US Bank Lending to Small Businesses: An Analysis of COVID-19 and the Paycheck Protection Program

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Data and Sample

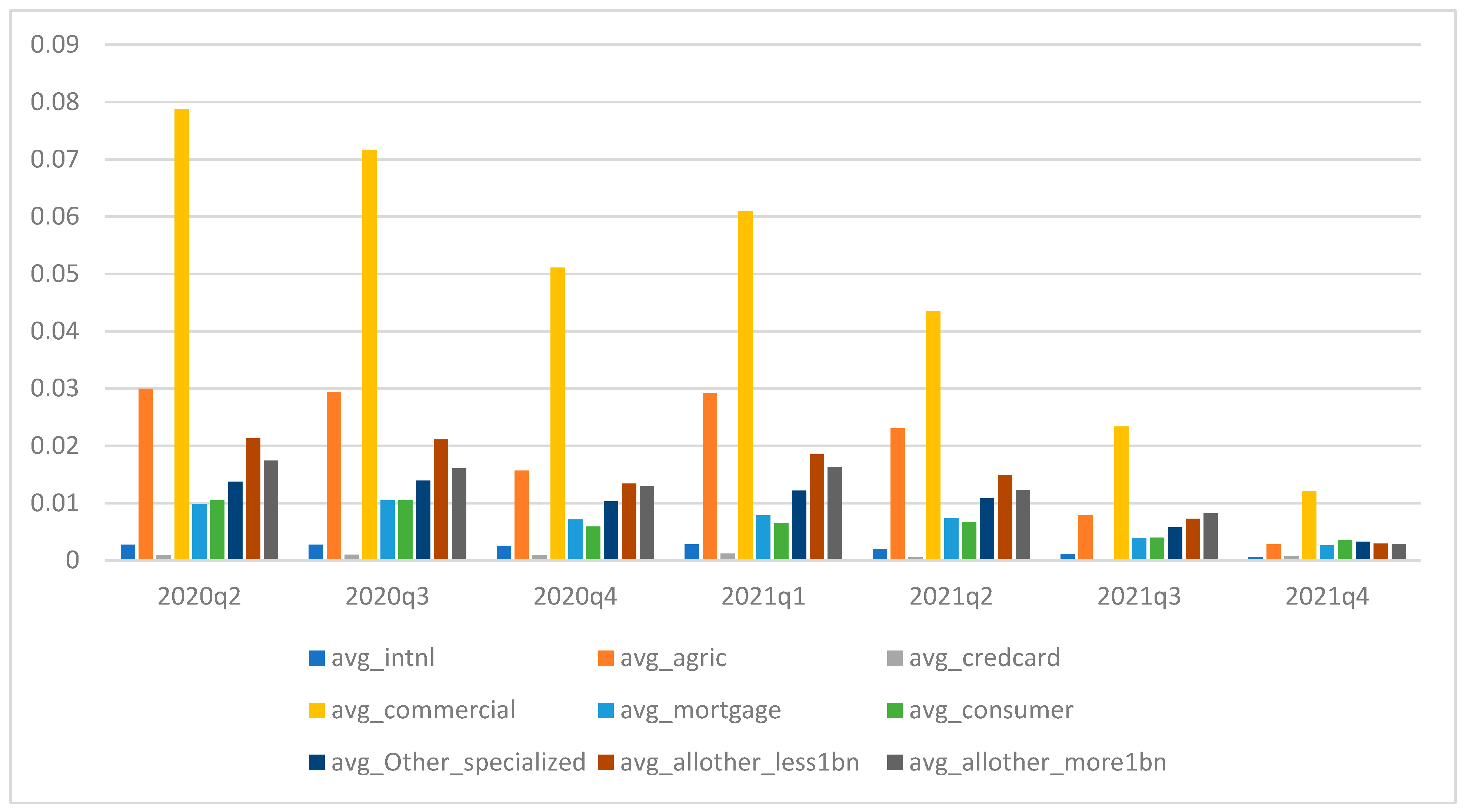

3.2. Trends in Lending

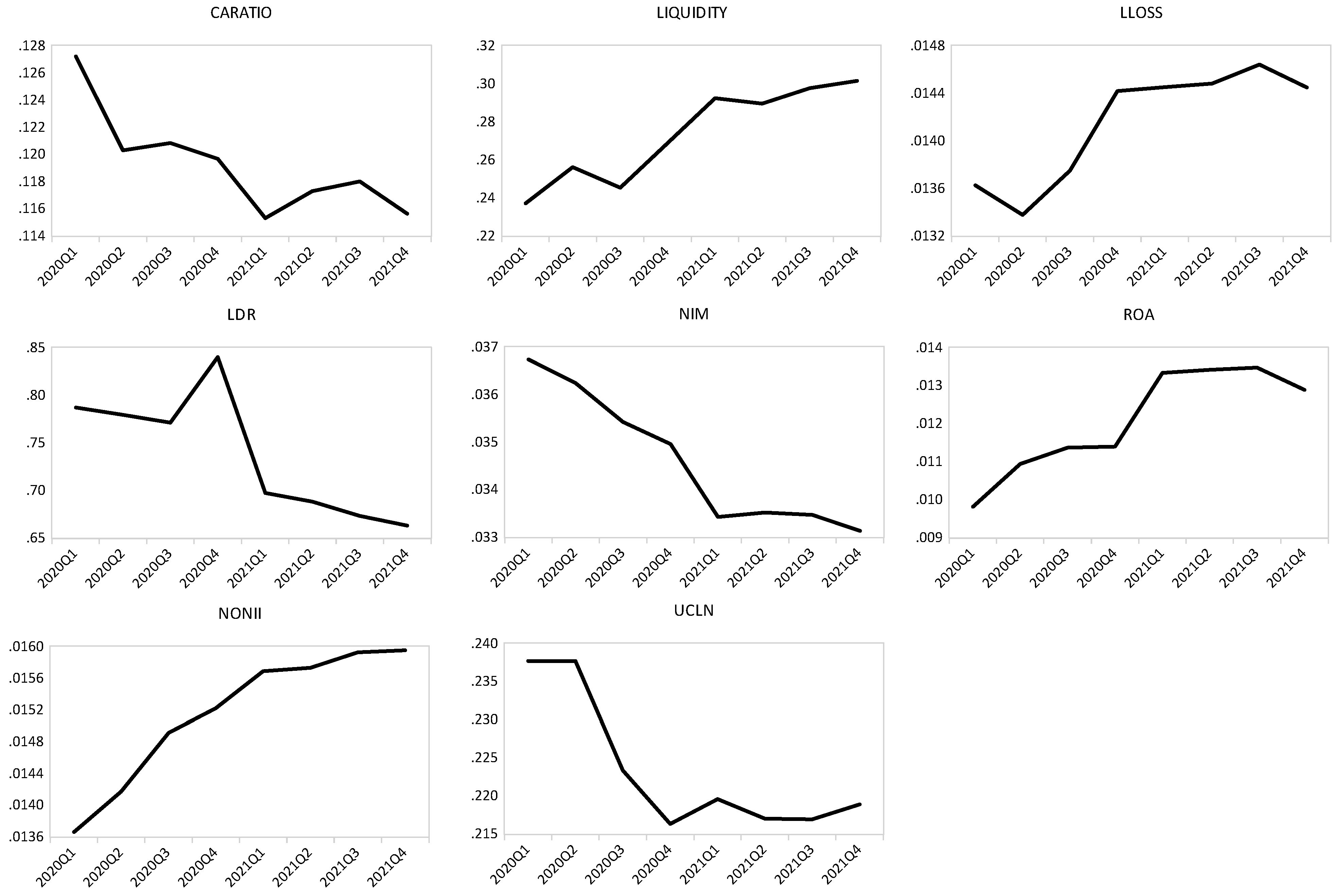

3.3. Trends in Key Bank Characteristics

Estimation Model

4. Empirical Results

4.1. Further Analyses of the Risk Aversion Channel

4.2. PPP and Bank Specialization

5. Robustness

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Abbreviation | Definition | Data Source |

|---|---|---|---|

| Lending | CIL | Commercial and industrial loans to all businesses. This variable includes PPP loans. | FDIC |

| Lending | CILS | Commercial and industrial loans to small businesses | FDIC |

| Lending | PPP | Paycheck Protection Program loans | FDIC |

| Lending | NCIL | Net CIL, calculated as CIL minus PPP | FDIC |

| Lending | CILL | Commercial and industrial loans to large businesses, calculated as CIL minus PPP minus CILS | FDIC |

| Growth in Lending | G_LEND | Growth in lending as a percent of the previous quarter’s total assets; where lending is CILS, PPP, NCIL, or CILL. | FDIC |

| Growth in Lending | G_CIL | Growth in CIL as a percent of the previous quarter’s total assets. | FDIC |

| Growth in Lending | G_CILS | Growth in CILS as a percent of the previous quarter’s total assets. | FDIC |

| Growth in Lending | G_PPP | Growth in PPP as a percent of the previous quarter’s total assets. | FDIC |

| Growth in Lending | G_CILL | Growth in CILL as a percent of the previous quarter’s total assets. | FDIC |

| Growth in Lending | G_NCIL | Growth in NCIL as a percent of the previous quarter’s total assets. | FDIC |

| Net Loans and Leases to Deposits | LDR | Loans and lease financing receivables net of unearned income, allowances, and reserves as a percent of total deposits. | FDIC |

| Capital Ratio | CARATIO | Total equity capital as a percent of total assets. | FDIC |

| Intermediation Profitability | NIM | Total interest income less total interest expense (annualized) as a percent of average earning assets. | FDIC |

| Overall Profitability | ROA | Net income after taxes and extraordinary items (annualized) as a percent of total assets. | FDIC |

| Credit Quality | LLOSS | Allowance for loan and lease losses as a percent of total loan and lease financing receivables, excluding unearned income. | FDIC |

| Unused Credit Line | UCLN | Unused credit line as a percent of total assets. | FDIC |

| Non-Interest Income | NONII | Income derived from bank services and sources other than interest-bearing assets (annualized) as a percent of total assets. | FDIC |

| Insolvency Risk | Z-SCORE | Sum of current period values of PROFITABILITY and equity-to-asset ratio, as a percent of the standard deviation of PROFITABILITY computed over the full sample. | Authors’ computation; FDIC |

| Earnings Variability | CV | Standard deviation of quarterly net income, as a percent of the mean over the past 12 quarters. | Authors’ computation; FDIC |

| Bank Size | SIZE | Natural logarithm of total assets. | FDIC |

| Liquidity | LIQUIDITY | Sum of cash, federal funds sold, and securities purchased to resell as a percent of total assets. | FDIC |

| Economic Condition | G_GDP | Quarterly growth rate in real GDP. | Bureau of Economic Analysis |

| COVID-19 | G_COVID | Quarterly growth rate in the number of total COVID-19 cases. | US Center for Disease Control and Prevention |

| Financial Institution | Financial Institution | |

|---|---|---|

| Ally Financial Inc., Detriot, MI USA | Discover Financial Services, Riverwoods, IL, USA | Santander Holdings USA, Inc., Boston, MA, USA * |

| American Express Company, New York, NY USA | Fifth Third Bancorp, Cincinnati, OH, USA | State Street Corporation, Boston, MA, USA * |

| Bank of America Corporation, Charlotte, NC USA * | HSBC North America Holdings Inc., New York, NY, USA * | TD Group US Holdings LLC, Cherry Hill, NJ, USA |

| Barclays US LLC, Philadelphia, PA, USA. * | Huntington Bancshares Incorporated, Columbus, OH, USA | The Bank of New York Mellon Corporation, New York, NY, USA * |

| BMO Financial Corp., Chicago, IL, USA | JPMorgan Chase & Co., New York, NY, USA * | The Charles Schwab Corporation, Westlake, Texas, USA |

| BNP Paribas USA, Inc. New York, NY, USA * | KeyCorp, Cleveland, OH, USA | The Goldman Sachs Group, Inc., New York, NY, USA * |

| Capital One Financial Corporation, McLean, VA, USA | M&T Bank Corporation, Bufalo, NY, USA | The PNC Financial Services Group, Inc., Pittsburg, PA, USA |

| Citigroup Inc., New York, NY, USA * | Morgan Stanley, New York, NY, USA * | Truist Financial Corporation, Charlotte, NC, USA |

| Citizens Financial Group, Inc., Providence, RI, USA | Northern Trust Corporation, Chicago, IL, USA | U.S. Bancorp, Minneapolis, MN, USA |

| Credit Suisse Holdings (USA), Inc., Madison, NY, USA * | RBC US Group Holdings LLC, Raleigh, NC, USA * | UBS Americas Holding LLC, New York, NY, USA * |

| DB USA Corporation, New York, NY, USA | Regions Financial Corporation, Birmingham, AL, USA | Wells Fargo & Company, San Francisco, CA, USA * |

| 1 | According to Berger and Demirgüç-Kun (2021) and Beck and Keil (2022), the COVID-19 pandemic was also different from other economic crises for the following reasons. (i) it has been identified as a global crisis that featured the most unanticipated large and widespread economic shocks; (ii) though the COVID-19 crisis triggered declines in aggregate demand, this was rapid and transient, leading to increases rather than decreases in business loans as firms required liquidity buffers to ride the storm; (iii) the crisis prompted the swiftest and largest set of policy responses including the PPP bailout that was several times larger than the Troubled Asset Relief Program (TARP) bank bailout during the 2007–2009 credit crunch. |

| 2 | The Wall Street Journal chronicles reported that about 200,000 small businesses folded up during the first year of the pandemic (https://www.wsj.com/articles/small-businesses-on-one-chicago-street-struggle-to-meet-demand-as-COVID-19-restrictions-end-11624267802, accessed on 20 November 2024). |

| 3 | By design, the PPP was generally directed towards small businesses with at most 500 employees. Numerous prior studies have considered PPP as representing lending to small businesses (Chodorow-Reich et al., 2022; Karakaplan, 2021; Marsh & Sharma, 2024; Lopez & Spiegel, 2023). |

| 4 | First round: CARES Act enacted on 27 March 2020—349 billion USD; second round: PPP and Healthcare Enhancement Act enacted on 24 April 2020—321 billion USD; and third round: Consolidated Appropriations Act enacted on 21 December 2020—284 billion USD. |

| 5 | |

| 6 | 285.83% × 0.013 = 3.72%. The standard deviation of 285.83% is from Table 1. See papers such as Ivashina and Scharfstein (2010), Brogaard and Detzel (2015), and Javadi et al. (2017), which use a similar interpretation. |

| 7 | |

| 8 | The results of the chi-square tests are available upon request. |

| 9 | We thank an anonymous reviewer for pointing this out. |

| 10 | We use various definitions of ‘large banks’ specified in the robustness section. |

| 11 | “2021 list of global systemically important banks (G-SIBs)” Financial Stability Board. https://www.fsb.org/wp-content/uploads/P231121.pdf, accessed on 20 November 2024. “2020 list of global systemically important banks (G-SIBs)” (PDF). Financial Stability Board. https://www.fsb.org/wp-content/uploads/P111120.pdf, accessed on 20 November 2024. |

| 12 | https://www.federalreserve.gov/supervisionreg/dfa-stress-tests-2022.htm, accessed on 20 November 2024. |

References

- Abedifar, P., Molyneux, P., & Tarazi, A. (2018). Non-interest income and bank lending. Journal of Banking and Finance, 87, 411–426. [Google Scholar] [CrossRef]

- Acharya, V. V., & Steffen, S. (2020). The risk of being a fallen angel and the corporate dash for cash in the midst of COVID. The Review of Corporate Finance Studies, 9(3), 430–471. [Google Scholar] [CrossRef]

- Acs, Z., & Audretsch, D. (1990). Innovation and small firms. MIT Press. [Google Scholar]

- Amiram, D., & Rabetti, D. (2020). The relevance of relationship lending in times of crisis. Working Paper. Available online: https://www.researchgate.net/publication/344415359_The_Relevance_of_Relationship_Lending_in_Times_of_Crisis (accessed on 20 November 2024).

- Angrist, J., & Pischke, J. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton University Press. [Google Scholar]

- Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58, 277–297. [Google Scholar] [CrossRef]

- Armstrong, C., Balakrishnan, K., & Cohen, D. (2012). Corporate governance and the information environment: Evidence from State antitakeover laws. Journal of Accounting and Economics, 53, 185–204. [Google Scholar] [CrossRef]

- Autor, D., Cho, D., Crane, L. D., Goldar, M., Lutz, B., Montes, J., Peterman, W. B., Ratner, D., Villar, D., & Yildirmaz, A. (2022). An evaluation of the paycheck protection program using administrative payroll microdata. Journal of Public Economics, 211, 104664. [Google Scholar] [CrossRef]

- Balyuk, T., Prabhala, N. R., & Puri, M. (2021). Small bank financing and funding hesitancy in a crisis: Evidence from the paycheck protection program. Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3717259 (accessed on 20 November 2024).

- Bartik, A. W., Cullen, Z. B., Glaeser, E. L., Luca, M., Stanton, C. T., & Sunderam, A. (2020). The targeting and impact of paycheck protection program loans to small businesses (Technical report, NBER, working paper 27623). National Bureau of Economic Research.

- Beauregard, R., Lopez, J. A., & Spiegel, M. M. (2020). Small Business Lending during COVID-19. Federal Reserve Bank of San Francisco. Economic Letter November 23. Small, 2020, 35. [Google Scholar]

- Beck, T., & Keil, J. (2022). Are banks catching corona? Effects of COVID on lending in the US. Journal of Corporate Finance, 72, 102160. [Google Scholar] [CrossRef]

- Beck, T., & Laeven, L. (2006). Resolution of failed banks by deposit insurers: Cross–country evidence (World Bank policy research working paper 3920). World Bank Publications.

- Berger, A. N., & Demirgüç-Kunt, A. (2021). Banking research in the time of COVID-19. Journal of Financial Stability, 57, 100939. [Google Scholar] [CrossRef]

- Berger, A. N., Freed, P. G., Scott, J. A., & Zhang, S. (2021). The Paycheck Protection Program (PPP) from the small business perspective: Did the PPP help alleviate financial and economic constraints? Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3908707 (accessed on 20 November 2024).

- Berger, A. N., Karakaplan, M. U., & Roman, R. A. (2023). Whose bailout is it anyway? The roles of politics in PPP bailouts of small businesses vs. banks. Journal of Financial Intermediation, 56, 101044. [Google Scholar] [CrossRef]

- Bertrand, M., & Mullainathan, S. (2003). Enjoying the quiet life? Corporate governance and managerial preferences. Journal of Political Economy, 111, 1043–1075. [Google Scholar] [CrossRef]

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. [Google Scholar] [CrossRef]

- Boeckx, J., de Sola Perea, M., & Peersman, G. (2020). The transmission mechanism of credit support policies in the euro area. European Economic Review, 124, 103403. [Google Scholar] [CrossRef]

- Bond, S. R., Hoeffler, A., & Temple, J. R. W. (2001). GMM estimation of empirical growth models. CEPR Discussion Paper 3048. Available online: https://papers.ssrn.com/sol3/papers.cfm?Abstract_id=290522 (accessed on 20 November 2024).

- Brewer, E., III, Minton, B. A., & Moser, J. T. (2000). Interest-rate derivatives and bank lending. Journal of Banking and Finance, 24, 353–379. [Google Scholar] [CrossRef]

- Brogaard, J., & Detzel, A. (2015). The asset-pricing implications of government economic policy uncertainty. Management Science, 61(1), 3–18. [Google Scholar] [CrossRef]

- Calmès, C., & Théoret, R. (2015). Product-mix and bank performance: New U.S. and Canadian evidence. Managerial Finance, 41(8), 773–805. [Google Scholar] [CrossRef]

- Cecchetti, S. G., King, M. R., & Yetm, J. (2011). Weathering the financial crisis: Good policy or good luck? BIS Working Paper No. 351. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1942165 (accessed on 20 November 2024).

- Chetty, R., Friedman, J. N., & Stepner, M. (2023). The economic impacts of COVID-19: Evidence from a new public database built using private sector data. Quarterly Journal of Economics, 139(2), 829–889. [Google Scholar] [CrossRef]

- Chodorow-Reich, G., Darmouni, O., Luck, S., & Plosser, M. C. (2022). Bank liquidity provision across the firm size distribution. Journal of Financial Economics, 144(3), 908–932. [Google Scholar] [CrossRef]

- Core, F., & De Marco, F. (2021). Public guarantees for small businesses in Italy during COVID-19. CEPR Discussion Paper No. DP15799. Available online: https://www.bundesbank.de/resource/blob/875918/de7856951091081783b1fdaf01b37aa7/mL/2021-09-27-online-core-data.pdf (accessed on 20 November 2024).

- De Nicoló, G. (2000). Size, charter value and risk in banking: An international perspective (International Finance Discussion Papers No. 689). Board of Governors of the Federal Reserve System (U.S.).

- Diamond, D. (1991). Monitoring and reputation: The choice between bank loans and directly placed debt. Journal of Political Economy, 99(4), 689–721. [Google Scholar] [CrossRef]

- Dilger, R. (2018). Small business administrative and job creation. Congressional Research Service. [Google Scholar]

- Disalvo, J., & Johnston, R. (2017). The rise in loan-to-deposit ratios: Is 80 the new 60? Federal Reserve Bank of Philadelphia, 2(3), 18–23. [Google Scholar]

- Duchin, R., & Hackney, J. (2021). Buying the vote? The economics of electoral politics and small-business loans. Journal of Financial and Quantitative Analysis, 56(7), 2439–2473. [Google Scholar] [CrossRef]

- Ennis, H., & Jarque, A. (2021). Bank lending in the time of COVID. Richmond Fed Economic Brief. Available online: https://www.richmondfed.org/publications/research/economic_brief/2021/eb_21-05 (accessed on 20 November 2024).

- Granja, J., Makridis, C., Yannelis, C., & Zwick, E. (2022). Did the paycheck protection program hit the target? Journal of Financial Economics, 145(3), 725–761. [Google Scholar] [CrossRef] [PubMed]

- Greenwald, D. L., Krainer, J., & Paul, P. (2020). The credit line channel (Working paper series). Federal Reserve Bank of San Francisco. [Google Scholar]

- Griffin, J. M., Kruger, S., & Mahajan, P. (2023). Did FinTech lenders facilitate PPP fraud? The Journal of Finance, 78(3), 1777–1827. [Google Scholar] [CrossRef]

- Headd, B. (2010). An analysis of small business and jobs. US Small Business Administration, Office of Advocacy. [Google Scholar]

- Hesse, H., & Čihák, M. (2007). Cooperative banks and financial stability (IMF working paper 07/2). International Monetary Fund.

- Honda, T., Hosono, K., Miyakawa, D., Ono, A., & Uesugi, I. (2023). Determinants and effects of the use of COVID-19 business support programs in Japan. Journal of The Japanese and International Economies, 67, 101239. [Google Scholar] [CrossRef]

- Hoshi, T., Kawaguchi, D., & Ueda, K. (2023). Zombies, again? The COVID-19 business support programs in Japan. Journal of Banking & Finance, 147, 106421. [Google Scholar]

- Hubbard, R. G., & Strain, M. R. (2020). Has the paycheck protection program succeeded? Technical Report, NBER, Working Paper 28032. Available online: https://www.nber.org/papers/w28032 (accessed on 20 November 2024).

- Humphries, J. E., Neilson, C. A., & Ulyssea, G. (2020). Information frictions and access to the paycheck protection program. Journal of Public Economics, 190, 104244. [Google Scholar] [CrossRef]

- Ivashina, V., & Scharfstein, D. (2010). Bank lending during the financial crisis of 2008. Journal of Financial Economics, 97(3), 319–338. [Google Scholar] [CrossRef]

- Javadi, S., Kim, S., Krehbiel, T., & Nejadmalyeri, A. (2017). Measuring correlated default risk: A new metric and validity tests. Journal of Fixed Income, 27(2), 1–24. [Google Scholar] [CrossRef]

- Joaquim, G., & Netto, F. (2021). Bank incentives and the impact of the paycheck protection program. Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3704518 (accessed on 20 November 2024).

- Karakaplan, M. U. (2021). This time is really different: The multiplier effect of the Paycheck Protection Program (PPP) on small business bank loans. Journal of Banking and Finance, 133, 106223. [Google Scholar] [CrossRef]

- Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: First evidence on materiality. Accounting Review, 91(6), 1697–1724. [Google Scholar] [CrossRef]

- Kobe, K. (2012). How did the financial crisis affect small business lending in the United States? Research Issue No. 10-M-0258. Small Business Administration Office of Advocacy. [Google Scholar]

- Kuratko, D. F., & Hodges, R. M. (1998). Entrepreneurship: A contemporary approach. Dryden Press. [Google Scholar]

- Lepetit, L., & Strobel, F. (2015). Bank insolvency risk and Z-score measures: A refinement. Finance Research Letters, 13, 214–224. [Google Scholar] [CrossRef]

- Li, L., & Strahan, P. (2021). Who supplies PPP loans (and does it matter)? Banks, relationships, and the COVID crisis. Journal of Financial and Quantitative Analysis, 56(7), 2411–2438. [Google Scholar] [CrossRef]

- Lopez, J. A., & Spiegel, M. M. (2023). Small business lending under the PPP and PPPLF programs. Journal of Financial Intermediation, 53, 101017. [Google Scholar] [CrossRef]

- Marsh, W. B., & Sharma, P. (2024). Loan guarantees in a crisis: An antidote to a credit crunch? Journal of Financial Stability, 72, 101244. [Google Scholar] [CrossRef]

- Mkhaiber, A., & Werner, R. A. (2021). The relationship between bank size and the propensity to lend to small firms: New empirical evidence from a large sample. Journal of International Money and Finance, 110, 102281. [Google Scholar] [CrossRef]

- Ono, A., Uesugi, I., & Yasuda, Y. (2013). Are lending relationships beneficial or harmful for public credit guarantees? Evidence from Japan’s emergency credit guarantee program. Journal of Financial Stability, 9(2), 151–167. [Google Scholar] [CrossRef]

- Orzechowski, P. E. (2020). U.S. small business administration loans and U.S. state-level employment. Journal of Economics and Finance, 44, 486–505. [Google Scholar] [CrossRef]

- Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. American Economic Review, 88(3), 559–586. [Google Scholar]

- Santomero, A. W., & Chung, E.-J. (1992). Evidence in support of broader banking powers. Financial markets. Institutions and Instruments, 1, 1–69. [Google Scholar]

- Sengupta, R., & Byrdak, A. 2021 November. Bank profitability rebounds despite compressed interest margins. Economic Bulletin, Federal Reserve Bank of Kansas City. [Google Scholar]

- Sharpe, S. A., & Acharya, S. (1992). Loan losses, bank capital, and the credit crunch. Federal Reserve Board of Governors. [Google Scholar]

- Sinkey, J. F., & Nash, R. C. (1993). Assessing the riskiness and profitability of credit-card banks. Journal of Financial Services Research, 7(2), 127–150. [Google Scholar] [CrossRef]

- Stiroh, K. J. (2004a). Diversification in banking: Is noninterest income the answer? Journal of Money, Credit and Banking, 36(5), 853–882. [Google Scholar] [CrossRef]

- Stiroh, K. J. (2004b). Do community banks benefit from diversification? Journal of Financial Services Research, 25(2–3), 135–160. [Google Scholar] [CrossRef]

| Panel A: Descriptive Statistics | ||||||

| N | Mean | Median | Min | Max | Std | |

| G_PPP (%) | 29,067 | 0.187 | 0.000 | −7.325 | 14.819 | 3.492 |

| G_CILS (%) | 34,692 | 0.285 | −0.075 | −3.977 | 6.236 | 2.555 |

| G_CILL (%) | 29,819 | −0.136 | 0.015 | −13.060 | 8.855 | 3.736 |

| LDR (%) | 34,825 | 71.055 | 72.183 | 33.884 | 103.582 | 18.956 |

| CARATIO (%) | 34,782 | 11.201 | 10.520 | 7.635 | 18.567 | 2.818 |

| NIM (%) | 34,775 | 3.395 | 3.393 | 2.109 | 4.706 | 0.676 |

| ROA (%) | 34,782 | 1.084 | 1.059 | −3.219 | 3.771 | 0.803 |

| LLOSS (%) | 34,520 | 1.351 | 1.272 | 0.583 | 2.536 | 0.493 |

| UCLN (%) | 34,827 | 11.083 | 9.843 | 1.209 | 44.377 | 7.601 |

| NONII (%) | 34,782 | 0.706 | 0.527 | 0.096 | 2.444 | 0.597 |

| LIQUIDITY (%) | 34,827 | 0.273 | 0.253 | 0.086 | 0.561 | 0.130 |

| G_GDP (%) | 34,827 | 1.227 | 0.550 | −9.080 | 12.230 | 6.441 |

| G_COVID (%) | 34,827 | 2.124 | 0.868 | −0.693 | 10.679 | 3.651 |

| Panel B: Mean Difference Tests | ||||||

| B1: G_PPP | B2: G_CILS | |||||

| Low | High | Low CILS | High CILS | |||

| Mean | Mean | Difference | Mean | Mean | Difference | |

| LDR | 69.145 | 78.232 | 9.087 *** | 75.066 | 73.590 | −1.476 *** |

| CARATIO | 12.001 | 9.333 | −2.668 *** | 11.142 | 12.411 | 1.269 *** |

| ROA | 1.322 | 1.165 | −0.157 *** | 1.085 | 1.051 | −0.033 *** |

| LLOSS | 1.403 | 1.438 | 0.035 ** | 1.451 | 1.379 | −0.072 *** |

| UCLN | 9.433 | 12.540 | 3.107 *** | 0.121 | 0.325 | 0.203 *** |

| NONII | 0.721 | 0.834 | 0.113 *** | 0.982 | 2.068 | 1.086 *** |

| NIM | 2.294 | 2.853 | 0.563 *** | 3.419 | 3.483 | 0.064 *** |

| LIQUIDITY | 0.268 | 0.290 | 0.022 *** | 0.285 | 0.271 | −0.013 *** |

| N | 14,278 | 14,280 | 17,351 | 17,349 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|

| VARIABLES | G_PPP | G_PPP | G_PPP | G_CILS | G_CIL | G_CILL |

| LDRt−1 | 0.013 *** | 0.026 *** | 0.013 *** | −0.026 *** | 0.007 ** | −0.028 *** |

| (3.80) | (3.23) | (3.58) | (−3.07) | (2.14) | (−3.42) | |

| CARATIOt−1 | 0.013 | 0.010 | 0.031 | 0.040 *** | 0.107 *** | 0.036 ** |

| (0.70) | (0.54) | (1.61) | (4.35) | (3.57) | (2.06) | |

| NIMt−1 | 0.108 | 0.107 | 0.058 | 0.060 | −0.127 | 0.420 *** |

| (0.90) | (0.88) | (0.49) | (0.77) | (−0.94) | (3.43) | |

| ROAt−1 | −0.391 *** | −0.377 *** | −0.371 *** | −0.097 *** | −0.300 *** | 0.130 *** |

| (−5.92) | (−5.71) | (−5.78) | (−3.35) | (−4.65) | (3.59) | |

| LLOSSt−1 | 0.332 ** | 0.274 ** | 0.326 ** | −0.105 ** | 0.280 ** | −0.248 *** |

| (2.49) | (2.54) | (2.53) | (−2.04) | (2.49) | (−3.16) | |

| UCLNt−1 | −0.004 | −0.004 | 0.006 | 0.006 | 0.047 *** | 0.008 |

| (−0.43) | (−0.39) | (0.70) | (0.49) | (3.45) | (0.87) | |

| NONIIt−1 | 0.231 *** | 0.219 *** | 0.215 *** | 0.059 *** | 0.158 *** | −0.053 |

| (4.61) | (4.43) | (4.40) | (3.11) | (3.02) | (−1.60) | |

| LIQUIDITYt−1 | 0.748 * | 1.818 ** | 1.166 ** | −1.632 ** | 2.262 *** | 0.418 |

| (1.67) | (2.57) | (2.57) | (−2.09) | (4.70) | (0.74) | |

| G_NCILt−1 | 0.026 * | |||||

| (1.82) | ||||||

| G_NCILt | −0.244 *** | |||||

| (−9.36) | ||||||

| G_GDPt−1 | −0.127 *** | −0.128 *** | −0.127 *** | 0.285 *** | −0.130 *** | 0.722 *** |

| (−25.82) | (−23.69) | (−25.97) | (25.70) | (−21.88) | (43.93) | |

| G_COVIDt−1 | 0.557 *** | 0.556 *** | 0.551 *** | 1.103 *** | 0.556 *** | −2.063 *** |

| (35.76) | (33.98) | (35.67) | (25.90) | (30.07) | (−42.67) | |

| Constant | −2.651 *** | −3.730 *** | −2.682 *** | −1.222 * | −2.603 *** | −0.910 |

| (−4.13) | (−4.27) | (−4.21) | (−1.78) | (−3.98) | (−1.12) | |

| Observations | 28,561 | 28,561 | 28,561 | 29,440 | 29,440 | 29,440 |

| Adj. R-squared | 0.118 | 0.119 | 0.143 | 0.092 | 0.108 | 0.179 |

| Bank FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Bank clustering | Yes | Yes | Yes | Yes | Yes | Yes |

| 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|

| Panel A: G_PPP | Panel B: G_ CILS | Panel C: G_CILL | ||||

| Low Risk | High Risk | Low Risk | High Risk | Low Risk | High Risk | |

| LDRt−1 | 0.013 | 0.057 *** | −0.026 ** | −0.016 * | −0.019 * | −0.025 *** |

| (0.94) | (3.62) | (−2.35) | (−1.81) | (−1.73) | (−2.71) | |

| CARATIOt−1 | 0.038 | 0.127 ** | 0.052 *** | 0.088 *** | 0.137 *** | 0.196 *** |

| (1.50) | (2.04) | (2.91) | (3.04) | (4.21) | (2.81) | |

| NIMt−1 | −0.000 | 0.424 ** | 0.092 | 0.100 | −0.190 ** | −0.284 *** |

| (−0.00) | (2.40) | (1.05) | (0.62) | (−2.04) | (−2.84) | |

| ROAt−1 | −0.265 *** | −0.609 *** | −0.088 ** | −0.321 *** | 0.009 | 0.169 *** |

| (−3.36) | (−4.40) | (−2.14) | (−3.97) | (0.18) | (2.67) | |

| LLOSSt−1 | 0.164 | 0.605 *** | −0.070 | −0.079 | −0.299 | −0.252 |

| (1.54) | (3.24) | (−1.16) | (−0.79) | (−1.33) | (−1.04) | |

| UCLNt−1 | 0.000 | −0.026 *** | −0.006 | 0.912 | 0.017 | 0.060 *** |

| (1.00) | (−2.80) | (−0.82) | (1.49) | (1.01) | (3.76) | |

| NONIIt−1 | 0.161 *** | 0.361 *** | 0.054 ** | 0.120 *** | 0.004 | −0.102 |

| (2.93) | (2.69) | (1.98) | (2.82) | (0.04) | (−0.78) | |

| LIQUIDITYt−1 | 1.505 | 5.292 *** | −1.171 | −0.647 | 1.063 | 1.036 |

| (1.32) | (3.11) | (−1.13) | (−0.75) | (1.28) | (1.06) | |

| G_GDPt−1 | −0.112 *** | −0.164 *** | 0.279 *** | 0.296 *** | 0.010 | −0.005 |

| (−10.33) | (−16.31) | (11.23) | (18.18) | (1.44) | (−0.72) | |

| G_COVIDt−1 | 0.479 *** | 0.698 *** | 1.067 *** | 1.211 *** | −0.039 * | −0.008 |

| (14.74) | (22.76) | (11.14) | (20.28) | (−1.93) | (−0.38) | |

| Constant | −2.504 | −9.337 *** | −1.552 * | −3.114 *** | 0.307 | 0.576 |

| (−1.54) | (−5.54) | (−1.83) | (−3.69) | (0.30) | (0.57) | |

| Observations | 9007 | 9004 | 9007 | 9004 | 9007 | 9004 |

| Adj. R-squared | 0.039 | 0.223 | 0.074 | 0.138 | 0.286 | 0.094 |

| Bank FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Bank clustering | Yes | Yes | Yes | Yes | Yes | Yes |

| 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|

| G_PPP | G_CILS | G_CILL | G_PPP | G_CILS | G_CILL | |

| Z-SCOREt−1 | −0.028 *** | −0.014 | 1.147 *** | |||

| (−14.05) | (−0.90) | (4.75) | ||||

| CVt−1 | 0.600 *** | 0.228 | −0.335 | |||

| (2.78) | (1.29) | (−1.20) | ||||

| Constant | −0.060 | −1.195 * | −1.905 ** | −4.042 *** | −1.322 ** | −0.812 |

| (−0.09) | (−1.73) | (−2.34) | (−4.42) | (−2.01) | (−0.96) | |

| Observations | 28,561 | 29,440 | 29,440 | 28,561 | 29,440 | 29,440 |

| Adj. R-squared | 0.133 | 0.092 | 0.181 | 0.120 | 0.092 | 0.179 |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Bank FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Bank clustering | Yes | Yes | Yes | Yes | Yes | Yes |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

|---|---|---|---|---|---|---|---|---|---|

| Inter | Agric | Credit Card | Comm-ercial | Mortgage | Consumer | Other Specialized | All Other Less1bn | All Other More1bn | |

| LDRt−1 | 0.008 | 0.051 *** | 0.002 | 0.022 * | 0.000 | −0.007 | 0.001 | −0.001 | 0.018 ** |

| (0.66) | (6.83) | (1.69) | (1.89) | (0.03) | (−0.68) | (1.00) | (−0.06) | (2.01) | |

| CARATIOt−1 | −0.028 | 0.164 ** | 0.000 | 0.014 | −0.004 | 0.009 | 0.010 | 0.083 * | 0.082 ** |

| (−0.40) | (2.28) | (0.08) | (0.52) | (−0.23) | (0.55) | (0.91) | (1.73) | (2.42) | |

| NIMt−1 | 0.764 | −0.122 | −0.018 ** | 0.398 *** | 0.016 | 0.075 | 0.062 | 0.193 * | 0.205 |

| (1.91) | (−0.38) | (−2.46) | (2.63) | (0.18) | (0.95) | (0.69) | (1.93) | (1.62) | |

| ROAt−1 | −0.001 | −0.786 *** | 0.029 *** | −0.804 *** | −0.022 | −0.061 | −0.024 * | −0.231 ** | 0.013 |

| (−0.00) | (−4.85) | (3.31) | (−6.13) | (−1.25) | (−1.25) | (−1.70) | (−2.09) | (0.19) | |

| LLOSSt−1 | −0.066 | 0.226 * | 0.054 *** | 0.887 *** | 0.109 | −0.055 | 0.020 | 0.185 | 0.023 ** |

| (−1.17) | (1.80) | (3.55) | (3.21) | (1.24) | (−0.70) | (0.55) | (1.02) | (2.00) | |

| UCLNt−1 | −1.647 | 0.821 * | −0.015 | −2.960 *** | −1.049 | 0.094 | 0.003 | −0.790 | −1.812 *** |

| (−1.09) | (1.72) | (−0.49) | (−3.17) | (−1.08) | (0.24) | (0.65) | (−1.25) | (−3.07) | |

| NONIIt−1 | −0.021 | −0.036 | −0.005 | 0.333 ** | 0.012 | −0.011 | 0.015 | 0.074 * | −0.013 |

| (−0.05) | (−0.23) | (−1.64) | (2.10) | (1.59) | (−0.37) | (1.51) | (1.75) | (−0.25) | |

| LIQUIDITYt−1 | −0.862 | 4.845 *** | 0.048 | 1.038 | −0.312 | 1.400 | 0.586 | 1.290 * | 2.061 ** |

| (−1.73) | (7.49) | (0.25) | (0.94) | (−0.51) | (0.89) | (0.89) | (1.72) | (2.39) | |

| G_GDPt−1 | −0.003 | −0.119 *** | −0.018 | −0.167 *** | −0.012 ** | −0.008 | −0.029 *** | −0.035 *** | −0.056 *** |

| (−1.32) | (−12.08) | (−1.67) | (−18.70) | (−2.30) | (−0.59) | (−2.81) | (−4.49) | (−6.49) | |

| G_COVIDt−1 | 0.002 | 0.513 *** | 0.058 | 0.721 *** | 0.077 *** | 0.065 | 0.159 *** | 0.214 *** | 0.217 *** |

| (0.24) | (17.97) | (1.76) | (26.60) | (4.48) | (1.62) | (5.14) | (8.92) | (8.15) | |

| Constant | −0.047 | −6.187 *** | −0.582 ** | −4.721 *** | −0.177 | −0.120 | −1.056 ** | −2.510 *** | −3.173 *** |

| (−0.09) | (−5.76) | (−2.66) | (−3.26) | (−0.28) | (−0.10) | (−2.38) | (−2.81) | (−3.35) | |

| Observations | 30 | 6807 | 66 | 15,413 | 1615 | 194 | 1573 | 2821 | 458 |

| Adj. R-squared | 0.561 | 0.142 | 0.172 | 0.132 | 0.200 | 0.207 | 0.289 | 0.214 | 0.476 |

| Bank FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Bank clustering | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|

| Panel A: Panel Fixed Effects | Panel B: GMM | |||||

| G_PPP | G_CILS | G_CILL | G_PPP | G_CILS | G_CILL | |

| PPPt−1 | 0.058 *** | 0.007 | ||||

| (4.83) | (0.13) | |||||

| G_CILSt−1 | −0.145 *** | −0.409 *** | ||||

| (−2.86) | (−3.87) | |||||

| G_CILLt−1 | −0.398 *** | −0.125 *** | ||||

| (−29.24) | (−2.62) | |||||

| LDRt−1 | 0.010 *** | −0.029 *** | −0.001 *** | 0.581 *** | −0.343 *** | −0.242 ** |

| (3.69) | (−2.79) | (−4.52) | (4.75) | (−4.82) | (−2.41) | |

| CARATIOt−1 | 0.030 ** | 0.045 *** | 0.041 | 0.677 | 0.164 * | 0.315 *** |

| (2.05) | (5.31) | (1.29) | (0.48) | (1.67) | (2.76) | |

| NIMt−1 | 0.097 | 0.055 | 0.087 | −0.477 | −0.142 ** | −0.078 |

| (0.83) | (1.03) | (0.67) | (−0.82) | (−2.46) | (−0.03) | |

| ROAt−1 | −0.350 *** | −0.061 ** | 0.339 *** | −0.434 ** | −0.172 *** | 0.117 |

| (−5.91) | (−2.50) | (5.30) | (−2.19) | (−4.42) | (0.67) | |

| LLOSSt−1 | 0.322 *** | −0.106 ** | −0.126 | 0.334 *** | 0.150 ** | −0.422 *** |

| (2.64) | (−2.30) | (−1.20) | (3.45) | (2.43) | (−7.57) | |

| UCLNt−1 | 0.007 | 0.361 ** | 2.818 *** | 1.423 | 0.890 | 0.196 *** |

| (0.93) | (2.33) | (2.80) | (1.36) | (0.31) | (6.04) | |

| NONIIt−1 | 0.204 *** | 0.030 ** | −0.171 *** | 0.364 ** | 0.103 *** | −0.321 *** |

| (4.52) | (1.98) | (−4.22) | (2.34) | (3.66) | (−2.70) | |

| LIQUIDITYt−1 | 0.619 * | −2.032 ** | 2.802 *** | 0.787 *** | −0.441 ** | 0.643 |

| (1.66) | (−2.12) | (4.71) | (3.37) | (−2.53) | (0.33) | |

| G_GDPt−1 | −0.161 *** | 0.004 | 0.006 *** | −0.172 ** | 0.737 *** | 0.022 *** |

| (−17.59) | (1.61) | (3.21) | (−2.09) | (5.65) | (3.18) | |

| G_COVIDt−1 | 0.626 *** | 0.197 *** | −0.236 *** | 0.701 ** | −0.126 *** | −0.235 *** |

| (27.36) | (13.77) | (−19.87) | (2.39) | (−3.62) | (−3.03) | |

| Constant | −2.420 *** | 1.296 | −0.809 | |||

| (−4.26) | (1.46) | (−1.41) | ||||

| Observations | 29,440 | 29,440 | 29,440 | 28,561 | 29,440 | 29,440 |

| p-val (AR (2)) | 0.577 | 0.217 | 0.939 | |||

| p-val (Hansen Stat) | 0.204 | 0.190 | 0.482 | |||

| Adj. R-Square | 0.129 | 0.103 | 0.211 | |||

| Bank FE | Yes | Yes | Yes | |||

| Year FE | Yes | Yes | Yes | |||

| Bank Clustering | Yes | Yes | Yes | |||

| (1) | (2) | (3) | |

|---|---|---|---|

| G_PPP | G_CILS | G_CILL | |

| LDRt−1 | 0.009 *** | −0.026 *** | −0.028 *** |

| (2.58) | (−3.08) | (−3.39) | |

| CARATIOt−1 | −0.116 *** | 0.041 *** | 0.049 *** |

| (−5.01) | (4.39) | (2.70) | |

| NIMt−1 | −0.075 | 0.066 | 0.432 *** |

| (−0.63) | (0.83) | (3.47) | |

| ROAt−1 | −0.312 *** | −0.097 *** | 0.126 *** |

| (−5.81) | (−3.36) | (3.43) | |

| LLOSSt−1 | 0.197 ** | −0.109 ** | −0.239 *** |

| (2.17) | (−2.07) | (−3.20) | |

| UCLNt−1 | −0.001 *** | 0.004 | 0.019 * |

| (−7.06) | (0.41) | (1.89) | |

| NONIIt−1 | 0.162 *** | 0.059 *** | −0.049 |

| (3.83) | (3.12) | (−1.46) | |

| LIQUIDITYt−1 | 2.143 *** | −1.586 ** | 0.304 |

| (4.40) | (−2.06) | (0.54) | |

| SIZEt−1 | −7.397 *** | 0.027 | 0.773 * |

| (−11.33) | (1.58) | (1.75) | |

| G_GDPt−1 | −0.159 *** | 0.285 *** | 0.714 *** |

| (−27.98) | (25.65) | (42.98) | |

| G_COVIDt−1 | 0.606 *** | 1.104 *** | −2.032 *** |

| (37.65) | (25.82) | (−41.20) | |

| Constant | 94.002 *** | −1.590 ** | −10.971 * |

| (10.99) | (−2.43) | (−1.86) | |

| Observations | 28,561 | 29,440 | 29,440 |

| Adj. R-squared | 0.172 | 0.092 | 0.180 |

| Bank FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Bank clustering | Yes | Yes | Yes |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

|---|---|---|---|---|---|---|---|---|---|

| Excl. 1 bn USD | Excl. 10 bn USD | Excl. SIBs | |||||||

| G_PPP | G_CILS | G_CILL | G_PPP | G_CILS | G_CILL | G_PPP | G_CILS | G_CILL | |

| LDRt−1 | 0.015 *** | −0.014 *** | −0.037 *** | 0.016 *** | −0.029 *** | −0.027 *** | 0.014 *** | −0.026 *** | −0.029 *** |

| (4.67) | (−4.21) | (−4.80) | (4.15) | (−3.53) | (−3.37) | (3.87) | (−3.09) | (−3.41) | |

| CARATIOt−1 | 0.029 | 0.044 *** | 0.030 | 0.007 | 0.044 *** | 0.037 ** | 0.012 | 0.040 *** | 0.035 ** |

| (1.56) | (4.56) | (1.64) | (0.35) | (4.79) | (2.12) | (0.64) | (4.37) | (1.99) | |

| NIMt−1 | 0.032 | −0.072 | 0.450 *** | 0.139 | 0.069 | 0.413 *** | 0.110 | 0.059 | 0.422 *** |

| (0.27) | (−1.25) | (3.35) | (1.11) | (0.86) | (3.32) | (0.91) | (0.75) | (3.43) | |

| ROAt−1 | −0.384 *** | −0.062 *** | 0.135 *** | −0.442 *** | −0.101 *** | 0.140 *** | −0.402 *** | −0.098 *** | 0.131 *** |

| (−5.24) | (−2.65) | (2.69) | (−5.50) | (−3.38) | (3.28) | (−5.87) | (−3.36) | (3.55) | |

| LLOSSt−1 | 0.460 *** | −0.090 * | −0.427 *** | 0.379 ** | −0.133 ** | −0.282 *** | 0.343 ** | −0.112 ** | −0.245 *** |

| (3.43) | (−1.66) | (−3.64) | (2.44) | (−2.43) | (−3.12) | (2.50) | (−2.14) | (−3.12) | |

| UCLNt−1 | 0.000 | −0.004 | 0.004 | −0.000 | 0.003 | 0.008 | −0.000 | 0.005 | 0.007 |

| (0.39) | (−1.04) | (0.42) | (−0.75) | (0.32) | (0.94) | (−0.50) | (0.48) | (0.79) | |

| NONIIt−1 | 0.224 *** | 0.037 ** | −0.062 | 0.262 *** | 0.061 *** | −0.059 * | 0.238 *** | 0.059 *** | −0.053 |

| (4.45) | (2.36) | (−1.57) | (4.53) | (3.13) | (−1.70) | (4.62) | (3.13) | (−1.59) | |

| LIQUIDITYt−1 | 1.012 ** | −0.576 | 0.259 | 0.876 * | −1.867 ** | 0.258 | 0.744 * | −1.639 ** | 0.381 |

| (2.23) | (−1.60) | (0.40) | (1.85) | (−2.50) | (0.44) | (1.65) | (−2.10) | (0.66) | |

| G_GDPt−1 | −0.111 *** | 0.300 *** | 0.743 *** | −0.127 *** | 0.291 *** | 0.734 *** | −0.128 *** | 0.286 *** | 0.724 *** |

| (−21.13) | (26.14) | (40.17) | (−24.96) | (26.51) | (43.69) | (−25.72) | (25.68) | (43.84) | |

| G_COVIDt−1 | 0.513 *** | 1.104 *** | −2.112 *** | 0.558 *** | 1.120 *** | −2.094 *** | 0.558 *** | 1.107 *** | −2.066 *** |

| (30.93) | (26.13) | (−39.15) | (34.72) | (26.53) | (−42.46) | (35.65) | (25.86) | (−42.54) | |

| Constant | −2.928 *** | −1.885 *** | −0.316 | −2.917 *** | −1.005 | −0.960 | −2.675 *** | −1.210 * | −0.873 |

| (−5.22) | (−5.42) | (−0.39) | (−4.34) | (−1.50) | (−1.20) | (−4.14) | (−1.76) | (−1.06) | |

| Observations | 22,815 | 26,580 | 26,534 | 27,629 | 28,976 | 28,975 | 28,417 | 29,230 | 29,255 |

| Adj. R-squared | 0.140 | 0.090 | 0.160 | 0.128 | 0.098 | 0.179 | 0.118 | 0.092 | 0.179 |

| Bank FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Bank clustering | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abugri, B.A.; Osah, T.T. US Bank Lending to Small Businesses: An Analysis of COVID-19 and the Paycheck Protection Program. J. Risk Financial Manag. 2025, 18, 231. https://doi.org/10.3390/jrfm18050231

Abugri BA, Osah TT. US Bank Lending to Small Businesses: An Analysis of COVID-19 and the Paycheck Protection Program. Journal of Risk and Financial Management. 2025; 18(5):231. https://doi.org/10.3390/jrfm18050231

Chicago/Turabian StyleAbugri, Benjamin A., and Theophilus T. Osah. 2025. "US Bank Lending to Small Businesses: An Analysis of COVID-19 and the Paycheck Protection Program" Journal of Risk and Financial Management 18, no. 5: 231. https://doi.org/10.3390/jrfm18050231

APA StyleAbugri, B. A., & Osah, T. T. (2025). US Bank Lending to Small Businesses: An Analysis of COVID-19 and the Paycheck Protection Program. Journal of Risk and Financial Management, 18(5), 231. https://doi.org/10.3390/jrfm18050231