1. Introduction

In recent years, the world has faced a urgent climate change problem and a depletion problem of fossil fuels. The portion of renewable energy sources (RESs) has gradually increased instead of fossil fuel based generators in many countries. We expect that worldwide penetration of solar power rapidly increase until 2030 since it is manageable to build, operate, and maintain PV systems [

1]. Utility-scale photovoltaic (PV) plants have been rapidly installed in many countries. For example, China, Germany, and the USA have tens of utility-scale PV farms. In addition, China, Japan and European countries have operated a feed-in tariff (FIT) policy to increase investment in PV industry, while the USA and South Korea adopted a renewable portfolio standard (RPS) in order to spread PV systems [

2].

However, PV output power generally exhibits an ‘intermittent’ output characteristic depending on weather conditions [

3]. Due to the poor predictability, PV systems may experience a power imbalance during those operation. Therefore, it is difficult for MW-scale PV power producers to participate in energy markets due to the prediction errors. Furthermore, this intermittent property may decrease the economical profit for utility-scale PV power producers since higher capacity of energy storage systems (ESSs) is required to absorb the prediction errors of PV power generation and avoid the variability of utility.

Integration of RES output power in the power system would highly depend on accurate forecasts [

4,

5]. Therefore, a number of studies on the prediction of solar irradiance or PV output power have been found in literature. The persistence scheme may be effective only for its use in short-term forecast (e.g., intra-hour) applications [

6]. Cloud motion vector (CMV) by total sky imagers [

7] and satellite images [

8] were utilized to analyze cloud movement and predict short-term irradiance at the ground level. For longer time horizons (hours to days), numerical weather prediction (NWP) schemes have been applied [

9,

10]. A number of time series prediction schemes such as autoregressive moving average (ARMA) [

11], autoregressive integrated moving average (ARIMA) [

12], and autoregressive moving average with exogenous inputs (ARMAX) [

13] have also been used to design the prediction model based on stochastic characteristics of solar irradiance. In addition, a number of prediction studies have developed nonlinear solar or PV output power prediction schemes based on machine learning (ML). In specific, artificial neural networks (ANN) [

14], support vector machine (SVM) [

15,

16], and hybrid schemes [

17] have been utilized in prediction models.

The Federal Energy Regulatory Commission (FREC) issued the Order 764, which aims to remove a barrier for the integration of renewable energy resources into the power grid [

18]. In the existing energy market, the FERC noted that the suppliers of renewable energy resources should pay for imbalance penalties for any difference between their settled energy and actual delivery in that hour. In addition, the suppliers of renewable energy resources need to provide bids in RT markets, based on forecasts and then follow dispatch instructions in the current Independent System Operator (ISO)/Regional Transmission Organization (RTO) markets [

19]. New York (NYISO), PJM Interconnection (PJM), Electric Reliability Council of Texas (ERCOT), and California ISO (CAISO) have the market policy of the imbalance settlements and deviation penalties. If renewable generation is a capacity resource, it must bid in DA market and RT market. Also, a deviation penalty applies. However, the previous PV power prediction studies did not consider the energy market for PV power trading. Few studies dealt with energy markets, which are regulation markets [

20,

21] and locational marginal price (LMP) markets [

4,

22] for wind power trading.

ESSs play an important role in integrating RES into power grid. However, there are only few studies considering the contributions of the renewable prediction schemes based on the economic analysis such as an assessment of the profit for the PV power producers. The power capacity of ESSs was calculated to compensate the wind power generation [

23]. However, the operational environment of the ESS is different for absorbing the deviation due to the prediction errors between the wind and PV systems. For example, ESSs for the PV system can be operated at night and day time from the power grid in order to prevent an unnecessary increase in the energy capacity. The capacity of ESSs was calculated to reduce the power fluctuation of PV output power in [

24]. However, the authors did not consider the uncertainty of the prediction schemes. As a result, the previous studies on the ESS operation strategy mainly focused on cost minimization of a given system under a Time-of-Use (ToU) pricing or real-time pricing [

25,

26]. It is evident that the prior studies often neglected the uncertainty of forecasting PV output power. Therefore, it should be considered to provide the accurate operation for various operational conditions. In this paper, by using the prediction scheme, we propose an efficient ESS management scheme in order to estimate the accurate deviation penalties in energy markets.

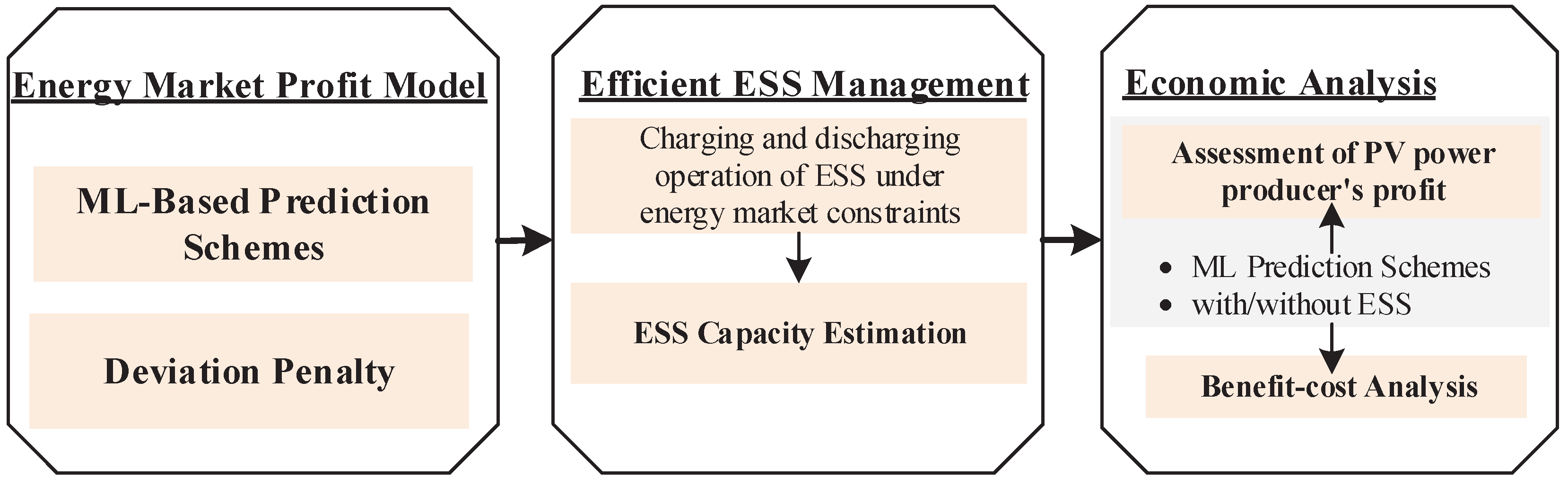

In this paper, we estimate the effect of the prediction errors on energy storage system (ESS)-based PV power trading as shown in

Figure 1. First, we evaluate the performance of PV power prediction models with the ANN and SVM schemes, and their prediction errors are fitted by a

t location-scale distribution in order to describe a characteristic of heavy tails. And then, we characterize the ESS role in forthcoming energy markets and propose an efficient ESS management scheme for charging and discharging operation of ESS in order to reduce the deviation penalties from differences between day-ahead (DA) schedule and real-time (RT) supply in energy markets. As a case study, we estimate the capacity of ESSs from different energy market constraints in terms of a tolerance limit and a penalty factor. We calculate the PV power producer’s profit considering the deviation penalties in case of ML-based prediction schemes with/without ESS in order to quantitatively estimate the effect of ESS for different prediction accuracies of two ML-based prediction schemes. As a result, we analyze the benefit from the accurate prediction scheme with ESS management as a case study on the participation of a utility-scale PV farm at a locational marginal price (LMP) market in the United States. Furthermore, we study the economic analysis of ESS installation for using both the ANN and SVM schemes through the benefit cost analysis (BCA).

Some studies have investigated the economic analysis of PV systems based on the installation cost analysis [

26]. And, few studies have considered the uncertainty of the renewable power prediction for renewable power trading. A persistence prediction scheme was utilized in order to estimate the profit for wind energy trading [

22]. But, they did not consider ML-based prediction schemes. In addition, the distributions of PV prediction errors is slightly different from that of wind power prediction errors. Therefore, it is valuable to apply the accurate prediction scheme based on ML in PV power trading. Also, more quantitative analysis is required for analyzing the effect of the prediction accuracy for PV power trading in detail. The contributions of this paper can be summarized as follows: (1) We estimate the accuracy of two ML-based prediction schemes and characterize their error distributions in order to quantitatively estimate the effect of the prediction accuracy for PV power trading; (2) The capacity of ESSs, which can reduce cost associated with PV prediction errors for PV power trading, is estimated from different market parameters; (3) In case of ML-based prediction schemes with/without ESS, the benefit from the accurate prediction scheme with ESS management is analyzed as a case study; (4) The economic analysis of ESS installation for two ML-based prediction schemes is done through the BCA.

The rest of this paper is organized as follows. We briefly introduce two ML-based prediction schemes for PV output power in

Section 2. In

Section 3, we estimate the prediction accuracy of two ML-based prediction schemes and their error distributions for PV output power prediction. In

Section 4, we characterize the ESS role and describe the participation of PV producers in forthcoming energy markets. And then, we determine the efficient ESS management, which consists of the operation and sizing of ESS for PV power trading in forthcoming energy markets. In

Section 5, we analyze the benefits from the accurate prediction scheme with ESS management as a case study. Finally, we give conclusive remarks in

Section 6.

5. Case Study

We calculate the PV power producer’s profit by considering the deviation penalties with/without ESS in order to quantitatively estimate the effect of ESS for different prediction accuracies of two ML-based prediction schemes. In addition, we evaluate the PV power trading in energy market for a utility-scale PV farm. We assume that each prediction scheme is applied to a 30-MW PV system with a lithium-ion ESS to absorb prediction errors. The power efficiency (

) of the PCS is approximately 95%, and the roundtrip energy efficiency (

) of large-scale lithium-ion battery is approximately 85% [

42]. Since the occurrence probability of both the positive and negative errors are the same (

), the ESS should maintain 50% of a state-of-charge (SoC) before 7:00 A.M. (

) in order to prevent an unnecessary increase in

. In addition, we assume that the available SoC range is located between 10% and 90% for in order to guarantee the maximum life cycle of the lithium-ion battery [

43]. The ESS never goes out the available SoC region during the total operating duration. Finally, we estimate the optimum energy capacity of ESS for the ANN and SVM schemes by considering three different power capacities of ESSs, i.e., 5%, 10%, and 15% of the installed PV capacity.

Then, we evaluate the performance of the different prediction schemes by using historical data for DA and RT LMP from the PJM over a 12-month in 2014 [

44]. The average DA LMP and RT LMP in 2014 are

$53.76/MWh and

$52.72/MWh, respectively. In addition, the DA bids due is 12 a.m., and we assume that PV power producers can submit RT re-bids at 1-hour ahead of the operating hour.

5.1. ESS Sizing for Machine Learning Prediction Schemes

In this section, three different power capacities of the ESS,

, are considered for absorbing the prediction errors.

Figure 8 shows the operation of the PCS of the ESS, which utilizes the ANN scheme for varying time intervals of day time (7:00 A.M. to 6:00 P.M.) with a

tolerance limit of the installed PV capacity. The power output of the PCS of the ESS is obtained in a straightforward calculation from Equations (

16) and (

17). The ESS power is very frequently charged or discharged in order to reduce the prediction error for the ANN scheme. In addition, it can be inferred that the deviation penalties of the small-sized PCS (5% of the installed PV capacity) would be significantly larger than that of the large-sized PCS (15% of the installed PV capacity) because a large amount of prediction errors is still not absorbed by the ESS in case of 5% of the installed PV capacity. Similarly, the power output of the PCS for the SVM scheme is shown in

Figure 9. In case of the SVM scheme, The ESS power is less frequently charged or discharged, compared with that of the ANN scheme and the average power output of the PCS of the ESS is also smaller than that of the ANN scheme. Furthermore, in order to quantitatively compare the amount of exchanged power of ESS between the ANN and SVM schemes, we estimate the average amount of the hourly exchanged power of ESS (

), which is calculated as

.

Table 3 summarizes the average amount of the hourly exchanged power of ESS both the ANN and SVM schemes for a 30-MW PV system. This result also shows that the average amount of the hourly exchanged power of ESS for the SVM scheme is smaller than that of the ANN scheme for three different power capacities of the ESS. In addition, compared with the smaller power capacity of ESS for the SVM scheme, the average amount of the hourly exchanged power of the SVM scheme is very slightly increased and most of the prediction errors do not exceed the allowable limit

when the power capacity of the ESS is 15% of the installed PV capacity.

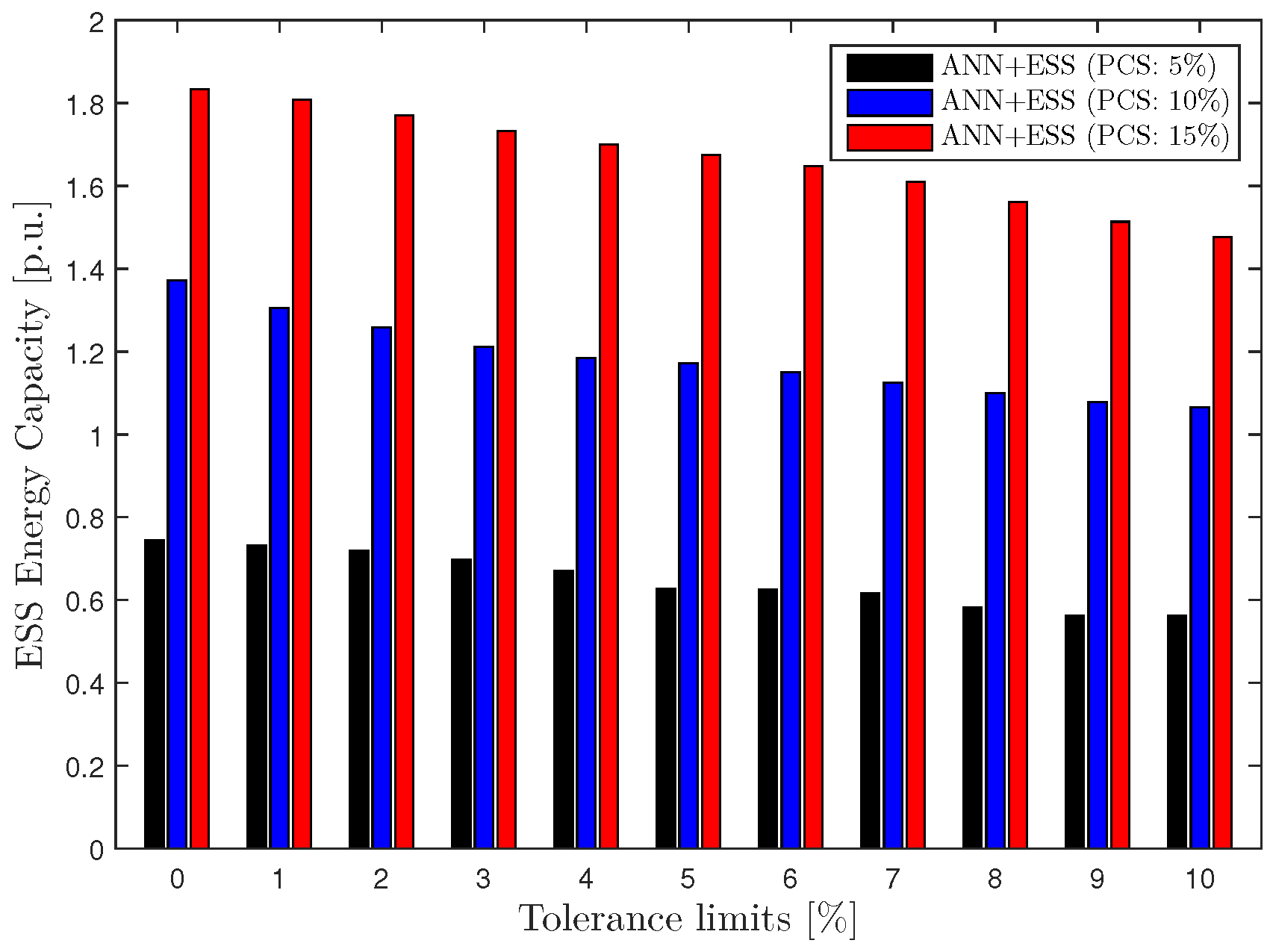

The optimum ESS energy capacity,

, has been calculated by Equation (

18).

Figure 10 shows the energy capacity of the ANN scheme with different tolerance limits. As the power capacity of the ESS

increases,

rapidly becomes larger. On the other hand, the tolerance limit does not have a significant effect on the decrease in

for the ANN scheme because there still exist greater prediction errors than

even if we consider the tolerance limit.

Figure 11 shows the energy capacity of the SVM scheme with different tolerance limits. Most prediction errors of the SVM scheme occur in the small error region (−0.05 to 0.05 [p.u.]), as shown in

Figure 4 and a large portion of prediction errors for the SVM scheme is reduced by the tolerance limit. Therefore, as the tolerance limit increases,

gradually becomes smaller.

Table 4 summarizes the energy capacity of both of the ANN and SVM schemes with different tolerance limits.

5.2. Assessment of the Profit for the PV Power Producers

Figure 12 shows the hourly deviation penalties for varying tolerance limits with a penalty factor

of 1.0. The hourly deviation penalties have been calculated by Equations (

14) and (

15) considering the 10% power capacity as a fraction of the 30-MW PV farm. It can be observed that the deviation penalties from the SVM scheme without ESS significantly decrease, compared with those of the ANN scheme without ESS due to high prediction accuracy. The SVM-based prediction scheme without ESS yields a decrease in the deviation penalty by up to 48%, compared with that of the ANN scheme. In addition, the deviation penalties can be quite reduced by using ESS. Since the ESS power is more frequently charged or discharged for the ANN scheme, compared with that of the SVM scheme, as shown in

Figure 8, the effect of the ESS for the ANN scheme is greater than that of the SVM scheme in terms of the deviation penalty reduction. Considering the 10% power capacity as a fraction of the 30-MW PV farm, the deviation penalty for using ESS for the ANN and SVM schemes decreases by up to 87% and 74%, respectively.

Table 5 summarizes the hourly deviation penalties [

$/h] for both of the ANN and SVM schemes with different power capacities and tolerance limits.

Figure 13 shows the variation of the hourly energy market profit with different tolerance limits and a penalty factor of 1.0. As the tolerance limit

increases, the hourly energy market profit for both of the ANN and SVM schemes with ESS gradually approaches the no-penalty market profit (

$ 589/h). It implies that a zero deviation penalty would be given to both of the ANN and SVM schemes with ESS when energy markets allow a tolerance limit

of larger than 10%.

In Equation (

12), the hourly deviation penalties with a tolerance limit of 5% for both of the ANN and SVM schemes increase in proportion to an increase in the penalty factor, as shown in

Figure 14. In addition, in high penalty factors, the hourly deviation penalties for both of the ANN and SVM schemes with ESS is negligible, compared with those for both of the ANN and SVM schemes without ESS. As a result, a reasonable selection of the tolerance limit and the penalty factor is required to satisfy the economic feasibility of the PV producers in order to introduce the successful energy market introduction of ESSs. In

Section 5.3, we can find the appropriate market policy or parameters for both the ANN and SVM schemes from the benefit-cost analysis (BCA) of PV power trading.

5.3. Benefit-Cost Analysis (BCA) for the ESS in PV Power Trading

The BCA provides the comparison of the total expected cost of against the total expected benefit to confirm whether the benefit outweighs the cost and by how much [

45]. In the BCA, the benefit-cost ratio (B-C ratio) is the present value of benefit divided by the present value of cost. In order that a project may be economically feasible, the B-C ratio should be greater than one [

46]. The benefit-cost ratio is computed as

where

is the benefit in the

i-th year and

is the cost in the

i-th year. Moreover,

is the life of the project (years) and

is the rate of interest (fraction) and

is the inflation rate (fraction).

In this paper,

represents the profit difference between with/without ESS in the

i-th year for BCA in PV power trading. Considering the cost reduction of the ESS, the power system cost (

$/kW) is set to

$300/kW and the energy storage cost (

$/kWh) of the lithium-ion battery is set to

$450/kWh [

42]. Moreover, we consider the life-time of the project of 10 years, the rate of interest (

) of 4%, and the inflation rate (

), the increase rate of electricity price) of 2%.

Figure 15 shows the benefit-cost ratio of the ANN scheme with a power capacity of 10% of the installed PV capacity. When the energy market permits a low tolerance limit (≤6%) and a high penalty factor (≥1.9), the benefit-cost ratio of the ANN scheme is greater than one. In other words, there is economical benefit of installing the ESS when the energy market enforces a harsh policy in terms of the tolerance limit and penalty factor for PV power producers. The maximum B-C Ratio of the ANN scheme is 1.1034 in a tolerance limit of 4% and a penalty factor of 2.0.

Figure 16 shows the benefit-cost ratio of the SVM scheme with a power capacity of 10% of the installed PV capacity. The SVM scheme yields a larger benefit-cost ratio than that of the ANN scheme in the same market parameters because the SVM scheme requires a quite smaller amount of the energy capacity of the ESS than the ANN scheme, as shown in

Figure 11. When the tolerance limit is smaller than 11% and the penalty factor is larger than 1.0, the benefit-cost ratio of the SVM scheme is greater than one. When PV power producers adopt the SVM scheme for PV output power prediction, they also obtain much higher profit at a hard penalty market than a soft penalty market. Furthermore, the maximum benefit-cost ratio (BCR) value of the SVM scheme is 2.2043 in a tolerance limit of 2% and a penalty factor of 2.0.

Table 6 summarizes the maximum BCR value of the ANN and SVM schemes for three different power capacities of ESSs. The smaller power capacity of the ESS has a greater maximum BCR value for each prediction scheme. However, the smaller power capacity of the ESS is not always the best choice because a power capacity of 10% of the installed PV capacity yields a higher maximum BCR value (2.20) than that of a power capacity of 5% of the installed PV capacity (2.02) for the SVM scheme when a tolerance limit of less than 2% is allowed in a specific energy market. Therefore, PV producers need to select the optimal size of the ESS, which has the highest BCR value to absorb the prediction errors, considering the different energy market policies. In addition, it can be observed that the PV power producer’s profit also significantly increases by achieving high accuracy of the prediction scheme.

6. Conclusions

In this paper, it has been shown that the accurate machine learning (ML)-based PV output power prediction schemes with ESS management could significantly increase the market profit of PV power producers. For that purpose, the ANN and SVM schemes were utilized for predicting the PV output power from various meteorological big data. In addition, the capacity of ESSs, which can compensate the prediction error, was estimated from different energy market constraints. And then, we calculated the PV power producer’s profit considering the deviation penalties in case of ML-based prediction schemes with/without ESS in order to quantitatively estimate the effect of ESS for different prediction accuracies of two ML-based prediction schemes. Numerical results were presented as a case study on the participation of a 30-MW PV farm in the LMP market of the PJM. These results showed the SVM scheme without ESS yields a decrease in the deviation penalties by up to 48% than the ANN scheme without ESS. In case of ML-based prediction schemes with ESS, the ANN and SVM schemes yield an decrease in the deviation penalty by up to 87% and 74%, respectively, compared with the profit of the ANN and SVM schemes without ESS. From the benefit-cost analysis (BCA) in the case study, it could be observed that the maximum B-C ratio of PV power producers significantly increases by using a more accurate prediction scheme with ESS and the maximum B-C ratio is 2.32 for the SVM scheme. Furthermore, the BCA results provided the economic regions of market parameters for both of the ANN and SVM schemes. As a result, the proposed ESS-based PV power trading could be suitable for the participation of PV power producers in order to increase the profit in a penalized market.

In this paper, since we utilized the actual meteorological data instead of the forecasted meteorological data, which has already been known in the prediction time, due to a difficulty in obtaining the proper forecasted meteorological data set, the prediction accuracy of the ANN and SVM schemes may slightly degrade in a real environment due to the forecasting accuracy of the meteorological parameters. We need to enhance the prediction scheme by reflecting the forecasted meteorological data for the practicality of prediction in further works.