Impact of Energy and Carbon Emission of a Supply Chain Management with Two-Level Trade-Credit Policy

Abstract

:1. Introduction

- This price reduction policy for green products attracts new customers.

- It should cause a decline in sales since it takes time to profit from this delay period more often, and some customers will pay more rapidly.

Research Gap

2. Problem Description, Notations, and Assumptions

2.1. Problem Description

2.2. Notation

2.2.1. Decision Variables

- T: Producer’s cycle length;

- N: Credit period offered by supplier;

- P: Production rate for the producer.

2.2.2. Producer’s Parameters

- C1p: Producer’s stock holding cost ($/unit/week);

- Cp: Producer’s item cost ($/unit/week);

- C2p: Producer’s setup cost ($/set up);

- C’1p: Cost which include energy and carbon emission due to holding items ($/unit/week);

- C’p: Cost which include energy and carbon emission due to deterioration ($/unit/week);

- C’2p: Cost which include energy and carbon emission due to setup ($/setup);

- φ(P): Production cost.

2.2.3. Supplier’s Parameters

- M: Credit period offered by producer;

- ie: Interest rate earned by supplier;

- ip: Interest rate payable by supplier;

- C1s: Holding cost of supplier ($/unit/week);

- Cs: Item cost of supplier ($/unit);

- C2s: Ordering cost ($/order);

- C’1s: Cost which include energy and carbon emission due to holding items ($/unit/week);

- C’2s: Cost which include energy and carbon emission due to ordering items ($/order);

- C’s: Cost which include carbon emission and energy due to deterioration ($/unit/week);

- c: Purchasing cost ($/unit);

- r: Inflation rate;

- n: Number of cycles;

- T2: Per delivery cycle length; T2= T/n.

2.3. Assumptions

- As for the environment requirements, this paper assumed the carbon emission and energy cost in holding cost, item cost, and setup/ordering costs for producer and supplier (Ahmed and Sarkar [12]).

- Due to agile manufacturing, a controllable production rate controls the excess holding or shortage any time during the whole cycle-length. There is no shortage, since the production rate is considered a decision variable (Sana and Chaudhuri [2]).

- Here, the demand rate is variable, and demand varies with the supplier’s credit period and selling price. Therefore, D = W − (W − f)(1 − z)N + α p−τ, where W and f are the maximum and initial demand of products (unit/week), respectively, z is the demand saturation rate (unit/week). α and τ are the scaling parameter and price elasticity parameter of the selling price p, respectively (Jaggi et al. [13]).

- The deterioration rate (0 ≤ θ ≤ 1) exists and is very small.

- In this paper, TLTCP is applied. In this policy, the producer gives a fixed time M to the supplier, and the supplier also proposes a period N to their clients for the settlement of the account (Jaggi et al. [13]).

- A complete model is studied in the inflationary environment (Yadav et al. [20]).

- Due to agile manufacturing, production cannot be constant. That is why production cost is given below (Sana and Chaudhuri [3]):

- µ is the material cost.

- The second term is is associated with labor and energy cost. As the production rate (P) increases, this cost decreases.

- The term (sP) represents a tool or die costs.

- The last term represents a critical value of the production rate (Pc) for the machine. The formed stock is to be defective for a very high production rate (P > Pc).

3. Material and Methods

3.1. Producer’s Model

3.1.1. Holding Cost

3.1.2. Setup Cost

3.1.3. Item Cost

3.1.4. Production Cost

3.1.5. Producer’s Total Cost

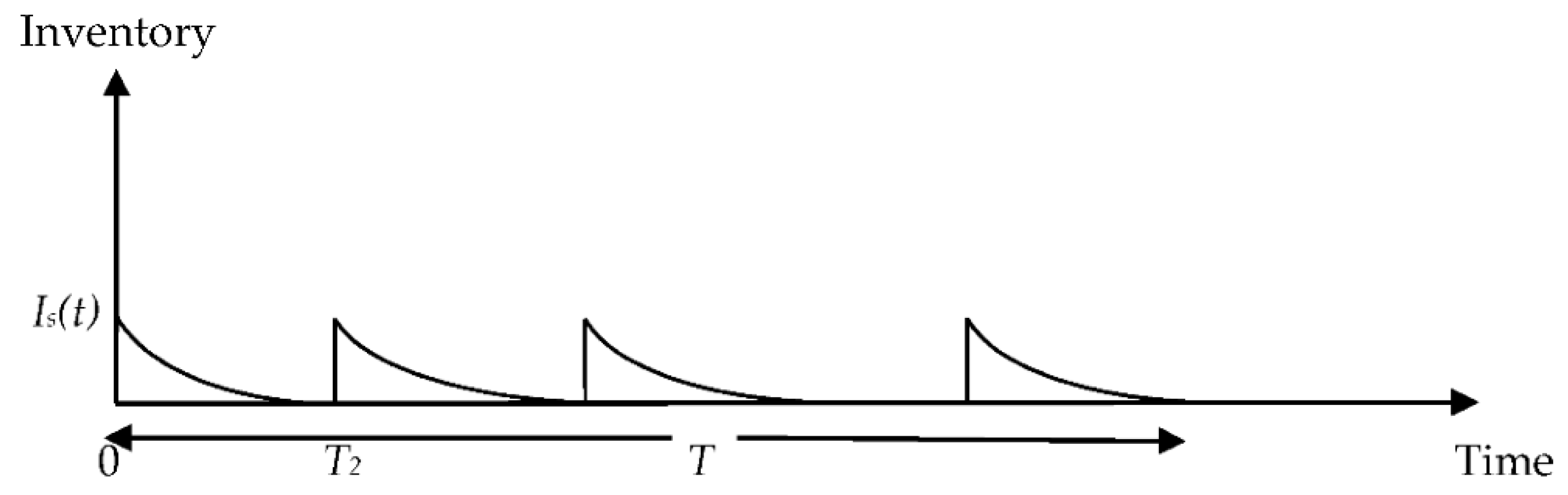

3.2. Supplier’s Model for Selling Strategy of Products

3.2.1. Holding Cost for Items

3.2.2. Ordering Cost for Items

3.2.3. Item Cost

3.2.4. Supplier’s Total Cost

3.2.5. Supplier’s Total Cost in Two Different Credit Policy

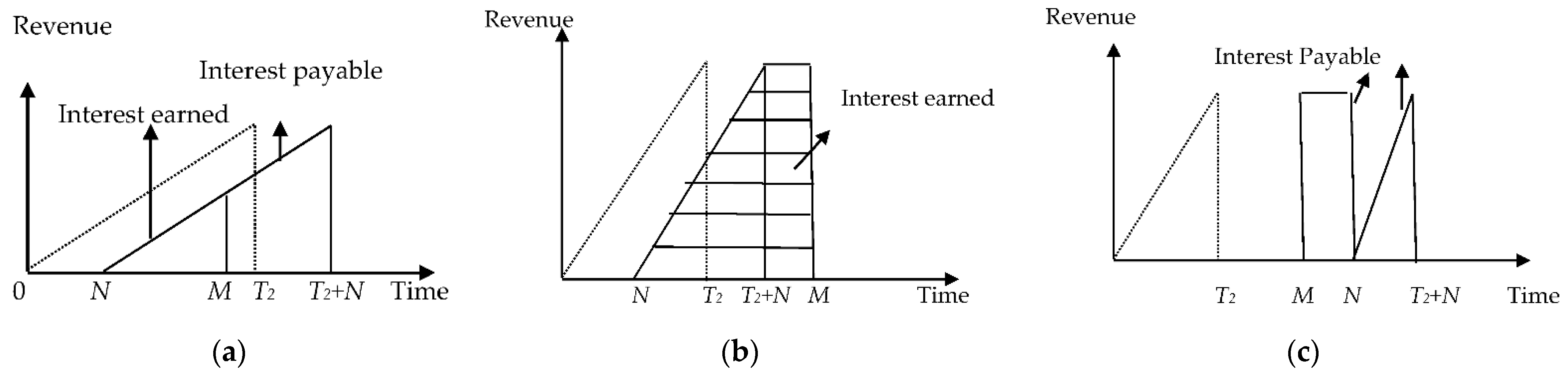

Case I-When N ≤ M ≤ T2 + N

Case II-N ≤ T2 + N ≤ M

Case III-M ≤ N ≤ T2 + N

3.3. Integrated Cost Function for Two-Echelon Supply Chain Management

3.3.1. The Total Integrated Cost in Case I

3.3.2. The Total Integrated Cost in Case II

3.3.3. The Integrated Total Cost in Case III

3.4. Solution Methodology

4. Numerical Examples

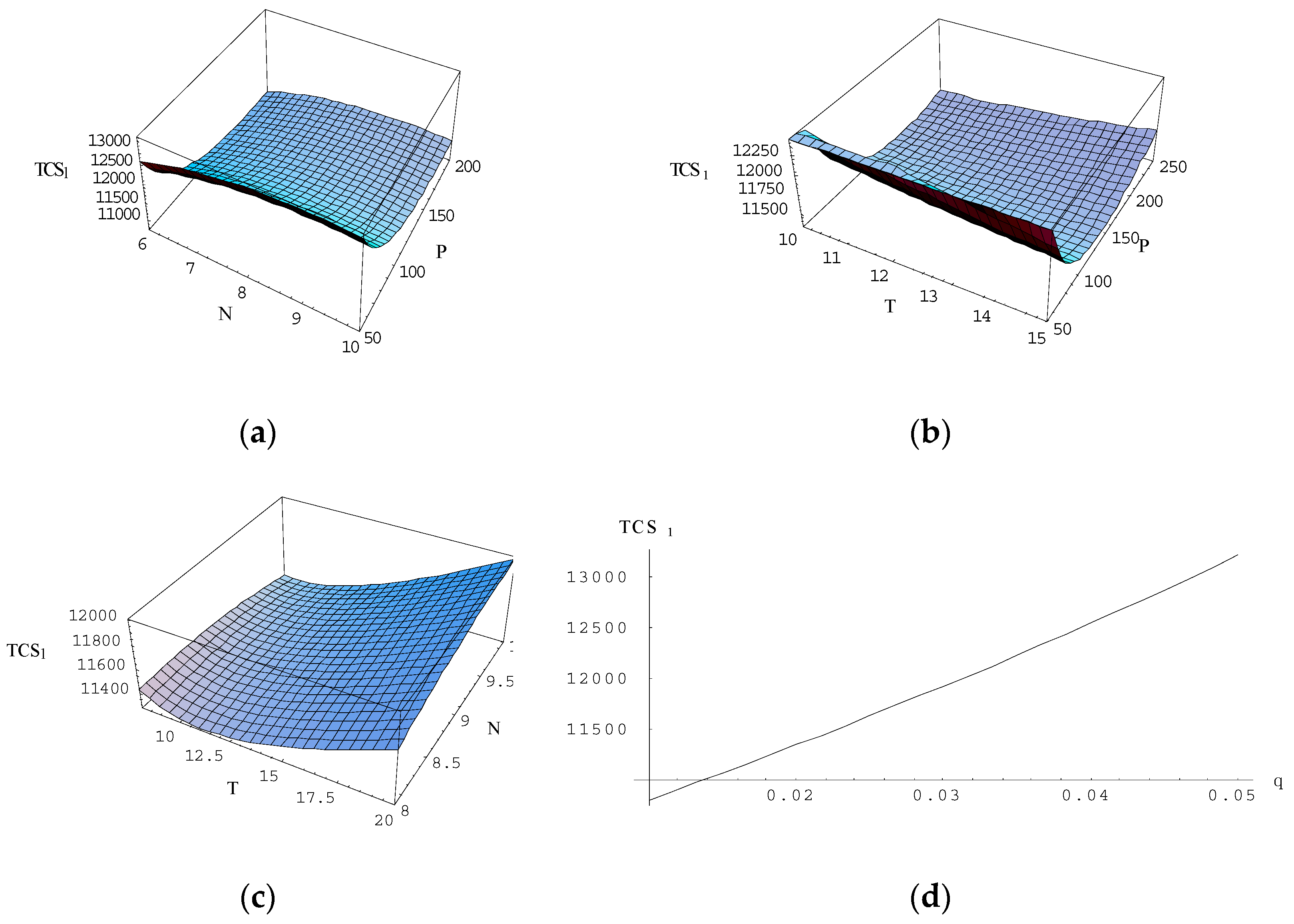

4.1. Numerical Example 1

4.1.1. Nature of Total Cost Concerning Two Decision Variables and the Third One Is Fixed

4.1.2. Effect of the Various Parameters on the Decision Variables and the Total Integrated Cost

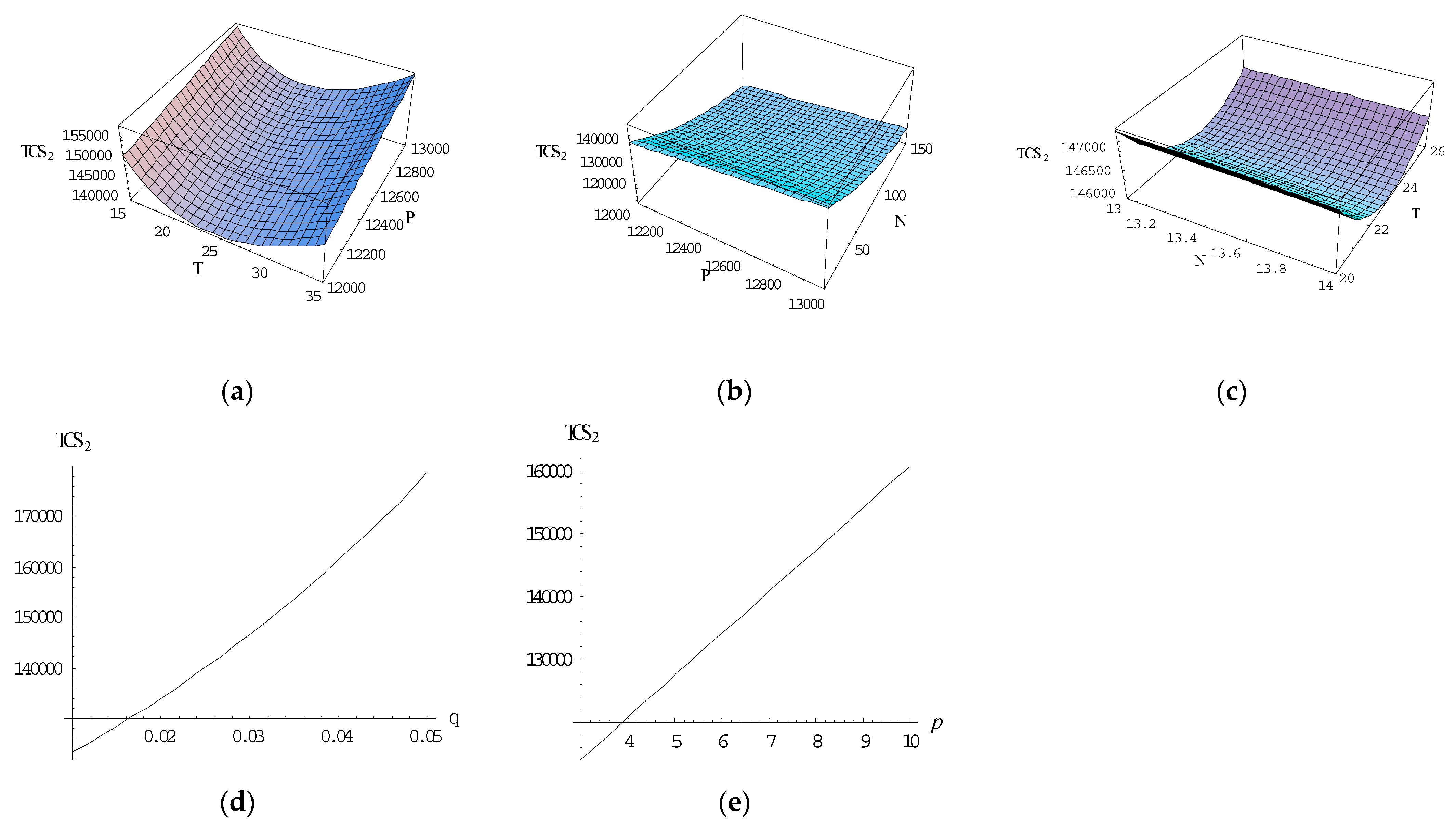

4.2. Numerical Example 2

4.2.1. Nature of Total Cost with Respect to Two Decision Variables and the Third One Is Fixed

4.2.2. Effect of the Various Parameters on the Decision Variables and the Total Integrated Cost

4.2.3. Effect of the Deterioration Rate and Selling Price on the Total Integrated Cost

5. Discussion and Managerial Insights

- The result presents the strategy and critical implication for producers in managing inventory systems under agile manufacturing to incorporate energy and carbon emissions costs. The producer should also focus on the deterioration and demand rates, as it is susceptible to the total cost. Since the deterioration rate increases, the total cost of the model increases. In numerical 1 and 2, it has been proved that if the demand rate changes, then the total cost is very much affected, which is shown in Table 2 and Table 3, respectively. Here the total cost is analyzed in three cases. One is demand depends on selling price and credit period. Second, demand depends on the credit period only, and the third one is that demand depends on the price of sale only. It is observed that the total cost is minimum in case one. Thus, it is suggested to the manager to balance the different studies regarding the demand parameter.

- The producer can adjust the production rate during production to meet the customer’s demand since it is a decision variable. The producer must be vigilant about the demands of the market. This model gives the fundamental insight for planning his credit period as per the production to fulfill all the requirements.

- The inventory model can benefit from creating decisions to progress the inventory system by incorporating energy and carbon emission costs. The decision-maker should take care of energy and carbon emission costs while modeling as different rules impose regularity authorities.

- To acquire more demand, TLTCP is used, due to which, both producer and supplier can earn more interest. Different cases of credit periods are shown through numerical examples. The results revealed that the TCP offered to the customer has a good effect on demand, reducing the total integrated cost. Offering TCP is the supply chain’s motivational tool, so the decision-maker should take care of this issue.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Cárdenas-Barrón, L.E.; Sana, S.S. A production-inventory model for a two-echelon supply chain when demand is dependent on sales teams׳ initiatives. Int. J. Prod. Econ. 2014, 155, 249–258. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Kalantari, S.S.; Cárdenas-Barrón, L.E. Pricing and lot sizing for an EPQ inventory model with rework and multiple shipments. TOP 2016, 24, 143–155. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Khanbaglo, M.P.S.; Cárdenas-Barrón, L.E. An EOQ inventory model with partial backordering and reparation of imperfect products. Int. J. Prod. Econ. 2016, 182, 418–434. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Kumar, V.; Kumar, N. Low carbon warehouse management under cap-and-trade policy. J. Clean. Prod. 2016, 139, 894–904. [Google Scholar] [CrossRef] [Green Version]

- Sarkar, B.; Ahmed, W.; Kim, N. Joint effects of variable carbon emission cost and multi-delay-in-payments under single-setup-multiple-delivery policy in a global sustainable supply chain. J. Clean. Prod. 2018, 185, 421–445. [Google Scholar] [CrossRef]

- Khanna, A.; Kishore, A.; Sarkar, B.; Jaggi, C. Supply chain with customer-based two-level credit policies under an imperfect quality environment. Mathematics 2018, 6, 299. [Google Scholar] [CrossRef] [Green Version]

- Aljazzar, S.M.; Gurtu, A.; Jaber, M.Y. Delay-in-payment—A strategy to reduce carbon emissions from supply chains. J. Clean. Prod. 2018, 170, 636–644. [Google Scholar] [CrossRef]

- Tiwari, S.; Ahmed, W.; Sarkar, B. Multi-item sustainable green production system under trade-credit and partial backordering. J. Clean. Prod. 2018, 204, 82–95. [Google Scholar] [CrossRef]

- Sarkar, B. Mathematical and analytical approach for the management of defective items in a multi-stage production system. J. Clean. Prod. 2019, 218, 896–919. [Google Scholar] [CrossRef]

- Tayyab, M.; Sarkar, B. Optimal batch quantity in a cleaner multi-stage lean production system with random defective rate. J. Clean. Prod. 2016, 139, 922–934. [Google Scholar] [CrossRef]

- Kim, M.S.; Sarkar, B. Multi-stage cleaner production process with quality improvement and lead time dependent ordering cost. J. Clean. Prod. 2017, 144, 572–590. [Google Scholar] [CrossRef]

- Ahmed, W.; Sarkar, B. Impact of carbon emissions in a sustainable supply chain management for a second generation biofuel. J. Clean. Prod. 2018, 186, 807–820. [Google Scholar] [CrossRef]

- Sarkar, M.; Chung, B.D. Flexible work-in-process production system in supply chain management under quality improvement. Int. J. Prod. Res. 2019, 58, 3821–3838. [Google Scholar] [CrossRef]

- Sana, S.; Chaudhuri, K.S. On a volume flexible stock dependent inventory model. Adv. Model. Optim. 2003, 5, 197–210. [Google Scholar]

- Sana, S.; Chaudhuri, K.S. On a volume flexible production policy for a deteriorating item with time dependent demand and shortage. Adv. Model. Optim. 2004, 6, 57–73. [Google Scholar]

- Singh, S.R.; Singh, A.P.; Bhatia, D. A supply chain model with variable holding cost for flexible manufacturing system. Int. J. Oper. Res. Optim. 2010, 1, 107–120. [Google Scholar]

- Singh, S.R.; Gupta, V.; Bansal, P. EOQ model with volume agility, variable demand rate, Weibull deterioration rate and inflation. Int. J. Comput. Appl. 2013, 72, 1–6. [Google Scholar]

- Dem, H.; Singh, S.R. Joint replenishment modelling of a multi-item system with greening policy and volume flexibility. Int. J. Oper. Res. 2015, 22, 148–166. [Google Scholar] [CrossRef]

- Sangal, I.; Gupta, V. Vendor-supplier cooperative inventory model with two warehouse and variable demand rate under the environment of volume agility. In Proceedings of the Fifth International Conference on Soft Computing for Problem Solving; Springer: Singapore, 2016; pp. 109–123. [Google Scholar]

- Singh, S.R.; Gupta, V. Vendor–buyer model with error in quality inspection and selling price dependent demand rate under the effect of volume agility. Int. J. Oper. Quant. Manag. 2016, 22, 357–371. [Google Scholar]

- Gautam, P.; Kamna, K.M.; Jaggi, C.K. Sustainable production policies under the effect of volume agility, preservation technology and price- reliant demand. Yugosl. J. Oper. Res. 2020, 30, 307–324. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Teng, J.T.; Chuang, K.W.; Chuang, B.R. An optimal inventory policy with non instantaneous receipt under trade-credit. Int. J. Prod. Econ. 2005, 98, 290–300. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Goyal, S.K.; Goel, S.K. Retailer’s optimal replenishment decisions with credit-linked demand under permissible delay in payments. Eur. J. Oper. Res. 2008, 190, 130–135. [Google Scholar] [CrossRef]

- Sarkar, B. An EOQ model with delay in payments and time varying deterioration rate. Math. Comput. Mod. 2012, 55, 367–377. [Google Scholar] [CrossRef]

- Khanra, S.; Mandal, B.; Sarkar, B. An inventory model with time dependent demand and shortages under trade-credit policy. Econ. Model. 2013, 35, 349–355. [Google Scholar] [CrossRef]

- Chung, K.J. The EPQ model under conditions of two levels of trade-credit and limited storage capacity in supply chain management. Int. J. Syst. Sci. 2013, 44, 1675–1691. [Google Scholar] [CrossRef]

- Sarkar, B.; Sana, S.S.; Chaudhuri, K. An inventory model with finite replenishment rate, trade-credit policy and price-discount offer. J. Ind. Eng. 2013, 2013, 672504. [Google Scholar] [CrossRef]

- Sarkar, B.; Gupta, H.; Chaudhuri, K.; Goyal, S.K. An integrated inventory model with variable lead time, defective units and delay in payments. Appl. Math. Comput. 2014, 237, 650–658. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, B.; Cárdenas-Barrón, L.E. An inventory model with trade-credit policy and variable deterioration for fixed lifetime products. Ann. Oper. Res. 2015, 229, 677–702. [Google Scholar] [CrossRef]

- Yadav, D.; Singh, S.R.; Kumari, R. Retailer’s optimal policy under inflation in fuzzy environment with trade credit. Int. J. Syst. Sci. 2015, 42, 754–762. [Google Scholar] [CrossRef]

| Researcher (s) | Model Type | Manufacturing Type | Financial Policy | Demand Pattern | Environmental Effect |

|---|---|---|---|---|---|

| Cárdenas-Barrón [1] | EPQ | Traditional | Trade-credit | Variable | Not applicable |

| Taleizadeh et al. [2,3] | EOQ | Not applicable | Not applicable | Constant | Not applicable |

| Sarkar et al. [5] | SSCM | Traditional | Trade-credit | Constant | Carbon emission |

| Tiwari et al. [8] | EPQ | Traditional | Trade-credit | Constant | Not applicable |

| Sarkar [9] | SCM | Traditional | Not applicable | Constant | Not applicable |

| Kim and Sarkar [11] | EPQ | Traditional | Not applicable | Constant | Carbon emission |

| Ahmed and Sarkar [12] | SSCM | Traditional | Not applicable | Constant | Carbon emission |

| Sana and Chaudhuri [14] | EPQ | Agile | Not applicable | Variable | Not applicable |

| Ouyang et al. [22] | EOQ | Not applicable | Trade-credit | Constant | Not applicable |

| Jaggi et al. [23] | Integrated inventory | Traditional | Trade-credit | Constant | Not applicable |

| Chung [26] | EPQ | Traditional | Trade-credit | Constant | Not applicable |

| This model | GSCM | Agile | Trade-credit | Variable | Carbon emission |

| Parameter Changes | T (week) | N (week) | P | TCS2 ($) | |

|---|---|---|---|---|---|

| n | 2 | 8.1689 | 9.4597 | 199.611 | 10,867.2 |

| 3 | 10.1445 | 8.994 | 182.435 | 11,356.2 | |

| 4 | 12.1536 | 8.7306 | 164.183 | 11,760.5 | |

| 5 | 14.483 | 8.5827 | 142.532 | 12,103.6 | |

| 6 | 18.637 | 8.6091 | 105.998 | 12,127.4 | |

| Demand rate | D = W − (W − f)(1 − z)N | 10.1342 | 8.996 | 182.629 | 12,155.3 |

| D = W + α p−τ | 18.7961 | 0.47419 | 84.6265 | 14,451.6 | |

| D = W − (W − f)(1 − z)N ++ α p−τ | 10.1445 | 8.995 | 182.436 | 11,356.2 | |

| C’1p | 0.2 | 10.1445 | 8.995 | 182.436 | 11,356.2 |

| 0.3 | 9.920 | 8.950 | 182.023 | 11,374.1 | |

| 0.4 | 9.7421 | 8.912 | 181.629 | 11,396.3 | |

| 0.5 | 9.5324 | 8.88 | 181.147 | 11,405.2 | |

| 0.6 | 9.2456 | 8.85 | 180.843 | 11,422.8 | |

| C’p | 0.1 | 10.2312 | 9.120 | 182.36 | 11,356.0 |

| 0.2 | 10.1445 | 8.995 | 182.436 | 11,356.1 | |

| 0.3 | 10.0123 | 8.812 | 182.148 | 11,356.2 | |

| 0.4 | 9.8245 | 8.723 | 181.962 | 11,356.3 | |

| 0.5 | 9.7310 | 8.621 | 181.823 | 11,356.4 | |

| C’2p | 8 | 10.1421 | 8.992 | 182.421 | 11,356.0 |

| 10 | 10.1445 | 8.995 | 182.436 | 11,356.2 | |

| 12 | 10.1462 | 8.999 | 182.446 | 11,356.4 | |

| 14 | 10.1483 | 9.002 | 182.459 | 11,356.6 | |

| 16 | 10.1494 | 9.014 | 182.463 | 11,356.8 | |

| Parameter Changes | T (week) | N (week) | P | TCS2 ($) | |

|---|---|---|---|---|---|

| n | 2 | 22.9585 | 13.0415 | 12,849.9 | 146,438 |

| 3 | 28.2951 | 12.504 | 11,061.8 | 153,318 | |

| 4 | 31.5985 | 12.2168 | 11,052.3 | 170,615 | |

| 5 | 33.9561 | 12.0324 | 11,497.2 | 190,263 | |

| 6 | 36.1785 | 11.8809 | 11,650.9 | 206,448 | |

| Demand rate | D = W − (W − f)(1 − z)N | 22.8706 | 13.052 | 12,991.3 | 147,304 |

| D = W + α p−τ | 6.1727 | 4.84 | 1238.7 | 168,514 | |

| D = W − (W − f)(1 − z)N ++ α p−τ | 22.9585 | 13.0415 | 12,849.9 | 146,438 | |

| C’1p | 0.6 | 23.7101 | 13.641 | 12,906.1 | 146,369 |

| 0.7 | 23.5245 | 13.610 | 12,884.3 | 126,401 | |

| 0.8 | 23.0124 | 13.370 | 12,860.1 | 146,438 | |

| 0.9 | 22.9559 | 13.041 | 12,849.9 | 146,461 | |

| 1.0 | 22.5157 | 12.880 | 12,812.3 | 146,492 | |

| C’p | 1.3 | 23.3410 | 13.44 | 12,852.3 | 146,425 |

| 1.4 | 23.0120 | 13.28 | 12,851.2 | 146,435 | |

| 1.5 | 22.9511 | 13.04 | 12,849.9 | 146,438 | |

| 1.6 | 22.8147 | 12.84 | 12,847.0 | 146,440 | |

| 1.7 | 22.6312 | 12.51 | 12,846.6 | 146,443 | |

| C’2p | 26 | 22.95.3 | 12.315 | 12,818.4 | 146,420 |

| 28 | 22.9574 | 12.712 | 12,824.1 | 146,426 | |

| 30 | 22.9585 | 13.041 | 12,849.9 | 146,438 | |

| 32 | 22.9591 | 13.512 | 12,855.6 | 146,445 | |

| 34 | 22.9600 | 14.143 | 12,901.2 | 146,450 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vandana; Singh, S.R.; Yadav, D.; Sarkar, B.; Sarkar, M. Impact of Energy and Carbon Emission of a Supply Chain Management with Two-Level Trade-Credit Policy. Energies 2021, 14, 1569. https://doi.org/10.3390/en14061569

Vandana, Singh SR, Yadav D, Sarkar B, Sarkar M. Impact of Energy and Carbon Emission of a Supply Chain Management with Two-Level Trade-Credit Policy. Energies. 2021; 14(6):1569. https://doi.org/10.3390/en14061569

Chicago/Turabian StyleVandana, S. R. Singh, Dharmendra Yadav, Biswajit Sarkar, and Mitali Sarkar. 2021. "Impact of Energy and Carbon Emission of a Supply Chain Management with Two-Level Trade-Credit Policy" Energies 14, no. 6: 1569. https://doi.org/10.3390/en14061569

APA StyleVandana, Singh, S. R., Yadav, D., Sarkar, B., & Sarkar, M. (2021). Impact of Energy and Carbon Emission of a Supply Chain Management with Two-Level Trade-Credit Policy. Energies, 14(6), 1569. https://doi.org/10.3390/en14061569