China’s Carbon Market Development and Carbon Market Connection: A Literature Review

Abstract

1. Introduction

2. Background Overview

3. An Overview of the Development of the Pilot Areas of Carbon Trading in China

3.1. The Legal Basis of the Pilot Areas

3.2. Modes of Quota Allocation in Pilot Areas

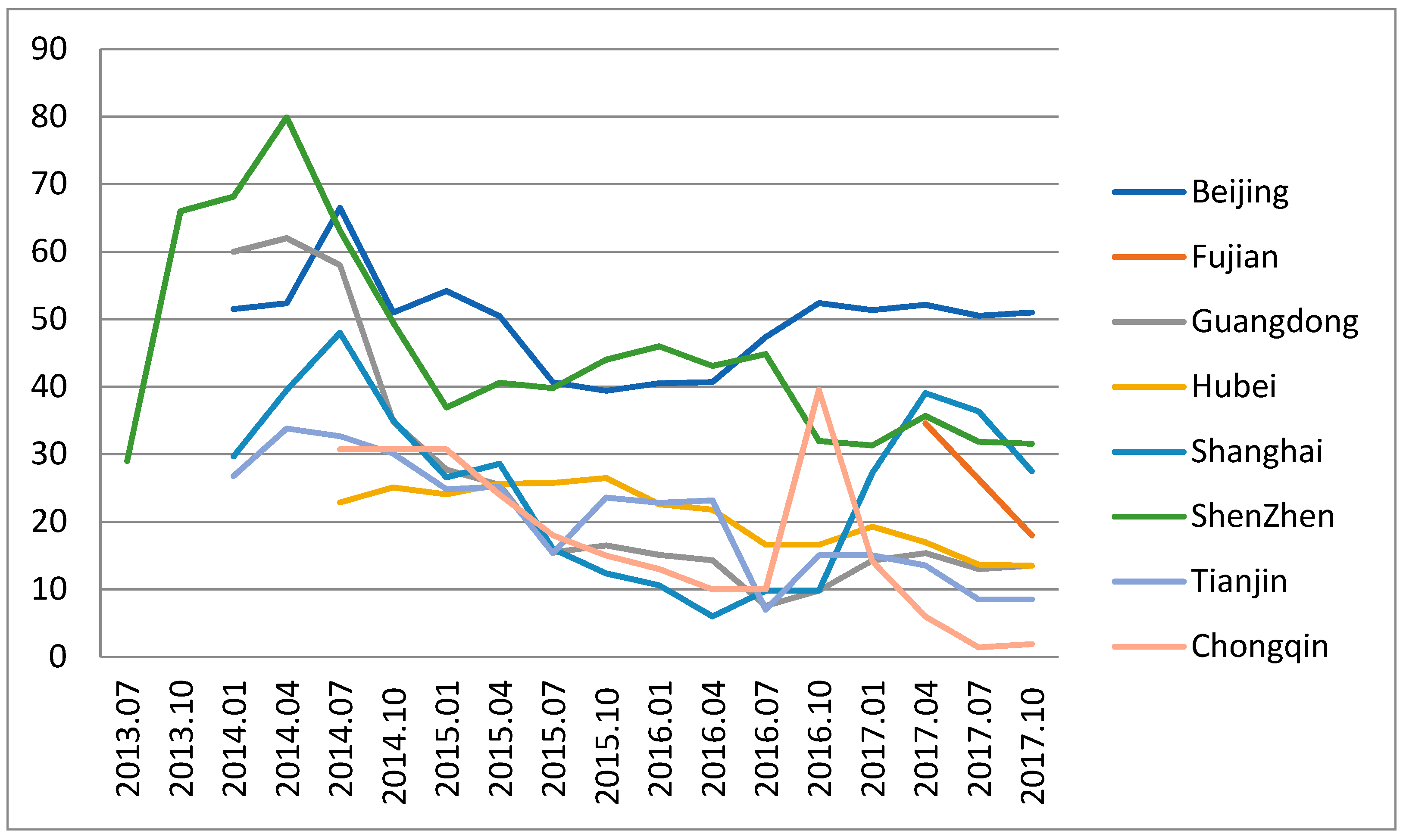

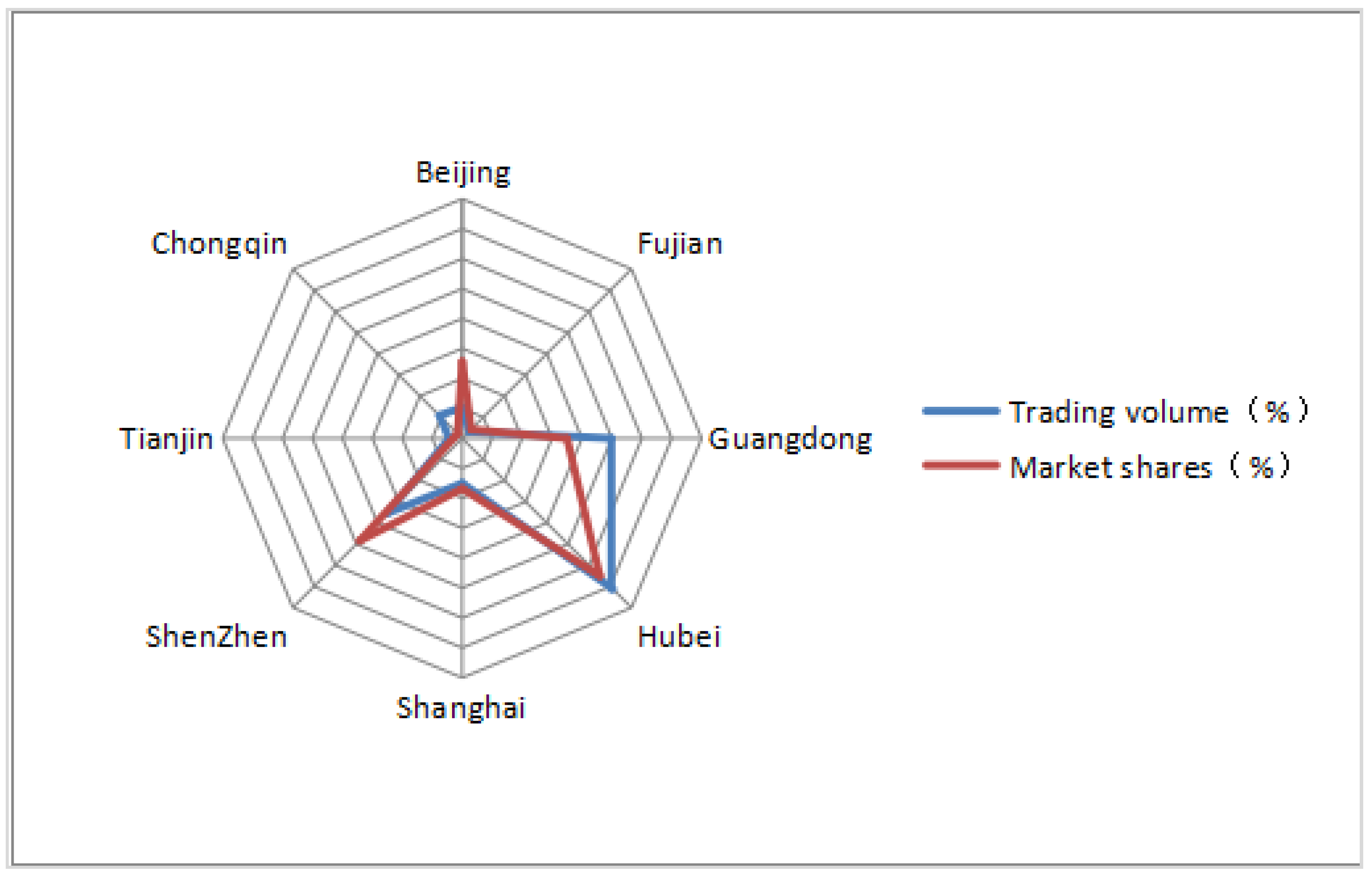

3.3. Trading Conditions in Pilot Area

4. Elements in Urgent Need of Improvement Upon the Establishment of a Unified Chinese Market

4.1. Carbon Price

4.2. Carbon Quota

4.3. Total Amount and Carbon Emission Sources Coverage

4.4. Legal and Policy System

5. Connection between the Chinese and the World Carbon Market

5.1. Necessity and Significance of Connection

5.1.1. Economic Benefits

5.1.2. Political Benefits

5.2. Matchmaking Mode

5.3. Compatibility Analysis of Carbon Market Connection

5.4. Successful International Cases in the Connection of Carbon Markets

5.4.1. The Position and Connection of EU ETS

5.4.2. The Position and Connection of US Carbon Emissions Trading System

5.5. Feasibility of Connecting CCM with International Carbon Market

5.6. Insufficient of CCM Compared to the International Carbon Market and Improvement Measures in the near Future

5.6.1. Insufficient Market Participation

5.6.2. Unreasonable Method and Mechanism of Quota Allocation

5.6.3. Strict Control Mechanism for Carbon Emission Data

5.6.4. Improving Legal Basis of the Carbon Market

6. Conclusions and Outlook

Author Contributions

Funding

Conflicts of Interest

References

- Dong, F.; Wang, Y.; Su, B.; Hua, Y.; Zhang, Y. The process of peak CO2 emissions in developed economies: A perspective of industrialization and urbanization. Resour. Conserv. Recycl. 2019, 141, 61–75. [Google Scholar] [CrossRef]

- Duan, M.; Pang, T. Basic elements of emissions trading scheme. China Popul. Resour. Environ. 2013, 23, 110–117. (In Chinese) [Google Scholar]

- Egenhofer, C. The making of the EU emissions trading scheme. Eur. Manag. J. 2007, 25, 453–463. [Google Scholar] [CrossRef]

- Peng, S.; Chang, Y.; Zhang, J. Considerations on some key issues of carbon market development in China. China Popul. Resour. Environ. 2014, 24, 1–5. (In Chinese) [Google Scholar] [CrossRef]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Hultman, N.E.; Pulver, S.; Guimarães, L.; Deshmukh, R.; Kane, J. Carbon market risks and rewards: Firm perceptions of CDM investment decisions in Brazil and India. Energy Policy 2012, 40, 90–102. [Google Scholar] [CrossRef]

- Lanzi, E.; Chateau, J.; Dellink, R. Alternative approaches for levelling carbon prices in a world with fragmented carbon markets. Energy Econom. 2012, 34, S240–S250. [Google Scholar] [CrossRef]

- Li, H.; An, H. How does the coal stock market, carbon market and coal price co-movement with each other in China: A co-movement matrix transmission network perspective. Energy Procedia 2017, 105, 3479–3484. [Google Scholar] [CrossRef]

- Zhang, W.; Ma, H.; Yang, L. The linkage of international carbon market and its implication to China. Finance Econ. 2014, 2, 122–130. (In Chinese) [Google Scholar]

- Dong, F.; Bian, Z.; Yu, B.; Wang, Y.; Zhang, S.; Li, J.; Su, B.; Long, R. Can land urbanization help to achieve CO2 intensity reduction target or hinder it? Evidence from China. Resour. Conserv. Recycl. 2018, 134, 206–215. [Google Scholar] [CrossRef]

- BP. Statistical Review of World Energy; BP: London, UK, 2018. [Google Scholar]

- Dong, F.; Yu, B.; Tergel, H.; Dai, Y.; Wang, Y.; Zhang, S.; Long, R. Drivers of carbon emissions intensity change in China. Resour. Conserv. Recycl. 2018, 129, 187–201. [Google Scholar] [CrossRef]

- Jiang, J.J.; Ye, B.; Ma, X.M. The construction of Shenzhen’ s carbon emission trading scheme. Energy Policy 2014, 75, 17–21. [Google Scholar] [CrossRef]

- Jotzo, F.; Löschel, A. Emissions trading in China: Emerging experiences and international lessons. Energy Policy 2014, 75, 3–8. [Google Scholar] [CrossRef]

- Qi, S.; Wang, B.; Zhang, J. Policy design of the Hubei ETS pilot in China. Energy Policy 2014, 75, 31–38. [Google Scholar] [CrossRef]

- Ministry of Foreign Affairs of P.R.C. (MFA). U.S.-China Joint Presidential Statement on Climate Change; MFA: Beijing, China, 2016. (In Chinese)

- Development and Reform Commission of P.R.C. (DRC). Launched the National Carbon Emission Trading Market in 2017; DRC: Beijing, China, 2017. (In Chinese)

- Li, W.; Zhang, Y.; Lu, C. The impact on electric power industry under the implementation of national carbon trading market in China: A dynamic CGE analysis. J. Clean. Prod. 2018, 200, 511–523. [Google Scholar] [CrossRef]

- Liu, Z.; Geng, Y.; Dai, H.; Wilson, J.R.; Xie, Y.; Wu, R.; You, W.; Yu, Z. Regional impacts of launching national carbon emissions trading market: A case study of Shanghai. Appl. Energy 2018, 230, 232–240. [Google Scholar] [CrossRef]

- Economic Information Daliy (EID). National Carbon Market “Three-Step” Roadmap Started; EID: Beijing, China, 2017. (In Chinese) [Google Scholar]

- Development and Reform Commission of P.R.C. (DRC). Notice of the General Office of the National Development and Reform Commission on Doing a Good Job in the National Carbon Emissions Trading Market; DRC: Beijing, China, 2016. (In Chinese)

- ICAP. Emission Trading Worldwide: Status Report 2018; ICAP: Berlin, Germany, 2018. [Google Scholar]

- WB. State and Trends of Carbon Pricing 2018; WB: Washington, DC, USA, 2018. [Google Scholar]

- Xinhua, China’s Carbon Trading Transaction Value Exceeds 6 bln yuan. Available online: http://www.china.org.cn/business/2018-11/27/content_74212670.htm (accessed on 23 February 2019).

- Gao, S.; Li, M.Y.; Duan, M.S.; Wang, C. International carbon markets under the Paris Agreement: Basic form and development prospects. Adv. Clim. Chang 2019, in press. [Google Scholar] [CrossRef]

- Du, H.; Li, B.; Brown, M.A.; Mao, G.; Rameezdeen, R.; Chen, H. Expanding and shifting trends in carbon market research: A quantitative bibliometric study. J. Clean. Prod. 2015, 103, 104–111. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Song, Y.; Liu, T.; Li, Y.; Liang, D. Region division of China’s carbon market based on the provincial municipal carbon intensity. J. Clean. Prod. 2017, 164, 1312–1323. [Google Scholar] [CrossRef]

- Weng, Q.; He, X. A review of China’s carbon trading market. Renew. Sustain. Energy Rev. 2018, 91, 613–619. [Google Scholar] [CrossRef]

- Alberola, E.; Chevallier, J. European carbon prices and banking restrictions: Evidence from Phase I (2005–2007). Energy J. 2009, 30, 51–79. [Google Scholar] [CrossRef]

- Feng, Z.H.; Zou, L.L.; Wei, Y.M. Carbon price volatility: Evidence from EU ETS. Appl. Energy 2011, 88, 590–598. [Google Scholar] [CrossRef]

- Feng, Z.H.; Wei, Y.M.; Wang, K. Estimating risk for the carbon market via extreme value theory: An empirical analysis of the EU ETS. Appl. Energy 2012, 99, 97–108. [Google Scholar] [CrossRef]

- Jiang, Y.; Lei, Y.L.; Yang, Y.Z.; Wang, F. Factors affecting the pilot trading market of carbon emissions in China. Petrol. Sci. 2018, 15, 1–9. [Google Scholar] [CrossRef]

- Chang, K.; Chen, R.; Chevallier, J. Market fragmentation, liquidity measures and improvement perspectives from China’s emissions trading scheme pilots. Energy Econ. 2018, 75, 249–260. [Google Scholar] [CrossRef]

- Dong, F.; Long, R.; Yu, B.; Wang, Y.; Li, J.; Wang, Y.; Dai, Y.; Yang, Q.; Chen, H. How can China allocate CO2, reduction targets at the provincial level considering both equity and efficiency? Evidence from its Copenhagen accord pledge. Resour. Conserv. Recycl. 2018, 130, 31–43. [Google Scholar] [CrossRef]

- Zhao, X.G.; Jiang, G.W.; Li, A.; Yun, L. Technology, cost, a performance of waste-to-energy incineration industry in China. Renew. Sustain. Energy Rev. 2016, 55, 115–130. [Google Scholar]

- China Industry Research Network (CIRN). 2018 Edition of China’s Carbon Trading Market Status Survey and Development Prospect Analysis Report; CIRN: Beijing, China, 2017. (In Chinese) [Google Scholar]

- Fan, J.H.; Todorova, N. Dynamics of China’s carbon prices in the pilot trading phase. Appl. Energy 2017, 208, 1452–1467. [Google Scholar] [CrossRef]

- Jiang, J.; Xie, D.; Ye, B.; Shen, B.; Chen, Z. Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 2016, 178, 902–917. [Google Scholar] [CrossRef]

- Zhang, M.; Fan, D.; Dou, Y. Analysis on EU carbon market progress and its reference to China. Environ. Prot. 2014, 42, 64–66. [Google Scholar]

- Ibikunle, G.; Andros, G.; Hoepner, A.G.F.; Rhodes, M. Liquidity and market efficiency in the world’s largest carbon market. Br. Account. Rev. 2016, 48, 431–447. [Google Scholar] [CrossRef]

- Zhao, X.G.; Jiang, G.W.; Nie, D.; Chen, H. How to improve the efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 2016, 59, 1229–1245. [Google Scholar] [CrossRef]

- Cheng, X.; Lu, S. Basic elements and design of China’s future unified national emissions trading scheme. Reg. Econ. Rev. 2016, 6, 92–98. (In Chinese) [Google Scholar]

- Lin, W.; Liu, B. Chinese carbon market: Current status and future perspectives. J. Tsinghua Univ. 2015, 55, 1315–1323. (In Chinese) [Google Scholar]

- Perdan, S.; Azapagic, A. Carbon trading: Current schemes and future developments. Energy Policy 2011, 39, 6040–6054. [Google Scholar] [CrossRef]

- Zhang, D.; Karplus, V.J.; Cassisa, C.; Zhang, X. Emissions trading in China: Progress and prospects. Energy Policy 2014, 75, 9–16. [Google Scholar] [CrossRef]

- Xiong, L.; Shen, B.; Qi, S.; Price, L. Assessment of allowance mechanism in China’s carbon trading pilots. Energy Procedia 2015, 75, 2510–2515. [Google Scholar] [CrossRef][Green Version]

- Tang, L.; Wu, J.; Yu, L.; Bao, Q. Carbon emissions trading scheme exploration in China: A multi-agent-based model. Energy Policy 2015, 81, 152–169. [Google Scholar] [CrossRef]

- Ji, C.; Hu, Y.; Tang, B. Research on carbon market price mechanism and influencing factors: A literature review. Nat. Hazards 2018, 92, 761–782. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Wang, A.D.; Tan, W. The impact of China’s carbon allowance allocation rules on the product prices and emission reduction behaviors of ETS-covered enterprises. Energy Policy 2015, 86, 176–185. [Google Scholar] [CrossRef]

- Jiang, R. Carbon trading and China’s carbon market outlook. China Econ. Rep. 2017, 5, 52–56. (In Chinese) [Google Scholar]

- Flachsland, C.; Marschinski, R.; Edenhoffer, O. To link or not to link: Benefits and disadvantages of linking cap-and-trade systems. Clim. Policy 2009, 9, 358–372. [Google Scholar] [CrossRef]

- Perthuis, C.D.; Trotignon, R. Governance of CO2 markets: Lessons from the EU ETS. Energy Policy 2014, 75, 100–106. [Google Scholar] [CrossRef]

- Xiong, L.; Shen, B.; Qi, S.; Price, L.; Ye, B. The allowance mechanism of China’s carbon trading pilots: A comparative analysis with schemes in EU and California. Appl. Energy 2017, 185, 1849–1859. [Google Scholar] [CrossRef]

- Carbon Trading Net. Available online: http://www.tanpaifang.com/tanhangqing/ (accessed on 6 June 2018). (In Chinese).

- Yi, L.; Li, Z.; Yang, L.; Liu, J.; Liu, Y. Comprehensive evaluation on the maturity of China’s carbon markets. J. Clean. Prod. 2018, 198, 1336–1344. [Google Scholar] [CrossRef]

- Chen, B. The supervision dilemma of China’s carbon market financialization and its system perfection. Secur. Market Herald 2017, 9, 69–78. (In Chinese) [Google Scholar]

- Lo, A.Y.; Yu, X. Climate for business: Opportunities for financial institutions and sustainable development in the Chinese Carbon Market. Sustain. Dev. 2015, 23, 369–380. [Google Scholar] [CrossRef]

- Charles, A.L.; Darn, O.; Fouilloux, J. Market efficiency in the European carbon markets. Energy Policy 2013, 60, 785–792. [Google Scholar] [CrossRef]

- Munnings, C.; Morgenstern, R.D.; Wang, Z.; Liu, X. Assessing the design of three carbon trading pilot programs in China. Energy Policy 2016, 96, 688–699. [Google Scholar] [CrossRef]

- Chen, B. The establishment of China’s national carbon market and its macro-control strategy. China Popul. Resour. Environ. 2013, 23, 9–15. (In Chinese) [Google Scholar]

- Jin, M.; Kong, L.; Wang, Z. Analysis of the current status and problems of the carbon emission trading pilots in China. Environ. Prot. Sci. 2016, 42, 134–140. (In Chinese) [Google Scholar]

- Perkis, D.F.; Cason, T.N.; Tyner, W.E. An experimental investigation of hard and soft price ceilings in emissions permit markets. Environ. Resour. Econ. 2016, 63, 1–16. [Google Scholar] [CrossRef]

- Wei, Q. Study on the pathway of China to mitigate emissions based on the compatibility of carbon tax and ETS. China Popul. Resour. Environ. 2015, 5, 35–43. (In Chinese) [Google Scholar]

- Chen, B. Research on linkage of China’s ETS and macro-control mechanism. China Popul. Resour. Environ. 2015, 10, 18–22. (In Chinese) [Google Scholar]

- Jotzo, F. Emissions Trading in China: Principles, Design Options and Lessons from International Practice; CCEP Working Paper 1303; Crawford School of Public Policy, Australian National University: Canberra, Australia, 2013. [Google Scholar]

- Wang, Q.; Li, J. China’s regional carbon emission allowance prices regulation mechanism based on TVP model. China Popul. Resour. Environ. 2016, 26, 31–38. (In Chinese) [Google Scholar]

- Wu, X. Research on the Allocation Method of Total Carbon Emission from the National Level to the Enterprise Level Constrained by Peak Target. Master’s Thesis, Tianjin University of Technology, Tianjin, China, 2016. (In Chinese). [Google Scholar]

- Quemin, S.; Wang, W. Overview of Climate Change Policies and Development of Emissions Trading in China; Les Cahiers de la Chaire Economie du Climat Information and Debate Series; International Nuclear Information System: Paris, France, 2014. [Google Scholar]

- Zhao, X.G.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Duan, M.; Zhou, L. Key issues in designing China’s national carbon emissions trading system. Econ. Energy Environ. Policy 2017, 6, 55–72. [Google Scholar] [CrossRef]

- Fang, G.; Liu, M.; Tian, L.; Fu, M.; Zhang, Y. Optimization analysis of carbon emission rights allocation based on energy justiced: The case of China. J. Clean. Prod. 2018, 202, 748–758. [Google Scholar] [CrossRef]

- Pang, T.; Zhou, L.; Duan, M. Study on the linking of China’s emissions trading pilot schemes. China Popul. Resour. Environ. 2014, 24, 6–12. (In Chinese) [Google Scholar]

- Mehling, M.; Haites, E. Mechanisms for linking emissions trading schemes. Clim. Policy 2009, 9, 169–184. [Google Scholar] [CrossRef]

- Qi, T.; Weng, Y. Economic impacts of an international carbon market in achieving the INDC targets. Energy 2016, 109, 886–893. [Google Scholar] [CrossRef]

- Hübler, M.; Voigt, S.; Löschel, A. Designing an emissions trading scheme for China? An up-to-date climate policy assessment. Energy Policy 2014, 75, 57–72. [Google Scholar] [CrossRef]

- Wang, L.; Wei, Q. The inspiration and reference for China based on preliminary study of emission trading schemes linkage. Ecol. Econ. 2016, 32, 53–57. (In Chinese) [Google Scholar]

- Jaffe, J.L.; Stavins, R.N. Linking a U.S. Cap-and-Trade System for Greenhouse Gas Emissions: Opportunities, Implications, and Challenges. SSRN Electron. J. 2008, 554. [Google Scholar] [CrossRef][Green Version]

- Stavins, R.N. Addressing climate change with a comprehensive U.S. Cap-and-Trade System. Soc. Sci. Electron. Publ. 2008, 24, 298–321. [Google Scholar] [CrossRef]

- Tuerk, A.; Mehling, M.; Flachsland, C.; Ganasterk, W. Linking carbon markets: Concepts, case studies and pathways. Clim. Policy 2009, 9, 341–357. [Google Scholar] [CrossRef]

- Burtraw, D.; Palmer, K.L.; Munnings, C.; Weber, P.; Woerman, M. Linking by Degrees: Incremental Alignment of Cap-And-Trade Markets. RFF Discussion Paper. 2013. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2249955 (accessed on 29 April 2019).

- Chang, Y.C.; Wang, N. Environmental regulations and emissions trading in China. Energy Policy 2010, 38, 3356–3364. [Google Scholar] [CrossRef]

- Flachsland, C.; Luderer, C.; Steckel, G.; Knopf, J. International emissions: Trading and the global deal. Diabetes Care 2015, 28, 33–39. [Google Scholar]

- MacKay, D.J.C.; Cramton, P.; Ockenfels, A.; Stoft, S. Price carbon-I will if you will. Nature 2015, 526, 315–316. [Google Scholar] [CrossRef]

- Johannsdottir, L.; Mcinerney, C. Calls for carbon markets at COP21: A conference report. J. Clean. Prod. 2016, 124, 405–407. [Google Scholar] [CrossRef]

- Karpf, A.; Mandel, A.; Battiston, S. Price and network dynamics in the European carbon market. J. Econ. Behav. Organ. 2018, 153, 103–122. [Google Scholar] [CrossRef]

- Mizrach, B. Integration of the global carbon markets. Energy Econ. 2012, 34, 335–349. [Google Scholar] [CrossRef]

- Fu, J.Y.; Zhang, Y.F. The Link Mechanism of International Carbon Emission Trading System and Its Enlightenment to China. Environ. Prot. Circ. Econ. 2016, 4, 4–11. (In Chinese) [Google Scholar]

- Chan, H.S.; Li, S.; Zhang, F. Firm competitiveness and the European Union emissions trading scheme. Energy Policy 2013, 63, 1056–1064. [Google Scholar] [CrossRef]

- European Commission (EC). Emission Trading: Commission Announces Linkage EU ETS with Norway, Iceland and Liechtenstein; EC: Brussels, Belgium, 2007. [Google Scholar]

- Zhang, L.; Li, Y.; Jiab, Z. Impact of carbon allowance allocation on power industry in China’s carbon trading market: Computable general equilibrium based analysis. Appl. Energy 2018, 229, 814–827. [Google Scholar] [CrossRef]

- Ministry of Commerce of the P.R.C. (MC). Carbon Emissions Trading Data Shows EU Has Lower Carbon Emissions in 2014; MC: Beijing, China, 2015. (In Chinese)

- Liu, H.Y.; Zheng, S. The Construction of American Carbon Market and Its Enlightenment to China. China Econ. Trade Herald 2014, 8, 7–8. (In Chinese) [Google Scholar]

- Diodati, M.L.N.; Purdon, M. Political Uncertainty or Carbon Leakage State of California-Quebec Carbon Market Since the August 2016 Auction Sale; IQ Carbone Research Note; IQ Carbone: Quebec, Canada.

- Dormady, N.; Healy, P.J. The consignment mechanism in carbon markets: A laboratory investigation. J. Commodity Mark. 2018, 7, 1–15. [Google Scholar] [CrossRef]

- Liao, Z.; Zhu, X.; Shi, J. Case study on initial allocation of Shanghai carbon emission trading based on Shapley value. J. Clean. Prod. 2015, 103, 338–344. [Google Scholar] [CrossRef]

| Pilot | Quota Measurement Methods | Covered Industries | Controlled Gas | Threshold | |||

|---|---|---|---|---|---|---|---|

| Historical Emissions | Industry Benchmarks | Historical Intensities | Game Playing | ||||

| Beijing | √ | √ | Electricity and heat, cement, petrochemical and other industrial sectors, service industries, urban public transport, power transmission, manufacturing, and large public buildings | CO2 | Carbon emissions > 5000 t/year | ||

| Tianjin | For carbon emission stock | For carbon emission increment | Steel, chemical, power and heat, petrochemical, oil and gas development | CO2 | Carbon emissions > 20,000 t/year | ||

| Shanghai | √ | Electricity and heat, automotive glass | CO2 | Water transport: standard coal consumption > 50,000 t/year or carbon emissions > 100,000 t/year Other industries: standard coal consumption > 5000 t/year or carbon emissions > 10,000 t/year | |||

| √ | Aviation, port, water transport, tap water supply; companies with high carbon emissions and no more than 3 products | ||||||

| √ | Shopping malls, hotels, business offices, airports; companies with special products or ineffective use of historical emissions or historical intensities’ methods | ||||||

| Shenzhen | For mainly industry | For some enterprises in the same industry | 26 industries (electricity and heat, public buildings, etc.) | CO2 | Industry: Carbon emissions > 3000 t/year Public building area > 10,000 m2 Other industries not included can voluntarily join the carbon trading market. | ||

| Guangdong | √ | √ | Electricity, steel, cement, petrochemical | CO2 | Carbon emissions > 20,000 t/year | ||

| Hubei | √ | Cement, electricity and heat | CO2 | Metal products, paper industry and power industry: standard coal consumption > 10,000 t/year Other industries: standard coal consumption > 60,000 t/year | |||

| √ | Glass and other building materials, ceramic manufacturing | ||||||

| √ | Automotive, general equipment manufacturing, steel, petrochemical, chemical fibre, chemical, non-ferrous metals and other metal products, food and beverage manufacturing, pharmaceutical, paper-making | ||||||

| Chongqing | For mainly industry | For carbon emission increment | Electrolytic aluminium, ferroalloy, calcium carbide, caustic soda, cement, steel | Six greenhouse gases covered in the Kyoto Protocol | Carbon emissions > 20,000 t/year | ||

| Fujian | √ | Power generation, cement, electrolytic aluminium, flat glass | CO2 | Standard coal consumption > 10,000 t/year Carbon emissions > 26,000 t/year | |||

| √ | Power grid, copper smelting, steel, chemical, crude oil processing, ethylene, pulp manufacturing, machine paper and cardboard, air passenger transportation, air cargo transportation, airports, building ceramics | ||||||

| √ | Daily ceramics and sanitary ceramics, gardening | ||||||

| EU ETS Phase I&II | √ | Electricity, petrochemical, steel, building materials, paper-making and aviation | CO2 | Each industry has different standards | |||

| EU ETS Phase III | √ | Electricity, paper, petrochemical, steel, building materials, chemicals, aviation and aluminium | CO2, NO2, PECs | ||||

| CA CAT | √ | Electricity, oil refining, oil and gas, glass, food processing, cement and transportation | Six greenhouse gases covered in the Kyoto Protocol, Nitrogen trifluoride and other fluorinated greenhouse gases | Carbon emissions > 20,000 t/year | |||

| Pilots | Allocation Method | Offset Mechanism | Punitive Measures | |

|---|---|---|---|---|

| Free | Paid | |||

| Beijing | Distribution based on the previous year’s emission quotas | The auction ratio not exceeding 5% of the total annual amount | Not exceeding 5% of emissions and not exceeding half of local CCERs | Companies failing to fulfil their obligation shall pay a fine of 3–5 times based on the average market price of carbon quotas; companies failing not deliver or confirm carbon emissions reports shall pay a fine of not more than 50,000 yuan. |

| Tianjin | Free allocation for annual increment | No more than 10% of emissions | Companies failing to complete MRV shall not enjoy government-related preferential policies or investments. | |

| Shanghai | Enterprises autonomously choose whether to participate in carbon quota auctions | No more than 5% of carbon quotas | Companies failing to complete or confirm the carbon emission report, or performance contract shall pay a fine of 10,000–30,000 yuan, not more than 50,000 yuan, and 50,000–100,000 yuan, shall be recorded in the credit record, and shall not enjoy government-related preferential policies or investment. | |

| ShenZhen | Including pre-allocated quotas, new enterprise reserve quotas, and adjusted quota allocations: allocated once a year | The auction rate less than 3% of the total annual quota B. Quotas can be sold at a fixed price | No more than 10% of emissions | Companies failing to fulfil their obligations shall pay a three-fold fine based on the average market price of carbon quotas. |

| Guangdong | 95% free quota for power companies; 97% free quota for iron, petrochemical, and cement companies | 2 million t quota for auction is planned | Not exceeding 10% of emissions and not exceeding half of local CCERs | Companies refusing to complete the performance shall be deducted twice the amount of the uncompleted part of the performance in the second year and shall pay a fine of 50,000 yuan |

| Hubei | Including annual initial quota, new reserve quota, and government reserve quota: allocated once a year | 20% of the total annual carbon quotas is required for auction | Not exceeding 10% of the carbon quota; 1 t CCER is equivalent to 1 t emission quota | Companies refusing to complete the performance shall be deducted twice the quota for uncompleted performance in the second year, and shall pay a fine of 1–3 times the average market price of the quota. |

| Chongqing | All for free allocation | Otherwise regulated by the authority | Companies refusing to complete the performance shall be reported publicly for the violations and deprived of government-related preferential policies or investments. | |

| Fujian | All for free allocation | Not more than 10% of the confirmed emissions in the current year, forestry carbon sink (FFCER) recorded with CCER and Fujian Carbon Exchange can be used to offset | Quota penalties and fines for companies refusing to fulfil their payment obligations: disciplinary punishment for companies refusing to perform their duties | |

| EU ETS Phase I & II | Phase I > 95% Phase II > 90% | Phase I < 5% Phase II < 10% | ||

| EU ETS Phase III | Achieve at least 50% of auctions and plan to achieve a 100% quota auction for the power industry by 2020 | Partial offset by JI and CDM credits is allowed; yet the offset should not exceed 50% of emissions during 2008–2020 | Companies failing to fulfil their obligations shall be fined 100 euros per t carbon quota. | |

| CA CAT | Public utilities and natural gas distributors | Auction Also can sell at a fixed rate | No more than 8% of emissions | Companies failing to fulfil their obligations shall pay a four-fold fine for excessive emissions. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hua, Y.; Dong, F. China’s Carbon Market Development and Carbon Market Connection: A Literature Review. Energies 2019, 12, 1663. https://doi.org/10.3390/en12091663

Hua Y, Dong F. China’s Carbon Market Development and Carbon Market Connection: A Literature Review. Energies. 2019; 12(9):1663. https://doi.org/10.3390/en12091663

Chicago/Turabian StyleHua, Yifei, and Feng Dong. 2019. "China’s Carbon Market Development and Carbon Market Connection: A Literature Review" Energies 12, no. 9: 1663. https://doi.org/10.3390/en12091663

APA StyleHua, Y., & Dong, F. (2019). China’s Carbon Market Development and Carbon Market Connection: A Literature Review. Energies, 12(9), 1663. https://doi.org/10.3390/en12091663