Key Technologies and Economic Analysis of Decentralized Wind Power Consumption: A Case Study in B City, China

Abstract

:1. Introduction

2. Overview of Key Technical Solutions

2.1. Energy Storage Scheduling

2.1.1. Energy Storage Battery

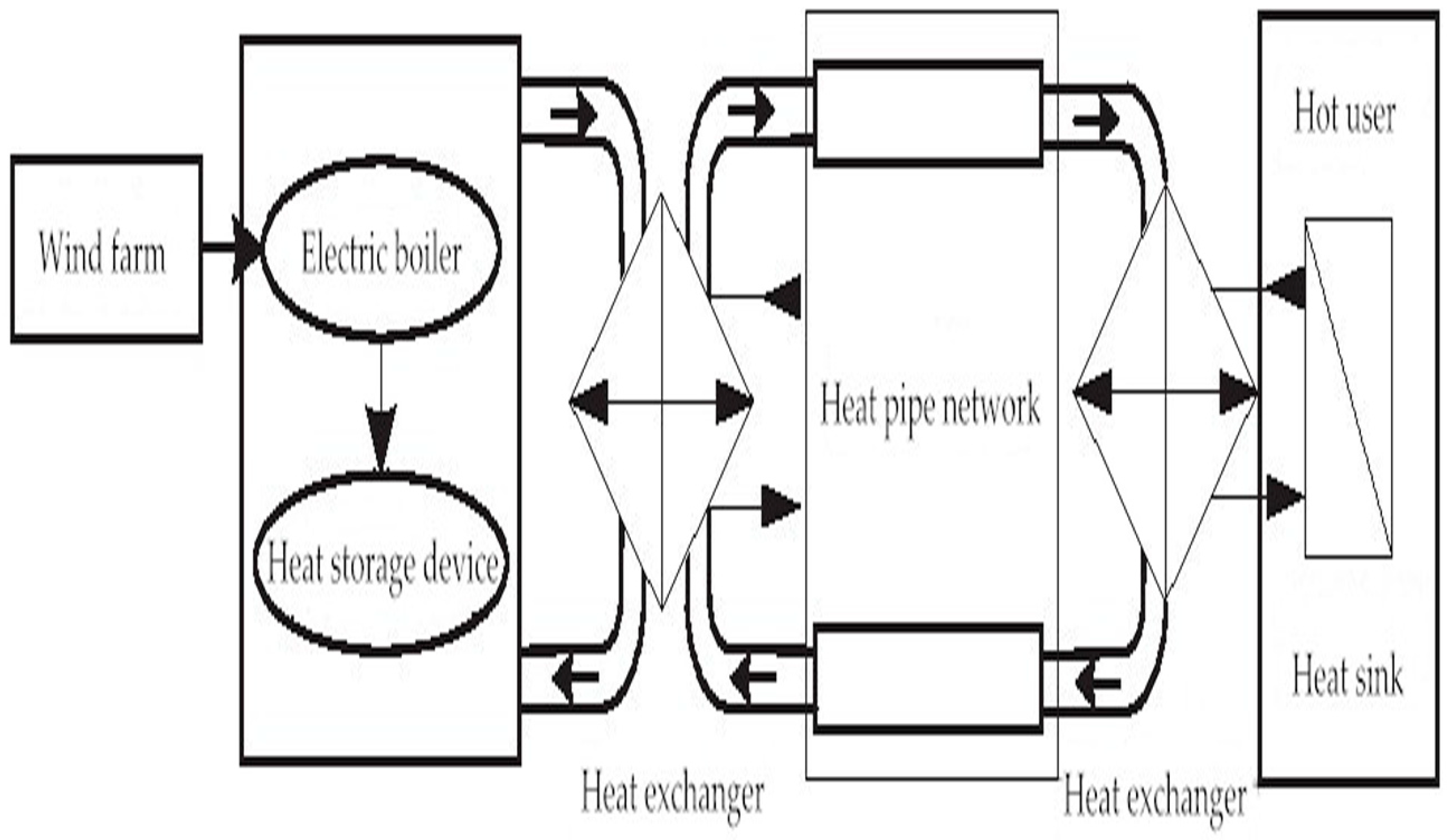

2.1.2. Electric Boiler Heat Storage

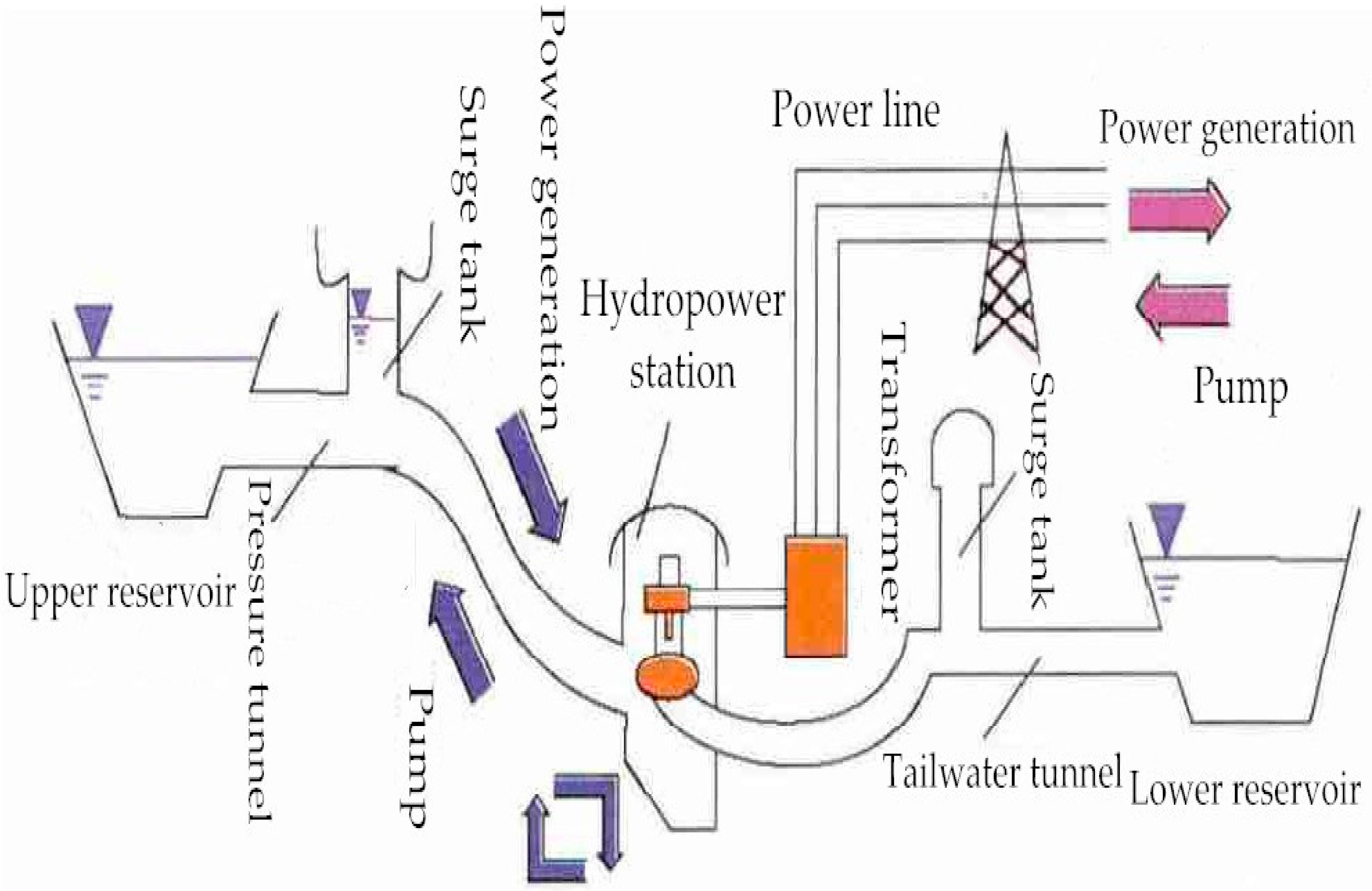

2.1.3. Pumped Storage

2.1.4. Compressed Air Energy Storage

2.2. Transmission and Distribution Lines

2.2.1. Cross-Regional Absorption

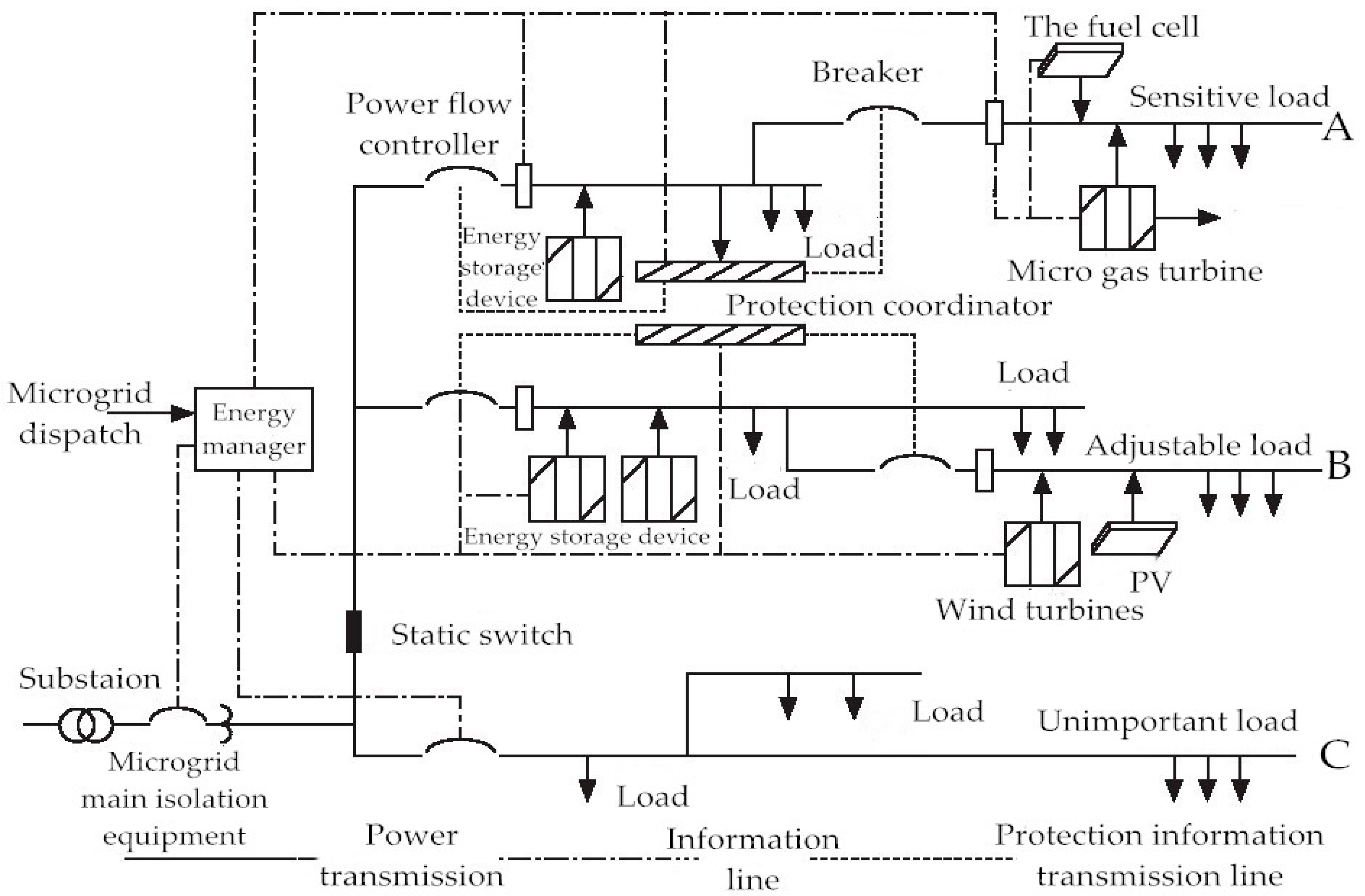

2.2.2. Smart MG

2.3. Load Response

2.3.1. Electric Vehicle Charging Station

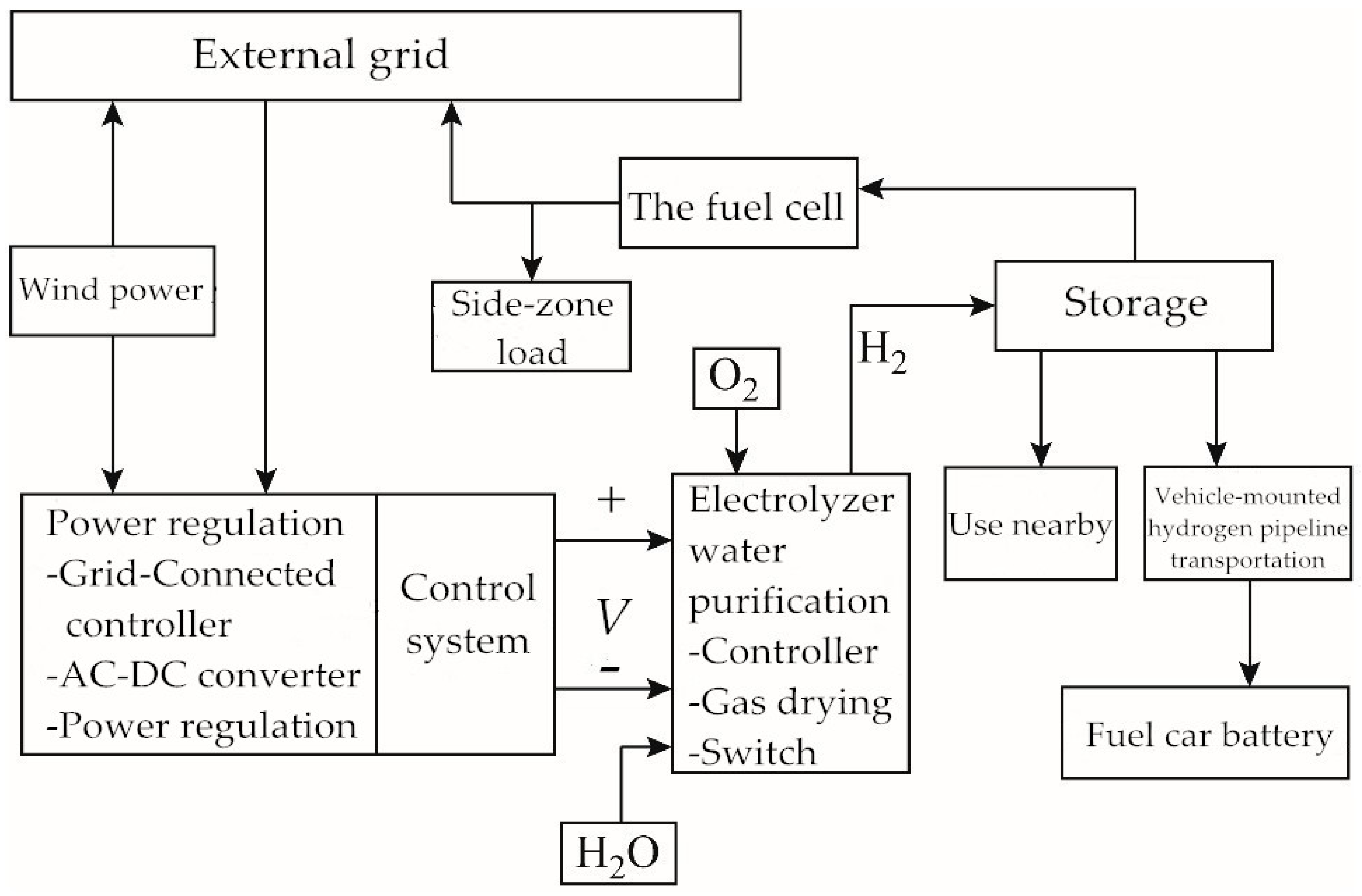

2.3.2. Hydrogen Production by Wind Power

3. Methods and Data Management

3.1. Economic Analysis Methods

3.1.1. NPV Method

- The NPV mainly inspects the absolute value index of the project profitability. It reflects the present value of the excess profits that the project can obtain in addition to the profits that meet the requirements of the discount rate. The financial NPV of the project is greater than 0, indicating that the project is feasible and reaches or exceeds the profit level required by the discount rate.The NPV can be calculated as follows:where “CI” represents the annual income of the project in CNY 0.001 million, “CO” represents the annual expenditure of the project which includes static investment and dynamic investment in CNY 0.001 million, “i” represents the discount rate in percentage and “t” represents the operation period of the project in year.

- The IRR refers to the discount rate that can make the accumulated present value of the net cash flow of the project in each year equal to zero in the whole calculation period. The IRR is therefore a measure of the financial risk and is used to evaluate the profitability of the investment. When the IRR ≥ i, the project is feasible. The project is not feasible in other situations. The calculation formula is:

- The Pt refers to the time required to recover the project investment with the net income of the project, which is widely calculated by the dynamic investment recovery period. The shorter the investment payback time, the better the profitability and anti-risk ability of the project. The criterion of the investment payback time is the benchmark investment payback period, which can be determined according to the industry level or the requirements of investors. The formula is:

3.1.2. RO Method

3.2. Data Management

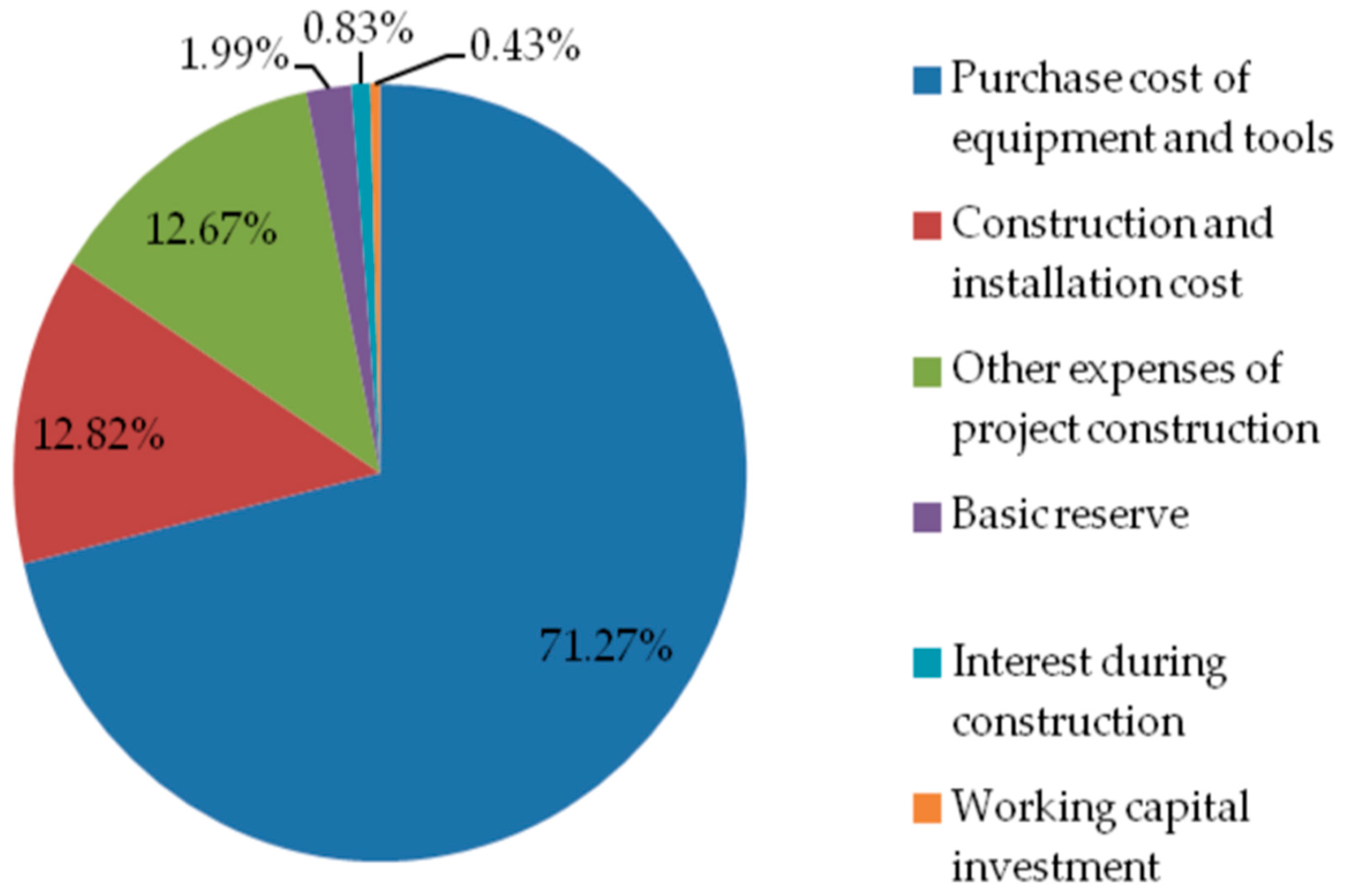

- Step 1: Estimate the cost. Collect the cost indicators of wind power projects by using the estimation method. Estimate the project cost, other project construction costs, basic reserve funds, construction period interest and working capital investment by the cost quota method with reference to the feasibility study report, environmental assessment report and Code for Economic Evaluation of Wind Power Projects (NB/T 31085-2016).

- Step 2: Calculate the income. The annual income of the project is calculated by multiplying the annual power generation or daily power generation that affects the income and that is officially released by the government where the wind power project is located by the local on-grid electricity price (including government subsidies) at that time. In addition, other subsidies given by the government should also be included in the annual income of the project, such as energy conservation and emission reduction income.

- Step 3: Calculate the net income. Calculate the annual net income of the project by subtracting the estimated project cost from the project income calculated in the previous step.

- Step 4: Set assumptions. It is assumed that the construction period of the project is 1 year and the operation period is 15 years. The loan during the construction period is CNY 13.2782 million. The service life of major fixed assets such as wind turbines is 15 years. The depreciation is carried out by the straight-line method and the residual value rate is 5% during the operation period.

- Step 5: Calculate the NPV, IRR and Pt. The NPV, IRR and Pt can be solved by substituting the data into the formulae (1)–(3).

- Step 6: Calculate the real option value (ROV). Bring the numerical value calculated in step 5 and relevant assumptions into the formulae (4)–(6).

- Step 7: Economic analysis. Analyze the economy and feasibility of the project according to the NPV, IRR, Pt and ROV results.

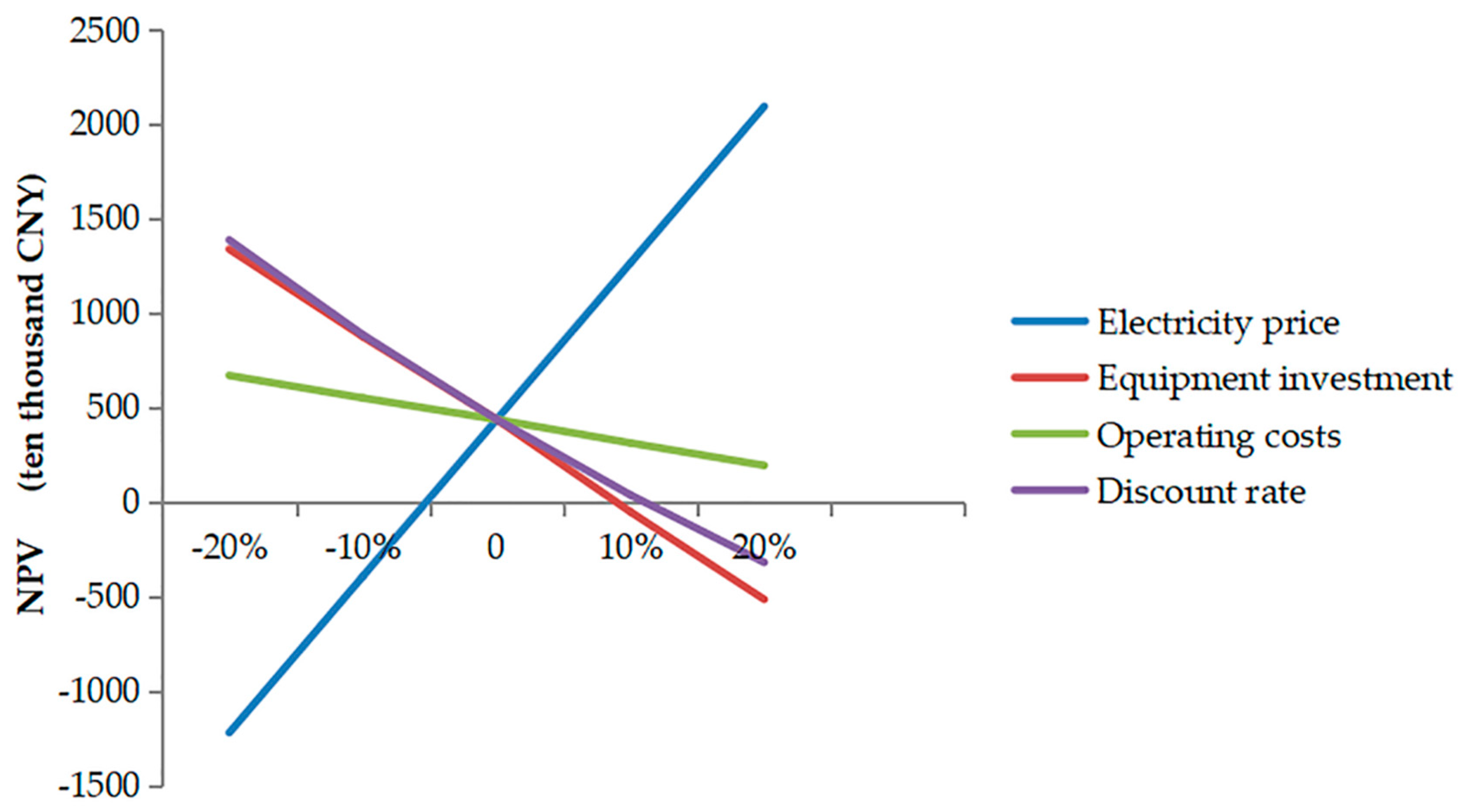

- Step 8: Sensitivity analysis. Analyze the factors affecting the project economy, and conduct sensitivity analysis on the influence of the project investment cost, operating cost, on-grid electricity price and discount rate in order to make the project more economical.

4. Case Analysis

4.1. Basic Overview

4.2. Economic Analysis

4.2.1. NPV Method Results and Analysis

4.2.2. RO Method Results and Analysis

4.2.3. Sensitivity Analysis

4.2.4. Conclusion of Economic Evaluation

5. Conclusions

- It can be seen from the economic analysis that wind power projects have made outstanding contributions to energy conservation, emission reduction and social benefits. It is better to develop vigorously clean energy, especially wind energy, to optimize the energy structure. This will accelerate the pace of China’s achievement of energy conservation and emission reduction targets.

- It is considerably difficult for DWP project investment enterprises to achieve profitability without government subsidies, especially for the small and low-profit enterprises mentioned in this case. Therefore, China should continue to implement the electricity price subsidy policy and innovate the way by which the electricity price is subsidized. Issuance of green certificates and a quota system through the market could generate economic benefits.

- Equipment investment costs play a vital role in the economy of DWP projects [61]. The manufacturing cost of major equipment such as wind turbines will be further reduced with scientific and technological innovation. This can contribute to achieving higher economic benefits and provide space for normalized prices.

- Finally, the utilization hours of wind farms should be increased. This can increase revenue, achieve the emission reduction targets promised by China in the international community as quickly as possible, and promote a sound and rapid development pace of China’s economy.

Author Contributions

Funding

Conflicts of Interest

References

- Xinhuanet. Xi Jinping’s Speech at the Opening Ceremony of the Paris Climate Change Conference. 2015. Available online: http://www.xinhuanet.com//world/2015-12/01/c_1117309642.htm (accessed on 19 May 2020).

- Falcone, P.M. Tourism-based circular economy in Salento (South Italy): A SWOT-ANP analysis. Soc. Sci. 2019, 8, 216. [Google Scholar] [CrossRef] [Green Version]

- Thombs, R.P. When democracy meets energy transitions: A typology of social power and energy system scale. Energy Res. Soc. Sci. 2019, 52, 159–168. [Google Scholar] [CrossRef]

- Kokkinos, K.; Karayannis, V.; Moustakas, K. Circular bio-economy via energy transition supported by Fuzzy Cognitive Map modeling towards sustainable low-carbon environment. Sci. Total Environ. 2020, 721, 137754. [Google Scholar] [CrossRef] [PubMed]

- Falcone, P.M.; Lopolito, A.; Sica, E. Instrument mix for energy transition: A method for policy formulation. Technol. Forec. Soc. Chang. 2019, 148, 119706. [Google Scholar] [CrossRef]

- Owen, R.; Geraldine, B.; Fergus, L. Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 2018, 31, 137–145. [Google Scholar] [CrossRef]

- National Energy Administration. The Revolutionary Strategy of Energy Production and Consumption (2016–2030). 2017. Available online: http://www.gov.cn/xinwen/2017-04/25/content_5230568.htm (accessed on 8 June 2020).

- National Energy Administration. Notice of China Energy Administration on the Development of Decentralized Access Wind Power. 2011. Available online: https://www.doc88.com/p-7793288661915.html (accessed on 8 August 2020).

- National Energy Administration. Guidance on the Development and Construction of Decentralized Access Wind Power Projects. 2011. Available online: http://www.waizi.org.cn/doc/35139.html (accessed on 8 August 2020).

- National Energy Administration. Guidance on the Implementation of the “Thirteenth Five-Year” plan for Renewable Energy Development. 2017. Available online: http://zfxxgk.nea.gov.cn/auto87/201707/t20170728_2835.htm (accessed on 8 August 2020).

- National Energy Administration. Notice on Accelerating the Construction of a Decentralized Access Wind Power Project. 2017. Available online: http://zfxxgk.nea.gov.cn/auto87/201706/t20170606_2801.htm (accessed on 8 August 2020).

- Rao, A.G.; Van den Oudenalder, F.S.; Klein, S.A. Natural gas displacement by wind curtailment utilization in combined-cycle power plants. Energy 2019, 168, 477–491. [Google Scholar] [CrossRef]

- Li, C. Comprehensive review of renewable energy curtailment and avoidance: A specific example in China. Renew. Sustain. Energy Rev. 2015, 41, 1067–1079. [Google Scholar] [CrossRef]

- Bird, L.; Lew, D.; Milligan, M.; Carlini, E.M.; Estanqueiro, A.; Flynn, D.; Gomez-Lazaro, E.; Holttinen, H.; Menemenlis, N.; Orths, A.; et al. Wind and solar energy curtailment: A review of international experience. Renew. Sustain. Energy Rev. 2016, 65, 577–586. [Google Scholar] [CrossRef] [Green Version]

- Pei, W.; Chen, Y.; Sheng, K.; Deng, W.; Du, Y.; Qi, Z.; Kong, L. Temporal-spatial analysis and improvement measures of Chinese power system for wind power curtailment problem. Renew. Sustain. Energy Rev. 2015, 49, 148–168. [Google Scholar] [CrossRef]

- National Energy Administration. Notice on Doing a Good Job of Renewable Energy Consumption in the “Three North” Region. 2016. Available online: http://zfxxgk.nea.gov.cn/auto92/201602/t20160216_2202.htm (accessed on 8 June 2020).

- National Energy Administration. Notice on Promoting Electric Energy Storage to Participate in Peak Load Regulation Auxiliary Services in the “Three North” Region. 2016. Available online: http://zfxxgk.nea.gov.cn/auto92/201606/t20160617_2267.htm (accessed on 8 June 2020).

- National Energy Administration. Measures for the Administration of Full Guaranteed Acquisition of Renewable Energy Power Generation. 2020. Available online: http://guangfu.bjx.com.cn/news/20160328/720237.shtml (accessed on 8 June 2020).

- Energy Research Institute. Road Map for Wind Power Development in China 2050; Energy Research Institute: Beijing, China, 2020; pp. 58–67. [Google Scholar]

- Zhang, N.; Lu, X.; McElroy, M.B.; Nielsen, C.P.; Chen, X.; Deng, Y.; Kang, C. Reducing curtailment of wind electricity in China by employing electric boilers for heat and pumped hydro for energy storage. Appl. Energy 2016, 184, 987–994. [Google Scholar] [CrossRef] [Green Version]

- Shi, Q.; Ding, J.; Liu, K.; Yan, W. Economic optimal operation of microgrid integrated energy system with electricity, gas and heat storage. Electr. Power Autom. Equip. 2019, 39, 269–276. [Google Scholar] [CrossRef]

- Lu, Z.; Yang, Y.; Geng, L.; Pan, L.; He, L.; Li, X. Low-carbon economic dispatch of the integrated electrical and heating systems based on benders decomposition. Proc. CSEE 2018, 7, 1922–1933. [Google Scholar] [CrossRef]

- Lv, Q.; Jiang, H.; Chen, T.; Wang, H.; Lv, Y.; Li, W. Wind power consumption scheme of thermal power plant based on electric boiler and its national economic evaluation. Autom. Electr. Power Syst. 2014, 38, 6–12. [Google Scholar] [CrossRef]

- Valverde-Isorna, L.; Ali, D.; Hogg, D.; Abdel-Wahab, M. Modelling the performance of wind–hydrogen energy systems: Case study the hydrogen office in Scotland/UK. Renew. Sustain. Energy Rev. 2016, 53, 1313–1332. [Google Scholar] [CrossRef]

- Jiang, K.; Li, H.; Li, W.; Cheng, S. On several battery technologies for power grids. Autom. Electr. Power. Syst. 2013, 37, 47–53. [Google Scholar] [CrossRef]

- Gur, T.M. Review of electrical energy storage technologies, materials and systems: Challenges and prospects for large-scale grid storage. Energy Environ. Sci. 2018, 10, 3055. [Google Scholar] [CrossRef]

- Zhang, M.; Liang, J.; Sun, Y.; Ling, Z. Availability of distributed wind power—Battery energy storage system. Power Constr. 2016, 37, 29–34. [Google Scholar] [CrossRef]

- Schmidt, O.; Melchior, S.; Hawkes, A.; Staffell, I. Projecting the future levelized cost of electricity storage technologies. Joule 2019, 3, 81–100. [Google Scholar] [CrossRef] [Green Version]

- Dehghani-Sanij, A.R.; Tharumalingam, E.; Dusseault, M.B.; Fraser, R. Study of energy storage systems and environmental challenges of batteries. Renew. Sustain. Energy Rev. 2019, 104, 192–208. [Google Scholar] [CrossRef]

- Ge, W.; Gao, M.; Zhang, Y.; Li, J.; Che, X.; Liu, Y. Optimal economic dispatch of integrated energy system based on electric boiler for wind power accommodation. South. Power Syst. Technol. 2019, 13, 59–66. [Google Scholar] [CrossRef]

- Ehsan, A.; Yang, Q. Scenario-based investment planning of isolated multi-energy microgrids considering electricity, heating and cooling demand. Appl. Energy 2019, 235, 1277–1288. [Google Scholar] [CrossRef]

- Wang, F.; Li, D.; Fang, J.; Han, X. Economic evaluation of wind power consumption based on energy storage systems coordinated regenerative electric boilers. Advan. Technol. Electr. Engin. Energy 2019, 38, 50–56. [Google Scholar] [CrossRef]

- Li, G.; Zhuang, G.; Tian, C.; Wang, H. Multi-objective optimization control of wind power consumption based on regenerative electric boiler system integrated with large-scale energy storage. Electr. Power Autom. Equip. 2018, 38, 46–52. [Google Scholar] [CrossRef]

- Cui, Y.; Chen, Z.; Yan, G.; Tang, Y. Coordinated wind power accommodating dispatch model based on electric boiler and chp with thermal energy storage. Proc. CSEE. 2016, 36, 4072–4081. [Google Scholar] [CrossRef]

- Xu, M.; Jiang, D. Energy efficiency and economic analysis of wind power heating system. China Energy 2015, 37, 42–47. [Google Scholar] [CrossRef]

- Lv, Q.; Chen, T.; Wang, H.; Yu, T.; Li, Q.; Tang, W. Analysis on peak-load regulation ability of cogeneration unit with heat accumulator. Autom. Electr. Power. Syst. 2014, 38, 34–41. [Google Scholar] [CrossRef]

- Lv, Q.; Chen, T.; Wang, H.; Li, L.; Lv, Y.; Li, W. Combined heat and power dispatch model for power system with heat accumulator. Electr. Power Autom. Equip. 2014, 34, 79–85. [Google Scholar] [CrossRef]

- Li, J.; Xing, Z.; Xing, J.; Fan, X.; Yan, G. Desing of optimized planning platform of electric boiler with heat storage to enhance wind power consumption. Acta Energ. Solar. Sin. 2018, 39, 3270–3276. [Google Scholar]

- Benato, A.; Stoppato, A. Pumped thermal electricity storage: A technology overview. Therm. Sci. Eng. Prog. 2018, 6, 301–315. [Google Scholar] [CrossRef]

- Han, M.; Chang, X.; Li, J.; Yang, G.; Shang, T.U. Application and development of pumped storage technology. Sci. Technol. Rev. 2016, 34, 57–67. [Google Scholar] [CrossRef]

- Lv, Q.; Li, L.; Zhu, Q.; Wang, H.; Liu, R.; Li, W. Comparison of coal saving effect and national economy of three schemes of wind rejection and absorption. Autom. Electr. Power. Syst. 2015, 39, 75–83. [Google Scholar] [CrossRef]

- Ghorbani, N.; Makian, H.; Breyer, C. A GIS-based method to identify potential sites for pumped hydro energy storage-case of iran. Energy 2019, 169, 854–867. [Google Scholar] [CrossRef]

- Li, Y.; Miao, S.; Yin, B.; Luo, X.; Wang, J. Real-time dispatch model for power system with advanced adiabatic compressed air energy storage. Trans. China Electrotech. Soc. 2019, 34, 387–397. [Google Scholar] [CrossRef]

- Shu, Y.; Zhang, Z.; Guo, J.; Zhang, Z. A study on key factors and solution of renewable energy accommodation. Proc. CSEE 2017, 37, 1–9. [Google Scholar] [CrossRef]

- Zhang, Y.; Hu, B. Study on wind power exploitation, transmission and accommodation in northern region of China. Electr. Power 2012, 45, 1–6. [Google Scholar] [CrossRef]

- Li, G.; Zhao, J.; Yao, Z. Control strategy study roundup of intelligent microgrid. Electrotech. Electr. 2012, 1, 1–4. [Google Scholar] [CrossRef]

- Saponara, S.; Saletti, R.; Mihetpopa, L. Hybrid micro-grids exploiting renewables sources, battery energy storages and bi-directional converters. Appl. Sci. 2019, 9, 4973. [Google Scholar] [CrossRef] [Green Version]

- Rong, J.; Ai, X.; Wu, J.; Tian, Y.; Zhang, L. Unit commitment strage considering cooperated dispatch of high proportion of electric vehicles and wind power generation. Smart Power 2019, 47, 25–31. [Google Scholar] [CrossRef]

- Wang, L.; Wu, X.; Li, H.; Tong, H.; Yang, J. Research on cooperative optimal scheduling of flexible electric vehicles and distributed generator. Renew. Energy Res. 2020, 38, 252–258. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, H.; Zhang, S. Game model of wind power and electric vehicles as virtual power plants participating in the power market. Autom. Electr. Power. Syst. 2019, 43, 155–164. [Google Scholar] [CrossRef]

- Limmer, S.; Rodemann, T. Peak load reduction through dynamic pricing for electric vehicle charging. Int. J. Electr. Power Energy Syst. 2019, 113, 117–128. [Google Scholar] [CrossRef]

- Sun, H.; Li, Z.; Chen, A.; Zhang, Y.; Mei, C. Current status and development trend of hydrogen production technology by wind power. Trans. China Electrotech. Soc. 2019, 34, 4071–4083. [Google Scholar] [CrossRef]

- Duan, Q.; CNY, T.; Mei, S.; Chen, J. Energy coordination control of wind power-hydrogen energy storage and coal chemical multi-functional coupling system. High Volt. Technol. 2018, 44, 176–186. [Google Scholar] [CrossRef]

- Cai, G.; Chen, C.; Kong, L.; Peng, L. Control of hybrid system of wind/hydrogen/fuel cell/supercapacitor. Trans. China Electrotech. Soc. 2017, 32, 84–94. [Google Scholar] [CrossRef]

- Cai, G.; Chen, C.; Kong, L.; Peng, L.; Zhang, H. Modeling and control of grid-connected system of wind/PV/electrolyzer and SC. Power Syst. Technol. 2016, 40, 2982–2990. [Google Scholar] [CrossRef]

- Haghi, E.; Fwoler, M.; Raahemifar, K. Economic analysis of hydrogen production in context of a microgrid. In Proceedings of the IEEE International Conference on Smart Energy Grid Engineering, Oshawa, ON, Canada, 14–17 August 2017. [Google Scholar] [CrossRef]

- Cai, G.; Kong, L.; Xue, Y.; Sun, B. Overview of research on wind power coupled with hydrogen production technology. Autom. Electr. Power Syst. 2014, 38, 127–135. [Google Scholar] [CrossRef]

- Dorota, K. Fuzzy capital budgeting. Fuzzy Sets Syst. 2000, 11, 367–385. [Google Scholar] [CrossRef]

- Lin, Q. Financial Engineering, 3rd ed.; China Renmin University Press: Beijing, China, 2013. [Google Scholar]

- De Neufville, R. Real options: Dealing with uncertainty in systems planning and design. Int. Asses. 2003, 4, 26–34. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Projected Costs of Generating Electricity (2010 Edition); IEA: Paris, France, 2010; p. 154. [Google Scholar]

- FD.BJX.COM.CN. Taking the 10 MW Distributed Wind Power Project in the Eastern Region as a Sample to Calculate the Project Economy. 2020. Available online: http://news.bjx.com.cn/html/20180402/889137.shtml (accessed on 8 August 2020).

| Index | Equipment Purchase Cost | Construction and Installation Cost | Other Engineering and Construction Cost | Basic Reserve Cost | Interest during the Construction Period | Working Capital Investment | Total Cost |

|---|---|---|---|---|---|---|---|

| 10 MW Distributed Wind Power Grid Connection Project | 4988.71 | 897.08 | 887.05 | 139.4 | 57.76 | 30 | 7000 |

| Index | Power Generation Income | Coal Saving Income | Subsidy Income | Fixed Assets Recovery Income | Total Income |

|---|---|---|---|---|---|

| 10 MW Distributed Wind Power Grid-Connected Project | 1044.82 | 590.02 | 21.18 | 294.3 | 1950.32 |

| Index | NPV (CNY 10,000) | IRR (%) | Pt (year) |

|---|---|---|---|

| 10 MW Distributed Wind Power Grid-Connected Project | 437.21 | 9 | 9.04 |

| Factors | Equipment Investment (CNY 10,000) | Operating Cost (CNY 10,000) | Discount Rate (%) | Feed-in Tariff (CNY/kWh) |

|---|---|---|---|---|

| Reference value | 5000 | 150 | 8 | 0.34 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, H.; Du, Y.; Song, S.; Guo, Y. Key Technologies and Economic Analysis of Decentralized Wind Power Consumption: A Case Study in B City, China. Energies 2020, 13, 4147. https://doi.org/10.3390/en13164147

Huang H, Du Y, Song S, Guo Y. Key Technologies and Economic Analysis of Decentralized Wind Power Consumption: A Case Study in B City, China. Energies. 2020; 13(16):4147. https://doi.org/10.3390/en13164147

Chicago/Turabian StyleHuang, Hui, Yingying Du, Shizhong Song, and Yanlei Guo. 2020. "Key Technologies and Economic Analysis of Decentralized Wind Power Consumption: A Case Study in B City, China" Energies 13, no. 16: 4147. https://doi.org/10.3390/en13164147

APA StyleHuang, H., Du, Y., Song, S., & Guo, Y. (2020). Key Technologies and Economic Analysis of Decentralized Wind Power Consumption: A Case Study in B City, China. Energies, 13(16), 4147. https://doi.org/10.3390/en13164147