Microgrid Group Trading Model and Solving Algorithm Based on Blockchain

Abstract

:1. Introduction

2. Coupling Analysis of the Microgrid Group Trading and Block Chain Technology

2.1. Blockchain Technology

2.1.1. Definition of Blockchain

2.1.2. Characteristic of the Blockchain

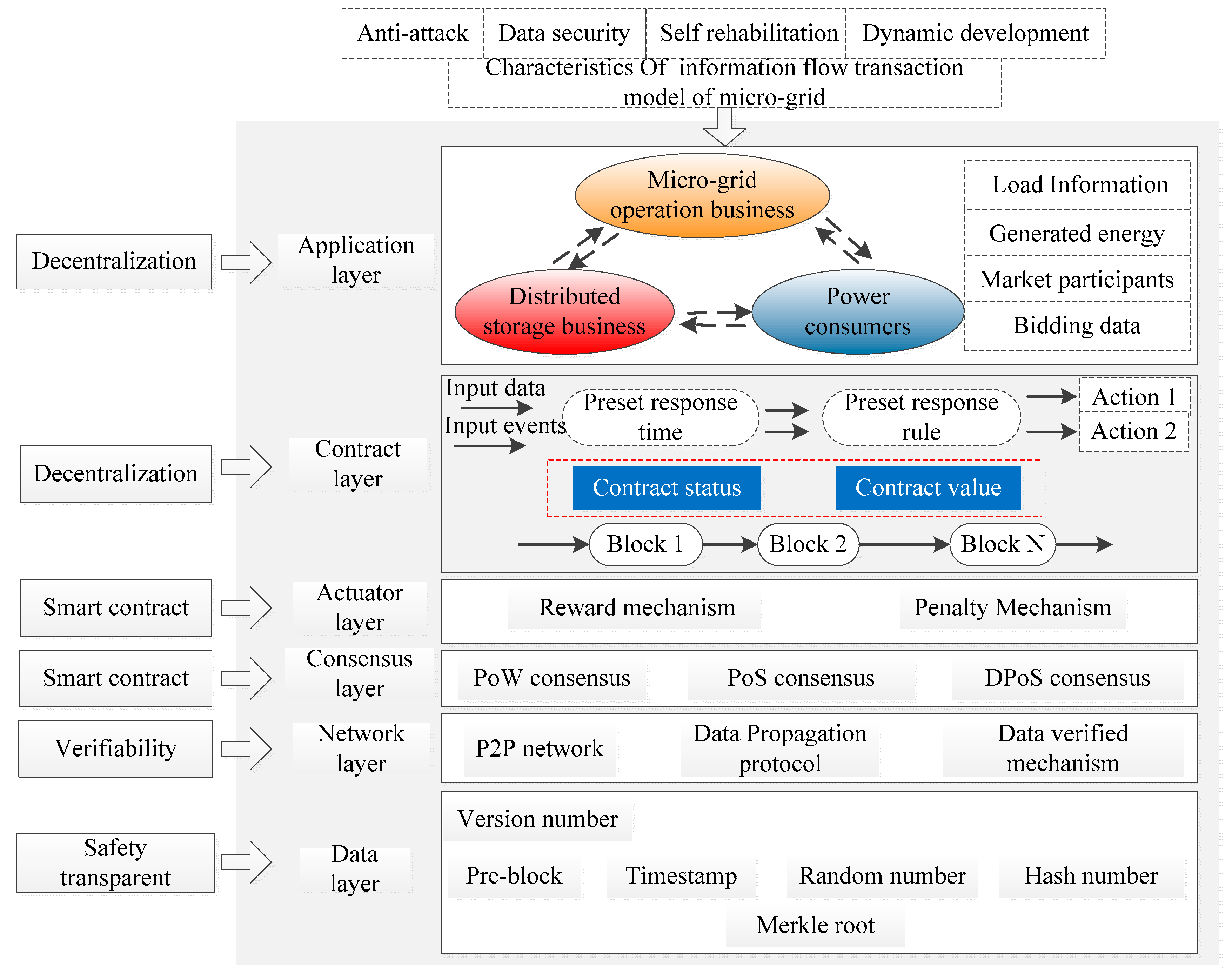

2.1.3. Basic Architecture Model of Blockchain

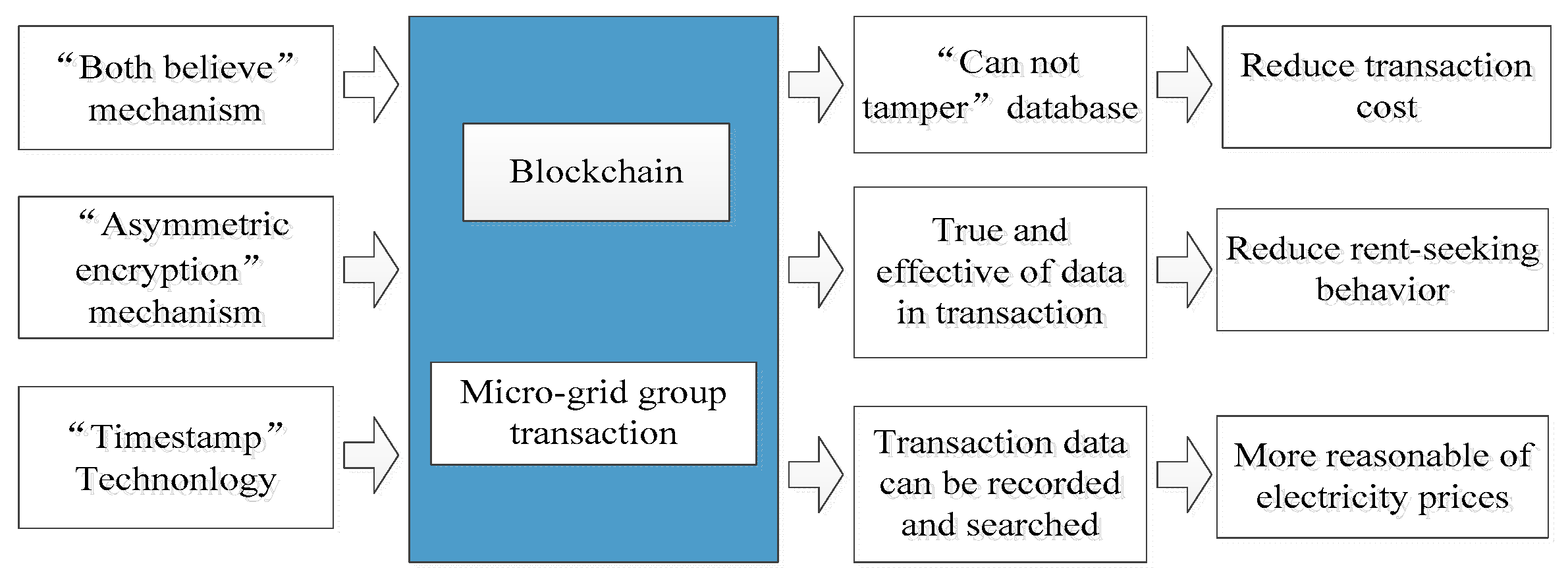

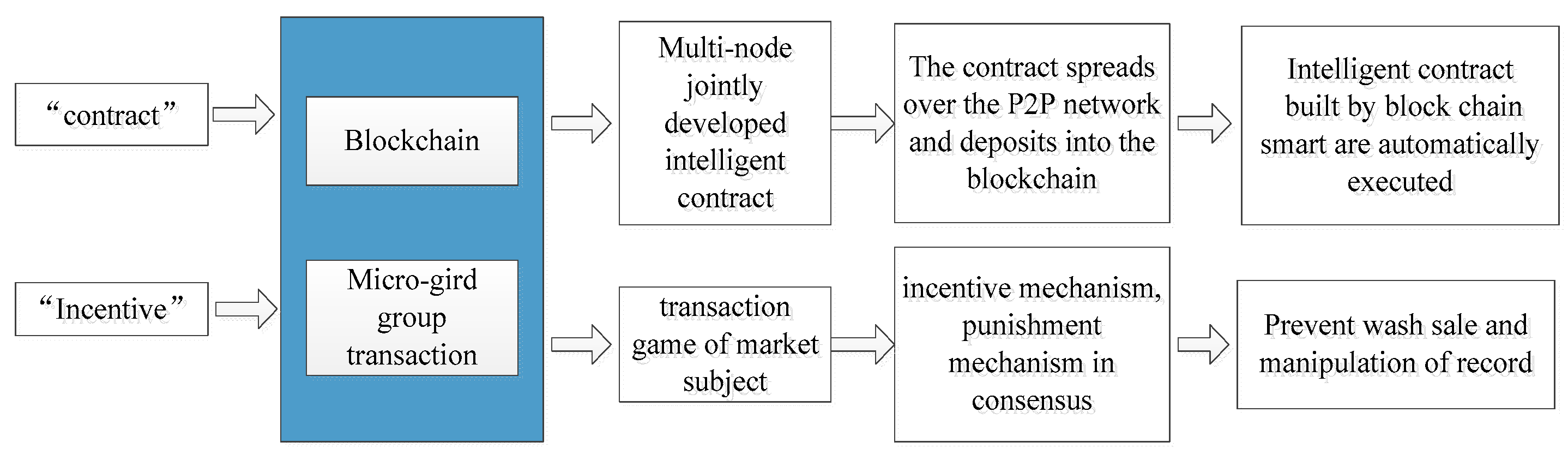

2.2. Coupling Analysis

2.2.1. Subject Coupling

2.2.2. Trading Mechanism Coupling

2.2.3. Smart Contract Coupling

3. Microgrid Group Transaction Model

3.1. Information Flow Trading Model

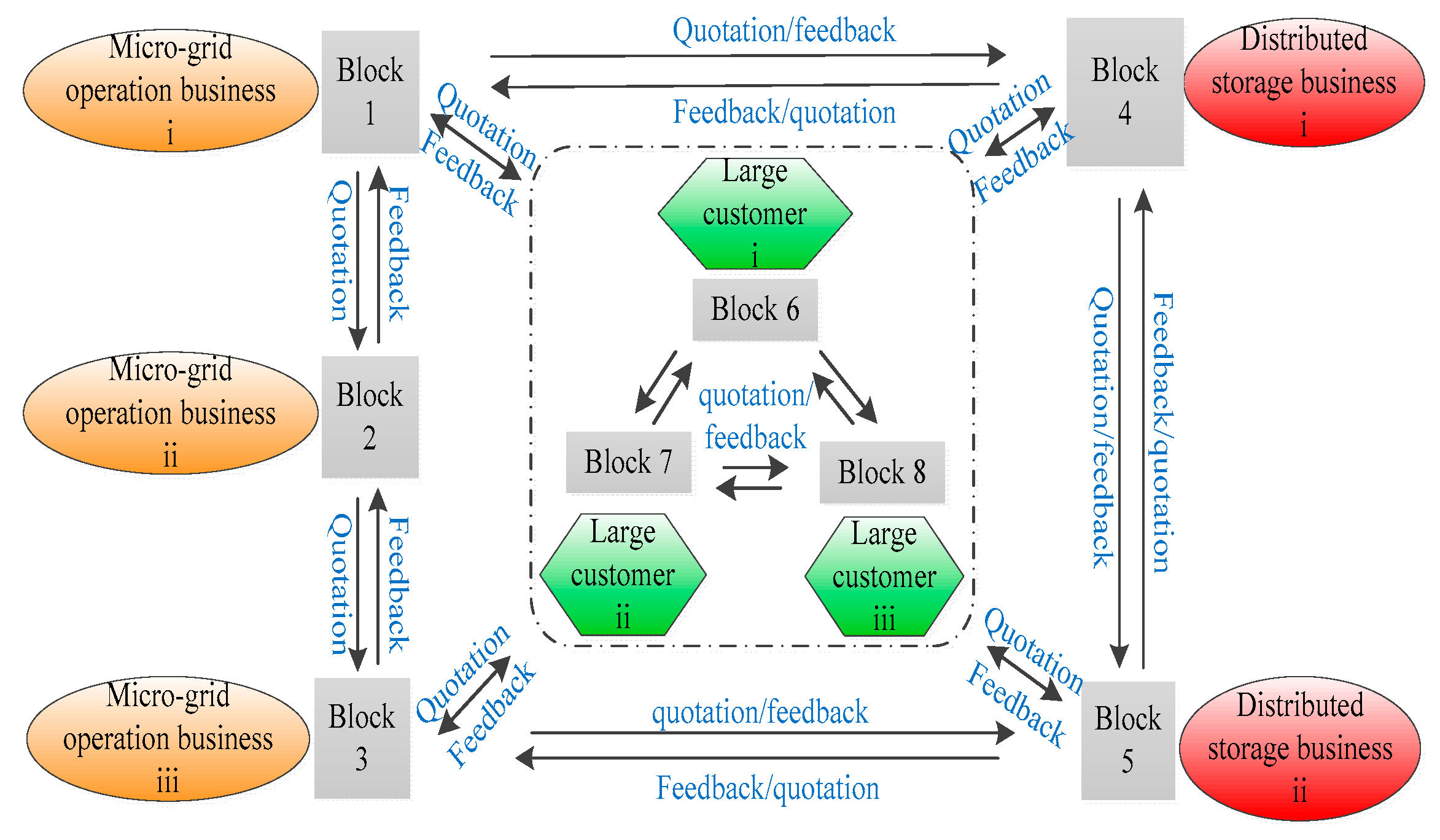

3.2. Physical Flow Trading Model

3.2.1. Basic Structure of Microgrid

3.2.2. Mathematical Model of Microgrid Group Subject

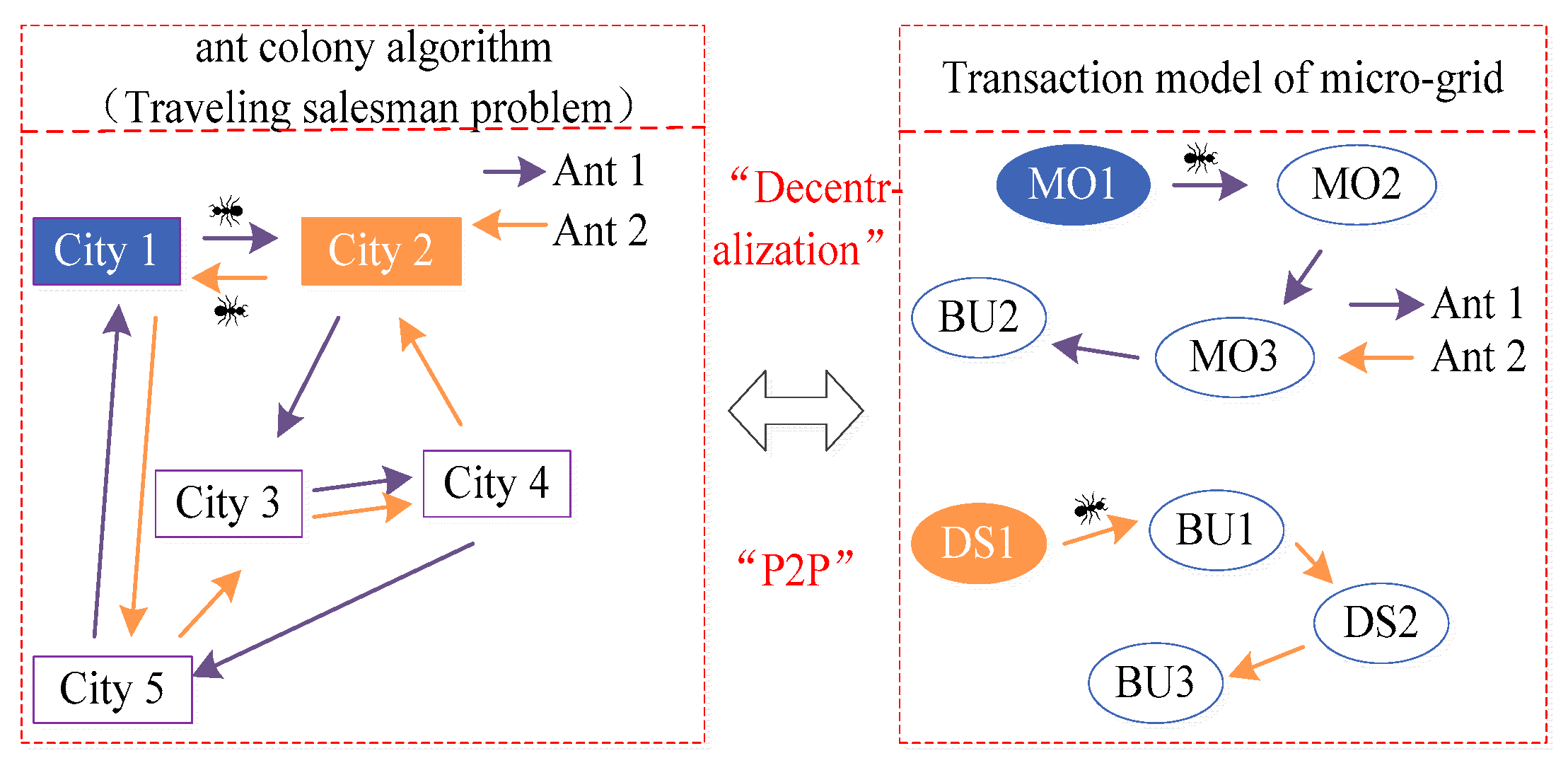

4. Transaction Model Solution of Microgrid Group Based on Blockchain Technology

4.1. Traditional Ant Colony Algorithm

4.2. Improvement of the Ant Colony Algorithm

4.2.1. Improvement of Pheromone Concentration

4.2.2. Amendment of Parameters

4.3. Algorithm Implementation

4.3.1. “Closed Problem”

4.3.2. Calculation of Heuristic Function

5. Analysis of Examples

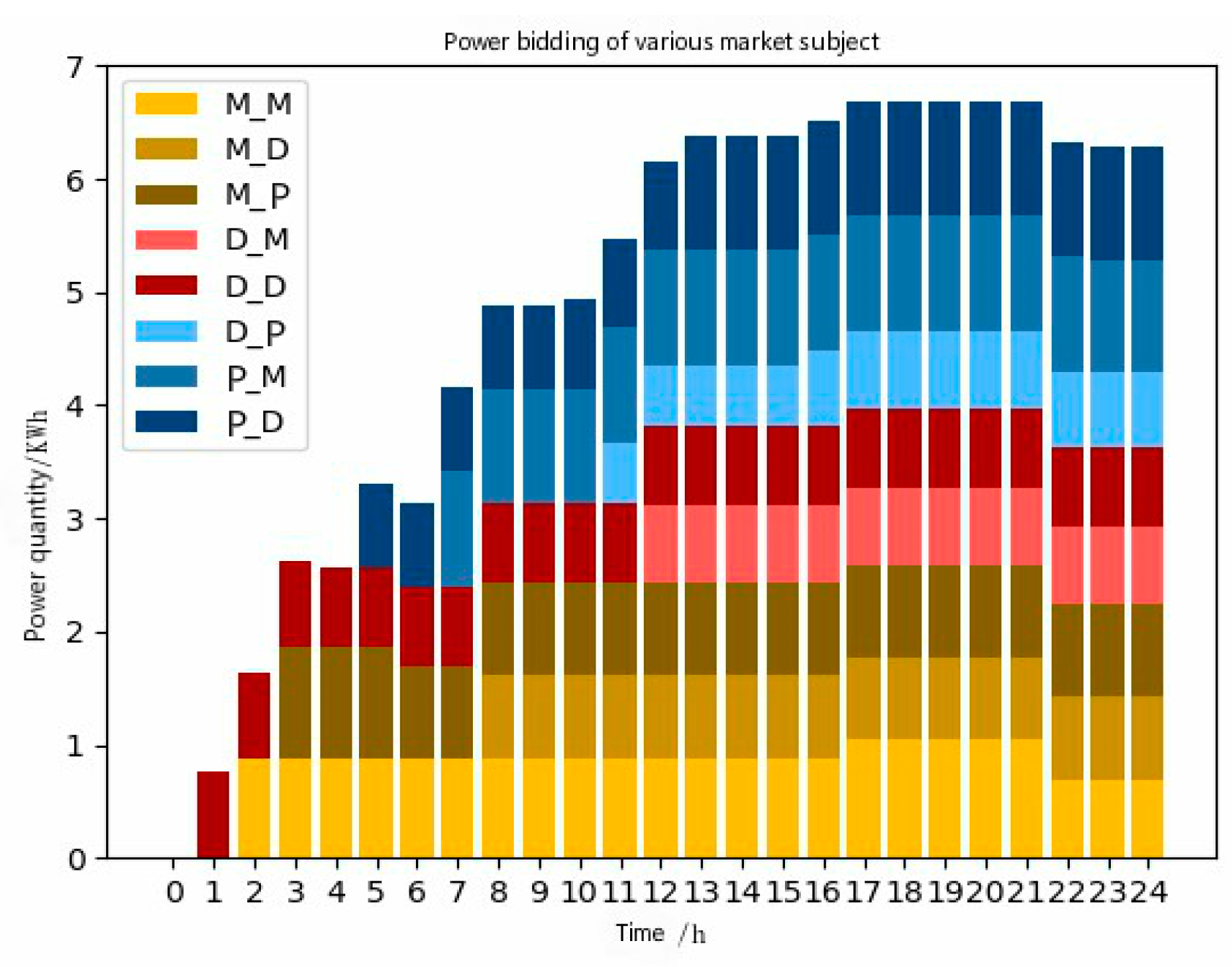

5.1. Example 1

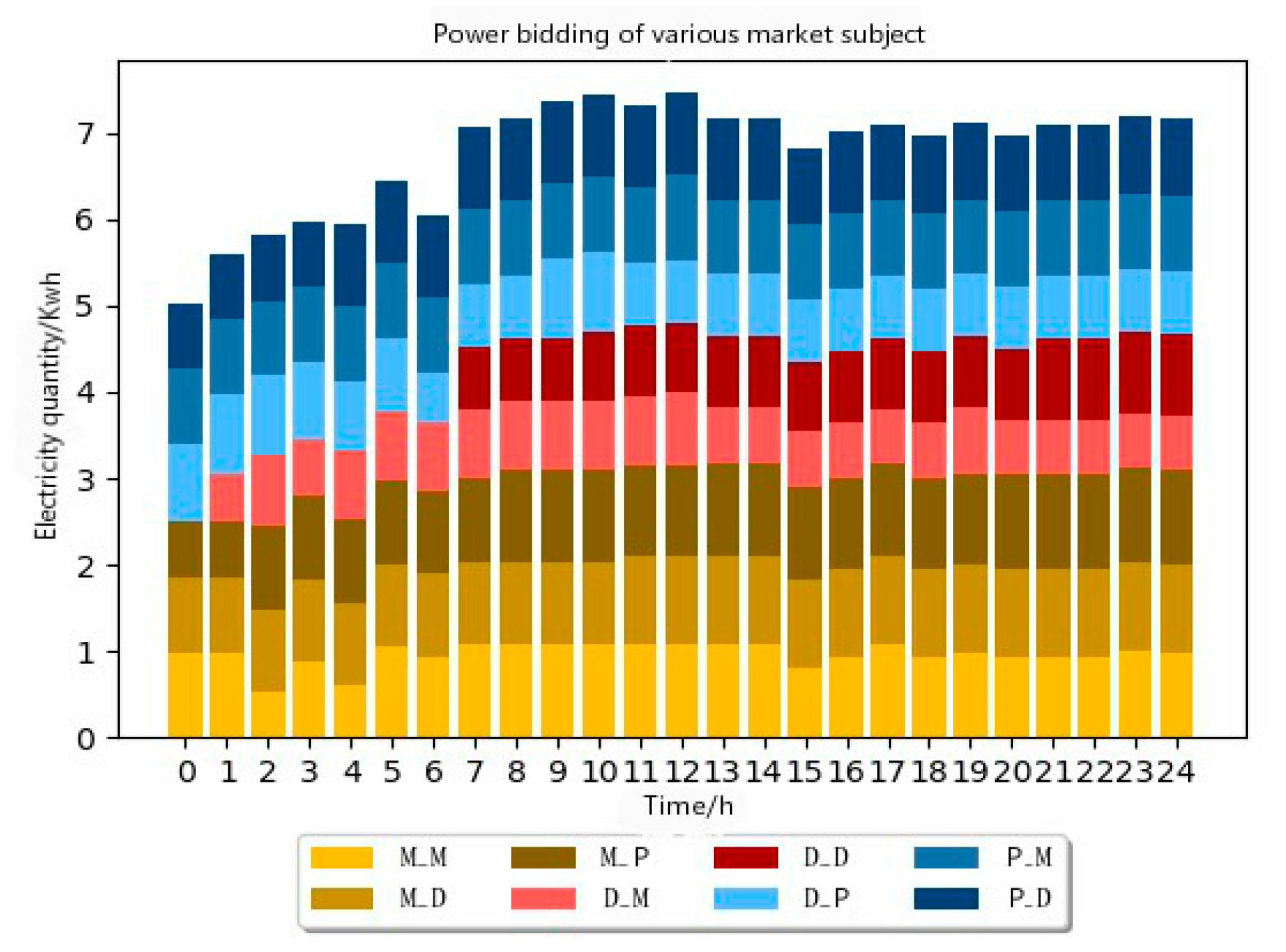

5.2. Example 2

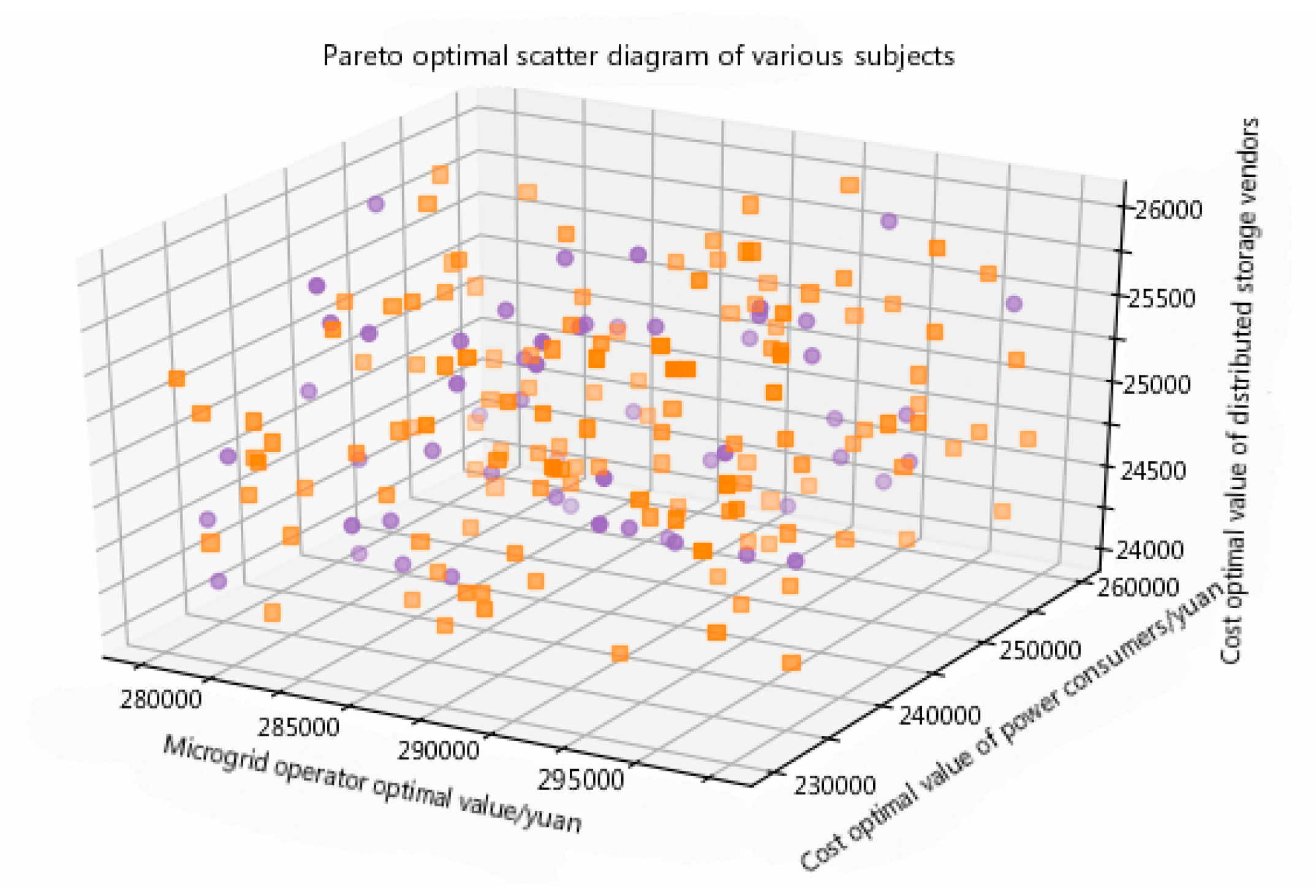

5.3. Pareto Near Global Optimum Scatter Diagram

6. Discussion

6.1. Peer-to-Peer Network in Trading System

6.2. Transaction Settlement Based on Blockchain

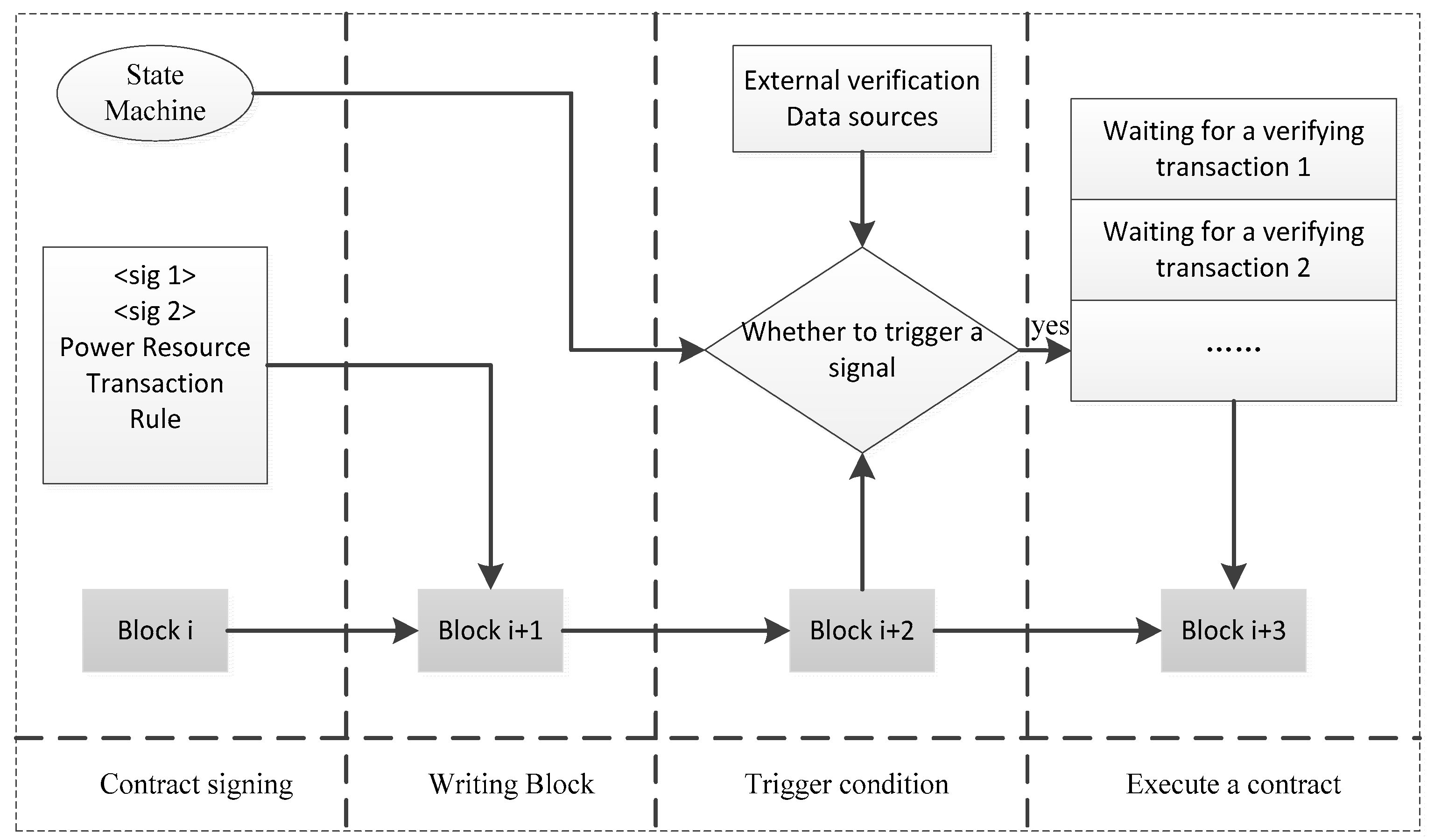

- (1)

- Contract signing: Each power selling and purchasing transaction node predefines an electronic commitment, which includes the electronic signature of both subjects, the amount of electricity and virtual tokens needed by power exchanges, power trading rules, and a complete state machine.

- (2)

- Writing block: smart contracts with electronic signatures spread to the whole network through P2P in the process of transaction. After consensus verification, they are written into distributed accounts of each node in the blockchain.

- (3)

- Trigger conditions: judging whether all triggering conditions are met in power trading.

- (4)

- Contract execution: If a power transaction meets the conditions in (3), it will be verified by pushing out of the blockchain to the queue. When it passes the verification as well as agreed by most nodes, the smart contract is activated and executed to complete the settlement of the transaction funds automatically.

6.3. Prospect

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zhou, K.; Yang, S.; Shao, Z. Energy Internet: The business perspective. Appl. Energy 2016, 178, 212–222. [Google Scholar] [CrossRef]

- Liu, D.N.; Zeng, M.; Huang, R.L. Business models and market mechanisms of E-Net. Power Syst. Technol. 2015, 11, 2057–2063. [Google Scholar]

- Chen, P. Power Market Transaction and Economic Operation Based on Microgrid. Ph.D. Thesis, Beijing Jiaotong University, Beijing, China, 2011. [Google Scholar]

- Chen, J.; Liu, Y.T.; Zhang, W. Analysis of multi-level microgrid optimal allocation in distribution network based on game theory. Power Syst. Autom. 2016, 1, 45–52. [Google Scholar]

- Sinha, A.; Lahiri, R.N.; Neogi, S. Analysis of market price for distributed generators (DGs) in Microgrid. In Proceedings of the 2009 International Conference on the European Energy Market, Leuven, Belgium, 27–29 May 2009; pp. 1–5. [Google Scholar]

- Zhao, M.; Shen, C.; Liu, F. A Game-theoretic Approach to Analyzing Power Trading Possibilities in Multi-microgrids. Proc. CSEE 2015, 4, 848–857. [Google Scholar]

- Liu, Y.; Guo, L.; Wang, C.S. Optimal Bidding Strategy for Microgrids in Electricity Distribution Market. Power Syst. Technol. 2017, 8, 2469–2476. [Google Scholar]

- Li, H.L.; Liu, C.Q. A Study on the Model and Control Algorithm for Coalitional Game of Microgrid. Smart Grid 2016, 3, 291–296. [Google Scholar]

- Javadi, M.; Marzband, M.; Akorede, M.F. A Centralized Smart transactive energy framework in grid-connected multiple home microgrids under independent and coalition operations. Renew. Energy 2018, 11, 95–106. [Google Scholar]

- Marzband, M.; Azarinejadian, F.; Savaghebi, M.; Pouresmaeil, E.; Guerrero, J.M.; Lightbody, G. Smart transactive energy framework in grid-connected multiple home microgrids under independent and coalition operations. Renew. Energy 2018, 126, 95–106. [Google Scholar] [CrossRef]

- Tai, X.; Sun, H.B.; Guo, Q.L. Electricity transactions and congestion management based on blockchain in energy internet. Power Syst. Technol. 2016, 12, 3630–3638. [Google Scholar]

- Wang, A.P.; Fan, J.G.; Guo, Y.L. Application of blockchain in energy interconnection. Electr. Power Inf. Commun. Technol. 2016, 9, 1–6. [Google Scholar]

- Mihaylov, M.; Jurado, S.; Avellana, N. NRGcoin: virtual currency for trading of renewable energy in smart grids. In Proceedings of the 2014 International Conference on the European Energy Market, Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar]

- Bitcoin: A Peer-to-Peer Electronic Cash System. Available online: https://genius.com/Satoshi-nakamoto-bitcoin-a-peer-to-peer-electronic-cash-system-annotated (accessed on 1 January 2008).

- Ji, Z.D. Blockchain and Practice of Business Process Reengineering. Inf. Technol. Stand. 2017, 3, 22–24. [Google Scholar]

- Xie, Q.H. Research on blockchain technology and financial business innovation. Financ. Dev. Res. 2017, 5, 77–82. [Google Scholar]

- Wang, C.L.; Wang, Y.D.; Qin, Q. Supply chain logistics information ecosystem model based on blockchain. Intell. Theory Pract. 2017, 7, 115–121. [Google Scholar]

- Wang, Z.M. A Text Similarity Metrics Method Using TF-IDF Method Combined with Lexical Semantic Information. Ph.D. Thesis, Jilin University, Changchun, China, 2015. [Google Scholar]

- Yuan, Y.B.; Liu, Y.; Wu, B. Improved Ant Colony Algorithm for Solving Shortest Path Problem. Comput. Eng. Appl. 2016, 6, 8–12. [Google Scholar]

- Shah, S.; Kothari, R.; Chandra, S. Debugging ants how ants find the shortest route. In Proceedings of the 2011 Communications and Signal Processing, Singapore, 13–16 December 2011; pp. 1–5. [Google Scholar]

- Sun, W.; Ma, T. The power distribution network structure optimization based on improved ant colony algorithm. J. Intell. Fuzzy Syst. 2014, 6, 2799–2804. [Google Scholar]

- Liu, L.; Wang, J.X.; Qin, S.S. A Kind of Application of Improve Ant Colony Algorithm in Power Distribution Network Optimization Planning. Sci. Technol. Eng. 2011, 24, 5801–5803. [Google Scholar]

- Zeng, B. Research on Efficiency Evaluation of Electricity Market Economy Based on Improved Ant Colony Algorithm. Shaanxi Electr. Power 2008, 2, 6–10. [Google Scholar]

- Ma, T.N.; Peng, L.L.; Du, Y. Competition game model and algorithm for local multi-microgrid market under blockchain technology. Power Autom. Equip. 2018, 5, 1–12. [Google Scholar]

- Shen, X.; Pei, Q.Q.; Liu, X.F. Survey of block chain. Chin. J. Netw. Inf. Secur. 2016, 11, 11–20. [Google Scholar]

| Various Market Subject | Bidding Strategy Interval |

|---|---|

| Microgrid operators | 0.5~1.1 yuan/(kWh) |

| Distributed storage vendors | 0.5~0.95 yuan/(kWh) |

| Power consumers | 0.5~1.05 yuan/(kWh) |

| Two Trading Parties | Electricity Price (yuan/kWh) | Two Trading Parties | Electricity Price (yuan/kWh) |

|---|---|---|---|

| 0.91 | 0.84 | ||

| 0.85 | 0.84 | ||

| 0.84 | 0.69 | ||

| 0.91 | 0.84 |

| Two Trading Parties | Electricity Price (yuan/kWh) | Two Trading Parties | Electricity Price (yuan/kWh) |

|---|---|---|---|

| 1.07 | 1.02 | ||

| 1.07 | 0.79 | ||

| 0.82 | 0.72 | ||

| 0.87 | 0.95 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, Z.; Yang, D.; Li, W. Microgrid Group Trading Model and Solving Algorithm Based on Blockchain. Energies 2019, 12, 1292. https://doi.org/10.3390/en12071292

Xu Z, Yang D, Li W. Microgrid Group Trading Model and Solving Algorithm Based on Blockchain. Energies. 2019; 12(7):1292. https://doi.org/10.3390/en12071292

Chicago/Turabian StyleXu, Zixiao, Dechang Yang, and Weilin Li. 2019. "Microgrid Group Trading Model and Solving Algorithm Based on Blockchain" Energies 12, no. 7: 1292. https://doi.org/10.3390/en12071292

APA StyleXu, Z., Yang, D., & Li, W. (2019). Microgrid Group Trading Model and Solving Algorithm Based on Blockchain. Energies, 12(7), 1292. https://doi.org/10.3390/en12071292