Emission Mitigation and Energy Security Trade-Off: Role of Natural Gas in the Indian Power Sector

Abstract

:1. Introduction

2. Natural Gas as a Transition Fuel

2.1. Sustainable Energy Management Practices

2.2. Techno-Economical Aspect

2.3. The Geopolitical Aspect

3. Methodology

3.1. Scenario Analysis

3.1.1. Key Assumption

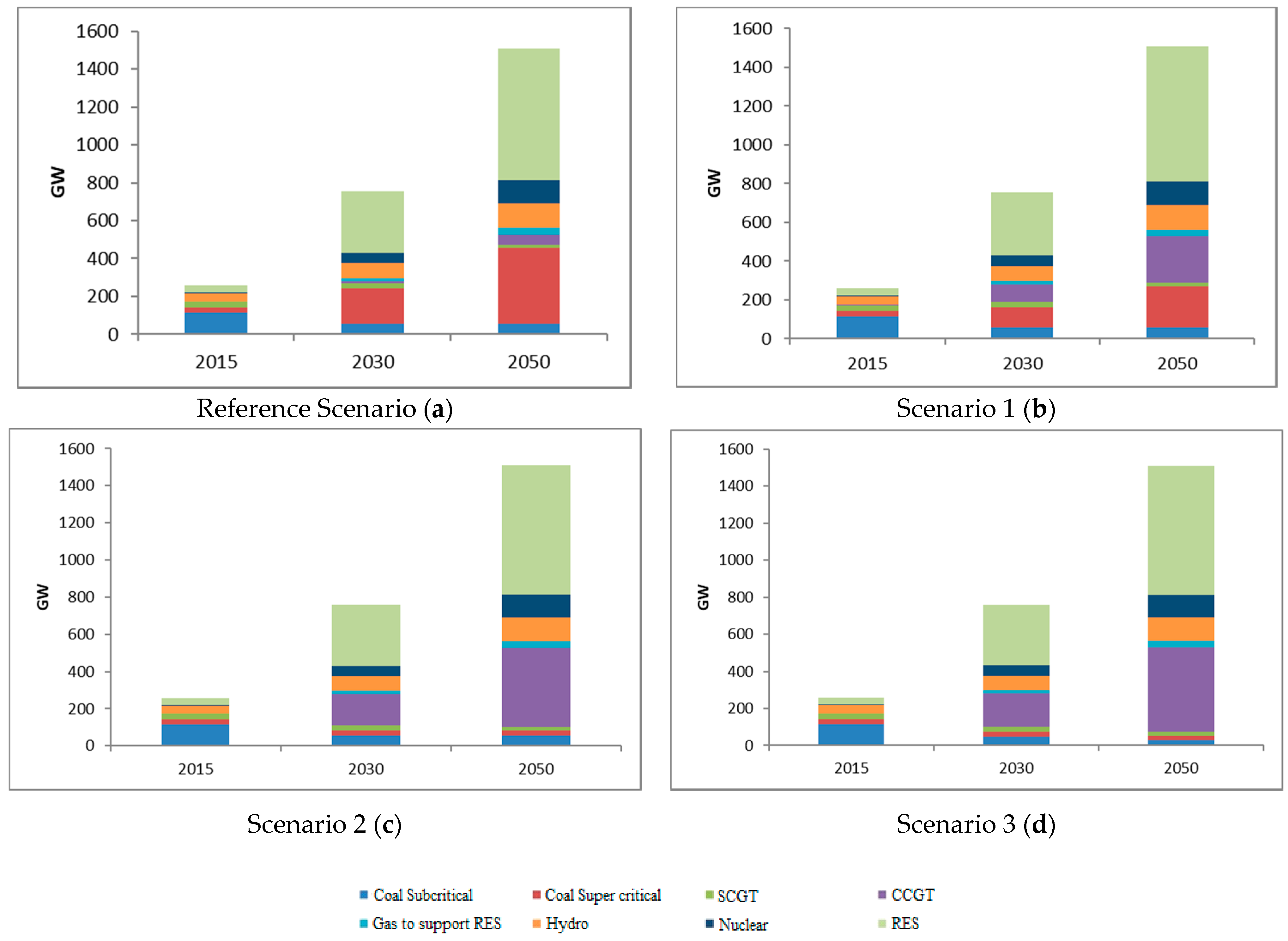

- The commensurate supply-side capacity expansion has been assumed for the demand increase. The technology and fuel choice are assumed to align with various policy measures in the National Electricity Plan, 2016 [20]. While the total installed capacity grows over time, they are assumed to be the same under all scenarios in a particular year.

- The share of non-fossil fuel grows over time, as mentioned in the NDC targets, but does not vary across scenarios. In terms of installed capacity, where the fossil to non-fossil share is approximately 7:3 in 2015, it is almost reversed to become 3:7 in 2050 as per vision documents (Table 1). The figures in Table 1 are reflections of India’s NDC targets up to 2030; beyond that, it has been assumed that the contribution of fossil fuel will be reduced by 1% every five years up to 2050 [34].

- Coal and natural gas constitute fossil fuel shares, and the non-fossil sources consist of nuclear, large hydro, and renewable sources, including solar, wind, small hydro, and biomass [33]. Different scenarios are developed to explore the implications of the different mixes of natural gas and coal in fossil fuel-based power generation. The scenarios are constructed for the time frame 2015–2050, and the assumptions of these scenarios are summarized in Table 2.

| Source | 2015 | 2020 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 |

|---|---|---|---|---|---|---|---|---|

| Fossil | 66% | 53% | 45% | 40% | 39% | 38% | 37% | 36% |

| Non-Fossil | 34% | 47% | 55% | 60% | 61% | 62% | 63% | 64% |

| Non-Fossil Energy Sources | Potential [35] | Status (2015) [20] | Target [6] |

|---|---|---|---|

| Wind | 302 GW | 23.76 GW installed capacity | 60 GW installed capacity by 2022 |

| Solar | 750 GW | 4.06 GW installed capacity | 100 GW by 2022 |

| Biomass | 25 GW | 4.4 GW current capacity | 10 GW by 2022 |

| Hydro | Large hydro 149 GW, Small hydro 21 GW | 46.1 GW current installed capacity out of 4.1 GW small hydro and 41.99 GW large hydro | - |

| Nuclear | - | 5.78 GW current installed capacity | 63 GW by 2032 |

3.1.2. Reference Scenario

3.1.3. Other Scenarios

3.2. Determination of Emission Level and Annual Fuel Requirement

3.3. Energy Security Indicators

4. Results and Discussion

4.1. Emission Scenario

4.2. Fuel Requirement

4.3. Energy Security Indicators

Projection of Energy Security by 2030

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BCM | Billion Cubic Meters |

| CAGR | Compound Annual Growth Rate |

| CBM | Coal Bed Methane |

| CCGT | Combined Cycle Gas Turbine |

| CCS | Carbon Capture and Storage |

| EF | Emission factor |

| GDP | Gross Domestic Product |

| GHGs | Greenhouse gases |

| GW | Gigawatt |

| GWP | Global Warming Potentials |

| HHI | Herfindahl–Hirschman Index |

| IEA | International Energy Agency |

| IGCC | Integrated Gasification Combined Cycle |

| IPCC | Intergovernmental Panel on Climate Change |

| LNG | Liquefied Natural Gas |

| MT/MWh | Megatons/Megawatt Hour |

| NDC | Nationally Determined Contributions |

| O and M | Operation and Maintenance |

| PLF | Plant Load Factor |

| ppm CO2e | Parts per million CO2 equivalent |

| SCGT | Simple Cycle Gas Turbine |

| SHR | Station Heat Rate |

| SWI | Shannon–Weiner index |

| SWN | Shannon–Wiener–Neumann index |

| TWh | Terawatt-hour |

| UNDP | United Nations Development Programme |

| WEO | World Energy Outlook |

References

- UNFCCC. Aggregate Effect of the Intended Nationally Determined Contributions: An Update. 2016. Available online: http://unfccc.int/resource/docs/2016/cop22/eng/02.pdf (accessed on 10 June 2017).

- Masson-Delmotte, V.P.; Zhai, H.-O.; Pörtner, D.; Roberts, J.; Skea, P.R.; Shukla, A.; Pirani, W.; Moufouma-Okia, C.; Péan, R.; Pidcock, S.; et al. (Eds.) IPCC: Global Warming of 1.5 °C. In An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; 2018; (In press). Available online: https://www.ipcc.ch/site/assets/uploads/sites/2/2019/05/SR15_SPM_version_report_LR.pdf (accessed on 3 May 2021).

- IPCC. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Edenhofer, O.R., Pichs-Madruga, Y., Sokona, E., Farahani, S., Kadner, K., Seyboth, A., Adler, I., Baum, S., Brunner, P., Eickemeier, B., et al., Eds.; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Das, N.; Roy, J. India can increase its mitigation ambition: An analysis based on historical evidence of decoupling between emission and economic growth. Energy Sustain. Dev. 2020, 57, 189–199. [Google Scholar] [CrossRef]

- Press Information Bureau, Government of India Website. Promote New & Renewable Energy to Ensure Energy Security, to Protect Climate & to Reduce Pollution. Available online: http://pib.nic.in/newsite/PrintRelease.aspx?relid=189632 (accessed on 3 May 2021).

- Government of India. Intended Nationally Determined Contributions. New Delhi. 2015. Available online: https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/India%20First/INDIA%20INDC%20TO%20UNFCCC.pdf (accessed on 25 May 2021).

- Government of India. India Energy Security Scenario 2047; Niti Aayog, Government of India: New Delhi, India, 2016.

- Viebahn, P.; Vallentin, D.; Höller, S. Prospects of carbon capture and storage (CCS) in India’s power sector—An integrated assessment. Appl. Energy 2014, 117, 62–75. [Google Scholar] [CrossRef] [Green Version]

- Kapila, R.V.; Chalmers, H.; Haszeldinea, S. CCS prospects in India: Results from an expert stakeholder survey. Energy Procedia 2011, 4, 6280–6287. [Google Scholar] [CrossRef] [Green Version]

- Parikh, J. Analysis of Carbon Capture and Storage (CCS) Technology in the Context of Indian Power Sector. 2010. Available online: https://www.irade.org/website%20documents/CCS_IRAde_DST.pdf (accessed on 21 November 2017).

- Akash, A.R.; Rao, A.B.; Chandel, M.K. Prospects of implementing CO2 capture and sequestration (CCS) in the proposed supercritical coal power plants in India. Energy Procedia 2016, 90, 604–612. [Google Scholar] [CrossRef]

- Busch, C.; Gimon, E. Natural Gas versus Coal: Is Natural Gas Better for the Climate? Electr. J. 2014, 27, 97–111. [Google Scholar] [CrossRef]

- Safari, A.; Das, N.; Langhelle, O.; Roy, J.; Assadi, M. Natural gas: A transition fuel for sustainable energy system. Energy Sci. Eng. 2019, 7, 1075–1094. [Google Scholar] [CrossRef]

- Brown, S.P.; Huntington, H.G. Energy security and climate change protection: Complementarity or trade-off? Energy Policy 2008, 36, 3510–3513. [Google Scholar] [CrossRef]

- Chu, S.; Cui, Y.; Liu, N. The path towards sustainable energy. Nat. Mater. 2016, 16, 16–22. [Google Scholar] [CrossRef] [PubMed]

- Abdul Latif, S.N.; Chiong, M.S.; Rajoo, S.; Takada, A.; Chun, Y.-Y.; Tahara, K.; Ikegami, Y. The Trend and Status of Energy Resources and Greenhouse Gas Emissions in the Malaysia Power Generation Mix. Energies 2021, 14, 2200. [Google Scholar] [CrossRef]

- Zimon, G.; Zimon, D. The Impact of Purchasing Group on the Profitability of Companies Operating in the Renewable Energy Sector—The Case of Poland. Energies 2020, 13, 6588. [Google Scholar] [CrossRef]

- IPCC. IPCC Guidelines for National Greenhouse Gas Inventories, Vol 2, Energy. By the Intergovernmental Panel on Climate Change. 2006. Available online: https://www.ipcc-nggip.iges.or.jp/public/2006gl/vol2.html (accessed on 18 November 2017).

- Government of India. Ministry of Coal. Provisional Coal Statistics 2014–2015. 2015. Available online: http://coal.nic.in/sites/default/files/2020-01/Provisional_Coal_Statistics_2014-15.pdf (accessed on 20 November 2017).

- Website of Government of India, Ministry of Power. National Electricity Plan. 2016. Available online: https://powermin.gov.in/en/content/national-electricity-plan-0 (accessed on 23 May 2021).

- Ministry of Petroleum & Natural Gas, Government of India. Hydrocarbon Vision 2025. New Delhi. 2000. Available online: http://petroleum.nic.in/sites/default/files/vision.pdf (accessed on 20 November 2017).

- Ministry of Petroleum & Natural Gas, Government of India, Petroleum and Natural Gas Statistics 2016–2017. New Delhi. 2017. Available online: http://www.indiaenvironmentportal.org.in/files/file/pngstat%202016-17.pdf (accessed on 21 November 2017).

- Petroleum & Natural Gas Regulatory Board, Vision 2030: Natural Gas Infrastructure in India. 2013. Available online: https://www.pngrb.gov.in/Hindi-Website/pdf/vision-NGPV-2030-06092013.pdf (accessed on 21 November 2017).

- Safari, A.; Das, N.; Jafari, S.; Langhelle, O.; Roy, J.; Assadi, M. Role of gas-fuelled solutions in support of future sustainable energy world: Part II: Case Studies. In Sustainable Energy Technology and Policies. Green Energy and Technology; De, S., Bandyopadhyay, S., Assadi, M., Mukherjee, D.A., Eds.; Springer: Singapore, 2018; pp. 35–86. ISBN 978-981-10-7188-1. [Google Scholar]

- Power Technology Home Page. Irsching Siemens Gas Turbine, Germany. Available online: https://www.power-technology.com/projects/irsching/ (accessed on 3 June 2021).

- Zhang, X.; Sugishita, H.; Ni, W.; Li, Z. Economics and performance forecast of gas turbine combined cycle. Tsinghua Sci. Technol. 2015, 110, 633–636. [Google Scholar] [CrossRef]

- Colpier, U.C.; Cornland, D. The economics of the combined cycle gas turbine—an experience curve analysis. Energy Policy 2002, 30, 309–316. [Google Scholar] [CrossRef]

- Sims, R.E.; Rogner, H.-H.; Gregory, K. Carbon emission and mitigation cost comparisons between fossil fuel, nuclear and renewable energy resources for electricity generation. Energy Policy 2003, 31, 1315–1326. [Google Scholar] [CrossRef]

- Jeong, S.-J.; Kim, K.-S.; Park, J.-W.; Lim, D.-S.; Lee, S.-M. Economic comparison between coal-fired and liquefied natural gas combined cycle power plants considering carbon tax: Korean case. Energy 2008, 33, 1320–1330. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook; International Energy Agency: Paris, France, 2017. [Google Scholar]

- IEA. World Energy Outlook; International Energy Agency: Paris, France, 2018. [Google Scholar]

- IEA. India Energy Outlook; International Energy Agency: Paris, France, 2015. [Google Scholar]

- Website of Government of India, Ministry of Power. Growth of Electricity Sector in India from 1947–2017. 2017. Available online: https://cea.nic.in/wp-content/uploads/pdm/2020/12/growth_2020.pdf (accessed on 20 November 2017).

- Das, N.; Roy, J. Making Indian Power Sector Low Carbon: Opportunities and Policy Challenges. In Sustainable Energy and Transportation; Gautam, A., De, S., Dhar, A., Gupta, J.G., Pandey, A., Eds.; Springer: Singapore, 2018; pp. 163–183. ISBN 978-981-10-7508-7. [Google Scholar]

- Ministry of New and Renewable Energy, Government of India. Year-End Review 2017—MNRE. Available online: http://pib.nic.in/PressReleaseIframePage.aspx?PRID=1514215 (accessed on 23 May 2021).

- Central Electricity Authority, Ministry of Power, Government of India, Annual Report 2014–2015. 2015. Available online: https://vol11.cases.som.yale.edu/sites/default/files/cases/mera_gao_power/annual_report-2015.pdf (accessed on 20 November 2017).

- Ministry of Power, Government of India. Ultra Mega Power Projects. 2015. Available online: https://powermin.nic.in/sites/default/files/uploads/ultra_mega_power_project.pdf (accessed on 24 February 2021).

- Planning Commission of India. Twelfth Five Year Plan; Planning Commission of India: New Delhi, India, 2012.

- International Institute for Applied Systems Analysis (IIASA). Global Energy Assessment; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Chuang, M.C.; Ma, H.W. Energy security and improvements in the function of diversity indices—Taiwan energy supply structure case study. Renew. Sustain. Energy Rev. 2013, 24, 9–20. [Google Scholar] [CrossRef]

- Bhattacharya, S.C. Energy Security Issues in Energy Economics; Springer: Berlin/Heidelberg, Germany, 2011; pp. 463–484. ISBN 978-0-85729-268-1. [Google Scholar]

- Kruyt, B.; Vuuren, D.P.V.; Vries, H.J.M.; Groenenberg, H. Indicators for energy security. Energy Policy 2009, 37, 2166–2181. [Google Scholar] [CrossRef]

- United Nations Development Programme. World Population Prospects: The 2017 Revision; United Nations: New York, NY, USA, 2017. [Google Scholar]

- Ministry of Statistics and Programme Implementation, Government of India. Energy Statistics 2016. Available online: http://www.mospi.nic.in/publication/energy-statistics-2016 (accessed on 21 November 2017).

- Indian Bureau of Mines; Ministry of Mines; Government of India. Indian Minerals Yearbook; Indian Bureau of Mines: New Delhi, India, 2015.

- World Bank Home Page. Available online: https://databank.worldbank.org/reports.aspx?source=worldwide-governance-indicators (accessed on 23 May 2021).

| Scenario | Coal | Gas | Non-Fossil |

|---|---|---|---|

| Reference Scenario | Subcritical coal capacity will gradually decline up to 2030, starting from 2020. Capacity addition to coal-based power generation will be only through supercritical technology. | The existing capacity of SCGT will remain unchanged up to 2025 and continue to decline at a 10% rate every five years after that. New capacity addition to natural gas will be mainly in CCGT based power generation at a 10% rate every five years. SCGT capacity of 5% of total renewable capacity to support grid balance. | Following the current trend of capacity addition to hydro, 12 GW capacity will be added to large hydro every five years. The total installed capacity of solar is estimated to be approximately 480 GW by 2050. |

| Scenario 1 | In total, 50% of the additions to fossil fuel-based capacity will be through coal-based supercritical plants, and the rest will be through natural gas-based CCGT. | The same as the Reference Scenario. | |

| Scenario 2 | No coal-based supercritical capacity additions will take place after 2015, and it remains constant at 26 GW | Capacity addition to supercritical power generation under the reference scenario will now be shifted to CCGT. | The same as the Reference Scenario. |

| Scenario 3 | Existing coal-based subcritical capacity will gradually but partially be replaced by CCGT in a phased manner. | The same as the Reference Scenario. | |

| Emission Factor and GWP | CO2 | CH4 | N2O | Source |

|---|---|---|---|---|

| Emission factor of Coal (kg/TJ) | 95,810 | 1.00 | 1.50 | [18] |

| Emission factor of Natural Gas (kg/TJ) | 56,100 | 1.00 | 1.00 | [18] |

| Emission factor Biomass (kg/TJ) | 112,000 | 30 | 4 | [18] |

| Global Warming Potential of 100 years | 1 | 34 | 298 | [3] |

| Continents/Sub-continents | Market Share (xi) | xi^2 | xi × Negln (xi) | Political Stability = bi | Share of Domestic Production = gi | bi × xi Neg ln(xi)(1 + gi) |

|---|---|---|---|---|---|---|

| Middle East and Caspian | 0.89 | 0.79 | 0.10 | 3.1 | 0.67 | 0.55 |

| Asia | 0.04 | 0.00 | 0.14 | 2.7 | 0.67 | 0.62 |

| Africa | 0.06 | 0.00 | 0.17 | 2.4 | 0.67 | 0.68 |

| Europe | 0.00 | 0.00 | 0.03 | 3.6 | 0.67 | 0.16 |

| Total | HHI = 0.80 | SWI = 0.44 | SWN = 2.01 |

| Continents/Sub-Continents | Market Share (xi) | xi^2 | xi × Neg(ln (xi)) | Political Stability = bi | Share of Domestic Production = gi | bi × xi Neg ln(xi)(1 + gi) |

|---|---|---|---|---|---|---|

| Middle East and Caspian | 0.25 | 0.06 | 0.35 | 3.1 | 0.46 | 1.59 |

| USA | 0.08 | 0.01 | 0.20 | 3.6 | 0.46 | 1.06 |

| Russia | 0.10 | 0.01 | 0.23 | 2.1 | 0.46 | 0.69 |

| Africa | 0.20 | 0.04 | 0.32 | 2.7 | 0.46 | 1.27 |

| Latin America | 0.07 | 0.00 | 0.19 | 3.0 | 0.46 | 0.80 |

| Australia | 0.25 | 0.06 | 0.35 | 4.0 | 0.46 | 2.04 |

| Europe | 0.05 | 0.00 | 0.15 | 3.5 | 0.46 | 0.76 |

| Total | HHI = 0.19 | SWI = 1.78 | SWN = 8.21 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Das, N.; Dasgupta, S.; Roy, J.; Langhelle, O.; Assadi, M. Emission Mitigation and Energy Security Trade-Off: Role of Natural Gas in the Indian Power Sector. Energies 2021, 14, 3787. https://doi.org/10.3390/en14133787

Das N, Dasgupta S, Roy J, Langhelle O, Assadi M. Emission Mitigation and Energy Security Trade-Off: Role of Natural Gas in the Indian Power Sector. Energies. 2021; 14(13):3787. https://doi.org/10.3390/en14133787

Chicago/Turabian StyleDas, Nandini, Shyamasree Dasgupta, Joyashree Roy, Oluf Langhelle, and Mohsen Assadi. 2021. "Emission Mitigation and Energy Security Trade-Off: Role of Natural Gas in the Indian Power Sector" Energies 14, no. 13: 3787. https://doi.org/10.3390/en14133787

APA StyleDas, N., Dasgupta, S., Roy, J., Langhelle, O., & Assadi, M. (2021). Emission Mitigation and Energy Security Trade-Off: Role of Natural Gas in the Indian Power Sector. Energies, 14(13), 3787. https://doi.org/10.3390/en14133787