1. Introduction

There is growing interest by the global aviation industry to consume significant amounts of sustainable aviation fuels (SAF). Commercial and military aircraft test flights have successfully demonstrated the feasibility of SAF as a substitute for petroleum-based jet fuel [

1,

2]. Several commercial airlines have also signed a memorandum of understanding from potential SAF suppliers [

1,

2]. A driving force for aviation industry interest in SAF is the United Nations International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) adopted in 2016 [

3]. CORSIA is a market-based mechanism designed to offset growth in greenhouse gas emissions from aviation starting in 2020.

In the US, interest in SAF by the commercial aviation industry is mainly driven by petroleum-based jet fuel price instability, energy security, environmental performance, and the impending implementation of CORSIA for international flights [

4]. Currently, at least two biorefineries are commercializing SAF in the US. AltAir Paramount, acquired in March 2018 by World Energy LLC, entered an agreement in 2016 to sell up to 56.78 million liters SAF to United Airlines by converting tallow, Brassica carinata, and other oilseeds into SAF [

5]. Gevo, Inc., also produces, at lower quantities compared to AltAir’s, SAF that has been used to fuel approximately 195 domestic and international flights departing from Brisbane, Australia [

6]. Overall, production of SAF in the US is still limited.

The potential for growth of SAF consumption in the US depends upon several factors including feedstock availability, oil conversion technology, aviation industry demand, and overall supply chain profitability. Lewis et al. [

4] modeled SAF production capacity in the US and concluded that significant production and distribution of SAF are possible by 2030 if appropriate incentives, such as higher guarantee rates or higher renewable identification number (RIN) prices along with high oil prices and investment deployment are in place. Without substantial changes in current incentives, the authors conclude that between 0.76 and 10.22 billion liters of SAF could be produced and distributed by 2030, with simulations showing that 1 billion gallons could be produced by 2030 with a 38% probability. A better understanding of feedstock supply chains, which is the goal of this study, should improve the likelihood of increased production and consumption of SAF.

One of the main challenges for the production of renewable fuels, in general, is the relatively high cost of production, particularly for biofuels produced using field crops such as corn. Dedicated energy crops are then expected to play an increasing role in meeting the demand for SAF [

2]. Field pennycress (

Thlaspi arvense L.), hereafter referred to as pennycress, is a non-food crop that has been documented to have high potential as feedstock for SAF production [

1,

7].

Pennycress may have economic advantages over other dedicated energy crops produced in place of food crops because it can be grown as a winter cover cash crop within an existing field cropping system. An example is the incorporation of pennycress into a two-year corn (first year)–soybean (second year) rotation that is widely adopted in US agriculture [

8]. For a corn–pennycress–soybean rotation, pennycress seed is aerial broadcast onto the field before the harvest of corn. Pennycress grows as a winter cover crop and is harvested using a combine in the spring of the second year of the rotation. Soybeans are planted after the pennycress harvest to complete the rotation. This production system provides three cash crops to a farmer instead of two over the two-year sequence. In addition, oilseeds such as pennycress that are planted as a winter cover within existing crop rotations may provide ecological and environmental benefits, e.g., reduced pest pressure, erosion control, and immobilization of excess nutrient levels in soils normally left bare over the winter [

9].

Another advantage of pennycress is the relatively high content of seed oil, about twice the content in soybeans and comparable to camelina’s [

1], that can be subsequently converted into SAF at a high level of efficiency [

10]. Most importantly, the properties of pennycress oil meets feedstock requirements for biodiesel production under the United States American Society for Testing and Materials (ASTM) D6751 regulation [

11,

12]. Therefore, biofuel derived from pennycress oil is expected to meet all the specifications for its use in SAF blends up to 50% [

1]. Studies have also shown that the pennycress cake or meal left after oil extraction has potential uses such as biofumigant [

13], secondary energy source [

1], industrial adhesive [

14], and livestock feed [

1].

Tao et al. [

15] estimate that the cost of pennycress bio-oil feedstock to produce SAF is 68% of minimum SAF selling price. Therefore, the cost of bio-oil feedstock has a substantial impact on expected cost and profit profiles of a biorefinery and other enterprises within the prospective biofuel supply chain [

15,

16,

17]. However, little is known about supply chain cost structures for second-generation energy crops such as pennycress [

18]. This study contributes to the literature in this regard.

In a pennycress supply chain, a crushing facility would purchase and convert pennycress oilseed into the bio-oil that is subsequently transformed into SAF by a biorefinery [

1,

15].

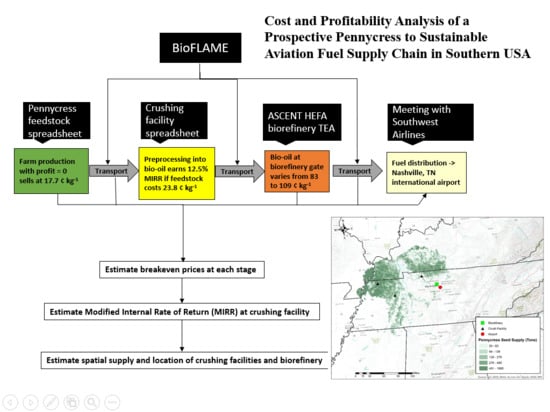

Figure 1 shows the three major enterprises of a stylized pennycress SAF supply chain. Researchers have evaluated the farm-level costs—enterprise (1) in

Figure 1—of producing field pennycress and potential output prices required to induce farmers to produce pennycress oilseed for conversion to SAF [

8]. However, there is still substantial uncertainty about pennycress oilseed yields, cost structures, and prices required to induce oilseed production that are significant barriers to the development of a feedstock supply chain for SAF [

8]. For example, the impact of potential bio-oil and coproduct costs and prices from crushing pennycress oilseed on the expected profitability and breakeven prices paid for feedstock by a crushing facility—enterprise (2) in

Figure 1—has not been quantified. We determine profit profile and breakeven pennycress oilseed prices at the plant-gate from investment in an oilseed crushing facility located in Southeastern US. The crushing facility would supply bio-oil to biorefineries—enterprise (3) in

Figure 1—producing SAF for the Nashville, Tennessee international airport, and other co-products. Using a spatial biorefineries sitting model, we also estimate the number and locations of potential crushing facilities and biorefineries in the supply chain. Finally, the cost structure of the pennycress oil supply chain up the biorefinery gate is discussed.

2. Methods

The steps used to accomplish the objective of the study are as follows. First, breakeven pennycress oilseed prices (profit = 0) required to induce farm-level production of oilseed are evaluated using partial budgeting and one-way sensitivity analysis of the costs of alternative pennycress production practices [

19]. Second, a crushing facility discounted cash flow model and one-way sensitivity analysis are used to evaluate breakeven prices for pennycress oilseed given an expected rate of return. Third, the biofuels facility location analysis modeling endeavor (BioFLAME), a spatial biorefineries sitting model, is used to determine the number and locations of potential crushing facilities and biorefineries to supply SAF to the Nashville international airport [

20].

2.1. Farm-Level Pennycress Oilseed Breakeven Prices

The plant-gate cost of feedstock is the largest component of total operating costs for an oilseed crushing facility [

21]. Given that pennycress production is not commercially harvested, there is considerable uncertainty about oilseed yields, the inputs used in production, and the costs of production [

14]. Budget-based costs of production vary widely depending on assumptions about oilseed yields, seeding rates at planting, fertilization rates, herbicide practices, harvest practices, and feedstock transport distances from the field to the crushing facility [

1,

7,

8,

22].

Effects of uncertain budget inputs on feedstock costs at the crushing facility plant gate are evaluated using breakeven and one-way sensitivity analysis [

19]. The resulting breakeven pennycress oilseed price (¢ kg

−1) is the minimum price (profit = 0) that covers the cost of production and transportation to the crushing facility for a given oilseed yield. The base scenario is the production practices and input quantities specified in a field pennycress budget by Markel et al. [

8] (details provided in the notes of

Table 1). In addition, the base one-way travel distance of 80.47 km to transport pennycress oilseed from the field to the crushing facility is from Fan et al. [

1]. The one-way sensitivity analysis is accomplished by changing one partial budget model variable (oilseed yield and each input practice) at a time from the base value while holding the other variables at their base values. A tornado diagram presents the one-way sensitivity analysis effects of each variable on minimum potential plant-gate cost of pennycress oilseed [

19]. Yields, production practices reported in the literature, and costs for the lower and upper bound values are also presented in

Table 1.

2.2. Crushing Facility Pennycress Oilseed Breakeven Prices

A discounted cash flow model is used to evaluate the maximum (breakeven) price that a crushing facility can pay for pennycress oilseed, including transportation cost, to obtain a specified hurdle rate of return expected by investors. The main financial metrics estimated are net present value (NPV) and the modified internal rate of return (MIRR). NPV provides an estimate, in present value terms, of the amount of money that replicates the forecast cash flows of the project after deducting the opportunity cost of capital. Thus, NPV is a reference showing the total amount exceeding or falling short of investors’ expected return, where expected return is measured by the opportunity cost of capital. The maximum buying price is estimated so that NPV equals zero; or equivalently, so that the crushing facility can obtain a 12.5% MIRR. The crushing facility maximum (breakeven) oilseed price is compared with the minimum (breakeven) pennycress oil prices required to induce farm production.

To evaluate price ranges instead of a point estimate, similarly to the analysis performed for pennycress farm level costs, we evaluate the effects of uncertain pennycress to oil conversion rate, pennycress output—oil and meal—prices, weighted average cost of capital, income tax rate, and assumed number of days inventory for the facility to hold.

Table 2 provides data and assumptions for this breakeven analysis. Other key financial metrics for the crushing facility are also reported.

The cost structure, plant design, and feedstock capacity for the pennycress oilseed crushing facility are adapted from oilseed processing models developed by Shumaker et al. [

37] and English et al. [

38]. Both studies have distinctive characteristics found suitable as references for this pennycress oilseed crushing facility feasibility study. First, those studies were the result of a concerted effort by researchers, farmers, and industry consulting, (research faculty involved in the studies were from The Center for Agribusiness and Economic Development at University of Georgia [

1] and The Agri-Modelling and Analysis Group at University of Tennessee Knoxville [

2]. A farmer association involved was The South Dakota Soybean Processors [

1], a farmer owned soybean crushing operation. Frazier, Barnes & Associates, LLC., a consulting firm specialized in agricultural and renewable fuel products collaborated in both studies [

1,

2].) arguably resulting in balanced analyses in terms of applicability and rigor. Second, the studies concur on their assessment that a cost-efficient facility size in the region, capturing much of the available economies of scale, would be one processing between 725.75 and 816.47 Mg of feedstock per day. This study assumes the crushing oilseed facility processes 725.75 Mg of pennycress oilseed per day, equivalent to 238,771 Mg per year working 24 hours a day at 90% plant capacity or about 329 days annually.

To provide context, one crushing facility would supply about one-third of the refined bio-oil demand of the bio-refinery. (This assessment is based on communications by the authors with researchers currently involved in conceptualized biorefinery projects by the Aviation Sustainability Center (ASCENT). The pennycress oilseed facility in this study can provide, according to the baseline estimation, about 78,541 Mg of pennycress oil, which represents around 30% of the 260,706 Mg of bio-oil that a typical ASCENT conversion facility would demand. Thus, the preprocessing facility in this study assumes approximately a three-to-one crushing-to-biorefinery ratio. For the biorefinery to operate at 90%, an additional 25,000 Mg of bio-oil would need to be purchased in the market place.) The biorefinery assumed in this analysis is a hydroprocessed esters and fatty acids (HEFA) facility conceptualized by ASCENT and further developed in a technical economic analysis. Finally, the cost structure and plant design in English et al. [

38] and Shumaker et al. [

37] envisioned flexible facilities, with the potential to handle multiple oilseed crops and preserve the identity of oils and coproducts. This multi-crop flexibility could be a risk reduction mechanism in case of short supply of pennycress oilseed, which is a possibility particularly during the early stage of the life cycle of a newly adopted crop.

The discounted cash flow model to value the crushing facility, assumptions, and data are described next.

2.3. Discounted Cash Flow (DCF) Model

DCF is used to analyze profitability, risk, and breakeven pennycress prices at the plant-gate for the crushing facility. NPV is calculated by discounting the forecasted free cash flows (FCF) during the life of the project:

is the incremental cash flow per year attributable to the pennycress crushing facility accruing to equity and debt holders and is computed as

where

is net operating income after taxes, computed as revenues minus cost of goods sold and operating expenses—including depreciation—minus income taxes;

is depreciation expenses;

is capital expenditures, defined as investments in fixed asset; and

is year to year change in net operating working capital, defined as the firm’s investment in net operating current assets.

, and depreciation methods are defined in more detail in the “Capital budgeting for the crushing facility” section. Assumed income tax rate is assumed 40% for the baseline.

, in Equation (1), is a nominal risk-adjusted discount rate. According to surveys, most firms in the US use the weighted average cost of capital (WACC) as a discount rate [

39], which is a weighted average of the annual cost of debt and cost of equity. For this study, WACC = 12.5% is used following ASCENT’s assumptions for biorefinery feasibility studies in the US [

36].

Regarding the forecast period (T, in Equation (1)), the DCF model in this study forecasts two and a half years of establishment or construction plus 10 years of productive life for the crushing facility. At the 10th year of productive life, a residual value—the book value of total assets—is added to the operating FCF of that year. Ten years of productive life is a common assumption used when valuing bioenergy facilities [

17,

38].

In addition to NPV, we also estimate the modified internal rate of return (MIRR), which is the rate of return that makes the NPV equals zero; providing an annual rate of return that would satisfy both debt holders and shareholders. The MIRR has been used in agricultural enterprise valuations and has been argued to be a superior metric relative to the traditional internal rate of return [

40,

41].

2.4. Capital Budgeting for the Crushing Facility

2.4.1. Investments

Capital expenditures—

Table 3 provides a breakdown of CAPEX required to establish the crushing/refining oilseed pennycress facility. Establishment CAPEX estimations in Shumaker et al. [

37] were re-expressed as of 2017 USD by using IMPLAN inflators by economic sectors. About

$75.45 million CAPEX is estimated to build such a facility. The model assumes that the facility is completed within two and a half years, with cash outflows spent evenly in 2017 and 2018, and operations starting in spring 2019 following field pennycress harvest. No subsequent CAPEX is forecasted other than regular maintenance expenses.

Net operating working capital investment—beginning operations, in year 3, investment in current assets is needed to build up inventories and support credit sales. Net operating working capital investment (NOWC), defined as

provides an estimate for the amount of firm’s net operating current assets (i.e., operating current assets minus operating current liabilities) or, equivalently, an estimate of capital invested in short-term assets.

is days inventory, assumed to be 60 or two months;

is days accounts receivable, assumed one month; and

is days accounts payable, assumed one month.

is cost of goods sold per day, including depreciation. The year-to-year change in NOWC, ΔNOWC, represents the annual marginal capital investment in short-term assets.

The relevant assumption in this working capital estimation is the number of days inventories to hold in the facility. The plant will have the needed infrastructure to store pennycress oilseed mainly and pennycress oil and meal (item (a) in

Table 3). The startup capital needed to hold, on average, two months of inventory is equivalent to approximately

$14.0 million.

Under contract production, the crushing facility would receive up to 238,771 Mg of pennycress oilseed, the total planned annual plant processing capacity, during a relative short window of two to three months during the late spring or early summer.

Table 4 provides the monthly value of inventories for a stylized typical year, assuming pennycress seed cost of 23.8 ¢ kg

−1 (the breakeven cost as will be explained in the results section), three months seed buying window, and uniform production and sales.

Table 4 shows that funding for working capital needs is seasonal, with funding required during the buying window (the last line in

Table 4) almost doubling the yearly average working capital investment.

2.4.2. Operating Costs

Operating costs categories, in order of magnitudes, include: (1) Feedstock cost, (2) depreciation, and (3) other costs. Each category is described next.

Feedstock cost—since an established market for pennycress does not exist yet, in this study we estimate the maximum price that the crushing firm could pay for pennycress and still make the enterprise profitable.

Depreciation—depreciable assets are expended during 10 years according to a modified accelerated cost recovery system (MACRS) schedule. Depreciation rates are estimated using a double declining balance (DDB) method as prescribed by MACRS [

43].

Other costs—the budget includes labor, energy, sewer and water, processing materials, water treatment, fixed costs, and other costs related to both the crushing and refinery stages of the oil extraction process. Costs in Shumaker [

37] were re-expressed as of 2017 USD by using IMPLAN inflators.

Table 5 provides breakdown of operating costs, other than depreciation and feedstock cost, as a percentage of total revenues in the baseline scenario.

2.4.3. Output Prices

Refined pennycress oil is the main product of the oil extraction facility, which will be sold to a SAF refinery firm. Pennycress oilseed meal is a co-product to be sold as an ingredient of a livestock feed ration.

Pennycress oil price—pennycress oil is assumed to be sold at prices equivalent to soybean oil due to its perceived similarity in quality [

1]. Soybean oil (nominal) price projections by the USDA are used for the 10-year forecast period in this study [

32]. Available soybean oil price projections (6 years) by FAPRI [

33] is also used, as in previous biofuel studies [

44], along with soybean oil future prices available for two years from the Chicago Mercantile Exchange (CME) [

34]. Using these price series, a simple average is calculated and used as pennycress oil price in the model. Forecast prices by FAPRI and prices at CME are more conservative than USDA’s forecast prices because they were updated after the trade war with China started in the summer 2018. Thus, the forecast prices in this model already consider the potential negative effect of tariffs on US soybean oil prices particularly for the first years of the forecast period.

Pennycress meal price—prices of distillers’ dried grain with solubles (DDGS) are used to proxy pennycress meal prices. Pennycress meal would be part of a feed ration for livestock, providing mainly protein content of around 30% [

1], which is similar to the protein content of DDGS [

45].

DDGS low and high monthly prices delivered in St. Louis, MO, from 2000 to 2018, were obtained from the Agricultural Marketing Service website [

35], and re-expressed as of the end of 2018 using consumer price index. The simple average of the median of low and high price series was used as the price for pennycress meal for the first year of production. Prices for subsequent years were updated according to the assumed inflation rates.

2.4.4. Inflation Rates

Forecast inflation rates vary around 2% to 2.4% during the 10-year period, according to the USDA [

32].

2.5. Pennycress Supply Chain Site Location Analysis

BioFLAME—a GIS-based bioenergy facility-siting model maintained by the Department of Agricultural and Resource Economics, The University of Tennessee, Knoxville [

20]—is used to determine the least-cost pennycress supply chain configuration to provide SAF to the Nashville international airport. The airport consumes about 340.69 million liters of aviation fuel annually. BioFLAME has been used to estimate the economic effects of preprocessing facilities to supply switchgrass for a potential commercial-size biorefinery in Tennessee [

46] and to evaluate the impacts on regional employment of the optimal siting of biorefineries in the southeastern United States [

47].

The BioFLAME GIS database includes geo-spatial data layers for crop area, crop yields including field pennycress, county-level costs of crop production budgets, crop prices, transportation costs, available industrial parks for siting crushing and biorefinery facilities, the real road network, and other geo-spatial layers. A two-step process is used within BioFLAME. The initial step locates the crushing facilities, given current land use patterns, by minimizing the cost of feedstock using the annual cost of procuring and transporting feedstock based on farm and crushing facility costs described earlier in this paper. The second step determines the location of the biorefinery based on existing infrastructure, feedstock supply potential in the region, and the location of the demand center (airport) for SAF.

To project potential supply of field pennycress, it is assumed that pennycress can grow where a corn/soybean rotation is utilized. The NASS crop data layer is used to identify locations where corn and soybeans are grown using a grid of 13 km2 hexagons. These serve as the potential supply regions and potential pennycress supply is estimated by multiplying pennycress yield times the minimum of corn or soybean hectares. No reduction in soybean yield is assumed as result of the potential delay in planting due to pennycress harvest activities.

The algorithm in BioFLAME uses GIS functions and database management operations to determine the facility locations minimizing the plant-gate cost of pennycress bio-oil. County-level budgets, crop area, and prices are used to calculate a breakeven pennycress bio-oil price above which farmers would convert from a corn–soybean rotation to a corn–pennycress–soybean rotation. Total bio-oil demand is set by the biorefinery and is based on ASCENT’s HEFA techno-economic analysis [

48].

The shortest path to each potential feedstock supply unit defined as 13 km2 hexagons in the model along the real road transportation network is determined and used to generate a least-cost transportation layer. The model evaluates the costs of siting crushing and biorefinery facilities in the set of all candidate sites in a region. Crush candidate sites are defined by several criteria including that the location must occur in an industrial park with electricity, natural gas, access to major state highway or interstate, and more than 4.05 ha available for development. Transportation and farm-gate costs are minimized at a preferred site. The model is rerun assuming that the preferred crushing candidate sites are suppliers of bio-oil to the biorefinery using minimized feedstock cost plus transportation costs of SAF to the airport as the location determinant.

Model output in this study includes the cost minimizing crushing and biorefinery facility locations and pennycress feedstock-draw areas corresponding with each facility location. In addition, the costs of producing and transporting the feedstock to the crushing facility as well as the costs of transporting the bio-oil to the biorefinery and the aviation fuel to the airport are outputs from BioFLAME. The costs of transporting the coproducts (meal at the crushing facilities and diesel, gasoline, naphtha, and LPG at the biorefinery) are not incorporated into the analysis since their destination is unknown.

Biorefinery requirements are taken from the ASCENT HEFA biorefinery techno economic assessment (AHTEA) [

48]. The biorefinery requires 260,706 Mg per year of bio-oil, which can be purchased on the market or produced from three crushing facilities. In this analysis, the feedstock is converted from oilseed to bio-oil through the establishment of three crushing facilities. The AHTEA assumes that bio-oil can be delivered to the biorefinery for a cost of

$1.03 kg

−1. The AHTEA assumes production levels of 162 million liters of jet fuel, 24.17 million liters of Naphtha, 71.46 million liters of diesel, 31.6 million liters of LPG, and 22.12 million liters of propane, and sells that production for

$1.24,

$1.19,

$1.30,

$0.54, and

$0.54 per liter

−1, respectively. In addition to selling the production of the biorefinery, RINs would be produced for each gallon of SAF and renewable diesel. Since the price of these RINs fluctuate, they are not incorporated into the analysis.

4. Conclusions

Based on the estimates presented in the paper, it appears that there are areas of profitability for players in a prospective pennycress supply chain to supply SAF to the Nashville International Airport in Tennessee. Breakeven cost (profit = 0) estimate of growing, harvesting, and transporting pennycress seed to a crushing facility is equal to 17.7 ¢ kg−1. A crushing facility can pay up to 23.8 ¢ kg−1 for pennycress seed during the first year of production and provide investors 12.5% annual rate of return. The crushing facility could use the up to 6.1 ¢ kg−1 profit margin to induce pennycress producers to supply oilseed for processing into bio-oil and SAF. This base scenario result indicates that oil and meal from pennycress oilseed that are priced similar to soybean oil and DDGS have the potential to provide positive profits to both pennycress producers and oilseed crushers in a potential SAF supply chain. However, the estimated profit margin was sensitive mainly to uncertain oilseed yields, changes in field production costs, and pennycress meal and oil prices.

The total cost of the feedstock over the supply chain at the biorefinery gate, including crushing and transportation to biorefinery, is estimated between 83 cents kg−1 and 109 ¢ kg−1 if pennycress oilseed is purchased at 17.7 and 23.8 ¢ kg−1, respectively. The upper bound of this cost is only slightly above ASCENT’s HEFA technoeconomic analysis estimated cost at 103 ¢ kg−1. In order to breakeven (NPV = 0 for the crushing facility), assuming the crushing facility is the only entity in the supply chain adjusting its profit structure, the crushing facility will need one or a combination of the following actions: Produce more bio-oil by increasing its daily operating capacity, reduce the overall oilseed cost, or more specifically, pay farmers a price below 23.8 ¢ kg−1.

BioFLAME output suggests that three crushing facilities are located in Union City, Huntington, and Clarksville, TN, to supply bio-oil to the biorefinery, with the biorefinery sited in an industrial park about 24.14 km from the Nashville international airport aviation fuel storage. Overall, results in this paper suggests profitability opportunities but also uncertainties. The pennycress yield assumption needs future investigation. Analysis of planting pennycress best management practices and their impacts on yield is needed to reduce producer resistance and risk.