2. Literature Review

The main function of an audit of financial statements should be to protect the information needs of those who make certain management decisions based on financial statements [

4]. Auditors are generally required to evaluate the preparation of financial statements in all material in accordance with the requirements of the applicable financial reporting framework [

5]. An audit of financial statements includes the regulatory framework for the audit, the subject area of the audits, and the methodology for verifying individual sections of a financial statement and work to be audited. The audit of financial statements is not perfect, as it does not have clear requirements for the audit of the financial statements of an enterprise [

6].

Increasingly, corporations and large organizations disclose material information about their financial and non-financial capital in integrated reports. The intent of these integrated reports is to increase their legitimacy with institutions and stakeholders as they must communicate all aspects of their value creation activities, business models, and strategic priorities [

7,

8]. At the same time, one should take into account fluctuations in the integrated development of companies [

9].

In the energy sector, significant reductions in harmful emissions can be quickly achieved through a carbon tax. It is also necessary to take these data into account when auditing energy companies [

10]. Disclosure of carbon emissions is relatively low. It is assumed that the board of directors may have different levels of knowledge in relation to this information. Therefore, the level of information disclosure does not correspond to the number of board members. The final reason for this thesis is that the audit committee is more focused on the information contained in the financial statements rather than other information [

11]. Corporate governance mechanisms, such as the independence of the board of directors, audit committee, and property, have a positive effect on the financial performance of oil companies. However, the corporate governance mechanism composed of the board of directors has a negative impact on the financial performance of oil companies. Therefore, the number of board members should not be too large, so as not to outweigh the benefits. This implies that the size of the board must be manageable in order to run the business efficiently and effectively, as an increase in size can lead to ineffective decisions and, thus, negatively affect the results of operations. In addition, the independence of the board must be adopted and strengthened at all times to ensure that financial performance improves. It is also recommended to diversify the composition of the board of directors in terms of gender, skills, and experience [

12].

The effectiveness of corporate governance in its modern theory is measured by the added value it creates for an enterprise [

13]. The goal of the internal audit is to improve the efficiency of corporate governance itself, and, consequently, the result of the work of the internal audit service is assessed by the contribution it made to the creation of an additional value [

13]. This is carried out by the internal audit service by managing risks that arise before the enterprise, institution, and organization. The internal audit at the present stage is not as much a control as a process management tool [

14,

15].

There is now a general trend toward environmental reporting in an increasing number of companies [

16]. An environmental audit is required to check and diagnose environmental reporting as a financial audit including financial reporting. Today, more businesses that are fined for violations of safety at work simply want to take the initiative and reduce risks by implementing environmental audits as part of their regular activities [

17]. Sustainability reporting has become common practice and is generally considered a positive side of a company’s operations. The assurance statements do not demonstrate a substantial and reliable verification process. Rather, they look like hyper-realistic practices, largely divorced from critical sustainability issues and stakeholder interests. This practice is based on a rhetoric of self-referential and procedural accounting, underpinned by trust standards not tied to the specific requirements of sustainability reporting [

18,

19].

Climate change involves increasing corporate responsibility in running one’s business [

20]. Carbon emissions are the main source of climate change that countries must tackle [

21,

22]. Energy companies make a significant contribution to most of the carbon dioxide emissions [

23]. Since stakeholders now pay great attention to environmental issues, energy companies are aware that their activities related to a responsible attitude to the environment are important for stakeholders [

24]. This determined the purpose of this study to assess the impact of non-financial factors in the structure of financial audit on its quality in energy companies. Based on the formed goal, the following research hypotheses were determined.

H1: Integral indicators of the level of performance of a company according to financial statements, sustainable development, and corporate social responsibility have an impact on the representativeness of energy company results.

H2: The structure of a financial audit, which includes non-financial factors, has an impact on the representativeness of energy company results.

H3: Integral indicators of the level of company’s performance and the structure of financial audit in aggregate have an impact on the representativeness of energy company results.

3. Materials and Methods

The challenge for energy companies is to meet growing energy demand while improving air quality, reducing emissions, and addressing the challenges of climate change and resource diminution. Therefore, the introduction of non-financial information and environmental indicators in integrated reports is seen as a positive step and indicates a growing interest in environmental issues (including, in particular, negative environmental consequences of the organization’s activities) among stakeholders. To determine the integrated performance indicators of companies for the audit, indicators were formed in the following categories: economic, environmental, and social aspects of activities (

Table 1).

To assess the performance of the companies under study, the authors’ method was used by determining the length of the integrated audit vector (

). To do this, it is necessary to calculate the performance, which is determined on the basis of the length of the vector for each of the companies as follows.

where,

—integrated indicator of the company’s performance according to financial statements;

—integrated indicator of the company’s performance in the context of its sustainable development;

—integrated indicator of the company’s performance in the context of the effectiveness of corporate social responsibility.

The values calculated using the formula allow us to assess the degree of influence of the financial audit on the performance indicators of a particular company. Within the framework of this assessment, companies can be compared with each other. The main criterion of efficiency is the magnitude of the vector in comparison with the classical version of the financial audit and other companies.

Accordingly, when analyzing the impact of the classical financial audit (

on the performance indicators of the studied companies using this model, it is necessary to calculate changes in the financial component in the context of sustainable development and corporate responsibility (as integral components of a modern enterprise) and determine the length of the vector.

where

—change in the level of the integrated indicator of the company’s performance according to financial statements,

—change in the level of an integrated indicator of the company’s performance in the context of its sustainable development, —change in the level of the integrated indicator of the company’s performance in the context of the effectiveness of corporate social responsibility.

The main criterion of efficiency is the increase in the vector length, which implies the possibility of choosing the directions of transformation of the financial audit of energy companies. The proposed methodology can be used to increase the level for assessing the performance of companies by taking into account modern requirements of economic development, that is, as a way to justify decision-making on transforming the structure of financial analysis and conducting an integrated audit.

In general, the methodology of this study involves the determination of integral indicators, according to the economic, environmental, and social aspects of energy companies’ performance. On their basis, it is possible to determine the vectors of the financial audit in the context of the performance of companies by taking into account sustainable development and aspects of corporate social responsibility. The next step is a comparative analysis of the length of vectors of energy companies. Based on its results, at the final stage, a two-way analysis of variance with repetitions was carried out to confirm or refute the formed hypotheses of this study in the context of the influence of factors and the structure of financial audit for energy companies.

The study was carried out on the basis of materials from large energy (oil and gas) companies from five countries: Gazprom (Russian Federation), E.ON (Germany), Pioneer Natural Resources (PNR) (USA), JTXG (Japan), and Santos (Australia). For the study, companies from five countries have been selected that are representatives of different regions of the world. The main motivation for this has been the fact that companies in these countries prepare their financial statements in accordance with various accounting rules and standards. These companies were selected to study the regional features of financial audit as well as to determine the possibilities of its transformation in the context of sustainable development and corporate social responsibility.

4. Results

The common thing for all the companies under study is that the financial audit is conducted by an independent auditing company. In order to meet the requirements of Federal Law No. 307-FZ dated December 30, 2008, “On Auditing Activities,” an open competitive selection of an auditor for Gazprom is held annually. Over the past five years, LLC “financial and accounting consultants” has won the competitive selection of auditors for Gazprom. A financial audit is carried out on the basis of three types of reporting.

- -

accounting (financial) statements of Gazprom (parent company), formed in accordance with Russian Accounting Standards (RAS),

- -

consolidated accounting statements of the Gazprom Group, formed in accordance with RAS,

- -

consolidated financial statements of the Gazprom Group prepared in accordance with International Financial Reporting Standards.

At PNR, financial audits are conducted in accordance with the PCAOB (The Public Company Accounting Oversight Board) standards. An audit involves performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures to mitigate those risks. Such procedures include examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements.

For the financial audit of Santos, Australian accounting standards require that an assessment be made throughout the reporting period whether there is any indication that an asset is impaired or whether a previously recognized impairment is required to reverse. If any such indication exists, the entity must estimate the asset’s recoverable amount. In 2019, indications of impairment were identified for certain oil and gas generating units and an impairment charge of $37 million was recognized. This affected the performance of the company in the context of financial indicators. The assessment of oil and gas reserves and resources was carried out by experts who are specialist engineers. These estimates can have a significant impact on the financial statements and results of operations, primarily in the following areas.

- -

capitalization and classification of expenses as exploration and evaluation assets or oil and gas assets,

- -

appraisal of oil and gas assets and test for possible impairment,

- -

calculation of depreciation, recovery, and disposal of assets,

- -

calculation of reserves for their decommissioning and restoration.

In 2019, E.ON conducted an audit in two areas: transactions with Rheinisch-Westfälisches Elektrizitätswerk (RWE) (electricity generation company) and recoverability of goodwill.

JXTG places great emphasis on an internal audit. For example, the JXTG’s Audit and Oversight Committee conducts organized and systematic audits based on close collaboration between its full-time members with high intelligence analysis skills and external auditors. At the same time, as part of the internal audit report, special attention is paid to corporate social responsibility as well as the impact of JXTG on the external environment. This indicates the company’s intention to expand not only its responsibility to society, but also to demonstrate its effectiveness. An external financial audit takes place in accordance with national standards, but, in 2020, new auditing standards have been introduced in Japan, which are mandatory for public companies. Therefore, for JXTG, changes are coming in the process of conducting financial audits in the future.

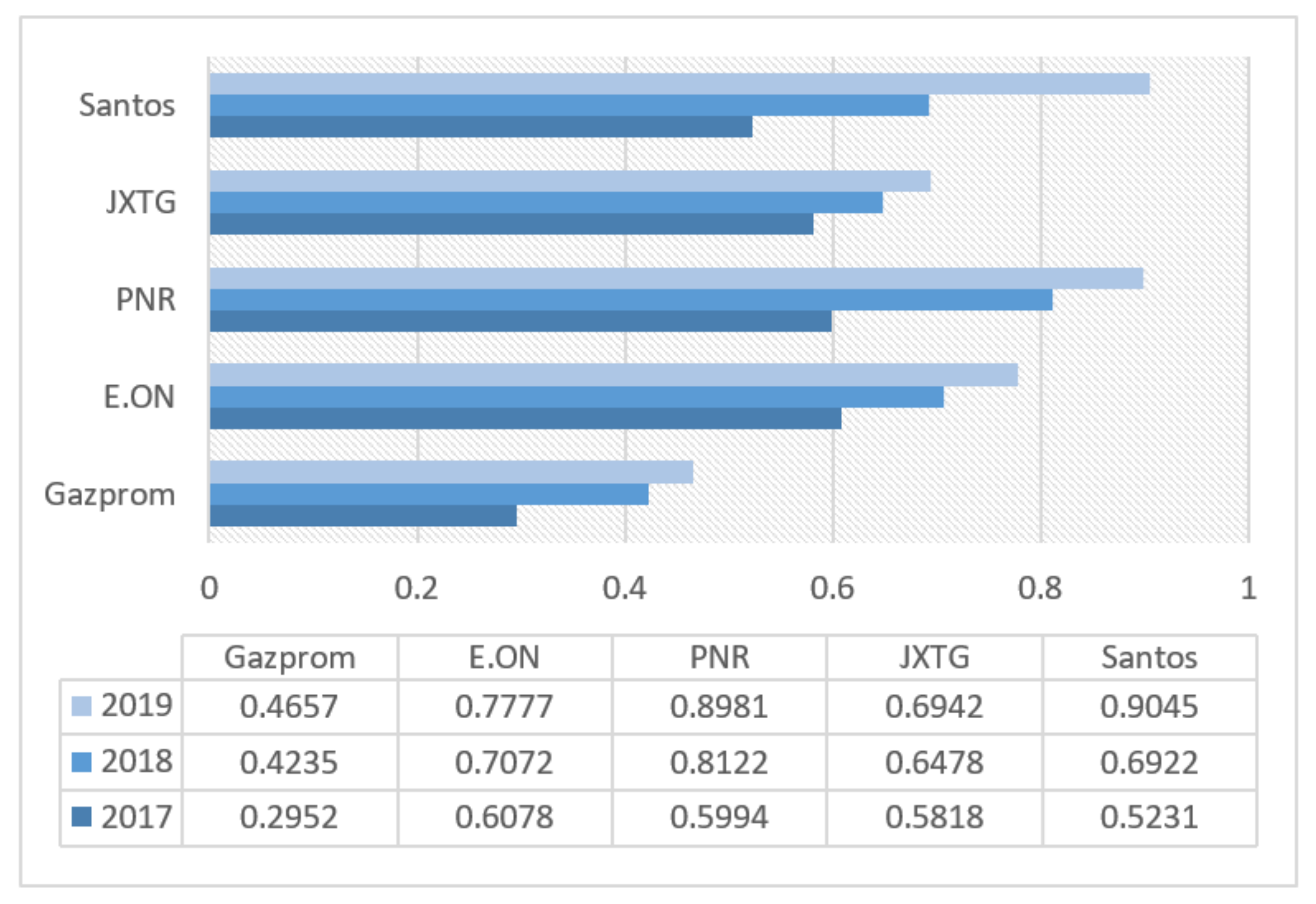

When conducting financial audits of energy companies, the main focus is on the indicators of financial statements and diagnostics of their compliance with the results obtained. Therefore, in order to determine the fundamental effects of the functioning of companies, an assessment of the performance of companies was carried out on the basis of integrated financial indicators for 2017–2019 (

Figure 1).

All the energy companies under study are characterized by positive dynamics of their performance. Moreover, each company has its own characteristics of conducting a financial audit. At Santos, there is a slight decline in integrated indicators in 2018. The financial audit of the Santos company is based on the assessment of external and internal factors, their significant changes, and collection and reconciliation of the obtained data with supporting financial documentation. Depending on the generating units, these procedures include:

- -

reconciliation of future production profiles with the latest reserves and resources estimates, current authorized development budgets, long-term asset plans, and past activities;

- -

assessing changes in commodity price assumptions taking into account contractual agreements, market prices, etc.;

- -

assessment of discount rates and exchange rates taking into account risk-free interest rates, market indices, market risk, etc.;

- -

assessing the operating performance of generating units against the plan, comparing future operating and development costs with current authorized budgets and long-term asset plans, and ensuring that they meet expectations based on other information obtained during the audit;

- -

examining the reasons for the change in recoverable amounts from previous estimates;

- -

checking the mathematical accuracy of discounted cash flow models.

For exploration and evaluation assets, an impairment test was performed for the indicators of impairment set out in AASB 6 Exploration for and Evaluation of Mineral Resources.

At PNR, when calculating proven oil and gas reserves, due to the complexity of the estimate in this context, management engaged independent petroleum engineers for the audit. The audit procedures included, inter alia, an assessment of the professional qualifications and objectivity of PNR engineers responsible for preparing the reserve estimate and the audit of the estimates themselves. For proven undeveloped reserves, an audit firm has assessed the development plan drawn up by PNR management for compliance with the requirements of the US Securities and Exchange Commission (SEC). The mathematical accuracy of exploration and production calculations was also verified, including a comparison of the proven oil and gas reserves used to compile the PNR reserve statement.

E.ON is not subject to an audit of the content of the corporate governance statement according to HGB (Handelsgesetzbuch: German Commercial Code). The consolidated annual statements in all material respects comply with the European Union International Financial Reporting Standards (EU IFRS) and additional requirements of German commercial law in accordance with the Code of Business Practice, and fairly and objectively reflect the assets, liabilities, and financial position of E.ON.

For Santos, the financial statement includes deferred income tax assets, including income tax losses and petroleum resource rent tax (PRRT). Determining the volume, likelihood, and timing of realization of deferred tax assets related to income taxes and PRRTs is subjective due to the interpretation of the PRRT and income tax legislation as well as the assessment of future taxable profit. There may be changes or uncertainties in the application of tax laws. This requires Santos to apply assumptions and clarifications when assessing the impact of tax laws. The actual tax results from the audit could differ from the estimates made by the company’s management.

PNR has internal control and audit over the preparation of financial statements. PNR’s internal control over the preparation of financial statements includes those principles and procedures that relate to accounting. They are sufficiently detailed, and accurately and reliably reflect the operations and disposal of the company’s assets. They provide reasonable assurance that transactions are recorded as necessary for the preparation of financial statements in accordance with generally accepted accounting principles, and that income and expenses of the company are made only with the permission of the company’s management and senior management. Prevention or timely detection of unauthorized acquisition, use, or disposal of company assets affecting the financial statements is ensured. Due to inherent limitations, PNR’s internal controls over financial reporting and auditing cannot prevent or detect incorrect data. In addition, projections of performance for future periods are subject to the risk that control may become inadequate due to changing conditions, or that compliance with policies or procedures may deteriorate.

JXTG has a Company Audit and Oversight Committee. It conducts organized and systematic audits with a high degree of efficiency and objectivity through appropriate collaboration between full-time committee members, who are empowered to gather information, and experienced independent external directors. Each committee member exercises voting rights as a director at board meetings and each director who is not a committee member exercises his/her voting rights on personnel and renumeration matters.

Under the pressure of the sustainable development paradigm, energy companies are forced to transform their operations (including changing approaches to the extraction and use of resources). In order to determine the need for transformation of accounting systems in this context, the financial results were assessed by taking into account the efficiency of sustainable development of the companies under study (

Figure 2).

Having compared the trends of integrated indicators for assessing the performance of the studied energy companies, taking into account sustainable development, one can state the same positive dynamics of their growth as in the context of a traditional financial audit.

It should be noted that, in 2018, Santos embarked on a program to convert oil well pumps to solar power in the Cooper River Basin. Converting oil well pumps to solar energy has brought clear environmental benefits through reduced crude oil consumption, long-distance fuel transport, and emissions associated with the combustion of crude oil. The pilot well has proven that solar power and batteries can remain reliable and affordable in the harsh conditions of the Cooper River Basin. It was Australia’s first solar-powered, battery-powered off-grid oil well.

Since E.ON managed renewable energy activities prior to their sale, these activities continued to be fully included in their respective key performance indicators and segment reporting. Due to contractual agreements with RWE, in September 2019, E.ON lost control over almost all renewable energy activities. After reclassification to a foreign exchange gain or loss, which was previously recognized directly in equity, the deconsolidation resulted in a total gain of €0.8 billion, which was recorded in “Discontinued operations” together with current business-related profit or loss. The transferred operating activities up to 18 September 2019 were accounted for in the segment reporting and key performance indicators of E.ON’s management. As a result of the sale of nuclear power shares, a loss of EUR 0.1 billion was received. At the same time, the company retained its positive dynamics of performance.

At JXTG, senior management and corporate auditors are required to work toward realizing the company’s philosophy, sustaining growth for the JXTG Group, and achieving an increase in corporate value over the medium and long-term. To this end, to support efforts to expand the necessary knowledge and skills, JXTG provides the opportunity for each of them to receive training related to the Companies Law, internal audit and control systems, accounting and taxes, business strategies, and organizations. In addition, the company pays for the costs associated with self-study.

The introduction of corporate social responsibility practice by energy companies requires the introduction of additional socially oriented measures. In the process of financial audit, their control ex post facto is very difficult to carry out. At the same time, corporate social responsibility is an additional lever of pressure on the company from employees and society, which stimulates the company to be stricter about corporate accounting. Therefore, an assessment was made of the performance of energy companies in the context of corporate social responsibility (

Figure 3).

Gazprom’s social responsibility is implemented in such key areas as support for culture and art, sports, socially unprotected segments of the population, company’s employees, environmental projects, and the trade union. At the same time, among the companies under study, Gazprom’s social responsibility has, although stable, the lowest results. When conducting a financial audit, this component of performance does not have a significant impact. This encourages the company to focus more on financial performance. In order to improve the efficiency of financial auditing, E.ON considers effective corporate governance as the central basis for responsible and value-based governance, transparent disclosure, and proper risk management.

The most effective corporate social responsibility is characteristic of PNR. The company views sustainability as an interdisciplinary focus that balances economic growth, environmental management, and social responsibility. PNR develops natural resources while supporting the relevant communities in the area and protecting the environment. Socially, Pioneer maintains a proactive safety culture, supports a diverse workforce, and inspires team spirit to innovate. The company’s Board of Directors has a Health, Safety, and Environment Committee and a Nominating and Corporate Governance Committee to ensure that proper ESG (environmental, social, and corporate governance) protocols are in place and to foster a culture of continuous improvement in safety and environmental practices.

Taking into account such a positive result of the mutual development of these components, an assessment of the vectors of classical and integrated financial audit for the studied energy companies was carried out (

Figure 4) in order to determine the impact of the transformation of a financial audit in this direction.

Vectors allow us not only to compare companies in the same area of operation, but also to determine the degree of influence of financial audit on their performance indicators. Despite the annual increase in financial indicators according to the classical audit option, the vector of an integrated audit is of less importance in Gazprom and E.ON. This is due to insufficiently effective corporate social responsibility, which influenced the results of the financial component and sustainable development of these companies. At the same time, for PNR, JTXG, and Santos, the vector of integrated audit exceeds the value of the vector of a classical audit. The prerequisites for this are effective sustainable development based on a financial component and corporate social responsibility, which drive the increase in company value and the creation of value for consumers. This is essential not only for the development of these companies at the national, but also at the global level. Thus, changes in the conditions for the formation of efficient activities of energy companies in the direction of not only the financial component, but also sustainable development and social responsibility require the transformation of financial audit in the context of its integration.

For the purpose of a deeper study of the level of influence of the factors included in the integral indicators

, and the structure of the financial audit

on the representativeness of performance indicators of companies, an analysis of variance was carried out. The results of this are shown in

Table 2.

The results of analysis of variance refute the first and third hypotheses because, for all the companies under study, changes in the factors included in the structure of financial audit have no significant effect (p-value > 0.05). By themselves, the integral indicators of the level of a company’s performance, according to financial statements, sustainable development, and corporate social responsibility, as well as in conjunction with changes in the audit structure, do not have an impact on the representativeness of energy company results. At the same time, for four companies, the structure of financial audit has a significant impact on the representativeness of performance indicators of companies. This confirms the second hypothesis (p-value < 0.05). Thus, the structure of a financial audit, including non-financial factors, has an impact on the representativeness of energy company results. Based on the sum of squares (SS) in the overall influence of the factors under study, it is possible to determine the degree of influence of a financial audit structure on the interpretation of studied energy companies’ performance. The greatest influence of the structure of financial audit is observed for Santos (53%), Gazprom (38%), and JXTG (38%).

5. Discussion

The importance of the results of this study is due to the fact that consistency and comparability of information improve the quality of reporting, taking into account all stakeholders. Without consistency and comparability, the relevance of information is very low [

16]. For example, share price has become a very important indicator for shareholders, banks, and financial institutions when assessing the performance of companies [

28]. The oil and gas industry seems to be going through a difficult era of development due to the market prices of its products. In addition, climate change and renewable energy are barriers to fossil energy [

29,

30]. Over the past seven years, the selected companies’ energy recovery rates and the financial return on unconventional oil and gas operations have shown distinctly different trends as a result of fluctuations in oil prices. However, their composite energy/financial performance indicators do not show a significant trend that was different from the cases for any of the individual indicators. Proposed in this study, the complex (integrated) indicator that combines both energy and financial performance indicators can be more accurate than either of them individually for measuring the sustainability and true value of a company or business unit, taking into account both economic and biophysical factors [

31]. Summary statistics, according to the indicators system proposed in this study, will be more useful to investors and policy analysts than the various energy efficiency statistics in the reports of the Global Reporting Initiative (GRI), which is voluntarily compiled by various companies [

32]. These summary statistics will motivate companies to innovate and improve efficiency and achieve government energy and environmental policy goals, even if the price of raw materials makes it easier to achieve financial goals [

33]. However, internal controls have a greater impact on the financial performance of public corporations in the energy sector, which is followed by stakeholder management, organizational culture, and leadership.

Given that stakeholders, namely investors, are concerned with environmental information, it can be argued that the proposed integral indicator based on the determination of the vector length can affect the disclosure of information on harmful emissions in combination with other indicators of a company’s socio-economic activity. The governance instruments relevant to disclosure are board size, management ownership, and an audit committee. It is anticipated that the size of the board, the degree of management ownership, and the composition of the audit committee may affect carbon disclosures [

7,

34,

35].

This study confirms a significant positive relationship between corporate social responsibility practices and corporate financial performance. This is due to the fact that the annual report is a general document that companies regularly prepare, and is widely used in diagnosing the activities of a business structure related to corporate social responsibility [

36].

Energy analysis has recently been added to the annual reporting system of Russian gas companies. This new practice indicates that corporate reports are improving their analysis by addressing energy issues and the financial efficiency of energy production. However, the use of energy aggregates is limited in these annual reports [

37]. Therefore, the proposed methodological approach of this study can be useful, so far, at the level of an internal audit of energy companies. This is confirmed by the fact that some publicly interested entities, including listed companies already disclose non-financial information in their corporate reports. They can be driven by raising awareness of corporate social responsibility [

38]. In addition, they can be influenced by the institutions and expectations of stakeholders regarding the role of business in society [

39]. In their integrated reporting (IR), report writers often combine both financial and material information about environmental, social, and governance performance (ESG). Their corporate communications stimulate integrated thinking as report writers gather information about the governance, performance, and prospects of their organizations in the strategic and operations departments [

40,

41]. Therefore, they can use regulatory instruments, including standards or frameworks, to support their internal planning and control. The implemented internationally recognized standards, approaches, and principles have led to significant improvements in the dialogue of organizations with a growing number of stakeholders [

42] and help them increase their accountability for a broad base of financial and non-financial capital [

7]. Therefore, the results of this study can become a starting point for expanding the range of indicators of companies’ performance, taking into account non-financial factors.

Given the environmental component of the methodological approach proposed in the study, energy companies should pay special attention to information disclosure in this context. Environmental and economic instruments for managing the activities of oil and gas enterprises should be among the most significant elements of managing the economic activities of the industry of the corresponding region and the state as a whole and develop in the following main areas:

- -

improving the mechanism of payments for environmental pollution;

- -

orientation of fines and tariffs on the amount of necessary environmental protection costs;

- -

environmental audit for compliance with environmental requirements, standards, and regulations;

- -

taking into account the environmental factor in pricing and tax policy;

- -

exemption from income tax for activities aimed at environmental protection;

- -

exemption from value-added tax on works financed from environmental funds [

43,

44].

One of the limitations of using an integrated audit is to obtain a sufficient level of confidence in it, especially on the basis of an audit report. In this regard, one should take into account the expansion of the expectations of this audit users by including their interests in additional quantitative and qualitative parameters that should be taken into account when forming the criteria for evaluating information. Thus, in the future, it is necessary to conduct a study on approaches for identifying and assessing user expectations of the results contained in the integrated audit of business entities [

45]. Taking into account the versatile orientation of indicators for conducting an audit in the future, this study can focus on specific components of the conducted assessment to deepen and concretize the parameters of an integrated audit.