Trusted Transactions in Micro-Grid Based on Blockchain

Abstract

1. Introduction

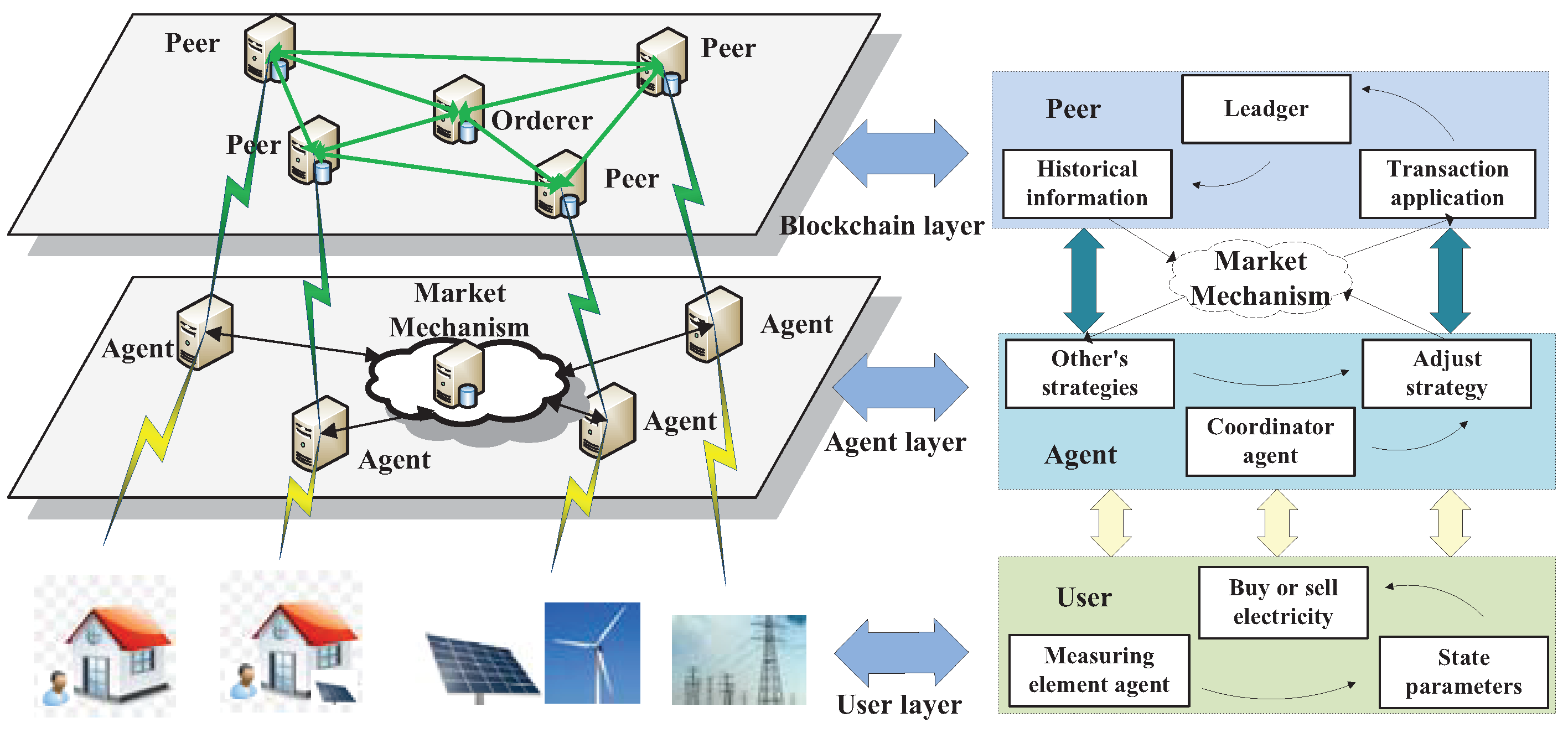

- In view of the shortcomings of the existing microgrid transaction architecture model, this paper proposes a new model HBTS and illustrates the feasibility of the model in detail.

- In order to maximize the revenue of each microgrid, this paper proposes an improved bidding algorithm based on Bayesian to provide more accurate bidding strategy guidance for microgrid providers when the total power of microgrid meets the market demand.

2. Literature Review

2.1. P2P Transactions in LEM

2.2. Blockchain-Based Microgrid

2.3. Consensus Mechanism in Blockchain

- (1)

- Proof of Work (PoW). In 2009, Satoshi Nakamoto applied the PoW in the Bitcoin blockchain network as the consensus mechanism for the whole network consistency. In this mechanism, each node on the network uses the SHA256 hash algorithm to compute the hash value of a constantly changing block header. The consensus is that the value must be equal to or less than a given value. In a distributed network, all participants need to use different random Numbers to continuously calculate the hash value until the target is reached. When one node has an exact value, all the other nodes must verify with each other that the value is correct. After that, the transactions in the new block will be verified to prevent fraud. The advantage of PoW is complete decentralization and distributed ledger. The disadvantages are also very obvious. Due to a large amount of resource waste caused by mining and a long time for PoW to reach a consensus, the 10-min block generation process makes it difficult to meet the requirements for commercial use.

- (2)

- Proof of Stake (PoS). Criticism to PoW led to an alternative algorithm being proposed broadly known as PoS. PoS is an energy saving alternative to PoW. It does not require users to find a random number in an unrestricted space. Instead, it is a system that provides corresponding interest according to the amount and time you hold certain digital coins. There are still some problems in mining, but the difficulty of mathematical problems is related to the age of the coinholder. In short, the longer coins are held by the holder, the simpler the puzzle becomes, thus shortening the time required for the blockchain consensus as a whole. However, the low cost of mining increases the possibility of attack, and nodes in the network still need nodes in the network for mining calculation in essence.

- (3)

- Practical Byzantine Fault Tolerance (PBFT). The practical Byzantine fault tolerance algorithm was proposed by MiguelCastro of MIT in 1999, it is the first practical consensus algorithm to realize Byzantine fault tolerance in asynchronous distributed network. Now the PBFT algorithm is a key component of building most modern blockchain systems using a voting-based consensus approach. Transactions are individually validated and signed by known validator nodes, which makes the PBFT more suitable for trusted environments than public permissionless ledger applications. When enough signatures have been collected, the transaction is considered valid and a consensus is reached. PBFT provides instant finality because blocks that have been globally validated cannot be reversed. Hyperledger, an open-source project led by the Linux foundation, currently uses just such a consensus mechanism.

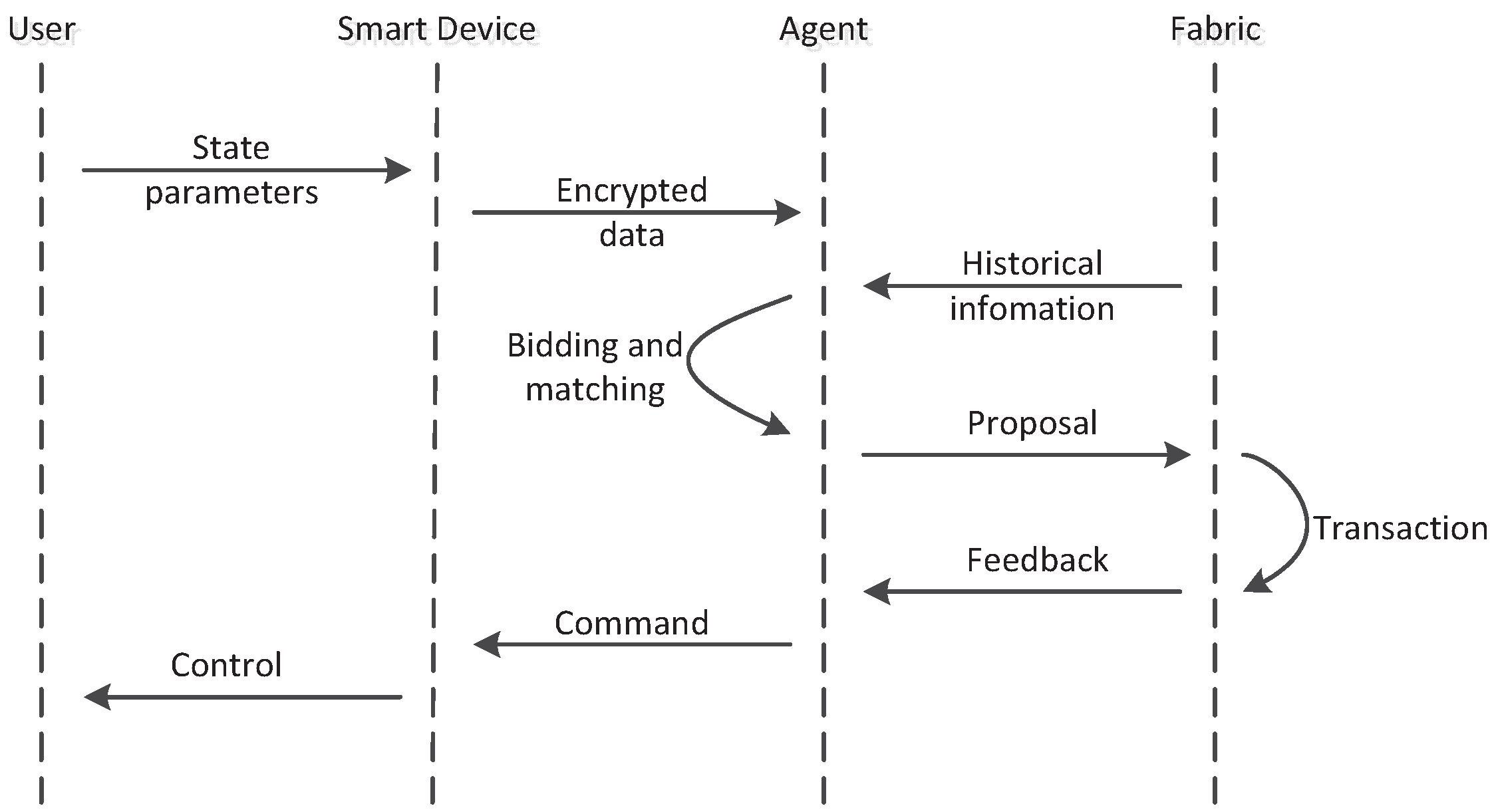

3. The Proposed HBTS

3.1. Hierarchical Bidding and Trading System Based on Blockchain

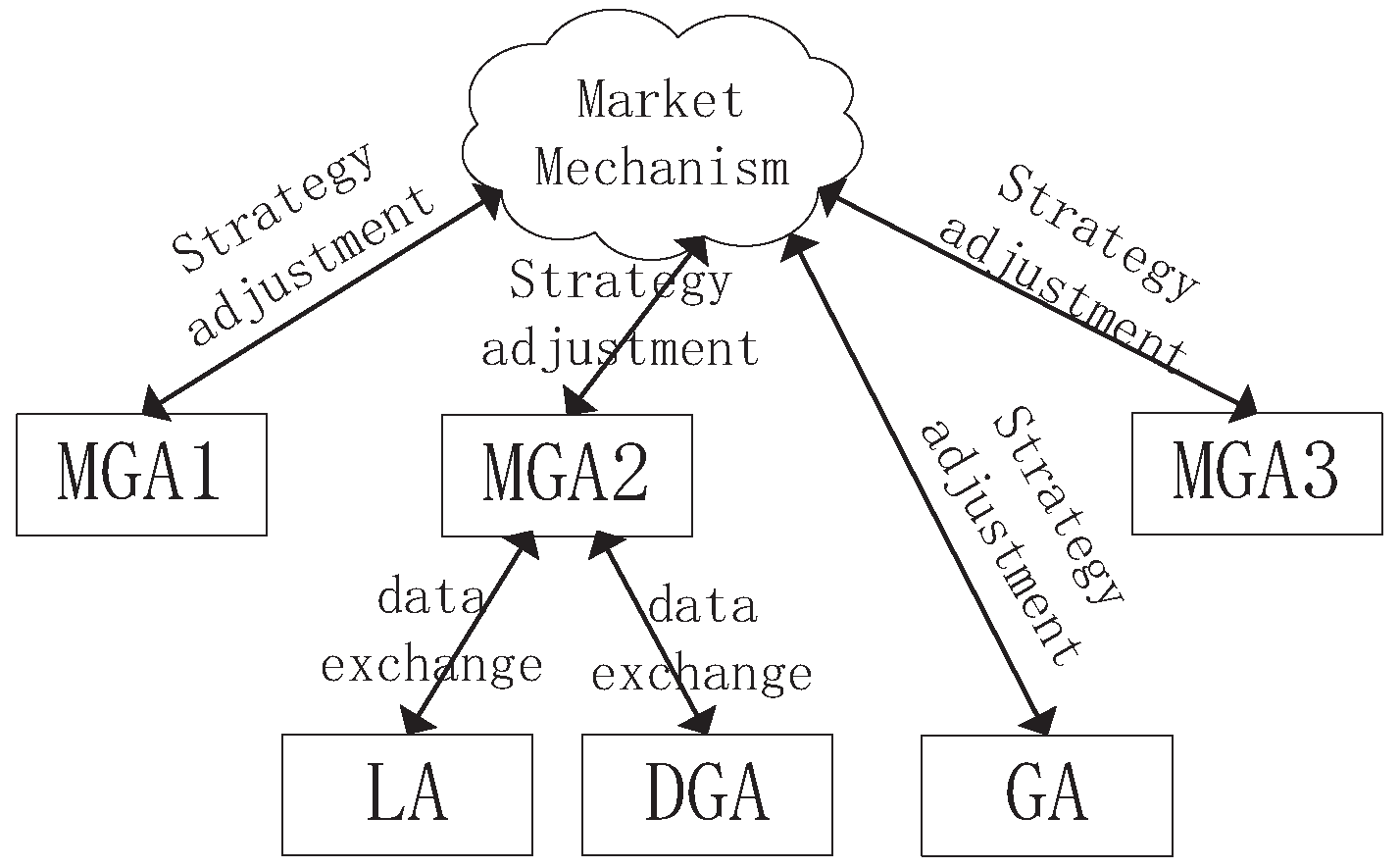

3.2. Description of the Bidding Strategy

- The information of each microgrid is obtained through the electricity market trading center, and the information of the cost function of other microgrids is basically the same. Besides knowing their own real production cost, they do not know the production cost of other microgrids.

- There is no collusion and cooperation among microgrids.

- The total supply in the market equals the demand, i.e., the balance between supply and demand.

4. Case Study

4.1. Pre-Set the Parameters of Microgrid

4.2. Results

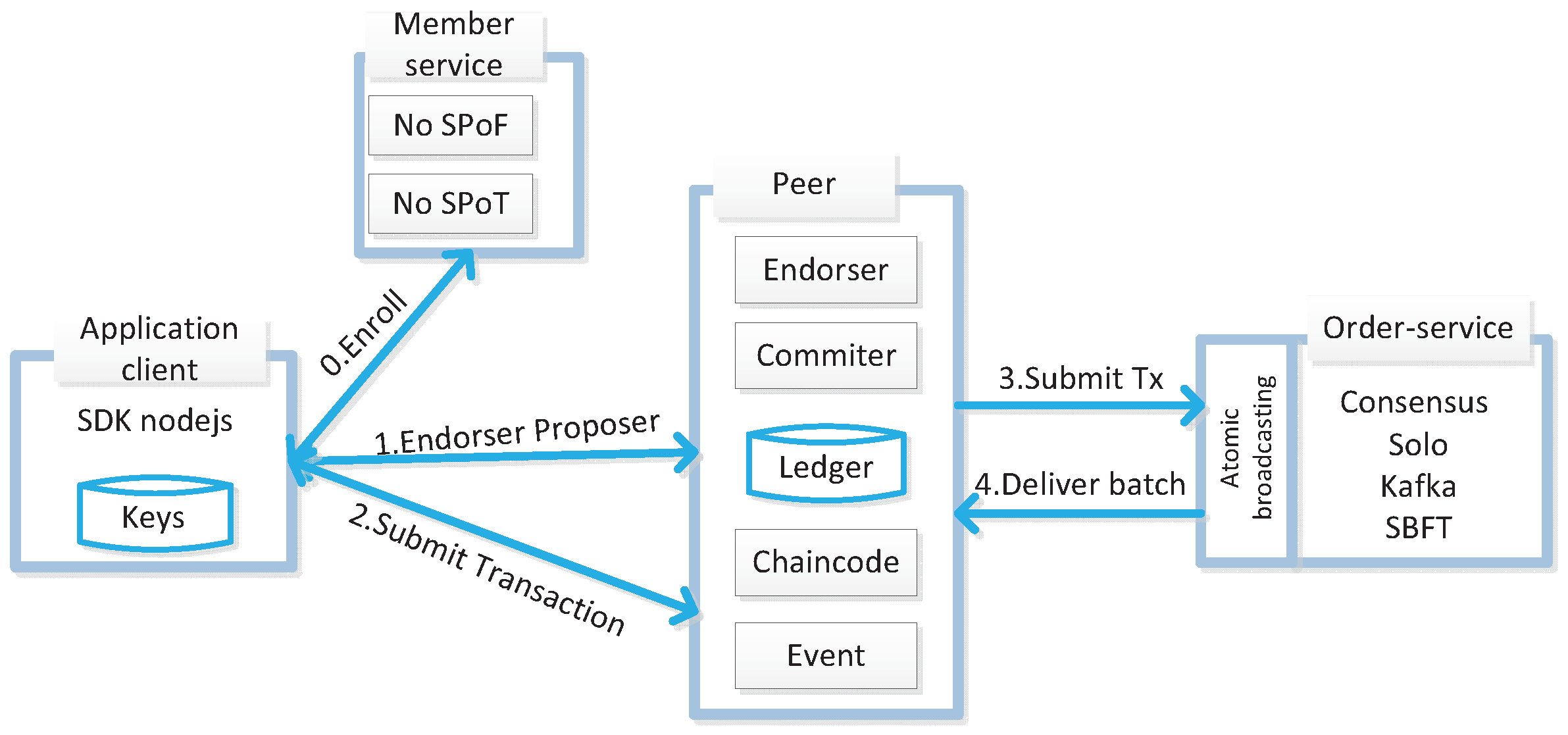

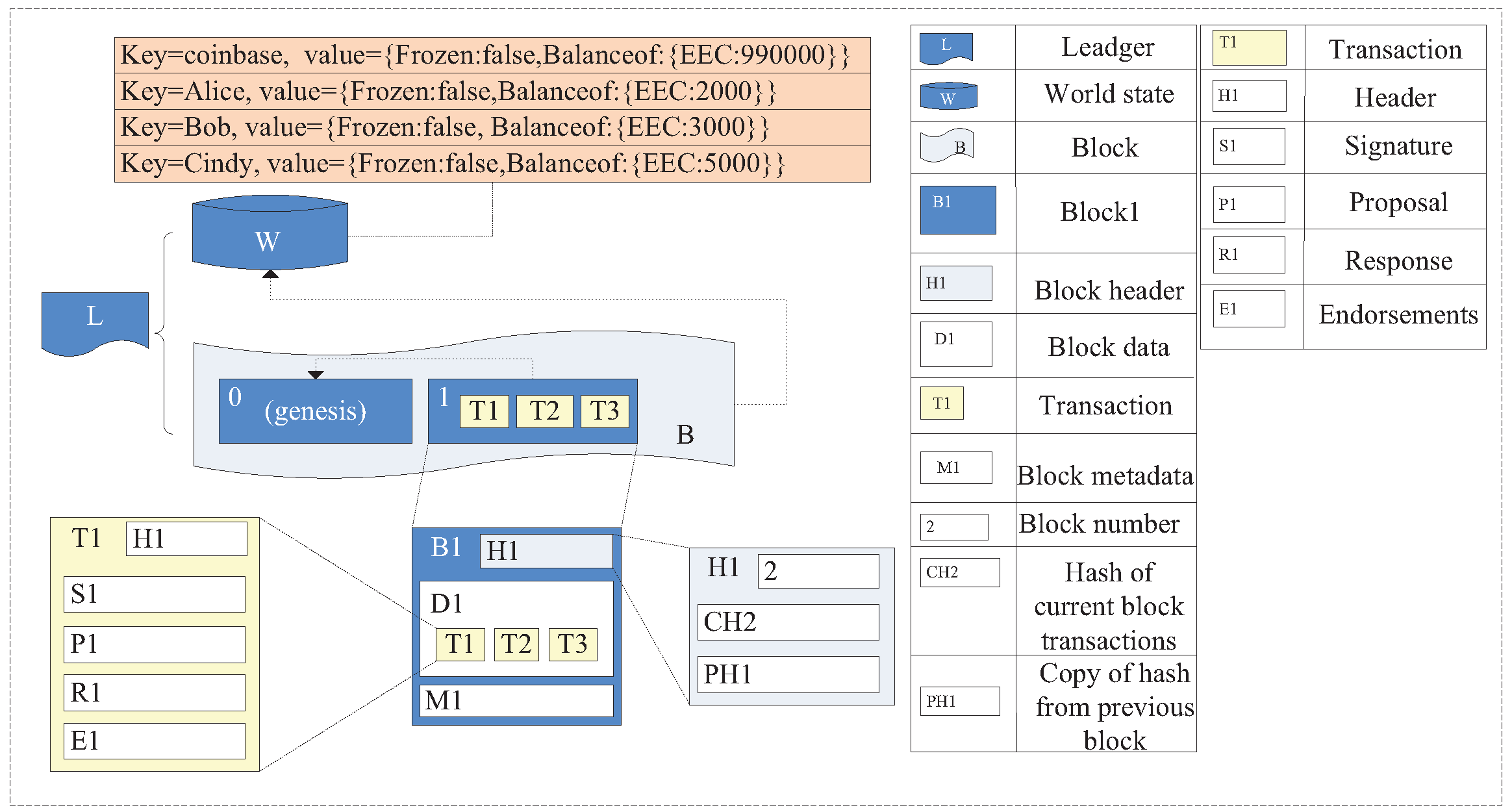

4.3. Analysis of Microgrid Transaction Settlement Process

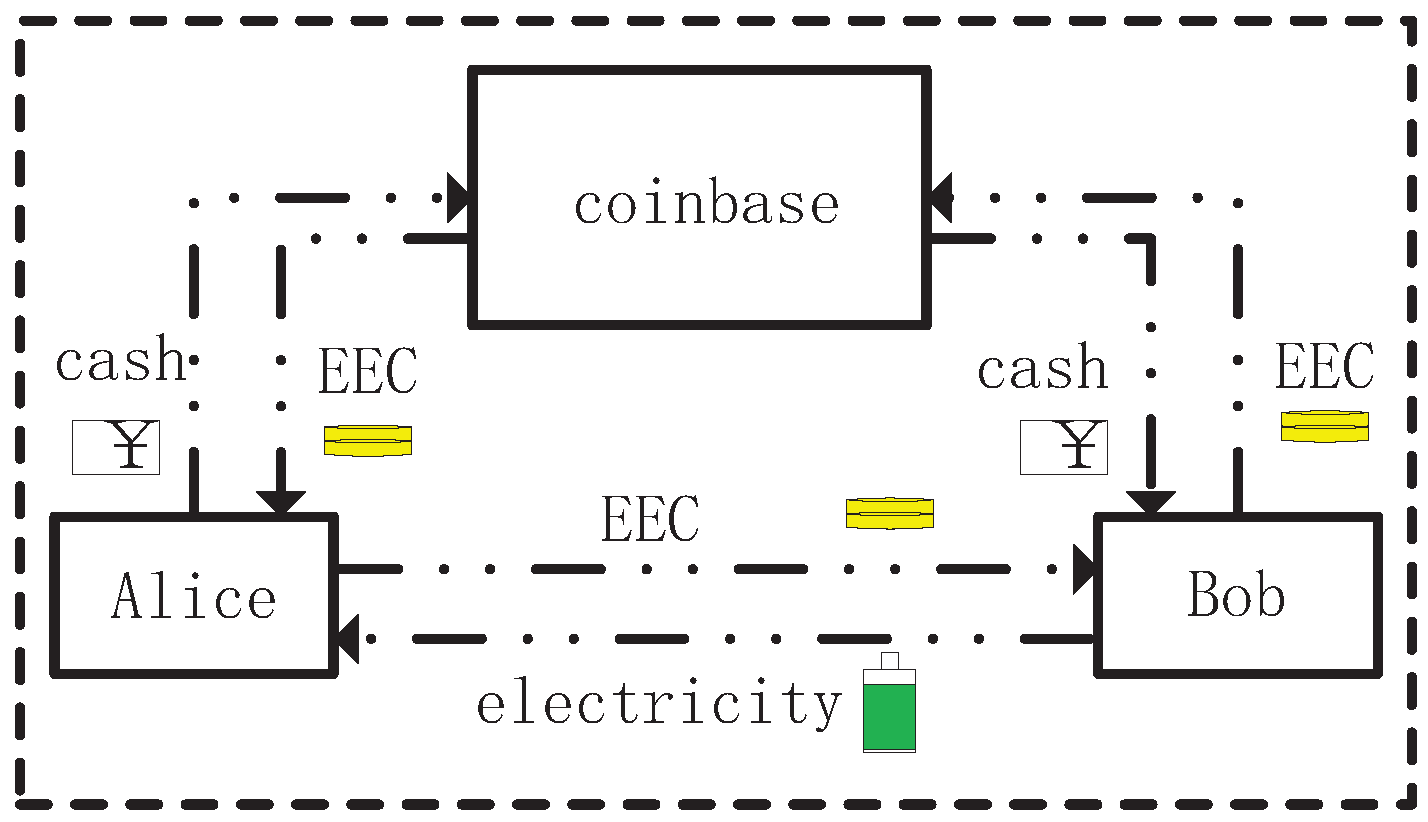

- 1.

- Identify users of the joined Hyperledger Fabric network

- 2.

- Issues the appropriate amount of EEC

- 3.

- Customers initiate EEC transfer transactions to purchase electricity

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| MGs | Microgrids |

| DERs | Distributed energy resources |

| DGs | Distributed generations |

| LEM | Local electricity market |

| P2P | Peer to peer |

| HBTS | Hierarchical bidding and transaction structure based on blockchain |

| REs | Renewable energy resources |

| ICES | Integrated community energy system |

| MG | Microgrid |

| SPoF | Single Point of Failure |

| MAS | Multi-agent systems |

| LA | Load Agent |

| DGA | Distributed Generation Agent |

| GA | Grid Agent |

| MGA | Micro-Grid Agent |

| EEC | Electricity Energy Coin |

References

- Zhang, T.; Pota, H.; Chu, C.C.; Gadh, R. Real-time renewable energy incentive system for electric vehicles using prioritization and cryptocurrency. Appl. Energy 2018, 226, 582–594. [Google Scholar] [CrossRef]

- Lv, T.; Ai, Q. Interactive energy management of networked microgrids-based active distribution system considering large-scale integration of renewable energy resources. Appl. Energy 2016, 163, 408–422. [Google Scholar] [CrossRef]

- Coester, A.; Hofkes, M.W.; Papyrakis, E. Economics of renewable energy expansion and security of supply: A dynamic simulation of the German electricity market. Appl. Energy 2018, 231, 1268–1284. [Google Scholar] [CrossRef]

- Rosen, C.; Madlener, R. An auction design for local reserve energy markets. Decis. Support Syst. 2013, 56, 168–179. [Google Scholar] [CrossRef]

- Li, Y.; Yang, Z.; Li, G.; Mu, Y.; Zhao, D.; Chen, C.; Shen, B. Optimal scheduling of isolated microgrid with an electric vehicle battery swapping station in multi-stakeholder scenarios: A bi-level programming approach via real-time pricing. Appl. Energy 2018, 232, 54–68. [Google Scholar] [CrossRef]

- Li, Y.; Yang, Z.; Li, G.; Zhao, D.; Tian, W. Optimal Scheduling of an Isolated Microgrid With Battery Storage Considering Load and Renewable Generation Uncertainties. IEEE Trans. Ind. Electron. 2019, 66, 1565–1575. [Google Scholar] [CrossRef]

- Li, Y.; Yang, Z.; Zhao, D.; Lei, H.; Cui, B.; Li, S. Incorporating energy storage and user experience in isolated microgrid dispatch using a multi-objective model. IET Renew. Power Gener. 2019, 13. [Google Scholar] [CrossRef]

- Koirala, B.P.; Koliou, E.; Friege, J.; Hakvoort, R.A.; Herder, P.M. Energetic communities for community energy: A review of key issues and trends shaping integrated community energy systems. Renew. Sustain. Energy Rev. 2016, 56, 722–744. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Dong, Z.; Luo, F.; Liang, G. Blockchain: A secure, decentralized, trusted cyber infrastructure solution for future energy systems. J. Mod. Power Syst. Clean Energy 2018, 6, 958–967. [Google Scholar] [CrossRef]

- Aitzhan, N.Z.; Svetinovic, D. Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. IEEE Trans. Dependable Secur. Comput. 2018, 15, 840–852. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Res. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Barwar, N.C.; Rajesh, B. Network Performance Analysis of Startup Buffering for Live Streaming in P2P VOD Systems for Mesh-Based Topology. In Proceedings of the International Congress on Information and Communication Technology; Satapathy, S.C., Bhatt, Y.C., Joshi, A., Mishra, D.K., Eds.; Springer: Singapore, 2016; pp. 271–279. [Google Scholar]

- Tran, M.H.; Ha, S.V.U.; Nguyen, V.S. Decentralized online social network using peer-to-peer technology. REV J. Electron. Commun. 2016, 5. [Google Scholar] [CrossRef]

- Suri, N.; Benincasa, G.; Tortonesi, M.; Stefanelli, C.; Kovach, J.; Winkler, R.; Kohler, U.S.R.; Hanna, J.; Pochet, L.; Watson, S. Peer-to-peer communications for tactical environments: Observations, requirements, and experiences. IEEE Commun. Mag. 2010, 48, 60–69. [Google Scholar] [CrossRef]

- Beitollahi, H.; Deconinck, G. Peer-to-peer networks applied to power grid. In Proceedings of the International Conference on Risks and Security of Internet and Systems (CRiSIS)’ in Conjunction with the IEEE GIIS’07, Marrakech, Morocco, 2–5 July 2007; p. 8. [Google Scholar]

- Wu, Y.; Tan, X.; Qian, L.; Tsang, D.H.; Song, W.Z.; Yu, L. Optimal Pricing and Energy Scheduling for Hybrid Energy Trading Market in Future Smart Grid. IEEE Trans. Ind. Inform. 2015, 11, 1585–1596. [Google Scholar] [CrossRef]

- Lüth, A.; Zepter, J.M.; del Granado, P.C.; Egging, R. Local electricity market designs for peer-to-peer trading: The role of battery flexibility. Appl. Energy 2018, 229, 1233–1243. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of Existing Peer-to-Peer Energy Trading Projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Alam, M.R.; St-Hilaire, M.; Kunz, T. An optimal P2P energy trading model for smart homes in the smart grid. Energy Effic. 2017, 10, 1475–1493. [Google Scholar] [CrossRef]

- Coelho, V.N.; Cohen, M.W.; Coelho, I.M.; Liu, N.; Guimarães, F.G. Multi-agent systems applied for energy systems integration: State-of-the-art applications and trends in microgrids. Appl. Energy 2017, 187, 820–832. [Google Scholar] [CrossRef]

- Morstyn, T.; Teytelboym, A.; Mcculloch, M.D. Bilateral Contract Networks for Peer-to-Peer Energy Trading. IEEE Trans. Smart Grid 2019, 10, 2026–2035. [Google Scholar] [CrossRef]

- Sorin, E.; Bobo, L.; Pinson, P. Consensus-Based Approach to Peer-to-Peer Electricity Markets with Product Differentiation. IEEE Trans. Power Syst. 2019, 34, 994–1004. [Google Scholar] [CrossRef]

- Jogunola, O.; Ikpehai, A.; Anoh, K.; Adebisi, B.; Hammoudeh, M.; Gacanin, H.; Harris, G. Comparative Analysis of P2P Architectures for Energy Trading and Sharing. Energies 2017, 11, 62. [Google Scholar] [CrossRef]

- Stoica, I.; Morris, R.; Karger, D.; Kaashoek, M.F.; Balakrishnan, H. Chord: A Scalable Peer-to-peer Lookup Service for Internet Applications. In Proceedings of the 2001 Conference on Applications, Technologies, Architectures, and Protocols for Computer Communications (SIGCOMM ’01), San Diego, CA, USA, 27–31 August 2001; pp. 149–160. [Google Scholar] [CrossRef]

- Maymounkov, P.; Mazieres, D. Kademlia: A peer-to-peer information system based on the xor metric. In Peer-to-Peer Systems; Springer: Berlin/Heidelberg, Germany, 2002; pp. 53–65. [Google Scholar]

- Navimipour, N.J.; Milani, F.S. A comprehensive study of the resource discovery techniques in peer-to-peer networks. Peer Netw. Appl. 2015, 8, 474–492. [Google Scholar] [CrossRef]

- Chawathe, Y.; Ratnasamy, S.; Breslau, L.; Lanham, N.; Shenker, S. Making gnutella-like p2p systems scalable. In Proceedings of the 2003 Conference on Applications, Technologies, Architectures, and Protocols for Computer Communications, Karlsruhe, Germany, 25–29 August 2003; pp. 407–418. [Google Scholar]

- Ripeanu, M. Peer-to-peer architecture case study: Gnutella network. In Proceedings of the First International Conference on Peer-to-Peer Computing, Linkoping, Sweden, 27–29 August 2001; pp. 99–100. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef]

- Sabounchi, M.; Wei, J. Towards resilient networked microgrids: Blockchain-enabled peer-to-peer electricity trading mechanism. In Proceedings of the 2017 IEEE Conference on Energy Internet and Energy System Integration (EI2), Beijing, China, 26–28 November 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Zyskind, G.; Nathan, O.; Pentland, A. Decentralizing Privacy: Using Blockchain to Protect Personal Data. In Proceedings of the 2015 IEEE Security and Privacy Workshops, San Jose, CA, USA, 21–22 May 2015; pp. 180–184. [Google Scholar] [CrossRef]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; de Abril, I.M.; Nowé, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the 2014 11th International Conference on the European Energy Market (EEM), Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar]

- Li, Z.; Kang, J.; Yu, R.; Ye, D.; Deng, Q.; Zhang, Y. Consortium blockchain for secure energy trading in industrial internet of things. IEEE Trans. Ind. Inform. 2018, 14, 3690–3700. [Google Scholar] [CrossRef]

- Münsing, E.; Mather, J.; Moura, S. Blockchains for decentralized optimization of energy resources in microgrid networks. In Proceedings of the 2017 IEEE Conference on Control Technology and Applications (CCTA), Mauna Lani, HI, USA, 27–30 August 2017; pp. 2164–2171. [Google Scholar]

- Harsanyi, J.C.; Selten, R. A General Theory of Equilibrium Selection in Games; MIT Press: Cambridge, MA, USA, 1988; p. xviii+378. [Google Scholar]

| Model | Fully P2P | SPoF | Flexibility | Data Privacy | Bidding Strategy | Ref. |

|---|---|---|---|---|---|---|

| Centralized | no | yes | no | vulnerable | maybe | [20,21] |

| Structured | no | yes | no | vulnerable | no | [26,27] |

| Unstructured | yes | no | maybe | threatened | no | [29,30] |

| Blockchain | yes | no | yes | safety | no | [12,13,34,35,36] |

| HTBS | yes | no | yes | safety | yes | this study |

| Cost | ⋯ | – | |||

|---|---|---|---|---|---|

| probability | ⋯ |

| Cost | ⋯ | – | |||

|---|---|---|---|---|---|

| probability | ⋯ |

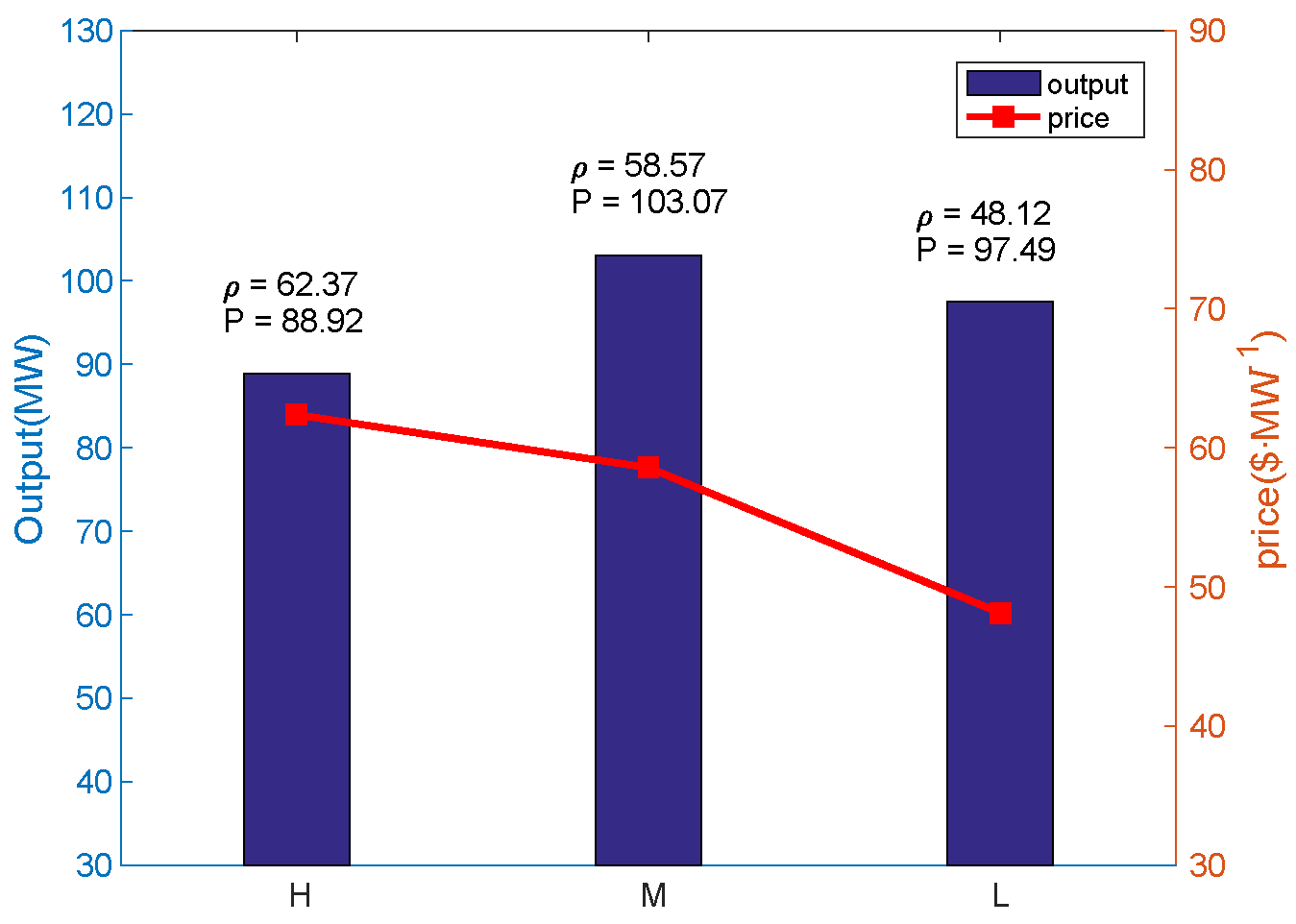

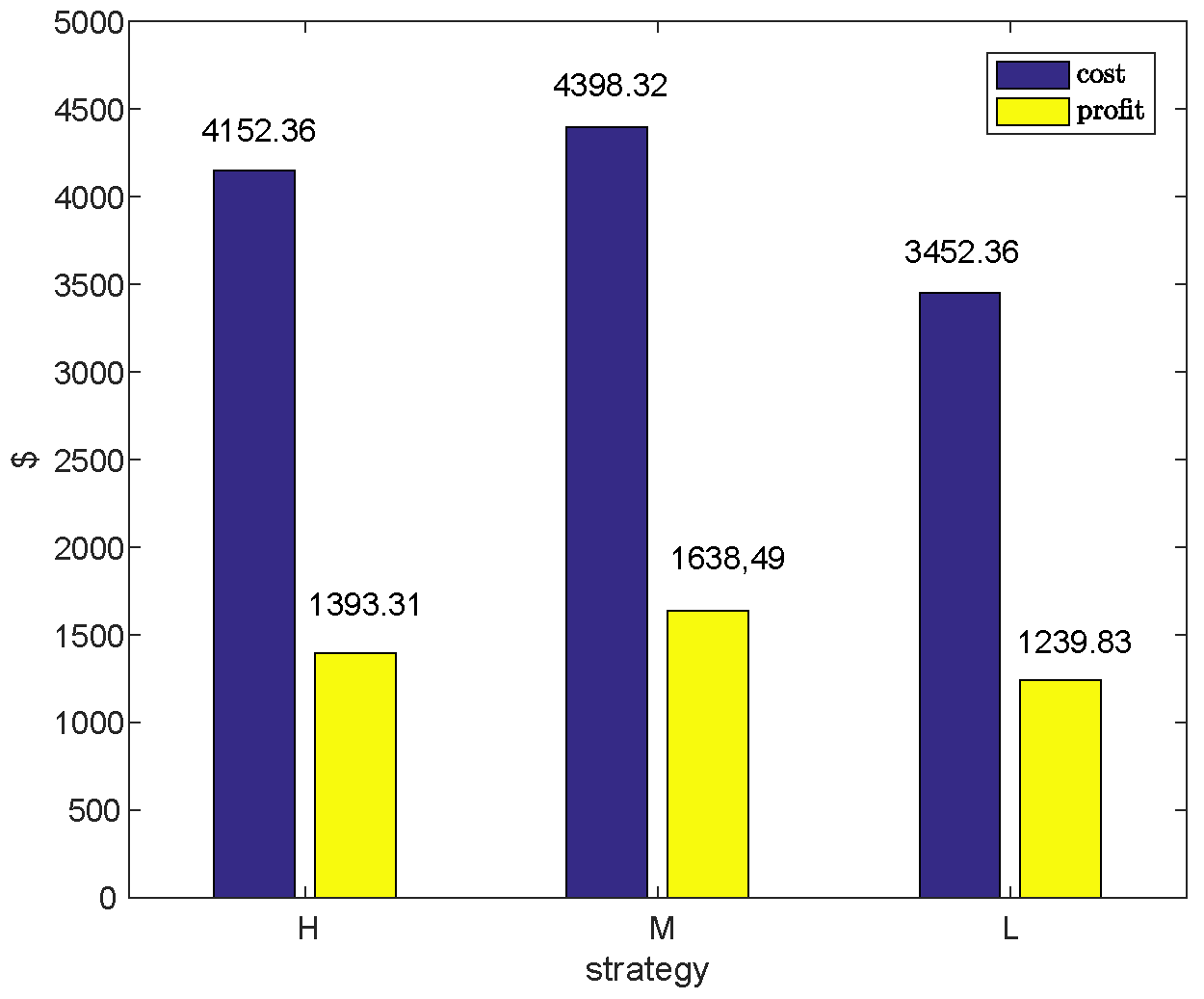

| Microgrid | Type | a | b | c | Max Output/MW | Min Output/MW | Accurate Probability | Guessing Probability |

|---|---|---|---|---|---|---|---|---|

| 1 | H | 0.182 | 30.0 | 46 | 150 | 0 | 0.40 | 0.35 |

| M | 0.158 | 26.0 | 40 | 150 | 0 | 0.40 | 0.50 | |

| L | 0.134 | 22.0 | 34 | 150 | 0 | 0.20 | 0.15 | |

| 2 | H | 0.240 | 28.5 | 55 | 100 | 10 | 0.30 | 0.25 |

| M | 0.210 | 25.3 | 50 | 100 | 10 | 0.50 | 0.50 | |

| L | 0.180 | 21.5 | 42 | 100 | 10 | 0.20 | 0.25 | |

| 3 | H | 0.170 | 33.9 | 27 | 100 | 50 | 0.25 | 0.30 |

| M | 0.140 | 29.5 | 23 | 100 | 50 | 0.35 | 0.30 | |

| L | 0.120 | 25.0 | 20 | 100 | 50 | 0.40 | 0.40 |

| H | M | L | |||||||

|---|---|---|---|---|---|---|---|---|---|

| H | M | L | H | M | L | H | M | L | |

| 0.60 | 0.40 | 0.20 | 0.20 | 0.60 | 0.20 | 0.30 | 0.20 | 0.10 | |

| H | M | L | H | M | L | H | M | L | |

| 0.60 | 0.40 | 0.25 | 0.50 | 0.30 | 0.40 | 0.10 | 0.30 | 0.20 | |

| H | M | L | |||||||

|---|---|---|---|---|---|---|---|---|---|

| H | M | L | H | M | L | H | M | L | |

| 0.375 | 0.50 | 0.125 | 0.125 | 0.75 | 0.125 | 0.375 | 0.50 | 0.125 | |

| H | M | L | H | M | L | H | M | L | |

| 0.45 | 0.30 | 0.25 | 0.375 | 0.225 | 0.40 | 0.15 | 0.45 | 0.40 | |

| H | M | L | |||||||

|---|---|---|---|---|---|---|---|---|---|

| parameter | |||||||||

| microgrid 2 | 0.22 | 26.03 | 50.88 | 0.31 | 25.23 | 49.63 | 0.22 | 26.03 | 50.88 |

| microgird 3 | 0.15 | 30.36 | 24.05 | 0.14 | 29.35 | 23.30 | 0.14 | 28.36 | 22.40 |

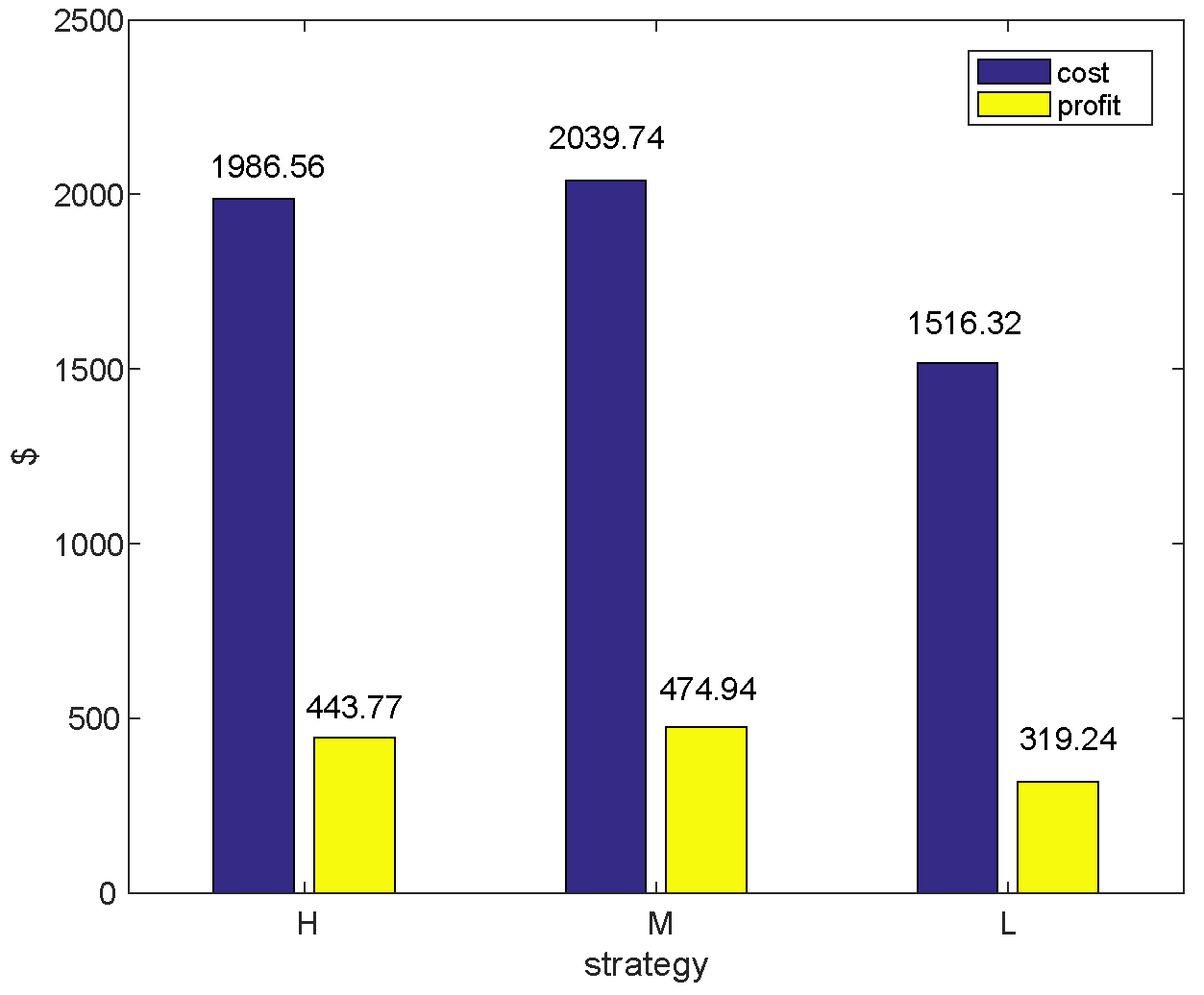

| Methods | Price ($•MW−1) | Output (MW) | Cost ($) | Profit ($) |

|---|---|---|---|---|

| General method | 55.30 | 69.5 | 3010.11 | 833.24 |

| Actual situation | 44.78 | 40.6 | 1564.00 | 254.07 |

| This study | 48.09 | 49.7 | 1986.56 | 443.77 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Y.; Guo, Y.; Min, W.; Zeng, F. Trusted Transactions in Micro-Grid Based on Blockchain. Energies 2019, 12, 1952. https://doi.org/10.3390/en12101952

Yu Y, Guo Y, Min W, Zeng F. Trusted Transactions in Micro-Grid Based on Blockchain. Energies. 2019; 12(10):1952. https://doi.org/10.3390/en12101952

Chicago/Turabian StyleYu, Yunjun, Yanghui Guo, Weidong Min, and Fanpeng Zeng. 2019. "Trusted Transactions in Micro-Grid Based on Blockchain" Energies 12, no. 10: 1952. https://doi.org/10.3390/en12101952

APA StyleYu, Y., Guo, Y., Min, W., & Zeng, F. (2019). Trusted Transactions in Micro-Grid Based on Blockchain. Energies, 12(10), 1952. https://doi.org/10.3390/en12101952