Abstract

We study a discrete-time interaction risk model with delayed claims within the framework of the compound binomial model. Using the technique of generating functions, we derive both a recursive formula and a defective renewal equation for the expected discounted penalty function. As applications, the probabilities of ruin and the joint distributions of the surplus one period to ruin and the deficit at ruin are investigated. Numerical illustrations are also given.

1. Introduction

In the last decade, risk models with time-correlated claims have been extensively studied in insurance and actuarial literature. For instance, see [1,2,3,4,5,6] and the reference therein. Among them, risk models with delayed claims (incurred, but not reported or reported, but not settled claims) have received considerable attention. Yuen and Guo [1] study a delayed claims risk model within the framework of the compound binomial model and obtain recursive formulas for the finite time ruin probabilities. Xiao and Guo [7] further investigate the aforementioned risk model and derive a recursive equation for the joint distribution of the surplus immediately prior to ruin and deficit at ruin. Bao and Liu [8] generalize the model in [1] by considering random premium income; both the probability of ultimate ruin and the joint distribution of the surplus prior to and at ruin are studied. When dividend payments are ruled by a constant dividend barrier in the model studied by [1], Wu and Li [9] investigate the expected present value of total dividends. Meanwhile, attention has also been paid to risk models whose aggregate claim process is a book of insurance business. For instance, see [10,11,12,13,14,15], among many others. In the case of two classes of business, Wu and Yuen [16] consider an interaction risk model with delayed claims and derive a recursive equation for the finite time survival probabilities. More results about risk models with delayed claim settlements can be found in [17,18,19].

In this paper, we propose a discrete-time interaction risk model that involves two classes of insurance claims, namely Class 1 and Class 2. In each time period, the probability of having a main claim in Class is and the probability of no main claim is . Thus, the number of main claims in Class is a binomial process with parameter . Independence is assumed between and . The claim amount random variables (r.v.s) in Class 1 and Class 2 are denoted by and , which are two sequences of independent and identically distributed (i.i.d.) positive and integer valued r.v.s. For , we define

The genetic r.v.s of and are denoted by X and Y with mean and , respectively. It is assumed that each main claim in one class induces a by-claim in the other class. Each main claim in Class and its associated by-claim in the other class may occur simultaneously with probability or the occurrence of the by-claim may be delayed to the next time period with probability .

Under the above assumptions, claims in each of the classes can be classified into two groups, one for main claims in the current class and one for by-claims induced by the main claims occurring in the other class. Note that the interaction comes from the assumption that main claims and by-claims within the same class are identically distributed. Although this assumption seems to be barely satisfactory, we imagine it could make sense in some special circumstances. For example, an insurer provides warehousing companies with a type of “full coverage” insurance. More precisely, risk management services are provided for: (i) the goods stored; and (ii) the warehouses of the company. In this case, a spontaneous fire of the goods might lead to an explosion and destroy the warehouses. On the other hand, a destruction of the warehouses would probably cause severe damage to the goods.

The total claim amount process is given by

where is the total claims (including main claims and by-claims) in Class i in the first t time period. If we suppose that the insurance company collects a unit amount of premium in each time period, then the surplus process can be written as

where is the initial surplus. This leads to the definition of the time of ruin

It is obvious that is the surplus one period prior to ruin, and is the deficit at ruin. The expected discounted penalty function is defined as

Here, is the one-period discount factor, is the so-called penalty function and is the indicator function.

It is not difficult to verify that . Additionally, for , it holds that

To guarantee that Equation (2) has a positive drift, we further assume

where is the relative safety loading parameter.

The rest of paper is structured as follows. In Section 2, the explicit expression for the generating function of is derived by introducing three supplementary surplus processes. In Section 3, we derive not only the recursive formula, but also the defective renewal equation for . Based on these results, the joint distributions of the surplus one period prior to ruin and the deficit at ruin, as well as the probabilities of ruin are studied in Section 4. Numerical illustrations are also given in Section 4.

2. The Generating Function of the Expected Discounted Penalty Function

To deal with in detail, we need to define the following supplementary surplus processes

where and are independent r.v.s having the same distribution function with X and Y, respectively. The expected discounted penalty function associated with the surplus process is denote by for .

By conditioning on the occurrence (or not) of claims and their amounts (if necessary) in the next period in risk process Equation (2), one finds, for ,

where * is the convolution factor, is the probability mass function defined by Equation (1) and

We use the technique of generating functions to investigate the expected discounted penalty function. The generating function of a function f is denoted by adding a hat on the corresponding letter, i.e., . Moreover, if is a matrix with being its elements, then .

Multiplying both sides of Equation (8) by and summing over u from 1 to ∞ yields

where and for .

Similar to the derivation of Equation (9), it can be obtained from the supplementary surplus processes Equations (4)–(6) that

where

On the other hand, it is known from Equation (9) that

Substituting Equation (11) into Equation (10) yields

where and for .

To give the explicit expression for the generating function of the expected discounted penalty function, we define

with and being the (defective) distribution functions of g and h, respectively. Then, it is easy to see that

For the rest of the paper, we denote by for . Then, combining Equations (9) and (12) yields

In order to determine the constant , we need to investigate the so-called Lundberg’s fundamental equation defined as

Lemma 1. The Lundberg’s fundamental Equation (14) has exactly two roots, say and .

Proof. It is easy to verify that and , which implies that is an increasing convex function. Hence, Equation (14) has at most two roots. By noting that

we conclude that there is a root to Equation (14). Moreover, it is known from the safety loading condition Equation (3) that

which yields that there exists another real number , such that . ☐

Setting in Equation (13), we can derive an expression for .

Theorem 1. When the initial surplus is zero, the expected discounted penalty function can be calculated by

To end this section, we conclude that an explicit expression for the generating function of is given by Equation (13), where the constant is determined by Equation (15).

3. Recursive Equations for

In this part, we show that can be calculated by a recursive equation, from which the defective renewal equation for can be obtained.

Theorem 2. For , it holds that

where

and the constant can be determined by Equation (15).

Proof. It is known from Equation (13) that

After some modification, one could see that Equation (17) is equivalent to

which yields Equation (16) by comparing the coefficients of . ☐

Now, we are in a position to derive the defective renewal equation for . It is known from Equation (16) that

Multiplying both sides of Equation (18) by and summing over k from one to u yields

which can be rewritten as

Substituting Equation (14) into Equation (19), we get

To simplify the right-hand side of Equation (20), we define the following auxiliary functions:

where

After some algebra, we know from Equation (15) that

Hence, substituting Equation (23) into Equation (20) yields the following result for .

Theorem 3. For , it holds that

Now, we demonstrate that the renewal Equation (24) is defective. When , we obtain by reversing the order of summation:

When , it is easy to see that

Consequently, we know from the safety loading condition that

Therefore, we conclude from Equations (25) and (27) that Equation (24) is a defective renewal equation.

It is obvious that the values of can be recursively evaluated by Equation (16) or Equation (24). Moreover, applying Equation (16) in a recursive procedure seems to be much easier than applying Equation (24). However, the defective renewal Equation (24) can be used to deduce both a compound geometric tail expression and an asymptotic estimate for (see, for instance, [20], in which the analogue results are obtained for probabilities of ruin in the classical risk model).

4. Ruin-Related Quantities

In this section, we investigate some ruin-related quantities. For , denote by

the probabilities of ruin. For and , let

be the joint distribution of the surplus one period prior to ruin and the deficit at ruin. Then, it is obvious that .

4.1. The Evaluation of

Throughout this part, it is assumed that and , . In this special case, we have for . By noting

we define the following auxiliary functions

where , for any coefficients and functions . Then, it is known from Equation (28) that

and

for . Hence, substituting Equation (29) into Equation (15) yields

where

Similarly, we know from Equations (16), (26) and (30) that

We remark that Equations (14) and (21) in [7] are recovered by Equations (32) and (33) in the present paper with , respectively.

It is notable that the defective renewal equation for can also be obtained. In the case of , we know from Equation (30) that

Similarly, it is not difficult to verify that

and consequently,

Substituting Equations (26), (34) and (35) into Equation (24) yields the defective renewal equation for as follows:

where and are tails of G and H, i.e., for .

Example 1. Suppose that claim amount r.v.s in both of the two classes are zero-truncated geometrically distributed with

for and . If we set , , and , then it easy to see that

which ensures that the safety loading condition Equation (3) holds. The numerical results of are given in Table 1.

Table 1.

The values of with and .

| (0, 1) | (0, 0) | 0.2411265 | 0.1440916 | 0.1242079 | 0.0978323 | 0.0697250 | 0.0443761 |

| (0.2, 0.3) | 0.2016123 | 0.1048111 | 0.0925975 | 0.0735956 | 0.0524333 | 0.0333685 | |

| (0.7, 0.6) | 0.1760715 | 0.0747127 | 0.0679853 | 0.0545247 | 0.0388603 | 0.0247297 | |

| (1, 1) | 0.1805556 | 0.0702160 | 0.0649220 | 0.0524670 | 0.0375076 | 0.0238703 | |

| (2, 2) | (0, 0) | 0.0172947 | 0.0217721 | 0.0258049 | 0.0181552 | 0.0127906 | 0.0081399 |

| (0.2, 0.3) | 0.0220675 | 0.0285528 | 0.0344494 | 0.0216139 | 0.0153322 | 0.0097567 | |

| (0.7, 0.6) | 0.0255570 | 0.0342691 | 0.0422659 | 0.0244623 | 0.0174832 | 0.0111258 | |

| (1, 1) | 0.0263873 | 0.0366490 | 0.0461370 | 0.0257016 | 0.0184810 | 0.0117674 | |

| (0, 5) | (0, 0) | 0.0067270 | 0.0052610 | 0.0045711 | 0.0035766 | 0.0025444 | 0.0016194 |

| (0.2, 0.3) | 0.0098012 | 0.0060842 | 0.0053607 | 0.0042411 | 0.0030194 | 0.0019216 | |

| (0.7, 0.6) | 0.0121226 | 0.0058755 | 0.0053210 | 0.0042648 | 0.0030384 | 0.0019335 | |

| (1, 1) | 0.0127322 | 0.0049514 | 0.0045781 | 0.0036998 | 0.0026449 | 0.0016832 | |

| (4, 2) | (0, 0) | 0.0025660 | 0.0032303 | 0.0038286 | 0.0048460 | 0.0032192 | 0.0020417 |

| (0.2, 0.3) | 0.0042676 | 0.0055218 | 0.0066621 | 0.0085932 | 0.0052395 | 0.0033295 | |

| (0.7, 0.6) | 0.0055996 | 0.0075085 | 0.0092606 | 0.0122356 | 0.0070499 | 0.0044883 | |

| (1, 1) | 0.0059314 | 0.0082381 | 0.0103709 | 0.0140154 | 0.0077988 | 0.0049779 | |

| (3, 5) | (0, 0) | 0.0003576 | 0.0004502 | 0.0005336 | 0.0005255 | 0.0003656 | 0.0002324 |

| (0.2, 0.3) | 0.0007714 | 0.0009981 | 0.0012042 | 0.0010776 | 0.0007582 | 0.0004823 | |

| (0.7, 0.6) | 0.0011091 | 0.0014871 | 0.0018341 | 0.0015225 | 0.0010926 | 0.0006952 | |

| (1, 1) | 0.0011517 | 0.0015995 | 0.0020136 | 0.0015696 | 0.0011413 | 0.0007273 | |

| (5, 3) | (0, 0) | 0.0003576 | 0.0004502 | 0.0005336 | 0.0006754 | 0.0005648 | 0.0003558 |

| (0.2, 0.3) | 0.0007714 | 0.0009981 | 0.0012042 | 0.0015533 | 0.0012039 | 0.0007628 | |

| (0.7, 0.6) | 0.0011091 | 0.0014871 | 0.0018341 | 0.0024234 | 0.0017872 | 0.0011391 | |

| (1, 1) | 0.0011517 | 0.0015995 | 0.0020136 | 0.0027213 | 0.0019283 | 0.0012343 | |

| (5, 5) | (0, 0) | 0.0000479 | 0.0000602 | 0.0000714 | 0.0000904 | 0.0000766 | 0.0000482 |

| (0.2, 0.3) | 0.0001319 | 0.0001707 | 0.0002060 | 0.0002657 | 0.0002090 | 0.0001323 | |

| (0.7, 0.6) | 0.0002010 | 0.0002696 | 0.0003325 | 0.0004393 | 0.0003288 | 0.0002095 | |

| (1, 1) | 0.0001973 | 0.0002740 | 0.0003449 | 0.0004661 | 0.0003303 | 0.0002114 |

4.2. The Evaluation of

In this part, we aim to derive recursive equations for the probabilities of ultimate ruin. If and , then for .

Corollary 1. The probabilities of ultimate ruin can be calculated by

- (i)

- For , it holds thatwith

- (ii)

- For , we have

Proof. We can obtain Equations (37)–(39) by summing Equations (32), (33) and (36) over , respectively. ☐

We remark that Equation (15) in [7] is recovered by Equation (38) in the present paper with .

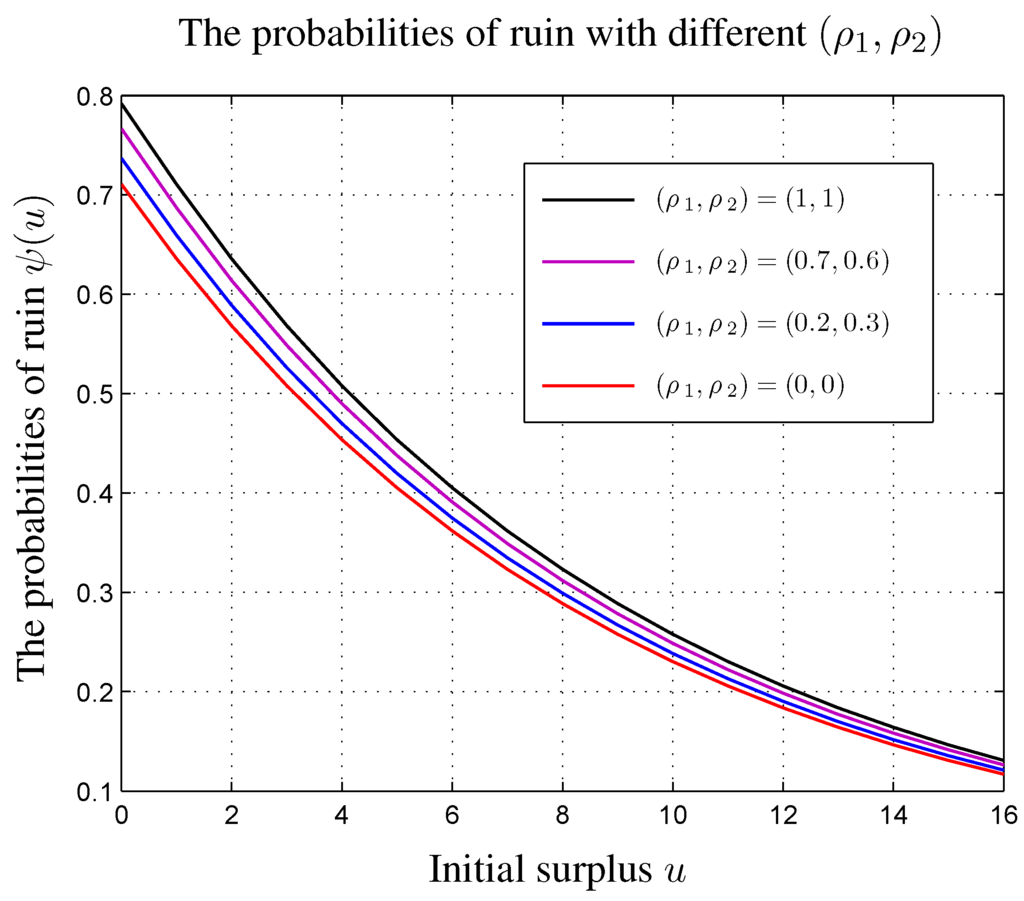

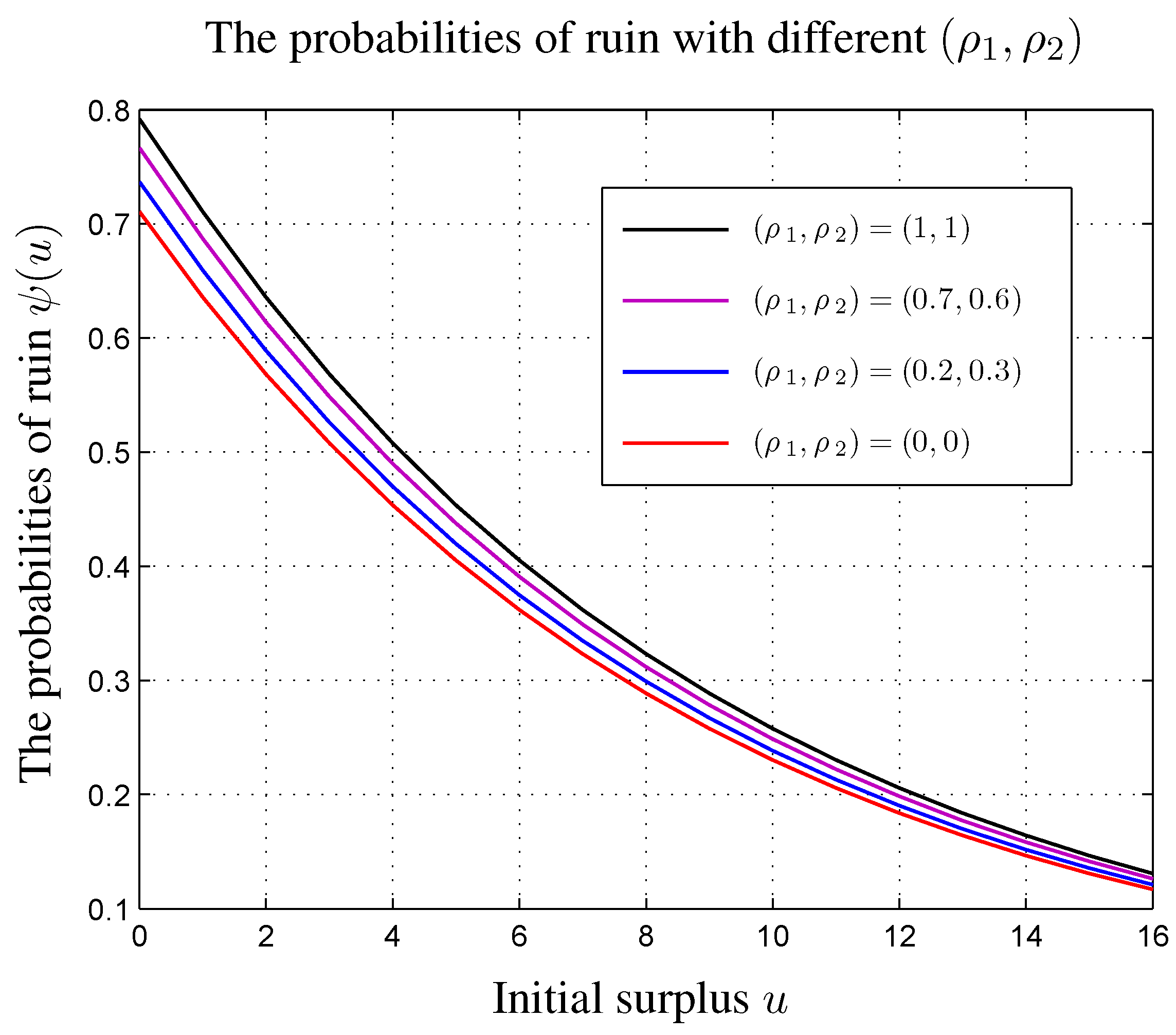

Example 2. We now revisit the example in Section 4.1. Suppose X and Y are both geometric distributed with and , respectively. The corresponding numerical results for are shown in Figure 1 with , , and .

Figure 1.

The values of with and .

Figure 1.

The values of with and .

5. Concluding Remarks

We study a discrete-time interaction risk model with delayed claims, which can be regarded as an extension to the prior work on time-correlated claims studied by [1,7]. Some analytic techniques are applied to study the expected discounted penalty function. We show that the expected discounted penalty function satisfies not only a recursive equation, but also a defective renewal equation. The results obtained in the present paper include the corresponding results in [7].

The model in this paper can be further extended. For instance, suppose that the dividend payments are ruled by a constant barrier in the framework of this paper; then, the calculation of the expected discounted dividend payments is necessarily possible.

Acknowledgments

The authors are grateful to the anonymous referees for their insightful comments and suggestions. This research was supported by the Ministry of Education of Humanities and Social Science Project (15YJC910001) and the Program for Liaoning Excellent Talents in University (LR2014031).

Author Contributions

Both authors have made equal contributions. Both authors read and approved the final manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- K.C. Yuen, and J. Guo. “Ruin probabilities for time-correlated claims in the compound binomial model.” Insur. Math. Econ. 29 (2001): 47–57. [Google Scholar] [CrossRef]

- H. Albrecher, and O. Boxma. “A ruin model with dependence between claim sizes and claim intervals.” Insur. Math. Econ. 35 (2004): 245–254. [Google Scholar] [CrossRef]

- E. Marceau. “On the discrete-time compound renewal risk model with dependence.” Insur. Math. Econ. 44 (2009): 245–259. [Google Scholar] [CrossRef]

- H. Cossette, E. Marceau, and F. Marri. “Analysis of ruin measures for the classical compound Poisson risk model with dependence.” Scand. Actuar. J. 2010 (2010): 221–245. [Google Scholar] [CrossRef]

- J.K. Woo. “A generalized penalty function for a class of discrete renewal processes.” Scand. Actuar. J. 2012 (2012): 130–152. [Google Scholar] [CrossRef]

- Z. Zhang, H. Yang, and H. Yang. “On a Sparre Andersen risk model with time-dependent claim sizes and jump-diffusion perturbation.” Methodol. Comput. Appl. Probab. 14 (2012): 973–995. [Google Scholar] [CrossRef]

- Y. Xiao, and J. Guo. “The compound binomial risk model with time-correlated claims.” Insur. Math. Econ. 41 (2007): 124–133. [Google Scholar] [CrossRef]

- Z. Bao, and H. Liu. “The compound binomial risk model with delayed claims and random income.” Math. Comput. Model. 55 (2012): 1315–1323. [Google Scholar] [CrossRef]

- X. Wu, and S. Li. “On a discrete time risk model with time-delayed claims and a constant dividend barrier.” Insur. Mark. Co. Anal. Actuar. Comput. 3 (2012): 50–57. [Google Scholar]

- R.S. Ambagaspitiya. “On the distribution of a sum of correlated aggregate claims.” Insur. Math. Econ. 23 (1998): 15–19. [Google Scholar] [CrossRef]

- R.S. Ambagaspitiya. “On the distributions of two classes of correlated aggregate claims.” Insur. Math. Econ. 24 (1999): 301–308. [Google Scholar] [CrossRef]

- H. Cossette, and E. Marceau. “The discrete-time risk model with correlated classes of business.” Insur. Math. Econ. 26 (2000): 133–149. [Google Scholar] [CrossRef]

- S. Li, and J. Garrido. “Ruin probabilities for two classes of risk processes.” Astin Bull. 35 (2005): 61–77. [Google Scholar] [CrossRef]

- S. Chadjiconstantinidis, and A.D. Papaioannou. “Analysis of the Gerber-Shiu function and dividend barrier problems for a risk process with two classes of claims.” Insur. Math. Econ. 45 (2009): 470–484. [Google Scholar] [CrossRef]

- L. Ji, and C. Zhang. “The Gerber-Shiu penalty functions for two classes of renewal risk processes.” J. Comput. Appl. Math. 233 (2010): 2575–2589. [Google Scholar] [CrossRef]

- X. Wu, and K.C. Yuen. “On an Interaction Risk Model with Delayed Claims.” In Proceedings of The 35th Astin Colloquium, Bergen, Norway, 6–9 June 2004; Volume 17.

- P. Brémaud. “An insensitivity property of Lundberg’s estimate for delayed claims.” J. Appl. Probab. 37 (2000): 914–917. [Google Scholar] [CrossRef]

- J. Trufin, H. Albrecher, and M. Denuit. “Ruin problems under IBNR dynamics.” Appl. Stoch. Models Bus. Ind. 27 (2011): 619–632. [Google Scholar] [CrossRef]

- A. Dassios, and H. Zhao. “A risk model with delayed claims.” J. Appl. Probab. 50 (2013): 686–702. [Google Scholar] [CrossRef]

- T. Rolski, H. Schmidli, V. Schmidt, and J.L. Teugels. Stochastic Processes for Insurance and Finance. Chichester, UK: Wiley, 1999, pp. 167–176. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).