Current State and Future Prospective of Repowering Wind Turbines: An Economic Analysis

Abstract

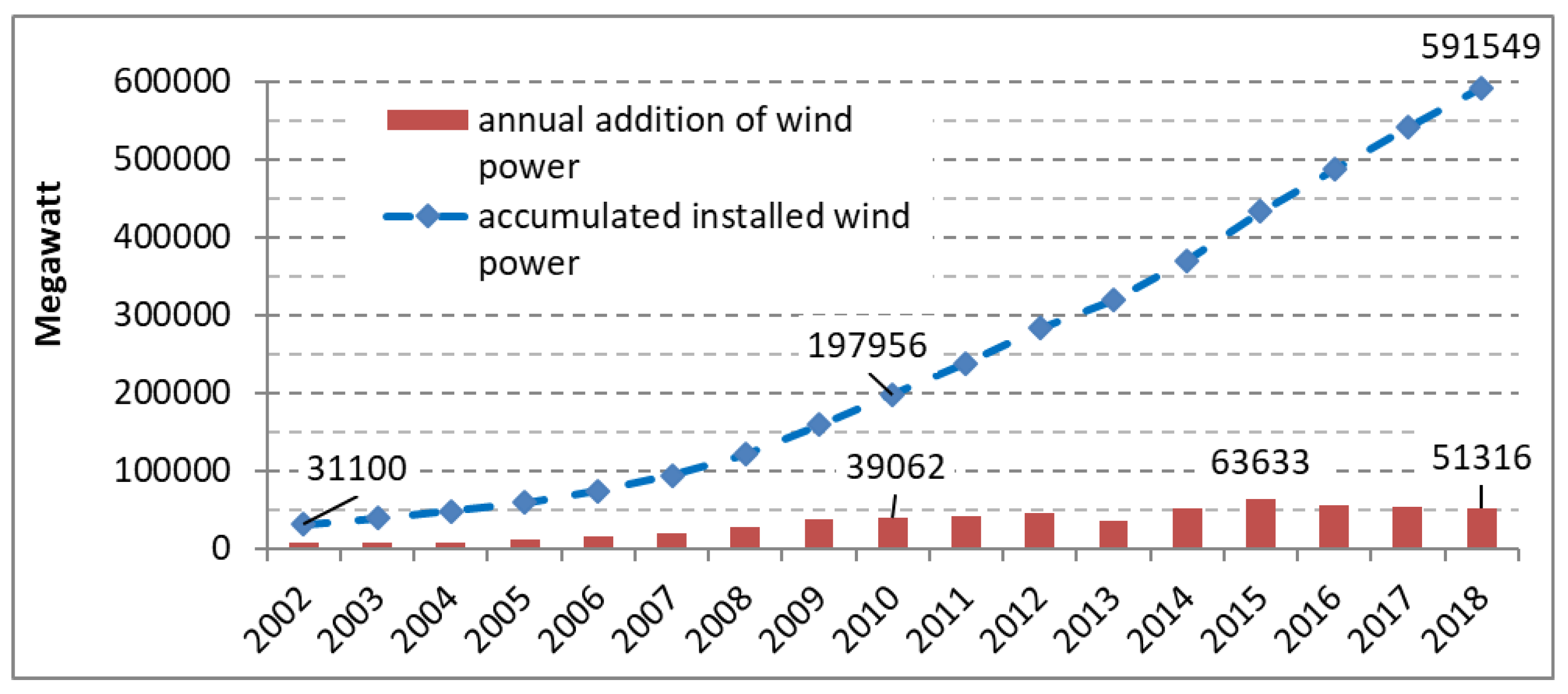

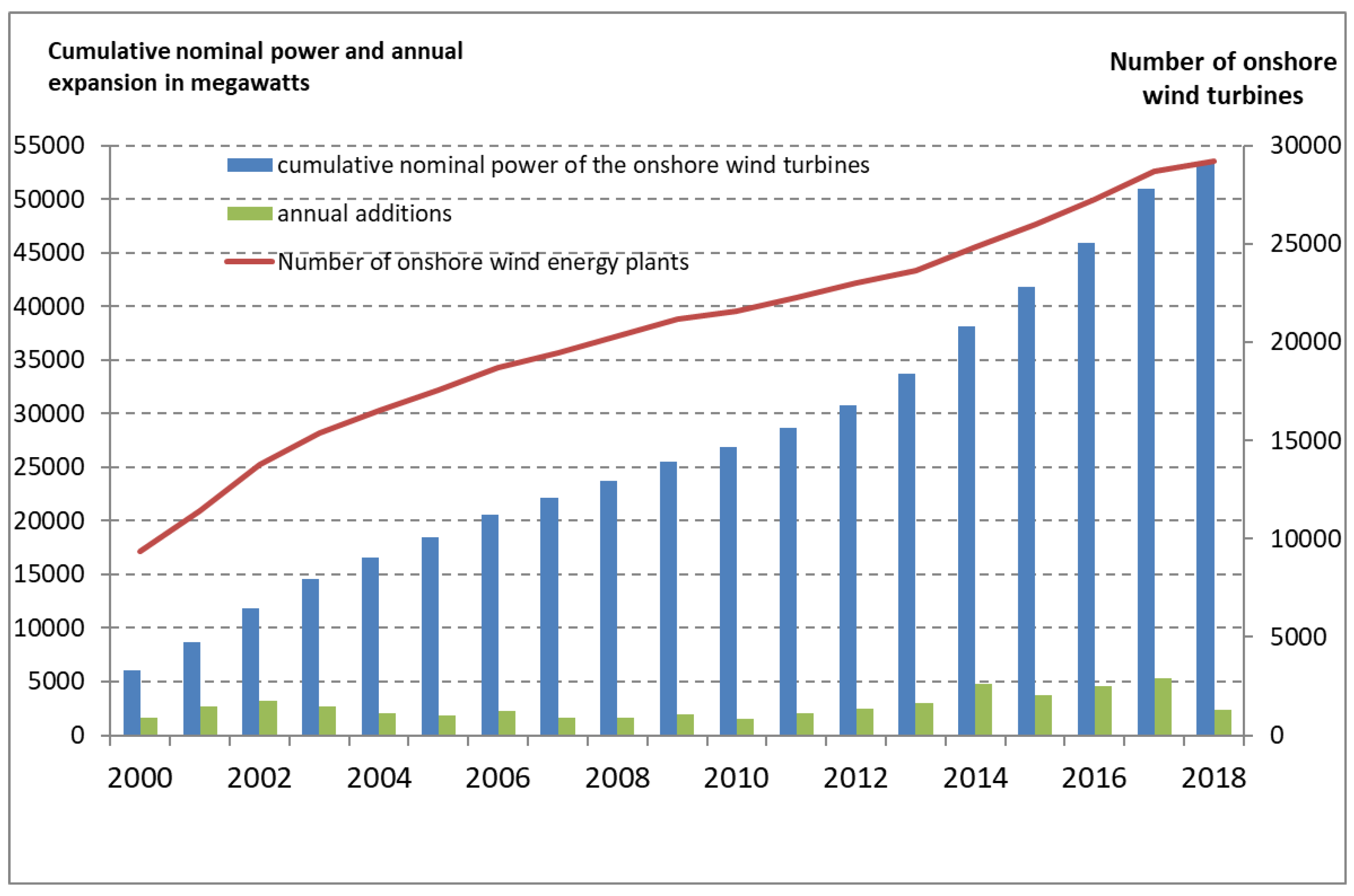

1. Introduction

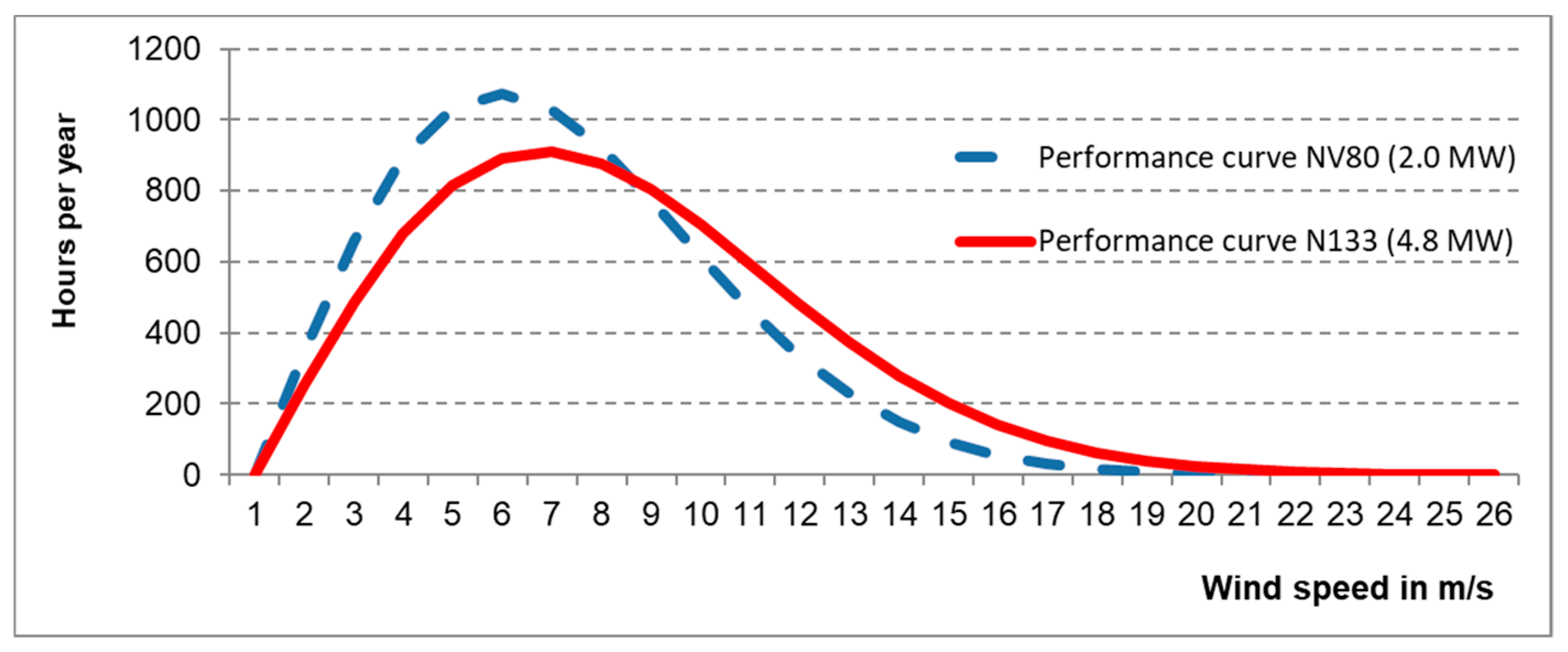

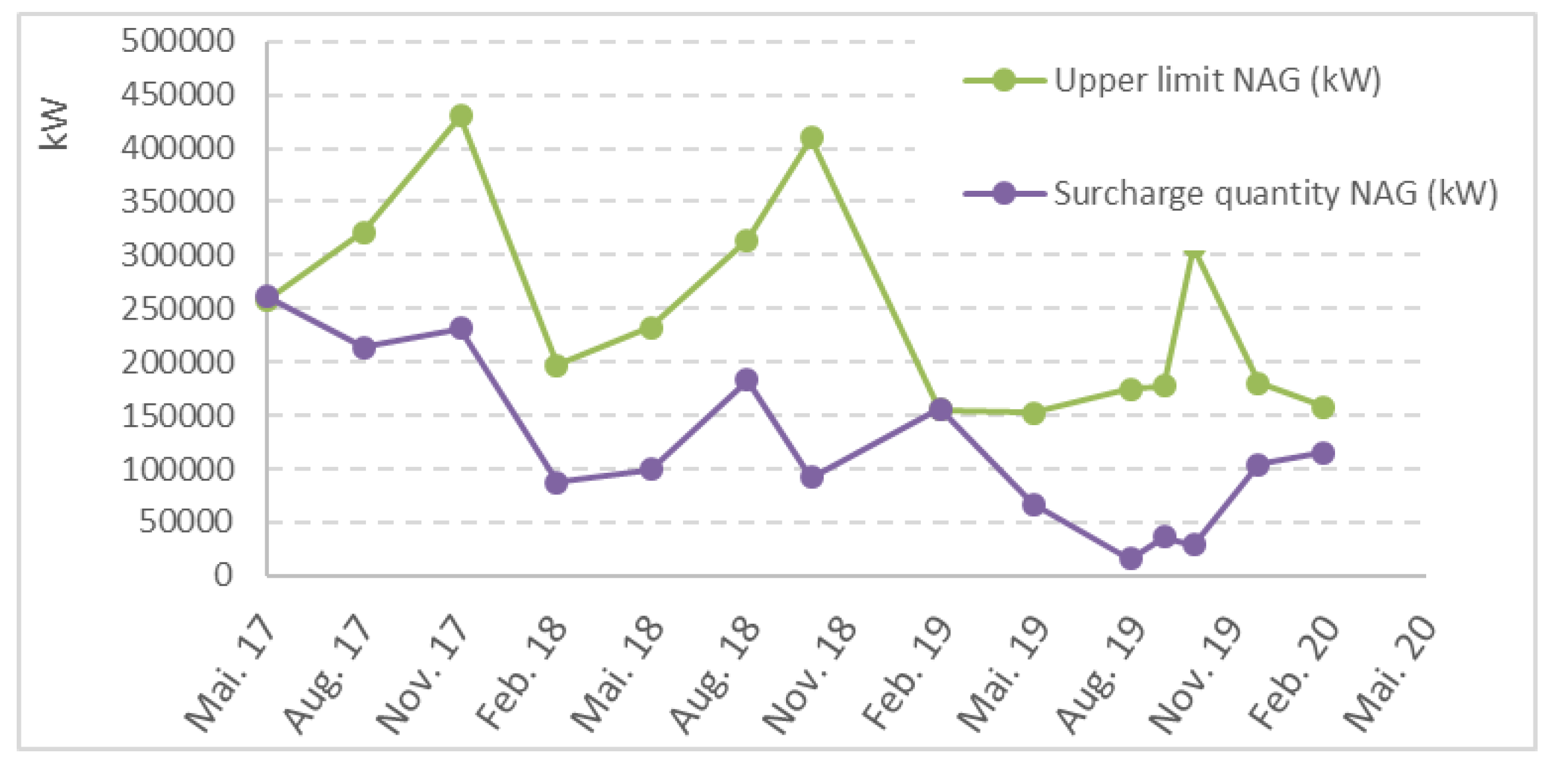

2. Description of the Wind Farm Example and the Technical Innovations of Repowering

3. Investment Analysis

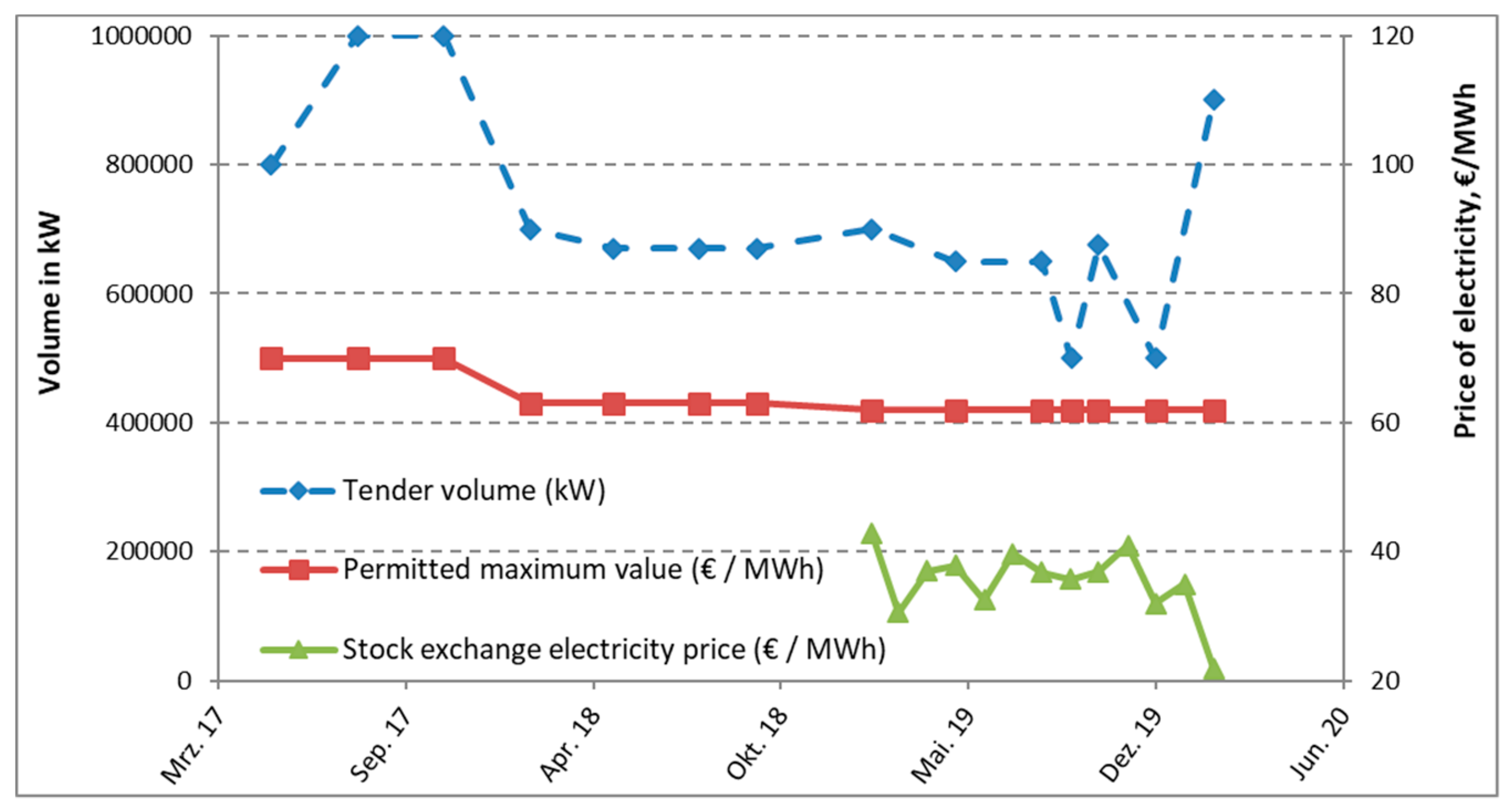

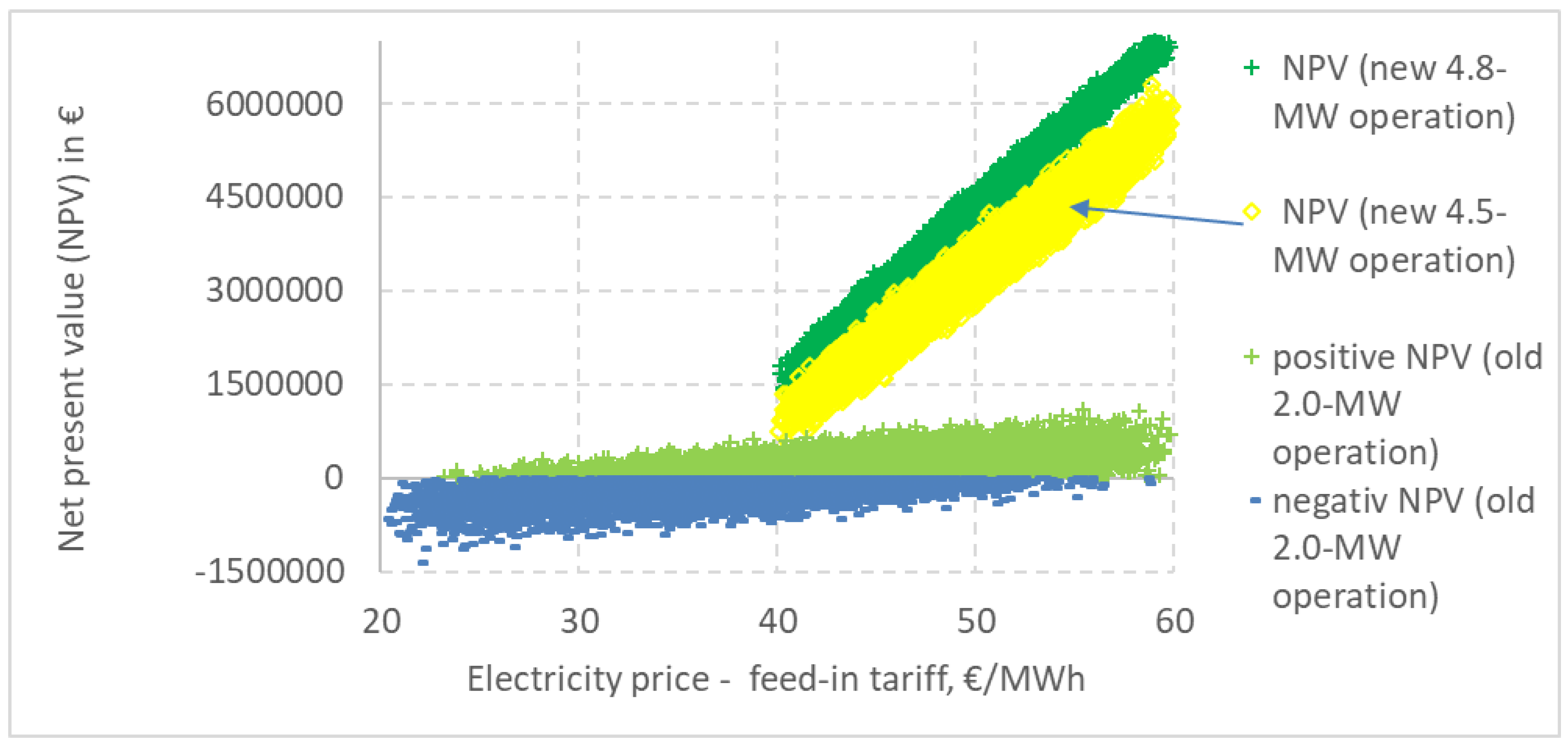

3.1. Static Analysis: Continued Operation or Investment at Currently High Remuneration Prices

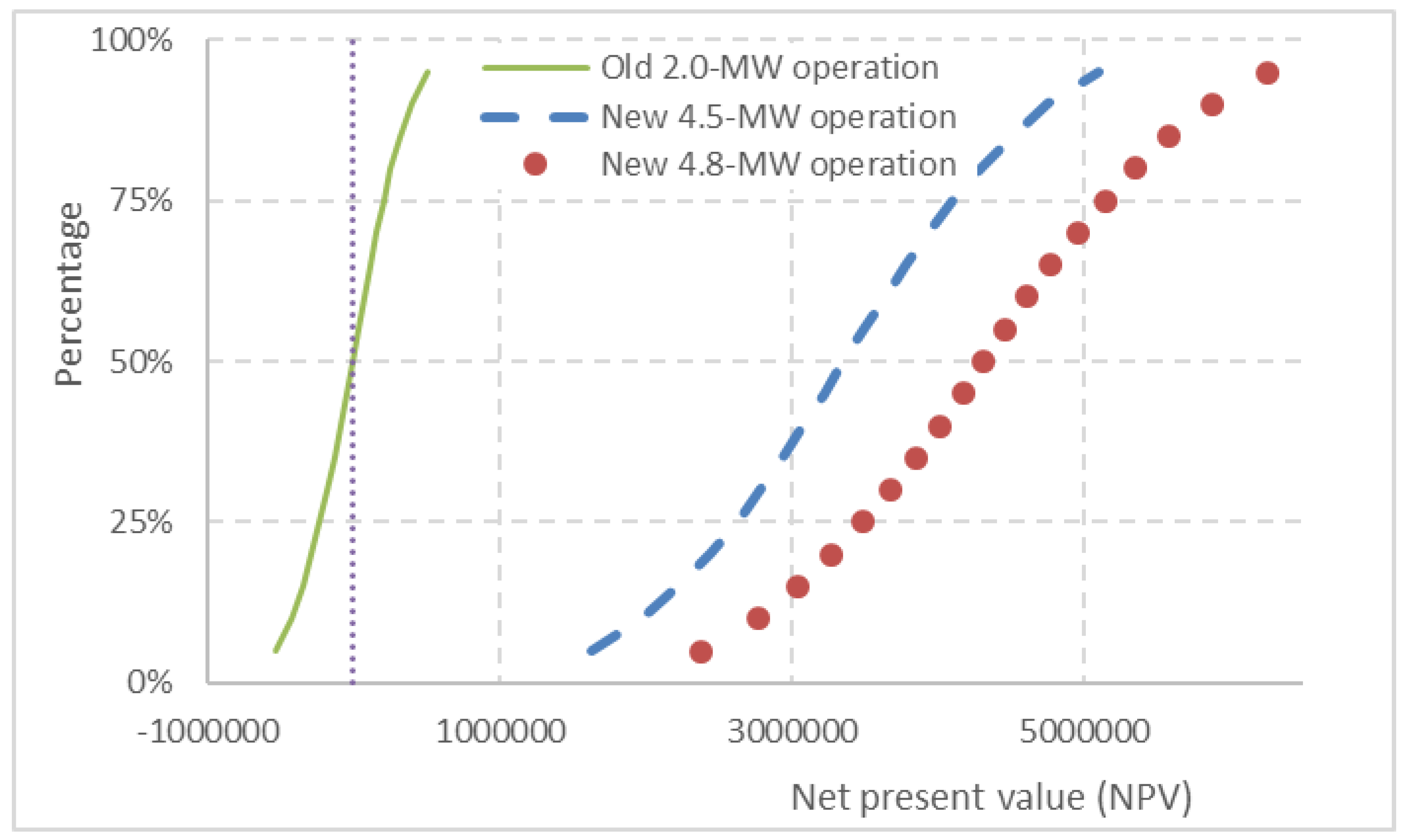

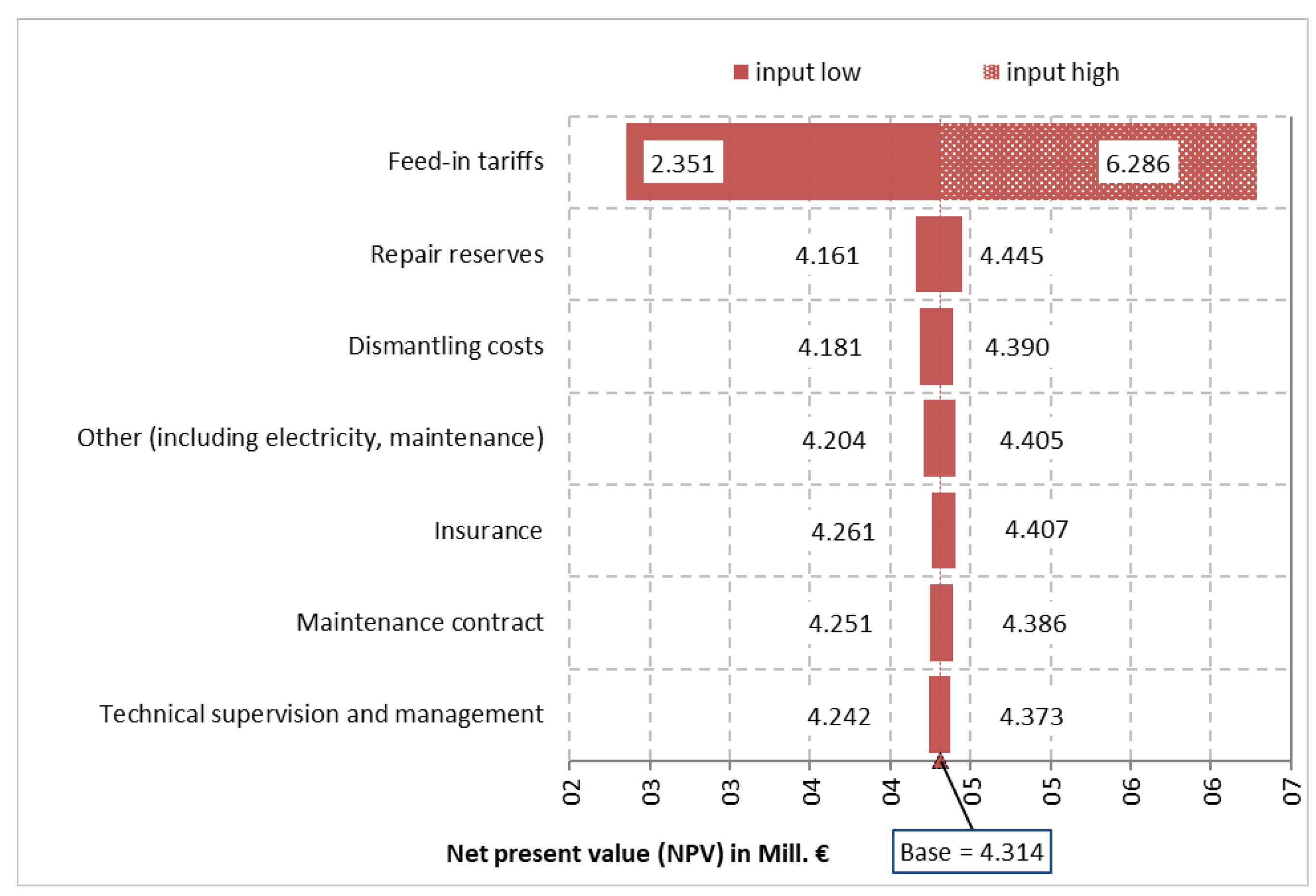

3.2. Results of the Risk Analysis: Future Development

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Bundesministerium für Umwelt, Naturschutz und nukleare Sicherheit (BMU). Klimaschutzplan 2050—Klimapolitische Ziele und Grundsätze der Bundesregierung, 2nd ed.; Bundesministerium für Umwelt, Naturschutz und nukleare Sicherheit (BMU): Berlin, Germany, 2019. [Google Scholar]

- Bundesamt für Justiz. Erneuerbare-Energien-Gesetz (EEG); vom 21. Juli 2014 (BGBl. I S. 1066), zuletzt geändert durch Artikel 1 des Gesetzes vom 25. Mai 2020 (BGBl. I S. 1070); Bundesamt für Justiz: Bonn, Germany, 2020. [Google Scholar]

- AG Energiebilanzen e.V. Bruttostromerzeugung in Deutschland nach Energieträgern 1990–2019. Available online: https://www.ag-energiebilanzen.de/ (accessed on 3 January 2020).

- Anonymous. Windenergie Weltweit; Statista: Hamburg, Germany, 2020; Available online: https://de.statista.com/statistik/studie/id/22071/dokument/windenergie-weltweit-statista-dossier/ (accessed on 10 June 2020).

- Anonymous. Onshore-Windenergie in Deutschland; Statista: Hamburg, Germany, 2019; Available online: https://de.statista.com/statistik/studie/id/6462/dokument/windenergie-in-deutschland-statista-dossier/ (accessed on 10 June 2020).

- Zeit online Ausbau von Windrädern stockt- Bundesregierung am Zug. Available online: https://www.zeit.de/news/2019-10/22/ausbau-von-windraedern-an-land-eingebrochen (accessed on 21 April 2020).

- Madlener, R.; Schumacher, M. Ökonomische Bewertung des Repowering von Onshore- Windenergieanlagen in Deutschland. Zeitschrift für Energiewirtschaf 2011, 35, 297–320. [Google Scholar] [CrossRef]

- Deutscher Wetterdienst (DWD). Available online: https://www.dwd.de/DE/Home/home_node.html (accessed on 8 July 2019).

- I17-Wind GmbH & Co.KG. Gutachten “Masterplan Entwurf_2” (für spezifischen Windpark); I17-Wind GmbH & Co.KG: Friedrichstadt, Germany, 2018. [Google Scholar]

- Konstantin, P. Praxisbuch Energiewirtschaft- Energieumwandlung,-Transport und -Beschaffung im Liberalisierten Markt, 3rd ed.; Springer: Stuttgart, Germany, 2013. [Google Scholar]

- The Windpower-Wind Energy Market Intelligence. Hauptdaten der V80/2000. Available online: https://www.thewindpower.net/turbine_de_30_vestas_v80-2000.php (accessed on 20 August 2019).

- Vestas V80-2.0. Available online: https://www.wind-turbine-models.com/turbines/19-vestas-v80-2.0 (accessed on 20 August 2019).

- Vestas V90. Available online: https://www.wind-turbine-models.com/turbines/16-vestas-v90 (accessed on 20 August 2019).

- Nordex N149/4.0-4.5. Available online: https://www.wind-turbine-models.com/turbines/1705-nordex-n149-4.0-4.5 (accessed on 20 August 2019).

- Nordex N133/4800 Delta. Available online: https://www.wind-turbine-models.com/turbines/1831-nordex-n133-4800-delta (accessed on 20 August 2019).

- Hau, E. Windkraftanlagen: Grundlagen, Technik, Einsatz, Wirtschaftlichkeit, 6th ed.; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Bundesamt für Justiz. Gesetz zum Schutz vor schädlichen Umwelteinwirkungen durch Luftverunreinigungen, Geräusche, Erschütterungen und ähnliche Vorgänge (Bundes-Immissionsschutzgesetz—BImSchG); In der Fassung der Bekanntmachung vom 17. Mai 2013 (BGBl. I S. 1274), zuletzt geändert durch Artikel 1 des Gesetzes vom 8. April 2019 (BGBl. I S. 432); Bundesamt für Justiz: Bonn, Germany, 2019. [Google Scholar]

- Fachagentur Windenergie an Land. Dauer und Kosten des Planungs- und Genehmigungsprozesses von Windenergieanlagen an Land; Fachagentur Windenergie an Land: Berlin, Germany, 2015; Available online: https://www.fachagentur-windenergie.de/fileadmin/files/Veroeffentlichungen/FA-Wind_Analyse_Dauer_und_Kosten_Windenergieprojektierung_01-2015.pdf (accessed on 10 June 2020).

- Ministerium für Energie, Infrastruktur und Landesentwicklung. Landesraumentwicklungsprogramm Mecklenburg-Vorpommern; Mecklenburg-Vorpommern: Schwerin, Germany, 2016. [Google Scholar]

- Bundesnetzagentur. Beendete Ausschreibungen -Ausschreibungen 2019- Ergebnisse der Ausschreibungsrunden für Windenergie-Anlagen an Land 2019. Available online: https://www.bundesnetzagentur.de/DE/Sachgebiete/ElektrizitaetundGas/Unternehmen_Institutionen/Ausschreibungen/Wind_Onshore/BeendeteAusschreibungen/BeendeteAusschreibungen_node.html (accessed on 2 January 2020).

- Kaltschmitt, M.; Schlüter, M.; Schulz, D.; Skiba, M.; Özdirik, B. Erneuerbare Energien—Systemtechnik, Wirtschaftlichkeit, Umweltaspekte, 5th ed.; Kaltschmitt, M., Streicher, W., Wiese, A., Eds.; Springer: Hamburg, Germany; Innsbruck, Austria; Frankfurt, Germany; Berlin/Heidelberg, Germany, 2012. [Google Scholar]

- Paschotta, R. Repowering. Available online: https://www.energie-lexikon.info/repowering.html (accessed on 12 November 2019).

- Arnold, T. How Net Present Value Is Implemented. In A Pragmatic Guide to Real Options; Palgrave Macmillan: New York, NY, USA, 2014. [Google Scholar]

- Deutsche Bundesbank. Entwicklung des Kapitalmarktzinssatzes in Deutschland in den Jahren 1975 bis 2018. Statista: Hamburg, Germany; Available online: https://de.statista.com/statistik/daten/studie/201419/umfrage/entwicklung-des-kapitalmarktzinssatzes-in-deutschland/ (accessed on 13 July 2019).

- Deutscher Bundestag. Kontrolle und Entsorgung von Windkrafträdern. Antwort der Bundesregierung auf die Kleine Anfrage der Abgeordneten Oliver Luksic, Karlheinz Busen, Frank Sitta, weiterer Abgeordneter und der Fraktion der FDP – Drucksache 19/3619. Available online: http://dipbt.bundestag.de/dip21/btd/19/038/1903835.pdf (accessed on 1 June 2020).

- Breitkopf, A. Strombörse—Preisentwicklung am EPEX-Spotmarkt bis Oktober 2019. 4 November 2019. Available online: https://de.statista.com/statistik/daten/studie/289437/umfrage/strompreis-am-epex-spotmarkt/ (accessed on 12 December 2019).

- Fuchs, C.; Marquardt, K.; Kasten, J.; Skau, K. Wind Turbines on German Farms—An Economic Analysis. Energies 2019, 12, 1587. [Google Scholar] [CrossRef]

| Key Figure | Unit | Old Wind Turbine | New Wind Turbines | |

|---|---|---|---|---|

| Type/kW | - | V80/2000 | N149/4500 | N133/4800 |

| Manufacturer | - | Vestas | Nordex | |

| Installation | Jahr | 2001 | New | |

| Tower height | m | 78 | 105/125/164 | 78/83/110 |

| Performance Characteristics | ||||

| Rated capacity | kW | 2000 | 4500 | 4800 |

| Power regulation | - | Pitch | Pitch | Pitch |

| Switch-on speed | m/s | 3.5 | 3 | 3 |

| Nominal wind speed | m/s | 14.5 | 11.5 | |

| Shutdown speed | m/s | 25 | 20 | 20 |

| Power density | m2/kW | 2.52 | 3.9 | 2.9 |

| Rotor | ||||

| Rotor diameter | m | 80 | 149.1 | 133.2 |

| Number of blades | - | 3 | 3 | 3 |

| Swept area | m2 | 5027 | 17,460 | 13,935 |

| Variable speed | U/min | 9–19 | 6.4–12.3 | 6.9–13.9 |

| Transmission | ||||

| Type | - | spur/planetary | planetary | planetary-spur gear |

| Generator | ||||

| Type | - | Asynchronous | Double Fed induction | Double Fed Asyn |

| Nominal voltage | V | 690 | 660 | 690 |

| Maximal generator speed | U/min | 1909 | 1420 | |

| Key Figure | Cost Range in €/kW | Average Specific Costs in €/kW | in % | Costs in 000 € * | |||

|---|---|---|---|---|---|---|---|

| Size/type | 4.5 MW | 4.8 MW | |||||

| Acquisition costs of site rights | 50 | – | 100 | 75 | 5.64 | 337.5 | 360 |

| Project development | 20 | – | 50 | 69 | 5.19 | 310.5 | 331.2 |

| Wind turbine including transport and construction | 900 | – | 1100 | 1000 | 75.24 | 4500 | 4800 |

| Technical infrastructure | |||||||

| Foundations | 40 | – | 60 | 50 | 3.76 | 225 | 240 |

| Paths and parking space | 10 | – | 20 | 15 | 1.13 | 67.5 | 72 |

| Internal wiring | 10 | – | 20 | 15 | 1.13 | 67.5 | 72 |

| Grid connection | 40 | – | 60 | 50 | 3.76 | 225 | 240 |

| Total technical infrastructure | 100 | – | 160 | 130 | 9.78 | 585 | 624 |

| Other costs | |||||||

| Construction management | 5 | – | 10 | 7.5 | 0.56 | 33.75 | 36 |

| Compensatory measures | 15 | – | 30 | 22.5 | 1.69 | 101.25 | 108 |

| Reserve | 20 | – | 30 | 25 | 1.88 | 112.5 | 120 |

| Total other costs | 40 | – | 70 | 55 | 4.14 | 247.5 | 264 |

| Technical investment costs | 1110 | – | 1480 | 1329 | 100% | ||

| Total investment costs | 5980.5 | 6379.2 | |||||

| Key Figure | Percentage of the Ex-Factory Price * | Mean (%) | Proportional Costs (in €) for a 2.0 MW Operation | Proportional Costs (in €) for a 4.5 MW Operation | Proportional Costs (in €) for a 4.8 MW Operation | ||

|---|---|---|---|---|---|---|---|

| Maintenance contract | 0.7 | – | 0.9 | 0.80 | 16,000 | 36,000 | 38,400 |

| Repair reserves | 0.5 | – | 1.0 | 0.75 | 15,000 | 33,750 | 36,000 |

| Insurance | 0.5 | – | 0.6 | 0.55 | 11,000 | 24,750 | 26,400 |

| Technical supervision and management | 0.5 | – | 0.6 | 0.55 | 11,000 | 24,750 | 26,400 |

| Other (including electricity, maintenance) | 0.8 | – | 1.0 | 0.9 | 18,000 | 40,500 | 43,200 |

| Total annual operating costs | 3 | – | 4.2 | 3.6 | 71,000 ** | 159,750 | 170,400 |

| Opportunity costs for the lease of the location | Share of lease of electricity revenue | Annual lease (€ per location) | |||||

| 4% | – | 10% | 7% | 10,752 | 48,899 | 51,154 | |

| Total | 81,752 | 208,649 | 221,554 | ||||

| Key Figure | Old Operation (2.0 MW) | New 4.5 MW Operation | New 4.8 MW Operation |

|---|---|---|---|

| Input: Risk Parameters (Triangular Distribution with Minimum—Median—Maximum Value) | |||

| Feed-in tariffs | 20—35—60 €/MWh | 40—50—60 €/MWh | |

| Operating costs * | Factor 1—2—3 | 3%—3.6%—4.2% from factory price | |

| Remaining service life | 5—7.5—10 years | 20 years (fix) | |

| Dismantling costs | - | 100 T€—300 T€—500 T€ | |

| Lease rate | 4%—7%—10% of yearly electricity revenues | ||

| Result: Net Present Value (NPV) | |||

| Minimum (5%-Limit) | −533,372 € | 1,634,061 € | 2,374,956 € |

| Average | −10,305 € | 3,360,819 € | 4,314,152 € |

| Maximum (95%-Limit) | 505,066 € | 5,103,302 € | 6,247,754 € |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fuchs, C.; Kasten, J.; Vent, M. Current State and Future Prospective of Repowering Wind Turbines: An Economic Analysis. Energies 2020, 13, 3048. https://doi.org/10.3390/en13123048

Fuchs C, Kasten J, Vent M. Current State and Future Prospective of Repowering Wind Turbines: An Economic Analysis. Energies. 2020; 13(12):3048. https://doi.org/10.3390/en13123048

Chicago/Turabian StyleFuchs, Clemens, Joachim Kasten, and Maxi Vent. 2020. "Current State and Future Prospective of Repowering Wind Turbines: An Economic Analysis" Energies 13, no. 12: 3048. https://doi.org/10.3390/en13123048

APA StyleFuchs, C., Kasten, J., & Vent, M. (2020). Current State and Future Prospective of Repowering Wind Turbines: An Economic Analysis. Energies, 13(12), 3048. https://doi.org/10.3390/en13123048