Analyzing the Trade-Offs between Meeting Biorefinery Production Capacity and Feedstock Supply Cost: A Chance Constrained Approach

Abstract

1. Introduction

2. Chance Constrained Programming and Application in Biofuel Supply Chain Research

3. Materials and Methods

3.1. Optimization Model

3.2. Study Region and Data

3.2.1. Oklahoma and Decision Making Unit

3.2.2. Switchgrass Yields

3.2.3. Production, Logistic, and Transportation Costs and Land Availability

3.2.4. Biorefinery Production Capacity and Switchgrass Biomass Demand Scenarios

4. Results

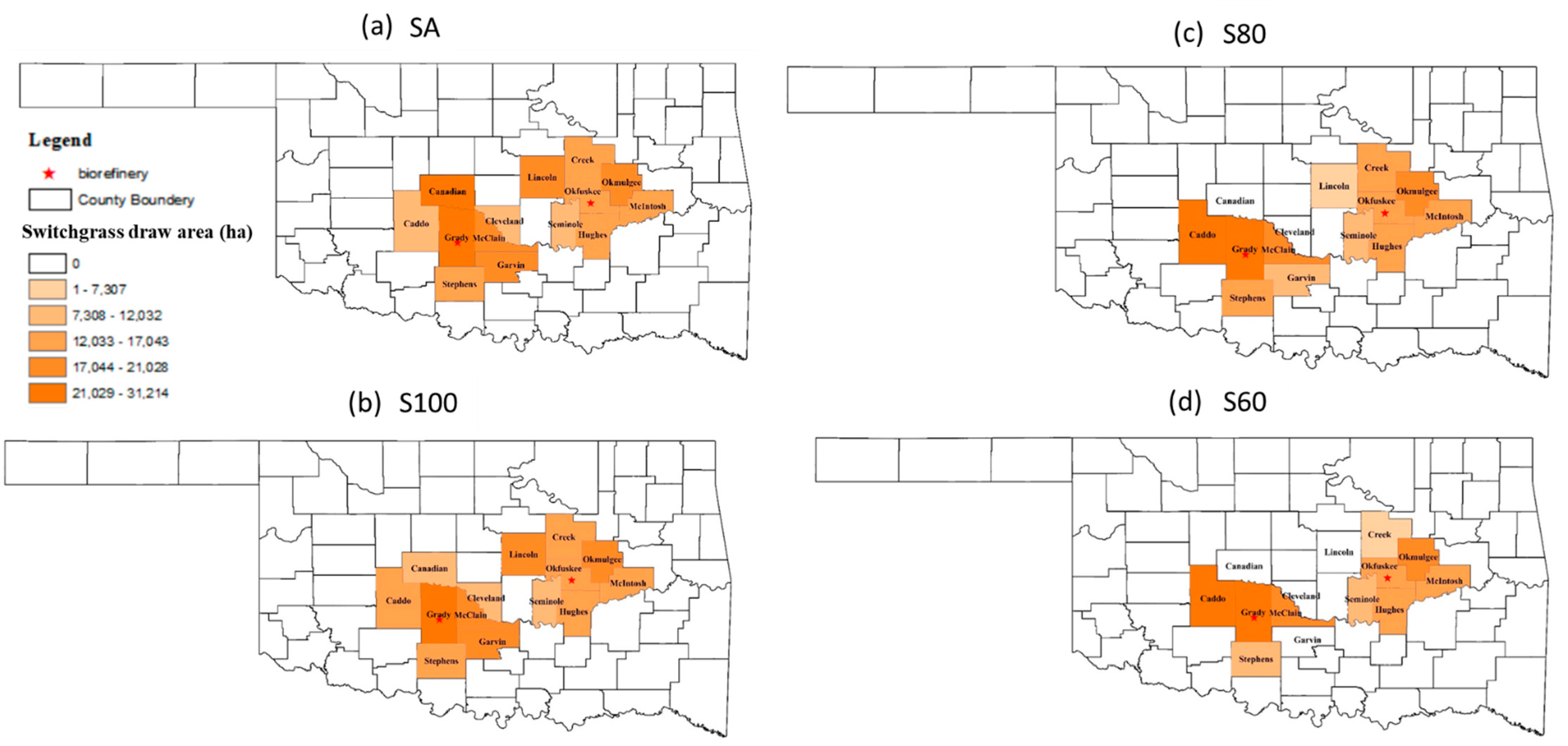

4.1. Switchgrass Production Area and Locations

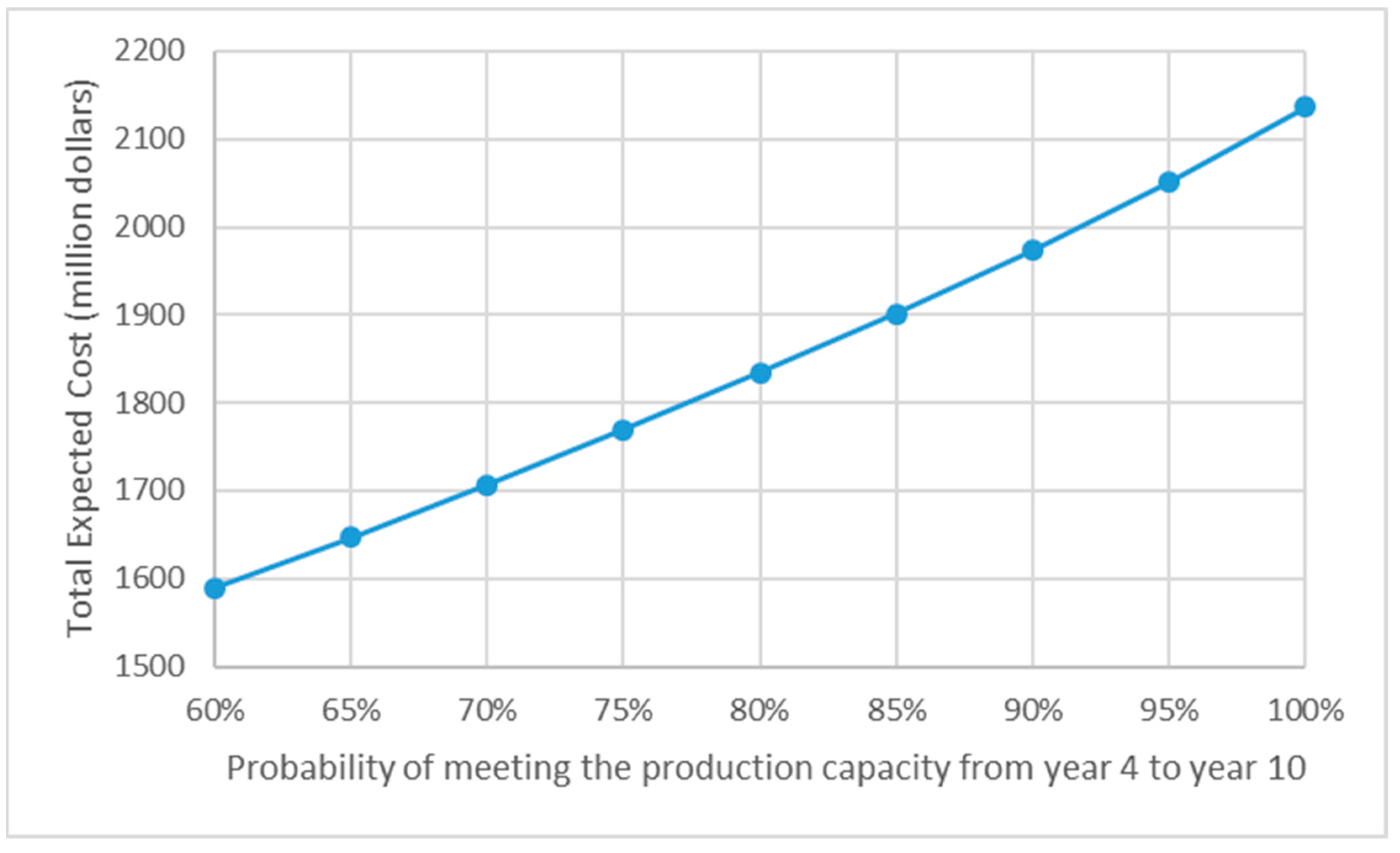

4.2. Estimated Costs

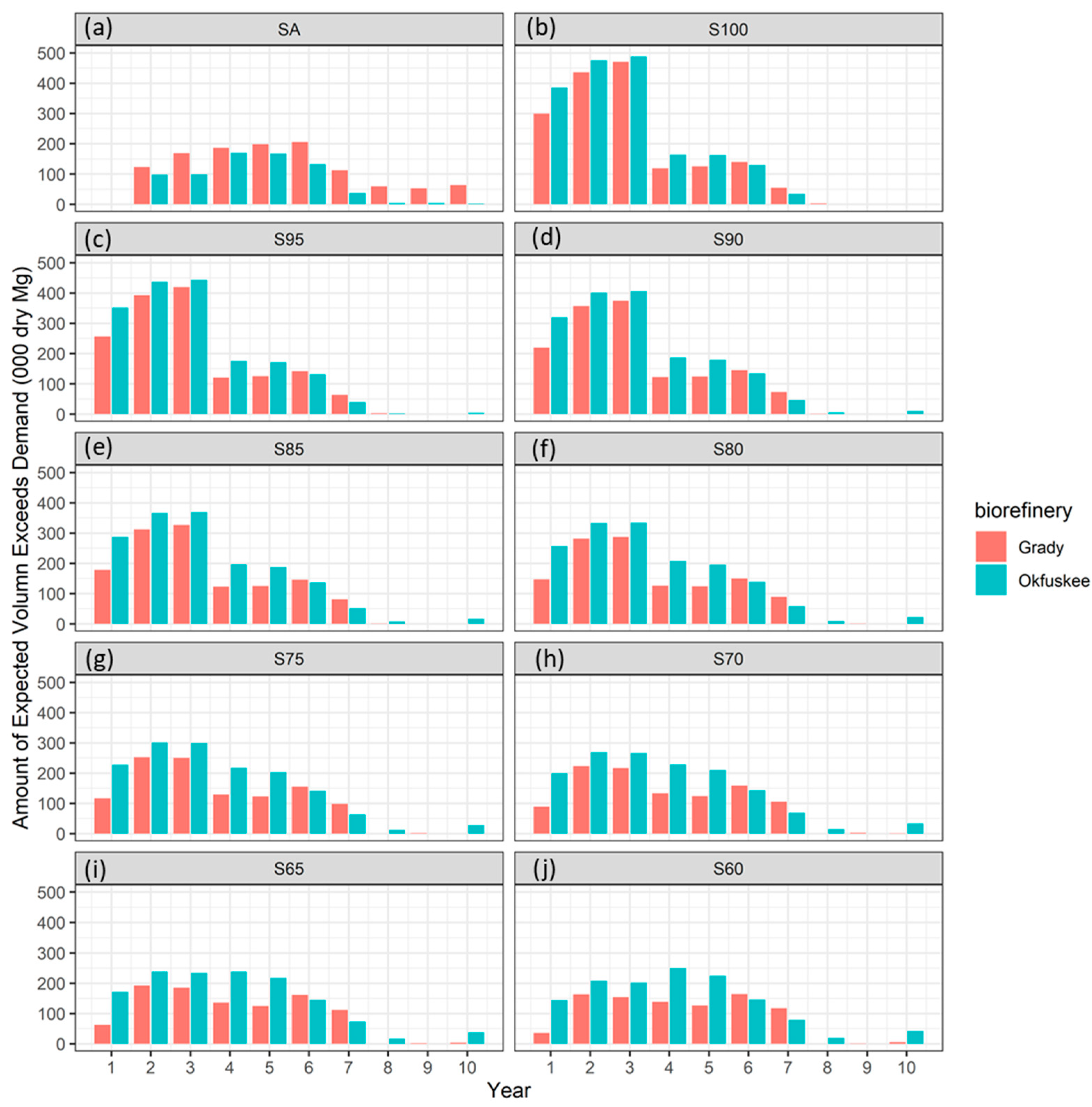

4.3. Excess Supply of Switchgrass

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Padella, M.; O’Connell, A.; Prussi, M. What is still Limiting the Deployment of Cellulosic Ethanol? Analysis of the Current Status of the Sector. Appl. Sci. 2019, 9, 4523. [Google Scholar] [CrossRef]

- Naik, S.; Goud, V.V.; Rout, P.K.; Dalai, A.K. Production of first and second generation biofuels: A comprehensive review. Renew. Sustain. Energy Rev. 2010, 14, 578–597. [Google Scholar] [CrossRef]

- Carriquiry, M.A.; Du, X.; Timilsina, G.R. Second generation biofuels: Economics and policies. Energy Policy 2011, 39, 4222–4234. [Google Scholar] [CrossRef]

- Federal Register. Rules and Regulations. Available online: https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/Energy/ccc_2015_0001_0001 (accessed on 18 June 2021).

- Larson, J.A.; English, B.C.; He, L. Economic analysis of farm-level supply of biomass feedstocks for energy produc-tion under alternative contract scenarios and risk. In Proceedings of the Integration of Agricultural and Energy Systems Conference, Atlanta, GA, USA, 12–13 February 2008. [Google Scholar]

- Yoder, J.R.; Alexander, C.E.; Ivanic, R.; Rosch, S.; Tyner, W.E.; Wu, S.Y. Risk Versus Reward, a Financial Analysis of Alternative Contract Specifications for the Miscanthus Lignocellulosic Supply Chain. BioEnergy Res. 2014, 8, 644–656. [Google Scholar] [CrossRef]

- Burli, P.; Forgoston, E.; Lal, P.; Billings, L.; Wolde, B. Adoption of switchgrass cultivation for biofuel under uncertainty: A dis-crete-time modeling approach. Biomass Bioenergy 2017, 105, 107–115. [Google Scholar] [CrossRef]

- Schmer, M.R.; Vogel, K.P.; Mitchell, R.B.; Perrin, R.K. Net energy of cellulosic ethanol from switchgrass. Proc. Natl. Acad. Sci. USA 2008, 105, 464–469. [Google Scholar] [CrossRef]

- Wang, M.; Han, J.; Dunn, J.B.; Cai, H.; Elgowainy, A. Well-to-wheels energy use and greenhouse gas emissions of ethanol from corn, sugarcane and cellulosic biomass for US use. Environ. Res. Lett. 2012, 7, 045905. [Google Scholar] [CrossRef]

- Field, J.L.; Evans, S.G.; Marx, E.; Easter, M.; Adler, P.R.; Dinh, T.; Willson, B.; Paustian, K. High-resolution techno–ecological modelling of a bioenergy landscape to identify climate mitigation opportunities in cellulosic ethanol production. Nat. Energy 2018, 3, 211–219. [Google Scholar] [CrossRef]

- Epplin, F.M.; Haque, M. Policies to Facilitate Conversion of Millions of Acres to the Production of Biofuel Feedstock. J. Agric. Appl. Econ. 2011, 43, 385–398. [Google Scholar] [CrossRef]

- Osmani, A.; Zhang, J. Stochastic optimization of a multi-feedstock lignocellulosic-based bioethanol supply chain under multiple uncertainties. Energy 2013, 59, 157–172. [Google Scholar] [CrossRef]

- Roni, S.; Ekşioğlu, S.D.; Searcy, E.; Jacobson, J.J.; Roni, M. Estimating the variable cost for high-volume and long-haul transportation of densified biomass and biofuel. Transp. Res. Part D Transp. Environ. 2014, 29, 40–55. [Google Scholar] [CrossRef]

- Yu, T.E.; English, B.C.; He, L.; Larson, J.A.; Calcagno, J.; Fu, J.; Wilson, B. Analyzing Economic and Environmental Performance of Switchgrass Biofuel Supply Chains. BioEnergy Res. 2016, 9, 566–577. [Google Scholar] [CrossRef]

- Sharma, B.P.; Yu, T.E.; English, B.C.; Boyer, C.N.; Larson, J.A. Stochastic optimization of cellulosic biofuel supply chain incorporating feedstock yield uncertainty. Energy Procedia 2019, 158, 1009–1014. [Google Scholar] [CrossRef]

- Mamun, S.; Hansen, J.K.; Roni, M. Supply, operational, and market risk reduction opportunities: Managing risk at a cellulosic biorefinery. Renew. Sustain. Energy Rev. 2020, 121, 109677. [Google Scholar] [CrossRef]

- Jager, H.I.; Baskaran, L.; Brandt, C.C.; Davis, E.B.; Gunderson, C.A.; Wullschleger, S. Empirical geographic modeling of switchgrass yields in the United States. GCB Bioenergy 2010, 2, 248–257. [Google Scholar] [CrossRef]

- Epplin, F.M. Cost to produce and deliver switchgrass biomass to an ethanol-conversion facility in the southern plains of the United States. Biomass Bioenergy 1996, 11, 459–467. [Google Scholar] [CrossRef]

- Kumar, A.; Sokhansanj, S. Switchgrass (Panicum vigratum L.) delivery to a biorefinery using integrated biomass supply analysis and logistics (IBSAL) model. Bioresour. Technol. 2007, 98, 1033–1044. [Google Scholar] [CrossRef]

- Khanna, M.; Dhungana, B.; Clifton-Brown, J. Costs of producing miscanthus and switchgrass for bioenergy in Illinois. Biomass Bioenergy 2008, 32, 482–493. [Google Scholar] [CrossRef]

- Awudu, I.; Zhang, J. Uncertainties and sustainability concepts in biofuel supply chain management: A review. Renew. Sustain. Energy Rev. 2012, 16, 1359–1368. [Google Scholar] [CrossRef]

- Zhang, J.; Osmani, A.; Awudu, I.; Gonela, V. An integrated optimization model for switchgrass-based bioethanol supply chain. Appl. Energy 2013, 102, 1205–1217. [Google Scholar] [CrossRef]

- Park, Y.S.; Szmerekovsky, J.; Osmani, A.; Aslaam, N.M. Integrated Multimodal Transportation Model for a Switchgrass-Based Bioethanol Supply Chain: Case Study in North Dakota. Transp. Res. Rec. J. Transp. Res. Board 2017, 2628, 32–41. [Google Scholar] [CrossRef]

- He-Lambert, L.; English, B.C.; Lambert, D.M.; Shylo, O.; Larson, J.A.; Yu, T.E.; Wilson, B. Determining a geographic high resolution supply chain network for a large scale biofuel industry. Appl. Energy 2018, 218, 266–281. [Google Scholar] [CrossRef]

- De Meyer, A.; Cattrysse, D.; Rasinmäki, J.; Van Orshoven, J. Methods to optimise the design and management of biomass-for-bioenergy supply chains: A review. Renew. Sustain. Energy Rev. 2014, 31, 657–670. [Google Scholar] [CrossRef]

- Huang, Y.; Fan, Y.; Chen, C.-W. An Integrated Biofuel Supply Chain to Cope with Feedstock Seasonality and Uncertainty. Transp. Sci. 2014, 48, 540–554. [Google Scholar] [CrossRef]

- Debnath, D.; Stoecker, A.L.; Epplin, F.M. Impact of Environmental Values on the Breakeven Price of Switchgrass. Biomass Bioenergy 2014, 70, 184–195. [Google Scholar] [CrossRef]

- Sharma, B.P.; Yu, T.E.; English, B.C.; Boyer, C.N.; Larson, J.A. Impact of government subsidies on a cellulosic biofuel sector with diverse risk preferences toward feedstock uncertainty. Energy Policy 2020, 146, 111737. [Google Scholar] [CrossRef]

- Kim, J.; Realff, M.J.; Lee, J.H. Optimal design and global sensitivity analysis of biomass supply chain networks for biofuels under uncertainty. Comput. Chem. Eng. 2011, 35, 1738–1751. [Google Scholar] [CrossRef]

- Tenerelli, P.; Carver, S. Multi-criteria, multi-objective and uncertainty analysis for agro-energy spatial modelling. Appl. Geogr. 2012, 32, 724–736. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W. Chance-Constrained Programming. Manag. Sci. 1959, 6, 73–79. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W. Deterministic Equivalents for Optimizing and Satisficing under Chance Constraints. Oper. Res. 1963, 11, 18–39. [Google Scholar] [CrossRef]

- Eisel, L.M. Chance constrained reservoir model. Water Resour. Res. 1972, 8, 339–347. [Google Scholar] [CrossRef]

- Askew, A.J. Chance-constrained Dynamic Programing and the Optimization of Water Resource Systems. Water Resour. Res. 1974, 10, 1099–1106. [Google Scholar] [CrossRef]

- Loucks, D.P.; Dorfman, P.J. An evaluation of some linear decision rules in chance-Constrained models for reservoir planning and operation. Water Resour. Res. 1975, 11, 777–782. [Google Scholar] [CrossRef]

- Guo, P.; Huang, G.H. Two-stage fuzzy chance-constrained programming: Application to water resources management under dual uncertainties. Stoch. Environ. Res. Risk Assess. 2008, 23, 349–359. [Google Scholar] [CrossRef]

- Grosso, J.; Ocampo-Martinez, C.; Puig, V.; Joseph, B. Chance-constrained model predictive control for drinking water networks. J. Process. Control. 2014, 24, 504–516. [Google Scholar] [CrossRef]

- Xu, J.; Huang, G.; Li, Z.; Chen, J. A two-stage fuzzy chance-constrained water management model. Environ. Sci. Pollut. Res. 2017, 24, 12437–12454. [Google Scholar] [CrossRef]

- Danok, A.B.; McCarl, B.A.; White, T.K. Machinery Selection Modeling: Incorporation of Weather Variability. Am. J. Agric. Econ. 1980, 62, 700–708. [Google Scholar] [CrossRef]

- Zhu, M.; Taylor, D.B.; Sarin, S.C.; Kramer, R.A. Chance Constrained Programming Models for Risk-Based Economic and Policy Analysis of Soil Conservation. Agric. Resour. Econ. Rev. 1994, 23, 58–65. [Google Scholar] [CrossRef]

- Moghaddam, K.S.; DePuy, G.W. Farm management optimization using chance constrained programming method. Comput. Electron. Agric. 2011, 77, 229–237. [Google Scholar] [CrossRef]

- Mills, E.F.E.A.; Yu, B.; Gu, L. On meeting capital requirements with a chance-constrained optimization model. SpringerPlus 2016, 5, 500. [Google Scholar] [CrossRef][Green Version]

- Sun, Y.; Aw, G.; Loxton, R.; Teo, K.L. Chance-constrained optimization for pension fund portfolios in the presence of default risk. Eur. J. Oper. Res. 2017, 256, 205–214. [Google Scholar] [CrossRef]

- Lubin, M.; Dvorkin, Y.; Backhaus, S. A Robust Approach to Chance Constrained Optimal Power Flow with Renewable Generation. IEEE Trans. Power Syst. 2015, 31, 3840–3849. [Google Scholar] [CrossRef]

- Roald, L.; Andersson, G. Chance-Constrained AC Optimal Power Flow: Reformulations and Efficient Algorithms. IEEE Trans. Power Syst. 2017, 33, 2906–2918. [Google Scholar] [CrossRef]

- Cai, Y.; Huang, G.; Yang, Z.; Lin, Q.; Tan, Q. Community-scale renewable energy systems planning under uncertainty—An interval chance-constrained programming approach. Renew. Sustain. Energy Rev. 2009, 13, 721–735. [Google Scholar] [CrossRef]

- Dall’Anese, E.; Baker, K.; Summers, T. Chance-Constrained AC Optimal Power Flow for Distribution Systems with Renewables. IEEE Trans. Power Syst. 2017, 32, 3427–3438. [Google Scholar] [CrossRef]

- Hogan, A.J.; Morris, J.G.; Thompson, H.E. Decision Problems Under Risk and Chance Constrained Programming: Dilemmas in the Transition. Manag. Sci. 1981, 27, 698–716. [Google Scholar] [CrossRef]

- Nau, R.F. Note—Blau’s Dilemma Revisited. Manag. Sci. 1987, 33, 8. [Google Scholar] [CrossRef][Green Version]

- Quddus, M.A.; Ibne Hossain, N.U.; Mohammad, M.; Jaradat, R.M.; Roni, M.S. Sustainable Network Design for Multi-Purpose Pellet Processing Depots under Biomass Supply Uncertainty. Comput. Ind. Eng. 2017, 110, 462–483. [Google Scholar] [CrossRef]

- Zhao, S.; You, F. Distributionally Robust Chance Constrained Programming with Generative Adversarial Networks (GANs). AIChE J. 2020, 66, e16963. [Google Scholar] [CrossRef]

- Wu, C.B.; Huang, G.H.; Li, W.; Xie, Y.L.; Xu, Y. Multistage Stochastic Inexact Chance-Constraint Programming for an Integrated Biomass-Municipal Solid Waste Power Supply Management under Uncertainty. Renew. Sustain. Energy Rev. 2015, 41, 1244–1254. [Google Scholar] [CrossRef]

- Li, Y.; Feng, B.; Li, G.; Qi, J.; Zhao, D.; Mu, Y. Optimal Distributed Generation Planning in Active Distribution Networks Considering Integration of Energy Storage. Appl. Energy 2018, 210, 1073–1081. [Google Scholar] [CrossRef]

- North, R.M. Risk analyses applicable to water resources program and project planning and evaluation. In Risk Benefit Analysis in Water Resources Planning and Management; Haimes, Y.Y., Ed.; Plenum Press: Now York, NY, USA, 1981. [Google Scholar]

- Dixon, J.A.; James, D.E.; Sherman, P.B. The Economics of Dryland Management; Earthscan Publications Ltd.: London, UK, 1989. [Google Scholar]

- Farmland Information Center Oklahoma Data and Statistics. 2019. Available online: https://farmlandinfo.org/statistics/oklahoma-statistics/ (accessed on 25 January 2021).

- Haque, M.; Epplin, F.M.; Biermacher, J.T.; Holcomb, R.B.; Kenkel, P.L. Marginal cost of delivering switchgrass feedstock and producing cellulosic ethanol at multiple biorefineries. Biomass Bioenergy 2014, 66, 308–319. [Google Scholar] [CrossRef][Green Version]

- Fike, J.H.; Parrish, D.J.; Wolf, D.D.; Balasko, J.A.; Green, J.T.; Rasnake, M.; Reynolds, J.H. Long-Term Yield Potential of Switchgrass-for-Biofuel Systems. Biomass Bioenergy 2006, 30, 198–206. [Google Scholar] [CrossRef]

- Alexopoulou, E.; Zanetti, F.; Papazoglou, E.G.; Christou, M.; Papatheohari, Y.; Tsiotas, K.; Papamichael, I. Long-Term Studies on Switchgrass Grown on a Marginal Area in Greece under Different Varieties and Nitrogen Fertilization Rates. Ind. Crops Prod. 2017, 107, 446–452. [Google Scholar] [CrossRef]

- ESRI. ArcGIS Desktop: Release 10; Environmental Systems Research Institute: Redlands, CA, USA, 2011. [Google Scholar]

- Williams, J.R. The EPIC model. In Computer Models of Watershed Hydrology; Singh, V.P., Ed.; Water Resources Publications: Englewood, CO, USA, 1995; pp. 909–1000. [Google Scholar]

- Roni, M.S.; Thompson, D.N.; Hartley, D. Distributed biomass supply chain cost optimization to evaluate multiple feedstocks for a biorefinery. Appl. Energy 2019, 254, 113660. [Google Scholar] [CrossRef]

- Roni, M.S.; Thompson, D.; Hartley, D.; Searcy, E.; Nguyen, Q. Optimal blending management of biomass resources used for biochemical conversion. Biofuels, Bioprod. Biorefining 2018, 12, 624–648. [Google Scholar] [CrossRef]

- Doye, D.; Brorsen, B.W. Pasture Land Values: A “Green Acres” Effect? Choices 2011, 26. Available online: http://choicesmagazine.org/choices-magazine/theme-articles/farmland-values/pasture-land-values-a-green-acres-effect (accessed on 15 May 2021).

- Davis, R.; Tao, L.; Scarlata, C.; Tan, E.C.D.; Ross, J.; Lukas, J.; Sexton, D. Process Design and Economics for the Conversion of Lignocellulo-Sic Biomass to Hydrocarbons: Dilute-Acid and Enzymatic Deconstruction of Biomass to Sugars and Catalytic Conversion of Sug-Ars to Hydrocarbons; Technical Report NREL/TP-5100-62498; National Renewable Energy Laboratory: Golden, CO, USA, 2015. [Google Scholar]

| Crop Reporting District (CRD) | Statistic | Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | ||

| CRD-1 | min a | 3.93 | 3.98 | 5.38 | 4.64 | 5.33 | 5.02 | 3.22 | 4.37 | 4.63 | 4.24 |

| max b | 11.12 | 14.43 | 11.45 | 12.47 | 11.66 | 11.43 | 15.64 | 12.75 | 14.34 | 10.24 | |

| mode c | 7.21 | 7.31 | 8.26 | 7.79 | 8.96 | 8.14 | 7.51 | 8.18 | 9.05 | 7.14 | |

| CRD-2 | min | 3.59 | 3.09 | 2.73 | 4.16 | 4.03 | 4.14 | 2.9 | 2.81 | 3.61 | 2.57 |

| max | 14.72 | 17.3 | 14.92 | 19.56 | 16.07 | 16.75 | 19.41 | 13.95 | 13.11 | 14.74 | |

| mode | 7.16 | 7.66 | 7.31 | 8.57 | 7.56 | 7.2 | 7.19 | 6.36 | 7.21 | 6.1 | |

| CRD-3 | min | 2.72 | 2.99 | 2.32 | 3.01 | 3.4 | 3.29 | 2.18 | 2.34 | 2.57 | 2.27 |

| max | 14.46 | 20.56 | 19.96 | 19.41 | 20.82 | 18.12 | 19.56 | 17.42 | 15.36 | 15.95 | |

| mode | 7 | 7.75 | 7.43 | 7.82 | 7.62 | 7.39 | 7.11 | 7.1 | 7.08 | 5.9 | |

| CRD-4 | min | 3.29 | 3.08 | 2.74 | 3.59 | 3.41 | 3.86 | 2.88 | 3.39 | 3.27 | 2.91 |

| max | 16.27 | 16.39 | 16.57 | 20.43 | 17.25 | 17.74 | 18.33 | 14.24 | 15.72 | 16.54 | |

| mode | 6.84 | 7.29 | 7.35 | 7.98 | 7.56 | 6.73 | 7.44 | 6.83 | 6.83 | 6 | |

| CRD-5 | min | 3.17 | 3.73 | 3.03 | 3.62 | 3.55 | 3.89 | 2.91 | 3.27 | 3.43 | 3.08 |

| max | 13.85 | 16.43 | 20.53 | 18.41 | 19.57 | 18.63 | 17.56 | 14.74 | 13.75 | 17.36 | |

| mode | 6.78 | 7.87 | 7.61 | 7.64 | 7.59 | 7.34 | 7.11 | 6.56 | 6.66 | 5.98 | |

| CRD-6 | min | 3.75 | 3.71 | 2.76 | 3.51 | 3.97 | 4.22 | 3.13 | 3.45 | 3.94 | 3.04 |

| max | 15.15 | 17.75 | 19.53 | 23.45 | 21.01 | 17.28 | 17.12 | 15.52 | 14.47 | 16.16 | |

| mode | 7.26 | 7.94 | 7.63 | 8.63 | 8.31 | 7.88 | 7.29 | 7.14 | 7.06 | 6.3 | |

| CRD-7 | min | 2.62 | 3.24 | 2.87 | 3.18 | 3.18 | 3.94 | 2.66 | 3.09 | 3.28 | 2.89 |

| max | 12.33 | 18.7 | 16.58 | 20.45 | 16.83 | 21.34 | 23.07 | 17.11 | 18.13 | 13.64 | |

| mode | 6.47 | 7.7 | 7.98 | 7.91 | 7.33 | 8 | 7.67 | 6.94 | 7.74 | 6.49 | |

| CRD-8 | min | 3.17 | 2.81 | 3.45 | 3.74 | 3.68 | 4 | 2.55 | 3.74 | 3.47 | 3.18 |

| max | 13.15 | 16.87 | 19.53 | 20.26 | 21.75 | 20.23 | 21.75 | 16.11 | 16.49 | 18.12 | |

| mode | 7.05 | 7.87 | 7.99 | 8.08 | 7.92 | 7.7 | 7.46 | 7.6 | 7.21 | 6.48 | |

| CRD-9 | min | 2.7 | 2.79 | 2.19 | 2.94 | 2.48 | 3.53 | 2.31 | 2.91 | 2.64 | 2.45 |

| max | 9.78 | 11.26 | 14.13 | 15.76 | 15.69 | 14.13 | 14.39 | 11.04 | 11.53 | 13.99 | |

| mode | 5.41 | 5.57 | 5.59 | 5.79 | 5.91 | 5.7 | 5.45 | 5.44 | 5.15 | 4.72 | |

| Symbol | Parameters | Value | Source |

|---|---|---|---|

| α | Product Cost (USD/Mg) | 58.39 | Roni et al., 2019 |

| γ | Logistic Cost (USD/Mg) | 23.7 | Roni et al., 2019 |

| M | biomass demand (dry Mg/year) | 724,000 | Davis et al., 2015 |

| Scenarios a | Establishment Years | Post-Establishment Years | ||

|---|---|---|---|---|

| Year 1 | Year 2 | Year 3 | Years 4~10 | |

| SA | 100% | 100% | 100% | 100% |

| S100 | 35% | 45% | 55% | 100% |

| S95 | 35% | 45% | 55% | 95% |

| S90 | 35% | 45% | 55% | 90% |

| S85 | 35% | 45% | 55% | 85% |

| S80 | 35% | 45% | 55% | 80% |

| S75 | 35% | 45% | 55% | 75% |

| S70 | 35% | 45% | 55% | 70% |

| S65 | 35% | 45% | 55% | 65% |

| S60 | 35% | 45% | 55% | 60% |

| Biorefinery | County (Crop Reporting District) | Scenarios a | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| SA | S100 | S95 | S90 | S85 | S80 | S75 | S70 | S65 | S60 | ||

| Grady | Caddo (CRD-7) | 9582 | 14,130 | 16,494 | 19,481 | 19,637 | 22,217 | 24,674 | 25,569 | 25,569 | 25,569 |

| Canadian (CRD-5) | 22,215 | 8170 | 1317 | ||||||||

| Cleveland (CRD-5) | 8940 | 8940 | 8940 | 8940 | |||||||

| Garvin (CRD-8) | 18,418 | 18,418 | 18,418 | 12,902 | 17,295 | 11,358 | 5739 | 1733 | |||

| Grady (CRD-5) | 31,214 | 31,214 | 31,214 | 31,214 | 31,214 | 31,214 | 31,214 | 31,214 | 31,214 | 31,214 | |

| McClain (CRD-5) | 18,765 | 18,765 | 18,765 | 18,765 | 18,765 | 18,765 | 18,765 | 18,765 | 18,765 | 18,765 | |

| Stephens (CRD-8) | 15,002 | 15,002 | 15,002 | 15,002 | 15,002 | 15,002 | 15,002 | 15,002 | 13,700 | 10,749 | |

| Okfuskee | Creek (CRD-5) | 16,194 | 16,194 | 16,194 | 16,194 | 16,194 | 16,194 | 16,194 | 13,301 | 10,266 | 7307 |

| Hughes (CRD-6) | 15,772 | 15,772 | 15,772 | 15,772 | 15,772 | 15,772 | 15,772 | 15,772 | 15,772 | 15,772 | |

| Lincoln (CRD-5) | 18,126 | 20,882 | 13,756 | 10,196 | 6762 | 3442 | 226 | ||||

| McIntosh (CRD-6) | 16,298 | 13,171 | 16,298 | 16,298 | 16,298 | 16,298 | 16,298 | 16,298 | 16,298 | 16,298 | |

| Okfuskee (CRD-5) | 17,043 | 17,043 | 17,043 | 17,043 | 17,043 | 17,043 | 17,043 | 17,043 | 17,043 | 17,043 | |

| Okmulgee (CRD-6) | 21,028 | 21,028 | 21,028 | 21,028 | 21,028 | 21,028 | 21,028 | 21,028 | 21,028 | 21,028 | |

| Seminole (CRD-5) | 12,032 | 12,032 | 12,032 | 12,032 | 12,032 | 12,032 | 12,032 | 12,032 | 12,032 | 12,032 | |

| Total | 240,627 | 230,761 | 222,272 | 214,867 | 207,041 | 200,364 | 193,987 | 187,756 | 181,687 | 175,777 | |

| Scenarios a | Production Cost | Transportation Cost | Logistic Cost | Total |

|---|---|---|---|---|

| SA | 1317 | 296 | 535 | 2147 |

| S100 | 1264 | 281 | 513 | 2058 |

| S95 | 1220 | 269 | 495 | 1984 |

| S90 | 1179 | 257 | 478 | 1914 |

| S85 | 1138 | 248 | 462 | 1848 |

| S80 | 1101 | 237 | 447 | 1785 |

| S75 | 1065 | 227 | 432 | 1724 |

| S70 | 1030 | 218 | 418 | 1666 |

| S65 | 996 | 210 | 404 | 1611 |

| S60 | 964 | 202 | 391 | 1557 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lambert, L.H.; DeVuyst, E.A.; English, B.C.; Holcomb, R. Analyzing the Trade-Offs between Meeting Biorefinery Production Capacity and Feedstock Supply Cost: A Chance Constrained Approach. Energies 2021, 14, 4763. https://doi.org/10.3390/en14164763

Lambert LH, DeVuyst EA, English BC, Holcomb R. Analyzing the Trade-Offs between Meeting Biorefinery Production Capacity and Feedstock Supply Cost: A Chance Constrained Approach. Energies. 2021; 14(16):4763. https://doi.org/10.3390/en14164763

Chicago/Turabian StyleLambert, Lixia H., Eric A. DeVuyst, Burton C. English, and Rodney Holcomb. 2021. "Analyzing the Trade-Offs between Meeting Biorefinery Production Capacity and Feedstock Supply Cost: A Chance Constrained Approach" Energies 14, no. 16: 4763. https://doi.org/10.3390/en14164763

APA StyleLambert, L. H., DeVuyst, E. A., English, B. C., & Holcomb, R. (2021). Analyzing the Trade-Offs between Meeting Biorefinery Production Capacity and Feedstock Supply Cost: A Chance Constrained Approach. Energies, 14(16), 4763. https://doi.org/10.3390/en14164763