Cost–Benefit Analysis of Pumped Hydroelectricity Storage Investment in China

Abstract

:1. Introduction

- Governmental and regional targets for carbon reduction have been stimulating the integration of renewable energy sources (RES) for years. The rapid development of wind energy in the north and west of China can be considered as the prime driver for increased PHS development. In 2020, China reached record wind capacity of 288 GW (278 GW on-shore and 10 GW off-shore), accounting for 39% of the global installed capacity, while solar PV capacity reached 254 GW, accounting for 36% of the global capacity.

- In October 2020, more than 400 companies in the Chinese wind industry adopted the Beijing Declaration, which aims for 50 GW of annual installations from 2021 to 2025 and 60 GW from 2026 onwards. This would bring China’s cumulative wind capacity to 800 GW by 2030 and 3000 GW by 2060. Storage strategies are necessary to cope with this new amount of variable renewable energy sources to avoid curtailment [3].

- Variable renewable energy curtailment in China is mainly due to the rapid growth of wind and PV installations in the remote northwestern areas of China, while most of the electricity demand is located in the populated and industrialized urban areas of the southeastern coast of China. Wind energy curtailment reached a global average of around 17% in 2016, while around 11% of solar energy was curtailed in 2015. Regarding economic impact, as an example, the cost of curtailment was evaluated at around $1 billion in the period 2011–2017. The situation is getting better, with wind energy curtailment in 2019 coming down to 4%, although this still accounted for 17 TWh lost [4].

- Electricity consumption has been growing due to China’s rapid industrial development, so PHS is urgently needed to bridge the valley-to-peak gap.

- Because the security of the electric power supply has been emphasized by regulators, PHS needs to be widely used to contribute to the reliability of the power grid as it can provide ancillary services [5].

2. Literature Review

3. Zhanghewan Case Study Model

4. Scenario Development

5. Application of the Model on PHS in China

6. Data

7. Results and Discussion

8. Conclusions

- The “peak shaving” and “valley filling” of PHS help coal-based stations save fuel, avoid restart, smooth the output, and improve load efficiency. This is one of the system-wide effects of PHS, and it is known as levelling the load curve (LLC). While adjusting the demand–supply balance, PHS reduces the gap between the peak and off-peak demand. This provides thermal/nuclear power plants an “apparent” load curve (improved load curve), which allows them to operate continuously for a long time at stable output, thereby increasing fuel efficiency and decreasing operational stresses.

- PHS can adapt quickly to load changes and modulate frequency as well as maintain voltage. Therefore, it can just be used as an emergency backup to prevent system collapse.

- PHS is complementary in balancing the disequilibrium of renewable power generation and regulating the frequency of the grid [75].

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sospiro, P.; Amarnath, L.; di Nardo, V.; Talluri, G.; Gandoman, F.H. Smart Grid in China, EU, and the US: State of Implementation. Energies 2021, 14, 5637. [Google Scholar] [CrossRef]

- Dotzauer, M.; Pfeiffer, D.; Lauer, M.; Pohl, M.; Mauky, E.; Bär, K.; Sonnleitner, M.; Zörner, W.; Hudde, J.; Schwarz, B.; et al. How to measure flexibility—Performance indicators for demand driven power generation from biogas plants. Renew. Energy 2019, 134, 135–146. [Google Scholar] [CrossRef]

- Global Wind Report|GWEC. Wind Energy Global Status. Available online: http://www.gwec.net/global-figures/wind-energy-global-status/ (accessed on 2 December 2021).

- Statista. Wind Power Curtailment in China 2013–2020. Available online: https://www.statista.com/statistics/973688/china-wind-power-curtailment (accessed on 15 June 2021).

- Zhou, Y.; Lu, S. China’s Renewables Curtailment and Coal Assets Risk Map: Research Findings and Map User Guide. Available online: https://data.bloomberglp.com/bnef/sites/14/2017/10/Chinas-Renewable-Curtailment-and-Coal-Assets-Risk-Map-FINAL_2.pdf (accessed on 30 October 2020).

- Liang, Y.; Yu, B.; Wang, L. Costs and benefits of renewable energy development in China’s power industry. Renew. Energy 2019, 131, 700–712. [Google Scholar] [CrossRef]

- Barbour, E.; Wilson, I.G.; Radcliffe, J.; Ding, Y.; Li, Y. A review of pumped hydro energy storage development in significant international electricity markets. Renew. Sustain. Energy Rev. 2016, 61, 421–432. [Google Scholar] [CrossRef] [Green Version]

- Rogeau, A.; Girard, R.; Kariniotakis, G. A generic GIS-based method for small Pumped Hydro Energy Storage (PHES) potential evaluation at large scale. Appl. Energy 2017, 197, 241–253. [Google Scholar] [CrossRef] [Green Version]

- IHA: International Hydropower Association. Available online: https://hydropower-assets.s3.eu-west-2.amazonaws.com/publications-docs/2020_hydropower_status_report.pdf (accessed on 2 July 2021).

- Cook, O.; Leschke, M. Accelerating Corporate Renewable Energy Engagement in China. Available online: https://resource-solutions.org/wp-content/uploads/2019/11/Accelerating-Corporate-RE-Engagement-in-China.pdf (accessed on 26 April 2021).

- Anuta, O.H.; Taylor, P.; Jones, D.; McEntee, T.; Wade, N. An international review of the implications of regulatory and electricity market structures on the emergence of grid scale electricity storage. Renew. Sustain. Energy Rev. 2014, 38, 489–508. [Google Scholar] [CrossRef] [Green Version]

- Masiello, R.D.; Roberts, B.; Sloan, T. Business Models for Deploying and Operating Energy Storage and Risk Mitigation Aspects. Proc. IEEE. 2014, 102, 1052–1064. [Google Scholar] [CrossRef]

- Kapsali, M.; Kaldellis, J. Combining hydro and variable wind power generation by means of pumped-storage under economically viable terms. Appl. Energy 2010, 87, 3475–3485. [Google Scholar] [CrossRef]

- Nikolaidis, P.; Poullikkas, A. Cost metrics of electrical energy storage technologies in potential power system operations. Sustain. Energy Technol. Assess. 2018, 25, 43–59. [Google Scholar] [CrossRef]

- Ming, Z.; Kun, Z.; Daoxin, L. Overall review of pumped-hydro energy storage in China: Status quo, operation mechanism and policy barriers. Renew. Sustain. Energy Rev. 2013, 17, 35–43. [Google Scholar] [CrossRef]

- Welisch, M.; Ortner, A.; Resch, G. Assessment of RES technology market values and the merit-order effect—an econometric multi-country analysis. Energy Environ. 2016, 27, 105–121. [Google Scholar] [CrossRef] [Green Version]

- Connolly, D.; Lund, H.; Finn, P.; Mathiesen, B.; Leahy, M. Practical operation strategies for pumped hydroelectric energy storage (PHES) utilising electricity price arbitrage. Energy Policy 2011, 39, 4189–4196. [Google Scholar] [CrossRef] [Green Version]

- Zhang, F.; Xu, Z.; Jiao, B.; Feng, J. Study on Pricing Mechanism of Pumped Hydro Energy Storage (PHES) under China’s Electricity Tariff Reform. Available online: https://www.e3s-conferences.org/articles/e3sconf/abs/2018/13/e3sconf_icemee2018_04016/e3sconf_icemee2018_04016.html (accessed on 18 November 2020).

- Gaudard, L.; Romerio, F. The future of hydropower in Europe: Interconnecting climate, markets and policies. Environ. Sci. Policy 2014, 37, 172–181. [Google Scholar] [CrossRef]

- eStorage. Overview of Potential Locations for New Pumped Storage Plants in EU 15, Switzerland and Norway. Available online: https://www.estorage-project.eu/wp-content/uploads/2013/06/eStorage_D4.2-Overview-of-potential-locations-for-new-variable-PSP-in-Europe.pdf (accessed on 15 September 2020).

- eStorage. eStorage Study Shows Huge Potential Capacity of Exploitable Pumped Hydro Energy Storage Sites in Europe. Available online: https://www.prnewswire.com/news-releases/estorage-study-shows-huge-potential-capacity-of-exploitable-pumped-hydro-energy-storage-sites-in-europe-577386191.html (accessed on 15 September 2020).

- Margeta, J.; Glasnovic, Z. Feasibility of the green energy production by hybrid solar + hydro power system in Europe and similar climate areas. Renew. Sustain. Energy Rev. 2010, 14, 1580–1590. [Google Scholar] [CrossRef]

- Rehman, S.; Al-Hadhrami, L.M.; Alam, M. Pumped hydro energy storage system: A technological review. Renew. Sustain. Energy Rev. 2015, 44, 586–598. [Google Scholar] [CrossRef]

- Anagnostopoulos, J.S.; Papantonis, D.E. Pumping station design for a pumped-storage wind-hydro power plant. Energy Convers. Manag. 2007, 48, 3009–3017. [Google Scholar] [CrossRef]

- Javanbakht, P.; Mohagheghi, S.; Simoes, M.G. Transient performance analysis of a small-scale PV-PHS power plant fed by a SVPWM drive applied for a distribution system. In Proceedings of the 2013 IEEE Energy Conversion Congress and Exposition, Denver, CO, USA, 15–19 September 2013; pp. 4532–4539. [Google Scholar] [CrossRef]

- De Negri, J.F.; Pezzutto, S.; Gantioler, S.; Moser, D.; Sparber, W. A Comprehensive Analysis of Public and Private Funding for Photovoltaics Research and Development in the European Union, Norway, and Turkey. Energies 2020, 13, 2743. [Google Scholar] [CrossRef]

- Carolus, J.F.; Hanley, N.; Olsen, S.; Pedersen, S.M. A Bottom-up Approach to Environmental Cost-Benefit Analysis. Ecol. Econ. 2018, 152, 282–295. [Google Scholar] [CrossRef] [Green Version]

- Snyder, B.; Kaiser, M.J. Ecological and economic cost-benefit analysis of offshore wind energy. Renew. Energy 2009, 34, 1567–1578. [Google Scholar] [CrossRef]

- Krarti, M.; Dubey, K. Review analysis of economic and environmental benefits of improving energy efficiency for UAE building stock. Renew. Sustain. Energy Rev. 2018, 82, 14–24. [Google Scholar] [CrossRef]

- Nurmi, V.; Ahtiainen, H. Distributional Weights in Environmental Valuation and Cost-benefit Analysis: Theory and Practice. Ecol. Econ. 2018, 150, 217–228. [Google Scholar] [CrossRef]

- Pikas, E.; Kurnitski, J.; Thalfeldt, M.; Koskela, L. Cost-benefit analysis of nZEB energy efficiency strategies with on-site photovoltaic generation. Energy 2017, 128, 291–301. [Google Scholar] [CrossRef]

- Sardi, J.; Mithulananthan, N.; Gallagher, M.; Hung, D.Q. Multiple community energy storage planning in distribution networks using a cost-benefit analysis. Appl. Energy 2017, 190, 453–463. [Google Scholar] [CrossRef]

- Judd, S.; Al Momani, F.; Znad, H.; Al Ketife, A. The cost benefit of algal technology for combined CO2 mitigation and nutrient abatement. Renew. Sustain. Energy Rev. 2017, 71, 379–387. [Google Scholar] [CrossRef] [Green Version]

- Dobraja, K.; Barisa, A.; Rosa, M. Cost-benefit Analysis of Integrated Approach of Waste and Energy Management. Energy Procedia 2016, 95, 104–111. [Google Scholar] [CrossRef] [Green Version]

- Johansson, P.-O. On lessons from energy and environmental cost–benefit analysis. Technol. Forecast. Soc. Chang. 2016, 112, 20–25. [Google Scholar] [CrossRef]

- Reinoso, C.S.; de Paula, M.; Buitrago, R. Cost–benefit analysis of a photovoltaic power plant. Int. J. Hydrogen Energy 2014, 39, 8708–8711. [Google Scholar] [CrossRef]

- Azevedo, I.; Glachant, J.M.; He, X.; Olmos, L. Cost Benefit Analysis in the Context of the Energy Infrastructure Package; 2013. Available online: https://op.europa.eu/it/publication-detail/-/publication/b5d3ecd3-4da4-42d6-b79d-f177c631d9d6/language-en (accessed on 23 November 2021).

- Hanley, N.; Spash, C. Cost-Benefit Analysis and the Environment. Environ. Values 1996, 5, 182–183. [Google Scholar]

- Bollen, J.; van der Zwaan, B.; Brink, C.; Eerens, H. Local air pollution and global climate change: A combined cost-benefit analysis. Resour. Energy Econ. 2009, 31, 161–181. [Google Scholar] [CrossRef] [Green Version]

- Pickin, J. Representations of environmental concerns in cost–benefit analyses of solid waste recycling. Resour. Conserv. Recycl. 2008, 53, 79–85. [Google Scholar] [CrossRef]

- Clinch, J. Cost–Benefit Analysis Applied to Energy. Encycl. Energy 2004, 715–725. [Google Scholar] [CrossRef]

- Clinch, J.; Healy, J.D. Cost-benefit analysis of domestic energy efficiency. Energy Policy 2001, 29, 113–124. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, T.; Ye, S.; Liu, Y. Cost-benefit analysis for Energy Efficiency Retrofit of existing buildings: A case study in China. J. Clean. Prod. 2018, 177, 493–506. [Google Scholar] [CrossRef]

- Liu, Y.-H.; Liao, W.-Y.; Li, L.; Huang, Y.-T.; Xu, W.-J.; Zeng, X.-L. Reduction measures for air pollutants and greenhouse gas in the transportation sector: A cost-benefit analysis. J. Clean. Prod. 2019, 207, 1023–1032. [Google Scholar] [CrossRef]

- Wang, Y.; Geng, S.; Zhao, P.; Du, H.; He, Y.; Crittenden, J. Cost–benefit analysis of GHG emission reduction in waste to energy projects of China under clean development mechanism. Resour. Conserv. Recycl. 2016, 109, 90–95. [Google Scholar] [CrossRef]

- Gao, J.; Yuan, Z.; Liu, X.; Xia, X.; Huang, X.; Dong, Z. Improving air pollution control policy in China—A perspective based on cost–benefit analysis. Sci. Total. Environ. 2016, 543, 307–314. [Google Scholar] [CrossRef] [PubMed]

- Wang, X.; Lu, M.; Mao, W.; Ouyang, J.; Zhou, B.; Yang, Y. Improving benefit-cost analysis to overcome financing difficulties in promoting energy-efficient renovation of existing residential buildings in China. Appl. Energy 2015, 141, 119–130. [Google Scholar] [CrossRef]

- Shih, Y.-H.; Tseng, C.-H. Cost-benefit analysis of sustainable energy development using life-cycle co-benefits assessment and the system dynamics approach. Appl. Energy 2014, 119, 57–66. [Google Scholar] [CrossRef]

- Liu, Y.; Guo, X.; Hu, F. Cost-benefit analysis on green building energy efficiency technology application: A case in China. Energy Build. 2014, 82, 37–46. [Google Scholar] [CrossRef]

- Rosenow, J.; Bayer, E. Costs and benefits of Energy Efficiency Obligations: A review of European programmes. Energy Policy 2017, 107, 53–62. [Google Scholar] [CrossRef]

- Beria, P.; Munari, F. “I metodi di valutazione dei costi ambientali del trasporto all’interno delle analisi costi-benefici” from Cambiamenti climatici e trasporti. Un approccio interdisciplinare. Aracne 2017, 1, 39–47. [Google Scholar]

- Barbieri, C.; Bruno, F.; Mussaif, N. Analisi Costi-Benefici del Modello di Gestione Ambientale ECOCluster. Available online: https://pdc.minambiente.it/sites/default/files/progetti/azione22_analisi.costi.benefici.pdf (accessed on 29 November 2020).

- European Association for Storage of Energy. EASE Input to the Methodology Defining a Cost-Benefit Analysis for Energy Storage. Available online: https://ease-storage.eu/wp-content/uploads/2015/08/EASE-input-to-the-methodology-defining-a-CBAnalysis-ES_2013.04.26-final1.pdf (accessed on 18 March 2021).

- Brocco, M.; Calò, E.; Lucci, A.; Pasquali, M. Analisi Costi e Benefici Sull’introduzione di Sistemi di Accumulo ad Idrogeno e Flow Battery Nella Rete Elettrica Italiana. Available online: https://www.enea.it/it/Ricerca_sviluppo/documenti/ricerca-di-sistema-elettrico/accumulo/2012/rds-2013-255.pdf (accessed on 4 May 2021).

- Diakoulaki, D.; Karangelis, F. Multi-criteria decision analysis and cost–benefit analysis of alternative scenarios for the power generation sector in Greece. Renew. Sustain. Energy Rev. 2007, 11, 716–727. [Google Scholar] [CrossRef]

- Alberini, A.; Longo, A.; Rosato, P.; Zanatta, V. II valore di non uso nell’analisi costi benefici della salvaguardia ambientale. Aestimum 2009, 43, 1–24. [Google Scholar] [CrossRef]

- Asian Development Bank. Hebei Zhanghewan Pumped Storage Project. Available online: https://www.adb.org/projects/documents/hebei-zhanghewan-pumped-storage-project-seia (accessed on 16 August 2021).

- L’Ecluse, C.; Frith, J.; Pumped Hydro: A Primer. BloombergNEF 2021. Available online: https://genexpower.com.au/wp-content/uploads/2021/10/pumped_hydro_a_primer.pdf (accessed on 11 October 2021).

- China Energy Portal. Available online: https://chinaenergyportal.org/en/2018-electricity-other-energy-statistics/ (accessed on 16 August 2020).

- Zhang, D.; Chen, T.; Li, Y. Survey on Pumped Storage Power Stations in Japan. Available online: https://caod.oriprobe.com/articles/23590926/Survey_on_Pumped_Storage_Power_Stations_in_Japan.htm (accessed on 15 November 2019).

- Rogner, M.; Law, S. Pumped Storage Tracking Tool. Available online: https://www.hydropower.org/hydropower-pumped-storage-tool (accessed on 24 June 2019).

- ENTSO-E Transparency Platform. Available online: https://transparency.entsoe.eu/ (accessed on 18 August 2021).

- IEA: International Energy Agency. Available online: https://www.iea.org/reports/world-energy-outlook-2017-china (accessed on 25 October 2020).

- The World Bank. Available online: https://data.worldbank.org/country/china (accessed on 19 April 2020).

- OECD Organisation for Economic Co-operation and Development. China GDP Growth Forecast 2019–2024 and up to 2060, Data and Charts. Available online: https://knoema.com/loqqwx/china-gdp-growth-forecast-2019-2024-and-up-to-2060-data-and-charts (accessed on 12 September 2020).

- U.S. Energy Information Administration. Chinese Coal-Fired Electricity Generation Expected to Flatten as Mix Shifts to Renewables. Available online: https://www.eia.gov/todayinenergy/detail.php?id=33092 (accessed on 25 September 2020).

- IEA International Energy Agency/OECD Organisation for Economic Co-operation and Development. Electricity Production from Coal Sources (% of Total)—China. Available online: https://data.worldbank.org/indicator/EG.ELC.COAL.ZS?locations=CN (accessed on 19 September 2020).

- World Nuclear Association. Heat Values of Various Fuels. Available online: https://www.world-nuclear.org/information-library/facts-and-figures/heat-values-of-various-fuels.aspx (accessed on 7 March 2021).

- Power. Who Has the World’s Most Efficient Coal Power Plant Fleet? Available online: https://www.powermag.com/who-has-the-worlds-most-efficient-coal-power-plant-fleet/ (accessed on 10 April 2021).

- Jingjing, J.; Bin, Y.; Xiaoming, M. The Impact of International Greenhouse Gas Emission Constraints on Coal-Fired Power Plant in China-Based on LCAModel. In Proceedings of the 2013 Fourth International Conference on Digital Manufacturing & Automation, Shinan, China, 29–30 June 2013; pp. 1468–1472. [Google Scholar] [CrossRef]

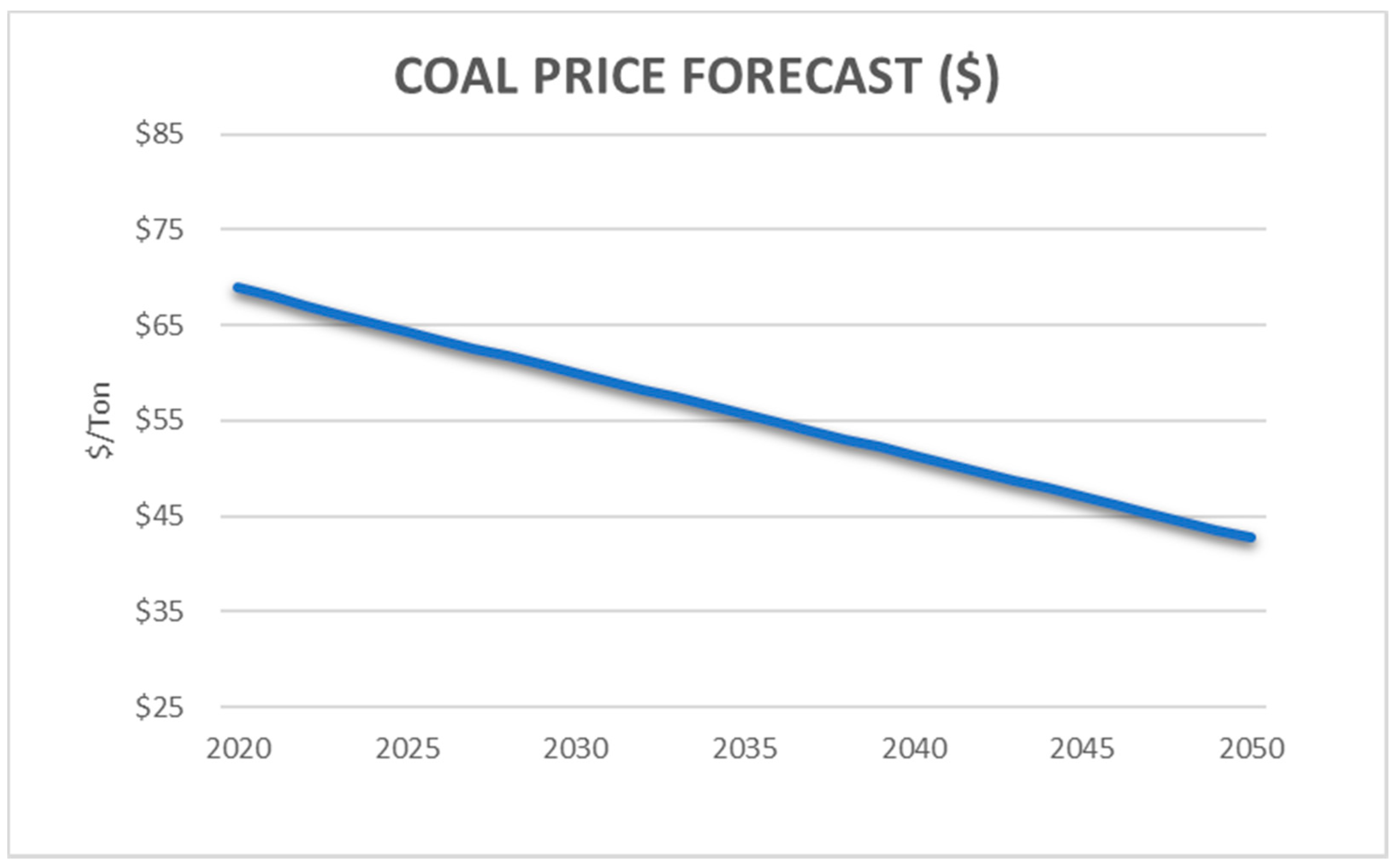

- The World Bank. World Bank Commodities Price Forecast (Nominal US Dollars). Available online: http://pubdocs.worldbank.org/en/633541587395091108/CMO-April-2020-Forecasts.pdf (accessed on 5 September 2021).

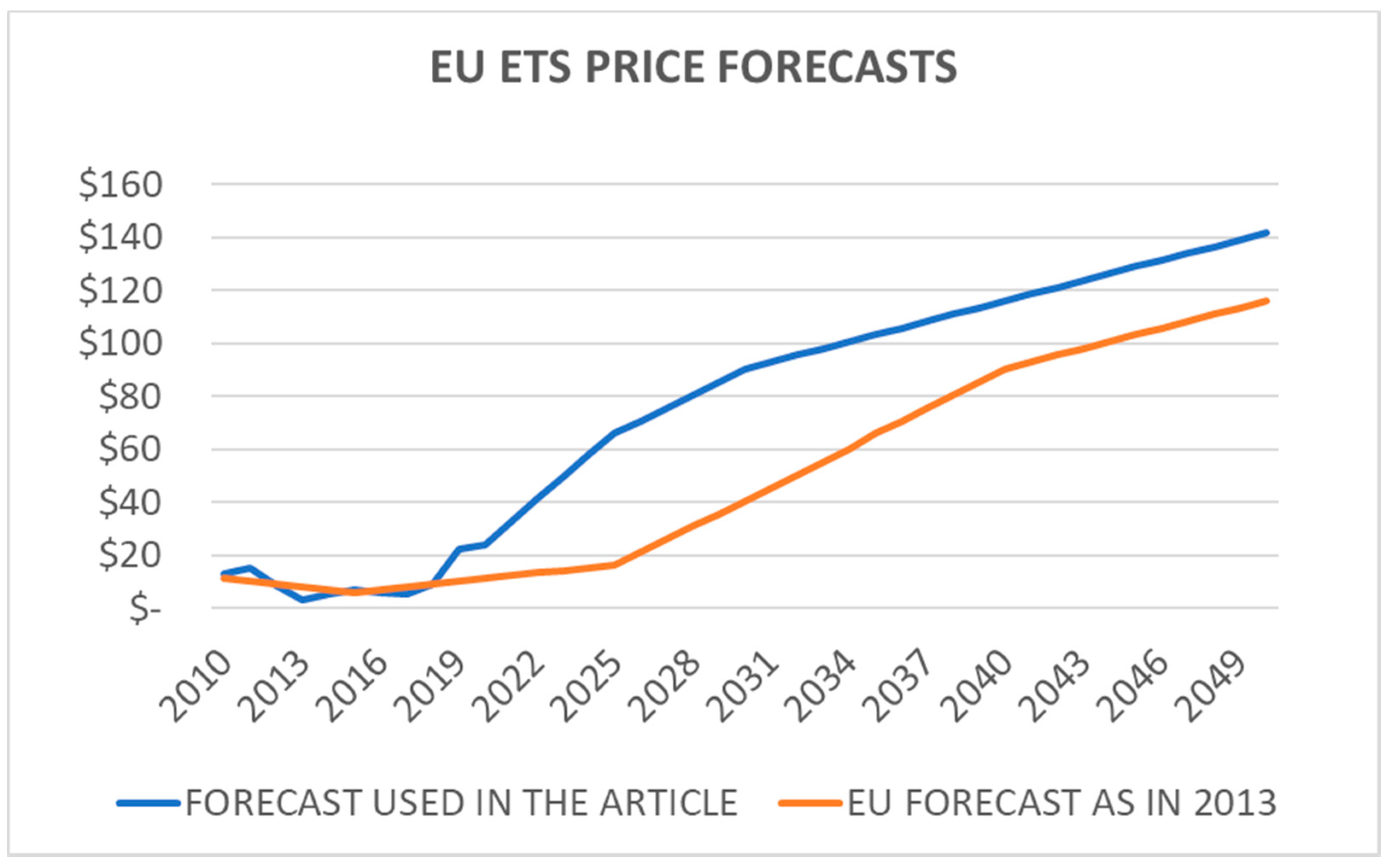

- European Commission. Trends to 2050. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/trends_to_2050_update_2013.pdf (accessed on 30 September 2021).

- Zhang, D.; Paltsev, S. The Future of Natural Gas in China: Effects of Pricing Reform and Climate Policy. MIT Joint Program on the Science and Policy of Global Change 2016. Available online: https://dspace.mit.edu/bitstream/handle/1721.1/103778/MITJPSPGC_Rpt294.pdf?sequence=1&isAllowed=y (accessed on 18 August 2021).

- The World Bank. Inflation, Consumer Prices (Annual %). Available online: https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG (accessed on 22 May 2021).

- Zhu, B.S.; Ma, Z. Development and Prospect of the Pumped Hydro Energy Stations in China. J. Physics Conf. Ser. 2019, 1369, 012018. [Google Scholar] [CrossRef]

| Installed Capacity 1 GW Zhanghewan PHS Plant | |

|---|---|

| Costs | Value |

| Pumped storage powerplantsTransmission line | $422,100,000.00 $16,500,000.00 |

| Rural electrification | $135,500,000.00 |

| Closure of coal-fired power plants | $1,600,000.00 |

| Afforestation | $10,600,000.00 |

| Institutional strengthening | $1,400,000.00 |

| Irrigation | $12,900,000.00 |

| Subtotal | $600,600,000.00 |

| Contingencies | $117,100,000.00 |

| Interest and other charges during construction | $57,100,000.00 |

| TOTAL | $774,800,000.00 |

| TOTAL (€) | €667,645,160.00 |

| Data | GW |

|---|---|

| Global pumped storage installed capacity 2019 | 158 |

| China’s pumped storage installed capacity 2019 | 30.3 |

| Scenario | Actual Capacity | Forecasted Capacity in 2050 | Annual Capacity to Be Installed |

|---|---|---|---|

| 4.5% | 30.3 GW | 167 GW | 4.4 GW/y |

| 6% | 30.3 GW | 223 GW | 6.2 GW/y |

| 8% | 30.3 GW | 297 GW | 8.6 GW/y |

| 11% | 30.3 GW | 409 GW | 12.2 GW/y |

| 14% | 30.3 GW | 520 GW | 15.8 GW/y |

| Scheme 4. | 4.5% | 6% | 8% | 11% | 14% |

|---|---|---|---|---|---|

| 2020 | $3.51 bn | $4.94 bn | $6.85 bn | $9.71 bn | $12.56 bn |

| 2030 | $2.28 bn | $3.21 bn | $4.45 bn | $6.31 bn | $8.16 bn |

| 2040 | $1.56 bn | $2.19 bn | $3.04 bn | $4.30 bn | $5.57 bn |

| 2050 | $1.04 bn | $1.46 bn | $2.03 bn | $2.88 bn | $3.72 bn |

| Avg. Cost Per Year | $2.00 bn | $2.82 bn | $3.90 bn | $5.53 bn | $7.16 bn |

| Scenario | 4.5% | 6% | 8% | 11% | 14% |

|---|---|---|---|---|---|

| 2025 | $0.18 bn | $0.26 bn | $0.36 bn | $0.50 bn | $0.65 bn |

| 2035 | $1.74 bn | $2.44 bn | $3.38 bn | $4.80 bn | $6.21 bn |

| 2045 | $2.80 bn | $3.94 bn | $5.46 bn | $7.74 bn | $10.02 bn |

| 2050 | $3.09 bn | $4.43 bn | $6.14 bn | $8.70 bn | $11.26 bn |

| Avg. Cost Per Year | $1.91 bn | $2.70 bn | $3.72 bn | $5.28 bn | $6.83 bn |

| Scenario | 4.5% | 6% | 8% | 11% | 14% |

|---|---|---|---|---|---|

| 2025 | $0.49 B | $0.69 B | $0.95 B | $1.35 B | $1.75 B |

| 2035 | $8.4 B | $11.82 B | $16.38 B | $23.22 B | $30.06 B |

| 2045 | $20.02 B | $28.16 B | $39.02 B | $55.32 B | $71.61 B |

| 2050 | $27.23 B | $38.31 B | $53.09 B | $75.26 B | $97.42 B |

| Avg. Cost Per Year | $11.99 B | $16.87 B | $23.37 B | $33.13 B | $42.89 B |

| Scenario | Coal Benefit (Avg per Year) | CO2-Eq Benefit (Avg per Year) | Implementation Cost (Avg per Year) |

|---|---|---|---|

| 4.5% | $1.91 B | $11.99 B | $2.00 B |

| 6% | $2.69 B | $16.87 B | $2.82 B |

| 8% | $3.72 B | $23.37 B | $3.9 B |

| 11% | $5.28 B | $33.13 B | $5.53 B |

| 14% | $6.83 B | $42.89 B | $7.16 B |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sospiro, P.; Nibbi, L.; Liscio, M.C.; De Lucia, M. Cost–Benefit Analysis of Pumped Hydroelectricity Storage Investment in China. Energies 2021, 14, 8322. https://doi.org/10.3390/en14248322

Sospiro P, Nibbi L, Liscio MC, De Lucia M. Cost–Benefit Analysis of Pumped Hydroelectricity Storage Investment in China. Energies. 2021; 14(24):8322. https://doi.org/10.3390/en14248322

Chicago/Turabian StyleSospiro, Paolo, Leonardo Nibbi, Marco Ciro Liscio, and Maurizio De Lucia. 2021. "Cost–Benefit Analysis of Pumped Hydroelectricity Storage Investment in China" Energies 14, no. 24: 8322. https://doi.org/10.3390/en14248322

APA StyleSospiro, P., Nibbi, L., Liscio, M. C., & De Lucia, M. (2021). Cost–Benefit Analysis of Pumped Hydroelectricity Storage Investment in China. Energies, 14(24), 8322. https://doi.org/10.3390/en14248322