keywords (DE) | 1427 |

| Authors | 1268 |

| Author appearances | 1348 |

| Authors of single-authored docs | 51 |

| Single-authored docs | 51 |

| Documents per author | 0.308 |

| Co-authors per doc | 3.46 |

| International co-authorships % | 30.51 |

| Authors | Articles | Articles Fractionalized |

|---|---|---|

| Zhang Y. | 7 | 2.36 |

| Li J. | 4 | 1.83 |

| Boustani N.M. | 2 | 1.50 |

| Chen A.P. | 3 | 1.33 |

| Wang X. | 3 | 1.25 |

| Zhang S. | 2 | 1.20 |

| Liu Y. | 2 | 1.17 |

| Zhou H. | 5 | 1.01 |

| Ceron B.M. | 2 | 1.00 |

| Manahov V. | 2 | 1.00 |

| Source | No. of Papers Pub. | H-Index | G-Index | Total No. of Citations |

|---|---|---|---|---|

| IEEE ACCESS | 18 | 9 | 17 | 299 |

| Expert Systems with Applications | 8 | 8 | 8 | 506 |

| Journal of Behavioral and Experimental Finance | 4 | 4 | 4 | 308 |

| Applied Soft Computing Journal | 3 | 3 | 3 | 76 |

| Decision Support Systems | 3 | 3 | 3 | 66 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bayakhmetova, A.; Rudenko, L.; Krylova, L.; Suleimenova, B.; Niyazbekova, S.; Nurpeisova, A. Artificial Intelligence in Financial Behavior: Bibliometric Ideas and New Opportunities. J. Risk Financial Manag. 2025, 18, 159. https://doi.org/10.3390/jrfm18030159

Bayakhmetova A, Rudenko L, Krylova L, Suleimenova B, Niyazbekova S, Nurpeisova A. Artificial Intelligence in Financial Behavior: Bibliometric Ideas and New Opportunities. Journal of Risk and Financial Management. 2025; 18(3):159. https://doi.org/10.3390/jrfm18030159

Chicago/Turabian StyleBayakhmetova, Aliya, Lyudmila Rudenko, Liubov Krylova, Buldyryk Suleimenova, Shakizada Niyazbekova, and Ardak Nurpeisova. 2025. "Artificial Intelligence in Financial Behavior: Bibliometric Ideas and New Opportunities" Journal of Risk and Financial Management 18, no. 3: 159. https://doi.org/10.3390/jrfm18030159

APA StyleBayakhmetova, A., Rudenko, L., Krylova, L., Suleimenova, B., Niyazbekova, S., & Nurpeisova, A. (2025). Artificial Intelligence in Financial Behavior: Bibliometric Ideas and New Opportunities. Journal of Risk and Financial Management, 18(3), 159. https://doi.org/10.3390/jrfm18030159