An Ex-Post Assessment of RES-E Support in Greece by Investigating the Monetary Flows and the Causal Relationships in the Electricity Market

Abstract

:1. Introduction

- The intermittency in the RES-E generation requires now more challenging conventional generation capacity services to the market, while these services need to be reduced in order to achieve decarbonization targets;

- The day-ahead electricity price declines reaching a zero value, to become equal to the marginal and opportunity costs of large RES-E integration, while there is going to be a higher variation of daily average prices.

2. Materials and Methods

2.1. Step 1: Identifying the Relevant Monetary Flows

2.2. Step 2: Quantifying Costs and Benefits from RES-E Generation

- Costs: Fiscal support of RES-E generation. Taxes are not considered. The levy often paid by RES-E generators to the local municipalities is omitted, as it has only a distributional effect.

- Benefits: Substitution of the fossil-fueled generation by RES-E could be quantified by the induced reduction in the wholesale day-ahead electricity price or in the use of fossil-fuels. To omit transfer payments, we check if there is any energy consumption or savings, e.g., regarding fossil-fuel use or the net impact on public expenditures.To quantify the benefits attributed to RES-E the following sub-steps are implemented:

- Estimating the mix of the conventional power generation that is substituted by RES-E generation, and

- Estimating the capacity value of RES-E, while keeping the electricity system’s reliability at a designated level.

2.2.1. Sub-Step: Estimating the Mix of the Conventional Power Generation that Is Substituted by RES-E Generation

- Regarding the system load, increasing the RES-E generation must result in equally decreasing of the conventional generation, so that the electricity generated is always equal to demand plus total losses, and

- Avoiding conventional electricity generation results in increasing RES-E generation, which changes under the varying marginal costs of the dispatchable electricity generation. As a result, the impact of RES-E generation differentiates according to demand levels (i.e., high or low).

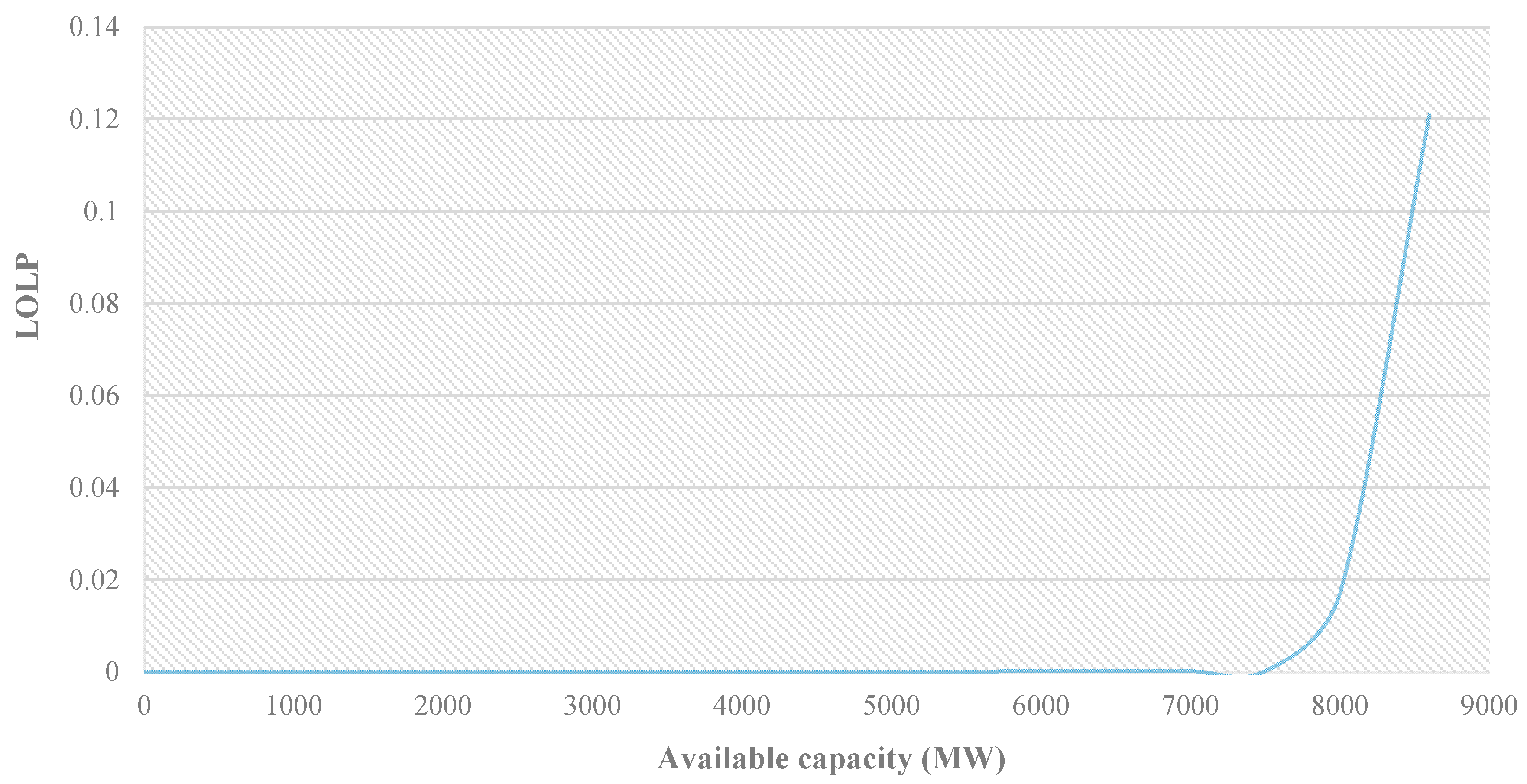

2.2.2. Sub-Step: Estimating the Capacity Value of RES-E, While Keeping the Electricity System’s Reliability in a Designated Level

- -

- : the total available (in service) capacity of the electricity system, and

- -

- : the total load of the electricity system at time .

- -

- : the capacity of the new generator added (i.e., capacity value), and

- -

- : the additional load that can be integrated into the electricity system.

- -

- : the outage capacity (MW);

- -

- : the probability of outage capacity when adding the jth unit;

- -

- : the probability of outage capacity before adding the jth unit;

- -

- : the equivalent perfectly reliable capacity of the jth unit;

- -

- : the demand equivalent forced outage rate of the jth unit.

3. Application to the Electricity Market in Greece

3.1. Identifying the Relevant Monetary Flows

- The payments to RES-E generators for each MWh generated at SMP, and

- The RES-E levy paid directly by final consumers. This levy was basically the monetary difference between the tariff and SMPs, or between the tariff and the average variable costs for non-interconnected regions such as islands.

- -

- was the system marginal price during hour h,

- -

- was the Feed-in-Tariff reimbursement for technology i,

- -

- was the RES-E generation (MW) during hour h, from technology i.

3.2. Quantifying Costs and Benefits from RES-E Generation

- ◦

- Costs: Paying for the FiTs reimbursement.

- ◦

- Benefits: Under the assumption that the SMP reduction due to the substitution of conventional generation by RES-E generation is balanced by VCRM, a better way to approximate economic benefits owing to the offset of fossil-fueled generators is the reduction in fuel use. Given that lignite is an indigenous energy source in Greece [52], monetizing the lignite consumption avoided due to RES-E generation can be calculated by considering the lignite export price. However, there are no trends indicating the prices for lignite-fueled generation in liberalized markets, as its transport over longer distances is considered an uneconomic choice due to its low calorific value. As an alternative, the pre-tax avoided cost of lignite use and natural gas imports, and the avoided Carbon Dioxide (CO2) emissions, owing to offset from RES-E generation, will be regarded as benefits.

- -

- : the RES-E generation during year (kWh).

- -

- : CO2 emissions coefficient of the displaced fossil-fueled generator during year .

3.2.1. Estimating the Mix of the Conventional Power Generation that is Substituted by RES-E Generation

- -

- is a factor capable of adjusting to the volatility of fuel prices. It was calculated on a daily basis as the total price change of the different fuels according to their contribution in the generation output :The price variation of each fuel was calculated as the difference between the previous day and the mean price of the same month for the last three years:Finally, was calculated as the mean contribution to the total fossil-fueled generation for the last three years:

- -

- is the reference value of the displacement of thermal generation due to hydroelectric generation. The reference value was calculated as the rolling mean value of the SMP during month over the last three years, considering the respective hydroelectric generation variable over the same period:

- -

- is the actual lignite-(natural gas-)fueled electricity generation during hour and day , and

- -

- , where

- is the system load during hour and day ,

- is the actual RES-E generation during hour and day ,

- is the hydroelectric generation during hour and day , and

- are the total available capacities during hour and day for natural gas-fueled and lignite-fueled electricity generation, respectively.

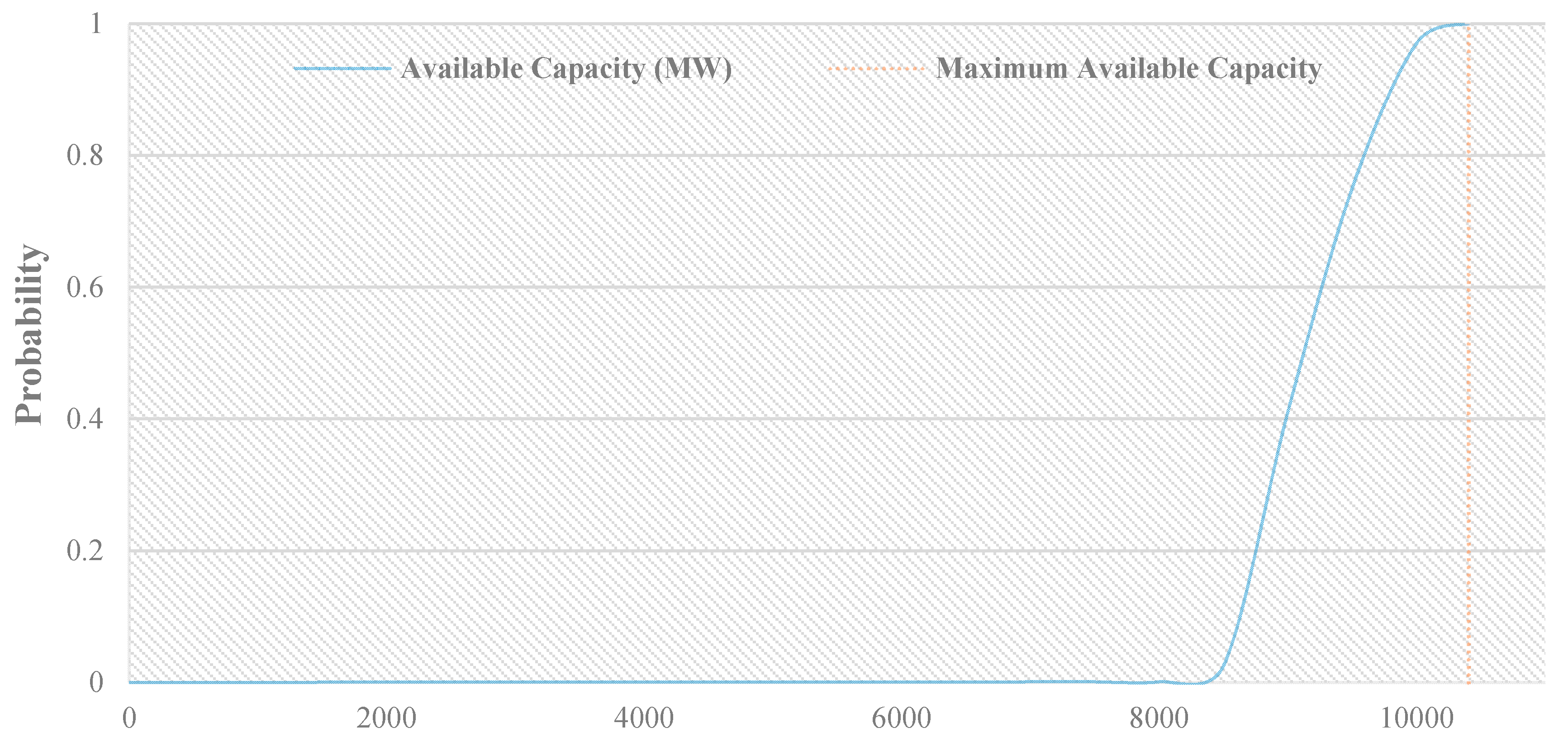

3.2.2. Estimating the Capacity Value of RES-E, While Keeping the Electricity System’s Reliability in a Designated Level

4. Results and Discussion

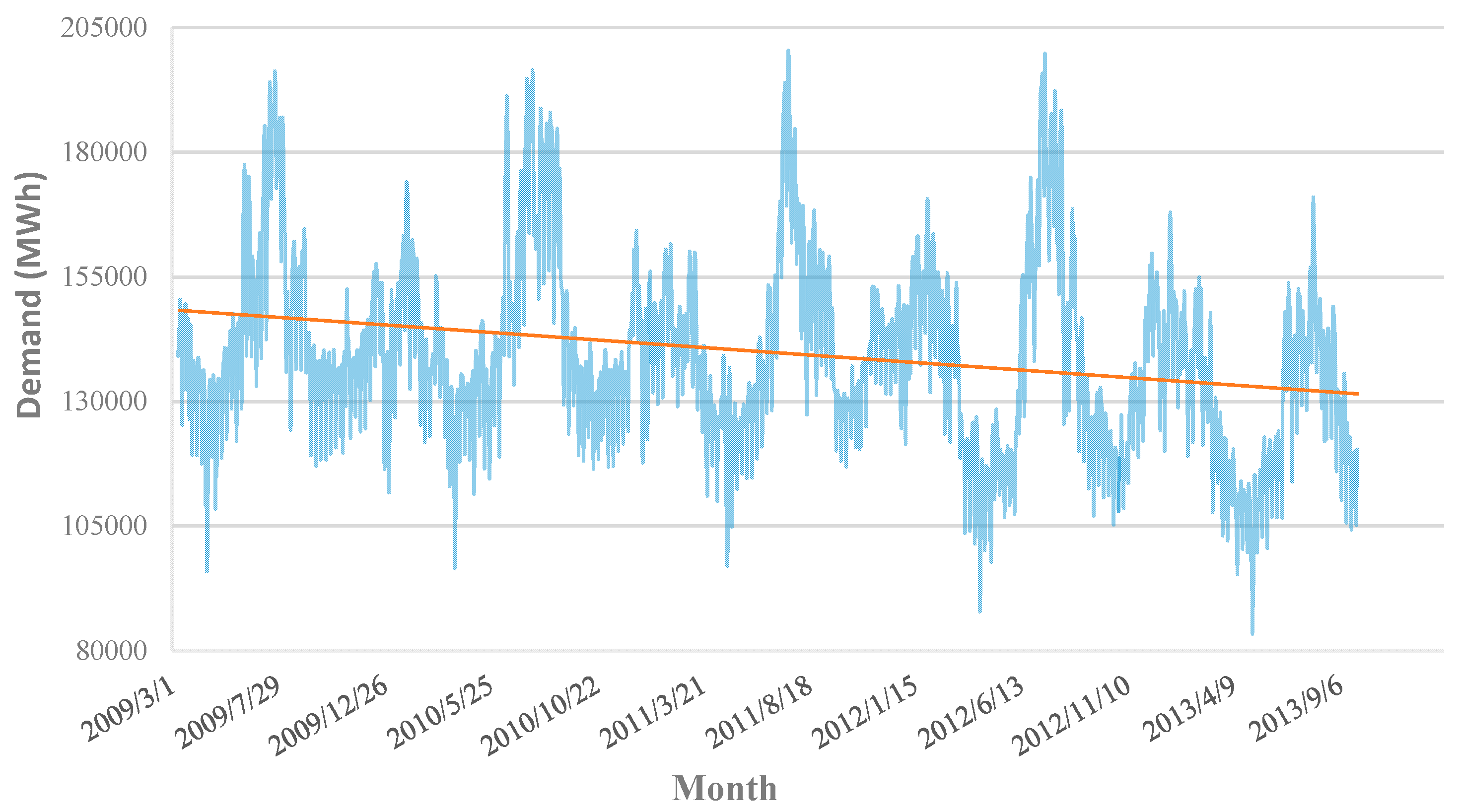

4.1. The Long-Run Equilibrium Relationship between the Lignite-(Natural Gas-)Fueled Generation and the Wind RES-E Generation

4.2. Economic Benefits from the Wind RES-E Generation

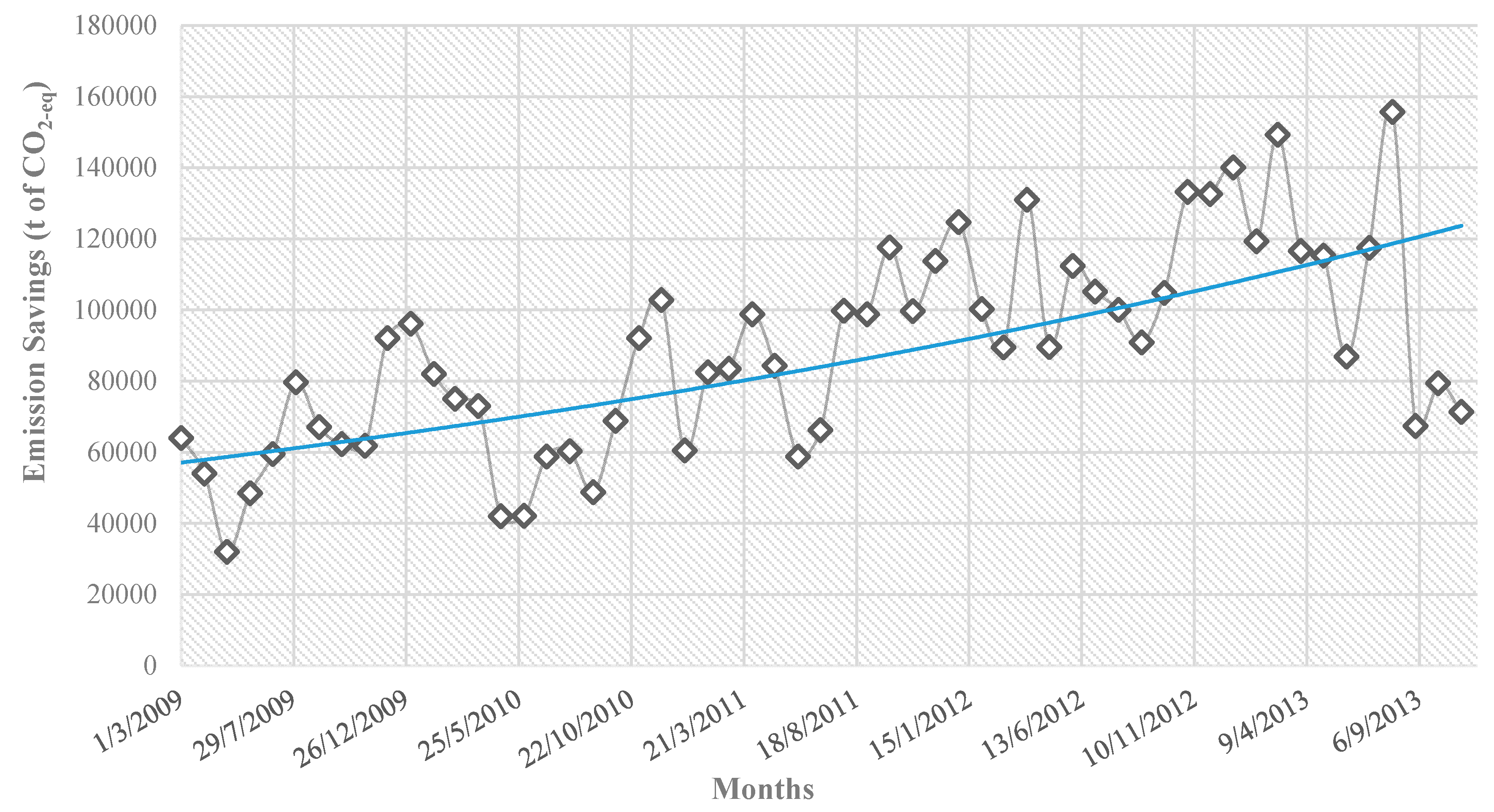

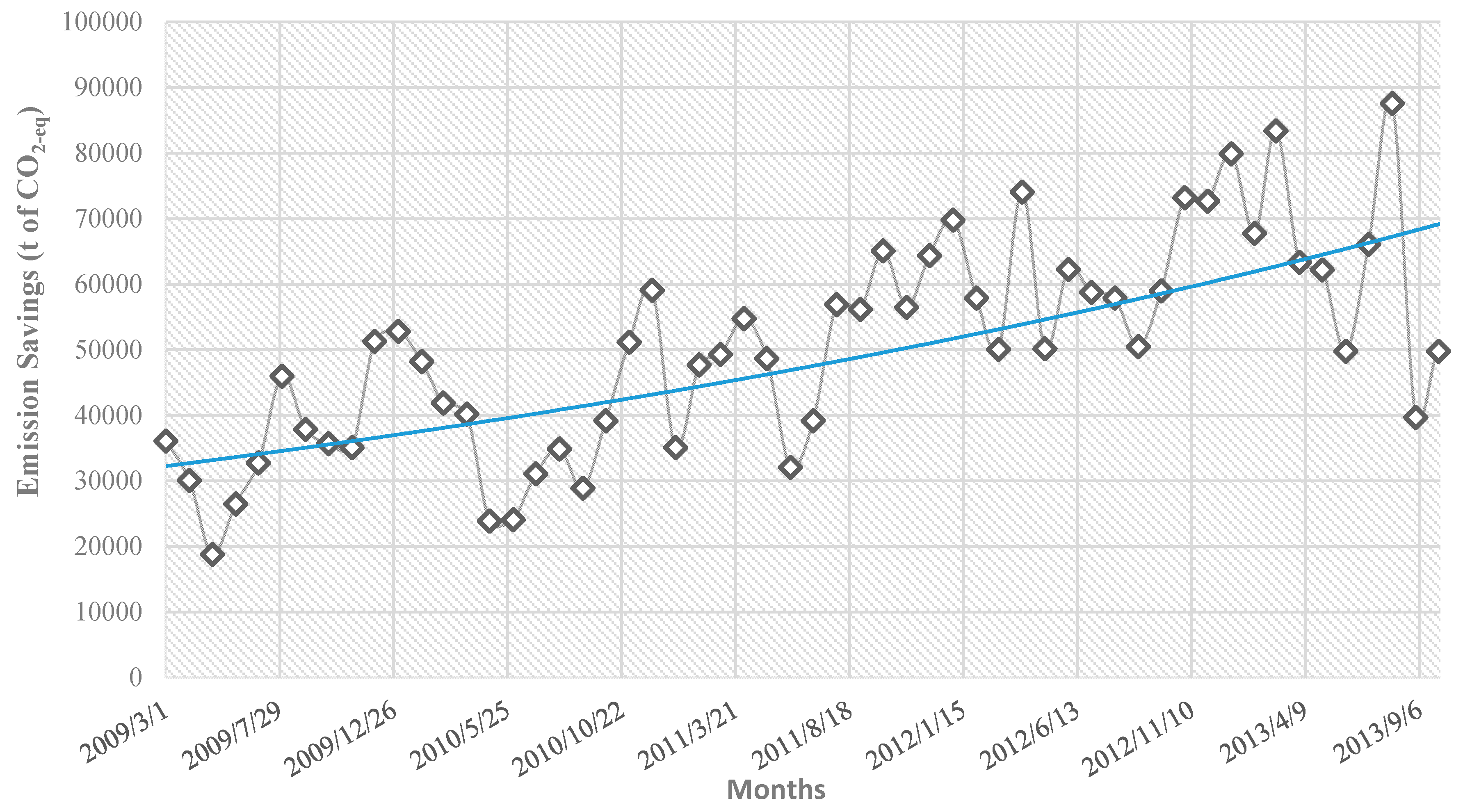

4.3. Environmental Benefits: CO2 Emissions Savings from the Wind RES-E Generation

4.4. Capacity Adequacy of the Wind RES-E Generation

5. Conclusions and Implications for Policy and Practice

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| Nomenclature | RES-E | Electricity generation from RES | |

| Acronyms & Abbreviations | SIMP | System imbalances marginal price | |

| ARDL | Autoregressive distributed lag | SMP | System marginal price |

| CA | cointegration analysis | SO2 | Sulfur dioxide |

| CAT | Capacity availability ticket | USA | United States of America |

| CEMS | Continuous emissions monitoring systems | VAR | Vector autoregressive |

| CO2 | Carbon dioxide | VCRM | Variable cost recovery mechanism |

| COPT | Capacity outage probability table | VECM | Vector error-correction modeling |

| CRES | Center of renewable energy sources | Parameters | |

| DAS | Day-ahead scheduling | PNCP | Noncompliance penalty value |

| EC | European Commission | εp | Emissions coefficient |

| ECM | Error-correction model | σ | Adjustment factor |

| EFORd | Demand equivalent forced outage rate | Indices & sets | |

| ELCC | Effective load carrying capability | d | Index of time period |

| EU | European Union | h | Index of time period |

| FiPs | Feed-in-premiums | i | Index |

| FiTs | Feed-in-tariffs | j | Index |

| GHG | Greenhouse Gas | m | Index of time period |

| HEDNO | Hellenic Electricity Distribution Network Operator | n | Total number of elements in a set |

| HEMO | Hellenic Electricity Market Operator | t | Index of time period |

| LAGIE | Hellenic Operator of Electricity Market | y | Index of time period |

| IPTO | Independent power transmission operator | Variables | |

| KPI | Key performance indicator | a | Percentage |

| LOLE | Loss of load expectation | C | Capacity |

| LOLP | Loss of load probability | CF | Capacity factor |

| MDI | Ministry of Development and Investments | G | Generation |

| MEE | Ministry of Environment and Energy | L | Load |

| MWV | Marginal water value | P | Price |

| NECP | National energy and climate plan | p | Probability |

| NEM | Net-metering | W | Explanatory variable |

| NOx | Nitrogen oxide | X | Capacity |

| PM | Particulate matter | Y | Explanatory variable |

| PV | Photovoltaics | Z | Explanatory variable |

| RES | Renewable energy sources | ||

Appendix A

| CO2 | SO2 | NOX | PM | ||||

|---|---|---|---|---|---|---|---|

| Plant | Value | Plant | Value | Plant | Value | Plant | Value |

| Megalopolis A | 1652 | Megalopolis A | 8.70 | Ag. Dimitrios | 2.16 | Ptolemaida | 2.78 |

| Ptolemaida | 1577 | Amyntaio | 8.65 | Kardia | 2.08 | Kardia | 0.68 |

| Kardia | 1500 | Ag. Dimitrios | 3.11 | Amyntaio | 1.37 | Megalopolis A | 0.42 |

| Ag. Dimitrios | 1435 | Ptolemaida | 2.73 | Ptolemaida | 1.36 | Amyntaio | 0.18 |

| Amyntaio | 1349 | Florina | 2.29 | Megalopolis B | 1.15 | Megalopolis B | 0.12 |

| Megalopolis B | 1340 | Kardia | 1.73 | Megalopolis A | 1.09 | Ag. Dimitrios | 0.10 |

| Florina | 1210 | Megalopolis B | 0.69 | Florina | 0.82 | Florina | 0.02 |

| Results: OLS | ||||||

|---|---|---|---|---|---|---|

| Model: | OLS | AIC: | 21,217.4836 | |||

| Dependent variable: | diff(ngas) | BIC: | 21,346.0190 | |||

| No. Observations | 1565 | Log-Likelihood: | −10,585 | |||

| Df Model: | 23 | F-statistic: | 70.18 | |||

| Df Residuals: | 1541 | Prob (F-statistic): | 2.64 × 10−220 | |||

| R-squared: | 0.512 | Scale: | 44,552 | |||

| Adj. R-squared: | 0.504 | |||||

| Coefficient | Standard Error | t | P > |t| | [0.025 | 0.975] | |

| const | −70.2991 | 68.8041 | −1.0217 | 0.3071 | −205.2587 | 64.6606 |

| L1.ngas | −0.2276 | 0.0200 | −11.3680 | 0.0000 | −0.2669 | −0.1883 |

| L1.Load | 0.0695 | 0.0102 | 6.7959 | 0.0000 | 0.0494 | 0.0895 |

| L1.RES | −0.0520 | 0.0384 | −1.3569 | 0.1750 | −0.1273 | 0.0232 |

| L1.Hydro | −0.0961 | 0.0175 | −5.4984 | 0.0000 | −0.1304 | −0.0618 |

| L1.Lignite | −0.0525 | 0.0165 | −3.1914 | 0.0014 | −0.0848 | −0.0202 |

| L1.NGas | 0.0811 | 0.0112 | 7.2465 | 0.0000 | 0.0592 | 0.1031 |

| diff(Load) | 0.3626 | 0.0139 | 26.1010 | 0.0000 | 0.3353 | 0.3898 |

| diff(RES) | −0.4262 | 0.0305 | −13.9603 | 0.0000 | −0.4860 | −0.3663 |

| diff(Hydro) | −0.3718 | 0.0236 | −15.7492 | 0.0000 | −0.4181 | −0.3255 |

| diff(Lignite) | −0.0979 | 0.0156 | −6.2835 | 0.0000 | −0.1285 | −0.0673 |

| diff(NGas) | 0.1178 | 0.0207 | 5.6865 | 0.0000 | 0.0771 | 0.1584 |

| L1.diff(ngas) | −0.1970 | 0.0272 | −7.2506 | 0.0000 | −0.2503 | −0.1437 |

| L1.diff(Load) | 0.1192 | 0.0181 | 6.5870 | 0.0000 | 0.0837 | 0.1548 |

| L1.diff(RES) | −0.1016 | 0.0361 | −2.8175 | 0.0049 | −0.1724 | −0.0309 |

| L1.diff(Hydro) | −0.0127 | 0.0286 | −0.4460 | 0.6557 | −0.0688 | 0.0433 |

| L1.diff(Lignite) | −0.0721 | 0.0171 | −4.2286 | 0.0000 | −0.1055 | −0.0387 |

| L1.diff(NGas) | 0.0506 | 0.0233 | 2.1695 | 0.0302 | 0.0049 | 0.0964 |

| L2.diff(ngas) | −0.0653 | 0.0251 | −2.5968 | 0.0095 | −0.1146 | −0.0160 |

| L2.diff(Load) | 0.0507 | 0.0164 | 3.0843 | 0.0021 | 0.0185 | 0.0830 |

| L2.diff(RES) | −0.0528 | 0.0325 | −1.6252 | 0.1043 | −0.1164 | 0.0109 |

| L2.diff(Hydro) | 0.0146 | 0.0254 | 0.5756 | 0.5650 | −0.0352 | 0.0645 |

| L2.diff(Lignite) | −0.0171 | 0.0161 | −1.0658 | 0.2867 | −0.0486 | 0.0144 |

| L2.diff(NGas) | −0.0007 | 0.0210 | −0.0346 | 0.9724 | −0.0418 | 0.0404 |

| Omnibus: | 46.774 | Durbin–Watson: | 2.024 | |||

| Prob(Omnibus): | 0.000 | Jarque–Bera (JB): | 92.237 | |||

| Skew: | 0.188 | Prob(JB): | 0.000 | |||

| Kurtosis: | 4.128 | Condition No.: | 99,643 | |||

| Results: OLS | ||||||

|---|---|---|---|---|---|---|

| Model: | OLS | AIC: | 22,453.3982 | |||

| Dependent variable: | Ngas | BIC: | 22,485.5436 | |||

| No. Observations | 1568 | Log-Likelihood: | −11,221 | |||

| Df Model: | 5 | F-statistic: | 465.1 | |||

| Df Residuals: | 1562 | Prob (F-statistic): | 4.14 × 10−306 | |||

| R-squared: | 0.598 | Scale: | 96,575 | |||

| Adj. R-squared: | 0.597 | |||||

| Coefficient | Standard Error | t | P > |t| | [0.025 | 0.975] | |

| const | −406.4450 | 85.9341 | −4.7297 | 0.0000 | −575.0032 | −237.8867 |

| Load | 0.3226 | 0.0102 | 31.5526 | 0.0000 | 0.3026 | 0.3427 |

| RES | −0.3723 | 0.0386 | −9.6433 | 0.0000 | −0.4480 | −0.2966 |

| Hydro | −0.4386 | 0.0193 | −22.6832 | 0.0000 | −0.4765 | −0.4007 |

| Lignite | −0.2190 | 0.0172 | −12.6977 | 0.0000 | −0.2529 | −0.1852 |

| NGas | 0.3558 | 0.0113 | 31.5874 | 0.0000 | 0.3337 | 0.3779 |

| Omnibus: | 6.508 | Durbin–Watson: | 0.659 | |||

| Prob(Omnibus): | 0.039 | Jarque–Bera (JB): | 6.657 | |||

| Skew: | 0.122 | Prob(JB): | 0.036 | |||

| Kurtosis: | 3.205 | Condition No.: | 83,351 | |||

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

| Most volatile month | December | November | September | November | March |

| Day of max wind | 2009/12/25 | 2010/11/23 | 2011/09/27 | 2012/11/29 | 2013/3/14 |

| Max wind (MWh) | 11,756 | 15,464 | 17,753 | 23,328 | 23,014 |

| Day of min wind | 2009/12/08 | 2010/11/16 | 2011/09/1 | 2012/11/26 | 2013/3/1 |

| Min wind (MWh) | 682 | 556 | 1395 | 1626 | 2476 |

| Volatility | . 89% | 93% | . 85% | 87% | 81% |

| Plant Name | Plant Fuel | EFORd (%) | Net Capacity (MW) |

|---|---|---|---|

| AG_DIMITRIOS1. | Lignite | 8.302. | 274 |

| AG_DIMITRIOS2 | Lignite | 7.534 | 274 |

| AG_DIMITRIOS3 | Lignite | 7.074 | 283 |

| AG_DIMITRIOS4 | Lignite | 10.174 | 283 |

| AG_DIMITRIOS5 | Lignite | 5.355 | 342 |

| AG_GEORGIOS8 | Natural gas | 14.231 | 151 |

| AG_GEORGIOS9 | Natural gas | 3.229 | 188 |

| ALIVERI3 | Oil | 0.749 | 144 |

| ALIVERI4 | Oil | 1.767 | 144 |

| ALOUMINIO | Natural gas | 42.39 | 334 |

| AMYNDEO1 | Lignite | 11.284 | 273 |

| AMYNDEO2 | Lignite | 11.472 | 273 |

| ELPEDISON_THESS | Natural gas | 6.29 | 389.38 |

| ELPEDISON_THISVI | Natural gas | 5.67 | 410 |

| HERON1 | Natural gas | 6.67 | 49.254 |

| HERON2 | Natural gas | 7.79 | 49.254 |

| HERON3 | Natural gas | 7.38 | 49.254 |

| HERON_CC | Natural gas | 5.67 | 422.142 |

| KARDIA1 | Lignite | 9.815 | 275 |

| KARDIA2 | Lignite | 7.607 | 275 |

| KARDIA3 | Lignite | 9.658 | 280 |

| KARDIA4 | Lignite | 17.76 | 280 |

| KOMOTINI | Natural gas | 5.88 | 476.3 |

| LAVRIO1 | Oil | 3.02 | 123 |

| LAVRIO2 | Oil | 8.97 | 287 |

| LAVRIO3 | Natural gas | 11.55 | 173.4 |

| LAVRIO4 | Natural gas | 6.49 | 550.2 |

| LAVRIO5 | Natural gas | 3.11 | 377.66 |

| LIPTOL1 | Lignite | 6.42 | 30 |

| LIPTOL2 | Lignite | 6.42 | 8 |

| MEGALOPOLI1 | Lignite | 20.485 | 113 |

| MEGALOPOLI2 | Lignite | 20.485 | 113 |

| MEGALOPOLI3 | Lignite | 20.485 | 255 |

| MEGALOPOLI4 | Lignite | 7.265 | 256 |

| MELITI | Lignite | 10.141 | 289 |

| PROTERGIA_CC | Natural gas | 5.67 | 432.7 |

| KORINTHOS_POWER | Natural gas | 5.67 | 433.46 |

| PTOLEMAIDA1 | Lignite | 27.07 | 64 |

| PTOLEMAIDA2 | Lignite | 27.07 | 116 |

| PTOLEMAIDA3 | Lignite | 28.4 | 116 |

| TOLEMAIDA4 | Lignite | 27.08 | 274 |

References

- Michas, S.; Stavrakas, V.; Spyridaki, N.; Flamos, A. Identifying Research Priorities for the further development and deployment of Solar Photovoltaics Identifying Research Priorities for the further development. Int. J. Sustain. Energy 2018, 38, 276–296. [Google Scholar] [CrossRef] [Green Version]

- Stavrakas, V.; Spyridaki, N.-A.; Flamos, A. Striving towards the deployment of bio-energy with carbon capture and storage (BECCS): A review of research priorities and assessment needs. Sustainability 2018, 10, 2206. [Google Scholar] [CrossRef] [Green Version]

- Cooper, M. Renewable and distributed resources in a post-Paris low carbon future: The key role and political economy of sustainable electricity. Energy Res. Soc. Sci. 2016, 19, 66–93. [Google Scholar] [CrossRef]

- Vandyck, T.; Keramidas, K.; Saveyn, B.; Kitous, A.; Vrontisi, Z. A global stocktake of the Paris pledges: Implications for energy systems and economy. Glob. Environ. Chang. 2016, 41, 46–63. [Google Scholar] [CrossRef]

- Ackermann, T.; Andersson, G.; Söder, L. Overview of government and market driven programs for the promotion of renewable power generation. Renew. Energy 2000, 22, 197–204. [Google Scholar] [CrossRef]

- Hirth, L. The market value of variable renewables: The effect of solar wind power variability on their relative price. Energy Econ. 2013, 38, 218–236. [Google Scholar] [CrossRef] [Green Version]

- Ringel, M. Fostering the use of renewable energies in the European Union: The race between feed-in tariffs and green certificates. Renew. Energy 2006, 31, 1–17. [Google Scholar] [CrossRef]

- Butler, L.; Neuhoff, K. Comparison of feed-in tariff, quota and auction mechanisms to support wind power development. Renew. Energy 2008, 33, 1854–1867. [Google Scholar] [CrossRef] [Green Version]

- Campoccia, A.; Dusonchet, L.; Telaretti, E.; Zizzo, G. An analysis of feed’in tariffs for solar PV in six representative countries of the European Union. Sol. Energy 2014, 107, 530–542. [Google Scholar] [CrossRef]

- Li, S.J.; Chang, T.H.; Chang, S.L. The policy effectiveness of economic instruments for the photovoltaic and wind power development in the European Union. Renew. Energy 2017, 101, 660–666. [Google Scholar] [CrossRef]

- Fuchs, C.; Kasten, J.; Vent, M. Current State and Future Prospective of Repowering Wind Turbines: An Economic Analysis. Energies 2020, 13, 3048. [Google Scholar] [CrossRef]

- Nicolini, M.; Tavoni, M. Are renewable energy subsidies effective? Evidence from Europe. Renew. Sustain. Energy Rev. 2017, 74, 412–423. [Google Scholar] [CrossRef]

- Koumparou, I.; Christoforidis, G.C.; Efthymiou, V.; Papagiannis, G.K.; Georghiou, G.E. Configuring residential PV net-metering policies—A focus on the Mediterranean region. Renew. Energy 2017, 113, 795–812. [Google Scholar] [CrossRef]

- Antonelli, M.; Desideri, U. The doping effect of Italian feed-in tariffs on the PV market. Energy Policy 2014, 67, 583–594. [Google Scholar] [CrossRef]

- Couture, T.D.; Cory, K.; Kreycik, C.; Williams, E. Policymaker’s Guide to Feed-in Tariff Policy Design; National Renewable Energy Lab.: Golden, CO, USA, 2010. [Google Scholar]

- Frondel, M.; Schmidt, C.M.; Vance, C. Revisiting Germany’s solar cell promotion: An unfolding disaster. Econ. Anal. Policy 2014, 44, 3–13. [Google Scholar] [CrossRef]

- De Boeck, L.; Van Asch, S.; De Bruecker, P.; Audenaert, A. Comparison of support policies for residential photovoltaic systems in the major EU markets through investment profitability. Renew. Energy 2016, 87, 42–53. [Google Scholar] [CrossRef]

- Kyritsis, A.; Voglitsis, D.; Papanikolaou, N.; Tselepis, S.; Christodoulou, C.; Gonos, I.; Kalogirou, S.A. Evolution of PV systems in Greece and review of applicable solutions for higher penetration levels. Renew. Energy 2017, 109, 487–499. [Google Scholar] [CrossRef]

- Stavrakas, V.; Flamos, A. A modular high-resolution demand-side management model to quantify benefits of demand-flexibility in the residential sector. Energy Convers. Manag. 2020, 205, 112339. [Google Scholar] [CrossRef]

- Mart, H.; Coronas, S.; Alonso, À.; de Hoz, J.; Matas, J. Renewable Energy Auction Prices: Near Subsidy-Free? Energies 2020, 13, 3383. [Google Scholar]

- Batlle, C.; Pérez-Arriaga, I.J.; Zambrano-Barragán, P. Regulatory design for RES-E support mechanisms: Learning curves, market structure, and burden-sharing. Energy Policy 2012, 41, 212–220. [Google Scholar] [CrossRef] [Green Version]

- Eid, C.; Guillén, J.R.; Marín, P.F.; Hakvoort, R. The economic effect of electricity net-metering with solar PV: Consequences for network cost recovery, cross subsidies and policy objectives. Energy Policy 2014, 75, 244–254. [Google Scholar] [CrossRef]

- Nikolaidis, A.I.; Milidonis, A.; Charalambous, C.A. Impact of fuel-dependent electricity retail charges on the value of net-metered PV applications in vertically integrated systems. Energy Policy 2015, 79, 150–160. [Google Scholar] [CrossRef]

- Ramïrez, F.J.; Honrubia-Escribano, A.; Gómez-Lázaro, E.; Pham, D.T. Combining feed-in tariffs and net-metering schemes to balance development in adoption of photovoltaic energy: Comparative economic assessment and policy implications for European countries. Energy Policy 2017, 102, 440–452. [Google Scholar] [CrossRef]

- Danchev, S.; Maniatis, G.; Tsakanikas, A. Returns on investment in electricity producing photovoltaic systems under de-escalating feed-in tariffs: The case of Greece. Renew. Sustain. Energy Rev. 2010, 14, 500–505. [Google Scholar] [CrossRef]

- Papaioannou, G.P.; Dikaiakos, C.; Dagoumas, A.S.; Dramountanis, A.; Papaioannou, P.G. Detecting the impact of fundamentals and regulatory reforms on the Greek wholesale electricity market using a SARMAX/GARCH model. Energy 2017, 142, 1083–1103. [Google Scholar] [CrossRef]

- Michas, S.; Stavrakas, V.; Papadelis, S.; Flamos, A. A transdisciplinary modeling framework for the participatory design of dynamic adaptive policy pathways. Energy Policy 2020, 139. [Google Scholar] [CrossRef]

- Sotiriou, C.; Michopoulos, A.; Zachariadis, T. On the cost-effectiveness of national economy-wide greenhouse gas emissions abatement measures. Energy Policy 2019, 128, 519–529. [Google Scholar] [CrossRef]

- Newbery, D.; Pollitt, M.G.; Ritz, R.A.; Strielkowski, W. Market design for a high-renewables European electricity system. Renew. Sustain. Energy Rev. 2018, 91, 697–707. [Google Scholar] [CrossRef] [Green Version]

- Iychettira, K.K.; Hakvoort, R.A.; Linares, P. Towards a comprehensive policy for electricity from renewable energy: An approach for policy design. Energy Policy 2017, 106, 169–182. [Google Scholar] [CrossRef]

- Nikas, A.; Stavrakas, V.; Arsenopoulos, A.; Doukas, H.; Antosiewicz, M.; Witajewski-Baltvilks, J.; Flamos, A. Barriers to and consequences of a solar-based energy transition in Greece. Environ. Innov. Soc. Transit. 2018, 35. [Google Scholar] [CrossRef]

- Papadelis, S.; Stavrakas, V.; Flamos, A. What do capacity deployment rates tell us about the efficiency of electricity generation from renewable energy sources support measures in Greece? Energies 2016, 9, 38. [Google Scholar] [CrossRef] [Green Version]

- Anagnostopoulos, P.; Spyridaki, N.A.; Flamos, A. A “new-deal” for the development of photovoltaic investments in Greece? A parametric techno-economic assessment. Energies 2017, 10, 1173. [Google Scholar] [CrossRef]

- Giannini, E.; Moropoulou, A.; Maroulis, Z.; Siouti, G. Penetration of photovoltaics in Greece. Energies 2015, 8, 6497–6508. [Google Scholar] [CrossRef]

- Karteris, M.; Papadopoulos, A.M. Legislative framework for photovoltaics in Greece: A review of the sector’s development. Energy Policy 2013, 55, 296–304. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A.; Macedo, D.P. The impact of feed-in and capacity policies on electricity generation from renewable energy sources in Spain. Util. Policy 2019, 56, 159–168. [Google Scholar] [CrossRef]

- Hellenic Republic. National Energy and Climate Plan of Greece; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- European Commission. Communication from the Commission: The European Green Deal; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Sotiriou, C.; Zachariadis, T. Optimal timing of greenhouse gas emissions abatement in Europe. Energies 2019, 12, 1872. [Google Scholar] [CrossRef] [Green Version]

- Taliotis, C.; Giannakis, E.; Karmellos, M.; Fylaktos, N.; Zachariadis, T. Estimating the economy-wide impacts of energy policies in Cyprus. Energy Strategy Rev. 2020, 29, 100495. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- De Jong, C.; Schneider, S. Cointegration between gas and power spot prices. J. Energy Mark. 2009, 2, 27–46. [Google Scholar] [CrossRef]

- Bosco, B.; Parisio, L.; Pelagatti, M.; Baldi, F. Long-run relations in European electricity prices. J. Appl. Econom. 2010, 25, 805–832. [Google Scholar] [CrossRef]

- Ferkingstad, E.; Løland, A.; Wilhelmsen, M. Causal modeling and inference for electricity markets. Energy Econ. 2011, 33, 404–412. [Google Scholar] [CrossRef] [Green Version]

- Chen, Z.; Wu, L.; Shahidehpour, M. Effective load carrying capability evaluation of renewable energy via stochastic long-term hourly based SCUC. IEEE Trans. Sustain. Energy 2015, 6, 188–197. [Google Scholar] [CrossRef]

- Keane, A.; Milligan, M.; Dent, C.J.; Hasche, B.; D’Annunzio, C.; Dragoon, K.; Holttinen, H.; Samaan, N.; Söder, L.; O’Malley, M. Capacity value of wind power. IEEE Trans. Power Syst. 2010, 26, 564–572. [Google Scholar] [CrossRef] [Green Version]

- Kahn, E.P. Capability of Wind Generation: Initial Results with Public Data. Electr. J. 2004, 17, 85–95. [Google Scholar]

- Independent Power Transmission Operator (IPTO). Market Statistics and Data Relating to the Operation of the Greek Wholesale Electricity Market. Available online: https://www.admie.gr/agora/statistika-agoras/dedomena (accessed on 8 August 2020).

- Sakellaris, K. The greek capacity adequacy mechanism: Design, incentives, strategic behavior and regulatory remedies. In Proceedings of the 6th International Conference on the European Energy Market (EEM), Leuven, Belgium, 27–29 May 2009; IEEE: Piscataway, NJ, USA, 2009; pp. 1–6. [Google Scholar]

- Biskas, P.N.; Marneris, I.G.; Chatzigiannis, D.I.; Roumkos, C.G.; Bakirtzis, A.G.; Papalexopoulos, A. High-level design for the compliance of the Greek wholesale electricity market with the Target Model provisions in Europe. Electr. Power Syst. Res. 2017, 152, 323–341. [Google Scholar] [CrossRef]

- Flamos, A. A sectoral micro-economic approach to scenario selection and development: The case of the greek power sector. Energies 2016, 9, 77. [Google Scholar] [CrossRef]

- Kaldellis, J.K.; Zafirakis, D.; Kondili, E. Contribution of lignite in the Greek electricity generation: Review and future prospects. Fuel 2009, 88, 475–489. [Google Scholar] [CrossRef]

- Kaldellis, J.K.; Kapsali, M. Evaluation of the long-term environmental performance of Greek lignite-fired power stations. Renew. Sustain. Energy Rev. 2014, 31, 472–485. [Google Scholar] [CrossRef]

- De Gouw, J.A.; Parrish, D.D.; Frost, G.J.; Trainer, M. Reduced emissions of CO2, NOx, and SO2 from U.S. power plants owing to switch from coal to natural gas. Earths Future 2014, 2, 75–82. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Stavrakas, V.; Papadelis, S.; Flamos, A. An agent-based model to simulate technology adoption quantifying behavioural uncertainty of consumers. Appl. Energy 2019, 255, 113795. [Google Scholar] [CrossRef]

- Loumakis, S.; Giannini, E.; Maroulis, Z. Renewable Energy Sources Penetration in Greece: Characteristics and Seasonal Variation of the Electricity Demand Share Covering. Energies 2019, 12, 2441. [Google Scholar] [CrossRef] [Green Version]

- Tipping, J.P.; Read, G.E.; Mcnickle, D. The Incorporation of Hydro Storage into a Spot Price Model for the New Zealand Electricity Market. In Proceedings of the Sixth European Energy Conference: Modelling in Energy Economics and Policy, Zurich, Switzerland, 2–3 September 2004; pp. 1–25. [Google Scholar]

- Uddin, M.; Romlie, M.F.; Abdullah, M.F.; Abd Halim, S.; Abu Bakar, A.H.; Kwang, T.C. A review on peak load shaving strategies. Renew. Sustain. Energy Rev. 2018, 82, 3323–3332. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis in Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium; Cambridge University Press: Cambridge, UK, 1999; pp. 1–31. ISBN 9781139052221. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Salim, R.A.; Hassan, K.; Shafiei, S. Renewable and non-renewable energy consumption and economic activities: Further evidence from OECD countries. Energy Econ. 2014, 44, 350–360. [Google Scholar] [CrossRef] [Green Version]

- Behrens, P.; Rodrigues, J.F.D.; Brás, T.; Silva, C. Environmental, economic, and social impacts of feed-in tariffs: A Portuguese perspective 2000–2010. Appl. Energy 2016, 173, 309–319. [Google Scholar] [CrossRef] [Green Version]

- Roinioti, A.; Koroneos, C. The decomposition of CO2 emissions from energy use in Greece before and during the economic crisis and their decoupling from economic growth. Renew. Sustain. Energy Rev. 2017, 76, 448–459. [Google Scholar] [CrossRef]

- Kim, H.; Kim, M.; Kim, H.; Park, S. Decomposition Analysis of CO2 Emission from Electricity Generation: Comparison of OECD Countries before and after the Financial Crisis. Energies 2020, 13, 3522. [Google Scholar] [CrossRef]

- Hatzigeorgiou, E.; Polatidis, H.; Haralambopoulos, D. CO2 emissions in Greece for 1990–2002: A decomposition analysis and comparison of results using the Arithmetic Mean Divisia Index and Logarithmic Mean Divisia Index techniques. Energy 2008, 33, 492–499. [Google Scholar] [CrossRef]

- Diakoulaki, D.; Mavrotas, G.; Orkopoulos, D.; Papayannakis, L. A bottom-up decomposition analysis of energy-related CO2 emissions in Greece. Energy 2006, 31, 2638–2651. [Google Scholar] [CrossRef]

- Lu, S.; Diao, R.; Samaan, N.; Etingov, P. Capacity Value of PV and Wind Generation in the NV Energy System; Pacific Northwest National Lab.: Richland, WA, USA, 2012. [Google Scholar]

| Natural Gas | Lignite | |||||||

|---|---|---|---|---|---|---|---|---|

| Hour of the Day | ||||||||

| 0 | 10 | 16 | 20 | 0 | 10 | 16 | 20 | |

| Load | 0.32 | 0.41 | 0.38 | 0.46 | 0.41 | 0.35 | 0.37 | 0.34 |

| RES | −0.37 | −0.42 | −0.40 | −0.43 | −0.31 | −0.27 | −0.33 | −0.25 |

| Hydro | −0.44 | −0.37 | −0.35 | −0.28 | −0.53 | −0.46 | −0.49 | −0.40 |

| NGas | 0.36 | 0.30 | 0.28 | 0.30 | −0.12 | −0.10 | −0.11 | −0.08 |

| Lignite | −0.22 | −0.25 | −0.24 | −0.24 | 0.31 | 0.37 | 0.37 | 0.38 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stavrakas, V.; Kleanthis, N.; Flamos, A. An Ex-Post Assessment of RES-E Support in Greece by Investigating the Monetary Flows and the Causal Relationships in the Electricity Market. Energies 2020, 13, 4575. https://doi.org/10.3390/en13174575

Stavrakas V, Kleanthis N, Flamos A. An Ex-Post Assessment of RES-E Support in Greece by Investigating the Monetary Flows and the Causal Relationships in the Electricity Market. Energies. 2020; 13(17):4575. https://doi.org/10.3390/en13174575

Chicago/Turabian StyleStavrakas, Vassilis, Nikos Kleanthis, and Alexandros Flamos. 2020. "An Ex-Post Assessment of RES-E Support in Greece by Investigating the Monetary Flows and the Causal Relationships in the Electricity Market" Energies 13, no. 17: 4575. https://doi.org/10.3390/en13174575