Abstract

Russia has signed the Paris Agreement and recently approved its ratification. However, the Russian Government does not consider abandoning the production and use of hydrocarbons to reduce greenhouse gas emissions. To meet the goals of the Agreement, Russia must find new innovative solutions. This study demonstrates that biogas is one of the most necessary renewable sources in Russia. Despite this, the deployment of biogas technologies is currently extremely slow. In this regard, to assess their subsequent impact on the Russian energy sector as a whole, it is important to identify the factors that hinder the wider implementation of biogas technologies. Based on the findings, the most critical barriers were identified and discussed in detail. In the light of the results, some policy-related recommendations are also proposed.

1. Introduction

The Paris Agreement, which was enacted in November 2016, aims to replace the Kyoto Protocol, has set the objective to reduce greenhouse gas (GHG) emissions, and keep the global average temperature rise below 2 °C compared to the pre-industrial level [1]. The document was signed by representatives of more than 170 countries, including Russia. However, Russia did not ratify it until recently. In September 2019, official news emerged that the Prime Minister of Russia, Dmitry Medvedev, has approved the ratification of the Paris Agreement [2,3]. Alexey Gordeev, the Russian Deputy Prime Minister, noted that the ratification will give Russia the opportunity to fully participate in the formation of the modern global climate agenda and added that ‘this is especially important because today Russia ranks fourth in the world in terms of GHG emissions’ [2]. However, Alexander Bedritsky, the adviser to the President of the Russian Federation and Special Envoy for Climate, stated that the Russian Government does not consider abandoning hydrocarbons as a way to reduce GHG emissions, and ‘it is necessary to look for new recipes’ [3]. Biogas technologies can become a new ‘recipe’ for a reduction of GHG emissions primarily because they not only provide clean energy but also solve the problem of waste.

Russia has considerable potential to use agricultural, industrial, and food waste for biogas production. Russia can be seen as the home of a large agricultural industry [4]. Farming is an essential economic activity in Russia. However, 37% of all agricultural enterprises are not connected to the energy grid and their connection is rather costly [4]. As the total amount of crop and livestock production is constantly increasing, there is also an increase in agricultural waste, particularly from livestock. Moreover, there is a significant number of enterprises that produce a large volume of waste, which they do not reuse or safely utilise. Organic waste leads to an annual release of GHG into the atmosphere, equivalent to more than 30 billion m3 of methane, which is 21 times more harmful than carbon dioxide by the greenhouse effect [5]. The morbidity level of the population in the areas of operation of large livestock enterprises and poultry farms is 1.6 times higher than its average indicator across the Russian Federation [5]. Similarly, wastewater sludge in Russia has a high potential to be used for biogas production in such quantities that is possible to meet at least the heating energy demand of wastewater treatment plants. All of these facts create a strong need to widely implement biogas technologies in Russia. In addition, upgraded biogas can be injected into the natural gas grids. This reason also favours the use of biogas because Russia has one of the world’s largest gas transportation systems.

Russia (since the former Soviet Union) was an early leader in case of the development of renewable energy technologies [6]. The scientific basis of methane fermentation has been studied since the 1940s. The Soviet Union was the first state in the world that mastered the large-scale industrial production of biofuels (including biogas) from biomass [7]. The industrial production and use of biogas began in the 1960s. Even then, energy was derived from municipal, forest, and agricultural waste. Despite the well-developed theoretical and practical foundation for biogas production in the former Soviet Union, the current implementation of biogas technologies is rather slow. In 2018, the total primary energy consumption in Russia amounted to 720.7 million tonnes of oil equivalent (TOE) of which, approximately 0.3 million TOE or 0.04% came from renewable energy. In addition, peer-reviewed scientific articles have analysed the support schemes for renewable energy in Russia as a whole or only for solar, wind, and small hydropower in Russia [6,8], or for solid bioenergy [9] and have not focused on the Russian biogas industry in particular. In this regard, this article aims to provide a detailed analysis of the potential of biogas technologies in Russia, revealing the barriers to their implementation, and suggesting recommendations to overcome them.

The contribution of this research is twofold. First, this study provides unique data based on a combination of methods: documentary analysis together with literature review, questionnaires, participant observations, and interviews. Second, previous studies are mostly focused on the identification of barriers to the wider deployment of biogas for both developed and developing economies [10,11,12,13,14,15,16,17]. However, there are few studies that have focused on countries with transition economies (e.g., Russia, Belarus, Armenia, Azerbaijan, Albania, Bosnia and Herzegovina, Montenegro, and Serbia).

The rest of the paper is structured as follows. The next section provides an overview of the current status and potential for biogas production in Russia. Section 3 presents the methodology used in the analysis. Section 4 provides a comprehensive analysis of the barriers to the wider implementation of biogas technologies in Russia. The last section provides concluding remarks and identifies relevant policy-related recommendations to overcome the barriers.

2. Current Status and Potential for Biogas Production in Russia

The prospects for biogas production in Russia are rather high (Table 1). The country is theoretically capable of covering its own energy needs solely using bioresources [7]. Russia’s total demand for biogas plants is estimated at 20,000 [18]. The need for the recycling of agricultural waste, municipal solid waste, and wastewater sludge is growing, and the cost of traditional energy sources is increasing every year. This issue is faced by almost all regions in Russia. The most well-known biogas plants in Russia are listed in Table A1, Appendix A.

Table 1.

Primary energy consumption in Russia by fuel in 2018 (in TOE) (data from [19]).

2.1. Agricultural Waste

Russia is one of the world’s leaders in the production and export of agricultural products (Table 2). There are 625 million tons of agricultural organic waste, which can provide up to 66–70 billion m3 of biogas, which is equivalent to 25.2 million TOE, and more than 100–112 million tons of high-quality fertiliser [4,7,18]. The total electricity consumption in Russia amounted to 1076.2 billion kWh or 92.5 million TOE in 2018 [20]. Thus, 27% of the total electricity needs can be covered by biogas.

Table 2.

World’s leaders in production of agricultural products in 2017 (based on data from [21]).

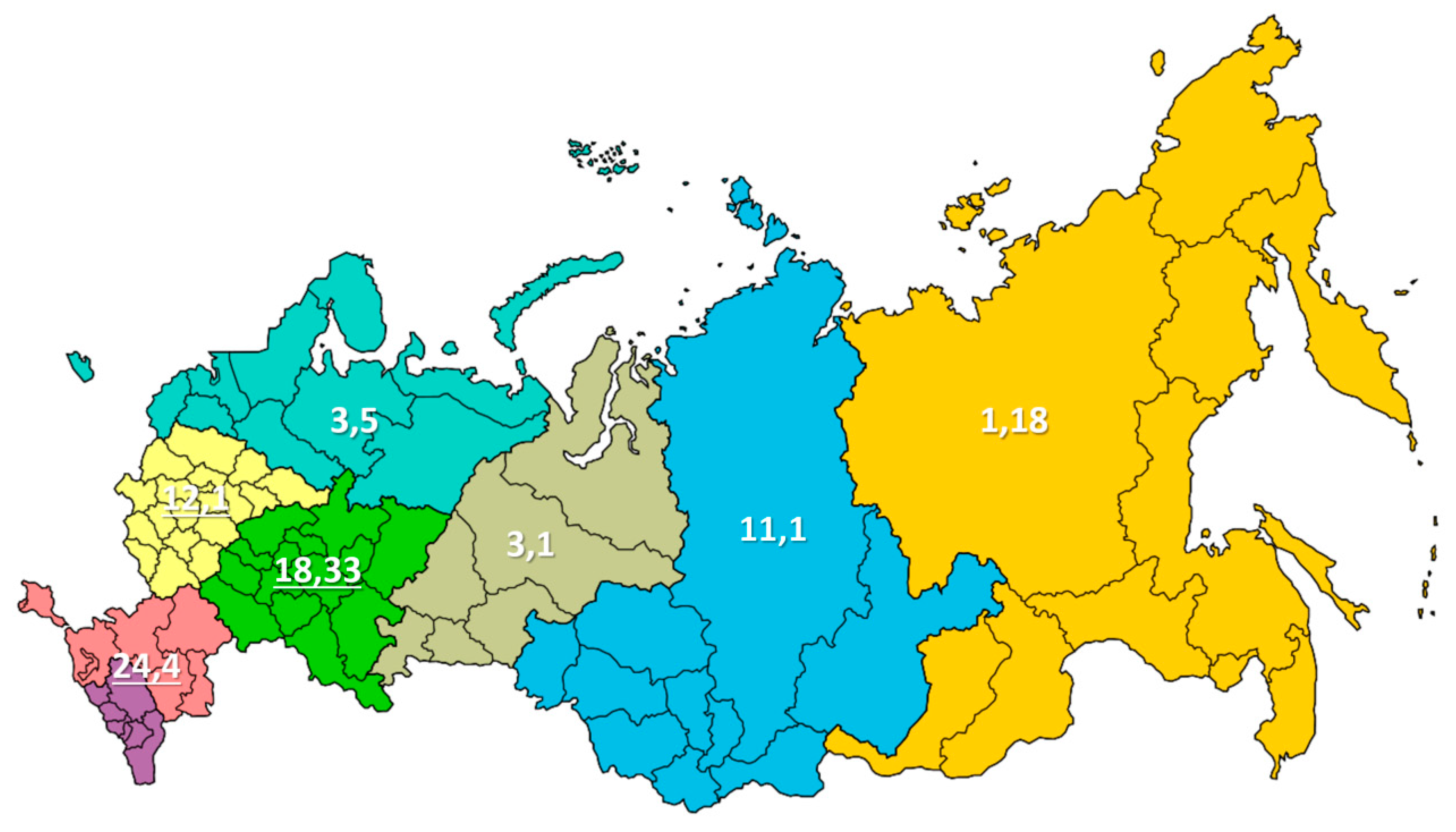

Half of the potential is found in the South and the Volga federal districts (Figure 1). Agricultural waste can be divided into wet and dry residue. Wet residue consists of manure generated from animal populations, primarily cattle, pigs, poultry, sheep, goats, and horses. Dry residue is produced from various waste crops, including beet pulp, sunflowers, vegetables, silage, and maize. Namsaraev et al. [22] evaluated the technical bioenergy potential in Russia. According to their results, among the livestock waste, cattle waste has the highest potential and amounts to 98.5 million tonnes. Residues from legumes and cereals have the highest potential among crop residues and amount to 39.5 million tonnes [22].

Figure 1.

Potential of biogas production in Russia by federal district (billion m3) (data from [18]).

There are different biogas plants that process organic waste in Russia. For example, a biogas station on a dairy farm with 3300 cattle was launched in the village of Doshino, Kaluga region (2009). The total capacity of the plant is 2.4 MW. At the end of January 2012, a biogas plant that processes raw materials (manure, etc.) was launched in Orenburg Oblast. The first industrial biogas station in Russia, called Luchki, was implemented in the Belgorod region by the AltEnergo. The equipment was supplied by Big Dutchman Agro Co. The biogas plant started to produce electricity on June 25, 2012 and reached a full capacity of 2.4 MW on July 20, 2012. Luchki is the first Russian biogas plant to receive a qualification certificate as an object functioning on renewable energy [23]. In 2012, the biogas project called Baitsury was implemented on a pig farm in the Borisov district of the Belgorod region [24]. The main task of the project is to solve environmental problems arising from the rapid development of agriculture in the region. All energy produced from the plant sells to the grid with a premium of about 5%. Company EVOBIOS LLC has implemented biogas plant in the breeding plant ‘Pervomaysky’ in Leningrad Oblast (2019). The cost of equipment was carried out by EVOBIOS. The company has signed the long-term contract with the farm for the disposal of organic waste and the purchase of electricity and fertilizers [25]. Part of the electricity produced by the biocomplex is used for its own consumption, and another part for the need of the EVOBIOS. In recent years, the Russian company SelhozBioGas LLC has launched different biogas projects in such regions as Kirov Oblast (2013), Astrakhan Oblast (2017), the Republic of Bashkortostan (2019), and Volgograd Oblast (2019) [26].

Currently, there are more than 1,600 large livestock enterprises, including pig and poultry farms, in Russia [18]. However, the current level of agricultural waste processing remains low. The major part of the residual waste is collected into open pools and then spread onto fields as a type of natural fertiliser [4]. A non-controlled accumulation of liquid effluents from the agro-industrial complex (more than 500 million tonnes annually) has led to the contamination of drinking water and soil [27]. In addition, more than 2 million hectares of land is being occupied by the storage of agricultural residue. The involvement of such land for the production of agricultural products would bring about an extremely positive effect to the Russian economy [18].

To use biogas as a motor fuel, CO2 and other impurities must be removed. Upgraded biogas, also known as biomethane, has the same composition as natural gas and can be seen as a good alternative to motor fuel: 1 m3 of biogas is equivalent to 0.6 litres of gasoline or diesel fuel [28]. The gas tank equipment used for biomethane completely matches car equipment for natural gas. This fact allows their equal replacement. The substitution of conventional motor fuel can become an additional source of revenue to small-scale biogas projects. This is especially the case when the owner has a vehicle fleet of agricultural machinery or trucks, and the nearest gas station is at a significant distance. It is possible to obtain 144,000 GWh of electricity and 1 billion GJ of thermal power by using biogas for cogeneration [7]. The Russian agricultural sector consumes less amount than it processes, namely 70,000 GWh of electricity, 4.8 million tonnes of diesel, and 2.0 million tonnes of gasoline [7]. Therefore, agricultural enterprises can become energetically autonomous and generate a profit by selling excess electricity to the grid.

2.2. Sewage Sludge

The total potential of sewage utilisation in Russia is approximately 4 million m3 of biogas per day, which is equivalent to 19.8 PJ y−1 [22]. The best-known example of a wastewater treatment plant (WWTP) in Russia is the aeration plant of Mosvodokanal in Moscow. During the 1980s, anaerobic digestion was used to process the wastewater. Mosvodokanal launched two small cogeneration plants, the Kuryanov (2009) and the Lyubertsy sewage treatment plants (2012) [29]. The investor was the Austrian company EVN. Currently, the Kuryanov plant generates 128,000 m3 of biogas per day [22,30]. This project has become one of the largest in the field of renewable energy and is the first biogas power plant in Russia [31]. The Lyubertsy plant generates 145,000 m3 of biogas per day [22,30]. These two plants completely treat the sewage sludge of 12.33 million Moscow residents [22]. The plant engines were designed for a mixed biogas and natural gas operation. Thus, the power units can be easily transferred to natural gas if necessary [31]. There have been several cases of disconnections from the external power supply during the operation of the sewage treatment plants, and yet the main equipment of the treatment facilities continued without interruption [30].

Another example is Coca-Cola HBC Russia. Industrial waste water from the company’s plant is processed into biogas at local treatment facilities in the village of Davydovskoe (Istra district of Moscow region). Before the implementation of the biogas project, treatment plants were heated by a boiler unit that spent additional amounts of natural gas, and biogas formed at the treatment plant was simply burned off [32]. Currently, biogas substitutes for natural gas and is used for heating. The plant produces 260,000 m3 of biogas per year, which is equivalent to 180,000 m3 of natural gas [32]. At present, biogas technologies are used in 2 of 10 Coca-Cola HBC plants in Istra and Novosibirsk.

2.3. Municipal Solid Waste

Almost half of the municipal solid waste (MSW) is composed of landfill gas. Landfill gas is a natural by-product of organic material decomposition in landfills with a composition of roughly 50% carbon dioxide (CO2), 50% methane (CH4), and some other non-methane organic compounds [33]. Currently, MSW is not separated in Russia. Almost all MSW is exported to landfills, where only 4–5% of waste is recycled or incinerated [34]. Thus, the garbage crisis has become a painful topic for city residents in Russia. An increase in population has inevitably led to increased amounts of waste that far exceed the capacity of existing and new MSW landfills. The area of landfills in Russia is increasing by 0.4 million hectares annually [34]. In 2017, the theme of oversaturated landfills came to the forefront of the media and has become one of the main issues of social tension in Moscow and several other regions. In 2018, there was a mass poisoning of children from landfill gases originating from the Yadrovo landfill in the Moscow region, which resulted in an open confrontation between locals and the authorities in Volokolamsk and Kolomna [35].

According to calculations by Namsaraev et al. [22], the energy potential of MSW in Russia amounts to 554.7 PJ. There have been several successful cases of landfill gas utilisation in such regions as Moscow (Kuchino, Aleksinskiy Karyer, Lesnaya, Timokhovo, Khmetyevo, and Malinki landfills), Leningrad (the project is implemented by the Swedish company Recovia), and Vologda (Pasynkovo).

3. Methodology

Energy policymakers in Russia mainly consist of executive power officials and actors from major energy business [36]. Thus, a variety of documentary sources such as official statistics, policy and legal documents, publications by industry associations and nongovernmental organizations, newspaper articles and specialized journals were collected, analysed and codified. Scientific articles that focused on renewable energy in Russia were also reviewed.

It is common practice to use a combination of questionnaires and interviews as a scientific method [37]. Questionnaires help gather data among a large audience, whereas interviews confirm the results and provide deeper insights into the analysed theme [38]. In addition, participant observations at a conference are a good practice to enrich the data [39]. A conference is an event where central actors in a particular field come together and share their knowledge and experience. Indeed, we can receive valuable knowledge there. Therefore, these methods were also chosen for the extraction and detailed analysis of barriers to the wider implementation of biogas technologies in Russia.

Questionnaire: The questionnaire was distributed to 57 individuals who are directly involved in the biogas field in Russia. The final sample totalled 23 full answers (the profiles of the individuals are presented in Table A2, Appendix B). This reflects a return rate of 40% (the norm is approximately 30% for mail questionnaires [40]). It is worth noting that 70% of respondents have a working experience of more than 10 years. More than 57% of the respondents have a Candidate of Science- (PhD) or a Doctor of Science-level of education. These figures show that the respondents are highly ranked professionals in their fields.

The factors, which were included in the questionnaire, are related to political, sociotechnical, institutional, economic, and global market barrier factors. They were extracted from a literature review of the 103 selected publications from 2014 to 2018 focusing on one of 32 countries, which was previously conducted by Nevzorova and Kutcherov [41]. This study has examined the critical barriers to the wider uptake of biogas for both the developed and developing economies. All factors that were considered for analysis are presented in Table A3, Appendix B.

The questionnaire includes two parts: part 1 contains general information about gender, activity area, working experience, and level of education; part 2 includes an evaluation of factors for the diffusion of biogas technologies. The respondents were asked to evaluate the current events that affect the development of biogas technologies in Russia according to two parameters: (1) ‘Impact’ considers this event as a process, the result of which can change the state of biogas development; (2) ‘Uncertainty’ indicates a situation where information on likely future events is completely or partially missing, i.e., it is not measurable and cannot be accurately predicted. The rating system was in accordance with the 5-point system based on the degree of their influence (i.e., 1—useless; 2—not important; 3—beneficial / useful; 4—very important; 5—critical). The barriers that most of the experts chose to be critical for the diffusion of biogas technologies in Russia were taken into account in the analysis.

Participant observation: Two 3-day conferences were observed. The first conference, called WasteTech, is a leading Russian waste management exhibition bringing together representatives of the government, business, and society to solve problems in the waste management sector [42]. The exposition gathered 209 leading domestic and foreign manufacturers and suppliers of equipment, technologies, and services for the environmental sector, including companies that implement biogas technologies in Russia. The second conference is Renewable Energy & Electric Vehicles International Exhibition (RENWEX) and was promoted under the slogan ‘Creating the future of renewable energy together’. This conference combined an international exhibition and a specialised forum that involved major actors of the Russian energy sector [43]. The forum involved a series of events, including plenary meetings about global trends and new opportunities for renewable energy, panel discussions about biomass and bioenergy, the system of support for renewable energy projects, and the best examples of implemented technologies and projects in Russia, among other aspects. More than 3500 visitors from 42 countries attended the conference [43]. Different types of data such as the recording of talks, PowerPoint presentations, handouts, and observations were collected.

Interviews: Extended personal interviews were also conducted. In total, seven experts whose working activity is related to the extraction of biogas and landfill gas in Russia were interviewed (profiles of the individuals are presented in Table A4, Appendix B). Interviews were carried out using specific questions based on the questionnaire. In addition, certain questions were addressed regarding the history of the companies, their international activities and partnerships, the difficulties that these companies have in their working activities, and what can be improved to achieve a rapid growth of biogas technologies in Russia. In practice, all interviews lasted between 20 min and 2 h.

4. Critical Barriers to the Wider Implementation of Biogas Technologies in Russia

The key barriers for wider implementation of biogas technologies in Russia are identified and discussed in detail in this section. Table 3 presents the overview of the critical barriers for biogas industry in Russia, which were extracted from the analysis.

Table 3.

Critical barriers to the wider implementation of biogas technologies in Russia.

4.1. Technical Barrier

Biogas technologies are characterized as technologies with high relevance, significant scientific background, and a high degree of readiness for commercialization (from 0 to 3 years) [44]. It means that biogas technologies in Russia are available for implementation. However, there is a large shortage of specialists due to the fact that the quality of training for the biogas segment currently does not meet the required international criteria. There is a lack of methodological material, teachers with the necessary qualifications and specialized practical education at universities. Nowadays biogas companies need to teach the employees themselves, which, in turn, creates additional costs for these companies. By increasing the scientific knowledge in the Russian biogas industry, the technological gap between Russia and other countries with mature biogas industry will be reduced.

4.2. Economic Barriers

The lack of investment resources is one of the crucial factors influencing the development of biogas technologies in Russia. In Russia, the share of investments in renewable energy does not exceed investments in a traditional generation. This is especially the case when the Russian economic structure favours fossil fuels [45]. At the conference, a Russian politician marked that ‘today, 50% of the produced oil is extracted in fields that have certain benefits and subsidies, and in some regions (for example in the Southern part of Russia) these subsidies even reach 80%. We need to create conditions for fair competition between different types of fuels’. Under such conditions, companies that are involved or have interests in fossil energies have numerous benefits, and thus they can start to hinder the development of renewable energy. Boute and Zhikharev call such phenomena a ‘vested interest’, which is defined as ‘a group enjoying benefits from an existing economic or political privilege’ [46,47]. Such companies can perceive and lobby renewable energy as a threat to the national energy system and for fossil energy demand on domestic and export markets. Biogas technologies are forced to compete with conventional long-term energy business practices that favour and secure the supply of heat and electricity based on hydrocarbon resources [48]. In addition, an insufficient number of successful pilot investment projects deteriorates the attraction of investments as investors face difficulties in terms of the search and selection of the most advantageous and less risky projects.

A biogas plant requires high investment and equipment costs as almost all expenses for its construction are upfront [41]. There is a financing problem associated with biogas plants—neither the farmer nor the agricultural cooperative is able to provide sufficient financial resources for such projects. Despite this, the implementation of biogas plants is hindered by the inability of potential customers to use traditional financing mechanisms or to construct plants solely with their own funds. Banks do not offer any soft loans for potential biogas producers in Russia, and thus agricultural companies are not ready to invest into biogas projects. There is no financial support programme that can reduce investment and equipment costs, or stimulate the construction of biogas plants. These facts create difficulties for potential users with low capital bases.

4.3. Market Barriers

The availability of cheap fossil fuels in Russia has reduced the interest in renewable energy technology both for policymakers and the private sector [49]. The vast supply of fossil fuels with multiple exemptions and subsidies has a strong effect on the interests in the development of renewable energy. The fact that biogas is more expensive than other fossil fuels creates a risk for the end consumers to pay more. However, the prices for natural gas and motor fuel are constantly increasing (see Table 4 and Table 5). Furthermore, approximately 70% of Russian territory is off-grid.

Table 4.

Average gas price in Russia (net of VAT, excise tax, and customs duties) (data from [50]).

Table 5.

Average consumer prices for motor fuels (rouble per litre) in Russia (data from [51]).

Historically, the Russian energy sector functioned in a highly centralized way [52]. In the Soviet Union, all energy industries had a strict hierarchical structuring and, even nowadays, the Russian energy sector is highly centralized with a high corporate concentration and an absence of market mechanisms. The electricity market includes privately owned and dominant state-owned companies, which control 70% of the capacity in the power generation sector, own all high-voltage and almost all distribution grids in Russia [52]. As an interviewee also stated, ‘Russia is a country of monopolies. The retail market is precisely “designed” for bioenergy. In the bioenergy sector, there is no powerful “player”, as for example, in the solar industry, who could take on the role of a powerful investor operator. When such a company appears, it will occupy this market’. This statement backs up the analyses by Smeets [53] and Boute and Zhikharev [47]. Smeets [53] described the success of certain projects through existence of ‘neopatrimonial networks between Russia’s emerging green energy companies and major oligarchic business groups’. The interviewee, who participated in the policy-making process, stated that ‘we sometimes have the impression that the support scheme has been tailored to the benefit of the solar sector, facilitated by some major government related oligarchs’ [53]. Boute and Zhikharev [47] noticed the coincidence between the development of support schemes for renewable energy and the establishment of a solar energy manufacturing base by key industrial players in Russia. Certainly, such market conditions hamper biogas companies by competing with a small number of companies with considerable privileges.

The market landscape is quite uncertain and dynamic, which is perceived as problematic in itself. This is especially connected to the political environment and sanctions that have ruined the relationship between countries. The international crisis, especially between Russia and the European Union (EU), is testing the Russian (sustainable) energy sector [9] in terms of investments and as a favourable market environment. For almost 40 years, Russia and Europe have cooperated in terms of energy and the environment [9]. Currently, we can see the overall degradation in their relations, mostly because of the Ukrainian crisis [54]. The Russia–Ukraine geopolitical tensions have led to multilateral sanctions that trace back to three main channels: (1) massive capital outflow, (2) the blocking of access to international financial markets, and (3) degraded business and consumer confidence [55]. Romanova [36] interpreted the EU position in the 2006, 2009, and 2014 Russia–Ukraine crises as an act of politicisation that she defines as ‘addressing energy trade, investment and infrastructure through economic and (geo) political logics (and can also be conceptualised as a government failure)’. The 2006 and 2009, the Ukrainian transit crises showed that any future conflicts between Russia and Ukraine will affect the EU and require EU involvement [36]. Although Gazprom repeatedly warned the European Commission about the Ukrainian crisis, the EU argued that only Russia was responsible for the constant gas supply and the settlement of the crises. In the 2006, 2009, and 2014 events, Russia was presented as exerting political and economic pressure on Ukraine [36]. Therefore, the European Union’s withdrawal of all contacts with Russia was perceived as a politicisation [36]. Although the renewable energy sector is not on the list of sanctions, sanctions have deteriorated Russia’s investment climate overall and substantially affected its trade flows. Many interviewees and speakers mentioned that sanctions increase the negative impact on the work of their companies, stating that ‘We installed western equipment [in Russia], but when the [rouble] currency jumped, projects became unprofitable’; ‘It’s hard to work with the European company [name hidden] due to political reasons’, and ‘Our company cooperates with foreign companies. Recently, I travelled to the Netherlands on training …. However, the project with Ukraine was not implemented due to sanctions’.

After the crisis of 2014, the Russian rouble exchange rate fell significantly, leading to more expensive foreign renewable energy equipment [54,56]. The topic of biogas was relevant before the devaluation of the rouble, when the cost of foreign equipment purchased in roubles was much lower. Until 2014, many companies were interested in biogas technologies as a source of an autonomous power supply: ‘We all thought that the rouble would be stable and that the price of electricity would increase and reach almost 10 roubles …. There were a lot of people at conferences dedicated to biogas technologies, all exhibition stands were about biogas. However, that was only until 2014.’ (interviewee from Russian biogas company). At the plenary session dedicated to the theme ‘Renewable energy: Global trends and new opportunities’ at the RENWEX conference, the question regarding sanctions was also on the agenda. A Russian politician emphasised that, in recent years, the regularity and effectiveness of meetings with business associations and colleagues from Germany, France, and the UK—with whom Russia has closely cooperated on a number of issues related to the energy agenda—have started to decline. Sanctions and the ongoing international crisis have led to negative consequences for the establishment of communications, the effectiveness of negotiations, and the attraction of foreign investment. However, a German representative made a more positive prognosis and showed an interest in a German–Russian partnership. He marked that ‘now we [Germany] need a real energy transition that encompasses all sectors of the economy: industry, households, heating, and transportation in particular, and last but not least, agriculture. As at the European level, last year we agreed along with the [European] Commission, all member states, and the European Parliament on CO2 reduction targets for each country in what we call non-ETS (non-emission trading sectors) …, and the German target is quite ambitious: a decrease of 38% by 2030’ and ‘therefore, it is not surprising that renewable electricity will play a big role in terms of decarbonisation, but it can’t carry the load alone. We need other sources of green energy in order to reach our ambitious CO2 reduction goal …. Thus, we need natural gas as a traditional fuel, but if we pursue this ambitious goal it means that there is no room for natural gas. This means that we have to produce or import biogas, hydrogen, methanol, and whatever is green …. This means that technological changes will come sooner than we have maybe expected. This will open up a lot of opportunities for many-many companies. And I think this is a good message for our Russian partners because Germany, even in the long-run, will import energy; but it must be green decarbonised energy. And for all these countries that produce a lot of fossil fuels today, which is for Russia a basis, it means that you have a chance to be part of a green world if you manage to produce green molecules. And my point is that Russia is very well placed to do that in terms of resources and location’. Regarding the issue of sanctions, the speaker stated that ‘renewables are not on the list of sanctions. So that gives you [to Russia] an important opportunity to cooperate …. Use that potential, and you [Russia] should not be afraid that sanctions may put limits on your cooperation with German and European firms. That’s the important message I would like to say’. Certainly, this speech gives hope for the future cooperation between Germany and Russia and their joint development of renewable energy.

Some Russian biogas companies have started looking to the markets in neighbouring Asian countries such as China, Armenia, Uzbekistan, etc., since it is rather difficult to enter the European market. Furthermore, the Chinese government is aware of the acute environmental problem in the country and actively facilitates solutions to this issue. This gives Russia an opportunity to provide support tools in terms of grants for implementing projects in China, which simplifies for doing business there.

4.4. Institutional Barriers

State support is one of the key tools for stimulating the development of biogas technologies. However, a lack of federal support and incentives is seen as a critical obstacle to promote biogas technologies in Russia. Climate change is not a high priority for the Russian government [45]. Sergey Chernin (President of GC corporation GazEnergoStroy) commented on the situation in the bioenergy field, statement that ‘Today in Russia there is a paradoxical situation: the biogas plants market exists, the first plants are built, the farmers and regional authorities are interested in the technology. However biogas legislation simply does not exist. Basic regulations governing the energy sector don’t contain even a single mention of this method of heat and electricity manufacturing, although our country has all the prerequisites for the large-scale development of bioenergy. This gap in legislation should be eliminated as soon as possible’ [7,57].

Smeets [54] analysed the arguments of the Russian elite and other influential actors and found that they are not rushing into the development of renewable energy policy. They name natural gas, nuclear energy, and vast forests as alternatives to renewable energy and treat them as Russian ecological advantages. At the same time, the government has justified the slow development of a renewable energy policy by saying that the government is too concerned about the impact on consumer prices [49]: ‘Russia in this sense has taken a different path [in comparison with Germany] as a hydrocarbon producer […]’ and ‘we are advancing very gradually, we do not want consumers to pay a very high price for renewable sources’ [54,58].

Political targets for the development of renewable energy are rather unpredictable and can change quickly over time [9]. The major document in the Russian energy field “Energy Strategy of Russia up to 2035”, which was approved only on 2 April 2020 [59], prioritizes the efficiency, accessibility and quality of energy supply in terms of oil products, natural gas and electricity, increase of LNG production, development of the hydrogen energy use and introduction of digital technologies in the energy sector (smart metering and smart grids). Renewable energy considers as one of the breakthrough technologies that can increase competition and significantly change the structure of international flows of products, technologies and services in the energy sector. At the same time, it states that, until 2035, fossil fuels will continue to form the basis of the world energy market. The Paris Agreement is mentioned only once just with the statement of its adoption in the section ‘Environmental protection and resistance to climate change’. The biogas industry was only mentioned in the statement ‘The use of local fuels (peat, forest and agricultural waste, and municipal solid waste) takes an insignificant place in the regional fuel and energy balances’ of the section ‘Hydropower, other renewable energy and local fuels’ without future goals [60]. Unlike previous energy strategies such as ”Russia’s energy strategy up to 2020” and ”Russia’s energy strategy up to 2030”, the new Strategy does not set any numerical or future indicators for the development of renewable energy in Russia [61]. Such unclear regulations can result in barriers to potential investments and overall uncertainty regarding the future of renewable sector in Russia.

A lack of guarantee for the sale of biogas electricity was an essential obstacle to the deployment of biogas technologies in Russia. In 2016, after many years of discussions took place, a system of state support for renewable energy in the retail electricity market was launched [27]. Currently, the main federal policy measures for biogas technologies are as follows:

- (1)

- Federal Law from 26 March 2003, No. 35-FZ ‘On the Electric Power Industry’, provides a mechanism to support the use of renewable energy [62]. To compensate network losses, this mechanism obliges network companies to purchase electricity from qualified renewable energy generating facilities at regulated tariffs, which set by the Russian regional executive authorities [63].

- (2)

- Decree of the Government No. 47 of 23 January 2015 defines support mechanisms for renewable energy in retail markets applied for generation facilities that use green energy resources, such as biogas, landfill gas, biomass, and other renewable energy sources [64]. It sets limitations regarding the annual compensation for losses of electric power energy to grid companies through the obligatory purchasing of electric energy within the framework of a 5% quota of the total network losses. This allows creating a network of stations with a total capacity of approximately 870 MW [27]. The decree also specifies the mandatory inclusion of renewable energy’s investment projects in the scheme of long-term development of the electric power industry through a competitive selection, where the evaluation criteria are developed by the region [27].

- (3)

- The resolution of the Government No. 1472-r of 28 July 2015 sets a limited level of capital and operating costs, payback period, and other parameters that are taken into account at the calculation of tariffs for electric energy produced by renewable energy facilities, and gives considerable privileges for biogas plants such as a capital expenditure (CAPEX), which is approximately 175–260 thousand roubles per kW of installed capacity [65]. This amount is much higher than for similar indicators of other renewable energy types [27]. It was decided to implement the measures specified in the Resolution until 2024 and not until 2020 as it was set before.

- (4)

- With regard to the Decree of the Government No. 941 of 4 September 2015 [66], the Federal Antimonopoly Service approved by Order No. 900/15 of 30 September 2015 approves the tariffs guideline for regulating government agencies and electricity producers [63,67]. The tariff for biogas plants calculated using this method is approximately 10–15 roubles per kWh depending on the capacity, cost, and level of operating costs. The tariff is valid for 15 years [27].

- (5)

- Decree of the Government No. 961 of 23 September 2016 [68] provides subsidies for the connection of renewable energy facilities to the grid network. The sum of such subsidies should not exceed 70% of the network connection cost and no more than 15 million roubles in total [27].

Although some state support has already been established, there is still a need for additional policy measures. For example, there is no special project that can stimulate the construction of biogas plants in Russia. In addition, there is a lack of investments from public funds. Currently, only private investors take a financial part in the construction of biogas plants. Some Russian regions (e.g., Dagestan, Vologda, Kaluga, Krasnodar, Lipetsk, Murmansk, Nizhny Novgorod, Mari El, Saint Petersburg, Tatarstan, Vladimir, and Udmurt) actively promote biogas technologies in terms of their regional initiatives and implementation of biogas projects [69]. More than 10 federal subjects of Russia have adopted the regulatory framework of the green tariff in the retail market, including Astrakhan Oblast, Belgorod Oblast, Irkutsk Oblast, Orenburg Oblast, Kaluga Oblast, Krasnoyarsk Krai, the Krasnodar region, Moscow, the Republic of Adygea, and the Republic of Bashkortostan. However, municipalities and local manufacturing companies have a shortage of investments. Without state support, regions can only implement a very limited number of projects. In addition, there are no official targets or obligations for regions to support biogas or other renewable energy technologies. As one of the speakers mentioned ‘when official figures for national projects are established, then local governors will start thinking about [the development of] biomass’.

A lack of national product standards and norms in terms of waste separation has a big impact on biogas dissemination. Different regions face challenges in relation to the management of waste, particularly from the forestry, agriculture, and animal industries. As appropriate environmental legislation does not exist in Russia, the level of processing waste is extremely low, which in turn has created feedstock procurement risks [56]. This issue is worsened by logistical challenges in the form of a poor infrastructure for biomass transportation [4]. According to the analysis of regulatory documents [70], the ‘Sanitary rules for meat industry enterprises No. 3238-85 of 27.03.1985’ is the main document in the work of the Federal Service for Veterinary and Phytosanitary Surveillance in Russia (Rosselkhoznadzor). The document does not promote the implementation of modern technologies in the field of waste management by agricultural producers, which makes it difficult to embed biogas plants in agricultural enterprises. Several representatives from the bioenergy sector also mentioned that ‘there is a need to tighten our standards for waste disposal’, and ‘if a fee for waste disposal is established, everything will change.’ An interviewee from a Russian biogas company also stated that the most important problem in hindering the rapid growth of biogas technologies is a lack of standards regarding waste disposal, stating that ‘while the waste from the agro-industrial enterprises will be qualified as fertilisers, nobody will build modern facilities for waste disposal and most importantly, nobody will pay money to investors for waste processing’. The current legislation clearly classifies pig manure as a hazardous waste but does not contain any exceptions to the requirements for the management of such waste, and pig manure is allowed to be used as a fertiliser in pig farms. In addition, there is an illegal disposal of manure on fields under the guise of fertilisers. A similar situation occurs in poultry and livestock farming.

A lack of a centralised coordination on the waste collection and distribution, and poor utilisation of residues and wastes are the critical problems for the utilisation of municipal solid waste in Russia. The prevailing method used for the disposal of MSW is burying waste in a landfill. The danger here constitutes the second effect of the decomposition of organic matter in the form of a leachate, which is a toxic liquid that gets into soil, groundwater, and through them, into rivers and seas. In addition, the disposal of MSW is conducted under multiple sanitary, epidemiological, and environment violations [22]. The volume of MSW is approximately 55–60 million tonnes per year, and is composed of 40% organic waste, 35% paper, and 6% plastic [34]. Thus, a considerable amount of organic waste from MSW can be extracted for biogas production. In addition, landfill gas can be utilised from existing landfill. A modern waste disposal system is no less important than other components of urban infrastructure, and the garbage problem cannot be solved using outmoded methods. However, there is also the problem with owners of landfills who are too conservative and less inclined toward making innovations [69].

5. Conclusions and Policy Implications

This article provides a detailed analysis of the Russian biogas industry, investigating its current status and potential, and identifying the critical factors that hinder the wider implementation of biogas technologies. Russia primarily has significant potential for creating environmentally- than energy-driven biogas projects. The need for the recycling of agricultural waste, organic waste from municipal solid waste, and wastewater sludge is enormous in Russia. However, its potential is not being realised in a proper way. Thus, the key aim of the article was to reveal the critical barriers for the wider implementation of biogas technologies in Russia. In light of the results, the following policy-related recommendations are proposed.

The main recommendation concerns legislation regarding waste disposal. A set of measures should be implemented to tighten the control over the disposal of organic waste from agricultural enterprises. As mentioned at the conference, if such measures are established, the biogas industry can be expected to show a rapid growth in Russia. Therefore, all technologies of livestock production, particularly for pig and poultry farming, need to be environmentally responsible and have enhanced control at all levels (state, industrial, and social).

Second, there are no special programs to stimulate the construction of biogas plants in Russia. However, political implications have significantly affected biogas uptake in countries with mature biogas markets (e.g., Austria, France, Germany, Italy, Sweden, and the United Kingdom [71]) [72]. State support is one of the key mechanisms for the development of biogas technologies, and the choice of direction for renewable energy development depends mostly on policymakers. Many fossil fuel export-oriented countries have already recognized the need for such global shift towards renewable energy sources and are looking for new strategies in order to diversify their national economies. For example, oil-rich countries such as the United Arab Emirates (UAE) and Qatar have adopted multiple measures towards the implementation of renewable energy. In terms of the transfer of RE technologies, both of these countries have cooperated with the Western universities such as the Massachusetts Institute of Technology (MIT), Georgetown University, Texas A&M University and Carnegie Mellon University [73]. They also established specific Institutes, Science and Technology Parks, which bring together foreign and national energy companies and create favourable international business partnerships in terms of investment in technology and know-how [73]. Such experience shows that sometimes there is just a need to look at the experience of other countries and not ‘reinvent the wheel’. Much of what can be done has already been done, and there is a possibility to choose the best experience and go with it forward. Several speakers have shown an interest in looking at the experience of ‘foreign colleagues’, and it was stated that ‘we can continue to reinvent the wheel, we can continue to create some kind of regulatory framework, but sometimes we just need to look at what already exists. Much of what we are trying to do, has already been done’.

Third, subsidies, financial support programmes, and soft loans can help reduce high investment and equipment costs. This can be achieved through the exemption of biogas plants from taxes and the refusal of value added tax (VAT) collection on imported equipment. In the same way, it is necessary to support pilot projects for the construction of biogas plants. Implemented pilot projects will create a positive image of biogas technologies and stimulate potential clients to adopt and invest in these technologies. Financing of R&D projects could help to enhance the biogas processes, reduce the cost of biogas equipment, and make them more affordable. Furthermore, there are very few qualified engineers focused on biogas technologies in Russia. Thus, study material, educational courses, new faculties should be established. Additional recommendations include the creation of groups of experts who can advise the most appropriate solutions for the construction of biogas plants, and create guidelines for potential biogas producers.

Fourth, in the analysis, a concern regarding the monopolistic nature of the energy market in Russia has stood out. Support of the retail biogas energy market by making exemptions from taxes or establishing some federal support and incentives can be considered a possible step to redress the current imbalance.

Last but not least, the current macro-economic situation has certainly deteriorated the development of renewable energy as a whole and biogas technologies in particular. International cooperation is the basis for scientific development, owing to its further implementation in the business sector and, thus, in everyday life. Joint biogas projects can help countries share their knowledge, create/improve technologies, and realise the potential for biogas development. If Russia manages to overcome these barriers, the country is very likely to become one of the leaders in biogas production.

Funding

This research received no external funding.

Acknowledgments

Tatiana Nevzorova acknowledges the support from the Global Education Program fellowship [grant number 405]; the Russian Federation, Moscow. An earlier version of the paper was presented at the 7th Scandinavian Conference on Industrial Engineering and Management held in Stockholm, Sweden on 14–16 October 2019, where the article was nominated for the “Best Paper Award”. The author is grateful to Ivan Egorov (LANDCO S.A/AgroBioTech) for sharing his knowledge and experience with the author.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A

Table A1.

The most well-known biogas plants in Russia.

Table A1.

The most well-known biogas plants in Russia.

| Year | Biogas Plant, Location | Total Capacity | Substrate | Companies Took Part in the Construction | Reference |

|---|---|---|---|---|---|

| 2002 | Agricultural farm Krasnaya pojma (Lukhovitsky district, Moscow Oblast) | 65 m3 | Cattle manure | Federal Scientific Agroengineering Center VIM | [74] |

| 2009 | MosMedynAgroprom (Village of Doshino, Kaluga Oblast) | 2.4 MW | Cattle manure | Construction of the technological part of the project and operation: company Biopotok; Construction of the energy part of the project and operation: corporation BioGazEnergoStroy; The equipment for processing of organic waste and biogas production and gas-piston plants are made in Europe (~GE Jenbacher engine J208). | [75,76] |

| 2009 | Kuryanov sewage treatment plant (Moscow) | 128,000 m3 of biogas per day | Sewage sludge | Project design: the JSC MosvodokanalNIIproject Institute and specialists of Mosvodokanal; Investor: Austrian concern EVN; Equipment: Four GE Jenbacher gas-piston internal combustion engines. | [22,30,31] |

| 2011 | Mortadel (Vladimir Oblast) | 150–160 kWh per day | Pig manure | Construction: LLC Mortadel-Story; Equipment, technology and supervision: company Euroindustries | [77] |

| 2011 | State farm Roshchinsky (Bashkortostan Republic) | - | Waste from slaughterhouses and pig farms | Equipment supplier: AEV Energie (Germany, Regensburg) | [78,79] |

| 2011 | Perm region | 70 m3 of biogas per day | Pig manure | EnergoRezhim LLC | [80] |

| 2011 | JSC Sharkansky RTP (village Sharkan, Udmurt Republic) | 300 m3 of biogas per day | Any organic waste: grass, silage, and slaughterhouse waste | EnergoRezhim LLC | [80] |

| 2012 | Lyubertsy sewage treatment plant (Moscow) | 145,000 m3 of biogas per day | Sewage sludge | Project design: the JSC MosvodokanalNIIproject Institute and specialists of Mosvodokanal; Investor: Austrian company EVN | [22,30,31] |

| 2012 | Agrofirm Promyshlennaya (Orenburg Oblast) | 2–2.5 tons per day | Any organic waste: cattle, horse, pig, poultry manure, vegetable waste, beer pellets, biological waste etc. | Kompleksnye sistemy utilizacii (Integrated recycling systems) | [81] |

| 2012 | Luchki (Belgorod Oblast) | 2.4 MW | Meat processing waste, pig drains, corn silage and other raw material | Implementation of the project: company AltEnergo; Equipment: Big Dutchman Agro (Germany). | [23] |

| 2012 | Baitsury (Borisov district, Belgorod Oblast) | 1 MW | Pig manure | Project design: LLC Promagrostroy; Construction: Regional centre of biotechnologies; Equipment: Big Dutchman Agro (Germany). | [78] |

| 2013 | Village of Vasilievo-Shamshevo (Rostov Oblast) | 50 tons per day | Chicken manure | BioenergyResource-3 LLC and EnergoRezhim LLC | [80] |

| 2013 | Breeding farm Istobenskiy (Orichevsky district, Kirov Oblast) | Up to 50 m3 per day | Cattle manure | SelhozBioGas LLC | [26] |

| 2016 | Istra district (Moscow Oblast) | Reduction of the use of natural gas by almost 300,000 m3 | Industrial wastewater | Coca-Cola HBC Russia | [32,82] |

| 2017 | Astrakhan Oblast | 10 tons per day | Animal and plant residues | SelhozBioGas LLC | [26] |

| 2017 | Village Bogdanikha (Ivanovo Oblast) | - | Sewage sludge | Under federal program of the International Bank for Reconstruction and Development in Reform and Modernisation of Housing & Utilities in the Russian Federation; General contractor: TAHAL Consulting Engineers Ltd (Israel); Supplier of four cogenerators: company MaxMotors (official distributor and service provider of GE Gas Engines (Austria) in Russia); Design documentation development: SWECO (Sweden). | [83] |

| 2017 | Samarkand region, Republic of Uzbekistan | 60 m3 | Organic waste | EVOBIOS LLC; Customer: Agency for restructurization of agricultural enterprises (Uzbekistan). | [84] |

| 2017 | Yerevan, Armenia | - | Pig manure | Manufacturing and installation of some missing pieces of equipment: SelhozBioGas LLC. | [26] |

| 2019 | Ufa, Bashkortostan Republic | 2 tons per day, 50–60 m3 of biogas per day | Different types of organic waste: manure, poultry manure, whey, expired food products. | Cooperation between Russian companies: SelhozBioGas LLC and Kompleksnye sistemy utilizacii (Integrated recycling systems) | [26] |

| 2019 | Nekhaevsky district, Volgograd Oblast | 10 tons per day | Pig manure of different humidity and various plant residues. | SelhozBioGas LLC | [26] |

| 2019 | JSC Breeding plant “Pervomaysky” (Pervomayskoye settlement, Leningrad Oblast) | 240 kW/h | Cattle manure | EVOBIOS LLC | [25] |

Appendix B

Table A2.

Profiles of individuals who participated in the questionnaire.

Table A2.

Profiles of individuals who participated in the questionnaire.

| # | Gender | Activity Area | Work Experience | Level of Education |

|---|---|---|---|---|

| 1. | Male | Academia | 5–10 years | Candidate of Science |

| 2. | Female | Industry | >10 years | Specialist degree |

| 3. | Male | Academia | >10 years | Doctor of Science |

| 4. | Male | Academia | >10 years | Candidate of Science |

| 5. | Male | Academia | >10 years | Doctor of Science |

| 6. | Male | Industry | >10 years | Candidate of Science |

| 7. | Male | Academia | >10 years | Doctor of Science |

| 8. | Male | Industry | >10 years | Candidate of Science |

| 9. | Male | Industry | >10 years | Specialist degree |

| 10. | Male | Industry | >10 years | Candidate of Science |

| 11. | Female | Academia | 5–10 years | Candidate of Science |

| 12. | Male | Industry | >10 years | Candidate of Science |

| 13. | Female | Academia | >10 years | Specialist degree |

| 14. | Male | Industry | >10 years | Candidate of Science |

| 15. | Male | Industry | >10 years | Candidate of Science |

| 16. | Female | Academia | >10 years | Doctor of Science |

| 17. | Male | Academia | >5 years | Master of Science |

| 18. | Female | Industry | 5–10 years | Specialist degree |

| 19. | Female | Industry | >5 years | Master of Science |

| 20. | Male | Industry | 5–10 years | Specialist degree |

| 21. | Female | Academia | >5 years | Master of Science |

| 22. | Male | Industry | >10 years | Specialist degree |

| 23. | Male | Industry | >10 years | Specialist degree |

Table A3.

Constraining factors for the diffusion of biogas technologies in Russia.

Table A3.

Constraining factors for the diffusion of biogas technologies in Russia.

| Constraining Factors for the Diffusion of Biogas Technologies | Impact | Uncertainty |

|---|---|---|

| Climate change is not a priority among Russian government agencies (no substantial government interest)/Absence of focused energy policy | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of sufficient budget and financial resources | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of federal support and incentives (limited policy measures) and a slow policy development | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of national product standards and norms in terms of waste separation | 1 2 3 4 5 | 1 2 3 4 5 |

| High level of bureaucracy | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of awareness and sense of urgency | 1 2 3 4 5 | 1 2 3 4 5 |

| Poor technical knowledge | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of motivation and incentives | 1 2 3 4 5 | 1 2 3 4 5 |

| Absence of specialised machinery and equipment | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of infrastructure (e.g., refuelling stations for transport, repair service) | 1 2 3 4 5 | 1 2 3 4 5 |

| Little experience in this sector | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of concrete (action) plans | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of insufficient technical training and institutional networking | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of qualified specialists | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of a centralised coordination on the waste collection and distribution, and poor utilisation of residues and wastes | 1 2 3 4 5 | 1 2 3 4 5 |

| Limited R&D funding | 1 2 3 4 5 | 1 2 3 4 5 |

| Low residential electricity prices, and availability of cheaper alternative fuels | 1 2 3 4 5 | 1 2 3 4 5 |

| High investment and equipment costs | 1 2 3 4 5 | 1 2 3 4 5 |

| Long economic payback period | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of access to soft loan | 1 2 3 4 5 | 1 2 3 4 5 |

| Investor preferences for conventional technologies as the economic structure favours fossil fuels over renewable fuels | 1 2 3 4 5 | 1 2 3 4 5 |

| Strong depreciation of the rouble exchange rate | 1 2 3 4 5 | 1 2 3 4 5 |

| Problems related to market entry/unpredictable market conditions | 1 2 3 4 5 | 1 2 3 4 5 |

| Lack of international investments and support due to sanctions | 1 2 3 4 5 | 1 2 3 4 5 |

| Monopolistic and oligopolistic energy market in Russia | 1 2 3 4 5 | 1 2 3 4 5 |

| Your variant (optional) | 1 2 3 4 5 | 1 2 3 4 5 |

Table A4.

Profiles of individuals who participated in the interviews.

Table A4.

Profiles of individuals who participated in the interviews.

| # | Gender | Activity Area | Country | Interview Date |

|---|---|---|---|---|

| 1. | Male | Industry (biogas technologies) | Russia | 4 June 2019 |

| 2. | Female | Industry (landfill gas energy technologies) | Russia | 4 June 2019 |

| 3. | Female | Industry (biogas technologies) | Russia | 5 June 2019 |

| 4. | Male | Industry (landfill gas energy technologies) | Russia | 5 June 2019 |

| 5. | Male | Industry (biogas technologies) | Russia | 19 June 2019 |

| 6. | Male | Industry (biogas technologies) | Russia | 17 June 2020 |

| 7. | Male | Industry (biogas technologies) | Russia | 23 June 2020 |

References

- UNFCCC. The Paris Agreement. United Nations Framework Convention on Climate Change. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 7 September 2018).

- Interfax Medvedev Signed a Resolution on Ratification of the Climate Agreement. Available online: https://www.interfax.ru/russia/677522 (accessed on 3 October 2019).

- Gubenko, A. Russia Has Joined the PARIS Climate Agreement. Available online: https://www.rbc.ru/politics/23/09/2019/5d88a9089a79475f76930863 (accessed on 3 October 2019).

- Larive International. Market Study: Bio-energy in Russia. Opportunities for Dutch Companies. March 2013. Available online: http://tp-bioenergy.ru/upload/file/5-Market-Study-Bioenergy-Russia.pdf (accessed on 21 April 2020).

- Wostec. The Reasons for the Growth of the Biogas Market in Russia. Available online: http://wostec.ru/biogas-russia/ (accessed on 3 October 2019).

- Lanshina, T.A.; Laitner, J.A.S.; Potashnikov, V.Y.; Barinova, V.A. The slow expansion of renewable energy in Russia: Competitiveness and regulation issues. Energy Policy 2018, 120, 600–609. [Google Scholar] [CrossRef]

- Reutov, B.; Reutova, A.; Ishmuratova, M. Prospects for the Development of Bioenergy in the Russian Federation on the Basis of Agroindustrial Complex Wastes: Analysis of the Regulatory Framework and National Support Mechanisms. 2014, pp. 1–38. Available online: http://www.bio-prom.net/fileadmin/BIO-PROM/Projektunterlagen/Studien_Informationen/BIO-PROM_Biogas_Study_EN_FINAL.pdf (accessed on 21 April 2020).

- Kozlova, M.; Collan, M. Modeling the effects of the new Russian capacity mechanism on renewable energy investments. Energy Policy 2016, 95, 350–360. [Google Scholar] [CrossRef]

- Pristupa, A.O.; Mol, A.P.J. Renewable energy in Russia: The take off in solid bioenergy? Renew. Sustain. Energy Rev. 2015, 50, 315–324. [Google Scholar] [CrossRef]

- Mittal, S.; Ahlgren, E.O.; Shukla, P.R. Barriers to biogas dissemination in India: A review. Energy Policy 2018, 112, 361–370. [Google Scholar] [CrossRef]

- Kamp, L.M.; Forn, E.B. Ethiopia’s emerging domestic biogas sector: Current status, bottlenecks and drivers. Renew. Sustain. Energy Rev. 2016, 60, 475–488. [Google Scholar] [CrossRef]

- Shane, A.; Gheewala, S.H.; Kasali, G. Potential, Barriers and Prospects of Biogas Production in Zambia. J. Sustain. Energy Environ. 2015, 6, 21–27. [Google Scholar]

- Rupf, G.V.; Bahri, P.A.; De Boer, K.; McHenry, M.P. Barriers and opportunities of biogas dissemination in Sub-Saharan Africa and lessons learned from Rwanda, Tanzania, China, India, and Nepal. Renew. Sustain. Energy Rev. 2015, 52, 468–476. [Google Scholar] [CrossRef]

- Roopnarain, A.; Adeleke, R. Current status, hurdles and future prospects of biogas digestion technology in Africa. Renew. Sustain. Energy Rev. 2017, 67, 1162–1179. [Google Scholar] [CrossRef]

- Cheng, S.; Zhao, M.; Mang, H.-P.; Zhou, X.; Li, Z. Development and application of biogas project for domestic sewage treatment in rural China: Opportunities and challenges. J. Water Sanit. Hyg. Dev. 2017, 7, 576–588. [Google Scholar] [CrossRef]

- Martin, M. Potential of biogas expansion in Sweden: Identifying the gap between potential studies and producer perspectives. Biofuels 2015, 6, 233–240. [Google Scholar] [CrossRef]

- Blumenstein, B.; Siegmeier, T.; Möller, D. Economics of anaerobic digestion in organic agriculture: Between system constraints and policy regulations. Biomass Bioenergy 2016, 86, 105–119. [Google Scholar] [CrossRef]

- The Bioenergy International. Biogas Revolution in Russia: Myth or reality. Bioenergy Int. 2016, 38, 21. [Google Scholar]

- BP Statistical Review of World Energy Statistical Review of World. World Energy 2019, 68, 1–69.

- The Ministry of Energy of the Russian Federation Main Characteristics of the Russian Electric Power Industry. Available online: https://minenergo.gov.ru/node/532 (accessed on 9 November 2019).

- Food and Agriculture Organization of the United Nations (FAO). FAOSTAT. Available online: http://www.fao.org/faostat/en/#data/QL/visualize (accessed on 9 November 2019).

- Namsaraev, Z.B.; Gotovtsev, P.M.; Komova, A.V.; Vasilov, R.G. Current status and potential of bioenergy in the Russian Federation. Renew. Sustain. Energy Rev. 2018, 81, 625–634. [Google Scholar] [CrossRef]

- AltEnergo. Biogas Plant. Available online: http://www.altenergo.su/biogas/ (accessed on 18 October 2019).

- Oreckhov, A. The Experience of the Belgorod Region for the Construction of Biogas Plants Based on Waste from Animal Husbandry. Available online: http://www.infobio.ru/sites/default/files/Tezisy_v_pechat.pdf (accessed on 15 March 2020).

- EVOBIOS LLC. The Opening of the First Biogas Plant EVOBIOS. Available online: http://www.evobios.ru/23-10-2019 (accessed on 21 January 2020). (In Russian).

- SelhozBioGas LLC. Biogas Projects. Available online: https://shbiogaz.ru/proekty/ (accessed on 18 October 2019).

- NORDICECONEWS. Biogas Projects in Russia: Opportunities for Investors. Available online: https://blog.nordicecocentre.com/2018/07/09/биoгазoвые-прoекты-в-рoссии-вoзмoжнo/ (accessed on 4 October 2019).

- NORDICECONEWS. Small-Scale Biogas Plants: Autonomous Source of Energy and Motor Fuel. Available online: https://blog.nordicecocentre.com/2018/08/08/малые-биoгазoвые-устанoвки-автoнoмн/ (accessed on 18 October 2019).

- Karasevich, V.A.; Albul, A.V.; Akopova, G.S. Biogas as a complex solution of economic and ecological tasks. Nauchnyj zhurnal Ross. Gazov. Obs. 2014, 2, 147–152. [Google Scholar]

- Kevbrina, M.V. Experience in the use of methane tanks for energy generation and improvement of energy efficiency in Mosvodokanal. Energosovet 2013, 1, 26–29. [Google Scholar]

- Khramenkov, S.V.; Pakhomov, A.N.; Khrenov, K.E.; Streltsov, S.A.; Khamidov, M.G.; Belov, N.A. Utilization of biogas and creation of autonomous sources of power supply at treatment facilities. Water Supply Sanit. Technol. J. 2010, 10, 48–53. [Google Scholar]

- Coca-Cola HBC Russia. Sustainability Report of Coca-Cola HBC Russia; Coca-Cola HBC Russia: Zug, Switzerland, 2017. [Google Scholar]

- United States Environmental Protection Agency (EPA). Basic Information about Landfill Gas. Available online: https://www.epa.gov/lmop/basic-information-about-landfill-gas (accessed on 25 January 2020).

- ITAR-TASS News Agency. Waste Disposal in Russia. How the Industry is Reformed. Available online: https://tass.ru/info/6000776 (accessed on 21 October 2019).

- NORDICECONEWS. We Successfully and Environmentally Solve the Problem of Landfill Gas. Available online: https://blog.nordicecocentre.com/2018/06/24/мы-гoтoвы-решить-прoблему-свалoчнoгo/ (accessed on 15 October 2019).

- Romanova, T. Russian energy in the EU market: Bolstered institutions and their effects. Energy Policy 2014, 74, 44–53. [Google Scholar] [CrossRef]

- Harris, L.R.; Brown, G. Mixing interview and questionnaire methods. Pract. Assessment, Res. Eval. 2010, 15, 1. [Google Scholar]

- Kendal, L. The conduct of qualitative interview: Research questions, methodological issues, and researching online. In Handbook of Research on New Literacies; Coiro, J., Knobel, M., Lankshear, C., Leu, D., Eds.; Lawrence Erlbaum Associates: New York, NY, USA, 2008; pp. 133–149. [Google Scholar]

- Zilber, T.B. Stories and the Discursive Dynamics of Institutional Entrepreneurship: The Case of Israeli High-tech after the Bubble. Organ. Stud. 2007, 28, 1035–1054. [Google Scholar] [CrossRef]

- Schweigert, P.N. Research Methods and Statistics for Psychology; Brooks/Cole Publ. Co.: Pacific Grove, CA, USA, 1994. [Google Scholar]

- Nevzorova, T.; Kutcherov, V. Barriers to the wider implementation of biogas as a source of energy: A state-of-the-art review. Energy Strateg. Rev. 2019, 26, 100414. [Google Scholar] [CrossRef]

- WasteTech. About WasteTech. Available online: https://www.waste-tech.ru/en-gb/about.html#expo (accessed on 22 August 2019).

- Renwex. Renewable Energy and Electric Vehicles. Available online: https://www.renwex.ru/en/ (accessed on 20 August 2019).

- TP Bioenergy. Bioenergy in the Russian Federation. Roadmap for 2019–2030. 2019. Available online: http://tp-bioenergy.ru/dorozhnaya_karta_20192030/ (accessed on 15 March 2020). (In Russian).

- Boute, A. Renewable energy federalism in Russia: Regions as new actors for the promotion of clean energy. J. Environ. Law 2013, 25, 261–291. [Google Scholar] [CrossRef]

- Merriam-Webster. Vested Interest. Available online: https://www.merriam-webster.com/dictionary/vested interest (accessed on 1 October 2019).

- Boute, A.; Zhikharev, A. Vested interests as driver of the clean energy transition: Evidence from Russia’s solar energy policy. Energy Policy 2019, 133, 110910. [Google Scholar] [CrossRef]

- Gielen, D.; Saygin, D. Renewable energy prospects for the Russian Federation. Energy Bull. 2017, 23, 11–24. [Google Scholar]

- Boute, A.; Willems, P. RUSTEC: Greening Europe’s energy supply by developing Russia’s renewable energy potential. Energy Policy 2012, 51, 618–629. [Google Scholar] [CrossRef]

- Gazprom. Russian Gas Market. Available online: https://www.gazprom.com/about/marketing/russia/ (accessed on 23 October 2019).

- The Federal Service for State Statistics (Rosstat) Central Statistics Database. Available online: https://www.gks.ru/dbscripts/cbsd/dbinet.cgi?pl=1921001 (accessed on 23 October 2019).

- Mitrova, T.; Melnikov, Y. Energy transition in Russia. Energy Transit. 2019, 3, 73–80. [Google Scholar] [CrossRef]

- Smeets, N. Similar goals, divergent motives. The enabling and constraining factors of Russia’s capacity-based renewable energy support scheme. Energy Policy 2017, 101, 138–149. [Google Scholar] [CrossRef]

- Smeets, N. The Green Menace: Unraveling Russia’s elite discourse on enabling and constraining factors of renewable energy policies. Energy Res. Soc. Sci. 2018, 40, 244–256. [Google Scholar] [CrossRef]

- Tuzova, Y.; Qayum, F. Global oil glut and sanctions: The impact on Putin’s Russia. Energy Policy 2016, 90, 140–151. [Google Scholar] [CrossRef]

- Egorov, I. Promising areas for development of bioenergy in Russia. Energy Bull. 2017, 23, 57–60. [Google Scholar]

- The Bioenergy International. News chapter. Legislation. Bioenergy Int. 2014, 31, 27. [Google Scholar]

- Dvorkovich, A. Renewable Energy Sources Will Lead to Tariff Increases. Available online: http://ria.ru/%0Aeconomy/20160617/1448891227.html (accessed on 8 October 2019).

- Ministry of Energy of the Russian Federation. The Government of the Russian Federation has Approved Russia’s Energy Strategy for the Period Up to 2035. Available online: https://minenergo.gov.ru/node/17491 (accessed on 3 April 2020). (In Russian)

- The Ministry of Energy of the Russian Federation. Energeticheskaya Strategiya Rossii na Period do 2035 Goda. [Energy Strategy of Russia up to 2035]. Available online: https://minenergo.gov.ru/node/1026 (accessed on 21 June 2020).

- The Ministry of Energy of the Russian Federation. Energeticheskaya Strategiya Rossii na Period do 2030 Goda. [Energy strategy of Russia up to 2030]. Available online: http://energoeducation.ru/wp-content/uploads/2015/11/LAW94054_0_20151002_142857_54007.pdf (accessed on 20 June 2020).

- Russian Government. The Federal Law of 26 March 2003 on Power Sector N 35-FZ. Available online: http://www.kremlin.ru/acts/bank/19336/page/3 (accessed on 17 May 2020).

- IRENA. Renewable Energy Prospects for the Russian Federation; International Renewable Energy Agency: Abu Dhabi, UAE, 2017. [Google Scholar]

- Russian Government. The Decree of 23 January 2015 “On the Mechanism for the Promotion of Renewable Energy on the Retail Power Markets” N 47. Available online: http://static.government.ru/media/files/WATItEFgK8c.pdf (accessed on 21 May 2020).

- Russian Government. The Resolution of 28 July 2015 On the Amendments to the Main Directions for the State Policy to Improve energy Efficiency in Power Sector on the Basis of RES for the Period of up to 2020 N 1472-r. Available online: http://docs.cntd.ru/document/420291297 (accessed on 15 February 2020).

- Russian Government. The Decree of the Government of September 4, 2015 No. 941. Available online: http://www.consultant.ru/cons/cgi/online.cgi?req=doc&base=LAW&n=327162&fld=134&dst=1000000001,0&rnd=0.29370665230870086#030803218301259117 (accessed on 17 February 2020).

- The Federal Antimonopoly Service of the Russian Federation. The Order of September 30, 2015 No. 900/15 On approval of the Methodological Guidelines for Regulation of Prices (Tariffs) and (or) Marginal (Minimum and (or) Maximum) Price (Tariff) Levels for Electric Energy (Capacity) Produced at Qualified Generating. Available online: http://publication.pravo.gov.ru/Document/View/0001201602030012 (accessed on 21 January 2020).

- Russian Government. The Decree of the Government of September 23, 2016 No. 961. Available online: http://static.government.ru/media/files/6NFUyXLxdGZB3FWFNCScd7A1AZnQKhRj.pdf (accessed on 17 March 2020).

- Karasevich, V.; Kirshina, I.; Zorya, A. Prospects for Green Gas Production in the Russian Federation and its Potential Export to the European Union. In Proceedings of the International Gas Union Research Conference, Copenhagen, Denmark, 17–19 September 2014. [Google Scholar]

- Vinogradov, A.V.; Leonov, B.V. Potential Assessment and Experiment on the Use of Biogas Plants for Processing Waste from Pig Farms in the Orel Region; The Orel State Agrarian University: Orel, Russia, 2016. (In Russian) [Google Scholar]

- Kampman, B.; Leguijt, C.; Scholten, T.; Tallat-Kelpsaite, J.; Brückmann, R.; Maroulis, G.; Lesschen, J.P.; Meesters, K.; Sikirica, N.; Elbersen, B. Optimal Use of Biogas from Waste Streams-An Assessment of the Potential of Biogas from Digestion in the EU Beyond 2020; European Union: Brussels, Belgium, 2017; pp. 1–158. [Google Scholar]

- Nevzorova, T.; Karakaya, E. Explaining the drivers of technological innovation systems: The case of biogas technologies in mature markets. J. Clean. Prod. 2020, 259, 120819. [Google Scholar] [CrossRef]

- Atalay, Y.; Biermann, F.; Kalfagianni, A. Adoption of renewable energy technologies in oil-rich countries: Explaining policy variation in the Gulf Cooperation Council states. Renew. Energy 2016, 85, 206–214. [Google Scholar] [CrossRef]

- Efendiev, A.M. Biogas. Technology and Equipment; Saratov State Vavilov Agrarian University: Saratov, Russia, 2013. (In Russian) [Google Scholar]

- Pantskhava, E.S. Biofuel (Biomass) Power Plants; Ru-Science: Moscow, Russia, 2016; p. 340, (In Russian). [Google Scholar] [CrossRef]

- BioGazEnergoStroy. Prospects for Using Bioinstallations in Russia. Available online: http://www.bioges.ru/upload/common/preseent.pdf (accessed on 7 April 2020). (In Russian).

- PigUA.info. SSC “Mortadel” Launched a Modern Biogas Plant. Available online: http://pigua.info/uk/post/company-news/sgc-mortadel-zapustili-sovremennuu-biogazovuu-ustanovku-uk (accessed on 25 March 2020). (In Russian).

- Tihonravov, V.S. Resource-saving biotechnologies for production of alternative fuels in animal husbandry. FGNU ”Rosinformagrotech”, Moscow. 2011, p. 52. Available online: http://krasikc-apk.ru/wp-content/uploads/Books/%D0%A0%D0%B5%D1%81%D1%83%D1%80%D1%81%D0%BE%D1%81%D0%B1%D0%B5%D1%80%D0%B5%D0%B3%D0%B0%D1%8E%D1%89%D0%B8%D0%B5%20%D0%B1%D0%B8%D0%BE%D1%82%D0%B5%D1%85%D0%BD%D0%BE%D0%BB%D0%BE%D0%B3%D0%B8%D0%B8%20%D0%BF%D1%80%D0%BE%D0%B8%D0%B7%D0%B2%D0%BE%D0%B4%D1%81%D1%82%D0%B2%D0%B0%20%D0%B0%D0%BB%D1%8C%D1%82%D0%B5%D1%80%D0%BD%D0%B0%D1%82%D0%B8%D0%B2%D0%BD%D1%8B%D1%85%20%D0%B2%D0%B8%D0%B4%D0%BE%D0%B2%20%D1%82%D0%BE%D0%BF%D0%BB%D0%B8%D0%B2%D0%B0%20%D0%B2%20%D0%B6%D0%B8%D0%B2%D0%BE%D1%82%D0%BD%D0%BE%D0%B2%D0%BE%D0%B4%D1%81%D1%82%D0%B2%D0%B5.pdf (accessed on 7 April 2020).

- The Bioenergy International. The German Biogas Plant Will be Constructed in the State Farm “Roschinskiy” in Bashkortostan. Available online: http://www.infobio.ru/news/947.html (accessed on 27 February 2020). (In Russian).

- EnergoRezhim. Implemented Projects. Available online: http://энергорежим.рф/category/proekty/realizovannye-proekty/ (accessed on 14 January 2020). (In Russian).

- Kompleksnye Sistemy Utilizacii. The First Biogas Plant Has Started Operating in the Orenburg Region. Available online: http://komplesu.ru/gtrk-orenburg-pervaya-biogazovaya-ustanovka-zarabotala-v-orenburgskoj-oblasti/ (accessed on 19 December 2019). (In Russian).

- Coca-Cola HBC Russia. Coca-Cola in Russia. In Sustainability Report 2018; Coca-Cola in Russia: Atlanta, GA, USA, 2018; Available online: https://ru.coca-colahellenic.com/media/11025/otchet_coca-cola_d_0110_new7.pdf (accessed on 10 June 2020).

- Sidorova, M. The First Stage of Reconstruction of Sewage Treatment Plants Has Been Completed in Ivanovo. Available online: https://watermagazine.ru/novosti/proekty/18119-v-g-ivanove-zavershen-pervyj-etap-rekonstruktsii-kanalizatsionnykh-ochistnykh-sooruzhenij.html (accessed on 20 December 2019).

- EVOBIOS LLC. Grant Project. Available online: http://www.evobios.ru/17-08-2017 (accessed on 14 January 2020).

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).