Carbon Pricing and Complementary Policies—Consistency of the Policy Mix for Decarbonizing Buildings in Germany

Abstract

:1. Introduction

2. Materials and Methods

- The policy strategy is defined as a combination of policy objectives and the principal plans for achieving them. This work sets the scope as the national objectives and approach for addressing the decarbonization of the buildings sector. While the national strategy is influenced by the EU-level targets and strategies, the interaction between these two levels is not in the focus of our work.

- Instruments are defined as concrete tools to achieve overarching objectives. Rogge (2016) propose a type–purpose classification of instruments including three types of instruments (economic instruments, regulations and information) and three primary purposes (technology push, demand pull, systemic). This work focuses on the existing national policies addressing the decarbonization of buildings, and policies at EU partially considered when showing a direct impact at national level.

- The instrument mix combines the individual instruments and takes into account interactions between the instruments. In the analysis of interactions, we focus on the interaction between the newly introduced carbon pricing scheme with the remaining elements of the instrument mix.

- The consistency of the policy strategy is addressed by assessing the alignment of policy objectives and the consistency of principal action plans with the policy objectives.

- The consistency of the instrument mix is addressed through interaction analysis, where instruments in an instrument mix are consistent when they reinforce rather than undermine each other in the pursuit of policy objectives.

- The consistency of the instrument mix with the policy strategy addresses the interplay of the policy mix with the policy strategy, i.e., if the instrument mix is consistent with the policy objectives.

3. Results and Discussion

3.1. Elements of the Policy Mix

3.1.1. Strategy

3.1.2. Instruments

- With the carbon pricing scheme increasing the economic benefits of renewable heating solutions and energy efficiency measures, it is likely that the uptake of the funding schemes increases with the introduction of carbon pricing.

- Part of the revenues from the carbon pricing scheme are used to limit the electricity price for consumers by limiting the renewable energy surcharge. The reduced electricity price in combination with the higher fossil fuel prices provide an additional incentive to invest in heat pumps. This is particularly significant because heat pumps are seen as a key technology for decarbonizing the buildings sector.

3.2. Policy Process

3.3. Consistency of the Policy Mix

3.3.1. Consistency of the Policy Strategy

3.3.2. Consistency of the Instrument Mix

- Time and ambition: Meeting ambitious climate targets requires fast and ambitious climate action. Not only “low-hanging fruits”, but also more expensive technologies need to be diffused on a short timescale [8,10], particularly in view of the very long investment cycles in the building sector. Carbon pricing does typically not lead to deep emissions reductions, such that even in countries with high prices only incremental emissions reductions occur and complementary phase-out policies are introduced [53].

- Political feasibility: Even though carbon pricing plays an increasing role in climate policy, the currently implemented schemes are at a price level that is not consistent with ambitious climate actions. Prices that would be needed in order to meet the agreed targets would be high and unlikely to be implemented [8,53,54]. For the German carbon pricing scheme to provide a relevant contribution to meeting the reduction targets for the buildings sector, carbon prices would need to be increased considerably as compared to the price path specified for the years 2021–2025. For example, the German National Energy and Climate Plan submitted to the EU Commission in 2020 assumes that carbon pricing increases the consumer prices of national gas by 62% and oil by 47% to support the calculations for target achievement, reflecting prices that are far above the current price levels. It does not seem likely that price increases of the required magnitude will be politically feasible.

- Market failures and imperfections: Complementary instruments are needed in order to correct market failures and imperfections, such as information asymmetries and split incentives [7]. Market failures and imperfections play a crucial role for the decarbonization of the buildings sector. The buildings sector is characterized by a large number of structural and nonmonetary barriers, including the lack of knowledge and interest of building owners, the distribution of costs and benefits between landlords and tenants as well as decision-making based on heuristic approaches rather than rational behavior [55,56,57,58]. In Germany, the structure of the housing sector with more than half of the households living in rented dwellings poses a considerable challenge. As the costs for carbon emissions are currently borne entirely by the tenants, the carbon pricing scheme does not provide direct incentives for the owners of rented buildings to invest in energy efficiency measures and renewable heating [59].

- Carbon pricing does not foster innovation in new technologies, such that complementary policies are needed to support innovation [8,12,60]. The full decarbonization of the buildings sector requires innovation in technologies and processes for thermal retrofit and renewable heating systems. An important example are innovative industrial supply chain approaches to thermal retrofit, which are expected to decrease the cost, time and on-site labor intensity of deep thermal retrofits. The decrease of on-site labor is of particular importance for the transformation of the buildings stock in Germany, as key climate protection scenarios show that the annual refurbishment rate needs to more than double to meet the targets (e.g., [61,62,63], while already at current levels Germany faces a shortage of skilled workers [64].

3.3.3. Consistency of the Policy Mix

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- World Bank. Carbon Pricing Dashboard. Up-to-Date Overview of Carbon Pricing Initiatives. Available online: https://carbonpricingdashboard.worldbank.org/ (accessed on 6 October 2021).

- Baranzini, A.; Van den Bergh, J.C.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon pricing in climate policy: Seven reasons, complementary instruments, and political economy considerations. Wiley Interdiscip. Rev. Clim. Chang. 2017, 8, e462. [Google Scholar] [CrossRef] [Green Version]

- High-Level Commission on Carbon Prices. Report of the High-Level Commission on Carbon Prices; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Bergh, J.V.D.; Botzen, W. Low-carbon transition is improbable without carbon pricing. Proc. Natl. Acad. Sci. USA 2020, 117, 23219–23220. [Google Scholar] [CrossRef]

- Bertram, C.; Luderer, G.; Pietzcker, R.; Schmid, E.; Kriegler, E.; Edenhofer, O. Complementing carbon prices with technology policies to keep climate targets within reach. Nat. Clim. Chang. 2015, 5, 235–239. [Google Scholar] [CrossRef]

- Kalkuhl, M.; Edenhofer, O.; Lessmann, K. Renewable energy subsidies: Second-best policy or fatal aberration for mitigation? Resour. Energy Econ. 2013, 35, 217–234. [Google Scholar] [CrossRef] [Green Version]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. A tale of two market failures: Technology and environmental policy. Ecol. Econ. 2005, 54, 164–174. [Google Scholar] [CrossRef] [Green Version]

- Mehling, M.; Tvinnereim, E. Carbon Pricing and the 1.5 °C Target: Near-Term Decarbonisation and the Importance of an Instrument Mix. Carbon Clim. Law Rev. 2018, 12, 50–61. [Google Scholar] [CrossRef]

- Klenert, D.; Mattauch, L.; Combet, E.; Edenhofer, O.; Hepburn, C.; Rafaty, R.; Stern, N. Making carbon pricing work for citizens. Nat. Clim. Chang. 2018, 8, 669–677. [Google Scholar] [CrossRef]

- Patt, A.; Lilliestam, J. The Case against Carbon Prices. Joule 2018, 2, 2494–2498. [Google Scholar] [CrossRef] [Green Version]

- Rosenbloom, D.; Markard, J.; Geels, F.W.; Fuenfschilling, L. Opinion: Why carbon pricing is not sufficient to mitigate climate change—And how “sustainability transition policy” can help. Proc. Natl. Acad. Sci. USA 2020, 117, 8664–8668. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Del Río, P. Why does the combination of the European Union Emissions Trading Scheme and a renewable energy target makes economic sense? Renew. Sustain. Energy Rev. 2017, 74, 824–834. [Google Scholar] [CrossRef]

- Matthes, F.C. Greenhouse Gas Emissions Trading and Complementary Policies: Developing a Smart Mix for Ambitious Climate Policies. 2010. Available online: https://www.oeko.de/oekodoc/1068/2010-114-en.pdf (accessed on 29 September 2021).

- Bataille, C.; Guivarch, C.; Hallegatte, S.; Rogelj, J.; Waisman, H. Carbon prices across countries. Nat. Clim. Chang. 2018, 8, 648–650. [Google Scholar] [CrossRef] [Green Version]

- Twomey, P. Rationales for Additional Climate Policy Instruments under a Carbon Price. Econ. Labour Relat. Rev. 2012, 23, 7–31. [Google Scholar] [CrossRef]

- Yin, G.; Zhou, L.; Duan, M.; He, W.; Zhang, P. Impacts of carbon pricing and renewable electricity subsidy on direct cost of electricity generation: A case study of China’s provincial power sector. J. Clean. Prod. 2018, 205, 375–387. [Google Scholar] [CrossRef]

- Shahnazari, M.; McHugh, A.; Maybee, B.; Whale, J. Overlapping carbon pricing and renewable support schemes under political uncertainty: Global lessons from an Australian case study. Appl. Energy 2017, 200, 237–248. [Google Scholar] [CrossRef]

- Palmer, K.; Paul, A.; Woerman, M.; Steinberg, D.C. Federal policies for renewable electricity: Impacts and interactions. Energy Policy 2011, 39, 3975–3991. [Google Scholar] [CrossRef]

- IEA. Tracking Buildings 2020. Available online: https://www.iea.org/reports/tracking-buildings-2020# (accessed on 5 January 2021).

- Asche, F.; Nilsen, O.B.; Tveterås, R. Natural Gas Demand in the European Household Sector. Energy J. 2008, 29, 27–46. [Google Scholar] [CrossRef] [Green Version]

- Bissiri, M.; Reis, I.F.; Figueiredo, N.C.; da Silva, P.P. An econometric analysis of the drivers for residential heating consumption in the UK and Germany. J. Clean. Prod. 2019, 228, 557–569. [Google Scholar] [CrossRef]

- Estrada, J.; Fugleberg, O. Price Elasticities of Natural Gas Demand in France and West Germany. Energy J. 1989, 10, 77–90. [Google Scholar] [CrossRef]

- Filippini, M.; Kumar, N. Gas demand in the Swiss household sector. Appl. Econ. Lett. 2020, 28, 359–364. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J.M.; López-Otero, X. A meta-analysis on the price elasticity of energy demand. Energy Policy 2017, 102, 549–568. [Google Scholar] [CrossRef] [Green Version]

- Charlier, D. Energy efficiency investments in the context of split incentives among French households. Energy Policy 2015, 87, 465–479. [Google Scholar] [CrossRef]

- Kemp, P.A.; Kofner, S. Contrasting Varieties of Private Renting: England and Germany. Int. J. Hous. Policy 2010, 10, 379–398. [Google Scholar] [CrossRef]

- Melvin, J. The split incentives energy efficiency problem: Evidence of underinvestment by landlords. Energy Policy 2018, 115, 342–352. [Google Scholar] [CrossRef]

- Rogge, K.S.; Reichardt, K. Policy mixes for sustainability transitions: An extended concept and framework for analysis. Res. Policy 2016, 45, 1620–1635. [Google Scholar] [CrossRef]

- Rosenow, J.; Kern, F.; Rogge, K.S. The need for comprehensive and well targeted instrument mixes to stimulate energy transitions: The case of energy efficiency policy. Energy Res. Soc. Sci. 2017, 33, 95–104. [Google Scholar] [CrossRef]

- Purkus, A.; Hagemann, N.; Bedtke, N.; Gawel, E. Towards a sustainable innovation system for the German wood-based bioeconomy: Implications for policy design. J. Clean. Prod. 2018, 172, 3955–3968. [Google Scholar] [CrossRef]

- Imbert, E.; Ladu, L.; Morone, P.; Quitzow, R. Comparing policy strategies for a transition to a bioeconomy in Europe: The case of Italy and Germany. Energy Res. Soc. Sci. 2017, 33, 70–81. [Google Scholar] [CrossRef]

- González, P.D.R. The interaction between emissions trading and renewable electricity support schemes. An overview of the literature. Mitig. Adapt. Strat. Glob. Chang. 2007, 12, 1363–1390. [Google Scholar] [CrossRef]

- Kern, F.; Howlett, M. Implementing transition management as policy reforms: A case study of the Dutch energy sector. Policy Sci. 2009, 42, 391–408. [Google Scholar] [CrossRef]

- Kern, F.; Kivimaa, P.; Martiskainen, M. Policy packaging or policy patching? The development of complex energy efficiency policy mixes. Energy Res. Soc. Sci. 2017, 23, 11–25. [Google Scholar] [CrossRef] [Green Version]

- Nilsson, M.; Zamparutti, T.; Petersen, J.E.; Nykvist, B.; Rudberg, P.; McGuinn, J. Understanding Policy Coherence: Analytical Framework and Examples of Sector-Environment Policy Interactions in the EU. Environ. Policy Gov. 2012, 22, 395–423. [Google Scholar] [CrossRef]

- Kern, F.; Rogge, K.S.; Howlett, M. Policy mixes for sustainability transitions: New approaches and insights through bridging innovation and policy studies. Res. Policy 2019, 48, 103832. [Google Scholar] [CrossRef]

- BMUB. Climate Action Plan 2050-Principles and Goals of the German Government’s Climate Policy. Federal Ministry for the Environment; Nature Conservation; Building and Nuclear Safety. 2016. Available online: https://www.bmu.de/fileadmin/Daten_BMU/Pools/Broschueren/klimaschutzplan_2050_en_bf.pdf (accessed on 29 September 2021).

- BMWI. Energy Efficiency Strategy for Buildings. Bundesministerium für Wirtschaft und Energie. 2015. Available online: https://www.bmwi.de/Redaktion/EN/Artikel/Energy/energy-efficiency-strategy-for-buildings.html (accessed on 29 September 2021).

- Bundesregierung. Integrated National Energy and Climate Plan. 2020. Available online: https://ec.europa.eu/energy/sites/default/files/documents/de_final_necp_main_en.pdf (accessed on 29 September 2021).

- Bundesregierung. Long-Term Renovation Strategy of the Federal Government. 2020. Available online: https://ec.europa.eu/energy/sites/default/files/documents/de_2020_ltrs_official_en_translation.pdf (accessed on 29 September 2021).

- Corradini, M.; Costantini, V.; Markandya, A.; Paglialunga, E.; Sforna, G. A dynamic assessment of instrument interaction and timing alternatives in the EU low-carbon policy mix design. Energy Policy 2020, 120, 73–84. [Google Scholar] [CrossRef]

- Freyre, A.; Klinke, S.; Patel, M.K. Carbon tax and energy programs for buildings: Rivals or allies? Energy Policy 2020, 139, 111218. [Google Scholar] [CrossRef]

- Raymond, L. Carbon pricing and economic populism: The case of Ontario. Clim. Policy 2020, 20, 1127–1140. [Google Scholar] [CrossRef]

- BMF. Immediate Climate Action Programme for 2022. Available online: https://www.bundesfinanzministerium.de/Content/EN/Standardartikel/Topics/Priority-Issues/Climate-Action/immediate-climate-action-programme-for-2022.html (accessed on 4 October 2021).

- Bundesregierung. Eckpunkte für das Klimaschutzprogramm 2030. 2019. Available online: https://www.bundesfinanzministerium.de/Content/DE/Standardartikel/Themen/Schlaglichter/Klimaschutz/2019-09-20-Eckpunkte-Klimaschutz-Download.pdf?__blob=publicationFile&v=4 (accessed on 29 September 2021).

- FÖS. Lenkungs- und Verteilungswirkungen einer klimaschutzorientierten Reform der Energiesteuern. 2019. Available online: https://foes.de/pdf/2019-07-FOES_CO2Preis_Hintergrundpapier_BMU.pdf (accessed on 29 September 2021).

- DIW. Für eine Sozialverträgliche CO2-Bepreisung. 2019. Available online: https://www.diw.de/documents/publikationen/73/diw_01.c.635193.de/diwkompakt_2019-138.pdf (accessed on 29 September 2021).

- German Council of Economic Experts. Aufbruch zu einer neuen Klimapolitik. 2019. Available online: https://www.sachverstaendigenrat-wirtschaft.de/fileadmin/dateiablage/gutachten/sg2019/sg_2019.pdf (accessed on 29 September 2021).

- BMWI. Ein CO2-Preis–aber Wie? Available online: https://www.bmwi.de/Redaktion/DE/Schlaglichter-der-Wirtschaftspolitik/2019/08/kapitel-1-6-ein-co2-preis-aber-wie.html (accessed on 29 September 2021).

- EU Commission. Proposal for a Directive of the European Parliament and of the Council Amending Directive 2003/87/EC Establishing a System for Greenhouse Gas Emission Allowance Trading within the Union, Decision (EU) 2015/1814 Concerning the Establishment and Operation of a Market Stability Reserve for the Union Greenhouse Gas Emission Trading Scheme and Regulation (EU) 2015/757. 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0551 (accessed on 29 September 2021).

- EU Commission. Stepping up Europe’s 2030 Climate Ambition: Investing in a Climate-Neutral Future for the Benefit of our People. COM(2020) 562 Final. 2020. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2020:562:FIN (accessed on 29 September 2021).

- BMWI. Dialog Klimaneutrale Wärme-Zielbild, Bausteine und Weichenstellungen 2030/2050. 2021. Available online: https://www.bmwi.de/Redaktion/DE/Publikationen/Energie/dialog-klimaneutrale-waerme-zielbild-bausteine-weichenstellung-2030-2050.pdf?__blob=publicationFile&v=16 (accessed on 29 September 2021).

- Tvinnereim, E.; Mehling, M. Carbon pricing and deep decarbonisation. Energy Policy 2018, 121, 185–189. [Google Scholar] [CrossRef]

- Jenkins, J.D.; Karplus, V.J. Carbon Pricing under Binding Political Constraints; United Nations University World Institute for Development Economics Research: Helsinki, Finland, 2016; ISBN 978-92-9256-087-4. [Google Scholar]

- Vogel, J.A.; Lundqvist, P.; Arias, J. Categorizing Barriers to Energy Efficiency in Buildings. Energy Procedia 2015, 75, 2839–2845. [Google Scholar] [CrossRef] [Green Version]

- Phillips, Y. Landlords versus tenants: Information asymmetry and mismatched preferences for home energy efficiency. Energy Policy 2012, 45, 112–121. [Google Scholar] [CrossRef]

- Palm, J.; Reindl, K. Understanding barriers to energy-efficiency renovations of multifamily dwellings. Energy Effic. 2018, 11, 53–65. [Google Scholar] [CrossRef]

- Gigerenzer, G.; Gaissmaier, W. Heuristic Decision Making. Annu. Rev. Psychol. 2011, 62, 451–482. [Google Scholar] [CrossRef] [Green Version]

- Oeko-Insitut; Klinski, S. Begrenzung der Umlagemöglichkeit der Kosten Eines Brennstoff-Emissionshandels auf Mieter*innen 2020. Available online: https://www.oeko.de/fileadmin/oekodoc/Kurzstudie-Umwaelzung-CO2-Bepreisung.pdf (accessed on 29 September 2021).

- Sandén, B.A.; Azar, C. Near-term technology policies for long-term climate targets—economy wide versus technology specific approaches. Energy Policy 2005, 33, 1557–1576. [Google Scholar] [CrossRef]

- Dena. Szenarien für Eine Marktwirtschaftliche Klima-und Ressourcenschutzpolitik 2050 im Gebäudesektor. Deutsche Energie-Agentur. 2017. Available online: https://www.dena.de/fileadmin/dena/Dokumente/Pdf/9220_Gebaeudestudie_Szenarien_Klima-_und_Ressourcenschutzpolitik_2050.pdf (accessed on 29 September 2021).

- Bürger, V.; Hesse, T.; Köhler, B.; Palzer, A.; Engelmann, P. German Energiewende—Different visions for a (nearly) climate neutral building sector in 2050. Energy Effic. 2019, 12, 73–87. [Google Scholar] [CrossRef]

- Öko-Institut; Fraunhofer ISI. Klimaschutzszenario 2050–2. Endbericht. 2015. Available online: https://www.oeko.de/oekodoc/2451/2015-608-de.pdf (accessed on 29 September 2021).

- Kenkmann, T.; Braungardt, S. How to make energy efficiency policies in buildings deliver?–The role of refurbishment companies and skilled craft workers. In Proceedings of the International Energy Policy and Programme Evaluation Conference, Vienna, Austria, 26 June 2018. [Google Scholar]

- Klinski, S.; Keimeyer, F. Zur Finanzverfassungsrechtlichen Zulässigkeit Eines Nationalen Zertifikatehandels für CO2-Emissionen aus Kraft- und Heizstoffen. 2019. Available online: https://www.oeko.de/fileadmin/oekodoc/Verfassungsrecht_Emissionshandel_Gebaeude-Verkehr.pdf (accessed on 29 September 2021).

- IKEM; Rodi, M. Verfassungsmäßigkeit des Entwurfs zum Brennstoffemissions-Handelsgesetzes (BEHG-E). Rechtwissenschaftliches Kurzgutachten und Stellungnahme. 2019. Available online: https://www.ikem.de/wp-content/uploads/2019/11/2019-11-05_IKEM_Kurzgutachten_BEHG-E_final.pdf (accessed on 29 September 2021).

- Braungardt, S.; Bürger, V.; Hartwig, J. The proposed national emissions trading system in Germany-Discussion of implications for the buildings sector. In Proceedings of the 16th Symposium Energieinnovation, Graz, Austria, 12–14 February 2020. [Google Scholar]

- Oeko-Insitut; Fraunhofer ISI; IREES. Treibhausgasminderungswirkung des Klimaschutzprogramms 2030. 2020. Available online: https://www.umweltbundesamt.de/publikationen/treibhausgasminderungswirkung-klimaschutzprogramm-2030 (accessed on 29 September 2021).

- Prognos; Navigant; Oeko-Institut; Ifeu; Adelphi; BBH; Dena. Kurzgutachten zu Maßnahmen zur Zielerreichung 2030 zur Begleitung des Klimakabinetts. 2020. Available online: https://www.bmwi.de/Redaktion/DE/Publikationen/Studien/kurzgutachten-zu-massnahmen-zur-zielerreichung-2030-zur-begleitung-des-klimakabinetts.pdf?__blob=publicationFile&v=8 (accessed on 29 September 2021).

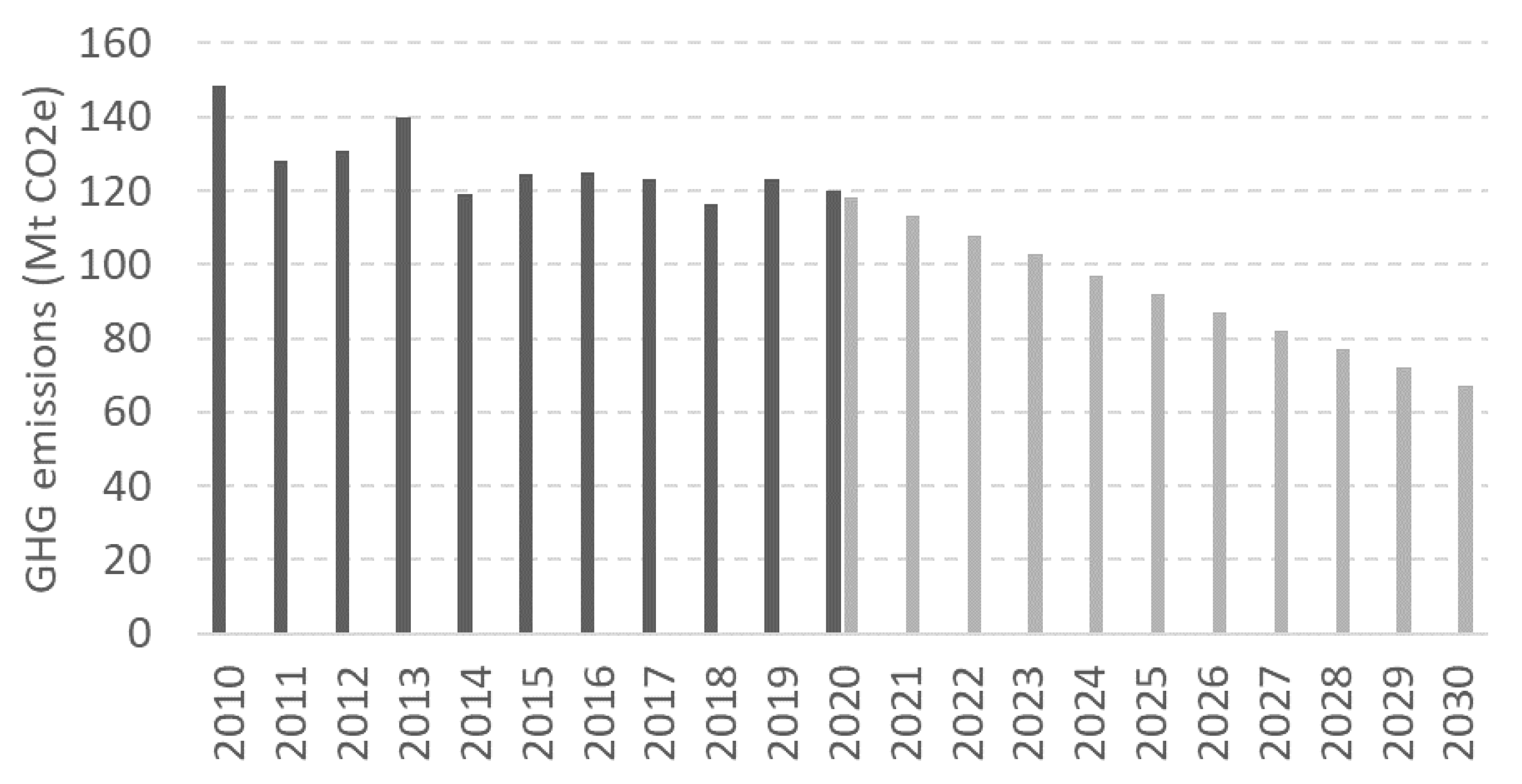

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|

| Annual emission budgets for the buildings sector (Mt CO2e) | ||||||||||

| 118 | 113 | 108 | 103 | 97 | 92 | 87 | 82 | 77 | 72 | 67 |

| Technology Push | Demand Pull | Systemic |

|---|---|---|

| Economic instruments | ||

| Funding of serial renovation work Further development of the innovative Future Building (Zukunft Bau) program Building the Energy Transition (Energiewendebauen) initiative | Federal Support for Efficient Buildings (BEG: energy-related renovations and high-efficiency new-builds of residential and nonresidential buildings, as well as individual renovation measures in the area of energy efficiency; funding for installations which use renewable energies to generate heating and cooling, as well as for certain heat storage facilities and local heat networks, both in residential and nonresidential buildings) Tax incentives for energy-related building renovations Funding for mini cogeneration plants | Heating Network Systems 4.0: Expansion of funding program for heating networks, heat storage systems and multibuilding investments Energy-efficient urban redevelopment and further development of the Urban Development Funding Program Funding of energy performance contract consulting within the framework of energy consulting for nonresidential buildings owned by municipalities/charitable organizations Model energy saving contracting projects Municipality-level energy efficiency and resource efficiency networks |

| Regulation | ||

| Buildings Energy Act (Building Code): Minimum energy efficiency standards for new buildings and major renovations; renewable energy quota for new buildings; restrictions on the installation of oil-fired boilers from 2026. EU level: Minimum standards and labels for heating and cooling appliances under the Ecodesign Directive | Exemplary role of federal buildings Submetering (planned implementation: additional billing information during the year) | |

| Information | ||

| Independent consultancy services provided by National Consumer Agency (Verbraucherzentrale Bundesverband e.V., vzbv) Federal funding for energy consulting for residential buildings (on-site consulting, individual renovation roadmap) Energy consulting for nonresidential buildings owned by municipalities/charitable organizations Federal funding for energy consulting for SMEs National efficiency label for old heating installations | Dialogue on contracting between the Federal Government and the federal states Information on sample contracts and guidelines (contracting) Information and Competency Center for Future-Oriented Construction | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Braungardt, S.; Bürger, V.; Köhler, B. Carbon Pricing and Complementary Policies—Consistency of the Policy Mix for Decarbonizing Buildings in Germany. Energies 2021, 14, 7143. https://doi.org/10.3390/en14217143

Braungardt S, Bürger V, Köhler B. Carbon Pricing and Complementary Policies—Consistency of the Policy Mix for Decarbonizing Buildings in Germany. Energies. 2021; 14(21):7143. https://doi.org/10.3390/en14217143

Chicago/Turabian StyleBraungardt, Sibylle, Veit Bürger, and Benjamin Köhler. 2021. "Carbon Pricing and Complementary Policies—Consistency of the Policy Mix for Decarbonizing Buildings in Germany" Energies 14, no. 21: 7143. https://doi.org/10.3390/en14217143

APA StyleBraungardt, S., Bürger, V., & Köhler, B. (2021). Carbon Pricing and Complementary Policies—Consistency of the Policy Mix for Decarbonizing Buildings in Germany. Energies, 14(21), 7143. https://doi.org/10.3390/en14217143