1. Introduction

The planet’s population is using its natural resources at an extremely accelerated rate and this consumption is already leading to obvious environmental consequences. Mitigating and adapting to climate change are key challenges of the 21st century, and at the core of these challenges is the question of energy—more precisely, our overall energy consumption and our dependence on fossil fuels. To succeed in limiting global warming, the world urgently needs to use energy efficiently while embracing clean energy sources if we wish to see real changes in the near future.

According to data from the European Environment Agency, the residential and commercial sectors are the third biggest sector responsible for Greenhouse Gas (GHG) emissions, only behind the transport and industry sectors [

1]. There have been continuous efforts to reduce these emissions by reducing consumption from fossil fuels in the sector, specifically by introducing renewables as one of (or the only) consumption source. This continuous and significant integration of Renewable Energy Sources (RES) has only been possible due to major kick-starting incentives and support policies created by governments. However, as the technologies become cost-competitive with fossil fuels, previous incentives are being lowered, and new approaches need to be employed to maintain the evolution of said technologies and reach the desired environmental goals.

Policy changes regarding RES have been essential for an increase of their share in worldwide energy generation. For photovoltaic (PV) systems especially the initial investment is a significant burden to the investor and even if the cost of technology has been decreasing significantly over the last years, the incentives coming from governments as a way to promote RES were incredibly important to “kickstart” their growth. The application of Feed-in Tariffs specifically showed the most effective promotion of wind and PV systems, which lead to a significant growth in generation from these sources [

2]. High Feed-in Tariffs in the last decade helped PV technology to grow and mature, leading to the significant cost decrease. With this decrease, a threshold of economic feasibility was reached and the FIT schemes have been reduced or even terminated in various countries. For these solutions to continue to be affordable to costumers, innovation and sustainable solutions are needed, which currently means shifting to self-consumption of PV energy rather than selling it [

3].

Rodrigues et al. (2016) [

4] analyzed a representative set of countries to determine the ones with the best investment opportunities for self-consumption schemes. It was seen that the profitability of the projects always increased with more self-consumption, and for the majority of the cases, the 100% self-consumption scenario was the most viable. Lang et al. (2016) [

5] also saw that self-consumption can already be attractive for many buildings in central Europe, particularly, large residential and commercial buildings, and it tends to be more favourable in commercial, rather than in residential buildings, due to a naturally better match of the demand and PV production curves. The implementation of these systems in public educational buildings has been studied, and has shown positive results [

6,

7,

8].

Since the curves will never be a perfect match, not only residential but also commercial buildings can benefit from applying demand side management or adding a Battery Energy Storage System (BESS) to the installation [

9]. Many authors have studied the implementation of a BESS for the improvement of self-consumption shares [

9,

10,

11], and found that due to the high price and short life-cycle of batteries, the overall benefits of the implementation are negative. However, the declining cost and increasing life-cycle of batteries are the main factors that will turn these projects viable in the near future. In the end, what makes or breaks a project can be how the consumed and stored energy are managed.

This article aims to show the feasibility of implementing a PV system in an educational building considering new regulations and incentives for the technology. The viability of implementing a BESS together with the RES should also be studied, especially seeing how battery technologies are a growing solution that will start to be viable not just for residential applications. The regulation scheme considered are inserted in the Portuguese legal frame, apart from net metering, which is not allowed, but will also be studied. The comparison of these implementations is done through an economical analysis.

Following this introduction, in

Section 2 the methodology for the study is presented, detailing the PV system topology, the legal workframe of the implementations and the economical model. In

Section 3, the system is sized and implemented according to the building needs and area. Finally, the results of the implementation are discussed in

Section 4, which is followed by the conclusions in

Section 5.

2. Methodology

2.1. Photovoltaic System Topology

To calculate the PV system’s output, the solar cell behavior needs to be modeled. For this effect, the PVsyst software is used, and the outline of these calculations is presented to understand what are the factors that influence the system behavior and in what sense. To simulate the behavior of a solar cell, the one diode and five parameters model [

12,

13] defined by the equivalent circuit in

Figure 1, is considered.

The unknown variables of this model are the current supplied by the module (I) and the voltage at its terminals (V), which will be dependent on the remaining five variables, as seen in Equation (

1). As this is an implicit equation, it needs to be solved using a successive approximations approach [

12,

13].

To determine the unknown variables, the five parameters that have to be calculated are: the photocurrent

, the diode inverse saturation current

, the series and shunt resistance,

and

(

), and the diode’s ideality factor n. These parameters can be calculated using the three following equations for the most relevant points on the I-V curve: short circuit, open circuit and maximum power point. Seeing that there are five different parameters to calculate and only three equations that result from these points, the calculations involve lengthy mathematical manipulation, as well as the use of other relations between the parameters in those equations [

12,

13,

14].

The cell temperature and incident irradiance are the two main factors on which the cell’s behavior will depend, because the short circuit current and open circuit voltage results are based on those parameters. The cell temperature is determined with regards to the energy balance between the ambient temperature and the cell’s heating up due to incident irradiance, and this irradiance is calculated based on the values of its different components.

The irradiance has three components: direct, diffuse and albedo. Here, only the calculation of the direct component is detailed, and the geometrical relations seen in

Figure 2 are considered. The vale of

depends on the elevation angle (

), which is the angular height of the sun in the sky, and the panel’s tilt angle (

) for which the optimal choice in Portugal is around 33° [

14]. These parameters are all present in Equation (

2).

2.2. Compensation Schemes

In this work, the Portuguese legal framework for the decentralized production of energy for self-consumption or grid-injection is considered. The decree-law that is exposed here presents the conditions in which Self-consumption Units (UPACs) and Small Production Units (UPPs) can be implemented [

15]. The addition of a battery system inserted in the self-consumption framework is also considered, as well as the implementation of net metering for self-consumption, which is not allowed in Portugal.

2.2.1. Self-Consumption

In this operating mode, the PV energy is generated by a UPAC and is directly consumed by the installation to which it is connected. In this case the UPAC is connected to the grid, so when the PV generated energy is higher than the consumer’s needs, the surplus is injected into the grid and remunerated considering 90% of the monthly average Iberian electricity market (OMIE) closing price, as seen in Equation (

3), where

is the remuneration in EUR (€),

is the energy injected in the grid, and

is the average Iberian market closing price; all considered for each month m. In this case, the value of

will be constant and equal to the average price for the year of 2019, which was 47.87 €/MWh.

Furthermore, for the entities that install these self-consumption units, the government has also permitted the exemption of the costs Energy Policy, Sustainability and General Economic Interest (CIEG) [

16]. Units with installed capacity above 30 kW are exempt from paying 50% of these costs, during the first seven years of the project’s lifetime. With this exemption, the yearly cash flows from the UPAC installations will correspond to the savings resulting from self-consumption and the exemption of CIEG costs, combined with the revenue of selling surplus energy to the grid.

Since this implementation of a UPAC is grid-connected, there will need to be two different electric meters installed: one at the interconnection of the installation with the UPAC to measure the installation’s self-consumption, and another at the interconnection with the grid, to count the injected surplus and the purchased energy. The system configurations with the necessary interconnections can be seen in

Figure 3. Furthermore, the UPAC’s yearly generation must be inferior to the installation’s consumption needs, and the power connection to the grid should be less than 100% of the installation’s contracted power.

2.2.2. Battery Implementation

For the battery implementation, the same legal framework as for regular self-consumption will apply, with the only difference being where the energy is consumed from (battery or PV system directly) and when it is injected in the grid or stored in the battery. In this work, only one type of implementation for the battery is considered: the energy is stored as soon as it is available (when there is a surplus of PV production), and then is “immediately” used when the consumer’s consumption needs have to be satisfied. Since the storage capacity is limited, once the battery reaches its maximum state of charge, if there is still surplus, it will be injected into the grid. In this implementation the battery is only connected to the PV system, and never trades any energy with the utility grid. With the addition of the technology, the system display and energy flows are now as it is displayed in

Figure 4.

2.2.3. Net Metering

This model simply presents a different remuneration method for a self-consumption system, and it is based on the concept that the grid can be used as a “long-term storage”. Therefore, the functioning of the system is exactly like before, given that the surplus PV production will still be injected into the grid; but in net metering that energy is recorded as credits. As this model is applied to UPACs, the energy is measured like it is presented in

Figure 3, and the metering is not done instantaneously, but rather after a more extended period of time (depending on the regulation).

Since, at present time, this operation is not allowed in Portugal, the example of another EU country that allows for net metering is applied as if it were legal also in Portugal. The chosen country was Cyprus, where net metering can be used in households with small capacities but also commercial units and public administration buildings [

17]. In this regime, the electricity offsetting will be carried out each month, for each calendar year. This means that if, for example, at the end of January there is a surplus of production it will be recorded as credits that are available for usage in the following months, and the credits remaining in December are not available for the following year.

2.2.4. Full Grid-Injection

In this implementation, the production unit (UPP) is only connected to the grid and not the installation, so the totality of the produced energy will be sold to the grid, with the remuneration being done through a bidding scheme. This regime applies for a period 15 years, during which it is considered that the energy is sold at the rate of the reference tariff for 2020, which is 0.045 €/kWh [

18]. After that period, the UPP has to sell its energy to the last resort trader, through the general regime [

19], in which the monthly remuneration (

) is calculated as seen in Equation (

4), where i represents the tariff periods (peak or off-peak) during which electricity is delivered to the installation;

(kWh) is the energy generated in month m, during period i;

(€/kWh) is the average Iberian market closing price, relative to month m;

is a factor to account for losses during each period; and

is the weighting coefficient for each period (0.86 for off-peak, and 1.13 for peak).

In the display of this implementation seen in

Figure 5 there are still two electric meters, but they are both uni-directional since they only measure the energy sold to the grid by the UPP, and the energy consumed from the grid by the installation. Furthermore, for each kW of installed power, the maximum amount of electricity that can be sold to the grid per year is 2.6 MWh; the yearly UPP produced energy cannot be higher than two times the energy consumed by the installation; the power connection to the grid should be lower than 100% of the installation’s contracted power, and lower than 250 kW.

2.3. Financial Analysis

This analysis is based on the revenues (R) from the different compensation schemes and, in contrast, the cost of technology. The savings and compensation from the different schemes will be compared, to conclude which implementation might be the most profitable investment, by using different economic performance measurements such as the Net Present Value (NPV), Internal Rate of Return (IRR) and Return on Investment (ROI). The Simple Payback Time (SPBT) is also calculated.

Since there are three different implementations, the yearly cash flows will be different for all of them, but generally, they can be defined by Equation (

5).

The values of all of these components are presented in EUR (€) and differ for each of the implementations. The savings refer to the money that is saved from self-consuming energy and the compensation is the revenue from selling energy to the grid.

The

NPV metric shows the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive

NPV means that a project or investment’s estimated profits surpass the planned costs, and that it is considered to be profitable. The metric is calculated with Equation (

6), in which the initial investment

is considered to be done in year 0, and a discount rate

i is applied to the annual cash flows until the end of the project’s lifetime

n.

The cash flows to consider in this calculation will be different for each implementation: in the regular self consumption and net metering there is a constant cash flow until year 7 because of the CIEG savings, and then a different one from year 8 until the end-of-life and in the battery implementation, because its lifetime is shorter than the project’s and higher than 7, there will be one constant cash flow from year 1 to 7 with savings from CIEG exemption and higher self-consumption, another from year 8 to 10 only for the battery utilization without the CIEG exemption and another until the end-of-life that will be equal to the cash flow from the regular self-consumption, since the battery has reached its end-of-life. Lastly, for the UPP implementation, there are two different cash flows: from year 1 until 15, and after that until the end-of-life.

These same cash flows will apply to the calculation of the

IRR, expression (

7), which is essentially the discount rate that makes the

NPV equal to zero, so it estimates a project’s break-even discount rate, which indicates the annual rate of growth an investment is expected to generate. If the

IRR obtained is above the discount rate i considered in Equation (

6), then the project will most likely be accepted. Otherwise, it is rejected.

Lastly, the

ROI calculates the ratio of the gain from an investment relative to the amount invested, expression (

8), but it does not consider the time frame of the investment as it just indicates the total growth of the investment from start to finish, and not annually like the

IRR.

Life Cycle Analysis

With this assessment, the environmental impacts associated with the life-cycle of the complete system (PV modules and Balance of System (BoS) are studied, so the energy requirements throughout the complete life cycle (manufacturing, transport, operation, disposal, etc.) are estimated to perform the evaluation. Even though there are no CO

2 emissions that result from the PV energy generation, the system still presents an environmental impact in other phases of its life, especially during the manufacturing and disposal. The net saving of emissions is calculated in tons through the carbon balance, in Equation (

9), where

is the yearly energy generated by the PV system, in MWh;

and

are the grid and PV system life cycle emissions in gCO

2/kWh and tCO

2, respectively; n is the project’s lifetime in years.

Furthermore, to understand the impacts of the system, the greenhouse gas and energy payback time are calculated as seen in Equations (

10) and (

11), respectively.

5. Conclusions

This work presented the study of different compensation schemes for PV technology, and their financial viability, as well as the environmental impacts and gains of the implementation. The different schemes were applied as it is foreseen in the Portuguese law, excluding the net-metering implementation, which is not allowed. Other than self-consumption with net metering, this work implements the self-consumption legislation with and without storage, and full grid injection.

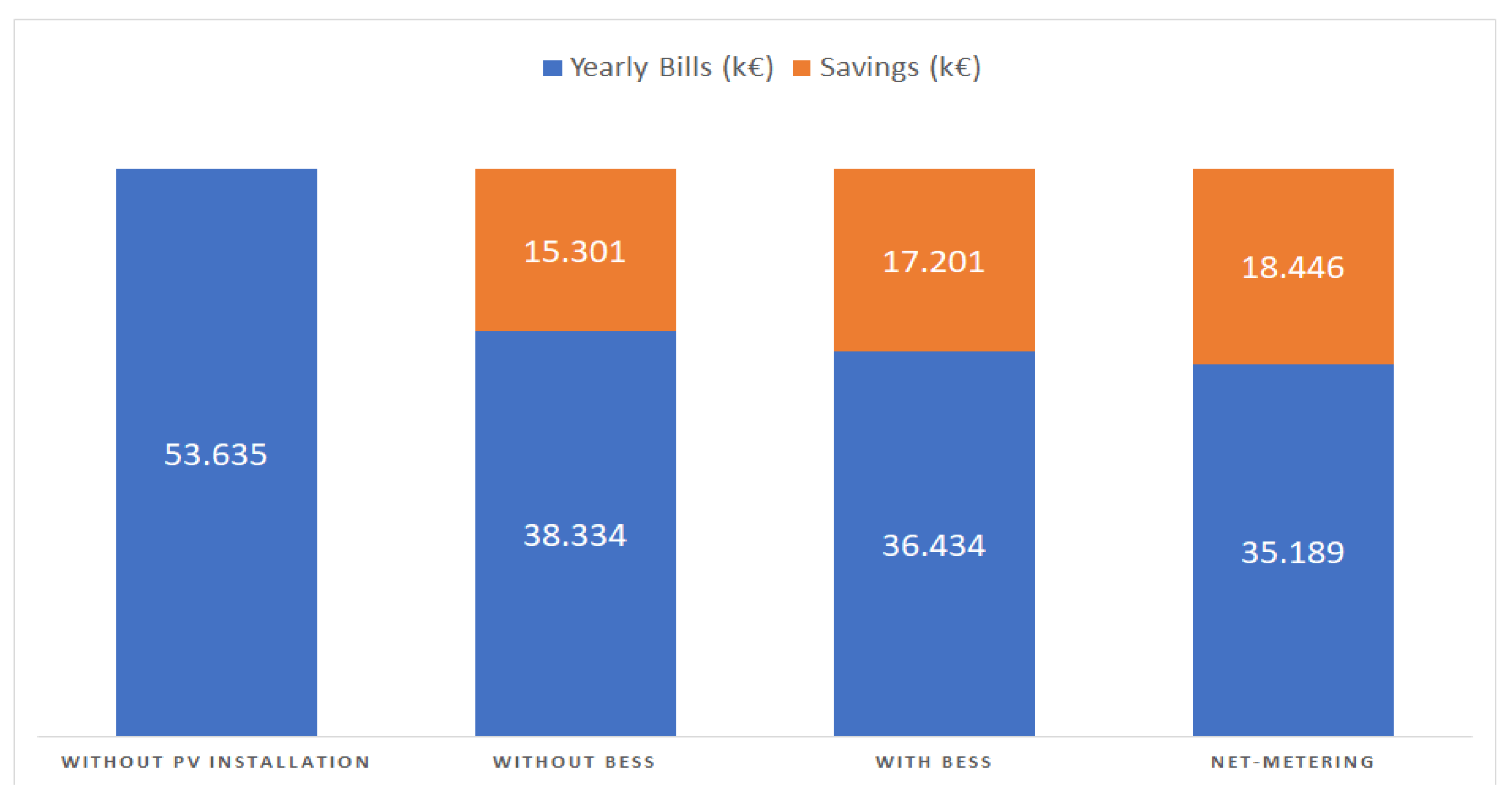

In most months out of the simulated year, the PV produced energy did not match the needs of the building, and yearly it represents around 79% of the needs. With the regular self-consumption, the solar energy consumed by the building was still lower than the amount that was bought from the grid, but with the BESS and net-metering, the self-consumption was 1.6 and 1.9 times higher, respectively, compared to the regular implementation.

The profitability of self-consumption and selling energy to the grid was first studied by calculating only the positive cash flows for each implementations. It was seen that the self-consumption allows for an average saving of 71.49 €/MWh, while the revenues from selling energy to the grid were 43.083 €/MWh, clearly showing why self-consumption is preferred over the selling of surplus. This is observed because of the termination of FITs, and therefore, continuous discouragement of grid-injection schemes.

The results of the financial analysis showed that only the net metering and regular self-consumption schemes would be a viable investment, and as expected, the net-metering implementation showed the most attractive results for investment. As for the BESS implementation and the full grid-injection, both schemes show negative results overall and the investment fails to reach attractiveness, with the lowest NPV result seen for the BESS implementation, and the only negative IRR for the grid-injection. The overall results of the analysis show that the self-consumption of energy is more profitable than grid-injection, and BESS technology still needs to improve to see a significant price reduction for its implementation and become viable on a medium-system scale.