Tax or Clean Technology? Measuring the True Effect on Carbon Emissions Mitigation for Sweden and Norway

Abstract

:1. Introduction

Literature Review

2. Materials and Methods

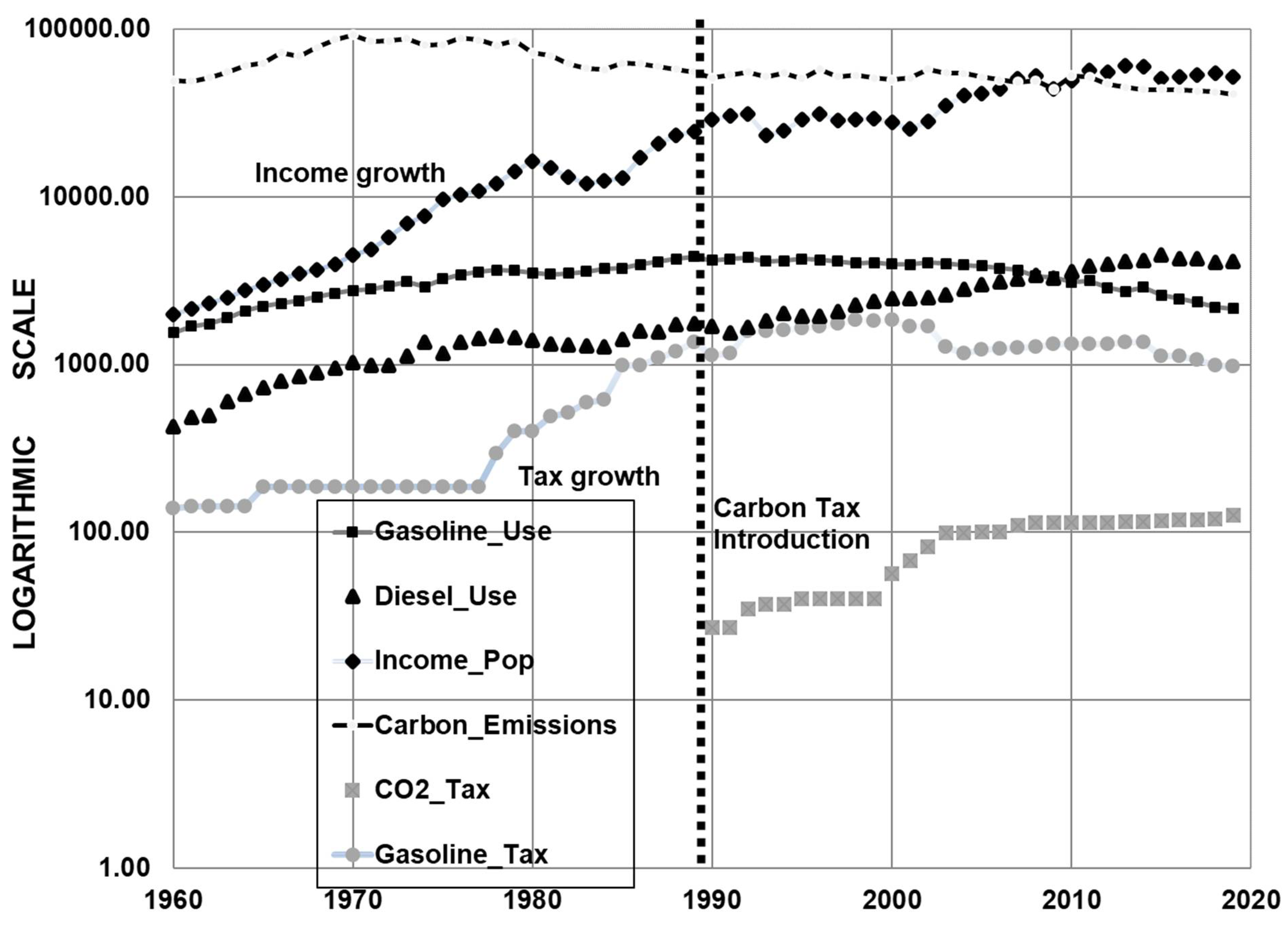

2.1. Materials: Trends Emissions of CO2 of Sweden and Norway

2.2. Key Relationships and Variables

2.2.1. Hypothesis of Equilibrium Relationships

2.2.2. Data and Descriptive Statistics

2.3. Estimation Procedure

2.4. Testing for Stationarity of CO2 Emissions

2.5. Applying the Single EqCM to Establish Cointegration System

3. Results: EqCM MODEL

3.1. Calculated Coefficients: Results

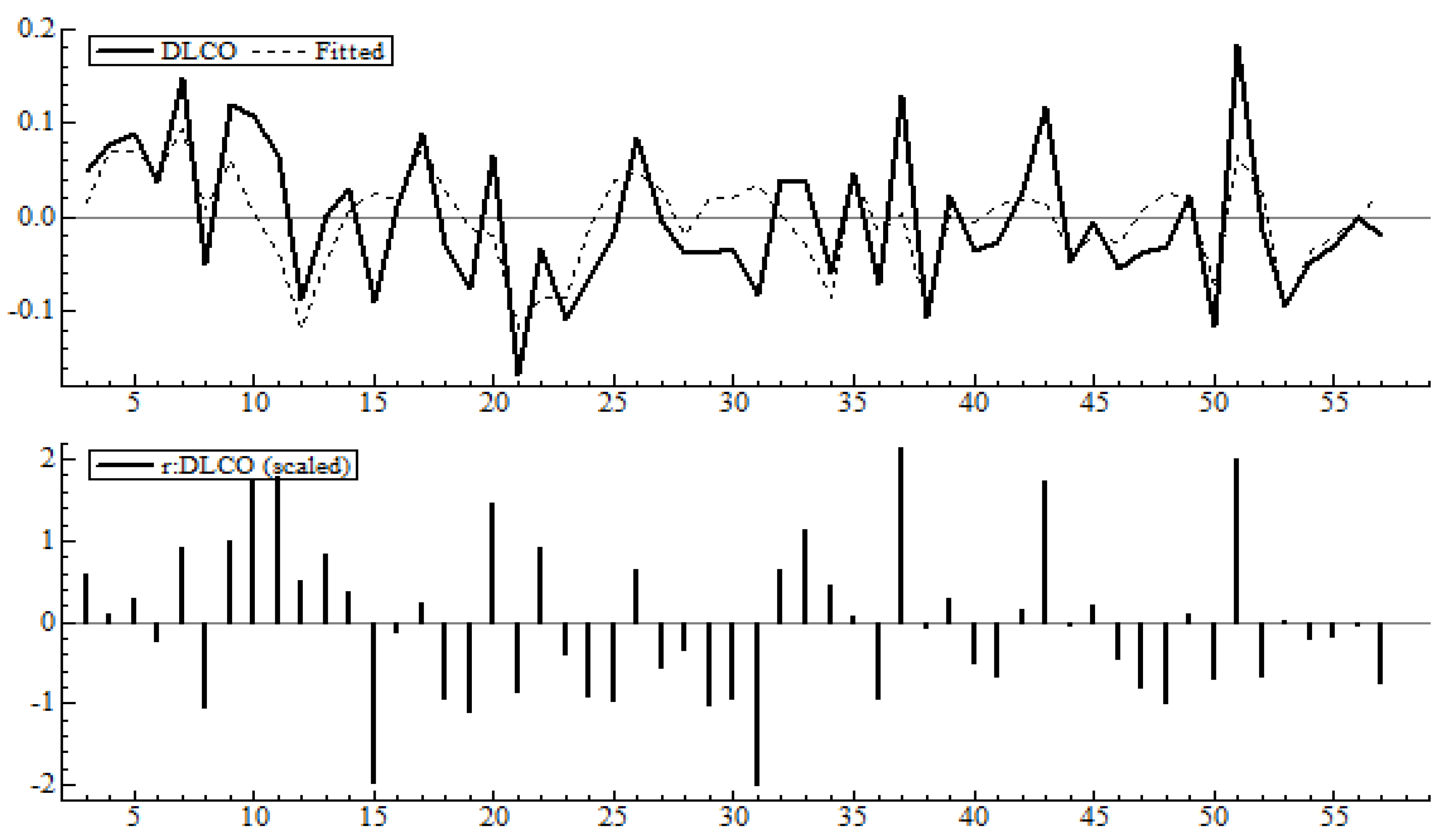

3.2. Results: Sweden

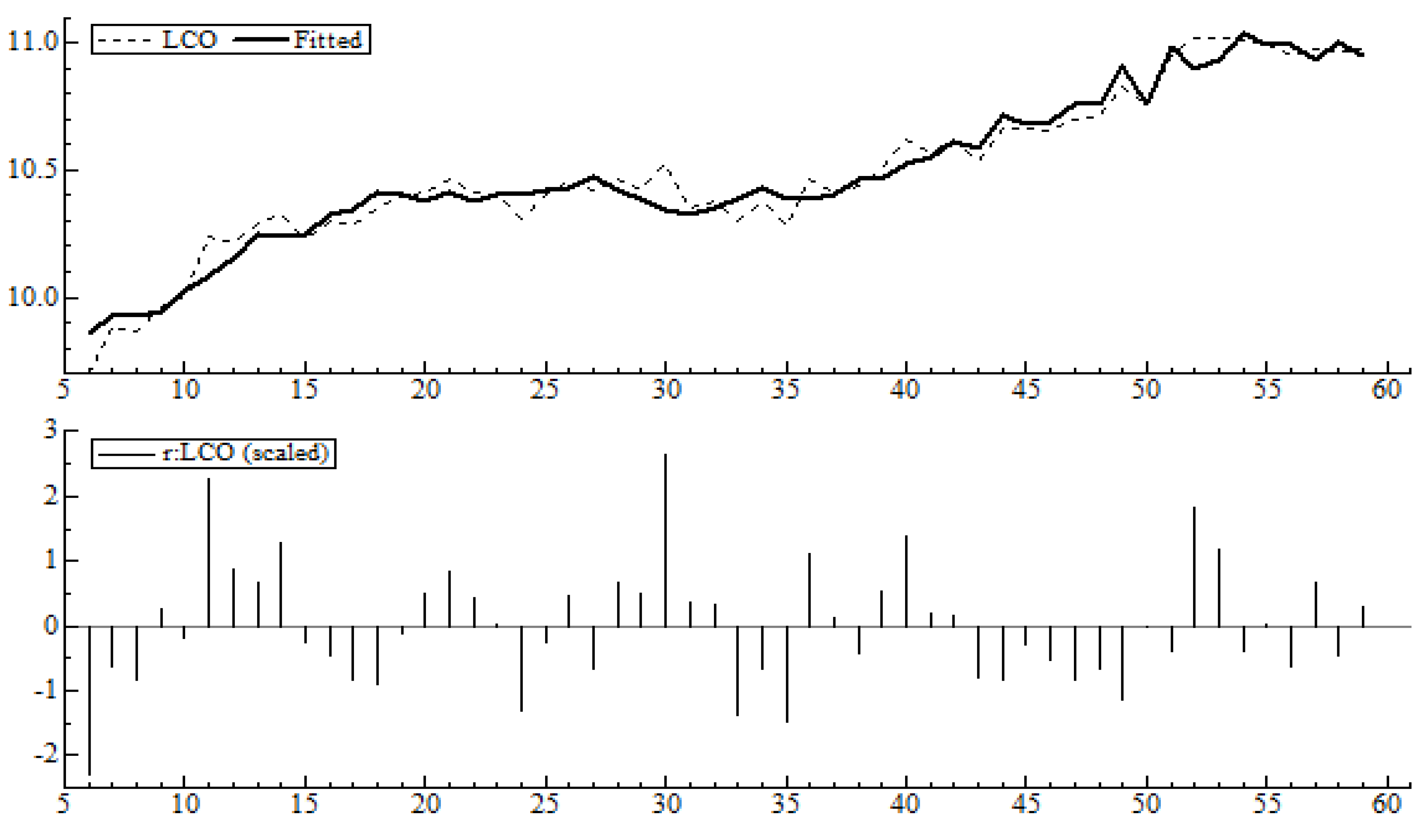

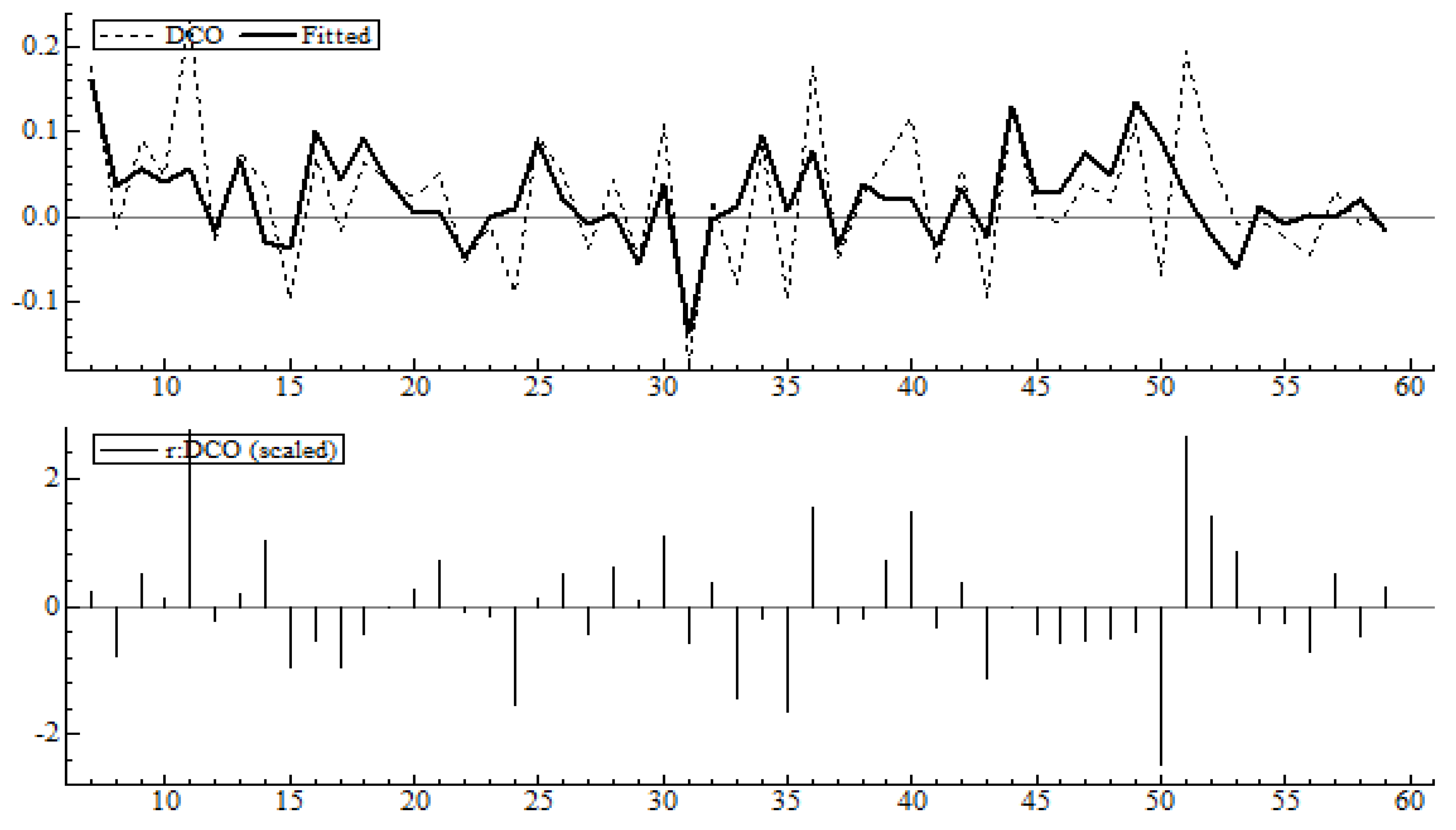

3.3. Results: Norway

3.4. Results of Tests

3.5. Results for Unit Roots in Data Series: 1960–2018

3.6. Model Performance

4. Discussion

4.1. Discussion on Sweden

4.2. Discussion on Norway

5. Conclusions

- ▪

- The first outcome of our considered policies is that the CO2 tax has cut emissions in Norway more than in Sweden, but only in the first years following the introduction of the tax.

- ▪

- Second the effect of the tax can be slow, since authorities use the tax as a revenue-raising device: in recessions, it will tend to rise, and in expansions it will decline. The tax will interact with (a) fuel taxes and (b) the rate of adoption of low-CO2 technology. The tax’s effect on emissions, however, must be seen in relation to other policy measures that are introduced. For these reasons, the shifts in CO2 taxes will not necessarily track emission cuts.

- ▪

- Third, in both nations, the cuts in emissions occurred as a result of energy supply-side policies through nuclear power or hydropower generation.

- ▪

- Fourth, the EqCM analysis shows that the effect of the tax on emissions is negative and permanent; however, the effect of technology (nuclear, renewables and hydro-power) is also essential to reduce emissions. Unlike Reference [6], we found that the diesel tax was more effective in cutting emissions than the direct CO2 tax in both countries, but Norway’s diesel taxes were less powerful than those of Sweden, suggesting that higher taxes are needed in the former. The high personal income level explains the lower long-term price elasticity in Norway.

- ▪

- Fifth, energy tax reform should also focus on other non-transport sectors; this reform will be needed since green tax revenue mostly relies on transport-related taxes, but the effectiveness of the latter may diminish after road electrification, which will lower tax revenue from transport energy (gasoline and diesel).

- ▪

- Sixth, in Sweden, long-term emissions increase with economic growth. The response of emissions to fossil-fuel use is positive, as expected from a CO2-intensive energy source, but emissions respond negatively to (1) the CO2 tax and fuel tax, (2) energy-efficiency measures, and (3) technology changes (i.e., nuclear power), as well as to (4) other unobservable effects. This is an R&D-led economy that is expected to produce lower growth rates of CO2 emissions.

- ▪

- Seventh, in Norway, emissions are still growing strongly despite enforced taxes on the supply side (oil and gas extraction) and the demand side. CO2 emissions move in opposing directions: taxes, effective carbon prices and income effects and technological changes lead to cuts in emissions, while oil extraction activities and transport activities push up emissions. The long-term responses of emissions to economic growth, CO2 prices and fuel taxes ensure that emissions decline.

- ▪

- Future work is needed to examine further ways to cut emissions in the transport sector. Our analysis reveals that policy ought to focus on the greater electrification of transport for both nations, a reduction in energy use for road transport (Norway) and a removal of tax exemptions for industry, including carbon taxes.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Hendry, D.F. Equilibrium correction models. In The New Palgrave Dictionary in Economics; Palgrave Macmillan: London, UK, 2008; pp. 1–11. [Google Scholar]

- Nelson, C.; Ploser, C. Trends and Random Walks in Macroeconomic Time Series: Some Evidence and Implications. J. Monet. Econ. 1982, 10, 139–169. [Google Scholar] [CrossRef]

- Turnovsky, S. Stabilization theory and policy: 50 years after the Phillips curve. Economica 2011, 78, 67–88. [Google Scholar] [CrossRef]

- Phillips, A.W.H. Stabilization policy in a closed economy. Econ. J. 1954, 64, 290–333. [Google Scholar] [CrossRef]

- Phillips, A.W.H. Stabilization policy and the time form of lagged response. Econ. J. 1957, 67, 265–277. [Google Scholar] [CrossRef]

- Andersson, J. Carbon Taxes and CO2 Emissions: Sweden as a Case Study. Am. Econ. J. Econ. Policy 2019, 11, 1–30. [Google Scholar] [CrossRef] [Green Version]

- Metcalf, G.E.; Stock, J.H. Measuring the Macroeconomic Impacts of Carbon Taxes. Am. Econ. Rev. Pap. Proc. 2020, 110, 101–106. [Google Scholar] [CrossRef]

- Bruvoll, A.; Larsen, M. Greenhouse gas emissions in Norway: Do carbon taxes work? Energy Policy 2004, 32, 493–505. [Google Scholar] [CrossRef] [Green Version]

- Agnolucci, P.; Barker, T.; Ekins, P. Hysteresis and Energy Demand: The Announcement Effects of the UK Climate Change Levy; UKERC: London, UK, 2004; pp. 1–16. [Google Scholar]

- Bohlin, F. The Swedish Carbon Dioxide tax: Effects on Biodiesel Use and Carbon Dioxide Emissions. Biomass Bioenergy 1998, 15, 283–291. [Google Scholar] [CrossRef]

- Ekins, P.; Barker, T. Carbon Taxes and Carbon Emission Trading. J. Econ. Surv. 2001, 15, 325–376. [Google Scholar] [CrossRef]

- Harju, J.; Kosonen, T.; Laukkanen, M.; Palanne, K. The Heterogenous Incidence of Fuel Carbon Taxes: Evidence From Fuel Station Level Data. J. Environ. Econ. Manag. 2022, 112, 2–33. [Google Scholar] [CrossRef]

- Rivers, N.; Schaufele, B. Salience of Carbon Taxes in the Gasoline Market. J. Environ. Econ. Manag. 2015, 74, 23–36. [Google Scholar] [CrossRef]

- Metcalf, G.E. On the Economics of a Carbon Tax for the United States. Brook. Pap. Econ. Act. 2019, 1, 405–458. [Google Scholar] [CrossRef]

- Prettis, F. Does a Carbon Tax Reduce CO2 Emissions? Evidence from British Columbia; Department of Economics, University of Victoria: Victoria, BC, Canada, 2019. [Google Scholar]

- Pigou, A.C. A Study in Public Finance; Macmillan & Co., Ltd.: New York, NY, USA, 1929; Volume 17, pp. 1–323. [Google Scholar]

- Weitzman, M.L. Prices vs. Quantities. Rev. Econ. Stud. 1974, 41, 477–491. [Google Scholar] [CrossRef]

- Baumol, W.; Oates, W. The Theory of Environmental Policy (pp. I–IV); Cambridge University Press: Cambridge, UK, 1988; pp. 1–312. [Google Scholar]

- Nordhaus, W. A Question of Balance: Weighing the Options on Global Warming Policies; Yale University Press: New Haven, CT, USA, 2008; pp. 1–234. [Google Scholar]

- Manne, A.; Richels, R. Buying Greenhouse Insurance: The Economic costs of CO2 emissions limits; MIT Press: Cambridge, MA, USA, 1992; pp. 1–194. [Google Scholar]

- Criqui, P.; Kouvartakis, N.; Scharttonenholzer, L. The impacts of carbon constraint on power generation and renewable energy technologies. In Sectoral Economic Costs and Benefits of GHG Mitigation: Proceedings of an IPCC Expert Meeting, Eisenach, Germany, 14–15 February 2000; Bernstein, L., Pan, J., Eds.; Technical support Unit, IPCC working Group III: Geneva, Switzerland, 2000. [Google Scholar]

- Barker, T.; Scrieciu, S. Modeling Low Climate Stabilization with E3MG: Towards a ‘New Economics’ Approach to Simulating Energy-Environment-Economy System Dynamics. Energy J. Int. Assoc. Energy Econ. 2010, 31, 137–164. [Google Scholar] [CrossRef]

- Hendry, D.F.; Pretis, F. Anthropogenic influences on atmospheric CO2. In Energy and Climate Change; Fouqet, R., Ed.; Edward Elgar: Cheltenham, UK, 2013; pp. 287–327. [Google Scholar]

- Kverndokk, S.; Rosendahl, K.E. CO2 Mitigation Costs and Ancillary Benefits in the Nordic Countries, the UK and Ireland: A Survey. Memorandum. Department of Economics, University of Oslo: Oslo, Norway, 2000; pp. 1–53. [Google Scholar]

- Pesaran, H.; Smith, R. Structural analysis and cointegrating vars. J. Econ. Surv. 1998, 12, 471–505. [Google Scholar] [CrossRef]

- Carattini, S.; Baranzini, A.; Thalmann, P.; Varone, P.; Vöhringer, F. Green Taxes in a post-Paris World: Are Millions of Nays Inevitable? Environ. Resour. Econ. 2017, 68, 97–128. [Google Scholar] [CrossRef] [Green Version]

- Wondgagegn, T.; Gren, I.M. Road fuel demand and regional effects of carbon taxes in Sweden. Energy Policy 2020, 144, 111648. [Google Scholar]

- Sterner, T. Political Economy Obstacles to Fuel Taxation. Energy J. 2004, 25, 1–18. [Google Scholar]

- Brannlund, R.; Lundgren, T. Environmental Policy and Profitability—Evidence from Swedish Industry. Environ. Econ. Policy Stud. 2010, 12, 59–78. [Google Scholar] [CrossRef]

- Lundgren, T.; Marklund, P.-O.; Climate Policy and Profit Efficiency. CERE Working Paper No. 11. Umea: Centre for Environmental and Resource Economics. Available online: http://www.cere.se/ironmental (accessed on 15 May 2018).

- Brannlund, R.; Lundgren, T.; Marklund, P.-O. Carbon Intensity in Production and the Effects of Climate Policy—Evidence from Sweden. Energy Policy 2014, 67, 844–857. [Google Scholar] [CrossRef]

- Andersen, M.S. Vikings and virtues-a decade of CO2 taxation. Clim. Policy 2004, 4, 13–24. [Google Scholar] [CrossRef] [Green Version]

- Productivity Commission. Carbon Emission Policies in Key Economies, Research Report. 2011. Canberra, Australia. October. pp. 1–760. Available online: http://www.pc.gov.au/inquiries/completed/carbon-prices/report (accessed on 10 January 2014).

- Bjorner, T.; Jensen, H.H. Energy taxes, voluntary agreements and investment subsidies—A micro-panel analysis of the effect on Danish industrial companies’ energy demand. Resour. Energy Econ. 2004, 24, 229–249. [Google Scholar] [CrossRef]

- OECD. Taxing Energy Use: A Graphical Analysis; Report: Paris, France, 2018. [Google Scholar]

- Laing, T.; Misato, S.; Grubb, M.; Comberti, C. Assessing the Effectiveness of the Emissions Trading Scheme (ETS); Working Paper 106; Grantham Research Institute of Climate Change and the Environment: London, UK, 2013; pp. 1–35. [Google Scholar]

- Ellerman, A.D.; Buchner, B. Over-Allocation or Abatement? A Preliminary Analysis of the EU ETS Based on the 2005–06 Emissions Data. Environ. Resour. Econ. 2008, 41, 267–287. [Google Scholar] [CrossRef] [Green Version]

- Anderson, B.; Di Maria, C. Abatement and Allocation in the Pilot Phase of the EU ETS. Environ. Resour. Econ. 2011, 48, 83–101. [Google Scholar] [CrossRef] [Green Version]

- Fezzy, C.; Bunn, D. Structural interactions of European carbon prices. J. Energy Mark. 2009, 24, 53–69. [Google Scholar] [CrossRef]

- Jaraite, J.; Kazukauskas, A.; Lundgren, T. The effects of climate policy on environmental expenditure and investment: Evidence from Sweden. J. Environ. Econ. Policy 2014, 3, 148–166. [Google Scholar] [CrossRef]

- Broberg, T.; Marklund, P.-O.; Samakovlis, E. Testing the Porter Hypothesis: The Effects of Environmental Investments on Efficiency in Swedish Industry. J. Product. Anal. 2013, 40, 43–56. [Google Scholar] [CrossRef]

- World Bank. State and Trends of Carbon Pricing; Report, p. 94; World Bank, Ecofys and Vivid Economics: Washington, DC, USA, 2019. [Google Scholar]

- Declerq, B.; Delarue, E.; D’haeseleer, W. Impact of the economic recession on the European power sectors CO2 emissions. Energy Policy 2011, 39, 1677–1686. [Google Scholar] [CrossRef]

- Cambridge Econometrics. An Impact Assessment of the Current Economic Downturn on UK CO2 Emissions: A final report for the Committee on Climate Change; The Committee on Climate Change: London, UK, 2009. [Google Scholar]

- Statistics Sweden. Environmental Taxes. 2020. Available online: http://www.scb.se/en_/Findingstatistics/Statistics-by-subject-area/Environment/Environmental-accounts-andsustainable-development/System-of-Environmental-and-Economic-Accounts/Aktuell-Pong/38171/Environmental-taxes/271568/ (accessed on 3 March 2017).

- World Bank. World Development Indicators. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 10 February 2020).

- UN. Statistics. 2019. Available online: http://data.un.org/ (accessed on 2 October 2019).

- Statistics Norway. National Accounts 1978–1996 (Various Years), Official Statistics of Norway. 2020. Available online: https://www.ssb.no/en/forside;jsessionid=4CD26C5C8D4E3B34AF695B73C56CB126.kpld-as-prod03?hide-from-left-menu=true&language-code=en&menu-root-alternative-language=true (accessed on 3 March 2017).

- IEA (International Energy Agency). Carbon Emissions from Fuel Combustion; Edition. Various years; OECD: Paris, France, 2013; p. 417. [Google Scholar]

- Swedish Energy Agency. Economic Instruments in Environmental Policy. Stockholm. Sweden: Swedish Environmental Protection Agency and the Swedish Energy Agency. Available online: https://www.energimyndigheten.se/en/ (accessed on 20 May 2018).

- Government Bill. 20.65. En Samlad politik for klimatet-klimatpolitisk handlingsplan 2019. Available online: https://eef.se/wp-content/uploads/2019/12/Klimatpolitisk-handlingsplan-prop.-dec-2019.pdf (accessed on 12 December 2019).

- Swedish Climate Policy Council. Klimatpolitiska Radet. 2020. Available online: https://www.klimatpolitiskaradet.se/en (accessed on 12 December 2019).

- Norwegian Ministry of Climate and Environment. Norway’s Fourth Biennal Report. Under the framework Convention on Climate Change; Status Report: Oslo, Norway, 2020; p. 92.

- Nocera, S.; Cavallaro, F. Economic Evaluation of Future Carbon Impacts on the Italian Highways. Procedia Soc. Behav. Sci. 2012, 54, 1360–1369. [Google Scholar] [CrossRef] [Green Version]

- Nocera, S.; Tonin, S. A Joint Probability Density Function for reducing the Uncertainty of Marginal Social Cost of Carbon Evaluation in Transport Planning. Adv. Intell. Syst. Comput. 2014, 262, 113–126. [Google Scholar]

- Holtsmark, B.; Skonhoft, A. The Norwegian support and subsidy policy of electric cars. Should it be adopted by other countries? Environ. Sci. Policy 2014, 42, 160–168. [Google Scholar] [CrossRef]

- Olson, E.L. The financial and environmental costs and benefits for Norwegian electric car subsidies: Are they good public policy? Int. J. Technol. Policy Manag. 2015, 15, 277–296. [Google Scholar] [CrossRef] [Green Version]

- Bjerkan, K.Y.; Nørbech, T.E.; Nordtømme, M.E. Incentives for promoting Battery Electric Vehicle (BEV) adoption in Norway. Transp. Res. Part D Transp. Environ. 2016, 43, 169–180. [Google Scholar] [CrossRef] [Green Version]

- Hill, R.C.; Griffith, W.E.; Lim, G.C. Principles of Econometrics, 5th ed.; Wiley: Hoboken, NJ, USA, 2018; pp. 1–192. [Google Scholar]

| Years | GDP (%/Year) | CO2 Emissions (%/Year) |

|---|---|---|

| 1960–1965 | 5.18 | 4.94 |

| 1965–1970 | 4.05 | 8.08 |

| 1970–1975 | 2.59 | −2.64 |

| 1975–1980 | 1.34 | −2.35 |

| 1980–1985 | 1.99 | −2.76 |

| 1985–1990 | 2.4 | −3.9 |

| 1990–1995 | 0.71 | −0.15 |

| 1995–2000 | 3.57 | −0.38 |

| 2000–2005 | 2.62 | 0.7 |

| 2005–2010 | 1.59 | 0.37 |

| 2010–2019 | 1.31 | −2.72 |

| Year | GDP (%/year) | CO2 Emissions (%/Year) |

|---|---|---|

| 1960–1965 | 4.63 | 4.6 |

| 1965–1970 | 3.75 | 11.29 |

| 1970–1975 | 4.84 | 1.15 |

| 1975–1980 | 4.53 | 3.38 |

| 1980–1985 | 3.33 | −0.09 |

| 1985–1990 | 1.7 | −2.1 |

| 1990–1995 | 3.73 | 2.16 |

| 1995–2000 | 3.68 | 2.14 |

| 2000–2005 | 2.2 | 1.8 |

| 2005–2010 | 0.76 | 6.15 |

| 2010–2019 | 2.86 | −1.91 |

| Variable (Sweden) | Definition |

|---|---|

| Income per population | 000′s; Constant 2010 USD. |

| CO2 Emissions | 000′s Tonnes of CO2 equivalent per year |

| Diesel use | 000′s Tonnes of fuel |

| Gasoline use | 000′s Tonnes of fuel |

| Nuclear electricity generation | GWh |

| Trend | 1960–2018 |

| Gasoline taxes (implicit CO2 tax) | 2014 Swedish Kronas per Tonne of fuel |

| Motor diesel Tax (implicit CO2 tax) | 2014 Swedish Kronas per Tonne of fuel |

| CO2 tax (direct tax) | 2014 Euro per Tonne of CO2 |

| Variable (Norway: 1960–2018; Except Otherwise Indicated) | Definition |

|---|---|

| Income per population | 000′s, constant 2005 USD. |

| CO2 Eq. Emissions (GHG) | 000′s tonnes of CO2 equivalent per year |

| Oil and gas extraction: Value added (1971–2018) | Million Krones, 2018 |

| Fossil fuel energy use (coal, oil, petroleum, natural gas) | % of total energy supply |

| Diesel use (transport) | 000′s Tonnes of fuel |

| Gasoline use | 000′s Tonnes of fuel |

| Hydro power | GWh |

| Trend (1960–2018) | |

| Diesel taxes (1978–2018) | 2014 Norwegian Krones per Tonne of fuel |

| Long-Term Model. Dependent Variable: Log of CO2 Emissions | Observation Period: 1960–2018; Test Statistic (Critical Values in Brackets at 5% Significance Level) | |

|---|---|---|

| All variable in natural logs. | Coefficient | t-values, probability value in brackets |

| Income per capita | 0.136 | −2.30 (0.025) |

| Nuclear power generation | 0.005 | 1.61 (0.114) |

| Diesel Use | 0.555 | 4.04 (0.000) |

| Gasoline Use | 0.473 | 4.10 (0.000) |

| Tax: Gasoline and CO2 (SEK/Tonne--CO2) | −0.197 | −4.05 (0.000) |

| Dummy_CO2Tax (1960–1989: 0; otherwise, 1) | 0.014 | 0.342 (0.733) |

| Time Trend | −0.013 | −1.76 (0.084) |

| Adjusted R2 | 0.90 | |

| Observations: 56 | ||

| AR 1-2 test: F(2,46) = 2.0461 [0.1408] | Normality test: Chi^2(2) = 3.1151 [0.2107] | |

| ARCH 1-1 test: F(1,54) = 0.0089473 [0.9250] | ||

| Hetero test: F(13,42) = 0.78204 [0.6739] | RESET23 test: F(2,46) = 6.3850 [0.0036] ** | |

| Hetero-X test: F(28,27) = 0.66640 [0.8542] | ||

| Short-Term Model (** Critical Values in Brackets at 5% Significance Level) | ||

| Dependent variable: ΔCO2 = ln (CO2/CO2 t-1) | ||

| Coefficient | t-values | |

| Δ Income per capita | 0.087 | 1.11 (0.274) |

| ΔNuclear | 0.001 | 0.532 (0.597) |

| ΔDiesel_Use | 0.453 ** | 3.61 (0.000) |

| ΔGasoline_Use | 0.199 ** | 1.79 (0.079) |

| ΔGtax | −0.095 | −1.53 (0.132) |

| EqCM (t-1) | −0.715 | 5.18 (0.000) |

| Constant | −0.024 | 2.27 (0.027) |

| No. Observations: 55 | ||

| Adjusted R2 | 0.45 | |

| AR 1-2 test: F(2,46) = 0.22605 [0.7986] | Hetero test: F(12,42) = 0.71503 [0.7284] | Normality test: Chi^2(2) = 1.3351 [0.5130] |

| ARCH 1-1 test: F(1,53) = 0.025305 [0.8742] | Hetero-X test: F(27,27) = 0.77170 [0.7474] | |

| RESET23 test: F(2,46) = 2.6841 [0.0790] | ||

| Long-Term Model. Dependent Variable Log of CO2 Emissions | Observation Period: 1960–2018; Test Statistic (** Critical Values in Brackets at 5% Significance Level). | |

|---|---|---|

| All variables in natural logs. | Coefficient | t-value |

| Income per capita | −0.182 | −0.985 |

| Fossil fuel use (Oil, Petroleum, Natural gas, Coal) | 1.163 ** | 5.13 |

| Oil and Gas Extraction (Value added) | 0.029 | 4.71 |

| Diesel tax (Indirect CO2Tax) | −0.035 | −2.21 |

| Dummy (Year I:50) 2009 | −0.192 | −2.59 |

| Dummy_CO2Tax (1960–1989 = 0; 1 1990–2018) | −0.113 | −2.01 |

| Time Trend | 0.026 | 8.46 |

| Adjusted R2 | 0.95 | |

| Observations: 54 | ||

| AR 1-2 test: F(2,44) = 2.2604 [0.1163] | Hetero test: F(11,41) = 1.0476 [0.4250] | Normality test: Chi^2(2) = 3.0791 [0.2145] |

| ARCH 1-1 test: F(1,52) = 0.80326 [0.3743] | Hetero-X test: F(21,31) = 0.64780 [0.8488] | |

| Short-Term Model | ||

| Dependent variable ΔCO2 = ln(CO2/CO2 t-1) | ||

| Independent Variables | Coefficient | t-value |

| Δ Income | −0.172 | −0.880 |

| Δ FossilUse | 0.736 | 3.17 |

| Δ Diesel tax | −0.028 | −1.16 |

| Δ Oil & Gas Extraction | 0.0373 | 2.32 |

| EqCM (t-1) | −0.735 | −4.89 |

| No. observations: 53 | ||

| AR 1-2 test: F(2,45) = 0.58673 [0.5603] | Hetero test: F(10,42) = 1.2719 [0.2769] | Normality test: Chi^2(2) = 6.7762 [0.0338] * |

| ARCH 1-1 test: F(1,51) = 2.2090 [0.1434] | Hetero-X test: F(20,32) = 1.0299 [0.4587] | |

| RESET23 test: F(2,45) = 0.23639 [0.7904] | ||

| Augmented Dickey Fuller Test for Unit Root (in Levels and in First Differences). t-ADF Value. Test Statistic (** Critical Values at 1 % Significance Level; * critical value at 5% level). Includes Trend and Constant (IT), Constant (I), no Constant. WOL: Variable without a Time Lag | ||||

|---|---|---|---|---|

| Variable | IT (A) | I (B) | Without a Constant (C) | Akaike Info Criterion (for Column A) |

| ECM term (test for no cointegration) | −4.485 ** | −4.212 ** | −4.267 ** | −5.451 |

| WOL | −5.222 ** | −5.027 ** | −5.091 ** | −5.482 |

| Δ ECM | −6.19 ** | −5.594 ** | −5.660 ** | −5.111 |

| WOL | −9.619 ** | −8.809 ** | −8.908 ** | −5.139 |

| Log (CO2) | −3.109 | −0.8090 | −0.1303 | −5.239 |

| WOL | −3.221 | −1.112 | −0.1397 | −5.240 |

| Δ CO2 | 4.498 ** | −4.147 ** | −4.583 ** | −5.005 |

| WOL | −7.721 ** | −7.705 ** | −8.445 ** | −5.026 |

| Log (GDP per capita) | −1.885 | −1.979 | 2.270 | 4.523 |

| WOL | −1.397 | −2.317 | 3.622 | −4.474 |

| ΔGDP_per capita | −5.430 ** | −5.042 ** | −3.916 ** | −4.502 |

| WOL | −5.643 ** | −5.369 ** | −4.521 ** | −4.492 |

| Log (CO2 tax and gasoline tax) | −0.6767 | −1.331 | 2.598 | -3.847 |

| WOL | −0.8542 | −1.315 | 2.618 | −3.879 |

| Δ (CO2 tax and gasoline tax) * | −5.628 ** | −5.473 ** | −4.448 ** | −3.842 |

| WOL | −7.872 ** | −7.758 ** | −6.766 ** | −3.875 |

| Log (Gasoline use) | −0.1964 | −2.017 | 0.3196 | −6.583 |

| WOL | −0.3216 | −2.440 | 0.6248 | −6.566 |

| Δ (Gasoline use) | −5.967 ** | −5.285 ** | −5.083 ** | −5.116 |

| WOL | −8.845 ** | −8.266 ** | −8.085 ** | −5.142 |

| Log (Diesel use) | −2.766 | −0.6672 | 3.643 | −5.575 |

| WOL | −2.708 | −0.7004 | 4.582 | −2.708 |

| Δ (diesel) | −5.396 ** | −5.500 ** | −3.794 ** | −5.437 |

| WOL | −7.097 ** | −7.205 ** | −5.524 ** | −5.468 |

| Log (Nuclear electricity generation) | −5.605 ** | −6.026 ** | 0.2785 | 1.322 |

| WOL | −5.645 ** | −5.991 ** | 0.3391 | 1.292 |

| ΔNuclear | −5.878 * | -5.106 ** | -4.889 ** | 1.788 |

| WoL | −7.689 ** | −7.002 ** | 5.822 ** | 1.765 |

| Augmented Dickey Fuller Test for Unit Root (in Levels and in First Differences). t-ADF Value. Test Statistic (** Critical Values at 1 % Significance Level; *critical value at 5% level). Includes Trend and Constant (IT), Constant (I), no Constant. WOL: Variable without Time Lag | ||||

|---|---|---|---|---|

| Variable | IT (A) | I (B) | Without an Constant or Trend (C) | Akaike Information Criterion (for Column A) |

| ECM Term (cointegration test: ADF) with lag | −4.426 ** | −4.344 ** | −4.350 ** | −5.285 |

| WOL | −5.592 ** | −5.540 ** | −5.559 ** | −5.324 |

| ΔECM | −6.249 ** | −6.329 ** | −6.390 ** | −4.941 |

| WOL | −10.13 ** | −10.25 ** | −10.35 ** | −4.970 |

| Log (CO2kt) | −2.633 | −2.443 | 3.196 | −5.266 |

| WOL | −3.048 | −2.083 | 2.229 | −5.153 |

| ΔCO2 | −4.678 ** | −4.523 ** | −3.848 ** | −5.200 |

| WOL | −11.18 ** | −10.94 ** | −9.595 ** | −5.175 |

| Log (Income per pop) | −2.669 | −0.007096 | 1.923 | −6.226 |

| WOL | −2.039 | −0.7175 | 4.666 | −6.173 |

| Δ Income | −1.163 | −1.919 | −0.3832 | −6.106 |

| WOL | −0.9929 | −1.749 | -0.3867 | −6.135 |

| Log (Fossil Fuel use) | −2.147 | −2.124 | −0.3244 | −6.575 |

| WOL | −2.709 | −2.690 | −0.2997 | |

| Δ (Fossil Fuel Use) | 6.13 ** | −6.191 ** | −6.235 ** | −6.495 |

| WOL | −9.410 ** | −9.499 ** | −9.576 ** | |

| Log (Oil & Gas: Value added) | −1.504 | −2.209 | 0.6646 | −1.225 |

| WOL | −0.9964 | −2.674 | 1.583 | −1.086 |

| Δ (Oil and Gas: Value added) | −4.977 ** | −4.488 ** | −3.920 ** | −1.226 |

| WOL | −4.910 ** | −4.564 ** | −4.126 ** | −1.218 |

| Log (Oil price) | −0.7437 | −1.669 | −0.7388 | −0.8269 |

| WOL | −0.9338 | −1.620 | −0.7467 | −0.8633 |

| Δ (Oil price) | −5.119 ** | −4.948 ** | −4.645 ** | −2.571 |

| WOL | −5.996 ** | −5.871 ** | −5.636 ** | −2.595 |

| Log (Diesel Tax) | −1.073 (lag) | −0.8977 | −3.520 ** | −2.032 |

| WOL | −0.6841 (no lag) | −0.8831 | −5.312 ** | −2.015 |

| Δ (Diesel Tax) | −4.059 * | −4.053 ** | 0.8335 | −2.023 |

| WOL | −5.911 ** | −5.920 ** | 1.399 | −2.046 |

| Total | 100,811 |

|---|---|

| Energy tax | 75,704 |

| Tax on diesel oil | |

| Energy tax on fuels | 26,617 |

| Energy tax on electricity | 25,510 |

| Carbon dioxide tax | 22,167 |

| Nuclear power tax | n.a |

| Tax on thermal effect of nuclear power | n.a. |

| Sulphur tax | 5 |

| Emisson permits | 1405 |

| Hydroelectic power tax | n.a. |

| Tax on pollution | 2533 |

| Fee to the battery fund | 4 |

| Fee for chemical products | 47 |

| Tax on insecticides | 126 |

| Tax on chemicals | 1468 |

| Environmental protection fee [1] | |

| NOx fee | 636 |

| Tax on waste | 252 |

| Tax on insecticides and fertilizers | |

| Tax on commercial fertilizers | |

| Tax on natural resources | 138 |

| Natural gravel tax | 138 |

| Tax on transportation | 22,436 |

| Fee for vehicles | |

| Fee to the vehicle scrap fund | |

| Tax on air travel | 1786 |

| Vehicle tax | 13,908 |

| Sales tax on motor vehicles | |

| Kilometre tax | |

| Tax on road traffic insurance | 2829 |

| Congestion tax | 2684 |

| Road charges | 1229 |

| Area | Decision | Date Effective | Type of Decision | Government Presents Impact Assessment |

|---|---|---|---|---|

| Fossil-free and energy-efficient vehicles | Lower enumeration of the tax amount (petrol and diesel, 31 Dec. 2019) | July 2019 | Change in tax | Partly |

| Reduction in the CO2 tax on petrol and diesel relative to the rate corresponding to the increase in the CPI and GDP | June 2019 | Change in tax | No | |

| Renewable fuels and electrification | Funding for non-public charging infrastructure, i.e., housing associations. | June 2019 | New funding | No |

| New fuel blend in 2019 and 2020. | 1 January 2019 | Change in blend levels | No | |

| A transport-efficient society | Change in transport policy objectives | Budget Bill, 2020 | Change in target formulation | No |

| Amendment to urban environmental agreements | 1 April 2020 | Change in existing funding | No | |

| Municipalities given greater opportunities to introduce environmental zones | January 2020 | Change in rules for existing instruments | No |

| Tax Type | Tax Rate | Date Introduced |

|---|---|---|

| CO2 tax | Varies from 30 to 509 (NOK/t-CO2) | 1991 |

| CO2 tax on emissions in petroleum activities on the continental shelf. | Varies from 406 to 462 | 1991 |

| Motor vehicle registration tax | Varies | 1955 |

| Annual tax on motor vehicles | Varies | 1917 |

| Annual weight-based tax on vehicles | Varies | 1993 |

| Road usage tax on petrol (NOK/Litre) | 1933 | |

| Sulphur free | 5.25 | |

| Bio-ethanol | 0 to 5.25 | |

| Road usage tax on Diesel (NOK/Litre) | 1993 | |

| Sulphur-free | 3.81 | |

| Bio-diesel | 0 to 3.81 | |

| Road usage tax on LPG (NOK/kg LPG) | 2.98 | 2016 |

| Lubricating Oil tax (NOK/Litre) | 2.23 | 1998 |

| Sulphur Tax (NOK/litre per 0.25 % Sulfur content above 0.05 weight %. | 0.133 | 1970 |

| Tax on health and environmentally damaging chemicals | 2000 | |

| Trichloroethene (NOK/kg) | 73.37 | |

| Tetrachloroethene (NOk/kg) | 73.37 | |

| Tax on HFC and PFC (NOK/Tonne CO2 eq. | 508 | 2003 |

| Tax on emissions of Nox (NOk/kg) | 22.27 | 2007 |

| Environmental tax on pesticides | varies | 1998 |

| Environmental tax on beverage packaging: | 1973 | |

| Carton and cardboard | 1.45 | |

| Plastics (NOK/Unit) | 3.55 | |

| Metal (NOK/Unit | 5.88 | |

| Glass (NOK/Unit | 5.88 | |

| Electricity Tax (NOK/kWh) | 1951 | |

| Standard Rate (NOK/KWh) | 0.15 | |

| Reduced Rate (manufacturing) (NOK/kWh) | 0.005 | |

| Base tax on minerals, etc. (NOK/Litre) | 2000 | |

| Standard Rate, NOK/Litre) | 1.665 | |

| Reduced Rate (Pulp and paper, dyes, pigment industry) NOK/litre) | 0.21 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bonilla, D.; Banister, D.; Nieto, U.S. Tax or Clean Technology? Measuring the True Effect on Carbon Emissions Mitigation for Sweden and Norway. Energies 2022, 15, 3885. https://doi.org/10.3390/en15113885

Bonilla D, Banister D, Nieto US. Tax or Clean Technology? Measuring the True Effect on Carbon Emissions Mitigation for Sweden and Norway. Energies. 2022; 15(11):3885. https://doi.org/10.3390/en15113885

Chicago/Turabian StyleBonilla, David, David Banister, and Uberto Salgado Nieto. 2022. "Tax or Clean Technology? Measuring the True Effect on Carbon Emissions Mitigation for Sweden and Norway" Energies 15, no. 11: 3885. https://doi.org/10.3390/en15113885

APA StyleBonilla, D., Banister, D., & Nieto, U. S. (2022). Tax or Clean Technology? Measuring the True Effect on Carbon Emissions Mitigation for Sweden and Norway. Energies, 15(11), 3885. https://doi.org/10.3390/en15113885